UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________________________

FORM 10-K

| (Mark One) | ||||||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the fiscal year ended December 31 , 2023

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the transition period from to

Commission File Number 001-13459

__________________________________________________________________________

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) | |||||||

(Address of principal executive offices)

(800 ) 345-1100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

At June 30, 2023 , the aggregate market value of the common stock held by non-affiliates of the registrant, based upon the closing price of $149.89 on June 30, 2023 on the New York Stock Exchange, was $5,227,465,462 . There were 32,794,127 shares of the registrant’s common stock outstanding on February 14, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission within 120 days after December 31, 2023, and delivered to stockholders in connection with the registrant’s annual meeting of stockholders, are incorporated by reference into Part III of this Annual Report on Form 10-K.

FORM 10-K

TABLE OF CONTENTS

i

PART I

Forward-Looking Statements

Certain matters discussed in this Annual Report on Form 10-K, in our other filings with the Securities and Exchange Commission (the “SEC”), in our press releases, and in oral statements made with the approval of an executive officer may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, and other non-historical statements, and may be prefaced with words such as “outlook,” “guidance,” “believes,” “expects,” “potential,” “preliminary,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “projects,” “positioned,” “prospects,” “intends,” “plans,” “estimates,” “pending investments,” “anticipates,” or the negative version of these words or other comparable words. Such statements are subject to certain risks and uncertainties, including, among others, the factors discussed under the caption “Item 1A. Risk Factors.” These factors (among others) could affect our financial condition, business activities, results of operations, cash flows, or overall financial performance and cause actual results and business activities to differ materially from historical periods and those presently anticipated and projected. Forward-looking statements speak only as of the date they are made, and we will not undertake and we specifically disclaim any obligation to release publicly the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of events, whether or not anticipated. In that respect, we caution readers not to place undue reliance on any such forward-looking statements.

References throughout this report to “AMG,” “we,” “us,” “our,” the “Company” and similar references refer to Affiliated Managers Group, Inc., unless otherwise stated or the context otherwise requires.

Item 1.Business

AMG is a strategic partner to leading independent investment firms globally. Our strategy is to generate long-term value by investing in a diverse array of high-quality independent partner-owned firms, referred to as “Affiliates,” through a proven partnership approach, and allocating resources across our unique opportunity set to the areas of highest growth and return. With their entrepreneurial, investment-centric cultures and alignment of interests with clients through direct equity ownership by firm principals, independent firms have fundamental competitive advantages in offering unique return streams to the marketplace. Through AMG’s distinctive approach, we enhance these advantages to magnify the long-term success of our Affiliates and actively support their independence. Our innovative model enables each Affiliate’s management team to retain autonomy and significant equity ownership in their firm, while they leverage our strategic capabilities and insight, including growth capital, product strategy and development, capital formation, and incentive alignment and succession planning. As of December 31, 2023, our aggregate assets under management were approximately $673 billion across a diverse range of private markets, liquid alternative, and differentiated long-only investment strategies.

We generate long-term value by investing in new and existing Affiliates, and strategic value-add capabilities through which we can leverage our scale and resources on behalf of our Affiliates, and then by returning excess capital to shareholders, primarily through share repurchases. We are focused on investing in areas of secular growth and long-term client demand, including in private markets, liquid alternatives, Asia, wealth management, and sustainable investing; accordingly, we partner with leading independent investment firms managing differentiated strategies in the aforementioned growth areas.

Through our partnership approach, we hold meaningful equity interests in each of our Affiliates, and typically each Affiliate’s management team retains a significant equity interest in their own firm. Affiliate management equity ownership (along with our long-term ownership) aligns our interests and preserves Affiliate management equity incentives, including the opportunity for Affiliate management to participate directly in the long-term future growth and profitability of their firms.

Our goal in partnering with Affiliates is to be an excellent and engaged partner, and to collaborate with Affiliates to magnify each firm’s long-term success. We take a long-term partnership approach with our Affiliates, which provides stability in facilitating succession planning across generations of Affiliate management principals. We are uniquely able to provide strategic capabilities and expertise across various stages of our Affiliates’ growth. In certain cases, we invest in our Affiliates by providing growth capital or complementing their own marketing resources with our proven product development and distribution capabilities. We also provide succession planning solutions and advice to many of our Affiliates, which can include a degree of liquidity and financial diversification along with incentive alignment for next-generation partners.

1

Our innovative partnership approach enhances our Affiliates’ ability to achieve their long-term strategic objectives while maintaining their independence and autonomy, and therefore, their unique entrepreneurial and investment-centric cultures. We believe that clients recognize these fundamental characteristics of partner-owned firms, as well as the alignment created by direct equity ownership by firm principals, as competitive advantages in achieving client investment goals and objectives. Our investment approach preserves these essential elements of our Affiliates’ success.

Independent firms seeking an institutional partner are attracted to our unique partnership approach and our global reputation as a successful strategic partner to independent investment firms around the world.

We anticipate that the principal owners of independent investment firms will continue to seek access to an evolving range of growth and succession solutions. We will, therefore, continue to have a significant opportunity to invest in additional high-quality firms across the global investment management industry. In addition, we have the opportunity to make additional equity investments in our existing Affiliates, or invest in their growth by providing seed or other growth capital. We are well-positioned to execute upon these investment opportunities through our:

•established process of identifying and cultivating high-quality prospective Affiliates;

•broad industry network and proprietary relationships developed with prospects over many years;

•substantial experience and expertise in structuring and negotiating transactions;

•global reputation as an excellent partner to our Affiliates, having provided innovative solutions for the strategic needs of independent investment firms across three decades; and

•successful engagement with our Affiliates to enhance their long-term prospects, including through product development, distribution, and other business development initiatives.

Investment Management Operations

Our Affiliates provide a diverse range of differentiated return streams through their specialized investment processes. Given their long-term performance records, our Affiliates are recognized as being among the industry’s leaders in their respective investment disciplines. Our Affiliates’ attractive return streams are utilized in client portfolios to address a range of specialized needs for institutional and wealth clients globally; certain Affiliates also provide investment management and customized investment counseling and fiduciary services to high net worth individuals and families and institutional clients.

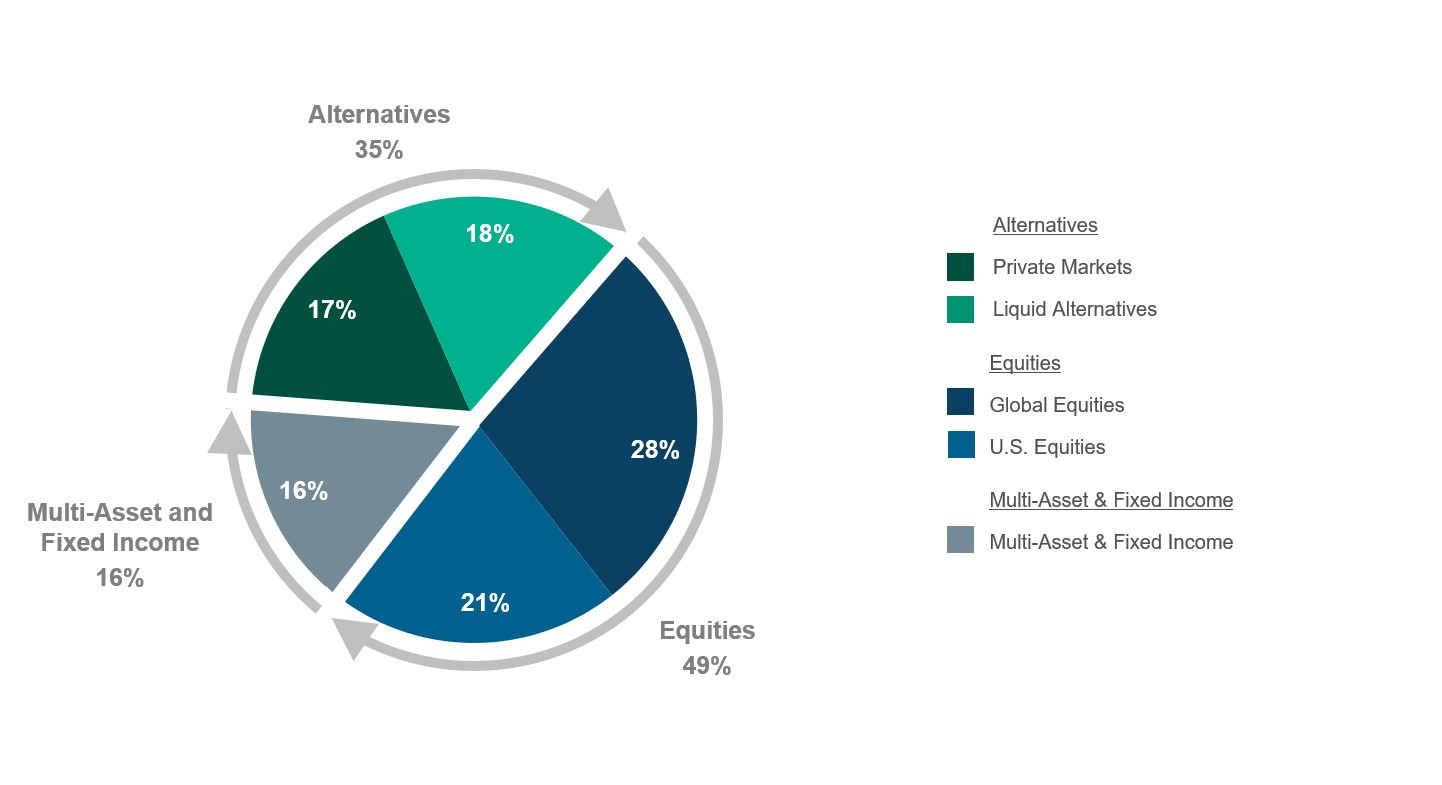

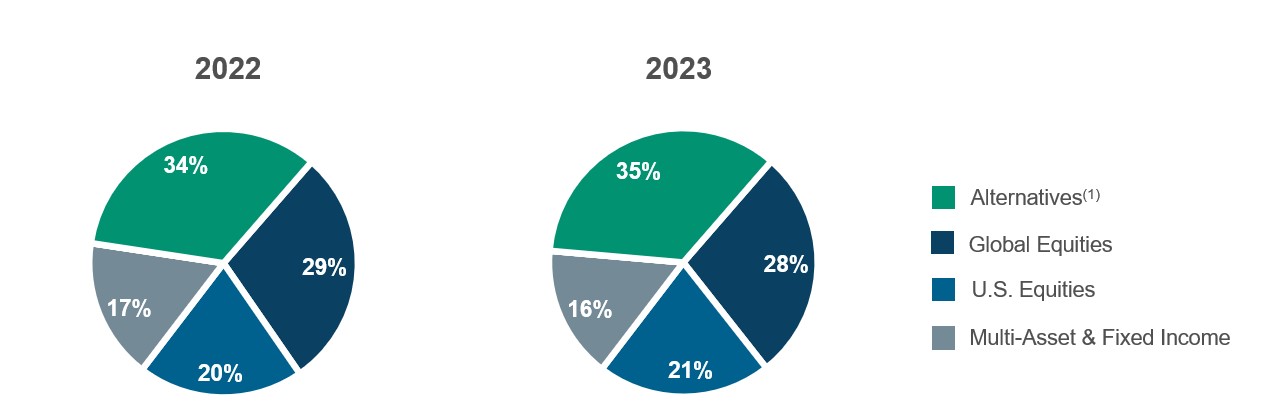

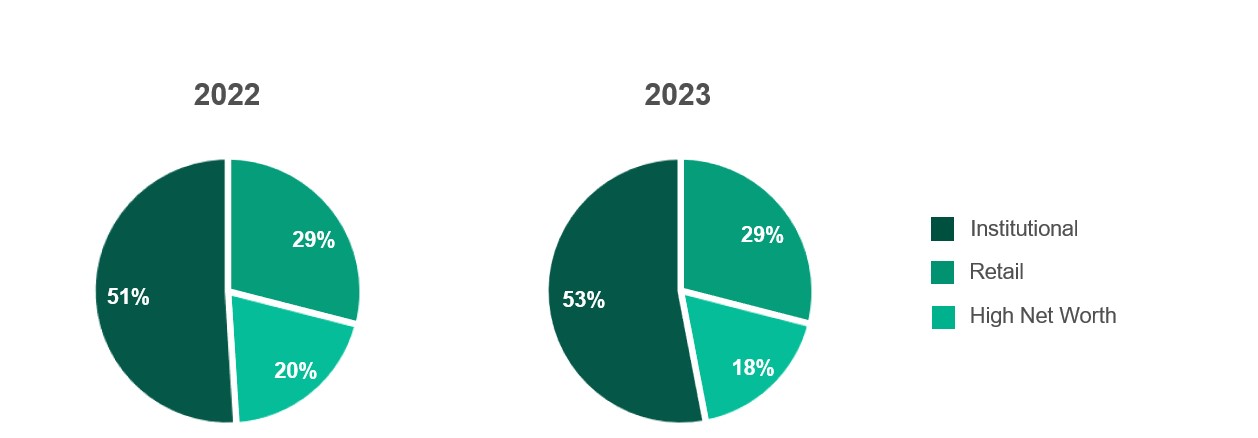

With meaningful earnings contributions from each of private markets, liquid alternatives, and differentiated long-only strategies (which includes global equities, U.S. equities, and multi-asset and fixed income strategies), AMG’s business profile is highly diversified. As of December 31, 2023, our Affiliates managed approximately $673 billion across a broad range of investment styles and geographies, in alternative, equity, and multi-asset and fixed income strategies, as the following chart illustrates.

2

Assets Under Management | ||

| ||

Our Affiliates currently manage assets for investors in more than 50 countries, including all major developed markets. Our Affiliates distribute their investment services and products to institutional and wealth clients through direct sales efforts and established relationships with consultants and intermediaries around the world through their own business development capabilities.

In addition, AMG supports the long-term growth and client diversification of our Affiliates by operating a distribution platform in which each Affiliate may choose to participate. Our distribution capabilities, which provide access to institutional and wealth clients, serve to extend the reach of our Affiliates’ own business development efforts, including strategy, marketing, distribution, and product development, and our Affiliates benefit from the expertise of our senior sales and marketing professionals servicing the U.S., Europe, the UK, the Middle East, Asia, and Australia.

Our Partnership Structure and Relationship with Affiliates

We believe that Affiliate management equity ownership in their firms (along with our long-term partnership) aligns our and our Affiliates’ interests, enhances Affiliate management equity incentives, and preserves the opportunity for Affiliate management to participate directly in the long-term future growth and profitability of their firm. Although the equity structure of each Affiliate investment is tailored to meet the needs of the management equity owners of the particular Affiliate, we typically maintain a meaningful equity interest in the Affiliate, with a significant equity interest retained by Affiliate management principals.

Each of our Affiliates operates through distinct legal entities, which affords us the flexibility to design a separate operating agreement for each Affiliate that reflects customized arrangements with respect to governance, economic participation, equity incentives, and the other terms of our relationship. In each case, the operating agreement provides for a governance structure that gives Affiliate management the authority to manage and operate the business on a day-to-day basis. The operating agreement also reflects the specific terms of our economic participation in the Affiliate, which, in each case, uses a “structured partnership interest” to ensure alignment of our economic interests with those of Affiliate management.

The form of our structured partnership interests in our Affiliates differs from Affiliate to Affiliate and ranges from structures where we contractually share in the Affiliate’s revenue without regard to expenses, comprising Affiliates that contribute a majority of our Consolidated revenue, to others where we contractually share in the Affiliate’s revenue less agreed-upon expenses. Further, the structure at a particular Affiliate, or the expenses that we agree to share in, may change during the course of our investment.

Where we share in the Affiliate’s revenue without regard to expenses, the Affiliate allocates a specified percentage of its revenue to us and Affiliate management, while using the remainder for operating expenses and additional distributions to Affiliate management. We and Affiliate management, therefore, participate in any increase or decrease in revenue, and only Affiliate management participates in any increase or decrease in expenses. Under these structured partnership interests our contractual share of revenue generally has priority over distributions to Affiliate management.

3

Where we share in the Affiliate’s revenue less agreed-upon expenses, we benefit from any increase in revenue or any decrease in the agreed-upon expenses, but also have exposure to any decrease in revenue or any increase in such agreed-upon expenses. The degree of our exposure to agreed-upon expenses from these structured partnership interests varies by Affiliate, and includes several Affiliates in which we fully share in the expenses of the business.

When we own a controlling equity interest in an Affiliate, we consolidate the Affiliate’s financial results into our Consolidated Financial Statements. When we do not own a controlling equity interest in an Affiliate, but have significant influence, we account for our interest in the Affiliate under the equity method. Under the equity method of accounting, we do not consolidate the Affiliate’s results into our Consolidated Financial Statements. Instead, our share of earnings or losses, net of amortization and impairments, is included in Equity method income (net) in our Consolidated Statements of Income, and our interest in these Affiliates is recorded in Equity method investments in Affiliates (net) in our Consolidated Balance Sheets.

Whether we consolidate an Affiliate’s financial results or use the equity method of accounting, we maintain the same innovative partnership approach and offer support and assistance in substantially the same manner for all of our Affiliates. From time to time, we may restructure our interest in an Affiliate to better support the Affiliate’s growth strategy, but only if doing so is in the best interest of the Affiliate’s business, management partners, and clients, as well as our stakeholders.

Competition

Our Affiliates compete with numerous investment management firms globally, as well as with subsidiaries of larger financial organizations. These firms may have significantly greater financial, technological, and marketing resources; access to captive distribution; and assets under management. Many of these firms may offer products and services that our Affiliates may not, in particular investment strategies such as passively-managed products, including exchange traded funds, which typically carry lower fee rates. Certain Affiliates offer their investment management services to the same client types and, from time to time, may compete with each other for clients. In addition, there are relatively few barriers to entry for new investment management firms, especially for those providing investment management services to institutional and high net worth investors. We believe that the most important factors affecting our Affiliates’ ability to compete for clients are the:

•investment performance, investment styles, and reputations of our Affiliates and their management teams;

•differentiation of our Affiliates’ investment strategies and products and the continued development of investment strategies and products to meet the evolving needs and demands of investors;

•depth and continuity of our and our Affiliates’ client relationships and the level of client service offered;

•maintenance of strong business relationships by us and our Affiliates with major intermediaries; and

•continued success of our and our Affiliates’ distribution efforts.

Additionally, our strategy includes investing in independent partner-owned investment firms, and in this area we compete with a number of acquirers and investors, including investment management companies, private equity firms, sovereign wealth funds, and larger financial organizations. We believe that the most important factors on which we compete for future investments are purchase price and liquidity; our partnership investment model, including the equity incentive structures and access to strategic capabilities we offer; and the breadth and depth of our relationships, and our reputation, with investment firm prospects.

Government Regulation

Our Affiliates offer their investment management services and products around the world, and are subject to complex and extensive regulation by regulatory and self-regulatory authorities and exchanges in various jurisdictions. Virtually all aspects of the asset management business, including the provision of advice, investment strategies and trading, fund sponsorship, and product-related sales and distribution activities, are subject to regulation. These regulations are primarily intended to protect the clients of investment advisers and generally grant regulatory authorities broad administrative and enforcement powers.

The majority of our Affiliates are registered with the SEC as investment advisers under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Advisers Act imposes numerous obligations on registered investment advisers, including fiduciary duties, compliance and disclosure obligations, and operational and recordkeeping requirements. Our Affiliates operating outside of the U.S. may be subject to the Advisers Act and are also subject to regulation by various regulatory and self-regulatory authorities and exchanges in the relevant jurisdictions, including, for those Affiliates active in the UK, the Financial Conduct Authority (the “FCA”). Many of our Affiliates also sponsor or advise registered and unregistered

4

funds in the U.S. and in other jurisdictions, and are subject to regulatory requirements in the jurisdictions where those funds are sponsored or offered, including, with respect to mutual funds in the U.S., the Investment Company Act of 1940, as amended (the “Investment Company Act”). The Investment Company Act governs the operations of mutual funds and imposes obligations on their advisers, including investment restrictions and other governance, compliance, reporting, and fiduciary obligations relating to the management of mutual funds. Many of our Affiliates are also subject to directives and regulations in the European Union and other jurisdictions relating to funds, such as the Undertakings for the Collective Investment of Transferable Securities (“UCITS”) Directive and the Alternative Investment Fund Managers Directive (“AIFMD”), with respect to depositary functions, remuneration policies and sanctions, among other matters.

Our Affiliates’ sales and marketing activities are subject to regulation by authorities in the jurisdictions in which they offer investment management products and services. Our Affiliates’ ability to transact business in these jurisdictions, and to conduct related cross-border activities, is subject to the continuing availability of regulatory authorizations and exemptions. Through our distribution platform, we also engage in sales and marketing activities that extend the reach of our Affiliates’ own business development efforts, and which are subject to regulation in numerous jurisdictions. Our U.S. wealth distribution subsidiary is registered with the SEC under the Advisers Act. This subsidiary sponsors mutual funds registered under the Investment Company Act, and serves as an investment adviser and/or administrator for our fund complex. In the UK, our institutional distribution subsidiary is regulated by the FCA. We also have institutional distribution subsidiaries or branches of subsidiaries regulated by the Dubai Financial Services Authority and the Australian Securities and Investments Commission, and our activities in the European Union are regulated by various regulators in European jurisdictions.

Certain of our Affiliates and our U.S. wealth distribution subsidiary are subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and related regulations, with respect to retirement plan clients. ERISA imposes duties on persons who are fiduciaries under ERISA, and prohibits certain transactions involving related parties to a retirement plan. The U.S. Department of Labor administers ERISA and regulates investment advisers who service retirement plan clients, and has been increasingly active in proposing and adopting additional regulations applicable to the investment management industry. Certain of our Affiliates and our U.S. wealth distribution subsidiary are also members of the National Futures Association and are regulated by the U.S. Commodity Futures Trading Commission (“CFTC”) with respect to the management of funds and other products that utilize futures, swaps or other CFTC-regulated instruments.

In addition, certain of our Affiliates and our U.S. wealth broker-dealer subsidiary are registered broker-dealers and members of the Financial Industry Regulatory Authority (“FINRA”), for the purpose of distributing funds or other products. FINRA has adopted extensive regulatory requirements relating to sales practices, registration of personnel, compliance and supervision, and compensation and disclosure. FINRA and the SEC have the authority to conduct periodic examinations of member broker-dealers, and may also conduct administrative proceedings. These broker-dealers are also subject to net capital rules in the U.S. that mandate the maintenance of certain levels of capital, and our Affiliates and our other distribution subsidiaries may also be subject to other regulatory capital requirements imposed by non-U.S. regulatory authorities.

Due to the extensive laws and regulations to which we and our Affiliates are subject, we and our Affiliates must devote substantial time, expense and effort to remain current on, and to address, legal and regulatory compliance matters. We have established compliance programs for each of our operating subsidiaries, and each of our Affiliates has established compliance programs to address regulatory compliance requirements for its operations. We and our Affiliates have experienced legal and compliance professionals in place to address these requirements, and have relationships with various legal and regulatory advisers in each of the countries where we and our Affiliates conduct business. See “Item 1A. Risk Factors”.

Human Capital Management

As of December 31, 2023, we and our Affiliates had approximately 4,000 employees, the substantial majority of which were employed by our Affiliates and not by AMG. Each Affiliate’s management team retains autonomy in managing and operating their business on a day-to-day basis, including with respect to their human capital. Given this, the following is a discussion of AMG’s workforce, or approximately 250 of the total employees, and the policies and cultural initiatives which pertain to our human capital.

Our employees and our reputation are our most important assets, and attracting, retaining, and motivating top talent to execute on our strategic business objectives is a fundamental imperative. We support that imperative through our strong values-based culture, commitment to career development and training, employee engagement initiatives, attractive compensation and benefits programs, attention to succession planning, and fostering of organizational diversity at all levels of our organization.

5

Our leadership training and sponsored skills development programs cover a wide range of subject area expertise as well as career development generally, and are anchored on a comprehensive performance review process, which includes a company-wide 360-degree review program. Further, we support employees’ educational pursuits relating to degree programs and certifications through company-supported time off for professional development and flexible work arrangements tailored to individual employees’ educational goals. We regularly conduct company-wide surveys to solicit feedback from our employees on a variety of topics, including corporate culture, philanthropic interests, and general job satisfaction, which help us to enhance employee engagement and retention. Our annual anonymous employee engagement survey reported an employee satisfaction rating of 90% in 2023, which we attribute to our focus and commitment to our employees, our entrepreneurial culture and partnership orientation, and our meaningful involvement with communities surrounding our offices.

We prioritize employee engagement through a range of cross-functional, multi-level communication and collaboration mediums through both in-person and virtual forums, including small working group lunches, company-wide gatherings and town halls, management off-sites, and charitable volunteer activities. Through employee participation in our corporate philanthropic initiatives across our global offices, we are committed to giving back to the communities in which we work and live, and we believe that these initiatives also support our efforts to attract and retain employees. We provide company-supported time off to encourage employees in their charitable endeavors. We also offer a formal gift-matching program to match employee donations to eligible non-profit institutions through AMG and The AMG Charitable Foundation, as well as a volunteer-matching program, wherein volunteer hours are matched with philanthropic credits that employees may donate to eligible organizations. Through our matching program as well as through direct grants, AMG and The AMG Charitable Foundation have made donations to more than 800 organizations around the world to date.

We believe that organizational diversity results in a highly creative and innovative workforce, and are committed to fostering and promoting an inclusive and diverse work environment. We seek to recruit the best people for the job without regard to gender, ethnicity or other protected traits, and it is our policy to comply fully with all domestic, foreign and local laws relating to discrimination in the workplace. We have achieved gender diversity of 38% across management positions in our workforce, and nearly half (47%) of our employees are women. Further, three of eight (38%) independent members of our Board of Directors are women, and two of eight (25%) independent directors are ethnically diverse, in each case, above the average of S&P 500 companies. In addition, two of our three Board committees are chaired by women. We continually seek to enhance the diversity of our employee base, as our employees around the world contribute their distinct perspectives to improve our business and the communities in which our businesses operate. Our executive management team has responsibility for diversity initiatives, in coordination with our Sustainability Committee, and reviews these initiatives with our Board of Directors at least annually.

Our Website

Our website is www.amg.com. Our website provides information about us, and, from time to time, we may use it to distribute material company information. We routinely post financial, investment performance, and other important information regarding the Company in the Investor Relations section of our website and we encourage investors to consult that section regularly. The Investor Relations section of our website also includes copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, including exhibits, and any amendments to those reports filed or furnished with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. We make these reports available through our website as soon as reasonably practicable after our electronic filing of such materials with, or the furnishing of them to, the SEC. The information contained or incorporated on our website is not a part of this Annual Report on Form 10-K.

6

Item 1A.Risk Factors

We and our Affiliates face a variety of risks that are substantial and inherent in our businesses. The following are some of the more important factors that could affect our and our Affiliates’ businesses. Investors should carefully consider these risks, along with the other information contained in this Annual Report on Form 10-K, before making an investment decision regarding our common stock or other publicly-listed securities. There may be additional risks of which we are currently unaware, or which we currently consider immaterial. Any of these risks could have a material adverse effect on our financial condition, results of operations, and the market price of our common stock. Certain statements in “Risk Factors” are forward-looking statements. See “Forward-Looking Statements.”

RISKS RELATED TO OUR INDUSTRY, BUSINESS AND OPERATIONS

Our financial results depend on our Affiliates’ receipt of asset- and performance-based fees, and are impacted by investment performance, as well as changes in fee levels, product mix, and the relative levels of assets under management among our Affiliates.

Our financial results depend on our Affiliates’ receipt of asset- and performance-based fees, which may vary substantially from year to year. Our Affiliates’ ability to maintain current fee levels depends on a number of factors, including our Affiliates’ investment performance, as well as competition and trends in the investment management industry, such as investor demand for passively-managed products, including index and exchange traded funds, that typically carry lower fee rates, or preferences for other developing strategies or trends. Further, different types of assets under management can generate different ratios of asset-based fees to assets under management (“asset-based fee ratio”), based on factors such as the investment strategy and the type of client. Thus, a change in the composition of our assets under management, either within an Affiliate or among our Affiliates, could result in a decrease in our aggregate fees even if our aggregate assets under management remains unchanged or increases. Products that use fee structures based on investment performance may also vary significantly from period to period, depending on the investment performance of the particular product. For some of our Affiliates, performance-based fees include a high-watermark provision, which generally provides that if a product underperforms on an absolute basis or relative to its benchmark, it must regain such underperformance before the Affiliate will earn any performance-based fees. In addition, in the ordinary course of business, our Affiliates may reduce or waive fees on certain products for particular time periods, to attract or retain assets or for other reasons. No assurances can be given that our Affiliates will be able to maintain current fee structures or levels. A reduction in the fees that our Affiliates receive could have an adverse impact on our financial condition and results of operations.

Additionally, our structured partnership interests are tailored to meet the needs of each Affiliate and are therefore varied, and our earnings may be adversely affected by changes in the relative performance or in the relative levels and mix of assets under management among our Affiliates, independent of our aggregate operating performance measures. Challenging market conditions, volatility or slowdowns affecting a particular asset class, client type, product structure, geographic region, industry or other category of investment could have a significant adverse impact on a specific Affiliate if its investments are concentrated in that area, which could result in lower investment returns and in turn, lower fees earned at that Affiliate. Further, certain Affiliates contribute more significantly to our results than other Affiliates and, therefore, changes in fee levels, product mix, assets under management, or investment performance of such Affiliates could have a disproportionate adverse impact on our financial condition and results of operations.

Our financial results could be adversely affected by any reduction in our assets under management, which could reduce the asset- and performance-based fees earned by our Affiliates.

Our financial results may be impacted by changes in the total level of our assets under management. The total level of our assets under management generally or with respect to particular products or Affiliates could be adversely affected by conditions outside of our control, including:

•a decline in the market value of our assets under management, due to declines or heightened volatility in the capital markets, fluctuations in foreign currency exchange rates and interest rates, the recent inflationary environment, changes in the yield curve, and other market factors;

•changes in investor risk tolerance or investment preferences, which could result in investor allocations away from strategies and products offered by our Affiliates;

7

•our Affiliates’ ability to attract and retain client assets and market products and services, which may be impacted by investment performance, client relationships, demand for product and service offerings, their continued development of products to meet the changing demands of investors, and the prices of securities generally;

•global economic conditions, which may be exacerbated by changes in the equity or debt markets, including impacts from monetary policies of the U.S. Federal Reserve Bank and other global central banks in response to inflation, or instability and liquidity issues in the financial system generally;

•financial crises, political or diplomatic developments in the U.S. or globally, including rising trade tensions between the U.S. and China, pandemics or other public health crises, trade wars, social or civil unrest, insurrection, war, terrorism, natural disasters, or risks associated with global climate change; and

•other factors that are difficult to predict.

A reduction in our assets under management could adversely affect the fees payable to our Affiliates and, ultimately, our financial condition and results of operations. To the extent any of these conditions or factors adversely affect our or our Affiliates’ operations or global economic conditions generally, they may also have the effect of heightening other risks described below.

If our or our Affiliates’ reputations are harmed, we could suffer losses in our business and financial results.

The success of our business depends on earning and maintaining the trust and confidence of our Affiliates and our stockholders, our ability to compete for future investment opportunities, and our and our Affiliates’ reputations among existing and potential clients. Our and our Affiliates’ reputations are critical to our business and could be impacted by events that may be difficult or impossible to control, and costly or impossible to remediate, including:

•alleged or actual failures by us, our Affiliates or our respective employees to comply with applicable laws, rules or regulations;

•errors in our public reports;

•cyber-attack or data breach incidents;

•fund liquidity or valuation issues including with respect to non-traded, illiquid assets within funds or products of certain of our Affiliates;

•threatened or actual litigation against us, any of our Affiliates or our respective employees;

•perceived or actual conflict between us and any of our Affiliates or among our Affiliates;

•negative perceptions of our or certain of our Affiliates’ investments or business practices by stakeholder groups who have increasingly expressed divergent views on a range of environmental, social, and governance (“ESG”) matters; or

•other events and factors that are difficult to predict including those that could impact our Affiliates’ ability to compete effectively with other firms, our ability to successfully pursue our growth strategy, and other risks described elsewhere in this “Risk Factors” section.

Any of the foregoing events, or the public announcement and potential publicity surrounding these issues, even if inaccurate, satisfactorily addressed, or if no violation or wrongdoing actually occurred, could adversely impact our Affiliates’ reputations and their relationships with clients, our relationships with our Affiliates, and our ability to negotiate agreements with new independent investment firms, any of which could have an adverse effect on our reputation, our financial condition and results of operations, or the market price of our common stock.

The investment management industry is highly competitive.

Our Affiliates compete with numerous investment management firms globally, including public, private and client-owned investment advisers; firms managing passively-managed products, including exchange traded funds; firms associated with securities broker-dealers, financial institutions, insurance companies, private equity firms, sovereign wealth funds; and other entities. These firms may have significantly greater financial, technological, and marketing resources, captive distribution and assets under management, and many of these firms may offer products and services that our Affiliates may not in particular investment strategies. These firms may also compete by seeking to capitalize on a trend towards institutions consolidating the

8

number of investment managers they work with. Competition from these firms may reduce the fees that our Affiliates can obtain for investment management services, or could impair our Affiliates’ ability to attract and retain client assets, and any failure by our Affiliates to successfully develop competing new products and services, or effectively manage the associated operational risks, could harm our Affiliates’ reputations and expose them to additional costs or regulatory scrutiny, which could adversely affect our assets under management, financial condition and results of operations. We believe that our Affiliates’ ability to compete effectively with other firms depends upon the performance of our Affiliates’ investment strategies, the applicability of products to meet client objectives and preferences, and the continued development of strategies and products to meet the evolving needs and demands of investors, as well as our Affiliates’ reputations, client relationships, fee structures, client-servicing capabilities, and the marketing and distribution of their investment strategies, among other factors. See “Competition” in Item 1. Our Affiliates may not compare favorably with their competitors in any or all of these categories, and technological developments, including financial applications and services based on artificial intelligence (“AI”), may over time reduce the demand for, or clients’ willingness to pay for, certain products and services. From time to time, our Affiliates may also compete with each other for clients and investment opportunities.

Investment management contracts are subject to termination on short notice.

Through our Affiliates, we derive almost all of our asset- and performance-based fees from clients pursuant to investment management contracts. While certain of our Affiliates’ private equity and alternative products have long-term commitment periods, many of our Affiliates’ investment management contracts are terminable by the client without penalty upon relatively short notice (typically not longer than 60 days). We cannot be certain that our Affiliates will be able to retain their existing clients or attract new clients. If our Affiliates’ clients terminate their investment management contracts or withdraw a substantial amount of assets, it is likely to harm our results of operations. In addition, investment management contracts with mutual funds or other similar products are subject to annual approval by the fund’s board of directors.

Valuation methodologies for assets within private markets funds, liquid alternatives, and similar products of certain of our Affiliates can be subject to significant subjectivity.

Certain of our Affiliates offer private markets, liquid alternative, and other strategies that may invest in assets for which there may be no readily ascertainable market prices available on a regular basis or at all. In addition, many of these investments are, or may in the future be, concentrated in industries or sectors that could experience volatility or uncertainties, and may be subject to rapid changes in value caused by company-specific or industry-wide developments. The determination of the net asset values for these funds, therefore, takes a range of factors into consideration in applying valuation methodologies, and may reflect estimates or valuation models of independent third parties. These valuation methodologies require the use of estimates and assumptions, and involve a significant degree of judgment and, accordingly, the fair values of such investments reflected in a particular fund or product’s net asset value do not necessarily reflect the prices that would be obtained if the assets were to be liquidated on the date of the valuation, or on the date when an investor purchases, redeems or otherwise transacts in the fund or product, and may differ significantly from the prices obtained when such investments are ultimately realized. These factors could result in reduced earnings or losses for the applicable Affiliate, fund, or product, increase liquidity management risks for the fund or product, or result in difficulties in raising additional capital or launching similar products, any of which could have an adverse effect on our reputation, our financial condition and results of operations, or the market price of our common stock.

We may need to raise additional capital in the future, and existing or future resources may not be available to us in sufficient amounts or on acceptable terms.

While we believe that our existing cash resources and cash flow from operations will be sufficient to meet our working capital needs for normal operations for the foreseeable future, our continuing acquisitions of interests in independent investment firms and our other strategic initiatives may require additional capital. Further, we have significant purchase obligations relating to Affiliate equity interests, as well as commitments relating to general partner and seed capital investments, and it is difficult to predict the frequency and magnitude of these purchases or associated capital calls. As of December 31, 2023, the current redemption value relating to Affiliate equity interests was $447.3 million, of which $393.4 million was presented as Redeemable non-controlling interests (including $11.8 million of consolidated Affiliate sponsored investment products primarily attributable to third-party investors), and $53.9 million was included in Other liabilities. See “Liquidity and Capital Resources-Affiliate Equity” in Item 7 and Notes 16 and 17 of the Consolidated Financial Statements. Unfunded commitments relating to general partner and seed capital investments were $187.2 million as of December 31, 2023. See Notes 3 and 7 of the Consolidated Financial Statements. These obligations may require more cash than is then available from our existing cash resources and cash flows from operations. Thus, we may need to raise capital through additional borrowings or by selling shares of our common stock or other equity or debt securities, or otherwise refinance a portion of these obligations.

9

As of December 31, 2023, we had outstanding debt of $2.6 billion. Our level of indebtedness may increase if we fund future investments or other expenses through borrowings. We may also seek to refinance existing indebtedness for the purpose of managing maturity dates, to seek alternative financing terms or for other reasons, which may not be available on similar terms as our existing indebtedness, including with respect to interest rates. Any additional indebtedness could increase our vulnerability to general adverse economic and industry conditions and may require us to dedicate a greater portion of our cash flows from operations to payments on our indebtedness.

The financing activities described above could increase our Interest expense, decrease our Net income (controlling interest) or dilute the interests of our existing stockholders. In addition, our access to additional capital, and the cost of capital we are able to access, is influenced by a number of factors, including the state of global credit and equity markets, interest rates, credit spreads and our credit ratings. As a result, we may be unable to enter into new credit facilities or issue debt or equity in the future on attractive terms, or at all. We are currently rated A3 by Moody’s Investors Service and BBB+ by S&P Global Ratings. A reduction in our credit ratings could also increase our borrowing costs under our credit facilities or, in certain cases, give rise to a termination right by the counterparty under our derivative financial instruments. There can be no assurance that we will achieve a particular credit rating or maintain any particular rating in the future.

Our debt agreements impose certain covenants relating to the conduct of our business, including financial covenants under our credit facilities, any breach of which could result in the acceleration of the repayment of any amounts borrowed or outstanding thereunder.

Our debt agreements contain customary affirmative operating covenants and negative covenants that, among other things, place certain limitations on our and our subsidiaries’ ability to incur debt, merge or transfer assets, and create liens and, in the case of our credit facilities, require us to maintain specified financial ratios, including a maximum leverage ratio and a minimum interest coverage ratio. The breach of any covenant (either due to our actions or omissions or, in the case of financial covenants, due to a significant and prolonged market-driven decline in our operating results) could result in a default under the applicable debt agreement and, in the case of our credit facilities, lenders could refuse to make further extensions of credit to us. Further, in the event of certain defaults, amounts borrowed under our debt agreements, together with accrued interest and other fees, could become immediately due and payable. If any indebtedness were to become subject to accelerated repayment, we may not have sufficient liquid assets to repay such indebtedness in full.

We have substantial intangibles on our balance sheet, and any impairment of our intangibles could adversely affect our financial condition and results of operations.

As of December 31, 2023, our total assets were $9.1 billion, of which $4.3 billion were intangibles, and $2.3 billion were equity method investments in Affiliates, an amount primarily composed of intangible assets. We cannot be certain that we will realize the value of such intangible assets. Our intangible assets may become impaired as a result of any number of factors, including changes in market conditions, declines in the value of assets under management, client attrition, product performance, reductions in fee rates, and changes in strategic objectives or growth prospects of an Affiliate. An impairment of our intangible assets or an other-than-temporary decline in the value of our equity method investments could adversely affect our financial condition and results of operations. Determining the value of intangible assets, and evaluating them for impairment, requires management to exercise significant judgment. In recent periods, we have recorded expenses to reduce the carrying value to fair value of certain Affiliates and certain acquired client relationships, and may experience similar impairment events in future reporting periods. See “Critical Accounting Estimates and Judgments” in Item 7 and Notes 8 and 9 of the Consolidated Financial Statements.

Market risk management activities may adversely affect our liquidity and results of operations.

Cash management transactions, capital markets financings, and certain investments or other transactions may create exposure for us or our Affiliates to changes in interest rates, foreign currency exchange rates, marketable securities, and financial markets generally, which we or our Affiliates may seek to offset by entering into derivative financial instruments. The scope of these risk management activities is selective and varies based on the level and volatility of interest rates, foreign currency exchange rates, applicable marketable securities, and other changing market conditions. We and our Affiliates do not seek to hedge exposure to all market risks, which means that exposure to certain market risks is not limited. Further, the use of derivative financial instruments does not entirely eliminate the possibility of fluctuations in the value of the underlying position or prevent losses if the value of the position declines, and also can limit the opportunity for gain if the value of the position increases. There can be no assurance that our or our Affiliates’ derivative financial instruments will meet their overall objective or that we or our Affiliates will be successful in entering into such instruments in the future. Further, while hedging arrangements may reduce certain risks, such arrangements themselves may entail other risks, may generate significant

10

transaction costs, and may require the posting of cash collateral. For example, if our or our Affiliates’ counterparties fail to honor their obligations in a timely manner, including any obligations to return posted collateral, our liquidity and results of operations could be adversely impacted.

RISKS RELATED TO OUR STRATEGY AND OUR STRUCTURED PARTNERSHIPS WITH AFFILIATES

Our growth strategy depends in part upon our ability to make investments in independent investment firms and to pursue other strategic partnerships.

Our continued success in investing in independent investment firms will depend upon our ability to find suitable firms in which to invest or make additional investments in our existing Affiliates, our ability to negotiate agreements with such firms on acceptable terms, maintaining our relationships with prospects and our reputation as a leading partner to these firms, and our ability to raise the capital necessary to finance such transactions. The market for acquisitions of interests in these firms is highly competitive. Many other public and private financial services companies, including commercial and investment banks, private equity firms, sovereign wealth funds, insurance companies, and investment management firms, also invest in independent investment firms and may have significantly greater resources than we do. In addition to direct competition on particular prospects, these firms can also negatively impact the volume and value of transactions more broadly. Further, our innovative partnership approach with our Affiliates is designed to enhance our Affiliates’ ability to achieve their long-term strategic objectives, while preserving their independence and autonomy, and, therefore, their unique entrepreneurial and investment-centric cultures, and the management of some target firms may prefer terms and structures offered by our competitors.

We may not be successful in making investments in new firms or maintaining existing investments, and any firms that we do invest in may not have favorable results or performance following our initial investment or any subsequent investment, which could have an adverse effect on our financial condition and results of operations. Our investments involve a number of risks, including the existence of unknown liabilities that may arise after making an investment, some of which may depend upon factors that are not under our control. Further, the consummation of our announced investments is generally subject to a number of closing conditions, contingencies and approvals, including, but not limited to, obtaining certain consents of the independent investment firm’s clients and applicable regulatory approvals. In the event that an announced transaction is not consummated, we may experience a decline in the price of our common stock.

Our growth strategy also includes pursuing strategic partnerships and transactions in areas where we can assist our Affiliates in growing and diversifying their businesses to further enhance our competitive position, which may involve new operational areas, product structures or strategies, and expanding the geography and scope of our operations. These initiatives involve risks and uncertainties and may require resources and investment, including the implementation of new operational controls and procedures, compliance with additional regulatory and disclosure requirements, exposure to more volatile market segments and reputational risks, and require complex contractual arrangements and specialized skills, and there is no certainty that such initiatives will deliver the anticipated benefits over the expected time frame or at all, or that our stockholders will react favorably. Any failure to successfully execute on strategic partnerships or transactions, including in connection with our entry into new operational areas or effectively managing associated risks, could harm our reputation and expose us to additional costs, which could adversely affect our assets under management, financial condition, and results of operations.

The structure of our partnership interests in our Affiliates may expose us to unanticipated changes in Affiliate revenue, operating expenses, and other commitments, which we may not anticipate and may have limited ability to control.

The form of our structured partnership interests in our Affiliates differs from Affiliate to Affiliate, and ranges from structures where we contractually share in the Affiliate’s revenue without regard to expenses, comprising Affiliates that contribute a majority of our Consolidated revenue, to others where we contractually share in the Affiliate’s revenue less agreed-upon expenses. Further, the structure at a particular Affiliate, or the expenses that we agree to share in, may change during the course of our investment.

Where we share in the Affiliate’s revenue without regard to expenses, the Affiliate allocates a specified percentage of its revenue to us and Affiliate management, while using the remainder for operating expenses and additional distributions to Affiliate management. In these types of structures, while our distributions generally have priority, our agreed allocations may not anticipate changes in the revenue and operating expense base of the Affiliate, and the revenue remaining after our specified share is allocated to us may not be large enough to cover all of the Affiliate’s operating expenses, which could result in a reduction of the amount allocated to us or could negatively impact the Affiliate’s operations and prospects.

11

Where we share in the Affiliate’s revenue less agreed-upon expenses, we benefit from any increase in revenue or any decrease in the agreed-upon expenses, but also have exposure to any decrease in revenue or any increase in such expenses. The degree of our exposure to agreed-upon expenses from these structured partnership interests varies by Affiliate and includes several Affiliates in which we fully share in the expenses of the business. In these types of structures, we may have limited or no ability to control the level of expenses at the Affiliate, and our distributions generally do not have priority. Further, the impact of Affiliate expenses on our earnings and our stock price could increase if the portion of our earnings derived from such Affiliates increases.

As a result of these factors, unanticipated changes in revenue, operating expenses, or other commitments at any of our Affiliates could leave the Affiliate with a shortfall in remaining funds for distribution to us or Affiliate management, or for funding their operations. Changes in the global marketplace in particular could result in rapid changes to our Affiliates’ earnings or expenses, and our Affiliates may be unable to make appropriate expense reductions in a timely manner to respond to such changes. Any of these developments could have an adverse effect on our financial condition generally, and on our results of operations for the applicable reporting period.

Additionally, regardless of the particular structure, we may agree to change the structure, or may elect to defer or forgo the receipt of our share of an Affiliate’s revenue or earnings, or adjust expenses allocated to us, to permit the Affiliate to fund expenses in light of unanticipated changes in revenue or operating expenses, with the aim of maximizing the long-term benefits for us and the Affiliate. These types of activities could increase during periods where an Affiliate’s revenues decline rapidly or other events occur that impact the Affiliate’s expenses or operations. We cannot be certain that any such deferral or forbearance would be of any greater long-term benefit to us, and such a deferral or forbearance may have an adverse effect on our near- or long-term financial condition and results of operations.

We may reposition or divest our equity interests in our Affiliates, and we cannot be certain that any such repositioning or divestment will benefit us in the near- or long-term.

From time to time, we may reposition our relationships with our Affiliates, which could, among other things, include changes to our structured partnership interests, including changes in our ownership level and in the calculation of our share of revenue and/or operating expenses. Such repositioning may be done in order to address an Affiliate’s succession planning, changes in its revenue or operating expense base, our or the Affiliate’s strategic planning, or other developments. Any repositioning of our interest in an Affiliate may result in increased exposure to changes in the Affiliate’s revenue and/or operating expenses, or in additional investments or commitments from us, or could increase or reduce, or change the structure of, our interest in the Affiliate. In some cases, this could result in the full divestment of our interest to Affiliate management or to a third-party, or in our acquisition of all of the equity interests of the Affiliate. In addition, certain of our Affiliates have customary rights in certain circumstances to restructure or sell their interests in their firm to a third-party, which could be through a direct majority or minority sale transaction, a private or public offering, or otherwise, and to cause us to participate in such restructuring or sale, which could be on terms that we view as less favorable than an alternative transaction or to retaining our interest. Any such transactions or changes, or disputes in relation to such transactions or changes which do not resolve in our favor, could have an adverse impact on our reputation, financial condition, and results of operations.

We and our Affiliates rely on certain key personnel and cannot guarantee their continued service.

We depend on the efforts of our executive officers and our other officers and employees. Our executive officers, in particular, play an important role in the stability and growth of our existing Affiliates and in identifying potential investments in independent investment firms. There is no guarantee that these executive officers will remain with the Company. We do not have employment agreements with our executive officers, although each has a significant deferred equity interest in the Company and is subject to non-solicitation and non-competition restrictions that may be triggered upon their departure. Further, we seek to attract and retain our key officers and employees through a number of initiatives and programs, including developing a strong values-based culture, a commitment to career development, employee engagement, attractive compensation and benefits programs, attention to succession planning, and fostering of diversity and inclusion, any of which may not be successful in contributing to the retention of such employees. Changes in our management team, in particular, may be disruptive to our business, and failure to attract and retain members of our executive or senior management team, or to effectively implement and manage appropriate succession plans, could adversely affect our business, financial condition, and results of operations.

In addition, our Affiliates depend heavily on the services of key principals who, in many cases, have managed their firms for many years. These principals often are primarily responsible for their firm’s investment decisions. Although we use a combination of economic incentives, transfer restrictions and, in some instances, non-solicitation, non-competition, and

12

employment agreements in an effort to retain key Affiliate personnel, there is no guarantee that these principals will remain with their firms or refrain from competing with us if they depart their firms. Since certain of our Affiliates contribute more significantly to our results than other Affiliates, the loss of key personnel at these Affiliates could have a disproportionately adverse impact on our business, financial condition, and results of operations.

RISKS RELATED TO OUR COMMON STOCK

Equity markets and our common stock have been volatile.

The market price of our common stock has experienced and may continue to experience volatility, and the broader equity markets have experienced and may continue to experience significant price and volume fluctuations. In addition, announcements of our financial and operating results or other material information, including changes in net client cash flows and assets under management, announcements and activity regarding our share repurchase programs, changes in our financial guidance or our failure to meet such guidance, our new investments activity, changes in general conditions in the economy or the financial markets, perceptions regarding our ESG profile or sustainable investment decisions of our Affiliates, and other developments affecting us, our Affiliates or our competitors, as well as geopolitical, social, regulatory, capital markets, economic, public health, and other factors unrelated to us, could cause the market price of our common stock to fluctuate substantially.

The sale or issuance of substantial amounts of our common stock, or the expectation that such sales or issuances will occur, could adversely impact the price of our common stock.

The sale or issuance of substantial amounts of our common stock in the public market could adversely impact its price. In connection with our financing activities, we have issued junior convertible trust preferred securities and maintain an equity distribution program, either of which may result in the issuance of our common stock upon the occurrence of certain events. We also have outstanding option and restricted stock awards that have been granted under our share-based incentive plans. Additionally, we have the right to settle certain Affiliate equity purchase obligations with shares of our common stock. Moreover, in connection with future financing activities, we may issue additional convertible securities or shares of our common stock, including through forward equity transactions. Any such issuance of shares of our common stock could have the effect of substantially diluting the interests of our current equity holders. In the event that a large number of shares of our common stock are sold or issued in the public market, or the expectation that such sales or issuances will occur, the price of our common stock may decline as a result.

Provisions in our organizational documents, Delaware law, and other factors could delay or prevent a change in control of the Company, or adversely affect our financial results in periods prior to and following a change in control.

Provisions in our charter and by-laws and anti-takeover provisions under Delaware law could discourage, delay, or prevent an unsolicited change in control of the Company. These provisions may also have the effect of making it more difficult for third parties to replace our executive officers without the consent of our Board of Directors. These provisions include:

•the ability of our Board of Directors to issue preferred stock and to determine the terms, rights, and preferences of the preferred stock without stockholder approval;

•the prohibition on the right of stockholders to call meetings or act by written consent and limitations on the right of stockholders to present proposals or make nominations at stockholder meetings; and

•legal restrictions on mergers and other business combinations between us and any holder of 15 percent or more of our outstanding common stock.

Further, given our long-term innovative partnership approach with our Affiliates, which is designed to maintain their independence and autonomy, and, therefore, their unique entrepreneurial and investment-centric cultures, a change in control may be viewed negatively by our Affiliates, impacting their relationships with us. Additionally, the disposition of certain of our Affiliates following a change in control could result in the immediate realization of taxes owed on any excess proceeds above our tax basis in the relevant Affiliate, which could impact the valuation a third-party may apply to us in a change in control. Any of the forgoing factors may inhibit a change in control in circumstances that could give our stockholders the opportunity to realize a premium over the market price of our common stock, or may result in negative impacts on our financial results in periods prior to and following a change in control.

13

In addition, a change in control of the Company or the acquisition of a large ownership position in shares of our outstanding common stock by a single holder may constitute a change in control for certain of our Affiliates for purposes of the Advisers Act and the Investment Company Act. In that case, absent client consents, the Affiliate’s management agreements may be deemed to be “assigned” in violation of the agreement and, for mutual fund clients, will terminate. We cannot be certain that any required client consents (which the impacted Affiliates would need to be involved in requesting) would be obtained if such a change of control occurs. Any termination, deemed assignment or renegotiation of any of our Affiliates’ management agreements could result in a reduction in our assets under management or the fees payable to our Affiliates and, ultimately, our aggregate fees. Further, certain of our Affiliates operate regulated businesses in jurisdictions outside of the U.S. that, in some cases, require regulatory notifications and other filings if a single stockholder acquires an ownership position in the Company exceeding certain specified thresholds, regardless of whether a change in control has occurred for purposes of the Advisers Act or the Investment Company Act. Such an ownership position could also trigger approvals under FINRA, for Affiliates operating a broker-dealer in the U.S. As a result, a large ownership position in our stock, whether or not resulting in a change of control of the Company, could result in increased regulatory reporting and compliance costs, and potential restrictions on our or our Affiliates’ business activities, and could reduce the fees that our Affiliates receive under investment management contracts, any of which could have an adverse effect on the Company’s financial condition and results of operations.

LEGAL AND REGULATORY RISKS

Our and our Affiliates’ businesses are highly regulated.

Our and our Affiliates’ businesses are subject to complex and extensive regulation by regulatory and self-regulatory authorities and exchanges in various jurisdictions around the world, which, for our Affiliates and our U.S. wealth distribution subsidiary, include those applicable to investment advisers, as detailed in “Government Regulation” in Item 1. Applicable laws, rules and regulations impose requirements, restrictions, and limitations on our and our Affiliates’ businesses, and can result in significant compliance costs. Further, this regulatory environment may be altered without notice by new laws or regulations, revisions to existing laws or regulations, or new or revised interpretations, guidance or enforcement priorities. Any determination of a failure to comply with applicable laws, rules or regulations could expose us, our Affiliates, or our respective employees to civil liability, criminal liability, or disciplinary or enforcement action, with penalties that could include the disgorgement of fees, fines, sanctions, suspensions, termination of adviser status, or censure of individual employees or revocation or limitation of business activities or registration, and may result in monetary losses that are not covered by insurance in adequate amounts or at all, any of which could have an adverse impact on our stock price, financial condition, and results of operations. Further, if we, any of our Affiliates or our respective employees or third-party service providers were to fail to comply with applicable laws, rules, or regulations, or be named as a subject of an investigation or other regulatory action, the public announcement and potential publicity surrounding any such investigation or action could have an adverse effect on our or our Affiliates’ reputations and on our stock price and result in increased costs, even if we, our Affiliates, or our respective employees or third-party service providers were found not to have violated such laws, rules or regulations.

Recently implemented and proposed regulations globally have called for more stringent oversight of the financial services industry in which we and our Affiliates operate. In the U.S., the presidential administration has actively pursued an expanded scope of enforcement priorities under existing regulations, and has been pursuing additional rulemaking and disclosure obligations, impacting public companies and the financial services industry, including private and public funds. These and other regulatory developments could adversely affect our and our Affiliates’ businesses, increase compliance costs, require that we or our Affiliates change or curtail operations or investment offerings, or impact our and our Affiliates’ access to capital and the market for our common stock.

Further, in recent years, regulators in the U.S., the UK, and other jurisdictions have expanded rules and devoted greater resources and attention to the enforcement of anti-bribery and anti-money laundering laws, and while we and our Affiliates have developed and implemented policies and procedures designed to comply with these rules, such policies and procedures may not be effective in all instances to prevent violations.

Our and our Affiliates’ international operations are subject to foreign risks, including political, regulatory, economic, and currency risks.

We and certain of our Affiliates conduct business outside the U.S., and a number of our Affiliates are based or have offices outside the U.S. and, accordingly, are subject to risks inherent in doing business internationally. These risks may include difficulties in staffing and managing foreign operations, longer payment cycles, difficulties in collecting investment advisory fees receivable, different (and in some cases less stringent) legal, regulatory and accounting regimes, political instability,

14

exposure to fluctuations in currency exchange rates, expatriation controls, expropriation risks, and potential adverse tax consequences. For example, regulations in the European Union (the “EU”) pertaining to integrating ESG topics may materially impact the investment management industry in member states that have adopted, or may in the future adopt, such legislation. For example, the EU’s Sustainable Finance Disclosure Regulation requires MiFID firms and AIFMs to take ESG factors into account in their organizational, risk and governance arrangements and are designed to, among other things, establish EU labels for green financial products, clarify managers’ duties regarding sustainability in their investment decisions, and increase disclosure requirements relating to ESG matters including those relating to “greenwashing” (i.e., the holding out of a product as having green or sustainable characteristics where this is not, in fact, the case). Similar regulatory measures have been, and may in the future be, introduced in other jurisdictions in which we or our Affiliates currently have investments or plan to invest in the future, including in the U.S. and the UK, as applicable. These types of ESG-related regulations could impact our or our Affiliates’ businesses, increase regulatory and compliance costs, and adversely affect our profitability, which effects could be exacerbated in the event of regulatory uncertainty or conflicting or inconsistent regulatory guidance related thereto. In addition, as a result of operating internationally, certain of our Affiliates and our global capital distribution platform are subject to requirements under foreign regulations to maintain minimum levels of capital. Such capital requirements may be increased from time to time, which may have the effect of limiting withdrawals of capital and the payment of distributions to us or, if there were a significant change in the required capital or an extraordinary loss or charge against net capital at a particular Affiliate, could adversely impact such Affiliate’s ability to expand or maintain operations. These or other risks related to our and our Affiliates’ international operations may have an adverse effect on our business, financial condition, and results of operations.

Changes in tax laws or exposure to additional tax liabilities could have an adverse impact on our business, financial condition, and results of operations.