UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Message from |

OceanFirst Financial Corp. 110 West Front Street Red Bank, New Jersey 07701 1.888.623.2633 |

Christopher D. Maher

Chairman, President and Chief Executive Officer

April 11, 2024

|

“Thank you for your continued support and investment in OceanFirst.”

|

Dear Fellow Stockholder:

On behalf of your Board of Directors, I am pleased to invite you to participate in the OceanFirst Financial Corp. (“OCFC” or the “Company”) Annual Meeting of Stockholders (the “Annual Meeting”) to be held as a virtual meeting on Tuesday, May 21, 2024 at 8:00 a.m. Eastern Time. For detailed information regarding how to access the live webcast of the Annual Meeting and instructions for how to vote your shares, please refer to your proxy card. We welcome questions from stockholders during the meeting; please remember, however, you will need the information printed on the proxy card to submit questions during the virtual meeting.

We encourage you to vote your shares prior to the Annual Meeting to ensure your stock is represented, even if you are planning to attend the virtual meeting. For your convenience, there are multiple options for voting your shares, including voting by telephone or online, using the instructions included on the proxy card. In addition, you may mail the proxy card using the envelope provided, however, please allow sufficient time for the proxy card to be received prior to the deadline.

Please take a few moments to review the pages that follow in the Proxy Statement, as well as the Annual Report to Stockholders and Form 10-K. In addition to the formal business of the Annual Meeting, we plan to provide an update on the Company’s accomplishments in 2023. In 2023, the Company delivered profitable growth, increased deposits, and prudently grew our loan portfolio, all during a challenging operating environment.

The Company’s Board of Directors, executive officers, and representatives from the Company’s independent registered accounting firm will be available during the question and answer period on the agenda of the virtual meeting. For those who are unable to attend the live webcast of the Annual Meeting, a replay will be available after and can be accessed by visiting www.oceanfirst.com and selecting the Investor Relations area.

Thank you for your continued support and investment in OceanFirst.

Sincerely,

|

Tuesday, May 21, 2024

8:00 a.m. Eastern Time

Virtually at www.virtualshareholdermeeting.com/OCFC2024

ITEMS OF BUSINESS

| 1. | The election of 13 directors of the Company; |

| 2. | An advisory vote on executive compensation as disclosed in these materials; |

| 3. | The ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| 4. | Such other matters as may properly come before the Annual Meeting or any adjournments thereof. The Board of Directors is not aware of any other business to come before the Annual Meeting. |

By order of the Board of Directors,

Steven J. Tsimbinos

Corporate Secretary

RECORD DATE

In order to vote, you must have been a stockholder at the close of business on March 25, 2024.

PROXY VOTING

It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the enclosed proxy card, or by voting via the internet or by telephone by following the voting instructions printed on your proxy card. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the proxy statement.

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: |  |

|

|

| ||||

| Please refer to the enclosed proxy materials or the information forwarded by your bank, broker, or other holder of record to see which voting methods are available to you. | BY INTERNET

Visit the website |

BY TELEPHONE

Call the telephone |

BY MAIL

Sign, date and return |

VIRTUALLY

Follow the |

1

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 21, 2024:

Pursuant to the rules of the Securities and Exchange Commission, OceanFirst Financial Corp. furnished a Notice of Internet Availability of Proxy Materials (“Notice”) to all stockholders. This Notice includes instructions on how to access our 2024 Proxy Statement and 2023 Annual Report online, and how to vote online for the 2024 Annual Meeting of Stockholders. If you received a Notice and would like to receive a printed version of our proxy materials, please follow the instructions for requesting such materials included in the Notice.

To be admitted into the Annual Meeting at www.virtualshareholdermeeting.com/OCFC2024, you must enter the 16-digit control number found on your proxy card, voting instruction form, or Notice you previously received.

If you hold your shares through a broker, your shares will not be voted unless (i) you provide voting instructions, or (ii) the matter is one for which brokers have discretionary authority to vote.

The Notice of Annual Meeting, Proxy Statement, and Annual Report are available on our Investor Relations website at https://ir.oceanfirst.com/default.aspx. Additionally, you may access our proxy materials at www.proxyvote.com, a site that does not have “cookies” that identify visitors to the site.

2

Table of Contents

3

| Proposal | Board Recommendation | Page Reference | ||

| Proposal 1 – Election of Directors | The Board of Directors recommends a vote “FOR” each of the nominees for director. | 15 | ||

| Proposal 2 – Advisory Vote on Executive Compensation | The Board of Directors recommends a vote “FOR” the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in these materials. | 69 | ||

| Proposal 3 – Ratification of the appointment of Deloitte & Touche LLP as the independent registered public accounting firm | The Board of Directors recommends a vote “FOR” the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm. | 70 |

| Name | Age | Director Since | Independent | Committees | ||||

| John F. Barros | 50 | 2023 |  |

Finance | ||||

| Anthony R. Coscia | 64 | 2018 |  |

Leadership | ||||

| Jack M. Farris | 65 | 2015 |  |

Human Resources/Compensation, Information Technology, and Risk | ||||

| Robert C. Garrett | 66 | 2023 |  |

Audit | ||||

| Kimberly M. Guadagno | 64 | 2018 |  |

Human Resources/Compensation | ||||

| Nicos Katsoulis | 64 | 2019 |  |

Finance and Risk | ||||

| Joseph J. Lebel III | 61 | 2022 | None | |||||

| Christopher D. Maher | 57 | 2014 | None | |||||

| Joseph M. Murphy, Jr. | 65 | 2020 |  |

Finance and Information Technology | ||||

| Steven M. Scopellite | 58 | 2019 |  |

Information Technology and Leadership | ||||

| Grace C. Torres | 64 | 2018 |  |

Audit, Leadership, and Human Resources/Compensation | ||||

| Patricia L. Turner | 55 | 2020 |  |

Audit, Finance, and Information Technology | ||||

| Dalila Wilson-Scott | 50 | 2023 |  |

Human Resources/Compensation |

The below table represents the diversity matrix for the Director Nominees noted above:

| 2024 Director Nominees Diversity Matrix | |||

| Total Number of Directors | 13 | ||

| Part I: Gender Identity | Female | Male | |

| Directors | 4 | 9 | |

| % of Total | 30.8% | 69.2% | |

| Part II: Demographic Background | |||

| African American or Black | 3 | ||

| White | 9 | ||

| Hispanic or Latinx | 1 | ||

| Asian | 1 | ||

| Two or More Ethnicities | 1 | ||

| LGBTQ+ | 0 | ||

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 4

|

Comprehensive annual self-assessment of Board, Committees, and director performance by the Leadership Committee |  |

Continued Board refreshment added to the Board’s diversity with the election of three new directors, two of whom are racially diverse | |

|

Appointment of David Berninger as Executive Vice President/Chief Risk Officer, following the retirement of Grace Vallacchi as Chief Risk Officer |  |

Enhancement of the Compliance Department of OceanFirst Bank, N.A. (the “Bank”) with the addition of several new positions and the establishment of a Board-level Compliance Committee | |

|

Restructure of Information Technology Department with appointment of Brian Schaeffer as Chief Information Officer and Timothy Green as Chief Information Security Officer |  |

Demonstrating the Bank’s commitment and support to its communities through the second annual CommUNITYFirst Day. | |

|

Provided stockholder value with the 108th consecutive quarterly common stock dividend payment in 2024 and continued payments of Preferred Stock dividends |

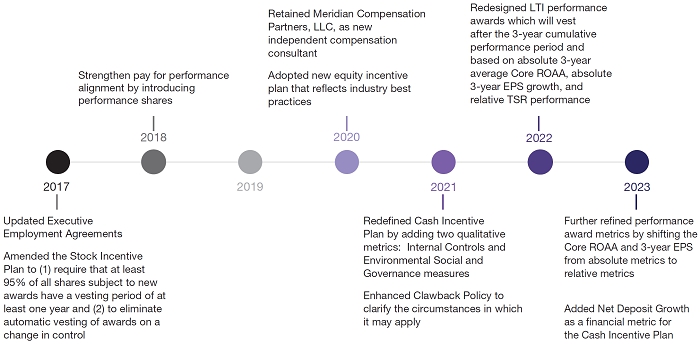

| • | Base Salaries for Named Executive Officers were unchanged for 2023 |

| • | Addition of new Cash Incentive Plan metric reflecting the importance of deposits and funding |

| • | Continued strong stockholder support of compensation program |

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 5

The Company periodically reviews its corporate governance policies and procedures to ensure that the Company meets the highest standards of ethical conduct, reports results with accuracy and transparency, and maintains full compliance with the laws, rules and regulations that govern the Company’s operations. As part of this periodic corporate governance review, the Board of Directors reviews and adopts best corporate governance policies and practices for the Company.

The Company has taken several actions to improve its internal governance since last year’s Annual Meeting of Stockholders. These actions include:

| Self-Assessment | The Leadership Committee, with the assistance of an independent consultant, performed a comprehensive assessment of the performance of the Board and its committees. Previous self-assessments by the Board have resulted in governance actions such as the adoption of a skills matrix, amendment of the Company’s Bylaws to eliminate age and geographic restrictions for directors, and increasing the diversity of the Board to better match the communities the Company serves. | |

| Board Refreshment | The Board appointed three new directors in 2023: John F. Barros was appointed in September 2023, and Robert C. Garrett and Dalila Wilson-Scott were appointed in October 2023. All three directors bring valuable experiences and perspectives to the Board and, for Mr. Barros and Ms. Wilson-Scott, knowledge about the Boston and Philadelphia markets, respectively. These appointments also increased the Board’s diversity, adding two racially diverse directors, one of which is also a woman.

As part of its Board refreshment, two of our longest-tenured Directors, Michael D. Devlin and John W. Walsh, are not standing for re-election and will exit off the Board at the conclusion of the 2024 Annual Meeting of Stockholders. Mr. Devlin will remain as a director of the Bank. | |

| Appointment of David L. Berninger as Executive Vice President/Chief Risk Officer | In October 2023, David L. Berninger was appointed Executive Vice President/Chief Risk Officer, following the retirement of Grace Vallacchi. Mr. Berninger previously served as Chief Risk Officer for the US Region of the Industrial and Commercial Bank of China and Deputy Chief Risk Officer of Valley National Bank and has extensive leadership and risk management experience at several financial services organizations. | |

| Restructure of Information Technology Department | In connection with a series of productivity and efficiency initiatives, the Bank appointed Brian Schaeffer as its Chief Information Officer in August 2023. Mr. Schaeffer previously served as the Bank’s Chief Information Security Officer and was the Chief Information Officer at Sun National Bank prior to its acquisition by the Bank in 2018. In November 2023, the Bank appointed Timothy Green as Chief Information Security Officer. Mr. Green previously served as Chief Cyber Defense Officer at Kearny Bank. | |

| Enhancement of the Compliance Department | Recognizing the importance of maintaining continued compliance with increasing regulatory requirements, the Bank made several enhancements to its Compliance Department in 2023, including the additions of a Compliance Program Officer and a dedicated Complaints Officer. In addition, the Bank established a Board-level Compliance Committee, chaired by Director Michael Devlin, to oversee the Bank’s compliance with banking laws and regulations and the Bank’s responses to regulatory examination findings. | |

| Common and Preferred Dividend Payments | In February 2024, the Company paid its 108th consecutive quarterly cash dividend to common stockholders. The Company also paid $4.0 million in perpetual preferred stock dividends during 2023. | |

| CommUNITYFirst Day | Following its success last year, the Bank held its second annual CommUNITYFirst Day on September 12, 2023. All Bank locations closed early, allowing employees to spend the day helping 90 non-profit organizations in five states, with a focus on those organizations that provide housing, alleviate food insecurity, and build inclusive communities. |

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 6

The Company maintains a Corporate Governance Policy to govern certain activities, including:

| (1) | the duties and responsibilities of the Board of Directors and each director; |

| (2) | the composition and operation of the Board of Directors; |

| (3) | the establishment and operation of Board committees; |

| (4) | convening executive sessions of independent directors; |

| (5) | succession planning; |

| (6) | the Board of Directors’ interaction with management; and |

| (7) | the evaluation of the performance of the Board of Directors, its committees, and of the CEO. |

In accordance with the Corporate Governance Policy, at least a majority of the directors on the Board must be “independent directors” as defined in the listing requirements of the Nasdaq Stock Market (“Nasdaq”).

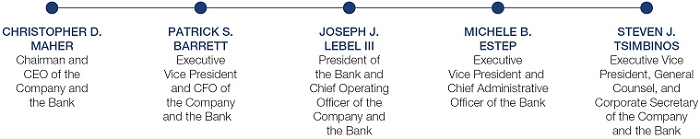

The Board is led by the Chairman of the Board, Christopher D. Maher, who also serves as President of the Company and CEO of the Company and the Bank. Mr. Maher served as the President of the Bank until January 1, 2021, at which time he was succeeded by Mr. Lebel. The Board believes that combining the Chairman and CEO positions, together with the appointment of an independent lead director (the “Lead Director”), is the appropriate Board leadership structure for the Company at this time. The Company has historically been led by a combined Chairman and CEO and the Board believes that the CEO is most knowledgeable about our business and corporate strategy and is in the best position to lead the Board of Directors, especially in relation to its oversight of corporate strategy and execution. In addition, having a combined Chairman and CEO provides a complete alignment on corporate strategy and vision. To assure effective independent oversight, the Board has adopted a number of governance practices, including:

| • | the establishment of the Lead Director; |

| • | executive sessions of the independent directors at every regularly scheduled Board meeting, during which the independent directors may discuss the performance of the CEO/Chairman, management succession planning, and other appropriate matters; |

| • | the independence of 13 of 15 of the Board members; |

| • | the Company’s General Counsel reports directly to the Board; |

| • | stock ownership guidelines for directors and those executive officers named in the Summary Compensation Table herein (the “NEOs”); |

| • | an annual performance evaluation of the CEO by the Human Resources/Compensation Committee (the “Compensation Committee”); and |

| • | the Company’s Board Audit, Compensation, Leadership, and Risk Committees are composed entirely of independent members. |

The Company’s Corporate Governance Policy provides that the Chair of the Leadership Committee, currently Anthony R. Coscia, will also serve as the Lead Director. The Corporate Governance Policy provides that the duties of the Lead Director include assisting the Board in assuring compliance with and implementation of the Company’s Corporate Governance Policy, coordinating the agenda for and moderating sessions of the Board’s independent directors, and acting as principal liaison on certain issues between the independent and inside directors, including the Chairman of the Board, as applicable.

While the Board believes that the current leadership structure is best suited for the Company, it recognizes that other leadership models in the future might be appropriate, depending on the circumstances. Accordingly, the Board periodically reviews its leadership structure.

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 7

Under the Company’s Corporate Governance Policy, the business and affairs of the Company are managed by the officers under the direction and oversight of the Board. The Board is charged with providing oversight of the Company’s risk management function (framework and processes) and the Joint Risk Committee of the Boards of the Company and the Bank (the “Risk Committee”) has been delegated primary responsibility for overseeing the risk management function. In addition, the Compensation Committee and the Company and Bank’s senior management are tasked with oversight of the Company’s compensation processes to ensure they do not encourage taking unnecessary and excessive risks that would threaten the value of the Company. The duties of each of the Risk Committee, the Compensation Committee, and senior management with respect to such oversight is summarized below.

Board of Directors

The Board is charged with providing oversight of the Company’s risk management function.

| |

Risk Committee

• Its primary responsibility is overseeing the risk management function at the Company on behalf of the Board. • Meets at least quarterly with executive management and the Chief Risk Officer (the “CRO”) and receives comprehensive reports and dashboards on enterprise risk management, including management’s assessment of risk exposures (including risks related to liquidity, credit, operations, interest rates, compliance, reputation and strategic, among others), and the processes in place to monitor and control such exposures. • The Risk Committee may receive updates between meetings, as may be necessary, from the CRO, the CEO, the Chief Financial Officer (the “CFO”) and other members of management relating to risk oversight matters. • Provides a report to the full Board on at least a quarterly basis. • In addition, each quarter, the Audit Committee discusses with management and the independent registered public accountant their review of the Company’s financial statements and significant findings based upon the independent registered public accounting firm’s review, and any material issues are relayed to the Risk Committee. • Representatives from Internal Audit and Risk Management attend Risk and Audit Committee meetings. |

Compensation Committee

• At least annually, the Compensation Committee reviews the CRO’s assessment of the Company’s compensation plans for all employees, including the CEO and other NEOs, to ensure that these plans do not encourage taking unnecessary and excessive risks that would threaten the value of the Company. • The Compensation Committee from time to time may enact metrics under the Cash Incentive Plan to encourage risk mitigation and safe and sound banking. |

Senior Management

The Bank’s Chief Compliance Officer provides quarterly reports to the Board regarding the Bank’s compliance with existing regulations, as well as future regulations that may impact the Bank.

The CRO performs a quarterly risk assessment of the Bank’s products, services, operations, and regulatory requirements to determine the overall risk to the Bank and reports compliance with the approved Statement of Risk Appetite to the Risk Committee.

The Enterprise Risk Management Committee evaluates and monitors the Bank’s risk profile in the context of the Statement of Risk Appetite to ensure that the Bank’s risk management practices appropriately identify, measure, monitor, and control existing and emerging risks with the approved risk appetite and comply with regulatory guidelines. This Committee is composed of several senior officers, including the President and COO, the CFO, the Chief Administrative Officer, the General Counsel, the Chief Compliance Officer, the Chief Credit Officer, the Treasurer, the Chief Information Officer, the Chief Information Security Officer, and the Chief Banking Operations Officer, and is chaired by the CRO. The minutes of this Committee are provided to the Risk Committee. | |

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 8

The Board of Directors of the Company maintains the Audit Committee, the Compensation Committee, the Leadership Committee, the Risk Committee, the Finance Committee, and the Information Technology Committee. The following is a description of each of the Company’s Board committees.

| Audit Committee | Meetings during 2023: 5 |

|

Grace C. Torres* (Chair)

Michael D. Devlin*

Robert C. Garrett**

Patricia L. Turner**

John E. Walsh

|

The Audit Committee meets periodically with the independent registered public accounting firm and management to review accounting, auditing, internal control structure, and financial reporting matters. Each member of the Audit Committee is “independent” in accordance with Nasdaq listing standards and the heightened independence standards applicable to audit committees.

The Board of Directors has a separately-designated standing Audit Committee for the Company and Bank established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee acts under a written Charter adopted by the Board of Directors, which is available on the Company’s website (www.oceanfirst.com). The Audit Committee reviews and reassesses the adequacy of its Charter on an annual basis.

See “Proposal 3 – Ratification of Independent Registered Public Accounting Firm – Report of Audit Committee.”

|

| * | “Audit committee financial experts” under the Rules of the Securities and Exchange Commission (“SEC” or the “Commission”). |

| ** | Mr. Garrett and Dr. Turner were appointed to the Audit Committee in 2024. |

| Human Resources/Compensation Committee | Meetings during 2023: 6 |

|

Jack M. Farris (Chair)

Kimberly M. Guadagno

Grace C. Torres

Dalila Wilson-Scott*

|

The Compensation Committee of the Company and the Bank meets to establish the compensation for the executive officers and to review the Company’s incentive compensation program when necessary. The Compensation Committee is also responsible for establishing certain guidelines for compensation and benefit programs for other salaried officers and employees of the Company and the Bank.

Each member of the Compensation Committee is independent in accordance with Nasdaq listing standards.

The Compensation Committee acts under a written Charter adopted by the Board of Directors, which is available on the Company’s website (www.oceanfirst.com). The Compensation Committee reviews and reassesses the adequacy of its Charter on an annual basis.

See “Executive Compensation—Compensation Committee Report on Executive Compensation.”

|

| * | Ms. Wilson-Scott was appointed to the Human Resources/Compensation Committee in 2024. |

| Leadership Committee | Meetings during 2023: 4 |

|

Anthony R. Coscia (Chair)

Steven Scopellite*

Grace C. Torres

John E. Walsh

|

The Leadership Committee of the Company and the Bank, formerly named the Corporate Governance/Nominating Committee, takes a leadership role in shaping governance policies and practices, including reviewing and monitoring compliance with the Company’s Corporate Governance Policy. In addition, the Leadership Committee serves as the Company’s nominating committee and is responsible for identifying individuals qualified to become Board members and recommending to the Board the director nominees for election at the next Annual Meeting of Stockholders. The Committee also recommends to the Board director candidates for each committee for appointment by the Board and provides oversight of the Company’s Environmental, Social, and Corporate Governance (“ESG”) program and functions.

The Chair of the Leadership Committee functions as Lead Director. Each member of the Leadership Committee is independent in accordance with Nasdaq listing standards.

The Leadership Committee acts under a written Charter adopted by the Board of Directors. The Charter is available on the Company’s website (www.oceanfirst.com) and is reviewed on an annual basis by the Leadership Committee. The procedures of the Leadership Committee required to be disclosed by the Commission rules are included in this proxy statement. See “Election of Directors — Criteria for Director Nominees.”

|

| * | Mr. Scopellite was appointed to the Leadership Committee in 2024. |

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 9

| Risk Committee | Meetings during 2023: 6 |

|

Nicos Katsoulis

Michael D. Devlin

Jack M. Farris

|

The Risk Committee of the Company and the Bank assists the Board in enterprise risk management functions. The Chair and at least one other director will be independent in accordance with Nasdaq listing standards. The Risk Committee acts under a written Charter adopted by the Board of Directors. The Charter is available on the Company’s website (www.oceanfirst.com) and is reviewed on an annual basis by the Risk Committee.

See “Board Role in the Oversight of Risk/Risk Committee.”

|

| Finance Committee | Meetings during 2023: 4 |

|

Joseph M. Murphy (Chair)

John F. Barros*

Michael D. Devlin

Nicos Katsoulis

Patricia L. Turner

|

The Finance Committee of the Company and the Bank assists the Board in overseeing the financial management of the Company and developing the Company’s strategic and annual business plan and budget. The Chair and at least one other director of the Finance Committee will be independent in accordance with Nasdaq listing standards. The Finance Committee acts under a written Charter adopted by the Board of Directors. The Charter is available on the Company’s website (www.oceanfirst.com) and is renewed on an annual basis by the Finance Committee. |

| * | Mr. Barros was appointed to the Finance Committee in 2024. |

| Information Technology Committee | Meetings during 2023: 7 |

|

Steven M. Scopellite (Chair)

Jack M. Farris

Joseph M. Murphy

Patricia L. Turner

|

The Information Technology Committee of the Company and the Bank provides oversight of the execution of the Company’s technology strategies and cybersecurity program and reviews the Company’s technology-related risk management activities. The Chair and at least one other director of the Information Technology Committee will be independent in accordance with Nasdaq listing standards, and the Committee will include at least one individual having significant experience and knowledge regarding information technology matters with a financial institution of at least similar size and complexity of the Company.

The Information Technology Committee acts under a written Charter adopted by the Board of Directors. The Charter is available on the Company’s website (www.oceanfirst.com) and is renewed on an annual basis by the Information Technology Committee.

|

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 10

The following table identifies the standing committees and their members as of December 31, 2023.

| Director | Audit Committee |

Leadership Committee |

Human Resources/ Compensation Committee |

Risk Committee |

Finance Committee |

Information Technology Committee |

|||||||

| John F. Barros* |  |

||||||||||||

| Anthony R. Coscia |  |

||||||||||||

| Michael D. Devlin |  |

|

|

||||||||||

| Jack M. Farris |  |

|

|

||||||||||

| Robert C. Garrett* |  |

||||||||||||

| Kimberly M. Guadagno |  |

||||||||||||

| Nicos Katsoulis |  |

|

|||||||||||

| Joseph M. Murphy |  |

|

|||||||||||

| Steven M. Scopellite |  |

||||||||||||

| Grace C. Torres |  |

|

|

||||||||||

| Patricia L. Turner |  |

|

|||||||||||

| John E. Walsh |  |

|

|||||||||||

| Dalila Wilson-Scott* |  |

|

Chairperson |

|

Member |

| * | Mr. Barros, Mr. Garrett, and Ms. Wilson-Scott were appointed to their respective Committee effective January 1, 2024. |

The Company and Bank have a Code of Ethics and Standards of Personal Conduct to ensure that all directors, executive officers, and employees of the Company and Bank meet the highest standards of ethical conduct. The Code of Ethics and Standards of Personal Conduct requires that all directors, executive officers, and employees avoid conflicts of interest, protect confidential information and customer privacy, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the Company’s best interest. Under the terms of the Code of Ethics and Standards of Personal Conduct, all directors, executive officers, and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code.

To encourage compliance with the Code of Ethics and Standards of Personal Conduct, the Company and Bank established procedures to receive, retain and consider complaints received regarding accounting, internal accounting controls or auditing matters. These procedures ensure that individuals may submit concerns regarding questionable accounting or auditing matters in a confidential and anonymous manner. The Code of Ethics and Standards of Personal Conduct also prohibits the Company from retaliating against any director, executive officer, or employee who reports actual or apparent violations of the Code.

The Company also has a Code of Ethics for Senior Officers, which applies to the CEO, CFO, and the Chief Accounting Officer. This Code of Ethics requires that these officers act with honesty and integrity, avoid actual and apparent conflicts between their personal interests and those of the Company, comply with applicable federal, state, and local laws, and promptly report suspected violations to the Chair of the Audit Committee or outside counsel.

The Code of Ethics and Standards of Personal Conduct and the Code of Ethics for Senior Officers are available in the Investor Relations section of the Company’s website (www.oceanfirst.com). Amendments to and waivers from the Code of Ethics and Standards of Personal Conduct and the Code of Ethics for Senior Officers will be disclosed on our website as required by applicable law, regulations, or listing standards.

The Company recognizes the importance of conducting its business in a manner that both benefits its stockholders and contributes to the well-being of its customers, employees, and the communities it serves. As part of its efforts to achieve this goal, the Company strives to integrate ESG within all of its activities. Feedback received by the Company indicates that ESG is an important topic for stockholders, employees, and the customers and communities served by the Company. Management and the

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 11

Board considers the role of ESG when making decisions that affect the Company, understanding that the successful integration of ESG into the Company’s business activities benefits both the stockholders and the Company as a whole.

To better address ESG matters throughout the institution, the Bank redesigned its Corporate Social Responsibility Committee as the ESG Committee in 2021. The ESG Committee, which is chaired by the Director of Corporate Communications and Marketing and consists of representatives from various Bank departments, including the Chief Administrative Officer as its executive sponsor, meets regularly to discuss ESG initiatives, establish ESG goals for the Bank and the Company, and monitor Bank policies, procedures, and actions in furtherance of these goals. As part of these efforts, the Bank issued its first ESG Report in May 2022 and is expected to issue its next report in May 2024. This report, which is available on the Investor Relations section of the Bank’s website (www.oceanfirst.com), details the Bank’s actions and activities to integrate the Bank’s ESG goals with its business practices and better serve its communities.

While the Company is proud of actions taken to date to address ESG, management recognizes that further development and maturation of the Company’s ESG strategy is appropriate to help the Company grow and flourish.

The examples below highlight the Company’s ESG efforts and plans for future action:

| • | Continued integration of Interactive Teller Machines at Bank locations, allowing the Company to continue to service its customers while reducing its paper waste output |

| • | Utilization of Microsoft Teams to facilitate virtual meetings, reducing the Bank’s carbon footprint from travel between offices |

| • | Leveraging internal resources to house self-printing marketing materials |

| • | Adoption of a Director Attendance Policy that reduces the number of in-person Board meetings and decreases carbon emissions from director travel |

| • | Expansion of hybrid home equity and line of credit loan closings within the branch network to reduce waste while improving productivity and customer satisfaction |

| • | Completed HVAC replacements at eight Bank locations, increasing efficiency |

| • | Installed solar panels at the Red Bank administrative headquarters, generating approximately 102,000 kilowatt hours annually |

| • | Less than 1% of the Bank’s commercial loan portfolio is to environmentally high-risk industries |

| • | Preparing Bank data to comply with SEC climate disclosure proposals expected to go into effect in 2025 |

| • | At the second annual CommUNITYFirst Day, more than 730 Bank employees volunteered over 2,900 hours in one afternoon at non-profit organizations in five states throughout the Bank’s footprint, including the Toms River Housing and Homeless Coalition, the Food Bank of New Jersey, and the Salvation Army |

| • | Bank leadership, including CEO Christopher Maher, visited communities throughout the Bank’s footprint, walking around town and visiting non-profits and community organizations and providing opportunities for direct interaction with Bank management |

| • | Providing Cybersecurity education to both businesses and individual customers |

| • | Continued focus on minority-owned and women-owned business lending as well as businesses supporting low-to-moderate income individuals or neighborhoods |

| • | Providing opportunities for employee engagement through Employee Roundtables and Town Hall Discussions with executive management during the year as well as assessing employee sentiment through the Employee Engagement Survey and various Pulse Surveys throughout the year |

| • | Utilizing Professional Development programs, such as WomenLEAD, the Career Development Program, and Loan Officer Training, to attract, develop, and retain diverse employees |

| • | Encouraging home ownership through the Bank’s NeighborFirst and Special Purpose mortgage programs and the Federal Home Loan Bank Home Buyer Dream Program |

| • | Expansion of the Bank’s branch network with its New Brunswick branch in Middlesex County, New Jersey |

| • | Focusing on products and programs for unbanked and underbanked communities |

| • | The Company’s investment program largely follows ESG principals, including affordable mortgage loans, healthcare, and infrastructure improvement, while avoiding companies and securities related to predatory lending, alcohol, tobacco and weapons |

| • | Providing educational resources, such as Financial Literary materials, to customers and potential clients |

| • | The OceanFirst Foundation, founded in 1996, has granted over $48 million to hundreds of local charities, organizations, and schools throughout the Bank’s footprint. In addition, charitable donations by Bank employees are also eligible for an aggregate annual $50,0000 matching gift program administered by the Foundation. |

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 12

| • | Addition of three new directors, including representatives from the Boston and Philadelphia markets |

| • | Oversight of the Bank’s ESG program by the Board Leadership Committee |

| • | Establishment of a Board-level Compliance Committee to oversee the Bank’s compliance program and adherence to applicable bank regulations |

| • | Enhanced human capital, community involvement, and cybersecurity disclosures in its Form 10-K |

| • | ESG and Internal Controls/Regulatory Compliance included as measurable components of the Bank’s Cash Incentive Program |

| • | Bifurcated Codes of Ethics for Senior Officers and for all Bank employees. The Codes of Ethics can be viewed on the Company’s Investor Relations section of its website (www.oceanfirst.com) |

The Company strongly believes that having a workforce and Board that is reflective of the communities it serves is an important way to provide value to its employees, customers, and stockholders. As part of this effort, the Company has taken several actions to encourage and promote diversity at the Bank, including:

| • | Increased the number of women and minority directors on the Board |

| • | Regular meetings of the Bank’s Diversity & Inclusion Council, which provides governance and oversight for the Bank’s diversity efforts and creates accountability for the results of these efforts |

| • | Requiring diverse candidate slates for Bank positions at the Vice President level or higher as well as consideration of women- and minority-owned businesses for Bank vendors |

| • | Participants in the Bank’s Summer Internship program engaged in a diversity roundtable to discuss their perspectives on diversity and its impact in the workplace |

| • | The Bank’s Branch Ambassador Program, created in 2022, has traveled to 13 branch locations to obtain feedback on diversity issues at the Bank, with additional branch visits planned for 2024 |

| • | Utilizing a Bank-wide newspaper to provide updates of the Bank’s diversity efforts, promote awareness of the various cultural practices and observations by Bank employees, and highlight upcoming cultural events and celebrations |

| • | Board oversight of Company policies related to social responsibility issues, including diversity and equal opportunity employment, and ESG matters through the Compensation and Leadership Committees |

| • | Diversity and inclusion efforts incorporated as a metric for the Bank’s Cash Incentive Plan |

| • | Hosting various guest speaker events for Bank employees, with topics such as awareness of antisemitism, promoting a culture of belonging and inclusion, and achieving a lasting impact in the workplace with diversity, equity, and inclusion initiatives |

| • | Conducting an Employee Engagement Survey to evaluate Bank employees’ opinions on various topics, including diversity at the Bank |

The Company recognizes that developing a diverse and inclusive workplace is an ongoing process that requires broad participation from all employee levels and strongly supports Board, management, and employee involvement for diversity and inclusion events and initiatives.

The Company believes that regular communication with its stockholders is the best way to gauge stockholder sentiment and feedback as well as for management to convey its opinions on the Company’s position in the marketplace and strategic goals. Executive management utilizes a variety of avenues for stockholder communication, which in 2023 included:

| • | Participation in various investor conferences, industry forms, and investor roundtables. During 2023, Company management attended 15 such events. |

| • | Meetings and discussions with current and prospective stockholders. During 2023, management held over 100 meetings with 82 different institutional investment funds. |

| • | Company management responded to and initiated direct outreach to stockholders. |

| • | The Company also utilized media outlets, such as appearances on broadcast television and articles in local and regional publications. |

The Board of Directors of the Company and the Bank conduct business through meetings and the activities of the Boards and their committees. Board members are encouraged to attend all Board and Committee meetings. Their attendance and performance are among the criteria considered for nomination to the Board of Directors. During the fiscal year ended December 31, 2023, the Company’s Board of Directors held 11 meetings. All of the Directors of the Company attended at least 75% of the Board meetings and the meetings of committees held on which such Directors served during the fiscal year ended December 31, 2023.

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 13

It is the policy of the Company’s Leadership Committee to consider director candidates recommended by stockholders who appear to be qualified to serve on the Company’s Board of Directors. The Leadership Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Leadership Committee does not perceive a need to increase the size of the Board of Directors. In order to avoid the unnecessary use of the Leadership Committee’s resources, the Leadership Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

To submit a recommendation of a director candidate to the Leadership Committee, a stockholder should submit the following information in writing, addressed to the Chair of the Leadership Committee, care of the Corporate Secretary, at the main office of the Company:

| (1) | The name of the person recommended as a director candidate; |

| (2) | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Exchange Act; |

| (3) | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| (4) | As to the stockholder making the recommendation, the name and address, as they appear on the Company’s books, of such stockholder; provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit his or her name and address along with a current written statement from the broker holding the securities that reflects ownership of the Company’s common stock; and |

| (5) | A statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

In order for a director candidate to be considered for nomination at the Company’s Annual Meeting of stockholders, the recommendation must be received by the Leadership Committee at least 120 calendar days prior to the date the Company’s proxy statement was released to stockholders in connection with the previous year’s Annual Meeting, advanced by one year.

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 14

The Company’s Board of Directors currently consists of 15 directors. All of the directors are independent under current Nasdaq listing standards, with the exceptions of Christopher D. Maher, CEO and President of the Company and CEO of the Bank, and Joseph J. Lebel III, Executive Vice President and COO of the Company and President and COO of the Bank. All directors are elected to serve a one-year term expiring at the following Annual Meeting of Stockholders. Each of the members of the Board also serves as a director for the Bank. The experience and qualifications of each director are set forth under “Nominees for Director.”

Mr. Devlin and Mr. Walsh will not stand for reelection at the 2024 Annual Meeting of Stockholders due to their desire to retire and the Company’s desire to reduce the size of the Board. Mr. Devlin will retain his role as a director of the Bank. Following the expiration of their current terms, the size of the Board will be reduced to 13 members.

The Company believes that a Board composed primarily of independent directors is best suited to provide effective oversight and governance of the Company. As such, independent directors comprise the significant majority of Board members. However, the Board also includes two non-independent directors for whom the Company believes that their value to the Board outweighs any concerns regarding their independence. These non-independent directors are:

| • | Christopher Maher, whose role as combined Chairman and CEO was previously described in the Board Leadership Structure section. |

| • | Joseph J. Lebel III, Executive Vice President and COO of the Company and President and COO of the Bank. The Company believes that Mr. Lebel’s extensive commercial leadership experience and knowledge of the Bank’s markets provides significant value to the Board. |

The Board of Directors also includes Joseph Murphy, Jr., former CEO of Country Bank, which was acquired by the Bank on January 1, 2020, who, while independent under Nasdaq standards, may be considered non-independent by external observers. The Company believes that, similar to the two directors previously discussed, Mr. Murphy’s experience, contributions, and financial interest in the Company outweigh any independence concerns.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the nominees set forth in “Nominees for Director.” If any nominee is unable to serve, the persons named in the proxy card will vote your shares and approve the election of any substitute nominee proposed by the Board of Directors. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve.

The Leadership Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board of Directors. The same criteria are used for persons nominated by the Committee or by a stockholder. A candidate must meet any qualification requirements set forth in the Company’s bylaws or any Board or committee governing documents.

The Leadership Committee will consider the following criteria in selecting nominees:

| • | financial, regulatory and business experience; |

| • | familiarity with and participation in the communities served by the Company; |

| • | integrity, honesty and reputation; |

| • | dedication to the Company and its stockholders; |

| • | independence; and |

| • | any other factors the Leadership Committee deems relevant, including experience, demographic characteristics, size of the Board of Directors, and regulatory disclosure obligations. |

The Leadership Committee may weigh the foregoing criteria differently in different situations, depending on the composition of the Board of Directors at the time, and to fill a need if a director is expected to retire in the near future. While no single nominee may possess all of the skills needed to be a director, the Committee seeks to maintain a diversity of skills among the Board members necessary for the optimal functioning of the Board in its oversight of the Company. The Committee will strive to maintain at least one director who meets the definition of “audit committee financial expert” under the Commission’s regulations.

In addition, prior to nominating an existing director for re-election to the Board of Directors, the Leadership Committee will consider and review an existing director’s Board performance and attendance at Board and Committee meetings and other Company functions; length of Board service; experience, skills and contributions that the existing director brings to the Board; and independence.

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 15

The Board continually seeks to refresh and improve its composition and has added new directors both as a result of the acquisition of other banks, as well as through searches. Pursuant to the Leadership Committee Charter as approved by the Board, the Leadership Committee is charged with the central role in the process relating to director nominations, including identifying, interviewing and selecting individuals who may be nominated for election to the Board of Directors. The process the committee follows when it identifies and evaluates individuals to be nominated for election to the Board of Directors is as follows:

For purposes of identifying nominees for the Board of Directors, the Leadership Committee relies on personal contacts of the committee and other members of the Board of Directors as well as its knowledge of members of the Company’s local communities. The Leadership Committee will also consider director candidates recommended by stockholders in accordance with the policy and procedures set forth above. The Leadership Committee has in the past used, and may in the future use, an independent search firm to assist in identifying candidates to fill a vacancy on the Board of Directors but does not use a search firm to identify or evaluate potential director nominees in the ordinary course.

The Leadership Committee, in evaluating potential director candidates, conducts a check of the individual’s background, interviews the candidate, and determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the selection criteria set forth above.

The biography of each of the nominees below contains information regarding the person’s tenure as a director, business experience, other director positions held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused the Leadership Committee and the Board to determine that the person should serve as a director for the Company. The Board of Directors has determined that the Board as a whole must have the right diversity and complementary mix of characteristics and skills for its optimal functioning in its oversight of the Company. The Company considers the following criteria for each of its members of the Board:

| (1) | Experience: Current and past work and Board experience; knowledge of the banking industry and financial services companies; familiarity with the operations of public companies; and business and management experience and acumen. |

| (2) | Personal characteristics: Ability to work collaboratively with management and as a member of the Board; ability to think strategically and evaluate the strategic vision or central idea for the Company; familiarity with and participation in the local businesses and the communities served by the Bank; integrity, accountability, and independence. |

| (3) | Director commitment: Time and effort available to devote to being a director; awareness and ongoing education; attendance at Board and committee meetings and other Company functions; other board commitments; stock ownership; changes in professional responsibilities; and length of service. |

| (4) | Team and Company considerations: Balancing director contributions; diversity of skills; and financial condition. |

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 16

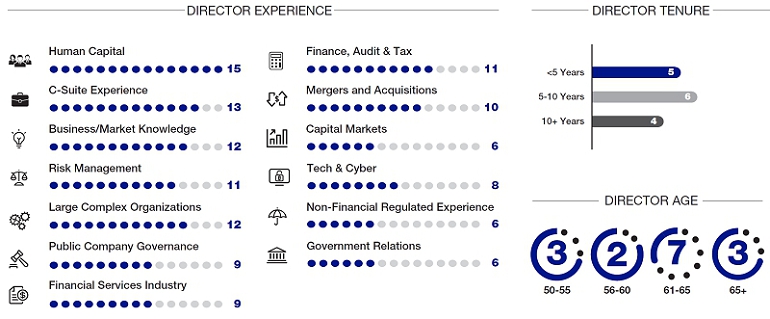

The Board adopted a skills matrix that represents certain skills that the Board identified as particularly valuable to the effective oversight of the Company and execution of its business. The following matrix shows those skills and the number of directors having each skill, highlighting the diversity of skills on the Board.

The following table summarize certain demographic characteristics of the Board of Directors:

| Board Diversity Matrix (As of March 25, 2024) | |||

| Total Number of Directors | 15 | ||

| Part I: Gender Identity | Female | Male | |

| Directors | 4 | 11 | |

| % of Total | 26.7% | 73.3% | |

| Part II: Demographic Background | |||

| African American or Black | 3 | ||

| White | 11 | ||

| Hispanic or Latinx | 1 | ||

| Asian | 1 | ||

| Two or More Ethnicities | 1 | ||

| LGBTQ+ | 0 | ||

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 17

Unless otherwise stated, each individual has held his or her current position for the last five years. The age indicated for each individual is as of December 31, 2023. The indicated period of service as a director includes service as a director of OceanFirst Bank.

The directors in the following section have been nominated by the Leadership Committee for election to the Board with terms to expire at the 2025 Annual Meeting of Stockholders. All directors were previously elected to a one-year term at the 2023 Annual Meeting of Stockholders, with the exceptions of Mr. Barros, Mr. Garrett, and Ms. Wilson-Scott.

| John F. Barros | ||

|

Age 50

Director since 2023

Committees: Finance

|

Skills and Qualifications:

• Former Chief of Economic Development for the City of Boston • Chair of Trustees of Charitable Donations for the City of Boston • Extensive construction and commercial real estate experience |

|

John F. Barros was appointed to the Board of Directors on September 18, 2023. He is the Managing Principal at Civitas Builder, a business focused on improving communities through the development of responsive real estate. Mr. Barros previously served as managing principal at Cushman and Wakefield from 2021 through 2023 and as the Chief of Economic Development for the City of Boston from 2014 through 2021.

Mr. Barros has a bachelor’s degree from Dartmouth College and a master’s degree in public policy from Tufts University. Mr. Barros serves on the Board of Advisors for Commodore Builders and as Chair of the Trustees of Charitable Donations for the City of Boston.

Mr. Barros provides the Board with significant managerial and leadership experience in the construction and commercial real estate sector, particularly with respect to the Boston market.

| ||

| Anthony R. Coscia | ||

|

Age 64

Director since 2018

Committees: |

Skills and Qualifications:

• Former Chairman of the Boards of Sun Bancorp, Inc. and Sun National Bank • Trustee of the Georgetown University and the New Jersey Community Development Corporation • Substantial private sector and government relations experience |

|

Anthony R. Coscia was the Chairman of the Boards of Sun Bancorp, Inc. and Sun National Bank from 2016 until those entities were acquired by the Company in 2018. Mr. Coscia served as a Director of Sun Bancorp, Inc. since 2010 and Sun National Bank since 2011 and was a member of the ALCO Committee and Chair of the Executive Committee. Mr. Coscia is admitted to the state bars of New Jersey and New York and is a Partner of Windels Marx, having been with the firm for over 35 years. Mr. Coscia serves as Chairman of the Board of Directors of the National Railroad Passenger Corporation (Amtrak), having been appointed to the Board of Amtrak by President Obama in 2010 and reappointed in 2015 and 2024. Mr. Coscia previously served as Chairman of the Port Authority of New York and New Jersey for over eight years, stepping down in 2011. Mr. Coscia is a graduate of Georgetown University School of Foreign Service and received his law degree from Rutgers University School of Law.

Mr. Coscia serves as trustee of Georgetown University and the New Jersey Community Development Corporation, a director of Neighborhood Property Group, LLC, Vice Chairman of the Gateway Development Commission, Senior Advisor to the Oaktree Transportation Infrastructure Fund, LP, and is a member of the Partnership for New York City. Mr. Coscia’s extensive background and reputation as a well-respected business leader actively involved in both the private and government sectors brings significant management and leadership skills to the Board.

| ||

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 18

| Jack M. Farris | ||

|

Age 65

Director since 2015

Committees: Human Resources/ |

Skills and Qualifications:

• Former Vice President and Deputy General Counsel, InfoSec & Cybersecurity for Verizon Communications, Inc. • Chair of the Human Resources/Compensation Committee • Substantial information technology, cybersecurity, and risk management experience |

|

Jack M. Farris was the Vice President and Deputy General Counsel, InfoSec & Cybersecurity for Verizon Communications, Inc., one of the world’s leading wireline, wireless and business communications companies, until his retirement at the end of 2018. Prior to that role, Mr. Farris had served as a Vice President and Deputy General Counsel for Verizon, supporting a variety of company functions, including systems and technology procurement, global operations security, information technology and information security matters, finance operations, regulatory compliance, business continuity and pandemic planning, as well as significant M&A transactions. During his 30-year tenure with Verizon, Mr. Farris participated in a number of pro bono activities including leading that company’s NJ Street Law effort for several years, where Verizon attorneys served as guest teachers of basic legal skills in local high schools. After his retirement, Mr. Farris formed Practical RM Associates, a company established to provide cyber and risk management services. In addition to his undergraduate and law degrees, Mr. Farris holds a Master of Science in computer engineering and is a Certified Information Systems Security Professional under (ISC)2.

Mr. Farris’s experience as a senior manager of a large corporation and his expertise in information technology and information security brings to the Board extensive knowledge and capability relating to communications, information technology, and cybersecurity, as well as significant experience in litigation, transactional matters and regulatory compliance.

| ||

| Robert C. Garrett | ||

|

Age 66

Director since 2023

Committees: Audit

|

Skills and Qualifications:

• CEO of Hackensack Meridian Health • Chair of the World Economic Forum’s Health and Healthcare Governor’s Community • Significant leadership and regulatory experience in the healthcare industry |

|

Robert C. Garrett was appointed to the Board of Directors on October 1, 2023. Mr. Garrett has spent over 38 years in the healthcare industry and has been the CEO of Hackensack Meridian Health, New Jersey’s largest and most comprehensive health network, since 2018.

Mr. Garrett has presented at numerous international events, including the International Vatican Healthcare Conference and the World Economic Forum Annual Meeting in Davos, Switzerland, where he serves as Chair of the Forum’s Health and Healthcare Governor’s Community.

Mr. Garrett has a bachelor’s degree from Binghamton University and a master’s degree in health administration from Washington University. Mr. Garrett provides the Board with significant risk management, leadership, and regulatory experience.

| ||

| Kimberly M. Guadagno | ||

|

Age 64

Director since 2018

Committees: Human Resources/ |

Skills and Qualifications:

• President and Executive Director of Mercy Center and Partner at Connell Foley LLP • Former Lieutenant Governor of the State of New Jersey • Significant government relations and regulatory experience |

|

Kimberly M. Guadagno is the President and Executive Director of Mercy Center, a non-profit that works to end generational poverty in the greater Asbury Park, New Jersey area by providing emergency food and wrap-around services to strengthen families and a non-denominational, tuition-free education for 4th through 8th grade girls. She is also a partner with the law firm of Connell Foley LLP and previously was the first Lieutenant Governor of New Jersey, serving from 2010 to 2018. She has also served eight years as New Jersey’s 33rd Secretary of State and in 2007 was elected the first woman sheriff of the Office of the Sheriff in Monmouth County. Ms. Guadagno founded the New Jersey Partnership for Action, a public-private partnership that promotes New Jersey businesses and job creation and chaired the Red Tape Review Commission, a bipartisan group charged with streamlining government services, cutting red tape, and proposing policy recommendations to further reduce the regulatory burdens on businesses. Ms. Guadagno has served 13 years in public service and has been an attorney for more than three decades.

Ms. Guadagno is a well-regarded leader in both the private and government sectors and brings significant managerial and legal skills to the Board.

| ||

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 19

| Nicos Katsoulis | ||

|

Age 64

Director since 2019

Committees: Finance and Risk |

Skills and Qualifications:

• Former Executive Vice President/Commercial Real Estate of the Bank • Chair of the Risk Committee • Extensive knowledge of commercial real estate and financial services |

|

Nicos Katsoulis is the former Executive Vice President/Commercial Real Estate of OceanFirst Bank, N.A., having retired in November 2018. Mr. Katsoulis joined the Bank upon the Bank’s acquisition of Sun National Bank in January 2018. At Sun, Mr. Katsoulis was Executive Vice President and Chief Lending Officer, overseeing lending activities including commercial and industrial and commercial real estate lending. During his banking career, Mr. Katsoulis served as a director of State Bancorp., Inc. and as Executive Vice President and Chief Lending Officer of Atlantic Bank of New York. Mr. Katsoulis is a graduate of the London School of Economics and Columbia University’s graduate school of business.

Mr. Katsoulis brings extensive banking and managerial experience to the Board, particularly with the commercial lending environment within the Bank’s current footprint and potential areas for expansion. He has been an active investor in commercial real estate, dry bulk shipping, and renewable energy.

| ||

| Joseph J. Lebel III | ||

|

Age 61

Director since: 2022

Committees: None |

Skills and Qualifications:

• President of the Bank and Chief Operating Officer of the Bank and Company • Board member of Auxilior Capital Partners and Nest Investments, LLC • Director of the New Jersey Chamber of Commerce |

|

Joseph J. Lebel III was appointed President and Chief Operating Officer of the Bank in January 2021 and Executive Vice President and Chief Operating Officer of the Company in June 2020. Prior to that, he served as Executive Vice President and Chief Operating Officer of the Bank since January 2019 and has previously served as Chief Banking Officer and Chief Lending Officer. Prior to joining the Bank, Mr. Lebel was employed with Wachovia Bank N.A. as a Senior Vice President in various leadership and revenue generating roles.

Mr. Lebel serves as a Trustee on various non-profits, including Community Medical Center, part of the St. Barnabas Health System, and the OceanFirst Foundation and is also a Board member of St. Joseph and Donovan Catholic schools. He recently completed nine years of service as a Trustee to Fulfill, a food bank based in Ocean and Monmouth Counties. He also is a Director of the New Jersey Chamber of Commerce. He serves on the boards of two for-profit companies in which the Bank has a minority ownership interest, Auxilior Capital Partners, a national equipment leasing company, and Nest Investments LLC, a hybrid robo-advisor.

Mr. Lebel provides significant leadership skills and in-depth experience in all facets of lending to the Board as well as extensive knowledge of the Bank’s markets and strategic outlook.

| ||

| Christopher D. Maher | ||

|

Age 57

Director since: 2014

Committees: None |

Skills and Qualifications:

• Chairman, President, and CEO of the Company • Director of the Federal Reserve Bank of Philadelphia • Chairman of the Board of OceanFirst Foundation and Board Member of the New Jersey Bankers Association |

|

Christopher D. Maher has served as Chairman of the Company and the Bank since January 2017 and as CEO of the Company and the Bank since 2015. He previously served as President of the Bank from January 2015 to January 2021, at which time he was succeeded by Mr. Lebel. He joined the Company and the Bank in 2013 as President and Chief Operating Officer and was appointed to the Board of Directors in 2014.

Mr. Maher is active in the non-profit community, serving as Chairman of the Board of the OceanFirst Foundation, a Trustee of Helen Keller Services for the Blind, a Trustee and Board Chair of Monmouth University, and as a Trustee and Board Chair of Hackensack Meridian Ambulatory Care. He is also active within the banking industry, as a director of the Federal Reserve Bank of Philadelphia since 2020 and as a member of the Board of the New Jersey Bankers Association, where he serves as Immediate Past Chairman.

Mr. Maher provides extensive leadership and managerial experience to the Board, particularly in regard to the Company’s business outlook and execution of its corporate strategy.

| ||

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 20

| Joseph M. Murphy, Jr. | ||

|

Age 65

Director since 2020

Committees: Finance and Information Technology |

Skills and Qualifications:

• Former President and CEO of Country Bank Holding Company and Country Bank • Co-founder of ValuExpress LLC, a commercial mortgage conduit with over $2.0 billion in originated loans • Trustee of Iona University |

|

Joseph M. Murphy, Jr. had served on the Board of Directors of Country Bank Holding Company since 2003 and on the Board of Country Bank since 1995 before being acquired by the Company in January 2020. Country Bank specialized in real estate lending to small businesses and commercial real estate investors and was ranked in the “Top 200 Community Banks” nationwide by US Banker magazine five of the ten years prior to its acquisition.

Prior to joining Country Bank, Mr. Murphy co-founded a commercial mortgage conduit, ValuExpress LLC, which had originated over $2.0 billion in loans for the real estate capital markets. For over 30 years he has owned and managed family real estate investments in various commercial properties throughout the United States. He currently serves as EVP of ValuExpress LLC and as President of Value Investors, Inc., his family’s investment office.

Mr. Murphy is a Trustee of Iona University, a private Roman Catholic university located in New Rochelle, New York. He has served on the Board of Directors for the New York Chapter of Juvenile Diabetes Research Foundation, the Finance Advisory Committee of the Congregation of Christian Brothers, and the Board of Trustees for the Greater New York Chapter of the American Red Cross. He also served on the Community Bankers Council of the American Bankers Association and is a Knight of St. Patrick, which supports the New York City St. Patrick’s Day Parade.

Mr. Murphy is a graduate of the University of Denver with a BSBA and holds a Master’s of Science in Real Estate Finance from New York University.

Mr. Murphy provides the Company with extensive banking knowledge and particularly with respect to the New York markets.

| ||

| Steven M. Scopellite | ||

|

Age 58

Director since 2019

Committees: Information Technology and Leadership |

Skills and Qualifications:

• Former Global Chief Information Officer of Goldman Sachs • Chair of the Information Technology Committee • Significant public company governance, information technology and cybersecurity experience |

|

Steven M. Scopellite retired from Goldman Sachs in 2013, having served as Global Chief Information Officer. Among his accomplishments during his distinguished career of nearly 30 years were leading Goldman Sachs’ penetration into new markets, pioneering the bank’s expansion into electronic trading, and developing the global funding platform. Mr. Scopellite currently serves as a Director of Soltage, LLC, a leading renewable energy provider, and is Co-Founder and Advisor to Aspec Scire, a groundbreaking drone-data analytics company.

Mr. Scopellite serves as Chairman to the Riverview Medical Center Foundation Board of Trustees. Mr. Scopellite provides the Board with significant management and risk management experience, particularly as they relate to information technology.

| ||

| Grace C. Torres | ||

|

Age 64

Director since 2018

Committees: Audit, Human Resources/ Compensation, and Leadership |

Skills and Qualifications:

• Trustee of Prudential Retail Mutual Funds • Registered CPA with audit experience of large financial services organizations • Chair of the Audit Committee |

|

Grace C. Torres has been a Trustee of Prudential Retail Mutual Funds, a retail mutual funds complex of more than 90 mutual funds, since 2014. Prior to that, Ms. Torres was Chief Financial Officer, Treasurer and Principal Financial Officer of Prudential Mutual Funds and Senior Vice President of Prudential Investments LLC from 1994 through 2014. Ms. Torres also previously served as Vice President, Mutual Funds Administration at Bankers Trust and as a Senior Manager, Audit Practice with Ernst & Young. Ms. Torres is a CPA in the State of New York and received a BS in Accounting and Management from New York University. Ms. Torres served as a Director of Sun Bancorp, Inc. and Sun National Bank since 2015, serving on the Audit, Nominating & Corporate Governance and Risk Committees and Chair of the ALCO Committee, until their acquisition by the Company in January 2018, at which time Ms. Torres joined the Board.

Ms. Torres brings to the Board additional financial reporting and audit experience, particularly with respect to large complex financial services organizations. Ms. Torres has been recognized as one the Top 50 business executives by Hispanic Business magazine and brings in-depth experience and expertise regarding the financial industry.

| ||

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 21

| Patricia L. Turner | ||

|

Age 55

Director since 2020

Committees: Audit, Finance, and Information Technology |

Skills and Qualifications:

• Executive Director and CEO of the American College of Surgeons • Member of the Board of Directors of the Council of Medical Specialty Societies • Managerial and leadership experience in the medical, business, and higher education sectors |

|

Patricia L. Turner, MD, MBA, FACS is the executive director and CEO of the American College of Surgeons and a clinical professor of surgery at the University of Chicago. Before joining the American College of Surgeons, Dr. Turner was in full-time academic practice on the faculty of the University of Maryland School of Medicine, serving as the surgery residency program director. She is a graduate of the University of Pennsylvania and the Bowman Gray School of Medicine at Wake Forest University and received her MBA from the University of Maryland Robert H. Smith School of Business.

Dr. Turner currently serves as a member of the Board of Directors of the Council of Medical Specialty Societies and is a past member of the Board of Wake Forest University Baptist Medical Center. Dr. Turner provides the Board with significant leadership and managerial experience related to health care, business, and higher education.

| ||

| Dalila Wilson-Scott | ||

|

Age 50

Director since 2023

Committees: Human Resources/ |

Skills and Qualifications:

• Executive Vice President and Chief Diversity Officer of Comcast Corporation • Board member of Main Line Health and the United Way of Greater Philadelphia and Southern NJ • Extensive governance and regulatory experience |

|

Dalila Wilson-Scott was appointed to the Board on October 1, 2023. She serves as the Executive Vice President and Chief Diversity Officer of Comcast Corporation and President of the Comcast NBCUniversal Foundation, overseeing all Diversity, Equity & Inclusion initiatives and philanthropic strategy for the corporation. Ms. Wilson-Scott also leads Comcast’s community impact initiatives, working across the organization to provide strategic leadership throughout all aspects of its corporate social responsibility programs.

Prior to joining Comcast, Ms. Wilson-Scott served as Head of Global Philanthropy at JP Morgan Chase & Co. and President of the JPMorgan Chase Foundation. She also served in the Corporate Merger Office at JP Morgan, as an integral member of the team managing the integration of JPMorgan Chase and Bank One.

Ms. Wilson-Scott serves on the boards of Main Line Health, United Way of Greater Philadelphia and Southern NJ, City Year, CodePath, and the Philadelphia Orchestra and Kimmel Center, Inc. Ms. Wilson-Scott speaks regularly on philanthropy and equity issues at various conferences. Prior to her appointment to the Board of Directors, Ms. Wilson-Scott also served on the Bank’s Advisory Board from July 2020 to September 2023.

Ms. Wilson-Scott has a bachelor’s degree in economics from New York University’s College of Arts and Sciences and an MBA in Finance and Management from New York University’s College of Arts and Science. Ms. Wilson-Scott provides the Board with significant regulatory and governance knowledge as well as experience with complex organizations.

| ||

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 22

On March 19, 2024, following the recommendation of the Leadership Committee, the Board did not nominate Mr. Devlin and Mr. Walsh for reelection at the 2024 Annual Meeting of Stockholders due to their desire to retire from the Board. Mr. Devlin joined the Board in 2016 as part of the Cape Bancorp, Inc. acquisition and served on the Audit and Finance Committees and as Chair of the Risk Committee. Mr. Walsh joined the Board in 2000 and served on the Audit Committee and as Lead Director/Chair of the Leadership Committee. Mr. Devlin will remain a director of the Bank.

The Company is grateful for Mr. Devlin’s and Mr. Walsh’s contributions to the Company.

Directors will be elected according to a plurality of the votes cast at the Annual Meeting. This means that the nominees receiving the greatest number of votes will be elected. There is no cumulative voting for the election of directors.

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL DIRECTORS LISTED IN “NOMINEES FOR DIRECTOR.” | |

OCEANFIRST FINANCIAL CORP. • 2024 Proxy Statement 23

The following table provides information as of March 25, 2024, with respect to the persons known by the Company to be the beneficial owners of more than 5% of its outstanding stock. A person is considered to beneficially own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power.

| Name and Address Of Beneficial Owner | Number

of Shares Owned |

Percent

of Common Stock Outstanding |

||

| BlackRock Inc. 50 Hudson Yards New York, NY 10001 |

8,507,527 | 14.3% | (1) | |

| The Vanguard Group 1000 Vanguard Blvd. Malvern, PA 19355 |

3,369,343 | 5.7% | (2) | |

| Dimensional Fund Advisors

LP 6300 Bee Cave Road, Building One Austin, TX 78746 |

3,152,468 | 5.3% | (3) |

| (1) | Based solely on SEC Schedule 13G Amendment No. 14 filed on January 23, 2024. |

| (2) | Based solely on SEC Schedule 13G Amendment No. 1 filed on February 13, 2024. |

| (3) | Based solely on SEC Schedule 13G Amendment No. 1 filed on February 9, 2024. |