| FILED PURSUANT TO RULE 424(b)(5) | ||

| REGISTRATION FILE NO.: 333-201743-01 | ||

PROSPECTUS SUPPLEMENT

(To Accompanying Prospectus dated September 14, 2015)

$703,324,000 (Approximate)

Banc of America Merrill Lynch Commercial Mortgage Inc.

Depositor

UBS Real Estate Securities Inc.

Bank of America, National Association

Sponsors and Mortgage Loan Sellers

Bank of America Merrill Lynch Commercial Mortgage Trust 2015-UBS7

Issuing Entity

Commercial Mortgage Pass-Through Certificates, Series 2015-UBS7

|

Consider

carefully the risk factors beginning on page

Neither the certificates nor the underlying mortgage loans are insured or guaranteed by any governmental agency.

The certificates will represent interests only in the issuing entity and will not represent interests in or obligations of the depositor, Bank of America, National Association, or any of their affiliates, including Bank of America Corporation.

|

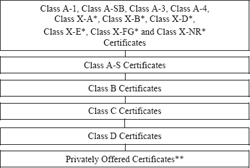

The Bank of America Merrill Lynch Commercial Mortgage Trust 2015-UBS7, Commercial Mortgage Pass-Through Certificates, Series 2015-UBS7 will consist of the following classes: · senior certificates consisting of the Class A-1, Class A-SB, Class A-3, Class A-4, Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR certificates; · subordinate certificates consisting of the Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H certificates; · the Class V certificates representing the right to receive certain payments of excess interest received with respect to mortgage loans having anticipated repayment dates; and · the residual certificates consisting of the Class R certificates. Only the Class A-1, Class A-SB, Class A-3, Class A-4, Class X-A, Class X-B, Class X-D, Class A-S, Class B, Class C and Class D certificates are offered hereby. Distributions on the offered certificates will occur monthly, commencing in October 2015, to the extent of available funds, as described in this prospectus supplement under “Description of the Offered Certificates—Distributions.” The mortgage loans constitute the sole source of repayment on the offered certificates. The issuing entity’s assets will consist primarily of forty-two (42) fixed rate mortgage loans and other property described in this prospectus supplement and the accompanying prospectus. The mortgage loans are secured by first liens on fifty-seven (57) commercial, multifamily and manufactured housing community properties. This prospectus supplement more fully describes the offered certificates, as well as the characteristics of the mortgage loans and the related mortgaged properties. The only credit support for any class of offered certificates will be provided by the subordination of the class(es), if any, that have a lower payment priority as described in this prospectus supplement under “Description of the Offered Certificates—Distributions—Subordination; Allocation of Collateral Support Deficit.” |

Certain characteristics of the offered certificates include:

| Class | Approximate

Initial Certificate Principal Balance or Notional Amount |

Approximate

Initial Pass-Through Rate |

Pass-Through Rate Description |

Expected

Final Distribution Date |

| Class A-1 | $ 38,700,000 | 1.608% | Fixed | September 2020 |

| Class A-SB | $ 62,400,000 | 3.429% | Fixed | June 2025 |

| Class A-3 | $ 200,000,000 | 3.441% | Fixed | August 2025 |

| Class A-4 | $ 228,996,000 | 3.705% | Fixed | September 2025 |

| Class X-A | $ 530,096,000 | 0.946% | Variable | September 2025 |

| Class X-B | $ 50,170,000 | 0.377% | Variable | September 2025 |

| Class X-D | $ 39,879,000 | 1.199% | Variable | September 2025 |

| Class A-S | $ 50,170,000 | 3.989% | Fixed/WAC Cap | September 2025 |

| Class B | $ 50,169,000 | 4.366% | WAC | September 2025 |

| Class C | $ 33,010,000 | 4.366% | WAC | September 2025 |

| Class D | $ 39,879,000 | 3.167% | Fixed | September 2025 |

(Explanatory notes to this table start on page S-1)

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these offered securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Merrill Lynch, Pierce, Fenner & Smith Incorporated, UBS Securities LLC and Drexel Hamilton, LLC, the underwriters, will purchase the certificates offered to you from Banc of America Merrill Lynch Commercial Mortgage Inc. and will offer them to the public in one or more negotiated transactions, or otherwise, at varying prices determined at the time of sale. The offered certificates are offered by the underwriters when, as and if issued by the issuing entity and delivered to and accepted by the underwriters and subject to their right to reject orders in whole or in part. The underwriters expect to deliver the offered certificates to purchasers on or about September 24, 2015. The depositor expects to receive from this offering approximately $746,151,618 plus accrued interest from the cut-off date, before deducting expenses payable by the depositor.

| BofA Merrill Lynch | UBS Securities LLC | |

| Drexel Hamilton | ||

| September 14, 2015 |

The information in this prospectus supplement is preliminary and may be supplemented or amended. The information in this prospectus supplement, if conveyed prior to the time of your commitment to purchase, supersedes information contained in any prior prospectus supplement relating to these securities. This prospectus supplement is not an offer to sell or a solicitation of an offer to buy these securities in any jurisdiction where such offer, solicitation or sale is not permitted. The securities referred to in this prospectus supplement are being offered when, as and if issued. Our obligation to sell securities to you is conditioned on the securities having the characteristics described in this prospectus supplement. If that condition is not satisfied, we will notify you, and neither the depositor nor any underwriter will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

IMPORTANT

NOTICE ABOUT INFORMATION PRESENTED IN THIS

PROSPECTUS SUPPLEMENT AND

THE ACCOMPANYING PROSPECTUS

Information about the certificates offered to you is contained in two (2) separate documents that progressively provide more detail: (a) the accompanying prospectus, which provides general information, some of which may not apply to the certificates offered to you; and (b) this prospectus supplement, which describes the specific terms of the certificates offered to you. You should read both this prospectus supplement and the accompanying prospectus in full to obtain material information concerning the offered certificates.

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. Banc of America Merrill Lynch Commercial Mortgage Inc. has not authorized anyone to provide you with information that is different from that contained in this prospectus supplement and the accompanying prospectus.

This prospectus supplement and the accompanying prospectus include cross references to sections in these materials where you can find further related discussions. The tables of contents in this prospectus supplement and the accompanying prospectus identify the pages where these sections are located. You should read both this prospectus supplement and the accompanying prospectus in full to obtain material information concerning the offered certificates.

The appendices attached to this prospectus supplement are hereby incorporated into and made a part of this prospectus supplement.

This prospectus supplement and the accompanying prospectus do not constitute an offer to sell or a solicitation of an offer to buy any security other than the offered certificates, nor do they constitute an offer to sell or a solicitation of an offer to buy any of the offered certificates to any person in any jurisdiction in which it is unlawful to make such an offer or solicitation to such person.

In this prospectus supplement, the terms “depositor,” “we,” “our” and “us” refer to Banc of America Merrill Lynch Commercial Mortgage Inc.

Until ninety (90) days after the date of this prospectus supplement, all dealers that buy, sell or trade the certificates offered by this prospectus supplement, whether or not participating in this offering, may be required to deliver a prospectus supplement and the accompanying prospectus. This is in addition to the dealer’s obligation to deliver a prospectus supplement and the accompanying prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The issuing entity will not be registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”). The issuing entity will be relying on an exclusion or exemption from the definition of “investment company” under the Investment Company Act contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity will not be relying upon Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act as a basis for not registering under the Investment Company Act. The issuing entity is

| iii |

being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule (as defined in this prospectus supplement) under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”).

NOTICE TO RESIDENTS WITHIN THE EUROPEAN ECONOMIC AREA

This prospectus supplement is not a prospectus for the purposes of the European Union’s Directive 2003/71/EC (as amended, including by Directive 2010/73/EU) (the “EU Prospectus Directive”) as implemented in any Member State of the European Economic Area (each, a “Relevant Member State”). This prospectus supplement has been prepared on the basis that all offers of the offered certificates in any Relevant Member State will be made pursuant to an exemption under the EU Prospectus Directive from the requirement to produce a prospectus in connection with offers of the offered certificates. Accordingly, any person making or intending to make any offer in that Relevant Member State of offered certificates which are the subject of the offering contemplated in this prospectus supplement may only do so in circumstances in which no obligation arises for the depositor, the issuing entity or any of the underwriters to produce a prospectus pursuant to Article 3 of the Prospectus Directive in relation to such offer. None of the depositor, the issuing entity or the underwriters have authorized, and none of such entities authorizes, the making of any offer of the offered certificates in circumstances in which an obligation arises for the depositor, the issuing entity or the underwriters to publish a prospectus for such offer.

NOTICE TO UNITED KINGDOM INVESTORS

THE DISTRIBUTION OF THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS IS BEING MADE ONLY TO, OR DIRECTED ONLY AT, PERSONS WHO (1) ARE OUTSIDE THE UNITED KINGDOM, OR (2) ARE INSIDE THE UNITED KINGDOM AND QUALIFY AS INVESTMENT PROFESSIONALS IN ACCORDANCE WITH ARTICLE 19(5) OR ARE PERSONS FALLING WITHIN ARTICLES 49(2)(A) THROUGH (D) (“HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.”) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS THE “RELEVANT PERSONS”). THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS

HONG KONG

THE OFFERED CERTIFICATES MAY NOT BE OFFERED OR SOLD BY MEANS OF ANY DOCUMENT OTHER THAN (I) IN CIRCUMSTANCES WHICH DO NOT CONSTITUTE AN OFFER TO THE PUBLIC WITHIN THE MEANING OF THE COMPANIES ORDINANCE (CAP. 32, LAWS OF HONG KONG), OR (II) TO “PROFESSIONAL INVESTORS” WITHIN THE MEANING OF THE SECURITIES AND FUTURES ORDINANCE (CAP. 571, LAWS OF HONG KONG) AND ANY RULES MADE THEREUNDER, OR (III) IN OTHER CIRCUMSTANCES WHICH DO NOT RESULT IN THE DOCUMENT BEING A “PROSPECTUS” WITHIN THE MEANING OF THE COMPANIES ORDINANCE (CAP. 32, LAWS OF HONG KONG), AND NO ADVERTISEMENT, INVITATION OR DOCUMENT RELATING TO THE OFFERED CERTIFICATES MAY BE ISSUED OR MAY BE IN THE POSSESSION OF ANY PERSON FOR THE PURPOSE OF ISSUE (IN EACH CASE WHETHER IN HONG KONG OR ELSEWHERE), WHICH IS DIRECTED AT, OR THE CONTENTS OF WHICH ARE LIKELY TO BE ACCESSED OR READ BY, THE PUBLIC OF HONG KONG (EXCEPT IF PERMITTED TO DO SO UNDER THE SECURITIES LAWS OF HONG KONG) OTHER THAN WITH RESPECT TO OFFERED CERTIFICATES WHICH ARE OR ARE INTENDED TO BE DISPOSED OF ONLY TO PERSONS OUTSIDE HONG KONG OR ONLY TO “PROFESSIONAL INVESTORS” WITHIN THE MEANING OF THE SECURITIES AND FUTURES ORDINANCE (CAP. 571, LAWS OF HONG KONG) AND ANY RULES MADE THEREUNDER.

| iv |

SINGAPORE

THIS PROSPECTUS SUPPLEMENT HAS NOT BEEN REGISTERED AS A PROSPECTUS WITH THE MONETARY AUTHORITY OF SINGAPORE. ACCORDINGLY, THIS PROSPECTUS SUPPLEMENT AND ANY OTHER DOCUMENT OR MATERIAL IN CONNECTION WITH THE OFFER OR SALE, OR INVITATION FOR SUBSCRIPTION OR PURCHASE, OF THE OFFERED CERTIFICATES MAY NOT BE CIRCULATED OR DISTRIBUTED, NOR MAY THE OFFERED CERTIFICATES BE OFFERED OR SOLD, OR BE MADE THE SUBJECT OF AN INVITATION FOR SUBSCRIPTION OR PURCHASE, WHETHER DIRECTLY OR INDIRECTLY, TO PERSONS IN SINGAPORE OTHER THAN (I) TO AN INSTITUTIONAL INVESTOR UNDER SECTION 274 OF THE SECURITIES AND FUTURES ACT, CHAPTER 289 OF SINGAPORE (THE “SFA”), (II) TO A RELEVANT PERSON, OR ANY PERSON PURSUANT TO SECTION 275(1A), IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275 OF THE SFA OR (III) OTHERWISE PURSUANT TO, AND IN ACCORDANCE WITH THE CONDITIONS OF, ANY OTHER APPLICABLE PROVISION OF THE SFA.

WHERE THE OFFERED CERTIFICATES ARE SUBSCRIBED OR PURCHASED UNDER SECTION 275 OF THE SFA BY A RELEVANT PERSON WHICH IS: (A) A CORPORATION (WHICH IS NOT AN ACCREDITED INVESTOR) THE SOLE BUSINESS OF WHICH IS TO HOLD INVESTMENTS AND THE ENTIRE SHARE CAPITAL OF WHICH IS OWNED BY ONE OR MORE INDIVIDUALS, EACH OF WHOM IS AN ACCREDITED INVESTOR; OR (B) A TRUST (WHERE THE TRUSTEE IS NOT AN ACCREDITED INVESTOR) WHOSE SOLE PURPOSE IS TO HOLD INVESTMENTS AND EACH BENEFICIARY IS AN ACCREDITED INVESTOR, SHARES, DEBENTURES AND UNITS OF SHARES AND DEBENTURES OF THAT CORPORATION OR THE BENEFICIARIES’ RIGHTS AND INTEREST IN THAT TRUST SHALL NOT BE TRANSFERABLE FOR 6 MONTHS AFTER THAT CORPORATION OR THAT TRUST HAS ACQUIRED THE OFFERED CERTIFICATES UNDER SECTION 275 EXCEPT: (1) TO AN INSTITUTIONAL INVESTOR UNDER SECTION 274 OF THE SFA OR TO A RELEVANT PERSON, OR ANY PERSON PURSUANT TO SECTION 275(1A) OF THE SFA, AND IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275 OF THE SFA; (2) WHERE NO CONSIDERATION IS GIVEN FOR THE TRANSFER; OR (3) BY OPERATION OF LAW.

JAPAN

THE OFFERED CERTIFICATES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS EXCHANGE ACT OF JAPAN (LAW NO. 25 OF 1948, AS AMENDED (THE “FIEL”)), AND EACH UNDERWRITER HAS AGREED THAT IT WILL NOT OFFER OR SELL ANY OFFERED CERTIFICATES, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY JAPANESE PERSON, OR TO OTHERS FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO ANY JAPANESE PERSON, EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE FIEL AND ANY OTHER APPLICABLE LAWS AND REGULATIONS. FOR THE PURPOSES OF THIS PARAGRAPH, “JAPANESE PERSON” SHALL MEAN ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS AND REGULATIONS OF JAPAN.

NOTICE TO RESIDENTS OF THE PEOPLE’S REPUBLIC OF CHINA

THE OFFERED CERTIFICATES WILL NOT BE OFFERED OR SOLD IN THE PEOPLE’S REPUBLIC OF CHINA (EXCLUDING HONG KONG, MACAU AND TAIWAN, THE “PRC”) AS PART OF THE INITIAL DISTRIBUTION OF THE OFFERED CERTIFICATES BUT MAY BE AVAILABLE FOR PURCHASE BY INVESTORS RESIDENT IN THE PRC FROM OUTSIDE THE PRC.

THIS PROSPECTUS SUPPLEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN THE PRC TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE THE OFFER OR SOLICITATION IN THE PRC.

THE PRC DOES NOT REPRESENT THAT THIS PROSPECTUS SUPPLEMENT MAY BE LAWFULLY DISTRIBUTED, OR THAT ANY OFFERED CERTIFICATES MAY BE LAWFULLY OFFERED, IN

| v |

COMPLIANCE WITH ANY APPLICABLE REGISTRATION OR OTHER REQUIREMENTS IN THE PRC, OR PURSUANT TO AN EXEMPTION AVAILABLE THEREUNDER, OR ASSUME ANY RESPONSIBILITY FOR FACILITATING ANY SUCH DISTRIBUTION OR OFFERING. IN PARTICULAR, NO ACTION HAS BEEN TAKEN BY THE PRC WHICH WOULD PERMIT AN OFFERING OF ANY OFFERED CERTIFICATES OR THE DISTRIBUTION OF THIS PROSPECTUS SUPPLEMENT IN THE PRC. ACCORDINGLY, THE OFFERED CERTIFICATES ARE NOT BEING OFFERED OR SOLD WITHIN THE PRC BY MEANS OF THIS PROSPECTUS SUPPLEMENT OR ANY OTHER DOCUMENT. NEITHER THIS PROSPECTUS SUPPLEMENT NOR ANY ADVERTISEMENT OR OTHER OFFERING MATERIAL MAY BE DISTRIBUTED OR PUBLISHED IN THE PRC, EXCEPT UNDER CIRCUMSTANCES THAT WILL RESULT IN COMPLIANCE WITH ANY APPLICABLE LAWS AND REGULATIONS.

NOTICE TO RESIDENTS OF THE REPUBLIC OF KOREA

THIS PROSPECTUS SUPPLEMENT IS NOT, AND UNDER NO CIRCUMSTANCES IS TO BE CONSTRUED AS, A PUBLIC OFFERING OF SECURITIES IN KOREA. NEITHER THE ISSUER NOR ANY OF ITS AGENTS MAKE ANY REPRESENTATION WITH RESPECT TO THE ELIGIBILITY OF ANY RECIPIENTS OF THIS PROSPECTUS SUPPLEMENT TO ACQUIRE THE OFFERED CERTIFICATES UNDER THE LAWS OF KOREA, INCLUDING, BUT WITHOUT LIMITATION, THE FOREIGN EXCHANGE TRANSACTION LAW AND REGULATIONS THEREUNDER (THE “FETL”). THE OFFERED CERTIFICATES HAVE NOT BEEN REGISTERED WITH THE FINANCIAL SERVICES COMMISSION OF KOREA FOR PUBLIC OFFERING IN KOREA, AND NONE OF THE OFFERED CERTIFICATES MAY BE OFFERED, SOLD OR DELIVERED, DIRECTLY OR INDIRECTLY, OR OFFERED OR SOLD TO ANY PERSON FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY IN KOREA OR TO ANY RESIDENT OF KOREA EXCEPT PURSUANT TO THE FINANCIAL INVESTMENT SERVICES AND CAPITAL MARKETS ACT AND THE DECREES AND REGULATIONS THEREUNDER (THE “FSCMA”), THE FETL AND ANY OTHER APPLICABLE LAWS, REGULATIONS AND MINISTERIAL GUIDELINES IN KOREA. WITHOUT PREJUDICE TO THE FOREGOING, THE NUMBER OF OFFERED CERTIFICATES OFFERED IN KOREA OR TO A RESIDENT OF KOREA SHALL BE LESS THAN FIFTY AND FOR A PERIOD OF ONE YEAR FROM THE ISSUE DATE OF THE OFFERED CERTIFICATES, NONE OF THE OFFERED CERTIFICATES MAY BE DIVIDED RESULTING IN AN INCREASED NUMBER OF OFFERED CERTIFICATES. FURTHERMORE, THE OFFERED CERTIFICATES MAY NOT BE RESOLD TO KOREAN RESIDENTS UNLESS THE PURCHASER OF THE OFFERED CERTIFICATES COMPLIES WITH ALL APPLICABLE REGULATORY REQUIREMENTS (INCLUDING, BUT NOT LIMITED TO, GOVERNMENT REPORTING APPROVAL REQUIREMENTS UNDER THE FETL AND ITS SUBORDINATE DECREES AND REGULATIONS) IN CONNECTION WITH THE PURCHASE OF THE OFFERED CERTIFICATES.

| vi |

Note regarding pie chart and map on the inside cover page: numbers may not total to 100% due to rounding

For more information

Banc of America Merrill Lynch Commercial Mortgage Inc. has filed with the SEC additional registration materials relating to the certificates. You may read and copy any of these materials at the SEC’s Public Reference Room at the following location:

·

SEC Public Reference Section

You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information that has been filed electronically with the SEC. The Internet address is http://www.sec.gov.

You may also contact Banc of America Merrill Lynch Commercial Mortgage Inc. in writing at One Bryant Park, New York, New York 10036, or by telephone at (980) 388-7451.

See also the sections captioned “Available Information” and “Incorporation of Certain Information by Reference” appearing at the end of the accompanying prospectus.

The file number of the registration statement to which this prospectus supplement relates is 333-201743. |

TABLE OF CONTENTS

| Executive Summary | S-1 |

| Summary of Prospectus Supplement | S-4 |

| Risk Factors | S-60 |

| General Risks | S-60 |

| Risks Related to Market Conditions | S-60 |

| Risks Related to the Mortgage Loans | S-61 |

| Risks Related to Conflicts of Interest | S-105 |

| Risks Related to the Offered Certificates | S-113 |

| Capitalized Terms Used in this Prospectus Supplement | S-130 |

| Forward looking Statements | S-130 |

| Transaction Parties | S-131 |

| The Sponsors, Mortgage Loan Sellers and Originators | S-131 |

| The Depositor | S-149 |

| The Issuing Entity | S-149 |

| The Trustee, Certificate Administrator and Custodian | S-150 |

| The Trust Advisor | S-152 |

| The Master Servicer | S-153 |

| The Special Servicer | S-154 |

| Other Servicers | S-158 |

| Affiliations and Certain Relationships | S-158 |

| Description of the Offered Certificates | S-160 |

| General | S-160 |

| Certificate Principal Balances and Notional Amounts | S-161 |

| Pass-Through Rates | S-163 |

| Accounts | S-165 |

| Distributions | S-167 |

| Optional Termination | S-186 |

| Advances | S-187 |

| Appraisal Reductions | S-192 |

| Reports to Certificateholders; Available Information | S-197 |

| Example of Distributions | S-204 |

| Expected Final Distribution Date | S-205 |

| Amendments to the Pooling and Servicing Agreement | S-205 |

| Evidence as to Compliance | S-208 |

| Voting Rights | S-208 |

| Matters Regarding the Certificate Administrator | S-209 |

| The Trustee | S-211 |

| Certificateholder Communications | S-215 |

| Retention of Certain Certificates by Affiliates of Transaction Parties | S-215 |

| Yield, Prepayment and Maturity Considerations | S-216 |

| General | S-216 |

| Pass-Through Rates | S-216 |

| Rate and Timing of Principal Payments | S-216 |

| Yield on the Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates | S-218 |

| Unpaid Distributable Certificate Interest | S-218 |

| Losses and Shortfalls | S-218 |

| vii |

| Relevant Factors | S-219 |

| Weighted Average Life | S-219 |

| Price/Yield Tables | S-224 |

| Description of the Mortgage Pool | S-228 |

| General | S-228 |

| Material Terms and Characteristics of the Mortgage Loans | S-229 |

| The A/B Whole Loans and the Loan Pairs | S-242 |

| The Non-Serviced Loan Combinations | S-255 |

| Additional Mortgage Loan Information | S-272 |

| Standard Hazard Insurance | S-279 |

| Sale of the Mortgage Loans | S-280 |

| Representations and Warranties | S-281 |

| Repurchases and Other Remedies | S-282 |

| Changes In Mortgage Pool Characteristics | S-284 |

| Servicing of the Mortgage Loans | S-285 |

| General | S-285 |

| The Master Servicer | S-294 |

| The Special Servicer | S-300 |

| Rating Agency Confirmations | S-308 |

| Waivers of Servicer Termination Events | S-310 |

| Withdrawals from the Collection Account | S-310 |

| Enforcement of “Due-On-Sale” and “Due-On-Encumbrance” Clauses | S-310 |

| Inspections | S-311 |

| The Controlling Class Representative | S-312 |

| The Trust Advisor | S-317 |

| Certain Matters Regarding the Parties to the Pooling and Servicing Agreement | S-325 |

| Asset Status Reports | S-326 |

| Mortgage Loan Modifications | S-327 |

| Sale of Defaulted Mortgage Loans and REO Properties | S-329 |

| Foreclosures | S-332 |

| Litigation Control | S-334 |

| Additional Matters Relating to the Servicing of the Non-Serviced Mortgage Loans | S-337 |

| Material Federal Income Tax Consequences | S-342 |

| Tax Classification of the Issuing Entity | S-343 |

| Special Tax Attributes of the Offered Certificates | S-343 |

| Taxation of the Offered Certificates | S-344 |

| REMIC Administrative Provisions | S-349 |

| Taxes on a REMIC | S-349 |

| Backup Withholding | S-350 |

| State, Local and Other Tax Considerations | S-350 |

| Certain Legal Aspects of the Mortgage Loans | S-351 |

| Certain ERISA Considerations | S-353 |

| Plan Assets and Prohibited Transactions | S-353 |

| Special Exemption Applicable to the Offered Certificates | S-354 |

| Insurance Company General Accounts | S-356 |

| General Investment Considerations | S-356 |

| Legal Investment | S-357 |

| Use of Proceeds | S-357 |

| Plan of Distribution (Conflicts of Interest) | S-358 |

| Legal Matters | S-360 |

| Ratings | S-361 |

| Index of Significant Terms | S-363 |

| viii |

| APPENDIX I - Certain Characteristics of the Mortgage Loans | I-1 |

| APPENDIX II - Mortgage Pool Information (Tables) | II-1 |

| APPENDIX III - Significant Loan Summaries | III-1 |

| APPENDIX IV - Form of Distribution Date Statement | IV-1 |

| APPENDIX V - Mortgage Loan Representations and Warranties | V-1 |

| APPENDIX VI - Exceptions to Mortgage Loan Representations and Warranties | VI-1 |

| APPENDIX VII - Class A-SB Planned Principal Balance | VII-1 |

| APPENDIX VIII-A - CHARLES RIVER PLAZA NORTH Amortization Schedule | VIII-A-1 |

| APPENDIX VIII-B – 200 HELEN STREET Note B - Amortization Schedule | VIII-B-1 |

| ix |

(THIS PAGE INTENTIONALLY LEFT BLANK)

Executive Summary

This Executive Summary highlights selected information regarding the certificates. It does not contain all of the information you need to consider in making your investment decision. To understand all of the terms of this offering and the underlying mortgage loans, you should read this entire prospectus supplement and the accompanying prospectus carefully.

Certificate Structure

|

|

|

|

|

|

|

|

|

|

|

| |||

|

Class |

|

Approximate Initial |

|

Approximate Initial Credit Support |

|

Approximate Initial Pass-Through Rate |

|

Expected Final |

|

Expected |

|

Principal | ||

| Class A-1 | $ | 38,700,000 | 30.000% | 1.608% | September 2020 | 2.80 | 1-60 | |||||||

| Class A-SB | $ | 62,400,000 | 30.000% | 3.429% | June 2025 | 7.61 | 60-117 | |||||||

| Class A-3 | $ | 200,000,000 | 30.000% | 3.441% | August 2025 | 9.85 | 117-119 | |||||||

| Class A-4 | $ | 228,996,000 | 30.000% | 3.705% | September 2025 | 9.94 | 119-120 | |||||||

| Class X-A | $ | 530,096,000 | N/A | 0.946% | September 2025 | N/A | N/A | |||||||

| Class X-B | $ | 50,170,000 | N/A | 0.377% | September 2025 | N/A | N/A | |||||||

| Class X-D | $ | 39,879,000 | N/A | 1.199% | September 2025 | N/A | N/A | |||||||

| Class A-S | $ | 50,170,000 | 23.375% | 3.989% | September 2025 | 9.98 | 120-120 | |||||||

| Class B | $ | 50,169,000 | 16.750% | 4.366% | September 2025 | 9.98 | 120-120 | |||||||

| Class C | $ | 33,010,000 | 12.391% | 4.366% | September 2025 | 9.98 | 120-120 | |||||||

| Class D | $ | 39,879,000 | 7.125% | 3.167% | September 2025 | 9.98 | 120-120 | |||||||

| Class X-E | $ | 17,038,000 | N/A | 1.250% | September 2025 | N/A | N/A | |||||||

| Class X-FG | $ | 15,146,000 | N/A | 1.250% | September 2025 | N/A | N/A | |||||||

| Class X-NR | $ | 21,772,331 | N/A | 1.250% | September 2025 | N/A | N/A | |||||||

| Class E | $ | 17,038,000 | 4.875% | 3.116% | September 2025 | 9.98 | 120-120 | |||||||

| Class F | $ | 7,573,000 | 3.875% | 3.116% | September 2025 | 9.98 | 120-120 | |||||||

| Class G | $ | 7,573,000 | 2.875% | 3.116% | September 2025 | 9.98 | 120-120 | |||||||

| Class H | $ | 21,772,331 | 0.000% | 3.116% | September 2025 | 9.98 | 120-120 | |||||||

| Class V | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||

| Class R | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||

| Offered certificates. | ||

| Certificates not offered pursuant to this prospectus supplement. |

When reviewing the table on the cover page of this prospectus supplement and the table above entitled “Certificate Structure,” please note the following:

| · | The certificate principal balances and notional amounts are approximate and on the closing date may vary by up to 5%. Mortgage loans may be removed from or added to the mortgage pool prior to the closing date within the same maximum permitted variance. Any reduction or increase in the aggregate principal balance of mortgage loans within these parameters will result in changes to the initial certificate principal balance or notional amount of each class of certificates (other than the Class V and Class R Certificates) and to the other statistical data contained in this prospectus supplement. In addition, the notional amounts of the Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates may vary depending upon the final pricing of the classes of principal balance certificates whose certificate principal balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of the Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates, as applicable, would be equal to zero, such class of certificates will not be issued on the closing date of this securitization. |

| · | The expected final distribution date for each class of certificates is the date on which that class is expected to be paid in full (or, in the case of the Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates, the date on which the related notional amount is reduced to zero), based on the |

| S-1 |

| assumptions described in “Description of the Offered Certificates—Expected Final Distribution Date” in this prospectus supplement. | |

| · | The pass-through rates for each class of the Class A-1, Class A-SB, Class A-3, Class A-4 and Class D Certificates will at all times be fixed at their respective initial per annum pass-through rates set forth in the table above. The pass-through rate for the Class A-S Certificates will at all times be a per annum rate equal to the lesser of (i) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) and (ii) 3.989%. The pass-through rate for each class of the Class B and Class C Certificates will at all times be a per annum rate equal to the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months). The pass-through rate for each class of the Class E, Class F, Class G and Class H Certificates will at all times be a per annum rate equal to the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360 day year consisting of twelve 30-day months) less 1.250%. |

| · | The initial pass-through rates are approximate as of the closing date. The percentages indicated under the column “Approximate Initial Credit Support” with respect to the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates represent the approximate initial credit support for the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates, in the aggregate. |

| · | The principal window is expressed in months following the closing date and reflects the period during which distributions of principal would be received under the assumptions set forth in the following sentence. The expected weighted average life and principal window figures set forth above are based on the following assumptions, among others: (i) no defaults or subsequent losses on the mortgage loans; (ii) no extensions of maturity dates of mortgage loans that do not have “anticipated repayment dates;” (iii) payment in full on the stated maturity date or, in the case of each mortgage loan having an anticipated repayment date, on the anticipated repayment date; and (iv) no prepayments of the mortgage loans prior to maturity or, in the case of a mortgage loan having an anticipated repayment date, prior to such anticipated repayment date. See the structuring assumptions set forth under “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in this prospectus supplement. |

| · | None of the Class X-E, Class X-FG, Class X-NR, Class E, Class F, Class G, Class H, Class V or Class R Certificates are offered pursuant to this prospectus supplement. We sometimes refer to these certificates collectively as the “privately offered certificates.” |

| · | The Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates (collectively, the “Class X Certificates”) will not have certificate principal balances and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A Certificates will be equal to the aggregate certificate principal balance of the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates outstanding from time to time. The notional amount of the Class X-B Certificates will be equal to the certificate principal balance of the Class A-S Certificates outstanding from time to time. The notional amount of the Class X-D Certificates will be equal to the certificate principal balance of the Class D Certificates outstanding from time to time. The notional amount of the Class X-E Certificates will be equal to the certificate principal balance of the Class E Certificates outstanding from time to time. The notional amount of the Class X-FG Certificates will be equal to the aggregate certificate principal balance of the Class F and Class G Certificates outstanding from time to time. The notional amount of the Class X-NR Certificates will be equal to the certificate principal balance of the Class H Certificates outstanding from time to time. |

| · |

The pass-through rate on the Class X-A Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates of the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates as described

|

| S-2 |

| in this prospectus supplement. The pass-through rate on the Class X-B Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class A-S Certificates as described in this prospectus supplement. The pass-through rate on the Class X-D Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class D Certificates as described in this prospectus supplement. The pass-through rate on the Class X-E Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class E Certificates as described in this prospectus supplement. The pass-through rate on the Class X-FG Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates of the Class F and Class G Certificates as described in this prospectus supplement. The pass-through rate on the Class X-NR Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class H Certificates as described in this prospectus supplement. | |

| · | The Class V and Class R Certificates will not have certificate principal balances, notional amounts or pass-through rates and will not be entitled to distributions of principal or interest (other than, with respect to the Class V Certificates, certain excess interest). The Class V Certificates represent a beneficial ownership interest held through the grantor trust in certain excess interest in respect of mortgage loans having anticipated repayment dates, if any. The Class R Certificates represent beneficial ownership of the residual interest in each of the real estate mortgage investment conduits, as further described in this prospectus supplement. |

| S-3 |

Summary of Prospectus Supplement

This summary highlights selected information from this prospectus supplement. It does not contain all of the information you need to consider in making your investment decision. To understand all of the terms of the certificates offered pursuant to this prospectus supplement, which we generally refer to as the “offered certificates,” you should read this entire prospectus supplement and the accompanying prospectus carefully.

What You Will Own

| General | Your certificates (together with the privately offered certificates) will represent beneficial interests in the issuing entity created by Banc of America Merrill Lynch Commercial Mortgage Inc. on the closing date pursuant to a pooling and servicing agreement dated as of September 1, 2015. All payments to you will come only from the amounts received in connection with the assets of the issuing entity. The issuing entity’s assets will primarily consist of forty-two (42) fixed rate mortgage loans secured by first liens on fifty-seven (57) multifamily, commercial and manufactured housing community properties. | |

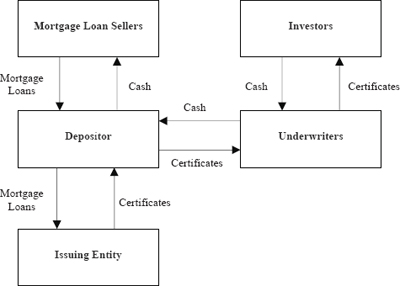

| The transfers of the mortgage loans from the mortgage loan sellers to the depositor, and from the depositor to the issuing entity in exchange for the certificates are illustrated below: | ||

|

| Title of Certificates | Commercial Mortgage Pass-Through Certificates, Series 2015-UBS7. | |

| Mortgage Pool | The mortgage pool consists of forty-two (42) mortgage loans with an aggregate principal balance as of September 1, 2015 of approximately $757,280,331 which may vary on the closing date by up to 5%. Each of the mortgage loans requires scheduled payments of principal and/or interest to be made monthly. For purposes of any mortgage loan that has a due date on a date other than the first of the month, we have assumed that amounts are due thereunder on the first of the month for purposes of determining its cut-off date and cut-off date balance. |

| S-4 |

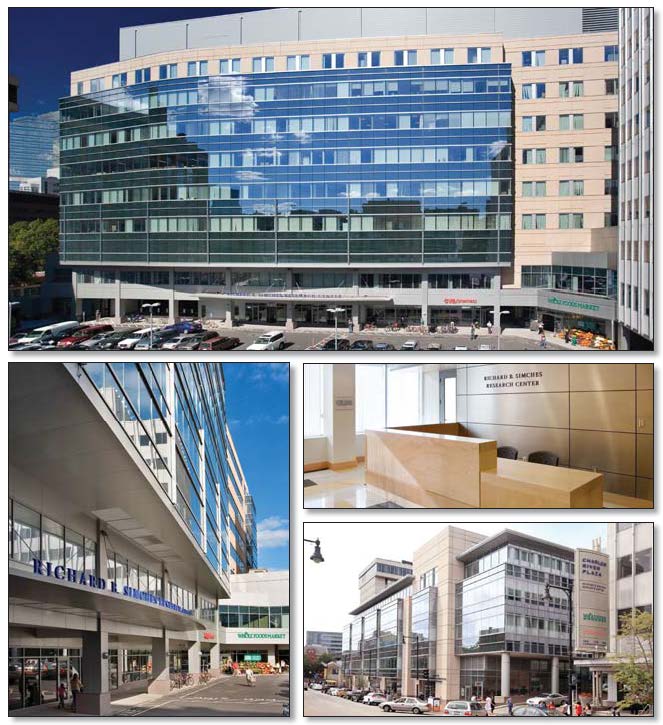

| The mortgaged property identified on APPENDIX I to this prospectus supplement as Charles River Plaza North secures a mortgage loan representing approximately 9.6% of the initial pool balance as well as two (2) pari passu non-serviced companion loans (evidenced by (3) pari passu promissory notes) and a separate subordinate note (the “Charles River Plaza North non-serviced B note” and a “B note”). Such mortgage loan is referred to herein as a “mortgage loan” and a “non-serviced mortgage loan” and, together with its pari passu non-serviced companion loans (and the related B note), as a “non-serviced loan combination.” Neither the related pari passu non-serviced companion loans nor the related B note will be a “mortgage loan” hereunder. The entire Charles River Plaza North non-serviced loan combination will be serviced under the CSAIL 2015-C3 pooling and servicing agreement. | ||

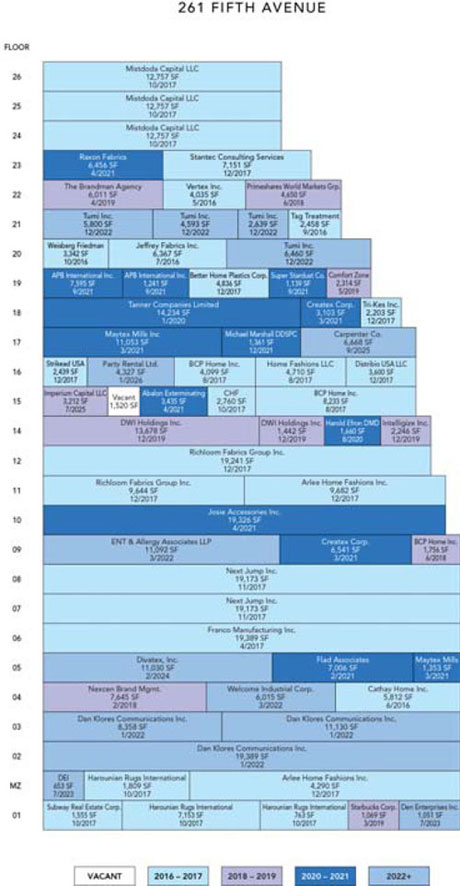

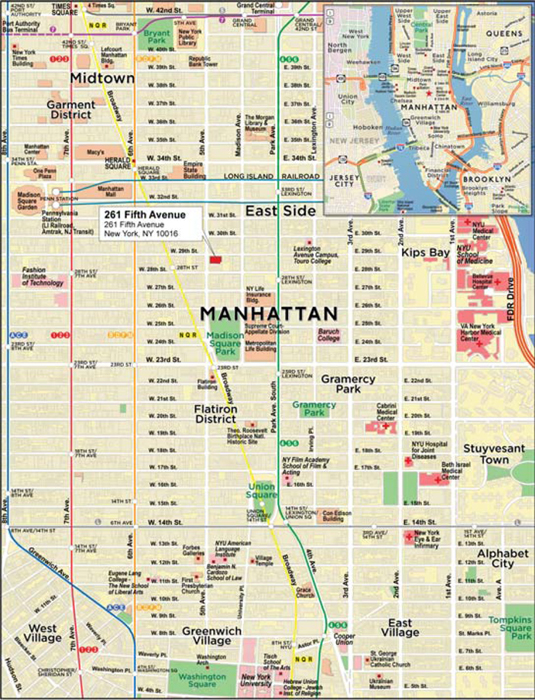

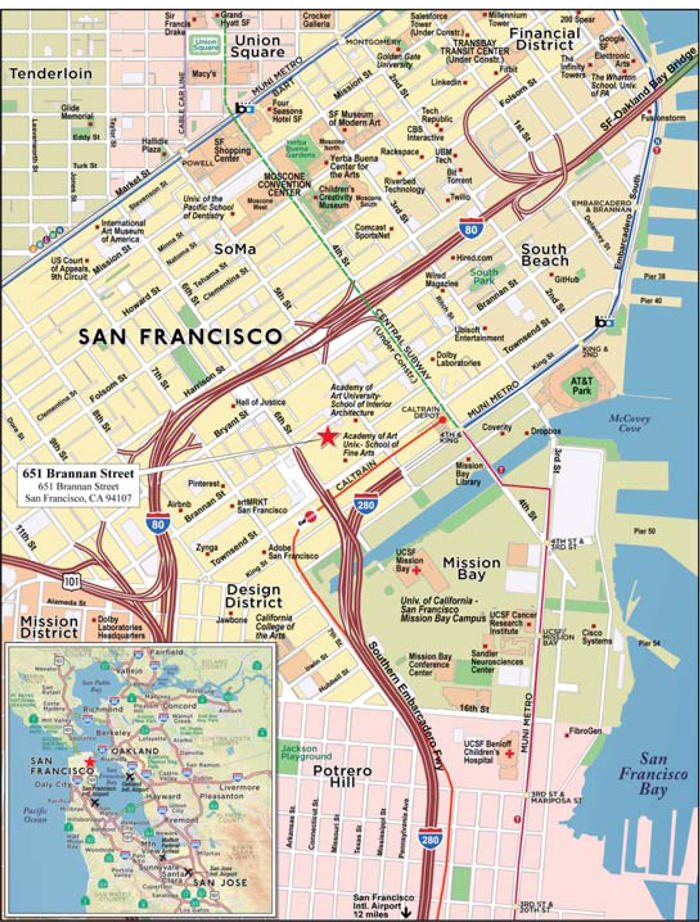

| The mortgaged property identified on APPENDIX I to this prospectus supplement as 261 Fifth Avenue secures a mortgage loan, representing approximately 9.2% of the initial pool balance, which will be initially serviced under the pooling and servicing agreement for this securitization and, for so long as any such mortgage loan is so serviced, will be referred to herein (together with its related pari passu companion loan) as a “loan pair.” After the securitization of the related pari passu companion loan, such mortgage loan (together with the related pari passu companion loan) will be serviced under a pooling and servicing agreement entered into in connection with such securitization and, under such circumstances, such mortgage loan (together with the related pari passu companion loan) will be referred to herein as a “non-serviced loan combination.” | ||

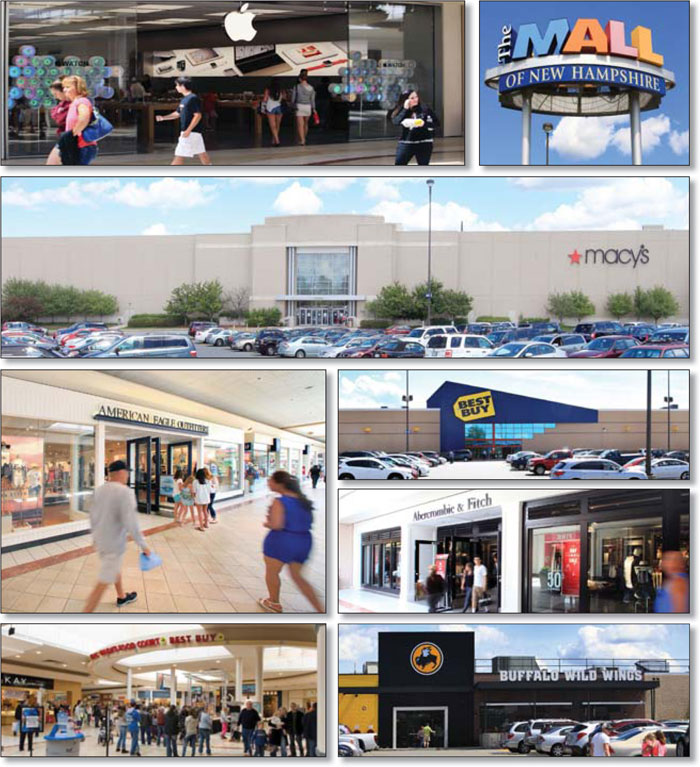

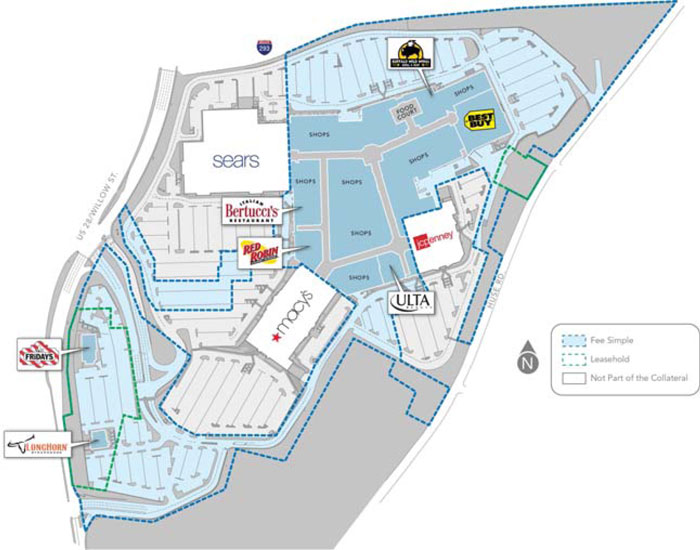

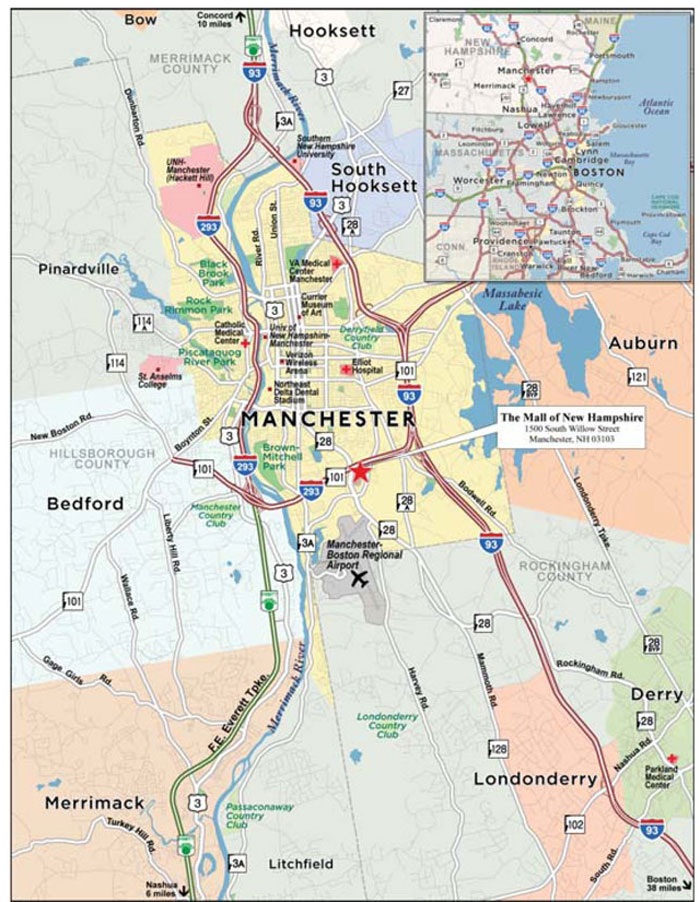

| The mortgaged property identified on APPENDIX I to this prospectus supplement as The Mall of New Hampshire secures a mortgage loan representing approximately 6.6% of the initial pool balance as well as a pari passu non-serviced companion loan. Such mortgage loan is referred to herein as a “mortgage loan” and a “non-serviced mortgage loan” and, together with its pari passu non-serviced companion loan, as a “non-serviced loan combination.” The related pari passu non-serviced companion loan will not be a “mortgage loan” hereunder. The entire The Mall of New Hampshire non-serviced loan combination will be serviced under the CSAIL 2015-C3 pooling and servicing agreement. | ||

| The mortgaged property identified on APPENDIX I to this prospectus supplement as 200 Helen Street secures a mortgage loan representing approximately 5.5% of the initial pool balance as well as a subordinate note (the “200 Helen Street B note” and a “B note”), such mortgage loan and B note constitute the only A/B whole loan related to the issuing entity as of the closing date. The 200 Helen Street A/B whole loan will be serviced under the pooling and servicing agreement. | ||

| The portfolio of mortgaged properties identified on APPENDIX I to this prospectus supplement as WPC Department Store Portfolio secures a mortgage loan, representing approximately 2.7% of the initial pool balance, that will be serviced under the pooling and servicing agreement for this transaction. Such portfolio of mortgaged properties also secures two pari passu companion loans (each, a “serviced pari passu companion loan”). With respect to such portfolio of mortgaged | ||

| S-5 |

| properties, the related mortgage loan is referred to herein (together with its related serviced pari passu companion loan) as a “loan pair.” | ||

| The mortgaged property identified on APPENDIX I to this prospectus supplement as Aviare Place Apartments secures a mortgage loan representing approximately 0.7% of the initial pool balance, as well as a pari passu non-serviced companion loan. Such mortgage loan is referred to herein as a “mortgage loan” and a “non-serviced mortgage loan” and, together with its pari passu non-serviced companion loan, as a “non-serviced loan combination.” The related pari passu non-serviced companion loan will not be a “mortgage loan” hereunder. The entire Aviare Place Apartments non-serviced loan combination will be serviced under the MSBAM 2015-C23 pooling and servicing agreement. | ||

| See “Information About the Mortgage Pool—Characteristics of the Mortgage Pool—The A/B Whole Loans, Loan Pairs and Non-Serviced Loan Combinations” below. | ||

| S-6 |

| Relevant Parties, Dates and Periods | ||

| Issuing Entity | Bank of America Merrill Lynch Commercial Mortgage Trust 2015-UBS7, a New York common law trust, will issue the certificates. The issuing entity will be formed pursuant to a pooling and servicing agreement to be dated as of September 1, 2015, between the depositor, the master servicer, the special servicer, the trustee, the certificate administrator, the custodian and the trust advisor, in each case identified below in this “—Relevant Parties, Dates and Periods” section. See “Transaction Parties—The Issuing Entity” in this prospectus supplement. | |

| Depositor | Banc of America Merrill Lynch Commercial Mortgage Inc. The Depositor was incorporated in the State of Delaware on December 13, 1995 under the name “NationsLink Funding Corporation” and filed Certificates of Amendment of Certificate of Incorporation changing its name to “Banc of America Commercial Mortgage Inc.” on August 24, 2000 and further changing its name to “Banc of America Merrill Lynch Commercial Mortgage Inc.” on July 1, 2010. The Depositor is a wholly owned subsidiary of Bank of America, National Association, one of the Sponsors. It is not expected that the Depositor will have any business operations other than offering mortgage pass-through certificates and related activities. | |

| The Depositor maintains its principal executive office at One Bryant Park, New York, New York 10036. Its telephone number is (980) 388-7451. See “Transaction Parties—The Depositor” in this prospectus supplement and “The Depositor” in the accompanying prospectus. Neither the Depositor nor any of its affiliates has insured or guaranteed the offered certificates. | ||

| Master Servicer | Midland Loan Services, a Division of PNC Bank, National Association, a national banking association, will act as master servicer with respect to all of the mortgage loans in the issuing entity and will be primarily responsible for servicing and administering, directly or through sub-servicers (including any primary servicer), the mortgage loans (other than any non-serviced mortgage loans) and any related B note (other than the Charles River Plaza North non-serviced B note) or serviced companion loan pursuant to the pooling and servicing agreement; provided, that certain major decisions and special servicer decisions will be processed by the special servicer. In addition, the master servicer will be the primary party responsible for making principal and interest advances and, other than with respect to any non-serviced mortgage loan, servicing advances under the pooling and servicing agreement. The principal servicing offices of Midland Loan Services, a Division of PNC Bank, National Association are located at 10851 Mastin Street, Building 82, Suite 300, Overland Park, Kansas 66210, and its telephone number is (913) 253-9000. See “Servicing of the Mortgage Loans—General,” “Transaction Parties—The Master Servicer” and “Servicing of the Mortgage Loans—The Master Servicer” in this prospectus supplement. | |

| The master servicer’s principal compensation for its servicing activities will be the master servicing fee. See “Offered Certificates—Distributions—Servicing and Administration Fees” below and | ||

| S-7 |

| “Servicing of the Mortgage Loans—General,” “Transaction Parties—The Master Servicer” and “Servicing of the Mortgage Loans—The Master Servicer” in this prospectus supplement. In addition, the master servicer will be entitled to retain certain borrower paid fees and certain income from investment of certain accounts maintained as part of the issuing entity, as additional servicing compensation. | |||

| Except as provided below, each non-serviced mortgage loan (including the 261 Fifth Avenue mortgage loan prior to the securitization of the related pari passu companion loan) will be serviced by the master servicer under, and pursuant to the terms of, the pooling and servicing agreement governing the securitization of the related non-serviced companion loan (or applicable portion thereof) as follows: | |||

| · | The Charles River Plaza North mortgage loan, representing approximately 9.6% of the initial pool balance, will be serviced by the master servicer under the pooling and servicing agreement for the CSAIL 2015-C3 securitization (currently Midland Loan Services, a Division of PNC Bank, National Association), which is similar to the pooling and servicing agreement for this securitization in respect of servicing. | ||

| · | The 261 Fifth Avenue mortgage loan, representing approximately 9.2% of the initial pool balance, will initially be serviced (together with its related pari passu companion loan) by the master servicer under the pooling and servicing agreement for this securitization. After the securitization of the related pari passu companion loan, such mortgage loan will be a “non-serviced mortgage loan” and will be serviced (together with the related pari passu companion loan) under, and by the master servicer designated in, the pooling and servicing agreement entered into in connection with such securitization which is expected to be substantially similar to the pooling and servicing agreement for this securitization in respect of servicing. The master servicer under the pooling and servicing agreement for this securitization will be entitled to compensation for servicing such mortgage loan and the related pari passu companion loan for the period before the servicing transfer, and its right to indemnification and certain other rights in respect of its servicing activities will survive such transfer. | ||

| · | The Mall of New Hampshire mortgage loan, representing approximately 6.6% of the initial pool balance, will be serviced by the master servicer under the pooling and servicing agreement for the CSAIL 2015-C3 securitization (currently Midland Loan Services, a Division of PNC Bank, National Association), which is similar to the pooling and servicing agreement for this securitization in respect of servicing. | ||

| · | The Aviare Place Apartments mortgage loan, representing approximately 0.7% of the initial pool balance, will be serviced by the master servicer under the pooling and servicing agreement for the MSBAM 2015-C23 securitization (currently Wells Fargo Bank, National Association), which is substantially similar to the pooling and servicing agreement for this securitization in respect of servicing. | ||

| S-8 |

| Each servicer of a non-serviced mortgage loan will be entitled to receive a primary servicing fee with respect to such non-serviced mortgage loan; however, the master servicer under the pooling and servicing agreement for this securitization will continue to be primarily responsible for making debt service advances with respect to such non-serviced mortgage loan (and will not be responsible for making debt service advances with respect to the related non-serviced companion loan). See “Description of the Mortgage Pool—The Non-Serviced Loan Combinations” and “Servicing of the Mortgage Loans—Additional Matters Relating to the Servicing of the Non-Serviced Mortgage Loans” in this prospectus supplement. | ||

| Special Servicer | LNR Partners, LLC, a Florida limited liability company, will act as special servicer with respect to all of the mortgage loans in the issuing entity (other than any non-serviced mortgage loans and excluded special servicer mortgage loans) pursuant to the pooling and servicing agreement. The special servicer will be primarily responsible for making decisions and performing certain servicing functions with respect to such mortgage loans (and any related serviced companion loan or serviced B note) and any REO loans in respect of the foregoing, in each case that, in general, are in default or as to which default is imminent, as well as processing certain major decisions and special servicer decisions for all such mortgage loans regardless of whether they are, or will be, in default. It is anticipated that LNR Partners, LLC will be appointed to be the special servicer for this transaction at the request of the initial controlling class representative, which is expected to be Ellington Management Group, LLC or an affiliate thereof. See “—Controlling Class Representative” below. The principal servicing office of LNR Partners, LLC is located at 1601 Washington Avenue, Suite 700, Miami Beach, Florida 33139 and its telephone number is (305) 695-5600. See “Servicing of the Mortgage Loans—General,” “Transaction Parties—The Special Servicer” and “Servicing of the Mortgage Loans—The Special Servicer” in this prospectus supplement. | |

| If special servicer becomes a “borrower party” (as defined under “Servicing of the Mortgage Loans—The Special Servicer—Replacement of the Special Servicer and Appointment of an Excluded Special Servicer” in this prospectus supplement) with respect to any mortgage loan (referred to as an “excluded special servicer mortgage loan”), then the special servicer will be required to resign with respect to such mortgage loan. The controlling class representative (during any Subordinate Control Period) will be entitled to appoint a separate special servicer that is not a borrower party (referred to as an “excluded special servicer”) with respect to such excluded special servicer mortgage loan unless such excluded special servicer mortgage loan is also an excluded mortgage loan, in which case the largest controlling class certificateholder (by certificate principal balance) that is not an excluded controlling class holder will be entitled to appoint the excluded special servicer. During any Collective Consultation Period the largest controlling class certificateholder (by certificate principal balance) that is not an excluded controlling class holder will be entitled to appoint the excluded special servicer. During any Senior Consultation Period, certificateholders holding more than 50% of the voting rights (provided 20% or more exercise their right to vote) will be entitled to appoint the excluded special servicer. See “—Controlling Class Representative” below. Any excluded special servicer will be | ||

| S-9 |

| required to perform all of the obligations of the special servicer and will be entitled to all special servicing compensation with respect to such excluded special servicer mortgage loan earned during such time as the related mortgage loan is an excluded special servicer mortgage loan. | |||

| As used herein, “Affiliate” means, with respect to any specified person, any other person controlling or controlled by or under common control with such specified person; provided, that “control” when used with respect to any specified person means the power to direct the management and policies of such person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing. | |||

| References herein to the “special servicer” mean individually or collectively, as the context may require, LNR Partners, LLC as special servicer with respect to all mortgage loans other than any excluded special servicer mortgage loans and any non-serviced mortgage loans, and the excluded special servicer, as special servicer with respect to any excluded special servicer mortgage loans. Unless specifically stated otherwise, any rights, conditions or obligations of or applicable to the “special servicer” described herein (including with respect to qualification under the pooling and servicing agreement, compensation and resignation) apply equally to both LNR Partners, LLC and any excluded special servicer. | |||

| The special servicer’s principal compensation for its special servicing activities will be the special servicing fee, the workout fee and the liquidation fee. See “Offered Certificates—Distributions—Servicing and Administration Fees” below and “Servicing of the Mortgage Loans—General,” “Transaction Parties—The Special Servicer” and “Servicing of the Mortgage Loans—The Special Servicer” in this prospectus supplement. In addition, the special servicer will be entitled to retain certain borrower paid fees and certain income from investment of certain accounts maintained as part of the issuing entity, as additional servicing compensation. | |||

| Except as provided below, each non-serviced mortgage loan (including the 261 Fifth Avenue mortgage loan prior to the securitization of the related pari passu companion loan) if circumstances require will be specially serviced, if necessary, by the special servicer under, and pursuant to the terms of, the pooling and servicing agreement governing the securitization of the related non-serviced companion loan (or applicable portion thereof) as follows: | |||

| · | If necessary, the Charles River Plaza North mortgage loan, representing approximately 9.6% of the initial pool balance, if circumstances require will be specially serviced by the special servicer under the pooling and servicing agreement for the CSAIL 2015-C3 securitization (currently Rialto Capital Advisors, LLC), which is similar to the pooling and servicing agreement for this securitization in respect of servicing. | ||

| · | If necessary, the 261 Fifth Avenue mortgage loan, representing approximately 9.2% of the initial pool balance, will initially be specially serviced by the special servicer under the pooling and | ||

| S-10 |

| servicing agreement for this securitization. After the securitization of the related pari passu companion loan, such mortgage loan (together with the related pari passu companion loan) will be (if the circumstances require) specially serviced by the special servicer designated in the pooling and servicing agreement entered into in connection with such securitization. If such mortgage loan becomes specially serviced prior to the securitization of the related pari passu companion loan, the special servicer will be responsible for the servicing and administration of such mortgage loan (and the related pari passu companion loan) and will be entitled to compensation as described under the pooling and servicing agreement and the related intercreditor agreement. If such mortgage loan is being specially serviced when the related pari passu companion loan is securitized, the special servicer will be entitled to compensation for the period during which it acted as special servicer with respect to such mortgage loan, as well as all surviving indemnity and other rights in respect of such special servicing role. See “Risk Factors—Risks Related to the Offered Certificates—The Servicing of the 261 Fifth Avenue Loan Pair Is Expected to Shift to Others” in this prospectus supplement. | |||

| · | If necessary, The Mall of New Hampshire mortgage loan, representing approximately 6.6% of the initial pool balance, if circumstances require will be specially serviced by the special servicer under the pooling and servicing agreement for the CSAIL 2015-C3 securitization (currently Rialto Capital Advisors, LLC), which is similar to the pooling and servicing agreement for this securitization in respect of servicing. | ||

| · | If necessary, the Aviare Place Apartments mortgage loan, representing approximately 0.7% of the initial pool balance, if circumstances require will be specially serviced by the excluded mortgage loan special servicer under the pooling and servicing agreement for the MSBAM 2015-C23 securitization (currently Wells Fargo Bank, National Association), which is substantially similar to the pooling and servicing agreement for this securitization in respect of servicing. | ||

| See “Description of the Mortgage Pool—The Non-Serviced Loan Combinations” and “Servicing of the Mortgage Loans—Additional Matters Relating to the Servicing of the Non-Serviced Mortgage Loans” in this prospectus supplement. | |||

| With respect to each non-serviced mortgage loan and the 261 Fifth Avenue mortgage loan (after the securitization of the related pari passu companion loan), the holder of the related controlling note (or a representative thereof) will be entitled to direct the servicing of the related non-serviced loan combination or loan pair, as applicable; however, the controlling class representative (during any Subordinate Control Period and Collective Consultation Period) will have certain consultation rights with respect to such servicing and the right to require the replacement of the special servicer for the non-serviced loan combination or loan pair, as applicable, in certain circumstances after a servicer termination event with respect to such special servicer. See “Description of the Mortgage Pool—The Non-Serviced Loan | |||

| S-11 |

| Combinations” and “—The A/B Whole Loans and the Loan Pairs—The 261 Fifth Avenue Loan Pair” in this prospectus supplement. | ||||

| With respect to any A/B whole loan, the holder of the related B note will be entitled to direct the special servicing of the related A/B whole loan prior to a 200 Helen Street AB Control Appraisal Event (as described below in “Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs—The 200 Helen Street A/B Whole Loan” in this prospectus supplement). | ||||

| The special servicer under the pooling and servicing agreement for this securitization or, in the case of any non-serviced loan combination, the applicable special servicer under the related other pooling and servicing agreement may be removed and a successor special servicer appointed, at any time, as follows: | ||||

| · | with respect to the pool of mortgage loans other than any non-serviced mortgage loans (and in the case of a mortgage loan that is part of an A/B whole loan or loan pair, subject to the third bullet of this paragraph), during any Subordinate Control Period (as defined below), at the direction of the controlling class representative, if any, (a) for cause at any time and (b) without cause if (i) LNR Partners, LLC or its affiliate is no longer the special servicer or (ii) LNR Securities Holdings, LLC or its affiliate owns less than 15% of the then controlling class of certificates; | |||

| · | with respect to the pool of mortgage loans other than any non-serviced mortgage loans (and in the case of a mortgage loan that is part of an A/B whole loan or loan pair, subject to the third bullet of this paragraph), during any Collective Consultation Period and any Senior Consultation Period (each such term, as defined below), if the holders of at least 25% of the voting rights of the certificates request a vote to replace the special servicer, by the holders of certificates evidencing at least 75% of the voting rights of the certificates; and | |||

| · | in the case of a mortgage loan that is part of an A/B whole loan, loan pair or non-serviced loan combination where, to the extent provided for in the related intercreditor agreement, the holder of a related B note or serviced companion loan, as applicable (for so long as such holder is the directing holder in respect of such A/B whole loan, loan pair or non-serviced loan combination, as applicable), may, without cause, replace the special servicer for the related A/B whole loan, loan pair or non-serviced loan combination. In particular, | |||

| ○ | With respect to the Charles River Plaza North non-serviced loan combination, the related special servicer under the CSAIL 2015-C3 pooling and servicing agreement may be removed, with or without cause, and a successor special servicer appointed, at any time, by the holder of the related B note if the principal balance of such B note (as reduced or notionally reduced, as applicable, by the application of payments, losses and appraisal reductions) has not been reduced below 25% of its original principal balance (as reduced by principal payments), and (if such B note does not | |||

| S-12 |

| satisfy such criteria) by the CSAIL 2015-C3 controlling class representative or certificateholders with the requisite CSAIL 2015-C3 voting rights, as applicable, all pursuant to the terms of the related intercreditor agreement and the CSAIL 2015-C3 pooling and servicing agreement, the terms of which pooling and servicing agreement are similar to those contained in the pooling and servicing agreement for this transaction; provided, that the CSAIL 2015-C3 pooling and servicing agreement imposes different limitations on the ability of the applicable controlling class representative to remove the special servicer without cause. | ||||

| ○ | With respect to the 261 Fifth Avenue loan pair, the related special servicer is subject to removal by the related pari passu companion loan holder and (following a securitization of the related pari passu companion loan) the related special servicer is expected to be subject to removal (and replacement by a successor special servicer) pursuant to similar terms contained in the pooling and servicing agreement related to the securitization of the related pari passu companion loan; provided, that such pooling and servicing agreement (i) may provide for certain variations in the percentage of certificateholders required to consent to a removal of the special servicer and (ii) different (or no) limitations on the ability of the applicable controlling class representative to remove the special servicer without cause. | |||

| ○ | With respect to any non-serviced loan combinations (other than 261 Fifth Avenue and Charles River Plaza North), the related special servicer under the pooling and servicing agreement pursuant to which such non-serviced loan combination is being serviced may generally be replaced on terms that are similar to those for the replacement of the special servicer under the pooling and servicing agreement for this transaction. | |||

| See “—Directing Holders” below and “Servicing of the Mortgage Loans—The Special Servicer—Replacement of the Special Servicer Without Cause,” “Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs” and “—The Non-Serviced Loan Combinations” in this prospectus supplement. | ||||

| In addition, the special servicer may be removed as special servicer with respect to a mortgage loan or Loan Pair if the special servicer becomes a “borrower party” with respect to an “excluded special servicer mortgage loan” under the circumstances described in “Servicing of the Mortgage Loans—The Special Servicer—Replacement of the Special Servicer and Appointment of an Excluded Special Servicer” in this prospectus supplement. | ||||

| Finally, in the case of any non-serviced loan combination (including the 261 Fifth Avenue mortgage loan (after the securitization of the related pari passu companion loan)), the applicable special servicer under the related other pooling and servicing agreement may contain provisions providing for the special servicer to be removed for conflicts similar to those described in “Servicing of the Mortgage Loans—The Special Servicer—Replacement of the Special Servicer and Appointment of an | ||||

| S-13 |

| Excluded Special Servicer” in this prospectus supplement pursuant to the terms of the related other pooling and servicing agreement. | ||

| Other Servicers | Rialto Capital Advisors, LLC is the special servicer with respect to the CSAIL 2015-C3 securitization and, accordingly, is responsible for servicing of the Charles River Plaza North Non-Serviced Loan Combination and The Mall of New Hampshire Non-Serviced Loan Combination. | |

| Trustee, Certificate Administrator | ||

| and Custodian | U.S. Bank National Association, a national banking association, will act as trustee of the issuing entity on behalf of the certificateholders, as certificate administrator, certificate registrar and authenticating agent for the certificates and as custodian of the mortgage loan files (or, in the case of any non-serviced mortgage loan, of only the related mortgage note). The corporate trust offices of U.S. Bank National Association are located at 190 S. LaSalle Street, 7th Floor, Mail Code: MK-IL-SL7C, Chicago, Illinois 60603, Attention: BACM 2015-UBS7, the office designated for purposes of certificate transfers and exchanges is located at 111 Fillmore Avenue, St. Paul, Minnesota 55107, Attention: Bondholder Services – BACM 2015-UBS7, and the document custody office is located at 1133 Rankin Street, Suite 100, St. Paul, Minnesota 55116, Attention: BACM 2015-UBS7. | |

| Following the transfer of the mortgage loans into the issuing entity, the trustee, on behalf of the issuing entity, will become the mortgagee of record of each mortgage loan transferred to the issuing entity (other than any non-serviced mortgage loan (including the 261 Fifth Avenue mortgage loan following the securitization of the related pari passu companion loan), with respect to which the mortgagee of record will be the holder of the related non-serviced companion loan or applicable portion thereof (or the trustee in respect of the securitization thereof)). In addition, the trustee will be primarily responsible for back-up advancing if the master servicer fails to perform its advancing obligations. | ||

| The certificate administrator will be primarily responsible for making allocations and distributions to the holders of the certificates. The certificate administrator will have, or will be responsible for appointing an agent to perform, additional duties with respect to tax administration of the issuing entity. See “Transaction Parties—The Trustee, Certificate Administrator and Custodian” in this prospectus supplement. | ||

| With respect to the 261 Fifth Avenue mortgage loan, the mortgage loan seller initially will be required to deliver the related mortgage loan documents (other than any promissory note evidencing the related pari passu companion loan) to the trustee or the custodian on its behalf. Following a securitization of the related pari passu companion loan, the person contributing such portion of the companion loan to the related securitization will be entitled to (a) direct the trustee or custodian to deliver (and to retain photocopies in connection therewith of) all such mortgage loan documents (other than any promissory note evidencing such mortgage loan) to the other trustee or custodian and (b) cause the | ||

| S-14 |

| completion and recordation of instruments of assignment in the name of such other trustee or custodian. | ||

| Controlling Class Representative | The controlling class representative will be the representative appointed by more than 50% of the controlling class certificateholders (by certificate principal balance), as determined by the certificate registrar from time to time as provided in the pooling and servicing agreement. A summary of the consent and consultation rights of the controlling class representative, and the limitations thereon, is set forth below. It is anticipated that Ellington Management Group, LLC or an affiliate thereof will be the initial controlling class representative. There will be no controlling class representative for an excluded mortgage loan. | |

| An “excluded mortgage loan” is a mortgage loan, A/B whole loan or loan pair with respect to which the controlling class representative, or any holder of more than 50% of the controlling class, is a borrower party. | ||

| The controlling class means, as of any time of determination, the most subordinate class of Control Eligible Certificates then outstanding that has an aggregate certificate principal balance (taking into account the application of any appraisal reductions to notionally reduce the aggregate certificate principal balance of such class) at least equal to 25% of the initial certificate principal balance of such class; provided that if no class of Control Eligible Certificates has an aggregate certificate principal balance (taking into account the application of any appraisal reductions to notionally reduce the aggregate certificate principal balance of such class) at least equal to 25% of the initial aggregate certificate principal balance of such class, then the controlling class will be the most senior class of Control Eligible Certificates. The controlling class on the closing date will be the Class H Certificates. | ||

| The Control Eligible Certificates will be the Class E, Class F, Class G and Class H Certificates. No other class of certificates will be eligible to act as the controlling class or appoint the controlling class representative. | ||

| A Subordinate Control Period means any period when the aggregate certificate principal balance of the Class E Certificates (taking into account the application of appraisal reductions to notionally reduce the aggregate certificate principal balance of such class) is at least 25% of the initial aggregate certificate principal balance of the Class E Certificates. | ||

| A Collective Consultation Period means any period when both (i) the aggregate certificate principal balance of the Class E Certificates (taking into account the application of appraisal reductions to notionally reduce the aggregate certificate principal balance of such class) is less than 25% of the initial aggregate certificate principal balance of the Class E Certificates and (ii) the aggregate certificate principal balance of the Class E Certificates (without regard to any appraisal reductions allocable to such class) is at least 25% of the initial aggregate certificate principal balance of the Class E Certificates. | ||

| A Senior Consultation Period means any period when the aggregate certificate principal balance of the Class E Certificates (without regard | ||

| S-15 |

| to any appraisal reductions allocable to such class) is less than 25% of the initial aggregate certificate principal balance of the Class E Certificates. | |

| During any Subordinate Control Period, the controlling class representative will have certain consent and consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters. | |

| During any Collective Consultation Period and any Senior Consultation Period, the controlling class representative will not have any consent rights. However, during any Collective Consultation Period, the controlling class representative will have non-binding consultation rights with respect to certain major decisions and other matters in accordance with the pooling and servicing agreement. | |

| During any Senior Consultation Period, the controlling class representative will not have any consent or consultation rights, except with respect to any such rights that are expressly operative during such period pursuant to the pooling and servicing agreement. See “Servicing of the Mortgage Loans—The Controlling Class Representative” in this prospectus supplement. | |

| If any mortgage loan is part of an A/B whole loan, loan pair or non-serviced loan combination, the controlling class representative’s consent and/or consultation rights with respect thereto may be limited as further described in this prospectus supplement. The existence of a Subordinate Control Period, Collective Consultation Period or Senior Consultation Period will not limit any control and/or consultation rights of the holder of any related B note or companion loan. See “—Directing Holders” below, and “Risk Factors—Risks Related to the Offered Certificates—Realization on a Mortgage Loan That Is Part of an A/B Whole Loan or Loan Pair May Be Adversely Affected by the Rights of the Related Directing Holder,” “Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs” and “—The Non-Serviced Loan Combinations” in this prospectus supplement. | |

| The controlling class representative will have certain approval rights and rights to direct and consult with the special servicer as described under “Servicing of the Mortgage Loans—The Controlling Class Representative” in this prospectus supplement. For instance, during a Subordinate Control Period, the controlling class representative may direct the special servicer to take actions that conflict with and adversely affect the interests of holders of certain classes of certificates. | |

| In connection with the servicing of the mortgage loans, the special servicer may, at the direction of the controlling class representative or a directing holder, as applicable, take actions with respect to the mortgage loans (other than any non-serviced mortgage loan) that could adversely affect the holders of some of the classes of certificates. Additionally, the special servicer may be removed without cause by the controlling class representative, if any (during a Subordinate Control Period and only if (i) LNR Partners, LLC or its affiliate is no longer the special servicer or (ii) LNR Securities Holdings, LLC or its affiliate owns less than 15% of the then controlling class of certificates), or with respect to a mortgage loan that is part of an A/B whole loan or loan pair, by the related directing holder. As a result of these rights, the | |

| S-16 |

| controlling class representative and any directing holder may have interests in conflict with those of the other certificateholders. See “Risk Factors—Risks Related to Conflicts of Interest—Conflicts of Interest of the Controlling Class Representative; Rights of the Controlling Class Representative Could Adversely Affect Your Investment” and “—Conflicts of Interest of the Directing Holders; Rights of the Directing Holders Could Adversely Affect Your Investment” in this prospectus supplement. | |

| The controlling class representative may have interests that differ from or are in conflict with those of other certificateholders and its decisions may not be in the best interest of or may be adverse to other certificateholders. | |