Exhibit (a)(5)(N)

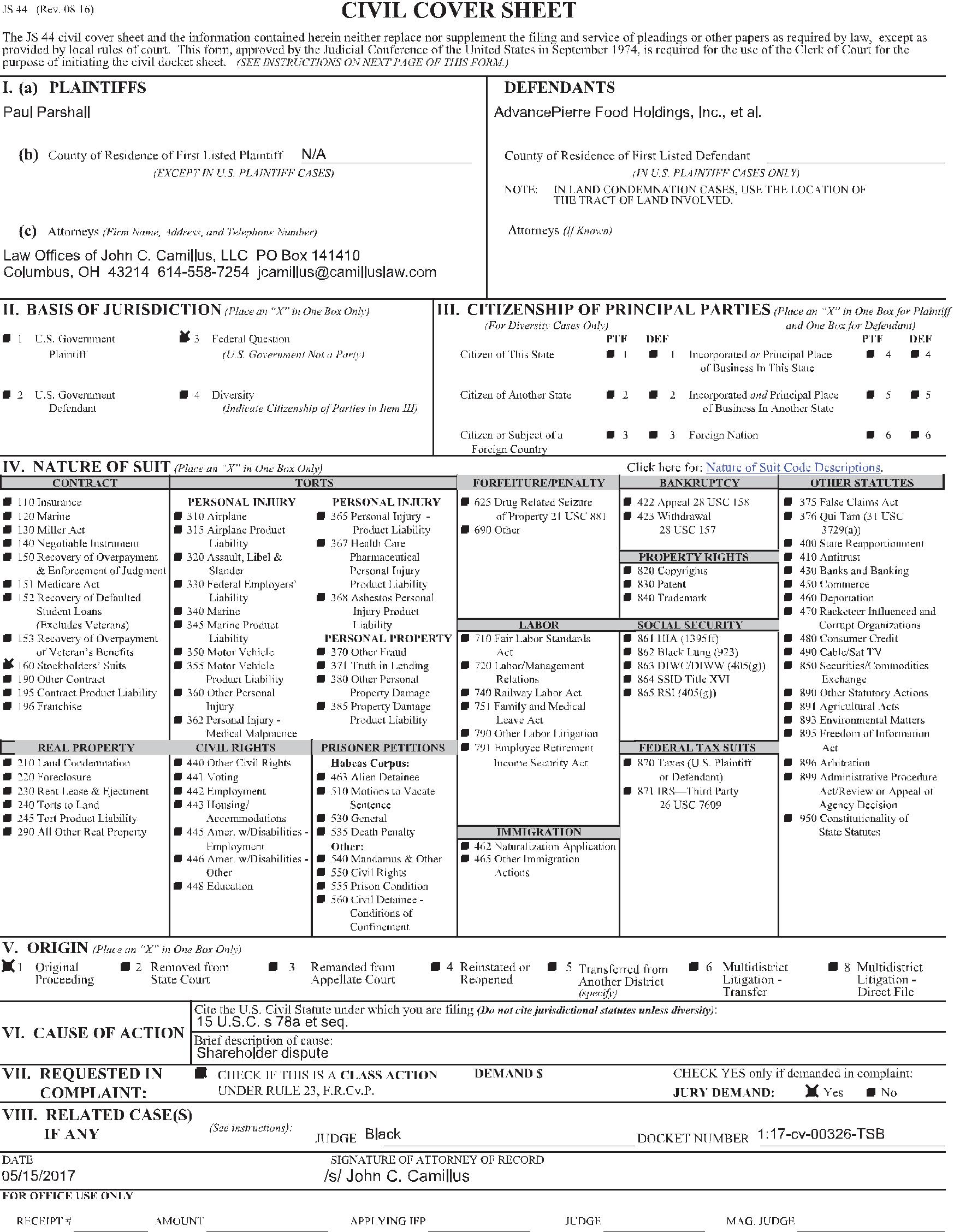

IN THE UNITED STATES DISTRICT COURT

FOR THE SOUTHERN DISTRICT OF OHIO

WESTERN DIVISION

PAUL PARSHALL, On Behalf of Himself and All Others Similarly Situated,

Plaintiff,

v.

ADVANCEPIERRE FOODS HOLDINGS, INC., DEAN HOLLIS, CELESTE A. CLARK, PETER C. DILLINGHAM, STEPHEN A. KAPLAN, GARY L. PERLIN, MATTHEW C. WILSON, JOHN N. SIMONS, JR., CHRISTOPHER D. SLIVA, TYSON FOODS, INC., and DVB MERGER SUB, INC.,

Defendants,

|

) ) ) ) ) ) ) ) ) ) ) |

Case No. _______________ Judge __________________ CLASS ACTION DEMAND FOR JURY TRIAL |

COMPLAINT FOR VIOLATION OF THE SECURITIES EXCHANGE ACT OF 1934

Plaintiff, by his undersigned attorneys, for this complaint against defendants, alleges upon personal knowledge with respect to himself, and upon information and belief based upon, inter alia, the investigation of counsel as to all other allegations herein, as follows:

NATURE OF THE ACTION

1.

This

action stems from a proposed transaction announced on April 25, 2017 (the “Proposed Transaction”), pursuant to which  AdvancePierre

Foods Holdings, Inc. (“AdvancePierre” or the “Company”) will be acquired by Tyson Foods, Inc.

(“Parent”) and its wholly-owned subsidiary, DVB Merger Sub, Inc. (“Merger Sub,” and together with

Parent, “Tyson”).

AdvancePierre

Foods Holdings, Inc. (“AdvancePierre” or the “Company”) will be acquired by Tyson Foods, Inc.

(“Parent”) and its wholly-owned subsidiary, DVB Merger Sub, Inc. (“Merger Sub,” and together with

Parent, “Tyson”).

2. On April 25, 2017, AdvancePierre’s Board of Directors (the “Board” or “Individual Defendants”) caused the Company to enter into an agreement and plan of merger (the “Merger Agreement”) with Tyson. Pursuant to the terms of the Merger Agreement, Tyson commenced a

tender offer, set to expire on June 6, 2017, and stockholders of AdvancePierre will receive $40.25 per share in cash.

3. On May 9 2017, defendants filed a Solicitation/Recommendation Statement (the “Solicitation Statement”) with the United States Securities and Exchange Commission (“SEC”) in connection with the Proposed Transaction.

4. The Solicitation Statement omits material information with respect to the Proposed Transaction, which renders the Solicitation Statement false and misleading. Accordingly, plaintiff alleges herein that defendants violated Sections 14(e), 14(d), and 20(a) of the Securities Exchange Act of 1934 (the “1934 Act”) in connection with the Solicitation Statement, and that the close of the tender offer should be enjoined until defendants disclose the material information sought herein.

JURISDICTION AND VENUE

5. This Court has jurisdiction over all claims asserted herein pursuant to Section 27 of the 1934 Act because the claims asserted herein arise under Sections 14(e), 14(d), and 20(a) of the 1934 Act and Rule 14a-9.

6. This Court has jurisdiction over defendants because each defendant is either a corporation that conducts business in and maintains operations within this District, or is an individual with sufficient minimum contacts with this District so as to make the exercise of jurisdiction by this Court permissible under traditional notions of fair play and substantial justice.

7. Venue is proper under 28 U.S.C. § 1391 because a substantial portion of the transactions and wrongs complained of herein occurred in this District.

PARTIES

8. Plaintiff is, and has been continuously throughout all times relevant hereto, the

2

owner of AdvancePierre common stock.

9. Defendant AdvancePierre is a Delaware corporation and maintains its principal executive offices at 9987 Carver Road, Blue Ash, Ohio 45242. AdvancePierre’s common stock is traded on the NYSE under the ticker symbol “APFH.”

10. Defendant Dean Hollis (“Hollis”) has served as a director of AdvancePierre since 2008 and is Chairman of the Board. According to the Company’s website, Hollis is a member of the Compensation Committee and the Nominating and Corporate Governance Committee.

11. Defendant Celeste A. Clark (“Clark”) has served as a director of AdvancePierre since February 2016. According to the Company’s website, Clark is Chair of the Nominating and Corporate Governance Committee and a member of the Audit Committee.

12. Defendant Peter C. Dillingham (“Dillingham”) has served as a director of AdvancePierre since 2014. According to the Company’s website, Dillingham is a member of the Compensation Committee and the Nominating and Corporate Governance Committee.

13. Defendant Stephen A. Kaplan (“Kaplan”) has served as a director of AdvancePierre since 2008.

14. Defendant Gary L. Perlin (“Perlin”) has served as a director of AdvancePierre since March 2016. According to the Company’s website, Perlin is Chair of the Audit Committee and Chair of the Compensation Committee.

15. Defendant Matthew C. Wilson (“Wilson”) has served as a director of AdvancePierre since 2008. According to the Company’s website, Wilson is a member of the Audit Committee and the Compensation Committee.

16. Defendant John N. Simons, Jr. (“Simons”) has served as a director and Chief Executive Officer (“CEO”) of AdvancePierre since October 2013.

3

17. Defendant Christopher D. Sliva (“Sliva”) has served as a director and President of AdvancePierre since November 2016.

18. The defendants identified in paragraphs 10 through 17 are collectively referred to herein as the “Individual Defendants.”

19. Defendant Parent is a Delaware corporation and a party to the Merger Agreement.

20. Defendant Merger Sub is a Delaware corporation, a wholly-owned subsidiary of Parent, and a party to the Merger Agreement.

CLASS ACTION ALLEGATIONS

21. Plaintiff brings this action as a class action on behalf of himself and the other public stockholders of AdvancePierre (the “Class”). Excluded from the Class are defendants herein and any person, firm, trust, corporation, or other entity related to or affiliated with any defendant.

22. This action is properly maintainable as a class action.

23. The Class is so numerous that joinder of all members is impracticable. As of April 21, 2017, there were approximately 78,664,929 shares of Company common stock outstanding, held by hundreds, if not thousands, of individuals and entities scattered throughout the country.

24. Questions of law and fact are common to the Class, including, among others: (i) whether defendants violated the 1934 Act; and (ii) whether defendants will irreparably harm plaintiff and the other members of the Class if defendants’ conduct complained of herein continues.

25. Plaintiff is committed to prosecuting this action and has retained competent counsel experienced in litigation of this nature. Plaintiff’s claims are typical of the claims of the other members of the Class and plaintiff has the same interests as the other members of the Class. Accordingly, plaintiff is an adequate representative of the Class and will fairly and adequately protect the interests of the Class.

4

26. The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications that would establish incompatible standards of conduct for defendants, or adjudications that would, as a practical matter, be dispositive of the interests of individual members of the Class who are not parties to the adjudications or would substantially impair or impede those non-party Class members’ ability to protect their interests.

27. Defendants have acted, or refused to act, on grounds generally applicable to the Class as a whole, and are causing injury to the entire Class. Therefore, final injunctive relief on behalf of the Class is appropriate.

SUBSTANTIVE ALLEGATIONS

Background of the Company and the Proposed Transaction

28. AdvancePierre is a leading national producer and distributor of value-added, convenient, ready-to-eat sandwiches, sandwich components, and other entrées and snacks to a wide variety of distribution outlets including foodservice, retail, and convenience store providers.

29. The Company offers a broad line of products across all day parts including ready-to-eat sandwiches, such as breakfast sandwiches, peanut butter and jelly sandwiches, and hamburgers; sandwich components, such as fully cooked hamburger and chicken patties, and Philly steaks; and other entrées and snacks, such as country-fried steak, stuffed entrées, chicken tenders, and cinnamon dough bites.

30. On March 9, 2017, AdvancePierre issued a press release wherein it reported its financial results for the fourth quarter and full year ended December 31, 2016.

31. For the fourth quarter, GAAP net income was $33.1 million, or $0.42 per diluted share, and adjusted net income was $42.0 million, or $0.53 per diluted share. Net sales were $409.4 million, which included organic core volume growth of 5.7%, and adjusted EBITDA was

5

$81.2 million.

32. For the full year 2016, GAAP net income was $136.3 million, or $1.90 per diluted share, and adjusted net income was $124.4 million, or $1.73 per diluted share. Net sales were $1.568 billion, which included organic core volume growth of 2.5%, and adjusted EBITDA was $300.2 million.

33. With respect to the financial results, Individual Defendant Simons commented:

Our fourth quarter results were highlighted by profitable growth in each of our three core segments, strong cash flow generation, and the completion of another strategic business acquisition[.] In 2016 we delivered on our commitments to achieve solid organic growth, increase earnings, and deploy cash flow to reward our shareholders with an attractive dividend.

34. Additionally, Individual Defendant Sliva commented: “We plan to continue to invest in highly accretive acquisitions and reduce leverage[.] Our growth trajectory sets us apart from the broader food industry and we are well positioned to continue our momentum driven by execution of our continuous improvement process, ‘the APF Way’, in 2017 and beyond.”

35. Nevertheless, the Board caused the Company to enter into the Merger Agreement, pursuant to which AdvancePierre will be acquired for inadequate consideration.

36. The Individual Defendants have all but ensured that another entity will not emerge with a competing proposal by agreeing to a “no solicitation” provision in the Merger Agreement that prohibits the Individual Defendants from soliciting alternative proposals and severely constrains their ability to communicate and negotiate with potential buyers who wish to submit or have submitted unsolicited alternative proposals. Sections 7.03(a) and (g) of the Merger Agreement provide:

(a) General Prohibitions. From and after the date hereof until the earlier to occur of the Acceptance Time or the date of termination of this Agreement in accordance with Article 11, neither the Company nor any of its Subsidiaries shall, nor shall the Company or any of its Subsidiaries authorize or permit any of its or their officers,

6

directors, employees, investment bankers, attorneys, accountants, consultants or other agents, advisors or other representatives (“Representatives”) to, directly or indirectly, (i) solicit, initiate or knowingly take any action to facilitate or encourage the submission of any Acquisition Proposal, (ii) enter into, engage in or participate in any discussions or negotiations with, furnish any nonpublic information relating to the Company or any of its Subsidiaries or afford access to the business, properties, assets, books or records of the Company or any of its Subsidiaries to, otherwise knowingly cooperate in any way with, or knowingly assist, participate in, facilitate or encourage any effort by any Third Party that is seeking to make, or has made, an Acquisition Proposal, (iii) (A) qualify, withdraw or modify in a manner adverse to Parent or Merger Sub, or propose publicly to qualify, withdraw or modify the Company Board Recommendation, (B) adopt, endorse, approve or recommend, or propose publicly to adopt, endorse, approve or recommend, any Acquisition Proposal, or resolve to take any such action, (C) publicly make any recommendation in connection with a tender offer or exchange offer (other than the Offer) other than a recommendation against such offer or a temporary “stop, look and listen” communication by the Board of Directors of the type contemplated by Rule 14d-9(f) under the 1934 Act; (D) other than with respect to a tender or exchange offer described in clause (C), following the date any Acquisition Proposal or any material modification thereto is first made public, fail to issue a press release reaffirming the Company Board Recommendation within ten Business Days after a request by Parent to do so (provided the Company shall not be required to issue more than one such press release in response to any Acquisition Proposal or any material modification thereto) or (E) fail to include the Company Board Recommendation in the Schedule 14D-9 when disseminated to the Company’s stockholders (any of the foregoing in this clause (iii), an “ Adverse Recommendation Change”), or (iv) enter into any agreement in principle, letter of intent, term sheet, merger agreement, acquisition agreement, option agreement or other Contract relating to an Acquisition Proposal. It is agreed that any violation of the restrictions on the Company set forth in this Section by any Subsidiary of the Company or any Representative of the Company or any of its Subsidiaries shall be a breach of this Section by the Company.

(g) Obligation of the Company to Terminate Existing Discussions. The Company shall, and shall cause its Subsidiaries and its and their Representatives to, cease immediately and cause to be terminated any and all existing activities, discussions or negotiations, if any, with any Third Party and its Representatives and its financing sources and shall promptly request that each such Third Party, if any, shall promptly return or destroy all confidential information heretofore furnished to such Person by or on behalf of the Company or any of its Subsidiaries (and all analyses and other materials prepared by or on behalf of such Person that contains, reflects or analyzes that information). If received by the Company, the Company shall provide to Parent all certifications of such return or destruction from such other Persons as promptly as practicable after receipt thereof.

37. Further, the Company must promptly advise Tyson of any proposals or inquiries

7

received from other parties. Section 7.03(d) of the Merger Agreement states:

(d) Required Notices. The Company shall notify Parent promptly (but in no event later than 24 hours) after receipt by the Company (or any of its Representatives) of any Acquisition Proposal or any request for nonpublic information relating to the Company or any of its Subsidiaries in connection with any such Acquisition Proposal (or for the purpose of facilitating the submission of an Acquisition Proposal) or request for access to the business, properties, assets, books or records of the Company or any of its Subsidiaries by any Third Party that has made an Acquisition Proposal or that has made such request for the purpose of facilitating the submission of an Acquisition Proposal. The Company shall provide such notice orally and in writing and shall identify the Third Party making, and the material terms and conditions of, any such Acquisition Proposal. The Company shall keep Parent reasonably informed, on a reasonably prompt basis, of the status of any such Acquisition Proposal and shall promptly (but in no event later than 24 hours after receipt) provide to Parent copies of all correspondence and written materials sent by or provided to the Company or any of its Subsidiaries or any of their respective Representatives that describes the material terms or conditions of any Acquisition Proposal (as well as written summaries of any oral communications addressing such matters). Any material amendment to any Acquisition Proposal will be deemed to be a new Acquisition Proposal for purposes of the Company’s compliance with this Section 7.03(d).

38. Moreover, the Merger Agreement contains a highly restrictive “fiduciary out” provision permitting the Board to withdraw its approval of the Proposed Transaction under extremely limited circumstances, and grants Tyson a “matching right” with respect to any “Superior Proposal” made to the Company. Section 7.03(e) of the Merger Agreement states:

(e) “Last Look”. Further, the Board of Directors shall not make an Adverse Recommendation Change or terminate this Agreement pursuant to Section 11.01(d)(i), unless (i) the Company notifies Parent in writing, at least five Business Days before taking that action, of its intention to do so, specifying in reasonable detail the reasons for such Adverse Recommendation Change and/or such termination, attaching (A) in the case of an Adverse Recommendation Change to be made in connection with a Superior Proposal or a termination of this Agreement pursuant to Section 11.01(d)(i), the most current version of the proposed agreement under which a Superior Proposal is proposed to be consummated and the identity of the third party making the Acquisition Proposal, or (B) in the case of an Adverse Recommendation Change to be made pursuant to an Intervening Event, a reasonably detailed description of the reasons for making such Adverse Recommendation Change, (ii) the Company has negotiated, and has caused its Representatives to negotiate, in good faith with Parent during such notice period any revisions to the terms of this Agreement that Parent proposes and has not

8

withdrawn in response to such Superior Proposal and that would be binding on Parent if accepted by the Company and (iii) following the end of such notice period, the Board of Directors shall have determined, in consultation with outside legal counsel and its independent financial advisor, and giving due consideration to such revisions proposed by Parent, that (A) in the case of an Adverse Recommendation Change to be made in connection with a Superior Proposal or a termination of this Agreement pursuant to Section 11.01(d)(i), such Superior Proposal would nevertheless continue to constitute a Superior Proposal (assuming such revisions proposed by Parent were to be given effect) (it being understood and agreed that any amendment to the financial terms or other material terms of such Superior Proposal shall require a new written notification from the Company and a new three Business Day period under this Section 7.03(e)) and (B) in the case of an Adverse Recommendation Change to be made pursuant to an Intervening Event, obviates the need for such recommendation change, and in either case, the Board of Directors determines in good faith, after consultation with outside legal counsel, that failure to take such action would be inconsistent with its fiduciary duties under Delaware Law.

39. Further locking up control of the Company in favor of Tyson, the Merger Agreement provides for a “termination fee” of $100 million payable by the Company to Tyson if the Individual Defendants cause the Company to terminate the Merger Agreement.

40. By agreeing to all of the deal protection devices, the Individual Defendants have locked up the Proposed Transaction and have precluded other bidders from making successful competing offers for the Company.

41. Additionally, Parent and Merger Sub entered into a tender and support agreement (the “Support Agreement”) with the principal stockholder of the Company, Oaktree Capital Management, L.P. and its affiliates (“Oaktree”), which beneficially own approximately 42% of the outstanding shares of Company common stock. Pursuant to the Support Agreement, Oaktree has agreed to tender its shares in the tender offer. Accordingly, such shares are already locked up in favor of the Proposed Transaction.

42. The merger consideration to be paid to plaintiff and the Class in the Proposed Transaction is inadequate.

9

43. Among other things, the intrinsic value of the Company is materially in excess of the amount offered in the Proposed Transaction.

44. The merger consideration also fails to adequately compensate the Company’s stockholders for the significant synergies that will result from the merger.

45. The analyses performed by the Company’s own financial advisors, Credit Suisse Securities (USA) LLC (“Credit Suisse”) and Moelis & Company LLC (“Moelis”), confirm the inadequacy of the merger consideration. For example, Moelis’s Discounted Cash Flow Analysis yielded implied per share values for the Company as high as $49.85. Additionally, Credit Suisse’s Discounted Cash Flow Analyses yielded implied per share values for the Company as high as $46.97.

46. Accordingly, the Proposed Transaction will deny Class members their right to share proportionately and equitably in the true value of the Company’s valuable and profitable business, and future growth in profits and earnings.

The Solicitation Statement Omits Material Information, Rendering It False and Misleading

47. Defendants filed the Solicitation Statement with the SEC in connection with the Proposed Transaction.

48. The Solicitation Statement omits material information regarding the Proposed Transaction, which renders the Solicitation Statement false and misleading.

49. First, the Solicitation Statement omits material information regarding the Company’s financial projections and the financial analyses performed by the Company’s financial advisors, Credit Suisse and Moelis.

50. With respect to the Company’s financial projections, the Solicitation Statement fails to disclose: unlevered, after-tax free cash flows; stock-based compensation expense; cash

10

taxes; net operating losses; capital expenditures; acquisitions; increases in net working capital; payments to pre-IPO stockholders of the Company; interest expense; income tax expense; depreciation and amortization; non-cash and other adjustment items; deferred tax asset valuation allowances; debt refinancing charges; impairment charges; restructuring expenses; sponsor fees and expenses; merger and acquisition expenses; public filing expenses; the “comments [to the “Management Plan”] from the Transactions Committee” provided on April 14, 2017; and a reconciliation of all non-GAAP to GAAP metrics.

51. The Solicitation Statement further fails to disclose the Company’s current estimated value of the “TRA Settlement Amount,” the value ascribed to it by Parent in connection with the Proposed Transaction, and who will ultimately receive such payment.

52. With respect to Credit Suisse’s Discounted Cash Flow Analyses, the Solicitation Statement fails to disclose: (i) the unlevered, after-tax free cash flows that the Company was forecasted to generate during the last three quarters of the fiscal year ending December 31, 2017 through the full fiscal year ending December 31, 2021, and the constituent line items; (ii) the net present value of the Company’s net tax attributes; (iii) the terminal values for the Company; and (iv) the inputs underlying the discount rate range of 6.0% to 7.0%.

53. With respect to Credit Suisse’s Selected Public Companies Analysis, the Solicitation Statement fails to disclose the individual multiples and financial metrics for the companies observed by Credit Suisse in the analysis.

54. With respect to Credit Suisse’s Selected Precedent Transactions Analysis, the Solicitation Statement fails to disclose the individual multiples and financial metrics for the transactions observed by Credit Suisse in the analysis.

55. With respect to Moelis’s Discounted Cash Flow Analysis, the Solicitation

11

Statement fails to disclose: (i) the Company’s estimated after-tax unlevered free cash flows for July 1, 2017 through December 31, 2021, and the constituent line items; (ii) the estimated terminal values; (iii) the cash flows related to tax attributes of the Company and related payments owed under the Company’s income tax receivable agreement; and (iv) the inputs underlying the discount rate range of 6.5% to 8.5%.

56. The disclosure of projected financial information is material because it provides stockholders with a basis to project the future financial performance of a company, and allows stockholders to better understand the financial analyses performed by the company’s financial advisor in support of its fairness opinion. Moreover, when a banker’s endorsement of the fairness of a transaction is touted to shareholders, the valuation methods used to arrive at that opinion as well as the key inputs and range of ultimate values generated by those analyses must also be fairly disclosed.

57. The omission of this material information renders the Solicitation Statement false and misleading, including, inter alia, the following section of the Solicitation Statement: “Item 4. The Solicitation or Recommendation.”

58. Second, the Solicitation Statement omits material information regarding potential conflicts of interest of the Company’s officers and directors.

59. Specifically, the Solicitation Statement fails to disclose the timing and nature of all communications regarding future employment and/or directorship of AdvancePierre’s officers and directors, including who participated in all such communications.

60. Communications regarding post-transaction employment during the negotiation of the underlying transaction must be disclosed to stockholders. This information is necessary for stockholders to understand potential conflicts of interest of management and the Board, as that

12

information provides illumination concerning motivations that would prevent fiduciaries from acting solely in the best interests of the Company’s stockholders.

61. The omission of this material information renders the Solicitation Statement false and misleading, including, inter alia, the following sections of the Solicitation Statement: (i) “Item 3. Past Contacts, Transactions, Negotiations and Agreements”; and (ii) “Item 4. The Solicitation or Recommendation.”

62. Third, the Solicitation Statement omits material information regarding the background of the Proposed Transaction. The Company’s stockholders are entitled to an accurate description of the process the directors used in coming to their decision to support the Proposed Transaction.

63. The Solicitation Statement fails to disclose the terms and values of the seven indications of interest received by the Company in 2015, as well as the terms and value of “Party A’s” proposal.

64. The Solicitation Statement also fails to disclose the “third party consultant” that prepared information for AdvancePierre regarding obligations under the tax receivable agreement, the nature of the services provided by the consultant in connection with the Proposed Transaction, the amount of compensation received or to be received by the consultant for such services, whether the consultant has performed past services for the Company, Tyson, Oaktree, or their affiliates, and the amount of compensation received for any such services.

65. The omission of this material information renders the Solicitation Statement false and misleading, including, inter alia, the following section of the Solicitation Statement: “Item 4. The Solicitation or Recommendation.”

66. Fourth, the Solicitation Statement omits material information regarding potential

13

conflicts of interest of Moelis and Credit Suisse.

67. For example, the Solicitation Statement fails to disclose whether Moelis has provided services to the Company or its affiliates in the past, as well as the amount of compensation received by Moelis for such services.

68. The Solicitation Statement fails to disclose the amount of compensation received by Credit Suisse for providing lender services under certain credit facilities of Oaktree and related entities.

69. Additionally, the Solicitation Statement fails to disclose Moelis’s and Credit Suisse’s holdings in Tyson and its affiliates’ stock.

70. Full disclosure of investment banker compensation and all potential conflicts is required due to the central role played by investment banks in the evaluation, exploration, selection, and implementation of strategic alternatives.

71. The omission of this material information renders the Solicitation Statement false and misleading, including, inter alia, the following section of the Solicitation Statement: “Item 4. The Solicitation or Recommendation.”

72. The above-referenced omitted information, if disclosed, would significantly alter the total mix of information available to AdvancePierre’s stockholders.

COUNT I

(Claim for Violation of Section 14(e) of the 1934 Act Against Defendants)

| 73. | Plaintiff repeats and realleges the preceding allegations as if fully set forth herein. |

| 74. | Section 14(e) of the 1934 Act states, in relevant part, that: |

It shall be unlawful for any person to make any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading . . . in connection with any tender offer or request or invitation for tenders[.]

14

75. Defendants disseminated the misleading Solicitation Statement, which contained statements that, in violation of Section 14(e) of the 1934 Act, in light of the circumstances under which they were made, omitted to state material facts necessary to make the statements therein not misleading.

76. The Solicitation Statement was prepared, reviewed, and/or disseminated by defendants.

77. The Solicitation Statement misrepresented and/or omitted material facts in connection with the Proposed Transaction as set forth above.

78. By virtue of their positions within the Company and/or roles in the process and the preparation of the Solicitation Statement, defendants were aware of this information and their duty to disclose this information in the Solicitation Statement.

79. The omissions in the Solicitation Statement are material in that a reasonable shareholder will consider them important in deciding whether to tender their shares in connection with the Proposed Transaction. In addition, a reasonable investor will view a full and accurate disclosure as significantly altering the total mix of information made available.

80. Defendants knowingly or with deliberate recklessness omitted the material information identified above in the Solicitation Statement, causing statements therein to be materially incomplete and misleading.

81. By reason of the foregoing, defendants violated Section 14(e) of the 1934 Act.

82. Because of the false and misleading statements in the Solicitation Statement, plaintiff and the Class are threatened with irreparable harm.

83. Plaintiff and the Class have no adequate remedy at law.

15

COUNT II

(Claim for Violation of 14(d) of the 1934 Act Against Defendants)

| 84. | Plaintiff repeats and realleges the preceding allegations as if fully set forth herein. |

| 85. | Section 14(d)(4) of the 1934 Act states: |

Any solicitation or recommendation to the holders of such a security to accept or reject a tender offer or request or invitation for tenders shall be made in accordance with such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors.

86. Rule 14d-9(d) states, in relevant part:

Any solicitation or recommendation to holders of a class of securities referred to in section 14(d)(1) of the Act with respect to a tender offer for such securities shall include the name of the person making such solicitation or recommendation and the information required by Items 1 through 8 of Schedule 14D-9 (§ 240.14d-101) or a fair and adequate summary thereof[.]

Item 8 requires that directors must “furnish such additional information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are made, not materially misleading.”

87. The Solicitation Statement violates Section 14(d)(4) and Rule 14d-9 because it omits the material facts set forth above, which renders the Solicitation Statement false and/or misleading.

88. Defendants knowingly or with deliberate recklessness omitted the material information set forth above, causing statements therein to be materially incomplete and misleading.

89. The omissions in the Solicitation Statement are material to plaintiff and the Class, and they will be deprived of their entitlement to make a fully informed decision with respect to the Proposed Transaction if such misrepresentations and omissions are not corrected prior to the expiration of the tender offer.

16

90. Plaintiff and the Class have no adequate remedy at law.

COUNT III

(Claim for Violation of Section 20(a) of the 1934 Act

Against the Individual Defendants and Tyson)

91. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

92. The Individual Defendants and Tyson acted as controlling persons of AdvancePierre within the meaning of Section 20(a) of the 1934 Act as alleged herein. By virtue of their positions as officers and/or directors of AdvancePierre and participation in and/or awareness of the Company’s operations and/or intimate knowledge of the false statements contained in the Solicitation Statement filed with the SEC, they had the power to influence and control and did influence and control, directly or indirectly, the decision making of the Company, including the content and dissemination of the various statements that plaintiff contends are false and misleading.

93. Each of the Individual Defendants and Tyson was provided with or had unlimited access to copies of the Solicitation Statement alleged by plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause them to be corrected.

94. In particular, each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of the Company, and, therefore, is presumed to have had the power to control and influence the particular transactions giving rise to the violations as alleged herein, and exercised the same. The Solicitation Statement contains the unanimous recommendation of the Individual Defendants to approve the Proposed Transaction. They were thus directly connected with and involved in the making of the Solicitation Statement.

95. Tyson also had direct supervisory control over the composition of the Solicitation

17

Statement and the information disclosed therein, as well as the information that was omitted and/or misrepresented in the Solicitation Statement.

96. By virtue of the foregoing, the Individual Defendants and Tyson violated Section 20(a) of the 1934 Act.

97. As set forth above, the Individual Defendants and Tyson had the ability to exercise control over and did control a person or persons who have each violated Section 14(e) of the 1934 Act and Rule 14a-9, by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, these defendants are liable pursuant to Section 20(a) of the 1934 Act.

98. As a direct and proximate result of defendants’ conduct, plaintiff and the Class are threatened with irreparable harm.

99. Plaintiff and the Class have no adequate remedy at law.

PRAYER FOR RELIEF

WHEREFORE, plaintiff prays for judgment and relief as follows:

A. Enjoining defendants and all persons acting in concert with them from proceeding with, consummating, or closing the Proposed Transaction;

B. In the event defendants consummate the Proposed Transaction, rescinding it and setting it aside or awarding rescissory damages;

C. Directing the Individual Defendants to file a Solicitation Statement that does not contain any untrue statements of material fact and that states all material facts required in it or necessary to make the statements contained therein not misleading;

D. Declaring that defendants violated Sections 14(e), 14(d), and 20(a) of the 1934 Act, as well as Rule 14a-9 promulgated thereunder;

E. Awarding plaintiff the costs of this action, including reasonable allowance for

18

plaintiff’s attorneys’ and experts’ fees; and

F. Granting such other and further relief as this Court may deem just and proper.

JURY DEMAND

Plaintiff hereby demands a trial by jury.

| Dated: May 15, 2017 | LAW OFFICE OF JOHN C. CAMILLUS, LLC | ||

| OF COUNSEL: | By: | /s/ John C. Camillus | |

| John C. Camillus (0077435) | |||

| RIGRODSKY & LONG, P.A. | P.O. Box 141410 | ||

| Columbus, Ohio 43214 | |||

| Brian D. Long | (614) 558-7254 | ||

| Gina M. Serra | (614) 559-6731 (Facsimile) | ||

| 2 Righter Parkway, Suite 120 | jcamillus@camilluslaw.com | ||

| Wilmington, DE 19803 | Attorneys for Plaintiff | ||

| (302) 295-5310 | |||

| Pro hac vice motions forthcoming | |||

| RM LAW, P.C. | |||

| Richard A. Maniskas | |||

| 1055 Westlakes Drive, Suite 3112 | |||

| Berwyn, PA 19312 | |||

| (484) 324-6800 | |||

| Pro hac vice motion forthcoming |

19

CERTIFICATION OF PLAINTIFF

I. Paul Parshall (“Plaintiff”), hereby declare as to the claims asserted under the federal securities laws that:

1. Plaintiff has reviewed the complaint and authorizes its filing.

2. Plaintiff did not purchase the security that is the subject of this action at the direction of Plaintiff’s counsel or in order to participate in any private action.

3. Plaintiff is willing to serve as a representative party on behalf of the class, either individually or as part of a group, and I will testify at deposition or trial, if necessary. I understand that this is not a claim form and that I do not need to execute this Certification to share in any recovery as a member of the class.

4. Plaintiff’s purchase and sale transactions in the AdvancePierre Foods Holdings, Inc. (NYSE: APFH) security that is the subject of this action during the class period is/are as follows:

| PURCHASES | SALES | ||||

| Buy Date | Shares | Price per Share | Sell Date | Shares | Price per Share |

| 8/3/16 | 30 | $24.02 | |||

Please list additional transactions on separate sheet of paper, if necessary.

5. Plaintiff has complete authority to bring a suit to recover for investment losses on behalf of purchasers of the subject securities described herein (including Plaintiff, any co-owners, any corporations or other entities, and/or any beneficial owners).

6. During the three years prior to the date of this Certification, Plaintiff has not moved to serve as a representative party for a class in an action filed under the federal securities laws.

7. Plaintiff will not accept any payment for serving as a representative party on behalf of the class beyond Plaintiff’s pro rata share of any recovery, except such reasonable costs and expenses (including lost wages) directly relating to the representation of the class as ordered or approved by the Court.

I declare under penalty of perjury that the foregoing is true and correct.

Executed this 11th day of May, 2017.

| /s/ Paul Parshall | |

| PAUL PARSHALL |

2