Exhibit 99.2

Consolidated Financial Statements

(Expressed in thousands of Canadian Dollars)

MOUNTAIN PROVINCE

DIAMONDS INC.

As at and for the years ended December 31, 2021 and 2020

CONTENTS |

Page | |

| Responsibility for Consolidated Financial Statements |

3 | |

| Management’s Report on Internal Controls Over Financial Reporting |

4 | |

| Report of Independent Registered Public Accounting Firm |

5 - 6 | |

| Report of Independent Registered Public Accounting Firm |

7 - 8 | |

| Consolidated Balance Sheets |

9 | |

| Consolidated Statements of Comprehensive Income (Loss) |

10 | |

| Consolidated Statements of Equity |

11 | |

| Consolidated Statements of Cash Flows |

12 | |

| Notes to the Consolidated Financial Statements |

13 – 46 | |

| Page | 2 |

| “Mark Wall” |

“Steven Thomas” | |

| Mark Wall |

Steven Thomas | |

| President and Chief Executive Officer |

VP Finance and Chief Financial Officer | |

| Toronto, Canada |

||

| March 28, 2022 |

||

| Page | 3 |

| Page | 4 |

| Page | 5 |

| • | evaluating foreign exchange rates by comparing them to third party estimates |

| • | evaluating the discount rate used by comparing to a discount rate that that was independently developed using third party sources and data for comparable entities |

| Page | 6 |

| Page | 7 |

| Page | 8 |

December 31, |

December 31, | |||||||||||

Notes |

2021 |

2020 | ||||||||||

| ASSETS |

||||||||||||

| Current assets |

||||||||||||

| Cash |

$ |

$ | |

|||||||||

| Amounts receivable |

5 |

|||||||||||

| Prepaid expenses and other |

||||||||||||

| Derivative assets |

14 |

|||||||||||

| Other Assets |

10 |

- |

||||||||||

| Inventories |

6 |

|||||||||||

| Restricted cash |

15 |

|||||||||||

| Reclamation deposit |

||||||||||||

| Derivative assets |

14 |

- |

||||||||||

| Property, plant and equipment |

7 |

|||||||||||

| Total assets |

$ |

$ | |

|||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||||

| Current liabilities |

||||||||||||

| Accounts payable and accrued liabilities |

15 |

$ |

$ | |||||||||

| Dunebridge revolving credit facility |

10 & 16 |

- |

||||||||||

| Decommissioning and restoration liability |

8 |

|||||||||||

| Lease obligations |

||||||||||||

| Secured notes payable |

9 |

- |

||||||||||

| Secured notes payable |

9 |

- |

||||||||||

| Lease obligations |

||||||||||||

| Decommissioning and restoration liability |

8 |

|||||||||||

| Deferred income tax liabilities |

|

17 |

|

|

|

|

|

|

- |

| ||

| Shareholders’ equity: |

||||||||||||

| Share capital |

12 |

|||||||||||

| Share-based payments reserve |

12 |

|||||||||||

| Deficit |

( |

) |

( |

) | ||||||||

| Accumulated other comprehensive income |

||||||||||||

| Total shareholders’ equity |

||||||||||||

| Total liabilities and shareholders’ equity |

$ |

$ | |

|||||||||

| Going concern |

1 |

|||||||||||

| Commitments |

15 & |

|||||||||||

| Subequent events |

1, 10, 12, 14 & 20 |

|||||||||||

| “Ken Robertson” |

“ Jonathan Comerford ” | |

| Director |

Director |

| Page | 9 |

Year ended |

Year ended | |||||||||

Notes |

December 31, 2021 |

December 31, 2020 | ||||||||

Sales |

$ |

$ | ||||||||

Cost of sales: |

||||||||||

Production costs |

||||||||||

Cost of acquired diamonds |

||||||||||

Depreciation and depletion |

||||||||||

Earnings (loss) from mine operations |

( |

) | ||||||||

Impairment (reversal) loss on property, plant and equipment |

7 |

( |

) |

|||||||

Exploration and evaluation expenses |

||||||||||

Selling, general and administrative expenses |

13 |

|||||||||

Operating income (loss) |

( |

) | ||||||||

Net finance expenses |

11 |

( |

) |

( |

) | |||||

Other Income |

- | |||||||||

Derivative ( losses) gains |

14 |

( |

) |

|||||||

Foreign exchange gains |

||||||||||

Income (loss) before taxes |

( |

) | ||||||||

Deferred income taxes |

( |

) |

||||||||

Net income (loss) for the year |

$ |

$ | ( |

) | ||||||

Total comprehensive income (loss) for the year |

$ |

$ | ( |

) | ||||||

Basic and diluted earnings (loss) per share |

12(iv) |

$ |

$ | ( |

) | |||||

Basic weighted average number of shares outstanding |

||||||||||

Diluted weighted average number of shares outstanding |

||||||||||

| Page | 10 |

Notes |

Number of shares |

Share capital |

Share-based payments reserve |

Deficit |

Accumulated other comprehensive income |

Total |

||||||||||||||||||||

| Balance, January 1, 2020 |

$ | $ | |

$ | ( |

) | $ | |

$ | |

||||||||||||||||

| Net loss for the year |

- |

( |

) | ( |

) | |||||||||||||||||||||

| Share-based payment |

11(iii) |

- |

||||||||||||||||||||||||

| Issuance of common shares – restricted share units |

( |

) | ||||||||||||||||||||||||

| Balance, December 31, 2020 |

$ | |

$ | |

$ | ( |

) | $ | |

$ | |

|||||||||||||||

| Net income for the year |

- |

|||||||||||||||||||||||||

| Share-based payment |

11(iii) |

- |

||||||||||||||||||||||||

| Issuance of common shares – restricted share units |

( |

) | ||||||||||||||||||||||||

| Balance, December 31, 2021 |

$ |

$ |

$ |

( |

$ |

$ |

||||||||||||||||||||

| Page | 11 |

Year ended |

Year ended |

|||||||||

Notes |

December 31, 2021 |

December 31, 2020 |

||||||||

| Cash provided by (used in): |

||||||||||

| Operating activities: |

||||||||||

| Net income (loss) for the year |

|

|

|

$ |

$ | ( |

) | |||

| |

|

|

||||||||

| Adjustments: |

|

|

|

|||||||

| |

|

|

||||||||

| Net finance expenses |

|

|

|

|||||||

| |

|

|

||||||||

| Depreciation and depletion |

|

|

|

|||||||

| Premium paid on foreign curency put option |

|

|

|

|

( |

|

|

|

| |

| |

|

|

||||||||

| Impairment (reversal) loss on property, plant and equipment |

|

|

|

( |

||||||

| |

|

|

||||||||

| Share-based payment expense |

|

|

|

|||||||

| |

|

|

||||||||

| Derivative losses (gains) |

|

|

|

( |

) | |||||

| |

|

|

||||||||

| Foreign exchange gains |

|

|

|

( |

( |

) | ||||

| Deferred income taxes |

|

|

|

|

|

|

|

- |

| |

| |

|

|

||||||||

| |

|

|

||||||||

| |

|

|

||||||||

| Changes in non-cash operating working capital: |

|

|

|

|||||||

| |

|

|

||||||||

| Amounts receivable |

|

|

|

( |

||||||

| |

|

|

||||||||

| Prepaid expenses and other |

|

|

|

|

( |

) | ||||

| |

|

|

||||||||

| Inventories |

|

|

|

( |

||||||

| |

|

|

||||||||

| Accounts payable and accrued liabilities |

|

|

|

( |

( |

) | ||||

| |

|

|

||||||||

| |

|

|

||||||||

| Investing activities: |

|

|

|

|||||||

| |

|

|

||||||||

| Restricted cash |

|

|

|

( |

( |

) | ||||

| |

|

|

||||||||

| Interest income |

|

|

|

|||||||

| |

|

|

||||||||

| Purchase of property, plant and equipment |

|

|

|

( |

( |

) | ||||

| |

|

|

( |

( |

) | |||||

| |

|

|

||||||||

| Financing activities: |

|

|

|

|||||||

| |

|

|

||||||||

| Payment of lease liabilities |

|

|

|

( |

( |

) | ||||

| |

|

|

||||||||

| Proceeds from settlement of currency contracts |

|

|

|

|||||||

| |

|

|

||||||||

| Provided by revolving credit facility |

|

|

|

|||||||

| |

|

|

||||||||

| Provided by Dunebridge revolving credit facility |

|

|

|

- |

||||||

| |

|

|

||||||||

| Provided by Dunebridge term facility |

|

|

|

- |

||||||

| |

|

|

||||||||

| Repayment of Dunebridge term facility |

|

|

|

( |

- |

|||||

| |

|

|

||||||||

| Repayment of Dunebridge revolving credit facility |

|

|

|

( |

- |

|||||

| |

|

|

||||||||

| Financing costs |

|

|

|

( |

( |

) | ||||

| |

|

|

( |

|||||||

| |

|

|

||||||||

| Effect of foreign exchange rate changes on cash |

|

|

|

|||||||

| |

|

|

||||||||

| (Decrease) increase in cash |

|

|

|

( |

||||||

| |

|

|

||||||||

| Cash, beginning of year |

|

|

|

|||||||

| |

|

|

||||||||

| Cash, end of year |

|

|

|

$ |

$ | |||||

| Page | 12 |

1. |

NATURE OF OPERATIONS AND GOING CONCERN |

| Page | 13 |

2. |

BASIS OF PRESENTATION |

● |

2435572 Ontario Inc. ( |

● |

2435386 Ontario Inc. ( |

● |

Kennady Diamonds Inc. ( |

3. |

SIGNIFICANT ACCOUNTING POLICIES |

(i) |

Foreign currency |

| Page | 14 |

(ii) |

Share-based payments |

(iii) |

Income taxes and deferred taxes |

| Page | 15 |

(iv) |

Mineral properties and exploration and evaluation costs and development costs |

● |

gathering exploration data through topographical and geological studies; |

● |

exploratory drilling, trenching and sampling; |

● |

determining the volume and grade of the resource; |

● |

test work on geology, metallurgy, mining, geotechnical and environmental; and |

● |

conducting and refining engineering, marketing and financial studies. |

● |

completion of a feasibility study; |

● |

obtaining required permits to construct the mine; |

| Page | 16 |

● |

completion of an evaluation of the financial resources required to construct the mine; |

● |

availability of financial resources necessary to commence development activities to construct the mine; and |

● |

management’s determination that a satisfactory return on investment, in relation to the risks to be assumed, is likely to be obtained. |

(v) |

Impairment of non-financial assets |

(vi) |

Capitalized interest |

(vii) |

Provisions |

| Page | 17 |

(viii) |

Earnings or loss per share |

(ix) |

Revenue recognition |

| Page | 18 |

(x) |

Property, plant and equipment |

| Corporate assets | ||

| Vehicles | ||

| Production and related equipment | ||

| General infrastructure | ||

| Earthmoving equipment | ||

| Mineral properties | ||

| Assets under construction | ||

(xi) |

Inventories |

| Page | 19 |

(xii) |

Capitalized stripping costs |

● |

It is probable that the future economic benefit (improved access to the component of the ore body) associated with the stripping activity will flow to the Company. |

● |

The Company can identify the component of the ore body for which access has been improved. |

● |

The costs relating to the stripping activity associated with that component can be measured reliably. |

(xiii) |

Financial Instruments |

Classification |

|

| Page | 20 |

Asset/Liability |

Classification | |||

| Cash | Amortized cost | |||

| Equity securities | FVTOCI | |||

| Amounts receivable | Amortized cost | |||

| Derivative assets | FVTPL | |||

| Accounts payable and accrued liabilities | Amortized cost | |||

| Dunebridge revolving credit facility | Amortized cost | |||

| Dunebridge term facility | Amortized cost | |||

| Secured notes payable | Amortized cost | |||

| Page | 21 |

(xiv) |

Leases |

(xv) |

Government grants and assistance |

4. |

SIGNIFICANT ACCOUNTING JUDGMENTS, ESTIMATES AND ASSUMPTIONS |

| Page | 22 |

i) |

Significant accounting estimates and assumptions |

| Page | 23 |

5. |

AMOUNTS RECEIVABLE |

| December 31, 2021 |

December 31, 2020 |

|||||||

| GST/HST receivable |

$ |

$ | |

|||||

| Other receivable |

||||||||

| Total |

$ |

$ | |

|||||

6. |

INVENTORIES |

| December 31, 2021 |

December 31, 2020 |

|||||||

| Ore stockpile |

$ |

$ | |

|||||

| Rough diamonds |

||||||||

| Supplies inventory |

||||||||

| Total |

$ |

$ | ||||||

| Page | 24 |

7. |

PROPERTY, PLANT AND EQUIPMENT |

Property, plant and equipment GK |

Assets under construction GK |

Property, plant and equipment KNP |

Exploration and evaluation assets KNP |

Assets under construction KNP |

Total |

|||||||||||||||||||

Cost |

||||||||||||||||||||||||

At January 1, 2020 |

$ | |

$ | |

$ | |

$ | |

$ | |

$ | |

||||||||||||

Decommissioning and restoration adjustment |

||||||||||||||||||||||||

Additions/transfers* |

||||||||||||||||||||||||

At December 31, 2020 |

||||||||||||||||||||||||

Decommissioning and restoration adjustment |

||||||||||||||||||||||||

Additions/transfers* |

||||||||||||||||||||||||

Disposals |

- |

- |

( |

) | - |

- |

( |

) | ||||||||||||||||

At December 31, 2021 |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||

Accumulated depreciation |

||||||||||||||||||||||||

At January 1, 2020 |

$ | ( |

) | $ | $ | ( |

) | $ | $ | $ | ( |

) | ||||||||||||

Depreciation and depletion** |

( |

) | - |

( |

) | - |

- |

( |

) | |||||||||||||||

Impairment loss |

( |

) | ( |

) | ||||||||||||||||||||

At December 31, 2020 |

( |

) | ( |

) | ( |

) | ||||||||||||||||||

Depreciation and depletion** |

( |

) | ( |

) | ( |

) | ||||||||||||||||||

Disposals |

- |

- |

- |

- |

||||||||||||||||||||

Impairment reversal*** |

- | - | - | - | ||||||||||||||||||||

At December 31, 2021 |

$ |

( |

) |

$ |

$ |

$ |

$ |

$ |

( |

) | ||||||||||||||

Carrying amounts |

||||||||||||||||||||||||

At December 31, 2020 |

$ |

$ |

$ |

$ |

$ |

$ |

||||||||||||||||||

At December 31, 2021 |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||

i) |

Fiscal 2021 – Impairment reversal of GK mine CGU |

| Page | 25 |

● |

estimated long-term diamond prices of US$ |

● |

forward U.S. foreign exchange rates between |

● |

proven and probable mineral reserves and converted resources of ; and |

● |

real discount rate of |

ii) |

Fiscal 2020 – Impairment at GK mine CGU |

8. |

DECOMMISSIONING AND RESTORATION LIABILITY |

December 31, 2021 |

December 31, 2020 |

|||||||

Expected undiscounted cash flows |

$ |

$ | |

|||||

Discount rate |

||||||||

Inflation rate |

||||||||

Periods |

||||||||

December 31, 2021 |

December 31, 2020 |

|||||||

Expected undiscounted cash flows |

$ |

$ | |

|||||

Discount rate |

||||||||

Inflation rate |

||||||||

Periods |

| Page | 26 |

GK Mine |

KNP |

Total |

||||||||||

Balance, at January 1, 2020 |

$ |

$ |

$ |

|||||||||

Change in estimate of discounted cash flows |

||||||||||||

Accretion recorded during the year |

||||||||||||

Balance, at December 31, 2020 |

$ |

$ |

$ |

|||||||||

Less: current portion of decommissioning and restoration liability |

||||||||||||

Non-current decommissioning and restoration liability, at December 31, 2020 |

$ |

$ |

$ |

|||||||||

Change in estimate of discounted cash flows |

||||||||||||

Accretion recorded during the year |

||||||||||||

Balance, at December 31, 2021 |

$ |

$ |

$ |

|||||||||

Less: current portion of decommissioning and restoration liability |

||||||||||||

Non-current decommissioning and restoration liability, at December 31, 2021 |

$ |

$ |

$ |

|||||||||

9. |

SECURED NOTES PAYABLE |

December 31, 2021 |

December 31, 2020 |

|||||||

Total outstanding secured notes payable |

$ |

$ | |

|||||

Less: unamortized deferred transaction costs and issuance discount |

( |

) |

( |

) | ||||

Total secured notes payable |

$ |

$ | |

|||||

| Page | 27 |

10. |

DUNEBRIDGE REVOLVING CREDIT FACILITY AND DUNEBRIDGE TERM FACILITY |

| Page | 28 |

11. |

NET FINANCE EXPENSE |

| |

Year ended December 31, 2021 |

|

|

Year ended December 31, 2020 |

| |||

| Interest income |

$ |

$ | |

|||||

| Accretion expense on decommissioning and restoration liability |

( |

) |

( |

) | ||||

| Interest expense |

( |

) |

( |

) | ||||

| Amortization of deferred financing costs |

( |

) |

( |

) | ||||

| Other finance costs* |

( |

) |

( |

) | ||||

$ |

( |

) |

$ | ( |

) | |||

| Page | 29 |

12. |

SHAREHOLDERS’ EQUITY |

i. |

Authorized share capital |

ii. |

Share capital |

iii. |

Stock options, RSUs, DSUs and share-based payments reserve |

| Year ended December 31, 2021 |

Year ended December 31, 2020 |

|||||||||||||||

Number of options |

|

Weighted average exercise price |

|

|

Number of options |

|

|

Weighted average exercise price |

| |||||||

| Balance at beginning of the year |

$ |

$ | ||||||||||||||

| Granted during the year |

- |

- |

||||||||||||||

| Expired during the year |

( |

( |

) | |||||||||||||

| Forfeited during the year |

( |

( |

) | |||||||||||||

| Balance at end of the year |

$ |

$ | |

|||||||||||||

| Options exercisable at the end of the year |

$ |

$ | |

|||||||||||||

Page |

30 |

| December 31, 2021 |

||||

| |

|

|

|

|

| Exercise price |

$ - $ |

|||

| |

|

|

|

|

| Expected volatility |

% - % |

|||

| |

|

|

|

|

| Expected option life |

||||

| |

|

|

|

|

| Contractual option life |

||||

| |

|

|

|

|

| Expected forfeiture |

none |

|||

| |

|

|

|

|

| Expected dividend yield |

||||

| Risk-free interest rate |

||||

| |

|

|

|

|

| Weighted average fair value per share granted |

$ |

|||

At December 31, 2021 |

||||||||||||||||

Expiry Date |

Black-Scholes Value |

Number of Options |

Number of Exercisable Options |

Exercise Price |

||||||||||||

| February 5, 2022 |

||||||||||||||||

| December 21, 2022 |

||||||||||||||||

| June 30, 2023 |

||||||||||||||||

| December 27, 2024 |

||||||||||||||||

| February 2, 2026 |

||||||||||||||||

| November 15, 2026 |

||||||||||||||||

| $ | |

$ | |

|||||||||||||

| Page | 31 |

December 31, 2021 |

December 31, 2020 | |||||||||||||||

| RSU | Number of units |

Weighted average value grant date fair value |

Number of units | Weighted average value grant date fair value |

||||||||||||

| Balance at beginning of year |

$ |

$ | ||||||||||||||

| Awards and payouts during the period (net): |

||||||||||||||||

| RSUs awarded |

||||||||||||||||

| RSUs settled and common shares issued |

( |

) |

( |

) | ||||||||||||

| RSUs forfeited |

( |

) |

( |

) | ||||||||||||

| Balance at end of the year* |

$ |

$ | ||||||||||||||

Year ended |

Year ended | |||||||

December 31, 2021 |

December 31, 2020 | |||||||

| Expense recognized in the year for share-based payments |

$ |

$ | ||||||

iv. |

Earnings (loss) per share |

Year ended December 31, 2021 |

Year ended December 31, 2020 |

|||||||

Numerator |

||||||||

Net income (loss) for the year |

$ |

$ | ( |

) | ||||

Effect of dilutive securities |

||||||||

$ |

$ | ( |

) | |||||

Denominator |

||||||||

For basic - weighted average number of shares outstanding |

||||||||

Effect of dilutive securities |

||||||||

For diluted - adjusted weighted average number of shares outstanding |

||||||||

Earnings (loss) Per Share |

||||||||

Basic |

$ |

$ | ( |

) | ||||

Diluted |

$ |

$ | ( |

) | ||||

| Page | 32 |

13. |

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES |

Year ended December 31, 2021 |

Year ended December 31, 2020 |

|||||||

Selling and marketing |

$ |

$ | |

|||||

General and administrative: |

||||||||

Consulting fees and payroll |

||||||||

Share-based payment expense |

||||||||

Depreciation |

||||||||

Office and administration |

||||||||

Professional fees |

||||||||

Promotion and investor relations |

||||||||

Director fees |

||||||||

Transfer agent and regulatory fees |

||||||||

Travel |

||||||||

$ |

$ | |

||||||

| Page | 33 |

14. |

DERIVATIVES ASSETS AND LIABILITIES |

December 31, 2021 |

December 31, 2020 |

|||||||

Prepayment option embedded derivatives |

$ |

$ | |

|||||

Currency derivative contract |

||||||||

Current portion of embedded derivatives |

||||||||

Total |

$ |

$ | |

|||||

| Page | 34 |

Year ended |

Year ended | |||||||

December 31, 2021 |

December 31, 2020 | |||||||

Gain on currency derivative contract |

$ |

$ | ||||||

Loss on prepayment option embedded derivative |

( |

) |

( |

) | ||||

Total |

$ |

( |

) |

$ | ||||

15. |

FINANCIAL INSTRUMENTS |

Carrying amount |

Fair value |

|||||||||||||||||||||||||||||||||

December 31, 2021 |

Assets at amortized cost |

Fair value through profit and loss |

Liabilities at amortized cost |

Total |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||||||||||||||||

Financial assets measured at fair value |

||||||||||||||||||||||||||||||||||

Derivative assets |

$ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||||||||||

Financial assets not measured at fair value |

||||||||||||||||||||||||||||||||||

Cash |

$ | $ | $ | $ | ||||||||||||||||||||||||||||||

Restricted cash |

4 | 4 | ||||||||||||||||||||||||||||||||

Amounts receivable |

||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||||||||||

Finacial liabilities not measured at fair value |

||||||||||||||||||||||||||||||||||

Accounts payable and accrued liabilities |

$ | $ | $ | $ | ||||||||||||||||||||||||||||||

Secured notes payable |

||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | |

||||||||||||||||||||||||||||||

| Page | 35 |

Carrying amount |

Fair value |

|||||||||||||||||||||||||||||||||

December 31, 2020 |

Assets at amortized cost |

Fair value through profit and loss |

Liabilities at amortized cost |

Total |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||||||||||||||||

Financial assets measured at fair value |

||||||||||||||||||||||||||||||||||

Derivative assets |

$ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||||||||||

Financial assets not measured at fair value |

||||||||||||||||||||||||||||||||||

Cash |

$ | $ | $ | $ | ||||||||||||||||||||||||||||||

Restricted cash |

||||||||||||||||||||||||||||||||||

Amounts receivable |

||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||||||||||

Financial liabilities not measured at fair value |

||||||||||||||||||||||||||||||||||

Accounts payable and accrued liabilities |

$ | $ | $ | $ | ||||||||||||||||||||||||||||||

Dunebridge revolving credit facility |

||||||||||||||||||||||||||||||||||

Secured notes payable |

||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | |

||||||||||||||||||||||||||||||

| Page | 36 |

Less than |

1 to 3 |

4 to 5 |

After 5 |

|||||||||||||||||

1 Year |

Years |

Years |

Years |

Total |

||||||||||||||||

Gahcho Kué Diamond Mine commitments |

$ | |

$ | $ | $ | $ |

||||||||||||||

Gahcho Kué Diamond Mine decommissioning fund |

||||||||||||||||||||

Notes payable - Principal |

||||||||||||||||||||

Notes payable - Interest |

||||||||||||||||||||

$ |

$ |

$ | $ | $ |

||||||||||||||||

| Page | 37 |

December 31, |

December 31, | |||||||

2021 |

2020 | |||||||

Cash |

$ | |

$ | |

||||

Derivative assets |

||||||||

Accounts payable and accrued liabilities |

( |

) | ( |

) | ||||

Dunebridge revolving credit facility |

( |

) | ||||||

Secured notes payable |

( |

) | ( |

) | ||||

Total |

$ |

( |

) |

$ |

( |

) | ||

16. |

RELATED PARTIES |

| Page | 38 |

| Page | 39 |

December 31, |

December 31, | |||||||

2021 |

2020 | |||||||

Payable De Beers Canada Inc. as the operator of the GK Mine* |

$ |

$ | |

|||||

Payable to De Beers Canada Inc. for interest on letters of credit |

||||||||

Revolving credit facility with Dunebridge Worldwide Ltd.** |

- |

|||||||

Payable to key management personnel |

||||||||

| *included | in accounts payable and accrued liabilities |

| **does | not include $ |

| Page | 40 |

Year ended |

Year ended | |||||||

December 31, 2021 |

December 31, 2020 | |||||||

The total of the transactions: |

||||||||

International Investment and Underwriting |

$ |

$ | |

|||||

Remuneration to key management personnel |

||||||||

Upside revenue on diamonds sold to Dunebridge Worldwide Ltd. |

||||||||

Diamonds sold to Dunebridge Worldwide Ltd. |

||||||||

Diamonds sold to De Beers Canada Inc. |

||||||||

Diamonds purchased from De Beers Canada Inc. |

||||||||

Finance costs incurred from De Beers Canada Inc. |

||||||||

Finance costs incurred from Dunebridge Worldwide Ltd. |

||||||||

Assets purchased from De Beers Canada Inc. |

||||||||

Management fee charged by the Operator of the GK Mine |

||||||||

Year ended |

Year ended | |||||||

December 31, 2021 |

December 31, 2020 | |||||||

Consulting fees, payroll, director fees, bonus and other short-term benefits |

$ |

$ | |

|||||

Share-based payments |

||||||||

$ |

$ | |||||||

| Page | 41 |

17. |

INCOME TAXES |

December 31, 2021 |

December 31, 2020 | |||||||

Income (loss) before income taxes |

$ |

$ | ( |

|||||

Tax expense calculated using statutory rates |

( |

) | ||||||

Expenses not deductible (earnings not taxable) |

( |

) | ||||||

Change in tax benefits not recognized |

( |

) |

||||||

Deferred mining taxes |

||||||||

Deferred income tax expenses |

$ |

$ | ||||||

| Page | 42 |

December 31, 2021 |

December 31, 2020 |

|||||||

Deferred tax liabilities |

||||||||

Inventory |

$ |

( |

$ ( |

|||||

Property, plant & equipment |

( |

( |

||||||

Derivative assets and debt |

( |

( |

||||||

Total deferred tax liabilities |

( |

( |

||||||

Deferred tax asset-tax losses |

||||||||

Net deferred taxes |

$ ( |

$ |

||||||

December 31, 2021 |

December 31, 2020 | |||||||

Property, plant and equipment |

$ |

$ | |

|||||

Decommissioning and restoration liability |

||||||||

Income tax benefit of deferred |

||||||||

Capital losses |

||||||||

Non-capital losses, expiring 2034 to 2041 |

||||||||

Share issuance cost |

||||||||

$ |

$ | |

||||||

18. |

CAPITAL MANAGEMENT |

| Page | 43 |

December 31, |

December 31, | |||||||

2021 |

2020 | |||||||

Secured notes payable |

$ |

$ |

||||||

Dunebridge revolving credit facility |

||||||||

Share capital |

||||||||

Share-based payments reserve |

||||||||

Deficit |

( |

( |

) | |||||

$ |

$ |

|||||||

| Page | 44 |

19. |

SEGMENTED REPORTING |

GK Mine |

KNP |

Total |

||||||||||

| Sales |

$ | |

$ | $ |

||||||||

| Cost of sales: |

||||||||||||

| Production costs |

||||||||||||

| Cost of acquired diamonds |

||||||||||||

| Depreciation and depletion |

||||||||||||

| Earnings from mine operations |

||||||||||||

| Impairment reversal on property, plant and equipment |

( |

) | ( |

) | ||||||||

| |

|

|

| |||||||||

| Exploration and evaluation expenses |

||||||||||||

| Selling, general and administrative expenses |

||||||||||||

| Operating income (loss) |

( |

) | ||||||||||

| Net finance expenses |

( |

) | ( |

) | ( |

) | ||||||

| Other income |

||||||||||||

| Derivative losses |

( |

) | ( |

) | ||||||||

| Foreign exchange gains |

||||||||||||

| |

|

|

| |||||||||

| Net |

$ | |

$ | ( |

) | $ |

||||||

| Total assets |

$ | |

$ | $ |

||||||||

| Total |

$ | |

$ | |

$ |

|||||||

| Page | 45 |

GK Mine |

KNP |

Total |

||||||||||

| Sales |

$ |

$ |

$ |

|||||||||

| Cost of sales: |

||||||||||||

| Production costs |

||||||||||||

| Cost of acquired diamonds |

||||||||||||

| Depreciation and depletion |

||||||||||||

| Loss from mine operations |

( |

( |

||||||||||

| Impairment loss on property, plant and equipment |

- |

|||||||||||

| Exploration and evaluation expenses |

||||||||||||

| Selling, general and administrative expenses |

||||||||||||

| Operating loss |

( |

( |

( |

|||||||||

| Net finance expenses |

( |

( |

( |

|||||||||

| Derivative gains |

||||||||||||

| Foreign exchange gains |

||||||||||||

| Net loss before taxes |

$ ( |

$ ( |

$ ( |

|||||||||

| Total assets |

$ |

$ |

$ |

|||||||||

| Total liabilities |

$ |

$ |

$ |

|||||||||

20. |

SUBSEQUENT EVENTS |

Page |

46 |

| TABLE OF CONTENTS |

Page | |

| Fourth Quarter and Year End 2021 Highlights |

3 | |

| Company Overview |

4 | |

| Gahcho Kué Diamond Mine |

5 | |

| 2022 Production Outlook |

7 | |

| Gahcho Kué Exploration |

8 | |

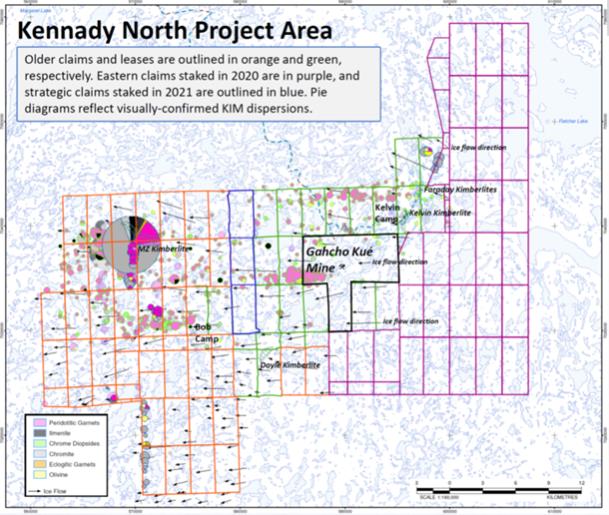

| Kennady North Project Exploration |

9 | |

| Results of Operations |

12 | |

| Selected Annual Information |

12 | |

| Summary of Full Year 2021 Financial Results |

12 | |

| Summary of Quarterly Results |

14 | |

| Summary of Fourth Quarter Financial Results |

16 | |

| Income and Mining Taxes |

17 | |

| Financial Position and Liquidity |

18 | |

| Off-Balance Sheet Arrangements |

20 | |

| Financial Instrument Risks |

20 | |

| Significant Accounting Policies Adopted in the Current Period |

22 | |

| Significant Accounting Judgments, Estimates and Assumptions |

22 | |

| Standards and Amendments to Existing Standards |

22 | |

| Related Party Transactions |

22 | |

| Contractual Obligations |

25 | |

| Non-IFRS Measures |

25 | |

| Subsequent Events |

26 | |

| Other Management Discussion and Analysis Requirements |

26 | |

| Disclosure of Outstanding Share Data |

27 | |

| Controls and Procedures |

28 | |

| Cautionary Note Regarding Forward-Looking Statements |

29 | |

● |

During the three months and year ended December 31, 2021, an impairment reversal on property, plant and equipment of $240,593 was recognized compared to an impairment loss on property, plant and equipment of $217,366 for the same periods in 2020. The impairment reversal was a result of an impairment test performed due to changes in market sentiment and long-term diamond prices. |

● |

Earnings from mine operations for the three months ended December 31, 2021, amounted to $31,664 compared to $22,823 for the same period in 2020. Earnings from mine operations for the year ended December 31, 2021, amounted to $113,728 compared to loss from mine operations of $1,485 for the same period in 2020. |

● |

Net income for the three months and year ended December 31, 2021, respectively, was $237,619 and $276,167 or $1.13 and $1.31 earnings per share (basic and diluted) compared to a net loss of $189,166 and $263,429 or $0.90 and $1.25 loss per share (basic and diluted) for the prior comparative periods. Adjusted EBITDA for these periods was $37,091 and $135,314 compared to $37,002 and $51,451 (Adjusted EBITDA is not defined under IFRS and therefore may not be comparable to similar measures presented by other issuers; refer to the Non-IFRS Measures section). Included in the net income for the three months and year ended December 31, 2021 is an impairment reversal of $240,593 compared to an impairment loss of $217,366 for the same periods in 2020. |

● |

Cash at December 31, 2021 was $25,000 with net working capital deficit of $275,691, reflecting secured notes payable, now categorized as current debt. Cash at December 31, 2020 was $35,152 with net working capital of $52,757. |

● |

In the fourth quarter of 2021, the Company sold 809,000 carats and recognized revenue of $85,144 at an average realized value of $105 per carat (US$84) compared to sales in the fourth quarter of 2020 totaling 957,000 carats and recognized revenue of $80,206 at an average realized value of $84 per carat (US$65). Revenue for the year ended December 31, 2021 totaled $298,325 (including direct sales of fancies and specials made to De Beers Canada Inc. and excluding the upside revenue from the Dunebridge Worldwide Ltd. “Dunebridge” Agreement) at an average realized value of $94 per carat (US$75) for 3,158,000 carats, compared to revenue for the year ended December 31, 2020 of $226,993 at an average realized value of $68 per carat (US$51) for 3,329,000 carats. The fourth quarter of 2021 revenue does not include any upside profit related to the Dunebridge diamonds (see below). |

● |

In the year ended December 31, 2021, all diamonds sold to Dunebridge in 2020 were sold by Dunebridge to third parties. Included in diamond sales of $308,723 for the year ended December 31, 2021, is $10,399 of upside proceeds related to this Dunebridge agreement (See related party transactions section below). |

● |

Cash costs of production, including capitalized stripping costs, for the three months ended December 31, 2021 were $111 per tonne of ore treated, and $60 per carat recovered compared to $116 per tonne of ore treated, and $56 per carat recovered for the same period in 2020. Cash costs of production, including capitalized stripping costs, for the year ended December 31, 2021 were $110 per tonne of ore treated, and $55 per carat recovered compared to $103 per tonne of ore treated and $51 per carat recovered for the same period in 2020 (cash costs of production per tonne and per carat are not defined under IFRS and may not be comparable to similar measures presented by other issuers; refer to the Non-IFRS Measures section). The costs per tonne for the year ended December 31, 2021 compared to the same period last year have increased mainly due to the effect on tonnes processed from the ongoing impact of COVID-19 and the unplanned operational stand down in February. Also, the Company incurred increased waste stripping costs in the year ended December 31, 2021, compared to the same period in 2020 mainly due in part to the deferral of previously scheduled activities in 2020 as a result of COVID-19. |

● |

Mining of waste and ore combined in the 5034, Hearne and Tuzo open pits for the three months December 31, 2021 was approximately 2,598,000 tonnes, 3,500,000 tonnes and 4,715,000 tonnes, respectively, for a total of 10,813,000 tonnes. This represents a 10% increase in tonnes mined over the comparative period in 2020, driven by improved equipment and labour availability. Ore mined for the three months totaled 1,019,000 tonnes, with approximately 748,000 tonnes of ore stockpile available at period end. For the comparative three months ended December 31, 2020, ore mined totaled 840,000 tonnes, with approximately 269,000 tonnes of ore stockpile. Mining performance also improved sequentially relative to the prior quarter, benefitting from improved equipment and labour availability, due in part to fewer incidences of extreme weather. |

● |

Mining of waste and ore combined in the 5034, Hearne and Tuzo open pits for the year ended December 31, 2021 was approximately 13,895,000 tonnes, 11,174,000 tonnes and 10,378,000 tonnes, respectively, for a total of 35,447,000 tonnes. This represents a 1% decrease in tonnes mined over the comparative period in 2020, mainly due to the unplanned operational stand-down in February to limit the spread of COVID-19. Ore mined for the year ended December 31, 2021 totalled 3,561,000 tonnes, with approximately 748,000 tonnes of ore stockpile available at year end. For the comparative year ended December 31, 2020, ore mined totalled 3,287,000 tonnes, with approximately 269,000 tonnes of ore stockpile. |

● |

For the year ended December 31, 2021, the GK Mine treated approximately 3,083,000 tonnes of ore and recovered approximately 6,229,000 carats on a 100% basis for an average recovered grade of approximately 2.02 carats per tonne (“cpt”). For the comparative year ended December 31, 2020, the GK Mine treated approximately 3,246,000 tonnes of ore and recovered approximately 6,518,000 carats on a 100% basis for an average recovered grade of approximately 2.01 cpt. |

Three months ended December 31, 2021 |

Three months ended December 31, 2020 |

Year ended December 31, 2021 |

Year ended December 31, 2020 |

|||||||||||||||

| GK operating data |

||||||||||||||||||

| Mining |

||||||||||||||||||

| *Ore tonnes mined |

kilo tonnes | 1,019 | 840 | 3,561 | 3,287 | |||||||||||||

| *Waste tonnes mined |

kilo tonnes | 9,794 | 8,956 | 31,886 | 32,583 | |||||||||||||

| *Total tonnes mined |

kilo tonnes | 10,813 | 9,796 | 35,447 | 35,870 | |||||||||||||

| *Ore in stockpile |

kilo tonnes | 748 | 269 | 748 | 269 | |||||||||||||

| Processing |

||||||||||||||||||

| *Ore tonnes treated |

kilo tonnes | 814 | 736 | 3,083 | 3,246 | |||||||||||||

| *Average plant throughput |

tonnes per day | 8,848 | 8,270 | 8,447 | 8,869 | |||||||||||||

| *Average plant grade |

carats per tonne | 1.86 | 2.07 | 2.02 | 2.01 | |||||||||||||

| *Diamonds recovered |

000’s carats | 1,511 | 1,521 | 6,229 | 6,518 | |||||||||||||

| Approximate diamonds recovered - Mountain Province |

000’s carats | 740 | 745 | 3,052 | 3,194 | |||||||||||||

| Cash costs of production per tonne of ore, net of capitalized stripping** |

$ | 77 | 89 | 89 | 86 | |||||||||||||

| Cash costs of production per tonne of ore, including capitalized stripping** |

$ | 111 | 116 | 110 | 103 | |||||||||||||

| Cash costs of production per carat recovered, net of capitalized stripping** |

$ | 42 | 43 | 44 | 43 | |||||||||||||

| Cash costs of production per carat recovered, including capitalized stripping** |

$ | 60 | 56 | 55 | 51 | |||||||||||||

| Sales |

||||||||||||||||||

| Approximate diamonds sold - Mountain Province*** |

000’s carats | 809 | 957 | 3,158 | 3,329 | |||||||||||||

| Average diamond sales price per carat |

US | $ | 84 | $ | 65 | $ | 75 | $ | 51 | |||||||||

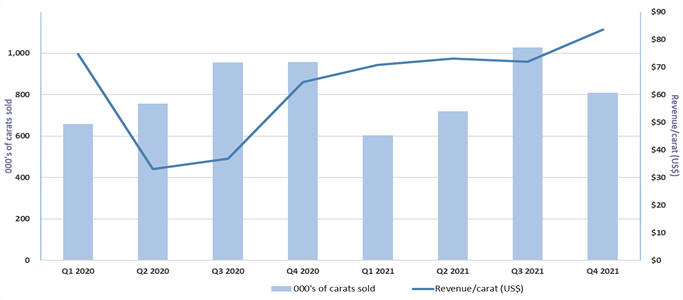

000’s of carats sold |

Revenue (US$ 000’s) |

Revenue/ carat (US$) |

||||||||||

| Q1 |

603 |

$ |

42,725 |

$ |

71 |

|||||||

| Q2 |

719 |

$ |

52,570 |

$ |

73 |

|||||||

| Q3 |

1,027 |

$ |

74,094 |

$ |

72 |

|||||||

| Q4 |

809 |

$ |

67,623 |

$ |

84 |

|||||||

| Total |

3,158 |

$ |

237,012 |

$ |

75 |

|||||||

000’s of carats sold |

Revenue (US$ 000’s) |

Revenue/ carat (US$) |

||||||||||

| Q1 |

659 |

$ |

49,220 |

$ |

75 |

|||||||

| Q2 |

757 |

$ |

25,003 |

$ |

33 |

|||||||

| Q3 |

956 |

$ |

35,309 |

$ |

37 |

|||||||

| Q4 |

957 |

$ |

61,746 |

$ |

65 |

|||||||

| Total |

3,329 |

$ |

171,278 |

$ |

51 |

|||||||

| • | 35 – 40 million total tonnes mined (ore and waste) |

| • | 3.75 – 4.30 million ore tonnes mined |

| • | 3.35 – 3.60 million ore tonnes treated |

| • | 6.2 – 6.4 million carats recovered |

| • | Production costs of $131—$137 per tonne treated |

| • | Production costs of $71 – $76 per carat recovered |

| • | Sustaining Capital Expenditure of approximately $11 million |

| Resource |

Classification | Tonnes (Mt) | Carats (Mct) | Grade (cpt) | Value (US$/ct) | |||||

| Kelvin |

Indicated | 8.50 | 13.62 | 1.60 | $63 | |||||

| Faraday 2 |

Inferred | 2.07 | 5.45 | 2.63 | $140 | |||||

| Faraday 1-3 |

Inferred | 1.87 | 1.90 | 1.04 | $75 |

| (1) | Mineral Resources are reported at a bottom cut-off of 1.0mm. Incidental diamonds are not incorporated into grade calculations. |

| (2) | Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. |

December 31 |

December 31 |

December 31 |

||||||||||

| Expressed in thousands of Canadian dollars |

2021 | 2020 | 2019 | |||||||||

$ |

$ |

$ |

||||||||||

| Sales |

308,723 | 226,993 | 276,334 | |||||||||

| Earnings (loss) from mine operations |

113,728 | (1,485 | ) | 24,843 | ||||||||

| Impairment reversal (loss) on property, plant and equipment |

240,593 | (217,366 | ) | (115,753 | ) | |||||||

| Operating (loss) income |

334,916 | (235,811 | ) | (112,852 | ) | |||||||

| Net Income (loss) for the year |

276,167 | (263,429 | ) | (128,758 | ) | |||||||

| Basic and diluted earnings (loss) per share |

1.31 | (1.25 | ) | (0.61 | ) | |||||||

| Cash flow provided by operating activities |

112,578 | 51,748 | 79,359 | |||||||||

| Cash flow provided by (used in) investing activities |

(53,743 | ) | (53,686 | ) | (27,574 | ) | ||||||

| Cash flow provided by (used in) financing activities |

(69,794 | ) | 2,009 | (47,479 | ) | |||||||

| Balance Sheet |

||||||||||||

| Total assets |

877,497 | 595,329 | 822,695 | |||||||||

| Total financial liabilities |

526,726 | 521,629 | 486,549 | |||||||||

| Total cash dividends declared per common share |

- |

- |

- |

|||||||||

Three months ended |

||||||||||||||||||||

December 31 2021 |

September 30 2021 |

June 30 2021 |

March 31 2021 |

|||||||||||||||||

| Earnings and Cash Flow |

||||||||||||||||||||

| Number of sales |

2 | 2 | 2 | 2 | ||||||||||||||||

| Sales |

$ | 85,144 | 94,208 | 75,147 | 54,224 | |||||||||||||||

| Impairment reversal on property, plant and equipment |

$ | 240,593 | - | - | - | |||||||||||||||

| Operating income |

$ | 265,491 | 30,137 | 28,756 | 10,532 | |||||||||||||||

| Net income for the period |

$ | 237,619 | 8,764 | 22,472 | 7,312 | |||||||||||||||

| Basic and diluted earnings per share |

$ | 1.13 | 0.04 | 0.11 | 0.03 | |||||||||||||||

| Adjusted EBITDA* |

$ | 37,091 | 41,171 | 37,874 | 19,178 | |||||||||||||||

| Cash flow provided by (used in) operating activities |

$ | 48,012 | 51,905 | 22,465 | (9,804 | ) | ||||||||||||||

| Cash flow provided by (used in) investing activities |

$ | (26,476 | ) | (8,849 | ) | (7,803 | ) | (10,615 | ) | |||||||||||

| Cash flow provided by (used in) financing activities |

$ | (41,014 | ) | (33,545 | ) | 5,471 | (706 | ) | ||||||||||||

| Balance Sheet |

||||||||||||||||||||

| Total assets |

$ | 877,497 | 624,288 | 632,728 | 613,723 | |||||||||||||||

Three months ended |

||||||||||||||||||||

December 31 2020 |

September 30 2020 |

June 30 2020 |

March 31 2020 |

|||||||||||||||||

| Earnings and Cash Flow |

||||||||||||||||||||

| Number of sales |

2 | 3 | 1 | 2 | ||||||||||||||||

| Sales |

$ | 80,206 | 47,337 | 34,020 | 65,430 | |||||||||||||||

| Impairment loss on property, plant and equipment |

$ | (217,366 | ) | - | - | - | ||||||||||||||

| Operating (loss) income |

$ | (198,643 | ) | (5,712 | ) | (38,958 | ) | 7,502 | ||||||||||||

| Net loss for the period |

$ | (189,166 | ) | (6,532 | ) | (26,762 | ) | (40,969 | ) | |||||||||||

| Basic and diluted loss per share |

$ | (0.90 | ) | (0.03 | ) | (0.13 | ) | (0.19 | ) | |||||||||||

| Adjusted EBITDA* |

$ | 37,220 | 15,300 | (23,894 | ) | 22,825 | ||||||||||||||

| Cash flow provided by (used in) operating activities |

$ | 51,396 | 21,117 | (21,941 | ) | 1,176 | ||||||||||||||

| Cash flow provided by (used in) investing activities |

$ | (22,302 | ) | (15,766 | ) | (10,452 | ) | (5,166 | ) | |||||||||||

| Cash flow provided by (used in) financing activities |

$ | (16,531 | ) | 1,427 | 17,462 | (349 | ) | |||||||||||||

| Balance Sheet |

||||||||||||||||||||

| Total assets |

$ | 595,329 | 793,919 | 795,789 | 842,332 | |||||||||||||||

December 31, 2021 |

December 31, 2020 |

|||||||

| Cash |

$ | 11,968 | $ | 33,703 | ||||

| Derivative assets |

731 | - | ||||||

| Accounts payable and accrued liabilities |

(1,949 | ) | (2,538 | ) | ||||

| Dunebridge revolving credit facility |

- | (31,813 | ) | |||||

| Secured notes payable |

(379,034 | ) | (381,674 | ) | ||||

| Total |

$ |

(368,284 |

) |

$ |

(382,322 |

) | ||

December 31, |

December 31, | |||||||

2021 |

2020 | |||||||

| Payable De Beers Canada Inc. as the operator of the GK Mine* |

$ |

2,732 |

$ | 2,789 | ||||

| Payable to De Beers Canada Inc. for interest on letters of credit |

99 |

550 | ||||||

| Revolving credit facility with Dunebridge Worldwide Ltd.** |

- |

31,813 | ||||||

| Payable to key management personnel |

67 |

158 | ||||||

Year ended |

Year ended | |||||||

December 31, 2021 |

December 31, 2020 | |||||||

| The total of the transactions: |

||||||||

| International Investment and Underwriting |

$ |

120 |

$ | 23 | ||||

| Remuneration to key management personnel |

3,329 |

1,875 | ||||||

| Upside revenue on diamonds sold to Dunebridge Worldwide Ltd. |

10,399 |

- |

||||||

| Diamonds sold to Dunebridge Worldwide Ltd. |

- |

66,671 | ||||||

| Diamonds sold to De Beers Canada Inc. |

10,338 |

12,610 | ||||||

| Diamonds purchased from De Beers Canada Inc. |

14,990 |

11,523 | ||||||

| Finance costs incurred from De Beers Canada Inc. |

135 |

198 | ||||||

| Finance costs incurred from Dunebridge Worldwide Ltd. |

5,882 |

852 | ||||||

| Assets purchased from De Beers Canada Inc. |

- |

42 | ||||||

| Management fee charged by the Operator of the GK Mine |

4,763 |

4,368 | ||||||

Year ended |

Year ended | |||||||

December 31, 2021 |

December 31, 2020 | |||||||

| Consulting fees, payroll, director fees, bonus and other short-term benefits |

$ |

2,982 |

$ | 1,357 | ||||

| Share-based payments |

467 |

541 | ||||||

$ |

3,449 |

$ | 1,898 |

Less than |

1 to 3 |

4 to 5 |

After 5 |

|||||||||||||||||

1 Year |

Years |

Years |

Years |

Total |

||||||||||||||||

| Gahcho Kué Diamond Mine commitments $ |

4,391 | $ | - |

$ | - |

$ | - |

$ |

4,391 |

|||||||||||

| Gahcho Kué Diamond Mine decommissioning fun |

10,000 | 20,000 | - |

- |

30,000 |

|||||||||||||||

| Notes payable - Principal |

379,034 | - |

- |

- |

379,034 |

|||||||||||||||

| Notes payable - Interest |

30,323 | - |

- |

- |

30,323 |

|||||||||||||||

$ |

423,748 |

$ |

20,000 |

$ |

- |

$ |

- |

$ |

443,748 |

|||||||||||

| (in thousands of Canadian dollars, except where otherwise noted) |

Three months ended December 31, 2021 |

|

Three months ended December 31, 2020 |

|

Year ended December 31, 2021 |

|

Year ended December 31, 2020 |

| ||||||||||

| Cost of sales production costs |

$ | 38,025 | 36,552 | 140,099 | 153,679 | |||||||||||||

| Timing differences due to inventory and other non-cash adjustments |

$ | (7,273 | ) | (4,535 | ) | (6,326 | ) | (16,430 | ) | |||||||||

| Cash cost of production of ore processed, net of capitalized stripping |

$ | 30,752 | 32,017 | 133,773 | 137,249 | |||||||||||||

| Cash costs of production of ore processed, including capitalized stripping |

$ | 44,124 | 41,681 | 166,661 | 164,408 | |||||||||||||

| Tonnes processed |

kilo tonnes | 399 | 361 | 1,511 | 1,591 | |||||||||||||

| Carats recovered |

000’s carats | 740 | 745 | 3,052 | 3,194 | |||||||||||||

| Cash costs of production per tonne of ore, net of capitalized stripping |

$ | 77 | 89 | 89 | 86 | |||||||||||||

| Cash costs of production per tonne of ore, including capitalized stripping |

$ | 111 | 116 | 110 | 103 | |||||||||||||

| Cash costs of production per carat recovered, net of capitalized stripping |

$ | 42 | 43 | 44 | 43 | |||||||||||||

| Cash costs of production per carat recovered, including capitalized stripping |

$ | 60 | 56 | 55 | 51 | |||||||||||||

Three months ended |

Three months ended | Year ended |

Year ended | |||||||||||||

December 31, 2021 |

December 31, 2020 | December 31, 2021 |

December 31, 2020 | |||||||||||||

| Net income (loss) for the period |

$ | 237,619 | $ | (189,166 | ) | $ | 276,167 | $ | (263,429 | ) | ||||||

| Add/deduct: |

||||||||||||||||

| Non-cash depreciation and depletion |

10,537 | 16,447 | 39,384 | 63,929 | ||||||||||||

| Impariment (reversal) loss on property, plant and equipment |

(240,593 | ) | 217,366 | (240,593 | ) | 217,366 | ||||||||||

| Share-based payment expense |

172 | 142 | 868 | 983 | ||||||||||||

| Net finance expenses |

9,254 | 9,297 | 40,373 | 39,997 | ||||||||||||

| Derivative gains |

(228 | ) | (177 | ) | (67 | ) | (127 | ) | ||||||||

| Deferred income taxes |

20,720 | - | 20,720 | - | ||||||||||||

| Unrealized foreign exchange gains |

(390 | ) | (16,689 | ) | (1,538 | ) | (7,268 | ) | ||||||||

| Adjusted earnings before interest, taxes, depreciation and depletion and impairment (Adjusted EBITDA) |

$ | 37,091 | $ | 37,220 | $ | 135,314 | $ | 51,451 | ||||||||

| Sales |

85,144 | 80,206 | 308,723 | 226,993 | ||||||||||||

| Adjusted EBITDA margin |

44 | % | 46 | % | 44 | % | 23 | % | ||||||||

◾ |

risk that the COVID-19 pandemic continues and materially impedes operations and/or the ability of the Company to sell and distribute diamonds; |

◾ |

risk of COVID-19 affecting commodity prices and demand for diamond inventory, future sales and increased market volatility; |

◾ |

risk that the production from the mine will not be consistent with the Company’s expectation; |

◾ |

risk that production and operating costs are not within the Company’s estimates; |

◾ |

risk that financing required to manage liquidity can be obtained with acceptable terms; |

◾ |

risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; |

◾ |

results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; mining exploration risks, including risks related to accidents, equipment breakdowns or other unanticipated difficulties with or interruptions in production; |

◾ |

the potential for delays in exploration activities or the completion of studies; |

◾ |

risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses; |

◾ |

risks related to foreign exchange fluctuations, prices of diamonds, and continued growth in demand for laboratory grown diamonds; |

◾ |

risks related to challenges in the diamond market causing the sale of some or all of the diamond inventory to be sold below cost; |

◾ |

risks related to commodity price fluctuations; |

◾ |

risks related to failure of its joint venture partner; |

◾ |

risks relating to complying with the covenants in our revolver credit facility; |

◾ |

development and production risks including and particularly risks for weather conducive to the building and use of the Tibbitt to Contwoyto Winter Road upon which the GK Mine is reliant upon for the cost-effective annual resupply of key inventory including fuel and explosives, the effects of climate change may limit or make impossible the building of the Winter Road; |

◾ |

risks related to environmental regulation, permitting and liability; |

◾ |

risks related to legal challenges to operating permits that are approved and/or issued; |

◾ |

political and regulatory risks associated with mining, exploration and development; |

◾ |

the ability to operate the Company’s GK Mine on an economically profitable basis; |

◾ |

aboriginal rights and title; |

◾ |

failure of plant, equipment, processes and transportation services to operate as anticipated; |

◾ |

possible variations in ore grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, land titles, and social and political developments, and other risks of the mining industry; and |

◾ |

other risks and uncertainties related to the Company’s prospects, properties and business strategy. |