Exhibit 10.1

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 0-26770

NOVAVAX, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 22-2816046 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 20 Firstfield Road, Gaithersburg, MD | 20878 | |

| (Address of principal executive offices) | (Zip code) |

(240) 268-2000

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares outstanding of the Registrant’s Common Stock, $0.01 par value, was 269,640,511 as of July 31, 2015.

NOVAVAX, INC.

TABLE OF CONTENTS

i

NOVAVAX, INC.

(in thousands, except share and per share information)

| June 30, | December 31, | |||||||

2015 | 2014 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 167,384 | $ | 32,335 | ||||

| Marketable securities | 147,554 | 135,721 | ||||||

| Restricted cash | — | 297 | ||||||

| Accounts receivable – billed | 2,342 | 7,510 | ||||||

| Account receivable – unbilled | 2,498 | 3,100 | ||||||

| Prepaid expenses and other current assets | 13,201 | 9,195 | ||||||

| Total current assets | 332,979 | 188,158 | ||||||

| Property and equipment, net | 26,134 | 19,737 | ||||||

| Intangible assets, net | 11,360 | 12,577 | ||||||

| Goodwill | 53,307 | 54,612 | ||||||

| Other non-current assets | 918 | 918 | ||||||

| Total assets | $ | 424,698 | $ | 276,002 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 7,117 | $ | 12,908 | ||||

| Accrued expenses | 16,522 | 19,397 | ||||||

| Current portion of notes payable | 532 | 603 | ||||||

| Deferred rent | 1,187 | 1,138 | ||||||

| Other current liabilities | 1,695 | 70 | ||||||

| Total current liabilities | 27,053 | 34,116 | ||||||

| Deferred revenue | 2,500 | 2,500 | ||||||

| Non-current portion of notes payable | 149 | 395 | ||||||

| Deferred rent | 7,320 | 7,734 | ||||||

| Other non-current liabilities | 73 | 1,639 | ||||||

| Total liabilities | 37,095 | 46,384 | ||||||

| Commitments and contingences | — | — | ||||||

| Stockholders’ equity: | ||||||||

| Preferred stock, $0.01 par value, 2,000,000 shares authorized; no shares issued and outstanding as of June 30, 2015 and December 31, 2014, respectively | — | — | ||||||

| Common stock, $0.01 par value, 600,000,000 shares authorized at June 30, 2015 and 300,000,000 shares authorized at December 31, 2014; 269,095,405 shares issued and 268,639,975 shares outstanding at June 30, 2015 and 239,287,294 shares issued and 238,831,864 shares outstanding at December 31, 2014 | 2,691 | 2,393 | ||||||

| Additional paid-in capital | 934,176 | 729,373 | ||||||

| Accumulated deficit | (538,104 | ) | (493,093 | ) | ||||

| Treasury stock, 455,430 shares, cost basis at both June 30, 2015 and December 31, 2014 | (2,450 | ) | (2,450 | ) | ||||

| Accumulated other comprehensive loss | (8,710 | ) | (6,605 | ) | ||||

| Total stockholders’ equity | 387,603 | 229,618 | ||||||

| Total liabilities and stockholders’ equity | $ | 424,698 | $ | 276,002 | ||||

The accompanying notes are an integral part of these financial statements.

| 1 |

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share information)

(unaudited)

For

the Three Months | For

the Six Months | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

| Revenue: | ||||||||||||||||

| Government contracts | $ | 13,720 | $ | 7,241 | $ | 22,966 | $ | 12,713 | ||||||||

| Research and development collaborations | 276 | 1,018 | 906 | 3,008 | ||||||||||||

| Total revenue | 13,996 | 8,259 | 23,872 | 15,721 | ||||||||||||

| Costs and expenses: | ||||||||||||||||

| Cost of government contracts revenue | 2,687 | 5,102 | 5,307 | 8,123 | ||||||||||||

| Research and development | 25,042 | 15,202 | 50,769 | 29,720 | ||||||||||||

| General and administrative | 7,088 | 5,806 | 12,931 | 10,114 | ||||||||||||

| Total costs and expenses | 34,817 | 26,110 | 69,007 | 47,957 | ||||||||||||

| Loss from operations | (20,821 | ) | (17,851 | ) | (45,135 | ) | (32,236 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Investment income | 134 | 20 | 256 | 32 | ||||||||||||

| Interest expense | (26 | ) | (51 | ) | (62 | ) | (103 | ) | ||||||||

| Other income (expense) | 72 | 18 | (70 | ) | 18 | |||||||||||

| Realized gains on marketable securities | ― | ― | ― | 615 | ||||||||||||

| Net loss | $ | (20,641 | ) | $ | (17,864 | ) | $ | (45,011 | ) | $ | (31,674 | ) | ||||

| Basic and diluted net loss per share | $ | (0.08 | ) | $ | (0.08 | ) | $ | (0.18 | ) | $ | (0.15 | ) | ||||

| Basic and diluted weighted average number of common shares outstanding | 268,083 | 217,178 | 254,727 | 213,075 | ||||||||||||

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands)

(unaudited)

For

the Three Months | For

the Six Months | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

| Net loss | $ | (20,641 | ) | $ | (17,864 | ) | $ | (45,011 | ) | $ | (31,674 | ) | ||||

| Other comprehensive income (loss): | ||||||||||||||||

| Net unrealized gains (losses) on investments available-for-sale | 4 | 27 | 47 | (1 | ) | |||||||||||

| Reclassification adjustment for gains included in net loss | ― | ― | ― | (615 | ) | |||||||||||

| Foreign currency translation adjustment | 1,042 | (1,410 | ) | (2,152 | ) | (1,543 | ) | |||||||||

| Other comprehensive income (loss) | 1,046 | (1,383 | ) | (2,105 | ) | (2,159 | ) | |||||||||

| Comprehensive loss | $ | (19,595 | ) | $ | (19,247 | ) | $ | (47,116 | ) | $ | (33,833 | ) | ||||

The accompanying notes are an integral part of these financial statements.

| 2 |

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

For

the Six Months | ||||||||

2015 | 2014 | |||||||

| Operating Activities: | ||||||||

| Net loss | $ | (45,011 | ) | $ | (31,674 | ) | ||

| Reconciliation of net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 2,795 | 1,956 | ||||||

| Amortization of net premiums on marketable securities | 593 | (80 | ) | |||||

| Deferred rent | (365 | ) | (45 | ) | ||||

| Non-cash stock-based compensation | 4,514 | 2,892 | ||||||

| Realized gains on marketable securities | ― | (615 | ) | |||||

| Other | 78 | 4 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Restricted cash | 297 | 1,214 | ||||||

| Accounts receivable – billed | 5,364 | (1,828 | ) | |||||

| Accounts receivable – unbilled | 602 | 149 | ||||||

| Prepaid expenses and other assets | (3,449 | ) | (1,823 | ) | ||||

| Accounts payable and accrued expenses | (8,339 | ) | (1,279 | ) | ||||

| Deferred revenue | 109 | (243 | ) | |||||

| Net cash used in operating activities | (42,812 | ) | (31,372 | ) | ||||

| Investing Activities: | ||||||||

| Capital expenditures | (9,240 | ) | (1,846 | ) | ||||

| Proceeds from disposal of property and equipment | ― | 12 | ||||||

| Proceeds from maturities of marketable securities | 63,350 | 13,440 | ||||||

| Purchases of marketable securities | (75,729 | ) | (104,686 | ) | ||||

| Net cash used in investing activities | (21,619 | ) | (93,080 | ) | ||||

| Financing Activities: | ||||||||

| Principal payments on capital leases | (33 | ) | (32 | ) | ||||

| Principal payments on notes payable | (315 | ) | (338 | ) | ||||

| Changes in restricted cash | ― | (1 | ) | |||||

| Cash paid with the Novavax AB acquisition | ― | (171 | ) | |||||

| Net proceeds from sales of common stock | 197,093 | 107,900 | ||||||

| Proceeds from the exercise of stock options and employee stock purchases | 2,815 | 1,510 | ||||||

| Net cash provided by financing activities | 199,560 | 108,868 | ||||||

| Effect of exchange rate on cash and cash equivalents | (80 | ) | (30 | ) | ||||

| Net increase (decrease) in cash and cash equivalents | 135,049 | (15,614 | ) | |||||

| Cash and cash equivalents at beginning of period | 32,335 | 119,471 | ||||||

| Cash and cash equivalents at end of period | $ | 167,384 | $ | 103,857 | ||||

| Supplemental disclosure of non-cash activities: | ||||||||

| Property and equipment purchases included in accounts payable and accrued expenses | $ | 2,165 | $ | 840 | ||||

| Sale of common stock under the Sales Agreement not settled at quarter-end | $ | 679 | $ | ― | ||||

Supplemental disclosure of cash flow information: | ||||||||

| Cash payments of interest | $ | 57 | $ | 100 | ||||

The accompanying notes are an integral part of these financial statements.

| 3 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2015

(unaudited)

Note 1 – Organization

Novavax, Inc. (“Novavax,” and together with its wholly owned subsidiary “Novavax AB,” the “Company”) is a clinical-stage vaccine company focused on the discovery, development and commercialization of recombinant nanoparticle vaccines and adjuvants. The Company’s product pipeline targets a variety of infectious diseases with vaccine candidates currently in clinical development for respiratory syncytial virus (“RSV”), seasonal influenza, pandemic influenza and Ebola virus (“EBOV”). The Company has additional preclinical stage programs in a variety of infectious diseases, including Middle East Respiratory Syndrome (“MERS”).

Note 2 – Operations

The Company’s vaccine candidates currently under development, some of which include adjuvants, will require significant additional research and development efforts that include extensive preclinical studies and clinical testing, and regulatory approval prior to commercial use.

As a clinical-stage vaccine company, the Company has primarily funded its operations from proceeds through the sale of its common stock in equity offerings and revenue under its contract with the Department of Health and Human Services, Biomedical Advanced Research and Development Authority (“HHS BARDA”) and, to a lesser degree, revenue under its prior contract with PATH Vaccine Solutions (“PATH”). Management regularly reviews the Company’s cash and cash equivalents and marketable securities relative to its operating budget and forecast to monitor the sufficiency of the Company’s working capital, and anticipates continuing to draw upon available sources of capital to support its product development activities.

Note 3 – Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X. The consolidated balance sheet as of June 30, 2015, the consolidated statements of operations and the consolidated statements of comprehensive loss for the three and six months ended June 30, 2015 and 2014 and the consolidated statements of cash flows for the six months ended June 30, 2015 and 2014 are unaudited, but include all adjustments (consisting of normal recurring adjustments) that the Company considers necessary for a fair presentation of the financial position, operating results, comprehensive loss and cash flows, respectively, for the periods presented. Although the Company believes that the disclosures in these consolidated financial statements are adequate to make the information presented not misleading, certain information and footnote information normally included in consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or omitted as permitted under the rules and regulations of the United States Securities and Exchange Commission (“SEC”).

The unaudited consolidated financial statements include the accounts of Novavax, Inc. and its wholly owned subsidiary, Novavax AB. All intercompany accounts and transactions have been eliminated in consolidation.

| 4 |

The accompanying consolidated financial statements are presented in U.S. dollars. The functional currency of Novavax AB, which is located in Sweden, is the local currency (Swedish Krona). The translation of assets and liabilities of Novavax AB to U.S. dollars is made at the exchange rate in effect at the consolidated balance sheet date, while equity accounts are translated at historical rates. The translation of the statement of operations data is made at the average exchange rate in effect for the period. The translation of operating cash flow data is made at the average exchange rate in effect for the period, and investing and financing cash flow data is translated at the exchange rate in effect at the date of the underlying transaction. Translation gains and losses are recognized as a component of accumulated other comprehensive loss in the accompanying consolidated balance sheets. The foreign currency translation adjustment balance included in accumulated other comprehensive loss was $8.7 million and $6.5 million at June 30, 2015 and December 31, 2014, respectively.

The accompanying unaudited consolidated financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014. Results for this or any interim period are not necessarily indicative of results for any future interim period or for the entire year. The Company operates in one business segment.

Use of Estimates

The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ materially from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents consist of highly liquid investments with maturities of three months or less from the date of purchase. Cash and cash equivalents consist of the following at (in thousands):

June 30, 2015 | December 31, 2014 | |||||||

| Cash | $ | 13,203 | $ | 4,481 | ||||

| Money market funds | 125,090 | 20,354 | ||||||

| Government-backed security | 28,000 | 7,500 | ||||||

| Asset-backed securities | 1,091 | ― | ||||||

| Cash and cash equivalents | $ | 167,384 | $ | 32,335 | ||||

Cash equivalents are recorded at cost plus accrued interest, which approximate fair value due to their short-term nature.

Fair Value Measurements

The Company applies Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements and Disclosures, for financial and non-financial assets and liabilities.

ASC 820 discusses valuation techniques, such as the market approach (comparable market prices), the income approach (present value of future income or cash flow) and the cost approach (cost to replace the service capacity of an asset or replacement cost). The statement utilizes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The following is a brief description of those three levels:

| · | Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| · | Level 2: Inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active. |

| · | Level 3: Unobservable inputs that reflect the reporting entity’s own assumptions. |

| 5 |

Marketable Securities

Marketable securities consist of commercial paper, asset-backed securities and corporate notes. Classification of marketable securities between current and non-current is dependent upon the maturity date at the balance sheet date taking into consideration the Company’s ability and intent to hold the investment to maturity.

Interest and dividend income is recorded when earned and included in investment income in the consolidated statements of operations. Premiums and discounts, if any, on marketable securities are amortized or accreted to maturity and included in investment income in the consolidated statements of operations. The specific identification method is used in computing realized gains and losses on the sale of the Company’s securities.

The Company classifies its marketable securities with readily determinable fair values as “available-for-sale.” Investments in securities that are classified as available-for-sale are measured at fair market value in the consolidated balance sheets, and unrealized holding gains and losses on marketable securities are reported as a separate component of stockholders’ equity until realized. Marketable securities are evaluated periodically to determine whether a decline in value is “other-than-temporary.” The term “other-than-temporary” is not intended to indicate a permanent decline in value. Rather, it means that the prospects for a near term recovery of value are not necessarily favorable, or that there is a lack of evidence to support fair values equal to, or greater than, the carrying value of the security. Management reviews criteria, such as the magnitude and duration of the decline, as well as the Company’s ability to hold the securities until market recovery, to predict whether the loss in value is other-than-temporary. If a decline in value is determined to be other-than-temporary, the value of the security is reduced and the impairment is recorded as other income, net in the consolidated statements of operations.

Restricted Cash

The Company’s current restricted cash at December 31, 2014 includes payments received under the prior PATH agreement (See Note 9) until such time as the Company has paid for the outside services performed under the agreement. In addition, the Company’s non-current restricted cash with respect to its manufacturing, laboratory and office space in Gaithersburg, Maryland functions as collateral for letters of credit, which serve as security deposits for the duration of the leases. At June 30, 2015 and December 31, 2014, non-current restricted cash is $0.8 million and is recorded as other non-current assets on the consolidated balance sheets.

Revenue Recognition

The Company performs research and development for U.S. Government agencies and other collaborators under cost reimbursable and fixed price contracts, including license and clinical development agreements. The Company recognizes revenue under research contracts when a contract has been executed, the contract price is fixed or determinable, delivery of services or products has occurred and collection of the contract price is reasonably assured. Payments received in advance of work performed are recorded as deferred revenue and losses on contracts, if any, are recognized in the period in which they become known.

Under cost reimbursable contracts, the Company is reimbursed and recognizes revenue as allowable costs are incurred plus a portion of the fixed-fee earned. The Company considers fixed-fees under cost reimbursable contracts to be earned in proportion to the allowable costs incurred in performance of the work as compared to total estimated contract costs, with such costs incurred representing a reasonable measurement of the proportional performance of the work completed. Under its HHS BARDA contract, certain activities must be pre-approved by HHS BARDA in order for their costs to be deemed allowable direct costs. Direct costs incurred under cost reimbursable contracts are recorded as cost of government contracts revenue. The Company’s HHS BARDA contract provides the U.S. government the ability to terminate the contract for convenience or to terminate for default if the Company fails to meet its obligations as set forth in the statement of work. The Company believes that if the government were to terminate the HHS BARDA contract for convenience, the costs incurred through the effective date of such termination and any settlement costs resulting from such termination would be allowable costs. Payments to the Company under cost reimbursable contracts with agencies of the U.S. Government, such as the HHS BARDA contract, are provisional payments subject to adjustment upon annual audit by the government. An audit of fiscal year 2013 has been initiated, but has not been completed as of the date of this filing. Management believes that revenue for periods not yet audited has been recorded in amounts that are expected to be realized upon final audit and settlement. When the final determination of the allowable costs for any year has been made, revenue and billings may be adjusted accordingly in the period that the adjustments are known and collection is probable.

| 6 |

The Company’s collaborative research and development agreements may include an upfront payment, payments for research and development services, milestone payments and royalties. Agreements with multiple deliverables are evaluated to determine if the deliverables can be divided into more than one unit of accounting. A deliverable can generally be considered a separate unit of accounting if both of the following criteria are met: (1) the delivered item(s) has value to the customer on a stand-alone basis; and (2) if the arrangement includes a general right of return relative to the delivered item(s), delivery or performance of the undelivered item(s) is considered probable and substantially in control of the Company. Deliverables that cannot be divided into separate units are combined and treated as one unit of accounting. Consideration received is allocated among the separate units of accounting based on the relative selling price method. Deliverables under these arrangements typically include rights to intellectual property, research and development services and involvement by the parties in steering committees. Historically, deliverables under the Company’s collaborative research and development agreements have been deemed to have no stand-alone value and as a result have been treated as a single unit of accounting. In addition, the Company analyzes its contracts and collaborative agreements to determine whether the payments received should be recorded as revenue or as a reduction to research and development expenses. In reaching this determination, management considers a number of factors, including whether the Company is principal under the arrangement, and whether the arrangement is significant to, and part of, the Company’s core operations. Historically, payments received under its contracts and collaborative agreements have been recognized as revenue since the Company acts as a principal in the arrangement and the activities are core to its operations.

When the performance under a fixed price contract can be reasonably estimated, revenue for fixed price contracts is recognized under the proportional performance method and earned in proportion to the contract costs incurred in performance of the work as compared to total estimated contract costs. Costs incurred under fixed price contracts represent a reasonable measurement of proportional performance of the work. Direct costs incurred under collaborative research and development agreements are recorded as research and development expenses. If the performance under a fixed price contract cannot be reasonably estimated, the Company recognizes the revenue on a straight-line basis over the contract term.

Revenue associated with upfront payments under arrangements is recognized over the contract term or when all obligations associated with the upfront payment have been satisfied.

Revenue from the achievement of research and development milestones, if deemed substantive, is recognized as revenue when the milestones are achieved and the milestone payments are due and collectible. If not deemed substantive, the Company would recognize such milestone as revenue upon its achievement on a straight-line basis over the remaining expected term of the research and development period. Milestones are considered substantive if all of the following conditions are met: (1) the milestone is non-refundable; (2) there is substantive uncertainty of achievement of the milestone at the inception of the arrangement; (3) substantive effort is involved to achieve the milestone and such achievement relates to past performance; and (4) the amount of the milestone appears reasonable in relation to the effort expended and all of the deliverables and payment terms in the arrangement.

Net Loss per Share

Net loss per share is computed using the weighted average number of shares of common stock outstanding. All outstanding stock options and unvested restricted stock awards totaling 23,248,254 and 16,514,230 at June 30, 2015 and 2014, respectively, are excluded from the computation, as their effect is antidilutive.

| 7 |

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”), which supersedes nearly all existing revenue recognition guidance under Topic 605, Revenue Recognition. The new standard requires a company to recognize revenue when it transfers goods and services to customers in an amount that reflects the consideration that the company expects to receive for those goods or services. ASU 2014-09 defines a five-step process that includes identifying the contract with the customer, identifying the performance obligations in the contract, determining the transaction price, allocating the transaction price to the performance obligations in the contract and recognizing revenue when (or as) the entity satisfies the performance obligations. In July 2015, the FASB approved a one-year deferral of the effective date of the new standard to 2018 for public companies, with an option that would permit companies to adopt the new standard as early as the original effective date of 2017. Early adoption prior to the original effective date is not permitted. The Company is evaluating the potential impact that ASU 2014-09 will have on its consolidated financial position and results of operations.

Note 4 – Fair Value Measurements

The following table represents the Company’s fair value hierarchy for its financial assets and liabilities measured at fair value on a recurring basis (in thousands):

| Fair Value at June 30, 2015 | Fair Value at December 31, 2014 | |||||||||||||||||||||||

| Assets | Level 1 | Level 2 | Level 3 | Level 1 | Level 2 | Level 3 | ||||||||||||||||||

| Money market funds | $ | 125,090 | $ | ― | $ | — | $ | 20,354 | $ | ― | $ | — | ||||||||||||

| Government-backed security | — | 28,000 | — | ― | 7,500 | — | ||||||||||||||||||

| Asset-backed securities | — | 49,466 | — | — | 46,624 | — | ||||||||||||||||||

| Corporate debt securities | — | 99,179 | — | — | 89,097 | — | ||||||||||||||||||

| Total cash equivalents and marketable securities | $ | 125,090 | $ | 176,645 | $ | — | $ | 20,354 | $ | 143,221 | $ | — | ||||||||||||

During the six months ended June 30, 2015, the Company did not have any transfers between levels.

The amounts in the Company’s consolidated balance sheet for accounts receivable – billed, accounts receivable – unbilled and accounts payable approximate fair value due to their short-term nature. Based on borrowing rates available to the Company, the fair value of capital lease and notes payable approximates their carrying value.

| 8 |

Note 5 – Marketable Securities

Marketable securities classified as available-for-sale as of June 30, 2015 and December 31, 2014 were comprised of (in thousands):

| June 30, 2015 | December 31, 2014 | |||||||||||||||||||||||||||||||

| Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | |||||||||||||||||||||||||

| Asset-backed securities | $ | 48,381 | $ | 1 | $ | (7 | ) | $ | 48,375 | $ | 46,660 | $ | — | $ | (36 | ) | $ | 46,624 | ||||||||||||||

| Corporate debt securities | 99,189 | 17 | (27 | ) | 99,179 | 89,126 | 8 | (37 | ) | 89,097 | ||||||||||||||||||||||

| Total | $ | 147,570 | $ | 18 | $ | (34 | ) | $ | 147,554 | $ | 135,786 | $ | 8 | $ | (73 | ) | $ | 135,721 | ||||||||||||||

Marketable Securities – Unrealized Losses

The Company owned 47 available-for-sale securities as of June 30, 2015. Of these 47 securities, 33 had combined unrealized losses of less than $0.1 million as of June 30, 2015. The Company did not have any investments in a loss position for greater than 12 months as of June 30, 2015. The Company has evaluated its marketable securities and has determined that none of these investments has an other-than-temporary impairment, as it has no intent to sell securities with unrealized losses and it is not more likely than not that the Company will be required to sell any securities with unrealized losses, given the Company’s current and anticipated financial position.

Note 6 – Goodwill and Other Intangible Assets

Goodwill

The change in the carrying amounts of goodwill for the six months ended June 30, 2015 was as follows (in thousands):

| Amount | ||||

| Balance at December 31, 2014 | $ | 54,612 | ||

| Currency translation adjustments | (1,305 | ) | ||

| Balance at June 30, 2015 | $ | 53,307 | ||

Identifiable Intangible Assets

Purchased intangible assets consisted of the following as of June 30, 2015 and December 31, 2014 (in thousands):

| June 30, 2015 | December 31, 2014 | |||||||||||||||||||||||

| Gross Carrying Amount | Accumulated Amortization | Intangible Assets, Net | Gross Carrying Amount | Accumulated Amortization | Intangible Assets, Net | |||||||||||||||||||

| Finite-lived intangible assets: | ||||||||||||||||||||||||

| Proprietary adjuvant technology | $ | 8,969 | $ | (860 | ) | $ | 8,109 | $ | 9,565 | $ | (678 | ) | $ | 8,887 | ||||||||||

| Collaboration agreements | 4,049 | (798 | ) | 3,251 | 4,319 | (629 | ) | 3,690 | ||||||||||||||||

| Total identifiable intangible assets | $ | 13,018 | $ | (1,658 | ) | $ | 11,360 | $ | 13,884 | $ | (1,307 | ) | $ | 12,577 | ||||||||||

| 9 |

Amortization expense for the six months ended June 30, 2015 and 2014 was $0.4 million and $0.6 million, respectively.

Estimated amortization expense for existing intangible assets for the remainder of 2015 and for each of the five succeeding years ending December 31 will be as follows (in thousands):

| Year | Amount | |||

| 2015 (remainder) | $ | 433 | ||

| 2016 | 865 | |||

| 2017 | 865 | |||

| 2018 | 865 | |||

| 2019 | 865 | |||

| 2020 | 865 | |||

Note 7 – Stockholders’ Equity

On June 18, 2015, the Company’s stockholders of record as of April 20, 2015 approved the amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Charter Amendment”) to increase the total number of shares of common stock that the Company is authorized to issue from 300,000,000 shares to 600,000,000 shares.

In March 2015, the Company completed a public offering of 27,758,620 shares of its common stock, including 3,620,689 shares of common stock that were issued upon the exercise in full of the option to purchase additional shares granted to the underwriters, at a price of $7.25 per share resulting in proceeds, net of offering costs of $11.6 million, of approximately $190 million.

In 2012, the Company entered into an At Market Issuance Sales Agreement (“Sales Agreement”), under which the Board of Directors of the Company (the “Board”) approved the Company’s sale of up to an aggregate of $50 million in gross proceeds of its common stock. These shares of common stock were offered pursuant to a shelf registration statement filed with the SEC in March 2013, which replaced the previous shelf registration statement filed in 2010. The Board’s standing Finance Committee (the “Committee”) assisted with its responsibilities to monitor, provide advice to the Company’s senior management and approve all capital raising activities. In doing so, the Committee set the amount of shares to be sold, the period of time during which such sales may occur and the minimum sales price per share. During the six months ended June 30, 2015, the Company sold 0.8 million shares at an average sales price of $10.01 per share, resulting in approximately $8 million in net proceeds, of which $0.7 million was received in July 2015 upon settlement. In July 2015, the Company sold the remaining $6.6 million of common stock (0.6 million shares at an average sales price of $11.53 per share) under the Sales Agreement. The Sales Agreement has thus been fully utilized.

Note 8 – Stock-Based Compensation

Stock Options

The Amended and Restated 2005 Stock Incentive Plan (“2005 Plan”) expired in February 2015 and no new awards may be made under such plan, although outstanding awards will continue in accordance with their terms. The Board adopted the 2015 Stock Incentive Plan (“2015 Plan”) in March 2015 and, consistent with historical practice, granted annual and new equity awards prior to the Company’s annual meeting of stockholders in June 2015 under the 2015 Plan; however, these awards were contingent upon stockholder approval of both the 2015 Plan and the Company’s Charter Amendment (See Note 7), both of which were approved at the Company’s annual meeting of stockholders in June 2015. Under the 2015 Plan, equity awards may be granted to officers, directors, employees and consultants of and advisors to the Company and any present or future subsidiary. The 2015 Plan authorizes the issuance of up to 25,000,000 shares of common stock under equity awards granted under the plan. All such shares authorized for issuance under the 2015 Plan have been reserved. The 2015 Plan will expire on March 4, 2025.

| 10 |

The 2015 Plan permits and the 2005 Plan permitted the grant of stock options (including incentive stock options), restricted stock, stock appreciation rights, and restricted stock units. In addition, under the 2015 Plan, unrestricted stock, stock units and performance awards may be granted. Stock options and stock appreciation rights generally have a maximum term of 10 years and may be or were granted with an exercise price that is no less than 100% of the fair market value of the Company’s common stock at the time of grant. Grants of stock options are generally subject to vesting over periods ranging from six months to four years.

Stock Options Awards

The following is a summary of option activity under the 2015 Plan, 2005 Plan and the 1995 Stock Option Plan (“1995 Plan”) for the six months ended June 30, 2015:

| 2015 Plan | 2005 Plan | 1995 Plan | ||||||||||||||||||||||

Stock Options | Weighted- Average Exercise Price | Stock Options | Weighted- Average Exercise Price | Stock Options | Weighted- Average Price | |||||||||||||||||||

| Outstanding at January 1, 2015 | — | $ | — | 16,928,098 | $ | 3.24 | 35,000 | $ | 2.21 | |||||||||||||||

| Granted | 7,369,441 | $ | 8.97 | 22,500 | $ | 6.70 | — | $ | — | |||||||||||||||

| Exercised | — | $ | — | (877,910 | ) | $ | 2.24 | (35,000 | ) | $ | 2.21 | |||||||||||||

| Canceled | (55,500 | ) | $ | 8.94 | (153,375 | ) | $ | 3.92 | — | $ | — | |||||||||||||

| Outstanding at June 30, 2015 | 7,313,941 | $ | 8.97 | 15,919,313 | $ | 3.29 | — | $ | — | |||||||||||||||

| Shares exercisable at June 30, 2015 | — | $ | — | 8,320,563 | $ | 2.51 | — | $ | — | |||||||||||||||

| Shares available for grant at June 30, 2015 | 17,686,059 | |||||||||||||||||||||||

As discussed in the “Stock Options” section above, prior to the Company’s annual meeting of stockholders in June 2015, the Company granted 7,014,441 stock options with a weighted-average exercise price of $8.94 under the 2015 Plan. Since the 2015 Plan and the Charter Amendment were approved at the Company’s annual meeting of stockholders in June 2015, the Company began to record stock-based compensation expense for these awards at that time.

The fair value of stock options granted under the 2015 Plan and 2005 Plan was estimated at the date of grant or the date upon which the 2015 Plan was approved by the Company’s stockholders for stock options granted prior to that time using the Black-Scholes option-pricing model with the following assumptions:

Three Months Ended June 30, | Six Months Ended June 30, | |||||||

| 2015 | 2014 | 2015 | 2014 | |||||

| Weighted-average Black- Scholes fair value of stock options granted | $4.42 | $1.92 | $4.42 | $2.48 | ||||

| Risk-free interest rate | 1.37%-2.13% | 1.33%-1.39% | 1.19%-2.13% | 1.24%-2.22% | ||||

| Dividend yield | 0% | 0% | 0% | 0% | ||||

| Volatility | 54.18%-68.39% | 52.87%-53.81% | 53.58%-68.39% | 52.47%-67.93% | ||||

| Expected term (in years) | 3.98-7.34 | 4.10-4.26 | 3.98-7.34 | 4.04-6.96 | ||||

| Expected forfeiture rate | 0%-16.33% | 0%-23.15% | 0%-16.33% | 0%-23.15% | ||||

The total aggregate intrinsic value and weighted-average remaining contractual term of stock options outstanding under the 2015 Plan and 2005 Plan as of June 30, 2015 was approximately $140.8 million and 8.1 years, respectively. The total aggregate intrinsic value and weighted-average remaining contractual term of stock options exercisable under the 2015 Plan and 2005 Plan as of June 30, 2015 was approximately $71.8 million and 6.6 years, respectively. The aggregate intrinsic value represents the total intrinsic value (the difference between the Company’s closing stock price on the last trading day of the period and the exercise price, multiplied by the number of in-the-money options) that would have been received by the option holders had all option holders exercised their options on June 30, 2015. This amount is subject to change based on changes to the closing price of the Company’s common stock. The aggregate intrinsic value of options exercised for the six months ended June 30, 2015 and 2014 was $6.0 million and $1.7 million, respectively.

| 11 |

Employee Stock Purchase Plan

In April 2013, the Company adopted an Employee Stock Purchase Plan (the “ESPP”), which authorized an aggregate of 2,000,000 shares of common stock to be purchased, which will increase 5% on each anniversary of its adoption up to a maximum of 3,000,000 shares. The ESPP allows employees to purchase shares of common stock of the Company at each purchase date through payroll deductions of up to a maximum of 15% of their compensation, at 85% of the lesser of the market price of the shares at the time of purchase or the market price on the beginning date of an option period (or, if later, the date during the option period when the employee was first eligible to participate). At June 30, 2015, there were 1,413,388 shares available for issuance under the ESPP.

The ESPP is considered compensatory for financial reporting purposes. As such, the fair value of ESPP shares was estimated at the date of grant using the Black-Scholes option-pricing model with the following assumptions:

Three Months Ended June 30, | Six Months Ended June 30, | |||||||

| 2015 | 2014 | 2015 | 2014 | |||||

| Range of Black-Scholes fair value of ESPP shares granted | $1.20-$2.24 | $0.97-$1.79 | $1.06-$2.24 | $0.97-$1.79 | ||||

| Risk-free interest rate | 0.07%-0.35% | 0.11%-0.14% | 0.05%-0.35% | 0.11%-0.14% | ||||

| Dividend yield | 0% | 0% | 0% | 0% | ||||

| Volatility | 40.79%-64.24% | 53.80%-67.57% | 40.79%-64.24% | 53.80%-67.57% | ||||

| Expected term (in years) | 0.5-2.0 | 0.5-1.0 | 0.5-2.0 | 0.5-1.0 | ||||

| Expected forfeiture rate | 5% | 5% | 5% | 5% | ||||

Restricted Stock Awards

The following is a summary of restricted stock awards activity for the six months ended June 30, 2015:

| Number of Shares | Per Share Weighted- Average Grant-Date Fair Value | |||||||

| Outstanding and Unvested at January 1, 2015 | 15,000 | $ | 4.48 | |||||

| Restricted stock granted | — | $ | — | |||||

| Restricted stock vested | — | $ | — | |||||

| Restricted stock forfeited | — | $ | — | |||||

| Outstanding and Unvested at June 30, 2015 | 15,000 | $ | 4.48 | |||||

The Company recorded all stock-based compensation expense in the consolidated statements of operations as follows (in thousands):

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Research and development | $ | 1,090 | $ | 651 | $ | 2,122 | $ | 1,175 | ||||||||

| General and administrative | 1,490 | 1,201 | 2,392 | 1,717 | ||||||||||||

| Total stock-based compensation expense | $ | 2,580 | $ | 1,852 | $ | 4,514 | $ | 2,892 | ||||||||

| 12 |

As of June 30, 2015, there was approximately $35.2 million of total unrecognized compensation expense (net of estimated forfeitures) related to unvested stock options, ESPP and restricted stock awards. This unrecognized non-cash compensation expense is expected to be recognized over a weighted-average period of 1.6 years, and will be allocated between research and development and general and administrative expenses accordingly. This estimate does not include the impact of other possible stock-based awards that may be made during future periods.

Note 9 – U.S. Government Agreement, Joint Venture and Collaborations

HHS BARDA Contract for Recombinant Influenza Vaccines

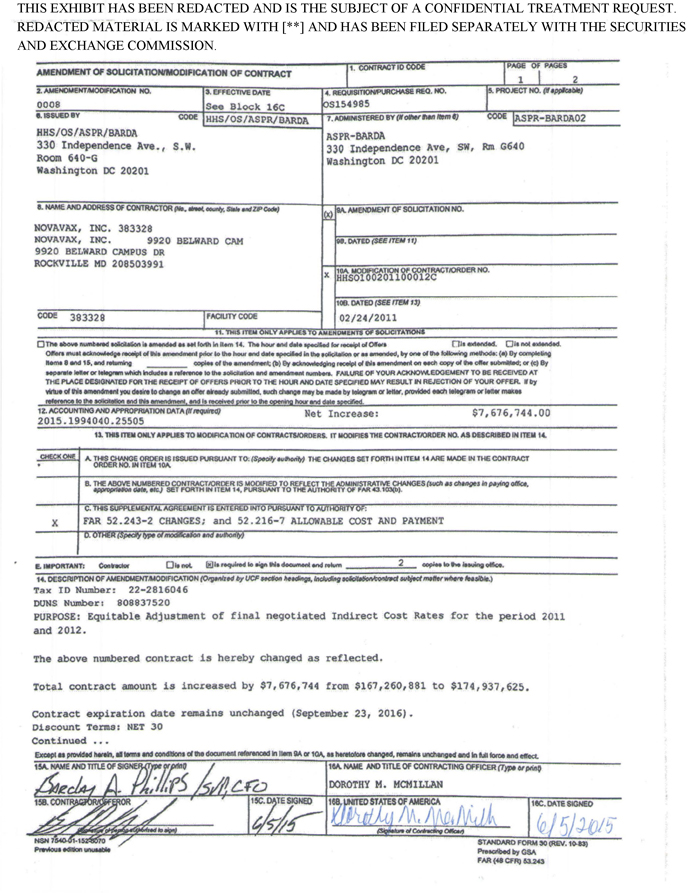

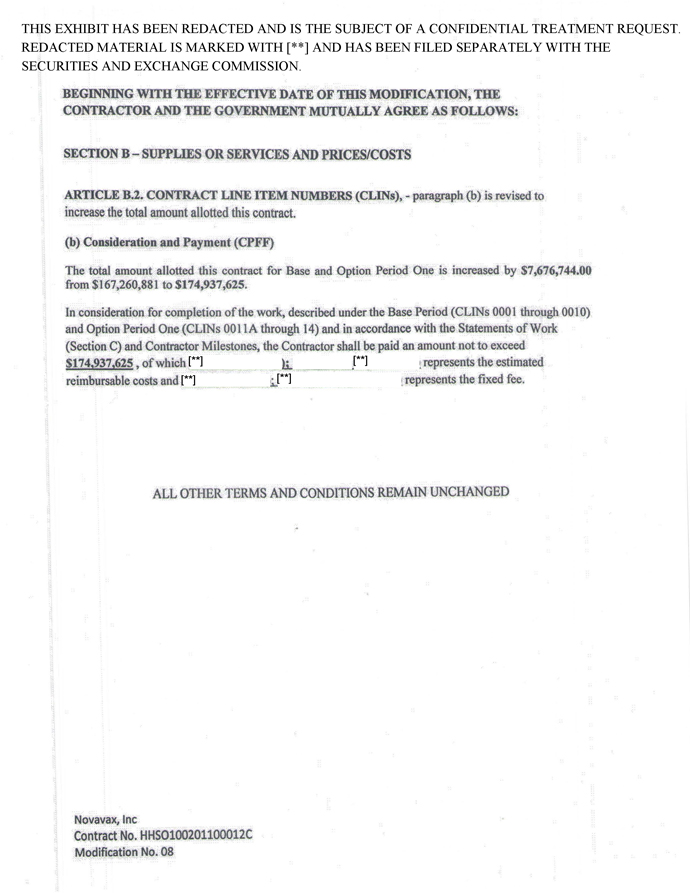

HHS BARDA initially awarded the Company a contract in 2011, which funds the development of both the Company’s seasonal and pandemic influenza VLP vaccine candidates. The contract with HHS BARDA is a cost-plus-fixed-fee contract, which reimburses the Company for allowable direct contract costs incurred plus allowable indirect costs and a fixed-fee earned in the ongoing clinical development and product scale-up of its multivalent seasonal and monovalent pandemic H7N9 influenza VLP vaccine candidates. In September 2014, HHS BARDA exercised and initiated a two-year option to the contract, which included scope to support development activities leading up to planned Phase 3 clinical studies, added $70 million of funding on top of the remainder of the $97 million base period funding, and extended the contract until September 2016. In June 2015, the contract was amended to increase the funding by $7.7 million to allow for the recovery of additional costs under the contract relating to the settlement of indirect rates for fiscal years 2011 and 2012. This additional amount was received and recorded as revenue in the three months ended June 30, 2015. During the three and six months ended June 30, 2015, the Company recognized revenue of $13.7 million and $23.0 million, respectively, and has recognized approximately $101 million in revenue since the inception of the contract. Billings under the contract are based on approved provisional indirect billing rates, which permit recovery of fringe benefits, overhead and general and administrative expenses. These indirect rates are subject to audit by HHS BARDA on an annual basis. An audit of fiscal year 2013 has been initiated, but has not been completed as of the date of this filing. Management believes that revenue for periods not yet audited has been recorded in amounts that are expected to be realized upon final audit and settlement. When the final determination of the allowable costs for any year has been made, revenue and billings may be adjusted accordingly in the period that the adjustments are known and collection is probable.

In 2012, HHS BARDA withheld payment on the outside costs of the Company’s Phase 2 clinical trial of its seasonal quadrivalent influenza VLP vaccine candidate in Australia (“205 Trial”). Such outside costs were recorded as expenses in the period incurred as a cost of government contracts revenue and the Company did not record revenue relating to such outside costs prior to the first quarter of 2015 because collection of the amount was not reasonably assured. In late 2014, the U.S. Food and Drug Administration, Center for Biologics Evaluation and Research (“FDA”) accepted the data from the 205 Trial as part of the Company’s investigational new drug (“IND”) application for its seasonal quadrivalent influenza VLP vaccine candidate. In the first quarter of 2015, HHS BARDA approved the reimbursement of the 205 Trial costs, and the Company recorded revenue of $3.1 million as collection of the amount became reasonably assured during the period. The Company also collected this amount in 2015.

CPLB Joint Venture

In 2009, the Company formed a joint venture with Cadila Pharmaceuticals Limited (“Cadila”) named CPL Biologicals Private Limited (“CPLB”) to develop and manufacture vaccines, biological therapeutics and diagnostics in India. CPLB is owned 20% by the Company and 80% by Cadila. The Company accounts for its investment in CPLB using the equity method. Because CPLB’s activities and operations are controlled and funded by Cadila, the Company accounts for its investment using the equity method. Since the carrying value of the Company’s initial investment was nominal and there is no guarantee or commitment to provide future funding, the Company has not recorded nor expects to record losses related to this investment in the foreseeable future.

| 13 |

LG Life Sciences, Ltd. (“LGLS”) License Agreement

In 2011, the Company entered into a license agreement with LGLS that allows LGLS to use the Company’s technology to develop and commercially sell influenza vaccines exclusively in South Korea and non-exclusively in certain other specified countries. At its own cost, LGLS is responsible for funding both its clinical development of the influenza VLP vaccines and a manufacturing facility to produce such vaccines in South Korea. Under the license agreement, the Company is obligated to provide LGLS with information and materials related to the manufacture of the licensed products, provide on-going project management and regulatory support and conduct clinical trials of its influenza vaccines in order to obtain FDA approval in the U.S. The term of the license agreement is expected to terminate in 2027. Payments to the Company under the license agreement include an upfront payment of $2.5 million, reimbursements of certain development and product costs, payments related to the achievement of certain milestones and royalty payments in the high single digits from LGLS’s future commercial sales of influenza VLP vaccines. The upfront payment has been deferred and recorded in deferred revenue in the consolidated balance sheets and will be recognized when the previously mentioned obligations in the agreement are satisfied, which may not occur until the end of the term of the agreement. Payments for milestones under the agreement will be recognized on a straight-line basis over the remaining term of the research and development period upon achievement of such milestone. Any royalties under the agreement will be recognized as earned.

PATH Vaccine Solutions (“PATH”) Clinical Development Agreement

In 2012, the Company entered into a clinical development agreement with PATH to develop its RSV F vaccine candidate (“RSV F Vaccine”) for maternal immunization in certain low-resource countries. The Company was awarded approximately $2.0 million by PATH for initial funding under the agreement to partially support its Phase 2 dose-ranging clinical trial in women of childbearing age. In October 2013, the funding under this agreement was increased by $0.4 million to support reproductive toxicology studies, which was necessary before the Company began conducting clinical trials in pregnant women. In December 2013, the Company entered into an amendment with PATH providing an additional $3.5 million in funding to support the Phase 2 dose-confirmation clinical trial in women of childbearing age. In October 2014, the Company entered into an amendment with PATH providing an additional $1.0 million towards the development of a strategy for conducting the planned Phase 3 clinical trials of the Company’s RSV maternal immunization program. The term of the PATH agreement expired in April 2015 and the Company retains global rights to commercialize the RSV product. The Company has submitted a funding proposal to the Bill & Melinda Gates Foundation (“BMGF”) for support of the Company’s continuing development of an affordable and accessible RSV vaccine for maternal immunization programs in low resource countries. The Company and BMGF are currently in ongoing discussions about such an arrangement, but there can be no assurances that it will be completed. The Company recognized revenue of $0.1 million and $0.5 million in the three and six ended June 30, 2015, and has recognized $6.8 million in revenue since the inception of the agreement. Revenue under this arrangement is being recognized under the proportional performance method and earned in proportion to the contract costs incurred in performance of the work as compared to total estimated contract costs. Costs incurred under this agreement represent a reasonable measurement of proportional performance of the services being performed.

Note 10 – Master Services Agreement with Cadila

The Company and Cadila entered into a master services agreement pursuant to which the Company may request services from Cadila in the areas of biologics research, preclinical development, clinical development, process development, manufacturing scale-up and general manufacturing related services in India. In July 2011, and subsequently in March 2013, March 2014 and February 2015, the master services agreement was amended to extend the term by one year for which services can be provided by Cadila under this agreement. Under the revised terms, if, by March 31, 2016, the amount of services provided by Cadila is less than $7.5 million, the Company will pay Cadila the portion of the shortfall amount that is less than or equal to $2.0 million. Through June 30, 2015, the Company has purchased $6.7 million in services from Cadila pursuant to this agreement, which includes services provided, since the beginning of 2013, by CPLB to the Company on behalf of Cadila pursuant to an October 2013 amendment authorizing such CPLB services. During the six months ended June 30, 2015, the Company purchased $1.0 million in services from Cadila pursuant to this agreement, all of which were provided by CPLB on behalf of Cadila. As of June 30, 2015, the Company’s remaining obligation to Cadila under the master services agreement is $0.8 million. The Company has recognized as expense the entire amount of purchases to date related to CPLB as the Company has not recorded any equity income (loss) of CPLB (see Note 9).

| 14 |

Note 11 – License agreement with Wyeth Holding Corporation

In 2007, the Company entered into an agreement to license certain rights from Wyeth Holding Corporation, a subsidiary of Pfizer Inc. (“Wyeth”). The Wyeth license is a non-exclusive, worldwide license to a family of patents and patent applications covering VLP technology for use in human vaccines in certain fields, with expected patent expiration in early 2022. The Wyeth license provides for the Company to make an upfront payment (previously made), ongoing annual license fees, sublicense payments, milestone payments on certain development activities and royalties on any product sales. The milestone payments are one-time only payments applicable to each related vaccine program. At present, the Company’s seasonal influenza VLP vaccine program (including CPLB’s seasonal influenza program) and its pandemic influenza VLP vaccine program are the only two programs to which the Wyeth license applies. The license may be terminated by Wyeth only for cause and may be terminated by the Company only after it has provided ninety (90) days’ notice that the Company has absolutely and finally ceased activity, including through any affiliate or sublicense, related to the manufacturing, development, marketing or sale of products covered by the license. Payments under the agreement to Wyeth as of June 30, 2015 aggregated $6.4 million. The Company is currently in discussions with Wyeth to potentially amend the agreement and restructure the milestone payment owed as a result of CPLB’s initiation of a Phase 3 clinical trial for its seasonal influenza VLP vaccine candidate in the third quarter of 2014. Such milestone payment is only owed once for the Company’s seasonal influenza VLP vaccine program and it would not be required to make another payment if it or any of its affiliates initiate an additional Phase 3 clinical trial in a seasonal influenza VLP vaccine candidate. The $3.0 million milestone continues to be accrued for on the consolidated balance sheet at June 30, 2015 and was recorded as a research and development expense in the third quarter of 2014.

15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Any statements in the discussion below and elsewhere in this Quarterly Report, about expectations, beliefs, plans, objectives, assumptions or future events or performance of Novavax, Inc. (Novavax, and together with its wholly owned subsidiary Novavax AB, the “Company,” “we” or “us”) are not historical facts and are forward-looking statements. Such forward-looking statements include, without limitation, statements with respect to our capabilities, goals, expectations regarding future revenue and expense levels; potential market sizes and demand for our product candidates; the efficacy, safety and intended utilization of our product candidates; the development of our clinical-stage product candidates and our recombinant vaccine and adjuvant technologies; the development of our preclinical product candidates; the conduct, timing and potential results from clinical trials and other preclinical studies; plans for and potential timing of regulatory filings; the expected timing and content of regulatory actions; reimbursement by Department of Health and Human Services, Biomedical Advanced Research and Development Authority (HHS BARDA); the potential modification to our license agreement with Wyeth; our available cash resources and the availability of financing generally, plans regarding partnering activities, business development initiatives and the adoption of stock incentive plans, and other factors referenced herein. You generally can identify these forward-looking statements by the use of words or phrases such as “believe,” “may,” “could,” “will,” “would,” “possible,” “can,” “estimate,” “continue,” “ongoing,” “consider,” “anticipate,” “intend,” “seek,” “plan,” “project,” “expect,” “should,” “would,” or “assume” or the negative of these terms, or other comparable terminology, although not all forward-looking statements contain these words.

Accordingly, these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed or implied in them. Any or all of our forward-looking statements in this Quarterly Report may turn out to be inaccurate or materially different than actual results.

Because the risk factors discussed in this Quarterly Report and identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, and other risk factors of which we are not aware, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by or on behalf of us, you should not place undue reliance on any such forward-looking statements. These statements are subject to risks and uncertainties, known and unknown, which could cause actual results and developments to differ materially from those expressed or implied in such statements. We have included important factors in the cautionary statements included in this Quarterly Report, particularly those identified in Part II, Item 1A “Risk Factors,” and in Part I, Item 1A “Risk Factors” of our Annual Report on Form 10-K, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. These and other risks may also be detailed and modified or updated in our reports and other documents filed with the Securities and Exchange Commission (“SEC”) from time to time. You are encouraged to read these filings as they are made.

Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee future results, events, levels of activity, performance or achievement. Further, any forward-looking statements speak only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

16

Overview

We are a clinical-stage vaccine company focused on the discovery, development and commercialization of recombinant nanoparticle vaccines and adjuvants. Using innovative proprietary recombinant nanoparticle vaccine technology, we produce vaccine candidates to efficiently and effectively respond to both known and newly emerging diseases. Our vaccine candidates are genetically engineered three-dimensional nanostructures that incorporate immunologically important proteins. Our product pipeline targets a variety of infectious diseases with vaccine candidates currently in clinical development for respiratory syncytial virus (“RSV”), seasonal influenza, pandemic influenza and Ebola virus (“EBOV”). We have additional preclinical stage programs in a variety of infectious diseases, including Middle East Respiratory Syndrome (“MERS”). Further, CPL Biologics Private Limited (“CPLB”), our joint venture company with Cadila Pharmaceuticals Limited (“Cadila”) in India, is actively developing a number of vaccine candidates that were genetically engineered by us, including its seasonal VLP influenza vaccine candidate that completed its Phase 3 clinical trial in India in 2014, and its rabies vaccine that completed its Phase 1/2 clinical trial in India in 2014. CPLB is owned 20% by us and 80% by Cadila. CPLB operates a manufacturing facility in India for the production of vaccines.

We are also developing proprietary technology for the production of immune stimulating saponin-based adjuvants, through our Swedish wholly owned subsidiary, Novavax AB. Our Matrix™ adjuvant technology utilizes selected quillaja fractions, which form separate matrix structures, to develop multi-purpose immune-modulating adjuvant products for a broad range of potential vaccine applications. Our lead adjuvant for human applications, Matrix-M™, has been successfully tested in a Phase 1/2 clinical trial for our pandemic H7N9 influenza VLP vaccine candidate, conducted under our contract with HHS BARDA, and we are currently testing Matrix-M in conjunction with our EBOV vaccine candidate in a Phase 1 clinical trial. Genocea Biosciences, Inc. (“Genocea”) has licensed rights to our Matrix technology and is developing its herpes simplex 2 vaccine candidate using Matrix-M.

Clinical Product Pipeline

A current summary of our significant research and development programs, along with the programs of our joint venture, CPLB, and status of the related products in development follows:

| Program | Development Stage | Funding Collaborator | ||

| Respiratory Syncytial Virus (RSV) | ||||

| ·Elderly | Phase 2 | |||

| ·Maternal Immunization | Phase 2 | PATH* | ||

| ·Pediatric | Phase 1 | |||

| Influenza | ||||

| ·Seasonal Quadrivalent | Phase 2 | HHS BARDA | ||

| ·Pandemic H7N9 | Phase 2 | HHS BARDA | ||

| Other | ||||

| ·Ebola Virus (EBOV) | Phase 1 | |||

| ·Combination (Influenza/RSV) | Preclinical | |||

| CPLB Programs (India) | ||||

| ·Seasonal Influenza | Phase 3 | |||

| ·Rabies | Phase 1/2 |

*As detailed below, our funding and development arrangement with PATH expired in April 2015.

17

Respiratory Syncytial Virus (RSV)

RSV is a major respiratory pathogen with a significant burden of disease in the very young and in the elderly. In healthy adults, RSV infections are generally mild to moderate in severity, but are typically more severe in infants and young children, as well as adults over the age of 60.1 Globally, RSV is a common cause of childhood respiratory infection, with a disease burden of 64 million cases and approximately 160,000 deaths annually.2 Severe RSV disease results in 3.4 million hospital admissions per year globally3 and disproportionately affects infants below six months of age. In infants, toddlers and young pre-school and school-age children, RSV infections result in the need for frequent medical care, including emergency room and office visits and are associated with increased recurrent wheezing that can persist for years. In the U.S., nearly all children become infected with RSV before they are two years of age, and it has been associated with 20% of hospitalizations and 15% of office visits for acute respiratory infection in young children.4 It is also estimated that between 11,000 and 17,000 elderly and high risk adults die of RSV infection or its complications annually in the U.S., and up to 180,000 are hospitalized for serious respiratory symptoms.5 Currently, there is no approved RSV vaccine available for any of these populations, so an RSV vaccine has the potential to protect millions of persons from this far-reaching unmet medical need.

We are developing our respiratory syncytial virus fusion (F) protein nanoparticle vaccine candidate (“RSV F Vaccine”) for the benefit of three susceptible target populations: the elderly, infants (receiving protection through antibodies transferred from their mothers who would be immunized during the last trimester of pregnancy) and pediatrics.

RSV Elderly Program

In August 2015, we announced positive top-line data from a Phase 2 clinical trial of our RSV F Vaccine in older adults (>60 years of age). The clinical trial demonstrated statistically significant vaccine efficacy in the prevention of symptomatic RSV disease in older adults, the first vaccine to demonstrate efficacy against RSV disease in any population. The clinical trial detected an attack rate of 4.9% for symptomatic RSV disease in 1,600 older adults. Similar to our findings in prior clinical trials, there were greater than four-fold increases in both anti-F IgG and palivizumab-competing antibody (PCA) concentrations with serological responses in over 95% of vaccinated subjects. We anticipate that the next steps in the development of the RSV F Vaccine for an older adult indication will include discussions with regulatory authorities and the initiation of a pivotal Phase 3 clinical trial, which could start as early as the fourth quarter of 2015.

RSV Maternal Immunization Program

In September 2014, we initiated a Phase 2 clinical trial of our RSV F Vaccine in fifty (50) healthy women in their third trimester of pregnancy. This trial is designed to evaluate the safety and immunogenicity of our RSV F Vaccine in pregnant women and assesses the impact of maternal immunization on RSV-specific antibody levels through the baby’s first six months of life and infant safety through the first year of life. The preliminary data from this trial are expected in the third quarter of 2015, and will inform the next steps in the development of our RSV maternal program. In November 2014, we announced that the U.S. Food and Drug Administration, Center for Biologics Evaluation and Research (“FDA”) had granted Fast Track Designation to our RSV F Vaccine for protection of infants via maternal immunization. The Fast Track designation, established by the FDA Modernization Act of 1997, is intended for products that treat serious or life-threatening diseases or conditions, and that demonstrate the potential to address unmet medical needs for such diseases or conditions. The program is intended to facilitate development and expedite review of drugs to treat serious and life-threatening conditions so that an approved product can reach the market expeditiously. Fast Track designation specifically facilitates meetings to discuss all aspects of development to support licensure and it provides the opportunity to submit sections of a Biologics License Application (“BLA”) on a rolling basis as data become available, which permits the FDA to review modules of the BLA as they are received instead of waiting for the entire BLA submission.

1 Dawson-Caswell, D, et al., (2011) Am Fam Physician. 83:143 - 146

2 Nair, H., et al., (2010) Lancet. 375:1545 - 1555

3 WHO, (2014) “RSV Vaccine Status;” www.who.int/immunization/research/meetings_workshops/WHO_PDVAC_RSV.pdf

4 Hall, CB, et al., (2009) N Engl J Med. 360(6):588-98

5 Falsey, A., et al., (2014) Infectious Disorders. 12(2): 98-102

18

In April 2014, we announced positive top-line safety and immunogenicity data from a Phase 2 clinical trial in women of childbearing age that were similar to, or exceeded, immune responses seen in our previous clinical trials. This Phase 2 clinical trial evaluated the safety and immunogenicity of two dose levels of our RSV F Vaccine, in one or two injections, with and without an aluminum phosphate adjuvant, in 720 healthy women of childbearing age. These positive data supported Novavax’ decision to conduct the Phase 2 clinical trial in pregnant women discussed above.

PATH Vaccine Solutions (“PATH”) Clinical Development Agreement for RSV Maternal Program

In conjunction with our development of our RSV F Vaccine for maternal immunization, in 2012 we entered into a clinical development agreement with PATH to develop our RSV F Vaccine in certain low-resource countries. We were awarded approximately $2.0 million by PATH for initial funding under the agreement to partially support our Phase 2 dose-ranging clinical trial in women of childbearing age described above. In October 2013, the funding under this agreement was increased by $0.4 million to support reproductive toxicology studies, which was necessary before we began conducting clinical trials in pregnant women. In December 2013, we entered into an amendment with PATH providing an additional $3.5 million in funding to support the Phase 2 dose-confirmation clinical trial in 720 women of childbearing age. In October 2014, we entered into an amendment with PATH providing an additional $1.0 million towards the development of a strategy for conducting Phase 3 clinical trials of our RSV maternal immunization program. The term of the PATH agreement expired in April 2015 and the Company retains global rights to commercialize the RSV product. The Company has submitted a funding proposal to the Bill & Melinda Gates Foundation (“BMGF”) for support of the Company’s continuing development of an affordable and accessible RSV vaccine for maternal immunization programs in low resource countries. The Company and BMGF are currently in ongoing discussions about such an arrangement, but there can be no assurances that it will be completed.

RSV Pediatric Program

While the burden of RSV disease falls heavily on newborn infants, RSV is also a prevalent and currently unaddressed problem in pediatrics. This third market segment for our RSV F Vaccine remains an important opportunity. In November 2014, we initiated Phase 1 of our RSV pediatric program and we expect to enroll additional healthy children two to six years old into our Phase 1 program in 2016.

Influenza

Influenza is a world-wide infectious disease that causes illness in humans with symptoms ranging from mild to life-threatening; serious illness occurs not only in susceptible populations such as pediatrics and the elderly, but also in the general population because of unique strains of influenza for which most humans have not developed protective antibodies. Influenza is a major burden on public health worldwide: estimates of one million deaths each year are attributed to influenza.6 It is further estimated that, each year, influenza attacks between 5% and 10% of adults and 20% to 30% of children, causing significant levels of illness, hospitalization and death.7

Although a number of licensed seasonal influenza vaccines are currently commercially available in most geographies, and these manufacturers have capabilities to develop influenza vaccines that are responsive to unique and emerging influenza strains, we believe our influenza virus-like particle (“VLP”) vaccine candidates have immunological advantages over currently available vaccines. These immunological advantages stem from the fact that our influenza VLPs contain three of the major structural virus proteins that are important for fighting influenza: hemagglutinin (“HA”) and neuraminidase (“NA”), both of which stimulate the body to produce antibodies that neutralize the influenza virus and prevent its spread through the cells in the respiratory tract, and matrix 1 (“M1”), which stimulates cytotoxic T lymphocytes to kill cells that may already be infected. Our VLPs are not made from live viruses and have no genetic nucleic material in their inner core, which render them incapable of replicating and causing disease. We also believe there are inherent advantages to our vaccine platform technology for more rapid and efficient development of new influenza vaccine candidates.

6 Resolution of the World Health Assembly. Prevention and control of influenza pandemics and annual epidemics. WHA56.19. 28 May 2003

7 WHO. Vaccines against influenza. WHO position paper – November 2012 Weekly Epidemiol Record 2012;87(47):461–76.

19

Seasonal Quadrivalent Influenza Vaccine

Developing and commercializing a seasonal influenza vaccine is an important business opportunity and strategic goal for Novavax. The Advisory Committee for Immunization Practices of the Center for Disease Control and Prevention (“CDC”) recommends that all persons aged six months and older should be vaccinated annually against seasonal influenza. In conjunction with these universal recommendations, attention from the 2009 influenza H1N1 pandemic, along with reports of other cases of avian-based influenza strains, has increased public health awareness of the importance of seasonal influenza vaccination, the market for which is expected to continue to grow worldwide in both developed and developing global markets.

In recent years, public health authorities have advocated for the development and licensure of quadrivalent (i.e., four influenza strains: two influenza A strains and two influenza B strains) influenza vaccines. It is expected that quadrivalent seasonal influenza vaccines will ultimately replace trivalent seasonal influenza vaccines in the global market. There are currently four quadrivalent influenza vaccines licensed in the U.S., although additional quadrivalent seasonal influenza vaccines are expected to be licensed over the next several years. Current estimates for seasonal influenza vaccine growth in the top seven markets (U.S., Japan, France, Germany, Italy, Spain and UK), show potential growth from approximately $3.2 billion in the 2012/13 season to $5.3 billion by the 2021/2022 season.8 Recombinant seasonal influenza vaccines, like the candidate we are developing, have an important advantage: once licensed for commercial sale, large quantities of vaccines can be quickly and cost-effectively manufactured without the use of either the live influenza virus or eggs.

In July 2015 we reported positive preliminary data from our Phase 2 clinical trial of our quadrivalent seasonal influenza VLP vaccine candidate in 400 healthy adults that we initiated in November 2014 under our contract with HHS BARDA. These data show that our quadrivalent seasonal influenza VLP vaccine candidate is both safe and well-tolerated, with results that met the immunogenicity targets. These results demonstrate the potential for our seasonal quadrivalent influenza VLP vaccine candidate to meet the FDA criteria for accelerated approval. We are assessing these preliminary data from this trial, and in conjunction with HHS BARDA, are evaluating the next steps in the development of our quadrivalent seasonal influenza VLP vaccine candidate.

Pandemic H7N9 Influenza Vaccine

In the aftermath of the 2009 pandemic of the A(H1N1) influenza strain, prevention of the potential devastation of a human influenza pandemic remains a key priority with both governmental health authorities and influenza vaccine manufacturers. In the U.S. alone, the 2009 H1N1 influenza pandemic led to the production of approximately 126 million doses of monovalent (single strain) vaccine. Public health awareness and government preparedness for the next potential influenza pandemic are driving development of vaccines that can be manufactured quickly against a potentially threatening influenza strain. Until the spring of 2013, industry and health experts focused attention on developing a monovalent H5N1 influenza vaccine as a potential key defense against a future pandemic threat; however, a significant number of reported cases in China of an avian-based influenza strain, known as A(H7N9), has shifted attention to the potential development of a monovalent H7N9 influenza vaccine.

8 Influenza Vaccines Forecasts. Datamonitor (2013)

20

In collaboration with HHS BARDA, we have now developed and delivered compelling safety and immunogenicity data on two pandemic vaccine candidates, H5N1 and H7N9, which provide the U.S. government with alternatives for dealing with future potential threats. In September 2014, we announced positive results from a Phase 1/2 clinical trial of our H7N9 influenza VLP vaccine candidate adjuvanted with Matrix-M in 610 healthy adults. Under our contract with HHS BARDA, the Phase 1/2 clinical trial was designed as a dose-ranging, randomized, observer-blinded, placebo-controlled clinical trial, to determine the contribution of Matrix-M to potential antigen dose sparing regimens. Our H7N9 influenza VLP vaccine candidate, with and without Matrix-M, was well tolerated and demonstrated a safety profile similar to our prior experience with another saponin-based adjuvant. Matrix-M adjuvanted formulations demonstrated immunogenicity and dose-sparing benefits relative to unadjuvanted antigen. Hemagglutination-inhibiting antibody titers were generally comparable to those reported in prior studies with another saponin adjuvant and the vaccine also elicited significant anti-neuraminidase antibodies. In October 2014, we announced that the FDA had granted fast track designation to our H7N9 influenza VLP vaccine candidate with Matrix-M. We expect to initiate a Phase 2 clinical trial of our H7N9 influenza VLP vaccine candidate with Matrix-M during the first quarter of 2016.

Potential Accelerated Approval Pathway for Influenza