Exhibit 99.1

Impax Signs Definitive Agreements to Acquire Generic Products

— Transaction Expected to Enhance Earnings Growth Potential —

— Immediately Accretive to 2016 Earnings after Closing —

— Expected to Increase Utilization of Impax Manufacturing Resources —

— Impax Provides Updated Full Year 2016 Financial Guidance —

— Conference Call Today at 8:30 AM ET —

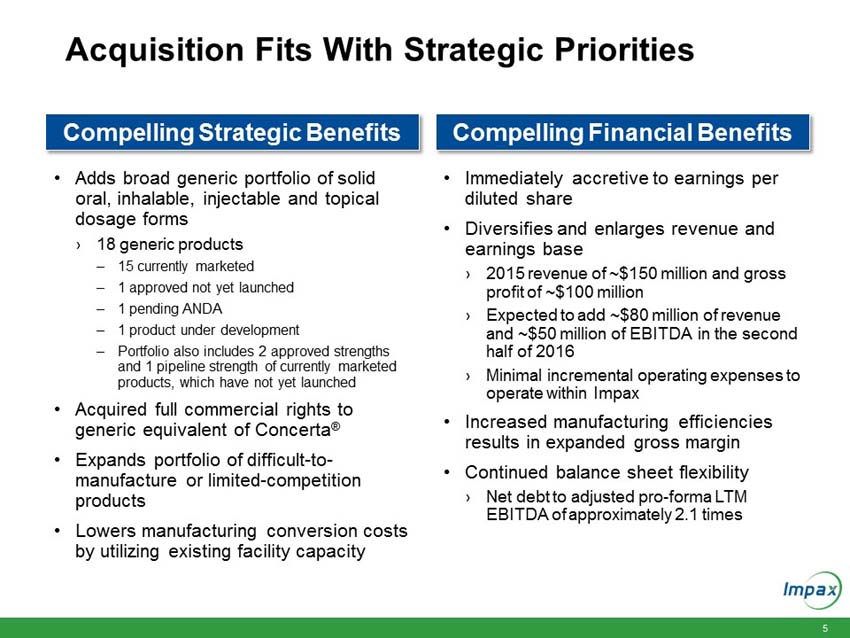

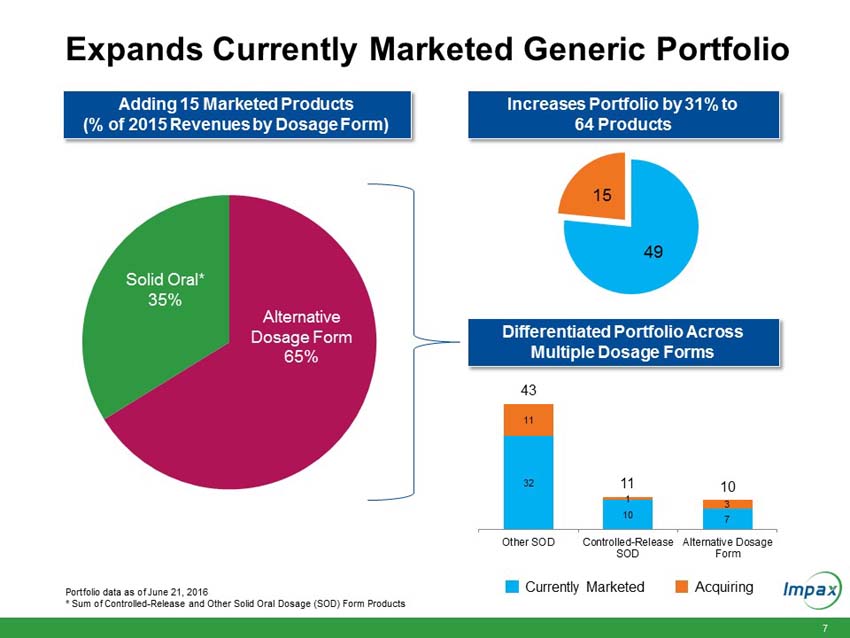

HAYWARD, Calif., June 21, 2016 – Impax Laboratories, Inc. (NASDAQ: IPXL), a specialty pharmaceutical company, today announced that it has signed definitive agreements with Teva Pharmaceutical Industries Ltd. (“Teva”) and affiliates of Allergan plc (“Allergan”) for the acquisition of a broad portfolio of generic products across solid oral, inhalable, injectable and topical dosage forms and the return to Impax of its rights to its pending abbreviated new drug application (“ANDA”) for the generic equivalent to Concerta® (methylphenidate hydrochloride) (the “Transaction”) for an aggregate purchase price of $586 million.

Upon closing of the Transaction, Impax is expected to add:

|

● |

A portfolio of 15 currently marketed generic products; |

|

● |

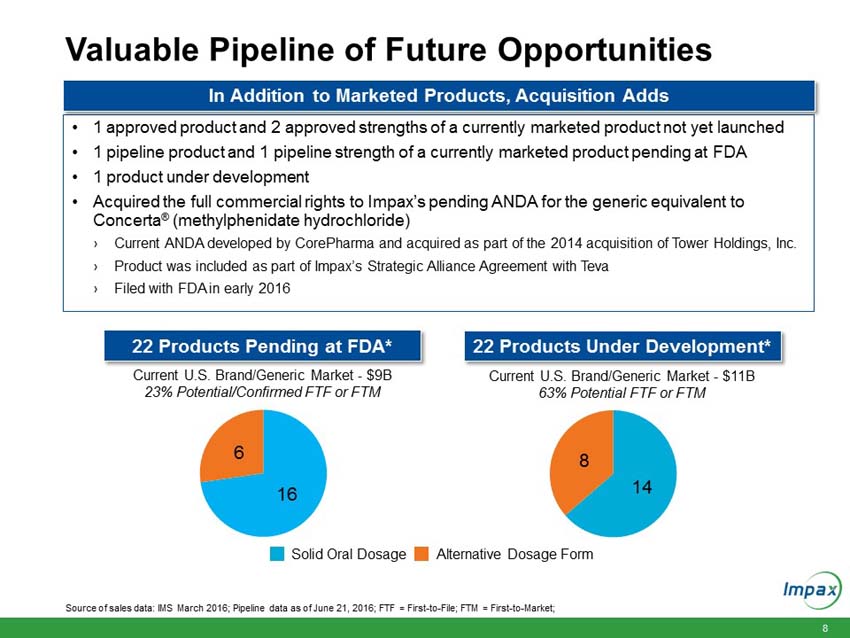

One approved generic product and two approved strengths of a currently marketed product, which have not yet launched; |

|

● |

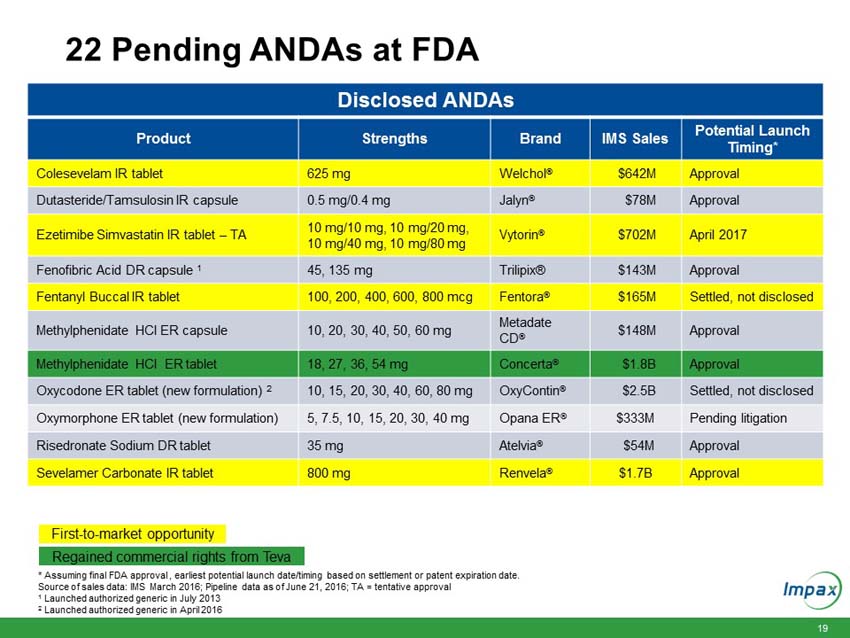

One pipeline generic product and one pipeline strength of a currently marketed product, which are pending U.S. Food and Drug Administration (FDA) approval; |

|

● |

The full commercial rights to Impax’s pending ANDA for the generic equivalent to Concerta® (methylphenidate hydrochloride), a product previously partnered with Teva; and |

|

● |

One generic product under development. |

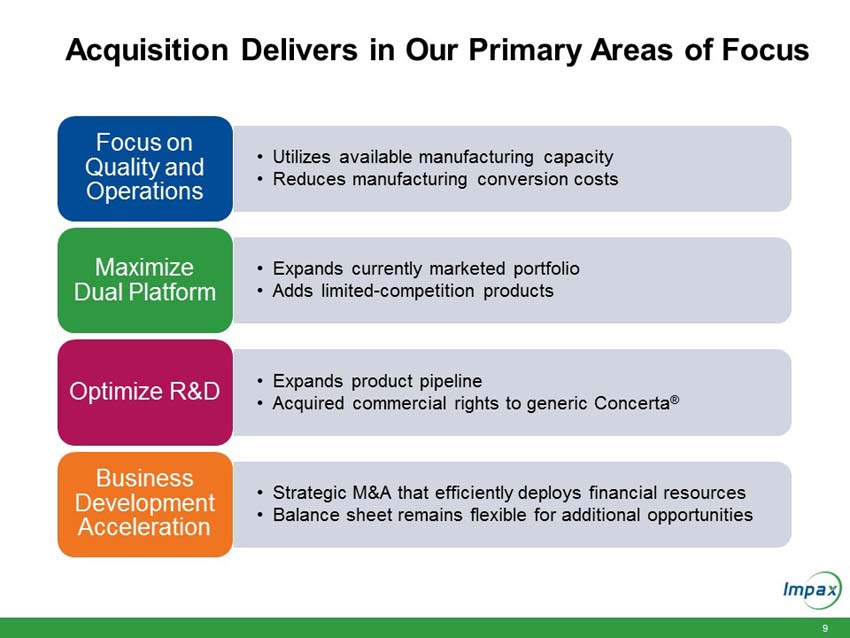

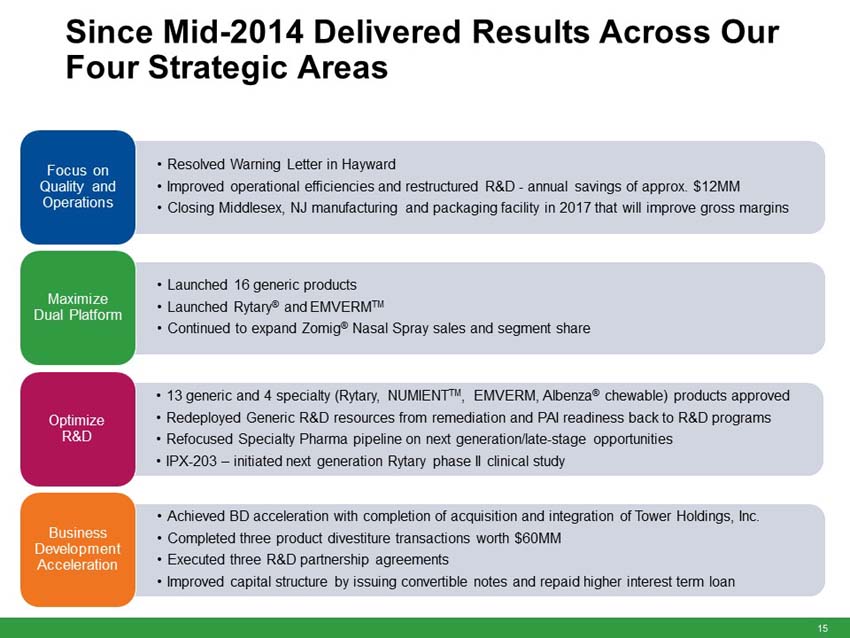

“The anticipated acquisition of these currently marketed and pipeline products fits with our strategic priorities of maximizing our generic platform, optimizing R&D and accelerating business development to create long term growth,” said Fred Wilkinson, President and Chief Executive Officer of Impax. “Through this transaction, we will be expanding our portfolio of difficult-to-manufacture or limited-competition products and maximizing utilization of our existing manufacturing facilities in Hayward, California and Taiwan. The acquisition of full commercial rights to generic Concerta provides an additional opportunity to add another valuable near term launch and accentuates the strength of our internal R&D program.”

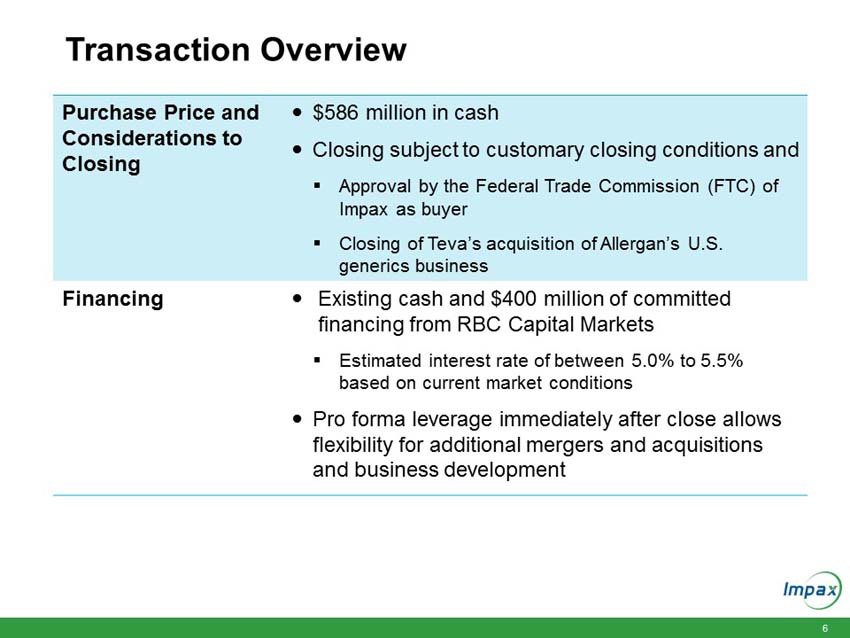

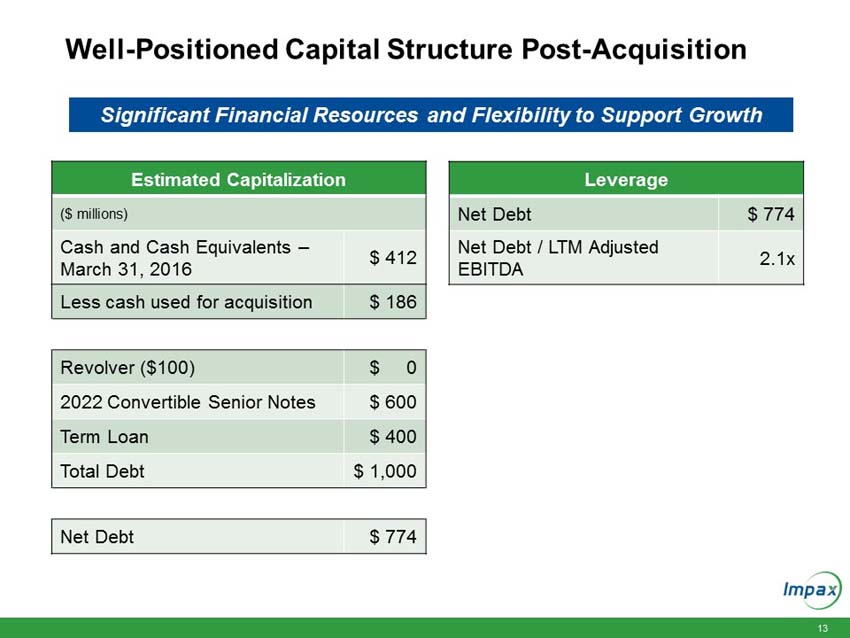

Upon closing, the immediately accretive transaction will provide Impax with a profitable and growing commercialized portfolio of products. The acquired marketed generic products generated approximately $150 million in net sales and approximately $100 million in gross profit in 2015. According to IMS Health (NSP), the pending and development pipeline programs are estimated to have U.S. brand and generic sales of approximately $3.1 billion for the 12 months ending in March 2016. The aggregate purchase price of $586 million for the portfolio of products will be funded with existing cash and $400 million in new fully committed term loans.

“We are excited about the opportunity to create long-term value and efficiently deploy our strong balance sheet. Following the completion of this acquisition, we will continue to have an efficient capital structure with our net debt to trailing 12 months adjusted pro-forma EBITDA ratio of approximately 2.1 times,” Wilkinson continued. “We will be well positioned to continue to invest in organic growth as well as judiciously pursue strategic business development and merger and acquisition opportunities that can strengthen our portfolio and create long-term stockholder value.”

The Transaction is in connection with the divestiture process mandated by the Federal Trade Commission (the “FTC”) in connection with the acquisition by Teva of the U.S. generics business of Allergan. The Transaction is subject to customary closing conditions, including approval by the FTC of Impax as buyer of the assets and the closing of Teva’s acquisition of Allergan’s global generics business.

Sullivan & Cromwell LLP and McDermott Will & Emery LLP served as legal advisors, and RBC Capital Markets is providing fully committed financing, to Impax. Greenhill & Co Inc. served as financial advisor and Kirkland & Ellis LLP served as legal advisor to Teva.

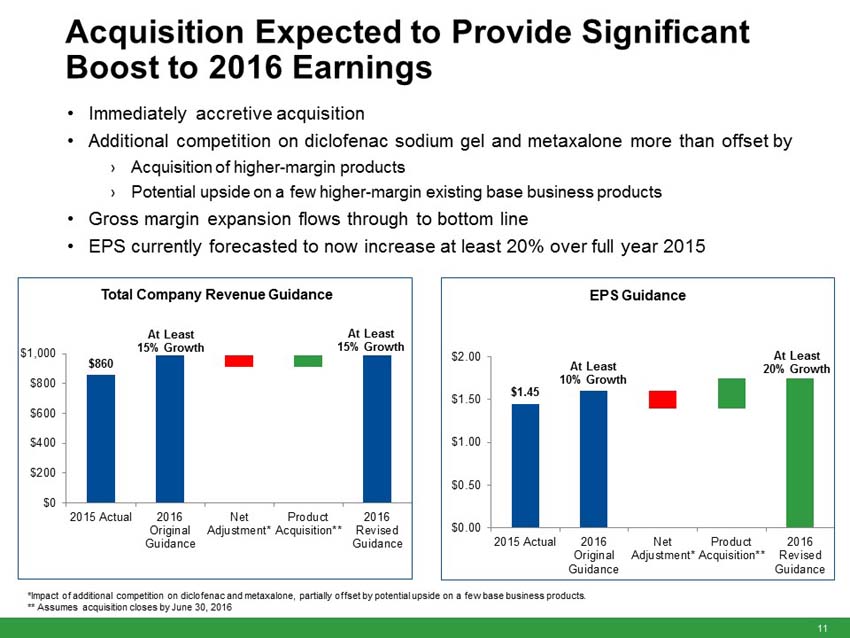

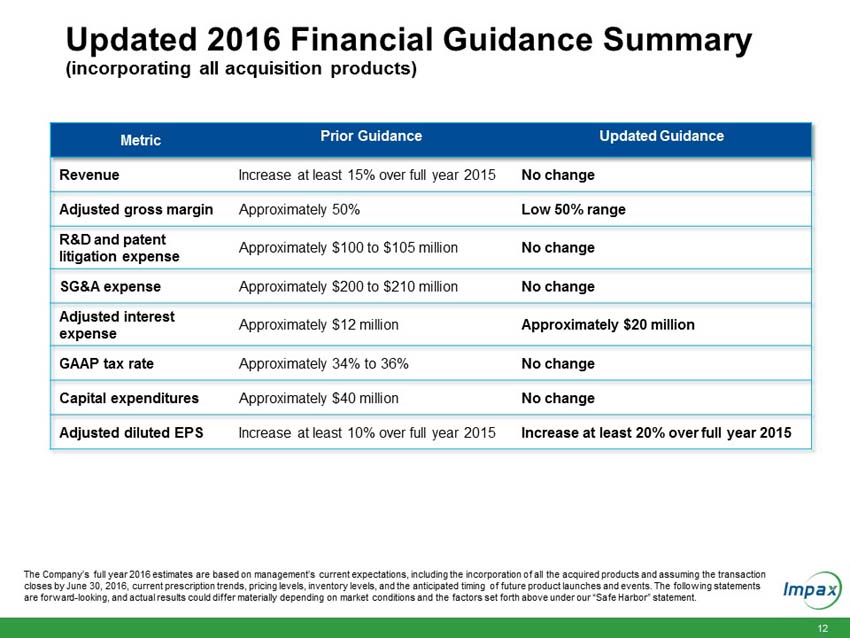

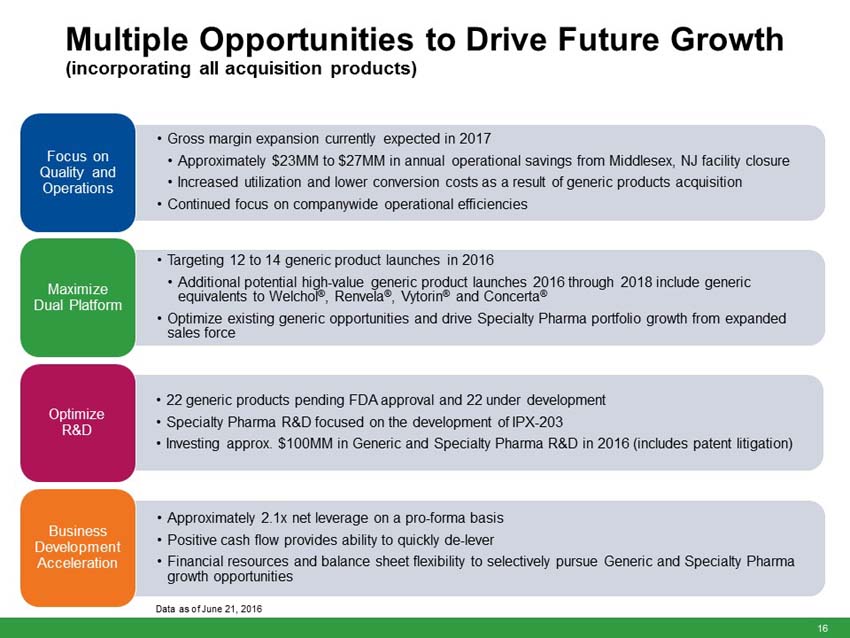

Updated 2016 Financial Guidance

Impax has updated its full year 2016 financial guidance from its original issuance on February 22, 2016. The Company’s full year 2016 estimates are based on management’s current expectations, including the incorporation of all the acquired products listed above and assuming the Transaction closes by June 30, 2016, current prescription trends, pricing levels, inventory levels, and the anticipated timing of future product launches and events. The 2016 guidance assumes 12 to 14 generic product launches including six to eight new generic product approvals. Year to date, the Company has launched two generic products including one of two products approved by the FDA in 2016. Closing is expected to occur coincident with the closing of the Teva-Allergan Generics transaction.

“The anticipated addition of 15 marketed products from the Transaction is currently expected to add approximately $80 million of revenue in the second half of 2016 and is expected to offset the revenue decline from recent competition on our diclofenac sodium gel and metaxalone products,” Wilkinson said. “However, the anticipated product portfolio from the Transaction is currently expected to add approximately $50 million to our 2016 EBITDA, expand our gross margins by several hundred basis points and provide a boost to our EPS, which is currently expected to increase by at least 20% over the prior year.”

The following statements are forward looking and actual results could differ materially depending on market conditions and the factors set forth under “Safe Harbor” below.

|

● |

Total Company revenues to increase at least 15% over full year 2015. |

|

● |

UPDATED - Adjusted gross margins as a percent of total revenue are expected to be in the low 50% range (previously approximately 50%). |

|

● |

Adjusted research and development expenses across the generic and specialty pharma divisions of approximately $100 million to $105 million (approximately 10% of total Company revenues). This includes patent litigation expenses. |

|

● |

Adjusted selling, general and administrative expenses of approximately $200 million to $210 million (approximately 20% to 21% of total Company revenues). |

|

● |

UPDATED - Adjusted interest expense of approximately $20 million (previously approximately $12 million). |

|

● |

Capital expenditures of approximately $40 million. |

|

● |

UPDATED - Adjusted EPS to increase at least 20% over full year 2015 adjusted diluted EPS (previously at least 10% over full year 2015 adjusted diluted EPS). |

|

● |

Effective tax rate of approximately 34% to 36% on a GAAP basis. The Company anticipates that its GAAP effective tax rate may experience volatility as the Company’s tax benefits may be high compared to the Company’s operating income or loss. |

Conference Call Information

The Company will host a conference call with a slide presentation on June 21, 2016 at 8:30 a.m. ET to discuss this announcement. The call and presentation can also be accessed via a live Webcast through the Investor Relations section of the Company’s Web site, www.impaxlabs.com. The number to call from within the United States is (877) 356-3814 and (706) 758-0033 internationally. The conference ID is 38162489. A replay of the conference call will be available shortly after the call for a period of seven days. To access the replay, dial (855) 859-2056 (in the U.S.) and (404) 537-3406 (international callers).

About Impax Laboratories, Inc.

Impax Laboratories, Inc. (Impax) is a specialty pharmaceutical company applying its formulation expertise and drug delivery technology to the development of controlled-release and specialty generics in addition to the development of central nervous system disorder branded products. Impax markets its generic products through its Impax Generics division and markets its branded products through the Impax Specialty Pharma division. Additionally, where strategically appropriate, Impax develops marketing partnerships to fully leverage its technology platform and pursues partnership opportunities that offer alternative dosage form technologies, such as injectables, nasal sprays, inhalers, patches, creams, and ointments. For more information, please visit the Company's Web site at: www.impaxlabs.com.

"Safe Harbor" statement under the Private Securities Litigation Reform Act of 1995:

To the extent any statements made in this news release contain information that is not historical; these statements are forward-looking in nature and express the beliefs and expectations of management. Such statements are based on current expectations and involve a number of known and unknown risks and uncertainties that could cause the Company’s future results, performance, or achievements to differ significantly from the results, performance, or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: fluctuations in revenues and operating income; the Company’s ability to successfully develop and commercialize pharmaceutical products in a timely manner; reductions or loss of business with any significant customer; the substantial portion of the Company’s total revenues derived from sales of a limited number of products; the impact of consolidation of the Company’s customer base; the impact of competition; the Company’s ability to sustain profitability and positive cash flows; any delays or unanticipated expenses in connection with the operation of the Company’s manufacturing facilities; the effect of foreign economic, political, legal, and other risks on the Company’s operations abroad; the uncertainty of patent litigation and other legal proceedings; the increased government scrutiny on the Company’s agreements with brand pharmaceutical companies; product development risks and the difficulty of predicting FDA filings and approvals; consumer acceptance and demand for new pharmaceutical products; the impact of market perceptions of the Company and the safety and quality of the Company’s products; the Company’s determinations to discontinue the manufacture and distribution of certain products; the Company’s ability to achieve returns on its investments in research and development activities; changes to FDA approval requirements; the Company’s ability to successfully conduct clinical trials; the Company’s reliance on third parties to conduct clinical trials and testing; the Company’s lack of a license partner for commercialization of NUMIENTTM (IPX066) outside of the United States; impact of illegal distribution and sale by third parties of counterfeits or stolen products; the availability of raw materials and impact of interruptions in the Company’s supply chain; the Company’s policies regarding returns, allowances and chargebacks; the use of controlled substances in the Company’s products; the effect of current economic conditions on the Company’s industry, business, results of operations and financial condition; disruptions or failures in the Company’s information technology systems and network infrastructure caused by third party breaches or other events; the Company’s reliance on alliance and collaboration agreements; the Company’s reliance on licenses to proprietary technologies; the Company’s dependence on certain employees; the Company’s ability to comply with legal and regulatory requirements governing the healthcare industry; the regulatory environment; the effect of certain provisions in the Company’s government contracts; the Company’s ability to protect its intellectual property; exposure to product liability claims; risks relating to goodwill and intangibles; changes in tax regulations; the Company’s ability to manage growth, including through potential acquisitions and investments; the risks related to the Company’s acquisitions of or investments in technologies, products or businesses; the restrictions imposed by the Company’s credit facility and indenture; the Company’s level of indebtedness and liabilities and the potential impact on cash flow available for operations; uncertainties involved in the preparation of the Company’s financial statements; the Company’s ability to maintain an effective system of internal control over financial reporting; the effect of terrorist attacks on the Company’s business; the location of the Company’s manufacturing and research and development facilities near earthquake fault lines; expansion of social media platforms and other risks described in the Company’s periodic reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as to the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, regardless of whether new information becomes available, future developments occur or otherwise.

Company Contact:

Mark Donohue

Investor Relations and Corporate Communications

(215) 558-4526

www.impaxlabs.com

Page 3 of 3