Exhibit 99.1

Management’s Discussion and Analysis

For the Three and Nine Months Ended September 30, 2017

TSX: MPVD |NASDAQ: MPVD

MOUNTAIN PROVINCE DIAMONDS INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2017

| TABLE OF CONTENTS | Page |

| Third Quarter 2017 Highlights | 3 |

| Company Overview | 5 |

| Gahcho Kué Diamond Mine | 6 |

| Non-IFRS Measures | 12 |

| Results of Operations | 14 |

| Financial Review | 15 |

| Summary of Quarterly Results | 15 |

| Earnings from Mine Operations, Costs and Expenses | 16 |

| Income and Resource Taxes | 17 |

| Financial Position and Liquidity | 17 |

| Off-Balance Sheet Arrangements | 19 |

| Significant Accounting Policies Adopted in the current year | 20 |

| Significant Accounting Judgments, Estimates and Assumptions | 22 |

| Standards and Amendments to Existing Standards | 23 |

| Related Party Transactions | 24 |

| Contractual Obligations | 25 |

| Other MD&A Analysis Requirements | 25 |

| Disclosure of Outstanding Share Data | 26 |

| Controls and Procedures | 26 |

| Cautionary Note Regarding Forward-Looking Statements | 27 |

This Management’s Discussion and Analysis (“MD&A”) as of November 13, 2017 provides a review of the financial performance of Mountain Province Diamonds Inc. (the “Company” or “Mountain Province” or “MPV”) and should be read in conjunction with the MD&A for the year ended December 31, 2016, the unaudited condensed consolidated interim financial statements and the notes thereto for the three and nine months ended September 30, 2017 and the audited consolidated statements for the year ended December 31, 2016. The following MD&A has been approved by the Board of Directors.

The unaudited condensed consolidated interim financial statements of the Company were prepared in accordance with IAS 34 - Interim Financial Reporting. Except as disclosed in the statements, the interim financial statements follow the same accounting policies and methods of computation as compared with the most recent annual financial statements for the year ended December 31, 2016, which were prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). Accordingly, the interim financial statements should be read in conjunction with the Company’s most recent annual financial statements.

All amounts are expressed in thousands of Canadian dollars, except share and per share amounts, unless otherwise noted.

Technical information included in this MD&A regarding the Company’s mineral property has been reviewed by Dino Pilotto, a Professional Engineer of JDS Energy and Mining Ltd and a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Properties (“NI 43-101”).

| Page 2 |

Additional information, related to the Company is available on SEDAR at http://sedar.com/ and on EDGAR at http://www.sec.gov/edgar.shtml.

HIGHLIGHTS

| • | The Gahcho Kué Diamond Mine (“GK Mine”) declared commercial production on March 1, 2017 having achieved more than 70% of nameplate capacity of 8,226 tonnes per day over the proceeding 30-day period. |

| • | Net income for the three and nine months ended September 30, 2017 was $27,669 and $33,079 respectively, with this third quarter reflecting the Company’s first full quarter of commercial mining operations results. |

| • | Revenue recognized in the nine months ended September 30, 2017 totaled $160,359 of which $67,493 was capitalized as pre-commercial production revenue and $92,866 is reported as sales in the statement of earnings. Most of this revenue was realized through seven tender sales conducted by the Company through its diamond broker based in Antwerp, with the balance realized through sales direct to De Beers in instances where production split bids for fancies and specials were won by De Beers. Revenue recognized year to date reflects an average realization of US$75 per carat. |

| • | Mining of overburden, waste rock and ore in the 5034 open pit for the nine months ended September 30, 2017 was approximately 24.4 million tonnes. Ore mined in the first nine months totalled 2,674,000, with approximately 695,000 tonnes of ore stockpile at period-end on a 100% basis. |

| • | For the nine months ended September 30, 2017, the GK Mine treated approximately 2,082,000 tonnes of ore through the process plant and recovered approximately 4,306,000 carats on a 100% basis for an average grade of approximately 2.07 carats per tonne (“cpt”). This recovered grade is approximately 28% above the original budget for the nine months ended September 30, 2017. The Company’s 49% attributable share of diamond production for the three months ended September 30, 2017 was approximately 894,000 carats and 2,110,000 carats for the nine months ended September 30, 2017. |

| • | Cash costs of production, including capitalized stripping costs, for the three and nine months ended September 30, 2017 were $73 and $80 per tonne respectively, and $33 and $37 per carat recovered respectively. Note that this term is not clearly defined under IFRS and therefore may not be comparable to similar measures presented by other issuers. Please refer to the Non-IFRS Measures section. |

| • | Gem and near-gem diamonds for the nine months ended September 30, 2017 contributed approximately 95% of the diamond sales proceeds at an average price of US$123 per carat. The remaining 5% of proceeds came from industrial diamonds at an average price of US$8 per carat. Gem and near-gem diamonds represented approximately 57% of sales by volume to September 30, 2017. |

| • | Participation at the Company’s tender sales has been strong from the outset, with participation rates increasing through the year. Bids per lot (approx. 125 lots per sale) increased from an average of 8.1 in January to 11.8 in September. There is a high level of market interest and competition for Gahcho Kué diamonds with an average of 100 companies bidding each sale. |

| Page 3 |

| • | In August 2017, the Company increased full-year 2017 production guidance on a 100% basis to 5.5 million carats recovered (2.7 million carats on a 49% basis) from 4.4 million carats previously (2.2 million carats on a 49% basis) and also increased guidance on carats sold to 2.4 million carats from 2.0 million previously. Given the continuation of strong plant performance and favourable grade experience at the GK Mine, the Company is on track to meet and exceed its current full-year 2017 production and sales guidance. |

| • | The Company announced price guidance on April 25, 2017 of approximately US$70 to US$90 per carat as the expected realized diamond price for the 2017 year, and full year realization is expected to be at the low end of that range. |

| • | At September 30, 2017, the Company had drawn US$357 million of its US$370 million Loan Facility, and no further draws against the facility will be made as the availability period defined under the facility has now ended. At September 30, 2017, the Company was subject to maintaining a debt service reserve account balance of approximately US$57.1 million, a sunk cost reserve account balance of $43.0 million and a cash call reserve account balance of approximately $27.9 million, all under the Loan Facility. On August 31, 2017, the lenders provided a waiver whereby funding of the amounts in the debt service reserve account and the sunk cost reserve account were deferred to November 30, 2017. The waiver required the Company to deposit a minimum of US$25 million in the cash call reserve account on or before September 15, 2017, which the Company has complied with (see Financial Position and Liquidity section). |

| • | The Company is well advanced in developing a near-term resolution of the project lending facility. The Company anticipates being in a position to publicly announce the specifics of such resolution in the coming few weeks. While the Company is confident that it will be successful in its efforts, there can be no guarantee of success, nor that the lenders will accommodate any further waivers or amendments the Company may seek. |

| • | If the Company is unsuccessful with its intended resolution and is unable to fully fund the required reserve accounts, or is unable to comply with other financial covenants, and is not successful in obtaining suitable waivers or amendments, it would result in an event of default, and the Loan Facility outstanding balance would become payable on demand. To mitigate against this, management may seek further alternative sources of financing. These conditions, until such time as they are resolved, indicate the existence of a material uncertainty that results in substantial doubt as to the Company’s ability to continue as a going concern. The financial statements do not include the adjustments to the amounts and classification of assets and liabilities that would be necessary should the Company be unable to continue as a going concern. These adjustments may be material. |

| Page 4 |

The following table summarizes key operating highlights for the period ended September 30, 2017.

| Three months ended | Three months ended | Nine months ended | Nine months ended | |||||||||||||||

| September 30, 2017 | September 30, 2016 | September 30, 2017 | September 30, 2016 | |||||||||||||||

| GK operating data | ||||||||||||||||||

| Mining | ||||||||||||||||||

| *Ore tonnes mined | kilo tonnes | 1,123 | 147 | 2,674 | 147 | |||||||||||||

| *Waste tonnes mined | kilo tonnes | 7,190 | 15,753 | 21,698 | 15,753 | |||||||||||||

| *Total tonnes mined | kilo tonnes | 8,313 | 15,900 | 24,372 | 15,900 | |||||||||||||

| *Ore in stockpile | kilo tonnes | 695 | 17 | 695 | 17 | |||||||||||||

| Processing | ||||||||||||||||||

| *Ore tonnes processed | kilo tonnes | 823 | 130 | 2,082 | 130 | |||||||||||||

| *Average plant throughput | tonnes per day | 8,944 | 2,410 | 7,626 | 2,410 | |||||||||||||

| *Average diamond recovery | carats per tonne | 2.22 | 1.52 | 2.07 | 1.52 | |||||||||||||

| *Diamonds produced | 000's carats | 1,825 | 97 | 4,306 | 97 | |||||||||||||

| Approximate diamonds produced - Mountain Province | 000's carats | 894 | 48 | 2,110 | 48 | |||||||||||||

| Cash costs of production per tonne, net of capitalized stripping ** | $ | 73 | – | 77 | – | |||||||||||||

| Cash costs of production per tonne of ore, including capitalized stripping** | $ | 73 | – | 80 | – | |||||||||||||

| Cash costs of production per carat recovered, net of capitalized stripping** | $ | 33 | – | 36 | – | |||||||||||||

| Cash costs of production per carat recovered, including capitalized stripping** | $ | 33 | – | 37 | – | |||||||||||||

| Sales | ||||||||||||||||||

| Approximate diamonds sold - Mountain Province*** | 000's carats | 764 | – | 1,650 | – | |||||||||||||

| Average diamond sales price per carat | US | $ | 69 | $ | – | $ | 75 | $ | – | |||||||||

* at 100% interest in the GK Mine

**See Non-IFRS Measures section

***Includes the sales directly to De Beers for fancies and specials lost during the bidding process

COMPANY OVERVIEW

Mountain Province is a Canadian-based resource company listed on the Toronto Stock Exchange and NASDAQ under the symbol ‘MPVD’. The Company’s registered office and its principal place of business is 161 Bay Street, Suite 1410, P.O. Box 216, Toronto, ON, Canada, M5J 2S1. The Company through its wholly owned subsidiaries 2435572 Ontario Inc. and 2435386 Ontario Inc., holds a 49% interest in the GK Mine, located in the Northwest Territories of Canada. De Beers Canada Inc. (“De Beers” or the “Operator”) holds the remaining 51% interest. The Joint Arrangement between the Company and De Beers is governed by the 2009 amended and restated Joint Venture Agreement. The Company’s primary asset is its 49% interest in the GK Mine.

Physical construction of the GK Mine was substantially completed at June 30, 2016 and the commissioning of the plant began July 2016. Ramp-up to commercial production commenced on August 1, 2016 and commercial production was declared on March 1, 2017 after the GK Mine achieved approximately 70% of nameplate capacity of 8,226 tonnes per day over a 30-day period.

| Page 5 |

Under the Gahcho Kué Joint Venture Agreement discussed below, commercial production for sunk cost repayment purposes is based on the first day after 30 days (excluding maintenance days) of achieving and maintaining 70% of designed production capacity. The $10 million sunk cost repayment on reaching commercial production was paid on March 31, 2017. The remaining principal balance of $24.4 million plus accumulated interest of $24.1 million is included in the payable to De Beers Canada on the condensed consolidated interim balance sheet, and is payable on September 1, 2018. For royalty purposes for the Government of the Northwest Territories, commercial production is based on the first day after 90 days of achieving 60% of designed production capacity, which was achieved on December 23, 2016.

The Company’s strategy is to mine and sell its 49% share of rough diamonds at the highest price on the day of the close of the auction. Inventory generally will not be held for speculative purposes, though the sale of certain diamonds may be accelerated or deferred in the short term for tactical marketing purposes. Mountain Province’s long-term view of the rough diamond market remains positive, based on the outlook for a tightening rough diamond supply and growing demand, particularly in developing markets such as China and India, resulting in real, long term price growth.

During the nine months ended September 30, 2017, the Company held seven of ten sales expected to take place in Antwerp during 2017. Sales are held approximately every five weeks during the year.

Revenue from diamond sales is recognized when the performance obligations are completed. Under the Company’s sales terms, the performance obligations are completed when payment has been received for diamonds by the Company or the Company’s agent and diamonds are delivered to the buyer by the Company or the Company’s agent.

GAHCHO KUÉ DIAMOND MINE

Gahcho Kué Joint Venture Agreement

The GK Mine is located in the Northwest Territories, about 300 kilometers northeast of Yellowknife. The mine covers approximately 10,353 acres, and encompasses four mining leases (numbers 4341, 4199, 4200, and 4201) held in trust by the Operator. The Project hosts four primary kimberlite bodies - 5034, Hearne, Tuzo and Tesla. The four main kimberlite bodies are within two kilometers of each other.

The GK Mine is an unincorporated Joint Arrangement between De Beers (51%) and Mountain Province (49%) through its wholly owned subsidiaries. On October 2, 2014, Mountain Province assigned its 49% interest to its wholly-owned subsidiary 2435386 Ontario Inc. to the same extent as if 2435386 Ontario Inc. had been the original party to the Joint Venture Agreement. The Company accounts for the mine as a joint operation in accordance with International Financial Reporting Standard 11, Joint Arrangements. Mountain Province through its subsidiaries holds an undivided 49% ownership interest in the assets, liabilities and expenses of the GK Mine.

Under provisions of the 2009 agreement the Company will repay De Beers $59 million (representing 49% of the agreed sum of $120 million) plus interest compounded on the outstanding amounts in settlement of the Company’s share of the agreed historical sunk costs. To date the Company has paid $34.6 million of historical sunk costs.

Amounts remaining to be paid is the balance of approximately $24.4 million plus accumulated interest due September 1, 2018. At September 30, 2017, accumulated interest is approximately $24.1 million plus the principal balance of $24.4 million is included in payable to De Beers Canada on the condensed consolidated interim balance sheet. Accumulated interest is being calculated at the prevailing LIBOR rate plus 5%.

The Company has agreed that the Company’s marketing rights under the 2009 Agreement may be diluted if the Company defaults on the remaining repayments described above, if and when such payments become due.

| Page 6 |

The GK Mine has been successfully constructed and commissioned, and the Company has funded its 49% share of these costs. The underlying value and recoverability of the amounts shown in the consolidated financial statements for the Company’s Mineral Properties is dependent upon having access to necessary working capital and future profitable production.

Between 2014 and 2016, the Company and De Beers signed agreements allowing the Operator to utilize De Beers’ credit facilities to issue reclamation and restoration security deposits to the federal and territorial governments. In accordance with these agreements, the Company agreed to a 3% fee annually for their share of the letters of credit issued. As at September 30, 2017, the Company’s share of the letters of credit issued were $23,419 (December 31, 2016 - $23,419).

Gahcho Kué Capital Program

For the period, January 1, 2017 to February 28, 2017, the date immediately preceding the declaration of commercial production, funding of approximately $24.9 million (excluding management fee) was requested by the Operator. Included in this amount are ramp-up operating costs, working capital and the remaining original capital related costs. The Company funded from the Loan Facility approximately $12.5 million representing its proportionate share.

Gahcho Kué Production Forecast

The Company provided initial full-year guidance in April 2017 of 2.7 million tonnes processed and 4.4 million carats produced for the year ended December 2017 and subsequently in August 2017 revised that guidance to 2.72 million tonnes processed and 5.5 million carats produced on a 100% basis. Given the continuation of strong plant performance and favourable grade experience at the GK Mine, the Company is on track to meet and exceed its current full-year 2017 production guidance. The Company expects to receive 2.7 million carats, being its 49% share of production.

The Company also provided initial guidance in April 2017 to sell at least 2 million carats of diamonds, including pre-commercial production sales and subsequently in August 2017 revised that guidance to sell at 2.4 million carats of diamonds. The Company is on track to meet and exceed its current full year 2017 sales guidance.

These production and sales expectations represent an increase from prior guidance of 2.2 million attributable carats of production and 2.0 million carats sold due to favourable production trends experienced during the second and third quarter of 2017, as the conveyor issues experienced earlier have been overcome and recovered carats per tonne has been higher than planned in certain portion of the 5034 pit. The increased performance is expected to carry throughout 2017.

Diamond Outlook

Q3 is typically impacted by the industry holiday periods in August and the run up to the Jewish and Hindu New Year factory shutdowns in October. The resultant slow-down has been more pronounced as major US retailers push seasonal purchasing to later in the year.

Confidence levels within the diamond midstream were impacted by two sizeable unforeseen bankruptcies in the third quarter. Both were long-established players in Belgium and India, who had been extended credit by multiple major diamond banks and fellow diamond companies and their bankruptcies led to a decline in counter-party trust between trading companies. Short-term, this creates some downward pressure on rough prices. Longer-term it may drive consolidation, a healthier midstream and a stronger banking model.

Feedback from September’s Hong Kong Gem and Jewellery Fair was more positive than the industry’s conservative expectations. Show traffic was good, with a solid turnout of buyers from China and other major markets. Trading levels were reported to be respectable, indicating a positive outlook for the months ahead.

| Page 7 |

Consumer markets are relatively stable. US majors have struggled in recent years, as have many mall-based chains from other product categories, as consumer purchasing habits migrate online. US retailers continue to seek opportunities to expand their digital presence, with one leading mall-based chain acquiring a leading online retailer of engagement rings and loose diamonds. The performance of US majors is critical to smaller sized and lower commercial quality rough.

Premium brands are performing well with several luxury goods houses reporting increased year-on-year jewellery and watch revenues. This should support price performance of top-end qualities, particularly in small sizes, where there have been some reported shortages.

Retail sales in major Asian markets were boosted by Chinese Golden week in October, shortly followed by Diwali in India. Hong Kong is recovering from a couple of recently difficult years. Tourists from mainland China to Hong Kong are an important driver of diamond jewellery demand. Mainland Chinese tourist numbers in Hong Kong increased 2.3% in H1 2017 and a major Chinese retailer reported double digit, same store sales growth in its Hong Kong stores last quarter.

The outlook for the remainder of 2017 is stable and expectations for 2018 are cautiously optimistic. Major producers are expected to responsibly manage supply and the midstream sector has purchasing and operational capacity. Manufacturers will however are expected to be less willing to buy loss-making rough and to be cautious in extending credit.

Gahcho Kué Diamond Mine Update

Construction and Development Update

As at September 30, 2017, procurement for the construction of the mine was 100% complete. The close-out of the various procurement packages from Q1 - 2017 was completed, and no significant remaining costs regarding mine construction and development are anticipated to be incurred.

During the GK mine’s first winter of operations, extreme cold conditions affected the mine’s conveyor systems which resulted in downtime and lowered throughput. In 2017, De Beers and the Company approved a capital project totalling $23 million on a 100% basis to install enclosures on two conveyors as well as to install dust collection systems at the primary crusher and plant feed bin. Work has commenced on this project and is expected to be completed by the end of Q1 2018, with the work completed to date considered sufficient to adequately mitigate the operating risk for this upcoming winter.

Mining

For the three months ended September 30, 2017, on a 100% basis, a total of 8.3 million tonnes of overburden, waste rock and ore had been extracted from the 5034 open pit, compared to the original 2017 third quarter plan of approximately 10 million tonnes (83% of plan). For the nine months ended September 30, 2017, on a 100% basis a total of 24.4 million tonnes of overburden, waste rock and ore had been extracted from the 5034 open pit, compared to an original plan of approximately 27.7 million tonnes (88% of plan).

For the three and nine months ended September 30, 2017, 823,000 tonnes and 2,082,000 tonnes of kimberlite ore was processed with 1,825,000 carats (100% basis) and 4,306,000 carats being recovered at a grade of 2.22 and 2.07 carats per tonne for the three and nine months ended September 30, 2017, respectively. It remains unclear at this time to what extent this positive grade variance will be sustainable.

At September 30, 2017, there was approximately 695,000 tonnes (100% basis) of stockpiled ore. Sufficient ore is available in the 5034 pit to meet the planned process throughput rate.

At September 30, 2017, the GK Mine had 573,360 carats on a 100% basis in rough diamond inventory at the GK Mine and at the sorting facility based in Yellowknife. The Company had 598,220 carats within its sale preparation channel plus its 49% share of the 573,360 carats or 280,950 carats for a total of 879,170 carats available for sale inventory.

| Page 8 |

Operating Plan Update

Annually at the GK mine, an internal operational review is undertaken mid year and the results are incorporated into updated budgets and operating plans for the subsequent years. The review conducted in 2017 has identified three main areas of update to the operating plans for 2018 and subsequent years.

| • | Based on realized and sustained plant throughput rates in 2017 and confirmatory engineering assessments, the nameplate capacity of the plant is being increased by 5% to 3,150,000 tonnes per annum. |

| • | Recovered diamond grade through the first three quarters of 2017 has exceeded plan. The 2014 Feasibility Study (entitled “Gahcho Kué Project 2014 Feasibility Study”, dated May 13, 2014 amended May 27, 2014) projected a 2017 recovered grade of 1.75 cpt, and initial 2017 guidance provided by the Company in April 2017 anticipated a recovered grade of 1.62 cpt. Actual recovered grade through the first three quarters of 2017 was 2.07 cpt, and for the third quarter was 2.22 cpt. Work on the annual GK mine reserve statement update is currently under way, with public release anticipated for early 2018. In addition to factoring in normal depletion from 2017 mining, also under consideration is the manner and extent to which the update will need to reflect this recovered grade increase, as well as actual experience regarding stone size and quality distributions. |

| • | As previously disclosed, for geotechnical reasons a layback of the planned east wall of the 5034 open pit is required. Relating primarily to a joint set encountered within the country rock, the revised pit wall design calls for a shallower overall pit slope angle of approximately 41°. The geotechnical issue was identified in the opening several benches of the pit wall, and the pushback of those opening benches was commenced during the summer. Accordingly, the primary impact on the mine plan will be additional waste removal due to the increased stripping requirements. If the joint set issue persists through the full depth of the pit wall, the additional waste removal over life of mine will be approximately 66 million tonnes (beyond initial design). Should the geotechnical issue dissipate at lower bench levels, it may be possible to step in and steepen the pit wall angle and commensurately reduce the additional waste removal required. |

For 2018, the GK operational plan anticipates total ore processing of approximately 3,115,000 tonnes, recovering between 6.3 million and 6.6 million carats (100% basis) and reflecting a recovered grade of between 2.02 cpt and 2.12 cpt. This reflects a current expectation that the grade experience of 2017, specifically that attributable to the Centre and East lobes of the 5034 pipe, will continue at least into 2018, and may be subject to revision pending completion of the annual GK mine reserve statement update. Actual cash costs of production, including capitalized stripping costs (see Non-IFRS Measures section), over the first three quarters of 2017 were $80 per tonne processed, versus $79 projected for 2017 in the 2014 Feasibility Study. The 2018 GK operational plan anticipates cash costs of production including capitalized stripping costs increasing to a run-rate of $100 per tonne. The increase in cost is due primarily to the increased waste removal attributed to the push back of the planned 5034 east wall. The 2018 GK operational plan anticipates sustaining and other capital expenditures (other than capitalized stripping) of approximately $47 million (100% basis), approximately $31 million of which is in respect of additional open pit mining equipment, including drill, shovel, haul trucks and ancillary equipment to accommodate the increased waste removal of the 5034 east wall. Exploration expenditures for 2018, if any, will be expensed and not capitalized based on the Company’s accounting policy.

A summary of key parameters from the updated GK operational plan over the next five years is provided as follows (100% basis):

| 2018 | 2019 | 2020 | 2021 | 2022 | ||

| Ore tonnes processed | 000s | 3,115 | 3,153 | 3,161 | 3,153 | 3,153 |

| Carats recovered | 000s | 6,300 - 6,600 | 6,000 - 6,300 | 6,300 - 6,600 | 5,700 - 6,000 | 5,300 - 5,600 |

| Cash costs of production per tonne, net of capitalized stripping | $ | 77 | 82 | 80 | 77 | 86 |

| Cash costs of production per tonne, including capitalized stripping | $ | 100 | 102 | 104 | 104 | 109 |

| Sustaining capital expeditures | $000s | 46,629 | 31,497 | 12,669 | 9,070 | 7,355 |

| Page 9 |

Not included in the updated GK operational plan is any potential processing of diamondiferous kimberlite from the Southwest Corridor, between the 5034 and Hearne pipes. Much of the Southwest Corridor is already scheduled under the mine plan to be mined as waste rock, and in the course of stripping activity to date, this area has been recognized as containing diamondiferous kimberlite that is not included in the current project resource or reserve statements. An exploration program is being carried out in the area of the Southwest Corridor to consider whether resource identification may be validated, with initial results anticipated in early 2018. Also, not included in the updated GK operational plan is any potential grade increase associated with the West lobe of the 5034 pipe. Evaluations are being conducted on the West lobe to better isolate and assess its grade performance, the outcomes of which are anticipated in early 2018 and may justify further revision to production estimates.

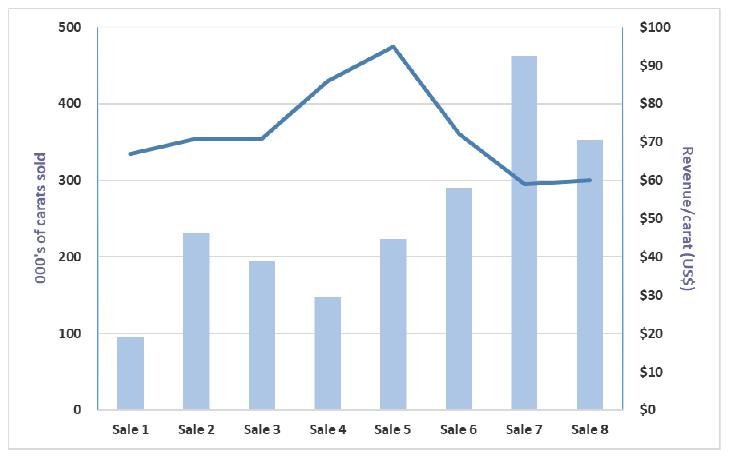

Diamond Sales

The Company undertook seven tender sales of diamonds during the first nine months of 2017 through its broker in Antwerp, Belgium, and an eighth sale was completed in October. Although the GK Mine declared commercial production on March 1st, revenues and costs from four out of the seven sales conducted in the first three quarters have been recorded against the mine construction costs rather than as revenue on the Company’s statement of comprehensive income (loss) as those diamonds sold were all recovered prior to the mine declaring commercial production. The majority of the Company’s revenue is derived from these tender sales, with the remainder attributed to sales of fancies and specials directly to De Beers on such occasions where De Beers has won the periodic fancies and specials bidding process.

| Page 10 |

The following table summarizes the results of each sale in Antwerp:

| 000's of carats sold | Gross proceeds (US$) | Revenue/carat (US$) | ||||||||||

| Sale 1(1) | 96 | $ | 6,423 | $ | 67 | |||||||

| Sale 2 | 231 | $ | 16,484 | $ | 71 | |||||||

| Sale 3(2) | 194 | $ | 13,747 | $ | 71 | |||||||

| Total Q1(3) | 521 | $ | 36,654 | $ | 70 | |||||||

| 000's of carats sold | Gross proceeds (US$) | Revenue/carat (US$) | ||||||||||

| Sale 4(4) | 148 | $ | 12,691 | $ | 86 | |||||||

| Sale 5(5) | 223 | $ | 21,118 | $ | 95 | |||||||

| Total Q2 | 371 | $ | 33,809 | $ | 91 | |||||||

| 000's of carats sold | Gross proceeds (US$) | Revenue/carat (US$) | ||||||||||

| Sale 6 | 290 | $ | 20,948 | $ | 72 | |||||||

| Sale 7 | 463 | $ | 27,108 | $ | 59 | |||||||

| Total Q3 | 753 | $ | 48,056 | $ | 64 | |||||||

| Total year to date | 1,645 | $ | 118,519 | $ | 72 | |||||||

| 000's of carats sold | Gross proceeds (US$) | Revenue/carat (US$) | ||||||||||

| Sale 8 | 353 | $ | 21,214 | $ | 60 | |||||||

| Total Q4 | 353 | $ | 21,214 | $ | 60 | |||||||

(1) Assuming the diamonds withdrawn were sold in sale 1 instead of sale 2.

(2) Although the diamond sale closed on March 29, 2017, the sale of 194,000 carats occurred during the first week of April.

(3) Although 522,000 carats were sold, in accordance with IFRS only 416,000 carats could be recognized as sales proceeds in the quarter. The remaining 106,000 carats were recognized in Q2 2017.

(4) Sold carats were produced in the period before declaration of commercial production, therefore were recorded against the property, plant and equipment in accordance with IFRS.

(5) Sale 5 represents the first sale of diamonds produced after the declaration of commercial production on March 1, 2017, therefore have been recorded as revenue on the statement of comprehensive income (loss). Although 222,000 carats were sold, in accordance with IFRS only 215,000 carats could be recognized as sales proceeds in the quarter. The remaining 7,000 carats have been recognized during Q3 2017.

| Page 11 |

To more meaningfully relate prices realized at sale events to production results, the Company provides the following table:

| Production period | Inception to end of year 2016 | Q1 2017 | April 2017 | May 2017 | June 2017 | July 2017 | Aug 2017 | Sept 2017 | YTD Total 2017 | |

| Sale in which goods were primarily sold | 1 & 2 | 3 to 5 | 6 | 7 | 7&8 | 8 | N/A** | N/A** | ||

| Tonnes processed (100%) (000's) | 515 | 492 | 201 | 276 | 289 | 314 | 269 | 241 | 2,082 | |

| Recovered grade (carats per tonne) | 1.64 | 1.76 | 2.27 | 2.09 | 1.99 | 2.13 | 2.32 | 2.22 | 2.07 | |

| Carats recovered (100%) (000's) | 847 | 867 | 457 | 579 | 578 | 669 | 622 | 535 | 4,307 | |

| Carats recovered (49%) (000's) | 415 | 425 | 224 | 284 | 283 | 328 | 305 | 262 | 2,111 | |

| Price per carat in US$, run of mine basis*** | $67 | $ 79 | $ 78 | $65 | $ 63 | $ 60 | N/A** | N/A** | ||

| Attributed value per tonne in CAD* | $ 143 | $ 188 | $225 | $ 172 | $ 157 | $ 160 | N/A** | N/A** | ||

*Attributed value per tonne has been determined based on realized sales results, with accelerated or deferred goods adjusted to their period production, reflecting only the Company’s 49% share of all diamonds including fancies and specials. Attributed value per tonne in CAD is not clearly defined under IFRS and therefore may not be comparable to similar measures presented by other issuers. Please refer to the Non-IFRS Measures section.

**Not applicable as goods from this production period have not yet been sold.

*** Price per carat in US$, run of mine basis is not clearly defined under IFRS and therefore may not be comparable to similar measures presented by other issuers. Please refer to the Non-IFRS Measures section.

The following table summarizes the revenue composition for the seven tender sales above:

| % Volume | % Value | Sale price per carat (US$/ct) | |

| Gem/ Near gem | 57% | 95% | 123 |

| Industrial/ Boart | 43% | 5% | 8 |

Though the positive experience gained by manufacturers in polishing GK Mine diamonds continues to deepen competition at the Company’s tender sales, instability in the rough diamond market arising from the two bankruptcies impacted price growth during the third quarter.

As previously reported, a significant proportion of diamonds sold to date, including much of the higher quality colourless diamonds, have exhibited varying degrees of fluorescence. As per industry norms, these continue to be discounted by the market compared to non-fluorescent diamonds.

The Company maintains the price guidance announced on April 25, 2017, of approximately US$70 to US$90 per carat as the expected realized diamond price for the remainder of 2017.

NON-IFRS MEASURES

The MD&A refers to the terms “Price per carat in US$, run of mine basis” and “Attributed value per tonne in CAD”, as well as “Cash costs of production per tonne of ore processed” and “Cash costs of production per carat recovered”, both including and net of capitalized stripping costs. Each of these is a non-IFRS performance measure, and is referenced in order to provide investors with information about the measures used by management to monitor performance. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. They do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers.

Price per carat in US$, run of mine basis, and attributed value per tonne in CAD are used by management to analyze the sales results based on date of production rather than sales date. Differences from reported sales are attributed to the holding back or accumulation of diamonds, the expediting of certain diamonds produced into an earlier sale batch, and the inclusion in revenue under IFRS of proceeds from the sale of De Beers’ 51% of fancies and specials won by the Company under the tender process, described as adjustments for stock movements and holdbacks.

| Page 12 |

Cash costs of production per tonne of ore processed and cash costs of production per carat recovered are used by management to analyze the actual cash costs associated with processing the ore, and for each recovered carat. Differences from production costs reported within cost of sales are attributed to the amount of production cost included in ore stockpile and rough diamond inventories.

The following table provides a reconciliation of price per carat in US$, run of mine basis, to the amounts included in property, plant and equipment on the condensed consolidated interim balance sheets, and the sales reported on the condensed consolidated interim statements of comprehensive income (loss), as applicable:

| Sales per carat (expressed in 000's, except per carat amounts) | Sales 1 & 2(1) | Sales 3 & 4(1) | Sale 5(2) | Sale 6(2) | Sale 7(2) | Sale 8(3) | ||||||||||||||||||

| Sales | $ | 30,431 | $ | 37,062 | $ | 27,648 | $ | 26,500 | $ | 33,316 | $ | 25,569 | ||||||||||||

| Less: effects of foreign exchange spot translations | $ | (7,524 | ) | $ | (9,577 | ) | $ | (6,765 | ) | $ | (5,318 | ) | $ | (6,208 | ) | $ | (4,355 | ) | ||||||

| Sales in $US | $ | 22,907 | $ | 27,485 | $ | 20,883 | $ | 21,182 | $ | 27,108 | $ | 21,214 | ||||||||||||

| Carats sold | 327 | 343 | 215 | 297 | 463 | 353 | ||||||||||||||||||

| Sales per carat, $US | $ | 70 | $ | 80 | $ | 97 | $ | 71 | $ | 59 | $ | 60 | ||||||||||||

| Reconciliation of date of sale to date recovered from processing plant (expressed in 000's) | Sales 1 & 2(1) | Sales 3 & 4(1) | Sale 5(2) | Sale 6(2) | Sale 7(2) | Sale 8(3) | Total | |||||||||||||||||||||

| Carats recovered through processing plant | ||||||||||||||||||||||||||||

| Inception to end of period 2016 | 327 | 88 | – | – | – | – | 415 | |||||||||||||||||||||

| First quarter production period 2017 | – | 255 | 163 | 7 | – | – | 425 | |||||||||||||||||||||

| April 2017 production period | – | – | 52 | 172 | – | – | 224 | |||||||||||||||||||||

| May 2017 production period | – | – | – | 118 | 166 | – | 284 | |||||||||||||||||||||

| June 2017 production period | – | – | – | – | 283 | – | 283 | |||||||||||||||||||||

| July 2017 production period | – | – | – | – | 14 | 314 | 328 | |||||||||||||||||||||

| Sales in $US adjusted for date recovered from processing plant | ||||||||||||||||||||||||||||

| Inception to end of period 2016 | $ | 22,907 | $ | 4,898 | $ | – | $ | – | $ | – | $ | – | $ | 27,805 | ||||||||||||||

| First quarter production period 2017 | $ | – | $ | 22,587 | $ | 11,179 | $ | – | $ | – | $ | – | $ | 33,766 | ||||||||||||||

| April 2017 production period | $ | – | $ | – | $ | 9,704 | $ | 7,768 | $ | – | $ | – | $ | 17,472 | ||||||||||||||

| May 2017 production period | $ | – | $ | – | $ | – | $ | 13,414 | $ | 5,046 | $ | – | $ | 18,460 | ||||||||||||||

| June 2017 production period | $ | – | $ | – | $ | – | $ | – | $ | 17,829 | $ | – | $ | 17,829 | ||||||||||||||

| July 2017 production period | $ | – | $ | – | $ | – | $ | – | $ | 4,233 | $ | 15,447 | $ | 19,680 | ||||||||||||||

| Production period (expressed in 000's, except per carat amounts) | Inception to end of 2016 | Q1 2017 | April 2017 | May 2017 | June 2017 | July 2017 | August 2017 | September 2017 | ||||||||||||||||||||||||

| Carats recovered through processing plant | 415 | 425 | 224 | 284 | 283 | 328 | N/A(3) | N/A(3) | ||||||||||||||||||||||||

| Sales in $US, date recovered through processing plant | $ | 27,805 | $ | 33,766 | $ | 17,472 | $ | 18,460 | $ | 17,829 | $ | 19,680 | N/A(3) | N/A(3) | ||||||||||||||||||

| Price per carat in $US, run of mine basis | $ | 67 | $ | 79 | $ | 78 | $ | 65 | $ | 63 | $ | 60 | N/A(3) | N/A(3) | ||||||||||||||||||

(1) Total revenue for sales 1 to 4 equates to the amounts included in property, plant and equipment on the condensed consolidated interim balance sheets.

(2) As presented in the condensed consolidated interim statements of comprehensive income (loss).

(3) Sale occurred subsequent to the quarter end, which will be reported in the fourth quarter of 2017.

(4) During Sale 8, approximately 353K of carats were sold, of which approximately 328k were processed in the one-month period ended July 31, 2017. The remainder were processed during August 2017.

| Page 13 |

The following table provides a reconciliation of the attributed value per tonne in CAD to the amounts included in property, plant and equipment on the condensed consolidated interim balance sheets, and the sales reported on the condensed consolidated interim statements of comprehensive income (loss):

| Production period (expressed in 000's, except per carat amounts) | Inception to end of 2016 | Q1 2017 | April 2017 | May 2017 | June 2017 | July 2017 | August 2017 | September 2017 | ||||||||||||||||||||||||

| Carats recovered through processing plant | 415 | 425 | 224 | 284 | 283 | 328 | N/A(3) | N/A(3) | ||||||||||||||||||||||||

| Average grade processed through processing plant | 1.64 | 1.76 | 2.27 | 2.09 | 2.00 | 2.13 | N/A(3) | N/A(3) | ||||||||||||||||||||||||

| Tonnes processed through processing plant | 253 | 241 | 99 | 136 | 142 | 154 | N/A(3) | N/A(3) | ||||||||||||||||||||||||

| Sales in $US, date recovered through processing plant | $ | 27,805 | $ | 33,766 | $ | 17,472 | $ | 18,460 | $ | 17,829 | $ | 19,680 | N/A(3) | N/A(3) | ||||||||||||||||||

| Add back effects of foreign exchange spot translations | $ | 8,381 | $ | 11,632 | $ | 4,731 | $ | 4,912 | $ | 4,387 | $ | 4,958 | N/A(3) | N/A(3) | ||||||||||||||||||

| Sales in $, date recovered through processing plant | $ | 36,186 | $ | 45,398 | $ | 22,203 | $ | 23,372 | $ | 22,216 | $ | 24,638 | N/A(3) | N/A(3) | ||||||||||||||||||

| Attributed value per tonne in CAD**** | $ | 143 | $ | 188 | $ | 225 | $ | 172 | $ | 157 | $ | 160 | N/A(3) | N/A(3) | ||||||||||||||||||

(1) Total revenue for sales 1 to 4 equates to amounts included in property, plant and equipment on the condensed consolidated interim balance sheets.

(2) As presented in the condensed consolidated interim statements of comprehensive income (loss).

(3) Sale occurred subsequent to the quarter end, which will be reported in the fourth quarter of 2017.

(4) Attributed value per tonne in CAD is calculated as ‘Sales in $, date recovered through processing plant’ divided by ‘Tonnes processed through plant.’

The following table provides a reconciliation of the cash costs of production per tonne of ore processed and per carat recovered and the production costs reported within cost of sales on the condensed consolidated interim statements of comprehensive income (loss):

| Three months ended | Three months ended | Nine months ended | Nine months ended | |||||||||||||||

| (in millions of Canadian dollars, except where otherwise noted) | September 30, 2017 | September 30, 2016 | September 30, 2017 | September 30, 2016 | ||||||||||||||

| Production costs | $ | 22,857 | – | 29,826 | – | |||||||||||||

| Variation in inventory, excluding depreciation | $ | 6,679 | – | 37,062 | – | |||||||||||||

| Cash cost of production of ore processed, net of capitalized stripping | $ | 29,536 | – | 66,888 | – | |||||||||||||

| Cash costs of production of ore processed, including capitalized stripping | $ | 29,536 | – | 69,665 | – | |||||||||||||

| Tonnes processed | kilo tonnes | 403 | – | 874 | – | |||||||||||||

| Carats recovered | 000's carats | 894 | – | 1,864 | – | |||||||||||||

| Cash costs of production per tonne of ore, net of capitalized stripping | $ | 73 | – | 77 | – | |||||||||||||

| Cash costs of production per tonne of ore, including capitalized stripping | $ | 73 | – | 80 | – | |||||||||||||

| Cash costs of production per carat recovered, net of capitalized stripping | $ | 33 | – | 36 | – | |||||||||||||

| Cash costs of production per carat recovered, including capitalized stripping | $ | 33 | – | 37 | – | |||||||||||||

Results of operations

The Company has funded its share of the remaining costs, associated fees, operating costs during the build-up to commercial production, which was declared on March 1, 2017. The Company, as discussed above, has held seven sales of diamonds during the nine months ended September 30, 2017 and expects to conduct another three sales during the fourth quarter of 2017.

| Page 14 |

FINANCIAL REVIEW

Three and nine months ended September 30, 2017 compared to the three and nine months ended September 30, 2016, expressed in thousands of Canadian dollars.

For the three months ended September 30, 2017, the Company recorded net income of $27,669 or $0.17 earnings per share compared to net loss $5,387 or $0.03 loss per share for the same period in 2016. For the nine months ended September 30, 2017, the Company recorded net income of $33,079 or $0.21 earnings per share compared to $13,104 net income or $0.08 earnings per share for the same period in 2016. One significant change was earnings from mine operations of $23,991 and $35,770 in the three and nine months ended September 30, 2017, respectively, compared to $nil for the same periods in 2016. An additional reason for the significant increase in net income for the nine months ended September 30, 2017 was the $32,984 foreign exchange gain, compared to $14,348 for the same period in 2016.

Quarterly financial information for the past eight quarters is shown in Table 1.

SUMMARY OF QUARTERLY RESULTS

| Table 1 - Quarterly Financial Data | ||||||||||||||||

| Expressed in thousands of Canadian dollars | ||||||||||||||||

| Three months ended | ||||||||||||||||

| September 30 | June 30 | March 31 | December 31 | |||||||||||||

| 2017 | 2017 | 2017 | 2016 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Earnings and Cash Flow | ||||||||||||||||

| Sales | 65,218 | 27,648 | – | – | ||||||||||||

| Operating expenses | (44,648 | ) | (19,985 | ) | (3,428 | ) | (2,479 | ) | ||||||||

| Net income (loss) for the period | 27,669 | 7,554 | (2,144 | ) | (8,305 | ) | ||||||||||

| Basic and diluted earnings (loss) per share | 0.17 | 0.05 | (0.01 | ) | (0.05 | ) | ||||||||||

| Cash flow provided by (used in) operating activities | 49,238 | (15,737 | ) | (27,239 | ) | 1,911 | ||||||||||

| Cash flow provided by (used in) investing activities | (38,715 | ) | 18,217 | 7,596 | (63,276 | ) | ||||||||||

| Cash flow provided by (used in) financing activities | (7,871 | ) | (8,826 | ) | 30,974 | 36,527 | ||||||||||

| Balance Sheet | ||||||||||||||||

| Total assets | 884,806 | 857,320 | 873,753 | 783,762 | ||||||||||||

| Three months ended | ||||||||||||||||

| September 30 | June 30 | March 31 | December 31 | |||||||||||||

| 2016 | 2016 | 2016 | 2015 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Earnings and Cash Flow | ||||||||||||||||

| Operating expenses | (1,426 | ) | (1,204 | ) | (1,168 | ) | (2,368 | ) | ||||||||

| Net income (loss) for the period | (5,387 | ) | (352 | ) | 18,843 | (10,248 | ) | |||||||||

| Basic and diluted earnings (loss) per share | (0.03 | ) | (0.00 | ) | 0.12 | (0.06 | ) | |||||||||

| Cash flow provided by (used in) operating activities | (4,296 | ) | (13,972 | ) | (1,654 | ) | (1,592 | ) | ||||||||

| Cash flow provided by (used in) investing activities | (16,404 | ) | (36,689 | ) | (89,198 | ) | (57,622 | ) | ||||||||

| Cash flow provided by (used in) financing activities | 32,539 | 59,271 | 92,870 | 36,316 | ||||||||||||

| Balance Sheet | ||||||||||||||||

| Total assets | 752,825 | 732,959 | 693,923 | 582,848 | ||||||||||||

| Page 15 |

EARNINGS FROM MINE OPERATIONS, COSTS AND EXPENSES

The earnings from mine operations, costs and expenses, expressed in thousands of Canadian dollars for the three and nine months ended September 30, 2017 compared to the three and nine months ended September 30, 2016 are comparable except for the following:

Earnings from mine operations

Earnings from mine operations for the three and nine months ended September 30, 2017 were $23,991 and $35,770, respectively. Diamond sales for the three and nine months ended September 30, 2017 were $65,218 and $92,866, respectively. Production costs (net of capitalized stripping costs) related to diamonds sold for the three and nine months ended September 30, 2017 were $22,857 and $29,826, respectively. Depreciation and depletion related to diamonds sold for the three and nine months ended September 30, 2017 were $16,493 and $21,587, respectively. The cost to acquire the fancies and specials diamonds sold for the three and nine months ended September 30, 2017 were $1,877 and $5,683, respectively. The GK Mine declared commercial production on March 1, 2017, and as a result, the diamond sales, and cost of goods sold have been recorded for the first time. These would have related to the first three sales taking place in Antwerp, along with any diamonds lost in the bidding process to De Beers. As a result of the declaration occurring on March 1, 2017, there were no earnings from mine operations in the comparative period for 2016.

Selling, general and administrative expenses

Selling, general and administrative expenses for the three and nine months ended September 30, 2017, respectively, were $3,334 and $10,878 compared to $1,426 and $3,798 for the same period in 2016. The significant expenses included in these amounts for the three and nine months ended September 30, 2017, respectively, were $1,489 and $4,614 relating to selling and marketing, $376 and $2,062 related to consulting fees and payroll, and $516 and $1,289 relating to share-based payment expense. Selling and marketing expenses were incurred in 2017 due to the Company holding its first seven sales. Consulting fees and payroll related expenses for the nine months ended September 30, 2017, have significantly increased from $1,024 in 2016 to $2,062 in 2017, both on a year-to-date basis, due to the transition in executive leadership during the period, and the associated costs of severance and transition.

Net finance income (expenses)

Net finance income (expenses) for the three and nine months ended September 30, 2017, respectively, were ($11,141) and ($26,280) compared to $12 and $123 for the same period in 2016. Included in these amounts for the three months and nine months ended September 30, 2017, respectively, were ($11,298) and ($26,578) relating to finance costs, ($140) and ($421) relating to accretion expense on decommissioning liability and $297 and $719 relating to interest income. Finance costs has increased for the three and nine months ended September 30, 2017 due to interest expense incurred on the Loan Facility for the months of March to September 2017 being expensed after the declaration of commercial production. The increase in accretion expense on decommissioning liability is due to a higher decommissioning liability balance. The decrease in interest income is as a result of a lower average balance in the restricted accounts.

Derivative gains

Derivative gains for the three and nine months ended September 30, 2017, respectively, were $635 and $1,415 compared $1,564 and $2,363 for the same period in 2016. For the nine months ended September 30, 2017, the overall derivative gain is attributed to the relative strengthening of the LIBOR rate, which has resulted in a derivative gain on the interest rate swap contracts. The overall derivative gains for the nine months ended September 30, 2016, related to the foreign currency forward strip contracts.

| Page 16 |

Foreign exchange gains (losses)

Foreign exchange gains (losses) for the three and nine months ended September 30, 2017, respectively, were $17,495 and $32,984 compared to ($5,560) and $14,348 for the same period in 2016. The foreign exchange gains for the three and nine months ended September 30, 2017 were a result of the Canadian dollar strengthening relative to the U.S. dollar and the translation of the Loan Facility, net of U.S. dollar cash balances, to Canadian dollar at the spot rate at the period end. At September 30, 2017, the spot exchange rate was $1.2472/US$1 compared to $1.3427/US$1 at December 31, 2016. At September 30, 2016, the spot exchange rate was $1.3117/US$1 compared to $1.384/US$1 at December 31, 2015. The foreign exchange gains for the three months ended September 30, 2016 was a result of the Canadian dollar weakening relative to the U.S. dollar and the translation of the Loan Facility and U.S. dollar cash balances to Canadian dollar at the spot rate at the period end.

INCOME AND RESOURCE TAXES

The Company is subject to income and mining taxes in Canada with the statutory income tax rate at 26.5%.

No deferred tax asset has been recorded in the financial statements as a result of the uncertainty associated with the ultimate realization of these tax assets.

The Company is subject to assessment by Canadian authorities, which may interpret tax legislation in a manner different from the Company. These differences may affect the final amount or the timing of the payment of taxes. When such differences arise, the Company makes provision for such items based on management’s best estimate of the final outcome of these matters.

The Company does not have any current tax expense as there are significant losses carried forward that are available to offset current taxable income.

FINANCIAL POSITION AND LIQUIDITY

The development of the GK Mine is complete and commercial production was declared on March 1, 2017. The underlying value and recoverability of the amounts shown as “Property, Plant and Equipment” are dependent upon future profitable production and proceeds from disposition of the Company’s mineral properties. Failure to meet the obligations for cash calls to fund the operating expenses for the Company’s share in the GK Mine may lead to dilution of the interest in the GK Mine and may require the Company to impair costs capitalized to date. As discussed above, the Company arranged the necessary equity and Loan Facility to fund its share of the construction and commissioning costs of the GK Mine. The Company held its first sales of diamonds in January, February, March, April, June, July, and September 2017 and will conduct sales approximately every five weeks thereafter.

Under the terms of the Company’s Loan Facility Agreement, the Company will be subject to funding of reserve accounts and certain financial covenants as discussed in Note 9 of the financial statements. The Loan Facility Agreement also contains material adverse effect clauses. In the absence of amendments or receipt of waivers, non-compliance with reserve funding requirements or other financial covenants, or the occurrence of a material adverse effect event, would be an event of default under the terms of the Loan Facility Agreement.

| Page 17 |

Commencing on March 31, 2017, the Company was subject to maintaining a cash call reserve account balance based upon certain budgeted amounts which will vary over the term of the Loan Facility. Approximately US$27.9 million was originally required to be deposited in the cash call reserve account on March 31, 2017. On March 27, 2017, the Company received a waiver deferring the requirement to fund the cash call reserve account to May 31, 2017. On May 31, 2017, the Company received an additional waiver extension to August 31, 2017. On August 31, 2017, the Company received another waiver extension for the debt service reserve account and the sunk cost reserve account to November 30, 2017. The Company was required to deposit a minimum of US$25 million in the cash call reserve account on or before September 15, 2017, which the Company has complied with. Under conditions of the waiver, certain information must be furnished to the lenders by August 31, 2017 including: an updated financial model including a life of mine plan and reflecting the changes to the JV plan and budget which have been approved by the technical agent. The failure to comply with any of the requirements of the waiver constitutes an event of default. All requirements have now been provided to the lenders, and are currently being assessed.

Under the terms of the Loan Facility Agreement, the Company is also subject to maintaining minimum levels of funding of reserve accounts (Note 9 of the financial statements). The table below describes requirements for initial funding of the minimum reserve balance by quarter:

| December 31, 2017 | March 31, 2018 | June 30, 2018 | September 30, 2018 | Total | ||||||||||||||||||

| Cash call reserve account(1) | US | $ | 2,900 | $ | – | – | – | $ | 2,900 | |||||||||||||

| Sunk cost reserve account(2) | 43,000 | – | – | (43,000 | ) | – | ||||||||||||||||

| Debt service reserve account(3) | 89,800 | – | – | – | 89,800 | |||||||||||||||||

| Environment reclamation reserve account(4) | 18,200 | 14,400 | – | – | 32,600 | |||||||||||||||||

| US | $ | 153,900 | $ | 14,400 | $ | – | $ | (43,000 | ) | $ | 125,300 | |||||||||||

(1) The amount was to be funded by March 31, 2017. On March 27, 2017, the lenders provided a waiver indicating the amount was to be funded by May 31, 2017. On May 31, 2017, the Company received an additional waiver extension to August 31, 2017. On August 31, 2017, the Company received a waiver extension for the debt service reserve account and the sunk cost reserve account to November 30, 2017 and the Company was required to deposit at a minimum of US$25 million in the cash call reserve account on or before September 15, 2017, which the Company complied with. The remaining US$2.9 million is required by December 31, 2017.

(2) The sunk cost reserve account is to be funded by September 1, 2017.Cash call reserve account minimum balance represents the cash calls expected to be paid to the Operator in the next three months. On August 31, 2017, the lenders provided a waiver indicating the amount is to be funded by November 30, 2017.

(3) The debt service reserve account is to be funded by September 30, 2017. On August 31, 2017, the lenders provided a waiver indicating the amount is to be funded by November 30, 2017.

Sunk cost reserve account minimum balance represents the total expected sunk cost payments to the Operator as described in note 8 of the financial statements.

(4) The environment reclamation reserve account is to be funded by December 31, 2017.

Debt service reserve account minimum balance represents the principal and interest payments on the loan facility expected to be paid to the lenders in the next nine months.

Environment reclamation reserve account minimum balance represents the Company’s share of all letters of credit issued and expected to be issued in the next nine months to any Government agency pursuant to any environmental or social permit.

At project completion, the Company can use the remaining balance available in the restricted cost overrun account (Note 7 of the financial statements) to fund a portion of the above reserve accounts. Management believes the Company will not be able to comply with the requirement to fully fund these reserve accounts and may from time to time not comply with the other financial covenants in the Loan Facility.

| Page 18 |

The Company is actively pursuing a near-term resolution to the requirements under the Loan Facility. There are no assurances the lenders will accommodate further waivers or amendments the Company may seek as to the timing and amount of the Loan Facility funding requirements. If the Company is unable to fully fund the required reserve accounts, or is unable to comply with other financial covenants, and is not successful in obtaining suitable waivers or amendments, or a material adverse event occurs, it would result in an event of default, and the Loan Facility outstanding balance would become payable on demand. Further, while management is well advanced in developing a resolution to the Loan Facility, which may include seeking alternative sources of financing, there are no guarantees that the Company will be successful in its efforts. These conditions indicate the existence of a material uncertainty that results in substantial doubt as to the Company’s ability to continue as a going concern. The financial statements do not include the adjustments to the amounts and classification of assets and liabilities that would be necessary should the Company be unable to continue as a going concern. These adjustments may be material.

In accordance with the waiver from the lenders, the Company paid the last two quarterly interest payments of approximately US$13.1 million from operating cash flows, rather than from the Loan Facility. As at September 30, 2017, the availability period of the Loan Facility period has ended, therefore the Company is no longer able to draw further debt.

Cash flow used in operating activities, including change in non-cash working capital for the nine months ended September 30, 2017 were $6,262 compared to ($19,924) for the same period in 2016. The increase in cash used is mainly as a result of the increase in inventories totalling approximately ($57,498). Included in the cash used in inventories of ($57,498) is ($14,320) used for supplies inventories, with the remainder being attributed to the increase of rough diamonds and stockpiled ore, since it is the first year of commercial production.

Investing activities for the nine months ended September 30, 2017 were ($12,902) compared to ($142,292) for the same period in 2016. For the nine months ended September 30, 2017, the outflow for the purchase of equipment and the expenditures directly related to the development of the GK Mine and other commissioned assets were $48,547 compared to $144,008 for the same period in 2016. Capitalized interest paid for the nine months ended September 30, 2017 was $5,451 compared to $17,617 for the same period in 2016. Cash used for investing activities for the nine months ended September 30, 2017 include $48,547 in property, plant and equipment, $5,451 for capitalized interest paid and $27,116 in restricted cash, offset by $67,493 in pre-production sales and $719 of interest income. Included in the $48,547 cash used in property, plant and equipment is the production and processing costs related to the pre-commercial production diamonds, which were sold and generated the $67,493 in pre-production sales.

Financing activities for the nine months ended September 30, 2017 were $14,277 compared to $184,681 for the same period in 2016. Cash flows from financing activities for the nine months ended September 30, 2017, related to cash draws of US$25 million or approximately $32.4 million Canadian dollar equivalent from January 1, 2017 to September 30, 2017 from the Loan Facility, net of financing costs of approximately $19.7million and proceeds from option exercises of $1,577. For the nine months ended September 30, 2016, financing activities related to cash draws of US$146 million or approximately $186.8 million Canadian dollar equivalent from January 1, 2016 to September 30, 2016 from the Loan Facility, net of financing costs of approximately $2.5 million and proceeds from option exercises of $411.

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

| Page 19 |

SIGNIFICANT ACCOUNTING POLICIES ADOPTED IN THE CURRENT YEAR

Effective March 1, 2017, upon declaring commercial production, the Company transitioned from accounting for certain costs as a development stage company to accounting for certain costs as an operating company. The significant financial reporting changes were as follows: the capitalized costs of the GK Mine were transferred from assets under construction to the relevant asset categories; assets began to be depreciated or depleted consistent with the Company’s accounting policies; capitalization of borrowing costs to assets under construction ceased; capitalization of pre-commercial production operating costs ceased; and mine operating results are recorded in the statement of comprehensive income (loss).

The new accounting policies adopted in the current year, are as follows:

(a) Property, plant and equipment

Upon entering commercial production stage, capitalized costs associated with the acquisition of the mineral property or the development of the mine, are amortized using the various methods based in the asset categories as follows:

| Corporate assets | two to seven years, straight line |

| Vehicles | three to five years, straight line |

| Production and related equipment | three to ten years or life of mine*, straight line or units of production method |

| General infrastructure | life of mine*, straight line |

| Earthmoving equipment | estimated hours |

| Mineral properties | units of production over proven and probable resources |

| Assets under construction | not depreciated until ready for use |

*Life of mine is estimated at approximately 12 years.

(b) Inventories

Inventories are recorded at the lower of cost and net realizable values. Net realizable value is the estimated selling price in the ordinary course of business, less estimated costs of completion. An impairment adjustment is made when the carrying amount is higher than the net realizable value.

Rough diamonds classified as finished goods comprise diamonds that have been subject to the sorting process. Cost is determined on a weighted average cost basis including production costs and value-added processing activity. As outlined in the joint venture agreement between the Company and De Beers Canada, fancies and special diamonds produced at the GK Mine are subject to a bid process. Upon a successful bid by the Company, the fancies and specials diamonds will be included in inventories and 51% of the bid amount will be paid to De Beers and capitalized to the cost of inventory. Cost for fancies and specials diamonds is determined on a weighted average cost basis including production costs and value-added processing activity plus the direct cost of acquiring the fancies and specials diamonds from De Beers.

Stockpiled ore represents coarse ore that has been extracted from the mine and is available for future processing. Stockpiled ore value is based on costs incurred in bringing ore to the stockpile. Costs are added to the stockpiled ore based on current mining costs per tonne and are removed at the average cost per tonne of ore in the stockpile.

Supplies inventory are consumable materials which are measured at the lower of weighted average cost and net realizable value.

| Page 20 |

(c) Capitalized stripping costs

In open pit mining operations, it is necessary to remove overburden and other waste materials to access ore from which minerals can be extracted economically. The process of mining overburden and waste materials is referred to as stripping. Stripping costs incurred in order to provide initial access to the ore body (referred to as pre-production stripping) are capitalized as mine development costs. These amounts were capitalized under assets under construction.

It may be also required to remove waste materials and to incur stripping costs during the production phase of the mine. The Company recognizes a stripping activity asset if all of the below conditions are met:

| • | It is probable that the future economic benefit (improved access to the component of the ore body) associated with the stripping activity will flow to the Company. |

| • | The Company can identify the component of the ore body for which access has been improved. |

| • | The costs relating to the stripping activity associated with that component can be measured reliably. |

The Company measures the stripping activity at cost based on an accumulation of costs incurred to perform the stripping activity that improves access to the identified component of ore, plus an allocation of directly attributable costs.

After initial recognition, the stripping activity asset is carried at cost less depreciation and impairment losses in the same way as the existing asset of which it is a part.

The stripping activity asset is depreciated over the expected useful life of the identified components of the ore body that becomes more accessible as a result of the stripping activity using the units of production method.

(d) Revenue

The Company early adopted IFRS 15, Revenue from Contracts with Customers, effective January 1, 2017.

The Company utilizes a sales agent to facilitate the sale of rough and/or fancies and specials diamonds to the end-customer. The Company recognizes revenue when consideration has been received by the Company’s sales agent, which represents the completion of the performance obligation of the Company.

As outlined in the joint venture agreement between the Company and De Beers Canada, fancies and specials diamonds produced at the GK Mine are subject to a bid process. When De Beers is the successful bidder, the Company recognizes 49% of the bid price as revenue at the completion of the bid process, as De Beers receives the fancies and specials diamonds and the Company is paid immediately for its share by De Beers.

(e) Statement of cash flows

In January 2016, the IASB issued an amendment to International Accounting Standard 7 (“IAS 7”), Statement of Cash Flows. The amended standard introduced additional disclosure requirements for liabilities arising from financing activities. The amendment is effective for annual periods beginning on or after January 1, 2017. The adoption of the amendment to IAS 7 did not have an effect on the condensed consolidated interim financial statements for the current period.

| Page 21 |

SIGNIFICANT ACCOUNTING JUDGMENTS, ESTIMATES AND ASSUMPTIONS

The preparation of the Company’s consolidated financial statements requires management to make judgments and/or estimates that affect the reported amounts of assets and liabilities at the date of the financial statements and reported amounts of expenses during the reporting period. These judgements and estimates are continuously evaluated and are based on management’s experience and knowledge of the relevant facts and circumstances. Actual results may differ from the estimates. The key areas where judgements, estimates and assumptions have been made are summarized below.

i) Significant judgments in applying accounting policies

The areas which require management to make significant judgments in applying the Company’s accounting policies are:

a) Impairment analysis - mineral properties

As required under IAS 36 - Impairment of Assets, the Company reviews its mineral properties for impairment based on results to date and when events and changes in circumstances indicate that the carrying value of the assets may not be recoverable. The Company is required to make certain judgments in assessing indicators of impairment. The Company’s assessment is that as at September 30, 2017 no indicator of an impairment in the carrying value of its mineral properties had occurred.

b) Commencement of commercial production

There are a number of quantitative and qualitative measures the Company considers when determining if conditions exist for the transition from pre-commercial production to commencement of commercial production of an operating mine, which include:

| • | all major capital expenditures have been completed to bring the mine to the condition necessary for it to be capable of operating in the manner intended by management; |

| • | mineral recoveries are at or near expected production levels; |

| • | the ability to sustain ongoing production of ore; and |

| • | the ability to operate the plant as intended. |

The list of measures is not exhaustive and management takes into account the surrounding circumstances before making any specific decision, which required significant judgment.

ii) Significant accounting estimates and assumptions

The areas which require management to make significant estimates and assumptions in determining carrying values include, but are not limited to:

Mineral reserves and resources

Mineral reserve and resource estimates include numerous uncertainties and depend heavily on geological interpretations and statistical inferences drawn from drilling and other data, and require estimates of the future price for the commodity and future cost of operations. The mineral reserve and resources are subject to uncertainty and actual results may vary from these estimates. Results from drilling, testing and production, as well as material changes in commodity prices and operating costs subsequent to the date of the estimate, may justify revision of such estimates. Changes in the proven and probable mineral reserves or measured and indicated and inferred mineral resources estimates may impact the carrying value of the properties. This will also impact the carrying value of the decommissioning and restoration liability and future depletion charges.

| Page 22 |

STANDARDS AND AMENDMENTS TO EXISTING STANDARDS

At the date of authorization of the interim financial statements, certain new standards and amendments to existing standards have been published but are not yet effective, and have not been adopted early by the Company. The Company anticipates that all of the relevant standards will be adopted by the Company in the first period beginning after the effective date of the standard. Information on new standards and amendments that are expected to be relevant to the Company’s financial statements is provided below.

Share-based payments

In June 2016, the IASB issued amendments to International Financial Reporting Standard 2, Share-based Payment (“IFRS 2”). IFRS 2 is effective for periods beginning on or after January 1, 2018 and is to be applied prospectively. The amendments clarify the classification and measurement of share-based payment transactions. Management is currently assessing the impact of the amendment to IFRS 2 on the consolidated financial statements.

Financial instruments

In July 2014, the IASB issued the final version of International Financial Reporting Standard 9, Financial Instruments (“IFRS 9”), bringing together the classification and measurement, impairment and hedge accounting phases of the IASB’s project to replace IAS 39 Financial Instruments: Recognition and Measurement. The mandatory effective date of IFRS 9 is annual periods beginning on or after January 1, 2018, with early adoption permitted. We are currently assessing the impact of adopting IFRS 9 on the consolidated financial statements along with timing of adoption of IFRS 9.

Leases

On January 13, 2016, the IASB issued International Financial Reporting Standard 16, Leases (“IFRS 16”). The new standard will replace existing lease guidance in IFRS and related interpretations, and requires companies to bring most leases on-balance sheet. The new standard is effective for annual periods beginning on or after January 1, 2019. The Company is currently assessing the impact of IFRS 16.

Foreign currency transactions and advance consideration

In December 2016, the IASB issued IFRIC Interpretation 22 “Foreign Currency Transactions and Advance Consideration” (“IFRIC 22”). IFRIC 22 is applicable for annual periods beginning on or after January 1, 2018, and permits early adoption. IFRIC 22 clarifies which date should be used for translation when a foreign currency transaction involves an advance payment or receipt. The interpretation clarifies that the date of the transaction for the purpose of determining the exchange rate to use on initial recognition of the related asset, expense or income (or part of it) is the date on which an entity initially recognizes the non-monetary asset or non-monetary liability arising from the payment or receipt of the advance consideration. The Company will adopt IFRIC 22 in its financial statements for the annual period beginning January 1, 2018 on a prospective basis. The Company has completed its assessment of the impact of IFRIC 22 and does not expect the interpretation to have a material impact on the consolidated financial statements.

Uncertainty over income tax treatments

On June 7, 2017, the IASB issued IFRIC Interpretation 23, Uncertainty over Income Tax Treatments (“IFRIC 23”). IFRIC 23 provides guidance on the accounting for current and deferred tax liabilities and assets in circumstances in which there is uncertainty over income tax treatments. IFRIC 23 is applicable for annual periods beginning on or after January 1, 2019. Earlier application is permitted. Management is currently assessing the impact of the IFRIC 23 on the consolidated financial statements.

| Page 23 |

RELATED PARTY TRANSACTIONS

The Company’s related parties include the Operator of the GK Mine, Dermot Desmond, Bottin (a corporation controlled by Dermot Desmond), key management and their close family members, and the Company’s directors. Dermot Desmond, indirectly through Bottin, is a beneficial owner of greater than 10% of the Company’s shares. Kennady Diamonds Inc. (“Kennady Diamonds”) is also a related party since the Company and Kennady Diamonds have a common member of key management. International Investment and Underwriting (“IIU”) is also a related party since it is controlled by Mr. Dermot Desmond.

Related party transactions are recorded at their exchange amount, being the amount agreed to by the parties.