|

|

Exhibit 99.1 |

SECOND QUARTER 2018

EARNINGS RELEASE

| ROYAL BANK OF CANADA REPORTS SECOND QUARTER 2018 RESULTS |

All amounts are in Canadian dollars and are based on financial statements prepared in compliance with International Accounting Standard 34 Interim Financial Reporting, unless otherwise noted. Effective November 1, 2017, we adopted IFRS 9 Financial Instruments. Prior period amounts are prepared in accordance with IAS 39 Financial Instruments: Recognition and Measurement. Our Q2 2018 Report to Shareholders and Supplementary Financial Information are available at: rbc.com/investorrelations.

|

Net Income

$3.1 Billion

Strong earnings growth of 9% YoY

|

Diluted EPS

$2.06

Double-digit growth of 11% YoY

|

ROE

18.1%

Balanced capital deployment for premium ROE

|

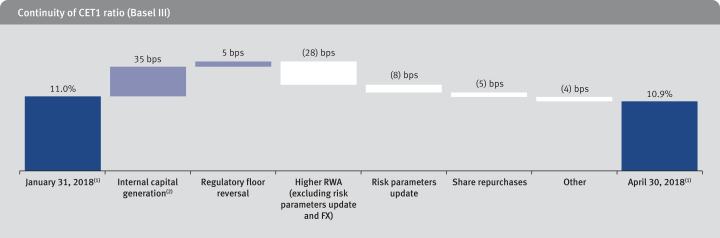

CET1 Ratio

10.9%

$224 million of share repurchases in Q2 2018

|

TORONTO, May 24, 2018 – Royal Bank of Canada (RY on TSX and NYSE) today reported net income of $3,060 million for the second quarter ended April 30, 2018, up $251 million or 9% from the prior year with double-digit diluted EPS(1) growth of 11%. Results reflect strong earnings growth in Wealth Management, Personal & Commercial Banking, and Investor & Treasury Services, and solid earnings in Insurance. Capital Markets performance was stable amidst less favourable market conditions. Strong credit quality also contributed to results, with provision for credit losses (PCL) on impaired loans ratio of 22 basis points (bps) reflecting a benign credit environment.

Compared to last quarter, net income was up $48 million or 2%, though market-related revenue moderated from strong first quarter levels. Continued margin expansion and strong loan growth on both sides of the border helped to offset the impact of a less favourable market environment and fewer days in the current quarter. The prior quarter also included the write-down of net deferred tax assets related to the U.S. Tax Reform(2).

| “We maintained good momentum in the second quarter, delivering earnings of $3.1 billion. Our businesses executed on client-focused growth strategies while continuing to demonstrate strong risk management. As we transform the bank to create more value for our clients, we’re proud to once again be ranked highest in overall customer satisfaction by J.D. Power.”

– Dave McKay, RBC President and Chief Executive Officer |

|

|

• Net income of $3,060 million • Diluted EPS of $2.06 • ROE(3) of 18.1% • CET1(4) ratio of 10.9% |

h 9% h 11% h 90 bps h 30 bps |

||||||

|

|

• Net income of $3,060 million • Diluted EPS of $2.06 • ROE of 18.1% • CET1 ratio of 10.9% |

h 2% h 2% h 70 bps i 10 bps |

||||||

|

|

• Net income of $6,072 million • Diluted EPS of $4.07 • ROE of 17.7% |

h 4% h 7% g 0 bps |

Excluding specified item(5): • Net income of $6,072 million • Diluted EPS of $4.07 • ROE of 17.7% |

h 8% h 11% h 70 bps |

Q2 2018 Business Segment Performance

| Personal & Commercial Banking |

Net income of $1,459 million increased $99 million or 7% from last year, mainly reflecting improved spreads on higher interest rates and average volume growth of 5%. Operating leverage was positive even as we continue to invest in people and marketing initiatives in support of business growth, and make investments to improve our clients’ online and mobile experience.

Compared to last quarter, Personal & Commercial Banking net income decreased $62 million or 4%, reflecting three fewer days in the quarter, partially offset by higher spreads in Canadian Banking. The prior quarter also included a gain related to the reorganization of Interac.

| (1) | Earnings per share (EPS). |

| (2) | In December 2017, the U.S. H.R. 1 (U.S. Tax Reform) was passed into law. |

| (3) | Return on Equity (ROE). This measure does not have a standardized meaning under GAAP. For further information, refer to the Key performance and non-GAAP measures section of our Q2 2018 Report to Shareholders. |

| (4) | Common Equity Tier 1 (CET1) ratio. |

| (5) | Results and measures excluding our share of a gain in Q1 2017 related to the sale by the U.S. operations of Moneris Solutions Corporation (Moneris) to Vantiv, Inc., which was $212 million (before- and after-tax) are non-GAAP measures. For further information, including a reconciliation, refer to the non-GAAP section on page 3 of this Earnings Release. |

- 1 -

| Wealth Management |

Net income of $537 million increased $106 million or 25% from a year ago, largely reflecting higher earnings on increased fee-based assets, an increase in net interest income on higher interest rates and volume growth, and a lower effective tax rate reflecting benefits from the U.S. Tax Reform. Operating leverage was strong, even with higher costs to support business growth and higher regulatory costs in the U.S.

Compared to last quarter, net income decreased $60 million or 10%, reflecting lower transaction and performance fee revenue and a net change in the fair value of our U.S. share-based compensation plan. A favourable accounting adjustment related to City National in the prior period also contributed to the decrease. These factors were partially offset by lower PCL and higher net interest income due to higher interest rates and volume growth.

| Insurance |

Net income of $172 million increased $6 million or 4% from a year ago, primarily reflecting favourable investment-related experience, partially offset by higher claims volumes in life retrocession and disability portfolios.

Compared to last quarter, net income increased $45 million or 35%, reflecting favourable investment-related experience and lower disability claims volumes.

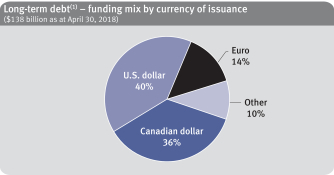

| Investor & Treasury Services |

Net income of $212 million increased $19 million or 10% from a year ago, primarily due to higher revenue from our asset services business including custody, improved margins and growth in client deposits. These factors were partially offset by lower funding and liquidity revenue and higher investment in client-focused technology initiatives.

Compared to last quarter, net income decreased $7 million or 3%, primarily due to decreased funding and liquidity revenue including lower gains from the disposition of certain securities compared to the prior quarter. These factors were partially offset by increased revenue from our asset services business including custody, driven by higher client activity and market volatility, and improved margins.

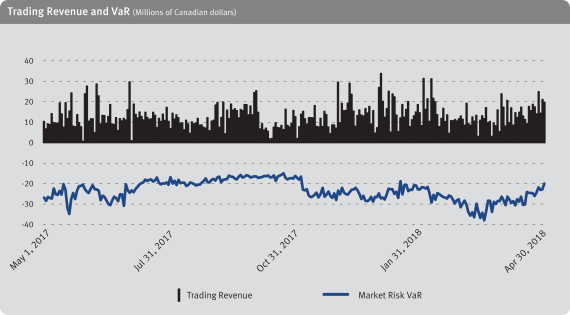

| Capital Markets |

Net income of $665 million was relatively flat from a year ago. A lower effective tax rate reflecting the benefits from the U.S. Tax Reform and changes in earnings mix were offset by lower revenue in Global Markets and Corporate and Investment Banking amidst less favourable market conditions.

Compared to last quarter, net income decreased $83 million or 11%, primarily due to lower equity originations mainly in North America reflecting lower market activity, and decreased fixed income trading revenue. Lower equity trading revenue in the U.S. also contributed to the decrease. These factors were partially offset by higher European Investment Banking revenue, lower variable compensation on decreased results, lower PCL, and higher municipal banking activity.

| Corporate Support |

Net income was $15 million in the current quarter, largely due to asset/liability management activities. Net loss was $200 million in the prior quarter, largely due to the impact of the U.S. Tax Reform of $178 million which was primarily related to the write-down of net deferred tax assets. Net loss was $9 million in the prior year, as asset/liability management activities were more than offset by higher legal and severance costs.

| Other Highlights |

Capital – As at April 30, 2018, Basel III CET1 ratio was 10.9%, down 10 bps from last quarter, largely reflecting higher risk-weighted assets due to business growth, an update to our retail lending risk parameters, partially offset by internal capital generation.

Credit Quality – Total PCL of $274 million includes PCL on loans of $278 million, which decreased $24 million or 8% from the prior year, mainly due to lower provisions in Wealth Management and Capital Markets, partially offset by higher provisions in Personal & Commercial Banking. PCL ratio on loans of 20 bps improved 3 bps. PCL ratio on impaired loans (Stage 3 PCL) was 22 bps.

Compared to last quarter, PCL on loans decreased $56 million or 17%, mainly due to lower provisions in Capital Markets and Wealth Management. PCL ratio on loans improved 4 bps.

- 2 -

Non-GAAP Measures

Results and measures excluding the specified item outlined below are non-GAAP measures:

| • | For the six months ended April 30, 2017, our share of a gain related to the sale by our payment processing joint venture Moneris of its U.S. operations to Vantiv, Inc., which was $212 million (before- and after-tax) and recorded in Personal & Commercial Banking. |

Given the nature and purpose of our management reporting framework, we use and report certain non-GAAP financial measures, which are not defined, do not have a standardized meaning under GAAP, and may not be comparable with similar information disclosed by other financial institutions. We believe that excluding these specified items from our results is more reflective of our ongoing operating results, will provide readers with a better understanding of management’s perspective on our performance, and will enhance the comparability of our comparative periods. For further information, refer to the Key performance and non-GAAP measures section of our Q2 2018 Report to Shareholders.

| Net Income, excluding specified item |

||||||||||||

| For the six months ended April 30, 2017 | ||||||||||||

| (Millions of Canadian dollars, except per share and percentage amounts) | Reported | |

Gain related to the sale by Moneris(1) |

|

Adjusted | |||||||

| Net income |

$ | 5,836 | $(212) | $ | 5,624 | |||||||

| Basic earnings per share |

$ | 3.84 | $(0.14) | $ | 3.70 | |||||||

| Diluted earnings per share |

$ | 3.82 | $(0.14) | $ | 3.68 | |||||||

| ROE |

17.7% | 17.0% | ||||||||||

|

Personal & Commercial Banking net income, excluding specified item |

||||||||||||

| For the six months ended April 30, 2017 | ||||||||||||

| (Millions of Canadian dollars) | Reported | |

Gain related to the sale by Moneris(1) |

|

Adjusted | |||||||

| Net income |

$ | 2,952 | $(212) | $ | 2,740 | |||||||

| (1) | Includes foreign currency translation. |

- 3 -

| CAUTION REGARDING FORWARD-LOOKING STATEMENTS |

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. We may make forward-looking statements in this Earnings Release, in filings with Canadian regulators or the U.S. Securities and Exchange Commission (SEC), in reports to shareholders and in other communications. Forward-looking statements in this document include, but are not limited to, statements relating to our financial performance objectives, vision and strategic goals, and include our President and Chief Executive Officer’s statements. The forward-looking information contained in this Earnings Release is presented for the purpose of assisting the holders of our securities and financial analysts in understanding our financial position and results of operations as at and for the periods ended on the dates presented, as well as our financial performance objectives, vision and strategic goals, and may not be appropriate for other purposes. Forward-looking statements are typically identified by words such as “believe”, “expect”, “foresee”, “forecast”, “anticipate”, “intend”, “estimate”, “goal”, “plan” and “project” and similar expressions of future or conditional verbs such as “will”, “may”, “should”, “could” or “would”.

By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our predictions, forecasts, projections, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct and that our financial performance objectives, vision and strategic goals will not be achieved. We caution readers not to place undue reliance on these statements as a number of risk factors could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. These factors – many of which are beyond our control and the effects of which can be difficult to predict – include: credit, market, liquidity and funding, insurance, operational, regulatory compliance, strategic, reputation, legal and regulatory environment, competitive and systemic risks and other risks discussed in the risks sections of our 2017 Annual Report and the Risk management section of our Q2 2018 Report to Shareholders; including global uncertainty and volatility, elevated Canadian housing prices and household indebtedness, information technology and cyber risk, including the risk of cyber-attacks or other information security events at or impacting our service providers or other third parties with whom we interact, regulatory change, technological innovation and non-traditional competitors, global environmental policy and climate change, changes in consumer behaviour, the end of quantitative easing, the business and economic conditions in the geographic regions in which we operate, the effects of changes in government fiscal, monetary and other policies, tax risk and transparency and environmental and social risk.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also adversely affect our results. When relying on our forward-looking statements to make decisions with respect to us, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Material economic assumptions underlying the forward looking-statements contained in this Earnings Release are set out in the Overview and outlook section and for each business segment under the Strategic priorities and Outlook headings in our 2017 Annual Report, as updated by the Overview and outlook section of our Q2 2018 Report to Shareholders. Except as required by law, we do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by us or on our behalf.

Additional information about these and other factors can be found in the risk sections of our 2017 Annual Report and the Risk management section of our Q2 2018 Report to Shareholders.

Information contained in or otherwise accessible through the websites mentioned does not form part of this Earnings Release. All references in this Earnings Release to websites are inactive textual references and are for your information only.

ACCESS TO QUARTERLY RESULTS MATERIALS

Interested investors, the media and others may review this quarterly Earnings Release, quarterly results slides, supplementary financial information and our Q2 2018 Report to Shareholders on our website at rbc.com/investorrelations.

Quarterly conference call and webcast presentation

Our quarterly conference call is scheduled for Thursday, May 24, 2018 at 8:00 a.m. (EDT) and will feature a presentation about our second quarter results by RBC executives. It will be followed by a question and answer period with analysts.

Interested parties can access the call live on a listen-only basis at rbc.com/investorrelations/quarterly-financial-statements.html or by telephone (416-340-2217, 866-696-5910, passcode 1545866#). Please call between 7:50 a.m. and 7:55 a.m. (EDT).

Management’s comments on results will be posted on RBC’s website shortly following the call. A recording will be available by 5:00 p.m. (EDT) from Thursday, May 24, 2018 until August 21, 2018 at rbc.com/investorrelations/quarterly-financial-statements.html or by telephone (905-694-9451 or 800-408-3053, passcode 9227794#).

Media Relations Contacts

Gillian McArdle, Senior Director, Communications, Group Risk Management and Finance, gillian.mcardle@rbc.com, 416-842-4231

Maria McGee, Senior Manager, Financial Communications, maria.mcgee@rbc.com, 416-974-2789

Investor Relations Contacts

Dave Mun, SVP & Head, Investor Relations, dave.mun@rbc.com, 416-974-4924

Asim Imran, Senior Director, Investor Relations, asim.imran@rbc.com, 416-955-7804

Jennifer Nugent, Senior Director, Investor Relations, jennifer.nugent@rbc.com, 416-955-7805

ABOUT RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 81,000+ employees who bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank, and one of the largest in the world based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our 16 million clients in Canada, the U.S. and 34 other countries. Learn more at rbc.com.

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-sustainability.

Trademarks used in this Earnings Release include the LION & GLOBE Symbol, ROYAL BANK OF CANADA and RBC which are trademarks of Royal Bank of Canada used by Royal Bank of Canada and/or by its subsidiaries under license. All other trademarks mentioned in this Earnings Release, which are not the property of Royal Bank of Canada, are owned by their respective holders.

- 4 -