Exhibit 99.2

Royal Bank of Canada second quarter 2024 results |

All amounts are in Canadian dollars and are based on financial statements presented in compliance with International Accounting Standard 34 , unless otherwise noted. Effective November 1, 2023, we adopted IFRS 17 (IFRS 17). Comparative amounts have been restated from those previously presented. Our Q2 2024 Report to Shareholders and Supplementary Financial Information are available at http://www.rbc.com/investorrelations and on https://www.sedarplus.com/.

Interim Financial Reporting

Insurance Contracts

Net income $4.0 Billion Up 7% YoY |

Diluted EPS 1 $2.74 Up 5% YoY |

Total PCL 1 $920 Million PCL on loans ratio 1 Up 4 bps 1 QoQ |

ROE 1, 2 14.5% Down 40 bps YoY |

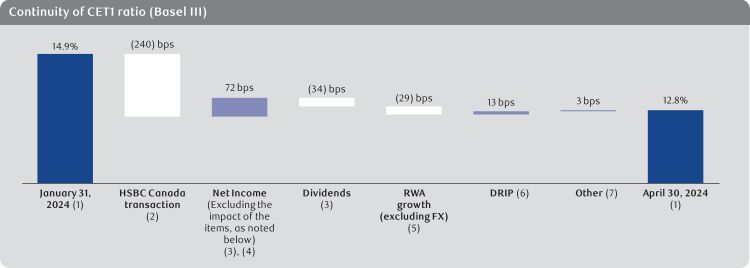

CET1 Ratio 1 12.8% Above regulatory requirements | ||||||||||||

Adjusted net income 3 $4.2 Billion Up 11% YoY |

Adjusted diluted EPS 3 $2.92 Up 9% YoY |

Total ACL 1 $6.1 Billion ACL on loans ratio 1 down 2 bps |

Adjusted ROE 3 15.5% Up 20 bps YoY |

LCR 1 128% Down from 132% last quarter |

TORONTO, May

30, 2024

4

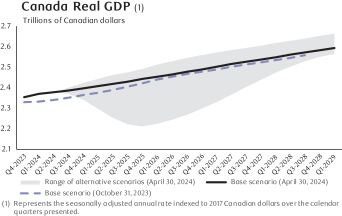

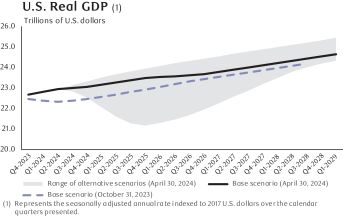

(RY on TSX and NYSE) today reported net income of $4.0 billion for the quarter ended April 30, 2024, up $270 million or 7% from the prior year. Diluted EPS was $2.74, up 5% over the same period. Record earnings in Capital Markets as well as higher results in Personal & Commercial Banking, Wealth Management and Insurance were partially offset by lower results in Corporate Support. Adjusted net income3

and adjusted diluted EPS3

of $4.2 billion and $2.92 were up 11% and 9%, respectively, from the prior year. On March 28, 2024, we completed the acquisition of HSBC Bank Canada (HSBC Canada). The inclusion of HSBC Canada results

5

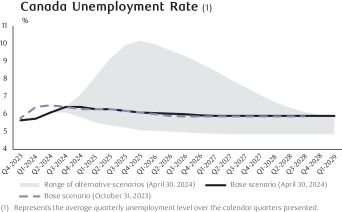

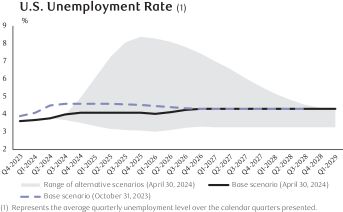

decreased net income by $51 million, reflecting $200 million ($145 million after-tax) of initial PCL on purchased performing financial assets. Total PCL increased $320 million from a year ago. The PCL on loans ratio of 41 bps increased 11 bps from the prior year. The PCL on impaired loans ratio was 30 bps, up 9 bps from the prior year as provisions continue to trend upwards, reflecting the impact of higher interest rates and rising unemployment.

Results also reflected the impact of specified items relating to the acquisition of HSBC Canada (HSBC Canada transaction). Transaction and integration costs ($358 million before-tax and $282 million after-tax) had an unfavourable impact, while management of closing capital volatility ($155 million before-tax and $112 million after-tax) benefitted the results.

Pre-provision, pre-tax earnings

6

of $5.8 billion were up $801 million or 16% from last year, mainly due to higher revenue in our Capital Markets business, higher net interest income reflecting higher spreads and solid volume growth, and higher fee-based client assets reflecting market appreciation and net sales. These factors were partially offset by higher expenses driven by higher variable compensation and continued investments in our franchises. Compared to last quarter, net income was up 10%, reflecting higher results in Wealth Management, Corporate Support and Capital Markets, partially offset by lower results in Insurance and Personal & Commercial Banking. The prior quarter included an unfavourable impact from the specified item relating to the management of closing capital volatility ($286 million before-tax and $207 million after-tax) as well as the cost of the Federal Deposit Insurance Corporation (FDIC) special assessment ($159 million before-tax and $115 million after-tax). Adjusted net income

3

was up 3% over the same period. Pre-provision, pre-tax earnings6

were up 13% on higher revenue and well-controlled expenses. We maintained a strong capital position, with a CET1 ratio of 12.8%, down 210 bps from the prior quarter, largely reflecting the impact from closing the HSBC Canada transaction.

Today, we declared a quarterly dividend of $1.42 per share reflecting an increase of $0.04 or 3%.

“ This quarter marked a pivotal milestone in RBC’s long-term growth story as we completed our acquisition of HSBC Bank Canada, welcoming thousands of colleagues and clients from across the country. This historic acquisition, along with our solid results driven by our strong balance sheet, expense control and volume growth across our premium franchises, shows that RBC has the right strategy in place to continue building the bank of the future and our position as a global competitor. We’re confident in our ability to build on this momentum and keep delivering sustainable, long-term value to our clients, communities and shareholders. – Dave McKay, President and Chief Executive Officer of Royal Bank of Canada | ||

Q2 2024 Compared to Q2 2023 |

Reported: • Net income of $3,950 million • Diluted EPS of $2.74 • ROE of 14.5% • CET1 ratio of 12.8% |

h h i i |

Adjusted 1 , 3 :• Net income of $4,198 million • Diluted EPS of $2.92 • ROE of 15.5% |

h h h | ||||||

Q2 2024 Compared to Q1 2024 |

• Net income of $3,950 million • Diluted EPS • ROE of 14.5% • CET1 ratio of 12.8% |

h h h i |

• Net income of $4,198 million • Diluted EPS • ROE of 15.5% |

h h h | ||||||

YTD 2024 Compared to YTD 2023 |

• Net income of $7,532 million • Diluted EPS • ROE of 13.8% |

h h h |

• Net income of $8,264 million • Diluted EPS • ROE of 15.2% |

h h i | ||||||

| (1) | See Glossary section of this Q2 2024 |

| (2) | Return on equity (ROE). This measure does not have a standardized meaning under generally accepted accounting principles (GAAP). For further information, refer to the Key performance and non-GAAP measures section of this Q2 2024 |

| (3) | These are non-GAAP measures. For further information, including a reconciliation, refer to the Key performance and non-GAAP measures section of this Q2 2024 |

| (4) | When we say “we”, “us”, “our”, “the bank” or “RBC”, we mean Royal Bank of Canada and its subsidiaries, as applicable. |

| (5) | HSBC Canada results reflect revenue, PCL, non-interest expenses and income taxes associated with the acquired operations and clients, which include the acquired assets, assumed liabilities and employees with the exception of assets and liabilities relating to treasury and liquidity management activities. For further details, refer to the Key corporate events section of this Q2 2024 Report to Shareholders. |

| (6) | Pre-provision, pre-tax (PPPT) earnings is calculated as income (April 30, 2024: $3,950 million; January 31, 2024: $3,582 million; April 30, 2023: $3,680 million) before income taxes (April 30, 2024: $976 million; January 31, 2024: $766 million; April 30, 2023: $765 million) and PCL (April 30, 2024: $920 million; January 31, 2024: $813 million; April 30, 2023: $600 million). This is a non-GAAP measure. PPPT earnings do not have a standardized meaning under GAAP and may not be comparable to similar measures disclosed by other financial institutions. We use PPPT earnings to assess our ability to generate sustained earnings growth outside of credit losses, which are impacted by the cyclical nature of a credit cycle. We believe that certain non-GAAP measures are more reflective of our ongoing operating results and provide readers with a better understanding of management’s perspective on our performance. |