Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

Commission file number 0-27610

LCA-Vision Inc.

(Exact name of registrant as specified in charter)

| Delaware | 11-2882328 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 7840 Montgomery Road, Cincinnati, OH | 45236 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (513) 792-9292

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.001 par value | The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ¨ No x

The aggregate market value of the Common Stock held by non-affiliates of the registrant as of June 30, 2012, the last business day of the registrant’s most recently completed second quarter, was approximately $81.8 million based on the closing price as reported on The NASDAQ Stock Market.

The number of shares outstanding of the registrant’s Common Stock as of February 15, 2013 was 19,050,504.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its Annual Meeting of Stockholders to be held May 21, 2013 are incorporated by reference in Items 10, 11, 12, 13 and 14 of Part III of this Report.

Table of Contents

LCA-VISION INC.

FISCAL YEAR 2012 FORM 10-K ANNUAL REPORT

| Page | ||||||

| Item 1. |

3 | |||||

| Item 1A. |

11 | |||||

| Item 1B. |

16 | |||||

| Item 2. |

16 | |||||

| Item 3. |

17 | |||||

| Item 4. |

17 | |||||

| Item 5. |

17 | |||||

| Item 6. |

18 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 | ||||

| Item 7A. |

26 | |||||

| Item 8. |

27 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

48 | ||||

| Item 9A. |

48 | |||||

| Item 9B. |

50 | |||||

| Item 10. |

50 | |||||

| Item 11. |

50 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

50 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

50 | ||||

| Item 14. |

50 | |||||

| Item 15. |

51 | |||||

| 53 | ||||||

2

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained in this Annual Report on Form 10-K, including information with respect to our future business plans, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. For this purpose, any statements that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believes,” “may,” “will,” “estimates,” “continues,” “anticipates,” “intends,” “plans,” “expects” and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cause our results to differ materially from those indicated by our forward-looking statements. These factors include those set forth in “Item 1A—Risk Factors.”

Background and History of Company

We are a provider of fixed-site laser vision correction services at our LasikPlus® vision centers. Our vision centers provide the staff, facilities, equipment and support services for performing laser vision correction that employ advanced laser technologies to help correct nearsightedness, farsightedness and astigmatism. Our vision centers are supported by independent ophthalmologists and credentialed optometrists, as well as other healthcare professionals. The ophthalmologists perform the laser vision correction procedures in our vision centers, and the ophthalmologists or optometrists conduct pre-procedure evaluations and post-operative follow-up care in-center. Most of our patients currently receive a procedure called laser-assisted in situ keratomileusis (“LASIK”), which we began performing in the United States in 1996. We have performed over 1.2 million laser vision correction procedures in our vision centers in the United States and Canada since 1996.

As of December 31, 2012, we operated 54 LasikPlus® fixed-site laser vision correction centers generally located in metropolitan markets in the United States, including two vision centers licensed to ophthalmologists who operate using our trademarks and four satellite vision centers which perform preoperative and postoperative care for patients living considerable distances from our full service vision centers. Beginning in 2011, we began offering standard cataract, premium intraocular lens (“IOL”) and implantable Collamer lens (“ICL”) services in certain of our existing markets under our new Visium Eye Institute® brand. In 2012 we expanded these initiatives to ten total markets utilizing the existing infrastructure in our laser vision correction centers. We expect this diversification, if successful, to lessen the impact of economic downturns over the long-term.

We derive substantially all of our revenues from the delivery of laser vision correction procedures performed in our vision centers. Financial information concerning revenues, profit and loss and total assets are contained in “Item 8. Financial Statements and Supplementary Data” under “Consolidated Balance Sheets” and “Consolidated Statements of Operations and Comprehensive Loss.” See Note 1 of the “Notes to Consolidated Financial Statements” for financial information by geographic area.

Procedure volume and revenues in our industry is highly correlated with the Consumer Confidence Index and has been severely affected by the general economic slowdown in the United States. In general, industry demand peaked during 2007 when there was strong consumer confidence, declined through 2010 with declining consumer confidence and began to improve in 2011 and 2012. However, industry reports anticipate demand for laser vision correction procedures to remain soft in 2013.

Laser Vision Correction Procedures

Laser vision correction procedures reshape the cornea with an excimer laser to correct refractive vision errors by changing the curvature of the cornea. These procedures may reduce the need for wearing corrective lenses such as glasses and contact lenses. Our doctors make an assessment of a patient’s candidacy for laser vision correction and determine the correction required to program the excimer laser. The software of the excimer laser then calculates the number and pattern of pulses needed to achieve the intended correction using a specially developed algorithm. The typical laser vision correction procedure takes approximately 15 – 20 minutes to complete. The eye is anesthetized using topical eye drops. The patient reclines under the laser, a lid speculum holds the eyelids open, and the patient focuses on a blinking fixation light while the excimer laser pulses are applied. The excimer laser is a high-energy ultraviolet “cold” laser, meaning that no heat is generated. This non-thermal ablation permits precise reshaping of the cornea. The amount of tissue ablated and the ablation pattern depend upon the refractive error being corrected. Shortly after the procedure, the patient leaves the laser vision center with instructions to rest the remainder of the day. Follow-up visits with an optometrist or ophthalmologist are typically scheduled for one day, one week and one to three months post-procedure.

We currently use two suppliers for our fixed-site excimer lasers: Abbott Medical Optics (“AMO”) and Alcon Inc. (“Alcon”).

3

Table of Contents

We provide primarily two types of procedures in our vision centers:

LASIK

In 1996, we began performing LASIK, which continues to account for the majority of the laser vision correction procedures performed in the United States. In LASIK procedures, our surgeons use a femtosecond laser to create a thin flap in the cornea, which remains hinged to the eye. The surgeon then lays back this corneal flap and applies excimer laser pulses to the exposed surface of the cornea to treat the eye according to the patient’s prescription. The surgeon then folds the corneal flap back to its original position and inspects it to ensure that it remains secured in position by the natural suction of the cornea. Because the surface layer of the cornea remains intact with LASIK, a bandage contact lens is normally not required and the patient typically experiences little discomfort. LASIK often has the advantage of more rapid recovery than Photorefractive Keratectomy (“PRK”), with most patients seeing well enough to drive a car the next day. The LASIK procedure generally allows an ophthalmologist to treat both eyes of a patient during the same visit.

PRK and Surface Ablation

In PRK procedures, the ophthalmologist removes the thin layer of cells covering the outer surface of the cornea (the epithelium) in order to apply the excimer laser pulses directly to the surface of the cornea. Following the PRK procedure, the ophthalmologist places a bandage contact lens on the eye to protect it. The patient may experience discomfort and blurred vision until the epithelium heals, which can take several days. The doctor generally will prescribe certain topical pharmaceuticals for use by the patient post-procedure to assist in alleviating discomfort, minimizing infection and helping to promote corneal healing. Although a patient generally experiences substantial improvement in clarity of vision within a few days following the procedure, it can take several months for the full benefits of the PRK procedure to be realized. Some patients elect to have one eye treated in one visit and the second eye treated at a later date.

LASIK and PRK procedures are performed using the same excimer lasers and offer the same results after healing occurs. Each has its advantages. Based on the pre-procedure examination and assessment, our doctors determine which laser correction procedure is best for each patient.

The Laser Vision Correction Market

More than 190 million Americans, or approximately 60% of the U.S. population, require eyeglasses or contact lenses to correct common vision problems. Most people seeking vision correction suffer from one or more refractive vision disorders, which often result from improper curvature of the cornea as related to the size and shape of the eye. If the cornea’s curvature is not precisely correct, it cannot properly focus the light passing through it onto the retina, resulting in a blurred image. Three common refractive vision disorders are:

| • | Myopia (nearsightedness)—images are focused in front of the retina, resulting in the blurred perception of distant objects |

| • | Hyperopia (farsightedness)—images are focused behind the retina, resulting in the blurred perception of near objects |

| • | Astigmatism—images are not focused on any point due to the varying curvature of the eye along different axes |

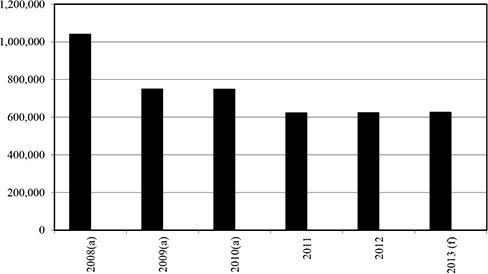

Since the U.S. Food and Drug Administration (“FDA”) approved the first laser to perform laser vision correction procedures in the United States in 1995, industry sources estimate that approximately 15.8 million eyes have been treated. Laser vision correction is currently one of the most widely performed elective surgical procedures in the United States, with an estimated 625,000 laser vision correction procedures performed in 2012, an increase of less than 1% from 2011. An industry report on the U.S. refractive market estimates that 2013 laser vision correction procedures are forecasted to increase 7% over 2012 and the potential market for laser vision correction procedures in the United States is approximately 146 million procedures. Laser vision correction is typically a private pay procedure performed on an outpatient basis.

4

Table of Contents

Estimated Number of Laser Vision Correction Procedures in North America per Year

Source: Market Scope, February 2013

(f) = 2013 data forecasted by Market Scope, February 2013

(a) = Market Scope recast 2011 and 2012 estimated laser vision correction volume, but did not recast years 2010 and prior.

Our Business Strategy

Our business strategy is to transform lives by providing quality laser vision correction services at an affordable price. We generally operate our vision centers as closed-access facilities, where we are responsible for marketing and patient acquisition and contract with independent ophthalmologists for their medical services.

We intend to grow our business through increased penetration in our current markets and, after the economy and our cash flow improve, expansion into new markets. Key elements of our business strategy include:

| • | Recruiting and retaining independent, board certified ophthalmologists and credentialed optometrists |

| • | Providing patients with continuity of care under our “LasikPlus Advantage Plan®” |

| • | Providing attractive patient financing alternatives |

| • | Nurturing relationships with leading managed care providers in the United States and partnership programs to source additional patients |

| • | Developing and implementing innovative direct-to-consumer marketing campaigns |

| • | Establishing and maintaining a partner network of independent optometrists to share patients |

| • | Adding complementary products and services |

Recruiting and retaining independent, board certified ophthalmologists and credentialed optometrists.

We generally focus our recruiting efforts on leading independent ophthalmologists and optometrists who have a reputation for providing quality eye care within their respective markets and who have experience in laser vision correction procedures. Our ophthalmologists have completed extensive FDA-mandated training and also have met our qualification criteria, which includes a review of state licensure, board certification, malpractice insurance and surgical experience.

Providing patients with continuity of care under our “LasikPlus Advantage Plan®”

We strive to achieve high patient satisfaction and have established the “LasikPlus Advantage Plan®,” the goal of which is to achieve the level of visual correction agreed to by the patient and physician. A patient’s care begins with our initial contact with the prospective patient. We train our call center personnel to answer questions regarding procedures and generally we provide potential patients access both to a physician to address more difficult inquiries and to past patients who can relate procedure experience. In the vision center, we provide potential patients a free eye evaluation with the local vision center’s optometrist or independent ophthalmologist as well as a consultation focused on educating the patient on vision correction procedures and how the procedure may help correct the patient’s specific refractive vision disorder. The ophthalmologist will determine whether the patient is a candidate and review the risks associated with the procedure and what results the patient may expect after the procedure. Additionally, we design our vision centers to create a patient-friendly environment to reduce any anxiety associated with having laser vision correction. We schedule post-surgical follow-up appointments with patients who have received the procedure to monitor results and provide enhancements to those patients who did not receive the desired correction in the initial procedure. The vast majority of our treated patients who respond to our patient satisfaction surveys indicate that they are satisfied with the care that they received in our vision centers.

5

Table of Contents

Providing attractive patient financing alternatives.

Because laser vision correction procedures are elective and generally not reimbursable by third party payers, including governmental programs such as Medicare and Medicaid, we currently offer patients several financing alternatives. A significant percentage of our patients finance some or all of the cost of their procedure. We work closely with an unaffiliated third-party finance company that offers multiple payment plans to qualifying patients. These payment plans typically provide for payments over a 12-month to 60-month period. We bear no credit risk for loans made under this third-party program. For patients not qualifying for these plans, we offer our own direct financing in which we charge an up-front fee, with the remaining balance paid by the patients in installments over a period of 12 to 36 months. We bear the credit risk of our own direct financing programs.

Nurturing relationships with leading managed care providers in the United States and partnership programs to source additional patients.

With a large number of employers offering vision services in their employee benefit packages, we continue to nurture, develop and grow relationships with managed care organizations, through which we offer discounted rates to plan participants. In general, the plan participant, and not the managed care organization, is responsible for the payment of our fees under these arrangements. We currently have agreements with most of the largest health and vision plans. In addition to the discounted programs, a small number of plans offer a funded, insured LASIK product that covers a portion of the procedure cost.

We continue to participate in partnership programs that have proven to be successful. These programs allow for their members to obtain reward points or discounts for attending a pre-operative appointment and for having the laser vision correction procedure performed. We will continue to evaluate expansions or terminations of these programs as well as explore opportunities for more partnership programs in 2013 and beyond.

We also partnered with the Wounded Warrior Project and Fisher House Foundation beginning in 2010 to provide laser vision correction at no cost to wounded U.S. military veterans and their primary caregivers. Our surgeons offer their services at no cost and our vendors support us in this cause.

Developing and implementing innovative consumer marketing campaigns.

Our marketing programs seek to reinforce the LasikPlus® brand name in addition to raising awareness concerning laser vision correction and promoting our vision centers and the experience of our independent ophthalmologists. In each market, we target a specific demographic group of potential patients through the use of traditional and online radio, internet, social media, mobile, print media and/or direct mail campaigns, among other strategies. In most advertisements, we provide prospective patients a website address and a toll-free number to contact us. Our call center representatives answer initial questions that potential patients may have, and attempt to schedule eye evaluation appointments with the local vision center to determine whether the prospective patient is a candidate for laser vision correction. We are also reaching new prospective patients through innovative programs such as partnerships with other companies that provide their members with options such as reduced out-of-pocket procedure costs or other incentives. With the support of advertising agencies, we continue to refine our branding to differentiate LasikPlus® from our competitors and to continually develop more compelling messages.

Adding complementary products and services.

We began expanding our patient care model in 2011 to include other medical and surgical eye services and products. We desire to diversify into related eye-health businesses to leverage our capabilities and resources, drive more revenue through our existing vision centers, capitalize on our past patients and high patient satisfaction rate, and lessen the impact of future economic downturns. Our focus is on programs that require minimal up-front investment and that we can roll out in a modular approach, allowing for phased introductions. We are also developing a partner network with optometrists and other eye health care providers. We see a partner network as an opportunity to make ourselves known to patients of optometrists and other eye health providers and to share in the care of those patients, whether for laser vision correction or cataract services.

During the third quarter of 2011 we began offering standard cataract and premium IOL services in two of our LasikPlus® markets under our new Visium Eye Institute® brand. As of December 31, 2012, we had 10 Visium Eye Institute® centers. Expansion into cataract services capitalizes on our current multi-site operation and clinical skills, while exposing us to a growing potential patient population of “Baby Boomers” as they begin to approach 70 years of age. Industry analysts estimate the cataract market is currently four times as large as the laser vision correction market. This expansion into cataract and premium IOL services is an expansion from our current model of operating solely in a self-pay environment and into services generally paid by third-party payers, including federal and state agencies (under the Medicare and Medicaid programs), managed care health plans, commercial insurance companies and employers. Additionally, while the pre-operative and post-operative exams are performed in our vision centers, the surgeries are performed at independent ambulatory surgery centers. Our revenue from cataract services was not significant in 2012 and we do not anticipate it to represent a significant portion of our operations in 2013. Attracting new patients remains the most significant challenge with growing our Visium Eye Institute® business. We are also offering ICL surgery in our Visium Eye Institute® markets. This procedure is not covered by Medicare or other third-party payers, but it is appropriate for some patients who are not candidates for LASIK due to conditions such as extreme nearsightedness, uncertain corneal topography or insufficient corneal thickness.

6

Table of Contents

Competition

Laser vision correction, whether performed at one of our vision centers or elsewhere, is an alternative to other surgical as well as non-surgical treatments to correct refractive vision disorders. These non-surgical treatments include eyeglasses and contact lenses. Other refractive surgery procedures include refractive lens exchange and ICL. In the future, other surgical procedures such as corneal inlays, currently under FDA trial, may prove to be an option as well.

We face competition from other providers of laser vision correction. A fragmented system of local providers, including individual or small groups of opticians, optometrists and ophthalmologists, and chains of retail optical stores and multi-site eye care vision centers deliver eye care services in the United States. Industry sources estimate that local ophthalmologists and hospitals represent approximately 70% of the laser vision correction market. Corporate laser vision correction providers, such as LasikPlus®, are a specialized type of provider, operating multi-site eye care centers that provide primarily laser vision correction. In many of our markets, we also compete with other corporate laser vision correction center chains.

We currently face competitors offering discounted prices in some geographic markets where we conduct business. It is possible that our business could be materially adversely affected in the future by discounting practices of competitors, including from both a price and volume perspective. Laser vision correction procedure volume correlates with the Consumer Confidence Index. In individual markets, our challenge is to leverage the national strengths of our company and enhance local efforts in order to grow market share.

Employees

As of December 31, 2012, we had approximately 381 employees, 335 of whom were full-time. The number of employees included 87 optometrists and independent ophthalmologists employed by professional corporations with which we have contracts. None of our employees are subject to a collective bargaining agreement nor have we experienced any work stoppages. We believe our relations with our employees are good.

Trademarks

We have several registered trademarks in the United States, including the name LasikPlus®. We have not registered all of the names that we use for our products and services with the United States Patent and Trademark Office. Where we use the “TM” (trademark) symbol, we intend to claim trademark rights on those names under common law. The duration of such trademarks under common law is the length of time that we continue to use them.

Suppliers of Equipment

We are not involved in the research, development or manufacture of ophthalmic laser systems or diagnostic equipment. Several companies, including AMO and Alcon, our two current suppliers, offer excimer and femtosecond laser systems which have been approved by the FDA for commercial sale in the United States. We currently rely primarily on AMO to provide us with patient interface kits and McKesson Corporation (“McKesson”) to provide other disposable items required in LASIK procedures. If our relationship with any of these suppliers ceased, we believe we would be able to enter into alternative supplier arrangements.

Government Regulation

Extensive federal, state and local laws, rules and regulations affecting the healthcare industry and the delivery of healthcare apply to our operations. Some of these include laws and regulations, which vary significantly from state to state, prohibiting unlawful rebates and division of fees, and limiting the manner in which we may solicit prospective patients. Furthermore, state and federal laws, some of which may be applicable to our business operations, extensively regulate contractual arrangements with surgery centers, ophthalmologists and optometrists.

The following is a more detailed description of certain laws and regulations that affect our operations.

Restrictions on medical devices

In the United States, the FDA regulates the use, manufacturing, labeling, distribution and marketing of medical devices, including excimer and femtosecond lasers and certain other equipment that we use in laser vision correction surgery.

Once medical device manufacturers obtain FDA approval, medical device manufacturers are subject to continuing FDA obligations. For example, the FDA requires that medical devices be manufactured in accordance with its Quality System Regulations. In essence, this means that medical devices must be manufactured and records must be maintained in a prescribed manner with respect to production, testing and control activities. In addition, the FDA imposes restrictions and requirements regarding the labeling and promotion of medical devices with which we must comply.

7

Table of Contents

If we or our excimer or femtosecond laser manufacturers fail to comply with applicable FDA requirements, the FDA could take enforcement action, including product seizures, recalls, withdrawal of approvals and imposition of civil and criminal penalties, any one or more of which could have a material adverse effect on our business, financial condition and results of operations. In addition, the FDA could withdraw clearance or approvals in some circumstances. If we or our principal suppliers fail to comply with regulatory requirements or any adverse regulatory action, we could be named as a party in ensuing litigation or incur a limitation on or prohibition of our use of excimer lasers, financing programs, or other necessary services to our business, which in turn would have a material adverse effect on our business, financial condition or results of operations. Discovery of problems, violations of current laws or future legislation or administrative action in the United States or elsewhere may adversely affect the ability of our suppliers to obtain or maintain appropriate regulatory approval.

The FDA requires that some medical facilities report serious injuries involving medical devices to device manufacturers and deaths involving medical devices to the FDA. The FDA requires that subject medical facilities have specific written procedures regarding such reporting obligations. Those of our vision centers that meet the FDA’s definition of user facilities are subject to these requirements. Although we believe that our procedures meet regulatory requirements, if the FDA determines that our procedures or our reporting practices are not adequate, we could be subject to FDA enforcement action. FDA enforcement action could discourage potential patients from having laser vision correction, or could limit our ability to use medical devices, potentially having a material adverse effect on our business, financial condition and results of operations by decreasing the total number of procedures that we perform.

Regulations require manufacturers to obtain a supplemental FDA authorization for new uses of existing medical devices. Obtaining these authorizations is time consuming and expensive, and we cannot be sure that manufacturers of the devices that we use will be able to obtain any such additional FDA authorizations. Further, later discovery of problems with the medical devices that we use may result in restrictions on use of the devices or enforcement action against the manufacturers, including withdrawal of devices from the market. Changes in legislation or regulation could affect whether and how we can use our medical devices. These and other regulatory actions could limit the supply of devices that we use or our ability to use them, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

FDA LASIK Review

The FDA’s advisory board on ophthalmic devices began reviewing concerns about post-LASIK surgery quality of life matters in 2010, and the FDA has commenced a major new study on LASIK outcomes and quality of life. The FDA or another agency could take legal or regulatory action against us or others in the laser vision correction industry. The outcome of this review or legal or regulatory action potentially could impact negatively the acceptance of LASIK.

Federal and state laws on “kickbacks”

Section 1128B(b) of the Social Security Act (42 U.S.C. § 3120a-7b(b)) prohibits knowingly and willfully soliciting or receiving, offering or paying remuneration directly or indirectly, in cash or in kind, in order to induce the referral of individuals for care reimbursable under Medicare, Medicaid and other federal health care programs, or in return for recommending, arranging, purchasing, leasing or ordering any goods or services reimbursable under Medicare, Medicaid and other federal health care programs (the “Anti-Kickback Statute”). This provision is extremely broad. The offense is classified as a felony and is punishable by fines of up to $25,000 and imprisonment for up to 5 years. Violations of the Anti-Kickback Statute also may result in the imposition of a civil money penalty (“CMP”) under Section 1128A(a)(7) of the Social Security Act (42 U.S.C. 1320a-7a(a)(7)) or exclusion from participation in Medicare and State health care programs under Section 1128 of the Social Security Act (42 U.S.C. 1320a-7). The Balanced Budget Act of 1997 amended the CMP provisions to allow the government to recover treble damages in addition to $50,000 for each violation of the Anti-Kickback Statute.

Courts have interpreted the Anti-Kickback Statute to require proof of a knowing and willful intent to induce or arrange for referrals or for other business reimbursable under the Federal health care programs. Thus, the extent to which conduct is motivated by inducing or arranging for referrals will, in large part, determine liability under the statute. To prove a violation of the Anti-Kickback Statute, it must be shown that the remuneration between two parties was intended to induce the referral of business payable under the federal health care programs. The U.S. Health and Human Services Office of Inspector General (“OIG”) has defined a narrow set of circumstances that create “safe harbors” from prosecution and enforcement under the Anti-Kickback Statute. The safe harbors have specific defined elements that must be met to give protection to a particular transaction. The OIG has stated that if a person participates in an arrangement that fully complies with a given safe harbor, he or she will be assured of not being prosecuted criminally or civilly for the arrangement that is the subject of that safe harbor.

Because laser vision correction procedures currently are not reimbursable by Medicare, Medicaid or other governmental health programs, we do not believe that the Anti-Kickback Statute applies to our laser vision correction business. Any changes in the reimbursement and coverage rules for these governmental health programs may cause such business to be subject to such federal laws. Although we do not anticipate such changes in the near future, we cannot predict this with any degree of certainty.

8

Table of Contents

Cataract services are reimbursable under Medicare, and thus the Anti-Kickback Statute may apply to our Visium Eye Institute® cataract business. Our arrangements with ophthalmologists and optometrists providing cataract services may not fit within a safe harbor to the Anti-Kickback Statute. However, the OIG has stated that the optional regulatory safe harbors do not purport to define the full range of lawful activity, and payment practices that do not fully comply with a safe harbor may still be lawful if no purpose of the payment practice is to induce referrals of Federal health care program business. We believe that our arrangements with ophthalmologists and optometrists providing cataract services comply with the Anti-Kickback Statute. However, if the OIG were to challenge successfully our arrangements with ophthalmologists and optometrists providing cataract services, we may be required to restructure such arrangements and/or be subject to civil or criminal fines and penalties, including the exclusion of our company and the ophthalmologists and optometrists from the Medicare and Medicaid programs, any of which events could have a material adverse effect on our business, financial condition, results of operations and cash flows.

“Stark” Law Prohibition on Physician Referrals

The Ethics in Patient Referral Act of 1989, as amended (the “Stark Law”), is a civil statute that generally (i) prohibits physicians from making referrals for designated health services to entities in which the physicians have a direct or indirect financial relationship and (ii) prohibits entities from presenting or causing to be presented claims or bills to any individual, third party payer, or other entity for designated health services furnished pursuant to a prohibited referral. Under the Stark Law, a physician may not refer patients for certain designated health services to entities with which the physician has a direct or indirect financial relationship, unless allowed under an enumerated exception. Under the Stark Law, there are numerous statutory and regulatory exceptions for certain otherwise prohibited financial relationships. A transaction must fall entirely within an exception to be lawful under the Stark Law.

The Stark Law contains significant civil sanctions for violations, including denial of payment, refunds of amounts collected in violation of the Stark Law and exclusion from Medicare or Medicaid programs. In addition, OIG may impose a penalty of not more than $15,000 for submitting an illegal claim or not refunding such a claim on a timely basis and a civil monetary penalty of up to $100,000 for each circumvention arrangement or scheme.

We believe that any referrals between or among the company, the ophthalmologists and optometrists providing cataract services, and the facilities at which cataract procedures are performed will be for services that are not designated health services under the Stark Law. For example, services for which payment is included in the ambulatory surgical center composite rate (e.g., IOLs used in cataract surgery) are not designated health services. If the ophthalmologists, optometrists or contracted surgical facilities make referrals between or among themselves for any designated health service, we will endeavor to structure their arrangements either to be exempt from the Stark Law or to meet a statutory or regulatory exception to the Stark Law prohibitions. If these arrangements are found to violate the Stark Law, we may be required to restructure such arrangements or be subject to civil or criminal fines and penalties, including the exclusion of our company, the ophthalmologists and optometrists, and the facilities from the Medicare and Medicaid programs, any of which events could have a material adverse effect on our business, financial condition and results of operations.

Some states have enacted statutes, similar to the federal Anti-Kickback Statute and Stark Law, which are applicable to our operations because they cover all referrals of patients regardless of the payer or type of healthcare service provided. These state laws vary significantly in their scope and penalties for violations. Although we have endeavored to structure our business operations to be in material compliance with such state laws, authorities in those states could determine that our business practices are in violation of their laws. This could have a material adverse effect on our business, financial condition and results of operations.

Advertising restrictions

Our business is heavily dependent on advertising, which is subject to regulation by the Federal Trade Commission (“FTC”). In 2002, the FTC conducted an extensive review of our advertising practices. Following this review, the FTC concluded that certain of our past advertisements contained claims that were not properly substantiated. We elected to settle voluntarily with the FTC. In July 2003, the FTC formally entered a Complaint and an Agreement Containing Consent Order in which we agreed, among other things, that we would not represent in our advertising that our LASIK surgery services eliminate the need for glasses and contacts for life, pose significantly less risk to patients’ eye health than wearing glasses or contacts or eliminate the risk of glare and haloing, unless, at the time made, we possess and rely upon competent and reliable scientific evidence that substantiates the representation. No monetary penalties were imposed on us. Although we consented to this order in 2003, we cannot be certain that this order will not restrict our ability to effectively generate demand for our laser vision correction services.

In 2009 the FDA issued a letter to eye care professionals noting that the FDA’s Ophthalmic Devices Panel had received complaints that advertisements for LASIK procedures and FDA-approved lasers used for LASIK procedures failed to inform consumers of the indications, limitations, and risks associated with LASIK procedures and the approved lasers used for the LASIK procedures. In this letter, the FDA said that an advertisement may be considered misleading if it fails to reveal facts that are material to representations made in the advertisement. In September 2011, the FDA issued a second letter to eye care professionals emphasizing the importance of providing adequate risk information in advertisements of FDA-approved lasers used in refractive procedures. The September 2011 letter stated that eye care professionals had 90 days from the letter’s date to correct any non-compliant advertisements and promotional materials and that the FDA may take regulatory action against eye care professionals whose advertisements and promotional materials violate FDA regulations. In 2012, the FDA issued

9

Table of Contents

warning letters to five eye care professionals to stop misleading advertising and promotion of refractive lasers. We believe that we have structured our advertising practices to be in material compliance with FDA and FTC regulations and guidance. However, we cannot be certain that the FDA or the FTC will not determine that our advertising practices are in violation of such laws and guidance.

In addition, the laws of many states restrict certain advertising practices by and on behalf of physicians and optometrists. Many states do not offer clear guidance on the bounds of acceptable advertising practices or on the limits of advertising provided by management companies on behalf of physicians and optometrists. Although we have endeavored to structure our advertising practices to be in material compliance with such state laws, authorities in those states could determine that our advertising practices are in violation of those laws.

Fee-splitting

Many states prohibit professionals (including ophthalmologists and optometrists) from paying a portion of a professional fee to another individual unless that individual is an employee or partner in the same professional practice. If we violate a state’s fee-splitting prohibition, we may be subject to civil or criminal fines, and the physician participating in such arrangements may lose his or her licensing privileges. Many states do not offer clear guidance on what relationships constitute fee-splitting, particularly in the context of providing management services for doctors. Although we have endeavored to structure our business operations in material compliance with these laws, state authorities could find that fee-splitting prohibitions apply to our business practices in their states. If any aspect of our operations were found to violate fee-splitting laws or regulations, this could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Corporate practice of medicine and optometry

The laws of many states prohibit business corporations, such as us, from practicing medicine and employing or engaging physicians to practice medicine. Some states prohibit business corporations from practicing optometry or employing or engaging optometrists to practice optometry. Such laws preclude companies that are not owned entirely by eye care professionals from:

| • | Employing eye care professionals |

| • | Controlling clinical decision making |

| • | Engaging in other activities that are deemed to constitute the practice of optometry or ophthalmology |

This prohibition is generally referred to as the prohibition against the corporate practice of medicine or optometry. Violation of this prohibition may result in civil or criminal fines, as well as sanctions imposed against the professional through licensing proceedings. Although we have endeavored to structure our contractual relationships to be in material compliance with these laws, if any aspect of our operations were found to violate state corporate practice of medicine or optometry prohibitions, this could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Facility licensure and certificates of need

State Departments of Health may require us to obtain licenses in the various states in which we have laser vision correction centers or other business operations. We believe that we have obtained the necessary material licensure in states where licensure is required and that we are not required to obtain licenses in other states. However, not all of the regulations governing the need for licensure are clear and there is limited guidance available regarding certain interpretative issues. Therefore, it is possible that a state regulatory authority could determine that we are improperly conducting business operations without a license in that state. This could subject us to significant fines or penalties, result in our being required to cease operations in that state or otherwise have a material adverse effect on our business, financial condition and results of operations. Although we currently have no reason to believe that we will be unable to obtain the necessary licenses without unreasonable expense or delay, there can be no assurance that we will be able to obtain any required licensure.

Some states require permission by the State Department of Health in the form of a Certificate of Need (“CON”) prior to the construction or modification of an ambulatory care facility or the purchase of certain medical equipment in excess of a certain amount. We believe that we have obtained the necessary CONs in states where a CON is required. However, not all of the regulations governing the need for CONs are clear and there is little guidance regarding certain interpretive issues. Therefore, it is possible that a state regulatory authority could determine that we are improperly conducting business operations without a CON in that state. There can be no assurance that we will be able to acquire a CON in all states where it is required, or that our failure or inability to obtain a CON in markets into which we believe we could otherwise be successful expanding will not have a material adverse effect on our business, financial condition and results of operations.

10

Table of Contents

Health Insurance Portability and Accountability Act.

In December 2000, the U.S. Department of Health and Human Services (“DHHS”) released final health privacy regulations implementing portions of the Administrative Simplification Provisions of the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”). These final health privacy regulations were effective in April 2003, for providers that engage in certain electronic transactions, including the submission of claims for payment. Additionally, DHHS published final standards to protect the security of health-related information in February 2003. Finally, in August 2009 DHHS published interim final breach notification regulations implementing section 13402 of the Health Information Technology for Economic and Clinical Health (“HITECH”) Act. The HIPAA privacy and security regulations and the HITECH Act extensively regulate the use and disclosure of individually identifiable health-related information. The ophthalmologists and their professional corporations with which we contract are covered entities under HIPAA if those entities provide services that are reimbursable under Medicare or other third-party payers (e.g., cataract services). Although the covered health care providers themselves are primarily liable for HIPAA compliance, as a “business associate” to these covered entities we are bound indirectly to comply with the HIPAA privacy regulations, and we are directly bound to comply with certain of the HIPAA security regulations.

Although we have endeavored to comply with these regulations, a finding of lack of compliance with these regulations could require us to incur substantial expenses, which could have a material adverse effect on our business, financial condition and results of operations. In addition, we will continue to remain subject to any state laws that are more restrictive than the privacy regulations issued under the Administrative Simplification Provisions.

Available Information

Our websites are www.lasikplus.com and www.lca-vision.com. There we make available, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports as well as any beneficial ownership reports of officers and directors filed on Forms 3, 4 and 5. We will make all such reports available as soon as reasonably practicable after we file them with or furnish them to the Securities and Exchange Commission (“SEC”). Our committee charters, governance guidelines and code of ethics are also available on our websites. To obtain a copy of any of these documents by mail, free of charge, please send a request to Investor Relations at LCA-Vision Inc., 7840 Montgomery Road, Cincinnati, Ohio 45236. Information contained on our websites is not part of this Annual Report on Form 10-K and is not incorporated by reference in this document. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

In evaluating and understanding us and our business, you should carefully consider (1) all of the information set forth in this Annual Report on Form 10-K, including the Consolidated Financial Statements and notes thereto and Management’s Discussion and Analysis, (2) information in our other filings with the SEC, including any future reports on Forms 10-Q and 8-K and (3) the risks described below. These are not the only risks we face. Additional risks not presently known or which we currently deem immaterial may also impact our business operations, and the risks identified below may adversely affect our business in ways we cannot currently anticipate. Our business, financial condition, results of operations and cash flows could be materially adversely affected by any of these risks.

We incurred losses in 2010, 2011 and 2012, and expect to continue to incur losses in 2013.

Our procedure volume remained consistent in 2012 compared with 2011, and we incurred losses in both years due in large part to continued weak consumer confidence, a weak overall economy, high unemployment and investment in our cataract services expansion. We sustained losses in three quarters in 2011 and three quarters in 2012. We anticipate that in 2013 we will continue generating losses and negative cash flows. These continued losses have reduced our working capital. At December 31, 2012 and 2011, we had approximately $34.5 million and $44.8 million, respectively, in cash and investments. We are uncertain as to how long the negative economic and industry conditions will continue. There could be a number of other effects from these adverse economic conditions on our business, including reduced consumer demand for our services; insolvency of our patients, resulting in increased provisions for credit losses; insolvency of our key equipment suppliers; inability of consumers to obtain credit to finance some or all of the cost of their procedures; and decreased consumer confidence. If macroeconomic conditions do not improve, our business, financial condition, results of operations and cash flows could be materially adversely affected.

Changes in general economic conditions may cause fluctuations in our revenues and profitability.

The cost of laser vision correction procedures typically is not reimbursed by third-party payers such as health care insurance companies or government programs. Accordingly, as we are experiencing and have experienced in prior fiscal periods, our operating results may vary based upon the impact of changes in the disposable income of consumers interested in laser vision correction, among other economic factors. A significant decrease in consumer disposable income in a weak economy results in a decrease in the number of laser vision correction procedures performed and a decline in our revenues and profitability. In addition, weak economic conditions may cause some of our patients to experience financial distress or declare bankruptcy, which may negatively impact our accounts receivable collection experience. Weak economic conditions also may change the risk profile or volume of business that our unaffiliated finance company partner is willing to underwrite, which could adversely affect our business, financial condition, results of operations and cash flows.

11

Table of Contents

Our industry is highly correlated with consumer confidence. Declines or volatility in consumer confidence may continue to negatively impact our business.

Recessionary economic conditions, uncertainty in the credit markets, a period of rising energy costs and depressed housing prices have all contributed to a deterioration in volume of procedures performed, especially for patients at middle- and lower-income levels. Depressed consumer confidence negatively impacts our financial performance. The current market conditions in the credit markets and high unemployment have created uncertainty and caused potential patients to be more cautious in their purchasing decisions.

Our quarterly and annual operating results are subject to significant fluctuations.

Our revenue and operating results have fluctuated and may continue to fluctuate significantly from quarter to quarter and from year to year depending on many factors, including but not limited to:

| • | The number of laser vision correction procedures performed |

| • | Fluctuating economic conditions in the geographic areas in which we operate, which can result in changes in demand for our laser vision correction services |

| • | The timing of advances by our suppliers and the purchase of such advances or upgrades of equipment by us or our competitors |

| • | The impact of competitors, including those who compete by deeply discounting the price of laser vision correction services, in the geographic areas in which we operate |

| • | The opening, closing or expansion of vision centers |

| • | Our ability to manage equipment and operating costs |

| • | Collection rates on self-financed procedures |

| • | The availability of third-party financing for our patients |

| • | Regulatory matters |

| • | Litigation |

| • | Acquisitions and other transactions |

In addition, our revenue and operating results are subject to seasonal factors. In terms of the number of procedures performed, our strongest quarter historically has been the first quarter of the year, and our business is generally weaker in the latter half of the year. We believe these fluctuations are due primarily to:

| • | The availability to potential patients of funds under typical employer medical flexible spending plans and health savings plans |

| • | Time constraints imposed by the summer vacation and holiday seasons and a desire by some individuals not to schedule procedures at those times of year |

Reductions in revenues or net income between quarters or our failure to achieve expected quarterly earnings per share has in the past and could in the future result in a decrease in the market price of our common stock.

Our business relies heavily upon direct-to-consumer marketing.

The effectiveness of our marketing programs and messages to consumers can have a significant impact on our financial performance. The effectiveness of marketing fluctuates, resulting in changes in the cost of marketing per procedure, and variations in our margins. Less effective marketing programs could adversely affect our business, financial condition and results of operations.

We derive substantially all of our revenue from laser vision correction services. A decrease in the provision of these services could result in a significant decrease in our revenues and profitability.

We derive substantially all of our revenues from laser vision correction services. If we are not able to provide those services or the number of laser vision correction procedures we perform significantly decreases, our revenues and results of operations will decrease materially. We do not currently have other matured diversified revenue sources to offset a significant decrease in revenues from our provision of laser vision correction services.

Our expansion into new services or products beyond laser vision correction may not be successful.

Beginning in 2011, we began offering standard cataract, premium IOL and ICL services in certain of our existing markets under our new Visium Eye Institute® brand. In 2012 we expanded these initiatives to ten total markets utilizing our existing infrastructure from our laser vision correction centers. This diversification requires us to incur start-up losses, and we have not received significant revenues from these services. Our diversification into cataract services may not be successful, and we can give no assurance that we can develop these opportunities or that we will have adequate capital to do so.

12

Table of Contents

If we are unable to attract and retain qualified independent ophthalmologists, our ability to maintain operations at existing vision centers, to attract patients or to open new vision centers could be negatively affected.

We generate our revenues through independent ophthalmologists who work with us to perform surgeries. In states where the corporate practice of medicine is prohibited, we contract with professional corporations for ophthalmologists to perform surgeries at our vision centers. The retention of those ophthalmologists is a critical factor in the success of our existing vision centers, and the hiring of independent qualified ophthalmologists is a critical factor in our ability to launch a new vision center successfully. However, it is sometimes difficult for us to retain or hire qualified ophthalmologists. If we are unable consistently to hire and retain qualified ophthalmologists, our ability to open new vision centers, maintain operations at existing vision centers, and attract patients could be negatively affected.

Throughout 2012, we continued to feature our ophthalmologists in local marketing materials. If we are unable to retain these featured ophthalmologists, our ability to maintain operations at existing vision centers and attract patients could be negatively affected.

If technological changes occur that render our equipment or services obsolete, or increase our cost structure, we may need to make significant capital expenditures or modify our business model, which could cause our revenues or results of operations to decline.

Industry, competitive or clinical factors, among others, may require us to introduce alternate ophthalmic laser technology or other surgical or non-surgical methods for correcting refractive vision disorders than those that we currently use in our laser vision correction centers. Such alternative technologies could include various intraocular lens technologies or other new technologies. Introducing such technology could require significant capital investment or force us to modify our business model in such a way as to make our revenues or results of operations decline. An increase in costs could reduce our ability to maintain our margins. An increase in prices could adversely affect our ability to attract new patients.

If a better-financed or lower-cost provider of laser vision correction or a competing vision treatment forces us to lower our laser surgery prices in a particular geographic area, our revenues and results of operations could decline.

Laser eye surgery competes with other surgical and non-surgical treatments for refractive vision disorders, including eyeglasses, contact lenses, other types of refractive surgery, corneal implants and other technologies currently under development. Among providers of laser vision correction, competition comes from firms similar to us and from hospitals, hospital-affiliated group entities, physician group practices and private ophthalmologists, among others that, in order to offer laser vision correction to patients, purchase or rent excimer lasers. Suppliers of conventional eyeglasses and contact lenses, such as optometry chains, also may compete with us by purchasing laser systems and offering laser vision correction to their customers.

Some of our current competitors or other companies that may choose to enter the industry in the future, including laser manufacturers themselves, may have substantially greater financial, technical, managerial, marketing or other resources and experience than we do and may be able to compete more effectively. Similarly, competition could increase if the market for laser vision correction does not experience growth, and existing providers compete for market share. Additional competition may develop, particularly if the price to purchase or rent excimer laser systems decreases. Our management, operations, strategy and marketing plans may not be successful in meeting this competition.

If more competitors offer laser vision correction or other competitive types of vision treatments in a given geographic market, we might find it necessary to reduce the prices we charge, particularly if competitors offer the procedures at lower prices than we do. If that were to happen or we were not successful in cost effectively acquiring patients for our procedures, we may not be able to make up for the reduced gross profit margin by increasing the number of procedures that we perform, and our business, financial condition and results from operations could be adversely affected, as we have experienced in prior fiscal periods.

Our business has been adversely affected in the past by deeply-discounted pricing by some competitors, and it is possible that such competitive practices may adversely affect our business in the future.

In the past, certain competitors have utilized deeply-discounted pricing in an effort to generate procedure volume. This practice has caused periods of intense price competition in our industry. As a result, we have lowered our prices in the past in order to remain competitive. We currently face competitors offering discounted prices, including several providers of laser vision correction procedures, in some geographic markets where we conduct business. It is possible that, in the future, business, financial condition and results of operations could be adversely affected, as a result of the discounting practices of competitors.

We have credit risk from accounts receivable from internally financed patients.

A significant percentage of our patients finance some or all of the cost of their procedure. We provide certain of our patients, including patients who could not otherwise obtain third-party financing, with the ability to pay for our procedures with direct financing. The terms of our direct financing typically require the patient to pay a fee up-front, with the remaining balance paid by the patient in up to 36 monthly installments. As of December 31, 2012, we had $5.5 million in gross patient receivables, compared to $4.8 million as of December 31, 2011. We are exposed to significant credit risk from our direct financing program, particularly given that patients who participate in the program

13

Table of Contents

generally have not been deemed creditworthy by third-party financing companies with more experience in credit issues. If the uncollectible amounts exceed the amounts that we have reserved, we could be required to write down our accounts receivable, and our cash flow and results of operations would be adversely affected.

Extensive state and federal laws and regulations, some of which may be applicable to our business operations, regulate the extension of credit to patients. Non-compliance could subject us to litigation, enforcement action, or civil or criminal penalties. Any such action could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Concerns about potential side effects and long-term results may negatively impact market acceptance of laser vision correction, result in potential liability for us and prevent us from growing our business.

Some people and publications have raised concerns with respect to the predictability and stability of results and potential complications or side effects of laser vision correction. Physicians have provided laser vision correction in the United States since 1995. Any long-term complications or side effects of laser vision correction may call into question its safety and effectiveness, which in turn may negatively affect market acceptance of laser vision correction. Complications or side effects of laser vision correction could lead to professional liability, malpractice or other claims against us and product liability claims against the manufacturers of our lasers. Courts have awarded several significant verdicts against non-affiliated refractive surgeons in the past. Consequences of proceedings could include increased liability to us in connection with malpractice litigation, increased difficulty in hiring and retaining qualified independent ophthalmologists who may be wary of the increased liability associated with laser eye surgery, and decreased operational and financial yield from pre-operative examinations, among other effects that would be adverse to our business, financial condition, and results of operations.

Some of the possible side effects of laser vision correction may include:

| • | Foreign body sensation |

| • | Pain or discomfort |

| • | Sensitivity to bright lights |

| • | Blurred vision or haze |

| • | Dryness or tearing |

| • | Fluctuation in vision |

| • | Night glare and halos |

| • | Poor or reduced visual quality |

| • | Overcorrection or undercorrection |

| • | Regression |

| • | Decreased corneal integrity |

| • | Corneal flap or corneal healing complications |

| • | Loss of best corrected visual acuity |

| • | Inflammation or infection of the eye |

| • | Need for corrective lenses or reading glasses post-operatively |

| • | Need for further treatment |

| • | Ectasia |

We depend on limited sources for the excimer lasers and diagnostic equipment we use and for the third-party financing made available to our patients. Shortages of these items or services could hinder our ability to increase our procedure volume.

We use two suppliers, AMO and Alcon, for our excimer lasers. If either or both of these companies became unwilling or unable to supply us with excimer lasers and diagnostic equipment or to repair or replace parts or to provide services, our ability to maintain or increase our capacity to perform laser vision correction services at existing vision centers or to open new vision centers could be restricted.

We currently rely primarily on AMO to provide us with femtosecond lasers and patient interface kits, the devices used to create the corneal flap in the LASIK procedure, and McKesson for other disposable items required for LASIK. If we were to require alternate or additional suppliers, there can be no assurance that such items would be available in the quantities, at the costs or within the time frames that we require. Any shortages in our supplies of this equipment could limit our ability to maintain or increase the volume of procedures that we perform, which could adversely affect our business, financial condition and results from operations.

We currently rely exclusively on one unaffiliated finance company for third-party financing made available to our patients. The percentage of our patients who choose to obtain financing from this unaffiliated finance company is significant. We cannot give assurance that financing services will be available on terms or at interest rates or costs that we or our patients may require. Any reduction in available financing could limit our ability to maintain or increase the volume of procedures that we perform, which could adversely affect our business, financial condition and results from operations.

14

Table of Contents

Our business may be impaired due to government regulations which could restrict our equipment, services and relationships with ophthalmologists, optometrists and other healthcare providers.

As described under “Government Regulation” and below, we, excimer laser manufacturers and our other business partners, including managed care companies and third-party patient financing companies, among others, are subject to extensive federal, state and foreign laws, rules and regulations, including all or some of the following:

| • | Federal restrictions on the approval, distribution and use of medical devices |

| • | Federal and state anti-kickback laws |

| • | Fee-splitting laws in some states |

| • | Corporate practice of medicine restrictions in some states |

| • | Federal and state physician self-referral laws |

| • | Federal and state information privacy and security laws |

| • | Anti-fraud provisions in some states |

| • | Facility license requirements and certificates of need in some states |

| • | Conflict of interest regulations in some states |

| • | FDA, FTC, and state rules and regulations regarding advertising and marketing practices |

| • | Credit and financing regulation |

Some of these laws and regulations are vague or ambiguous, and courts and regulatory authorities have not always provided clarification. Moreover, state and local law, including, but not limited to those on sales and use taxes, vary from jurisdiction to jurisdiction. As a result, some of our activities could be challenged, the success of which cannot be predicted.

The failure of our suppliers to obtain regulatory approvals for any additional uses of excimer or femtosecond lasers or otherwise comply with regulatory requirements could limit the number of excimer or femtosecond lasers that we have available for use and, therefore, limit the number of procedures that we can perform.

Failure of the laser manufacturers to comply with applicable FDA requirements could subject us, the independent ophthalmologists who practice in our vision centers or those manufacturers to enforcement actions, including product seizure, recalls, withdrawal of approvals and civil and criminal penalties. Further, failure to comply with regulatory requirements, or any adverse regulatory action, could result in limitations or prohibitions on our use of excimer or femtosecond lasers. Any such actions or proceedings could result in negative publicity, which in turn could result in decreased demand for our services and decrease our capacity to perform laser vision correction services.

Our business depends heavily on advertising, which is subject to regulation by the Federal Trade Commission (“FTC”) and various state boards of medicine and optometry. We are subject to a 2003 FTC Consent Order in which it was agreed, among other things, that we would not represent in our advertising that our LASIK surgery services eliminate the need for glasses and contacts for life, pose significantly less risk to patients’ eye health than wearing glasses or contacts, or eliminate the risk of glare and haloing, unless, at the time made, we possess and rely upon competent and reliable scientific evidence that substantiates the representation. We cannot be certain that this order to which we agreed, or any future action by the FTC, will not restrict our laser vision correction services, or otherwise result in negative publicity and damage our reputation.

Our business may be adversely impacted by health care reform.

The Patient Protection and Affordable Care Act (“PPACA”), as amended by the Health Care and Education Reconciliation Act (“HCERA,” and together with PPACA the “Affordable Care Act”) was signed into law on March 23, 2010. The Affordable Care Act contains provisions affecting numerous aspects of the health care and insurance industries. Effective in 2013, the Affordable Care Act will limit flexible spending account contributions to $2,500, which may negatively impact our business because many of our customers use flexible spending accounts to pay for our procedures. These changes could have a material adverse effect on our business, financial condition, results of operations and cash flows.

The FDA is conducting a study to examine LASIK’s impact on quality of life, the results of which could adversely impact broader market acceptance, and our profitability and growth.

The FDA has launched a collaborative study with the National Eye Institute and the U.S. Department of Defense to examine LASIK’s potential impact on quality of life. The goal of the LASIK Quality of Life Collaboration Project is to determine the percentage of patients with significant quality of life problems after LASIK surgery and to identify predictors of these problems. The results of the project will help identify factors that can affect quality of life following LASIK and potentially reduce the risk of adverse affects that can impact the surgical outcome. If any of these factors are related to the safety or effectiveness of the lasers used in LASIK surgery, the FDA will evaluate whether any action is necessary. The project is part of the FDA’s ongoing effort to better monitor and improve the safety and effectiveness of the lasers used in LASIK surgery. The results of this study could adversely impact broader market acceptance of LASIK, which could have a direct impact on our profitability and growth. In addition, any new adverse regulatory actions by the FDA could result in limitations or prohibitions with respect to LASIK surgery.

15

Table of Contents

We are subject to lawsuits for patient injuries, which could subject us to significant judgments and damage our reputation.

The laser vision correction procedures performed in our vision centers involve the risk of injury to patients. Such risk could result in professional liability, malpractice, or other claims brought against us, or our independent ophthalmologists and optometrists based upon injuries or alleged injuries associated with malpractice by an ophthalmologist, optometrist, technician or other healthcare professional. Product liability claims could also be made against our manufacturers associated with defects in their products. Some injuries or defects may not become evident for a number of years. Significant lawsuits against us could subject us to significant judgments and damage our reputation. In addition, a partially or completely uninsured claim against us could have a material adverse effect on our business, financial condition and results of operations. We rely primarily and intend to continue to rely primarily on the independent ophthalmologists’ professional liability insurance policies and the manufacturers’ product liability insurance policies, although we have limited umbrella general and professional liability insurance. We require the independent ophthalmologists who use our vision centers to maintain professional liability insurance, although an inability of an ophthalmologist to procure insurance could disrupt business while a replacement ophthalmologist is being recruited.

The availability of professional liability insurance has decreased and its cost has increased for a variety of reasons, including reasons outside our control, particularly in certain states. A future increase in cost could adversely affect the results of operations of our business, and a future lack of availability of coverage for us or our independent ophthalmologists could result in increased exposure to liability and potentially limit our ability to expand in certain markets.

We own a captive insurance company and its payment of significant claims could affect our results of operations and financial condition.

We maintain a captive insurance company to provide professional liability insurance coverage for claims brought against us and our optometrists after December 17, 2002. In addition, our captive insurance company’s charter allows it to provide professional liability insurance for our ophthalmologists. Our captive insurance company is capitalized and funded by us based on actuarial studies performed by an independent insurance consulting and management firm. We use the captive insurance company for both the primary insurance and excess liability coverage. A number of claims are now pending with our captive insurance company. The payment of significant claims by our captive insurance company could adversely affect our business, financial condition and results of operations.

Disputes with respect to intellectual property could result in a decrease in revenues and profitability.