el-202006300001001250FALSE--06-302020FYus-gaap:OtherAssetsus-gaap:DebtCurrentus-gaap:LongTermDebtNoncurrentP2YP3Y8/31/202000010012502019-07-012020-06-30iso4217:USD00010012502019-12-31xbrli:shares0001001250us-gaap:CommonClassAMember2020-08-200001001250us-gaap:CommonClassBMember2020-08-2000010012502018-07-012019-06-3000010012502017-07-012018-06-30iso4217:USDxbrli:shares00010012502020-06-3000010012502019-06-300001001250us-gaap:CommonClassAMember2019-06-300001001250us-gaap:CommonClassAMember2020-06-300001001250us-gaap:CommonClassBMember2020-06-300001001250us-gaap:CommonClassBMember2019-06-300001001250us-gaap:CommonStockMember2019-06-300001001250us-gaap:CommonStockMember2018-06-300001001250us-gaap:CommonStockMember2017-06-300001001250us-gaap:CommonStockMember2019-07-012020-06-300001001250us-gaap:CommonStockMember2018-07-012019-06-300001001250us-gaap:CommonStockMember2017-07-012018-06-300001001250us-gaap:CommonStockMember2020-06-300001001250us-gaap:AdditionalPaidInCapitalMember2019-06-300001001250us-gaap:AdditionalPaidInCapitalMember2018-06-300001001250us-gaap:AdditionalPaidInCapitalMember2017-06-300001001250us-gaap:AdditionalPaidInCapitalMember2019-07-012020-06-300001001250us-gaap:AdditionalPaidInCapitalMember2018-07-012019-06-300001001250us-gaap:AdditionalPaidInCapitalMember2017-07-012018-06-300001001250us-gaap:AdditionalPaidInCapitalMember2020-06-300001001250us-gaap:RetainedEarningsMember2019-06-300001001250us-gaap:RetainedEarningsMember2018-06-300001001250us-gaap:RetainedEarningsMember2017-06-300001001250us-gaap:RetainedEarningsMember2019-07-012020-06-300001001250us-gaap:RetainedEarningsMember2018-07-012019-06-300001001250us-gaap:RetainedEarningsMember2017-07-012018-06-300001001250el:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2017-06-300001001250el:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2019-06-300001001250el:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2018-06-300001001250us-gaap:RetainedEarningsMember2020-06-300001001250us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-300001001250us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-06-300001001250us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-06-300001001250el:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2017-06-300001001250us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-07-012020-06-300001001250us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-07-012019-06-300001001250us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-07-012018-06-300001001250us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300001001250us-gaap:TreasuryStockMember2019-06-300001001250us-gaap:TreasuryStockMember2018-06-300001001250us-gaap:TreasuryStockMember2017-06-300001001250us-gaap:TreasuryStockMember2019-07-012020-06-300001001250us-gaap:TreasuryStockMember2018-07-012019-06-300001001250us-gaap:TreasuryStockMember2017-07-012018-06-300001001250us-gaap:TreasuryStockMember2020-06-300001001250us-gaap:ParentMember2020-06-300001001250us-gaap:ParentMember2019-06-300001001250us-gaap:ParentMember2018-06-300001001250us-gaap:NoncontrollingInterestMember2019-06-300001001250us-gaap:NoncontrollingInterestMember2018-06-300001001250us-gaap:NoncontrollingInterestMember2017-06-300001001250us-gaap:NoncontrollingInterestMember2019-07-012020-06-300001001250us-gaap:NoncontrollingInterestMember2018-07-012019-06-300001001250us-gaap:NoncontrollingInterestMember2017-07-012018-06-300001001250us-gaap:NoncontrollingInterestMember2020-06-3000010012502018-06-3000010012502017-06-300001001250srt:MinimumMember2019-07-012020-06-300001001250srt:MaximumMember2019-07-012020-06-300001001250us-gaap:AccountingStandardsUpdate201409Member2018-07-012019-06-300001001250el:AdvertisingAndPromotionMember2019-07-012020-06-300001001250el:AdvertisingAndPromotionMember2018-07-012019-06-300001001250el:AdvertisingAndPromotionMember2017-07-012018-06-300001001250el:ResearchAndDevelopmentMember2019-07-012020-06-300001001250el:ResearchAndDevelopmentMember2018-07-012019-06-300001001250el:ResearchAndDevelopmentMember2017-07-012018-06-300001001250us-gaap:ShippingAndHandlingMember2019-07-012020-06-300001001250us-gaap:ShippingAndHandlingMember2018-07-012019-06-300001001250us-gaap:ShippingAndHandlingMember2017-07-012018-06-300001001250srt:MinimumMemberus-gaap:LicensingAgreementsMember2019-07-012020-06-300001001250srt:MaximumMemberus-gaap:LicensingAgreementsMember2019-07-012020-06-300001001250us-gaap:LicensingAgreementsMember2019-07-012020-06-300001001250el:COVID19PandemicMember2020-04-012020-06-300001001250us-gaap:SellingGeneralAndAdministrativeExpensesMemberel:COVID19PandemicMember2020-04-012020-06-300001001250us-gaap:CostOfSalesMemberel:COVID19PandemicMember2020-04-012020-06-300001001250el:COVID19PandemicMember2020-06-300001001250us-gaap:LandMember2020-06-300001001250us-gaap:LandMember2019-06-300001001250srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2019-07-012020-06-300001001250srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2019-07-012020-06-300001001250us-gaap:BuildingAndBuildingImprovementsMember2020-06-300001001250us-gaap:BuildingAndBuildingImprovementsMember2019-06-300001001250us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2019-07-012020-06-300001001250us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2019-07-012020-06-300001001250us-gaap:MachineryAndEquipmentMember2020-06-300001001250us-gaap:MachineryAndEquipmentMember2019-06-300001001250srt:MinimumMemberel:ComputerHardwareAndSoftwareMember2019-07-012020-06-300001001250srt:MaximumMemberel:ComputerHardwareAndSoftwareMember2019-07-012020-06-300001001250el:ComputerHardwareAndSoftwareMember2020-06-300001001250el:ComputerHardwareAndSoftwareMember2019-06-300001001250us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2019-07-012020-06-300001001250us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2019-07-012020-06-300001001250us-gaap:FurnitureAndFixturesMember2020-06-300001001250us-gaap:FurnitureAndFixturesMember2019-06-300001001250us-gaap:LeaseholdImprovementsMember2020-06-300001001250us-gaap:LeaseholdImprovementsMember2019-06-30xbrli:pure0001001250el:HaveBeCoLtdMember2019-12-180001001250el:HaveBeCoLtdMember2019-12-182019-12-180001001250el:HaveBeCoLtdMember2020-06-300001001250el:HaveBeCoLtdMember2019-12-180001001250el:HaveBeCoLtdMember2019-12-192020-06-300001001250el:HaveBeCoLtdMember2020-06-302020-06-300001001250el:HaveBeCoLtdMember2019-07-012019-12-310001001250el:HaveBeCoLtdMember2019-07-012020-06-300001001250el:HaveBeCoLtdMember2019-12-012019-12-310001001250el:HaveBeCoLtdMemberus-gaap:CustomerListsMember2019-12-012019-12-310001001250srt:MinimumMemberel:HaveBeCoLtdMemberus-gaap:CustomerListsMember2019-12-012019-12-310001001250srt:MaximumMemberel:HaveBeCoLtdMemberus-gaap:CustomerListsMember2019-12-012019-12-310001001250us-gaap:TrademarksMemberel:HaveBeCoLtdMember2019-12-012019-12-310001001250el:BobbiBrownMember2019-07-012020-06-300001001250el:BobbiBrownMember2018-07-012019-06-300001001250el:SkinCareMember2018-06-300001001250el:MakeupMember2018-06-300001001250el:FragranceMember2018-06-300001001250el:HairCareMember2018-06-300001001250el:SkinCareMember2018-07-012019-06-300001001250el:MakeupMember2018-07-012019-06-300001001250el:FragranceMember2018-07-012019-06-300001001250el:HairCareMember2018-07-012019-06-300001001250el:SkinCareMember2019-06-300001001250el:MakeupMember2019-06-300001001250el:FragranceMember2019-06-300001001250el:HairCareMember2019-06-300001001250el:SkinCareMember2019-07-012020-06-300001001250el:MakeupMember2019-07-012020-06-300001001250el:FragranceMember2019-07-012020-06-300001001250el:HairCareMember2019-07-012020-06-300001001250el:SkinCareMember2020-06-300001001250el:MakeupMember2020-06-300001001250el:FragranceMember2020-06-300001001250el:HairCareMember2020-06-300001001250us-gaap:OtherIntangibleAssetsMembersrt:MinimumMember2019-07-012020-06-300001001250us-gaap:OtherIntangibleAssetsMembersrt:MaximumMember2019-07-012020-06-300001001250el:CustomerListsAndOtherMember2020-06-300001001250el:CustomerListsAndOtherMember2019-06-300001001250us-gaap:LicensingAgreementsMember2020-06-300001001250us-gaap:LicensingAgreementsMember2019-06-300001001250el:TrademarksAndOtherMember2020-06-300001001250el:TrademarksAndOtherMember2019-06-300001001250el:TooFacedMember2020-04-012020-06-300001001250el:TooFacedMember2019-07-012020-06-300001001250el:TooFacedMember2020-06-300001001250el:BECCAMember2020-04-012020-06-300001001250el:BECCAMember2019-07-012020-06-300001001250el:BECCAMember2020-06-300001001250el:SmashboxMember2020-04-012020-06-300001001250el:SmashboxMember2019-07-012020-06-300001001250el:SmashboxMember2020-06-300001001250el:GLAMGLOWMember2020-04-012020-06-300001001250el:GLAMGLOWMember2019-07-012020-06-300001001250el:GLAMGLOWMember2020-06-300001001250el:EditionsDeParfumsFredericMalleMember2020-04-012020-06-300001001250el:EditionsDeParfumsFredericMalleMember2019-07-012020-06-300001001250el:EditionsDeParfumsFredericMalleMember2020-06-300001001250el:TooFacedBECCASmashboxGLAMGLOWAndEditionsDeParfumsFredericMalleMember2020-04-012020-06-300001001250el:TooFacedBECCASmashboxGLAMGLOWAndEditionsDeParfumsFredericMalleMember2019-07-012020-06-300001001250el:TooFacedBECCASmashboxGLAMGLOWAndEditionsDeParfumsFredericMalleMember2020-06-300001001250el:SmashboxMember2018-07-012019-06-300001001250el:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201602Member2019-06-3000010012502019-07-010001001250el:PropertyPlantAndEquipmentAndOtherLongLivedAssetsMember2019-07-012020-06-300001001250us-gaap:ProductAndServiceOtherMember2019-07-012020-06-300001001250srt:AmericasMember2019-07-012020-06-300001001250us-gaap:EMEAMember2019-07-012020-06-300001001250srt:AsiaPacificMember2019-07-012020-06-300001001250srt:MinimumMember2020-06-300001001250srt:MaximumMember2020-06-300001001250us-gaap:SalesReturnsAndAllowancesMemberel:LeadingBeautyForwardMultiYearProjectMember2019-07-012020-06-300001001250us-gaap:CostOfSalesMemberel:LeadingBeautyForwardMultiYearProjectMember2019-07-012020-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMember2019-07-012020-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:OtherOperatingIncomeExpenseMember2019-07-012020-06-300001001250el:LeadingBeautyForwardMultiYearProjectMember2019-07-012020-06-300001001250us-gaap:SalesReturnsAndAllowancesMemberel:LeadingBeautyForwardMultiYearProjectMember2018-07-012019-06-300001001250us-gaap:CostOfSalesMemberel:LeadingBeautyForwardMultiYearProjectMember2018-07-012019-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMember2018-07-012019-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:OtherOperatingIncomeExpenseMember2018-07-012019-06-300001001250el:LeadingBeautyForwardMultiYearProjectMember2018-07-012019-06-300001001250us-gaap:SalesReturnsAndAllowancesMemberel:LeadingBeautyForwardMultiYearProjectMember2017-07-012018-06-300001001250us-gaap:CostOfSalesMemberel:LeadingBeautyForwardMultiYearProjectMember2017-07-012018-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMember2017-07-012018-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:OtherOperatingIncomeExpenseMember2017-07-012018-06-300001001250el:LeadingBeautyForwardMultiYearProjectMember2017-07-012018-06-30el:position0001001250srt:MinimumMember2016-05-312016-05-310001001250srt:MaximumMember2016-05-312016-05-310001001250srt:MinimumMember2020-06-302020-06-300001001250srt:MaximumMember2020-06-302020-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2019-07-012020-06-300001001250us-gaap:SalesReturnsAndAllowancesMemberel:LeadingBeautyForwardMultiYearProjectMember2019-06-300001001250us-gaap:CostOfSalesMemberel:LeadingBeautyForwardMultiYearProjectMember2019-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMember2019-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:OtherOperatingIncomeExpenseMember2019-06-300001001250el:LeadingBeautyForwardMultiYearProjectMember2019-06-300001001250us-gaap:SalesReturnsAndAllowancesMemberel:LeadingBeautyForwardMultiYearProjectMember2020-06-300001001250us-gaap:CostOfSalesMemberel:LeadingBeautyForwardMultiYearProjectMember2020-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMember2020-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:OtherOperatingIncomeExpenseMember2020-06-300001001250el:LeadingBeautyForwardMultiYearProjectMember2020-06-300001001250us-gaap:RestructuringChargesMemberus-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2019-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2019-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2019-06-300001001250us-gaap:OtherRestructuringMemberus-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMember2019-06-300001001250us-gaap:RestructuringChargesMemberus-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2019-07-012020-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2019-07-012020-06-300001001250us-gaap:OtherRestructuringMemberus-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMember2019-07-012020-06-300001001250us-gaap:RestructuringChargesMemberus-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2020-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2020-06-300001001250us-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2020-06-300001001250us-gaap:OtherRestructuringMemberus-gaap:RestructuringChargesMemberel:LeadingBeautyForwardMultiYearProjectMember2020-06-300001001250us-gaap:SalesReturnsAndAllowancesMember2020-06-300001001250us-gaap:CostOfSalesMember2020-06-300001001250us-gaap:RestructuringChargesMember2020-06-300001001250us-gaap:OtherOperatingIncomeExpenseMember2020-06-300001001250us-gaap:RestructuringChargesMemberus-gaap:EmployeeSeveranceMember2020-06-300001001250us-gaap:RestructuringChargesMemberel:ImpairmentInValueOfAssetsMember2020-06-300001001250us-gaap:RestructuringChargesMemberus-gaap:ContractTerminationMember2020-06-300001001250us-gaap:OtherRestructuringMemberus-gaap:RestructuringChargesMember2020-06-300001001250us-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2015-07-012016-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2015-07-012016-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2015-07-012016-06-300001001250us-gaap:OtherRestructuringMemberel:LeadingBeautyForwardMultiYearProjectMember2015-07-012016-06-300001001250el:LeadingBeautyForwardMultiYearProjectMember2015-07-012016-06-300001001250us-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2016-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2016-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2016-06-300001001250us-gaap:OtherRestructuringMemberel:LeadingBeautyForwardMultiYearProjectMember2016-06-300001001250el:LeadingBeautyForwardMultiYearProjectMember2016-06-300001001250us-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2016-07-012017-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2016-07-012017-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2016-07-012017-06-300001001250us-gaap:OtherRestructuringMemberel:LeadingBeautyForwardMultiYearProjectMember2016-07-012017-06-300001001250el:LeadingBeautyForwardMultiYearProjectMember2016-07-012017-06-300001001250us-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2017-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2017-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2017-06-300001001250us-gaap:OtherRestructuringMemberel:LeadingBeautyForwardMultiYearProjectMember2017-06-300001001250el:LeadingBeautyForwardMultiYearProjectMember2017-06-300001001250us-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2017-07-012018-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2017-07-012018-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2017-07-012018-06-300001001250us-gaap:OtherRestructuringMemberel:LeadingBeautyForwardMultiYearProjectMember2017-07-012018-06-300001001250us-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2018-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2018-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2018-06-300001001250us-gaap:OtherRestructuringMemberel:LeadingBeautyForwardMultiYearProjectMember2018-06-300001001250el:LeadingBeautyForwardMultiYearProjectMember2018-06-300001001250us-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2018-07-012019-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2018-07-012019-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2018-07-012019-06-300001001250us-gaap:OtherRestructuringMemberel:LeadingBeautyForwardMultiYearProjectMember2018-07-012019-06-300001001250us-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2019-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2019-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2019-06-300001001250us-gaap:OtherRestructuringMemberel:LeadingBeautyForwardMultiYearProjectMember2019-06-300001001250us-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2019-07-012020-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2019-07-012020-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2019-07-012020-06-300001001250us-gaap:OtherRestructuringMemberel:LeadingBeautyForwardMultiYearProjectMember2019-07-012020-06-300001001250us-gaap:EmployeeSeveranceMemberel:LeadingBeautyForwardMultiYearProjectMember2020-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberel:ImpairmentInValueOfAssetsMember2020-06-300001001250el:LeadingBeautyForwardMultiYearProjectMemberus-gaap:ContractTerminationMember2020-06-300001001250us-gaap:OtherRestructuringMemberel:LeadingBeautyForwardMultiYearProjectMember2020-06-300001001250el:LeadingBeautyForwardMultiYearProjectMembersrt:ScenarioForecastMember2020-07-012021-06-300001001250el:LeadingBeautyForwardMultiYearProjectMembersrt:ScenarioForecastMember2021-07-012022-06-300001001250el:LeadingBeautyForwardMultiYearProjectMembersrt:ScenarioForecastMember2022-07-012023-06-300001001250us-gaap:AccountingStandardsUpdate201609Member2019-07-012020-06-300001001250us-gaap:AccountingStandardsUpdate201609Member2018-07-012019-06-300001001250us-gaap:AccountingStandardsUpdate201609Member2017-07-012018-06-300001001250el:SeniorNotesDueDecember2049Member2020-06-300001001250el:SeniorNotesDueDecember2049Member2019-06-300001001250el:SeniorNotesDueMarch1520472047SeniorNotesMember2020-06-300001001250el:SeniorNotesDueMarch1520472047SeniorNotesMember2019-06-300001001250el:SeniorNotesFourThirtySevenFivePercentDue2045Member2020-06-300001001250el:SeniorNotesFourThirtySevenFivePercentDue2045Member2019-06-300001001250el:SeniorNotesThreeSeventyPercentDue2042Member2020-06-300001001250el:SeniorNotesThreeSeventyPercentDue2042Member2019-06-300001001250el:SeniorNotesSixPercentDue2037Member2020-06-300001001250el:SeniorNotesSixPercentDue2037Member2019-06-300001001250el:SeniorNotesFiveSeventyFivePercentDue2033Member2020-06-300001001250el:SeniorNotesFiveSeventyFivePercentDue2033Member2019-06-300001001250el:SeniorNotesDueApril2030Member2020-06-300001001250el:SeniorNotesDueApril2030Member2019-06-300001001250el:SeniorNotesDueDecember2029Member2020-06-300001001250el:SeniorNotesDueDecember2029Member2019-06-300001001250el:SeniorNotesDueMarch1520272027SeniorNotesMember2020-06-300001001250el:SeniorNotesDueMarch1520272027SeniorNotesMember2019-06-300001001250el:SeniorNotesDueDecember2024Member2020-06-300001001250el:SeniorNotesDueDecember2024Member2019-06-300001001250el:SeniorNotesTwoThirtyFivePercentDue2022Member2020-06-300001001250el:SeniorNotesTwoThirtyFivePercentDue2022Member2019-06-300001001250el:SeniorNotesOneSeventyPercentDue2021Member2020-06-300001001250el:SeniorNotesOneSeventyPercentDue2021Member2019-06-300001001250el:SeniorNotesDueFebruary2020Member2020-06-300001001250el:SeniorNotesDueFebruary2020Member2019-06-300001001250us-gaap:CommercialPaperMember2020-06-300001001250us-gaap:CommercialPaperMember2019-06-300001001250el:OtherLongTermBorrowingsMember2020-06-300001001250el:OtherLongTermBorrowingsMember2019-06-300001001250el:OtherShortTermBorrowingsMember2020-06-300001001250el:OtherShortTermBorrowingsMember2019-06-300001001250us-gaap:RevolvingCreditFacilityMember2020-06-300001001250us-gaap:RevolvingCreditFacilityMember2019-06-300001001250us-gaap:LineOfCreditMember2020-06-300001001250us-gaap:SubsequentEventMemberel:RevolvingCreditFacilityExpiringOctober2023Member2020-08-012020-08-310001001250el:SeniorNotesDueDecember2049Member2019-07-012020-06-300001001250el:SeniorNotesDueMarch1520472047SeniorNotesMember2019-07-012020-06-300001001250el:SeniorNotesFourThirtySevenFivePercentDue2045Member2019-07-012020-06-300001001250el:SeniorNotesFourThirtySevenFivePercentDue2045AddendumMember2020-06-300001001250el:SeniorNotesFourThirtySevenFivePercentDue2045AddendumMember2019-07-012020-06-300001001250el:SeniorNotesThreeSeventyPercentDue2042Member2019-07-012020-06-300001001250el:SeniorNotesSixPercentDue2037Member2019-07-012020-06-300001001250el:SeniorNotesFiveSeventyFivePercentDue2033Member2019-07-012020-06-300001001250el:SeniorNotesDueApril2030Member2019-07-012020-06-300001001250el:SeniorNotesDueDecember2029Member2019-07-012020-06-300001001250el:SeniorNotesDueMarch1520272027SeniorNotesMember2019-07-012020-06-300001001250el:SeniorNotesDueDecember2024Member2019-07-012020-06-300001001250el:SeniorNotesTwoThirtyFivePercentDue2022Member2019-07-012020-06-300001001250el:SeniorNotesOneSeventyPercentDue2021Member2019-07-012020-06-300001001250el:SeniorNotesDueMarch1520472047SeniorNotesMemberus-gaap:TreasuryLockMember2016-11-300001001250el:SeniorNotesDueMarch1520472047SeniorNotesMemberus-gaap:TreasuryLockMember2016-11-012016-11-300001001250us-gaap:InterestRateSwapMemberel:SeniorNotesFourThirtySevenFivePercentDue2045Member2015-05-310001001250us-gaap:InterestRateSwapMemberel:SeniorNotesFourThirtySevenFivePercentDue2045Member2015-04-012015-05-310001001250el:SeniorNotesFourThirtySevenFivePercentDue2045Member2016-05-310001001250us-gaap:InterestRateSwapMemberel:SeniorNotesSixPercentDue2037Member2007-04-300001001250us-gaap:InterestRateSwapMemberel:SeniorNotesSixPercentDue2037Member2007-04-012007-04-300001001250el:SeniorNotesFiveSeventyFivePercentDue2033Memberus-gaap:TreasuryLockMember2003-05-310001001250el:SeniorNotesFiveSeventyFivePercentDue2033Memberus-gaap:TreasuryLockMember2003-05-012003-05-310001001250el:SeniorNotesDueMarch1520272027SeniorNotesMemberus-gaap:TreasuryLockMember2016-11-300001001250el:SeniorNotesDueMarch1520272027SeniorNotesMemberus-gaap:TreasuryLockMember2016-11-012016-11-300001001250us-gaap:InterestRateSwapMemberel:SeniorNotesOneSeventyPercentDue2021Member2018-06-300001001250el:SeniorNotesTwoThirtyFivePercentDue2022Memberus-gaap:InterestRateSwapMember2018-06-300001001250us-gaap:LondonInterbankOfferedRateLIBORMemberel:SeniorNotesDueFebruary720202020SeniorNotesMember2019-07-012020-06-300001001250el:SeniorNotesOneSeventyPercentDue2021Memberus-gaap:TreasuryLockMember2016-04-300001001250el:SeniorNotesOneSeventyPercentDue2021Memberus-gaap:TreasuryLockMember2016-04-012016-04-300001001250el:SeniorNotesDueDecember2029Memberus-gaap:TreasuryLockMember2019-05-310001001250el:SeniorNotesDueDecember2029Memberus-gaap:TreasuryLockMember2019-04-012019-05-310001001250el:RevolvingCreditFacilityExpiringOctober2021Member2018-10-310001001250el:RevolvingCreditFacilityExpiringOctober2023Member2018-10-310001001250el:RevolvingCreditFacilityExpiringOctober2023Member2019-07-012020-06-300001001250el:RevolvingCreditFacilityExpiringOctober2023Member2020-06-300001001250el:SeniorNotesDueDecember2024Member2019-11-300001001250el:SeniorNotesDueDecember2029Member2019-11-300001001250el:SeniorNotesDueDecember2049Member2019-11-300001001250el:SeniorNotesDueFebruary2020Member2019-11-300001001250el:SeniorNotesDueApril2030Member2020-04-300001001250el:OtherShortTermBorrowingsMember2019-07-012020-06-300001001250el:OtherShortTermBorrowingsMember2018-07-012019-06-300001001250us-gaap:NondesignatedMemberus-gaap:CashFlowHedgingMember2020-06-300001001250us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeForwardMember2020-06-300001001250us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeForwardMember2019-06-300001001250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeForwardMemberus-gaap:AccruedLiabilitiesMember2020-06-300001001250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeForwardMemberus-gaap:AccruedLiabilitiesMember2019-06-300001001250us-gaap:NetInvestmentHedgingMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001001250us-gaap:NetInvestmentHedgingMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-06-300001001250us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2020-06-300001001250us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2019-06-300001001250us-gaap:InterestRateContractMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001001250us-gaap:InterestRateContractMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-06-300001001250us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2020-06-300001001250us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2019-06-300001001250us-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001001250us-gaap:DesignatedAsHedgingInstrumentMember2019-06-300001001250us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2020-06-300001001250us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2019-06-300001001250us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:AccruedLiabilitiesMember2020-06-300001001250us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:AccruedLiabilitiesMember2019-06-300001001250us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMember2019-07-012020-06-300001001250us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMember2018-07-012019-06-300001001250us-gaap:ForeignExchangeForwardMemberus-gaap:SalesMemberus-gaap:CashFlowHedgingMember2019-07-012020-06-300001001250us-gaap:ForeignExchangeForwardMemberus-gaap:SalesMemberus-gaap:CashFlowHedgingMember2018-07-012019-06-300001001250us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2019-07-012020-06-300001001250us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2018-07-012019-06-300001001250us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMember2019-07-012020-06-300001001250us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMember2018-07-012019-06-300001001250us-gaap:NetInvestmentHedgingMemberus-gaap:ForeignExchangeForwardMember2019-07-012020-06-300001001250us-gaap:NetInvestmentHedgingMemberus-gaap:ForeignExchangeForwardMember2018-07-012019-06-300001001250us-gaap:NetInvestmentHedgingMember2019-07-012020-06-300001001250us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMember2019-07-012020-06-300001001250us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMember2018-07-012019-06-300001001250us-gaap:ShortTermDebtMemberus-gaap:FairValueHedgingMember2019-07-012020-06-300001001250us-gaap:ShortTermDebtMember2019-07-012020-06-300001001250us-gaap:LongTermDebtMemberus-gaap:FairValueHedgingMember2019-07-012020-06-300001001250us-gaap:LongTermDebtMember2019-07-012020-06-300001001250us-gaap:FairValueHedgingMember2019-07-012020-06-300001001250us-gaap:SalesMember2019-07-012020-06-300001001250us-gaap:InterestExpenseMember2019-07-012020-06-300001001250us-gaap:SalesMember2018-07-012019-06-300001001250us-gaap:InterestExpenseMember2018-07-012019-06-300001001250us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMember2019-07-012020-06-300001001250us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMemberus-gaap:FairValueHedgingMember2018-07-012019-06-300001001250us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2019-07-012020-06-300001001250us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMember2018-07-012019-06-300001001250us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2019-07-012020-06-300001001250us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2018-07-012019-06-300001001250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2020-06-300001001250us-gaap:CashFlowHedgingMember2020-06-300001001250us-gaap:CashFlowHedgingMember2019-06-300001001250us-gaap:InterestRateSwapMemberel:SeniorNotesOneSeventyPercentDue2021Memberus-gaap:FairValueHedgingMember2020-06-300001001250el:SeniorNotesTwoThirtyFivePercentDue2022Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2020-06-300001001250us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:InterestRateSwapMemberel:SeniorNotesOneSeventyPercentDue2021Memberus-gaap:FairValueHedgingMember2019-07-012020-06-300001001250us-gaap:LondonInterbankOfferedRateLIBORMemberel:SeniorNotesTwoThirtyFivePercentDue2022Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2019-07-012020-06-300001001250us-gaap:NetInvestmentHedgingMember2020-06-30el:Agency0001001250us-gaap:DerivativeMember2020-06-300001001250us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-06-300001001250us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-06-300001001250us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-06-300001001250us-gaap:FairValueMeasurementsRecurringMember2020-06-300001001250us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-06-300001001250us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-06-300001001250us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-06-300001001250us-gaap:FairValueMeasurementsRecurringMember2019-06-300001001250us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-06-300001001250us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-06-300001001250us-gaap:CarryingReportedAmountFairValueDisclosureMember2019-06-300001001250us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-06-300001001250us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ForeignExchangeForwardMember2020-06-300001001250us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ForeignExchangeForwardMember2020-06-300001001250us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ForeignExchangeForwardMember2019-06-300001001250us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ForeignExchangeForwardMember2019-06-300001001250us-gaap:InterestRateContractMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-06-300001001250us-gaap:InterestRateContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-06-300001001250us-gaap:InterestRateContractMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-06-300001001250us-gaap:InterestRateContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-06-300001001250el:TooFacedMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250el:TooFacedMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250el:SmashboxMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250el:SmashboxMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250us-gaap:FairValueInputsLevel3Memberel:EditionsDeParfumsFredericMalleMemberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberel:EditionsDeParfumsFredericMalleMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250us-gaap:FairValueInputsLevel3Memberel:BECCAMemberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberel:BECCAMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250el:GLAMGLOWMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250us-gaap:EstimateOfFairValueFairValueDisclosureMemberel:GLAMGLOWMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250el:TooFacedMemberus-gaap:TrademarksMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250el:TooFacedMemberus-gaap:TrademarksMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250el:SmashboxMemberus-gaap:TrademarksMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250el:SmashboxMemberus-gaap:TrademarksMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250us-gaap:TrademarksMemberus-gaap:FairValueInputsLevel3Memberel:EditionsDeParfumsFredericMalleMemberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250us-gaap:TrademarksMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberel:EditionsDeParfumsFredericMalleMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250us-gaap:TrademarksMemberus-gaap:FairValueInputsLevel3Memberel:BECCAMemberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250us-gaap:TrademarksMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberel:BECCAMemberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250us-gaap:TrademarksMemberel:GLAMGLOWMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250us-gaap:TrademarksMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberel:GLAMGLOWMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250us-gaap:TrademarksMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-07-012020-06-300001001250us-gaap:TrademarksMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-06-300001001250el:SmashboxMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2018-07-012019-06-300001001250el:SmashboxMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-06-300001001250el:SmashboxMemberus-gaap:TrademarksMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2018-07-012019-06-300001001250el:SmashboxMemberus-gaap:TrademarksMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2019-06-300001001250us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:ForeignExchangeForwardMember2019-07-012020-06-300001001250el:SwapYieldCurveMemberus-gaap:ForeignExchangeForwardMember2019-07-012020-06-300001001250el:MeasurementInputIncrementalBorrowingRateMemberus-gaap:FairValueInputsLevel2Memberel:AdditionalPurchasePricePayableMember2020-06-300001001250us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-06-300001001250us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-07-012020-06-300001001250us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-06-3000010012502020-07-012020-06-300001001250us-gaap:DifferenceBetweenRevenueGuidanceInEffectBeforeAndAfterTopic606Member2018-07-012019-06-300001001250us-gaap:CalculatedUnderRevenueGuidanceInEffectBeforeTopic606Member2018-07-012019-06-300001001250us-gaap:DifferenceBetweenRevenueGuidanceInEffectBeforeAndAfterTopic606Member2019-06-300001001250us-gaap:CalculatedUnderRevenueGuidanceInEffectBeforeTopic606Member2019-06-300001001250country:USus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250country:USus-gaap:PensionPlansDefinedBenefitMember2018-06-300001001250us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-06-300001001250us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-06-300001001250us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-06-300001001250country:USus-gaap:PensionPlansDefinedBenefitMember2019-07-012020-06-300001001250country:USus-gaap:PensionPlansDefinedBenefitMember2018-07-012019-06-300001001250us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-07-012020-06-300001001250us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-07-012019-06-300001001250us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-07-012020-06-300001001250us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-07-012019-06-300001001250country:USus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-06-300001001250country:USus-gaap:PensionPlansDefinedBenefitMember2017-07-012018-06-300001001250us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2017-07-012018-06-300001001250us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2017-07-012018-06-300001001250srt:MinimumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250srt:MaximumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250srt:MinimumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250srt:MaximumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250srt:MinimumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2018-06-300001001250srt:MaximumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2018-06-300001001250srt:MinimumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250srt:MaximumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250srt:MinimumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250srt:MaximumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250srt:MinimumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-06-300001001250srt:MaximumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-06-300001001250srt:MinimumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-06-300001001250srt:MaximumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-06-300001001250srt:MinimumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-06-300001001250srt:MaximumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-06-300001001250srt:MinimumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-06-300001001250srt:MaximumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-06-300001001250srt:MinimumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2019-07-012020-06-300001001250srt:MaximumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2019-07-012020-06-300001001250srt:MinimumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2018-07-012019-06-300001001250srt:MaximumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2018-07-012019-06-300001001250srt:MinimumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2017-07-012018-06-300001001250srt:MaximumMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2017-07-012018-06-300001001250srt:MinimumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-07-012020-06-300001001250srt:MaximumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-07-012020-06-300001001250srt:MinimumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-07-012019-06-300001001250srt:MaximumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-07-012019-06-300001001250srt:MinimumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2017-07-012018-06-300001001250srt:MaximumMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2017-07-012018-06-300001001250srt:MinimumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-07-012020-06-300001001250srt:MaximumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-07-012020-06-300001001250srt:MinimumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-07-012019-06-300001001250srt:MaximumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-07-012019-06-300001001250srt:MinimumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2017-07-012018-06-300001001250srt:MaximumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2017-07-012018-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2019-07-012020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-07-012020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-07-012020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2019-07-012020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2019-07-012020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-07-012020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-07-012020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2019-07-012020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2020-06-300001001250el:DefinedBenefitPlanRetirementGrowthAccountMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250el:DefinedBenefitPlanRetirementGrowthAccountMemberus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250el:DefinedBenefitPlanRestorationMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250el:DefinedBenefitPlanRestorationMemberus-gaap:PensionPlansDefinedBenefitMember2019-06-300001001250us-gaap:DefinedBenefitPlanEquitySecuritiesMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-06-300001001250us-gaap:DefinedBenefitPlanDebtSecurityMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-06-300001001250us-gaap:OtherInvestmentsMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:OtherInvestmentsMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-06-300001001250us-gaap:OtherInvestmentsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-06-300001001250el:DefinedBenefitPlanCommingledFundsMembersrt:MinimumMember2019-07-012020-06-300001001250el:DefinedBenefitPlanCommingledFundsMembersrt:MaximumMember2019-07-012020-06-300001001250el:LimitedPartnershipsAndHedgeFundInvestmentsMembersrt:MinimumMember2019-07-012020-06-300001001250el:LimitedPartnershipsAndHedgeFundInvestmentsMembersrt:MaximumMember2019-07-012020-06-300001001250us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2020-06-300001001250us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2020-06-300001001250el:DefinedBenefitPlanShortTermInvestmentFundsMemberus-gaap:FairValueInputsLevel2Member2020-06-300001001250el:DefinedBenefitPlanShortTermInvestmentFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-06-300001001250el:DefinedBenefitPlanShortTermInvestmentFundsMember2020-06-300001001250us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2020-06-300001001250us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2020-06-300001001250el:DefinedBenefitPlanCommingledFundsMemberus-gaap:FairValueInputsLevel1Member2020-06-300001001250el:DefinedBenefitPlanCommingledFundsMemberus-gaap:FairValueInputsLevel2Member2020-06-300001001250el:DefinedBenefitPlanCommingledFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-06-300001001250el:DefinedBenefitPlanCommingledFundsMember2020-06-300001001250el:DefinedBenefitPlanInsuranceContractsMemberus-gaap:FairValueInputsLevel3Member2020-06-300001001250el:DefinedBenefitPlanInsuranceContractsMember2020-06-300001001250el:LimitedPartnershipsAndHedgeFundInvestmentsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-06-300001001250el:LimitedPartnershipsAndHedgeFundInvestmentsMember2020-06-300001001250us-gaap:FairValueInputsLevel1Member2020-06-300001001250us-gaap:FairValueInputsLevel2Member2020-06-300001001250us-gaap:FairValueInputsLevel3Member2020-06-300001001250us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-06-300001001250us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2019-06-300001001250us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2019-06-300001001250el:DefinedBenefitPlanShortTermInvestmentFundsMemberus-gaap:FairValueInputsLevel2Member2019-06-300001001250el:DefinedBenefitPlanShortTermInvestmentFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2019-06-300001001250el:DefinedBenefitPlanShortTermInvestmentFundsMember2019-06-300001001250us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2019-06-300001001250us-gaap:USGovernmentSponsoredEnterprisesDebtSecuritiesMember2019-06-300001001250el:DefinedBenefitPlanCommingledFundsMemberus-gaap:FairValueInputsLevel1Member2019-06-300001001250el:DefinedBenefitPlanCommingledFundsMemberus-gaap:FairValueInputsLevel2Member2019-06-300001001250el:DefinedBenefitPlanCommingledFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2019-06-300001001250el:DefinedBenefitPlanCommingledFundsMember2019-06-300001001250el:DefinedBenefitPlanInsuranceContractsMemberus-gaap:FairValueInputsLevel3Member2019-06-300001001250el:DefinedBenefitPlanInsuranceContractsMember2019-06-300001001250el:LimitedPartnershipsAndHedgeFundInvestmentsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2019-06-300001001250el:LimitedPartnershipsAndHedgeFundInvestmentsMember2019-06-300001001250us-gaap:FairValueInputsLevel1Member2019-06-300001001250us-gaap:FairValueInputsLevel2Member2019-06-300001001250us-gaap:FairValueInputsLevel3Member2019-06-300001001250us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2019-06-300001001250el:DefinedBenefitPlanInsuranceContractsMemberus-gaap:FairValueInputsLevel3Member2019-07-012020-06-3000010012502020-06-302020-06-30el:vote0001001250us-gaap:CommonClassAMember2017-06-300001001250us-gaap:CommonClassBMember2017-06-300001001250us-gaap:CommonClassAMember2017-07-012018-06-300001001250us-gaap:CommonClassBMember2017-07-012018-06-300001001250us-gaap:CommonClassAMember2018-06-300001001250us-gaap:CommonClassBMember2018-06-300001001250us-gaap:CommonClassAMember2018-07-012019-06-300001001250us-gaap:CommonClassBMember2018-07-012019-06-300001001250us-gaap:CommonClassAMember2019-07-012020-06-300001001250us-gaap:CommonClassBMember2019-07-012020-06-300001001250us-gaap:CommonClassBMember2019-08-162019-08-160001001250us-gaap:CommonClassAMember2019-08-162019-08-160001001250us-gaap:CommonClassBMember2019-09-162019-09-160001001250us-gaap:CommonClassAMember2019-09-162019-09-160001001250us-gaap:CommonClassAMember2019-10-302019-10-300001001250us-gaap:CommonClassBMember2019-12-162019-12-160001001250us-gaap:CommonClassAMember2019-12-162019-12-160001001250us-gaap:CommonClassBMember2019-10-302019-10-300001001250us-gaap:CommonClassAMember2020-03-162020-03-160001001250us-gaap:CommonClassBMember2020-03-162020-03-160001001250us-gaap:CommonClassAMember2020-02-052020-02-050001001250us-gaap:CommonClassBMember2020-02-052020-02-050001001250us-gaap:SubsequentEventMemberus-gaap:CommonClassAMember2020-08-192020-08-190001001250us-gaap:CommonClassBMemberus-gaap:SubsequentEventMember2020-08-192020-08-19el:plan0001001250us-gaap:EmployeeStockOptionMember2019-06-300001001250us-gaap:EmployeeStockOptionMember2019-07-012020-06-300001001250us-gaap:EmployeeStockOptionMember2020-06-30el:tranche0001001250us-gaap:EmployeeStockOptionMember2018-07-012019-06-300001001250us-gaap:EmployeeStockOptionMember2017-07-012018-06-300001001250el:ShareBasedCompensationArrangementByShareBasedPaymentAwardEquityInstrumentsOtherThanOptionsVesting2020Memberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2019-07-012020-06-300001001250us-gaap:ShareBasedPaymentArrangementEmployeeMemberel:ShareBasedCompensationArrangementByShareBasedPaymentAwardEquityInstrumentsOtherThanOptionsVesting2021Memberus-gaap:RestrictedStockUnitsRSUMember2019-07-012020-06-300001001250us-gaap:ShareBasedPaymentArrangementEmployeeMemberel:ShareBasedCompensationArrangementByShareBasedPaymentAwardEquityInstrumentsOtherThanOptionsVesting2022Memberus-gaap:RestrictedStockUnitsRSUMember2019-07-012020-06-300001001250us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2019-06-300001001250us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2019-07-012020-06-300001001250us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2020-06-300001001250us-gaap:PerformanceSharesMemberel:ShareBasedCompensationArrangementByShareBasedPaymentAwardEquityInstrumentsOtherThanOptionsWillBeSettledIn2020Memberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:CommonClassAMember2019-07-012020-06-300001001250us-gaap:PerformanceSharesMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2019-07-012020-06-300001001250us-gaap:PerformanceSharesMemberel:ShareBasedCompensationArrangementByShareBasedPaymentAwardEquityInstrumentsOtherThanOptionsWillBeSettledIn2020Memberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:CommonClassAMember2020-01-012020-01-310001001250us-gaap:PerformanceSharesMemberel:ShareBasedCompensationArrangementByShareBasedPaymentAwardEquityInstrumentsOtherThanOptionsWillBeSettledIn2020Memberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:CommonClassAMember2020-03-012020-03-310001001250us-gaap:PerformanceSharesMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:CommonClassAMember2019-07-012020-06-300001001250us-gaap:PerformanceSharesMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:CommonClassAMember2018-09-012018-09-300001001250us-gaap:PerformanceSharesMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:CommonClassAMember2019-09-012019-09-300001001250us-gaap:PerformanceSharesMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2017-07-012018-06-300001001250us-gaap:PerformanceSharesMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2018-07-012019-06-300001001250us-gaap:PerformanceSharesMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2019-06-300001001250us-gaap:PerformanceSharesMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2020-06-300001001250srt:ExecutiveOfficerMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberel:LongTermPerformanceSharesMemberus-gaap:CommonClassAMember2015-09-012015-09-300001001250srt:ExecutiveOfficerMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberel:ShareBasedCompensationAwardPerformancePeriodJune302018Memberel:LongTermPerformanceSharesMemberus-gaap:CommonClassAMember2015-09-012015-09-300001001250srt:ExecutiveOfficerMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberel:LongTermPerformanceSharesMemberus-gaap:CommonClassAMember2015-09-040001001250el:ShareBasedCompensationAwardPerformancePeriodsEnding30June2018And2019Memberel:LongTermPerformanceSharesMember2019-07-012020-06-300001001250srt:ExecutiveOfficerMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberel:LongTermPerformanceSharesMemberus-gaap:CommonClassAMember2016-01-012016-01-310001001250srt:ExecutiveOfficerMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberel:LongTermPerformanceSharesMemberel:ShareBasedCompensationAwardPerformancePeriodJanuary292018Memberus-gaap:CommonClassAMember2016-01-012016-01-310001001250srt:ExecutiveOfficerMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberel:LongTermPerformanceSharesMemberus-gaap:CommonClassAMember2016-01-280001001250el:LongTermPerformanceSharesMemberel:ShareBasedCompensationAwardPerformancePeriodJanuary292019Memberus-gaap:CommonClassAMember2020-01-012020-01-310001001250el:LongTermPerformanceSharesMemberel:ShareBasedCompensationAwardPerformancePeriodJanuary292019Memberus-gaap:CommonClassAMember2019-07-012020-06-300001001250srt:ExecutiveOfficerMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberel:LongTermPerformanceSharesMemberus-gaap:CommonClassAMember2018-02-012018-02-280001001250el:ShareBasedCompensationAwardPerformancePeriod2022Membersrt:ExecutiveOfficerMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberel:LongTermPerformanceSharesMemberus-gaap:CommonClassAMember2018-02-012018-02-280001001250srt:ExecutiveOfficerMemberus-gaap:ShareBasedPaymentArrangementEmployeeMemberel:LongTermPerformanceSharesMemberus-gaap:CommonClassAMember2018-02-280001001250el:ShareUnitsMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2019-06-300001001250el:ShareUnitsMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2019-07-012020-06-300001001250el:ShareUnitsMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2020-06-300001001250el:CashUnitsMember2019-07-012020-06-300001001250el:CashUnitsMember2018-07-012019-06-300001001250el:CashUnitsMember2017-07-012018-06-300001001250us-gaap:PerformanceSharesMember2019-07-012020-06-300001001250us-gaap:PerformanceSharesMember2018-07-012019-06-300001001250us-gaap:PerformanceSharesMember2017-07-012018-06-300001001250us-gaap:RestrictedStockUnitsRSUMember2019-07-012020-06-300001001250us-gaap:RestrictedStockUnitsRSUMember2018-07-012019-06-300001001250us-gaap:RestrictedStockUnitsRSUMember2017-07-012018-06-300001001250us-gaap:EmployeeStockOptionMember2019-07-012020-06-300001001250us-gaap:EmployeeStockOptionMember2018-07-012019-06-300001001250us-gaap:EmployeeStockOptionMember2017-07-012018-06-300001001250el:ContingentlyIssuableShareMember2019-07-012020-06-300001001250el:ContingentlyIssuableShareMember2018-07-012019-06-300001001250el:ContingentlyIssuableShareMember2017-07-012018-06-300001001250us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-06-300001001250us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-06-300001001250us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2017-06-300001001250us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-07-012020-06-300001001250us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-07-012019-06-300001001250us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2017-07-012018-06-300001001250us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2017-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-07-012020-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-07-012019-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2017-07-012018-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeForwardMember2019-07-012020-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeForwardMember2018-07-012019-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeForwardMember2017-07-012018-06-300001001250us-gaap:InterestRateContractMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-07-012020-06-300001001250us-gaap:InterestRateContractMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-07-012019-06-300001001250us-gaap:InterestRateContractMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2017-07-012018-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2018-07-012019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2017-07-012018-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2018-07-012019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2017-07-012018-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-07-012020-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-07-012019-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-07-012018-06-300001001250us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-06-300001001250us-gaap:AccumulatedTranslationAdjustmentMember2019-06-300001001250us-gaap:AccumulatedTranslationAdjustmentMember2018-06-300001001250us-gaap:AccumulatedTranslationAdjustmentMember2017-06-300001001250us-gaap:AccumulatedTranslationAdjustmentMember2019-07-012020-06-300001001250us-gaap:AccumulatedTranslationAdjustmentMember2018-07-012019-06-300001001250us-gaap:AccumulatedTranslationAdjustmentMember2017-07-012018-06-300001001250us-gaap:AccumulatedTranslationAdjustmentMember2020-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeForwardMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-07-012020-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeForwardMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-07-012019-06-300001001250us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeForwardMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2017-07-012018-06-30el:segment0001001250srt:AmericasMember2018-07-012019-06-300001001250us-gaap:EMEAMember2018-07-012019-06-300001001250srt:AmericasMember2017-07-012018-06-300001001250us-gaap:EMEAMember2017-07-012018-06-300001001250el:SkinCareMember2017-07-012018-06-300001001250el:MakeupMember2017-07-012018-06-300001001250el:FragranceMember2017-07-012018-06-300001001250el:HairCareMember2017-07-012018-06-300001001250us-gaap:ProductAndServiceOtherMember2018-07-012019-06-300001001250us-gaap:ProductAndServiceOtherMember2017-07-012018-06-300001001250us-gaap:SalesReturnsAndAllowancesMember2019-07-012020-06-300001001250us-gaap:SalesReturnsAndAllowancesMember2018-07-012019-06-300001001250us-gaap:SalesReturnsAndAllowancesMember2017-07-012018-06-300001001250srt:AsiaPacificMember2018-07-012019-06-300001001250srt:AsiaPacificMember2017-07-012018-06-300001001250srt:AmericasMember2020-06-300001001250srt:AmericasMember2019-06-300001001250srt:AmericasMember2018-06-300001001250us-gaap:EMEAMember2020-06-300001001250us-gaap:EMEAMember2019-06-300001001250us-gaap:EMEAMember2018-06-300001001250srt:AsiaPacificMember2020-06-300001001250srt:AsiaPacificMember2019-06-300001001250srt:AsiaPacificMember2018-06-300001001250country:US2019-07-012020-06-300001001250country:US2018-07-012019-06-300001001250country:US2017-07-012018-06-300001001250us-gaap:CustomerConcentrationRiskMembercountry:CN2019-07-012020-06-300001001250us-gaap:CustomerConcentrationRiskMembercountry:CN2018-07-012019-06-300001001250us-gaap:CustomerConcentrationRiskMembercountry:CN2017-07-012018-06-300001001250country:US2020-06-300001001250country:US2019-06-300001001250country:US2018-06-3000010012502019-07-012019-09-3000010012502019-10-012019-12-3100010012502020-01-012020-03-3100010012502020-04-012020-06-3000010012502018-07-012018-09-3000010012502018-10-012018-12-3100010012502019-01-012019-03-3100010012502019-04-012019-06-300001001250el:HaveBeCoLtdMember2019-10-012019-12-310001001250el:HaveBeCoLtdMember2020-04-012020-06-300001001250us-gaap:SubsequentEventMemberel:RestructuringProgramMember2020-08-202020-08-200001001250us-gaap:SubsequentEventMemberel:RestructuringProgramMember2020-08-182020-08-180001001250srt:MinimumMemberus-gaap:SubsequentEventMemberel:RestructuringProgramMember2020-08-200001001250srt:MaximumMemberus-gaap:SubsequentEventMemberel:RestructuringProgramMember2020-08-200001001250us-gaap:SubsequentEventMember2020-08-012020-08-310001001250us-gaap:AllowanceForCreditLossMember2019-06-300001001250us-gaap:AllowanceForCreditLossMember2019-07-012020-06-300001001250us-gaap:AllowanceForCreditLossMember2020-06-300001001250us-gaap:AllowanceForCreditLossMember2018-06-300001001250us-gaap:AllowanceForCreditLossMember2018-07-012019-06-300001001250us-gaap:AllowanceForCreditLossMember2017-06-300001001250us-gaap:AllowanceForCreditLossMember2017-07-012018-06-300001001250el:ContractWithCustomerRefundLiabilityMember2019-06-300001001250el:ContractWithCustomerRefundLiabilityMember2019-07-012020-06-300001001250el:ContractWithCustomerRefundLiabilityMember2020-06-300001001250el:ContractWithCustomerRefundLiabilityMember2018-06-300001001250el:ContractWithCustomerRefundLiabilityMember2018-07-012019-06-300001001250el:ContractWithCustomerRefundLiabilityMember2017-06-300001001250el:ContractWithCustomerRefundLiabilityMember2017-07-012018-06-300001001250us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-06-300001001250us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-07-012020-06-300001001250us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-06-300001001250us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-06-300001001250us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-07-012019-06-300001001250us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2017-06-300001001250us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2017-07-012018-06-300001001250el:AccruedRestructuringAndOtherChargesMember2019-06-300001001250el:AccruedRestructuringAndOtherChargesMember2019-07-012020-06-300001001250el:AccruedRestructuringAndOtherChargesMember2020-06-300001001250el:AccruedRestructuringAndOtherChargesMember2018-06-300001001250el:AccruedRestructuringAndOtherChargesMember2018-07-012019-06-300001001250el:AccruedRestructuringAndOtherChargesMember2017-06-300001001250el:AccruedRestructuringAndOtherChargesMember2017-07-012018-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended June 30, 2020 |

OR | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission file number 1-14064

The Estée Lauder Companies Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware | 11-2408943 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

767 Fifth Avenue, New York, New York | 10153 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code 212-572-4200

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, $.01 par value | EL | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer ☒ | Accelerated filer ☐ | |

Non-accelerated filer ☐ | Smaller reporting company ☐ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s voting common equity held by non-affiliates of the registrant was approximately $45 billion at December 31, 2019 (the last business day of the registrant’s most recently completed second quarter).*

At August 20, 2020, 225,569,212 shares of the registrant’s Class A Common Stock, $.01 par value, and 135,235,429 shares of the registrant’s Class B Common Stock, $.01 par value, were outstanding.

Documents Incorporated by Reference

| | | | | | | | |

Document | | Where Incorporated |

Proxy Statement for Annual Meeting of Stockholders to be held November 10, 2020 | | Part III |

* Calculated by excluding all shares held by executive officers and directors of registrant and certain trusts without conceding that all such persons are “affiliates” of registrant for purposes of the Federal securities laws.

THE ESTÉE LAUDER COMPANIES INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

Cautionary Note Regarding Forward-Looking Information and Risk Factors

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include our expectations regarding sales, earnings or other future operations, financial performance or liquidity, our long-term strategy, restructuring and other initiatives, product introductions, geographic regions or channels, information technology initiatives and new methods of sale. Although we believe that our expectations are based on reasonable assumptions within the bounds of our knowledge of our business and operations, we cannot assure that actual results will not differ materially from our expectations. Factors that could cause actual results to differ from expectations are described herein; in particular, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Cautionary Note Regarding Forward-Looking Information.” In addition, there is a discussion of risks associated with an investment in our securities, see “Item 1A. Risk Factors.”

Unless the context requires otherwise, references to “we,” “us,” “our” and the “Company” refer to The Estée Lauder Companies Inc. and its subsidiaries.

PART I

Item 1. Business.

The Estée Lauder Companies Inc., founded in 1946 by Estée and Joseph Lauder, is one of the world’s leading manufacturers and marketers of quality skin care, makeup, fragrance and hair care products. Our products are sold in approximately 150 countries and territories under a number of well-known brand names including: Estée Lauder, Clinique, Origins, M·A·C, Bobbi Brown, La Mer, Aveda, Jo Malone London, Too Faced and Dr. Jart+. We are also the global licensee for fragrances, cosmetics and/or related products sold under various designer brand names. Each brand is distinctly positioned within the market for cosmetics and other beauty products.

We believe we are a leader in the beauty industry due to the global recognition of our brand names, our leadership in product innovation, our strong position in key geographic markets and the consistently high quality of our products and “High-Touch” services. We sell our prestige products through distribution channels that complement the luxury image and prestige status of our brands. Our products are sold on our own and authorized retailer websites, on third-party online malls, in stores in airports, in duty-free locations and in our own and authorized freestanding stores. In addition, our products are sold in brick-and-mortar retail stores, including department stores, specialty-multi retailers, upscale perfumeries and pharmacies and prestige salons and spas. We believe that our strategy of pursuing selective distribution strengthens our relationships with retailers and consumers, enables our brands to be among the best-selling product lines at the stores and online, and heightens the aspirational quality of our brands.

For a discussion of recent developments, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations – Overview.

The discussion of our net sales and operating results is based on specific markets in commercially concentrated locations, which may include separate discussions on territories within a country. For segment and geographical area financial information, see Item 8. Financial Statements and Supplementary Data – Note 22 – Segment Data and Related Information.

We have been controlled by the Lauder family since the founding of our Company. Members of the Lauder family, some of whom are directors, executive officers and/or employees, beneficially own, directly or indirectly, as of August 20, 2020, shares of Class A Common Stock and Class B Common Stock having approximately 86% of the outstanding voting power of the Common Stock.

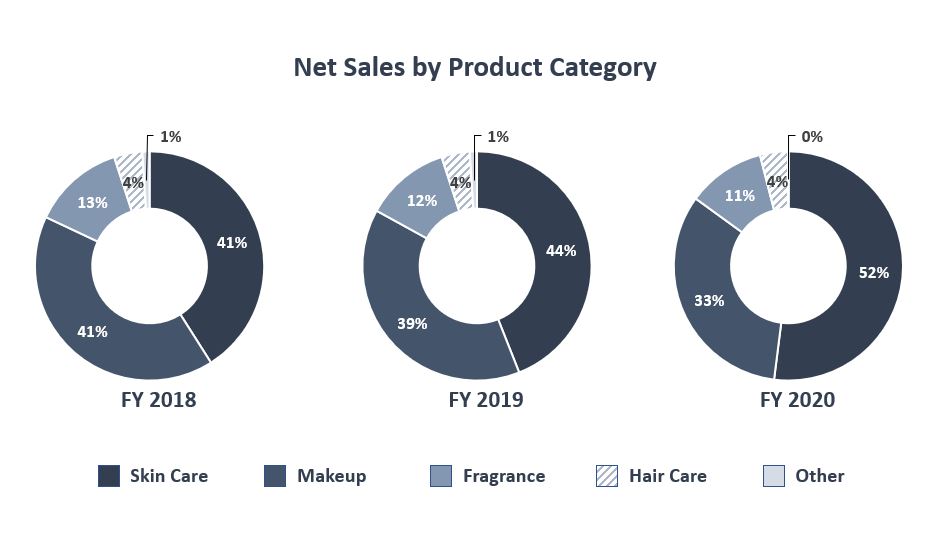

Products

Skin Care - Our broad range of skin care products addresses various skin care needs. These products include moisturizers, serums, cleansers, toners, body care, exfoliators, acne care and oil correctors, facial masks, and sun care products.

Makeup - Our full array of makeup products includes lipsticks, lip glosses, mascaras, foundations, eyeshadows, nail polishes and powders. Many of the products are offered in an extensive palette of shades and colors. We also sell related items such as compacts, brushes and other makeup tools.

Fragrance - We offer a variety of fragrance products. The fragrances are sold in various forms, including eau de parfum sprays and colognes, as well as lotions, powders, creams, candles and soaps that are based on a particular fragrance.

Hair Care - Our hair care products include shampoos, conditioners, styling products, treatment, finishing sprays and hair color products.

Other - We also sell ancillary products and services.

Our Brands

Given the personal nature of our products and the wide array of consumer preferences and tastes, as well as competition for the attention of consumers, our strategy has been to market and promote our products through distinctive brands seeking to address broad preferences and tastes. Each brand has a single global image that is promoted with consistent logos, packaging and advertising designed to enhance its image and differentiate it from other brands in the market. Beauty brands are differentiated by numerous factors, including quality, performance, a particular lifestyle, where they are distributed (e.g., prestige or mass) and price point. Below is a chart showing most of the brands that we sell and how we view them based on lifestyle and price point:

| | | | | | | | |

| | |

| | Estée Lauder brand products, which have been sold since 1946, have a reputation for innovation, sophistication and superior quality. Estée Lauder is one of the world’s most renowned beauty brands, producing iconic skin care, makeup and fragrances. |

| | |

| | |

| | We pioneered the marketing of prestige men’s fragrance, grooming and skin care products with the introduction of Aramis products in 1964. |

| | |

| | |

| | Introduced in 1968, Clinique skin care and makeup products are all allergy tested and 100% fragrance free and have been designed to address individual skin types and needs. Clinique also offers select fragrances. The skin care and makeup products are based on the research and related expertise of leading dermatologists. |

| | |

| | |

| | Lab Series, introduced in 1987, is a series of high performance, specialized skin care solutions uniquely created to improve the look and feel of men’s skin. |

| | |

| | |