Exhibit 99.1

Management’s Discussion and Analysis

For the Three and Six Months Ended June 30, 2018

TSX: MPVD |NASDAQ: MPVD

MOUNTAIN PROVINCE DIAMONDS INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2018

| TABLE OF CONTENTS | Page |

| Second Quarter 2018 Highlights | 3 |

| Company Overview | 4 |

| Gahcho Kué Diamond Mine | 5 |

| Acquisition of Kennady Diamonds Inc. | 9 |

| Kennady North Project Exploration | 10 |

| Gahcho Kué Exploration | 12 |

| Results of Operations | 14 |

| Summary of Quarterly Results | 14 |

| Summary of Second Quarter Financial Results | 14 |

| Income and Mining Taxes | 16 |

| Financial Position and Liquidity | 16 |

| Off-Balance Sheet Arrangements | 18 |

| Significant Accounting Policies Adopted in the Current Period | 18 |

| Significant Accounting Judgments, Estimates and Assumptions | 20 |

| Standards and Amendments to Existing Standards | 20 |

| Related Party Transactions | 21 |

| Contractual Obligations | 22 |

| Non-IFRS Measures | 22 |

| Subsequent Events | 24 |

| Other Management Discussion and Analysis Requirements | 24 |

| Disclosure of Outstanding Share Data | 25 |

| Controls and Procedures | 25 |

| Cautionary Note Regarding Forward-Looking Statements | 26 |

This Management’s Discussion and Analysis (“MD&A”) as of August 8, 2018 provides a review of the financial performance of Mountain Province Diamonds Inc. (the “Company” or “Mountain Province” or “MPVD”) and should be read in conjunction with the MD&A for the year ended December 31, 2017, the unaudited condensed consolidated interim financial statements and the notes thereto for the three and six months ended June 30, 2018 and the audited consolidated statements for the year ended December 31, 2017. The following MD&A has been approved by the Board of Directors.

The unaudited condensed consolidated interim financial statements of the Company were prepared in accordance with IAS 34 - Interim Financial Reporting. Except as disclosed in the statements, the interim financial statements follow the same accounting policies and methods of computation as compared with the most recent annual financial statements for the year ended December 31, 2017, which were prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). Accordingly, the interim financial statements should be read in conjunction with the Company’s most recent annual financial statements.

All amounts are expressed in thousands of Canadian dollars, except share and per share amounts, unless otherwise noted.

Technical information included in this MD&A regarding the Company’s mineral property has been reviewed by Keyvan Salehi, P.Eng., MBA, and Tom McCandless, Ph.D., P.Geo., both Qualified Persons as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Properties (“NI 43-101”).

| Page | 2 |

Additional information, related to the Company is available on SEDAR at http://sedar.com/ and on EDGAR at http://www.sec.gov/edgar.shtml.

HIGHLIGHTS

| • | Earnings from mine operations for the three and six months ended June 30, 2018 amounted to $18,501 and $43,066, respectively. |

| • | Net loss for the three and six months ended June 30, 2018 was $6,280 and $6,213 respectively, or $0.03 and $0.03 loss per share (basic and diluted), respectively. Adjusted EBITDA for those periods were $40,673 and $73,884, respectively. |

| • | Cash at June 30, 2018 was $33.5 million with net working capital of $100.4 million; US$50 million revolving credit facility remains undrawn. |

| • | The Company concluded three sales in the second quarter of 2018 in Antwerp, Belgium totaling 1,157,000 carats and recognized revenue of $99,075 at an average realized price of $86 per carat (US$73). Revenue for the six months ended June 30, 2018 totaled $165,640 through five sales at an average realized price of $101 per carat (US$79). No direct sales have been made to De Beers Canada Inc. (“De Beers”) during the first half of the year. |

| • | Mining of waste and ore in the 5034 and Hearne open pits for the six months ended June 30, 2018 was approximately 12.9 million tonnes and 5.6 million tonnes, respectively, for a total of 18.5 million tonnes with 10.3 million tonnes mined in the second quarter. Ore mined in the first half of the year totalled 1,082,000 tonnes, with approximately 238,000 tonnes of ore stockpile at quarter end on a 100% basis. |

| • | For the six months ended June 30, 2018, the GK Mine treated approximately 1,684,000 tonnes of ore and recovered approximately 3,571,500 carats on a 100% basis for an average recovered grade of approximately 2.12 carats per tonne (“cpt”). This recovered grade is in line with expectations. The Company’s 49% attributable share of diamond production for the three months ended June 30, 2018 was approximately 945,900 carats and 1,750,000 carats for the six months ended June 30, 2018. |

| • | Rough diamond market conditions in 2018 have remained buoyant compared to 2017, with sustained demand and price stability across the majority of rough diamond categories, interest and attendance at the Company’s sales remained strong during the period. The Company’s product offering in this period included a large number of fancies and specials, which generated considerable market interest and competition. In the fifth sale, the Company sold an exceptional 95 carat white gem stone which was the highest value individual diamond recovered to date from Gahcho Kué mine. |

| • | Cash costs of production, including capitalized stripping costs, for the three and six months ended June 30, 2018 were $112 and $96 per tonne respectively, and $52 and $45 per carat recovered, respectively (this term is not defined under IFRS and therefore may not be comparable to similar measures presented by other issuers; refer to the Non-IFRS Measures section.) |

| • | On April 13, 2018, the Company successfully completed the acquisition of Kennady Diamonds Inc. (“Kennady”), pursuant to which the Company has acquired all of the common shares of Kennady. The transaction adds diamondiferous bodies, which contain indicated resources of 13.62 million carats and inferred resources of 5.02 million carats. It also adds 67,164 hectares of highly prospective and 100% exploration ground strategically surrounding the GK Mine. |

| • | Subsequent to the six months ended June 30, 2018, the Company declared a dividend of $0.04 per common share, payable to the shareholders of record as of September 10, 2018. The dividend shall be paid on September 25, 2018. |

| Page | 3 |

The following table summarizes key operating highlights for the three and six months ended June 30, 2018 and 2017.

| Three months ended | Three months ended | Six months ended | Six months ended | |||||||||||||||

| June 30, 2018 | June 30, 2017 | June 30, 2018 | June 30, 2017 | |||||||||||||||

| GK operating data | ||||||||||||||||||

| Mining | ||||||||||||||||||

| *Ore tonnes mined | kilo tonnes | 341 | 940 | 1,082 | 1,551 | |||||||||||||

| *Waste tonnes mined | kilo tonnes | 9,943 | 7,449 | 17,404 | 14,508 | |||||||||||||

| *Total tonnes mined | kilo tonnes | 10,284 | 8,389 | 18,486 | 16,059 | |||||||||||||

| *Ore in stockpile | kilo tonnes | 238 | 396 | 238 | 396 | |||||||||||||

| Processing | ||||||||||||||||||

| *Ore tonnes processed | kilo tonnes | 899 | 767 | 1,684 | 1,259 | |||||||||||||

| *Average plant throughput | tonnes per day | 9,879 | 8,618 | 9,304 | 6,840 | |||||||||||||

| *Average diamond recovery | carats per tonne | 2.15 | 2.10 | 2.12 | 1.97 | |||||||||||||

| *Diamonds recovered | 000's carats | 1,931 | 1,614 | 3,572 | 2,481 | |||||||||||||

| Approximate diamonds recovered - Mountain Province | 000's carats | 946 | 791 | 1,750 | 1,216 | |||||||||||||

| Cash costs of production per tonne, net of capitalized stripping ** | $ | 82 | 75 | 80 | 63 | |||||||||||||

| Cash costs of production per tonne of ore, including capitalized stripping** | $ | 112 | 82 | 96 | 67 | |||||||||||||

| Cash costs of production per carat recovered, net of capitalized stripping** | $ | 38 | 36 | 38 | 32 | |||||||||||||

| Cash costs of production per carat recovered, including capitalized stripping** | $ | 52 | 39 | 45 | 34 | |||||||||||||

| Sales | ||||||||||||||||||

| Approximate diamonds sold - Mountain Province*** | 000's carats | 1,114 | 469 | 1,641 | 885 | |||||||||||||

| Average diamond sales price per carat | US | $ | 69 | $ | 87 | $ | 79 | $ | 80 | |||||||||

| * at 100% interest in the GK Mine including ramp-up period in 2017 | |||||

| **See Non-IFRS Measures section | |||||

| ***Includes the sales directly to De Beers for fancies and specials acquired by De Beers through the production split bidding process | |||||

COMPANY OVERVIEW

Mountain Province is a Canadian-based resource company listed on the Toronto Stock Exchange and NASDAQ under the symbol ‘MPVD’. The Company’s registered office and its principal place of business is 161 Bay Street, Suite 1410, P.O. Box 216, Toronto, ON, Canada, M5J 2S1. The Company, through its wholly owned subsidiaries 2435572 Ontario Inc. and 2435386 Ontario Inc., holds a 49% interest in the Gahcho Kué diamond mine (the “GK Mine”), located in the Northwest Territories of Canada. De Beers Canada Inc. (“De Beers” or the “Operator”) holds the remaining 51% interest. The Joint Arrangement between the Company and De Beers is governed by the 2009 amended and restated Joint Venture Agreement.

The Company’s primary assets are its aforementioned 49% interest in the GK Mine and 100% owned Kennady North Project (“KNP”). On April 13, 2018, the Company completed the asset acquisition of Kennady Diamonds Inc. (formerly KDI.V on the TSX Venture exchange), which included 100% of the mineral rights of the Kennady North Project.

The Company’s strategy is to mine and sell its 49% share of rough diamonds at the highest price on the day of the close of the sale. The Company’s long-term view of the rough diamond market remains positive, based on the outlook for a tightening rough diamond supply and growing demand, particularly in developing markets such as China and India, resulting in real, long term price growth. The Company also expects to build value through exploration and development of the Kennady North Project which covers properties adjacent to the GK Mine.

During the six months ended June 30, 2018, the Company held five sales in Antwerp. Sales are held ten times per year, approximately every five weeks. The Company anticipates conducting two sales in the third quarter, and three sales in the fourth quarter of 2018.

| Page | 4 |

GAHCHO KUÉ DIAMOND MINE

Gahcho Kué Joint Venture Agreement

The GK Mine is located in the Northwest Territories, approximately 300 kilometers northeast of Yellowknife. The mine covers 10,353 hectares, and encompasses four mining leases (numbers 4341, 4199, 4200, and 4201) held in trust by the Operator. The Project hosts four primary kimberlite bodies - 5034, Hearne, Tuzo and Tesla. The four main kimberlite bodies are within two kilometers of each other.

The GK Mine is an unincorporated Joint Arrangement between De Beers (51%) and Mountain Province (49%) through its wholly owned subsidiaries. On October 2, 2014, Mountain Province assigned its 49% interest to its wholly-owned subsidiary 2435386 Ontario Inc. to the same extent as if 2435386 Ontario Inc. had been the original party to the Joint Venture Agreement. The Company accounts for the mine as a joint operation in accordance with International Financial Reporting Standard 11, Joint Arrangements. Mountain Province through its subsidiaries holds an undivided 49% ownership interest in the assets, liabilities and expenses of the GK Mine.

Between 2014 and 2016, the Company and De Beers signed agreements allowing the Operator to utilize De Beers’ credit facilities to issue reclamation and restoration security deposits to the federal and territorial governments. In accordance with these agreements, the Company agreed to a 3% fee annually for their share of the letters of credit issued. As at June 30, 2018, the Company’s share of the letters of credit issued were $23.4 million (December 31, 2017 - $23.4 million).

Gahcho Kué Capital Program

During the GK Mine’s first winter of operations in the last quarter of 2016 and the first quarter of 2017, extreme cold conditions affected the mine’s conveyor systems which resulted in downtime and lowered throughput. In 2017, De Beers and the Company approved a capital project totalling $23 million on a 100% basis to install enclosures on two conveyors as well as to install dust collection systems at the primary crusher and plant feed bin. Work is progressing in order to complete the installation prior to the onset of the next winter season.

Additional mining equipment purchased in 2018 to support anticipated mining rates include three additional Komatsu 830E haul trucks and a PC5500 shovel.

Mining and Processing

For the three and six months ended June 30, 2018, on a 100% basis, a total of 10.3 million and 18.5 million tonnes of waste and ore respectively, had been extracted from the 5034 and Hearne open pits, compared to the original three and six months ended June 30, 2018 plan of approximately 10.8 million and 20.5 million tonnes, respectively (98% and 90% of plan respectively). Mining rates have increased as additional equipment has been commissioned. For the year ended December 31, 2017, on a 100% basis a total of 33 million tonnes of waste and ore had been extracted from the 5034 open pit, compared to an original plan of approximately 37.2 million tonnes (89% of plan).

For the three and six months ended June 30, 2018, 899,000 tonnes and 1,684,000 tonnes of kimberlite ore were processed (compared to an original plan of 803,000 tonnes and 1,560,000 tonnes, respectively) with 1,930,500 carats and 3,571,500 carats, respectively (100% basis) being recovered at a grade of 2.15 carats per tonne and 2.12 carats per tonne, respectively. Throughput was particularly strong in the second quarter as plant throughput averaged 9,879 tonnes per day. Cash costs of production including capitalized stripping were $112 per tonne for the three months ended June 30, 2018 and $96 per tonne for the six months ended June 30, 2018. These costs are generally in line with expectations.

At June 30, 2018, there was approximately 238,000 tonnes (100% basis) of stockpiled ore. Sufficient ore is available in the stockpile and 5034 pit to meet the planned process throughput rates for 2018.

At June 30, 2018, the GK Mine had 958,826 carats on a 100% basis in rough diamond inventory at the GK Mine and at the sorting facility in Yellowknife. The Company had 378,150 carats within its sale preparation channel plus its share of carats at the GK Mine and sorting facility for a total of 789,809 carats in inventory.

| Page | 5 |

Diamond Sales

The Company undertook five sales of diamonds during the first half of 2018 in Antwerp, Belgium. In fiscal 2017, the Company held 10 sales, and anticipates holding 10 sales in 2018. Although the GK Mine declared commercial production on March 1, 2017, revenues and costs from four out of the ten sales conducted in 2017 had been recorded against the mine construction costs rather than as revenue on the Company’s statement of comprehensive (loss) income as those diamonds sold were all recovered prior to the mine declaring commercial production. The majority of the Company’s revenue is derived from its sales, with the remainder attributed to sales of fancies and specials directly to De Beers on such occasions where De Beers has won the periodic fancies and specials bidding process. The average realized value per carat for the for the first five sales held in Antwerp, was US$82 per carat.

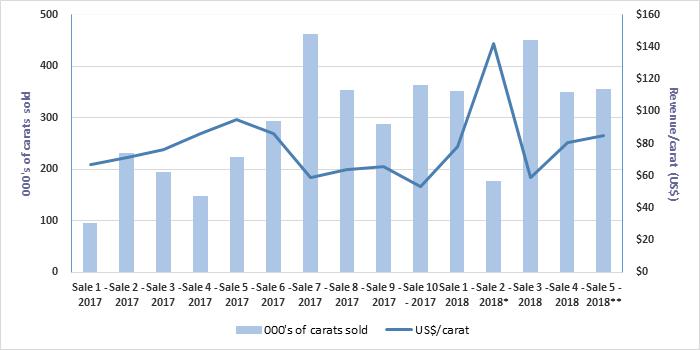

The following chart summarizes the sales in 2017 and 2018:

* Sale 2 in 2018 was heavily weighted towards fancies and specials, with a record number of stones contributing to a higher than normal realized price.

** Although the diamond sale closed on June 22, 2018, the sale of 43,000 carats occurred during the first half of July for IFRS purposes. The amount of revenue recognized for the 43,000 carats was approximately US$8.1 million or $10.7 million.

| Page | 6 |

The following table summarizes the results for sales in 2018:

| 000's of carats sold | Gross proceeds (US$ 000's) | Revenue/carat (US$) | ||||||||||

| Sale 1 | 350 | $ | 27,260 | $ | 78 | |||||||

| Sale 2(1) | 177 | $ | 25,098 | $ | 142 | |||||||

| Total Q1 | 527 | $ | 52,358 | $ | 99 | |||||||

| 000's of carats sold | Gross proceeds (US$ 000's) | Revenue/carat (US$) | ||||||||||

| Sale 3 | 451 | $ | 26,410 | $ | 59 | |||||||

| Sale 4 | 350 | $ | 28,264 | $ | 81 | |||||||

| Sale 5(2) | 356 | $ | 30,282 | $ | 85 | |||||||

| Total Q2(3) | 1,157 | $ | 84,956 | $ | 73 | |||||||

| Total year to date | 1,684 | $ | 137,314 | $ | 82 | |||||||

(1) Sale 2 in 2018 was heavily weighted towards fancies and specials, with a record number of stones

contributing to a higher than normal realized price.

(2) Although the diamond sale closed on June 22, 2018, the sale of 43,000 carats occurred during the first half of July 2018.

(3) Although 1,157,000 carats were sold, in accordance with IFRS only 1,114,000 carats could be recognized as sales proceeds in the quarter. The remaining 43,000 carats were recognized in Q3 2018. The amount of revenue recognized for the 43,000 carats was approximately US$8.1 million or $10.7 million.

The following table summarizes the results of sales in 2017:

| 000's of carats sold | Gross proceeds (US$ 000's) | Revenue/carat (US$) | ||||||||||

| Sale 1(1) | 96 | $ | 6,423 | $ | 67 | |||||||

| Sale 2 | 231 | $ | 16,484 | $ | 71 | |||||||

| Sale 3(2) | 195 | $ | 14,794 | $ | 76 | |||||||

| Total Q1(3) | 522 | $ | 37,701 | $ | 72 | |||||||

| 000's of carats sold | Gross proceeds (US$ 000's) | Revenue/carat (US$) | ||||||||||

| Sale 4(4) | 148 | $ | 12,691 | $ | 86 | |||||||

| Sale 5(5) | 223 | $ | 21,118 | $ | 95 | |||||||

| Total Q2 | 371 | $ | 33,809 | $ | 91 | |||||||

| 000's of carats sold | Gross proceeds (US$ 000's) | Revenue/carat (US$) | ||||||||||

| Sale 6 | 294 | $ | 25,154 | $ | 86 | |||||||

| Sale 7 | 463 | $ | 27,108 | $ | 59 | |||||||

| Total Q3 | 757 | $ | 52,262 | $ | 69 | |||||||

| 000's of carats sold | Gross proceeds (US$ 000's) | Revenue/carat (US$) | ||||||||||

| Sale 8 | 354 | $ | 22,801 | $ | 64 | |||||||

| Sale 9 | 288 | $ | 18,981 | $ | 66 | |||||||

| Sale 10 | 364 | $ | 19,091 | $ | 52 | |||||||

| Total Q4 | 1,006 | $ | 60,873 | $ | 61 | |||||||

| Total | 2,656 | $ | 184,645 | $ | 70 | |||||||

Note: Sales made directly to De Beers are attributed to the closest tender.

(1) Assuming the diamonds withdrawn were sold in sale 1 instead of sale 2.

(2) Although the diamond sale closed on March 29, 2017, the sale of 194,000 carats occurred during the first week of April.

(3) Although 522,000 carats were sold, in accordance with IFRS only 416,000 carats could be recognized as sales proceeds in the quarter. The remaining 106,000 carats were recognized in Q2 2017.

(4) Sold carats were produced in the period before declaration of commercial production, therefore were recorded against the property, plant and equipment in accordance with IFRS.

(5) Sale 5 represents the first sale of diamonds produced after the declaration of commercial production on March 1, 2017, therefore have been recorded as revenue on the statement of comprehensive income. Although 222,000 carats were sold, in accordance with IFRS only 215,000 carats could be recognized as sales proceeds in the quarter. The remaining 7,000 carats have been recognized during Q3 2017.

| Page | 7 |

Including the effects of diamond sales to De Beers Canada Inc. the average realized value per carat for the year ended December 31, 2017, was US$70 per carat.

Through the first five sales of 2018, rough diamond market conditions remained positive across the majority of rough diamond categories. The Company’s product offering to customers this period included a large number of fancies and specials, which generated considerable market interest and competition. The highest value stone recovered to date from the Gahcho Kué mine, an exceptional 95 carat white gem stone, was sold in the Company’s fifth sale.

After a successful first year of sales, the Gahcho Kué goods are now firmly established in the market and attract regular and sustained interest from customers. The Gahcho Kué orebody and product profile are complex, producing a broad range of white commercial goods together with large, high value special stones, as well as large volumes of small diamonds, and brown diamonds. The Gahcho Kué product also exhibits varying degrees of fluorescence for which the Company has attracted specialist customers who have developed strategies to positively market this product characteristic.

The Company’s diamond products have a market and an established customer base. With the natural exception of some industrials, the majority of the Company’s diamonds are sold into market segments that cut and polish the rough, with resultant polished destined for the major diamond jewellery markets of the US, India and China.

Given the complexities of the Gahcho Kué rough diamond product profile and the nature of the Joint Venture’s production splitting process, the mix of diamond categories present in an individual sale will differ. Each sale’s results can and will vary.

2018 Production Outlook

For 2018, the GK Mine operational plan anticipates total ore processing of approximately 3,115,000 tonnes, recovering between 6.3 million and 6.6 million carats (100% basis) and reflecting a recovered grade of between 2.02 cpt and 2.12 cpt. Based on production to date, the Company expects to achieve production in the upper end of the 2018 guidance range.

Diamond Outlook

Rough market reports indicate overall demand remains positive, buoyed by reasonable feedback from the recent JCK Vegas show in May/June and restrained levels of rough supply from the major producers including De Beers and Alrosa.

Industry financing feedback is mixed. Larger, well-financed diamond polishers report no issues obtaining finance to support buying of rough diamonds at current supply levels. However, some smaller Indian players are experiencing tighter procedural controls from lenders in India as a result of the alleged Gitanjali/ Modi fraud. It has been reported by the Indian Gem & Jewellery Export Promotion Council (GJEPC), that lending to the diamond sector in India has come down 10% since April 1, 2018. These smaller, Indian based diamond companies are key players in the brown, smaller size and lower quality diamonds and as a result, these market segments are expected to remain under price pressure in the short to medium term and represent the majority of the Company’s product mix.

De Beers announced at JCK Vegas its plans to sell laboratory-grown diamonds under a new retail jewellery brand, Lightbox. By creating a new, clearly differentiated, low price product segment, De Beers may be aiming to simultaneously reduce synthetics’ impact on the market for natural diamonds and capture a significant share of the growing market for laboratory-grown diamonds. Despite isolated exceptions, the industry’s response is largely positive seeing the move as bringing greater transparency to the synthetics sector.

| Page | 8 |

Post JCK Vegas show, US diamond market sentiment has remained positive with polished prices showing modest increases in June.

Jewellery retailers in Greater China continued to post strong growth results driven by positive consumer sentiment and increased tourism in Hong Kong. Further, China reduced its import duty on diamonds polished in India from 35% to 10%. This is expected to further boost imports of Indian polished into China.

ACQUISITION OF KENNADY DIAMONDS INC.

On January 29, 2018, the Company announced a definitive arrangement agreement pursuant to which the Company would acquire all of the issued and outstanding shares of Kennady Diamonds Inc. (“Kennady”) by way of a court-approved plan of arrangement (the “Transaction”). Under the terms of the Transaction, Kennady shareholders would receive 0.975 of a Mountain Province common share for each Kennady common share of Kennady. During the three-month period ended March 31, 2018, the Company obtained 3,000,000 Kennady shares, by way of a private placement. On April 9, 2018, approval of the Transaction was obtained from both Mountain Province and Kennady shareholders. On April 11, 2018, final approval of the Ontario Superior Court of Justice for the proposed transaction took place. On April 13, 2018, after all conditions precedent were satisfied, the Transaction was closed and Kennady became a wholly owned subsidiary of the Company. Kennady shareholders received 49,737,307 shares of Mountain Province for 51,012,599 shares of Kennady. The transaction was valued based on the share price of the Company on April 13, 2018.

Until April 13, 2018, the 3,000,000 shares of Kennady obtained were held as equity securities. During the six months ended June 30, 2018, the Company recognized a realized gain of $1,334, net of income taxes, related to the fair value adjustment of its equity securities. All equity securities owned by the Company are reclassified as FVTOCI, with fair value gains, net of income taxes, of $1,334 recorded in other comprehensive income for the six months ended June 30, 2018.

The acquisition of Kennady Diamonds Inc. is considered an asset acquisition, and not a business combination in accordance with IFRS 3. The following table summarizes the fair value of the consideration transferred to the Kennady shareholders and the final estimates of the fair values of identified assets acquired and liabilities assumed. The purchase price allocation and the net assets acquired were as follows:

| Purchase price: | ||||

| Common shares issued | $ | 153,688 | ||

| Purchase of equity securities prior to April 13, 2018 | 9,038 | |||

| Company transaction costs | 4,083 | |||

| Total | $ | 166,809 | ||

| Net assets acquired: | ||||

| Assets | ||||

| Cash | $ | 55 | ||

| Amounts receivable | 641 | |||

| Prepaid expenses | 119 | |||

| Reclamation deposit | 250 | |||

| Property, plant and equipment | 168,445 | |||

| Liabilities | ||||

| Accounts payable and accrued liabilities | (2,528 | ) | ||

| Decommissioning and restoration liability | (173 | ) | ||

| Total | $ | 166,809 | ||

| Page | 9 |

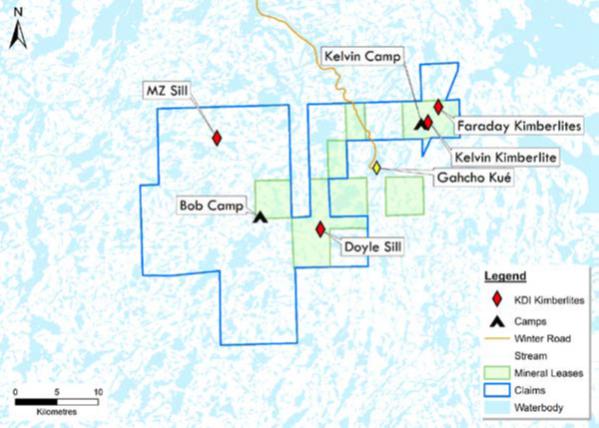

Exploration at Kennady North commenced in the late 1990’s and resulted in the discovery of the diamond-bearing Kelvin, Faraday, MZ and Doyle kimberlite occurrences. The number of diamonds recovered from the Kelvin and Faraday kimberlites and the size-frequency distribution indicated that they may be of comparable grade to the 5034 and Hearne kimberlites at the GK Mine.

The following map shows the location of the Kennady North properties relative to the GK Mine and the holdings consists of 22 federal leases and 58 claims covering an area of 67,164 hectares:

KENNADY NORTH PROJECT EXPLORATION

At the time Kennady was acquired by the Company, a winter exploration program was underway which completed in May 2018. The objectives of delineation drilling at Faraday 2, geotechnical drilling adjacent to Faraday 2, and drill testing of exploration targets within the Kelvin-Faraday Corridor were all successfully achieved. A total of 38 drill holes were completed for a program total of 6,826 metres. All of the drilling results were reported in a Kennady Diamonds news release on May 23, 2018.

Drilling at Faraday 2 kimberlite focused on the northwest extension, which was discovered in 2017 and extends the Faraday 2 kimberlite by over 150 metres. Geologic units in the inferred resource extend into the northwest extension, and the completed drilling is expected to enable this portion of Faraday 2 advance to an inferred level of confidence. Drilling results for Faraday 2 are summarized in the following table.

| Page | 10 |

Faraday 2 - 2018 Geotechnical and Delineation Drill Program

| Drill Hole | Drill Hole Purpose | Azimuth | Inclination | Kimberlite Intercepts (m) | End of Hole (m) | ||

| From | To | Intercept* | |||||

| KDI-18-010 | Geotech/Delineation | 220 | -65 | 270.91 | 322.70 | 51.79 | 346 |

| KDI-18-011 | Delineation | 040 | -65 | 280.74 | 313.26 | 32.52 | 350 |

| KDI-18-012a | Delineation/Exploration | 000 | -90 | 254.33 | 270.52 | 15.18** | 334 |

| 279.68 | 292.94 | 11.37** | 334 | ||||

| 297.36 | 298.34 | 0.45** | 334 | ||||

| 304.00 | 305.45 | 0.51** | 334 | ||||

| KDI-18-012b | Delineation/Exploration | 305 | -80 | - | - | - | 317 |

| KDI-18-013 | Delineation/Geotech | 038 | -66 | 258.69 | 288.97 | 28.05** | 319 |

*Intercepts are not true widths. **Includes minor country rock intercepts.

A drill hole completed at on Faraday 1-3 was designed to test the geotechnical characteristics of country rock for the purposes of open pit mine design and was not expected to intersect kimberlite. Results are summarised in the table below.

Faraday 1-3 - 2018 Geotechnical Drilling Results

| Drill Hole | DH Purpose | Azimuth | Inclination | Kimberlite Intercepts (m) | End of Hole (m) | ||

| From | To | Intercept | |||||

| KDI-18-017 | Geotechnical | 320 | -45 | - | - | - | 189 |

In addition to the geotechnical, delineation and exploration drilling, associated geotechnical surveys, ground water sampling and other required test work was also successfully completed. The combined work is expected to help advance the Faraday kimberlites from a scoping-level to a pre-feasibility level of confidence in terms of geotechnical analysis.

Three geophysically-defined grassroots exploration targets located in close proximity to the Faraday kimberlites were also drill-tested. All of the seven drill holes drilled into the targets intersected kimberlite, consisting of kimberlite sheet complexes with the largest intercept being 5.4 metres of coherent kimberlite. Drill results for the grassroots exploration targets are summarized in the table below.

| Page | 11 |

Grassroots Exploration - Drilling Results

| Drill Hole | Geophysical Target | Azimuth | Inclination | Kimberlite Intercepts (m) | End of Hole (m) | ||

| From | To | Intercept* | |||||

| KDI-18-014a | Target #18-01 | 000 | -90 | 34.53 | 35.55 | 1.02 | 165 |

| 46.20 | 46.31 | 0.11 | 165 | ||||

| KDI-18-014b | Target #18-01 | 017 | -45 | 89.33 | 89.54 | 0.21 | 199 |

| 91.15 | 93.64 | 2.49 | 199 | ||||

| 95.18 | 95.47 | 0.29 | 199 | ||||

| 96.89 | 98.09 | 1.20 | 199 | ||||

| KDI-18-015 | Target #18-01 | 283 | -45 | 78.87 | 79.18 | 0.31 | 199 |

| 91.66 | 97.30 | 5.41 | 199 | ||||

| KDI-18-016a | Target #18-02 | 000 | -90 | 64.48 | 66.49 | 2.01 | 119 |

| 75.18 | 76.91 | 0.93** | 119 | ||||

| KDI-18-016b | Target #18-02 | 220 | -65 | 61.03 | 61.31 | 0.28 | 131 |

| 62.00 | 65.37 | 2.29** | 131 | ||||

| KDI-18-016c | Target #18-02 | 220 | -45 | 66.89 | 68.98 | 1.68** | 122 |

| 79.51 | 82.65 | 3.14 | 122 | ||||

| KDI-18-018a | Target #18-03 | 340 | -90 | 128.00 | 133.00 | 5.00 | 179 |

*Intercepts are not true widths. **Includes minor country rock intercepts.

In each case, the geophysical targets were explained by intervals of highly altered and fractured country rock associated with kimberlite sheets. Similarly fractured and altered country rock is associated with both the Kelvin and the Faraday kimberlites. These latest results will be utilized in conjunction with other exploration data to prioritize remaining geophysical targets for future drill testing.

Gahcho KuÉ EXPLORATION

Subsequent to the GK Mine achieving commercial production in early 2017, exploration at the GK Mine began in the second half of 2017 with the implementation of airborne magnetics and electromagnetics over the entire lease area with the goal of identifying targets for adding potential resources to the GK Mine. A ground gravity survey was also conducted in the region between the Tesla and Tuzo kimberlites and within the Southwest Corridor. The Southwest Corridor lies between the 5034 and Hearne kimberlites, where mining has exposed kimberlite that is not included in the project resource statement. A 17-hole drill program, based on a 50 metre by 50 metre spacing was subsequently completed in the Southwest Corridor. The goal of the drill program within the Southwest Corridor is to enable a resource estimate of the newly-discovered kimberlite for eventual incorporation into the GK mine plan. Drilling results generated in early 2018 are summarized in the table below.

| Page | 12 |

Southwest Corridor - 2018 Drilling Results (reported April 10, 2018)

| Drill Hole | Azimuth | Inclination | Intercept1,2 (m) | Intercept True Thickness3 (m) | End of Hole (m) | ||

| From | To | Length | |||||

| MPV-17-435C4 | 300 | -54 | 76.65 | 120.08 | 43.43 | 25.4 | 126 |

| MPV-17-436C4 | 311 | -54 | 107.00 | 130.23 | 23.23 | 13.8 | 164 |

| MPV-17-437C4 | 329 | -54 | 151.80 | 199.70 | 47.90 | 26.4 | 230 |

| MPV-17-438C4 | 285 | -50 | 151.60 | 157.00 | 5.40 | 3.1 | 191 |

| MPV-17-439C4 | 305 | -60 | 157.00 | 164.50 | 7.50 | 3.5 | 224 |

| MPV-17-440C4 | 327 | -50 | 211.27 | 229.40 | 18.13 | 11.6 | 284 |

| MPV-18-441C | 309 | -58 | 196.20 | 197.76 | 1.56 | 0.8 | 283 |

| MPV-18-442C | 330 | -51 | 229.87 | 253.15 | 23.28 | 14.4 | 284 |

| MPV-18-443C | 130 | -49 | 62.69 | 89.60 | 26.91 | 18.1 | 122 |

| MPV-18-444C | 268 | -46 | 16.30 | 50.40 | 34.1 | 19.3 | 89 |

| MPV-18-445C | 300 | -46 | 37.75 | 56.83 | 19.08 | 13.2 | 100 |

| MPV-18-446C | 244 | -46 | 73.57 | 119.18 | 45.61 | 20 | 185 |

| MPV-18-447C | 25 | -53 | 31.38 | 199.49 | 168.11 | n/a5 | 130 |

| MPV-18-448C | 319 | -61 | 109.90 | 110.34 | 0.44 | 0.2 | 143 |

| MPV-18-449C | 293 | -54 | 129.80 | 131.10 | 1.30 | 0.8 | 170 |

| MPV-18-450C | 16 | -53 | 26.10 | 57.00 | 30.90 | n/a5 | 146 |

| 78.23 | 146.00 | 67.77 | n/a5 | 146 | |||

| MPV-18-452C | 275 | -46 | 51.00 | 51.50 | 0.50 | 0.3 | 92 |

| MPV-18-454C | 335 | -50 | 0.00 | 0.0 | 380 | ||

| 1 | Intercept is composed of kimberlite, kimberlite granite breccia, granite kimberlite breccia, and internal granitic dilution. |

| 2 | Not true thickness. |

| 3 | Estimated true thickness, to be confirmed. |

| 4 | Announced previously - see news release of January 17, 2018. |

| 5 | Holes MPV-18-447C and MPV-18-450C are drilled on strike and therefore cannot be used to determine true thickness. |

Drilling was also conducted between the north and south lobes of the Hearne kimberlite. The drill results confirm that the north and south lobes of the body are connected by a kimberlite breccia. The kimberlite breccia is present at 40 metres depth vertically from the surface and extends vertically to at least as deep as 220 metres from surface. A summary of drill results from Hearne is provided below.

Hearne - 2018 Drilling Results (reported July 11, 2018)

| Drill Hole | Azimuth | Inclination | Intercept1 (m) | Intercept True | End of Hole (m) | ||

| From | To | Length | Thickness2 (m) | ||||

| MPV-18-458C | 273 | -51 | 231.34 | 284.65 | 53.31 | 40.90 | 320 |

| MPV-18-459C | 228 | -54 | - | - | - | - | 380 |

| MPV-18-461C | 293 | -53 | - | - | - | - | 284 |

| MPV-18-462C | 250 | -50 | 54.00 | 102.78 | 48.78 | 27.30 | 134 |

| MPV-18-464C | 297 | -53 | - | - | - | - | 413 |

| MPV-18-466C | 280 | -50 | - | - | - | - | 416 |

1The intercept for MPV-18-458C is composed 96% of kimberlite granite breccia with 4% internal granitic dilution. The intercept for MPV-18-462C is composed 98% of kimberlite granite breccia with 2% internal granitic dilution. Kimberlite granite breccia is defined as having greater than 50% kimberlite present. 2Defined as the horizontal distance between drill hole contacts based on Hearne as a linear shape striking at an average azimuth of 353o and with vertical contacts.

Drill testing of the corridor between 5034 and Tuzo is currently ongoing. The initial focus has been the zone between the 5034 pipe and the North Pipe, and the zone extending immediately northeast of the North pipe. Drilling has so far confirmed kimberlitic material between the north lobe of 5034 and the North Pipe, as well as in the corridor extending northeast of the North Pipe towards Tuzo.

A ground gravity anomaly between the Tesla and Tuzo kimberlites referred to as the Curie target has also been drill tested. Preliminary results suggest that is it likely a blowout of the identified kimberlite body that is likely a blowout of the Dunn kimberlite sheet, which is located in an area of the northwest wall of the planned Tuzo pit towards the Tesla pipe. The vertical extent of the Curie body remains to be determined.

| Page | 13 |

Results of operations

The Company, as discussed above, held five sales of diamonds during the six months ended June 30, 2018.

Quarterly financial information for the past eight quarters is shown in Table 1.

SUMMARY OF QUARTERLY RESULTS

| Table 1 - Quarterly Financial Data | ||||||||||||

| Expressed in thousands of Canadian dollars | ||||||||||||

| Three months ended | ||||||||||||||||

| June 30 | March 31 | December 31 | September 30 | |||||||||||||

| 2018 | 2018 | 2017 | 2017 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Earnings and Cash Flow | ||||||||||||||||

| Sales | 99,075 | 66,565 | 77,242 | 65,218 | ||||||||||||

| Operating income | 11,187 | 20,105 | 11,176 | 20,657 | ||||||||||||

| Net (loss) income for the period | (6,280 | ) | 67 | (15,927 | ) | 27,669 | ||||||||||

| Basic and diluted (loss) earnings per share | (0.03 | ) | 0.00 | 0.10 | 0.17 | |||||||||||

| Cash flow provided by (used in) operating activities | 59,007 | 1,759 | 36,389 | 49,238 | ||||||||||||

| Cash flow provided by (used in) investing activities | (38,485 | ) | (16,098 | ) | 54,079 | (38,715 | ) | |||||||||

| Cash flow provided by (used in) financing activities | (15,535 | ) | (188 | ) | (62,970 | ) | (7,871 | ) | ||||||||

| Balance Sheet | ||||||||||||||||

| Total assets | 974,816 | 823,966 | 795,066 | 884,806 | ||||||||||||

| Three months ended | ||||||||||||||||

| June 30 | March 31 | December 31 | September 30 | |||||||||||||

| 2017 | 2017 | 2016 | 2016 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Earnings and Cash Flow | ||||||||||||||||

| Sales | 27,648 | – | – | – | ||||||||||||

| Operating income (loss) | 7,663 | (3,428 | ) | (2,479 | ) | (1,426 | ) | |||||||||

| Net income (loss) for the period | 7,554 | (2,144 | ) | (8,306 | ) | (5,387 | ) | |||||||||

| Basic and diluted earnings (loss) per share | 0.05 | (0.01 | ) | (0.05 | ) | (0.03 | ) | |||||||||

| Cash flow provided by (used in) operating activities | (15,737 | ) | (27,239 | ) | 2,017 | (4,298 | ) | |||||||||

| Cash flow provided by (used in) investing activities | 18,217 | 7,596 | (63,276 | ) | (16,404 | ) | ||||||||||

| Cash flow provided by (used in) financing activities | (8,826 | ) | 30,974 | 36,422 | 32,540 | |||||||||||

| Balance Sheet | ||||||||||||||||

| Total assets | 857,320 | 873,753 | 783,761 | 752,825 | ||||||||||||

summary of SECOND Quarter Financial Results

Three and six months ended June 30, 2018 compared to the three and six months ended June 30, 2017, expressed in thousands of Canadian dollars.

For the three months ended June 30, 2018, the Company recorded a net loss of $6,280 or $0.03 loss per share, respectively compared to a net income $7,554 or $0.05 earnings per share for the same period in 2017. For the six months ended June 30, 2018, the Company recorded a net loss of $6,213 or $0.03 loss per share compared to a net income of $5,410 or $0.03 earnings per share for the same period in 2017.

| Page | 14 |

A significant difference was earnings from mine operations of $43,066 in the six months ended June 30, 2018, compared to $11,779 for the same period in 2017, since the comparative period did not begin including earnings from mine operations until commercial production on March 1, 2017.

The total net finance expenses for the six months ended June 30, 2018 were $19,590, compared to $15,139 for the same period in 2017. The significant difference is due to the fact that in the same period for 2017 the finance expenses for January and February, until commercial production was declared, were capitalized as borrowing costs. Foreign exchange loss, for the three and six months ended June 30, 2018, was $7,746 and $18,122, respectively, compared to a foreign exchange gain of $11,260 and $15,489 for the same period in 2017. Substantially all of the foreign exchange loss amount relates to the unrealized losses arising from the translation of US$ denominated long-term debt outstanding through the period given the depreciation of the Canadian dollar since late 2017.

Earnings from mine operations

Earnings from mine operations for the three and six months ended June 30, 2018, respectively, were $18,501 and $43,066 compared to $11,779 for the same periods in 2017. For the three and six months ended June 30, 2018, diamond sales related to 1,114,000 and 1,164,000 carats were $99,075 and $165,640, respectively. Production costs (net of capitalized stripping costs) related to diamonds sold for the three and six months ended June 30, 2018 were $41,095and $60,009, respectively; depreciation and depletion were $29,265 and $42,348, respectively; and the cost of acquired diamonds were $10,214 and $20,217 respectively. which had been previously paid to De Beers when winning the periodic fancies and specials bids. For the three and six months ended June 30, 2017, the Company recorded its first sale and related costs during the three months ended June 30, 2017, as that was when the first diamonds were produced and sold after the declaration of commercial production, which resulted in lower earnings from mine operations compared to the three and six months ended June 30, 2018.

Exploration and evaluation expenses

Exploration and evaluation expenses for the three and six months ended June 30, 2018, respectively, were $3,562 and $4,433 with no expenses reported for the same periods in 2017. During the six months ended June 30, 2018, $1,930 of the total $4,433 exploration and evaluation expenses related to the Company’s 49% share of costs incurred on the GK Mine properties. The remaining $2,503 of exploration and evaluation expenses are a result of the KNP drill program which was in place at the date of acquisition, most of which can be attributed to drilling and technical consulting expenses.

Selling, general and administrative expenses

Selling, general and administrative expenses for the three and six months ended June 30, 2018, respectively, were $3,752 and $7,341 compared to $4,116 and $7,554 for the same period in 2017. The significant expenses included in these amounts for the three and six months ended June 30, 2018 were $1,650 and $3,216, relating to selling and marketing, $702 and $1,137 related to consulting fees and payroll, and $389 and $813 relating to share-based payment expense, respectively. For the three and six months ended June 30, 2017, selling and marketing were $1,459 and $3,125, consulting and payroll were $1,246 and $1,686, and share-based payment expense was $365 and $773, respectively. The overall decrease in selling, general, and administrative expenses can be attributed to lower consulting and payroll expenses compared to the prior period. Consulting and payroll expenses for the three and six months ended June 30, 2017 were higher due to a transition in executive leadership.

Net finance expenses

Net finance expenses for the three and six months ended June 30, 2018, respectively, were $9,890 and $19,590 compared to $11,376 and $15,139 for the same period in 2017. Included in the amount for the three and six months ended June 30, 2018, were $9,838 and $19,471 relating to finance costs, $165 and $331 relating to accretion expense on decommissioning liability and $113 and $212 relating to interest income, respectively. Finance costs have increased for the six months ended June 30, 2018 compared to the same period in 2017 due to interest expense incurred on the current secured notes payable being expensed whereas in the same period in 2017, interest expense incurred on the old Loan Facility was previously capitalized to the mine development and were only expensed after the declaration of commercial production. The increase in accretion expense on decommissioning liability is due to a higher decommissioning liability balance. Interest income in 2018 was lower than the 2017 period, due to a lower average cash balance. Finance costs have decreased for the three months ended June 30, 2018 compared to the same period in 2017 due to a decreased effective interest rate on the secured notes payable compared to the old Loan Facility.

| Page | 15 |

Derivative gains (losses)

Derivative gains (losses) for the three and six months ended June 30, 2018, respectively, were $267 and $782 compared to ($15) and $780 for the same period in 2017. For the three and six months ended June 30, 2018, the overall derivative gain is attributed to the embedded derivative asset from the secured notes payable. The overall derivative gains for the three and six months ended June 30, 2017, related to the relative strengthening of the LIBOR rate, which resulted in a derivative gain on the interest rate swap contracts.

Foreign exchange (losses) gains

Foreign exchange (losses) gains for the three and six months ended June 30, 2018, respectively, were ($7,746) and ($18,122) compared to $11,260 and $15,489 for the same period in 2017. The foreign exchange loss for the three and six months ended June 30, 2018 was a result of the Canadian dollar weakening relative to the U.S. dollar and the translation of the secured notes payable, net of U.S. dollar cash balances, to Canadian dollars at the spot rate at the period ended June 30, 2018. The foreign exchange gains for the three and six months ended June 30, 2017 was a result of the Canadian dollar strengthening relative to the U.S. dollar and the translation of the Loan Facility and U.S. dollar cash balances to Canadian dollar at the spot rate at the period end.

INCOME AND MINING TAXES

The Company is subject to income and mining taxes in Canada with the statutory income tax rate at 26.5%.

No deferred tax asset has been recorded in the financial statements as a result of the uncertainty associated with the ultimate realization of these tax assets

The Company is subject to assessment by Canadian authorities, which may interpret tax legislation in a manner different from the Company. These differences may affect the final amount or the timing of the payment of taxes. When such differences arise, the Company makes provision for such items based on management’s best estimate of the final outcome of these matters.

The Company’s current tax expenses are associated with mining royalty taxes in the Northwest Territories. There are no other current tax expenses for income tax purposes, as there are significant losses carried forward that are available to offset current taxable income.

FINANCIAL POSITION AND LIQUIDITY

The Company originally funded its share of the construction and commissioning costs of the GK Mine through a combination of equity and a project lending facility (the previous “Loan Facility”). In December 2017, the Company terminated its previous Loan Facility through the issuance of US$330 million in second lien secured notes payable. Concurrent with the closing of the Notes offering, the Company entered into an undrawn US$50 million first lien revolving credit facility (the “RCF”) with Scotiabank and Nedbank Limited in order to maintain a liquidity cushion for general corporate purposes. The RCF has a term of three years.

The RCF is subject to a quarterly commitment fee between 0.9625% and 1.2375%, depending on certain leverage ratio calculations at the time. Upon drawing on the RCF, an interest rate of LIBOR plus 2.5% to 4.5% per annum is charged for the number of days the funds are outstanding, based on certain leverage ratio calculations at the time. As at June 30, 2018, the RCF remained undrawn. The RCF is subject to several financial covenants, in order to remain available. The following financial covenants are calculated on a quarterly basis:

| • | Total leverage ratio of less than or equal to 4.50:1 calculated as total debt divided by EBITDA, up to and including December 31, 2019; and 4:1, thereafter until the maturity date. |

| Page | 16 |

| • | A ratio of EBITDA to interest expense no less than 2.25:1; and |

| • | A tangible net worth that is no less than 75% of the tangible net worth as reflected in the September 30, 2017 financial statements provided to the administrative agent as a condition precedent to closing, plus 50% of the positive net income for each subsequent quarter date. |

| • | Subsequent to the six months ended June 30, 2018, permitted distributions (which include dividends) are subject to the Company having a net debt to EBITDA ratio of less than or equal to 2.75:1 in 2018, 2.25:1 in 2019, and 1.75:1 in 2020. Net debt is equal to total debt, less cash and cash equivalents. The aggregate amount of all distributions paid during the rolling four quarters up to and including the date of such distribution does not exceed 25% of free cash flows (“FCF”) during such period. FCF is defined as EBITDA minus, without duplication, (a) capital expenditures, (b) cash taxes, (c) any applicable standby fee, other fees or finance costs payable to the finance parties in connection with the RCF, (d) interest expenses and (e) any indebtedness (including mandatory prepayments) permitted under the existing agreement. |

The Company is in compliance with all financial covenants as at June 30, 2018.

The indenture governing the secured notes contains certain restrictive covenants that limit the Company’s ability to, among other things, incur additional indebtedness, make certain dividend payments and other restricted payments, and create certain liens, in each case subject to certain exceptions. The restrictive covenant on the Company’s ability to pay potential future dividends relates to a fixed charge coverage ratio of no less than 2:1. The fixed charge coverage ratio is calculated as EBITDA over interest expense. Subject to certain limitations and exceptions, the amount of the restricted payments, which include dividends and share buybacks, is limited to a maximum dollar threshold, which is calculated at an opening basket of US$10 million plus 50% of the historical consolidated net income, subject to certain adjustments, reported from the quarter of issuance and up to the most recently available financial statements at the time of such restricted payment, plus an amount not to exceed the greater of US$15 million and 2% of total assets as defined in the indenture.

Cash flow provided by operating activities, including change in non-cash working capital for the three and six months ended June 30, 2018, respectively, were $59,007 and $60,766 compared to ($15,737) and ($42,976) for the same period in 2017. The increase in cash provided was a result of the increase in earnings from mine operations of $18,501 and $43,066. Although the net loss for the six-month period ended was $6,213, significant areas which were non-cash expenses included foreign exchange losses of $18,122, depreciation and depletion of $42,357, and share based payment expense of $813. Also, the comparative three and six-month period ended June 30, 2017 experienced a negative cash outflow, since June 2017 was the first sale which was included in operating activities, as that was when the first diamonds produced post commercial production declaration was included in earnings from mine operations.

Investing activities for the three and six months ended June 30, 2018, respectively, were ($38,485) and ($54,583) compared to $18,217 and $25,813 for the same period in 2017. For the six months ended June 30, 2018, the outflow for the purchase of equipment of the GK Mine, acquired KNP assets and other commissioned assets were $50,767 compared to $31,025 for the same period in 2017. Capitalized interest paid for the six months ended June 30, 2018 was $nil compared to $5,451 for the same period in 2017. Also, cash acquired and transaction costs on the acquisition of KNP assets were ($4,028). Cash used for investing activities for the six months ended June 30, 2018 included $50,767 in property, plant and equipment, $nil for capitalized interest paid and offset by $212 of interest income. Cash used for investing activities for the six months ended June 30, 2017 include $31,025 in property, plant and equipment, $5,451 for capitalized interest paid, offset by $67,493 in pre-production sales, ($5,626) in restricted cash and $422 of interest income. The most significant reason for the increase in cash outflows compared to the same period in 2017 is the pre-commercial production revenue which was included in 2017.

Financing activities for the three and six months ended June 30, 2018, respectively, were ($15,535) and ($15,723) compared to ($8,826) and $22,148 for the same period in 2017. Cash flows used in financing activities for the three and six months ended June 30, 2018, related to stand-by charges on the RCF, and interest paid on the secured noted payable. Under the terms of the secured notes payable, interest payments occur semi-annually, and as such will result in the June and December quarters having significantly higher cash outflows under financing activities. Cash flows from financing activities for the six months ended June 30, 2017 related to cash draws of US$25 million or approximately $32.4 million Canadian dollar equivalent from the Loan Facility, net of financing costs of approximately $11.8 million and proceeds from option exercises of $1,577.

| Page | 17 |

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

SIGNIFICANT ACCOUNTING POLICIES ADOPTED IN THE CURRENT PERIOD

The following are the new accounting policies adopted in the current period:

(a) Financial instruments

The Company has adopted all of the requirements of IFRS 9 Financial Instruments (“IFRS 9”), as of January 1, 2018. IFRS 9 has replaced IAS 39 Financial Instruments: Recognition and Measurement (“IAS 39”). IFRS 9 utilizes a revised model for recognition and measurement of financial instruments and a single, forward-looking “expected loss” impairment model. There are differences between IFRS 9 and IAS 39, however, most of the requirements in IAS 39 for classification and measurement of financial liabilities were carried forward in IFRS 9, so the Company’s accounting policy with respect to financial liabilities, including the accounting for the embedded derivative related to the secured notes payable, is unchanged.

As a result of the adoption of IFRS 9, management has changed its accounting policy for financial assets retrospectively, for assets that were recognized at the date of application. The change did not impact the carrying value of any financial assets on transition date. The main area of change is the accounting for cash previously classified as fair value through profit and loss.

The following is the Company’s new accounting policy for financial instruments under IFRS 9.

Classification

The Company classifies its financial instruments in the following categories: at fair value through profit and loss (“FVTPL”), at fair value through other comprehensive income (“FVTOCI”) or at amortized cost. The Company determines the classification of financial assets at initial recognition. The classification of debt instruments is driven by the Company’s business model for managing the financial assets and their contractual cash flow characteristics. Financial liabilities are measured at amortized cost unless they are required to be measured at FVTPL (such as instruments held for trading or derivatives) or the Company has opted to measure that at FVTPL.

The Company completed a detailed assessment of its financial assets and liabilities as at January 1, 2018. The following table shows the original classification under IAS 39 and the new classification under IFRS 9:

| Asset/Liability | Original classifciation IAS 39 | New classification IFRS 9 |

| Cash | FVTPL | Amortized cost |

| Equity securities | Available-for-sale | FVTOCI |

| Amounts receivable | Loans and receivables | Amortized cost |

| Derivative assets | FVTPL | FVTPL |

| Accounts payable and accrued liabilities | Other liabilties | Amortized cost |

| Secured notes payable | Other liabilties | Amortized cost |

The Company is not required to restate prior periods. The adoption of IFRS 9 resulted in no change to the opening accumulated deficit on January 1, 2018.

| Page | 18 |

Measurement

Financial assets at FVTOCI

Elected investments in equity instruments at FVTOCI are initially recognized at fair value plus transaction costs. Subsequently they are measured at fair value, with gains and losses arising from changes in fair value recognized in other comprehensive (loss) income.

Financial assets and liabilities at amortized cost

Financial assets and liabilities at amortized cost are initially recognized at fair value, plus transaction costs, and subsequently carried at amortized cost less any impairment. Financial liabilities carried at amortized cost utilize the effective interest method.

Financial assets and liabilities at FVTPL

Financial assets and liabilities carried at FVTPL are initially recorded at fair value and transaction costs are expensed in the consolidated statements of comprehensive (loss) income. Realized and unrealized gains and losses arising from changes in the fair value of the financial assets and liabilities held at FVTPL are included in the consolidated statements of comprehensive (loss) income in the period in which they arise.

The effective interest method is a method of calculating the amortized cost of a financial liability and of allocating interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments (including all fees and points paid or received that form an integral part of the effective interest rate, transaction costs and other premiums or discounts) through the expected life of the financial liability, or where appropriate, a shorter period, to the net carrying amount on initial recognition.

Derecognition

Financial assets

The Company derecognizes the financial assets only when the contractual rights to cash flows from the financial assets expire, or when it transfers the financial assets and substantially all the associated risks and rewards of ownership to another entity. Gains and losses on derecognition are generally recognized in the consolidated statements of comprehensive (loss) income. However, gains and losses on derecognition of financial assets classified as FVTOCI are reclassified to retained earnings (deficit) as a reclassification within equity.

Financial liabilities

The Company derecognizes financial liabilities only when its obligations under the financial liabilities are discharged, cancelled, or expired. The difference between the carrying amount of the financial liability derecognized and the consideration paid and payable, including any non-cash assets transferred or liabilities assumed, is recognized in the consolidated statements of comprehensive (loss) income.

(b) Foreign currency transactions and advance consideration

In December 2016, the IASB issued IFRIC Interpretation 22 “Foreign Currency Transactions and Advance Consideration” (“IFRIC 22”). IFRIC 22 is applicable for annual periods beginning on or after January 1, 2018 and permits early adoption. IFRIC 22 clarifies which date should be used for translation when a foreign currency transaction involves an advance payment or receipt. The interpretation clarifies that the date of the transaction for the purpose of determining the exchange rate to use on initial recognition of the related asset, expense or income (or part of it) is the date on which an entity initially recognizes the non-monetary asset or non-monetary liability arising from the payment or receipt of the advance consideration. The adoption of IFRIC 22 did not have an effect on the condensed consolidated interim financial statements for the period.

| Page | 19 |

(c) Impairment of non-financial assets

The carrying value of the Company’s capitalized property and equipment is assessed for impairment when indicators of potential impairment are identified to exist. If any indication of impairment is identified, an estimate of the asset’s recoverable amount is calculated to determine the extent of the impairment loss, if any. The recoverable amount is determined as the higher of the fair value less costs of disposal for the asset and the asset’s value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a discount rate that reflects current market assessments of the time value of money and the risks specific to the asset for which the estimates of future cash flows have not been adjusted.

Impairment is determined on an asset by asset basis, whenever possible. If it is not possible to determine impairment on an individual asset basis, then impairment is considered on the basis of a cash generating unit (“CGU”). CGUs represent the lowest level for which there are separately identifiable cash inflows that are largely independent of the cash flows from other assets or the Company’s other group of assets. The Company has determined that it has one CGU, which comprised of the GK Mine and the mineral asset rights under KNP.

If the carrying amount of the asset exceeds its recoverable amount, the asset is impaired and an impairment loss is charged immediately to profit or loss so as to reduce the carrying amount to its recoverable amount.

SIGNIFICANT ACCOUNTING JUDGMENTS, ESTIMATES AND ASSUMPTIONS

The preparation of the Company’s unaudited financial statements requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities and contingent liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting periods. Judgments, estimates and assumptions are continually evaluated and are based on management’s experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. However, actual outcomes can differ materially from these estimates. The significant judgments, estimates and assumptions made by management in applying the Company’s accounting policies were the same as those that applied to the audited financial statements as at and for the year ended December 31, 2017 except for the following:

Useful life of property, plant and equipment

The Company has changed its estimate of the useful life of the earthmoving equipment category within property, plant and equipment to better reflect the pattern of consumption being straight line over the remaining life of the mine, rather than estimated hours. This change in estimate did not result in a material difference to the depreciation in the current period. It is estimated it will not have a material impact on future periods depreciation.

Business combinations

Determination of whether a set of assets acquired and liabilities assumed constitute the acquisition of a business or asset may require may require the Company to make certain judgments as to whether or not the assets acquired and liabilities assumed include the inputs, processes and outputs necessary to constitute a business as defined in IFRS 3 - Business Combinations. Based on an assessment of the relevant facts and circumstances, the Company concluded that the acquisition of Kennady Diamonds Inc. on April 13, 2018 did not meet the criteria for accounting as a business combination (see Note 6 to the Financial Statements).

STANDARDS AND AMENDMENTS TO EXISTING STANDARDS

At the date of authorization of the financial statements, certain new standards and amendments to existing standards have been published but are not yet effective and have not been adopted early by the Company. The Company anticipates that all of the relevant standards will be adopted by the Company in the first period beginning after the effective date of the standard. Information on new standards and amendments that are expected to be relevant to the Company’s financial statements is provided below.

| Page | 20 |

Leases

On January 13, 2016, the IASB issued International Financial Reporting Standard 16, Leases (“IFRS 16”). The new standard will replace existing lease guidance in IFRS and related interpretations and requires companies to bring most leases on balance sheet. The significant change will affect the accounting treatment of leases currently classified as operating leases. The new standard is effective for annual periods beginning on or after January 1, 2019. The Company believes the adoption of IFRS 16 will have an increase in lease liabilities, representing the present value of future payments under arrangements currently classified as operating leases, along with a corresponding increase in property, plant and equipment. Upon increasing property, plant and equipment, there will be an impact on the statement of comprehensive income (loss), with an increase to depreciation and depletion, rather than operating expenses.

Uncertainty over income tax treatments

On June 7, 2017, the IASB issued IFRIC Interpretation 23, Uncertainty over Income Tax Treatments (“IFRIC 23”). IFRIC 23 provides guidance on the accounting for current and deferred tax liabilities and assets in circumstances in which there is uncertainty over income tax treatments. IFRIC 23 is applicable for annual periods beginning on or after January 1, 2019. Earlier application is permitted. Management is currently assessing the impact of the IFRIC 23 on the consolidated financial statements.

RELATED PARTY TRANSACTIONS

The Company’s related parties include the Operator of the GK Mine, Dermot Desmond, Bottin and Vertigol (corporations controlled by Dermot Desmond), key management and their close family members, and the Company’s directors. During the six-month period ended June 30, 2018, Dermot Desmond and Bottin transferred all owned shares of the Company to Vertigol Unlimited Company (a corporation beneficially owned by Dermot Desmond). Dermot Desmond, indirectly through Vertigol Unlimited Company, is a beneficial owner of greater than 10% of the Company’s shares. Kennady Diamonds Inc. (“Kennady Diamonds”) was also a related party since the Company and Kennady Diamonds had a common member of key management, until the date of acquisition on April 13, 2018. International Investment and Underwriting (“IIU”) is also a related party since it is controlled by Mr. Dermot Desmond.

Related party transactions are recorded at their exchange amount, being the amount agreed to by the parties.

The Company had the following transactions and balances with its related parties including key management personnel including the Company’s directors, Dermot Desmond, Vertigol, IIU, the Operator of the GK Mine, and Kennady Diamonds. The transactions with key management personnel are in the nature of remuneration. The transactions with the Operator of the GK Mine relate to the funding of the Company’s interest in the GK Mine for the current year’s expenditures, capital additions, management fee, and pre-production sales related to the 49% share of fancies and special diamonds. The transactions with Kennady Diamonds are for a monthly management fee charged by the Company for reimbursement of expenses paid on behalf of Kennady Diamonds. The transactions with IIU are for the director fees and travel expenses of the Chairman of the Company.

The balances as at June 30, 2018 and December 31, 2017 were as follows:

| June 30, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Payable to the Operator of the GK Mine* | $ | 603 | $ | 523 | ||||

| Payable to De Beers Canada Inc. for interest on letters of credit | 688 | 339 | ||||||

| Receivable from De Beers Canada Inc. for sunk cost overpayment | – | 21 | ||||||

| Payable to International Investment and Underwriting | 30 | 32 | ||||||

| Payable to key management personnel | 149 | 178 | ||||||

*included in accounts payable and accrued liabilities

| Page | 21 |

The transactions for the three and six months ended June 30, 2018 and 2017 were as follows:

| Three months ended | Three months ended | Six months ended | Six months ended | |||||||||||||

| June 30, 2018 | June 30, 2017 | June 30, 2018 | June 30, 2017 | |||||||||||||

| The total of the transactions: | ||||||||||||||||

| Kennady Diamonds | $ | 7 | $ | 22 | $ | 30 | $ | 45 | ||||||||

| International Investment and Underwriting | 17 | 12 | 30 | 25 | ||||||||||||

| Remuneration to key management personnel | 818 | 1,420 | 1,512 | 2,145 | ||||||||||||

| Sunk cost repayment to De Beers Canada Inc. | – | – | – | 10,000 | ||||||||||||

| Diamonds sold to De Beers Canada Inc. | – | – | – | 1,398 | ||||||||||||

| Diamonds purchased from De Beers Canada Inc. | 8,490 | 5,260 | 15,857 | 8,524 | ||||||||||||

| Finance costs incurred from De Beers Canada Inc. | 176 | 714 | 349 | 1,001 | ||||||||||||

| Management fee charged by the Operator of the GK Mine | 1,038 | 1,038 | 2,076 | 2,076 | ||||||||||||

The remuneration expense of directors and other members of key management personnel for the three and six months ended June 30, 2018 and 2017 were as follows:

| Three months ended | Three months ended | Six months ended | Six months ended | |||||||||||||

| June 30, 2018 | June 30, 2017 | June 30, 2018 | June 30, 2017 | |||||||||||||

| Consulting fees, payroll, director fees, bonus and other short-term benefits | $ | 497 | $ | 1,164 | $ | 866 | $ | 1,587 | ||||||||

| Share-based payments | 321 | 256 | 646 | 558 | ||||||||||||

| $ | 818 | $ | 1,420 | $ | 1,512 | $ | 2,145 | |||||||||

In accordance with International Accounting Standard 24 Related Parties, key management personnel are those persons having authority and responsibility for planning, directing and controlling the activities of the Company directly or indirectly, including any directors (executive and non-executive) of the Company.

CONTRACTUAL OBLIGATIONS

The following table summarizes the contractual maturities of the Company’s significant financial liabilities and capital commitments, including contractual obligations:

| Less than | 1 to 3 | 4 to 5 | After 5 | |||||||||||||||||

| 1 Year | Years | Years | Years | Total | ||||||||||||||||

| Operating lease obligations | $ | 231 | $ | 469 | $ | 473 | $ | 197 | $ | 1,370 | ||||||||||

| Gahcho Kué Diamond Mine commitments | 5,465 | – | – | – | 5,465 | |||||||||||||||

| Gahcho Kué Diamond Mine operating lease obligations | 827 | 1,099 | 213 | 83 | 2,222 | |||||||||||||||

| Revolving credit facility stand by charges | 813 | 1,124 | – | – | 1,937 | |||||||||||||||

| Notes payable - Principal | – | – | 433,389 | – | 433,389 | |||||||||||||||

| Notes payable - Interest | 35,153 | 70,402 | 52,777 | – | 158,332 | |||||||||||||||

| $ | 42,489 | $ | 73,094 | $ | 486,852 | $ | 280 | $ | 602,715 | |||||||||||

NON-IFRS MEASURES

The MD&A refers to the terms “Price per carat in US$, run of mine basis” and “Attributed value per tonne in CAD”, as well as “Cash costs of production per tonne of ore processed” and “Cash costs of production per carat recovered”, both including and net of capitalized stripping costs and “Adjusted Earnings Before Interest, Taxes Depreciation and Amortization (Adjusted EBITDA)”. Each of these is a non-IFRS performance measure and is referenced in order to provide investors with information about the measures used by management to monitor performance. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. They do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers.

Price per carat in US$, run of mine basis, and attributed value per tonne in CAD are used by management to analyze the sales results based on date of production rather than sales date. Differences from reported sales are attributed to the holding back or accumulation of diamonds, the expediting of certain diamonds produced into an earlier sale batch, and the inclusion in revenue under IFRS of proceeds from the sale of De Beers’ 51% of fancies and specials won by the Company under the tender process, described as adjustments for stock movements and holdbacks.

| Page | 22 |

Cash costs of production per tonne of ore processed and cash costs of production per carat recovered are used by management to analyze the actual cash costs associated with processing the ore, and for each recovered carat. Differences from production costs reported within cost of sales are attributed to the amount of production cost included in ore stockpile and rough diamond inventories.

Adjusted EBITDA is used by management to analyze the operational cash flows of the Company, as compared to the net income for accounting purposes. It is also a measure which is defined in the secured notes payable documents. The Q2 2018 period has been presented.

The following table provides a reconciliation of the Adjusted EBITDA with the net income on the condensed consolidated interim statements of comprehensive (loss) income:

| Three months ended | Three months ended | Six months ended | Six months ended | |||||||||||||

| June 30, 2018 | June 30, 2017 | June 30, 2018 | June 30, 2017 | |||||||||||||

| Net (loss) income for the period | $ | (6,280 | ) | $ | 7,554 | $ | (6,213 | ) | $ | 5,410 | ||||||

| Add/deduct: | ||||||||||||||||

| Non-cash depreciation and depletion | 29,265 | 5,094 | 42,348 | 5,094 | ||||||||||||

| Net finance expenses | 9,889 | 11,376 | 19,589 | 15,139 | ||||||||||||

| Derivative gains | (267 | ) | 15 | (782 | ) | (780 | ) | |||||||||

| Current and deferred income taxes | 157 | – | 657 | – | ||||||||||||

| Unrealized foreign exchange losses (gains) | 7,909 | (11,260 | ) | 18,285 | (15,489 | ) | ||||||||||

| Adjusted earnings before interest, taxes, depreciation and depletion (Adjusted EBITDA) | $ | 40,673 | $ | 12,779 | $ | 73,884 | $ | 9,374 | ||||||||

The following table provides a reconciliation of price per carat in US$, run of mine basis, to the sales reported on the condensed consolidated interim statements of comprehensive (loss) income, as applicable:

| Sales per carat (expressed in 000's, except per carat amounts) | Sales 3 to 7 | Sales 8 to 10 | 2018 Sale 1 | 2018 Sale 2 | 2018 Sale 3 | 2018 Sale 4 | 2018 Sale 5* | |||||||||||||||||||||||||

| Sales | $ | 129,928 | $ | 77,245 | $ | 34,201 | $ | 32,364 | $ | 33,262 | $ | 36,371 | $ | 29,443 | ||||||||||||||||||

| Less: effects of foreign exchange spot translations | $ | (29,063 | ) | $ | (16,372 | ) | $ | (6,941 | ) | $ | (7,266 | ) | $ | (6,852 | ) | $ | (8,109 | ) | $ | (7,304 | ) | |||||||||||

| Sales in $US | $ | 100,865 | $ | 60,873 | $ | 27,260 | $ | 25,098 | $ | 26,410 | $ | 28,262 | $ | 22,139 | ||||||||||||||||||

| Carats sold | 1,323 | 1,006 | 351 | 177 | 451 | 350 | 313 | |||||||||||||||||||||||||

| Sales per carat, $US | $ | 76 | $ | 61 | $ | 78 | $ | 142 | $ | 59 | $ | 81 | $ | 71 | ||||||||||||||||||

| Reconciliation of date of sale to date (expressed in 000's) | Sales 3 to 7 | Sales 8 to 10 | 2018 Sale 1 | 2018 Sale 2 | 2018 Sale 3 | 2018 Sale 4 | 2018 Sale 5* | Total | ||||||||||||||||||||||||

| Carats recovered | ||||||||||||||||||||||||||||||||

| H1 2017 production period | 1,216 | – | – | – | – | – | – | 1,216 | ||||||||||||||||||||||||

| Q3 2017 production period | 19 | 875 | – | – | – | – | – | 894 | ||||||||||||||||||||||||

| Q4 2017 production period | – | 131 | 351 | 177 | 138 | – | – | 797 | ||||||||||||||||||||||||

| January 2018 production period | – | – | – | – | 303 | – | – | 303 | ||||||||||||||||||||||||

| February 2018 production period | – | – | – | – | 10 | 208 | – | 218 | ||||||||||||||||||||||||

| March 2018 production period | – | – | – | – | – | 142 | 142 | 284 | ||||||||||||||||||||||||

| April 2018 production period | – | – | – | – | – | – | 171 | 171 | ||||||||||||||||||||||||

| May 2018 production period | – | – | – | – | – | – | – | – | ||||||||||||||||||||||||

| Sales in $US | ||||||||||||||||||||||||||||||||

| H1 2017 production period | $ | 86,336 | $ | – | $ | – | $ | – | $ | – | $ | – | $ | – | $ | 86,336 | ||||||||||||||||

| Q3 2017 production period | $ | 9,631 | $ | 44,903 | $ | – | $ | – | $ | – | $ | – | $ | – | $ | 54,534 | ||||||||||||||||

| Q4 2017 production period | $ | – | $ | 15,970 | $ | 27,260 | $ | 25,098 | $ | 2,235 | $ | – | $ | – | $ | 70,563 | ||||||||||||||||

| January 2018 production period | $ | – | $ | – | $ | – | $ | – | $ | 21,210 | $ | – | $ | – | $ | 21,210 | ||||||||||||||||

| February 2018 production period | $ | – | $ | – | $ | – | $ | – | $ | 2,965 | $ | 12,295 | $ | – | $ | 15,260 | ||||||||||||||||