REIT

WEEK: 2013 NAREIT Investor Forum June 5-6, 2013

Exhibit 99.1 |

2013 Duke Realty Corporation

2

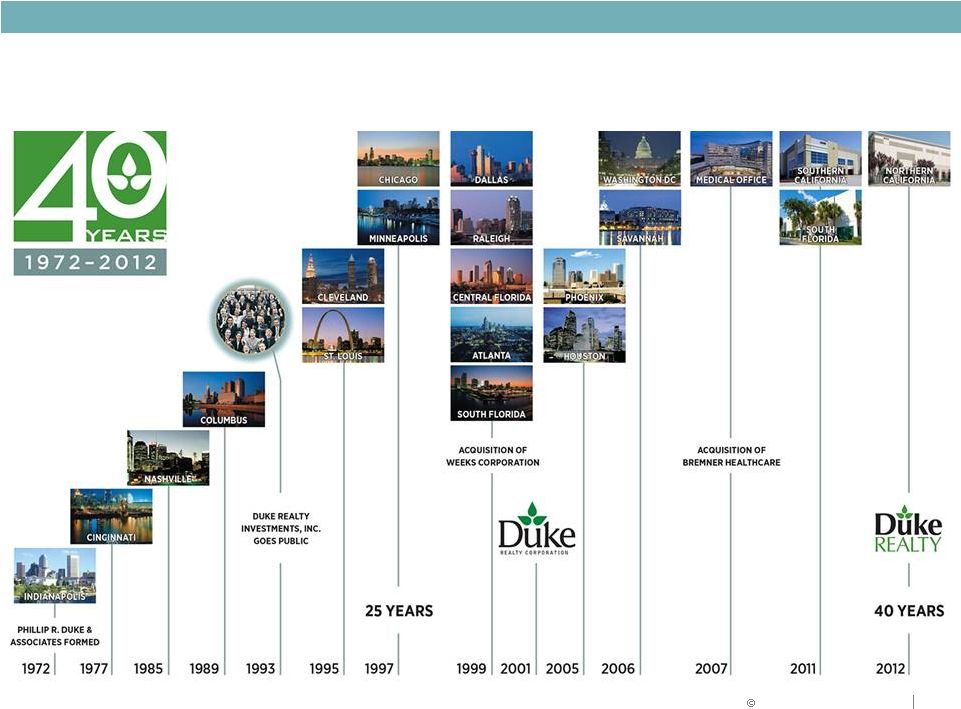

40 Years Timeline

RELIABLE. ANSWERS. |

2013 Duke Realty Corporation

3

Three-Pronged Strategy for Success

Strategies for delivering shareholder value

RELIABLE. ANSWERS. |

RELIABLE. ANSWERS.

2013 Duke Realty Corporation

Strategic Focus

2013 Goals and Objectives

2013 Update

•

Lease-up portfolio, manage cap ex; continue

positive same property income growth

•

Focus on rent growth to continue to drive same

property NOI growth

•

Development starts of $400 to $500 million focus

on industrial and medical office

•

Total portfolio occupancy as of quarter end 91.8%; industrial portfolio

at 93.1%; medical office at 92.4%

•

Approximately 6.4 million square feet of leases completed in Q1

•

2.6% same property NOI growth

•

$139MM development starts. Two bulk industrial projects 74%

leased (at 8.6% yield), four 100% leased medical office (7.9% yield)

and one 100% leased office (7.7% yield)

•

Continue strong momentum from 2012 on

repositioning of portfolio

•

Pursue acquisitions of industrial assets

•

Continue pruning suburban office primarily in

Midwest

•

Closed on $30MM of acquisitions during the quarter, weighted 26%

industrial and 74% medical; In May, closed on $312MM acquisition

of eight, class A bulk industrial facilities (“USAA”)

•

$223MM in dispositions of primarily suburban office assets in Q1

•

Disposed of Pembroke Pines retail center in May for $188 million

•

Opportunistically access capital markets . . .

push out debt maturity schedule further

•

Continue improving coverage ratios

•

Maintain minimal balance on line of credit

•

Debt to EBITDA @ 7.25x; Fixed charge ratio of 1.86x, improved from

prior year

•

Issued $572MM of equity at a $14.25 share price

•

Issued $250MM of senior notes at a 3.625% coupon maturing 2023

•

Redeemed $178MM of 8.375% Series O Preferred shares

•

Zero credit facility balance and $307MM of cash at quarter end

•

Closed on a $250MM 5 year term loan at LIBOR+1.35% in May

4

Solid start and executing across all three aspects of our strategy

Operations

Strategy

Asset

Strategy

Asset

Strategy

Capital

Strategy |

2013 Duke Realty Corporation

OPERATIONS STRATEGY

5 |

2013 Duke Realty Corporation

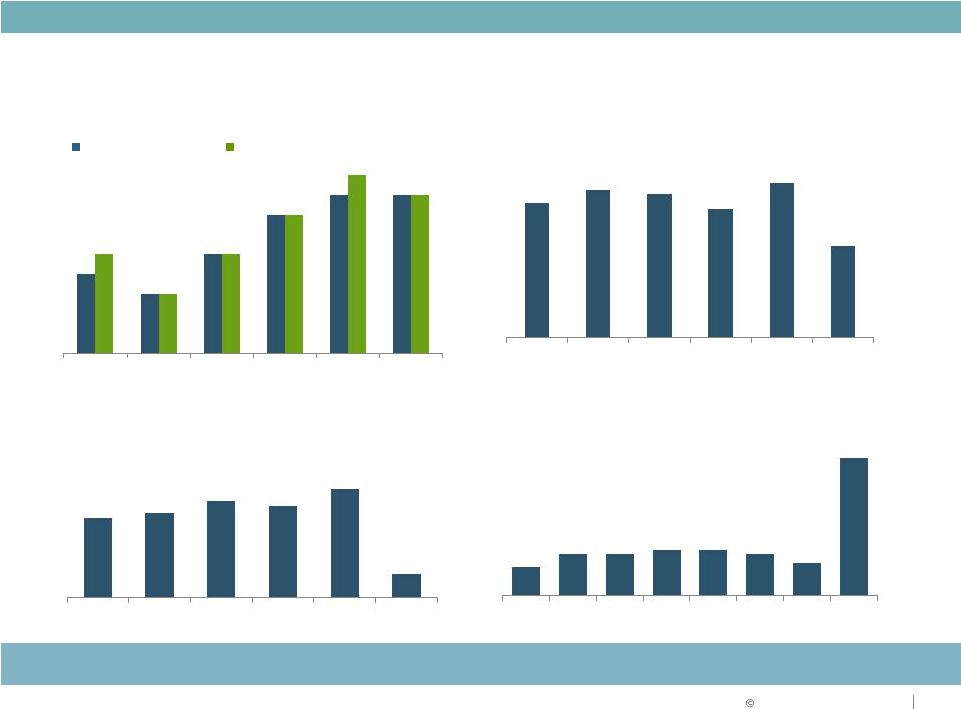

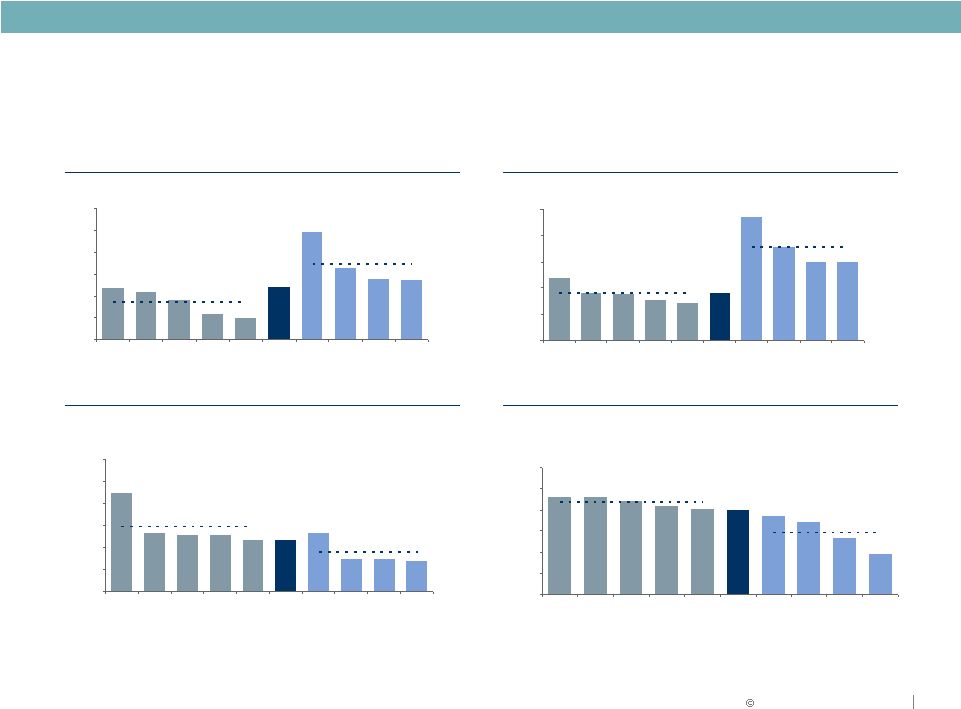

Consistent Operating Performance

Stabilized Occupancy (%)

Strong

historical

occupancy

–

fundamentals

solid

Lease Renewals (%)

Strong lease renewal percentages

Total occupancy

In-service occupancy

Leasing Activity

New

Leases

and

Renewals

–

Consistent

Execution

(in

millions

of

square feet)

Lease Maturity Schedule

Lease maturities are well balanced with no one year accounting for

more than 11%

88%

89%

87%

91%

91%

89%

89%

87%

6

OPERATIONS STRATEGY

93%

72%

79%

77%

69%

83%

21.4

22.7

25.9

24.5

29.3

92%

92%

2008

2009

2010

2011

2012

Q1 2013

92%

49%

2008

2009

2010

2011

2012

Q1 2013

6.4

2008

2009

2010

2011

2012

Q1 2013

7%

10%

10%

11%

11%

10%

8%

33%

2013

2014

2015

2016

2017

2018

2019

2020+

Demonstrated ability to maintain consistency through economic cycles

|

2013 Duke Realty Corporation

1.

2.

3.

Notes

Sources SNL and company filings

Duke Realty

Suburban Office Peers

(2)

Industrial Peers (3)

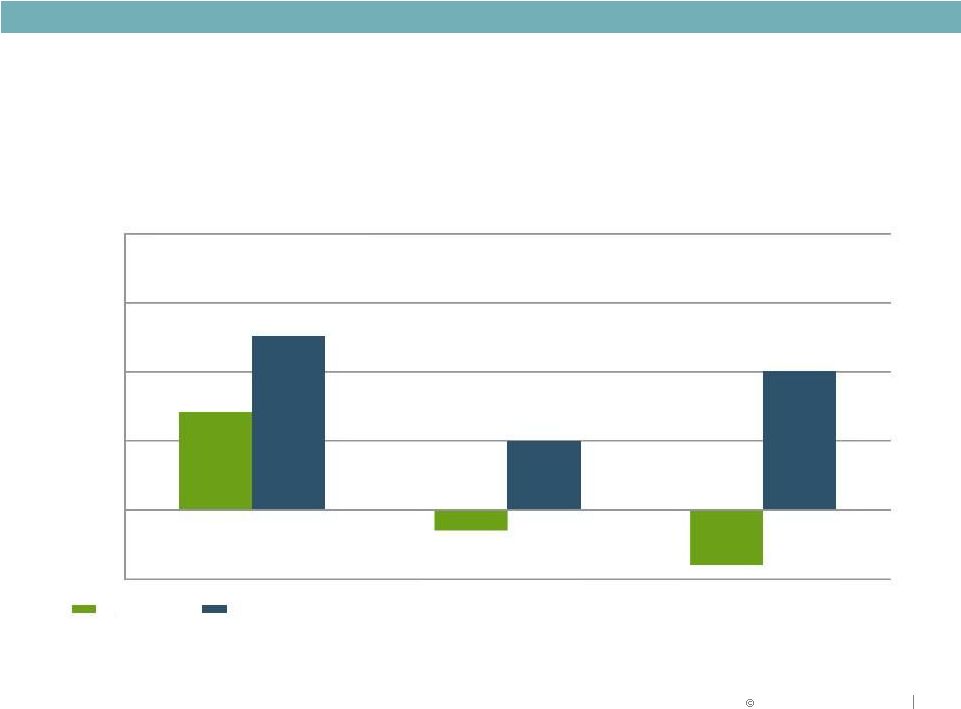

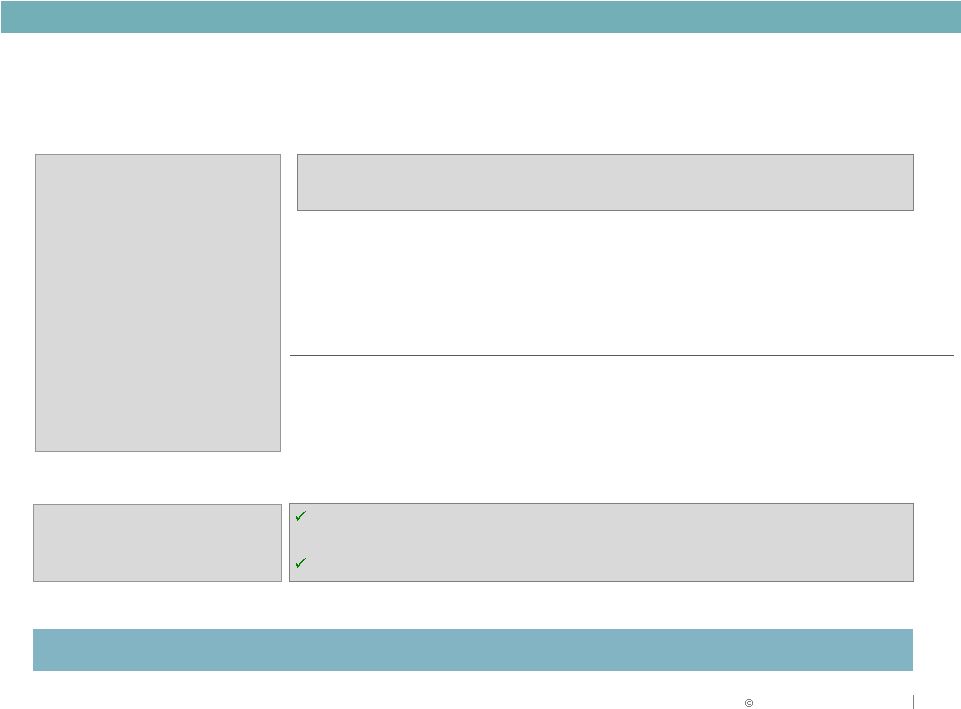

Consistent NOI Growth Outperformance

Relative Performance vs. Peers

OPERATIONS STRATEGY

7

1.4%

(0.3%)

(0.8%)

2.5%

1.0%

2.0%

(1.0%)

0.0%

1.0%

2.0%

3.0%

4.0%

5-Year Avg.

1-Year Avg.

Annual Same-Store

NOI Growth

(1)

Based on simple average of calendar year-over-year annual same-property cash NOI

growth. Five year analysis measures 2008 - 2012 Suburban Office Peers include

BDN, CLI, HIW, OFC and LRY; weighted by historical market cap Industrial includes DCT, EGP, FR,

AMB and PLD; weighted by historical market cap |

2013 Duke Realty Corporation

8

Positioned for NAV Growth

KEY NAV GROWTH DRIVERS

Lease-Up

existing

vacancy

In-service Portfolio occupancy of 92.1%

Strong leasing pipeline

Demonstrated track record of 65-85% tenant renewal rate over past 6 full

years Accretive

Development

Current development pipeline of $621 million (3.4MM SF of industrial, 1.0MM SF of

medical office and 0.7MM SF of suburban office, currently 83%

pre-leased) 2013 estimated development starts of $400 to $500

million High quality land bank to facilitate future development

Continued Asset

Repositioning

Acquisitions of primarily core and value-add bulk industrial, located in

strategic distribution markets, leased to high quality tenants with

contractual lease escalators Dispositions focused on more capital intensive

suburban office mainly in the Midwest, retail, and select older medical and

industrial/flex assets Asset recycling has been AFFO neutral to positive,

while extending average lease duration,

lowering

cash

flow

volatility,

improving

tenant

credit

and

improving

overall

quality of portfolio

Increase Rents

\

Reduced

Capex

Rent roll downs burning off and positive same property NOI performance

Forecasts

of

industrial

market

wide

average

annual

rent

growth

of

2.7%

*

from

2014-17

* Rent forecasts a composite of PPR and Green Street

OPERATIONS STRATEGY |

RELIABLE. ANSWERS.

2013 Duke Realty Corporation

Development Strategic Advantages

Development platform creates value

9

Duke Realty 40 years of experience in development

Recognized as one of the leading commercial developers nationally

Land bank in strategic locations that can support approximately 55

million square feet of development is a significant value advantage

Capital deployed in development can generate 75 to 150 basis

points of premium yield over comparable acquisition yields

Risk management policies in place to govern maximum

development pipeline size and speculative development starts

|

2013 Duke Realty Corporation

10

Land and Development Capabilities

OPERATIONS STRATEGY

$549

million

HELD FOR

DEVELOPMENT

Attractive positions contribute to future development and value

•

Strategically located in key distribution markets and

vibrant commercial corridors

•

Cost feasibility and development strategies

completed for all land investments; Land fully zoned

for intended use

•

Land bank can support approximately 55 million

square feet of future development

o

46.6 million square feet of future industrial

development in key distribution markets

o

8.0 million square feet of future office development

land primarily for build-to-suit

•

Monetizing land bank supports strong development

yield premiums and accelerates further

improvement in credit profile

•

Sales of $76 million since 2009 have resulted in an

approximate 5% gain over impaired basis

Office 36%

Industrial

64% |

RELIABLE. ANSWERS.

2013 Duke Realty Corporation

11

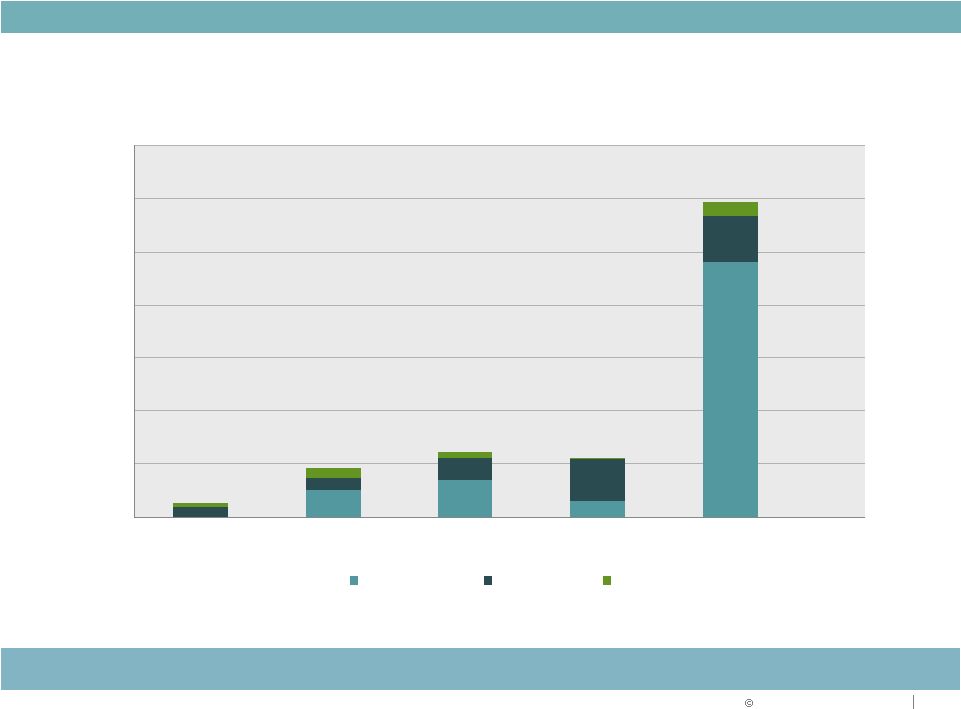

Historical Development Starts

National Development Platform Providing Solid Growth

Stabilized

Costs in

$millions

Original Pre-lease %:

39%

87%

88%

97%

77%

81%

Current Lease %:

91%

90%

99%

97%

80%

81%

Stabilized Yield:

8.2%

8.5%

8.9%

7.5%

7.3%

8.0%

$373

$236

$130

$202

$519

$138

Current development pipeline of 5.1 million square feet, $621 million in

stabilized costs, 83% pre-leased at a weighted average stabilized yield

of 7.5% 84

16

74

19

302

40

188

220

56

120

194

59

101

63

23

39

0

100

200

300

400

500

2008

2009

2010

2011

2012

2013 YTD

Office

Medical

Industrial |

2013 Duke Realty Corporation

Chicago Industrial

Select 2012 Industrial Development Starts

12

Columbus Industrial

•

OPERATIONS STRATEGY

Southern California Industrial

Atlanta Industrial

Greater Seattle Bulk Industrial

Delaware Industrial

•

Regional distribution center build-to-suit in greater

Seattle for internet retailer

•

1,016,000 square feet

•

15 year lease term

•

Yusen Logistics build-to-suit

•

O’Hare submarket on 26 acre brownfield redevelopment

•

230,000 square feet

•

12 year lease term

•

Regional distribution center build-to-

suit in Delaware for internet retailer

•

1,015,000 square feet

•

12 year lease term

•

Speculative development on Duke Realty land

in Chino, CA

•

Inland Empire West submarket

•

421,000 square feet

•

Kuehne & Nagel build-to-suit on Duke Realty land at Camp

Creek

•

South Atlanta submarket near Hartsfield Airport

•

211,000 square feet

•

10 year lease term

•

Restoration Hardware expansion for Eastern

U.S. Distribution Operations

•

West Jefferson submarket on 19 acres of

our land

•

418,000 square feet, as an addition to

existing 805,000 square feet

•

15 year lease term |

2013 Duke Realty Corporation

2013 YTD Development Starts

13

OPERATIONS STRATEGY

Nashville Industrial

Dallas Medical Office

Dallas Office

Houston Industrial

Waco Medical Office

•

•

•

•

Regional distribution center build-to-suit for

Starbucks

•

680,000 square feet

•

7.5 year lease term

•

Three Baylor Emergency (ER) facilities in Metro Dallas

(cities of Rockwell, Murphy and Burleson)

•

114,000 total square feet

•

$15 million project cost each ($45 million total)

•

Build-to-suit on Duke Realty land

•

200,000 square feet

•

16 year lease term

Scott & White Healthcare

37,000 square feet

15 year term

•

•

•

Speculative development on Duke Realty

land

Airport submarket

240,000 square feet |

2013 Duke Realty Corporation

ASSET STRATEGY

14 |

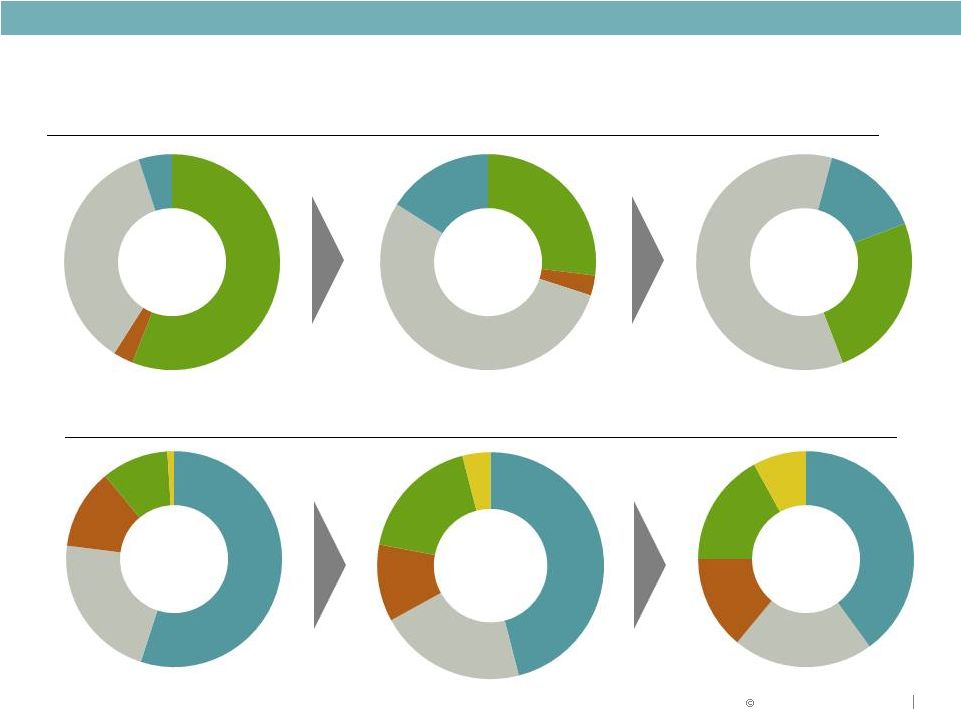

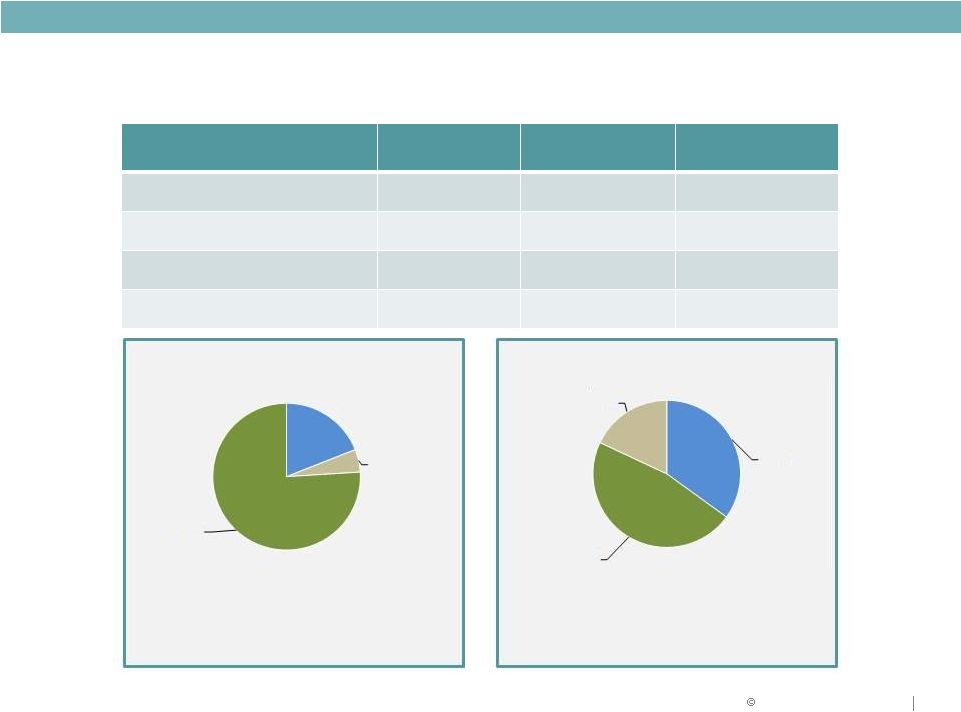

2013 Duke Realty Corporation

1Q 2013

YE

2013

15

Asset Strategy

BY PRODUCT

2009

BY GEOGRAPHY

ASSET STRATEGY

2009

YE

2013

Southeast

22%

Southeast

1Q 2013

Southeast

21%

Office

56%

Retail

3%

Industrial

36%

Medical

Office

5%

Office

27%

Retail

3%

Industrial

54%

Medical

Office

16%

Office

25%

Industrial

60%

Medical

Office

15%

Midwest

55%

East

12%

South

10%

West

1%

Note: Figures represents share of quarterly net operating income

Midwest

46%

East 11%

South 18%

West 4%

Midwest

40%

21%

East

14%

South

17%

West

8% |

2013 Duke Realty Corporation

16

New, High Quality Portfolio with Long-term Leases

ASSET STRATEGY

Premier portfolio of assets

Portfolio average

Bulk

Industrial

Suburban Office

Medical Office

Property age

11.3 years

15.0 years

6.7 years

Property size

230,000 SF

114,000 SF

78,000 SF

Lease term

7.2 years

6.8 years

11.3 years

Tenant size

80,000 SF

11,000 SF

9,000 SF |

2013 Duke Realty Corporation

17

Premier Quality Industrial Portfolio

ASSET STRATEGY

Focus on modern bulk warehouse

with strong performance characteristics

<100,000

100,000-500,000

>500,000

Percentage Total Square Feet

9%

55%

36%

Building Square Footage

(000's)

10,000

61,000

40,000

Number of Buildings

151

278

53

Average Tenant Size

22,000

88,000

482,000

Occupancy

90.3%

93.0%

95.3%

Building Size

Portfolio Metric

(As of March 31, 2013) |

2013 Duke Realty Corporation

18

2013 Notable Dispositions

Solid Momentum on Executing Disposition Strategy

Raleigh, NC

Sale of 50% joint venture at $98.3 million

sales price (building valuation $328/SF)

300,000 square feet

95% leased

Chambers Street Portfolio

ASSET STRATEGY

•

CapTrust Tower

•

•

•

17 primarily office and flex properties located across FL,

OH, MN, TX, AZ and NC

Sale of 20% joint venture interest to partner for $98.6

million sales price ($149/SF Office; $79/SF Industrial)

3.3 million square feet

98% leased

•

•

•

• |

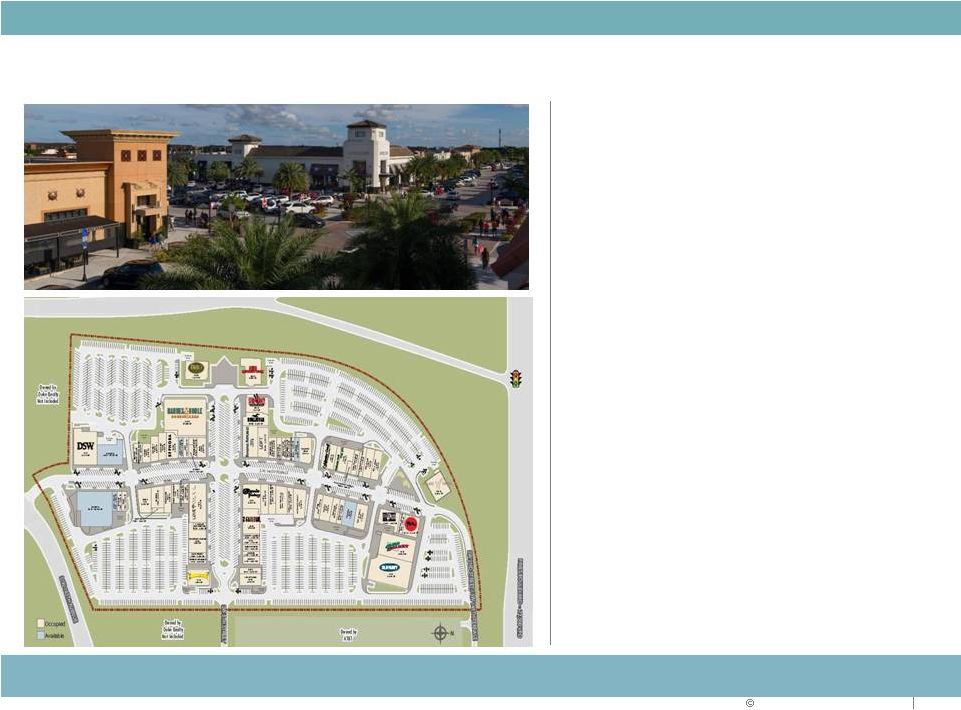

2013 Duke Realty Corporation

19

Pembroke Pines Retail Disposition

Pembroke Gardens

Lifestyle Center

INTERSTATE-75 / 136,000 VPD

Pembroke Pines, FL, on

Interstate 75

391,000 square feet, 90%

leased

$188 million sales proceeds

($480/SF)

Proceeds strategically recycled

into high quality industrial

portfolio

•

•

•

•

ASSET STRATEGY

Successful development, lease-up and gain on sale of non-core asset

|

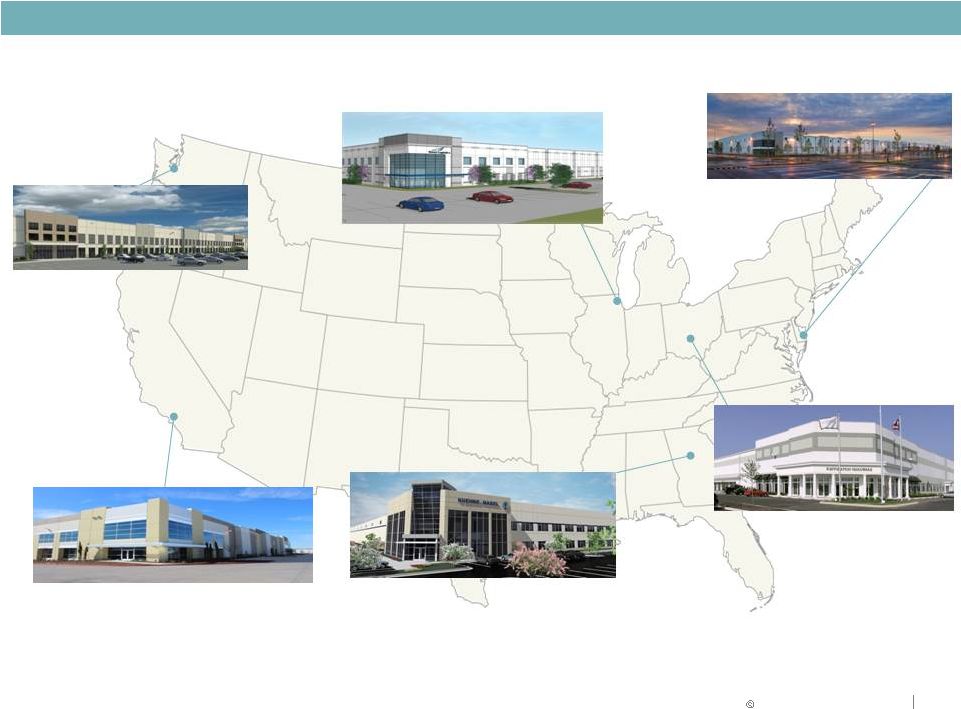

2013 Duke Realty Corporation

Consistent with long-term asset strategy, this transaction is an opportunity

to buy a portfolio of 100% modern, class A bulk assets in major distribution

markets 8 facilities, 4.9 million square feet, seven markets

$312 million purchase price, or ~$66/SF, $99 million of assumed debt. Closed

in May 2013.

100% leased to 10 tenants

90% in Duke Realty target markets . . . California, Pennsylvania, New Jersey and

Houston

The portfolio is representative of our existing portfolio and superior to most

acquisition opportunities:

–

Average age of 8 years

–

Average building size of 608,000 sf

–

Minimum clear height of 30’

with 7 assets 32’+

–

All assets are cross docked

Exceptional portfolio of Class A assets

20

ASSET STRATEGY

Transaction executed at attractive pricing

USAA Portfolio Industrial Acquisition |

2013 Duke Realty Corporation

21

ASSET STRATEGY

USAA Portfolio Acquisition

Strategic capital recycling into high quality bulk industrial portfolio

Home Depot Deployment

Center

Central Valley, CA

660,000 SF, 100% leased

JoAnne Stores

Central Valley, CA

635,000 SF, 100% leased

Redlands Commerce

Center

Inland Empire East

575,000 SF, 100% leased

Lakeview Commerce Center

St. Louis, MO

540,000 SF, 100% leased

Kimberly-Clark Regional DC

Kansas City, KS

447,000 SF, 100% leased

Interport Building I

Houston, TX

600,000 SF, 100% leased

1130 Commerce Blvd

Southern NJ

386,000 SF, 100% leased

Sears Distribution Center

Northeast PA

1,026,000 SF, 100% leased |

2013 Duke Realty Corporation

2 facilities totaling 950,000 SF

9 years old, 100% leased to

Crate & Barrel

Located in Cranbury, NJ, just off

I-95, equidistant to Philadelphia

and New York City, a key

distribution market in the

Eastern U.S.

One of three distribution

locations for Crate & Barrel, with

Duke Realty owning/managing

another location in Naperville, IL

$75 million purchase price, or

~$79/SF. Closed in April 2013

22

Central New Jersey Industrial Acquisition

ASSET STRATEGY

Duke Realty enters key distribution market in Eastern U.S.

Port of Newark

Container Terminal |

2013 Duke Realty Corporation

23

Midwest Office Portfolio being Marketed

Continue Pruning Midwest Suburban Office According to Plan

ASSET STRATEGY

•

17

Class

A

buildings,

2.3

million

square

feet,

average

age

of

16

years

•

Cincinnati, Cleveland and St. Louis markets

•

91.8% leased |

2013 Duke Realty Corporation

24

MEDICAL OFFICE STRATEGY |

2013 Duke Realty Corporation

25

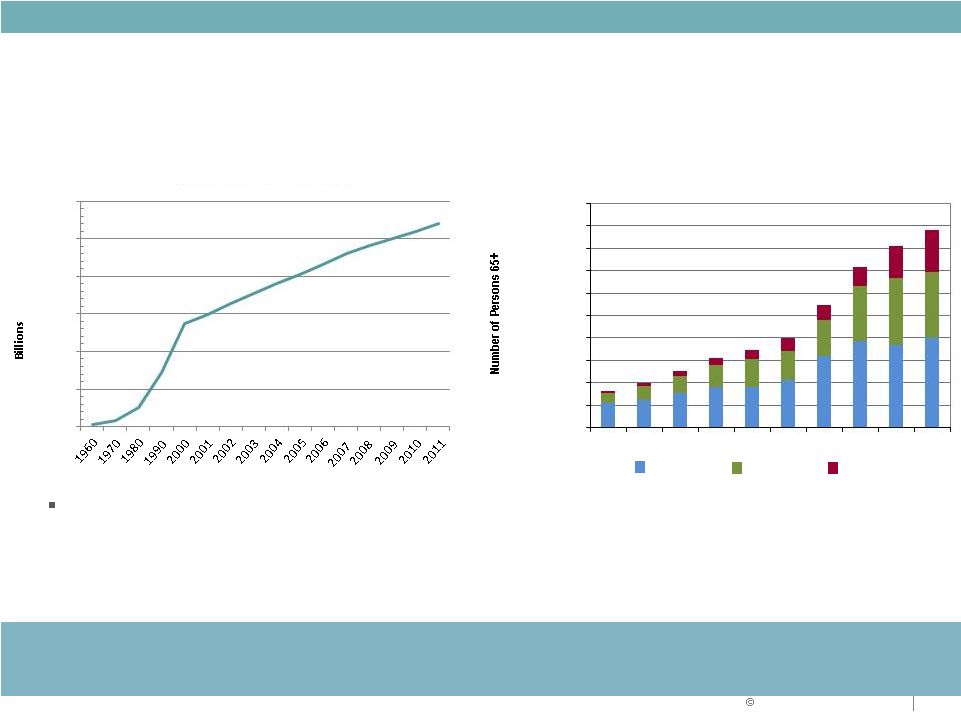

Healthcare Trends

The nation’s largest industry

•

More than 17% of GDP; predicted to exceed 23% by 2020

•

U.S. population 65+ expected to approach 90 million by 2050

•

Aging population driving increase in healthcare expenditures

MEDICAL OFFICE STRATEGY

Annual Healthcare

Expenditures

Source: U.S. Bureau of the Census

Population Age 65+: 1960-2050

Source: U.S. Bureau of the Census

Age 65-74

Age 75-84

Age 85+

Growing healthcare expenditures and demographics

should drive long term MOB demand

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

0

10,000,000

20,000,000

30,000,000

40,000,000

50,000,000

60,000,000

70,000,000

80,000,000

90,000,000

100,000,000

1960

1970

1980

1990

2000

2010

2020

2030

2040

2050 |

©

2013 Duke Realty Corporation

26

Healthcare Trends

MEDICAL OFFICE STRATEGY

Projected U.S. Residents with Insurance in 2021

Source: U.S. Bureau of the Census and U.S. Center for Disease Control and

Prevention Inpatient and Outpatient Trends

Source: Avalere Health, American Hospital Association

Annual Survey, U.S. Census Bureau

Inpatient Days

Outpatient Visits

Affordable Care Act should further improve trend for demand for lowest-cost

setting outpatient facilities such as Medical Office

223M

+253M

205

210

215

220

225

230

235

240

245

250

255

260

Before ACA

After ACA

0

500

1,000

1,500

2,000

2,500

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

Affordable Care Act

People insured expected to increase by 30 to 50 million – increased demand for care Number of physicians will increase – growing MOB space demand

Patient care shifting to more cost-efficient MOB settings with higher acuity

of services • Reduced reimbursements

will make real estate efficiency a priority – larger deals and floor plates

Healthcare system consolidation and physician employment by hospitals escalating – growing

MOB demand and improving tenant credit

•

•

•

• |

2013 Duke Realty Corporation

Our Plan

Existing healthcare assets $1.5 Billion

New developments projected

$200 Million

in 2013

92.4% leased at March 31, 2013 . . .

projected to increase in 2013

Recycle selected non-strategic assets and

recognize value created

Our Focus

Virtually all assets are on campus or affiliated with

a major health system

Goal: Grow Medical Office Primarily through Development

27

MEDICAL OFFICE STRATEGY |

2013 Duke Realty Corporation

28

In-Service

Under

Development

Total

Properties

70

13

83

Investment $

$1.2 B

$290 M

$1.5 B

Square Feet

5.5 M

1.0 M

6.5 M

Leased Occupancy

91%

100%

92%

Medical Office Portfolio at March 31, 2013

MEDICAL OFFICE STRATEGY

Portfolio investment

by product type

MOB

On-Campus

MOB

Off-Campus

Specialty

Hospital

19%

5%

76%

Regional

National

Portfolio investment by

hospital system

Local

35%

47%

18% |

©

2013 Duke Realty Corporation

29

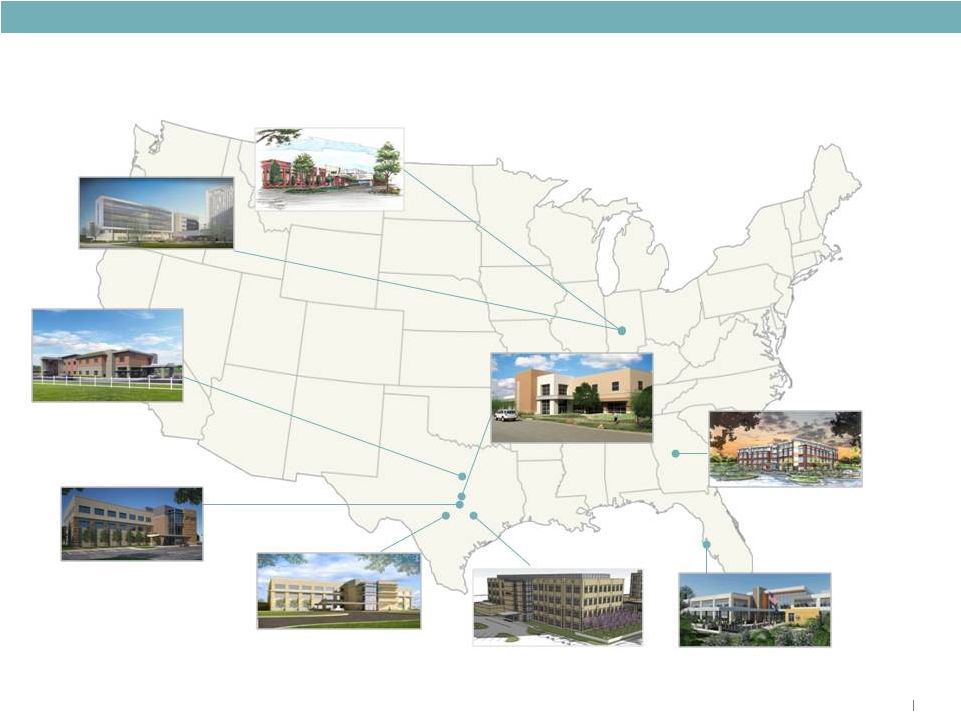

Healthcare Development Pipeline

MEDICAL OFFICE STRATEGY

Department of Veterans Affairs

Tampa, FL

117,000 SF, 100% pre-leased

Scott and White Healthcare

Marble Falls, TX

67,000 SF, 100% pre-leased

Wishard Health

Indianapolis, IN

274,000 SF, 100% pre-leased

Scott & White Healthcare

College Station, TX

119,000 SF, 100% pre-leased

Centerre / Community Health

Indianapolis, IN

60,000 SF, 100% pre-leased

Northside Hospital Orthopedic Clinic

Atlanta, GA

101,000 SF, 100% pre-leased

Scott & White Healthcare

Temple, TX

78,000 SF, 100% pre-leased

Baylor Healthcare (4 Facilities)

Dallas, TX

38,000 square feet each (152,000 total

square feet), 100% pre-leased

Scott & White Healthcare

Waco, TX

35,000 SF, 100% pre-leased |

©

2013 Duke Realty Corporation

30

1%

3%

1%

4%

4%

8%

5%

0%

2%

4%

6%

8%

10%

2013

2014

2015

2016

2017

2018

2019

Lease Expirations (% of In-Service Sq. Ft.) High credit tenants and limited lease

maturity result in stable and growing cash flow

Top Health System Relationships

Health System

Credit Rating

(Moody's)

Rentable SF

Ascension Health

Aa1

510,000

Baylor Health Care System

Aa2

450,000

Scott & White Healthcare

A1

438,000

Harbin Clinic

Unrated

313,000

Franciscan Alliance, Inc.

Aa3

288,000

Health & Hospital Corp Marion

County (Wishard)

Aa1

274,000

Trinity Health

Aa2

259,000

Catholic Health Initiatives

Aa2

250,000

Veterans Administration

Aaa

224,000

Northside Hospital

Unrated

210,000

MEDICAL OFFICE STRATEGY

As of 3/31/13 |

2013 Duke Realty Corporation

Strategic Benefits to Duke Realty

Medical office solid NOI growth and lower volatility

31

•

NOI growth with long term leases averaging over 11 years with very high

tenant retention

o

Typical lease includes 2-3% annual net rent escalators with

expenses passed through

•

Strong credit tenants with over 95% of the portfolio leased to, or affiliated

with major hospital systems (a majority credit-rated A or AA)

•

The newest portfolio in REIT sector with an average age of 7 years

•

Total portfolio occupancy of 92.4%

•

Medical office development starts solid with approximately $200 million

projected for 2013, majority 100% leased

•

Growth industry, defensive asset class

•

Capital markets liquidity benefits and G&A synergies

MEDICAL OFFICE STRATEGY |

2013 Duke Realty Corporation

CAPITAL STRATEGY AND 2013 GUIDANCE

32 |

2013 Duke Realty Corporation

Capital Strategy Focus

33

Reducing leverage

Increasing coverage ratios

Maintaining size and quality of unencumbered asset base

Executing portfolio repositioning in alignment with capital strategy

objectives

Further improve balance sheet strength and ratings

CAPITAL STRATEGY

1

2

3

4 |

2013 Duke Realty Corporation

•

Investment grade rated debt for over 16 years

•

Proven access to multiple capital sources

•

Available line of credit -

$850 million capacity

•

Conservative AFFO payout ratio (74%)

34

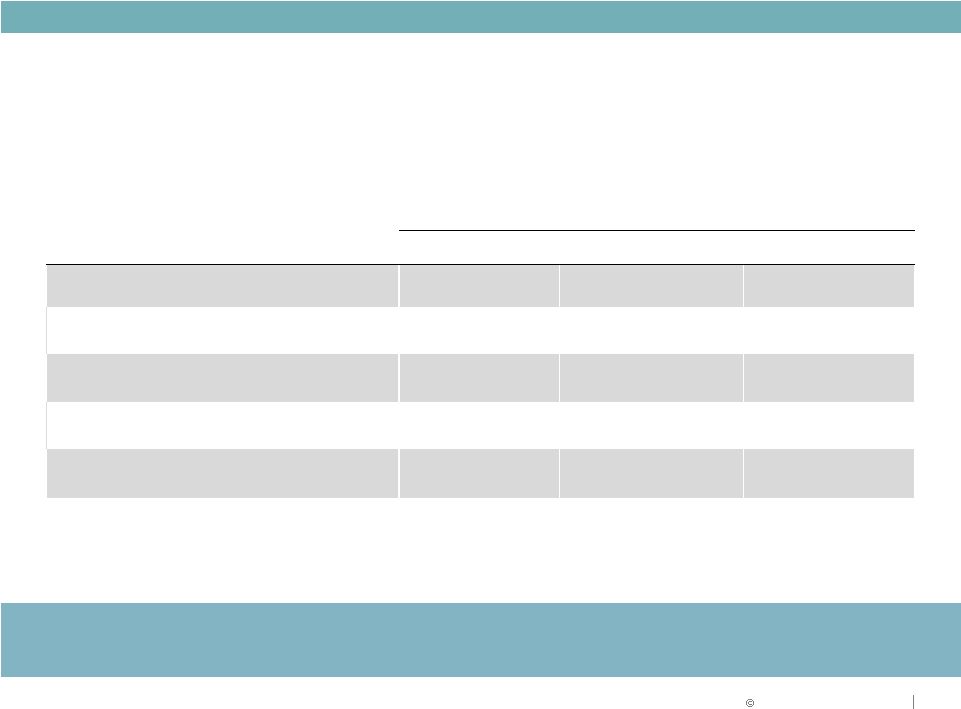

Key Capital Metrics & Goals

2010

Actual

2012

Actual

Q1

2013

Goal

Debt to Gross Assets

46.3%

49.7%

47.6%

45.0%

Debt + Preferred to

Gross Assets

55.5%

56.1%

52.1%

50.0%

Fixed Charge

Coverage Ratio

1.79 : 1

1.81 : 1

1.86 : 1

2.00 : 1

Debt + Preferred /

EBITDA

8.88

9.25

8.04

7.75

CAPITAL STRATEGY

Progressing toward strategic plan goals |

2013 Duke Realty Corporation

% Total Return

(1)

:

YTD 2013

FY 2012

FY 2011

DRE

+2.1%

DRE

+20.8%

S&P 400

+16.9%

RMS

+8.7%

Comps

(3)

+28.2%

DRE

+23.9%

Comps

(3)

-6.0%

S&P 500

+16.0%

RMS

+11.0%

S&P 500

+2.1%

S&P 400

+17.9%

S&P 500

+16.6%

S&P 400

-1.7%

RMS

+17.8%

Comps

(3)

+15.4%

Relative Performance of Duke Realty

Notes

1.

2.

3.

35

(2)

RELIABLE. ANSWERS.

DRE stock price as of end of trading 5/29/13,@ $16.85

Total return for comparable companies calculated on a market cap weighted basis Comparables include PLD, BDN,

CLI, DCT, HIW, LRY, FR, OFC, and EGP; PLD and AMB are included historically; figures shown on a market cap weighted basis |

RELIABLE. ANSWERS.

2013 Duke Realty Corporation

Industrial Average: 19.8x

Office Average: 12.9x

15.5x

14.7x

15.8x

25.7x

10.1x

13.4x

17.2x

10.9x

19.3x

17.0x

6.0x

10.0x

14.0x

18.0x

22.0x

26.0x

30.0x

LRY

OFC

HIW

CLI

BDN

DRE

PLD

EGP

FR

DCT

Industrial Average: 27.9x

Industrial Average: 3.0%

Office Average: 19.1x

Office Average: 4.4%

Office Average: 7.0%

Price / 2013E FFO

Implied Cap Rate

(1)

Dividend Yield

Price / 2013E AFFO

Key:

Office: LRY=Liberty; CLI=Mack-Cali; HIW=Highwoods; BDN=Brandywine;

OFC=Corporate Office Industrial: PLD=Prologis; FR=First Industrial; DCT=DCT

Industrial Trust; EGP=Eastgroup Source: SNL Financial, 5/29/13

(1) Per Wall Street research as of 5/20/13

Duke Realty Valuation Statistics

Duke Realty still undervalued by most levered and NAV metrics

Industrial Average: 5.8%

22.0x

19.2x

19.3x

33.7x

17.8x

19.0x

25.0x

25.0x

17.3x

28.0x

10.0x

15.0x

20.0x

25.0x

30.0x

35.0x

LRY

HIW

OFC

BDN

CLI

DRE

PLD

FR

EGP

DCT

8.5%

6.4%

6.6%

6.7%

6.6%

5.5%

5.4%

5.5%

6.4%

6.7%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

CLI

BDN

OFC

HIW

LRY

DRE

FR

DCT

PLD

EGP

4.6%

1.9%

3.5%

3.7%

4.0%

4.1%

2.7%

4.2%

4.5%

4.6%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

HIW

LRY

CLI

BDN

OFC

DRE

DCT

EGP

PLD

FR

36 |

RELIABLE. ANSWERS.

2013 Duke Realty Corporation

ATM Program –

Overview

Future Outlook

Recap and

Timeline Usage

Use opportunistically as business warrants; primarily to fund development

with 60% equity; very cost efficient capital

Integral to growth plans and de-levering goals

•

Raised $24.8MM in Q2 at a VWAP of $18.24

to close out second shelf program

37

Appropriately funding our business

ATM Timeline

Action

Initial $150MM

Program

Second $200MM

Program

Current $300MM

Program

Implemented Program

Feb 11, 2010

May 7, 2012

May 21, 2013

Completed Program

Mar 15, 2012

May 15, 2013 |

2013 Duke Realty Corporation

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

2013

2014

2015

2016

2017 and beyond

Unsecured Debt

Secured Debt

JV Debt

$609

38

Liquidity Position

($ in millions)

CAPITAL STRATEGY

Maturity ladder actively managed

$134

$463

$557

$2,973

Debt Maturity and Amortization Schedule

May 31, 2013 |

RELIABLE. ANSWERS.

2013 Duke Realty Corporation

2013 Range of Estimates

$ in millions

39

Leasing actions, capital recycling and development execution drive upside

2013 Range of Estimates

Metrics

2012

Actual

Q1 2013

Actual

Pessimistic

Optimistic

Key Assumptions

Core FFO per share

$1.02

$0.26

$1.03

$1.11

-

Continued improvement in operating fundamentals

-

Development projects

-

Growth in asset base from repositioning actitivies

AFFO Payout Ratio

83%

74%

83%

76%

-

Annual dividend maintained at $0.68 per share

Average

Occupancy

-

In-Service

92.2%

92.6%

92.0%

94.0%

-

Positive momentum continued, although slower pace

-

Expirations only 7% of portfolio

Same Property NOI Growth

2.5%

2.4%

1.0%

4.0%

-

Occupancy growth slowing

-

Slightly improved rental rate assumptions

Building Acquisitions

$801

$30

$300

$500

-

Remain selective regarding property type and

location in alignment with long-term strategy

Building Dispositions

$141

$222

$400

$600

-

Continue to prune remaining office and retail

Land Sale Proceeds

$12

$0.6

$15

$25

-

Selling identified non-strategic parcels

-

Demand still sluggish, but improving

Development Starts

$520

$139

$400

$500

-

Comprised mainly of industrial and medical office

-

Substantially pre-leased

Service Operations Income

$22

$9

$16

$24

-

Consistent third party volumes anticipated

General & Administrative expense

$44

$13

$43

$37

-

Continued efficiency gains |

2013 Duke Realty Corporation

40

WHY DUKE REALTY?

Quality portfolio improving with asset strategy

Solid balance sheet improving with capital strategy

Unmatched ability to execute on daily operations

Development capabilities in place with existing land bank

Talent and leadership depth to execute

Delivering on what we say we will do

RELIABLE. ANSWERS |

RELIABLE. ANSWERS.

2013 Duke Realty Corporation

41

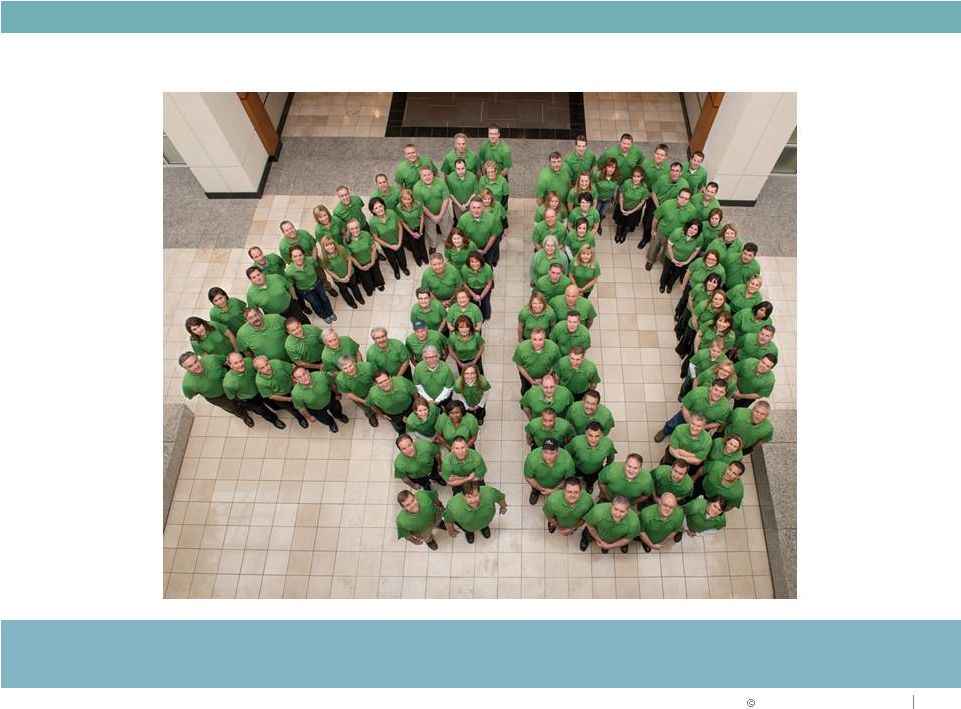

40 Years of Reliability

Long-tenured associates in our Indianapolis headquarters commemorated

Duke

Realty’s 40

th

year in business |

RELIABLE. ANSWERS.

2013 Duke Realty Corporation

Forward-Looking Statement

This slide presentation contains statements that constitute “forward-looking

statements” within the

meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934 as

amended by the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, among others, our statements regarding

(1) strategic initiatives with respect to our assets, operations and capital and (2) the

assumptions underlying our expectations. Prospective investors are cautioned

that any such forward- looking statements are not guarantees of future

performance and involve risks and uncertainties, and that actual results may

differ materially from those contemplated by such forward-looking statements. A

number of important factors could cause actual results to differ

materially from those contemplated by

forward-looking statements in this slide presentation. Many of these

factors are beyond our ability to control or predict. Factors that could

cause actual results to differ materially from those contemplated in this

slide presentation include the factors set forth in our filings with the Securities and Exchange

Commission, including our annual report on Form10-K, quarterly reports on Form

10-Q and current reports on Form 8-K. We believe these

forward-looking statements are reasonable, however, undue reliance should

not be placed on any forward-looking statements, which are based on current expectations. We

do

not assume any obligation to update any forward-looking statements as a result of

new information or future developments or otherwise.

Certain of the financial measures appearing in this slide presentation are or may be

considered to be non- GAAP financial measures. Management believes that

these non-GAAP financial measures provide additional appropriate measures

of our operating results. While we believe these non-GAAP financial

measures are useful in evaluating our company, the information should be considered

supplemental in nature and not a substitute for the information prepared in

accordance with GAAP. We have provided for

your reference supplemental financial disclosure for these measures, including the

most directly comparable GAAP measure and an associated reconciliation in our

most recent quarter supplemental report, which is available on our website at

www.dukerealty.com. Our most recent quarter supplemental report also

includes the information necessary to recalculate certain operational ratios and ratios of

financial position. The calculation of these non-GAAP measures may differ

from the methodology used by other REITs, and therefore, may not be

comparable. 42 |