Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Jun. 30, 2023 |

Jun. 30, 2022 |

| Pay vs Performance Disclosure |

|

|

| Pay vs Performance Disclosure, Table |

Pay Versus Performance

As required by Item 402(v) of Regulation S-K, we are providing the following information regarding the relationship between executive compensation and our financial performance for each of the last two completed calendar years. In determining the “compensation actually paid” to our named executive officers, we are required to make various adjustments to amounts that are reported in the Summary Compensation Table, as the SEC’s valuation methods for this section differ from those required in the Summary Compensation Table. The table below summarizes compensation values both reported in our Summary Compensation Table, as well as the adjusted values required in this section for the 2022 and 2023 fiscal years.

|

Year

|

|

Summary

Compensation

Table Total for

PEO(1)

($)

|

|

|

Compensation

Actually Paid to

PEO(2)

($)

|

|

|

Average Summary

Compensation

Table Total for

Non-PEO NEOs(3)

($)

|

|

|

Average

Compensation

Actually Paid to

Non-PEO NEOs(4)

($)

|

|

|

Value of Initial

Fixed $100

Investment

based on TSR

($)(5)

|

|

|

Net (Loss)

Income

($)(6)

|

|

|

2023

|

|

|

482,958 |

|

|

|

517,759 |

|

|

|

328,345 |

|

|

|

329,503 |

|

|

|

35.49 |

|

|

|

(9,642,000) |

|

|

2022

|

|

|

1,956,575 |

|

|

|

492,084 |

|

|

|

337,907 |

|

|

|

199,916 |

|

|

|

32.33 |

|

|

|

(8,330,000) |

|

|

(1)

|

The dollar amounts reported this column are the amounts of total compensation reported for Mr. Pickens, our Chief Executive Officer (the “PEO”), for each corresponding year in the “Total” column of the Summary Compensation Table. For additional information, see “Executive Compensation—Summary Compensation Table.”

|

|

|

| PEO Total Compensation Amount |

$ 482,958

|

$ 1,956,575

|

| PEO Actually Paid Compensation Amount |

$ 517,759

|

492,084

|

| Adjustment To PEO Compensation, Footnote |

|

(2)

|

The dollar amounts reported in this column represent the amount of “compensation actually paid” to Mr. Pickens, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or, paid to, Mr. Pickens during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to Mr. Pickens’s total compensation as reported in the SCT for each year to determine compensation actually paid:

|

|

Year

|

|

Reported

Summary Compensation Table

Total for PEO

($)

|

|

|

Exclusion of Reported

Value of Equity

Awards(a)

($)

|

|

|

Equity

Award Adjustments(b)

($)

|

|

|

Compensation Actually Paid to

PEO

($)

|

|

|

2023

|

|

|

482,958 |

|

|

|

— |

|

|

|

34,801 |

|

|

|

517,759 |

|

|

2022

|

|

|

1,956,575 |

|

|

|

(1,096,114) |

|

|

|

(368,377) |

|

|

|

492,084 |

|

| |

(a)

|

Represents the total of the amounts reported in the “Stock Awards” and "Options" columns in the Summary Compensation Table for the applicable year.

|

| |

(b)

|

The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; (iii) for awards that are granted and vest in same year, the fair value as of the vesting date; (iv) for awards granted in prior years that vested in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value; (v) for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the applicable year, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and (vi) the dollar value of any dividends or other earnings paid on stock or option awards in the applicable year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for the applicable year. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. The amounts deducted or added in calculating the equity award adjustments are as follows:

|

|

Year

|

|

Year End Fair

Value of

Outstanding and Unvested Equity Awards Granted

in the Year

($)

|

|

|

Year over Year

Change in Fair

Value of

Outstanding and

Unvested Equity

Awards Granted in

Prior Years

($)

|

|

|

Fair Value as

of Vesting

Date of

Equity

Awards

Granted and

Vested in the

Year

($)

|

|

|

Year over Year

Change in Fair

Value of Equity

Awards

Granted in

Prior Years

that Vested in

the Year

($)

|

|

|

Fair Value at the

End of the Prior

Year of Equity

Awards that

Failed to Meet

Vesting

Conditions in the

Year

($)

|

|

|

Value of Dividends or

other Earnings Paid

on Stock or Option

Awards not Otherwise

Reflected in Fair

Value or Total

Compensation

($)

|

|

|

Total

Equity

Award

Adjustments

($)

|

|

|

2023

|

|

|

— |

|

|

|

75,721 |

|

|

|

— |

|

|

|

(40,920) |

|

|

|

— |

|

|

|

— |

|

|

|

34,801 |

|

|

2022

|

|

|

728,247 |

|

|

|

(826,919) |

|

|

|

— |

|

|

|

(269,705) |

|

|

|

— |

|

|

|

— |

|

|

|

(368,377) |

|

|

(3)

|

The dollar amounts reported in this column represent the average of the amounts reported for the Company’s NEOs as a group (excluding Mr. Pickens) in the “Total” column of the Summary Compensation Table in each applicable year. The names of each of the NEOs (excluding Mr. Pickens) included for purposes of calculating the average amounts in each applicable year are as follows: for 2023, Mr. Hinojosa, our Chief Financial Officer, and for 2022, Mr. Hinojosa and Mr. Stober, our former Chief Financial Officer.

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 328,345

|

337,907

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 329,503

|

199,916

|

| Adjustment to Non-PEO NEO Compensation Footnote |

|

(4)

|

The dollar amounts reported in this column represent the average amount of “compensation actually paid” to the NEOs as a group (excluding Mr. Pickens), as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average amount of compensation earned by or paid to the named executive officers as a group (excluding Mr. Pickens) during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to average total compensation for the named executive officers as a group (excluding Mr. Pickens) as reported in the Summary Compensation Table for each year to determine the compensation actually paid, using the same methodology described above in Note (2):

|

|

Year

|

|

Average

Reported Summary Compensation Table

Total for Non-PEO NEOs

($)

|

|

|

Exclusion of

Average

Reported

Value of Equity

Awards(a)

($)

|

|

|

Average Equity

Award

Adjustments(b)

($)

|

|

|

Average Compensation Actually Paid

to Non-PEO NEOs

($)

|

|

|

2023

|

|

|

328,345 |

|

|

|

— |

|

|

|

1,158 |

|

|

|

329,503 |

|

|

2022

|

|

|

337,907 |

|

|

|

(58,774) |

|

|

|

(79,217) |

|

|

|

199,916 |

|

|

(a)

|

Represents the total of the amounts reported in the “Stock Awards” and "Options" columns in the Summary Compensation Table for the applicable year.

|

|

(b)

|

The amounts deducted or added in calculating the total average equity award adjustments are as follows:

|

|

Year

|

|

Year End Fair

Value of

Outstanding and

Unvested Equity

Awards Granted

in the Year

($)

|

|

|

Year over Year

Change in Fair

Value of

Outstanding and

Unvested Equity

Awards Granted in

Prior Years

($)

|

|

|

Fair Value as

of Vesting

Date of

Equity

Awards

Granted and

Vested in the

Year

($)

|

|

|

Year over Year

Change in Fair

Value of

Equity Awards

Granted in

Prior Years

that Vested in

the Year

($)

|

|

|

Fair Value at the

End of the Prior

Year of Equity

Awards that

Failed to Meet

Vesting

Conditions in the

Year

($)

|

|

|

Value of Dividends or

other Earnings Paid on

Stock or Option

Awards not Otherwise

Reflected in Fair Value

or Total Compensation

($)

|

|

|

Total

Equity

Award

Adjustments

($)

|

|

|

2023

|

|

|

— |

|

|

|

3,169 |

|

|

|

— |

|

|

|

(2,011) |

|

|

|

— |

|

|

|

— |

|

|

|

1,158 |

|

|

2022

|

|

|

19,216 |

|

|

|

(35,452) |

|

|

|

— |

|

|

|

(62,981) |

|

|

|

— |

|

|

|

— |

|

|

|

(79,217) |

|

|

(5)

|

Cumulative total shareholder return (“TSR”) is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period. No dividends were paid on stock or option awards in 2022 or 2023.

|

|

(6)

|

The dollar amounts reported represent the amount of net (loss) income reflected in our consolidated audited financial statements for the applicable year.

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

Compensation Actually Paid and Cumulative TSR

All information provided above under the “Pay Versus Performance” heading will not be deemed to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

|

|

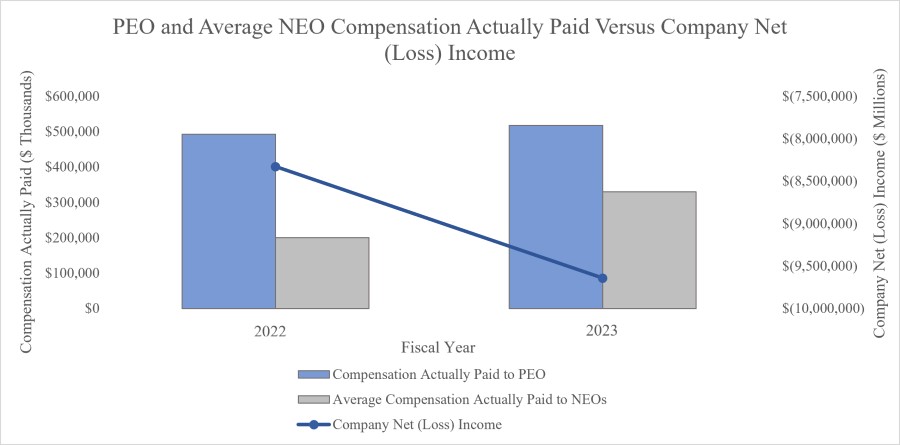

| Compensation Actually Paid vs. Net Income |

Analysis of the Information Presented in the Pay Versus Performance Table

We generally seek to incentivize long-term performance, and therefore do not specifically align our performance measures with “compensation actually paid” (as computed in accordance with Item 402(v) of Regulation S-K) for a particular year. In accordance with Item 402(v) of Regulation S-K, we are providing the following descriptions of the relationships between information presented in the Pay Versus Performance table.

Compensation Actually Paid and Net (Loss) Income

|

|

| Total Shareholder Return Amount |

$ 35.49

|

32.33

|

| Net Income (Loss) |

(9,642,000)

|

(8,330,000)

|

| PEO Exclusion of Reported Value of Equity Awards [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

0

|

(1,096,114)

|

| PEO Equity Award Adjustments [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

34,801

|

(368,377)

|

| PEO Year End Fair Value of Outstanding and Unvested Equity Awards Granted in the Year [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

0

|

728,247

|

| PEO Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

75,721

|

(826,919)

|

| PEO Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

| PEO Year over Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

(40,920)

|

(269,705)

|

| PEO Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Year [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

| PEO Value of Dividends or other Earnings Paid on Stock or Option Awards not Otherwise Reflected in Fair Value or Total Compensation [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

| NEO Exclusion of Average Reported Value of Equity Awards [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

0

|

(58,774)

|

| NEO Average Equity Award Adjustments [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

1,158

|

(79,217)

|

| NEO Year End Fair Value of Outstanding and Unvested Equity Awards Granted in the Year [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

0

|

|

| NEO Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

3,169

|

(35,452)

|

| NEO Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

| NEO Year over Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

(2,011)

|

(62,981)

|

| NEO Fair Value at the End of the Prior Year of Equity Awards that Failed to Meet Vesting Conditions in the Year [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

| NEO Value of Dividends or other Earnings Paid on Stock or Option Awards not Otherwise Reflected in Fair Value or Total Compensation [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

| NEO Equity Award Adjustments [Member] |

|

|

| Pay vs Performance Disclosure |

|

|

| Adjustment to Compensation, Amount |

$ 1,158

|

$ (79,217)

|