|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-227001

|

||

|

Pricing Supplement

Dated February 5, 2021

to the Product Prospectus Supplement No. CCBN-1 Dated September 10, 2018, the Prospectus Supplement Dated September 7, 2018 and the Prospectus Dated September 7, 2018

|

$1,570,000

Auto-Callable Contingent Coupon Barrier Notes

Linked to the VanEck Vectors® Gold Miners

ETF,

Due February 8, 2024

Royal Bank of Canada

|

||

Royal Bank of Canada is offering Auto-Callable Contingent Coupon Barrier Notes (the “Notes”) linked to the VanEck Vectors® Gold Miners ETF (the

“Reference Asset”). The Notes are our senior unsecured obligations, will pay a quarterly Contingent Coupon at the rate and under the circumstances specified below, and will have the terms described in the documents described above, as

supplemented or modified by this pricing supplement. The Notes do not guarantee any return of principal at maturity. Any payments on the Notes are subject to our credit risk.

Investing in the Notes involves a number of risks. See “Selected Risk Considerations” beginning on page P-8 of this pricing supplement, and “Risk Factors”

beginning on page PS-5 of the product prospectus supplement dated September 10, 2018 and page S-1 of the prospectus supplement dated September 7, 2018.

The Notes will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other

Canadian or U.S. government agency or instrumentality. The Notes are not subject to conversion into our common shares under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Notes or determined that this pricing

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

|

Issuer:

|

Royal Bank of Canada

|

Stock Exchange Listing:

|

None

|

|

Trade Date:

|

February 5, 2021

|

Principal Amount:

|

$1,000 per Note

|

|

Issue Date:

|

February 10, 2021

|

Maturity Date:

|

February 8, 2024

|

|

Observation Dates:

|

Quarterly, as set forth below.

|

Coupon Payment Dates:

|

Quarterly, as set forth below

|

|

Valuation Date:

|

February 5, 2024

|

Contingent Coupon Rate:

|

7.75% per annum

|

|

Initial Price:

|

$34.61, which was the closing price of the Reference Asset on the Trade Date.

|

||

|

Final Price:

|

The closing price of the Reference Asset on the Valuation Date.

|

||

|

Call Price:

|

100% of the Initial Price.

|

||

|

Trigger Price and Coupon

Barrier:

|

$24.23, which is 70% of the Initial Price (rounded to two decimal places).

|

||

|

Contingent Coupon:

|

If the closing price of the Reference Asset is greater than or equal to the Coupon Barrier on the applicable Observation Date, we will pay the

Contingent Coupon applicable to that Observation Date. You may not receive any Contingent Coupons during the term of the Notes.

|

||

|

Payment at Maturity (if held

to maturity):

|

If the Notes are not previously called, we will pay you at maturity an amount based on the Final Price:

For each $1,000 in principal amount, $1,000 plus the Contingent Coupon at maturity, unless the Final Price is less than the Trigger Price.

If the Final Price is less than the Trigger Price, then the investor will receive at maturity, for each $1,000 in principal amount, a cash payment

equal to: $1,000 + ($1,000 x Reference Asset Return)

Investors in the Notes will lose some or all of their principal amount if the Final Price of the Reference Asset is less than the

Trigger Price.

|

||

|

Call Feature:

|

If the closing price of the Reference Asset is greater than or equal to the Call Price starting on August 5, 2021 and on any Observation Date thereafter, the Notes will be automatically

called for 100% of their principal amount, plus the Contingent Coupon applicable to the corresponding Observation Date.

|

||

|

Call Settlement Dates:

|

The Coupon Payment Date corresponding to that Observation Date.

|

||

|

CUSIP:

|

78016E5P8

|

||

|

Per Note

|

Total

|

||

|

Price to public(1)

|

100.00%

|

$1,570,000

|

|

|

Underwriting discounts and commissions(1)

|

2.25%

|

$35,325

|

|

|

Proceeds to Royal Bank of Canada

|

97.75%

|

$1,534,675

|

(1) Certain dealers who purchase the Notes for sale to certain fee-based advisory accounts may forego some or all of their underwriting discount or selling

concessions. The public offering price for investors purchasing the Notes in these accounts may be between $977.50 and $1,000 per $1,000 in principal amount.

RBC Capital Markets, LLC (“RBCCM”), acting as our agent, will receive a commission of $22.50 per $1,000 in principal amount of the Notes and will use a portion of that commission

to allow selling concessions to other dealers of up to $22.50 per $1,000 in principal amount of the Notes. The other dealers may forgo, in their sole discretion, some or all of their selling concessions. See “Supplemental Plan of Distribution

(Conflicts of Interest)” below.

The initial estimated value of the Notes as of the Trade Date is $962.71 per $1,000 in principal amount, which is less than the price to public. The actual value of the Notes at any time will

reflect many factors, cannot be predicted with accuracy, and may be less than this amount. We describe our determination of the initial estimated value in more detail below.

RBC Capital Markets, LLC

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

SUMMARY

The information in this “Summary” section is qualified by the more detailed information set forth in this pricing supplement, the product prospectus supplement, the prospectus

supplement, and the prospectus.

|

General:

|

This pricing supplement relates to an offering of Auto-Callable Contingent Coupon Barrier Notes (the “Notes”) linked to the VanEck Vectors® Gold Miners ETF (the

“Reference Asset”).

|

|

Issuer:

|

Royal Bank of Canada (“Royal Bank”)

|

|

Trade Date:

|

February 5, 2021

|

|

Issue Date:

|

February 10, 2021

|

|

Valuation Date:

|

February 5, 2024

|

|

Maturity Date:

|

February 8, 2024

|

|

Denominations:

|

Minimum denomination of $1,000, and integral multiples of $1,000 thereafter.

|

|

Designated Currency:

|

U.S. Dollars

|

|

Contingent Coupon:

|

We will pay you a Contingent Coupon during the term of the Notes, periodically in arrears on each Coupon Payment Date, under the conditions described below:

• If the closing price of the Reference Asset is greater than or equal to the Coupon Barrier on the applicable Observation Date, we will pay the Contingent Coupon applicable to that

Observation Date.

• If the closing price of the Reference Asset is less than the Coupon Barrier on the applicable Observation Date, we will not pay you the Contingent Coupon applicable to that Observation

Date.

You may not receive a Contingent Coupon for one or more quarterly periods during the term of the Notes.

|

|

Contingent Coupon Rate:

|

7.75% per annum (1.9375% per quarter)

|

|

Observation Dates:

|

Quarterly, on May 5, 2021, August 5, 2021, November 5, 2021, February 7, 2022, May 5, 2022, August 5, 2022, November 7, 2022, February 6, 2023, May 5, 2023, August 7,

2023, November 6, 2023 and the Valuation Date.

|

|

Coupon Payment Dates:

|

The Contingent Coupon, if payable, will be paid quarterly on May 10, 2021, August 10, 2021, November 10, 2021, February 10, 2022, May 10, 2022, August 10, 2022, November

10, 2022, February 9, 2023, May 10, 2023, August 10, 2023, November 9, 2023 and the Maturity Date.

|

|

Record Dates:

|

The record date for each Coupon Payment Date will be one business day prior to that scheduled Coupon Payment Date; provided, however, that any Contingent Coupon payable at maturity or upon a call will be

payable to the person to whom the payment at maturity or upon the call, as the case may be, will be payable.

|

|

Call Feature:

|

If, starting on August 5, 2021 and on any Observation Date thereafter, the closing price of the Reference Asset is greater than or

equal to the Call Price, then the Notes will be automatically called.

|

|

Call Settlement Dates:

|

If the Notes are called on any Observation Date starting on August 5, 2021 and thereafter, the Call Settlement Date will be the Coupon Payment Date corresponding to that

Observation Date.

|

|

Payment if Called:

|

If the Notes are automatically called, then, on the applicable Call Settlement Date, for each $1,000 principal amount, you will receive $1,000 plus the Contingent Coupon

otherwise due on that Call Settlement Date.

|

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

|

Initial Price:

|

The closing price of the Reference Asset on the Trade Date, as set forth on the cover page of this pricing supplement.

|

|

Final Price:

|

The closing price of the Reference Asset on the Valuation Date.

|

|

Call Price:

|

100% of the Initial Price.

|

|

Trigger Price and Coupon

Barrier:

|

70% of the Initial Price, as set forth on the cover page of this pricing supplement.

|

|

Payment at Maturity (if

not previously called and

held to maturity):

|

If the Notes are not previously called, we will pay you at maturity an amount based on the Final Price of the Reference Asset:

• If the Final Price is greater than or equal to the Trigger Price, we will pay you a cash payment equal to the principal amount plus the Contingent Coupon otherwise due on the Maturity Date.

• If the Final Price is below the Trigger Price, you will receive at maturity, for each $1,000 in principal amount, a cash payment equal to: $1,000 + ($1,000 x Reference Asset Return)

The amount of cash that you receive will be less than your principal amount, if anything, resulting in a loss that is proportionate to the decline of the Reference Asset

from the Trade Date to the Valuation Date. Investors in the Notes will lose some or all of their principal amount if the Final Price of the Reference Asset is less than the Trigger Price.

|

|

Reference Asset Return:

|

Final Price – Initial Price

Initial Price

|

|

Stock Settlement:

|

Not applicable. Payments on the Notes will be made solely in cash.

|

|

Market Disruption Events:

|

The occurrence of a market disruption event (or a non-trading day) as to the Reference Asset will result in the postponement of an Observation Date or the Valuation

Date, as described in the product prospectus supplement.

|

|

Calculation Agent:

|

RBC Capital Markets, LLC (“RBCCM”)

|

|

U.S. Tax Treatment:

|

By purchasing a Note, each holder agrees (in the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to treat the Notes as

a callable pre-paid cash settled contingent income-bearing derivative contract linked to the Reference Asset for U.S. federal income tax purposes. However, the U.S. federal income tax consequences of your investment in the Notes are

uncertain and the Internal Revenue Service could assert that the Notes should be taxed in a manner that is different from that described in the preceding sentence. Please see the section below, “Supplemental Discussion of U.S. Federal

Income Tax Consequences” and the discussion (including the opinion of our counsel Morrison & Foerster LLP) in the product prospectus supplement dated September 10, 2018 under “Supplemental Discussion of U.S. Federal Income Tax

Consequences,” which apply to the Notes.

|

|

Secondary Market:

|

RBCCM (or one of its affiliates), though not obligated to do so, may maintain a secondary market in the Notes after the issue date. The amount that you may receive upon

sale of your Notes prior to maturity may be less than the principal amount.

|

|

Listing:

|

The Notes will not be listed on any securities exchange.

|

|

Settlement:

|

DTC global (including through its indirect participants Euroclear and Clearstream, Luxembourg as described under “Description of Debt Securities—Ownership and Book-Entry

Issuance” in the prospectus dated September 7, 2018.

|

|

Terms Incorporated in the

Master Note:

|

All of the terms appearing on the cover page and above the item captioned “Secondary Market” on pages P-2 and P-3 of this pricing supplement and the terms appearing

under the caption “General Terms of the Notes” in the product prospectus supplement dated September 10, 2018, as modified by this pricing supplement.

|

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

ADDITIONAL TERMS OF YOUR NOTES

You should read this pricing supplement together with the prospectus dated September 7, 2018, as supplemented by the prospectus supplement dated September 7, 2018 and the product prospectus supplement dated

September 10, 2018, relating to our Senior Global Medium Term Notes, Series H, of which these Notes are a part. Capitalized terms used but not defined in this pricing supplement will have the meanings given to them in the product prospectus

supplement. In the event of any conflict, this pricing supplement will control. The Notes vary from the terms described in the product prospectus supplement in several important ways. You

should read this pricing supplement carefully.

This pricing supplement, together with the documents listed below, contains the terms of the Notes and supersedes all prior or contemporaneous oral statements as well as any other written materials including

preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth

in “Risk Factors” in the prospectus supplement dated September 7, 2018 and in the product prospectus supplement dated September 10, 2018, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your

investment, legal, tax, accounting and other advisors before you invest in the Notes. You may access these documents on the Securities and Exchange Commission (the “SEC”) website at www.sec.gov as follows (or if that address has changed, by

reviewing our filings for the relevant date on the SEC website):

Prospectus dated September 7, 2018:

Prospectus Supplement dated September 7, 2018:

Product Prospectus Supplement dated September 10, 2018:

Our Central Index Key, or CIK, on the SEC website is 1000275. As used in this pricing supplement, “we,” “us,” or “our” refers to Royal Bank of Canada.

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

HYPOTHETICAL EXAMPLES

The table set out below is included for illustration purposes only. The table illustrates the Payment at Maturity of the Notes (including the final Contingent Coupon, if

payable) for a hypothetical range of performance for the Reference Asset, assuming the following terms and that the Notes are not automatically called prior to maturity:

|

Hypothetical Initial Price:

|

$100.00*

|

|

|

Hypothetical Trigger Price and Coupon Barrier:

|

$70.00, which is 70% of the hypothetical Initial Price

|

|

|

Contingent Coupon Rate:

|

7.75% per annum (or 1.9375% per quarter)

|

|

|

Contingent Coupon Amount:

|

$19.375 per quarter

|

|

|

Observation Dates:

|

Quarterly

|

|

|

Principal Amount:

|

$1,000 per Note

|

* The hypothetical Initial Price of $100 used in the examples below has been chosen for illustrative purposes only, and is not the actual Initial Price. The actual Initial

Price is set forth on the cover page of this pricing supplement.

Hypothetical Final Prices are shown in the first column on the left. The second column shows the Payment at Maturity for a range of Final Prices on the Valuation Date. The

third column shows the amount of cash to be paid on the Notes per $1,000 in principal amount. If the Notes are called prior to maturity, the hypothetical examples below will not be relevant, and you will receive on the applicable Coupon Payment

Date, for each $1,000 principal amount, $1,000 plus the Contingent Coupon otherwise due on the Notes.

|

Hypothetical Final Price of the

Reference Asset

|

Payment at Maturity as

Percentage of Principal Amount

|

Payment at Maturity (assuming

that the Notes were not

previously called)

|

|

$150.00

|

101.9375%*

|

$1,019.375*

|

|

$140.00

|

101.9375%*

|

$1,019.375*

|

|

$130.00

|

101.9375%*

|

$1,019.375*

|

|

$120.00

|

101.9375%*

|

$1,019.375*

|

|

$110.00

|

101.9375%*

|

$1,019.375*

|

|

$100.00

|

101.9375%*

|

$1,019.375*

|

|

$90.00

|

101.9375%*

|

$1,019.375*

|

|

$80.00

|

101.9375%*

|

$1,019.375*

|

|

$70.00

|

101.9375%*

|

$1,019.375*

|

|

$69.99

|

69.99%

|

$699.90

|

|

$60.00

|

60.00%

|

$600.00

|

|

$50.00

|

50.00%

|

$500.00

|

|

$40.00

|

40.00%

|

$400.00

|

|

$30.00

|

30.00%

|

$300.00

|

|

$20.00

|

20.00%

|

$200.00

|

|

$10.00

|

10.00%

|

$100.00

|

|

$0.00

|

0%

|

$0.00

|

*Including the final Contingent Coupon, if payable.

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

Hypothetical Examples of Amounts Payable at Maturity

The following hypothetical examples illustrate how the payments at maturity set forth in the table above are calculated, assuming the Notes have not been called.

Example 1: The price of the Reference Asset increases by 25% from the Initial Price of $100.00 to a Final Price of $125.00. Because the

Final Price is greater than the Trigger Price and its Coupon Barrier, the investor receives at maturity, in addition to the final Contingent Coupon otherwise due on the Notes, a cash payment of $1,000 per Note, despite the 25% appreciation in

the price of the Reference Asset.

Example 2: The price of the Reference Asset decreases by 10% from the Initial Price of $100.00 to a Final Price of $90.00. Because the

Final Price is greater than the Trigger Price and its Coupon Barrier, the investor receives at maturity, in addition to the final Contingent Coupon otherwise due on the Notes, a cash payment of $1,000 per Note, despite the 10% decline in the

price of the Reference Asset.

Example 3: The price of the Reference Asset decreases by 60% from the Initial Price of $100.00 to a Final Price of $40.00. Because the

Final Price is less than the Trigger Price and its Coupon Barrier, the final Contingent Coupon will not be payable on the Maturity Date, and we will pay only $400.00 for each $1,000 in the principal amount of the Notes, calculated as follows:

Principal Amount + (Principal Amount x Reference Asset Return)

= $1,000 + ($1,000 x -60.00%) = $1,000 - $600.00 = $400.00

* * *

The Payments at Maturity shown above are entirely hypothetical; they are based on theoretical prices of the Reference Asset that may not be achieved on the Valuation Date and

on assumptions that may prove to be erroneous. The actual market value of your Notes on the Maturity Date or at any other time, including any time you may wish to sell your Notes, may bear little relation to the hypothetical Payments at

Maturity shown above, and those amounts should not be viewed as an indication of the financial return on an investment in the Notes.

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

SELECTED RISK CONSIDERATIONS

An investment in the Notes involves significant risks. Investing in the Notes is not equivalent to investing directly in the Reference Asset. These risks are

explained in more detail in the section “Risk Factors,” in the product prospectus supplement. In addition to the risks described in the prospectus supplement and the product prospectus supplement, you should consider the following:

Risks Relating to the Terms of the Notes

| • |

You May Lose All or a Portion of the Principal Amount at Maturity — Investors in the Notes could lose all or a substantial portion of their

principal amount if there is a decline in the trading price of the Reference Asset between the Trade Date and the Valuation Date. If the Notes are not automatically called and the Final Price is less than the Trigger Price, the amount

of cash that you receive at maturity will represent a loss of your principal that is proportionate to the decline in the closing price of the Reference Asset from the Trade Date to the Valuation Date. Any Contingent Coupons received on

the Notes prior to the Maturity Date may not be sufficient to compensate for any such loss.

|

| • |

The Notes Are Subject to an Automatic Call — If on any Observation Date beginning in August 2021, the closing price of the Reference Asset is

greater than or equal to the Call Price, then the Notes will be automatically called. If the Notes are automatically called, then, on the applicable Call Settlement Date, for each $1,000 in principal amount, you will receive $1,000 plus

the Contingent Coupon otherwise due on the applicable Call Settlement Date. You will not receive any Contingent Coupons after the Call Settlement Date. You may be unable to reinvest your proceeds from the automatic call in an investment

with a return that is as high as the return on the Notes would have been if they had not been called.

|

| • |

You May Not Receive Any Contingent Coupons — We will not necessarily make any coupon payments on the Notes. If the closing price of the Reference

Asset on an Observation Date is less than the Coupon Barrier, we will not pay you the Contingent Coupon applicable to that Observation Date. If the closing price of the Reference Asset is less than the Coupon Barrier on each of the

Observation Dates and on the Valuation Date, we will not pay you any Contingent Coupons during the term of, and you will not receive a positive return on, your Notes. Generally, this non-payment of the Contingent Coupon coincides with a

period of greater risk of principal loss on your Notes. Accordingly, if we do not pay the Contingent Coupon on the Maturity Date, you will also incur a loss of principal, because the Final Price will be less than the Trigger Price.

|

| • |

The Call Feature and the Contingent Coupon Feature Limit Your Potential Return — The return potential of the Notes is limited to the pre-specified

Contingent Coupon Rate, regardless of the appreciation of the Reference Asset. In addition, the total return on the Notes will vary based on the number of Observation Dates on which the Contingent Coupon becomes payable prior to

maturity or an automatic call. Further, if the Notes are called due to the Call Feature, you will not receive any Contingent Coupons or any other payment in respect of any Observation Dates after the applicable Call Settlement Date.

Since the Notes could be called as early as August 2021, the total return on the Notes could be limited to one year. If the Notes are not called, you may be subject to the full downside performance of the Reference Asset even though

your potential return is limited to the Contingent Coupon Rate. As a result, the return on an investment in the Notes could be less than the return on a direct investment in the Reference Asset.

|

| • |

Your Return May Be Lower than the Return on a Conventional Debt Security of Comparable Maturity — The return that you will receive on the Notes,

which could be negative, may be less than the return you could earn on other investments. Even if your return is positive, your return may be less than the return you would earn if you bought a conventional senior interest bearing debt

security of Royal Bank.

|

| • |

Payments on the Notes Are Subject to Our Credit Risk, and Changes in Our Credit Ratings Are Expected to Affect the Market Value of the Notes — The

Notes are our senior unsecured debt securities. As a result, your receipt of any Contingent Coupons, if payable, and the amount due on any relevant payment date is dependent upon our ability to repay our obligations on the applicable

payment dates. This will be the case even if the price of the Reference Asset increases after the Trade Date. No assurance can be given as to what our financial condition will be during the term of the Notes.

|

| • |

Owning the Notes Is Not the Same as Owning the Reference Asset — The return on your Notes is unlikely to reflect the return you would realize if

you actually owned the Reference Asset. For instance, you will not receive

|

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

or be entitled to receive any dividend payments or other distributions on the Reference Asset during the term of your Notes. As an owner of

the Notes, you will not have voting rights or any other rights that holders of the Reference Asset may have. Furthermore, the Reference Asset may appreciate substantially during the term of the Notes, while your potential return will be limited

to the applicable Contingent Coupon payments.

| • |

Payments on the Notes Are Subject to Postponement Due to Market Disruption Events and Adjustments — The payment at maturity, each Observation Date, and the Valuation Date are subject to adjustment as described in the product prospectus supplement. For a description of what constitutes a market disruption event as well as

the consequences of that market disruption event, see “General Terms of the Notes—Market Disruption Events” in the product prospectus supplement.

|

Risks Relating to the Secondary Market for the Notes

| • |

There May Not Be an Active Trading Market for the Notes-Sales in the Secondary Market May Result in Significant Losses — There may be little or no

secondary market for the Notes. The Notes will not be listed on any securities exchange. RBCCM and our other affiliates may make a market for the Notes; however, they are not required to do so. RBCCM or any other affiliate of ours may

stop any market-making activities at any time. Even if a secondary market for the Notes develops, it may not provide significant liquidity or trade at prices advantageous to you. We expect that transaction costs in any secondary market

would be high. As a result, the difference between bid and asked prices for your Notes in any secondary market could be substantial.

|

Risks Relating to the Initial Estimated Value of the Notes

| • |

The Initial Estimated Value of the Notes Is Less than the Price to the Public — The initial estimated value that is set forth on the cover page of

this pricing supplement does not represent a minimum price at which we, RBCCM or any of our affiliates would be willing to purchase the Notes in any secondary market (if any exists) at any time. If you attempt to sell the Notes prior to

maturity, their market value may be lower than the price you paid for them and the initial estimated value. This is due to, among other things, changes in the price of the Reference Asset, the borrowing rate we pay to issue securities

of this kind, and the inclusion in the price to the public of the underwriting discount and the estimated costs relating to our hedging of the Notes. These factors, together with various credit, market and economic factors over the term

of the Notes, are expected to reduce the price at which you may be able to sell the Notes in any secondary market and will affect the value of the Notes in complex and unpredictable ways. Assuming no change in market conditions or any

other relevant factors, the price, if any, at which you may be able to sell your Notes prior to maturity may be less than your original purchase price, as any such sale price would not be expected to include the underwriting discount

and the hedging costs relating to the Notes. In addition to bid-ask spreads, the value of the Notes determined by RBCCM for any secondary market price is expected to be based on the secondary rate rather than the internal funding rate

used to price the Notes and determine the initial estimated value. As a result, the secondary price will be less than if the internal funding rate was used. The Notes are not designed to be short-term trading instruments. Accordingly,

you should be able and willing to hold your Notes to maturity.

|

| • |

The Initial Estimated Value of the Notes on the Cover Page of this Pricing Supplement Is an Estimate Only, Calculated as of the Time the Terms of the

Notes Were Set — The initial estimated value of the Notes is based on the value of our obligation to make the payments on the Notes, together with the mid-market value of the derivative

embedded in the terms of the Notes. See “Structuring the Notes” below. Our estimate is based on a variety of assumptions, including our credit spreads, expectations as to dividends, interest rates and volatility, and the expected term

of the Notes. These assumptions are based on certain forecasts about future events, which may prove to be incorrect. Other entities may value the Notes or similar securities at a price that is significantly different than we do.

|

The value of the Notes at any time after the Trade Date will vary based on many factors, including changes in market conditions, and cannot be predicted with accuracy. As a result, the actual value

you would receive if you sold the Notes in any secondary market, if any, should be expected to differ materially from the initial estimated value of your Notes.

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

Risks Relating to Conflicts of Interest and Our Trading Activities

| • |

Our Business Activities May Create Conflicts of Interest — We and our affiliates expect to engage in

trading activities related to the Reference Asset or the securities held by the Reference Asset that are not for the account of holders of the Notes or on their behalf. These trading activities may present a conflict between the

holders’ interests in the Notes and the interests we and our affiliates will have in their proprietary accounts, in facilitating transactions, including options and other derivatives transactions, for their customers and in accounts

under their management. These trading activities, if they influence the prices of the Reference Asset, could be adverse to the interests of the holders of the Notes. We and one or more of our affiliates may, at present or in the future,

engage in business with GDX or the issuers of the securities held by GDX, including making loans to or providing advisory services. These services could include investment banking and merger and acquisition advisory services. These

activities may present a conflict between our or one or more of our affiliates’ obligations and your interests as a holder of the Notes. Moreover, we and our affiliates may have published, and in the future expect to publish, research

reports with respect to the Reference Asset. This research is modified from time to time without notice and may express opinions or provide recommendations that are inconsistent with purchasing or holding the Notes. Any of these

activities by us or one or more of our affiliates may affect the price of the Reference Asset, and, therefore, the market value of the Notes.

|

| • |

You Must Rely on Your Own Evaluation of the Merits of an Investment Linked to the Reference Asset — In the ordinary course of their business, our

affiliates may have expressed views on expected movement in the Reference Asset or the equity securities that they represent, and may do so in the future. These views or reports may be communicated to our clients and clients of our

affiliates. However, these views are subject to change from time to time. Moreover, other professionals who transact business in markets relating to the Reference Asset may at any time have significantly different views from those of

our affiliates. For these reasons, you are encouraged to derive information concerning the Reference Asset from multiple sources, and you should not rely solely on views expressed by our affiliates.

|

Risks Relating to the Reference Asset

| • |

The Reference Asset and its Underlying Index Are Different — The performance of the Reference Asset may not exactly replicate the performance of

its underlying index, because the Reference Asset will reflect transaction costs and fees that are not included in the calculation of its underlying index. It is also possible that the performance of the Reference Asset may not fully

replicate or may in certain circumstances diverge significantly from the performance of its underlying index due to the temporary unavailability of certain securities in the secondary market, the performance of any derivative

instruments contained in such Reference Asset or due to other circumstances. The Reference Asset may use futures contracts, options, swap agreements, currency forwards and repurchase agreements in seeking performance that corresponds to

its underlying index and in managing cash flows.

|

During periods of market volatility, securities underlying the Reference Asset may be unavailable in the secondary market, market

participants may be unable to calculate accurately the net asset value per share of the Reference Asset and the liquidity of the Reference Asset may be adversely affected. This kind of market volatility may also disrupt the ability of market

participants to create and redeem shares of the Reference Asset. Further, market volatility may adversely affect, sometimes materially, the prices at which market participants are willing to buy and sell shares of the Reference Asset. As a

result, under these circumstances, the market value of shares of such Reference Asset may vary substantially from the net asset value per share of such Reference Asset. For all of the foregoing reasons, the performance of the Reference Asset

may not correlate with the performance of its underlying index as well as the net asset value per share of such Reference Asset, which could materially and adversely affect the value of the Notes in the secondary market and/or reduce any

payment under the Notes.

| • |

An Investment Linked to the Reference Asset Is Subject to Management Risk — The Reference Asset is not managed according to traditional methods of

“active” investment management, which involve the buying and selling of securities based on economic, financial and market analysis and investment judgment. Instead, the Reference Asset, utilizing a ‘‘passive’’ or indexing investment

approach, attempts to approximate the investment performance of its underlying index by investing in a portfolio of securities that generally replicate its underlying index. Therefore, unless a specific security is removed from its

underlying index, the Reference Asset generally

|

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

would not sell a security because the security’s issuer was in financial trouble. In addition, the Reference Asset is subject to the risk

that the investment strategy of its investment advisor may not produce the intended results.

| • |

There Is No Affiliation Between the Investment Advisor or the Index Sponsor and RBCCM, and RBCCM Is Not Responsible for any Disclosure by the Investment

Advisor or the Index Sponsor — We are not affiliated with the investment adviser of the Reference Asset or the index sponsor of its underlying index. However, we and our affiliates may currently, or from time to time in the

future, engage in business with these entities. Nevertheless, neither we nor our affiliates assume any responsibilities for the accuracy or the completeness of any information that any other entity prepares. You, as an investor in the

Notes, should make your own investigation into the Reference Asset and the companies in which it invests. None of these companies are involved in this offering, and have no obligation of any sort with respect to your Notes. These

companies have no obligation to take your interests into consideration for any reason, including when taking any corporate actions that might affect the value of your Notes.

|

| • |

The Policies of the Reference Asset’s Investment Adviser Could Affect the Amount Payable on the Notes and Their Market Value — The policies of the

Reference Asset’s investment adviser concerning the management of the Reference Asset, additions, deletions or substitutions of the securities held by the Reference Asset could affect the market price of shares of the Reference Asset

and, therefore, the amount payable on the Notes and the market value of the Notes. The amount payable on the Notes and their market value could also be affected if the Reference Asset’s investment adviser changes these policies, for

example, by changing the manner in which it manages the Reference Asset, or if the Reference Asset’s investment adviser discontinues or suspends maintenance of the Reference Asset, in which case it may become difficult to determine the

market value of the Notes. The Reference Asset’s investment adviser have no connection to the offering of the Notes and have no obligations to you as an investor in the Notes in making its decisions regarding the Reference Asset.

|

| • |

Changes that Affect the Underlying Index of the Reference Asset Will Affect the Market Value of the Notes and the Payments on the Notes — The

policies of the sponsor of the underlying index of the Reference Asset concerning the calculation of that index, additions, deletions or substitutions of the components of that index and the manner in which changes affecting those

components, such as stock dividends, reorganizations or mergers, may be reflected in that index and, therefore, could affect the share price of the Reference Asset, the amount payable on the Notes, if applicable, and the market value of

the Notes prior to maturity. The amount payable on the Notes and their market value could also be affected if the sponsor changes these policies, for example, by changing the manner in which it calculates the index, or if the

calculation or publication of the index is discontinued or suspended.

|

| • |

An Investment in the Notes Is Subject to Risks Associated with the Gold and Silver Mining Industries — All or substantially all of the stocks held

by the GDX are issued by gold or silver mining companies. As a result, the stocks that will determine the performance of the GDX are concentrated in one sector. Although an investment in the Notes

will not give holders any ownership or other direct interests in the stocks held by the GDX, the return on the Notes will be subject to certain risks associated with a direct equity investment in gold or silver mining companies.

|

In addition, these companies are highly dependent on the price of gold or silver, as applicable. These prices fluctuate widely and may be affected by numerous

factors. Factors affecting gold prices include economic factors, including, among other things, the structure of and confidence in the global monetary system, expectations of the future rate of inflation, the relative strength of, and

confidence in, the U.S. dollar (the currency in which the price of gold is generally quoted), interest rates and gold borrowing and lending rates, and global or regional economic, financial, political, regulatory, judicial or other events. Gold

prices may also be affected by industry factors such as industrial and jewelry demand, lending, sales and purchases of gold by the official sector, including central banks and other governmental agencies and multilateral institutions which hold

gold, levels of gold production and production costs, and short-term changes in supply and demand because of trading activities in the gold market. Factors affecting silver prices include general economic trends, technical developments,

substitution issues and regulation, as well as specific factors including industrial and jewelry demand, expectations with respect to the rate of inflation, the relative strength of the U.S. dollar (the currency in which the price of silver is

generally quoted) and other currencies, interest rates, central bank sales, forward sales by producers, global or regional political or economic events, and production costs and disruptions in major silver producing countries such as Mexico and

Peru. The supply of silver consists of a combination of new mine production and existing stocks of

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

bullion and fabricated silver held by governments, public and private financial institutions, industrial organizations and private

individuals. In addition, the price of silver has on occasion been subject to very rapid short-term changes due to speculative activities. From time to time, above-ground inventories of silver may also influence the market.

On the other hand, the GDX reflects the performance of shares of gold and silver mining companies and not gold bullion or silver

bullion. The GDX may under- or over-perform gold bullion and/or silver bullion over the term of the Notes.

| • |

There Are Risks Associated with Investments in Securities Linked to the Value of Foreign Equity Securities — The GDX includes equity securities

issued by non-U.S. companies. An investment in securities linked to the value of non-U.S. equity securities involves particular risks. Non-U.S. securities markets may be more volatile than U.S. securities markets, and market

developments may affect non-U.S. securities markets differently from the U.S. securities markets. Direct or indirect government intervention to stabilize these non-U.S. securities markets, as well as cross shareholdings among non-U.S.

companies, may affect trading prices and volumes in those markets. Also, there is generally less publicly available information in the U.S. about non-U.S. companies than about those companies that are subject to the reporting

requirements of the SEC, and non-U.S. companies are subject to accounting, disclosure, auditing and financial reporting standards and requirements that differ from those applicable to U.S. reporting companies.

|

Securities prices in non-U.S. countries are subject to political, economic, financial and social factors that may be unique to the

particular country. These factors, which could negatively affect the non-U.S. securities markets, include the possibility of recent or future changes in the economic and fiscal policies of non-U.S. governments, the possible imposition of, or

changes in, currency exchange laws or other non-U.S. laws or restrictions applicable to non-U.S. companies or investments in non-U.S. equity securities, the possibility of fluctuations in the rate of exchange between currencies, the possibility

of outbreaks of hostility and political instability, and the possibility of natural disaster or adverse public health developments in the region. Moreover, the economies of certain foreign countries may differ favorably or unfavorably from the

U.S. economy in important respects, such as growth of gross national product, rate of inflation, trade surpluses or deficits, capital reinvestment, resources and self-sufficiency.

| • |

The Notes Are Subject to Exchange Rate Risk — Because securities held by the GDX are traded in currencies

other than U.S. dollars, and the Notes are denominated in U.S. dollars, the amount payable on the Notes at maturity may be exposed to fluctuations in the exchange rate between the U.S. dollar and each of the currencies in which those

securities are denominated. These changes in exchange rates may reflect changes in various non-U.S. economies that in turn may affect the payment on the Notes at maturity. An investor’s net exposure will depend on the extent to which

the currencies in which the relevant securities are denominated either strengthen or weaken against the U.S. dollar and the relative weight of each security.

|

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

INFORMATION REGARDING THE REFERENCE ASSET

Information provided to or filed with the SEC relating to the GDX under the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended,

can be obtained through the SEC’s website at http://www.sec.gov. In addition, information regarding the Reference Asset may be obtained from other sources including, but not limited to, press releases, newspaper articles and other publicly

disseminated documents. We have not participated in the preparation of, or verified, such publicly available information. None of the forgoing documents or filings are incorporated by reference in, and should not be considered part of, this

document.

The following information regarding the Reference Asset is derived from publicly available information.

We have not independently verified the accuracy or completeness of reports filed by the Reference Asset with the SEC, information published by it on its website or in any

other format, information about it obtained from any other source or the information provided below.

The Notes are not sponsored, endorsed, sold or promoted by the investment adviser. The investment adviser makes no representations or warranties to the owners of the Notes or

any member of the public regarding the advisability of investing in the Notes. The investment adviser has no obligation or liability in connection with the operation, marketing, trading or sale of the Notes.

We obtained the information regarding the historical performance of the Reference Asset set forth below from Bloomberg Financial Markets.

We have not independently verified the accuracy or completeness of the information obtained from Bloomberg Financial Markets. The historical performance of the Reference

Asset should not be taken as an indication of its future performance, and no assurance can be given as to the market price of the Reference Asset at any time during the term of the Notes. We cannot give you assurance that the performance of

the Reference Asset will not result in the loss of all or part of your investment.

The VanEck Vectors® Gold Miners ETF (“GDX”)

The GDX is an investment portfolio maintained, managed and advised by Van Eck. The VanEck Vectors™ ETF Trust is a registered open-end investment company that consists of numerous

separate investment portfolios, including the GDX.

The GDX is an exchange traded fund that trades on NYSE Arca under the ticker symbol “GDX.”

The GDX seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the NYSE Arca Gold Miners Index (the “Underlying Index”). The

Underlying Index was developed by the NYSE Amex and is calculated, maintained and published by NYSE Arca. The Underlying Index is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in

mining for gold or silver.

The GDX utilizes a “passive” or “indexing” investment approach in attempting to track the performance of the Underlying Index. The GDX will invest in all of the securities which comprise the

Underlying Index. The GDX will normally invest at least 95% of its total assets in common stocks that comprise the Underlying Index.

The Notes are not sponsored, endorsed, sold or promoted by Van Eck. Van Eck makes no representations or warranties to the owners of the Notes or any member of the public regarding the advisability

of investing in the Notes. Van Eck has no obligation or liability in connection with the operation, marketing, trading or sale of the Notes.

The NYSE Arca Gold Miners Index

The Underlying Index is a modified market capitalization weighted index comprised of securities issued by publicly traded companies involved primarily in the mining of gold or silver. The

Underlying Index was developed by the NYSE Amex and is calculated, maintained and published by NYSE Arca.

Eligibility Criteria for Index Components

The Underlying Index includes common stocks, ADRs or GDRs of selected companies that are involved in mining for gold and silver and that are listed for trading and electronically quoted on a major stock market that

is accessible by foreign investors. Generally, this includes exchanges in most developed markets and major emerging markets, and includes companies that are cross-listed, i.e., both U.S. and Canadian listings. NYSE Arca will use its discretion

to avoid

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

exchanges and markets that are considered “frontier” in nature or have major restrictions to foreign ownership. The Underlying Index includes companies that derive at least 50% of their revenues

from gold mining and related activities (40% for companies that are already included in the Underlying Index). Also, the Underlying Index will maintain an exposure to companies with a significant revenue exposure to silver mining in addition to

gold mining, which will not exceed 20% of the Underlying Index weight at each rebalance.

Currently, only companies with a market capitalization of greater than $750 million that have an average daily trading volume of at least 50,000 shares and an average daily value traded of at

least $1 million over the past three months are eligible for inclusion in the Underlying Index. Starting in December 2013, for companies already included in the Underlying Index, the market capitalization requirement at each rebalance will be

$450 million, the average daily volume requirement will be at least 30,000 shares over the past three months and the average daily value traded requirement will be at least $600,000 over the past three months.

NYSE Arca has the discretion to not include all companies that meet the minimum criteria for inclusion.

Calculation of the Underlying Index

The Underlying Index is calculated by NYSE Arca on a price return basis. The calculation is based on the current modified market capitalization divided by a divisor. The divisor

was determined on the initial capitalization base of the Underlying Index and the base level and may be adjusted as a result of corporate actions and composition changes, as described below. The level of the Underlying Index was set at 500.00

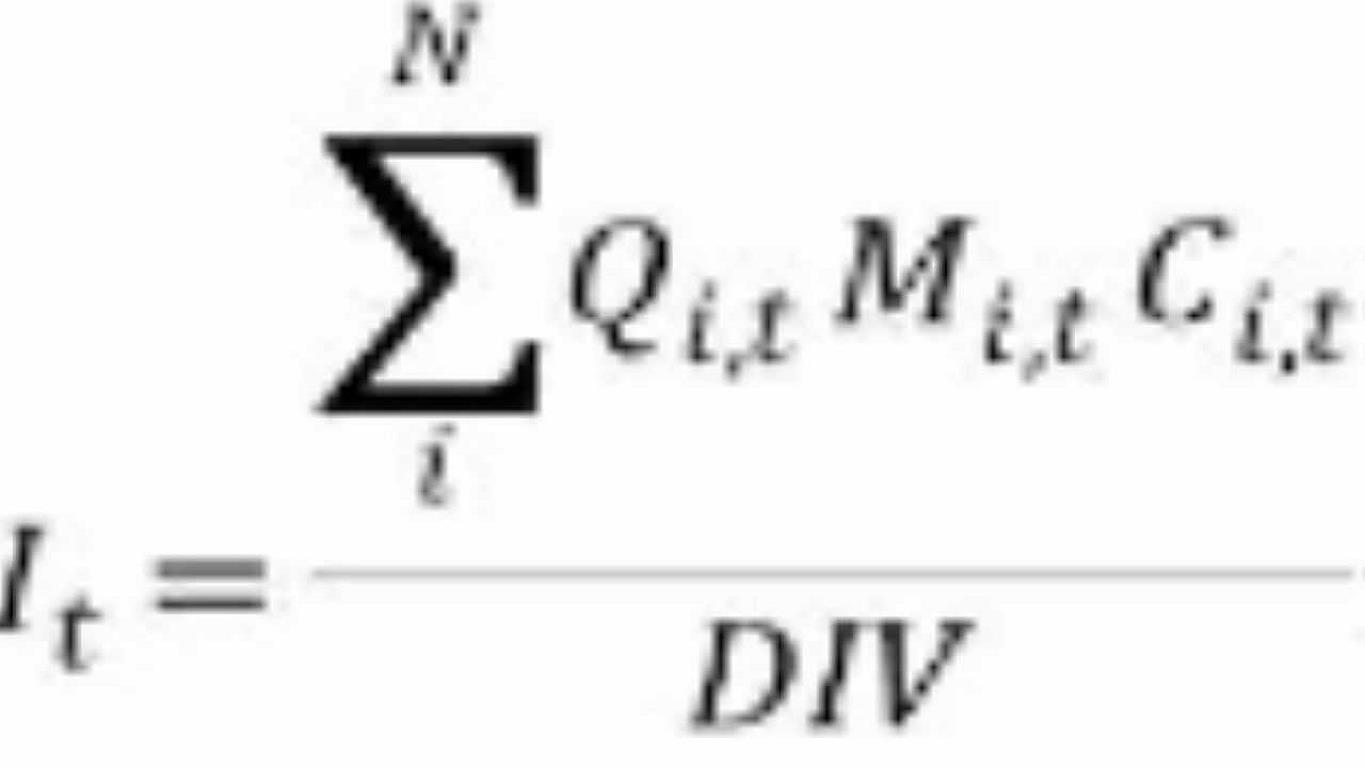

on December 20, 2002 which is the index base date. The Underlying Index is calculated using the following formula:

Where:

t = day of calculation;

N = number of constituent equities in the underlying index;

Qi,t = number of shares of equity i on day t;

Mi,t = multiplier of equity i;

Ci,t = price of equity i on day t; and

DIV = current index divisor on day t.

Underlying Index Maintenance

The Underlying Index is reviewed quarterly to ensure that at least 90% of the Underlying Index weight is accounted for by index components that continue to

meet the initial eligibility requirements. NYSE Arca may at any time and from time to time change the number of securities comprising the group by adding or deleting one or more securities, or replacing one or more securities contained in the

group with one or more substitute securities of its choice, if in NYSE Arca’s discretion such addition, deletion or substitution is necessary or appropriate to maintain the quality and/or character of the Underlying Index. Components will be

removed from the Underlying Index during the quarterly review if either (1) the market capitalization falls below $450 million or (2) the traded average daily shares for the previous three months is less than 30,000 shares and the average daily

traded value for the previous three months is less than $600,000.

At the time of the quarterly rebalance, the component security weights (also referred to as the multiplier or share quantities of each component security)

will be modified to conform to the following asset diversification requirements:

(1) the weight of any single component security may not account for more than 20% of the total value of the Underlying Index;

(2) the component securities are split into two subgroups – large and small, which are ranked by market capitalization weight in the Underlying Index. Large

securities are defined as having a starting index weight greater than or equal to 5%. Small securities are defined as having a starting index weight below 5%; and

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

(3) the final aggregate weight of those component securities which individually represent more than 4.5% of the total value of the

Underlying Index may not account for more than 45% of the total index value.

The weights of the components securities (taking into account expected component changes and share adjustments) are modified in accordance with the Underlying

Index’s diversification rules.

Diversification Rule 1: If any component stock exceeds 20% of the total value of the Underlying Index, then all stocks greater than 20% of the Underlying

Index are reduced to represent 20% of the value of the Underlying Index. The aggregate amount by which all component stocks are reduced is redistributed proportionately across the remaining stocks that represent less than 20% of the index

value. After this redistribution, if any other stock then exceeds 20%, the stock is set to 20% of the index value and the redistribution is repeated.

Diversification Rule 2: The components are sorted into two groups, large are components with a starting index weight of 5% or greater and small are components

with a weight of under 5% (after any adjustments for Diversification Rule 1). The large group will represent in the aggregate 45% and the small group will represent 55% in the aggregate of the final index weight. This will be adjusted through

the following process: The weight of each of the large stocks will be scaled down proportionately (with a floor of 5%) so that the aggregate weight of the large components will be reduced to represent 45% of the Underlying Index. If any large

component stock falls below a weight equal to the product of 5% and the proportion by which the stocks were scaled down following this distribution, then the weight of the stock is set equal to 5% and the components with weights greater than 5%

will be reduced proportionately. The weight of each of the small components will be scaled up proportionately from the redistribution of the large components. If any small component stock exceeds a weight equal to the product of 4.5% and the

proportion by which the stocks were scaled down following this distribution, then the weight of the stock is set equal to 4.5%. The redistribution of weight to the remaining stocks is repeated until the entire amount has been redistributed.

Changes to the Underlying Index composition and/or the component security weights in the Underlying Index are determined and announced prior to taking effect. These changes typically become effective after the close

of trading on the third Friday of each calendar quarter month in connection with the quarterly index rebalance. The share quantities of each component security in the index portfolio remains fixed between quarterly reviews except in the event

of certain types of corporate actions such as stock splits, reverse stock splits, stock dividends, or similar events. The share quantities used in the Underlying Index calculation are not typically adjusted for shares issued or repurchased

between quarterly reviews. However, in the event of a merger between two components, the share quantities of the surviving entity may be adjusted to account for any stock issued in the acquisition. NYSE Arca may substitute securities or change

the number of securities included in the Underlying Index, based on changing conditions in the industry or in the event of certain types of corporate actions, including mergers, acquisitions, spin-offs, and reorganizations. In the event of

component or share quantity changes to the index portfolio, the payment of dividends other than ordinary cash dividends, spin-offs, rights offerings, re-capitalization, or other corporate actions affecting a component security of the Underlying

Index, the index divisor may be adjusted to ensure that there are no changes to the index level as a result of nonmarket forces.

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

Historical Information

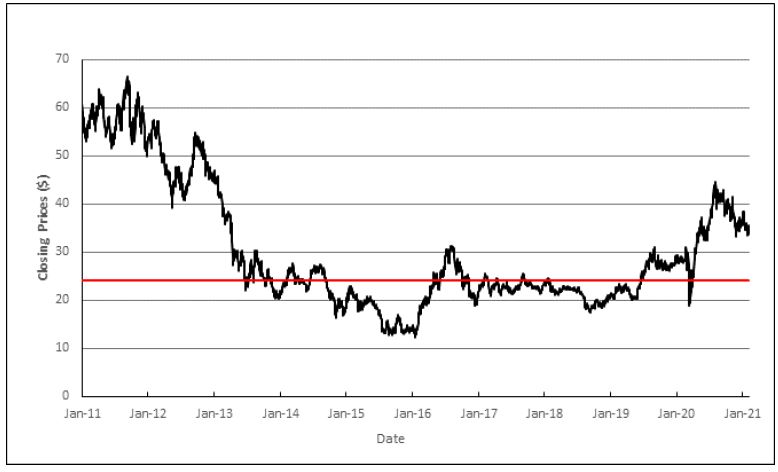

The graph below illustrates the performance of the Reference Asset from January 1, 2011 to February 5, 2021, reflecting its Initial Price of $34.61. The red

line represents the Coupon Barrier and Trigger Price of $24.23, which is equal to 70% of its Initial Price, rounded to two decimal places.

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

SUPPLEMENTAL DISCUSSION OF

U.S. FEDERAL INCOME TAX CONSEQUENCES

The following disclosure supplements, and to the extent inconsistent supersedes, the discussion in the product prospectus supplement dated September 10, 2018 under

“Supplemental Discussion of U.S. Federal Income Tax Consequences.”

Under Section 871(m) of the Code, a “dividend equivalent” payment is treated as a dividend from sources within the United States. Such payments generally would be subject to a

30% U.S. withholding tax if paid to a non-U.S. holder. Under U.S. Treasury Department regulations, payments (including deemed payments) with respect to equity-linked instruments (“ELIs”) that are “specified ELIs” may be treated as dividend

equivalents if such specified ELIs reference an interest in an “underlying security,” which is generally any interest in an entity taxable as a corporation for U.S. federal income tax purposes if a payment with respect to such interest could

give rise to a U.S. source dividend. However, the IRS has issued guidance that states that the U.S. Treasury Department and the IRS intend to amend the effective dates of the U.S. Treasury Department regulations to provide that withholding on

dividend equivalent payments will not apply to specified ELIs that are not delta-one instruments and that are issued before January 1, 2023. Based on our determination that the Notes are not delta-one instruments, non-U.S. holders should not be

subject to withholding on dividend equivalent payments, if any, under the Notes. However, it is possible that the Notes could be treated as deemed reissued for U.S. federal income tax purposes upon the occurrence of certain events affecting the

Reference Asset or the Notes (for example, upon a rebalancing of the Reference Asset), and following such occurrence the Notes could be treated as subject to withholding on dividend equivalent payments. Non-U.S. holders that enter, or have

entered, into other transactions in respect of the Reference Asset or the Notes should consult their tax advisors as to the application of the dividend equivalent withholding tax in the context of the Notes and their other transactions. If any

payments are treated as dividend equivalents subject to withholding, we (or the applicable withholding agent) would be entitled to withhold taxes without being required to pay any additional amounts with respect to amounts so withheld.

The accompanying product prospectus supplement notes that FATCA withholding on payments of gross proceeds from a sale or redemption of the Notes will only apply to payments made after December

31, 2018. That discussion is modified to reflect regulations proposed by the U.S. Treasury Department that eliminate the requirement of FATCA withholding on payments of gross proceeds upon the disposition of financial instruments. The U.S.

Treasury Department has indicated that taxpayers may rely on these proposed regulations pending their finalization. Prospective investors are urged to consult with their own tax advisors regarding the possible implications of FATCA on their

investment in the Notes.

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

SUPPLEMENTAL PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

Delivery of the Notes will be made against payment for the Notes on February 10, 2021, which is the third (3rd) business day following the Trade Date (this settlement cycle being

referred to as “T+3”). See “Plan of Distribution” in the prospectus dated September 7, 2018. For additional information as to the relationship between us and RBCCM, please see the section “Plan of Distribution—Conflicts of Interest” in the

prospectus dated September 7, 2018.

In the initial offering of the Notes, they will be offered to investors at a purchase price equal to par, except with respect to certain accounts as indicated on the cover

page of this document.

We will deliver the Notes on a date that is greater than two business days following the Trade Date. Under Rule 15c6-1 under the Exchange Act, trades in the secondary market

generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes more than two business days prior to the original issue date will be

required to specify alternative arrangements to prevent a failed settlement.

The value of the Notes shown on your account statement may be based on RBCCM’s estimate of the value of the Notes if RBCCM or another of our affiliates were to make a market

in the Notes (which it is not obligated to do). That estimate will be based upon the price that RBCCM may pay for the Notes in light of then prevailing market conditions, our creditworthiness and transaction costs. For a period of approximately

6 months after the issue date of the Notes, the value of the Notes that may be shown on your account statement may be higher than RBCCM’s estimated value of the Notes at that time. This is because the estimated value of the Notes will not

include the underwriting discount and our hedging costs and profits; however, the value of the Notes shown on your account statement during that period may initially be a higher amount, reflecting the addition of RBCCM’s underwriting discount

and our estimated costs and profits from hedging the Notes. This excess is expected to decrease over time until the end of this period. After this period, if RBCCM repurchases your Notes, it expects to do so at prices that reflect their

estimated value.

We may use this pricing supplement in the initial sale of the Notes. In addition, RBCCM or another of our affiliates may use this pricing supplement in a market-making

transaction in the Notes after their initial sale. Unless we or our agent informs the purchaser otherwise in the confirmation of sale, this pricing supplement is being used in a

market-making transaction.

Each of RBCCM and any other broker-dealer offering the Notes have not offered, sold or otherwise made available and will not offer, sell or otherwise make available any of the Notes to, any

retail investor in the European Economic Area (“EEA”) or in the United Kingdom. For these purposes, the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the Notes

to be offered so as to enable an investor to decide to purchase or subscribe the Notes, and a “retail investor” means a person who is one (or more) of: (a) a retail client, as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as

amended, “MiFID II”); or (b) a customer, within the meaning of Directive (EU) 2016/97, as amended, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (c) not a qualified

investor as defined in Regulation (EU) 2017/1129 (the “Prospectus Regulation”). Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Notes or

otherwise making them available to retail investors in the EEA or in the United Kingdom has been prepared, and therefore, offering or selling the Notes or otherwise making them available to any retail investor in the EEA or in the United

Kingdom may be unlawful under the PRIIPs Regulation.

|

|

|

|

Auto-Callable Contingent Coupon Barrier Notes

|

STRUCTURING THE NOTES

The Notes are our debt securities, the return on which is linked to the performance of the Reference Asset. As is the case for all of our debt securities,

including our structured notes, the economic terms of the Notes reflect our actual or perceived creditworthiness at the time of pricing. In addition, because structured notes result in increased operational, funding and liability management

costs to us, we typically borrow the funds under these Notes at a rate that is more favorable to us than the rate that we might pay for a conventional fixed or floating rate debt security of comparable maturity. Using this relatively lower

implied borrowing rate, rather than the secondary market rate, is a factor that reduced the initial estimated value of the Notes at the time their terms were set. Unlike the estimated value that is set forth on the cover page of this pricing

supplement, any value of the Notes determined for purposes of a secondary market transaction may be based on a different funding rate, which may result in a lower value for the Notes than if our initial internal funding rate were used.

In order to satisfy our payment obligations under the Notes, we may choose to enter into certain hedging arrangements (which may include call options, put options or other

derivatives) on the issue date with RBCCM or one of our other subsidiaries. The terms of these hedging arrangements take into account a number of factors, including our creditworthiness, interest rate movements, the volatility of the Reference

Asset, and the tenor of the Notes. The economic terms of the Notes and their initial estimated value depend in part on the terms of these hedging arrangements.

The lower implied borrowing rate is a factor that reduced the economic terms of the Notes to you. The initial offering price of the Notes also reflects the underwriting

commission and our estimated hedging costs. These factors resulted in the initial estimated value for the Notes on the Trade Date being less than their public offering price. See “Selected Risk Considerations—The Initial Estimated Value of the

Notes Is Less than the Price to the Public” above.

VALIDITY OF THE NOTES

In the opinion of Norton Rose Fulbright Canada LLP, the issue and sale of the Notes has been duly authorized by all necessary corporate action of the Bank in

conformity with the Indenture, and when the Notes have been duly executed, authenticated and issued in accordance with the Indenture and delivered against payment therefor, the Notes will be validly issued and, to the extent validity of the

Notes is a matter governed by the laws of the Province of Ontario or Québec, or the laws of Canada applicable therein, and will be valid obligations of the Bank, subject to equitable remedies which may only be granted at the discretion of a

court of competent authority, subject to applicable bankruptcy, to rights to indemnity and contribution under the Notes or the Indenture which may be limited by applicable law; to insolvency and other laws of general application affecting

creditors’ rights, to limitations under applicable limitations statutes, and to limitations as to the currency in which judgments in Canada may be rendered, as prescribed by the Currency Act (Canada).

This opinion is given as of the date hereof and is limited to the laws of the Provinces of Ontario and Québec and the federal laws of Canada applicable thereto. In addition, this opinion is subject to customary assumptions about the Trustee’s

authorization, execution and delivery of the Indenture and the genuineness of signatures and certain factual matters, all as stated in the letter of such counsel dated September 7, 2018, which has been filed as Exhibit 5.1 to Royal Bank’s Form

6-K filed with the SEC dated September 7, 2018.

In the opinion of Morrison & Foerster LLP, when the Notes have been duly completed in accordance with the Indenture and issued and sold as contemplated by the prospectus supplement and the

prospectus, the Notes will be valid, binding and enforceable obligations of Royal Bank, entitled to the benefits of the Indenture, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, concepts of

reasonableness and equitable principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith). This opinion is given as of the date hereof and is limited to the laws of the

State of New York. This opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery of the Indenture and the genuineness of signatures and to such counsel’s reliance on the Bank and other sources as to

certain factual matters, all as stated in the legal opinion dated September 7, 2018, which has been filed as Exhibit 5.2 to the Bank’s Form 6-K dated September 7, 2018.