|

|

Exhibit 99.1 |

FIRST QUARTER 2019

EARNINGS RELEASE

|

ROYAL BANK OF CANADA REPORTS FIRST QUARTER 2019 RESULTS

|

All amounts are in Canadian dollars and are based on financial statements prepared in compliance with International Accounting Standard 34 Interim Financial Reporting, unless otherwise noted. Our Q1 2019 Report to Shareholders and Supplementary Financial Information are available at: http://www.rbc.com/investorrelations.

| Net Income

$3.2 Billion

Continued earnings growth of 5% YoY

|

Diluted EPS1

$2.15

Solid 7% growth YoY

|

ROE2

16.7%

Balanced capital deployment

|

CET1 Ratio

11.4%

Strong capital ratio

|

TORONTO, February 22, 2019 – Royal Bank of Canada (RY on TSX and NYSE) today reported net income of $3,172 million for the quarter ended January 31, 2019, up $160 million or 5% from the prior year, with solid diluted EPS growth of 7%. Results reflect solid underlying earnings growth in Personal & Commercial Banking and Insurance. Challenging market conditions impacted several business segments in the first quarter of 2019 contributing to results being flat in Wealth Management and lower results in Capital Markets and Investor & Treasury Services. Our results also reflect an increase due to foreign exchange translation and the write-down of net deferred tax assets in the prior year related to the U.S. Tax Reform.

Compared to last quarter, net income was down $78 million with higher earnings in Wealth Management, Personal & Commercial Banking, and Investor & Treasury Services. These were more than offset by lower earnings in Insurance and Capital Markets due to challenging market conditions.

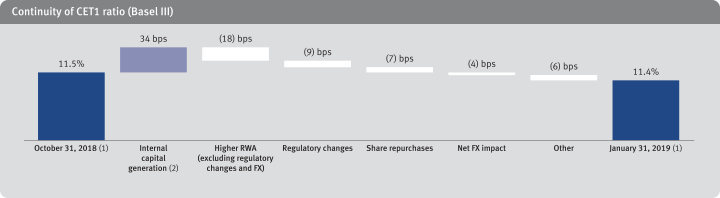

Results this quarter also reflect investments in client-facing staff and technology initiatives, as well as higher provisions for credit losses (PCL), with a total PCL ratio of 34 basis points (bps). PCL on impaired loans ratio of 28 bps was up 8 bps compared to last quarter, largely due to higher provisions related to one account in Capital Markets. Our capital position remained strong, with a Common Equity Tier 1 (CET1) ratio of 11.4%. In addition, today we announced an increase to our quarterly dividend of $0.04 or 4% to $1.02 per share.

|

“Our strategy and unwavering focus on delivering value for our clients and shareholders continues to underpin our ability to consistently deliver solid results, even against a challenging market backdrop. In addition to delivering earnings of $3.2 billion, we are pleased to increase our quarterly dividend by 4% today. We remain focused on prudently managing our risks and balancing our investments for long-term growth as we transform the client journey.”

– Dave McKay, RBC President and Chief Executive Officer |

|

| ||||||||

|

Q1 2019 Compared to Q1 2018 |

• Net income of $3,172 million • Diluted EPS1 of $2.15 • ROE2 of 16.7% • CET1 ratio of 11.4% |

h 5% h 7% i 70 bps h 40 bps |

||||||

|

| ||||||||

|

Q1 2019 Compared to Q4 2018 |

• Net income of $3,172 million • Diluted EPS1 of $2.15 • ROE2 of 16.7% • CET1 ratio of 11.4% |

i 2% i 2% i 90 bps i 10 bps |

||||||

|

| ||||||||

|

Personal & Commercial Banking

|

Net income increased $50 million or 3% from last year, mainly due to solid client-driven volume growth and higher deposit spreads from higher Canadian interest rates. These factors were partially offset by higher staff and technology related costs as we continue to execute on our vision of being a digitally-enabled relationship bank. Higher PCL and a gain relating to the reorganization of Interac in the prior year also impacted earnings growth. The current year also included a write-down of deferred tax assets resulting from a change in the corporate tax rate in Barbados.

Net income increased $33 million or 2% from last quarter, reflecting volume growth, seasonally lower marketing costs, and lower professional fees. These factors were partially offset by higher staff-related costs and an increase in PCL. The current year also included a write-down of deferred tax assets resulting from a change in the corporate tax rate in Barbados.

| 1 | Earnings per share (EPS). |

| 2 | Return on Equity (ROE). This measure does not have a standardized meaning under GAAP. For further information, refer to the Key Performance and non-GAAP measures section on page 3 of this Earnings Release. |

- 1 -

|

Wealth Management

|

Net income remained unchanged from a year ago. Net interest income increased due to higher interest rates and solid volume growth. Higher fee-based revenue was driven by an increase in average fee-based client assets as the diversification of our leading product offerings and strong distribution network drove net sales, despite challenging market conditions. These factors were offset by higher costs related to business growth, increases in PCL and regulatory costs, and lower transaction volumes as uncertainty impacted equity markets. A favourable accounting adjustment related to Canadian Wealth Management in the current period was largely offset by the impact of a favourable accounting adjustment related to City National in the prior period.

Compared to last quarter, net income increased $44 million or 8%, primarily reflecting an increase in net interest income, a favourable accounting adjustment related to Canadian Wealth Management in the current period, and the change in fair value of seed capital investments. These factors were partially offset by higher costs in support of business growth, and lower fee-based revenue resulting from challenging market conditions throughout the earlier part of the first quarter.

|

Insurance

|

Net income increased $39 million or 31% from a year ago, primarily reflecting favourable life retrocession contract renegotiations and lower claims costs.

Compared to last quarter, net income decreased $152 million or 48%, as the prior period included annual actuarial assumption updates, higher favourable investment-related experience, and higher favourable life retrocession contract renegotiations.

|

Investor & Treasury Services

|

Net income decreased $58 million or 26%, primarily due to lower funding and liquidity revenue, higher costs in support of business growth, and lower revenue from our asset services business due to challenging market conditions and lower client activity. These factors were partially offset by improved client deposit margins.

Compared to last quarter, net income increased $6 million or 4%, primarily due to higher funding and liquidity revenue, lower technology costs, and improved client deposit margins. These factors were partially offset by annual regulatory costs in the current period.

|

Capital Markets

|

Net income decreased $95 million or 13%, primarily due to higher PCL and lower revenue in Corporate and Investment Banking due to challenging market conditions and lower issuance activity. These factors were partially offset by a lower effective tax rate reflecting changes in earnings mix and the impact of foreign exchange translation.

Compared to last quarter, net income decreased $13 million or 2%, primarily due to lower revenue in Corporate and Investment Banking and higher PCL. These factors were partially offset by higher revenue in Global Markets and a lower effective tax rate reflecting changes in earnings mix.

|

Corporate Support

|

Net income was $24 million in the current quarter, largely reflecting net favourable tax adjustments. Net income was $20 million in the prior quarter, also largely reflecting net favourable tax adjustments. Net loss was $200 million in the prior year, primarily due to the impact of the U.S. Tax Reform of $178 million, which was primarily related to the write-down of net deferred tax assets.

|

Other Highlights

|

Capital – As at January 31, 2019, Basel III CET1 ratio was 11.4%, down 10 bps from last quarter as strong internal capital generation was partially offset by higher risk-weighted assets due to business growth and the impact from regulatory changes. We also continued to return a significant portion of our capital to our shareholders through dividends and buybacks.

Credit Quality – Total PCL of $514 million increased $180 million or 54% from the prior year, mainly due to a higher provision on impaired loans in Capital Markets taken on one account in the utilities sector. Higher provisions on performing loans, mainly in Capital Markets and Wealth Management, driven by unfavourable changes in certain near-term macroeconomic variables, also contributed to the increase.

Total PCL on loans of $516 million increased $183 million, or 55% from the prior quarter related to higher provisions in Capital Markets and Personal & Commercial Banking. PCL on performing loans of $93 million, compared to $44 million in the prior quarter, was driven by unfavourable changes in certain near-term macroeconomic variables, largely impacting Capital Markets and Wealth Management.

- 2 -

PCL on impaired loans of $423 million was up $134 million from the prior quarter, mainly due to a provision taken in the utilities sector in Capital Markets and higher provisions on the Caribbean Banking and Canadian Business Banking portfolios. PCL ratio on impaired loans of 28 bps was up 8 bps from last quarter.

|

Digitally Enabled Relationship Bank

|

90-day Active Mobile users increased 17% from a year ago to 4.0 million, resulting in a 22% increase in mobile sessions. Digital adoption increased to 51% as we continued our digital transformation journey.

Key Performance and Non-GAAP Measures

We measure and evaluate the performance of our consolidated operations and each business segment using a number of financial metrics, such as net income and ROE. ROE does not have a standardized meaning under GAAP. We use ROE as a measure of return on total capital invested in our business.

Additional information about ROE and other Key Performance and non-GAAP measures can be found under the Key Performance and non-GAAP measures section of our Q1 2019 Report to Shareholders.

- 3 -

|

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

|

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. We may make forward-looking statements in this Earnings Release, in other filings with Canadian regulators or the SEC, in other reports to shareholders and in other communications. Forward-looking statements in this document include, but are not limited to, statements relating to our financial performance objectives, vision and strategic goals, the Economic, market, and regulatory review and outlook for Canadian, U.S., European and global economies, the regulatory environment in which we operate, and the risk environment including our liquidity and funding risk, and include our President and Chief Executive Officer’s statements. The forward-looking information contained in this Earnings Release is presented for the purpose of assisting the holders of our securities and financial analysts in understanding our financial position and results of operations as at and for the periods ended on the dates presented, as well as our financial performance objectives, vision and strategic goals, and may not be appropriate for other purposes. Forward-looking statements are typically identified by words such as “believe”, “expect”, “foresee”, “forecast”, “anticipate”, “intend”, “estimate”, “goal”, “plan” and “project” and similar expressions of future or conditional verbs such as “will”, “may”, “should”, “could” or “would”.

By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our predictions, forecasts, projections, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct and that our financial performance objectives, vision and strategic goals will not be achieved. We caution readers not to place undue reliance on these statements as a number of risk factors could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. These factors – many of which are beyond our control and the effects of which can be difficult to predict – include: credit, market, liquidity and funding, insurance, operational, regulatory compliance, strategic, reputation, legal and regulatory environment, competitive and systemic risks and other risks discussed in the risks sections of our 2018 Annual Report and the Risk management section of our Q1 2019 Report to Shareholders including global uncertainty, Canadian housing and household indebtedness, information technology and cyber risk, regulatory changes, digital disruption and innovation, data and third party related risks, climate change, the business and economic conditions in the geographic regions in which we operate, the effects of changes in government fiscal, monetary and other policies, tax risk and transparency, and environmental and social risk.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also adversely affect our results. When relying on our forward-looking statements to make decisions with respect to us, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Material economic assumptions underlying the forward-looking statements contained in this Earnings Release are set out in the Economic, market, and regulatory review and outlook section and for each business segment under the Strategic priorities and Outlook headings in our 2018 Annual Report, as updated by the Economic, market and regulatory review and outlook section of our Q1 2019 Report to Shareholders. Except as required by law, we do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by us or on our behalf.

Additional information about these and other factors can be found in the risk sections of our 2018 Annual Report and the Risk management section of our Q1 2019 Report to Shareholders.

Information contained in or otherwise accessible through the websites mentioned does not form part of this Earnings Release. All references in this Earnings Release to websites are inactive textual references and are for your information only.

ACCESS TO QUARTERLY RESULTS MATERIALS

Interested investors, the media and others may review this quarterly Earnings Release, quarterly results slides, supplementary financial information and our Q1 2019 Report to Shareholders at rbc.com/investorrelations.

Quarterly conference call and webcast presentation

Our quarterly conference call is scheduled for February 22, 2019 at 8:00 a.m. (EST) and will feature a presentation about our first quarter results by RBC executives. It will be followed by a question and answer period with analysts.

Interested parties can access the call live on a listen-only basis at rbc.com/investorrelations/quarterly-financial-statements.html or (416-340-2217, 866-696-5910, passcode 2365112#). Please call between 7:50 a.m. and 7:55 a.m. (EST).

Management’s comments on results will be posted on RBC’s website shortly following the call. A recording will be available by 5:00 p.m. (EST) from February 22, 2019 until May 22, 2019 at rbc.com/investorrelations/quarterly-financial-statements.html or by telephone (905-694-9451 or 800-408-3053, passcode 5089314#)

Media Relations Contact

Gillian McArdle, Senior Director, Communications, Group Risk Management and Finance, gillian.mcardle@rbccm.com, 416-842-4231

Investor Relations Contacts

Dave Mun, SVP & Head, Investor Relations, dave.mun@rbc.com, 416-974-4924

Asim Imran, Senior Director, Investor Relations, asim.imran@rbc.com, 416-955-7804

Jennifer Nugent, Senior Director, Investor Relations, jennifer.nugent@rbc.com, 416-955-7805

ABOUT RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 84,000+ employees who bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank, and one of the largest in the world based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our 16 million clients in Canada, the U.S. and 33 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-sustainability.

Trademarks used in this earnings release include the LION & GLOBE Symbol, ROYAL BANK OF CANADA and RBC which are trademarks of Royal Bank of Canada used by Royal Bank of Canada and/or by its subsidiaries under license. All other trademarks mentioned in this earnings release, which are not the property of Royal Bank of Canada, are owned by their respective holders.

- 4 -