EX-99.2

Exhibit 99.2

|

|

|

|

|

|

| Royal Bank of Canada | Second Quarter 2016

Helping clients thrive and communities prosper |

|

|

|

|

| Royal Bank of Canada second quarter 2016 results

|

All amounts are in Canadian dollars and are based on financial statements prepared in compliance with International Accounting Standard

34 Interim Financial Reporting, unless otherwise noted.

TORONTO, May 26, 2016 – Royal Bank of Canada (RY on TSX and NYSE) today reported

net income of $2,573 million for the second quarter ended April 30, 2016, up $71 million or 3% from a year ago. Net income was up $179 million or 7%, excluding a specified

item(1) in the prior year as noted below. Results reflect strong earnings in Wealth Management, which benefited from the inclusion of City National Bank (City National), record earnings in

Personal & Commercial Banking and higher earnings in Insurance. These factors were partially offset by lower results in Capital Markets and Investor & Treasury Services as compared to strong levels last year. Our results also

include favourable foreign exchange translation and continuing benefits from our ongoing focus on efficiency management activities. Our total provision for credit losses (PCL) ratio of 0.36% is comprised of PCL on impaired loans ratio of 0.32% and

PCL on loans not yet identified as impaired ratio of 0.04%. PCL on impaired loans ratio increased 7 basis points (bps) from the prior year primarily as a result of the sustained low oil price environment.

Compared to last quarter, net income increased $126 million or 5%, mainly reflecting higher earnings in Wealth Management, Insurance, Capital Markets and

Personal & Commercial Banking, partially offset by lower earnings in Investor & Treasury Services. This quarter, PCL increased by $50 million ($37 million after-tax) for loans not yet identified as impaired. PCL on impaired loans

ratio of 0.32% was relatively flat from last quarter.

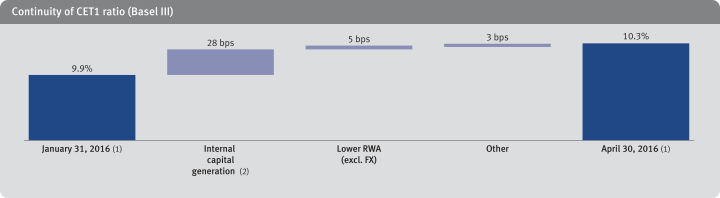

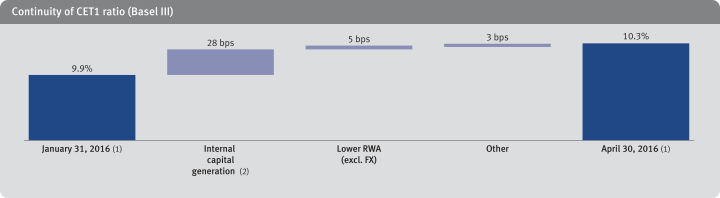

Our Basel III Common Equity Tier 1 (CET1) ratio strengthened to 10.3%, up 40 bps from the prior quarter.

“We delivered a solid quarter, with earnings of over $2.5 billion, reflecting underlying strength across our businesses. I’m very pleased with our performance

in the first half of the year with earnings of over $5 billion, particularly in the context of a challenging operating environment,” said Dave McKay, RBC President and CEO. “Underpinned by our culture and commitment to putting clients

first, RBC continues to be well positioned going forward given the strength of our diversified business model, our prudent risk management and our ability to effectively manage costs.”

Q2 2016 compared to Q2 2015

| • |

|

Net income of $2,573 million (up 3% from $2,502 million) |

| • |

|

Diluted earnings per share (EPS) of $1.66 (down $0.02 from $1.68) |

| • |

|

Return on common equity (ROE)(2) of 16.2% (down 310 bps from 19.3%) |

| • |

|

Basel III CET1 ratio of 10.3% (up 30 bps from 10.0%)

|

YTD 2016 compared to YTD 2015

| • |

|

Net income of $5,020 million (up 1% from $4,958 million) |

| • |

|

Diluted EPS of $3.25 (down $0.08 from $3.33) |

| • |

|

ROE of 15.8% (down 350 bps from 19.3%) |

Excluding specified item(1): Q2 2016 compared to Q2 2015

| • |

|

Net income of $2,573 million (up 7% from $2,394 million) |

| • |

|

Diluted EPS of $1.66 (up $0.05 from $1.61) |

| • |

|

ROE of 16.2% (down 230 bps from 18.5%)

|

Excluding specified item(1): YTD 2016 compared to YTD 2015

| • |

|

Net income of $5,020 million (up 4% from $4,850 million) |

| • |

|

Diluted EPS of $3.25 (down $0.01 from $3.26) |

| • |

|

ROE of 15.8% (down 310 bps from 18.9%) |

The specified item from Q2 2015 relates to a gain of

$108 million (before- and after-tax) from the wind-up of a U.S.-based subsidiary that resulted in the release of foreign currency translation adjustment that was previously booked in other components of equity.

| (1) |

These measures are non-GAAP. For further information, including a reconciliation, refer to the Key performance and non-GAAP measures section of this Q2 2016 Report to Shareholders. |

| (2) |

This measure does not have a standardized meaning under GAAP. For further information, refer to the Key performance and non-GAAP measures section of this Q2 2016 Report to Shareholders. |

Table of contents

2 Royal Bank of Canada Second Quarter 2016

|

|

| Management’s Discussion and Analysis

|

Management’s Discussion and Analysis (MD&A) is provided to enable a reader to assess our results of operations and financial

condition for the three and six months periods ended or as at April 30, 2016, compared to the corresponding periods in the prior fiscal year and the three month period ended January 31, 2016. This MD&A should be read in conjunction

with our unaudited Interim Condensed Consolidated Financial Statements for the quarter ended April 30, 2016 (Condensed Financial Statements) and related notes and our 2015 Annual Report. This MD&A is dated May 25, 2016. All amounts are

in Canadian dollars, unless otherwise specified, and are based on financial statements prepared in accordance with International Accounting Standard (IAS) 34, Interim Financial Reporting, as issued by the International Accounting Standards

Board (IASB), unless otherwise noted.

Additional information about us, including our 2015 Annual Information Form, is available free of charge on our website at

rbc.com/investorrelations, on the Canadian Securities Administrators’ website at sedar.com and on the EDGAR section of the United States (U.S.) Securities and Exchange Commission’s (SEC) website at sec.gov.

|

|

| Caution regarding forward-looking statements

|

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including the

“safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. We may make forward-looking statements in this Q2 2016 Report to Shareholders, in

other filings with Canadian regulators or the SEC, in other reports to shareholders and in other communications. Forward-looking statements in this document include, but are not limited to, statements relating to our financial performance

objectives, vision and strategic goals, the economic and market review and outlook for Canadian, U.S., European and global economies, the regulatory environment in which we operate, the outlook and priorities for each of our business segments, and

the risk environment including our liquidity and funding risk. The forward-looking information contained in this document is presented for the purpose of assisting the holders of our securities and financial analysts in understanding our financial

position and results of operations as at and for the periods ended on the dates presented; as well as our financial performance objectives, vision and strategic goals, and may not be appropriate for other purposes. Forward-looking statements are

typically identified by words such as “believe”, “expect”, “foresee”, “forecast”, “anticipate”, “intend”, “estimate”, “goal”, “plan” and “project”

and similar expressions of future or conditional verbs such as “will”, “may”, “should”, “could” or “would”.

By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to

the possibility that our predictions, forecasts, projections, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct and that our financial performance objectives, vision and strategic goals will not be

achieved. We caution readers not to place undue reliance on these statements as a number of risk factors could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. These

factors – many of which are beyond our control and the effects of which can be difficult to predict – include: credit, market, liquidity and funding, insurance, operational, regulatory compliance, strategic, reputation, legal and

regulatory environment, competitive and systemic risks and other risks discussed in the Risk management and Overview of other risks sections of our 2015 Annual Report and the Risk management section of this Q2 2016 Report to Shareholders; weak oil

and gas prices; the high levels of Canadian household debt; exposure to more volatile sectors, such as lending related to commercial real estate and leveraged financing; cybersecurity; anti-money laundering; the business and economic conditions in

Canada, the U.S. and certain other countries in which we operate; the effects of changes in government fiscal, monetary and other policies; tax risk and transparency; and environmental risk.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also adversely affect our results. When relying on our

forward-looking statements to make decisions with respect to us, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Material economic assumptions underlying the forward-looking

statements contained in this Q2 2016 Report to Shareholders are set out in the Overview and outlook section and for each business segment under the heading Outlook and priorities in our 2015 Annual Report, as updated by the Overview and outlook

section of this Q2 2016 Report to Shareholders. Except as required by law, we do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by us or on our behalf.

Additional information about these and other factors can be found in the Risk management and Overview of other risks sections of our 2015 Annual Report

and the Risk management section of this Q2 2016 Report to Shareholders.

Information contained in or otherwise accessible through the

websites mentioned does not form part of this report. All references in this report to websites are inactive textual references and are for your information only.

|

|

| About Royal Bank of Canada

|

Royal Bank of Canada is Canada’s largest bank, and one of the largest banks in the world, based on market capitalization. We are

one of North America’s leading diversified financial services companies, and provide personal and commercial banking, wealth management, insurance, investor services and capital markets products and services on a global basis. We have over

80,000 full- and part-time employees who serve more than 16 million personal, business, public sector and institutional clients through offices in Canada, the U.S. and 36 other countries. For more information, please visit rbc.com.

Royal Bank of

Canada Second Quarter 2016 3

|

|

| Selected financial and other highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As at or for the three months ended |

|

|

|

|

As at or for the six months ended |

|

| (Millions of Canadian dollars, except per share, number of and percentage amounts) |

|

April 30

2016 |

|

|

January 31

2016 |

|

|

April 30

2015 |

|

|

|

|

April 30

2016 |

|

|

April 30

2015 |

|

| Total revenue |

|

$ |

9,526 |

|

|

$ |

9,359 |

|

|

$ |

8,830 |

|

|

|

|

$ |

18,885 |

|

|

$ |

18,474 |

|

| Provision for credit losses (PCL) |

|

|

460 |

|

|

|

410 |

|

|

|

282 |

|

|

|

|

|

870 |

|

|

|

552 |

|

| Insurance policyholder benefits, claims and acquisition expense (PBCAE) |

|

|

988 |

|

|

|

829 |

|

|

|

493 |

|

|

|

|

|

1,817 |

|

|

|

2,015 |

|

| Non-interest expense |

|

|

4,887 |

|

|

|

4,960 |

|

|

|

4,736 |

|

|

|

|

|

9,847 |

|

|

|

9,356 |

|

| Income before income taxes |

|

|

3,191 |

|

|

|

3,160 |

|

|

|

3,319 |

|

|

|

|

|

6,351 |

|

|

|

6,551 |

|

| Net income |

|

$ |

2,573 |

|

|

$ |

2,447 |

|

|

$ |

2,502 |

|

|

|

|

$ |

5,020 |

|

|

$ |

4,958 |

|

| Segments – net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Personal & Commercial Banking |

|

$ |

1,297 |

|

|

$ |

1,290 |

|

|

$ |

1,200 |

|

|

|

|

$ |

2,587 |

|

|

$ |

2,455 |

|

| Wealth Management |

|

|

386 |

|

|

|

303 |

|

|

|

271 |

|

|

|

|

|

689 |

|

|

|

501 |

|

| Insurance |

|

|

177 |

|

|

|

131 |

|

|

|

123 |

|

|

|

|

|

308 |

|

|

|

308 |

|

| Investor & Treasury Services |

|

|

139 |

|

|

|

143 |

|

|

|

159 |

|

|

|

|

|

282 |

|

|

|

301 |

|

| Capital Markets |

|

|

583 |

|

|

|

570 |

|

|

|

625 |

|

|

|

|

|

1,153 |

|

|

|

1,219 |

|

| Corporate Support |

|

|

(9 |

) |

|

|

10 |

|

|

|

124 |

|

|

|

|

|

1 |

|

|

|

174 |

|

| Net income |

|

$ |

2,573 |

|

|

$ |

2,447 |

|

|

$ |

2,502 |

|

|

|

|

$ |

5,020 |

|

|

$ |

4,958 |

|

| Selected information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share (EPS) – basic |

|

$ |

1.67 |

|

|

$ |

1.59 |

|

|

$ |

1.68 |

|

|

|

|

$ |

3.26 |

|

|

$ |

3.34 |

|

|

– diluted |

|

|

1.66 |

|

|

|

1.58 |

|

|

|

1.68 |

|

|

|

|

|

3.25 |

|

|

|

3.33 |

|

| Return on common equity (ROE) (1), (2) |

|

|

16.2% |

|

|

|

15.3% |

|

|

|

19.3% |

|

|

|

|

|

15.8% |

|

|

|

19.3% |

|

| Total PCL as a % of average net loans and acceptances |

|

|

0.36% |

|

|

|

0.31% |

|

|

|

0.25% |

|

|

|

|

|

0.33% |

|

|

|

0.24% |

|

| PCL on impaired loans as a % of average net loans and acceptances |

|

|

0.32% |

|

|

|

0.31% |

|

|

|

0.25% |

|

|

|

|

|

0.31% |

|

|

|

0.24% |

|

| Gross impaired loans (GIL) as a % of loans and

acceptances (3) |

|

|

0.71% |

|

|

|

0.59% |

|

|

|

0.46% |

|

|

|

|

|

0.71% |

|

|

|

0.46% |

|

| Liquidity coverage ratio

(LCR) (4) |

|

|

133% |

|

|

|

127% |

|

|

|

113% |

|

|

|

|

|

133% |

|

|

|

n.a. |

|

| Capital ratios, Leverage ratio and multiples |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Equity Tier 1 (CET1) ratio |

|

|

10.3% |

|

|

|

9.9% |

|

|

|

10.0% |

|

|

|

|

|

10.3% |

|

|

|

10.0% |

|

| Tier 1 capital ratio |

|

|

11.9% |

|

|

|

11.3% |

|

|

|

11.6% |

|

|

|

|

|

11.9% |

|

|

|

11.6% |

|

| Total capital ratio |

|

|

14.0% |

|

|

|

13.4% |

|

|

|

13.5% |

|

|

|

|

|

14.0% |

|

|

|

13.5% |

|

| Leverage ratio |

|

|

4.2% |

|

|

|

4.0% |

|

|

|

4.0% |

|

|

|

|

|

4.2% |

|

|

|

4.0% |

|

| Selected balance sheet and other information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

1,150,357 |

|

|

$ |

1,200,352 |

|

|

$ |

1,032,172 |

|

|

|

|

$ |

1,150,357 |

|

|

$ |

1,032,172 |

|

| Securities |

|

|

224,371 |

|

|

|

233,711 |

|

|

|

222,643 |

|

|

|

|

|

224,371 |

|

|

|

222,643 |

|

| Loans (net of allowance for loan losses) |

|

|

508,194 |

|

|

|

516,186 |

|

|

|

448,310 |

|

|

|

|

|

508,194 |

|

|

|

448,310 |

|

| Derivative related assets |

|

|

115,298 |

|

|

|

132,560 |

|

|

|

107,004 |

|

|

|

|

|

115,298 |

|

|

|

107,004 |

|

| Deposits |

|

|

741,454 |

|

|

|

769,568 |

|

|

|

651,551 |

|

|

|

|

|

741,454 |

|

|

|

651,551 |

|

| Common equity |

|

|

60,825 |

|

|

|

63,111 |

|

|

|

51,779 |

|

|

|

|

|

60,825 |

|

|

|

51,779 |

|

| Average common equity (1) |

|

|

62,400 |

|

|

|

61,450 |

|

|

|

51,500 |

|

|

|

|

|

61,950 |

|

|

|

50,350 |

|

| Total capital risk-weighted assets |

|

|

437,148 |

|

|

|

462,449 |

|

|

|

398,992 |

|

|

|

|

|

437,148 |

|

|

|

398,992 |

|

| Assets under management (AUM) (5) |

|

|

544,900 |

|

|

|

561,500 |

|

|

|

486,300 |

|

|

|

|

|

544,900 |

|

|

|

486,300 |

|

| Assets under administration

(AUA) (5), (6) |

|

|

4,597,900 |

|

|

|

4,823,200 |

|

|

|

4,835,100 |

|

|

|

|

|

4,597,900 |

|

|

|

4,835,100 |

|

| Common share information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares outstanding (000s) – average basic |

|

|

1,487,346 |

|

|

|

1,486,560 |

|

|

|

1,442,078 |

|

|

|

|

|

1,486,871 |

|

|

|

1,442,339 |

|

|

– average diluted |

|

|

1,495,609 |

|

|

|

1,495,035 |

|

|

|

1,448,651 |

|

|

|

|

|

1,495,245 |

|

|

|

1,449,037 |

|

|

– end of period |

|

|

1,488,219 |

|

|

|

1,486,631 |

|

|

|

1,443,102 |

|

|

|

|

|

1,488,219 |

|

|

|

1,443,102 |

|

| Dividends declared per common share |

|

$ |

0.81 |

|

|

$ |

0.79 |

|

|

$ |

0.77 |

|

|

|

|

$ |

1.60 |

|

|

$ |

1.52 |

|

| Dividend yield (7) |

|

|

4.5% |

|

|

|

4.4% |

|

|

|

4.0% |

|

|

|

|

|

4.5% |

|

|

|

3.9% |

|

| Common share price (RY on TSX) (8) |

|

$ |

77.92 |

|

|

$ |

72.55 |

|

|

$ |

80.11 |

|

|

|

|

$ |

77.92 |

|

|

$ |

80.11 |

|

| Market capitalization

(TSX) (8) |

|

|

115,962 |

|

|

|

107,855 |

|

|

|

115,607 |

|

|

|

|

|

115,962 |

|

|

|

115,607 |

|

| Business information (number of) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Employees (full-time equivalent) (FTE) |

|

|

76,300 |

|

|

|

76,380 |

|

|

|

73,136 |

|

|

|

|

|

76,300 |

|

|

|

73,136 |

|

| Bank branches |

|

|

1,427 |

|

|

|

1,430 |

|

|

|

1,361 |

|

|

|

|

|

1,427 |

|

|

|

1,361 |

|

| Automated teller machines (ATMs) |

|

|

4,898 |

|

|

|

4,900 |

|

|

|

4,913 |

|

|

|

|

|

4,898 |

|

|

|

4,913 |

|

| Period average US$ equivalent of C$1.00 (9) |

|

$ |

0.768 |

|

|

$ |

0.728 |

|

|

$ |

0.806 |

|

|

|

|

$ |

0.748 |

|

|

$ |

0.822 |

|

| Period-end US$ equivalent of C$1.00 |

|

$ |

0.797 |

|

|

$ |

0.714 |

|

|

$ |

0.829 |

|

|

|

|

$ |

0.797 |

|

|

$ |

0.829 |

|

| (1) |

|

Average amounts are calculated using methods intended to approximate the average of the daily balances for the period. This includes ROE and Average common equity. For further details, refer to the Key performance and

non-GAAP measures section. |

| (2) |

|

These measures may not have a standardized meaning under generally accepted accounting principles (GAAP) and may not be comparable to similar measures disclosed by other financial institutions. For further details,

refer to the Key performance and non-GAAP measures section. |

| (3) |

|

GIL includes $531 million (January 31, 2016 – $636 million) related to the acquired credit impaired (ACI) loans portfolio from our acquisition of City National, with over 80% covered by

loss-sharing agreements with the Federal Deposit Insurance Corporation (FDIC). ACI loans added 10 bps to our second quarter 2016 GIL ratio (January 31, 2016 – 9 bps). For further details, refer to Note 2 and 5 of our

Condensed Financial Statements. |

| (4) |

|

LCR is a new regulatory measure under the Basel III Framework, and is calculated using the Liquidity Adequacy Requirements (LAR) guideline. Effective in the second quarter of 2015, LCR was adopted prospectively, and is

not applicable for prior periods. For further details, refer to the Liquidity and funding risk section. LCR for Q1 2016 has been revised from the amount previously presented. |

| (5) |

|

Represents period-end spot balances. |

| (6) |

|

AUA includes $19.8 billion and $9.9 billion (January 31, 2016 – $20.4 billion and $9.7 billion; April 30, 2015 – $22.5 billion and $7.9 billion) of securitized

residential mortgages and credit card loans, respectively. |

| (7) |

|

Defined as dividends per common share divided by the average of the high and low share price in the relevant period. |

| (8) |

|

Based on TSX closing market price at period-end. |

| (9) |

|

Average amounts are calculated using month-end spot rates for the period. |

4 Royal Bank of Canada Second Quarter 2016

|

|

| Economic, market and regulatory review and outlook – data as at

May 25, 2016 |

The predictions and forecasts in this section are based on information and assumptions from sources we consider reliable. If this

information or these assumptions are not accurate, actual economic outcomes may differ materially from the outlook presented in this section.

Canada

The Canadian economy is expected to grow in the first calendar quarter by an estimated annualized rate of 3.1% led by strong export performance and consumer

spending. This was partially attributable to accommodative monetary policy and a weaker Canadian dollar, which has helped the economy compensate for declines in the energy sector. Motor vehicle sales reached record levels, though housing starts

began to decline in April after increasing in the first calendar quarter of 2016. In addition, the labour market held steady, while wages continued to rise. The national unemployment rate decreased to 7.1%, compared to 7.2% in January, while

Alberta’s unemployment rate decreased to 7.2% in April, compared to 7.4% in January, attributable to a shrinking labour force. In the March 22 budget, the federal government announced new spending measures, including infrastructure

investment, which is expected to support economic growth. The recent improvement in oil prices as well as earlier indications of economic strength have provided a lift to the Canadian dollar. On May 25, the Bank of Canada (BoC) maintained its

overnight rate at 0.5%, stating that the economy’s structural adjustment to the oil price shock continues. BoC also highlighted the impact of the Alberta wildfires, which will result in a weaker than expected second calendar quarter due to the

halt in oil production. The economy is expected to rebound in the third calendar quarter as oil production resumes and reconstruction in Alberta begins.

In May, wildfires resulted in temporary production shutdowns at some oil sands facilities near Fort McMurray, Alberta. While the situation is still

evolving, these shutdowns are currently expected to lower annualized GDP growth by one percentage point in the second calendar quarter of 2016. Growth is forecast to rebound in the third calendar quarter when production is expected to return to

normal levels. Aside from this temporary setback, we continue to expect strengthening non-energy exports, solid consumer spending, and fiscal stimulus to offset declines in the energy sector. Net exports are expected to continue to increase as U.S.

domestic spending picks up and the weak Canadian dollar boosts exporters’ competitiveness. Our 2016 growth forecast of 1.8% is unchanged from February 23, 2016. For the remainder of 2016, we expect fiscal stimulus measures to boost the

economy as the energy industry continues to adjust to the lower price of oil. With these factors in consideration, we expect the BoC to maintain its overnight rate at 0.5% through calendar 2016 and begin raising interest rates in the first half of

2017.

U.S.

Growth in the U.S. economy slowed to an estimated

annualized rate of 0.5% in the first calendar quarter of 2016 compared to the prior quarter’s growth of 1.4%, due to declining exports, slower growth in consumer spending, and weaker business investment. The strong U.S. dollar and subdued

global growth continued to weaken export volumes. However, residential investments continued to improve as household income rose, while a rebound in government spending also helped offset the decline in business investment. The labour market

remained stable and the unemployment rate of 5.0% in April was close to full employment. Despite further improvement in the labour market, the U.S. Federal Reserve Bank (Fed) maintained a cautious policy stance in April and held its funds target

range at 0.25% to 0.5%.

We expect the U.S. economy to grow at a rate of 2.0% during calendar 2016, which is below our previous estimate of

2.3% as at February 23, 2016. We expect consumer spending to grow as indicators support income growth through higher wages and job creation throughout 2016. We also expect to see a modest rebound in non-energy business investment amid

accommodative financial conditions and improving business sentiment.

Europe

The Euro area economy continued its recovery and grew at a rate of 0.5% in the first quarter of 2016, boosted by growing business investment and improving domestic

consumption. The March unemployment rate of 10.2% reached its lowest level since August 2011, compared to 10.4% in December 2015. In March, the European Central Bank (ECB) also expanded its Asset Purchase Program, increasing monthly purchases by €20 billion to €80 billion and including non-financial corporate bonds in the program. Previously, only euro-denominated public sector securities,

asset-based securities and covered bonds were eligible.

Overall, we expect the Euro area economy to grow at an estimated rate of 1.7% for calendar

2016, unchanged from February 23, 2016, as the economy benefits from the ECB stimulus and further weakening in the euro. However, policymakers remain concerned about low inflation and subdued inflation expectations. In March, the ECB announced

that it would lower its deposit rate to (0.4)% from (0.3)%, which is consistent with our estimate in February.

Financial markets

Though markets saw significant fluctuations in the first part of the year, market volatility began to stabilize in the latter half of the quarter. Investor sentiment

improved as companies posted higher-than-expected earnings due to the strengthening of oil prices and supportive economic data. In addition, the central banks around the world reaffirmed their commitment to historically low interest rates as a

measure to stimulate sluggish growth and low inflation in developed economies. Credit spreads on corporate bonds widened earlier this year due to concerns over slowing global growth and continuing concerns from the energy sector, but corporate

spreads have tightened since mid-February. Oil prices continued to recover with crude oil reaching a six-month high of $45 per barrel but prices continue to be lower compared to the same period in 2015. The recent increase in oil prices and

strengthening government yields also boosted the Canadian dollar. Non-precious metals prices improved as signs of Chinese steel demand began to stabilize.

The macroeconomic headwinds discussed above, such as depressed oil prices, uncertainty in the Alberta oil sands and slower growth in the global economy

may alter our outlook and results for the remainder of fiscal 2016 and future periods as these continuing pressures may lead to higher PCL in our wholesale and retail loan portfolios and impact the general business and economic conditions in the

regions we operate.

Royal Bank of

Canada Second Quarter 2016 5

Regulatory environment

We

continue to monitor and prepare for regulatory developments in a manner that seeks to ensure compliance with new requirements while mitigating any adverse business or financial impacts. Such impacts could result from new or amended regulations and

the expectations of those who enforce them. Significant developments include continuing changes to global and domestic standards for capital and liquidity, over-the-counter (OTC) derivatives reform, initiatives to enhance requirements for

institutions deemed systemically important to the financial sector, and changes to resolution regimes addressing bail-in and total loss-absorbing capacity. We also continue to implement rules adopted under the U.S. Dodd-Frank Wall Street Reform

and Consumer Protection Act (the Dodd-Frank Act), including those related to the Fed’s enhanced prudential standards for bank holding companies and foreign banking organizations (FBO Rule).

Enhanced Prudential Standards for Foreign Banking Organizations

We continue to make progress in bringing our non-branch and non-agency U.S. assets under our U.S. Intermediate Holding Company (IHC) in accordance with the FBO Rule,

and in enhancing our existing risk management oversight and governance framework and practices in order to provide the governance and infrastructure needed to implement and support applicable requirements over the next several years. On March 4,

2016, the Fed re-proposed a separate rule to limit credit exposures of large banking organizations (including FBOs and IHCs) to any single counterparty or group or related counterparties, whether because of economic interdependence or control

relationships. As proposed, the net credit exposure of our combined U.S. operations (IHC and U.S. branches and agencies) to any unaffiliated counterparty or group of related companies will be limited to 25% of our consolidated Tier I capital ($13

billion using April 30, 2016 as a proxy), 15% of our consolidated Tier I capital for net credit exposures to G-SIBs ($8 billion using April 30, 2016 as a proxy), and 25% of our IHC’s Tier I regulatory capital for net credit exposures of

our IHC to any unaffiliated counterparty or group of related companies ($3 billion using March 31, 2016 as a proxy). We expect we will need to modify our existing systems and put in place appropriate monitoring and reporting mechanisms in order to

comply with these prescribed limits by the implementation deadline established after final rule issuance. As proposed, compliance will be required to be met daily, with monthly reporting to the Fed evidencing compliance. These impacts are not

expected to materially affect our overall results.

Canadian Bail-in Regime

On April 20, 2016, the Government of Canada (GoC) introduced legislation to create a bank recapitalization or “bail-in” regime for the six domestic

systemically important banks (D-SIBs). Under the regime, if the Superintendent of Financial Institutions is of the opinion that a D-SIB has ceased or is about to cease to be viable and its viability cannot be restored through the exercise of the

Superintendent’s powers, the GoC can, among other things, appoint the Canada Deposit Insurance Corporation (CDIC) as receiver of the bank and direct CDIC to convert certain shares and liabilities of the bank into common shares of the bank or

any of its affiliates. The shares and liabilities that will be subject to the conversion, as well as the terms and conditions of conversion, are to be prescribed by regulations to be made at a future date. The legislation also provides that the

Superintendent will require such designated D-SIBs to maintain a minimum capacity to absorb losses. Higher Loss Absorbency requirements would apply to ensure affected banks maintain sufficient capital to absorb the proposed conversions. The

legislation may be amended prior to being approved by Parliament. While the specific parameters around conversion and loss-absorbency are not yet known, RBC expects these changes may increase our cost of long-term unsecured funding. However, these

changes are not expected to materially impact our overall results.

Uniform Fiduciary Standards

On April 6, 2016, the U.S. Department of Labor issued a final rule establishing a uniform fiduciary standard for providers of investment advice and related

services in connection with U.S. retirement plans and holders of individual retirement accounts. As expected, the rule, which will be effective April 10, 2017, will impose new regulatory requirements and costs on our U.S. Wealth Management brokers

and investment advisors who provide individualized investment advice according to a “suitability” standard rather than a fiduciary standard. On April 28, 2016, the Canadian Securities Administrators proposed their own version of a

regulatory “best interest standard” intended to replace the current requirement for registered advisors, dealers and representatives to deal “fairly, honestly, and in good faith” with their clients. Similar standards have been

proposed or finalized in jurisdictions, such as the UK and Australia. While impacts of these delays are not expected to materially affect our overall results, they could require some modifications to our current Wealth Management business practices

and the practices of similarly affected organizations.

Regulation of Asset Management Activities

The Financial Stability Board (FSB) and the International Organization of Securities Commissions (IOSCO) have committed to developing policy recommendations by the end

of 2016 addressing structural vulnerabilities from asset management activities, to be delivered to G20 leaders in time for their September 2016 summit. Other jurisdictions, including the U.S. and U.K., are conducting similar analysis focused on the

potential risks asset management activities may pose to financial stability. We expect these efforts could result in new regulations impacting our Canadian and International mutual funds in areas such as liquidity management, enhanced reporting to

regulators, and additional disclosures to investors.

Global OTC Derivatives Reforms

Joint guidelines issued by the BCBS (Basel Committee on Banking Supervision) and the IOSCO in September 2013 include a requirement for mandatory exchange of initial and

variation margin (i.e. margin held as collateral to protect against potential counterparty default) on bilateral OTC derivatives. On February 29, 2016, the Office of the Superintendent of Financial Institutions

6 Royal Bank of Canada Second Quarter 2016

(OSFI) issued domestic rules implementing the joint BCBS/IOSCO guidelines, with compliance required by September 1,

2016. These new requirements represent a fundamental change in how non-centrally cleared OTC derivatives are traded and require all in-scope counterparties to be documented before the deadline. The amount of initial margin required may increase if

banks are not able to rely on internal models-based approaches and instead must use standardized (less risk-sensitive) approaches.

On

April 13, 2016, the SEC adopted final rules requiring securities-based swap dealers (SBSDs) to establish a supervisory regime for their securities-based swaps activities, including designating a Chief Compliance Officer. The final rule also

requires SBSDs to disclose risks, conflicts, and other material information about a swap to a counterparty, and ensure any recommendations made to a counterparty are suitable. The U.S. Commodity Futures Trading Commission (CFTC) is expected to issue

a final rule in 2016 establishing margin requirements for uncleared cross-border swaps (to the extent not already covered by its previously adopted uncleared swaps rules), a rule on capital requirements for swap dealers by mid-2016 and final rules

on algorithmic trading by the end of 2016. The CFTC is also considering the adoption of final rules that would impose limits on the size of positions that may be entered into in certain derivatives contracts.

Regulatory capital and related requirements

On April 29,

2016, the Office of the Superintendent of Financial Institutions (OSFI) released proposed updates to the regulatory capital requirements for loans secured by residential real estate. These updates will ensure that capital requirements remain prudent

in periods where housing prices are high relative to household income and introduces a risk-sensitive floor on internal ratings-based capital requirements to take into account periods where the value of properties pledged as collateral becomes less

certain.

On April 6, 2016, the BCBS released some proposed revisions to the design and calibration of the leverage ratio. This included the

adoption of a modified version of the standardized approach for measuring counterparty credit risk exposures (SA-CCR) to determine derivative exposures, alignment of the credit conversion factors for off-balance sheet items with those proposed for

the revised standardized approach to credit risk under the Basel III risk-based framework, and additional requirements intended to align the unsettled trade exposures for entities under settlement-date accounting and trade-date accounting.

On March 24, 2016, BCBS proposed new measures to reduce the complexity of the current Basel III internal-ratings-based regulatory capital framework and

improve comparability across institutions and jurisdictions, as well as address excess variability in certain capital requirements, particularly in areas with unreliable estimates.

On March 4, 2016, the BCBS proposed a revised Basel III operational risk capital framework, the Standardized Measurement Approach (SMA), to provide

simplicity, comparability, and risk sensitivity to the current framework. The SMA is intended to simplify the framework by replacing three existing standardized approaches, as well as the Advanced Measurement Approach. The BCBS expects this proposal

to have a relatively neutral impact on capital for most banks.

These papers were published on a consultative basis in order to obtain feedback and

comments from various stakeholders. As such, the revisions proposed within the above documents are not yet final. We continue to monitor regulatory developments published by the BCBS and OSFI as they arise.

For a discussion on risk factors resulting from these and other regulatory developments which may affect our business and financial results, refer to the Risk

management – Top and emerging risks and Legal and regulatory environmental risk sections of our 2015 Annual Report. For further details on our framework and activities to manage risks, refer to the Risk management and Capital management

sections of our 2015 Annual Report and the Risk management and Capital management sections of this Q2 2016 Report to Shareholders.

|

|

| Key corporate events of 2016

|

RBC General Insurance Company

On

January 21, 2016, we announced that we have signed a 15-year strategic agreement with Aviva Canada Inc. In addition, Aviva Canada will purchase RBC General Insurance Company for $582 million, subject to closing adjustments. The transaction is

expected to close in our third quarter of 2016 subject to customary closing conditions, including receipt of required regulatory approvals. A net after-tax gain on the transaction is currently estimated at $200 million. For further details, refer to

Note 6 of our Condensed Financial Statements.

Certain Caribbean Wealth Management businesses

On November 4, 2015, we entered into a purchase and sale agreement to sell our trust, custody and fund administration businesses in the Caribbean to SMP Partners

Group, subject to customary closing conditions and regulatory approvals. The transaction is expected to close in the latter half of calendar 2016. For further details, refer to Note 6 of our Condensed Financial Statements.

City National Corporation

On November 2, 2015, we completed the

acquisition of City National Corporation (City National), the holding company for City National Bank. Total consideration of $7.1 billion (US$5.5 billion) was paid with $3.4 billion (US$2.6 billion) in cash, 41.6 million RBC common shares,

and $360 million (US$275 million) of RBC first preferred shares. City National has been combined with the U.S. Wealth Management business within our Wealth Management segment. For further details, refer to Note 6 of our Condensed Financial

Statements.

Royal Bank of

Canada Second Quarter 2016 7

Q2 2016 vs. Q2 2015

Net income of $2,573

million was up $71 million or 3%. Diluted earnings per share (EPS) of $1.66 was down $0.02 and return on common equity (ROE) of 16.2% was down 310 bps from 19.3% last year. Both our diluted EPS and ROE were impacted by our acquisition of City

National due to the issuance of RBC common shares as noted above. Our Common Equity Tier 1 (CET1) ratio was 10.3%.

Excluding the prior year gain of

$108 million (before- and after-tax) which was identified as a specified item and is described below, net income was up $179 million or 7% from last year, and diluted EPS of $1.66 was up $0.05. Our results reflected higher earnings in Wealth

Management, Personal & Commercial Banking and Insurance. These factors were partially offset by lower earnings in Capital Markets and Investor & Treasury Services. Our results also included an increase due to foreign exchange

translation.

Wealth Management earnings increased, primarily reflecting the inclusion of our acquisition of City National, which contributed $66

million to net income (see Wealth Management segment discussion on pages 16-17 for further details). Benefits from our efficiency management activities, lower PCL and lower restructuring costs related to our International Wealth Management business

also contributed to the increase. These factors were partially offset by lower transaction volumes reflecting decreased client activity.

Personal & Commercial Banking earnings increased, mainly reflecting solid volume growth, the positive impact of one additional day in the

current quarter and fee-based revenue growth in Canada, as well as higher earnings in the Caribbean. These factors were partially offset by higher PCL in Canada. In addition, the prior year included a loss of $23 million (before- and after-tax)

related to the sale of RBC Royal Bank (Suriname) N.V. (RBC Suriname).

Insurance results increased mainly reflecting the favourable impact of

investment-related gains on the Canadian Life business and lower net claims costs in both Canadian and International Insurance.

Capital Markets

earnings decreased mainly due to lower results in our Global Markets and Corporate and Investment Banking businesses driven by lower client activity, and higher PCL. These factors were partly offset by lower variable compensation, lower taxes and an

increase due to foreign exchange translation.

Investor & Treasury Services earnings decreased, largely due to increased investment in

technology and lower earnings from foreign exchange market execution reflecting a decrease in client activity. These factors were partially offset by higher earnings on growth in client deposits and higher client deposit spreads, and an increase due

to foreign exchange translation.

For further details on our business segment results and CET1 ratio, refer to the Business segment results and

Capital management sections, respectively.

Q2 2016 vs. Q1 2016

Net

income increased $126 million or 5% from the prior quarter. Diluted EPS was up $0.08 and ROE was up 90 bps from 15.3% last quarter.

Our results

increased mainly due to higher earnings in Wealth Management driven by benefits from our efficiency management activities, lower variable compensation and higher earnings in City National due to loan growth and lower acquisition and integration

costs. A tax recovery from a prior year tax loss and lower net claims costs in Insurance, growth in debt and equity origination and higher loan syndication activity in Capital Markets, and lower staff costs and higher spreads in Canadian Banking

also contributed to the increase. These factors were partially offset by a lower impact from foreign exchange translation, a $50 million ($37 million after-tax) increase in the provision for credit losses for loans not yet identified as impaired,

the impact of seasonal factors including fewer days in the quarter, and lower funding and liquidity revenue resulting from lower market volatility in Investor & Treasury Services.

Q2 2016 vs. Q2 2015 (Six months ended)

Net income of $5,020 million

increased $62 million or 1% from a year ago. Six month diluted EPS of $3.25 was down $0.08 and ROE of 15.8% was down 350 bps. Both our diluted EPS and ROE were impacted by our acquisition of City National due to the issuance of RBC common shares as

noted above.

Excluding the prior year specified item described below, net income was up $170 million or 4% from the prior year, and diluted EPS was

down $0.01. Our results increased mainly reflecting higher earnings in Wealth Management and Personal & Commercial Banking, partially offset by lower earnings in Capital Markets and Investor & Treasury Services. Our results also

included an increase due to foreign exchange translation.

Wealth Management earnings increased primarily reflecting the inclusion of our

acquisition of City National, which contributed $119 million to net income. Lower restructuring costs, benefits from our efficiency management activities, and lower PCL also contributed to the increase. These factors were partially offset by lower

transaction volumes and lower earnings on average fee-based client assets.

Personal & Commercial Banking earnings increased mainly

reflecting solid volume growth across most businesses and fee-based revenue growth in Canada, as well as higher earnings in the Caribbean. These factors were partially offset by higher PCL in Canada, lower spreads and higher costs in support of

business growth. In addition, the prior year included a loss related to the sale of RBC Suriname as noted above.

Insurance earnings were flat, as

the favourable impact of investment-related gains on the Canadian Life business and new business volumes were offset by lower earnings from new U.K. annuity contracts and unfavourable life policyholder behaviour.

Capital Markets earnings decreased, mainly due to lower results in our Global Markets and Corporate and Investment Banking businesses reflecting lower

client activity, and higher PCL. These factors were partly offset by lower variable compensation, a lower effective tax rate, an increase due to foreign exchange translation and lower litigation provisions and related legal costs.

Investor & Treasury Services earnings decreased, largely due to increased investment in technology and lower revenue from foreign exchange

market execution resulting from lower client activity. These factors were partially offset by increased earnings on growth in client deposits and higher client deposit spreads, and an increase due to foreign exchange translation.

8 Royal Bank of Canada Second Quarter 2016

Specified item – for the three and six months ended April 30, 2015

For the three and six months ended April 30, 2015, our results were impacted by a gain of $108 million (before- and after-tax) from the wind-up of a U.S.-based

subsidiary that resulted in the release of foreign currency translation adjustment (CTA) that was previously booked in other components of equity (OCE), which was recorded in Corporate Support in the second quarter of 2015. Results excluding this

specified item are non-GAAP measures. For further details, refer to the Key performance and non-GAAP measures section.

Impact of foreign currency translation

Our foreign currency-denominated results are impacted by exchange rate fluctuations. Revenue, PCL, insurance policyholder benefits, claims and acquisition

expense (PBCAE), non-interest expense and net income denominated in foreign currency are translated at the average rate of exchange for the period.

The following table reflects the estimated impact of foreign exchange translation on key income statement items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

|

|

|

For the six months ended |

|

| (Millions of Canadian dollars, except per share amounts) |

|

Q2 2016 vs.

Q2 2015 |

|

|

Q2 2016 vs.

Q1 2016 |

|

|

|

|

Q2 2016 vs.

Q2 2015 |

|

| Increase (decrease): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

$ |

108 |

|

|

$ |

(202 |

) |

|

|

|

$ |

422 |

|

| PCL |

|

|

6 |

|

|

|

(8 |

) |

|

|

|

|

18 |

|

| PBCAE |

|

|

– |

|

|

|

(23 |

) |

|

|

|

|

27 |

|

| Non-interest expense |

|

|

59 |

|

|

|

(120 |

) |

|

|

|

|

243 |

|

| Income taxes |

|

|

11 |

|

|

|

(13 |

) |

|

|

|

|

42 |

|

| Net income |

|

|

32 |

|

|

|

(38 |

) |

|

|

|

|

92 |

|

| Impact on EPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.02 |

|

|

|

$ (0.03 |

) |

|

|

|

$ |

0.06 |

|

| Diluted |

|

|

0.02 |

|

|

|

(0.03 |

) |

|

|

|

|

0.06 |

|

The relevant average exchange rates that impact our business are shown in the following table:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

|

|

|

For the six months ended |

|

| (Average foreign currency equivalent of C$1.00) (1) |

|

April 30

2016 |

|

|

January 31

2016 |

|

|

April 30

2015 |

|

|

|

|

April 30

2016 |

|

|

April 30

2015 |

|

| U.S. dollar |

|

|

0.768 |

|

|

|

0.728 |

|

|

|

0.806 |

|

|

|

|

|

0.748 |

|

|

|

0.822 |

|

| British pound |

|

|

0.537 |

|

|

|

0.496 |

|

|

|

0.530 |

|

|

|

|

|

0.516 |

|

|

|

0.537 |

|

| Euro |

|

|

0.684 |

|

|

|

0.677 |

|

|

|

0.729 |

|

|

|

|

|

0.680 |

|

|

|

0.716 |

|

| |

(1) |

|

Average amounts are calculated using month-end spot rates for the period. |

|

Total revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

|

|

|

For the six months ended |

|

(Millions of Canadian dollars, except percentage

amounts) |

|

April 30

2016 |

|

|

January 31

2016 |

|

|

April 30

2015 |

|

|

|

|

April 30

2016 |

|

|

April 30

2015 |

|

| Interest income |

|

$ |

6,001 |

|

|

$ |

6,056 |

|

|

$ |

5,557 |

|

|

|

|

$ |

12,057 |

|

|

$ |

11,259 |

|

| Interest expense |

|

|

1,976 |

|

|

|

1,860 |

|

|

|

2,000 |

|

|

|

|

|

3,836 |

|

|

|

4,071 |

|

| Net interest income |

|

$ |

4,025 |

|

|

$ |

4,196 |

|

|

$ |

3,557 |

|

|

|

|

$ |

8,221 |

|

|

$ |

7,188 |

|

| Net interest margin (on average earning assets) (1) |

|

|

1.70% |

|

|

|

1.71% |

|

|

|

1.71% |

|

|

|

|

|

1.71% |

|

|

|

1.72% |

|

| Investments (2) |

|

$ |

2,086 |

|

|

$ |

2,140 |

|

|

$ |

2,020 |

|

|

|

|

$ |

4,226 |

|

|

$ |

4,007 |

|

| Insurance (3) |

|

|

1,351 |

|

|

|

1,159 |

|

|

|

806 |

|

|

|

|

|

2,510 |

|

|

|

2,698 |

|

| Trading |

|

|

181 |

|

|

|

90 |

|

|

|

359 |

|

|

|

|

|

271 |

|

|

|

699 |

|

| Banking (4) |

|

|

1,344 |

|

|

|

1,092 |

|

|

|

1,195 |

|

|

|

|

|

2,436 |

|

|

|

2,190 |

|

| Underwriting and other advisory |

|

|

469 |

|

|

|

374 |

|

|

|

559 |

|

|

|

|

|

843 |

|

|

|

1,004 |

|

| Other (5) |

|

|

70 |

|

|

|

308 |

|

|

|

334 |

|

|

|

|

|

378 |

|

|

|

688 |

|

| Non-interest income |

|

$ |

5,501 |

|

|

$ |

5,163 |

|

|

$ |

5,273 |

|

|

|

|

$ |

10,664 |

|

|

$ |

11,286 |

|

| Total revenue |

|

$ |

9,526 |

|

|

$ |

9,359 |

|

|

$ |

8,830 |

|

|

|

|

$ |

18,885 |

|

|

$ |

18,474 |

|

| Additional information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total trading revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

$ |

597 |

|

|

$ |

638 |

|

|

$ |

595 |

|

|

|

|

$ |

1,235 |

|

|

$ |

1,135 |

|

| Non-interest income |

|

|

181 |

|

|

|

90 |

|

|

|

359 |

|

|

|

|

|

271 |

|

|

|

699 |

|

| Total trading revenue |

|

$ |

778 |

|

|

$ |

728 |

|

|

$ |

954 |

|

|

|

|

$ |

1,506 |

|

|

$ |

1,834 |

|

| |

(1) |

|

Net interest margin (on average earning assets) is calculated as net interest income divided by average earning assets. |

|

| |

(2) |

|

Includes securities brokerage commissions, investment management and custodial fees, and mutual fund revenue. |

|

| |

(3) |

|

Includes premiums and investment and fee income. Investment income includes the change in fair value of investments backing policyholder liabilities and is largely offset in PBCAE. |

|

| |

(4) |

|

Includes service charges, foreign exchange revenue other than trading, card service revenue and credit fees. |

|

| |

(5) |

|

Includes other non-interest income, net gain (loss) on available-for-sale (AFS) securities and share of profit in joint ventures and associates. |

|

Royal Bank of

Canada Second Quarter 2016 9

Q2 2016 vs. Q2 2015

Total

revenue increased $696 million or 8% from last year. Excluding the prior year gain related to the release of CTA as noted above, total revenue increased $804 million or 9% which includes the positive change in fair value of investments backing our

policyholder liabilities of $525 million which was largely offset in PBCAE, and an increase due to foreign exchange translation this quarter, which increased our total revenue by $108 million.

Net interest income increased $468 million or 13%, mainly due to the inclusion of our acquisition of City National, solid volume growth across most of

our businesses in Canadian Banking, and an increase due to foreign exchange translation.

Net interest margin was down 1 bp compared to last year,

largely due to the continued low interest rate environment. The prior year included an unfavourable cumulative accounting adjustment.

Investments

revenue increased $66 million or 3%, mainly due to the inclusion of our acquisition of City National and growth in average fee-based client assets, and an increase due to foreign exchange translation. These were partially offset by lower transaction

volumes in Wealth Management, reflecting reduced client activity.

Insurance revenue increased $545 million or 68%, mainly reflecting the positive

change in fair value of investments backing our policyholder liabilities of $525 million which was largely offset in PBCAE.

Trading revenue in

Non-interest income decreased $178 million or 50%. Total trading revenue of $778 million, which comprises trading-related revenue recorded in Net interest income and Non-interest income, was down $176 million or 18%, due to lower equity trading

revenue as compared to the strong levels last year and lower fixed income trading revenue. These factors were partially offset by an increase due to foreign exchange translation.

Banking revenue increased $149 million or 12%, mainly due to the change in fair value of certain available-for-sale (AFS) securities used for funding

activities which is offset in Other revenue, as well as increased service fee revenue.

Underwriting and other advisory revenue decreased $90

million or 16%, largely reflecting lower equity and debt origination mainly in the U.S., and lower loan syndication revenue due to lower client activity. These factors were partially offset by higher client M&A activity in Canada, the U.S. and

Europe, as well as an increase due to foreign exchange translation.

Other revenue decreased $264 million or 79% from last year mainly due to the

change in fair value of certain derivatives used to economically hedge our funding activities noted above. In addition, the prior year included a gain related to the release of CTA as noted above.

Q2 2016 vs. Q1 2016

Total revenue increased $167 million or 2% from the

prior quarter, primarily due to the positive change in fair value of investments backing our policyholder liabilities, which was largely offset in PBCAE. Higher debt and equity origination, and increased loan syndication also contributed to the

increase. These factors were partially offset by a lower impact from foreign exchange translation and the negative impact of seasonal factors, including fewer days in the current quarter.

Q2 2016 vs. Q2 2015 (Six months ended)

Total revenue increased $411

million or 2%. Excluding the specified item last year noted above, total revenue increased $519 million or 3%, primarily reflecting an increase due to foreign exchange translation of $422 million. The inclusion of our acquisition of City

National, as well as solid volume and fee-based revenue growth across most businesses in Canadian Banking also contributed to the increase. These factors were partially offset by lower equity and fixed income trading revenue, and lower debt and

equity origination activity largely in the U.S., the negative change in fair value of investments backing our policyholder liabilities, largely offset in PBCAE, lower transaction volumes in Wealth Management reflecting reduced client activity and

lower earnings on average fee-based client assets due to unfavourable market conditions.

Revenue excluding the prior year specified item noted above is a non-GAAP

measure. For further details, including a reconciliation, refer to the Key performance and non-GAAP measures section.

Provision for credit losses (PCL)

Q2 2016 vs. Q2 2015

Total PCL increased $178 million or 63%, and

the total PCL ratio of 36 bps deteriorated 11 bps from a year ago, mainly due to higher provisions in Capital Markets largely due to the sustained low oil price environment, higher provisions in Canadian Banking, and a $50 million

($37 million after-tax) increase in PCL for loans not yet identified as impaired reflecting volume growth and ongoing economic uncertainty. These factors were partially offset by lower provisions in Wealth Management. Total PCL ratio of 36 bps

is comprised of PCL ratio on impaired loans of 32 bps and PCL ratio on loans not yet identified as impaired of 4 bps.

Q2 2016 vs. Q1 2016

Total PCL increased $50 million or 12%, and the total PCL ratio of 36 bps deteriorated 5 bps from the prior quarter, due to the increase in PCL for loans not

yet identified as impaired as noted above.

Q2 2016 vs. Q2 2015 (Six months ended)

Total PCL increased $318 million or 58%, and the PCL ratio of 33 bps, deteriorated 9 bps from the prior year, mainly due to higher provisions in Capital

Markets reflecting the sustained low oil price environment, higher provisions in Canadian Banking, and the increase in PCL for loans not yet identified as impaired as noted above. These factors were partially offset by lower provisions in Wealth

Management.

For further details on PCL, refer to Credit quality performance in the Credit Risk section.

Insurance policyholder benefits, claims and acquisition expense

Q2 2016

vs. Q2 2015

PBCAE increased $495 million or 100% from a year ago, mainly due to the change in fair value of investments backing our policyholder liabilities,

which was largely offset in revenue.

10 Royal Bank of Canada Second Quarter 2016

Q2 2016 vs. Q1 2016

PBCAE

increased $159 million or 19% from the prior quarter, mainly due to the change in fair value of investments backing our policyholder liabilities, largely offset in revenue.

Q2 2016 vs. Q2 2015 (Six months ended)

PBCAE decreased $198 million

or 10% from the prior year, mainly due to the change in fair value of investments backing our policyholder liabilities, largely offset in revenue.

Non-interest

expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

|

|

|

For the six months ended |

|

| (Millions of Canadian dollars, except percentage amounts) |

|

April 30

2016 |

|

|

January 31

2016 |

|

|

April 30

2015 |

|

|

|

|

April 30

2016 |

|

|

April 30

2015 |

|

| Salaries |

|

$ |

1,445 |

|

|

$ |

1,492 |

|

|

$ |

1,273 |

|

|

|

|

$ |

2,937 |

|

|

$ |

2,540 |

|

| Variable compensation |

|

|

1,046 |

|

|

|

1,074 |

|

|

|

1,264 |

|

|

|

|

|

2,120 |

|

|

|

2,445 |

|

| Benefits and retention compensation |

|

|

430 |

|

|

|

464 |

|

|

|

421 |

|

|

|

|

|

894 |

|

|

|

853 |

|

| Share-based compensation |

|

|

93 |

|

|

|

46 |

|

|

|

38 |

|

|

|

|

|

139 |

|

|

|

173 |

|

| Human resources |

|

$ |

3,014 |

|

|

$ |

3,076 |

|

|

$ |

2,996 |

|

|

|

|

$ |

6,090 |

|

|

$ |

6,011 |

|

| Equipment |

|

|

358 |

|

|

|

356 |

|

|

|

311 |

|

|

|

|

|

714 |

|

|

|

608 |

|

| Occupancy |

|

|

382 |

|

|

|

393 |

|

|

|

356 |

|

|

|

|

|

775 |

|

|

|

691 |

|

| Communications |

|

|

224 |

|

|

|

203 |

|

|

|

224 |

|

|

|

|

|

427 |

|

|

|

422 |

|

| Professional fees |

|

|

247 |

|

|

|

240 |

|

|

|

204 |

|

|

|

|

|

487 |

|

|

|

402 |

|

| Amortization of other intangibles |

|

|

229 |

|

|

|

234 |

|

|

|

178 |

|

|

|

|

|

463 |

|

|

|

352 |

|

| Other |

|

|

433 |

|

|

|

458 |

|

|

|

467 |

|

|

|

|

|

891 |

|

|

|

870 |

|

| Non-interest expense |

|

$ |

4,887 |

|

|

$ |

4,960 |

|

|

$ |

4,736 |

|

|

|

|

$ |

9,847 |

|

|

$ |

9,356 |

|

| Efficiency ratio (1) |

|

|

51.3% |

|

|

|

53.0% |

|

|

|

53.6% |

|

|

|

|

|

52.1% |

|

|

|

50.6% |

|

| |

(1) |

|

Efficiency ratio is calculated as non-interest expense divided by total revenue. |

|

Q2 2016 vs. Q2 2015

Non-interest

expense increased $151 million or 3%, largely due to the inclusion of City National, which increased non-interest expense $392 million, and included $48 million related to the amortization of intangibles, and $21 million related

to integration costs. An increase due to the impact of foreign exchange translation of $59 million, and higher costs in support of business growth also contributed to the increase. These factors were partially offset by lower variable

compensation in Capital Markets and Wealth Management, and continuing benefits from our efficiency management activities. The prior year included a loss of $23 million related to the sale of RBC Suriname.

Our efficiency ratio of 51.3% decreased 230 bps from 53.6% last year. Excluding the gain of $108 million related to the release of CTA which favourably

impacted revenue last year, our efficiency ratio decreased 300 bps from last year, mainly due to the positive change in fair value of investments backing our policyholder liabilities, which was largely offset in PBCAE, and continuing benefits from

our efficiency management activities. These factors were partially offset by the inclusion of our acquisition of City National.

Q2 2016 vs. Q1 2016

Non-interest expense decreased $73 million or 1%, primarily reflecting a decrease of $120 million due to a lower impact from foreign exchange translation, the

negative impact of seasonal factors including fewer days in the current quarter, and lower staff costs largely in Canadian Banking. These factors were partially offset by the change in fair value of our U.S. share-based compensation plan, and higher

litigation and related legal costs in Capital Markets.

Our efficiency ratio of 51.3% decreased 170 bps from 53.0% last quarter, mainly due to the

positive change in fair value of investments backing our policyholder liabilities, which was largely offset in PBCAE.

Q2 2016 vs. Q2 2015 (Six months ended)

Non-interest expense increased $491 million or 5% mainly due to the inclusion of City National, which increased non-interest expense $799 million, an increase

due to foreign exchange translation of $243 million, and higher costs in support of business growth. These factors were partially offset by lower variable compensation in Capital Markets and Wealth Management, continuing benefits from our

efficiency management activities, lower restructuring costs related to our International Wealth Management business, and lower litigation provisions and related legal costs in Capital Markets.

Our efficiency ratio of 52.1% increased 150 bps from 50.6% last year. Excluding the specified item in the prior year noted above, our efficiency

ratio increased 120 bps from last year mainly due to the negative change in fair value of investments backing our policyholder liabilities, which was largely offset in PBCAE, and the inclusion of our acquisition of City National. These factors

were partially offset by continuing benefits from our efficiency management activities.

The efficiency ratio excluding the specified item noted above is a