clb-ex101_30.htm

Exhibit 10.1

#6184110

AMENDMENT NO. 1 TO CREDIT AGREEMENT

This Amendment No. 1 to Seventh Amended and Restated Credit Agreement (this “Amendment”), dated as of June 22, 2020 (the “Effective Date”), is entered into among CORE LABORATORIES N.V., a Netherlands limited liability company, (the “Parent”), CORE LABORATORIES (U.S.) INTERESTS HOLDINGS, INC., a Texas corporation (the “US Borrower” and, together with the Parent, the “Borrowers” and, each a “Borrower”), Subsidiaries of the Parent party hereto as Guarantors, the lenders party to the Credit Agreement described below, and BANK OF AMERICA, N.A., as Administrative Agent (in such capacity, the “Administrative Agent”), Swing Line Lender and L/C Issuer.

INTRODUCTION

Reference is made to the Seventh Amended and Restated Credit Agreement dated as of June 19, 2018 (as amended, restated, or otherwise modified from time to time, the “Credit Agreement”), among the Borrowers, the lenders from time to time party thereto (collectively, the “Lenders” and individually, a “Lender”), and the Administrative Agent.

WHEREAS, the Borrowers have requested, and the Lenders and the Administrative Agent have agreed, on the terms and conditions set forth herein, to make certain amendments to the Credit Agreement, including decreasing the Aggregate Commitments from $300,000,000 to $225,000,000.

NOW THEREFORE, in connection with the foregoing and for other good and valuable consideration, the Borrowers, the Lenders, and the Administrative Agent hereby agree as follows:

Section 1.Definitions; References. Unless otherwise defined in this Amendment, each term used in this Amendment that is defined in the Credit Agreement has the meaning assigned to such term in the Credit Agreement.

Section 2.Commitment Reduction. The Aggregate Commitments are hereby permanently reduced from $300,000,000 to $225,000,000. In accordance with Section 2.06 of the Credit Agreement, such reduction shall be applied to the Commitment of each Lender according to its Applicable Percentage, and effective as of the Effective Date the Commitment of each Lender is decreased to the respective Commitment set forth opposite its name on Schedule 2.01 attached hereto. The parties to this Amendment hereby waive all notices required, if any, in connection with such partial, ratable reduction of the Aggregate Commitments pursuant to this Section 2.

Section 3.Amendments of Credit Agreement.

(a)Section 1.01 of the Credit Agreement is hereby amended by adding the following defined terms thereto in appropriate alphabetical order:

“Affected Financial Institution” means (a) any EEA Financial Institution or (b) any UK Financial Institution.

“Amendment No. 1 Effective Date” means June 22, 2020.

“BHC Act Affiliate” of a party means an “affiliate” (as such term is defined under, and interpreted in accordance with, 12 U.S.C. 1841(k)) of such party.

“Covered Entity” means any of the following: (i) a “covered entity” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 252.82(b); (ii) a “covered

bank” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 47.3(b); or (iii) a “covered FSI” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 382.2(b).

“Default Right” has the meaning assigned to that term in, and shall be interpreted in accordance with, 12 C.F.R. §§ 252.81, 47.2 or 382.1, as applicable.

“Leverage Ratio” has the meaning specified in Section 7.13(b).

“QFC” has the meaning assigned to the term “qualified financial contract” in, and shall be interpreted in accordance with, 12 U.S.C. 5390(c)(8)(D).

“QFC Credit Support” has the meaning specified in Section 10.25.

“Resolution Authority” means an EEA Resolution Authority or, with respect to any UK Financial Institution, a UK Resolution Authority.

“Supported QFC” has the meaning specified in Section 10.25.

“U.S. Special Resolution Regimes” has the meaning specified in Section 10.25.

“UK Financial Institution” means any BRRD Undertaking (as such term is defined under the PRA Rulebook (as amended form time to time) promulgated by the United Kingdom Prudential Regulation Authority) or any person subject to IFPRU 11.6 of the FCA Handbook (as amended from time to time) promulgated by the United Kingdom Financial Conduct Authority, which includes certain credit institutions and investment firms, and certain affiliates of such credit institutions or investment firms.

“UK Resolution Authority” means the Bank of England or any other public administrative authority having responsibility for the resolution of any UK Financial Institution.

(b)Section 1.01 of the Credit Agreement is hereby amended by restating the following defined terms therein as follows:

“Aggregate Commitments” means the Commitments of all the Lenders. As of the Amendment No. 1 Effective Date, the Aggregate Commitments are $225,000,000.

“Arranger” means BofA Securities, Inc. (formerly known as Merrill Lynch, Pierce, Fenner & Smith Incorporated) (or any of its designated Affiliates), in its capacity as sole lead arranger and sole bookrunner.

“Bail-In Action” means the exercise of any Write-Down and Conversion Powers by the applicable Resolution Authority in respect of any liability of an Affected Financial Institution.

“Bail-In Legislation” means, (a) with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law, rule, regulation or requirement for such EEA Member Country from time to time which is described in the EU Bail-In Legislation Schedule, and (b) with respect to the United Kingdom, Part I of the United

-2-

Kingdom Banking Act 2009 (as amended from time to time) and any other law, regulation or rule applicable in the United Kingdom relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (other than through liquidation, administration or other insolvency proceedings).

“Write-Down and Conversion Powers” means, (a) with respect to any EEA Resolution Authority, the write-down and conversion powers of such EEA Resolution Authority from time to time under the Bail-In Legislation for the applicable EEA Member Country, which write-down and conversion powers are described in the EU Bail-In Legislation Schedule, and (b) with respect to the United Kingdom, any powers of the applicable Resolution Authority under the Bail-In Legislation to cancel, reduce, modify or change the form of a liability of any UK Financial Institution or any contract or instrument under which that liability arises, to convert all or part of that liability into shares, securities or obligations of that person or any other person, to provide that any such contract or instrument is to have effect as if a right had been exercised under it or to suspend any obligation in respect of that liability or any of the powers under that Bail-In Legislation that are related to or ancillary to any of those powers.

(c)The defined term “Applicable Rate” in Section 1.01 of the Credit Agreement is hereby amended by restating the pricing grid therein to read as follows:

|

|

|

|

|

|

Applicable Rate |

|

Pricing Level |

Consolidated Net Indebtedness/ Consolidated EBITDA |

Commitment Fee |

Eurocurrency Rate +

Letters of Credit |

Base Rate + |

|

1 |

≥ 2.75x |

50.0 bps |

287.5 bps |

187.5 bps |

|

2 |

< 2.75x but ≥ 2.50x |

45.0 bps |

250.0 bps |

150.0 bps |

|

3 |

< 2.50x but ≥ 2.00x |

45.0 bps |

225.0 bps |

125.0 bps |

|

4 |

< 2.00x but ≥ 1.50x |

37.5 bps |

187.5 bps |

87.5 bps |

|

5 |

< 1.50x but ≥ 1.00x |

37.5 bps |

162.5 bps |

62.5 bps |

|

6 |

< 1.00x |

35.0 bps |

150.0 bps |

50.0 bps |

(d)The defined term “Base Rate” in Section 1.01 of the Credit Agreement is hereby amended by restating the proviso to read as follows:

provided that if the Base Rate shall be less than 0.50%, such rate shall be deemed 0.50% for purposes of this Agreement.

(e)The defined term “Eurocurrency Rate” in Section 1.01 of the Credit Agreement is hereby amended by restating the proviso at the end thereof to read as follows:

provided that (i) to the extent a comparable or successor rate is approved by the Administrative Agent in connection with any rate set forth in this definition, the approved rate shall be applied in a manner consistent with market practice; provided, further that to the extent such market practice is not administratively feasible for the Administrative Agent, such approved rate shall be applied in a manner as otherwise reasonably determined

-3-

by the Administrative Agent and (ii) if the Eurocurrency Rate shall be less than 0.50%, such rate shall be deemed 0.50% for purposes of this Agreement.

(f)The defined term “Subsidiary Guarantors” in Section 1.01 of the Credit Agreement is hereby amended by deleting “Core Laboratories (Gibraltar) Limited, a private company limited by shares incorporated under Laws of Gibraltar (together with its successors and assigns)” therefrom.

(g)Article I of the Credit Agreement is hereby amended by adding the following new Section 1.10 and Section 1.11, in each case as follows:

1.10Interest Rates. The Administrative Agent does not warrant, nor accept responsibility, nor shall the Administrative Agent have any liability with respect to the administration, submission or any other matter related to the rates in the definition of “Eurocurrency Rate” or with respect to any rate that is an alternative or replacement for or successor to any of such rate (including, without limitation, any LIBOR Successor Rate) or the effect of any of the foregoing, or of any LIBOR Successor Rate Conforming Changes.

1.11Divisions. For all purposes under the Loan Documents, in connection with any division or plan of division under Delaware law (or any comparable event under a different jurisdiction’s laws): (a) if any asset, right, obligation or liability of any Person becomes the asset, right, obligation or liability of a different Person, then it shall be deemed to have been transferred from the original Person to the subsequent Person, and (b) if any new Person comes into existence, such new Person shall be deemed to have been organized on the first date of its existence by the holders of its Equity Interests at such time.

(h)Section 2.15(a) of the Credit Agreement is hereby amended and restated in its entirety as follows:

(a)Request for Increase. Provided there exists no Default, upon notice to the Administrative Agent (which shall promptly notify the Lenders), the Parent may from time to time, request an increase in the Aggregate Commitments to an amount not exceeding $275,000,000 (the “Facility Increase”), cumulative for all such increases. At the time of sending such notice, the Parent (in consultation with the Administrative Agent) shall specify the time period within which each Lender is requested to respond (which shall in no event be less than ten (10) Business Days from the date of delivery of such notice to the Lenders).

(i)Section 3.07 of the Credit Agreement is hereby amended by restating the last paragraph thereof to read as follows:

Notwithstanding anything else herein, any definition of LIBOR Successor Rate shall provide that in no event shall such LIBOR Successor Rate be less than 0.50% for purposes of this Agreement.

(j)Section 5.24 of the Credit Agreement is hereby amended and restated in its entirety as follows:

5.24Affected Financial Institutions. No Loan party is an Affected Financial Institution.

-4-

(k)Section 7.01(b) of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

(b)Liens securing Indebtedness permitted pursuant to Section 7.03 of up to $5,000,000 in the aggregate at any one time outstanding;

(l)Section 7.03(n) of the Credit Agreement is hereby amended by replacing “$300,000,000” therein with “$250,000,000”.

(m)Section 7.05 of the Credit Agreement is hereby amended by restating clause (c), clause (h) and clause (j) thereof, in each case in appropriate order as follows:

(c)Restricted Disbursements in the form of the repurchase of the Parent’s outstanding shares of common stock and cash paid by either Borrower to the holders of such Borrower’s Equity Interests, in an aggregate amount not to exceed (x) $6,000,000 in the period commencing on the Amendment No. 1 Effective Date through and including December 31, 2020, and (y) $10,000,000 in any fiscal year thereafter, so long as (i) no Event of Default shall have occurred and be continuing at the time or would result therefrom, (ii) the Borrowers are in compliance with Section 7.13 as of the end of the fiscal quarter most recently ended and on a pro forma basis after giving effect to such Restricted Disbursement and any incurrence of Indebtedness in connection therewith, and (iii) Consolidated Liquidity (as measured on a pro forma basis after giving effect to such Restricted Disbursement and any incurrence of Indebtedness in connection therewith) exceeds $40,000,000; provided that in each case, any such repurchase is made pursuant to the valid authorization of the Parent’s shareholders and a copy of each such authorization or resolution shall be delivered to the Administrative Agent in accordance with Section 6.02(d) (each such repurchase, an “Eligible Share Repurchase”);

(h)Acquisitions by the Parent and its Subsidiaries so long as the Leverage Ratio is less than or equal to 2.50 to 1.00 as of the end of the fiscal quarter most recently ended and on a pro forma basis after giving effect to each such Acquisition and any incurrence of Indebtedness in connection therewith, if the aggregate amount of all consideration for all Acquisitions for the twelve-month period ending with (and including) the month in which such Acquisition is made (the “Applicable Period”) does not exceed (x) if the Leverage Ratio is less than or equal to 2.00 to 1.00 on a pro forma basis after giving effect to such Acquisition and any incurrence of Indebtedness in connection therewith, the Consolidated EBITDA for the four fiscal-quarter period most recently ended and (y) if the Leverage Ratio is greater than 2.00 to 1.00 but less than or equal to 2.50 to 1.00 on a pro forma basis after giving effect to such Acquisition and any incurrence of Indebtedness in connection therewith, $25,000,000, in each case so long as (i) Consolidated Liquidity (as measured on a pro forma basis after giving effect to such any such Acquisition and any incurrence of Indebtedness in connection therewith) exceeds $40,000,000, (ii) no Event of Default shall have occurred and be continuing at the time of any such Acquisition or would result therefrom, (iii) each such Acquisition is of an entity engaged in substantially the same line of business as the Borrowers and their respective Subsidiaries, and (iv) after giving pro forma effect to such Acquisition and any incurrence of Indebtedness in connection therewith, the Borrowers and the other Loan Parties are in compliance with each of the other covenants set forth in this Agreement, including without limitation, those set forth in Section 7.03 and 7.13; provided that in determining compliance with the foregoing, (A) if the Leverage Ratio or pro forma Leverage Ratio changes during any Applicable Period, Acquisition consideration paid with respect to

-5-

Acquisitions consummated pursuant to clause (x) above shall be included in calculating availability provided for in clause (y) above, and vice versa, for the remainder of such Applicable Period and (B) determinations shall be made on an incurrence basis, so that if an Acquisition is permitted when consummated, it will not cease to be permitted upon a subsequent change of the Leverage Ratio or pro forma Leverage Ratio;

(j)without limitation of Section 7.05(c), additional Restricted Disbursements in the form of the repurchase of the Parent’s outstanding shares of common stock and cash paid by either Borrower to the holders of such Borrower’s Equity Interests, so long as (i) no Event of Default shall have occurred and be continuing at the time or would result therefrom, (ii) the Borrowers are in compliance with Section 7.13 as of the end of the fiscal quarter most recently ended and on a pro forma basis after giving effect to such Restricted Disbursement and any incurrence of Indebtedness in connection therewith, (iii) Consolidated Liquidity (as measured on a pro forma basis after giving effect to such Restricted Disbursement and any incurrence of Indebtedness in connection therewith) exceeds $40,000,000, and (iv) as of the end of the fiscal quarter most recently ended and on a pro forma basis after giving effect to such Restricted Disbursement pursuant to this clause (j) and any incurrence of Indebtedness in connection therewith, the Leverage Ratio is less than 1.75 to 1.00; provided that in each case, any such repurchase is an Eligible Share Repurchase;

(n)Section 7.10 of the Credit Agreement is hereby amended and restated in its entirety as follows:

7.10Use of Proceeds. Use the proceeds of any Credit Extension, whether directly or indirectly, and whether immediately, incidentally or ultimately, to (i) purchase or carry margin stock (within the meaning of Regulation U of the FRB) or to extend credit to others for the purpose of purchasing or carrying margin stock or to refund indebtedness originally incurred for such purpose in violation of Regulation U of the FRB or (ii) redeem, repay, refinance or replace any portion of the Private Placement Notes unless Consolidated Liquidity (as measured on a pro forma basis after giving effect to such refinancing or replacement) is greater than or equal to $25,000,000.

(o)Section 7.13(b) of the Credit Agreement is hereby amended and restated in its entirety as follows:

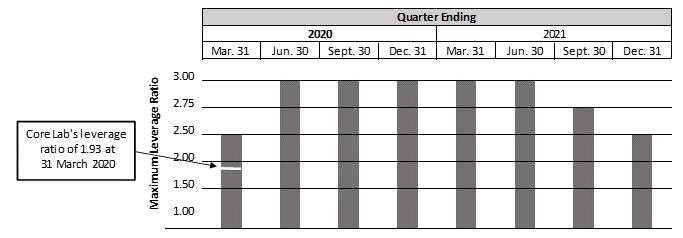

(b)Leverage Ratio. The Parent will not permit the ratio, determined as of the end of each of its fiscal quarters, for the then most-recently ended four fiscal quarters of (i) Consolidated Net Indebtedness to (ii) Consolidated EBITDA (the “Leverage Ratio”), to be greater than the ratio set forth below opposite such period:

|

|

|

Fiscal Quarter Ending |

Maximum Leverage Ratio |

|

June 30, 2020 through and including June 30, 2021 |

3.00 to 1.00 |

|

September 30, 2021 |

2.75 to 1.00 |

|

December 31, 2021 and each fiscal quarter thereafter |

2.50 to 1.00 |

provided that solely for the purposes of calculating Consolidated EBITDA for this Section 7.13(b) (including any calculation of the Leverage Ratio provided for in this Agreement), Consolidated EBITDA shall be measured on a pro forma basis reasonably acceptable to the Administrative Agent.

-6-

(p)Section 9.11 of the Credit Agreement is hereby amended by (i) deleting clause (c) thereof in its entirety and (ii) restating clause (b) thereof to read as follows:

(b)In addition, unless either (1) sub-clause (i) in the immediately preceding clause (a) is true with respect to a Lender or (2) a Lender has provided another representation, warranty and covenant in accordance with sub-clause (iv) in the immediately preceding clause (a), such Lender further (x) represents and warrants, as of the date such Person became a Lender party hereto, to, and (y) covenants, from the date such Person became a Lender party hereto to the date such Person ceases being a Lender party hereto, for the benefit of, the Administrative Agent and not, for the avoidance of doubt, to or for the benefit of the Borrowers or any other Loan Party, that the Administrative Agent is not a fiduciary with respect to the assets of such Lender involved in such Lender’s entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement (including in connection with the reservation or exercise of any rights by the Administrative Agent under this Agreement, any Loan Document or any documents related hereto or thereto).

(q)Section 10.17 of the Credit Agreement is hereby amended and restated in its entirety as follows:

10.17Electronic Execution. This Agreement and any document, amendment, approval, consent, information, notice, certificate, request, statement, disclosure or authorization related to this Agreement (each a “Communication”), including Communications required to be in writing, may be in the form of an Electronic Record and may be executed using Electronic Signatures. Each of the Loan Parties agrees that any Electronic Signature on or associated with any Communication shall be valid and binding on each of the Loan Parties to the same extent as a manual, original signature, and that any Communication entered into by Electronic Signature, will constitute the legal, valid and binding obligation of each of the Loan Parties enforceable against such in accordance with the terms thereof to the same extent as if a manually executed original signature was delivered. Any Communication may be executed in as many counterparts as necessary or convenient, including both paper and electronic counterparts, but all such counterparts are one and the same Communication. For the avoidance of doubt, the authorization under this paragraph may include, without limitation, use or acceptance by the Administrative Agent, the L/C Issuer, and each of the Lenders of a manually signed paper Communication which has been converted into electronic form (such as scanned into PDF format), or an electronically signed Communication converted into another format, for transmission, delivery and/or retention. The Administrative Agent, the L/C Issuer, and each of the Lenders may, at its option, create one or more copies of any Communication in the form of an imaged Electronic Record (“Electronic Copy”), which shall be deemed created in the ordinary course of the such Person’s business, and destroy the original paper document. All Communications in the form of an Electronic Record, including an Electronic Copy, shall be considered an original for all purposes, and shall have the same legal effect, validity and enforceability as a paper record. Notwithstanding anything contained herein to the contrary, neither the Administrative Agent, the L/C Issuer nor any Lender is under any obligation to accept an Electronic Signature in any form or in any format unless expressly agreed to by the Administrative Agent, the L/C Issuer or such Lender pursuant to procedures approved by it; provided, without limiting the foregoing, (a) to the extent the Administrative Agent, the L/C Issuer or any Issuer has agreed to accept such Electronic Signature, the Administrative Agent, the L/C Issuer and each of the Lenders shall be entitled to rely on any such Electronic Signature purportedly given by or on behalf of any

-7-

Loan Party without further verification and (b) upon the request of the Administrative Agent, the L/C Issuer, or any Lender, any Electronic Signature shall be promptly followed by such manually executed counterpart. For purposes hereof, “Electronic Record” and “Electronic Signature” shall have the meanings assigned to them, respectively, by 15 USC §7006, as it may be amended from time to time.

(r)Section 10.21 of the Credit Agreement is hereby amended and restated in its entirety as follows:

10.21Acknowledgement and Consent to Bail-In of Affected Financial Institutions. Notwithstanding anything to the contrary in any Loan Document or in any other agreement, arrangement or understanding among any such parties, each party hereto acknowledges that any liability of any Lender that is an Affected Financial Institution arising under any Loan Document, to the extent such liability is unsecured, may be subject to the write-down and conversion powers of the applicable Resolution Authority and agrees and consents to, and acknowledges and agrees to be bound by:

(a)the application of any Write-Down and Conversion Powers by the applicable Resolution Authority to any such liabilities arising hereunder which may be payable to it by any Lender that is an Affected Financial Institution; and

(b)the effects of any Bail-in Action on any such liability, including, if applicable:

(i)a reduction in full or in part or cancellation of any such liability;

(ii)a conversion of all, or a portion of, such liability into shares or other instruments of ownership in such Affected Financial Institution, its parent undertaking, or a bridge institution that may be issued to it or otherwise conferred on it, and that such shares or other instruments of ownership will be accepted by it in lieu of any rights with respect to any such liability under this Agreement or any other Loan Document; or

(iii)the variation of the terms of such liability in connection with the exercise of the write-down and conversion powers of the applicable Resolution Authority.

(s)Article X of the Credit Agreement is hereby amended by adding the following new Section 10.25:

10.25Acknowledgement Regarding Any Supported QFCs. To the extent that the Loan Documents provide support, through a guarantee or otherwise, for any Swap Contract or any other agreement or instrument that is a QFC (such support, “QFC Credit Support”, and each such QFC, a “Supported QFC”), the parties acknowledge and agree as follows with respect to the resolution power of the Federal Deposit Insurance Corporation under the Federal Deposit Insurance Act and Title II of the Dodd-Frank Wall Street Reform and Consumer Protection Act (together with the regulations promulgated thereunder, the “U.S. Special Resolution Regimes”) in respect of such Supported QFC and QFC Credit Support (with the provisions below applicable notwithstanding that the Loan Documents and any Supported QFC may in fact be stated to be governed by the laws of the State of New York and/or of the United States or any other state of the United States): in the event

-8-

a Covered Entity that is party to a Supported QFC (each, a “Covered Party”) becomes subject to a proceeding under a U.S. Special Resolution Regime, the transfer of such Supported QFC and the benefit of such QFC Credit Support (and any interest and obligation in or under such Supported QFC and such QFC Credit Support, and any rights in property securing such Supported QFC or such QFC Credit Support) from such Covered Party will be effective to the same extent as the transfer would be effective under the U.S. Special Resolution Regime if the Supported QFC and such QFC Credit Support (and any such interest, obligation and rights in property) were governed by the laws of the United States or a state of the United States. In the event a Covered Party or a BHC Act Affiliate of a Covered Party becomes subject to a proceeding under a U.S. Special Resolution Regime, Default Rights under the Loan Documents that might otherwise apply to such Supported QFC or any QFC Credit Support that may be exercised against such Covered Party are permitted to be exercised to no greater extent than such Default Rights could be exercised under the U.S. Special Resolution Regime if the Supported QFC and the Loan Documents were governed by the laws of the United States or a state of the United States. Without limitation of the foregoing, it is understood and agreed that rights and remedies of the parties with respect to a Defaulting Lender shall in no event affect the rights of any Covered Party with respect to a Supported QFC or any QFC Credit Support.

(t)Schedule 2.01 of the Credit Agreement is hereby amended by deleting it and replacing it in its entirety with Schedule 2.01 attached hereto.

Section 4.Lender Credit Decision. Each Lender acknowledges that it has, independently and without reliance upon the Administrative Agent, any other agent or any other Lender or L/C Issuer and based on the financial statements referred to in Section 6.01 of the Credit Agreement and such other documents and information as it has deemed appropriate, made its own credit analysis and decision to enter into this Amendment and to agree to the various matters set forth herein, including any decrease of its Commitment. Each Lender also acknowledges that it will, independently and without reliance upon the Administrative Agent, any other agent or any other Lender or L/C Issuer and based on such documents and information as it shall deem appropriate at the time, continue to make its own credit decisions in taking or not taking action under the Loan Documents.

Section 5.Representations and Warranties. Each Borrower represents and warrants that (a) the execution, delivery, and performance of this Amendment by each Loan Party are within the corporate or equivalent power and authority of such Loan Party and have been duly authorized by all necessary corporate or other organizational action; (b) this Amendment, and the Credit Agreement as amended hereby, constitute legal, valid, and binding obligations of each Loan Party, enforceable against each Loan Party in accordance with their terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, or similar laws of general applicability affecting the enforcement of creditors’ rights and the application of general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or law); (c) the representations and warranties of the Borrowers and each other Loan Party contained in each Loan Document are true and correct in all material respects as of the date of this Amendment, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct in all material respects as of such earlier date; and (d) no Default or Event of Default exists under the Loan Documents.

Section 6.Effect on Credit Documents. Except as amended herein, the Credit Agreement and all other Loan Documents remain in full force and effect as originally executed. Nothing herein shall act as a waiver of any of the Administrative Agent’s or any Lender’s rights under the Loan Documents as amended, including the waiver of any default or event of default, however denominated. Each Borrower acknowledges and agrees that this Amendment shall in no manner impair or affect the validity or

-9-

enforceability of the Credit Agreement. This Amendment is a Loan Document for the purposes of the provisions of the other Loan Documents. Without limiting the foregoing, any breach of representations, warranties, and covenants under this Amendment may be a default or event of default under the other Loan Documents.

Section 7.Effectiveness. This Amendment shall become effective, the Commitments shall be decreased, and the Credit Agreement shall be amended as provided for herein, upon the satisfaction on or prior to the Effective Date of the following conditions:

(a)the Administrative Agent (or its counsel) shall have received (i) counterparts hereof duly executed and delivered by a duly authorized officer of each Borrower, each Guarantor, and by the Lenders whose consent is required to effect the amendments contemplated hereby;

(b)the Administrative Agent (or its counsel) shall have received each of the following items, each in form and substance reasonably acceptable to the Administrative Agent and, where applicable, duly executed and delivered by a duly authorized officer of each applicable Loan Party:

(i)a certificate of each Loan Party dated as of the Effective Date signed by a Responsible Officer of such Loan Party (A) certifying and attaching the resolutions adopted by such Loan Party approving or consenting to this Amendment and related documents, and that such resolutions have not been modified, rescinded or amended and are in full force and effect, (B) certifying and attaching a true and complete copy of the governing documents of such Loan Party, together with all amendments or modifications thereto, as in effect on the Effective Date (or a certification that there have been no amendments or modifications to such governing documents of such Loan party since the date previously certified pursuant to the Credit Agreement), (C) certifying and attaching the certificate of formation or other formation documents of such Loan Party, together with all amendments or modifications thereto, as in effect on the Effective Date (or a certification that there have been no amendments to such certificate of formation or other formation documents of such Loan Party since the date previously certified pursuant to the Credit Agreement), and (D) in the case of the Parent, certifying that, after giving effect to this Amendment, (1) the representations and warranties contained in Article V of the Credit Agreement and the other Loan Documents are true and correct on and as of the Effective Date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they are true and correct as of such earlier date, and except that for purposes of such certification, the representations and warranties contained in subsections (a) and (b) of Section 5.05 of the Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant to clauses (a) and (b), respectively, of Section 6.01 of the Credit Agreement, and (2) no Default exists; and

(ii)such documents and certifications as the Administrative Agent may reasonably require to evidence that each of the Borrowers and the other Loan Parties is validly existing and to the extent applicable, in good standing and qualified to engage in business in each material jurisdiction where the conduct of its business requires such qualification.

(c)The Administrative Agent shall have received, for the account of each Lender that has delivered an executed counterpart of this Amendment to the Administrative Agent (or its counsel) by 5:00 p.m. (Central time) on June 19, 2020, a fee payable to such Lender as set forth in the discussion materials posted to the Lenders on June 11, 2020; and

(d)The Parent shall have paid all fees, charges, and disbursements of counsel to the Administrative Agent (directly to such counsel if requested by the Administrative Agent) incurred in

-10-

connection with the negotiation, preparation, execution and delivery of this Amendment and related documents to the extent then invoiced.

Section 8.Reaffirmation of Guaranty. By its signature hereto, each Guarantor represents and warrants that such Guarantor has no defense to the enforcement of the Guaranty to which it is a party, and that according to its terms such Guaranty will continue in full force and effect to guaranty the Borrowers’ obligations under the Credit Agreement and the other amounts described in such Guaranty following the execution of this Amendment.

Section 9.Reaffirmation of Intercompany Subordination Agreement. By its signature hereto, each Borrower and each Guarantor represents and warrants that it has no defense to the enforcement of the Subordination Agreement made by the Borrowers and the Guarantors for the benefit of the Administrative Agent, and that according to its terms the Subordination Agreement will continue in full force and effect to subordinate all intercompany indebtedness among the Loan Parties to the Obligations following execution of this Amendment.

Section 10.Governing Law. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, the LAW OF THE STATE OF TEXAS.

Section 11.Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective permitted successors and assigns; provided, however, that (a) neither Borrower may assign or transfer its rights or obligations hereunder without the prior written consent of the Administrative Agent and each Lender; and (b) the rights of sale, assignment and transfer of the Lenders are subject to Section 10.06 of the Credit Agreement.

Section 12.Miscellaneous. The miscellaneous provisions set forth in Article X of the Credit Agreement apply to this Amendment. This Amendment may be signed in any number of counterparts, each of which shall be an original, and may be executed and delivered electronically and by telecopier.

Section 13.ENTIRE AGREEMENT. THIS AGREEMENT AND THE OTHER LOAN DOCUMENTS REPRESENT THE FINAL AGREEMENT AMONG THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS AMONG THE PARTIES.

[signature page follows]

-11-

EXECUTED as of the first date above written.

CORE LABORATORIES N.V.,

a Netherlands limited liability company

By: Core Laboratories International B.V., its sole Managing Director

By: /s/ Jacobus Schouten

Name: Jacobus Schouten

Title: Managing Director

Core Laboratories (U.S.) Interests Holdings, Inc.,

a Texas corporation

By: /s/ Kevin Daniels

Name: Kevin Daniels

Title: Chief Accounting Officer and Treasurer

CORE LABORATORIES SALES N.V.,

a Curaçao company, by its managing director, Curaçao Corporation Company N.V.

By: /s/ S.J. Vis / R.M.P. Mendez

Name: S.J. Vis / R.M.P. Mendez

Title: Attorney in Fact

CORE LABORATORIES CANADA LTD., an Alberta, Canada corporation

By: /s/ Lawrence Bruno

Name: Lawrence Bruno

Title: President

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

SAYBOLT LP, a Delaware limited partnership

By: Core Laboratories LLC, its General Partner

By: /s/ Christopher Hill

Name: Christopher Hill

Title: Chief Financial Officer

OWEN OIL TOOLS LP, a Delaware limited partnership

By: Core Laboratories LLC, its General Partner

By: /s/ Christopher Hill

Name: Christopher Hill

Title: Chief Financial Officer

CORE LABORATORIES (IRELAND) LIMITED, a private limited liability company incorporated under the laws of Ireland

By: /s/ Stephen O’Donnell

Name: Stephen O’Donnell

Title: Director

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

CORE LABORATORIES LUXEMBOURG S.À, a public limited liability company incorporated under the laws of Luxembourg

By: /s/ Paul Brogan

Name: Paul Brogan

Title: Director

CORE LABORATORIES SALES B.V.,, a Netherlands private limited liability company

By: /s/ Jacobus Schouten

Name: Jacobus Schouten

Title: Managing Director B

CORE LABORATORIES LP, a Delaware limited partnership

By: Core Laboratories LLC, its General Partner

By: /s/ Christopher Hill

Name: Christopher Hill

Title: Chief Financial Officer

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

EXECUTED AND DELIVERED AS A DEED BY:

CORE LABORATORIES (U.K.) LIMITED, a company organized under the laws of England and Wales

ACTING BY:

By: /s/ George Bruce

Name: George Bruce

Title: Director

Address: Howe Moss Drive Kirkhill Industrial Estate Dyce, Scotland, Aberdeen AB21 OGL United Kingdom

Telephone:+44 1224 421000

Fax: +44 1224 421003

AND:

By: /s/ Jacqueline Watson

Name: Jacqueline Watson

Title: Director

Address: Howe Moss Drive Kirkhill Industrial Estate Dyce, Scotland, Aberdeen AB21 OGL United Kingdom

Telephone:+44 1224 421000

Fax: +44 1224 421003

IN THE PRESENCE OF:

By: /s/ Erhan Fatih Oguz

Name:Erhan Fatih Oguz

Address:7 Binghill Drive

Milltimber

AB13 0JE

Aberdeen

Occupation:Senior Project Engineer

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

BANK OF AMERICA, N.A., as Administrative Agent

By: /s/ Kyle D Harding

Name: Kyle D Harding

Title: Vice President

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

BANK OF AMERICA, N.A., as a Lender, L/C Issuer and Swing Line Lender

By: /s/ Tyler Ellis

Name: Tyler Ellis

Title: Director

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

WELLS FARGO BANK, N.A., as a Lender

By: /s/ Shannon Cunningham

Name: Shannon Cunningham

Title: Director

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

ABN AMRO CAPITAL USA LLC, as a Lender

By: /s/ Amit Wynalda

Name: Amit Wynalda

Title: Executive Director

By: /s/ Jamie Matos

Name: Jamie Matos

Title: Director

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

REGIONS BANK, as a Lender

By: /s/ David Valentine

Name: David Valentine

Title: Managing Director

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

COMERICA BANK, as a Lender

By: /s/ Bryan Turner

Name: Bryan Turner

Title: Relationship Manager – Senior Vice President

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

CREDIT SUISSE AG, CAYMAN ISLANDS BRANCH, as a Lender

By: /s/ Nupur Kumar

Name: Nupur Kumar

Title: Authorized Signatory

By: /s/ Christopher Zybrick

Name: Christopher Zybrick

Title: Authorized Signatory

Signature Page to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs

SCHEDULE 2.01

COMMITMENTS

AND APPLICABLE PERCENTAGES

|

|

|

|

Lender |

Commitment |

Applicable Percentage |

|

Bank of America, N.A. |

$60,000,000.00 |

26.666666667% |

|

Wells Fargo Bank, N.A. |

$45,000,000.00 |

20.000000000% |

|

ABN AMRO Capital USA LLC |

$37,500,000.00 |

16.666666667% |

|

Regions Bank |

$30,000,000.00 |

13.333333333% |

|

Comerica Bank |

$26,250,000.00 |

11.666666667% |

|

Credit Suisse AG, Cayman Islands Branch |

$26,250,000.00 |

11.666666667% |

|

Total |

$225,000,000.00 |

100.000000000% |

Schedule 2.01 to Amendment No. 1 to 7th A&R Credit Agreement – Core Labs