Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-33135

AdCare Health Systems, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Georgia | | 31-1332119 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification Number) |

454 Satellite Boulevard, Suite 100, Suwanee, GA 30024

(Address of principal executive offices)

(678) 869-5116

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | |

Large accelerated filer o | | Accelerated filer o |

| | |

Non-accelerated filer o | | Smaller reporting company x |

(Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of October 31, 2016: 19,938,034 shares of common stock, no par value, were outstanding.

AdCare Health Systems, Inc.

Form 10-Q

Table of Contents

Forward-Looking Statements

This Quarterly Report on Form 10-Q (this “Quarterly Report”) and certain information incorporated herein by reference contain forward-looking statements and information within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. This information includes assumptions made by, and information currently available to management, including statements regarding future economic performance and financial condition, liquidity and capital resources, and management’s plans and objectives. In addition, certain statements included in this Quarterly Report, in the Company’s future filings with the Securities and Exchange Commission (“SEC”), in press releases, and in oral and written statements made by us or with our approval, which are not statements of historical fact, are forward-looking statements. Words such as “may,” “could,” “should,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “seeks,” “plan,” “project,” “continue,” “predict,” “will,” “should,” and other words or expressions of similar meaning are intended by us to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are based on the Company’s current expectations about future events or results and information that is currently available to us, involve assumptions, risks, and uncertainties, and speak only as of the date on which such statements are made.

All forward-looking statements are subject to the risks and uncertainties inherent in predicting the future. The Company’s actual results may differ materially from those projected, stated or implied in these forward-looking statements as a result of many factors, including the Company’s critical accounting policies and risks and uncertainties related to, but not limited to, the operating results of the Company’s tenants, the overall industry environment and the Company’s financial condition. These and other risks and uncertainties are described in more detail in the Company’s most recent Annual Report on Form 10-K, as well as other reports that the Company files with the SEC.

Forward-looking statements speak only as of the date they are made and should not be relied upon as representing the Company’s views as of any subsequent date. The Company undertakes no obligation to update or revise such statements to reflect new circumstances or unanticipated events as they occur, except as required by applicable laws, and you are urged to review and consider disclosures that the Company makes in this Quarterly Report and other reports that the Company files with the SEC that discuss factors germane to the Company’s business.

Part I. Financial Information

Item 1. Financial Statements

ADCARE HEALTH SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Amounts in 000’s) |

| | | | | | | | |

| | September 30,

2016 | | December 31,

2015 |

| | (Unaudited) | | |

ASSETS | | |

| | |

|

Current assets: | | |

| | |

|

Cash and cash equivalents | | $ | 1,457 |

| | $ | 2,720 |

|

Restricted cash | | 1,796 |

| | 9,169 |

|

Accounts receivable, net of allowance of $10,303 and $12,487 | | 3,327 |

| | 8,805 |

|

Prepaid expenses and other | | 2,130 |

| | 3,214 |

|

Assets of disposal group held for sale | | 49,824 |

| | 1,249 |

|

Total current assets | | 58,534 |

| | 25,157 |

|

Restricted cash and investments | | 3,682 |

| | 3,558 |

|

Property and equipment, net | | 79,320 |

| | 126,676 |

|

Intangible assets - bed licenses | | 2,471 |

| | 2,471 |

|

Intangible assets - lease rights, net | | 2,920 |

| | 3,420 |

|

Goodwill | | 2,105 |

| | 4,183 |

|

Lease deposits | | 1,426 |

| | 1,812 |

|

Other assets | | 3,855 |

| | 1,996 |

|

Total assets | | $ | 154,313 |

| | $ | 169,273 |

|

LIABILITIES AND DEFICIT | | |

| | |

|

Current liabilities: | | |

| | |

|

Current portion of notes payable and other debt | | $ | 11,464 |

| | $ | 50,960 |

|

Current portion of convertible debt | | 7,700 |

| | — |

|

Accounts payable | | 4,041 |

| | 8,741 |

|

Accrued expenses and other | | 6,089 |

| | 3,125 |

|

Liabilities of disposal group held for sale | | 32,036 |

| | 958 |

|

Total current liabilities | | 61,330 |

| | 63,784 |

|

Notes payable and other debt, net of current portion: | | |

| | |

|

Senior debt, net | | 56,174 |

| | 54,742 |

|

Bonds, net | | 6,566 |

| | 6,600 |

|

Convertible debt, net | | 1,394 |

| | 8,968 |

|

Other debt, net | | 169 |

| | 531 |

|

Other liabilities | | 4,346 |

| | 3,380 |

|

Deferred tax liability | | 389 |

| | 389 |

|

Total liabilities | | 130,368 |

| | 138,394 |

|

Commitments and contingencies (Note 14) | |

| |

|

Preferred stock, no par value; 5,000 shares authorized; 2,764 and 2,427 shares issued and outstanding, redemption amount $69,096 and $60,273 at September 30, 2016 and December 31, 2015, respectively | | 61,504 |

| | 54,714 |

|

Stockholders’ deficit: | | |

| | |

|

Common stock and additional paid-in capital, no par value; 55,000 shares authorized; 19,892 and 19,861 issued and outstanding at September 30, 2016 and December 31, 2015, respectively | | 61,611 |

| | 60,958 |

|

Accumulated deficit | | (99,170 | ) | | (84,793 | ) |

Total stockholders’ deficit | | (37,559 | ) | | (23,835 | ) |

Total liabilities and stockholders’ deficit | | $ | 154,313 |

| | $ | 169,273 |

|

See accompanying notes to unaudited consolidated financial statements

ADCARE HEALTH SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in 000’s, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2016 | | 2015 | | 2016 | | 2015 |

Revenues: | | |

| | |

| | |

| | |

|

Rental revenues | | $ | 6,912 |

| | $ | 5,826 |

| | $ | 20,651 |

| | $ | 11,322 |

|

Management fee and other revenues | | 253 |

| | 304 |

| | 760 |

| | 827 |

|

Total revenues | | 7,165 |

| | 6,130 |

| | 21,411 |

| | 12,149 |

|

| | | | | | | | |

Expenses: | | |

| | |

| | |

| | |

|

Facility rent expense | | 2,176 |

| | 1,736 |

| | 6,523 |

| | 3,552 |

|

Depreciation and amortization | | 1,124 |

| | 1,911 |

| | 4,176 |

| | 5,384 |

|

General and administrative expense | | 1,598 |

|

| 2,114 |

|

| 6,275 |

|

| 8,014 |

|

Other operating expenses | | 241 |

| | 309 |

| | 1,413 |

| | 530 |

|

Total expenses | | 5,139 |

| | 6,070 |

| | 18,387 |

| | 17,480 |

|

| | | | | | | | |

Income (loss) from operations | | 2,026 |

| | 60 |

| | 3,024 |

| | (5,331 | ) |

| | | | | | | | |

Other expense: | | |

| | |

| | |

| | |

|

Interest expense, net | | 1,801 |

| | 1,830 |

| | 5,377 |

| | 6,599 |

|

Loss on extinguishment of debt | | — |

| | — |

| | — |

| | 680 |

|

Other expense | | — |

| | 268 |

| | 51 |

| | 749 |

|

Total other expense, net | | 1,801 |

| | 2,098 |

| | 5,428 |

| | 8,028 |

|

| | | | | | | | |

Income (loss) from continuing operations before income taxes | | 225 |

| | (2,038 | ) | | (2,404 | ) | | (13,359 | ) |

Income tax expense | | 3 |

| | — |

| | 3 |

| | 20 |

|

Income (loss) from continuing operations | | 222 |

| | (2,038 | ) | | (2,407 | ) | | (13,379 | ) |

| | | | | | | | |

Loss from discontinued operations, net of tax | | (2,210 | ) | | (3,057 | ) | | (6,513 | ) | | (2,328 | ) |

Net loss | | (1,988 | ) | | (5,095 | ) | | (8,920 | ) | | (15,707 | ) |

| | | | | | | | |

Net loss attributable to noncontrolling interests | | — |

| | 284 |

| | — |

| | 784 |

|

Net loss attributable to AdCare Health Systems, Inc. | | (1,988 | ) | | (4,811 | ) | | (8,920 | ) | | (14,923 | ) |

| | | | | | | | |

Preferred stock dividends | | (1,879 | ) | | (1,499 | ) | | (5,457 | ) | | (3,582 | ) |

Net loss attributable to AdCare Health Systems, Inc. Common Stockholders | | $ | (3,867 | ) | | $ | (6,310 | ) | | $ | (14,377 | ) | | $ | (18,505 | ) |

| | | | | | | | |

Net loss per share of common stock attributable to AdCare Health Systems, Inc. | | |

| | |

| | |

| | |

|

Basic and diluted: | | |

| | |

| | |

| | |

|

Continuing operations | | $ | (0.08 | ) | | $ | (0.18 | ) | | $ | (0.39 | ) | | $ | (0.86 | ) |

Discontinued operations | | (0.11 | ) | | (0.14 | ) | | (0.33 | ) | | (0.08 | ) |

| | $ | (0.19 | ) | | $ | (0.32 | ) | | $ | (0.72 | ) | | $ | (0.94 | ) |

| | | | | | | | |

Weighted average shares of common stock outstanding: | | |

| | |

| | |

| | |

|

Basic and diluted | | 19,917 |

| | 19,838 |

| | 19,909 |

| | 19,617 |

|

See accompanying notes to unaudited consolidated financial statements

ADCARE HEALTH SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ DEFICIT

(Amounts in 000’s)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | Shares of Common Stock | | Common Stock and Additional

Paid-in

Capital | | Accumulated

Deficit | | Total |

Balances, December 31, 2015 | | 19,861 |

| | $ | 60,958 |

| | $ | (84,793 | ) | | $ | (23,835 | ) |

| | | | | | | | |

Stock-based compensation | | — |

| | 890 |

| | — |

| | 890 |

|

| | | | | | | | |

Common stock repurchase program | | (150 | ) | | (312 | ) | | — |

| | (312 | ) |

| | | | | | | | |

Issuance of restricted stock | | 181 |

| | 75 |

| | — |

| | 75 |

|

| | | | | | | | |

Preferred stock dividends | | — |

| | — |

| | (5,457 | ) | | (5,457 | ) |

| | | | | | | | |

Net loss | | — |

| | — |

| | (8,920 | ) | | (8,920 | ) |

Balances, September 30, 2016 | | 19,892 |

| | $ | 61,611 |

| | $ | (99,170 | ) | | $ | (37,559 | ) |

See accompanying notes to unaudited consolidated financial statements

ADCARE HEALTH SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(Amounts in 000’s) |

| | | | | | | | |

| | Nine Months Ended September 30, |

| | 2016 | | 2015 |

Cash flows from operating activities: | | | | |

|

Net loss | | $ | (8,920 | ) | | $ | (15,707 | ) |

Loss from discontinued operations, net of tax | | 6,513 |

| | 2,328 |

|

Loss from continuing operations | | (2,407 | ) | | (13,379 | ) |

Adjustments to reconcile loss from continuing operations to net cash provided by (used in) operating activities: | | |

| | |

|

Depreciation and amortization | | 4,176 |

| | 5,384 |

|

Stock-based compensation expense | | 890 |

| | 677 |

|

Rent expense in excess (deficit) of cash paid | | 721 |

| | (39 | ) |

Rent revenue in excess of cash received | | (1,941 | ) | | (989 | ) |

Amortization of deferred financing costs | | 614 |

| | 949 |

|

Amortization of debt discounts and premiums | | 11 |

| | 11 |

|

Loss on debt extinguishment | | — |

| | 680 |

|

Bad debt expense | | — |

| | 203 |

|

Changes in operating assets and liabilities: | | | | |

Accounts receivable | | (657 | ) | | (383 | ) |

Prepaid expenses and other | | 929 |

| | (1,941 | ) |

Other assets | | 39 |

| | (2,250 | ) |

Accounts payable and accrued expenses | | (199 | ) | | (2,328 | ) |

Other liabilities | | 630 |

| | 905 |

|

Net cash provided by (used in) by operating activities - continuing operations | | 2,806 |

| | (12,500 | ) |

Net cash used in operating activities - discontinued operations | | (3,470 | ) | | (1,631 | ) |

Net cash used in operating activities | | (664 | ) | | (14,131 | ) |

| | | | |

Cash flows from investing activities: | | |

| | |

|

Change in restricted cash | | 3,625 |

| | (3,440 | ) |

Purchase of property and equipment | | (704 | ) |

| (1,328 | ) |

Proceeds from the sale of property and equipment | | 1,546 |

| | — |

|

Earnest deposit |

| 1,750 |

|

| — |

|

Net cash provided by (used in) investing activities - continuing operations | | 6,217 |

| | (4,768 | ) |

Net cash provided by investing activities - discontinued operations | | — |

| | 5,678 |

|

Net cash provided by investing activities | | 6,217 |

| | 910 |

|

| | | | |

Cash flows from financing activities: | | |

| | |

|

Proceeds from senior debt | | 3,940 |

| | 22,757 |

|

Proceeds from convertible debt | | — |

| | 2,049 |

|

Repayment of notes payable | | (10,496 | ) | | (24,410 | ) |

Repayment on bonds payable | | (85 | ) | | (35 | ) |

Repayment on convertible debt | | — |

| | (6,849 | ) |

Proceeds from lines of credit | | — |

| | 27,468 |

|

Repayment of lines of credit | | — |

| | (33,261 | ) |

Debt issuance costs | | (116 | ) | | (874 | ) |

Exercise of warrants and options | | — |

| | 1,471 |

|

Proceeds from preferred stock issuances, net | | 6,790 |

| | 29,727 |

|

Repurchase of common stock | | (312 | ) | | — |

|

Dividends paid on common stock | | — |

| | (2,083 | ) |

Dividends paid on preferred stock | | (5,457 | ) | | (3,582 | ) |

Net cash (used in) provided by financing activities - continuing operations | | (5,736 | ) | | 12,378 |

|

Net cash used in financing activities - discontinued operations | | (1,080 | ) | | (5,617 | ) |

Net cash (used in) provided by financing activities | | (6,816 | ) | | 6,761 |

|

Net change in cash and cash equivalents | | (1,263 | ) | | (6,460 | ) |

Cash and cash equivalents, beginning | | 2,720 |

| | 10,735 |

|

Cash and cash equivalents, ending | | $ | 1,457 |

| | $ | 4,275 |

|

| | | | |

|

| | | | | | | | |

Supplemental disclosure of cash flow information: | | |

| | |

|

Interest paid | | $ | 4,846 |

|

| $ | 6,402 |

|

Income taxes paid | | $ | 3 |

|

| $ | 20 |

|

Supplemental disclosure of non-cash activities: | | | | |

Notes repaid by setoff of amounts owed to the Company by noteholders

| | $ | — |

|

| $ | 5,651 |

|

Dividends on common stock | | $ | — |

| | $ | 1,193 |

|

Notes issued in conjunction with financing of exit fees | | $ | — |

| | $ | 680 |

|

Cancellation of insurance premium financing | | $ | — |

| | $ | 250 |

|

See accompanying notes to unaudited consolidated financial statements

ADCARE HEALTH SYSTEMS, INC. AND SUBSIDIARIES

Notes to Unaudited Consolidated Financial Statements

September 30, 2016

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

See Part II, Item 8, Notes to Consolidated Financial Statements, Note 1 - Organization and Significant Accounting Policies included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015, filed with the Securities and Exchange Commission (the “SEC”) on March 30, 2016 (the “Annual Report”), for a description of all significant accounting policies.

Description of Business

AdCare Health Systems, Inc. (“AdCare”), through its subsidiaries (together, the “Company” or “we”), is a self-managed real estate investment company that invests primarily in real estate purposed for long-term care and senior living. The Company’s business primarily consists of leasing and subleasing healthcare facilities to third-party tenants, which operate such facilities. The facility operators provide a range of healthcare services, including skilled nursing and assisted living services, social services, various therapy services, and other rehabilitative and healthcare services for both long-term and short-stay patients and residents.

As of September 30, 2016, the Company owned, leased, or managed for third parties 38 facilities primarily in the Southeast. Of the 38 facilities, the Company: (i) leased to third-party operators 22 skilled nursing facilities which it owned and subleased to third-party operators 11 skilled nursing facilities which it leased; (ii) leased to third-party operators two assisted living facilities which it owned; and (iii) managed on behalf of third-party owners two skilled nursing facilities and one independent living facility (see Note 7 - Leases below and Part II, Item 8, Notes to Consolidated Financial Statements, Note 7 - Leases in the Annual Report for a more detailed description of the Company’s leases). On October 6, 2016, the Company completed the sale of nine of its facilities in Arkansas (the “Arkansas Facilities”) (see Note 16 - Subsequent Events).

The Company was incorporated in Ohio on August 14, 1991, under the name Passport Retirement, Inc. In 1995, the Company acquired substantially all of the assets and liabilities of AdCare Health Systems, Inc. and changed its name to AdCare Health Systems, Inc. AdCare completed its initial public offering in November 2006. Initially based in Ohio, the Company expanded its portfolio through a series of strategic acquisitions to include properties in a number of other states, primarily in the Southeast. In 2012, the Company relocated its executive offices and accounting operations to Georgia, and AdCare changed its state of incorporation from Ohio to Georgia on December 12, 2013.

Historically, the Company’s business focused on owning and operating skilled nursing and assisted living facilities. The Company also managed facilities on behalf of unaffiliated owners with whom the Company entered into management contracts. In July 2014, the Company’s Board of Directors (the “Board”) approved a strategic plan to transition the Company to a healthcare property holding and leasing company through a series of leasing and subleasing transactions (the “Transition”). The Company effected the Transition through: (i) leasing to third-party operators all of the healthcare properties which it owns and previously operated; (ii) subleasing to third-party operators all of the healthcare properties which it leases (but does not own) and previously operated; and (iii) continuing the one remaining management agreement to manage two skilled nursing facilities and one independent living facility for third parties. The Company completed the Transition in December, 2015.

The Company leases its currently-owned healthcare properties, and subleases its currently-leased healthcare properties, on a triple-net basis, meaning that the lessee (i.e., the third-party operator of the property) is obligated under the lease or sublease, as applicable, for all costs of operating the property including insurance, taxes and facility maintenance, as well as the lease or sublease payments, as applicable. These leases are generally long-term in nature with renewal options and annual rent escalation clauses. As a result of the Transition, the Company has many of the characteristics of a real estate investment trust (“REIT”) and is focused on the ownership, acquisition and leasing of healthcare properties. The Board continues to analyze and consider: (i) whether and, if so, when, the Company could satisfy the requirements to qualify as a REIT under the Internal Revenue Code of 1986, as amended; (ii) the structural and operational complexities which would need to be addressed before the Company could qualify as a REIT, including the disposition of certain assets or the termination of certain operations which may not be REIT compliant; and (iii) if the Company were to qualify as a REIT, whether electing REIT status would be in the best interests of the Company and its shareholders in light of various factors, including our significant consolidated federal net operating loss carryforwards. There is no assurance that the Company will qualify as a REIT in future taxable years or, if it were to so qualify, that the Board would determine that electing REIT status would be in the best interests of the Company and its shareholders.

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Rule 8-03 of Article 8 of Regulations S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation of the results of operations for the periods presented have been included. Operating results for the three and nine months ended September 30, 2016 and 2015, are not necessarily indicative of the results that may be expected for the fiscal year. The balance sheet at December 31, 2015, has been derived from the audited consolidated financial statements at that date, but does not include all of the information and footnotes required by GAAP for complete financial statements.

You should read the accompanying unaudited consolidated financial statements together with the historical consolidated financial audited statements of the Company for the year ended December 31, 2015, included in the Annual Report.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported results of operations during the reporting period. Examples of significant estimates include allowance for doubtful accounts, deferred tax valuation allowance, fair value of employee and nonemployee stock based awards, valuation of goodwill and other long-lived assets, and cash flow projections. Actual results could differ materially from those estimates.

Reclassifications

Certain items previously reported in the consolidated financial statement captions have been reclassified to conform to the current financial statement presentation with no effect on the Company’s consolidated financial position or results of operations. These reclassifications did not affect total assets, total liabilities or stockholders’deficit. Reclassifications were made to the Consolidated Statements of Operations and Consolidated Statements of Cash Flows for the three and nine months ended September 30, 2015, to reflect the same facilities in discontinued operations for both periods presented.

Revenue Recognition and Allowances

Rental Revenues. The Company’s triple-net leases provide for periodic and determinable increases in rent. The Company recognizes rental revenues under these leases on a straight-line basis over the applicable lease term when collectibility is reasonably assured. Recognizing rental income on a straight-line basis generally results in recognized revenues during the first half of a lease term exceeding the cash amounts contractually due from our tenants, creating a straight-line rent receivable that is included in other assets on our consolidated balance sheets. Rent revenues for the Arkansas Facilities previously leased by the Company (see Note 16 - Subsequent Events) and two facilities in Georgia are recorded on a cash basis.

Management Fee Revenues and Other Revenues. The Company recognizes management fee revenues as services are provided. Further, the Company recognizes interest income from lease inducement receivables as other revenues.

Allowances. The Company assesses the collectibility of our rent receivables, including straight-line rent receivables. The Company bases its assessment of the collectibility of rent receivables on several factors including payment history, the financial strength of the tenant and any guarantors, the value of the underlying collateral, and current economic conditions. If the Company’s evaluation of these factors indicates it is probable that the Company will be unable to receive the rent payments, then the Company provides an allowance against the recognized rent receivable asset for the portion that we estimate may not be recovered. If the Company changes its assumptions or estimates regarding the collectibility of future rent payments required by a lease, then the Company may adjust its reserve to increase or reduce the rental revenue recognized in the period the Company makes such change in its assumptions or estimates.

As of September 30, 2016 and December 31, 2015, the Company allowed for approximately $10.3 million and $12.5 million, respectively, of gross patient care related receivables arising from our legacy operations. Allowance for patient care receivables are estimated based on an aged bucket method as well as additional analyses of remaining balances incorporating different payor types. Any changes in patient care receivable allowances are recognized as a component of discontinued operations. All patient care receivables exceeding 365 days are fully allowed at September 30, 2016 and December 31, 2015. Accounts receivable, net

totaled $3.3 million at September 30, 2016 and $8.8 million at December 31, 2015 of which $1.6 million and $8.0 million, respectively related to patient care receivables from our legacy operations.

Fair Value Measurements and Financial Instruments

Accounting guidance establishes a three-level valuation hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date. The categorization of a measurement within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement. The three levels are defined as follows:

Level 1— Quoted market prices in active markets for identical assets or liabilities

Level 2— Other observable market-based inputs or unobservable inputs that are corroborated by market data

Level 3— Significant unobservable inputs

The respective carrying value of certain financial instruments of the Company approximates their fair value. These instruments include cash and cash equivalents, restricted cash and investments, accounts receivable, notes receivable, and accounts payable. Fair values were assumed to approximate carrying values for these financial instruments since they are short-term in nature and their carrying amounts approximate fair values, they are receivable or payable on demand, or the interest rates earned and/or paid approximate current market rates.

Recent Accounting Pronouncements

Except for rules and interpretive releases of the SEC under authority of federal securities laws, the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") is the sole source of authoritative GAAP literature recognized by the FASB and applicable to the Company. The Company has reviewed the FASB accounting pronouncements and Accounting Standards Update ("ASU") interpretations that have effectiveness dates during the periods reported and in future periods.

In May 2014, the FASB issued ASU 2014-09 guidance which requires revenue to be recognized in an amount that reflects the consideration expected to be received in exchange for those goods and services. The new standard requires the disclosure of sufficient quantitative and qualitative information for financial statement users to understand the nature, amount, timing and uncertainty of revenue and associated cash flows arising from contracts with customers. The new guidance does not affect the recognition of revenue from leases. In August 2015, the FASB delayed the effective date of the new revenue standard by one year. Identifying performance obligations and licensing (ASU 2016-10) and narrow scope improvements (ASU 2016-12) were issued in April and May 2016 respectively. This new revenue standard is effective for annual reporting periods beginning after December 15, 2017, including interim periods within those reporting periods. Early application is permitted under the original effective date of fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016. The Company is currently evaluating the impact on the Company’s financial position and results of operations and related disclosures.

In August 2014, the FASB issued ASU 2014-15, which provides guidance regarding an entity’s ability to continue as a going concern, which requires management to assess a company’s ability to continue as a going concern and to provide related footnote disclosures in certain circumstances. Before this new standard, there was minimal guidance in GAAP specific to going concern. Under the new standard, disclosures are required when conditions give rise to substantial doubt about a company’s ability to continue as a going concern within one year from the financial statement issuance date. The guidance is effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period, with early adoption permitted. The Company has concluded that changes in its accounting required by this new guidance will not materially impact the Company’s financial position or results of operations and related disclosures.

In February 2015, the FASB issued ASU 2015-02, which changes the way reporting enterprises evaluate whether (i) they should consolidate limited partnerships and similar entities, (ii) fees paid to a decision maker or service provider are variable interests in a variable interest entity (“VIE”), and (iii) variable interests in a VIE held by related parties of the reporting enterprise require the reporting enterprise to consolidate the VIE. It also eliminates the VIE consolidation model based on majority exposure to variability that applied to certain investment companies and similar entities. This consolidation guidance is effective for public business entities for annual and interim periods beginning after December 15, 2015. The adoption of this guidance did not have a material impact on the Company’s consolidated financial condition, results of operations or cash flows.

In April 2015, the FASB issued ASU 2015-03, which requires debt issuance costs to be presented as a direct reduction from the carrying amount of the debt liability, consistent with the presentation of debt discounts. The amortization of debt issuance costs will be reported as interest expense. The new standard is to be applied on a retrospective basis and reported as a change in an

accounting principle. In August 2015, the FASB released clarifying guidance for debt issuance costs related to line-of-credit arrangements, which permits debt issuance costs to be presented as an asset, regardless of whether there are any outstanding borrowings on the line-of-credit arrangement. Debt issuance costs associated with a line of credit can be amortized ratably over the term of the line-of-credit arrangement. This standard is effective for annual reporting periods beginning after December 15, 2015, including interim periods within that reporting period. Early adoption is permitted for financial statements that have not been previously issued. The Company adopted this standard in the first quarter of 2016 and has retroactively applied it to the December 31, 2015 balance sheet presentation. This change represents a change in accounting principle. The amount of deferred financing costs reclassified against long-term debt was $2.5 million and $2.7 million for March 31, 2016 and December 31, 2015, respectively. The adoption did not materially impact the Company’s results of operations and related disclosures.

In September 2015, the FASB issued ASU 2015-16, which requires that an acquirer in a business combination recognize adjustments to provisional amounts that are identified during the measurement period in the reporting period in which the adjustment amounts are determined. Under this guidance the acquirer recognizes, in the same period’s financial statements, the effect on earnings of changes in depreciation, amortization, or other income effects, if any, as a result of the change to the provisional amounts, calculated as if the accounting had been completed at the acquisition date. New disclosures are required to present separately on the face of the income statement or disclose in the notes the portion of the amount recognized in current-period earnings by line item that would have been recognized in previous reporting periods if the adjustment to the provisional amounts had been recognized as of the acquisition date. This guidance is effective for annual reporting periods beginning after December 15, 2015, including interim periods within that reporting period. At adoption, the new guidance is to be applied prospectively to adjustments to provisional amounts that occur after the effective date with earlier application permitted for financial statements that have not been issued. The adoption of this guidance did not have a material impact on the Company’s consolidated financial condition, results of operations or cash flows.

In January 2016, the FASB issued ASU 2016-01, which provides revised accounting guidance related to the accounting for and reporting of financial instruments. This guidance significantly revises an entity’s accounting related to (i) the classification and measurement of investments in equity securities and (ii) the presentation of certain fair value changes for financial liabilities measured at fair value. It also amends certain disclosure requirements associated with the fair value of financial instruments. The ASU is effective for annual periods and interim periods within those annual periods beginning after December 15, 2017; earlier adoption is permitted. The adoption of this guidance is not expected to have a material impact on the Company’s consolidated financial condition, results of operations or cash flows.

In February 2016, the FASB issued ASU 2016-02, as a comprehensive new leases standard that amends various aspects of existing guidance for leases and requires additional disclosures about leasing arrangements. It will require companies to recognize lease assets and lease liabilities by lessees for those leases classified as operating leases under previous guidance, ASC 840, Leases. ASU 2016-02 creates a new Topic, ASC 842, Leases. This new Topic retains a distinction between finance leases and operating leases. The classification criteria for distinguishing between finance leases and operating leases are substantially similar to the classification criteria for distinguishing between capital leases and operating leases in the previous leases guidance. The ASU is effective for annual periods beginning after December 15, 2018, including interim periods within those fiscal years; earlier adoption is permitted. In the financial statements in which the ASU is first applied, leases shall be measured and recognized at the beginning of the earliest comparative period presented with an adjustment to equity. The Company is currently evaluating the impact of the adoption of this guidance on its consolidated financial condition, results of operations and cash flows.

In March 2016, the FASB issued ASU 2016-09, with the intention to simplify aspects of the accounting for share-based payment transactions, including income tax impacts, classification on the statement of cash flows, and forfeitures. The ASU is effective for fiscal years and interim periods within those years beginning after December 15, 2016. The various amendments within the standard require different approaches to adoption, on a retrospective, modified retrospective or prospective basis. Early adoption is permitted. The Company is currently evaluating the potential impact of this standard as well as the as available transition methods.

In June 2016, the FASB issued ASU 2016-13, which provides for an impairment model that is based on expected losses rather than incurred losses. Under ASU 2016-13, an entity recognizes as an allowance its estimate of expected credit losses. ASU 2016-13 is effective for the Company beginning January 1, 2020, and we do not expect its adoption will have a significant effect on our consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15, guidance which clarifies the treatment of several cash flow categories. In addition, the guidance clarifies that when cash receipts and cash payments have aspects of more than one class of cash flows and cannot be separated, classification will depend on the predominant source or use. This update is effective for annual periods beginning after December 15, 2017, and interim periods within those fiscal years, with early adoption permitted, including adoption in an interim period. The Company is currently evaluating the impact of the adoption of this guidance on its cash flows.

NOTE 2. EARNINGS PER SHARE

Basic earnings per share is computed by dividing net income or loss attributable to common stockholders by the weighted average number of shares of common stock outstanding during the respective period. Diluted earnings per share is similar to basic earnings per share except: (i) net income or loss is adjusted by the impact of the assumed conversion of convertible debt into shares of common stock; and (ii) the weighted average number of shares of common stock outstanding includes potentially dilutive securities (such as options, warrants and additional shares of common stock issuable under convertible debt outstanding during the period) when such securities are not anti-dilutive. Potentially dilutive securities from options and warrants are calculated in accordance with the treasury stock method, which assumes that proceeds from the exercise of all options and warrants with exercise prices exceeding the average market value are used to repurchase common stock at market value. The incremental shares remaining after the proceeds are exhausted represent the potentially dilutive effect of the securities. Potentially dilutive securities from convertible debt are calculated based on the assumed issuance at the beginning of the period, as well as any adjustment to income that would result from their assumed issuance. For the three and nine months ended September 30, 2016 and 2015, approximately 4.5 million and 5.0 million shares, respectively, of potentially dilutive securities were excluded from the diluted income (loss) per share calculation because including them would have been anti-dilutive for such periods.

The following tables provide a reconciliation of net loss for continuing and discontinued operations and the number of shares of common stock used in the computation of both basic and diluted earnings per share:

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

(Amounts in 000’s, except per share data) | | 2016 | | 2015 | | 2016 | | 2015 |

Numerator: | | | | | | | | |

Income (loss) from continuing operations | | $ | 222 |

| | $ | (2,038 | ) | | $ | (2,407 | ) | | $ | (13,379 | ) |

Preferred stock dividends | | (1,879 | ) | | (1,499 | ) | | (5,457 | ) | | (3,582 | ) |

Basic and diluted loss from continuing operations | | (1,657 | ) | | (3,537 | ) | | (7,864 | ) | | (16,961 | ) |

| | | | | | | | |

Loss from discontinued operations, net of tax | | (2,210 | ) | | (3,057 | ) | | (6,513 | ) | | (2,328 | ) |

Net loss attributable to noncontrolling interests | | — |

| | 284 |

| | — |

| | 784 |

|

Basic and diluted loss from discontinued operations | | (2,210 | ) | | (2,773 | ) | | (6,513 | ) | | (1,544 | ) |

Basic and diluted loss from continuing operations attributable to AdCare Health Systems, Inc common stockholders | | $ | (3,867 | ) | | $ | (6,310 | ) | | $ | (14,377 | ) | | $ | (18,505 | ) |

| | | | | | | | |

Denominator: | | | | | | | | |

Basic - weighted average shares | | 19,917 |

| | 19,838 |

| | 19,909 |

| | 19,617 |

|

Diluted - adjusted weighted average shares (a) | | 19,917 |

| | 19,838 |

| | 19,909 |

| | 19,617 |

|

| | | | | | | | |

Basic and diluted loss per share: | | | | | | | | |

Loss from continuing operations attributable to AdCare | | $ | (0.08 | ) | | $ | (0.18 | ) | | $ | (0.39 | ) | | $ | (0.86 | ) |

Loss income from discontinuing operations | | (0.11 | ) | | (0.14 | ) | | (0.33 | ) | | (0.08 | ) |

Loss attributable to to AdCare Health Systems, Inc. common stockholders | | $ | (0.19 | ) | | $ | (0.32 | ) | | $ | (0.72 | ) | | $ | (0.94 | ) |

| | | | | | | | |

(a) Securities outstanding that were excluded from the computation, prior to the use of the treasury stock method, because they would have been anti-dilutive are as follows: |

| | | | | | |

| | September 30, |

(Share amounts in 000’s) | | 2016 | | 2015 |

Stock options | | 355 |

| | 744 |

|

Warrants - employee | | 1,559 |

| | 1,559 |

|

Warrants - non employee | | 437 |

| | 567 |

|

Convertible notes | | 2,165 |

| | 2,165 |

|

Total anti-dilutive securities | | 4,516 |

| | 5,035 |

|

NOTE 3. LIQUIDITY AND PROFITABILITY

Sources of Liquidity

The Company continues to undertake measures to improve its operations and streamline its cost infrastructure in connection with its new business model, including: (i) increasing future lease revenue; (ii) refinancing or repaying debt to reduce interest costs and reducing mandatory principal repayments; and (iii) reducing general and administrative expenses.

At September 30, 2016, the Company had $1.5 million in cash and cash equivalents as well as restricted cash of $5.5 million. Over the next twelve months, the Company anticipates both access to and receipt of several sources of liquidity.

The Company routinely has discussions with existing and new potential lenders to refinance current debt on a long-term basis and, in recent periods, has refinanced short-term acquisition-related debt with traditional long-term mortgage notes, some of which have been executed under government guaranteed lending programs such as those operated by the United States (“U.S.”) Department of Housing and Urban Development (“HUD”).

On July 21, 2015, the Company entered into separate At Market Issuance Sales Agreements with each of MLV & Co. LLC and JMP Securities LLC (“JMP”), regarding the Company’s sale, from time to time, of up to 800,000 shares of the Company’s 10.875% Series A Cumulative Redeemable Preferred Stock, (the “Series A Preferred Stock”), through an “at-the-market” offering program (“ATM”). The Company subsequently announced that the Series A Preferred Stock offered and sold through the ATM will be sold exclusively through JMP on and after June 7, 2016. During the quarter ended September 30, 2016, the Company sold 106,796 shares of Series A Preferred Stock generating net proceeds to the Company of approximately $2.2 million. Since the inception of the ATM in July 2015 and through September 30, 2016, the Company sold 650,600 shares of Series A Preferred Stock under the ATM, generating net proceeds to the Company of approximately $13.5 million (see Note 11 - Common and Preferred Stock). The Company ceased sales under the ATM in September 2016, and will not engage in any additional sales of the Series A Preferred Stock until the Company’s recently announced preferred stock repurchase program has terminated or expired (See Note 16 - Subsequent Events).

On March 24, 2016, the Company obtained a lender commitment to extend the maturity date of the credit facility entered into on January 30, 2015, (the “Sumter Credit Facility”), between a certain-wholly owned subsidiary of the Company and The PrivateBank and Trust Company (the “PrivateBank”), from September 2016 to June 2017, subject to definitive documentation and certain closing conditions, which commitment expires on November 30, 2016. On June 13, 2016, the Company received a commitment to refinance the Sumter Credit Facility, subject to definitive documentation and certain closing conditions. The Company expects to close on such financing arrangement with HUD in the fourth quarter of 2016.

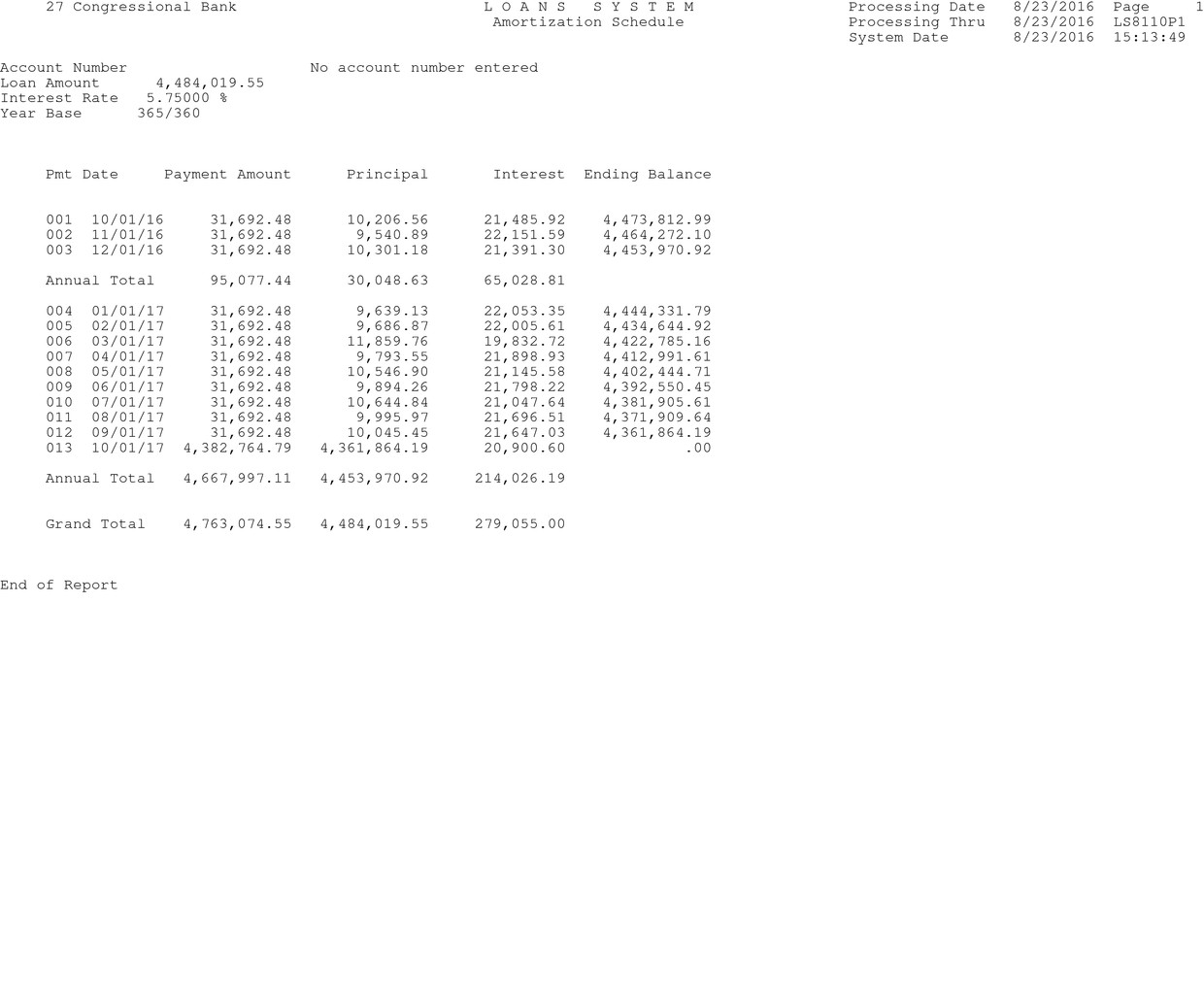

On September 19, 2016, the Company obtained an option to extend the maturity date of the credit facility entered into in September 2013, between a certain wholly-owned subsidiary of the Company and Housing & Healthcare Funding, LLC (the “Quail Creek Credit Facility”), from September 2017 to September 2018, which option management intends exercise.

On September 29, 2016, the Company closed on HUD-guaranteed financing in the amount of $3.7 million, which refinanced approximately $3.1 million in debt previously owed to the PrivateBank with respect to the Company’s facility located in Georgetown, South Carolina (the “Georgetown Facility”).

On September 30, 2016, total outstanding debt, net of deferred financing costs and restricted cash with respect to the Arkansas Facilities was approximately $28.4 million, included within “Liabilities of disposal group held for sale” in the Company’s unaudited consolidated balance sheet at September 30, 2016. All such debt and restricted cash was current at September 30, 2016. Proceeds to the Company from the sale of the Arkansas Facilities exceeded related obligations by approximately $23.0 million, less routine closing costs and the Skyline Note in the amount of $3.0 million. The cash impact of the sale of the Arkansas Facilities consisted of total sales proceeds of $55.0 million, payment of associated liabilities held for sale of $32.2 million (excluding deferred loan costs of $0.2 million), the Skyline Note in the amount of $3.0 million, payments for property taxes of $0.4 million, and release of restricted cash of $3.6 million, for total net cash to seller of $23.0 million.

On October 6, 2016, the Company completed the sale of the Arkansas Facilities for a total sale price of $55.0 million,which sale price consisted of: (i) a non-refundable deposit of $1.8 million; (ii) cash consideration of $50.3 million paid at closing; and (iii) a promissory note in the amount of $3.0 million (the “Skyline Note”) (see Note 16 - Subsequent Events).

On June 18, 2016, ADK Georgia, LLC, a wholly-owned subsidiary of the Company (“ADK Georgia”), entered into a new master sublease agreement (the “Peach Health Sublease”) with affiliates (collectively, “Peach Health Sublessee”) of Peach Health Group, LLC (“Peach Health”), providing that Peach Health Sublessee would take possession of the facilities (the “Peach Facilities”) subleased by ADK Georgia to affiliates of New Beginnings Care, LLC (“New Beginnings”) and operate them as a subtenant (see Note 7 - Leases). The Peach Facilities are comprised of: (i) an 85-bed skilled nursing facility located in Tybee Island, Georgia (the “Oceanside Facility”); (ii) a 50-bed skilled nursing facility located in Tybee Island, Georgia (the “Savannah Beach Facility”); and (iii) a 131-bed skilled nursing facility located in Jeffersonville,Georgia (the “Jeffersonville Facility”). Rent for the Oceanside Facility and the Jeffersonville Facility is $0.4 million and $0.6 million per annum, respectively; but such rent is only $1 per month for the Oceanside and Jeffersonville Facilities until the date such facilities are recertified by U.S. Department of Health and Human Services Center for Medicare and Medicaid Services (“CMS”) or April 1, 2017, whichever first occurs (the “Rent Commencement Date”). In addition, with respect to the Oceanside and Jeffersonville Facilities, Peach Health Sublessee is entitled to three months of $1 per month rent following the Rent Commencement Date and, following such three-month period, five months of rent discounted by 50%. In the event that the Savannah Beach Facility is decertified due to any previous non-compliance attributable to New Beginnings, rent for such facility will revert to $1 a month until it is recertified along with the other facilities. Under the terms of the Peach Health Sublease, Peach Health Sublessee agrees to use its best efforts to pursue recertification of the Jeffersonville and Oceanside Facilities with CMS as soon as possible. However if recertification fails to occur, then it could have an adverse effect on our business, financial condition and results of operations.

Cash Requirements

At September 30, 2016, the Company had $115.5 million in indebtedness of which the current portion is $51.2 million. This current portion is comprised of the following components: (i) debt of held for sale entities of approximately $32.0 million, primarily senior debt and mortgage indebtedness; and (ii) convertible debt of $7.7 million; and (iii) remaining debt of approximately $11.5 million which includes senior debt - bond and mortgage indebtedness (see Note 9 - Notes Payable and Other Debt). As indicated previously, the Company routinely has ongoing discussions with existing and potential new lenders to refinance current debt on a longer term basis and, in recent periods, has refinanced shorter term acquisition debt with traditional longer term mortgage notes, some of which have been executed under government guaranteed lending programs.

The Company anticipates, during the next twelve months, net principal disbursements of approximately $43.5 million (including $32.0 million of liabilities held for sale and repaid upon sale of the Arkansas Facilities, approximately $0.9 million of payments on short term vendor notes, $1.4 million of routine debt service amortization, and $0.7 million payment of other debt) which is inclusive of anticipated proceeds on refinancing of approximately $8.3 million. The Company anticipates operating cash requirements for the next twelve months as being substantially less than the previous twelve months due to the Transition. Based on the described sources of liquidity, the Company expects sufficient funds for its operations and scheduled debt service, at least through the next twelve months. On a longer term basis, at September 30, 2016, the Company had approximately $60.2 million of debt maturities due over the next two year period ending September 30, 2018, inclusive of $32.2 million of liabilities held for sale (gross of deferred financing costs). These debt maturities include $9.2 million of convertible promissory notes, which are convertible into shares of common stock. The Company believes its long-term liquidity needs will be satisfied by these same sources, as well as borrowings as required to refinance indebtedness.

During the three and nine months ended September 30, 2016, the Company generated negative cash flows, and anticipates positive cash flow starting in 2017, due to anticipated continued reductions in operating overhead primarily impacting general and administrative expenses.

In order to satisfy the Company’s capital needs, the Company seeks to: (i) continue improving operating results through its leasing and subleasing transactions executed with favorable terms and consistent and predictable cash flow; (ii) expand borrowing arrangements with certain lenders; (iii) refinance current debt, where possible, to obtain more favorable terms; and (iv) raise capital through the issuance of debt securities. The Company anticipates that these actions, if successful, will provide the opportunity to maintain liquidity on a short and long-term basis, thereby permitting the Company to meet its operating and financing obligations for the next twelve months. However, there is no guarantee that such actions will be successful or that anticipated operating results of the Transition will be realized. If the Company is unable to expand existing borrowing agreements, refinance current debt, or raise capital through the issuance of securities, then the Company may be required to restructure its outstanding indebtedness, implement further cost reduction initiatives or sell additional assets, or suspend payment of preferred dividends.

.

NOTE 4. RESTRICTED CASH

The following table sets forth the Company’s various restricted cash, escrow deposits and related financial instruments excluding $3.6 million classified as assets held for sale:

|

| | | | | | | | |

(Amounts in 000’s) | | September 30, 2016 | | December 31, 2015 |

Cash collateral and certificates of deposit | | $ | 245 |

| | $ | 7,687 |

|

Replacement reserves | | 836 |

| | 950 |

|

Escrow deposits | | 715 |

| | 532 |

|

Total current portion | | 1,796 |

| | 9,169 |

|

| | | | |

Restricted investments for other debt obligations | | 2,279 |

| | 2,264 |

|

HUD and other replacement reserves | | 1,403 |

| | 1,294 |

|

Total noncurrent portion | | 3,682 |

| | 3,558 |

|

Total restricted cash | | $ | 5,478 |

| | $ | 12,727 |

|

NOTE 5. PROPERTY AND EQUIPMENT

The following table sets forth the Company’s property and equipment excluding $44.1 million and $1.2 million classified as assets held for sale at September 30, 2016 and December 31, 2015, respectively :

|

| | | | | | | | | | |

(Amounts in 000’s) | | Estimated Useful Lives (Years) | | September 30, 2016 | | December 31, 2015 |

Buildings and improvements |

| 5-40 | | $ | 83,481 |

| | $ | 128,912 |

|

Equipment |

| 2-10 | | 9,194 |

| | 13,470 |

|

Land |

| — | | 3,988 |

| | 7,128 |

|

Computer related |

| 2-10 | | 2,894 |

| | 2,999 |

|

Construction in process | | — | | 627 |

| | 390 |

|

| | | | 100,184 |

| | 152,899 |

|

Less: accumulated depreciation and amortization | | | | (20,864 | ) | | (26,223 | ) |

Property and equipment, net | | | | $ | 79,320 |

| | $ | 126,676 |

|

Buildings and improvements includes the capitalization of costs incurred for the respective certificates of need (the “CON”). For additional information on the CON amortization, see Note 6 - Intangible Assets and Goodwill.

For the three months ended September 30, 2016 and 2015, total depreciation and amortization expense was $1.1 million and $1.9 million, respectively. For the nine months ended September 30, 2016 and 2015, total depreciation and amortization expense was $4.2 million and $5.4 million, respectively. There were no amounts of total depreciation and amortization expense recognized in Loss from discontinued operations, net of tax in the three and nine month periods ended September 30, 2016 nor the three month period ended September 30, 2015. Total depreciation and amortization expense excludes $0.1 million for the nine months ended September 30, 2015 that is recognized in Loss from discontinued operations, net of tax.

NOTE 6. INTANGIBLE ASSETS AND GOODWILL

Intangible assets consist of the following:

|

| | | | | | | | | | | | | | | | |

(Amounts in 000’s) | | CON (included in property and equipment) | | Bed Licenses - Separable | | Lease Rights | | Total |

Balances, December 31, 2015 | | |

| | |

| | |

| | |

|

Gross | | $ | 35,690 |

| | $ | 2,471 |

| | $ | 6,881 |

| | $ | 45,042 |

|

Accumulated amortization | | (4,760 | ) | | — |

| | (3,461 | ) | | (8,221 | ) |

Net carrying amount | | $ | 30,930 |

| | $ | 2,471 |

| | $ | 3,420 |

| | $ | 36,821 |

|

| | | | | | | | |

Transfers -Assets of disposal group held for sale | | | | | | | | |

Gross | | (12,879 | ) | | — |

| | — |

| | (12,879 | ) |

Accumulated amortization | | 2,123 |

| | — |

| | — |

| | 2,123 |

|

| | | | | | | | |

Amortization expense | | (676 | ) | | — |

| | (500 | ) | | (1,176 | ) |

| | | | | | | | |

Balances, September 30, 2016 | | | | | | | | |

Gross | | 22,811 |

| | 2,471 |

| | 6,881 |

| | 32,163 |

|

Accumulated amortization | | (3,313 | ) | | — |

| | (3,961 | ) | | (7,274 | ) |

Net carrying amount | | $ | 19,498 |

| | $ | 2,471 |

| | $ | 2,920 |

| | $ | 24,889 |

|

Amortization expense for the CON included in property and equipment was approximately $0.2 million and $0.7 million for the three and nine month periods ended September 30, 2016 and was approximately $0.3 million and $0.9 million for the three and nine month periods ended September 30, 2015, respectively.

Amortization expense for lease rights was approximately $0.2 million and $0.5 million for the three and nine month periods ended September 30, 2016 and was approximately $0.2 million and $0.5 million for the three and nine month periods ended September 30, 2015, respectively.

Expected amortization expense for all definite-lived intangibles for each of the years ended December 31, is as follows:

|

| | | | | | | | |

(Amounts in 000’s) | | Bed Licenses | | Lease Rights |

2016(a) | | $ | 171 |

| | $ | 166 |

|

2017 | | 683 |

| | 667 |

|

2018 | | 683 |

| | 667 |

|

2019 | | 683 |

| | 667 |

|

2020 | | 683 |

| | 482 |

|

Thereafter | | 16,595 |

| | 271 |

|

Total expected amortization expense | | $ | 19,498 |

| | $ | 2,920 |

|

(a) Estimated amortization expense for the year ending December 31, 2016, includes only amortization to be recorded after September 30, 2016.

The following table summarizes the carrying amount of goodwill: |

| | | | | | | | |

(Amounts in 000’s) | | September 30, 2016 | | December 31, 2015 |

Goodwill | | $ | 5,023 |

| | $ | 5,023 |

|

Transfers - Assets of disposal group held for sale | | (2,078 | ) | | — |

|

Accumulated impairment losses | | (840 | ) | | (840 | ) |

Net carrying amount | | $ | 2,105 |

| | $ | 4,183 |

|

The Company does not amortize indefinite-lived intangibles, which consist of separable bed licenses and goodwill.

NOTE 7. LEASES

Operating Leases

The Company leases a total of eleven skilled nursing facilities from unaffiliated owners under non-cancelable leases, most of which have rent escalation clauses and provisions for payments of real estate taxes, insurance and maintenance costs. Each of the skilled nursing facilities that are leased by the Company are subleased to and operated by third-party operators. The Company also leases certain office space located in Suwanee, Georgia. The Company has also entered into lease agreements for various equipment previously used in the facilities. These leases are included in future minimum lease payments below.

As of September 30, 2016, the Company is in compliance with all operating lease financial and administrative covenants.

Future Minimum Lease Payments

Future minimum lease payments for each of the next five years ending December 31, are as follows:

|

| | | | |

| | (Amounts in

000’s) |

2016(a) | | $ | 2,048 |

|

2017 | | 8,149 |

|

2018 | | 8,313 |

|

2019 | | 8,492 |

|

2020 | | 8,671 |

|

Thereafter | | 55,260 |

|

Total | | $ | 90,933 |

|

(a) Estimated minimum lease payments for the year ending December 31, 2016 include only payments to be recorded after September 30, 2016.

Leased and Subleased Facilities to Third-Party Operators

As a result of the completion of the Transition, the Company leases or subleases to third-party operators 35 facilities (24 owned by the Company and 11 leased to the Company) on a triple net basis, meaning that the lessee (i.e., the new third-party operator of the property) is obligated under the lease or sublease, as applicable, for all costs of operating the property, including insurance, taxes and facility maintenance, as well as the lease or sublease payments, as applicable. On October 6, 2016, the Company completed the sale of the Arkansas Facilities (see Note 16 - Subsequent Events).

Termination of Arkansas Leases. Until February 3, 2016, the Company subleased through its subsidiaries (the “Aria Sublessors”) the Arkansas Facilities to affiliates (the “Aria Sublessees”) of Aria Health Group, LLC (“Aria”) pursuant to separate sublease agreements (the “Aria Subleases”). Effective February 3, 2016, the Company terminated each Aria Sublease due to the applicable Aria Sublessee’s failure to pay rent pursuant to the terms of such sublease. The term of each Aria Sublease was approximately fifteen (15) years, and the annual aggregate base and special rent payable to the Company under the Aria Subleases was approximately $4.2 million in the first year of such subleases and the base rent was subject to specified annual rent escalators.

On July 17, 2015, the Company made a short-term loan to Highlands Arkansas Holdings, LLC, an affiliate of Aria (“HAH”), for working capital purposes, and, in connection therewith, HAH executed a promissory note (the “ HAH Note”) in favor of the Company. Since July 17, 2015, the HAH Note has been amended from time to time and at September 30, 2016, had an outstanding principal amount of $1.0 million and matured on December 31, 2015. The Company received $0.7 million in partial repayment of the HAH Note during the second quarter of 2016. The Company is currently seeking the repayment of the remaining balance of the HAH Note in accordance with its terms and expects full repayment.

Lease of Arkansas Facilities. From February 5, 2016, to October 6, 2016, nine wholly-owned subsidiaries of the Company (each, a “Skyline Lessor”) leased the Arkansas Facilities to Skyline Healthcare LLC (“Skyline”), or an affiliate of Skyline (the “Skyline Lessee”), pursuant to a Master Lease Agreement, dated February 5, 2016 (the “Skyline Lease”). The term of the Skyline Lease commenced on April 1, 2016. The initial lease term of the Skyline Lease was fifteen (15) years with two (2) separate renewal terms of five (5) years each. The Skyline Lease provided for annual rent in the first year of $5.4 million, and an annual rent escalator of 2.5% each year during the initial term and any subsequent renewal terms. Skyline guaranteed the obligations of its affiliates.

Sale of Arkansas Facilities. In connection with the Skyline Lease, the Skyline Lessors entered into an Option Agreement, dated February 5, 2016, with Joseph Schwartz, the manager of Skyline, pursuant to which Mr. Schwartz, or an entity designated by Mr. Schwartz (the “Purchaser”), had an exclusive and irrevocable option to purchase the Arkansas Facilities at a purchase price of $55.0 million, which the Purchaser could exercise in accordance with such agreement until May 1, 2016.

On April 22, 2016, the Purchaser delivered notice to the Company of its intent to exercise its option to purchase the Arkansas Facilities. Pursuant to such purchase option, on May 10, 2016, the Skyline Lessors and the Purchaser entered into a Purchase and Sale Agreement (the “Purchase Agreement”) whereby the Skyline Lessors agreed to sell, and the Purchaser agreed to buy, the Arkansas Facilities, together with all improvements, fixtures, furniture and equipment pertaining to such facilities (except for certain leased business equipment) and the Skyline Lessors’ intangible assets (including intellectual property) relating to the operation of the nursing home business at such facilities, for an aggregate purchase price of $55.0 million. Pursuant to the Purchase Agreement the purchase price consisted of: (i) a deposit of $1.0 million deposited by the Purchaser with an escrow agent at the time of the Purchaser’s exercise of the purchase option; (ii) cash consideration of $51.0 million to be paid at closing; and (iii) the Skyline Note from the Purchaser in favor of the Skyline Lessors with a principal amount of $3.0 million, to be executed and delivered at closing.

On July 14, 2016, August 26, 2016 and September 29, 2016, the Skyline Lessors entered into separate letter agreements with Skyline and the Purchaser, which in the aggregate amended the Purchase Agreement to extend the date by which the purchase and sale of the Arkansas Facilities was required to close from August 1, 2016 to October 6, 2016 and increased the deposit payable by the Purchaser from $1.0 million to $1.8 million.

On October 6, 2016, the Company completed the sale of the Arkansas Facilities to the Purchaser pursuant to the Purchase Agreement, as amended (see Note 16 - Subsequent Events).

New Beginnings. On January 22, 2016, New Beginnings filed petitions to reorganize its finances under the U.S. Bankruptcy Code. New Beginnings operated the Oceanside Facility, the Savannah Beach Facility and the Jeffersonville Facility (collectively, the “New Beginnings Facilities”) pursuant to a master lease dated November 3, 2015, with the Company. The Jeffersonville Facility was decertified by CMS in February 2016 for deficiencies related to its operations and maintenance of the facility. From January 1, 2016 until June 4, 2016, New Beginnings paid de minimis rent for the Oceanside and Savannah Beach Facilities and did not pay rent for the Jeffersonville Facility.

On March 4, 2016, due to defaults by New Beginnings, the Company petitioned the Bankruptcy Court to lift the automatic stay to enable the Company to regain possession of the New Beginnings Facilities. Prior to the court ruling on the motion, the Company entered into a consent order (the “Consent Order”) with New Beginnings, the debtors’ creditors’ committee, which represents the unsecured creditors in the proceedings, and Gemino Healthcare Finance, LLC (the debtors’ secured lender), in which the Company agreed to give the creditors’ committee until June 4, 2016 to sell all of New Beginnings’ assets, including the leasehold interests and personal property for the New Beginnings Facilities. The Consent Order further provided that if the creditors’ committee was unable to sell the assets by such date, the automatic stay would be lifted and the Company would be allowed to reclaim possession of the New Beginnings Facilities. The court signed the Consent Order on May 9, 2016, and it was entered on the docket on May 10, 2016. The automatic stay was lifted as of June 4, 2016, thereby allowing the Company to take possession of the New Beginnings Facilities from New Beginnings.

The Oceanside Facility was cited for deficiencies during a state survey on November 6, 2015 and had six months, or until May 5, 2016, to meet the pertinent provisions of Section 1819 and 1919 of the Social Security Act and be deemed in substantial compliance with each of the requirements for long term care facilities established by the Secretary of Health and Human Services in 42 CFR Section 483.1 et seq. (collectively, “CMS Requirements”) with regard to the facility. As of May 3, 2016, out of concern that decertification of the Oceanside Facility was imminent, New Beginnings obtained a preliminary injunction against the Georgia Department of Community Health and CMS and their officers, agents, servants, employees and attorneys prohibiting the termination of the facility’s Medicare and Medicaid provider agreements until the earlier of (i) July 1, 2016; (ii) the completion of the administrative review process pursuant to 42 U.S.C. § 405(g); or (iii) the full administration of the bankruptcy estate pursuant to Title 11 of the U.S. Code, in part in order to give New Beginnings time to market its leasehold interests and assets to potential buyers pursuant to the Consent Order. On May 9, 2016, a Notice of Involuntary Termination from CMS was issued to New Beginnings indicating that its operations at the Oceanside Facility were not in substantial compliance with CMS Requirements and that its provider agreements with CMS were terminated as of such date. The letter noted that the effectuation of the involuntary termination was stayed by the terms of the Bankruptcy Court’s order.

Peach Health. On June 18, 2016, ADK Georgia, entered into the Peach Health Sublease with Peach Health Sublessee, providing that Peach Health Sublessee would take possession of the Peach Facilities and operate them as a subtenant.

The Peach Health Sublease became effective for the Jeffersonville Facility, on June 18, 2016 and for the Savannah Beach and Oceanside Facilities on July, 13, 2016, (the date on which ADK Georgia accepted possession of the facilities from New Beginnings).

ADK Georgia shall be responsible for payment of all outstanding bed/provider taxes to the State of Georgia relating to the operation of the Savannah Beach Facility prior to the effective date of the Peach Health Sublease.

The Peach Health Sublease is structured as a triple net lease, except that ADK Georgia assumes responsibility for the cost of certain deferred maintenance at the Savannah Beach Facility and capital improvements that may be necessary for Peach Health Sublessee to recertify the Oceanside and Jeffersonville Facilities with CMS so they are eligible for Medicare and Medicaid reimbursement. The term of the Peach Health Sublease for all three Peach Facilities expires on August 31, 2027.

Rent for the Savannah Beach Facility, the Oceanside Facility and the Jeffersonville Facility is $0.3 million, $0.4 million and $0.6 million per annum, respectively; provided, however, that rent is only $1 per month for the Oceanside and Jeffersonville Facilities until the Rent Commencement Date. In addition, with respect to the Oceanside and Jeffersonville Facilities, Peach Health Sublessee is entitled to three months of $1 per month rent following the Rent Commencement Date and, following such three-month period, five months of rent discounted by 50%. In addition, in the event that the Savannah Beach Facility is decertified due to any previous non-compliance attributable to New Beginnings, rent for such facility will revert to $1 a month until it is recertified along with the other facilities. The annual rent for each of the Peach Facilities will escalate at a rate of 3% each year pursuant to the Peach Health Sublease.

Under the terms of the Peach Health Sublease, Peach Health Sublessee agrees to use its best efforts to pursue recertification of the Jeffersonville and Oceanside Facilities with CMS as soon as possible. In connection therewith, Peach Health Sublessee created an operating plan for such recertification, including a timetable and estimate of funds required from ADK Georgia for capital improvements for each such facility and submitted such plan to ADK Georgia for approval within sixty days of the commencement date of the Peach Health Sublease (a “Recertification Plan”). During the third quarter of 2016, the parties reached agreement on the terms of the Recertification Plan for both facilities.

In connection with the Peach Health Sublease, the Company has extended to Peach Health Sublessee a working capital line of credit of up to $1.0 million for operations at the Peach Facilities (the “LOC”), with interest accruing on the unpaid balance under the LOC at an interest rate of 13.5% per annum. The entire principal amount due under the LOC, together with all accrued and unpaid interest thereunder, shall be due one year from the date of the first disbursement. The LOC is secured by a first priority security interest in Peach Health Sublessee’s assets and accounts receivable pursuant to a security agreement executed by Peach Health Sublessee. At September 30, 2016, there was a $0.4 million outstanding balance on the LOC.

Future minimum lease receivables from the Company’s facilities leased and subleased to third party operators for each of the next five years ending December 31, are as follows:

|

| | | | |

| | (Amounts in

000's) (b) (c) |

2016(a) | | $ | 5,082 |

|

2017 | | 20,564 |

|

2018 | | 21,825 |

|

2019 | | 22,298 |

|

2020 | | 22,329 |

|

Thereafter | | 152,652 |

|

Total | | $ | 244,750 |

|

(a) Estimated minimum lease receivables for the year ending December 31, 2016, include only payments to be received after September 30, 2016.

(b) Excludes estimated minimum lease receivables for the nine Arkansas Facilities sold to the Purchaser on October 6, 2016.

(c) Assumes recertification of the Oceanside and Jeffersonville Facilities on April 1, 2017.

For further details regarding the Company’s leased and subleased facilities to third-party operators, see Part II, Item 8, Notes to Consolidated Financial Statements, Note 7 - Leases included in the Annual Report.

NOTE 8. ACCRUED EXPENSES AND OTHER

Accrued expenses and other consist of the following:

|

| | | | | | | | |

(Amounts in 000’s) | | September 30, 2016 | | December 31, 2015 |

Accrued employee benefits and payroll related | | $ | 622 |

| | $ | 1,332 |

|

Real estate and other taxes | | 1,113 |

| | 411 |

|

Self-insured reserve | | 1,530 |

| | 221 |

|

Accrued interest | | 438 |

| | 484 |

|

Other accrued expenses | | 575 |

| | 677 |

|

Total accrued expenses | | 4,278 |

|

| 3,125 |

|

Earnest deposit | | 1,750 |

| | — |

|

Prepaid sublease rent | | 61 |

| | — |

|

Total accrued expenses and other | | $ | 6,089 |

| | $ | 3,125 |

|

NOTE 9. NOTES PAYABLE AND OTHER DEBT

See Part II, Item 8, Notes to Consolidated Financial Statements, Note 9 - Notes Payable and Other Debt included in the Annual Report for a detailed description of all the Company’s debt facilities.

Notes payable and other debt consists of the following (a): |

| | | | | | | | |

(Amounts in 000’s) | | September 30, 2016 | | December 31, 2015 |

Senior debt—guaranteed by HUD | | $ | 28,767 |

| | $ | 25,469 |

|

Senior debt—guaranteed by USDA | | 25,929 |

| | 26,463 |

|

Senior debt—guaranteed by SBA | | 3,427 |

| | 3,548 |

|

Senior debt—bonds, net of discount | | 6,950 |

| | 7,025 |

|

Senior debt—other mortgage indebtedness | | 41,862 |

| | 51,128 |

|

Other debt | | 1,624 |

| | 2,638 |

|

Convertible debt | | 9,200 |

| | 9,200 |

|

Deferred financing costs | | (2,256 | ) | | (2,712 | ) |

Total debt | | $ | 115,503 |

| | $ | 122,759 |

|

Current debt | | 19,164 |

| | 50,960 |

|

Debt included in liabilities of disposal group held for sale (b) | | 32,036 |

| | 958 |

|