| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) 0-11 |

April 12, 2024

Dear Shareholders,

As more new therapeutics and novel modalities are developed, sensitivity requirements for PFAS and impurity testing in food and the environment escalate, and the mandate for safe and renewable energy grows, the need for Waters’ analytical instruments, software, and consumables continues to increase globally. Despite some significant market headwinds, we are pleased with the progress we made in 2023. We delivered strong operational results, successfully completed the acquisition of Wyatt Technology LLC and expanded our work in high-growth adjacent markets. These results were enabled by our employees’ relentless focus on execution and innovation to address our customers’ most critical needs.

In anticipation of these market shifts, the Waters Board has evolved to ensure we have the right skills to help guide the Company’s continued success. Demonstrating our commitment to active refreshment and adding the right expertise and diversity of experience to support our transformation, six of our nine directors have joined since 2020.

Recent Board priorities and successes include:

| • | In 2023, we appointed Rick Fearon to the Board who brings strong international business and financial experience, important for advancing the Company’s strategic priorities. |

| • | Waters has announced its commitment to the Science Based Targets Initiative to build on its progress and develop further emissions reduction targets. This commitment is an important step to advance the Company’s existing climate and environmental goals and it aligns with customers’ sustainability priorities. |

| • | The Board was honored to be recognized for its knowledge, leadership and governance as the 2024 Public Company Board of the Year by the National Association of Corporate Directors New England Chapter. We appreciate the recognition of our commitment to serving our company with strategic guidance and diversity of expertise and perspective. |

Thank you, on behalf of the entire Board, for your investment in Waters and engagement with our company. We are committed to delivering profitable and sustainable growth – and deeply value your continued input to achieve these objectives. We appreciate your voting support on the matters in this proxy statement.

| Sincerely, |

|

| Dr. Flemming Ornskov, M.D., M.P.H. Chair of the Board of Waters Corporation |

April 12, 2024

Dear Shareholders,

Thank you for being a part of our journey. This past year, we maintained strong commercial execution, introduced innovative new products, and made substantial progress in our higher growth adjacent markets. I would like to extend my sincere appreciation to our dedicated employees who strengthened the company with their indomitable spirit and collaboration.

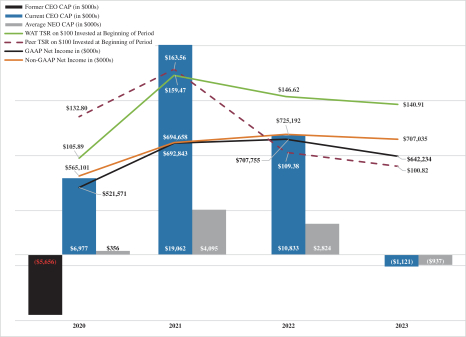

We focused on strong operational excellence to finish 2023 with a solid performance despite diminished Biotech funding, slowed capital spending, increased geopolitical tensions, and a weakened economy in China. Waters revenue growth declined 0.5% and 2%i on an organic constant currency basis in 2023, with an adjusted operating margin of 30.9%i. Waters shareholders experienced above-average total shareholder returns with a 4% decline in Waters TSR for the year, outpacing the peer average and leading among those with a higher instrument revenue mix. We launched several innovative products to address the needs of our customers across our portfolio of technologies. We also continue to be recognized for our environmental, social and governance efforts with industry accolades. We received another top score on the Human Rights Campaign Corporate Equality Index and earned a spot on the Dow Jones Sustainability Index. We are proud that our Board was named 2024 “Public Company Board of the Year” by the National Association of Corporate Directors (NACD) New England Chapter.

At our core, we use science to improve human health and well-being. We relentlessly focus on solving problems that matter by bringing complementary capabilities and deep scientific expertise to our customers’ greatest challenges. From identifying PFAS in food and water to advancing early disease detection to ensuring safety and efficiency of energy storage, we strive to simplify the path to progress so that, together with our customers, we can accelerate the benefits of pioneering science.

Three years ago, we initiated a transformation with three primary goals:

| 1. | Strengthen Execution to deliver strong operational results |

| 2. | Revitalize Innovation to renew our portfolio to address the needs of our customers |

| 3. | Enter Higher-Growth Market Segments by investing organically and inorganically to strengthen our position in high-growth adjacencies |

Since we started our transformation, we have been pleased with our continued strong commercial execution and progress on our commitments, which has resulted in a three-year organic constant currency revenue CAGR of 9%i through 2023.

We strengthened execution through strong operational performance as well as our commercial initiatives, in which we:

| • | Replaced aged instruments, with only 25% remaining in the original dataset. |

| • | Increased service attachment rate by +550 basis points |

| • | Drove +20% increase in eCommerce adoption of our Chemistry columns |

| • | Doubled Increased revenues from contract organizations by approximately 10% |

| • | Increased our product vitality index +500 basis points from our revitalized portfolio |

| i | Unless otherwise noted, sales growth percentages are presented on an organic constant currency basis. Adjusted operating income margin percentages are presented on a non-GAAP basis. See the Company’s website for the GAAP to non-GAAP reconciliations for the year-over-year organic constant currency revenue and the adjusted operating income margin percentage. |

We revitalized innovation and made significant strides to build upon Waters deep expertise in technology, science, and customer relationships over the past few years. We launched several new products in 2023, including Alliance™ iS HPLC System, Xevo™ TQ Absolute IVD System, Battery Cycler Microcalorimeter Solution, DynaPro™ ZetaStar™ Instrument, XBridge™ Premier GTx BEH™ SEC Columns, OligoWorks™ SPE Workflow and Kits, waters_connect™ System Monitoring, and Bioprocess Walk-Up Solutions.

Finally, we continued to invest and expand into adjacent, high-growth markets where our business model of solving problems in downstream, regulated applications can be deployed. For bioseparations and bioanalytical characterization, we made organic investments, launched new products, and deployed capital to M&A with our acquisition of Wyatt Technology LLC in May 2023. For diagnostics, we invested in our Clinical business and added workflows for specialty applications of mass spectrometry, which transformed related revenue growth from low to mid-single-digits to double-digits in the past several years. Finally, our focus on batteries is yielding strong results, with significant growth driven by new innovations for our battery customers; revenues from battery applications exceed 10 times 2019 levels.

As a result of our transformation over the past few years, we have made tremendous progress strengthening execution, revitalizing innovation, and executing our long-term strategy. As we look ahead, I am excited about the significant opportunities for growth as we continue to accelerate the benefits of pioneering science.

Thank you again for your trust in Waters.

| Sincerely,

Udit

|

| Udit Batra, Ph.D. President and Chief Executive Officer |

WATERS CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| Date: |

Thursday, May 23, 2024 | |

| Time: |

9:00 a.m., Eastern Time | |

| Place: |

The Annual Meeting (the “Annual Meeting”) of Waters Corporation (“Waters” or the “Company”) will be a virtual meeting held exclusively via the Internet. To attend, you must register at www.proxydocs.com/wat. After you register, you will receive instructions via email, including your unique links that will allow you access to the Annual Meeting and will permit you to submit questions. You will not be able to attend the Annual Meeting in person. | |

| Record Date: |

March 25, 2024. Only shareholders of record at the close of business on the record date are entitled to receive notice of, and vote at, the Annual Meeting. For at least ten (10) days prior to the the Annual Meeting, a list of the shareholders entitled to vote at the Annual Meeting will be available for inspection upon request. | |

| Items of Business: |

1. To elect directors to serve for the ensuing year and until their successors are elected; | |

| 2. To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; | ||

| 3. To approve, by non-binding vote, executive compensation; | ||

| 4. To amend the Company’s certificate of incorporation to provide for exculpation of certain officers of the Company as permitted by recent amendments to Delaware law; and | ||

| 5. To consider and act upon any other matters which may properly come before the Annual Meeting or any adjournment thereof. | ||

| Voting: |

Your vote is extremely important regardless of the number of shares you own. Whether or not you expect to participate in the Annual Meeting, we urge you to vote promptly by telephone or Internet or by signing, dating, and returning a printed proxy card or voting instruction form, as applicable. If you participate in the Annual Meeting, you may vote your shares electronically during the Annual Meeting even if you previously voted your proxy. Please vote as soon as possible to ensure that your shares will be represented and counted at the Annual Meeting. | |

|

Important Notice Regarding the Availability of Proxy Materials for Annual Meeting of Shareholders

To be Held on May 23, 2024: The Proxy Statement and the Annual Report on Form 10-K for the fiscal year

This Proxy Statement (the “Proxy Statement”) is being furnished by the Board of Directors (the “Board”) of

| ||

We are making the Proxy Statement and the form of Proxy first available on or about April 12, 2024.

| By order of the Board of Directors |

|

|

| Keeley A. Aleman |

| Senior Vice President, General Counsel and Secretary |

Milford, Massachusetts

April 12, 2024

TABLE OF CONTENTS

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 16 | ||||

| 16 | ||||

| 18 | ||||

| 18 | ||||

| 21 | ||||

| 22 | ||||

| REPORT OF THE AUDIT & FINANCE COMMITTEE OF THE BOARD OF DIRECTORS |

23 | |||

| 25 | ||||

| 25 | ||||

| PROPOSAL 2 — RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

26 | |||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

| 36 | ||||

| 42 | ||||

| 43 | ||||

| 49 | ||||

| 53 | ||||

| 54 | ||||

| 58 | ||||

| 61 | ||||

| 63 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

64 | |||

| 66 | ||||

| 66 | ||||

| 67 | ||||

| 68 | ||||

| 68 | ||||

| 69 | ||||

Certain of the statements in this Proxy Statement may contain “forward-looking” statements regarding future results and events. For this purpose, any statements that are not statements of historical fact may be deemed forward-looking statements. Without limiting the foregoing, the words “feels”, “believes”, “anticipates”, “plans”, “expects”, “intends”, “suggests”, “appears”, “estimates”, “projects” and similar expressions, whether in the negative or affirmative, are intended to identify forward-looking statements. The Company’s actual future results may differ significantly from the results discussed in the forward-looking statements within this Proxy Statement for a variety of reasons, including and without limitation, the factors discussed in the sections entitled “Forward-Looking Statements” and “Risk Factors” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”), as updated by the Company’s future filings with the Securities and Exchange Commission (the “SEC”). The forward-looking statements included in this Proxy Statement represent the Company’s estimates or views as of the date of this Proxy Statement and should not be relied upon as representing the Company’s estimates or views as of any date subsequent to the date of this Proxy Statement. Except as required by law, the Company does not assume any obligation to update any forward-looking statements.

The Company is providing its website address in this Proxy Statement solely for the information of investors. The Company does not intend the address to be an active link or to otherwise incorporate the contents of the website, including any reports that are noted in this Proxy Statement as being posted on the website, into this Proxy Statement or into any of our other filings with the SEC.

1

2

PROPOSAL 1 — ELECTION OF DIRECTORS

WHO WE ARE

At Waters, we believe that tone for excellence and integrity is set at the top — with us, the Board. In this Proxy Statement, we highlight examples of our strong oversight actions and the exceptional stature, accomplishments, and diversity amongst our members.

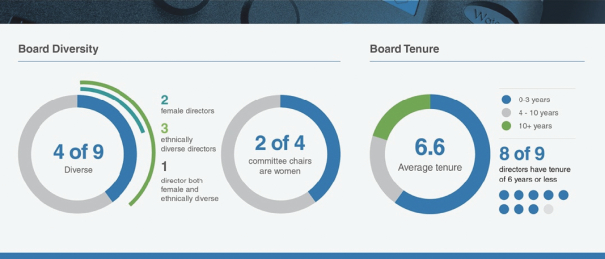

Our diverse Board is comprised of Directors with extensive industry experience and a broad set of skills, attributes, and backgrounds critical to providing us with strategic and operational oversight. The Board has an active search to identify a female director candidate who will bring additive and complementary skills to the Board. The Company believes that the decision-making of the Board of Directors is enriched when multiple viewpoints contribute to the discussion of matters within its purview. Creating a Board with diverse membership is important to the Company and the Board is committed to this objective.

Director Diversity & Tenure and Committee Composition

3

4

Director Experience and Skills Matrix

5

|

Dr. Flemming Ornskov, M.D., M.P.H.

Chairman of the Board

Chief Executive Officer, Galderma

Independent Director since 2017

Age: 66

COMMITTEES

• Nominating and Corporate Governance (Chair)

• Compensation |

Dr. Flemming Ornskov is currently CEO of Galderma (since 2019), a healthcare company focused on dermatology. He brings operational and medical knowledge along with extensive international, strategic planning and operational experience in the healthcare sector having an extensive career serving in senior leadership roles and on boards at a number of global pharmaceutical, biotechnology and healthcare companies.

ADDITIONAL EXPERIENCE

• Chief Executive Officer and Board member, Shire plc (2013 – 2019)

• Chief Marketing Officer and Global Head of Strategic Marketing for General & Specialty Medicine, Bayer AG (2010 – 2012)

• Global President of Pharmaceuticals and OTC, Bausch & Lomb, Inc. (2008 – 2010)

• Held roles of increasing responsibility at among others, Merck & Co. Inc. and Novartis AG

OTHER PUBLIC COMPANY BOARDS

• None

FORMER (PAST 5 YEARS)

• Karo Pharma AB n/k/a Karo Healthcare AB (STO: KARO) (2019 – 2022, when taken private)

• Centogene NV (NSDQ: CNTG) (2019 – 2023)

• Recordati S.p.A. (2019 – 2020)

EDUCATION

• MD, University of Copenhagen Medical School

• MPH, Harvard University School of Public Health

• MBA, INSEAD

| |

6

|

Linda Baddour

Former Executive Vice President and Chief Financial Officer, PRA Health Sciences

Independent Director since 2018

Age: 65

COMMITTEES

• Audit & Finance (Chair) |

Ms. Baddour is the former Executive Vice President and CFO of PRA Health Sciences (2007 – 2018).

She provides the Waters Board with significant accounting, finance and health care industry expertise, gained through her extensive experience as a senior financial executive across healthcare, life sciences, and pharmaceutical services and banking companies.

ADDITIONAL EXPERIENCE

• Chief Financial Officer and Accounting Officer (2002 – 2007), Chief Accounting Officer (1997 – 2007); Corporate Controller (1995 – 1997), Pharmaceutical Product Development, Inc.

• Controller, Cooperative Bank for Savings Inc. (1980 – 1995)

OTHER PUBLIC COMPANY BOARDS

• Cryoport, Inc. (NSDQ: CYRX) (2021 – present)

FORMER (PAST 5 YEARS)

• None

EDUCATION

• BA and MBA, University of North Carolina at Wilmington

• Certified Public Accountant

| |

7

|

Udit Batra, Ph.D.

President and Chief Executive Officer, Waters

Director since 2020

Age: 53 COMMITTEES

• None |

Dr. Batra is currently Chief Executive Officer of Waters, a position he has held since 2020.

He brings more than two decades of leadership and operational expertise in the healthcare and life sciences industries, including leadership of multi-billion-dollar global organizations.

ADDITIONAL EXPERIENCE

• Chief Executive Officer, MilliporeSigma, the life sciences business of publicly traded Merck KGaA (2014 – 2020)

• President and CEO, Consumer Health, Merck KGaA (2011 – 2014)

• Held various leadership roles, Novartis International AG (2006 – 2011)

• GlobaI Brand Director, Wound Care, Johnson & Johnson (2004 – 2005)

• Senior Engagement Manager, McKinsey & Company (2001 – 2004)

• Research Fellow, Merck & Co., Inc. (1996 – 2001)

OTHER PUBLIC COMPANY BOARDS

• None

FORMER (PAST 5 YEARS)

• None

EDUCATION

• BS, University of Delaware

• PhD, Chemical Engineering, Princeton University

| |

8

|

Dan Brennan

Executive Vice President and Chief Financial Officer, Boston Scientific Corporation

Independent Director since 2022

Age: 58

COMMITTEES

• Audit & Finance |

Mr. Brennan is currently Executive Vice President and Chief Financial Officer of Boston Scientific Corporation (since 2014), a global medical device company.

He brings more than two decades of finance leadership in the medical device industry, including at a multi-billion-dollar global organization where he is responsible for all financial operations, business development and strategic development. During his time at Boston Scientific, he helped oversee successful margin and revenue growth initiatives. He also possesses public company Board experience.

ADDITIONAL EXPERIENCE

• Senior Vice President and Corporate Controller, (2010 – 2013); Various roles of increasing responsibility within finance function (1996 – 2009), Boston Scientific Corporation

• Held roles of increasing responsibility within finance function, Millipore Corporation (1990 – 1996)

• Corporate Auditor, Standex, Inc. (1988 – 1989)

OTHER PUBLIC COMPANY BOARDS

• None

FORMER (PAST 5 YEARS)

• Nuance Communications (NASDAQ: NUAN) (2018 – 2022)

EDUCATION

• BS and MBA, Babson College

• Certified Public Accountant

| |

9

|

Richard Fearon

Former Vice Chairman & Chief Financial & Planning Officer, Eaton Corporation

Independent Director since 2023

Age: 68

COMMITTEES

• Audit & Finance |

Mr. Fearon is currently an independent director.

He brings international business experience with expertise in accounting, corporate development (M&A), information systems, internal audit, investor relations, and strategic planning to the Waters Board. He also possesses significant public company Board experience.

ADDITIONAL EXPERIENCE

• Non-Executive Chairman of the Board (Dec. 2023 – present), Avient Corporation (NYSE: AVNT)

• Vice Chairman (2009 – 2021); Chief Financial and Planning Officer (2002 – 2021), Eaton Corporation

• Senior Vice President, Corporate Development and Strategic Planning (1997 – 2001); Vice President, Corporate Development (1995 – 1997), Transamerica Corporation

• Vice Chairman, NatSteel Chemicals and General Manager, Corporate Development (1990 – 1995), NatSteel Ltd.

• Held positions at Booz Allen Hamilton, The Walt Disney Company, and The Boston Consulting Group

OTHER PUBLIC COMPANY BOARDS

• CRH plc (NYSE: CRH) (2020 – present)

• Crown Holdings, Inc. (NYSE: CCK) (2019 – present)

• Avient Corporation (NYSE: AVNT) (2004 – present)

FORMER (PAST 5 YEARS)

• Eaton Corporation plc (NYSE: ETN) (2015 – 2021)

• Hennessy Capital Investment Corporation VI (NSDQ: HCVIU) (2021 – 2023) (Mr. Fearon resigned from this board effective as of the date of his appointment to Waters’ board)

EDUCATION

• AB, Stanford University

• JD and MBA, Harvard University

| |

10

|

Pearl S. Huang, Ph.D.

President and Chief Executive Officer, Dunad Therapeutics

Independent Director since 2021

Age: 66

COMMITTEES

• Science and Technology (Chair)

• Nominating and Corporate Governance |

Dr. Huang is currently President and Chief Executive of Dunad Therapeutics, a Novartis-backed biopharmaceutical startup (since May 2022).

She brings deep scientific knowledge along with extensive international and operational experience in the pharmaceutical sector both in senior leadership and operational roles.

ADDITIONAL EXPERIENCE

• Chief Executive Officer, Cygnal Therapeutics (2019 – 2022)

• Venture Partner, Flagship Pioneering (2019 – 2022)

• Senior Vice President and Global Head, Therapeutic Modalities, F. Hoffman La-Roche, Ltd. (2014 – 2018)

• Vice President and Global Head of Discovery Academic Partnerships (DPAc) Alternative Discovery and Development, GlaxoSmithKline plc (2012 – 2014)

• Founder and CSO, Beigene LTD (2010 – 2012)

• Vice President, Oncology Integrator, Discovery and Early Development, Merck and Co. (2006 – 2010)

• Held roles of increasing responsibility at Merck & Co. Inc. and GlaxoSmithKline plc

OTHER PUBLIC COMPANY BOARDS

• BB Biotech AG (SWX: BION) (2022 – present)

FORMER (PAST 5 YEARS)

• None

EDUCATION

• BS, Biology, MIT

• Ph.D., Molecular Biology, Princeton University

| |

11

|

Wei Jiang

Former Executive Vice President, President of Pharmaceuticals Region China & Asia Pacific, and President, Bayer Group Greater China Region, Bayer AG

Independent Director since 2021

Age: 60

COMMITTEES

• Science and Technology |

Mr. Jiang is currently an independent director.

His more than 25 years’ experience in the pharmaceutical and medical device industries, with particular focus in China and the Asia/Pacific region at large allows him to bring experienced international perspective to the Waters Board. In addition, his service on a private company’s board of directors in the medical and life sciences industry provides additional perspective that benefits the Company.

ADDITIONAL EXPERIENCE

• Former EVP, President of Pharmaceuticals Region China &Asia Pacific (2015 – 2021), and President of Bayer Group Greater China Region (2019 – 2021), Bayer AG

• Senior Vice President, GRA BU & Key Accounts (2011 – 2012), held other management roles (2006 – 2010), AstraZeneca plc

• Managing Director, China Operations (2004 – 2006), Guidant Corporation

• Various management roles, Eli Lilly & Company (1999 – 2004)

OTHER PUBLIC COMPANY BOARDS

• STAAR Surgical Company (NASDAQ: STAA)

FORMER (PAST 5 YEARS)

• None

EDUCATION

• BBA, Campbell University

• MA, Economics and Finance, Indiana State University

| |

12

|

Christopher A. Kuebler

Former Chairman and Chief Executive Officer, Covance

Independent Director since 2006

Age: 70

COMMITTEES

• Compensation (Chair)

• Science and Technology |

Mr. Kuebler is currently an independent director and investor.

His 30 years of experience in the pharmaceutical and pharmaceutical service industries, including 10 years as Chairman and Chief Executive Officer of Covance allows him to bring an experienced management perspective to the Waters Board, as well as expertise in the oversight of financial accounting and business strategy.

ADDITIONAL EXPERIENCE

• Chairman and Chief Executive Officer (1994 – 2004), Chairman (during 2005), Covance Inc. and its predecessor companies

• Spent nearly 20 years in the pharmaceutical industry at Abbott Laboratories, Squibb, Inc., and the Monsanto Company

OTHER PUBLIC COMPANY BOARDS

• None

FORMER (PAST 5 YEARS)

• Nektar Therapeutics (NSDQ: NKTR) (2001 – 2018)

EDUCATION

• BS, Biology, Florida State University

| |

13

|

Mark Vergnano

Former Chairman, President and Chief Executive Officer, The Chemours Company

Independent Director since 2022

Age: 66

COMMITTEES

• Compensation

• Nominating and Corporate Governance |

Mr. Vergnano is currently an independent director.

He provides the Waters Board with significant senior executive leadership at global sciences companies. Mr. Vergnano brings deep operational experience and a proven track record of business transformation and consistent growth at The Chemours Company and DuPont. He also possesses public company Board experience.

ADDITIONAL EXPERIENCE

• Roles of increasing responsibility, including Chemours (2015 – 2021) Chairman (2021); President and CEO (2015 – 2021). DuPont (1980 – 2015) Executive Vice President (2009 – 2015); Group Vice President, Safety and Protection (2006 – 2009), Vice President/General Manager, Nonwovens and Building Innovations (2002 – 2006)

OTHER PUBLIC COMPANY BOARDS

• Johnson Controls International PLC (NYSE: JCI) (since 2016)

FORMER (PAST 5 YEARS)

• The Chemours Company (NYSE: CC) (2015 – 2022)

EDUCATION

• BS, University of Connecticut

• MBA, Virginia Commonwealth University

| |

14

Required Vote and Recommendation of the Board of Directors

A nominee for director shall be elected to the Board by a majority vote (i.e., the votes cast for such nominee must exceed the votes cast against such nominee) at any meeting of shareholders for the election of directors at which a quorum is present, except that directors will be elected by a plurality of the votes cast in a contested election. A “contested election” is one in which the Secretary of the Company receives a notice that a shareholder intends to nominate one or more persons for election to the Board in purported compliance with the Bylaws and such nomination notice has not been subsequently withdrawn or on prior to the tenth day before the notice of meeting is first mailed. If an incumbent director fails to be re-elected by a majority vote when such a vote is required and offers to resign, and if that resignation is not accepted by the Board, such director shall continue to serve until the next annual meeting and until his or her successor is duly elected, or his or her earlier resignation or removal. If an incumbent director’s resignation is accepted by the Board, or if a nominee for director is not elected and the nominee is not an incumbent director, then the Board, in its sole discretion, may fill any resulting vacancy or may decrease the size of the Board. “Abstentions” and shares with respect to which a broker or representative does not vote on a particular matter because it does not have discretionary voting authority on that matter (so-called “broker non-votes”) are counted as present for the purpose of determining whether a quorum is present. Abstentions and broker non-votes will not be treated as votes cast with respect to any nominee and therefore will not have an effect on the determination of whether a nominee has been elected.

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH NOMINEE FOR

|

15

CORPORATE GOVERNANCE

HOW WE ARE SELECTED AND ELECTED

Nine Directors are to be elected at the Annual Meeting, each to hold office until his or her successor is elected and qualified or until his or her earlier resignation, death or removal. It is intended that the Proxies in the form included with this Proxy Statement will be voted for the nominees set forth above unless shareholders specify to the contrary in their Proxies or specifically abstain from voting on this matter.

Majority Voting

The Company’s bylaws (the “Bylaws”) provide for majority voting for Directors in uncontested elections. A further description of the Company’s majority voting provisions can be found above.

Board Candidates

The Nominating and Corporate Governance Committee, together with the Board, is responsible for assessing the appropriate skills, attributes, experiences, and diversity of background, including a candidate’s gender and ethnic and racial background, that we seek in Board members in the context of the existing composition of the Board.

The Nominating and Corporate Governance Committee believes that candidates for service as a Director of the Company should meet certain minimum qualifications. The Company’s Corporate Governance Guidelines (the “Guidelines”) and Nominating and Corporate Governance Committee Charter (the “NGC Charter”) clarify that when assessing candidates for Director, the Nominating and Corporate Governance Committee considers candidates’ skills, experience, and diversity (such as, and including but not limited to, diversity of gender, race/ethnicity, age, geographic location, and nationality), and seeks individuals who are highly accomplished in their respective fields, with superior educational and professional credentials. The Nominating and Corporate Governance Committee strives to maintain an appropriate balance of tenure, skills, experience and diversity, with our average director tenure being approximately seven years. The Board does not maintain term limits, and, in 2024, the Board amended the Guidelines to remove the mandatory retirement age for directors, as the Board believes that continuity of service can provide stability and valuable insight. Candidates should also satisfy the Company’s independence criteria, which are part of its Guidelines and summarized below, and follow the applicable listing standards of the New York Stock Exchange.

The Nominating and Corporate Governance Committee also seeks to ensure proper engagement from each of the Directors and effective functioning of the Board. The Company’s Guidelines provide that a Director may serve on other public company boards so long as such Director is able to devote the time necessary to properly discharge his or her duties and responsibilities to the Board, except that no director may serve simultaneously on the audit committees of more than three public companies (including the Company) unless the Board first has determined that such simultaneous service would not impair the ability of such member to serve on the Board’s Audit & Finance Committee. The Company does not impose specific thresholds on the number of other public company boards its Directors may serve on as the Company believes such thresholds are arbitrary and do not permit the Board to review the facts and circumstances involved in a particular Director’s decision to serve on the board of more than one public company.

The Company has a process for identifying and selecting candidates for Board membership. Initially, the Chair, the President and Chief Executive Officer (“CEO”), the Nominating and Corporate Governance Committee, or other Board members identify a need either to expand the Board with a new member possessing certain specific characteristics or to fill a vacancy on the Board. A search is then undertaken by the Nominating and Corporate Governance Committee, working with recommendations and input from Board members, members of senior management, professional contacts, external advisors, nominations by shareholders, and/or the retention of a professional search firm, if necessary. Any shareholder wishing to propose a nominee should follow the process described in the Bylaws to submit the candidate’s name and appropriate biographical information to the Company, c/o Secretary, at 34 Maple Street, Milford, MA 01757. In addition to satisfying the requirements of the Bylaws, to comply with the SEC’s universal proxy rules, any shareholder intending to solicit

16

proxies in support of a nominee other than the Company’s nominees must also comply with the additional requirements of Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

An initial slate of candidates is identified that will satisfy the criteria for Board membership and is presented to the Nominating and Corporate Governance Committee for review. Upon review by the Nominating and Corporate Governance Committee, a series of interviews of one or more candidates is conducted by the Chair, the President and CEO, and at least one member of the Nominating and Corporate Governance Committee. During this process, the full Board is informally apprised of the status of the search and its input is solicited.

Upon identification of a final candidate, the entire Nominating and Corporate Governance Committee will meet to consider the credentials of the candidate and thereafter, if approved, will submit the candidate for approval by the full Board.

Proxy Access

The Board has adopted a proxy access bylaw provision that allows eligible shareholders or groups of up to 20 shareholders who have held at least 3% of our common stock continuously for three years to nominate up to two individuals or 20% of the Board, whichever is greater, for election at our annual shareholder meeting, and to have those individuals included in our proxy materials for that meeting.

Board/Director Independence

The Company’s Guidelines include criteria adopted by the Board to assist it in making determinations regarding the independence of its members. The Guidelines include the Company’s categorical standards of independence, which our Board approved. The Guidelines are available on the website https://ir.waters.com/corporate-citizenship/governance-documents/default.aspx under the caption “Governance Documents”. The criteria, summarized below, are consistent with the New York Stock Exchange listing standards regarding director independence. To be considered independent, the Board must determine that a director does not have a material relationship, directly or indirectly, with the Company. A director will not be considered independent if:

| • | he or she or an immediate family member is, or has been within the last three years, an executive officer of the Company; |

| • | he or she or an immediate family member is a current partner of an internal or external auditor of the Company or has been within the last three years a partner or employee of an internal or external auditor of the Company who personally worked on the Company’s audit; |

| • | he or she or an immediate family member is, or has been within the last three years, an executive officer of a public company where any of the Company’s present executive officers at the same time serves or served on the compensation committee of that company’s board; |

| • | he or she is a paid advisor or consultant to the Company receiving in excess of $120,000 per year in direct compensation from the Company (other than fees for service as a director) within the past three years or has an immediate family member who has been a paid advisor or consultant to the Company; or |

| • | he or she or an immediate family member is an employee (or in the case of an immediate family member, an executive officer) of a company that does business with the Company and the annual payments to or from the Company, in any of the last three fiscal years, exceeded the greater of $1 million or 2% of the other company’s annual gross revenues. |

In addition, a director will not be considered independent if he or she, or an immediate family member, is or has been an executive officer of a tax-exempt entity that receives contributions in any fiscal year from the Company exceeding the greater of $1 million or 2% of its gross revenues. A director also will not be considered independent if he or she is a current employee of an internal or external auditor of the Company or has an immediate family member who is a current employee of an internal or external auditor of the Company who participates in such firm’s audit, assurance, or tax compliance practice.

17

The Board has determined that each Director, other than Dr. Batra, the Company’s President and CEO, has no material relationship with the Company and otherwise qualifies as “independent” under these criteria and the applicable listing standards of the New York Stock Exchange.

HOW WE ARE EVALUATED

The Nominating and Corporate Governance Committee conducts an annual evaluation of the Board and each of its committees. In December 2023, the evaluation, in the form of a questionnaire, was circulated to all members of the Board and each committee. The Company’s General Counsel received all of the questionnaires, compiled the results, and circulated them to the Board and each committee for discussion and analysis during January and February 2024. It is the intention of the Nominating and Corporate Governance Committee to continue to engage in this process annually.

HOW WE GOVERN AND ARE GOVERNED

At Waters, we believe that sound principles of corporate governance are essential to protecting Waters’ reputation, assets, investor confidence, customer loyalty, and sustainability. Our Guidelines can be found on our website at https://ir.waters.com/corporate-citizenship/governance-documents/default.aspx and are available in print upon written request to the Company, c/o Secretary, at 34 Maple Street, Milford, MA 01757.

We also believe in sound principles of board governance — how we govern ourselves sets the tone for how our company is governed more generally. Our board governance practices include:

✓ Proxy Access

As described in the earlier section on how Directors are selected, the Company enables eligible shareholders to nominate director candidates via our proxy access process as governed by our Bylaws.

✓ Majority Approval Required for Director Elections

If an incumbent Director up for re-election at a meeting of shareholders fails to receive a majority of affirmative votes in an uncontested election, the Board will adhere to the director resignation process as provided in our Bylaws.

✓ Independent Board and Committees

All Directors except our President and CEO, and all members of the Audit & Finance Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Science and Technology Committee are independent.

✓ Engaged in Strategy

Our Board is engaged in advising and overseeing the Company’s strategy and strategic priorities.

✓ Director Qualifications and Evaluations

All independent Directors meet the candidate qualifications set forth in our Guidelines and as summarized in the above sections of this Proxy Statement: “— How We Are Selected and Elected — Board Candidates” and “— How We Are Selected and Elected — Board/Director Independence”.

✓ Regular Executive Sessions of Independent Directors

Our independent Directors meet privately on a regular basis. Our Chair presides at such meetings.

✓ Stock Ownership Requirements

We have robust stock ownership requirements for our Directors and executive officers.

✓ Enterprise Risk Management

We have an enterprise risk management framework to identify, assess, manage, report, and monitor enterprise risk, including cybersecurity risk, and areas that may affect our ability to achieve our objectives.

✓ Cybersecurity

Our Audit & Finance Committee has oversight of cybersecurity risks and actively works with the Board and management to identify, assess, manage, report, and monitor such cybersecurity risks.

18

✓ Human Capital Management

Our Board dedicates a meeting session to talent review, diversity, and succession.

✓ Director Orientation and Ongoing Director Education

Our Board, with management support, hosts a director orientation program for new directors. The Board also administers a twice-yearly director education program, whose topics are overseen by the Board’s Nominating and Corporate Governance Committee.

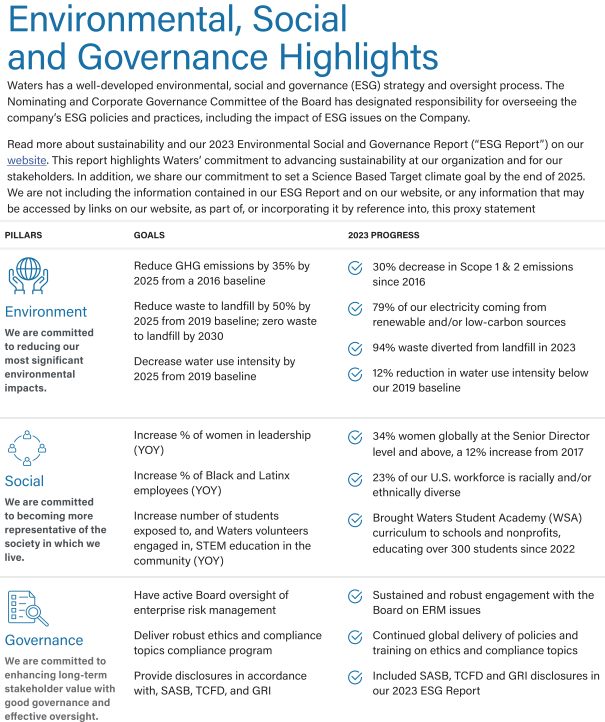

✓ Board and Committee Oversight of ESG

Our Board has delegated oversight of the Company’s ESG policies and practices to its Nominating and Corporate Governance Committee, which reports out to the Board at least annually.

Related Party Transactions Policy

The Board has adopted a written Related Party Transactions Policy, which covers “Interested Transactions” between a “Related Party” or parties and the Company. An Interested Transaction is a transaction or arrangement in which the aggregate amount involved will or may be expected to exceed $120,000 in any calendar year and in which the Company and/or any Related Party may have an interest. A Related Party includes an executive officer, director or nominee for election as a director of the Company, any holder of more than a 5% beneficial ownership interest in the Company, any immediate family member of any of the foregoing, or any firm, corporation or entity in which any of the foregoing persons is employed or is a general partner or principal or in which such person or persons collectively have a 10% or greater beneficial ownership interest.

Pursuant to the policy, the General Counsel is responsible for identifying potential Interested Transactions and determining whether a proposed transaction is an Interested Transaction and accordingly, reportable to the Nominating and Corporate Governance Committee for consideration at its next regularly scheduled meeting. The Nominating and Corporate Governance Committee will review the material facts of all Interested Transactions and report its recommendations to the Board which will either approve or disapprove the Interested Transaction.

The Nominating and Corporate Governance Committee and the Board have reviewed and determined that certain categories of Interested Transactions are deemed to be pre-approved or ratified (as applicable) by the Board under the terms of the policy. These are: (a) the employment and compensation arrangements of named executive officers required to be reported in the Company’s proxy statement; (b) Director compensation required to be reported in the Company’s proxy statement; (c) ordinary course charitable contributions periodically reviewed by the Compensation Committee of the Board; and (d) ordinary course business transactions conducted on an “arm’s length” basis with Galderma S.A. (of which Dr. Flemming Ornskov is Chief Executive Officer), and Avient Corp. (of which Mr. Fearon is an independent director but not an employee).

Stock Ownership Guidelines

In order to closely align Directors’ and executive officers’ interests with those of the Company’s shareholders, the Company has minimum stock ownership guidelines for its executive officers and non-employee Directors. These guidelines require the accumulation by anyone who holds the CEO position of common stock equal to five times his or her base salary over a three-year period and the accumulation by our other executive officers of common stock equal to two times their base salary over a five-year period. The stock ownership guidelines for non-employee Directors require the accumulation of a minimum of five times the annual cash Board retainer over a five-year period. Please refer to the section “— Compensation Discussion and Analysis — Compensation Philosophy, Governance, and Pay Practices — Stock Ownership Guidelines” for additional details regarding our stock ownership guidelines.

Guidelines, Code of Conduct, Global Complaint Reporting Policy, and Ethics Helpline

The Board has adopted the Guidelines, a Global Code of Business Conduct and Ethics for employees, executive officers, and Directors, and a Global Complaint Reporting Policy, the Company’s “whistleblower” policy, regarding the treatment of potential legal and compliance concerns, including those relating to accounting, internal accounting controls, and auditing matters. The Company’s Waters Ethics Helpline, which is confidentially operated by a third-party vendor, provides the Waters workforce and others a comprehensive and

19

confidential reporting tool to report concerns. All of the foregoing documents are available on the Company’s website at https://ir.waters.com/corporate-citizenship/governance-documents/default.aspx under the caption “Governance Documents” and copies may be obtained, without charge, upon written request to the Company, c/o Secretary, at 34 Maple Street, Milford, MA 01757. The Waters Ethics Helpline may be accessed at https://waters.ethicspoint.com/.

Policy Against Hedging

In 2013, the Board adopted a policy prohibiting Directors, executive officers, and certain key employees designated by the Company based on their access to material non-public information from making short sales of Company stock or trading in options on Company stock and purchasing financial instruments, including prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset any decrease in market value of equity securities of the Company. This prohibition does not apply to any bona fide pledge of equity securities of the Company not made for the purpose of hedging.

Risk Oversight

Board’s Role in Risk Oversight Generally

Included in the Company’s Annual Report are the risk factors affecting the Company, which are periodically reviewed by the Board and the Audit & Finance Committee and updated or expanded as warranted. The Board is responsible for overseeing the management and operations of the Company, including its risk assessment and risk management functions. The Board has delegated responsibility to reviewing the Company’s policy with respect to risk assessment and management, including with respect to cybersecurity, to the Audit & Finance Committee.

Additionally, the Company has an enterprise risk management framework under the oversight of the Vice President, Internal Audit, which includes an information security risk management framework under the specific oversight of the Vice President and Chief Information Officer. This program seeks to identify new risks, develop and implement risk mitigation plans, and monitor the results affecting the Company’s business and operations on an ongoing basis. Management of the Company actively participates in this program and briefs the Board on the strategic, operational, compliance, and financial risks affecting the Company and efforts undertaken to mitigate them. The Compensation Committee has responsibility for oversight of risk related to compensation matters as more fully described below.

ESG Risk Oversight

The Board, with and through its Nominating and Corporate Governance Committee, as appropriate, oversees the Company’s management of ESG matters. In particular, the Nominating and Corporate Governance Committee is responsible for reviewing and reporting to the Board on the Company’s policies and practices with respect to ESG matters, including the impact of ESG matters on the Company.

Cybersecurity Risk Oversight

The Board, including the Audit & Finance Committee, oversees the Company’s information security risk management framework that seeks to identify new risks, develop and implement risk mitigation plans, and monitor the results affecting the Company’s business and operations on an ongoing basis. The Company’s risk management framework is under the specific oversight of the Company’s Vice President and Chief Information Officer (the “CIO”). The CIO manages this framework, in collaboration with the Company’s businesses and functions. The CIO presents updates to the Audit & Finance Committee at least on an annual basis and, as necessary, to the full Board. These reports include detailed updates on the Company’s performance preparing for, preventing, detecting, responding to and recovering from cyber incidents. The CIO also promptly informs and updates the Audit & Finance Committee, and, as necessary, the Board of Directors about any information security incidents that may pose significant risk to the Company. The Company’s program is periodically evaluated by external experts, and the results of those reviews are reported to the Audit & Finance Committee and the Board. Together with management, the Audit & Finance Committee reviews the Company’s risk assessment and risk management practices and discusses major cybersecurity risk exposures as well as steps taken by management to monitor and control such exposures.

20

Compensation-Related Risk

The Compensation Committee conducted a review to determine if any of the Company’s compensation plans or practices would be reasonably likely to have a material adverse effect on the Company. The Compensation Committee reviewed various components and aspects of the Company’s compensation plans and practices, including their size, scope, and design. The Compensation Committee also reviewed whether the compensation plans and practices promote unnecessary risk-taking and the policies in place to mitigate risk associated with these plans. The review included an assessment of design features that could encourage excessive risk-taking and the potential magnitude of such risks, including design features such as a short-term oriented pay mix, overly aggressive goal setting, and over-weighting of annual incentives as compared to long-term incentives. The policies that exist to mitigate compensation-related risk include, among others, (1) the Company’s recoupment policies; (2) stock ownership guidelines for executive officers; (3) a five-year vesting period for stock options and three- to five-year vesting periods for RSUs; (4) a three-year performance period and a maximum payout cap for performance-based restricted stock units (“PSUs”); (5) a prohibition on hedging; (6) a required post-vesting holding period for PSUs; and (7) the independent oversight of compensation programs by the Compensation Committee, with input from an independent compensation consultant. In addition, several features of the Company’s annual incentive plan (the “AIP”) mitigate compensation-related risk, including the use of payout caps, a clear link between payouts under the plan and the Company’s financial performance, and the Compensation Committee’s oversight in determining payouts under the plan. Based on this review, the Compensation Committee and the Company do not believe that there are any compensation-related risks arising from the Company’s compensation plans and practices that would be reasonably likely to have a material adverse effect on the Company.

HOW WE ARE ORGANIZED

Board Leadership Structure

As stated in the Company’s Guidelines, the Board has no set policy with respect to the separation of the offices of Chair and CEO. In 2023, Dr. Flemming Ornskov served as Chair of the Board and Dr. Batra served as President and CEO of the Company. While no written policy currently exists, the Board believes that separating the offices of Chair and CEO facilitates an appropriate balance between strong and consistent leadership and independent and effective oversight of the Company’s business by the Board.

Role of Compensation Consultant, Compensation Committee, and Management in Decision-Making

The Compensation Committee engaged Pearl Meyer as its outside independent compensation consultant during 2023. Pearl Meyer participates in Compensation Committee meetings and executive sessions and advises the Compensation Committee on a range of executive officer and Director compensation matters, including annual and long-term incentive plan design, competitive market assessments, compensation trends and best practices, and technical and regulatory developments. Pearl Meyer provides services to the Compensation Committee related only to executive officer and Director compensation, including peer group composition, comparing executive officer and Director compensation arrangements to those of the peer group and the broader market, and providing market data and advice regarding executive and Director compensation plans. The Compensation Committee has the authority to engage and terminate independent legal, accounting, and other advisors as it deems necessary or appropriate to carry out its responsibilities.

The Compensation Committee regularly reviews the services provided by Pearl Meyer and has determined that Pearl Meyer is independent in providing consulting services to the Compensation Committee. The Compensation Committee conducted a review of its relationship with Pearl Meyer in 2023 and determined that Pearl Meyer’s work for the Compensation Committee did not raise any conflicts of interest, considering the factors set forth in the applicable rules of the SEC and the New York Stock Exchange.

The Compensation Committee approves all compensation decisions for our named executive officers, after consulting with Pearl Meyer, as appropriate. The Senior Vice President, Chief Human Resources Officer and the Vice President, Total Rewards also provide the Compensation Committee with information and analysis on the Company’s executive compensation programs, as requested. In the beginning of 2023, our President and CEO,

21

Dr. Batra, provided the Compensation Committee with his assessment of the performance of the Company and the other named executive officers, and made compensation recommendations for such other named executive officers. The Compensation Committee, however, makes all final decisions with respect to the compensation of the CEO and the other named executive officers. No named executive officer makes any decision or recommendation to the Compensation Committee on any element of his or her own compensation.

DIRECTOR MEETINGS AND BOARD COMMITTEES

Meetings

The Board held 10 (ten) meetings during the year ended December 31, 2023. The Board has determined that each Director other than Dr. Batra, the Company’s President and CEO, has no material relationship with the Company and otherwise qualifies as “independent” under applicable listing standards of the New York Stock Exchange and the Company’s independence criteria, which are summarized under the section “— How We Are Selected and Elected — Board/Director Independence” above. The Board meetings held in 2023 included sessions on strategy; innovation; enterprise risk management; cybersecurity; annual operating plan; talent review; diversity; succession; and ESG.

During 2023, eight of the of the Company’s nine current Directors attended 100% of the meetings of the Board held during the period for which he or she was a Director; the remaining Director attended 90% of the Board’s meetings held during their term. During 2023, each of the Company’s current Directors attended at least 75% of the meetings of the committees on which he or she served. During 2023, the Audit & Finance Committee met 8 (eight) times, the Compensation Committee met 3 (three) times and the Nominating and Corporate Governance Committee met 3 (three) times. In addition, during 2023, the now dissolved Finance Committee met 2 (two) times and the Science and Technology Committee met 2 (two) times.

The Company encourages Director attendance at annual shareholder meetings but does not have a formal policy requiring attendance. All Directors attended the 2023 annual meeting of shareholders.

Audit & Finance Committee

The Audit & Finance Committee currently consists of Ms. Linda Baddour (Chair), Mr. Dan Brennan and Mr. Richard Fearon. Effective March 27, 2023, Mr. Fearon replaced Mr. Edward Conard, who did not stand for re-election at the Annual Meeting. The Audit & Finance Committee oversees the activities of the Company’s independent registered public accounting firm, PricewaterhouseCoopers LLP (“PwC”), and provides oversight with respect to accounting and financial reporting and audit functions, as well as cybersecurity risk. The Audit & Finance Committee meets the definition of “Audit Committee” as defined in Section 3(a)(58)(A) of the Exchange Act. The Audit & Finance Committee engages the independent registered public accounting firm, and performs certain other functions pursuant to its charter, a copy of which is available on the Company’s website at https://ir.waters.com/corporate-citizenship/governance-documents/default.aspx under the caption “Governance Documents”. Each member of the Audit & Finance Committee is independent under SEC rules and the applicable listing standards of the New York Stock Exchange and the Company’s independence criteria, which are summarized under the section “— How We Are Selected and Elected — Board/Director Independence.” The Board has determined that each member of the Audit & Finance Committee is an “audit committee financial expert” within the meaning of the SEC rules and has “accounting or related financial management expertise” within the meaning of New York Stock Exchange rules.

Compensation Committee

The Compensation Committee currently consists of Mr. Christopher A. Kuebler (Chair), Dr. Flemming Ornskov and Mr. Mark P. Vergnano. The Compensation Committee approves the compensation of executive officers of the Company, makes recommendations to the Board with respect to Director compensation, and administers the Company’s incentive plans. The Compensation Committee (i) has the authority, in its sole discretion, to retain or to obtain the advice of one or more advisors and to terminate the service of such advisors and (ii) may form and delegate authority to subcommittees as it deems appropriate and to officers of the

22

Company such responsibilities of the Committee as may be permitted by applicable laws, rules or regulations, in each case in accordance with the listing standards set forth by the NYSE. The Compensation Committee’s charter is available on the Company’s website at https://ir.waters.com/corporate-citizenship/governance-documents/default.aspx under the caption “Governance Documents.” Each member of the Compensation Committee is independent under the applicable listing standards of the New York Stock Exchange and the Company’s independence criteria, which are summarized under the section “— How We Are Selected and Elected — Board/Director Independence.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee currently consists of Dr. Flemming Ornskov (Chair), Dr. Pearl Huang and Mr. Mark P. Vergnano. The Nominating and Corporate Governance Committee oversees, among other things, the Company’s ESG policies, practices and publications as well as the recruitment and Board composition and recommendation of candidates for the Board. The Nominating and Corporate Governance Committee may, as it deems appropriate, consider any candidates suggested by the shareholders of the Company. The Nominating and Corporate Governance Committee also develops and recommends to the Board the Guidelines for the Company. The Nominating and Corporate Governance Committee charter is available on the Company’s website at https://ir.waters.com/corporate-citizenship/governance-documents/default.aspx under the caption “Governance Documents”. Each member of the Nominating and Corporate Governance Committee is independent under the applicable listing standards of the New York Stock Exchange and the Company’s independence criteria, which are summarized under the section “— How We Are Selected and Elected — Board/Director Independence.”

Science and Technology Committee

The Science and Technology Committee currently consists of Dr. Pearl Huang (Chair) Mr. Wei Jiang, and Mr. Christopher A. Kuebler. The Science and Technology Committee reviews current and emerging scientific technologies applicable to the Company’s business. Among other things, it reviews scientific technology strategies and potential investments both internally and externally and provides updates to the Board. Each member of the Science and Technology Committee is independent under the Company’s independence criteria, which are summarized under the section “— How We Are Selected and Elected — Board/Director Independence.”

REPORT OF THE AUDIT AND FINANCE COMMITTEE OF THE BOARD OF DIRECTORS

The information contained in this report shall not be deemed to be “soliciting material” or “filed” except to the extent that Waters specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

During 2023, the Audit & Finance Committee of the Board, in conjunction with management and PwC, the Company’s independent registered public accounting firm, focused on the following items:

1. Compliance with Section 404 of the Sarbanes-Oxley Act of 2002 (the “Act”) and the adequacy of Company internal controls;

2. The appropriateness of Company financial reporting and accounting processes;

3. The independence and performance of the Company’s independent registered public accounting firm;

4. Company compliance with laws and regulations, including compliance with applicable provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; and

5. Review of the Company’s independent registered public accounting firm’s quality control procedures.

The Company’s compliance with Section 404 of the Act is managed primarily by the Company’s Vice President, Internal Audit in conjunction with the Company’s Senior Vice President and Chief Financial Officer. During 2023, the Audit & Finance Committee received regular and detailed briefings from the Company’s Vice

23

President, Internal Audit and PwC regarding the Company’s compliance with Section 404 of the Act. On February 20, 2024, the Company’s Vice President, Internal Audit and Chief Compliance Officer and PwC reported to the Audit & Finance Committee that no material weaknesses had been identified in the Company’s internal control over financial reporting as of December 31, 2023.

The Board has adopted a written charter setting out more specifically the functions that the Audit & Finance Committee is to perform. The charter is reviewed on an annual basis by the Audit & Finance Committee and the Audit & Finance Committee is advised as to any corporate governance developments which may warrant charter amendments. The charter is available on the Company’s website at https://ir.waters.com/corporate-citizenship/governance-documents/default.aspx under the caption “Governance Documents”. A discussion of the Audit & Finance Committee’s role in risk oversight can be found under the heading “— Risk Oversight — Board’s Role in Risk Oversight Generally” above.

As stated in its charter, the Audit & Finance Committee is tasked with, among other things, reviewing with management the Company’s guidelines and policies with respect to its approach to risk assessment and risk management. In addition, major financial risk exposures and means of monitoring and controlling these exposures, is to be discussed with management.

The Audit & Finance Committee held 8 (eight) meetings during the fiscal year ended December 31, 2023. The Audit & Finance Committee reviewed on a quarterly basis, with members of the Company’s management team, the Company’s quarterly and annual financial results prior to the release of earnings and the filing of the Company’s quarterly and annual financial statements with the SEC. The Board has determined that each of the three current members of the Audit & Finance Committee — Ms. Baddour (Chair), Mr. Dan Brennan and Mr. Richard Fearon — as well as the signatories of the audit committee report as of February 20, 2024, is an “audit committee financial expert” as defined under the applicable rules and regulations of the SEC and has “accounting or related financial management expertise” within the meaning of the New York Stock Exchange rules. Company management has primary responsibility for the financial statements and reporting processes. The Company’s independent registered public accounting firm, PwC, audits the annual financial statements and is responsible for expressing an opinion on their conformity with generally accepted accounting principles (“GAAP”).

The Audit & Finance Committee has adopted the following guidelines regarding the engagement of PwC to perform non-audit services for the Company:

Company management will submit to the Audit & Finance Committee for approval a list of non-audit services that it recommends the Audit & Finance Committee engage its independent registered public accounting firm to provide from time to time during the fiscal year and an estimated amount of fees associated with such services. Company management and the Company’s independent registered public accounting firm will each confirm to the Audit & Finance Committee that each non-audit service on the list is permissible under all applicable legal requirements. The Audit & Finance Committee will, in its discretion, either approve or disapprove both the list of permissible non-audit services and the estimated fees for such services. The Audit & Finance Committee will be informed routinely as to the non-audit services actually provided by the Company’s independent registered public accounting firm pursuant to this pre-approval process and the actual expenditure of fees associated therewith as well as new non-audit services being requested for approval.

To ensure prompt handling of unexpected matters, the Audit & Finance Committee delegates to its Chair the authority to amend or modify the list of approved permissible non-audit services and fees. The Chair will report action taken to the Audit & Finance Committee at the next Audit & Finance Committee meeting.

PwC and the Company ensure that all audit and non-audit services provided to the Company have been pre-approved by the Audit & Finance Committee.

The Audit & Finance Committee hereby reports for the fiscal year ended December 31, 2023 that:

1. It has reviewed and discussed the Company’s audited financial statements for the fiscal year ended December 31, 2023 with Company management;

2. It has reviewed and discussed with PwC those matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Commission);

24

3. It has received from PwC written disclosures and a letter required by the applicable requirements of the PCAOB regarding PwC’s communications with the Audit & Finance Committee concerning independence, and has discussed with PwC its independence;

4. It has considered whether, and determined that, the provision of non-audit services to the Company by PwC as set forth below, was compatible with maintaining auditor independence; and

5. It has reviewed and discussed with PwC its internal quality control procedures, and any material issues raised by the most recent internal quality control review, or peer review, or by any inquiry or investigation by governmental or professional authorities within the preceding five years.

Based on the items reported above, on February 20, 2024, the Audit & Finance Committee recommended to the Board that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for filing with the SEC. The recommendation was accepted by the Board on February 23, 2024.

Ms. Linda Baddour (Chair) Mr. Dan Brennan Mr. Richard Fearon

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

In 2023, the Compensation Committee consisted of Mr. Christopher A. Kuebler (Chair), Messrs. Edward Conard, Mark P. Vergnano and Dr. Flemming Ornskov. Mr. Conard resigned from the Board and its committees in May 2023. During 2023, no member of the Compensation Committee was an officer or employee of the Company or served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as members of the Company’s Board or its Compensation Committee and no executive officer of the Company served on the compensation committee or board of directors of any entity that has one or more executive officers serving on the Company’s Board or Compensation Committee.

HOW TO COMMUNICATE WITH US

The Board of Directors seeks input from a wide variety of shareholders and stakeholders to inform its work. We describe elsewhere in this Proxy Statement the Board’s and the Company’s shareholder engagement activities. We also enable communication via:

| • | participating in our annual meeting; |

| • | calling our investor and customer service line at (508) 478-2000; |

| • | using our ethics reporting email https://waters.ethicspoint.com/, our ethics@waters.com email, or our internal audit email internal_audit@waters.com. Our internal audit function has a direct reporting line to us, the Board; or |

| • | participating in our various investor relations communications opportunities. |

In addition, we enable shareholders and other interested parties to communicate with the Chair or with the non-employee Directors, individually or as a group, by writing to the Company, c/o Secretary, at 34 Maple Street, Milford, MA 01757. Any such communication should include the name and return address of the shareholder or other party, the specific Director or Directors to whom the contact is addressed, and the nature or subject matter of the contact. All communications will be sent directly to the appropriate Board member.

25

PROPOSAL 2 — RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit & Finance Committee of the Board has selected PricewaterhouseCoopers LLP, an independent registered public accounting firm, to audit the books, records, and accounts of the Company for the fiscal year ending December 31, 2024. In accordance with a vote of the Audit & Finance Committee and as approved by the Board, this selection is being presented to the shareholders for ratification at the Annual Meeting. A representative of PwC is expected to be present at the Annual Meeting to respond to appropriate questions and will be given the opportunity to make a statement if the representative desires to do so.

Fees

The aggregate fees for the fiscal years ended December 31, 2023 and 2022 billed by PwC were as follows:

| 2023 | 2022 | |||||||

| Audit Fees |

$ | 5,589,207 | $ | 5,256,247 | ||||

| Audit-Related Fees |

246,606 | 27,151 | ||||||

| Tax-Related Fees |

||||||||

| Tax Compliance |

1,225,132 | 589,022 | ||||||

| Tax Planning |

559,489 | 379,743 | ||||||

|

|

|

|

|

|||||

| Total Tax-Related Fees |

1,784,621 | 968,765 | ||||||

| All Other Fees |

900 | 956 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 7,621,334 | $ | 6,253,119 | ||||

Audit Fees — consists of fees for the audit of the Company’s annual financial statements, statutory audits, review of the interim condensed consolidated financial statements included in quarterly reports, assistance with review of documents filed with the SEC, and services that are normally provided by PwC in connection with statutory and regulatory filings or engagements, and attest services, except those not required by statute or regulation.

Audit-Related Fees — consists of fees for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not reported under “Audit Fees.” These services include employee benefit plan audits, acquisition-related services, attest services not required by statute or regulation, and accounting consultations and reviews for various matters.

Tax-Related Fees — consists of fees for tax compliance and planning services. Tax compliance fees include fees for professional services related to international tax compliance and preparation. Tax planning fees consist primarily of fees including but not limited to, the impact of acquisitions, restructurings, and changes in regulations.

All Other Fees — consists of fees for all permissible services other than those reported above.

The Audit & Finance Committee pre-approved 100% of the services listed under the preceding captions “Audit Fees,” “Audit-Related Fees,” “Tax-Related Fees,” and “All Other Fees.” The Audit & Finance Committee’s pre-approval policies and procedures are more fully described in its report set forth in this Proxy Statement.

26

Required Vote and Recommendation of the Board of Directors

Approval of the proposal requires a majority of the votes cast in person or by Proxy by the shareholders entitled to vote thereon. Abstentions and broker non-votes will be counted as present for the purpose of determining whether a quorum is present but will not be treated as votes cast with respect to the proposal and therefore will not have an effect on the determination of whether the proposal has been approved. Ratification by shareholders is not required. Brokerage firms may vote to ratify the appointment of PwC as it is a “discretionary” or “routine” item. If this Proposal 2 is not approved by the shareholders, the Audit & Finance Committee does not intend to change the appointment for fiscal year 2024, but will consider the shareholder vote in selecting an independent registered public accounting firm for fiscal year 2025.

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE

|

27

PROPOSAL 3 — NON-BINDING VOTE ON EXECUTIVE COMPENSATION

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), the shareholders of Waters are entitled to cast a non-binding vote at the Annual Meeting to approve the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement. Pursuant to the Dodd-Frank Act, the shareholder vote is an advisory vote only, and is not binding on Waters or the Board.

Although the vote is non-binding, the Compensation Committee and the Board value your opinions and will consider the outcome of the vote in establishing and evaluating the Company’s executive compensation program and making future compensation decisions.

As described more fully in the Compensation Discussion and Analysis, the Summary Compensation Table, and the other tables following the Summary Compensation Table, we believe the Company’s named executive officers are compensated in a manner consistent with our business strategy, competitive practice, and sound compensation governance principles, and with a focus on short- and long-term performance-based compensation.

Please refer to the section “— Compensation Discussion and Analysis” for a full description of our executive compensation practices and programs.

We are requesting your non-binding vote on the following resolution:

“RESOLVED, that the compensation of the Company’s named executive officers as described in the Compensation Discussion and Analysis and in the Summary Compensation Table and subsequent tables is approved.”

Required Vote and Recommendation of the Board of Directors

Approval, on an advisory basis, of the proposal requires a majority of the votes cast in person or by Proxy by the shareholders entitled to vote thereon. Abstentions and broker non-votes will be counted as present for the purpose of determining whether a quorum is present but will not be treated as votes cast with respect to the proposal and therefore will not have an effect on the determination of whether the proposal has been approved on an advisory basis. If you own shares through a bank, broker, or other holder of record, you must instruct your bank, broker or other holder of record how to vote in order for them to vote your shares so that your vote can be counted on this proposal.

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RESOLUTION. |

28

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

COMPENSATION DISCUSSION AND ANALYSIS

Our Business

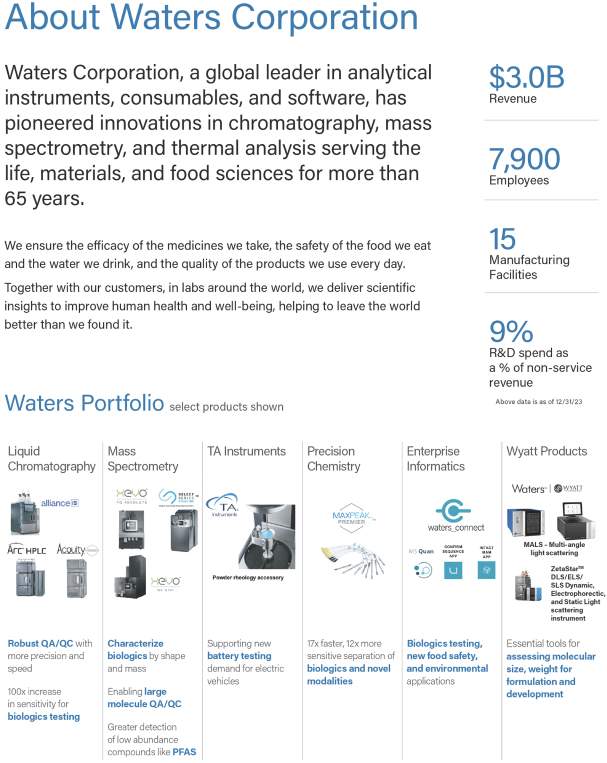

Waters Corporation, a global leader in analytical instruments and software, has pioneered innovations in chromatography, mass spectrometry and thermal analysis serving life, materials and food sciences for more than 65 years.

Waters has continually pioneered chromatography, mass spectrometry, and thermal analysis innovations. Whether it is discovering new pharmaceuticals, assuring the safety of the world’s food and water supplies, or ensuring the integrity of a chemical entity in production, we are constantly working with our customers to change the world.

With approximately 7,900 employees worldwide, Waters operates directly in over 35 countries, including 15 manufacturing facilities, with products available in more than 100 countries.

Our Performance