Exhibit 99.2

NOTICES OF MEETING

and

JOINT MANAGEMENT INFORMATION CIRCULAR

for the

SPECIAL MEETING OF SHAREHOLDERS OF

MOUNTAIN

PROVINCE DIAMONDS INC.

and the

SPECIAL MEETING OF SHAREHOLDERS OF

KENNADY

DIAMONDS INC.

each to be held on

April 9, 2018

DATED AS OF March 5, 2018

YOUR VOTE

IS IMPORTANT. PLEASE VOTE TODAY.

| These materials are important and require your immediate attention. If you have questions or require assistance with voting your shares, you may contact our proxy solicitation agent: |

| Laurel Hill Advisory Group |

| North American Toll-Free Number: 1-877-452-7184 |

| Collect Calls Outside North America: 416-304-0211 |

| Email:

assistance@laurelhill.com |

March 5, 2018

Dear Shareholders of Mountain Province Diamonds

Inc.:

It is my pleasure to extend to you, on behalf

of the board of directors (the “Mountain Province Board”) of Mountain Province Diamonds Inc. (“Mountain

Province”), an invitation to attend the special meeting (the “Mountain Province Meeting”) of the shareholders

of Mountain Province (the “Mountain Province Shareholders”) to be held at the Terminal City Club, 837 West Hastings

Street, Vancouver, British Columbia, Canada V6C 1B4 at 2:30 p.m. (Pacific Standard Time) on Monday, April 9, 2018.

The Arrangement

On January 28, 2018, Mountain Province entered

into a definitive arrangement agreement (the “Arrangement Agreement”) with Kennady Diamonds Inc. (“Kennady”),

whereby, subject to the terms and conditions of the Arrangement Agreement, Mountain Province will acquire all of the issued and

outstanding common shares of Kennady (the “Kennady Shares”) pursuant to a statutory plan of arrangement (the “Arrangement”)

under Section 182 of the Business Corporations Act (Ontario) (the “OBCA”).

Under the terms of the Arrangement, shareholders

of Kennady (the “Kennady Shareholders”) (other than Mountain Province and any Kennady Shareholders validly exercising

dissent rights) will receive 0.975 of a common share of Mountain Province (each such whole share, a “Mountain Province

Share”) in exchange for each Kennady Share held at the effective time of the Arrangement.

On January 28, 2018, concurrently with the

Arrangement Agreement, Kennady entered into an agreement with Mountain Province pursuant to which Mountain Province will provide

financing to Kennady of up to $10,000,000 via an equity private placement of 4,000,000 Kennady Shares at $2.50 per Kennady Share

in four equal tranches designed to coincide with the budget for Kennady’s current work program. The completion of the equity private

placement is not conditional upon the completion of the Arrangement.

Shareholder Vote

At the Mountain Province Meeting, Mountain

Province Shareholders will be asked to consider and, if deemed advisable, pass an ordinary resolution approving the issuance of

up to 54,673,383 Mountain Province Shares (subject to variation due to rounding of fractional interests) in connection with the

Arrangement, composed of up to 54,673,383 Mountain Province Shares to be issued to Kennady Shareholders (other than Mountain Province

and any Kennady Shareholders validly exercising dissent rights) in exchange for their Kennady Shares pursuant to the Arrangement

(the “Share Issuance Resolution”). To be effective, the Share Issuance Resolution must be approved at the Mountain

Province Meeting by (i) at least a majority of the votes cast on the Share Issuance Resolution by the Mountain Province Shareholders

present in person or represented by proxy and entitled to vote at the Mountain Province Meeting, and (ii) at least a majority

of the votes cast on the Share Issuance Resolution by the Minority Mountain Province Shareholders (as defined in the accompanying

Circular (as defined herein)) present in person or represented by proxy and entitled to vote at the Mountain Province Meeting.

The accompanying notice of special meeting

of Mountain Province Shareholders (the “Mountain Province Notice of Meeting”) and accompanying joint management

information circular dated March 5, 2018 (the “Circular”) provide a description of the Arrangement, and include

certain additional information to assist you in considering how to vote on the Share Issuance Resolution. You are urged to read

this information carefully and, if you require assistance, to consult your tax, financial, legal or other professional advisors.

Mountain Province Shareholders holding, in

the aggregate, approximately 24.3% of the outstanding Mountain Province Shares as of January 28, 2018 have entered into voting

and support agreements with Kennady agreeing to support the Arrangement and vote their Mountain Province Shares in favour of the

Share Issuance Resolution, subject to certain exceptions.

Mountain Province Special Committee Recommendation

After careful consideration, including a thorough

review of the Arrangement Agreement and receiving the oral fairness opinion (subsequently confirmed in writing) of RBC Capital

Markets delivered to the special committee of independent directors of Mountain Province (the “Mountain Province Special

Committee”), as well as a thorough review of other matters, including those discussed in the accompanying Circular, the

Mountain Province Special Committee unanimously determined that the Arrangement is in the best long-term interests of Mountain

Province. Accordingly, the Mountain Province Special Committee unanimously recommended that the Mountain Province Board approve

the Arrangement and enter into the Arrangement Agreement.

Mountain Province Board Recommendation

After careful consideration, the Mountain Province

Board (other than Mr. Comerford, who, having declared a potential conflict of interest in the matters being considered, was not

present and did not vote on the Arrangement) has determined, upon the recommendation of the Mountain Province Special Committee

and consultation with its legal and financial advisors, and based in part on an oral fairness opinion (subsequently confirmed in

writing) received by the Mountain Province Special Committee from RBC Capital Markets as described in the accompanying Circular,

that the Arrangement is in the best long-term interests of Mountain Province and the Mountain Province Shareholders, and unanimously

recommends that Mountain Province Shareholders vote FOR the Share Issuance Resolution. The determination of the Mountain

Province Board (other than Mr. Comerford, who, having declared a potential conflict of interest in the matters being considered,

was not present and did not vote on the Arrangement) is based on various factors described more fully in the accompanying Mountain

Province Notice of Meeting and Circular.

We recommend that you review in detail the

full reasons for the Mountain Province recommendation and the Kennady recommendation, which are set out in the accompanying Circular

under the headings “Reasons for the Mountain Province and Mountain Province Special Committee Recommendations”

and “Reasons for the Kennady Board and Kennady Special Committee Recommendations”.

Vote your Mountain Province Shares Today

FOR the Share Issuance Resolution.

Your vote is very important regardless of the

number of Mountain Province Shares you own. If you are a registered Mountain Province Shareholder (i.e., your name appears on the

register of the Mountain Province Shares maintained by or on behalf of Mountain Province) and you are unable to attend the Mountain

Province Meeting in person, we encourage you to complete, sign, date and return the accompanying Mountain Province Proxy so that

your Mountain Province Shares can be voted at the Mountain Province Meeting (or at any adjournments or postponements thereof) in

accordance with your instructions. To be effective, the enclosed Mountain Province Proxy must be received by Mountain Province’s

transfer agent, Computershare Investor Services Inc. (according to the instructions on the proxy), not later than 2:30 p.m. (Pacific

Standard Time) on Thursday, April 5, 2018, or not later than 48 hours (other than a Saturday, Sunday or holiday) immediately preceding

the time of the Mountain Province Meeting (as it may be adjourned or postponed from time to time). The deadline for the deposit

of proxies may be waived or extended by the Chair of the Mountain Province Meeting at their discretion, without notice.

If you hold Mountain Province Shares through

a broker, custodian, nominee or other intermediary, you should follow the instructions provided by your intermediary to ensure

your vote is counted at the Mountain Province Meeting.

Conditions

Subject to obtaining the requisite approvals

of the Mountain Province Shareholders, the Kennady Shareholders and the Ontario Superior Court of Justice (Commercial List), it

is anticipated that the Arrangement will be completed as soon as practicable following receipt of the final order of the Ontario

Superior Court of Justice (Commercial List),

which is expected to be obtained on or about

April 11, 2018, and following the satisfaction or waiver of all other conditions precedent to the Arrangement.

The accompanying Circular contains a detailed

description of the Arrangement, as well as detailed information regarding Mountain Province and Kennady and certain pro forma

and other information regarding the combined company after giving effect to the Arrangement.

Shareholder Questions

If you have any questions or need assistance

in your consideration of the Share Issuance Resolution, or with the completion and delivery of your proxy, please contact Laurel

Hill Advisory Group, the proxy solicitation agent, by telephone at: 1-877-452-7184 (North American Toll Free) or 416-304-0211 (Collect

Outside North America); or by email at: assistance@laurelhill.com.

On behalf of Mountain Province, I would like to thank all Mountain

Province Shareholders for their continuing support.

Yours truly,

“David Whittle”

David Whittle

Director, Interim President and Chief Executive Officer

|

Vote using the following methods prior to the Meeting.

Registered Shareholders

Shares held in own name and represented

by a physical certificate.

Beneficial Shareholders

Shares held with a broker, bank

or other intermediary. |

|

Internet

www.investorvote.com

www.proxyvote.com |

|

Telephone or Fax

Telephone: 1-866-732-8683

Fax: 1-866-249-7775

Call or fax to the number(s) listed on your

voting instruction form |

|

Mail

Return the form of proxy in the enclosed postage

paid envelope.

Return the voting instruction form in the postage

paid enclosed envelope. |

March 5, 2018

Dear Shareholders of Kennady Diamonds Inc.:

It is my pleasure to extend to you, on behalf

of the board of directors (the “Kennady Board”) of Kennady Diamonds Inc. (“Kennady”), an invitation

to attend the special meeting (the “Kennady Meeting”) of the shareholders of Kennady (the “Kennady Shareholders”)

to be held at the Terminal City Club, 837 West Hastings Street, Vancouver, British Columbia, Canada V6C 1B4, at 1:00 p.m. (Pacific

Standard Time) on Monday, April 9, 2018.

The Arrangement

On January 28, 2018, Mountain Province Diamonds

Inc. (“Mountain Province”) entered into a definitive arrangement agreement (the “Arrangement Agreement”)

with Kennady, whereby, subject to the terms and conditions of the Arrangement Agreement, Mountain Province will acquire all of

the issued and outstanding common shares of Kennady (the “Kennady Shares”) pursuant to a statutory plan of arrangement

(the “Arrangement”) under Section 182 of the Business Corporations Act (Ontario) (the “OBCA”).

Under the terms of the Arrangement, shareholders

of Kennady (the “Kennady Shareholders”) (other than Mountain Province and any Kennady Shareholders validly exercising

dissent rights) will receive 0.975 of a common share of Mountain Province (the “Arrangement Consideration”) (each

such whole share, a “Mountain Province Share”) in exchange for each Kennady Share held.

The Arrangement Consideration represents consideration

to Kennady Shareholders of $3.46 per Kennady Share based on the pre-announcement closing price of $3.55 per Mountain Province Share

on the TSX as at January 26, 2018 (being the last trading day prior to the announcement of the Arrangement). This value implies

an approximate 26% premium to the pre-announcement closing price of Kennady Shares on January 26, 2018, and an approximate 15%

premium to Kennady Shares based on the 20-day volume weighed average price of Mountain Province Shares on the TSX and Kennady Shares

on the TSXV ending January 26, 2018.

On January 28, 2018, concurrently with the

Arrangement Agreement, Kennady entered into an agreement with Mountain Province pursuant to which Mountain Province will provide

financing to Kennady of up to $10,000,000 via an equity private placement of 4,000,000 Kennady Shares at $2.50 per Kennady Share

in four equal tranches designed to coincide with Kennady’s budget for the current work program. The completion of the equity private

placement is not conditional upon the completion of the Arrangement.

Shareholder Vote

At the Kennady Meeting, the Kennady Shareholders

will be asked to consider and, if deemed advisable, pass a special resolution approving the Arrangement (the “Arrangement

Resolution”). To be effective, the Arrangement Resolution must be approved at the Kennady Meeting by (i) at least 66

⅔% of the votes cast on the Arrangement Resolution by the Kennady Shareholders present in person or represented by proxy

and entitled to vote at the Kennady Meeting, and (ii) at least a majority of the votes

cast on the Arrangement Resolution by the Minority Kennady Shareholders (as defined in the accompanying joint management information

circular dated March 5, 2018 (the “Circular”)) present in person or represented by proxy and entitled to vote

at the Kennady Meeting.

Kennady Shareholders holding, in the aggregate,

approximately 28.6% of the outstanding Kennady Shares as of January 28, 2018 have entered into voting and support agreements with

Mountain Province agreeing to support the Arrangement and vote their Kennady Shares in favour of the Arrangement Resolution, subject

to certain exceptions.

The accompanying notice of special meeting

of Kennady Shareholders (the “Kennady Notice of Meeting”) and accompanying Circular provide a description of the

Arrangement and include certain additional information to assist you in considering how to vote on the Arrangement Resolution.

You are urged to read this information carefully and, if you require assistance, to consult your tax, financial, legal or other

professional advisors.

Kennady Special Committee Recommendation

After careful consideration, including a thorough

review of the Arrangement Agreement and receiving the oral fairness opinion (subsequently confirmed in writing) of Haywood Securities

Inc. delivered to the special committee of independent directors of Kennady (the “Kennady Special Committee”),

as well as a thorough review of other matters, including those discussed in the accompanying Circular, the Kennady Special Committee

unanimously determined that the Arrangement is in the best interests of Kennady. Accordingly, the Kennady Special Committee unanimously

recommended that the Kennady Board approve the Arrangement and enter into the Arrangement Agreement and that the Kennady Board

recommend that Kennady Shareholders vote in favour of the Arrangement Resolution.

Kennady Board Recommendation

After careful consideration, the Kennady Board

(other than Mr. Comerford and Dr. Moore, who, having declared a potential conflict of interest in the matters being considered,

were not present and did not vote on the Arrangement) has determined, upon the recommendation of the Kennady Special Committee

and consultation with its legal and financial advisors, and based in part on an oral fairness opinion (subsequently confirmed in

writing) received by the Kennady Special Committee from Haywood Securities Inc., as described in the accompanying Circular, that

the Arrangement is in the best interests of Kennady and unanimously recommends that Kennady Shareholders vote FOR

the Arrangement Resolution. The determination of the Kennady Board (other than Mr. Comerford and Dr. Moore, who, having declared

a potential conflict of interest in the matters being considered, were not present and did not vote on the Arrangement) is based

on various factors described more fully in the accompanying Kennady Notice of Meeting and the accompanying Circular.

Vote Your Kennady Shares Today FOR

the Arrangement Resolution

Your vote is very important regardless of the

number of Kennady Shares you own. If you are a registered Kennady Shareholder (i.e., your name appears on the register of the Kennady

Shares maintained by or on behalf of Kennady) and you are unable to attend the Kennady Meeting in person, we encourage you to complete,

sign, date and return the accompanying Kennady Proxy so that your Kennady Shares can be voted at the Kennady Meeting (or at any

adjournments or postponements thereof) in accordance with your instructions. To be effective, the enclosed Kennady Proxy must be

received by Kennady’s transfer agent, Computershare Investor Services Inc. (according to the instructions on the proxy), not later

than 1:00 p.m. (Pacific Standard Time) on Thursday, April 5, 2018, or not later than 48 hours (other than a Saturday, Sunday or

holiday) immediately preceding the time of the Kennady Meeting (as it may be adjourned or postponed from time to time). The deadline

for the deposit of proxies may be waived or extended by the Chair of the Kennady Meeting at his discretion, without notice.

If you hold Kennady Shares through a broker,

custodian, nominee or other intermediary, you should follow the instructions provided by your intermediary to ensure your vote

is counted at the Kennady Meeting and should arrange for your intermediary to complete the necessary steps to ensure that you receive

payment for your securities as soon as possible following completion of the Arrangement.

If you are a Registered Kennady Shareholder

(as defined in the accompanying Circular), we encourage you to complete, sign, date and return the enclosed Letter of Transmittal

(printed on YELLOW PAPER) (the “Letter of Transmittal”) in accordance with the instructions set out therein and

in the Circular, together with the certificate(s) representing your Kennady Shares, if applicable, to the Depositary (as defined

in the accompanying Circular) at the address specified in the Letter of Transmittal. The Letter of Transmittal contains other procedural

information relating to the Arrangement and should be reviewed carefully.

Conditions

Subject to obtaining the requisite approvals

of the Kennady Shareholders, the Kennady Shareholders and the Ontario Superior Court of Justice (Commercial List), it is anticipated

that the Arrangement will be completed as soon as practicable following receipt of the final order of the Ontario Superior Court

of Justice (Commercial List), which is expected to be obtained on or about April 11, 2018, and following the satisfaction or waiver

of all other conditions precedent to the Arrangement.

The accompanying Circular contains a detailed

description of the Arrangement, as well as detailed information regarding Kennady and Mountain Province and certain pro forma

and other information regarding the combined company after giving effect to the Arrangement (as defined in the accompanying Circular).

It also includes certain risk factors relating to Kennady, Mountain Province and the combined company assuming the completion of

the Arrangement, and the potential consequences of a Kennady Shareholder exchanging Kennady Shares for Mountain Province Shares

in connection with the Arrangement.

Shareholder Questions

If you have any questions or need assistance

in your consideration of the Arrangement Resolution, or with the completion and delivery of your proxy, please contact Laurel

Hill Advisory Group, the proxy solicitation agent, by telephone at: 1-877-452-7184 (North American Toll Free) or 416-304-0211

(Collect Outside North America); or by email at: assistance@laurelhill.com.

On behalf of Kennady, I would like to thank all Kennady Shareholders

for their continuing support.

Yours truly,

“Rory Moore”

Dr. Rory Moore

Director, President and Chief Executive Officer

|

Vote using the following methods prior to the Meeting.

Registered Shareholders

Shares held in own name and represented

by a physical certificate.

Beneficial Shareholders

Shares held with a broker, bank

or other intermediary. |

|

Internet

www.investorvote.com

www.proxyvote.com |

|

Telephone or Fax

Telephone: 1-866-732-8683

Fax: 1-866-249-7775

Call or fax to the number(s) listed on your

voting instruction form |

|

Mail

Return the form of proxy in the enclosed postage

paid envelope.

Return the voting instruction form in the postage

paid enclosed envelope. |

NOTICE OF SPECIAL MEETING OF MOUNTAIN PROVINCE SHAREHOLDERS

NOTICE IS HEREBY GIVEN that a special

meeting (the “Mountain Province Meeting”) of shareholders (“Mountain Province Shareholders”)

of Mountain Province Diamonds Inc. (“Mountain Province”) will be held at 2:30 p.m. (Pacific Standard Time) on

Monday, April 9, 2018 at the Terminal City Club, 837 West Hastings Street, Vancouver, British Columbia, Canada V6C

1B4, for the following purposes:

| (a) | to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution

(the “Share Issuance Resolution”), the full text of which is set out in Schedule “B” – “Resolutions

to be Approved at the Mountain Province Meeting” to the accompanying joint management information circular dated March

5, 2018 (the “Circular”), to authorize and approve the issuance of up to 54,673,383 common shares of Mountain

Province (“Mountain Province Shares”) (subject to variation due to rounding of fractional interests) in connection

with the proposed acquisition by Mountain Province of all of the outstanding common shares (the “Kennady Shares”)

of Kennady Diamonds Inc. (“Kennady”) in connection with the proposed plan of arrangement under Section 182 of

the Business Corporations Act (Ontario) (the “Arrangement”) involving Mountain Province and Kennady to

be completed pursuant to the terms and subject to the conditions of the arrangement agreement dated January 28, 2018 between Mountain

Province and Kennady; and |

| (b) | to transact such other business as may properly be brought before the Mountain Province Meeting

or any adjournment thereof. |

Specific details of the matters proposed to

be put before the Mountain Province Meeting are set forth in the Circular that accompanies this Notice of Meeting. The full text

of the Share Issuance Resolution (being item (a) set out above) is set out in Schedule “B” – “Resolutions

to be Approved at the Mountain Province Meeting” to the accompanying Circular. If the Arrangement is not completed,

the Mountain Province Shares referred to in the Share Issuance Resolution will not be issued even if the Share Issuance Resolution

is approved at the Mountain Province Meeting.

At the Mountain Province Meeting, Mountain

Province Shareholders will be asked to consider and, if deemed advisable, pass the Share Issuance Resolution approving the issuance

of up to 54,673,383 Mountain Province Shares (subject to variation due to rounding of fractional interests) in connection with

the Arrangement, composed of up to 54,673,383 Mountain Province Shares to be issued to the holders of Kennady Shares (“Kennady

Shareholders”) (other than Mountain Province and any Kennady Shareholders validly exercising dissent rights) in exchange

for their Kennady Shares pursuant to the Arrangement.

Upon the recommendation of the special committee

of independent directors of Mountain Province, the board of directors of Mountain Province (the “Mountain Province Board”)

(other than Mr. Comerford, who, having declared a potential conflict of interest in the matters being considered, was not present

and did not vote on the Arrangement) unanimously recommends that Mountain Province Shareholders vote in favour of the Share Issuance

Resolution. It is a condition to the completion of the Arrangement that the Share Issuance Resolution be approved at the Mountain

Province Meeting.

The record date (the “Mountain Province

Record Date”) for determination of Mountain Province Shareholders entitled to receive notice of and to vote at the Mountain

Province Meeting is the close of business on March 5, 2018. Only Mountain Province Shareholders whose names have been entered in

the register of holders of Mountain Province

Shares on the close of business on the Mountain

Province Record Date are entitled to receive notice of and to vote at the Mountain Province Meeting. Each Mountain Province Share

entitled to be voted on each resolution at the Mountain Province Meeting will entitle the holder to one vote at the Mountain Province

Meeting on all matters to come before the Mountain Province Meeting. The Share Issuance Resolution must be approved by (i) at least

a majority of the votes cast on the Share Issuance Resolution by the Mountain Province Shareholders present in person or represented

by proxy and entitled to vote at the Mountain Province Meeting, and (ii) at least a majority of the votes cast on the Share Issuance

Resolution by the Minority Mountain Province Shareholders (as defined in the Circular) present in person or represented by proxy

and entitled to vote at the Mountain Province Meeting.

A Mountain Province Shareholder may attend

the Mountain Province Meeting in person or may be represented by proxy. Mountain Province Shareholders who are unable to attend

the Mountain Province Meeting or any adjournment thereof in person are requested to date, sign and return the accompanying form

of proxy (the “Mountain Province Proxy”) printed on WHITE PAPER for use at the Mountain Province Meeting or any adjournment

thereof. To be effective, the proxy must be received by our transfer agent, Computershare Investor Services Inc., by mail: Computershare

Investor Services Inc., Toronto Office, Proxy Department, at 100 University Avenue, 8th Floor, Toronto, Ontario, Canada, M5J 2Y1;

by telephone: 1-866-732-8683; or online: www.investorvote.com not later than 2:30 p.m. (Pacific Standard Time) on Thursday,

April 5, 2018 or 48 hours (other than a Saturday, Sunday or holiday) prior to the time to which the Mountain Province Meeting may

be adjourned. Notwithstanding the foregoing, the Chair of the Mountain Province Meeting has the discretion to accept proxies received

after such deadline.

If a Mountain Province Shareholder receives

more than one form of proxy because such holder owns Mountain Province Shares registered in different names or addresses, each

form of proxy should be completed and returned.

If you are a non-registered holder of Mountain

Province Shares and have received these materials through your broker, custodian, nominee or other intermediary, please complete

and return the form of proxy or voting instruction form provided to you by your broker, custodian, nominee or other intermediary

in accordance with the instructions provided therein.

The Mountain Province Proxy confers discretionary

authority with respect to: (i) amendments or variations to the matters of business to be considered at the Mountain Province Meeting;

and (ii) other matters that may properly come before the Mountain Province Meeting. As of the date hereof, management of Mountain

Province knows of no amendments, variations or other matters to come before the Mountain Province Meeting other than the matters

set forth in this Mountain Province Notice of Meeting. Mountain Province Shareholders who are planning on returning the accompanying

Mountain Province Proxy are encouraged to review the accompanying Circular carefully before submitting the proxy form. It is the

intention of the persons named in the enclosed Mountain Province Proxy, if not expressly directed to the contrary in such proxy,

to vote in favour of the Share Issuance Resolution.

If you have any questions or require any assistance

in completing your proxy or voting instruction form, please contact Laurel Hill Advisory Group, the proxy solicitation agent, by

telephone at: 1-877-452-7184 (North American Toll Free) or 416-304-0211 (Collect Outside North America); or by email at: assistance@laurelhill.com.

DATED at Toronto, Ontario, Canada, this 5th

day of March, 2018.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

/s/ David Whittle |

| |

David Whittle |

| |

Director, Interim President and Chief Executive |

| |

Officer |

| |

Mountain Province Diamonds Inc. |

NOTICE OF SPECIAL MEETING OF KENNADY SHAREHOLDERS

NOTICE IS HEREBY GIVEN that in accordance

with the interim order of the Ontario Superior Court of Justice (Commercial List) (the “Court”) rendered March

5, 2018, as may be further varied and amended (the “Interim Order”), a special meeting (the “Kennady Meeting”)

of shareholders (“Kennady Shareholders”) of Kennady Diamonds Inc. (“Kennady”) will be held at

1:00 p.m. (Pacific Standard Time) on Monday, April 9, 2018 at the Terminal City Club, 837 West Hastings Street, Vancouver,

British Columbia, Canada V6C 1B4, for the following purposes:

| (a) | to consider, pursuant to the Interim Order and, if deemed advisable, to pass, with or without variation,

a special resolution (the “Arrangement Resolution”), the full text of which is set out in Schedule “C”

– “Resolutions to be Approved at the Kennady Meeting” to the accompanying joint management information circular

dated March 5, 2018 (the “Circular”), to authorize and approve a plan of arrangement under Section 182 of the

Business Corporations Act (Ontario) (the “Plan of Arrangement’’) involving Kennady and Mountain Province Diamonds

Inc. (“Mountain Province”), whereby, subject to the terms and conditions of the arrangement agreement dated January

28, 2018 between Mountain Province and Kennady (the “Arrangement Agreement”), Mountain Province will acquire all

of the outstanding common shares in the capital of Kennady (“Kennady Shares”), as more particularly described

in the accompanying Circular; and |

| (b) | to transact such other business as may properly be brought before the Kennady Meeting or any adjournment

thereof. |

Specific details of the matters proposed to

be put before the Kennady Meeting are set forth in the accompanying Circular.

The record date for determining the Kennady

Shareholders entitled to receive notice of and vote at the Kennady Meeting is the close of business on March 5, 2018 (the “Kennady

Record Date”). A Kennady Shareholder may attend the Kennady Meeting in person or may be represented by proxy. Kennady

Shareholders who are unable to attend the Kennady Meeting or any adjournment thereof in person are requested to complete, date,

and sign the accompanying form of proxy (the “Kennady Proxy”) printed on BLUE PAPER and deliver it in accordance

with the instructions set out in the Kennady Proxy and in the accompanying Circular.

To be effective, the Kennady Proxy must

be received by our transfer agent, Computershare Investor Services Inc., not later than 1:00 p.m. (Pacific Standard Time) on Thursday,

April 5, 2018 or 48 hours (other than a Saturday, Sunday or holiday) prior to the time to which the Kennady Meeting may be adjourned.

Notwithstanding the foregoing, the Chair of the Kennady Meeting has the discretion to accept proxies received after such deadline.

If you are a non-registered holder of Kennady

Shares and have received these materials through your broker, custodian, nominee or other intermediary, please complete and return

the form of proxy or voting instruction form provided to you by your broker, custodian, nominee or other intermediary in accordance

with the instructions provided therein.

The Kennady Proxy confers discretionary authority

with respect to: (i) amendments or variations to the matters of business to be considered at the Kennady Meeting; and (ii) other

matters that may properly come before the Kennady Meeting. As of the date hereof, management of Kennady knows of no amendments,

variations or other matters to come before the Kennady Meeting other than the matters set forth in this Kennady Notice of Meeting.

Kennady Shareholders who are planning on returning the accompanying Kennady Proxy are encouraged to review the accompanying Circular

carefully before submitting the Kennady Proxy. It is the intention of the persons named in the

enclosed Kennady Proxy, if not expressly directed

to the contrary in such proxy, to vote in favour of the Arrangement Resolution.

Pursuant to and in accordance with the Interim

Order and the relevant provisions of Section 185 of the Business Corporations Act (Ontario) (“OBCA”) (as

may be modified or supplemented by the Plan of Arrangement, the Interim Order and any other order of the Court), each registered

Kennady Shareholder has been granted the right to dissent in respect of the Arrangement Resolution and the dissent rights are

described in the accompanying Circular. To exercise such right, registered Kennady Shareholders must (i) deliver a written notice

of dissent to the Arrangement Resolution to Kennady, by mail to: Kennady Diamonds Inc. c/o Bruce Ramsden, Chief Financial Officer,

161 Bay Street, Suite 1410, P.O. Box 216, Toronto, Ontario, Canada, M5J 2S1; or by facsimile transmission to: 416 640-3335, by

5:00 p.m. (Eastern Standard Time) on Thursday, April 5, 2018, or two Business Days (as defined in the accompanying Circular) prior

to any adjournment of the Kennady Meeting, (ii) not have voted in favour of the Arrangement Resolution, and (iii) have

otherwise complied with the provisions of Section 185 of the OBCA, as modified and supplemented by the Plan of Arrangement, the

Interim Order and any other order of the Court. The right to dissent is described in the accompanying Circular and the texts of

the Plan of Arrangement, Interim Order and Section 185 of the OBCA are set forth in Schedule “D” – “Plan

of Arrangement”, Schedule “G” – “Interim Order” and Schedule “H” – “Dissent

Rights Under the OBCA”, respectively, to the accompanying Circular.

Persons who are beneficial owners of Kennady

Shares registered in the name of a broker, custodian, nominee or other intermediary who wish to dissent should be aware that only

registered holders of Kennady Shares are entitled to dissent. Accordingly, a beneficial owner of Kennady Shares desiring to exercise

this right must make arrangements for the Kennady Shares beneficially owned by such person to be registered in his, her or its

name prior to the time the written notice of dissent to the Arrangement Resolution is required to be received by Kennady or, alternatively,

make arrangements for the registered holder of Kennady Shares to dissent on his, her or its behalf. Holders of securities convertible

into or exchangeable for Kennady Shares are not entitled to exercise dissent rights.

Failure to strictly comply with the requirements

set forth in Section 185 of the OBCA, as may be modified and supplemented by the Plan of Arrangement, the Interim Order and any

other order of the Court, will result in the loss of any right of dissent.

If you have any questions or require any assistance

in completing your proxy or voting instruction form, please contact Laurel Hill Advisory Group, the proxy solicitation agent,

by telephone at: 1-877-452-7184 (North American Toll Free) or 416-304-0211 (Collect Outside North America); or by email at: assistance@laurelhill.com.

DATED at Toronto, Ontario, Canada, this 5th

day of March, 2018.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

/s/ Rory Moore |

| |

Dr. Rory Moore |

| |

Director, President and Chief Executive Officer |

| |

Kennady Diamonds Inc. |

TABLE OF CONTENTS

| |

Page |

| |

|

| JOINT MANAGEMENT INFORMATION CIRCULAR |

1 |

| |

|

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

1 |

| |

|

| NOTE TO U.S. SECURITYHOLDERS |

2 |

| |

|

| GENERAL MATTERS |

4 |

| Reporting Currencies and Accounting Principles |

4 |

| Exchange Rate Data |

4 |

| Information Contained in this Circular |

5 |

| Information Contained in this Circular Regarding Mountain Province |

5 |

| Information Contained in this Circular Regarding Kennady |

5 |

| |

|

| SUMMARY OF CIRCULAR |

7 |

| The Meetings |

7 |

| Purpose of the Meetings |

7 |

| Parties to the Arrangement |

8 |

| Effects of the Arrangement |

8 |

| Mountain Province Shareholder Approval |

10 |

| Kennady Shareholder Approval |

10 |

| The Arrangement |

10 |

| Opinion of RBC Capital Markets |

17 |

| Opinion of Haywood Securities Inc. |

18 |

| The Arrangement Agreement |

18 |

| The Voting and Support Agreements |

18 |

| Court Approval of the Arrangement |

19 |

| Procedure for Exchange of Kennady Shares |

19 |

| Dissent Rights |

20 |

| Income Tax Considerations |

20 |

| Canadian Securities Laws |

20 |

| U.S. Securities Laws |

21 |

| Unaudited Pro Forma Condensed Consolidated Financial Information |

21 |

| Interests of Certain Persons in the Arrangement |

21 |

| |

|

| MOUNTAIN PROVINCE SHAREHOLDERS – QUESTIONS AND ANSWERS ABOUT THE ARRANGEMENT |

22 |

| |

|

| GENERAL PROXY INFORMATION – MOUNTAIN PROVINCE SHAREHOLDERS |

27 |

| Date, Time and Place of Mountain Province Meeting |

27 |

| Purpose of the Mountain Province Meeting |

27 |

| Mountain Province Shareholders Entitled to Vote |

27 |

| Voting By Registered Mountain Province Shareholders |

28 |

| Voting By Non-Registered Mountain Province Shareholders |

30 |

| Solicitation of Proxies |

31 |

| Questions |

31 |

| Approvals Under TSX Company Manual |

32 |

| |

|

| KENNADY SHAREHOLDERS – QUESTIONS AND ANSWERS ABOUT THE ARRANGEMENT |

33 |

| |

|

| GENERAL PROXY INFORMATION – KENNADY SHAREHOLDERS |

40 |

| Date, Time and Place of Kennady Meeting |

40 |

| Kennady Shareholders Entitled to Vote |

40 |

| Voting By Registered Kennady Shareholders |

41 |

| Voting By Non-Registered Kennady Shareholders |

42 |

| Solicitation of Proxies |

43 |

| Questions |

44 |

TABLE OF CONTENTS

(continued)

| |

Page |

| |

|

| THE ARRANGEMENT |

45 |

| Background to the Arrangement |

45 |

| Recommendation of the Mountain Province Special Committee |

49 |

| Recommendation of the Mountain Province Board |

49 |

| Recommendation of the Kennady Special Committee |

49 |

| Recommendation of the Kennady Board |

50 |

| Reasons for the Mountain Province Board and Mountain Province Special Committee |

|

| Recommendations |

50 |

| Reasons for the Kennady Board and Kennady Special Committee Recommendations |

52 |

| Opinion of RBC Capital Markets |

55 |

| Opinion of Haywood Securities Inc. |

56 |

| Effects of the Arrangement |

56 |

| Description of the Arrangement |

57 |

| Securityholder and Court Approvals |

59 |

| Dissent Rights |

61 |

| |

|

| THE ARRANGEMENT AGREEMENT |

63 |

| Representations and Warranties |

64 |

| Covenants |

64 |

| Conditions Precedent to the Arrangement |

66 |

| Non-Solicitation |

69 |

| Notification of Acquisition Proposals |

70 |

| Responding to Acquisition Proposals |

70 |

| Right to Match |

71 |

| Termination |

71 |

| Termination Fee |

73 |

| Amendment and Waiver |

74 |

| |

|

| THE VOTING AND SUPPORT AGREEMENTS |

74 |

| Mountain Province Voting and Support Agreements |

75 |

| Kennady Voting and Support Agreements |

76 |

| |

|

| PROCEDURE FOR EXCHANGE OF KENNADY SHARES |

77 |

| Letter of Transmittal |

77 |

| Exchange Procedure |

77 |

| Cancellation of Rights after Six Years |

78 |

| Fractional Interest |

79 |

| Withholding Rights |

79 |

| |

|

| SECURITIES LAW MATTERS |

79 |

| Canadian Securities Laws |

79 |

| U.S. Securities Laws |

82 |

| |

|

| REGULATORY MATTERS |

83 |

| |

|

| PRINCIPAL CANADIAN FEDERAL INCOME TAX CONSIDERATIONS |

84 |

| Principal Canadian Federal Income Tax Considerations |

84 |

| Holders Resident in Canada |

85 |

| Holders Not Resident in Canada |

87 |

| Eligibility for Investment |

89 |

| |

|

| CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR U.S. HOLDERS |

90 |

| U.S. Federal Income Tax Considerations Relating to the Arrangement |

91 |

| U.S. Federal Income Tax Considerations Relating to the Mountain Province Shares |

93 |

TABLE OF CONTENTS

(continued)

| |

Page |

| |

|

| NOTICE TO NON-CANADIAN KENNADY SHAREHOLDERS |

96 |

| |

|

| INTERESTS OF DIRECTORS AND OFFICERS OF MOUNTAIN PROVINCE IN THE ARRANGEMENT |

96 |

| Kennady Shares |

96 |

| Kennady Options and Kennady RSUs |

97 |

| |

|

| INTERESTS OF DIRECTORS AND OFFICERS OF KENNADY IN THE ARRANGEMENT |

98 |

| Kennady Shares |

98 |

| Kennady Options and Kennady RSUs |

99 |

| Benefits of Directors and Executive Officers of Kennady |

100 |

| Continuing Insurance Coverage for Directors and Executive Officers of Kennady |

100 |

| |

|

| THE KENNADY PRIVATE PLACEMENT |

101 |

| |

|

| RISK FACTORS |

101 |

| Risk Factors Relating to the Arrangement |

102 |

| Risk Factors Related to the Combined Company |

104 |

| Risk Factors Related to the Operations of Mountain Province |

111 |

| Risk Factors Related to the Operations of Kennady |

111 |

| |

|

| RESCISSION RIGHTS |

111 |

| |

|

| INFORMATION CONCERNING MOUNTAIN PROVINCE |

111 |

| |

|

| INFORMATION CONCERNING KENNADY |

111 |

| |

|

| INFORMATION CONCERNING THE COMBINED COMPANY |

112 |

| |

|

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS |

112 |

| |

|

| MANAGEMENT CONTRACTS |

112 |

| |

|

| AUDITORS |

112 |

| |

|

| LEGAL MATTERS |

112 |

| |

|

| ADDITIONAL INFORMATION |

113 |

| |

|

| OTHER MATTERS |

113 |

| |

|

| MOUNTAIN PROVINCE BOARD APPROVAL |

114 |

| |

|

| KENNADY BOARD APPROVAL |

115 |

| |

|

| CONSENT OF RBC CAPITAL MARKETS |

116 |

| |

|

| CONSENT OF HAYWOOD SECURITIES INC. |

117 |

| SCHEDULE “A” GLOSSARY OF TERMS |

|

| SCHEDULE “B” RESOLUTIONS TO BE APPROVED AT THE MOUNTAIN PROVINCE MEETING SCHEDULE “C” RESOLUTIONS TO BE APPROVED AT THE KENNADY MEETING |

|

| SCHEDULE “D” PLAN OF ARRANGEMENT |

|

| SCHEDULE “E” FAIRNESS OPINION OF RBC CAPITAL MARKETS SCHEDULE “F” FAIRNESS OPINION OF HAYWOOD SECURITIES INC. SCHEDULE “G” INTERIM ORDER |

|

| SCHEDULE “H” DISSENT RIGHTS UNDER THE OBCA SCHEDULE “I” NOTICE OF APPLICATION FOR FINAL ORDER |

|

| SCHEDULE “J” INFORMATION CONCERNING MOUNTAIN PROVINCE SCHEDULE “K” INFORMATION CONCERNING KENNADY SCHEDULE “L” FINANCIAL STATEMENTS OF KENNADY |

|

| SCHEDULE “M” MANAGEMENT’S DISCUSSION AND ANALYSIS OF KENNADY |

|

TABLE OF CONTENTS

(continued)

| |

Page |

| SCHEDULE “N” INFORMATION CONCERNING THE COMBINED COMPANY |

|

| SCHEDULE “O” UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL |

|

| STATEMENTS OF MOUNTAIN PROVINCE |

|

JOINT MANAGEMENT INFORMATION CIRCULAR

This Circular is furnished in connection with

the solicitation of proxies by or on behalf of the management of Mountain Province for use at the Mountain Province Meeting to

be held at the Terminal City Club, 837 West Hastings Street, Vancouver, British Columbia, Canada V6C 1B4, at 2:30 p.m. (Pacific

Standard Time) on Monday, April 9, 2018 and at any adjournment(s) or postponement(s) thereof for the purposes set

forth in the accompanying notice of special meeting of Mountain Province Shareholders (the “Mountain Province Notice of

Meeting”).

This Circular is also furnished in connection

with the solicitation of proxies by or on behalf of the management of Kennady for use at the Kennady Meeting to be held at the

Terminal City Club, 837 West Hastings Street, Vancouver, British Columbia, Canada V6C 1B4, at 1:00 p.m. (Pacific Standard Time)

on Monday, April 9, 2018 and at any adjournment(s) or postponement(s) thereof for the purposes set forth in the accompanying

notice of special meeting of Kennady Shareholders (the “Kennady Notice of Meeting”).

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Except for the statements of historical fact

contained herein, the information presented in this Circular and the information incorporated by reference herein, constitutes

“forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995

and “forward-looking information” within the meaning of applicable Canadian Securities Laws (together, “forward-looking

statements”) concerning the business, operations, plans and financial performance and condition of each of Mountain Province,

Kennady and the Combined Company (as defined herein). Often, but not always, forward-looking statements can be identified by words

such as “pro forma”, “plans”, “expects”, “may”, “should”, “could”,

“will”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates”, “believes”, or variations including negative variations thereof of such words and phrases that

refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved.

Forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the actual plans, results, performance or achievements of Mountain

Province, Kennady or the Combined Company to differ materially from any future plans, results, performance or achievements expressed

or implied by the forward- looking statements. Such factors include, among others, the timing, closing or non-completion of the

Arrangement, including due to the Parties failing to receive, in a timely manner and on satisfactory terms, the necessary Court,

securityholder, stock exchange and Regulatory Approvals or the inability of the Parties to satisfy or waive in a timely manner

the other conditions to the closing or the conditions precedent, as applicable, of the Arrangement; receipt of a Superior Proposal

by Kennady; receipt of a Superior Proposal by Mountain Province; inability to achieve the benefits or synergies anticipated from

the Arrangement; actual operating cash flows, operating costs, free cash flows, mineral resources, total cash, transaction costs,

and administrative costs of Mountain Province, Kennady or the Combined Company differing materially from those anticipated; project

infrastructure requirements, anticipated processing methods or exploration expenditures differing materially from those anticipated;

risks related to partnership or other joint operations; actual results of current exploration activities; variations in mineral

resources, mineral production, grades or recovery rates or optimization efforts and sales; delays in obtaining governmental approvals

or financing or in the completion of development or construction activities; uninsured risks, including, but not limited to, pollution,

cave ins or hazards for which insurance cannot be obtained; regulatory changes; defects in title; availability or integration of

personnel, materials and equipment; inability to recruit or retain management and key personnel; the composition of the board of

the Combined Company differing from the anticipated composition; performance of facilities, equipment and processes relative to

specifications and expectations; unanticipated environmental impacts on operations; market prices; production, construction and

technological risks related to Mountain Province, Kennady or the Combined Company; capital requirements and operating risks associated

with the operations or an expansion of the operations of Mountain Province and Kennady; dilution due to future equity financings,

fluctuations in diamond and other metal prices and currency exchange rates; uncertainty relating to future production, and cash

resources; inability to successfully complete new development projects, planned expansions or other projects within the timelines

anticipated; adverse changes to market, political and general economic conditions or laws, rules and regulations applicable to

Mountain Province, Kennady or the Combined Company; changes in project parameters; the possibility of project cost overruns or

unanticipated costs and expenses; accidents, labour disputes, community and stakeholder protests and other risks of the mining

industry; failure of plant, equipment or processes to operate as anticipated; risk of an undiscovered defect in title or other

adverse claim; factors discussed under the heading “Risk Factors”; those

risks set out in Schedule “K” –

“Information Concerning Kennady” to this Circular; and those risks set out in Schedule “J” –

Information Concerning Mountain Province” to this Circular, and the Mountain Province AIF and other Mountain Province

documents incorporated by reference herein, which are available on SEDAR under Mountain Province’s issuer profile at www.sedar.com.

In addition, forward-looking and pro forma

information herein is based on certain assumptions and involves risks related to the consummation or non-consummation of the Arrangement

and the business and operations of Mountain Province, Kennady and the Combined Company. Forward-looking and pro forma information

contained herein is based on certain assumptions including that Mountain Province Shareholders including Minority Mountain Province

Shareholders will vote in favour of the Share Issuance Resolution, that Kennady Shareholders including Minority Kennady Shareholders

will vote in favour of the Arrangement Resolution, that the Court will approve the Arrangement and that all other conditions to

the Arrangement are satisfied or waived and that the Arrangement will be completed. Other assumptions include, but are not limited

to, interest and exchange rates; the price of diamonds and other metals; competitive conditions in the mining industry; synergies

between Mountain Province and Kennady; title to mineral properties; financing and funding requirements; general economic, political

and market conditions; and changes in laws, rules and regulations applicable to Mountain Province and Kennady.

Although Mountain Province and Kennady have

attempted to identify important factors that could cause plans, actions, events or results to differ materially from those described

in forward-looking statements in this Circular, and the documents incorporated by reference herein, there may be other factors

that cause plans, actions, events or results not to be as anticipated, estimated or intended. There is no assurance that such statements

will prove to be accurate as actual plans, results and future events could differ materially from those anticipated in such statements

or information. Accordingly, readers should not place undue reliance on forward-looking statements in this Circular, nor in the

documents incorporated by reference herein. All of the forward-looking statements made in this Circular, including all documents

incorporated by reference herein, are qualified by these cautionary statements.

Certain of the forward-looking statements and

other information contained herein concerning the mining industry and Mountain Province’s and Kennady’s general expectations concerning

the mining industry, Mountain Province, Kennady and the Combined Company are based on estimates prepared by Mountain Province and

Kennady using data from publicly available industry sources as well as from market research and industry analysis and on assumptions

based on data and knowledge of this industry which Mountain Province and Kennady believe to be reasonable. However, although generally

indicative of relative market positions, market shares and performance characteristics, this data is inherently imprecise. While

Mountain Province and Kennady are not aware of any misstatement regarding any industry data presented herein, the mining industry

involves risks and uncertainties that are subject to change based on various factors.

Mountain Province Shareholders and Kennady

Shareholders are cautioned not to place undue reliance on forward- looking statements. Mountain Province and Kennady undertake

no obligation to update any of the forward-looking statements in this Circular or incorporated by reference herein, except as

required by law.

NOTE TO U.S. SECURITYHOLDERS

THE ARRANGEMENT AND THE SECURITIES ISSUABLE

IN CONNECTION WITH THE ARRANGEMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION

(THE “SEC”) OR THE SECURITIES REGULATORY AUTHORITIES OF ANY STATE IN THE UNITED STATES, NOR HAS THE SEC OR THE SECURITIES

REGULATORY AUTHORITIES OF ANY STATE IN THE UNITED STATES PASSED UPON THE FAIRNESS OR MERITS OF THE ARRANGEMENT OR UPON THE ADEQUACY

OR ACCURACY OF THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Mountain Province Shares to be issued to

Kennady Shareholders pursuant to the Arrangement have not been and will not be registered under the U.S. Securities Act of 1933,

as amended (the “U.S. Securities Act”) or the securities laws of any state of the United States, and are being

issued in reliance on the exemption from registration provided by Section 3(a)(10) of the U.S. Securities Act and exemptions provided

under the securities laws of each state of the United States in which the holders of Kennady Shares that reside in the United States

(the “Kennady U.S.

Shareholders”) reside. Section

3(a)(10) of the U.S. Securities Act exempts from the general registration requirements under the U.S. Securities Act securities

issued in exchange for one or more bona fide outstanding securities where the terms and conditions of the issuance and exchange

are approved by a court of competent jurisdiction that is expressly authorized by Law to grant such approval, after a hearing upon

the fairness of such terms and conditions of such issuance and exchange at which all persons to whom the securities will be issued

in such exchange have the right to appear and receive timely notice thereof. The Court will be advised prior to the hearing of

the application for the Final Order that if the terms and conditions of the Arrangement are approved by the Court, the Mountain

Province Shares to be issued to Kennady Shareholders pursuant to the Arrangement have not been and will not be registered under

the U.S. Securities Act and will be issued in reliance on the exemption from registration provided by Section 3(a)(10) thereunder

and that the Final Order will constitute the basis for such exemption. See “The Arrangement – Securityholder and

Court Approvals – Court Approval of the Arrangement”.

The Mountain Province Shares to be issued to

Kennady Shareholders pursuant to the Arrangement will be freely tradable under the U.S. Securities Act, except by persons who are

“affiliates” (as defined in Rule 144 under the U.S. Securities Act) of Mountain Province after the Arrangement or were

affiliates of Mountain Province within 90 days prior to completion of the Arrangement. Any resale of such Mountain Province Shares

by such an affiliate (or, if applicable, former affiliate) may be subject to the registration requirements of the U.S. Securities

Act, absent an exemption therefrom. See “Securities Law Matters – U.S. Securities Laws”.

Kennady Shareholders who are U.S. Holders

(as defined herein under the heading “Certain U.S. Federal Income Tax Considerations for U.S. Holders”) or otherwise

resident in the United States should be aware that the Arrangement described herein may have tax consequences both in the United

States and in Canada. Such consequences for Kennady Shareholders may not be described fully herein. For a general discussion of

the principal Canadian federal income tax considerations to investors who are resident in the United States, see “Principal

Canadian Federal Income Tax Considerations – Holders Not Resident in Canada”. For a general discussion of certain

U.S. federal income tax considerations to investors who are U.S. Holders, see “Certain U.S. Federal Income Tax Considerations

for U.S. Holders”. Kennady Shareholders who are U.S. Holders or otherwise resident in the United States are urged to consult

their own tax advisors with respect to such Canadian and U.S. federal income tax consequences and the applicability of any federal,

state, local, foreign and other tax laws.

Each of Mountain Province and Kennady is a

“foreign private issuer” within the meaning of Rule 405 under the U.S. Securities Act and Rule 3b-4 under the United

States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”). The solicitation of proxies

from Kennady Shareholders is not subject to the proxy requirements of Section 14(a) of the U.S. Exchange Act by virtue of an exemption

for foreign private issuers. Accordingly, the solicitation contemplated herein is being made to Kennady U.S. Shareholders only

in accordance with Canadian Securities Laws and Canadian corporate laws, and this Circular has been prepared in accordance with

the disclosure requirements of Canadian Securities Laws. Kennady U.S. Shareholders should be aware that, in general, such Canadian

disclosure requirements are different from those applicable to proxy statements, prospectuses or registration statements prepared

in accordance with U.S. laws.

The financial statements and information included

or incorporated by reference in this Circular have been prepared in accordance IFRS and are subject to Canadian auditing and auditor

independence standards and thus may not be comparable to financial statements prepared in accordance with U.S. GAAP and auditor

independence standards.

Information regarding mineral reserve and mineral

resource estimates in this Circular or in the documents incorporated by reference herein concerning the properties, operations

and royalty interests of Mountain Province and Kennady has been prepared in accordance with the requirements of securities laws

in effect in Canada, which may differ in material respects from the requirements of U.S. Securities Laws applicable to U.S. companies.

Mountain Province and Kennady are required to describe mineral reserves associated with the properties in which Mountain Province

and Kennady hold royalty interests utilizing Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definitions

of “proven” or “probable”, which categories of mineral reserves are recognized by NI 43-101, but which differ

from those definitions in the disclosure requirements promulgated by the SEC and contained in Industry Guide 7. In addition, under

NI 43-101 Mountain Province and Kennady are required to describe mineral resources associated with their respective properties

utilizing CIM definitions of “measured”, “indicated” or “inferred”, which categories of mineral resources

are recognized by Canadian regulations but are not defined terms under Industry Guide 7 and are

generally not permitted to be used in reports

and registration statements of U.S. companies filed with the SEC. Accordingly, information contained in this Circular regarding

the mineral deposits of Mountain Province and Kennady and the owners and operators of properties in which Mountain Province and

Kennady hold royalty interests may not be comparable to similar information disclosed by U.S. companies in reports filed with the

SEC. U.S. investors are cautioned not to assume that all or any part of measured mineral resources or indicated mineral resources

will ever be converted into mineral reserves. “Inferred resources” have an even greater amount of uncertainty as to their

existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred

mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may

not form the basis of feasibility or pre-feasibility studies, except in rare cases. U.S. readers are cautioned not to assume that

all or any part of an inferred resource exists, or is economically or legally mineable.

The enforcement by investors of civil liabilities

under the U.S. Securities Laws may be affected adversely by the fact that each of Mountain Province and Kennady is organized under

the laws of a jurisdiction other than the U.S., that some or all of their respective officers and directors are residents of countries

other than the U.S., that some or all of the experts named in this Circular and the documents incorporated by reference herein

may be residents of countries other than the U.S., and that all or a substantial portion of the assets of Mountain Province and

Kennady and such persons are located outside the U.S. As a result, it may be difficult or impossible for Mountain Province Shareholders

or Kennady Shareholders resident in the U.S. to effect service of process within the U.S. upon Mountain Province or Kennady, their

respective officers and directors or the experts named in this Circular and any documents incorporated by reference herein, or

to realize, against them, upon judgments of courts in the U.S. predicated upon civil liabilities under U.S. Securities Laws. In

addition, Mountain Province Shareholders and Kennady Shareholders resident in the U.S. should not assume that Canadian courts:

(a) would enforce judgments of U.S. courts obtained in actions against such persons predicated upon civil liabilities under U.S.

Securities Laws or the state-specific “blue sky” securities laws of any state within the U.S.; or (b) would enforce,

in original actions, liabilities against such persons predicated upon civil liabilities under U.S. Securities Laws or “blue

sky” laws of any state within the U.S.

GENERAL MATTERS

Reporting Currencies and Accounting Principles

Unless otherwise indicated, all references

to “$” or “C$” in this Circular refer to Canadian dollars.

The financial statements of Mountain Province

that are incorporated by reference in this Circular are reported in Canadian dollars and are prepared in accordance with IFRS.

The financial statements of Kennady that are included in Schedule “L” – “Financial Statements of Kennady”

and Schedule “M” – “Management’s Discussion and Analysis of Kennady” to this Circular are reported

in Canadian dollars and are prepared in accordance with IFRS. The pro forma financial statements of Mountain Province that

are included in Schedule “O” – “Unaudited Pro Forma Condensed Consolidated Financial Statements of Mountain

Province” to this Circular are reported in Canadian dollars.

Exchange Rate Data

The following table sets out: (i) the rates of exchange for one U.S. dollar expressed in Canadian dollars in

effect at the end of the periods indicated; (ii) the average rates of exchange for such periods; and (iii) the highest and lowest

rates of exchange during such periods, based on the noon rate or daily average exchange rate, as applicable, provided by the Bank

of Canada.

| |

Year ended December 31 |

| 2015 |

2016 |

2017 |

| Low |

1.1728 |

1.2544 |

1.2128 |

| High |

1.3990 |

1.4589 |

1.3743 |

| Average |

1.2787 |

1.3248 |

1.2986 |

| Year end |

1.3840 |

1.3427 |

1.2545 |

On January 1, 2017, the Bank of Canada began

a transition period to change its procedure for publishing exchange rate information. As of April 28, 2017, the Bank of Canada

no longer produces noon and closing daily exchange rates, instead publishing daily average exchange rates.

On March 5, 2018, the average daily exchange

rate for one United States dollar expressed in Canadian dollars as reported by the Bank of Canada was C$1.2977.

Information Contained in this Circular

The information contained in this Circular

is given as at March 5, 2018, except where otherwise noted and except that information in documents incorporated by reference is

given as of the dates noted therein. No person has been authorized to give any information or to make any representation in connection

with the Arrangement and other matters described herein other than those contained in this Circular and, if given or made, any

such information or representation should be considered not to have been authorized by Mountain Province or Kennady.

This Circular does not constitute the solicitation

of an offer to purchase, or the making of an offer to sell, any securities or the solicitation of a proxy by any person in any

jurisdiction in which such solicitation or offer is not authorized or in which the person making such solicitation or offer is

not qualified to do so or to any person to whom it is unlawful to make such solicitation or offer.

Information contained in this Circular should

not be construed as legal, tax or financial advice. Mountain Province Shareholders and Kennady Shareholders are urged to consult

with their own professional advisors to obtain legal, tax or financial advice.

Descriptions in this Circular of the terms

of the Arrangement Agreement, the Plan of Arrangement, and the Voting and Support Agreements are summaries of the terms of those

documents and are qualified in their entirety by such terms. Mountain Province Shareholders and Kennady Shareholders should refer

to the full text of each of the Arrangement Agreement, the Plan of Arrangement, and the Voting and Support Agreements for complete

details of those documents. The full text of the Arrangement Agreement is available on SEDAR under Mountain Province’s issuer profile

at www.sedar.com. The Plan of Arrangement is attached as Schedule “D” – “Plan of Arrangement”

to this Circular.

Information Contained in this Circular

Regarding Mountain Province

Certain information in this Circular pertaining

to Mountain Province has been furnished by Mountain Province, including, but not limited to (i) information pertaining to Mountain

Province in Schedule “J” – “Information Concerning Mountain Province” to this Circular, (ii) the

historical management’s discussion and analysis of Mountain Province incorporated by reference in this Circular, (iii) the historical

financial statements of Mountain Province incorporated by reference in this Circular, and (iv) information relating to Mountain

Province in the unaudited pro forma condensed consolidated financial statements in Schedule “O” – “Unaudited

Pro Forma Condensed Consolidated Financial Statements of Mountain Province” to this Circular. With respect to this information,

the Kennady Board has relied exclusively upon Mountain Province, without independent verification by Kennady. Although Kennady

does not have any knowledge that would indicate that such information is untrue or incomplete, neither Kennady nor any of its directors

or officers assumes any responsibility for the accuracy or completeness of such information including any of Mountain Province’s

financial statements, or for the failure by Mountain Province to disclose events or information that may affect the completeness

or accuracy of such information. For further information regarding Mountain Province, please refer to Mountain Province’s filings

with the Securities Authorities, which is available on SEDAR under Mountain Province’s issuer profile at www.sedar.com.

See Schedule “J” – “Information Concerning Mountain Province” to this Circular.

Information Contained in this Circular

Regarding Kennady

Certain information in this Circular pertaining

to Kennady has been furnished by Kennady, including, but not limited to (i) information pertaining to Kennady in Schedule “K”

– “Information Concerning Kennady” to this Circular, (ii) the historical financial statements of Kennady

included in Schedule “L” – “Financial Statements of Kennady” to this

Circular, (iii) management’s discussion and

analysis of Kennady included in Schedule “M” – “Management’s Discussion and Analysis of Kennady”

to this Circular, (iv) information pertaining to Kennady included in Schedule “N” – “Information Concerning

The Combined Company” to this Circular, and (v) information relating to Kennady in the unaudited pro forma condensed

consolidated financial statements attached as Schedule “O” – “Unaudited Pro Forma Condensed Consolidated

Financial Statements of Mountain Province” to this Circular. With respect to this information, the Mountain Province Board

has relied exclusively upon Kennady, without independent verification by Mountain Province. Although Mountain Province does not

have any knowledge that would indicate that such information is untrue or incomplete, neither Mountain Province nor any of its

directors or officers assumes any responsibility for the accuracy or completeness of such information including any of Kennady’s

financial statements, or for the failure by Kennady to disclose events or information that may affect the completeness or accuracy

of such information. For further information regarding Kennady, please refer to Kennady’s filings with the Securities Authorities,

which is available on SEDAR under Kennady’s issuer profile at www.sedar.com. See Schedule “K” – “Information

Concerning Kennady” to this Circular.

SUMMARY OF CIRCULAR

This Summary should be read together with

and is qualified in its entirety by the more detailed information and financial data and statements contained elsewhere in this

Circular, including the Schedules hereto and documents incorporated into this Circular by reference. Capitalized terms in this

Summary have the meanings set out in Schedule “A” – “Glossary of Terms” or as set out in this Summary.

The full text of the Arrangement Agreement, which is incorporated by reference in this Circular, may be viewed on SEDAR under Mountain

Province’s and Kennady’s issuer profiles, respectively, at www.sedar.com.

The Meetings

The Mountain Province Meeting

The Mountain Province Meeting will be held at the Terminal

City Club, 837 West Hastings Street, Vancouver, British Columbia, Canada V6C 1B4, at 2:30 p.m. (Pacific Standard Time) on Monday,

April 9, 2018.

The record date for determining the Mountain

Province Shareholders entitled to receive notice of and to vote at the Mountain Province Meeting is March 5, 2018. Only Mountain

Province Shareholders of record as of the close of business (5:00 p.m. (Eastern Standard Time)) on the Mountain Province Record

Date are entitled to receive notice of and to vote at the Mountain Province Meeting.

The Kennady Meeting

The Kennady Meeting will be held at the Terminal

City Club, 837 West Hastings Street, Vancouver, British Columbia, Canada V6C 1B4, at 1:00 p.m. (Pacific Standard Time) on Monday,

April 9, 2018.

The record date for determining the Kennady

Shareholders entitled to receive notice of and to vote at the Kennady Meeting is March 5, 2018. Only Kennady Shareholders of record

as of the close of business (5:00 p.m. (Eastern Standard Time)) on the Kennady Record Date are entitled to receive notice of and

to vote at the Kennady Meeting.

Purpose of the Meetings

Purpose of the Mountain Province Meeting

The purpose of the Mountain Province Meeting

is for Mountain Province Shareholders to consider and vote upon the Share Issuance Resolution, the full text of which is set out

in Schedule “B” – “Resolutions to be Approved at the Mountain Province Meeting” to this Circular.

Particulars of the subject matter relating to the Arrangement are described in this Circular under the heading “The Arrangement”.

If the Share Issuance Resolution does not

receive the requisite approval, the Arrangement will not proceed.

Management of Mountain Province and the

Mountain Province Board recommend that Mountain Province Shareholders vote FOR the Share Issuance Resolution.

Purpose of the Kennady Meeting

The purpose of the Kennady Meeting is for Kennady

Shareholders to consider and vote upon the Arrangement Resolution, the full text of which is set out in Schedule “C”

– “Resolutions to be Approved at the Kennady Meeting” to this Circular. Particulars of the subject matter

relating to the Arrangement are described in this Circular under the heading “The Arrangement”.

If the Arrangement Resolution does not receive

the requisite approval, the Arrangement will not proceed.

Management of Kennady and the Kennady Board

recommend that Kennady Shareholders vote FOR the Arrangement Resolution.

Parties to the Arrangement

Mountain Province is a corporation continued

under the OBCA. Mountain Province’s head office and registered office is located at 161 Bay Street, Suite 1410, P.O. Box 216, Toronto,

Ontario, Canada, M5J 2S1. The Mountain Province Shares are listed for trading on the TSX and Nasdaq under the symbol “MPVD”.

Kennady is a corporation incorporated under

the OBCA. Kennady’s head office is located at 1199 West Hastings Street, Suite 700, Vancouver, British Columbia, V6E 3T5 and its

registered office is located at 161 Bay Street, Suite 1410, P.O. Box 216, Toronto, Ontario, M5J 2S1. The Kennady Shares are listed

for trading on the TSXV under the symbol “KDI”.

See Schedule “J” – “Information

Concerning Mountain Province” to this Circular for a description of Mountain Province. See Schedule “K” –

“Information Concerning Kennady” to this Circular for a description of Kennady. See Schedule “N” –

“Information Concerning the Combined Company” to this Circular for a description of Mountain Province after giving

effect to the Arrangement.

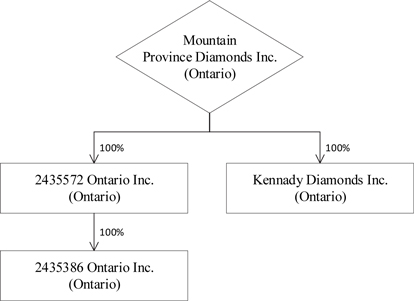

Effects of the Arrangement

The purpose of the Arrangement is to effect

the business combination of Mountain Province and Kennady. The Arrangement is to be carried out pursuant to the Arrangement Agreement

and the Plan of Arrangement. Upon completion of the Arrangement, Mountain Province will acquire all of the issued and outstanding

Kennady Shares and Kennady will become a wholly-owned subsidiary of Mountain Province.

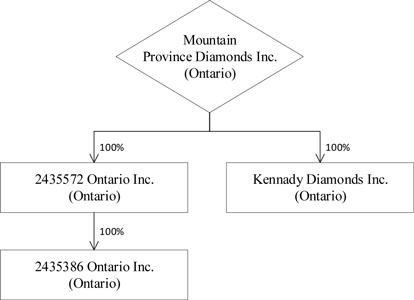

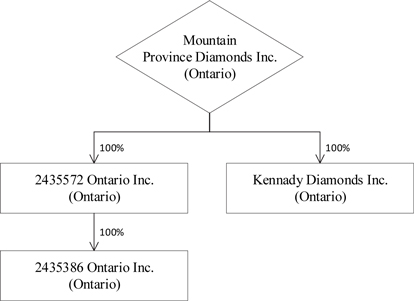

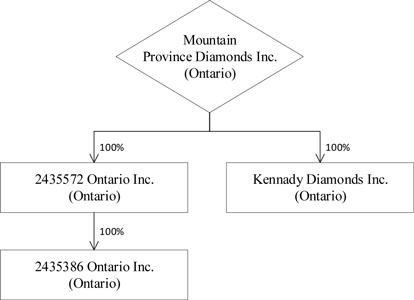

Corporate Structure