Exhibit (c)(v)

CONFIDENTIAL WORKING DRAFT – FOR DISCUSSION PURPOSES ONLY

Summary of Implied Transaction Premiums

Implied Transaction Premiums vs. Stock Trading History

Project Celtic

1

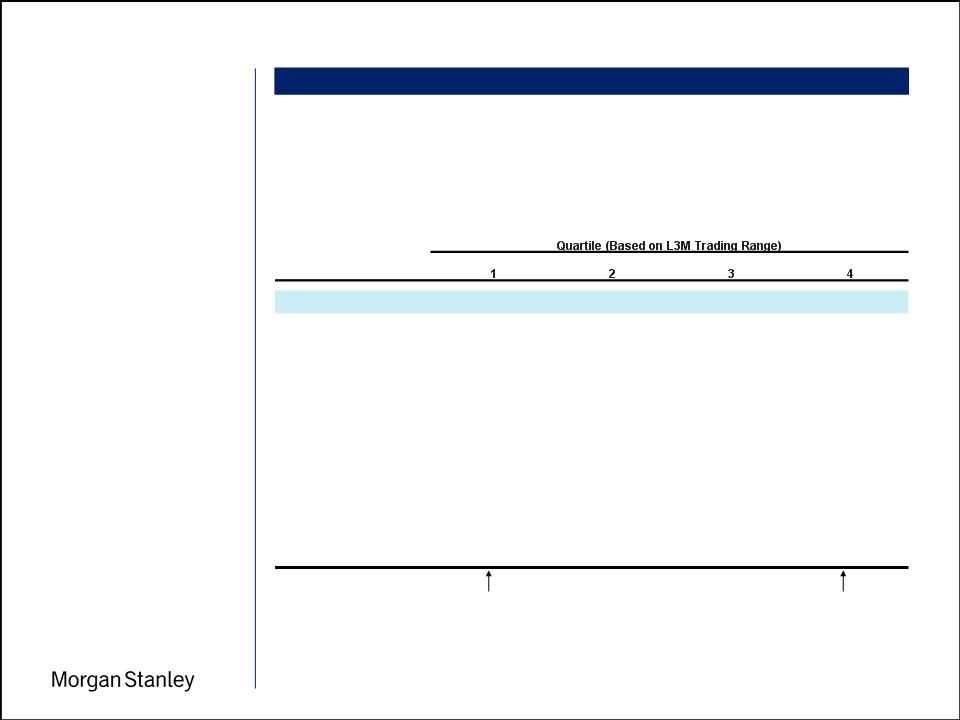

• Analysis divides selected

precedents into quartiles based

on where the target’s stock was

trading relative to its trading

range during the 3 months

immediately prior to

announcement

precedents into quartiles based

on where the target’s stock was

trading relative to its trading

range during the 3 months

immediately prior to

announcement

Notes

1. Based on selected deals since 2001; all cash; US targets; minority buy-in value of $25 - $500MM; majority shareholder owned less than 90% of target

2. Final premium statistics exclude Hearst-Argyle transaction, which has not been completed

Minority Buy-in Precedents (1)

Source Public Filings, Press Releases, FactSet

Prior to announcement,

stock price was in bottom

quartile of its 3-month

trading range

stock price was in bottom

quartile of its 3-month

trading range

Prior to announcement,

stock price was in top

quartile of its 3-month

trading range

stock price was in top

quartile of its 3-month

trading range

No. of deals

11

2

4

9

Initial Premium to Prior Day Price:

Median Premium

35.6%

58.6%

28.1%

11.5%

Mean Premium

32.4%

58.6%

38.4%

14.2%

High Premium

60.0%

91.4%

97.5%

38.8%

Low Premium

8.6%

25.8%

0.0%

(7.9%)

Final Premium to Prior Day Price:

(2)

Median Premium

45.5%

29.6%

53.8%

23.9%

Mean Premium

48.3%

29.6%

56.3%

26.1%

High Premium

140.0%

29.6%

97.5%

52.9%

Low Premium

13.2%

29.6%

20.0%

6.7%

CONFIDENTIAL WORKING DRAFT – FOR DISCUSSION PURPOSES ONLY

Implied Transaction Premiums vs. Stock Trading History (cont’d)

Project Celtic

2

Note

1. Based on selected deals since 2001; all cash; US targets; minority buy-in value of $25 - $500MM; majority shareholder owned less than 90% of target

Minority Buy-in Precedents (1)

Source Public Filings, Press Releases, FactSet

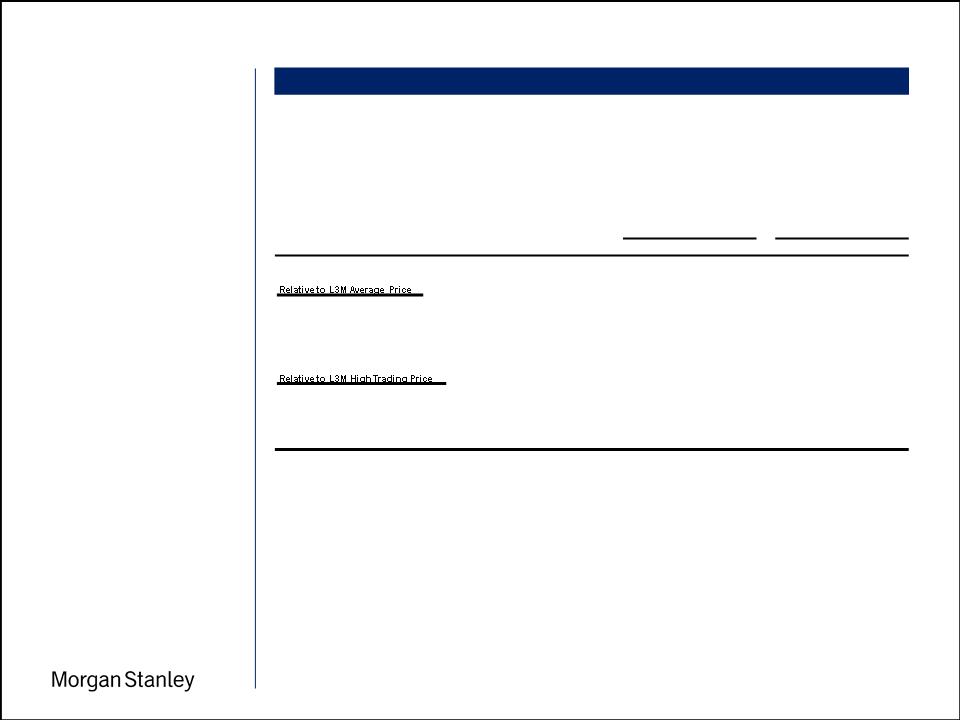

• Analysis evaluates premiums

paid in precedent transactions

based on where target was

trading relative to its L3M

average trading price and L3M

high trading price at the time a

transaction was announced

paid in precedent transactions

based on where target was

trading relative to its L3M

average trading price and L3M

high trading price at the time a

transaction was announced

Summary of Implied Transaction Premiums

Initial Premium To

Final Premium To

Prior Day

Prior Day Closing Price

Prior Day Closing Price

Trading Price

# of Transactions

Mean

Median

Mean

Median

Target Trading Above L3M Average

13

21.6%

11.5%

35.4%

29.8%

Target Trading Below L3M Average

13

36.4%

35.6%

46.8%

42.8%

Target Trading at 0 - 30% Discount to L3M High

18

21.4%

15.8%

33.4%

29.7%

Target Trading at 30%+ Discount to L3M High

8

46.2%

45.8%

60.2%

45.8%

CONFIDENTIAL WORKING DRAFT – FOR DISCUSSION PURPOSES ONLY

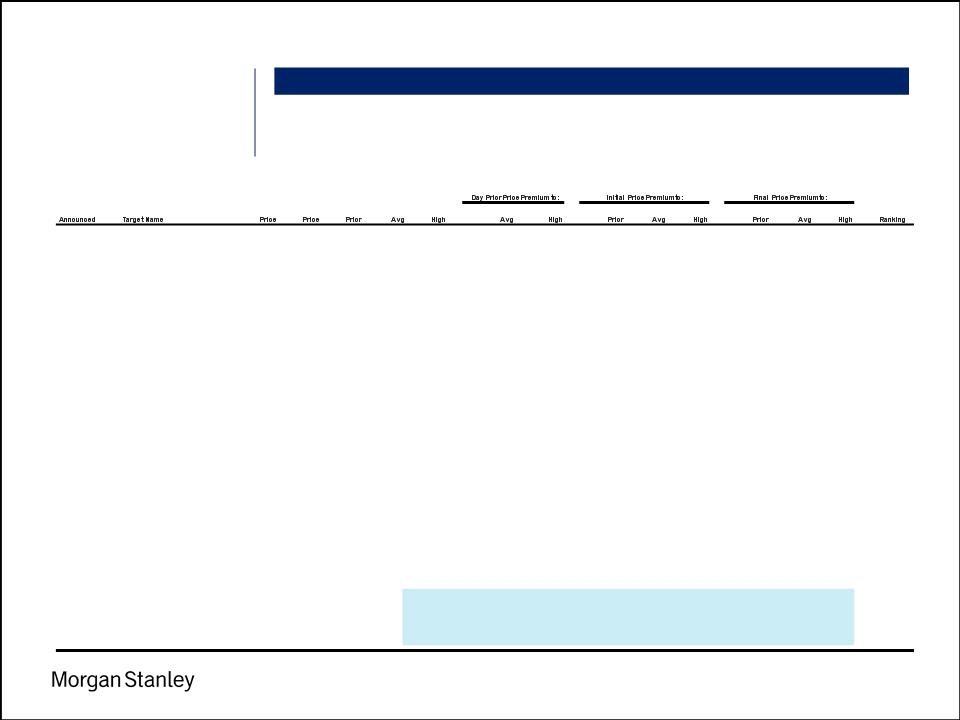

Minority Buy-in Precedents (1)

Project Celtic

3

Notes

1. Based on selected deals since 2001; all cash; US targets; minority buy-in value of $25 - $500MM; majority shareholder owned less than 90% of target

2. Ranking based on where target was trading relative to its 3-month trading range immediately prior to announcement

Breakdown of L3M Trading by Quartiles

Initial

Final

Day

L3M

L3M

L3M

L3M

Day

L3M

L3M

Day

L3M

L3M

Quartile

(2)

3/25/09

Hearst-Argyle Television Inc

$4.00

NA

$2.09

3.64

6.56

(42.6%)

(68.1%)

91.4%

9.8%

(39.0%)

NA

NA

NA

2

3/23/09

Cox Radio Inc

3.80

4.80

3.30

5.07

6.66

(34.9%)

(50.5%)

15.2%

(25.0%)

(42.9%)

45.5%

(5.3%)

(27.9%)

1

10/22/07

Waste Industries USA Inc

36.75

38.00

27.11

30.08

35.12

(9.9%)

(22.8%)

35.6%

22.2%

4.6%

40.2%

26.3%

8.2%

1

2/22/07

Great American Finl Res Inc

23.50

24.50

21.64

22.44

23.66

(3.6%)

(8.5%)

8.6%

4.7%

(0.7%)

13.2%

9.2%

3.6%

1

10/9/06

NetRatings Inc

16.00

21.00

14.57

13.90

14.99

4.9%

(2.8%)

9.8%

15.1%

6.7%

44.1%

51.1%

40.1%

3

3/21/06

Erie Family Life Insurance Co

32.00

32.00

30.00

27.84

30.00

7.8%

0.0%

6.7%

15.0%

6.7%

6.7%

15.0%

6.7%

4

9/13/05

CoolSavings Inc

0.80

0.80

0.55

0.67

0.83

(17.9%)

(33.7%)

45.5%

19.5%

(3.6%)

45.5%

19.5%

(3.6%)

1

4/12/04

Edelbrock Corp

14.80

16.75

13.52

12.81

14.00

5.5%

(3.4%)

9.5%

15.5%

5.7%

23.9%

30.7%

19.6%

4

7/24/03

Digex Inc

0.70

1.00

0.76

0.47

0.76

61.3%

0.0%

(7.9%)

48.5%

(7.9%)

31.6%

112.2%

31.6%

4

6/2/03

Ribapharm Inc

5.60

6.25

5.08

4.53

5.21

12.1%

(2.5%)

10.2%

23.6%

7.5%

23.0%

38.0%

20.0%

4

2/18/03

Lexent Inc

1.25

1.50

0.91

0.99

1.16

(8.4%)

(21.6%)

37.4%

25.9%

7.8%

64.8%

51.1%

29.3%

1

1/13/03

Next Level Communications Inc

1.04

1.18

0.91

0.79

1.10

15.8%

(17.4%)

14.4%

32.5%

(5.5%)

29.8%

50.3%

7.3%

4

7/30/02

JCC Holding Co

10.54

10.54

9.00

6.56

9.00

37.2%

0.0%

17.1%

60.7%

17.1%

17.1%

60.7%

17.1%

4

7/9/02

International Specialty Prods

10.00

10.30

7.95

8.31

10.10

(4.3%)

(21.3%)

25.8%

20.4%

(1.0%)

29.6%

24.0%

2.0%

2

3/18/02

Meemic Holdings Inc

29.00

29.00

26.00

22.64

26.00

14.8%

0.0%

11.5%

28.1%

11.5%

11.5%

28.1%

11.5%

4

3/14/02

Konover Property Trust Inc

1.75

2.10

1.75

1.62

1.85

7.9%

(5.4%)

0.0%

7.9%

(5.4%)

20.0%

29.5%

13.5%

3

2/19/02

Travelocity.com Inc

23.00

28.00

19.20

23.75

29.49

(19.2%)

(34.9%)

19.8%

(3.2%)

(22.0%)

45.8%

17.9%

(5.0%)

1

10/10/01

TD Waterhouse Group Inc

9.00

9.50

6.20

8.12

10.24

(23.7%)

(39.5%)

45.2%

10.8%

(12.1%)

53.2%

17.0%

(7.2%)

1

10/1/01

NCH Corp

47.50

52.50

39.19

42.71

44.90

(8.2%)

(12.7%)

21.2%

11.2%

5.8%

34.0%

22.9%

16.9%

1

8/22/01

Homeservices Com Inc

17.00

17.00

12.25

11.43

13.00

7.2%

(5.8%)

38.8%

48.8%

30.8%

38.8%

48.8%

30.8%

4

8/21/01

Spectra Physics Inc

20.00

17.50

13.69

20.33

25.00

(32.7%)

(45.2%)

46.1%

(1.6%)

(20.0%)

27.8%

(13.9%)

(30.0%)

1

8/16/01

Leeds Federal Bankshares Inc

32.00

32.00

16.20

15.97

17.10

1.5%

(5.3%)

97.5%

100.4%

87.1%

97.5%

100.4%

87.1%

3

5/30/01

Bacou USA Inc

28.50

28.50

23.40

25.28

25.85

(7.4%)

(9.5%)

21.8%

12.8%

10.3%

21.8%

12.8%

10.3%

1

5/23/01

Unigraphics Solutions Inc

27.00

32.50

21.25

19.00

23.00

11.8%

(7.6%)

27.1%

42.1%

17.4%

52.9%

71.0%

41.3%

4

5/14/01

Agency.com Ltd

3.00

3.35

2.05

1.81

3.06

13.5%

(33.1%)

46.3%

66.2%

(2.0%)

63.4%

85.5%

9.4%

3

3/26/01

CSFBdirect

4.00

6.00

2.50

3.86

5.25

(35.2%)

(52.4%)

60.0%

3.6%

(23.8%)

140.0%

55.5%

14.3%

1

Mean

(1.8%)

(19.4%)

29.0%

23.7%

1.3%

40.9%

38.3%

13.9%

Median

(1.1%)

(11.1%)

21.5%

17.5%

2.0%

34.0%

29.5%

11.5%

High

61.3%

0.0%

97.5%

100.4%

87.1%

140.0%

112.2%

87.1%

Low

(42.6%)

(68.1%)

(7.9%)

(25.0%)

(42.9%)

6.7%

(13.9%)

(30.0%)