Table of Contents

2014 ANNUAL REPORT

Run Simple

|

The Best-Run Businesses Run SAP®

|

Table of Contents

WHAT WE REPORT

We present our financial, social, and environmental performance in the SAP Integrated Report 2014, which is available at www.sapintegratedreport.com.

This Annual Report 2014 is an extract from the SAP Integrated Report 2014.It comprises all of the information required by accounting and disclosure standards applicable to us.

Table of Contents

Key Facts

Performance Summary

€ millions, unless otherwise stated

| 2014 | 2013 | Change in % | ||||||||||

| Financial key performance indicators | ||||||||||||

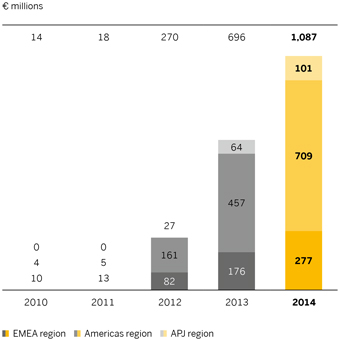

| Cloud subscriptions and support (IFRS) |

1,087 | 696 | 56 | |||||||||

| Non-IFRS adjustments |

14 | 61 | -77 | |||||||||

| Cloud subscriptions and support (non-IFRS) |

1,101 | 757 | 45 | |||||||||

| Software and support (IFRS) |

13,767 | 13,254 | 4 | |||||||||

| Non-IFRS adjustments |

5 | 21 | -76 | |||||||||

| Software and support (non-IFRS) |

13,773 | 13,275 | 4 | |||||||||

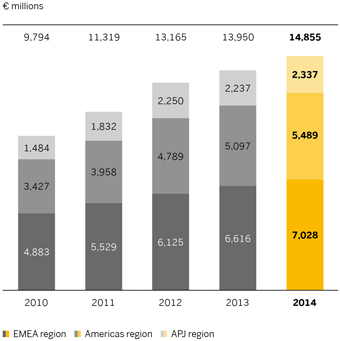

| Software and software-related service revenue (IFRS) |

14,855 | 13,950 | 6 | |||||||||

| Non-IFRS adjustments |

19 | 82 | -77 | |||||||||

| Software and software-related service revenue (non-IFRS) |

14,874 | 14,032 | 6 | |||||||||

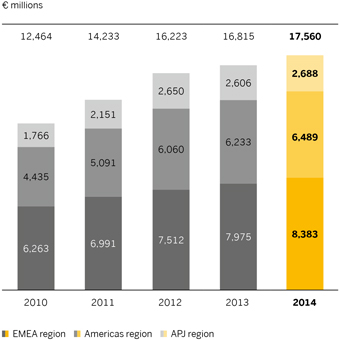

| Total revenue (IFRS) |

17,560 | 16,815 | 4 | |||||||||

| Non-IFRS adjustments |

19 | 82 | -77 | |||||||||

| Total revenue (non-IFRS) |

17,580 | 16,897 | 4 | |||||||||

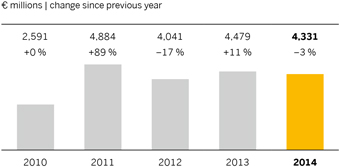

| Operating profit (IFRS) |

4,331 | 4,479 | -3 | |||||||||

| Non-IFRS adjustments |

1,307 | 1,003 | 30 | |||||||||

| Operating profit (non-IFRS) |

5,638 | 5,482 | 3 | |||||||||

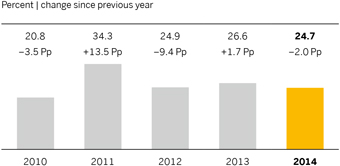

| Operating margin (as a percentage, IFRS) |

24.7 | 26.6 | -7 | |||||||||

| Operating margin (as a percentage, non-IFRS) |

32.1 | 32.4 | -1 | |||||||||

| Free cash flow |

2,762 | 3,266 | -15 | |||||||||

| Net liquidity |

-7,670 | -1,467 | 423 | |||||||||

| Days’ sales outstanding (DSO, in days) |

65 | 62 | 5 | |||||||||

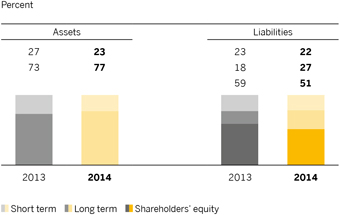

| Equity ratio (total equity as a percentage of total assets) |

51 | 59 | -14 | |||||||||

| Operating expenses | ||||||||||||

| Cloud subscriptions and support margin (as a percentage of corresponding revenue) |

56 | 55 | 2 | |||||||||

| Software and software-related service margin (as a percentage of corresponding revenue) |

81 | 81 | -1 | |||||||||

| Professional service and other services margin (as a percentage of corresponding revenue) |

12 | 16 | -25 | |||||||||

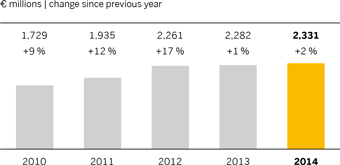

| Cost of research and development |

2,331 | 2,282 | 2 | |||||||||

| Cost of research and development (as a percentage of total revenue) |

13 | 14 | -5 | |||||||||

| Cost of research and development (as a percentage of total operating expenses) |

18 | 15 | 17 | |||||||||

| Financial performance measures | ||||||||||||

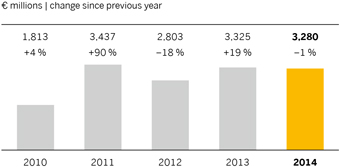

| Weighted average shares outstanding, basic (in millions) |

1,195 | 1,193 | 0 | |||||||||

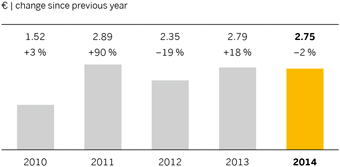

| Earnings per share, basic (in €) |

2.75 | 2.79 | -1 | |||||||||

| Dividend per share (in €) |

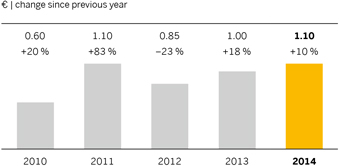

1.10 | 1.00 | 10 | |||||||||

| SAP share price2) (in €) |

58.26 | 62.31 | -6 | |||||||||

| Market capitalization2) (in € billions) |

71.6 | 76.5 | -6 | |||||||||

Table of Contents

Performance Summary

€ millions, unless otherwise stated

| 2014 | 2013 | Change in % | ||||||||||

| Employees and personnel expenses | ||||||||||||

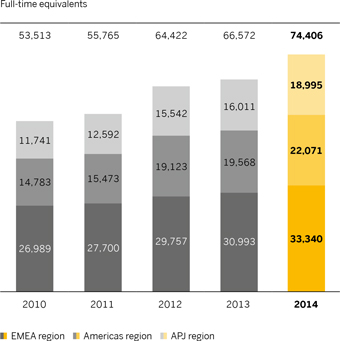

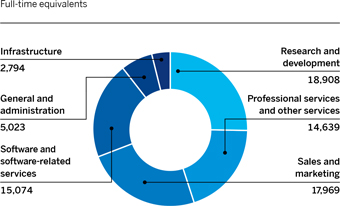

| Number of employees1), 2) |

74,406 | 66,572 | 12 | |||||||||

| Number of employees in research and development1), 2) |

18,908 | 17,804 | 6 | |||||||||

| Personnel expenses per employee – excluding share-based payments (in € thousands) |

111 | 109 | 1 | |||||||||

| Women working at SAP (as a percentage) |

31 | 31 | 0 | |||||||||

| Women in management2) (total, as a percentage) |

21.3 | 21.2 | 0 | |||||||||

| Employee Engagement Index (as a percentage) |

79 | 77 | 3 | |||||||||

| Business Health Culture Index (as a percentage) |

70 | 67 | 4 | |||||||||

| Employee retention (as a percentage) |

93.5 | 93.5 | 0 | |||||||||

| Environment | ||||||||||||

| Greenhouse gas emissions (in kilotons) |

500 | 545 | -8 | |||||||||

| Greenhouse gas emissions per employee1) (in tons) |

7.3 | 8.3 | -12 | |||||||||

| Greenhouse gas emissions per € revenue (in grams) |

28.4 | 32.4 | -12 | |||||||||

| Total energy consumption (in GWh) |

920 | 910 | 1 | |||||||||

| Energy consumed per employee1) (in kWh) |

13,400 | 13,900 | -4 | |||||||||

| Data center energy consumed (in GWh) |

179 | 173 | 3 | |||||||||

| Data center energy per employee1) (in kWh) |

NA | 2,633 | NA | |||||||||

| Data center energy per € revenue3) (in kWh) |

10 | NA | NA | |||||||||

| Renewable energy sourced (as a percentage) |

100 | 43 | 133 | |||||||||

| Customer | ||||||||||||

| Customer Net Promoter Score4) (as a percentage) |

19.1 | 12.1 | 58 | |||||||||

| 1) | Full-time equivalents |

| 2) | Numbers based on year-end |

| 3) | Data center energy consumption normalized against € revenue combines a relative measure of required energy to develop and operate solution in internal and external data center. |

| 4) | In addition to our on-premise customers, in 2014, for the first time we included Ariba, SuccessFactors, and Sybase customers in the survey. Therefore, the 2014 Customer Net Promoter Score is not fully comparable to the prior year’s score. |

Table of Contents

WHO WE ARE

For more than 40 years, SAP has helped companies of all sizes and in all industries run better. Through our Run Simple approach, we simplify technology and master complexity so customers can consume our software the way they want and ultimately run their businesses more simply. With an extensive global network of customers, partners, and employees around the world, SAP helps the world run better and improve people’s lives. Run Simple is more than our tagline, it is a promise. We realize the promise of Run Simple through our strategy to be “THE cloud company powered by SAP HANA.”

Table of Contents

| To Our Stakeholders | 5 | |||

| Combined Management Report | 54 | |||

| Consolidated Financial Statements IFRS | 158 | |||

| Additional Information | 265 | |||

2

Table of Contents

3

Table of Contents

19.1%

CUSTOMER LOYALTY

We use the Customer Net Promoter Score (NPS) to measure the willingness

of our customers to recommend or promote SAP to others on a scale

of -100% to 100%. We saw a strong increase in our score in 2014 (19.1%)

compared to our 2014 target of 16% and are committed to achieve

a score of 24% in 2015.

Table of Contents

5

Table of Contents

Dear Stakeholders,

In 2014, SAP’s more than 74,400 employees came together and delivered a performance worthy of our enduring vision to help the world run better and improve people’s lives.

We also seized on the most intractable CEO challenge of this generation: complexity. In acknowledging the common enemy facing businesses of all sizes in all industries, we established an audacious new operating principle for ourselves and for the world: Run Simple.

BUSINESS HIGHLIGHTS

Against the backdrop of an IT industry in the midst of massive transformation, SAP executed in 2014 with the strength and stability the world has come to expect from a market leader. We delivered €17.6 billion in non-IFRS total revenues and €5.6 billion in non-IFRS operating profit for the full year. This performance is the latest result of our carefully and effectively managed business transformation, driven by the accelerated growth in SAP’s cloud business.

As customer preference shifts toward the software-as-a-service model, SAP’s business results evolve as well. The transition results in less upfront revenue because, unlike perpetual software licenses, cloud subscriptions are recognized over time instead of at the moment of the initial delivery. The cloud business model does have considerable benefits, including increased revenue predictability over the long term.

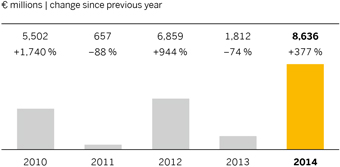

In 2014, this cloud transition accelerated for SAP. Non-IFRS cloud subscriptions and support revenue was €1.10 billion (compared with €757 million in 2013), an increase of 45%. SAP’s annual total cloud revenue run rate exceeded €1.7 billion. This is even more exciting when considering that only five years ago, SAP’s cloud revenues and registered cloud users were negligible.

Today, SAP is the fastest-growing enterprise cloud company at scale and the largest cloud company in the world by measure of users (70 million). By creating a “green cloud,” we have also tied our environmental strategy to our business strategy. Despite the increase in energy consumption from broader use of our cloud solutions, we were able to reduce our carbon footprint by 8% compared to 2013. And, for the eighth year in a row, we have been ranked the number-one software company in the Dow Jones Sustainability Index.

Other non-financial performance metrics also tell the story of SAP’s successful 2014. Our employee engagement index increased to 79%, again showing that our employees are engaged, supportive of our consistent strategy, and united in high trust. Our customers are not only satisfied, but also see us as a trusted partner for innovation, leading to an increase in customer loyalty, as measured by the Customer Net Promoter Score, to 19.1%.

Overall, our 2014 performance was driven by our people and by an innovations portfolio built around the business challenges and opportunities facing our more than 282,000 customers worldwide.

6 To Our Stakeholders

Table of Contents

THE GREAT SIMPLIFIER: SAP HANA

With fast-growing inputs from sources like social media and the Internet of Things, CEOs have made it clear: accessing and analyzing only 1% of their data is a clear manifestation of complexity. Only SAP could take on the challenge of Run Simple, because only we have SAP HANA to manage the Big Data of the enterprise – structured and unstructured. With skyrocketing customer adoption in 2014, we firmly established the leadership position of SAP HANA, with more than 5,800 SAP HANA customers and 1,850 SAP Business Suite powered by SAP HANA customers worldwide.

In 2014, we also unveiled a new breakthrough, SAP Simple Finance, a solution fundamentally redefining what it means to use real-time financial data in successful businesses. Changing the “read, then react” mindset in favor of prediction and simulation, SAP Simple Finance includes functionality and features natively built for the SAP HANA platform, delivering a consumer-grade user experience along with its revolutionary capabilities for finance professionals.

But SAP HANA also proved to be much more than just a transformational business innovation platform in 2014. It is changing everything from sports – SAP Match Insights powered by SAP HANA helped the German National Football Team win the 2014 FIFA World Cup – to healthcare – Heidelberg’s National Center for Tumor Diseases now uses SAP HANA to improve diagnostic and patient treatment capabilities. Whether it’s the Ebola outbreak in West Africa or infant mortality in the United States, SAP HANA is uniting future leaders from the Hasso Plattner Institute and other leading universities with business and political leaders to change the world.

APPLICATIONS IN THE CLOUD BUILT FOR BUSINESS

For the CIO to line-of-business executives in HR, procurement, and sales, we knew the cloud would be the pervasive computing theme of this generation. So back in 2010, SAP set out on a series of bold moves to build the broadest cloud portfolio in the technology industry. In 2014, that portfolio grew even stronger. SuccessFactors Employee Central became the fastest-growing core HR management solution in the marketplace. Combined with solutions from Fieldglass, SAP is the only cloud company that helps customers manage their total workforce – including temporary workers, which remains the fastest-growing segment of the labor force.

In addition to engaging the workforce, the CEO agenda in the cloud is also about engaging end-consumers in any channel, on any device. We knew that sales force automation had its place, but that legacy CRM wouldn’t help CEOs build growth strategies for the digital economy. That’s why our SAP solutions for customer engagement and commerce showed aggressive growth in 2014, including SAP hybris Marketing and SAP Cloud for Customer.

The cloud may be accelerating, but for customers the cloud is not a one-size-fits-all option. In 2014, SAP continued to invest in our public and managed cloud offerings, ensuring that customers could choose whether to run applications or entire enterprises in an SAP cloud – public, managed, or hybrid. However the customer chooses to consume our technology, we remain ever-focused on innovating for their specific industry with our four decades-long commitment to security and trust.

Letter from the CEO 7

Table of Contents

THE BUSINESS NETWORK

2014 also saw SAP take a defining step on the road to the next frontier in the cloud: a secure, real-time business network to reinvent commerce between companies. It started in 2012 with Ariba, the network for indirect materials in the enterprise. It expanded in mid-2014 with Fieldglass and contract workforces. At the end of 2014, we successfully completed the acquisition of Concur, the largest software-as-a-service acquisition in history, adding the US$1.2 trillion business travel market to the scope of SAP’s leadership position in the business network.

Concur completes our network vision and enables SAP to help customers reinvent resource management across all major categories of enterprise spend. To defeat complexity, it’s no longer adequate for business processes to end at the walls of an enterprise. Our business network extends those processes between companies, a significant step forward for Run Simple.

THE ROAD AHEAD

SAP enjoyed a strong and successful 2014, but we remain restless in our drive to shape the future of enterprise technology. In 2015, for example, we already made the largest product announcement in SAP’s history: SAP S/4HANA, a next-generation business suite built for the digital, networked economy. SAP S/4HANA is designed to drive instant value across lines of business and industries with the ultimate sophistication: simplicity. From a business value perspective, SAP S/4HANA can create unique opportunities to reinvent business models and drive new revenues. From an IT perspective, SAP S/4HANA can create unique opportunities to dramatically simplify the IT landscape and reduce total cost of ownership.

With SAP S/4HANA to revolutionize core business applications, the broadest cloud portfolio across industries and lines of business, and the business network to reinvent commerce between companies, we enter 2015 with the strongest collection of assets in the company’s history.

THIS REPORT

We invite all stakeholders to explore our SAP Integrated Report 2014 to learn more about SAP’s business strategy and performance. But we also believe in full transparency, which is why you’ll also find extensive information about our social and environmental performance. It’s no longer enough for great companies to be financially and operationally sound. The 21st century demands purpose-driven companies, keenly aware of the impact we have on our people and our environment. In this spirit, the SAP Integrated Report aims to be a role model. We welcome your interest and your feedback.

SAP, our employees, and our ecosystem are united in dedication to our customers. We see a future where every customer can run real time, run networked, and Run Simple. 2014 kept us on the right path and inspires us to continue leading in 2015 and beyond.

Bill McDermott

CEO, SAP SE

8 To Our Stakeholders

Table of Contents

Gerhard Oswald

Member of the Executive Board

Global Service & Support

Michael Kleinemeier

Member of the Global Managing Board

Head of Service & Support

Bernd Leukert

Member of the Executive Board

Products & Innovation

Stefan Ries

Member of the Global Managing Board

Chief Human Resources Officer

Ingrid-Helen Arnold

Member of the Global Managing Board

Chief Information Officer and

Head of Cloud Delivery

Global Managing Board 9

Table of Contents

Bill McDermott

CEO and Member of the Executive Board

Robert Enslin

Member of the Global Managing Board

President Global Customer Operations

Luka Mucic

Member of the Executive Board

Chief Financial Officer

and Chief Operating Officer

Steve Singh

Member of the Global Managing Board

CEO, Concur Technologies

10 To Our Stakeholders

Table of Contents

In 2014, we continued to engage in a dialog with our investors. Our conversations were highly focused on our growth strategy and our transition to THE cloud company powered by SAP HANA. Investors were keen on understanding how this business transformation was impacting SAP. These discussions also involved our acquisition strategy, because we acquired Concur and Fieldglass to complete our business network.

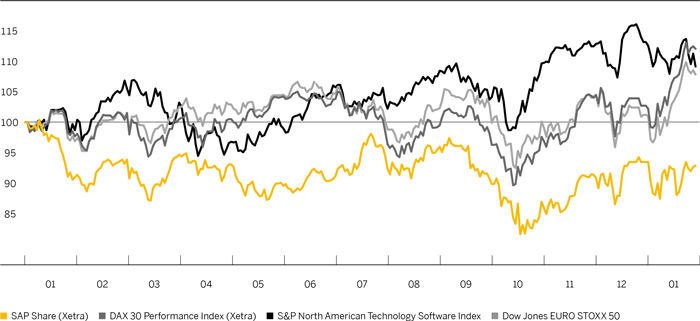

Indexes Scale New Heights Despite Troubles

The stock markets were volatile in 2014. Geopolitical trouble spots in Russia and the Ukraine as well as some countries in Latin America had a negative influence, as was weak economic growth in the euro area. On the other hand, central bank monetary policies and a fall in the price of oil more than outweighed this impact. As a result, there were record highs for the Dow Jones Industrial Average and the DAX 30.

Having risen each of the previous five years, our stock declined 6.5% in 2014. In contrast, the key blue chip and industry indexes climbed in response to increased liquidity on the financial markets. The DAX 30 and the EURO STOXX 50 index of euro-area blue chips gained 2.7% and 1.2% respectively in 2014. The Dow Jones Industrial Average gained 7.5%; the S&P 500 was up 11.4%; and the S&P North American Technology Software Index increased by 13.1%.

SAP Closes Stronger

After closing the end of 2013 at €62.31, our stock had already reached €62.55, its highest level for the year, by January 8, 2014. It weakened a little when, on January 21, we published our preliminary 2013 results and outlook for 2014. Soon after that, confidence across the market was undermined by the instability affecting some emerging economies’ currencies and by the developing crisis in Russia and Ukraine. During this phase, on March 14, SAP stock slipped to €54.31. Initially, the tension surrounding the situation in Russia and Ukraine did not escalate, and the stock markets rallied again. The recommendation from the Executive Board of an 18% dividend increase provided an extra boost for our stock.

Shortly after we published our results for the first quarter on April 17, stock markets again weakened in reaction to the troubles in Russia and Ukraine. The announcement of personnel changes on the Executive Board and the ex-dividend price adjustment after the Annual General Meeting of Shareholders brought our stock down as far as €54.41 on May 22. At the same time, the DAX was moving ahead on expectations that the European Central Bank (ECB) would further ease its monetary policy. After the ECB officially met those expectations, the DAX closed above 10,000 points for the first time ever on June 9. However, at the end of June, the geopolitical trouble spots and weak indicators from the U.S. economy impacted the mood on the markets.

SAP stock rallied when we announced our strong second-quarter results on July 17, reaching €61.12 on July 23. After that date, escalating troubles in Russia and Ukraine, as well as speculation that the interest rates would be raised in the United States negatively impacted sentiment on the stock exchanges. The ECB’s monetary policy boosted the markets again at the end of August. The announcement of the Concur acquisition on September 18 and an overall less favorable market environment at the time led investors to be more cautious.

The downward trend on the stock markets accelerated in October. In this environment, we published our third-quarter earnings on October 20 and lowered our operating profit target for 2014 in light of the rapid growth in our cloud business. That day, SAP stock touched its lowest point for the year, which was €50.90. The next day it rallied to €51.87. Subsequently, the stock markets recovered, not least because the ECB signaled further easing of its monetary policy. The DAX exceeded 10,000 points again and our stock closed the year at €58.26.

Investor Relations 11

Table of Contents

SAP Stock in Comparison to DAX 30, Dow Jones EURO STOXX 50 and to S&P North American Technology Software Index

December 31, 2013 (=100%) to January 31, 2015

Percent

Key Facts About SAP Stock/SAP ADRs

| Listings | ||||

| Germany |

Berlin, Frankfurt, Stuttgart | |||

| United States (ADR) |

New York Stock Exchange | |||

| IDs and symbols | ||||

| WKN/ISIN |

716460/DE0007164600 | |||

| NYSE (ADRs) |

803054204 (CUSIP) | |||

| Reuters |

SAPG.F or .DE | |||

| Bloomberg |

SAP GR | |||

| Weight (%) in indexes at 12/31/2014 | ||||

| DAX 30 |

6.63 | |||

| Prime All Share |

5.08 | |||

| CDAX |

5.23 | |||

| HDAX |

5.33 | |||

| Dow Jones STOXX 50 |

1.70 | |||

| Dow Jones EURO STOXX 50 |

2.79 |

DIVIDEND PAYOUT OF €1.10 PER SHARE

We believe our shareholders should benefit appropriately from the profit the Company made in 2014. Until now, our policy has been to distribute more than 30% of profit after tax in dividend. In recent years, the payout has been greater than 35% of profit after tax. Reflecting this, we are therefore amending our policy, which from now on will be to pay a dividend totaling more than 35% of profit after tax.

The Executive Board and the Supervisory Board will therefore recommend to the Annual General Meeting of Shareholders that the total dividend be increased by 10% to €1.10 per share (2013: €1.00). Based on this recommendation, the overall dividend payout ratio (which means here the total distributed dividend as a percentage of profit) would be 40% (2013: 36%).

12 To Our Stakeholders

Table of Contents

CAPITAL STOCK UNCHANGED

SAP’s capital stock on December 31, 2014, was €1,228,504,232 (2013: €1,228,504,232). It is issued as 1, 228,504,232 no-par shares, each with an attribute value of €1 in relation to capital stock.

LARGER FREE FLOAT

The proportion of our stock in free float increased again slightly in 2014. Applying the definition accepted on the Frankfurt Stock Exchange, which excludes treasury stock from the free float, at December 31, 2014, the free float stood at 75.7% (December 31, 2013 74.7%). In January 2015, approximately 21.6% (January 2014: 22.5%) of the stock was under the control of three of the founders and their trusts and holding companies. U.S. institutions remained the largest group of shareholders, holding around 16.2% (January 2014: 18.0%) of the stock in January 2015. Institutions in Ireland and the United Kingdom held about 15.1% (January 2014: 14.9%), followed by Continental European investors outside Germany, who held approximately 14.3% (January 2014: 13.8%) in January 2015. Institutions in Germany held 7.1% (January 2014: 7.6%) and investors from the rest of the world held 2.9% (January 2014: 2.7%) of the stock in January 2015. Private or unidentified investors held 18.7% (January 2014: 17.6%) in January 2015. Also as of January 2015, SAP held 2.7% (January 2014: 2.8%) of the stock in treasury.

Return on SAP Common Stock – WKN 716460/ISIN DE0007164600

Percent, unless otherwise stated

| Initial investment €10,000 | ||||||||||||

| Date of investment | 12/31/2004 | 12/31/2009 | 12/31/2013 | |||||||||

| Period of investment | 10 years | 5 years | 1 year | |||||||||

| Value on 12/31/20141) (in €) | 20,499 | 19,208 | 9,522 | |||||||||

| Average annual return (%) | 7.4 | 13.9 | -4.8 | |||||||||

| Performance comparators | ||||||||||||

| DAX 30 Performance – total return index |

8.7 | 10.5 | 2.7 | |||||||||

| REX General Bond – total return index |

4.5 | 4.7 | 7.1 | |||||||||

| S&P 500 Composite – total return index |

7.5 | 16.4 | 13.7 | |||||||||

| S&P North American Technology Software Index |

8.5 | 16.3 | 13.9 |

| 1) | Assuming all dividends were reinvested |

Source: Datastream

Return on SAP ADRs – 803054204 (CUSIP)

Percent, unless otherwise stated

| Initial investment US$10,000 | ||||||||||||

| Date of investment | 12/31/2004 | 12/31/2009 | 12/31/2013 | |||||||||

| Period of investment | 10 years | 5 years | 1 year | |||||||||

| Value on 12/31/20141) (in US$) | 17,668 | 15,931 | 8,133 | |||||||||

| Average annual return (%) | 5.9 | 9.8 | -18.7 | |||||||||

| Performance comparators | ||||||||||||

| S&P 500 Composite – total return index |

7.7 | 15.5 | 13.7 |

| 1) | Assuming all dividends were reinvested |

Source: Datastream

Investor Relations 13

Table of Contents

COMMUNICATION WITH INVESTORS

SAP aims for transparency and openness in a continuous dialog with the financial community. In several hundred one-on-one meetings held, during investor road shows worldwide, in virtual format over Telepresence or video conference, and at investor events, the Investor Relations team answered inquiries from institutional investors and analysts about SAP’s business strategy. We also held telephone conferences and analyst meetings when we published our quarterly results. Investor presentations at our Capital Markets Day in New York City and at the SAPPHIRE NOW conference in Orlando, Florida, in the United States, were key elements of our communication with the financial markets. In addition, SAP engages in regular dialog with socially responsible investors (SRIs), by providing insight into SAP’s environmental, social, and corporate governance policies.

COMPREHENSIVE SERVICE FOR PRIVATE INVESTORS

Providing a full service for retail investors is a priority for SAP. Our services for private investors include investor presentations at various retail shareholder events, a shareholder hotline, e-mail contact at investor@sap.com, investor relations information on our public Web site www.sap.com/investor, and a mobile Web site m.sapinvestorrelations.com. We provide a range of information for investors about SAP and SAP stock online, including press releases delivered by e-mail, social media including information provided on the SAP Investor Relations Twitter feed @sapinvestor, the quarterly SAP INVESTOR magazine, which investors can subscribe to free of charge, and a text message service. We also publish an overview of the latest analyst assessments in collaboration with Vara Research. All key events at which members of our Executive Board speak to financial analysts and institutional investors are broadcast live on the Internet, and we post the presentation materials on the investor relations area of our public Web site.

14 To Our Stakeholders

Table of Contents

We are a global company with an international shareholder base, so we rely on sound governance. Good corporate governance means managing the Company accountably and transparently to secure long-term value. We believe our shareholders, business partners, employees, and the financial markets reward good corporate governance with the high level of trust they place in our Company.

CORPORATE GOVERNANCE PRINCIPLES AT SAP

In 2014, SAP changed its legal form from a German-style stock corporation to European Company (Societas Europaea, or SE). The conversion reflects both our international outlook and our European roots. Being an SE headquartered in Germany, we are now subject to European and German law for SEs while remaining subject to German stock corporation law. Major characteristics of our governance structure remain in place since the conversion, notably our two-tier board comprising a Supervisory Board and an Executive Board, and parity for workforce representatives on the Supervisory Board. Because SAP SE is listed on a German stock exchange, our corporate governance is still based on the German Corporate Governance Code (“Code” in this report). Every year, as required by the German Stock Corporation Act, section 161, the Executive Board and Supervisory Board issue a declaration stating whether SAP has implemented and is following the Code’s recommendations, and identifying any recommendations that the Company has not followed – with a full explanation of why it has not done so. Our latest section 161 declaration, published on October 29, 2014, is on the SAP public Web site along with our declarations from previous years and links to the current and previous editions of the Code. As our 2014 declaration shows, we currently follow all but eight of the 105 recommendations and all of the suggestions in the current Code.

Since SAP is also listed in the United States, we comply with the rules that apply to non-U.S. companies listed on the New York Stock Exchange (NYSE). These include the requirements, as they apply to foreign private issuers, of the NYSE Corporate Governance Standards, the U.S. Sarbanes-Oxley Act of 2002, and the U.S. Securities and Exchange Commission (SEC).

CORPORATE GOVERNANCE STATEMENT

On February 18, 2015, the Executive Board published a corporate governance statement for 2014 as required by the German Commercial Code, section 289a. The statement is on the SAP public Web site. It comprises the current declaration pursuant to the German Stock Corporation Act, section 161, certain details of our corporate governance practices, and an account of how the Executive Board and the Supervisory Board work, who serves on which Supervisory Board committees, and how those committees work.

EXECUTIVE BOARD

The Executive Board currently has five members. It is solely responsible for managing the Company. It has a duty to exercise its management powers in the interest of the Company and in pursuit of the sustained growth of corporate value. It discusses and agrees its strategy for the Company with the Supervisory Board, ensures compliance with the requirements of the law throughout the Group, and maintains effective risk management structures and internal risk controls. There is information about each member’s portfolio of responsibilities on the SAP public Web site.

Corporate Governance Report 15

Table of Contents

GLOBAL MANAGING BOARD

The Global Managing Board helps the Executive Board with its work. It currently comprises all of the Executive Board and four other global managers who play a part in directing large sections of the business. These additional members are appointed by the Executive Board with the consent of the Supervisory Board. The Global Managing Board has a coordinating function, advises the Executive Board and helps it make decisions, but the Executive Board retains overall responsibility for everything the Company does. Information about each member of the Global Managing Board is available on the SAP public Web site.

SUPERVISORY BOARD

The size and composition of the Supervisory Board are governed not by the German Codetermination Act (which does not apply, because we are a European company) but by the Articles of Incorporation and the Employee Involvement Agreement. Both documents are on the SAP public Web site.

The Supervisory Board has 18 members who, in equal numbers, represent the shareholders and the employees. It appoints, monitors, and advises the Executive Board. The Executive Board involves the Supervisory Board in decisions on matters of fundamental importance for the Company. The Supervisory Board has reserved to itself the approval of certain transactions of fundamental importance, as set out in the Articles of Incorporation and detailed in the Supervisory Board’s list of reserved categories of transactions. The Executive Board regularly provides the Supervisory Board with full and timely reports on all material matters of strategy, business planning, and performance, including any deviations of actual business performance from plan, risks, risk management, and corporate compliance. We provide our shareholders with in-depth information about how the Executive and Supervisory Boards work, how the committees are composed, and how these committees work, in our corporate governance statement. For more information about the joint work of the Executive and Supervisory Boards and about the work of the Supervisory Board and its committees in 2014, see the Report from the Supervisory Board.

COMPOSITION OF THE SUPERVISORY BOARD

The Supervisory Board members as a group possess the knowledge, ability, and expert experience required to properly perform its duties in our global IT company. At least one independent member has financial reporting and auditing expertise. The Supervisory Board has defined the following objectives for its composition:

| ¡ | There should never be fewer than three people from the international stage on the shareholder representatives’ side of the Supervisory Board. |

| ¡ | No employee, consultant, or director of a significant SAP competitor should be a Supervisory Board member. |

| ¡ | At least five shareholder representatives on the Supervisory Board should be independent members in the meaning of section 5.4.2 of the Code. |

| ¡ | As a general rule, no member of the Supervisory Board should be older than 75 years. |

| ¡ | At least one shareholder representative on the Supervisory Board should be a woman. |

We believe the current composition of the Supervisory Board fulfills all of these objectives. There is information about each member, the committees, and who serves on which committee, on the SAP public Web site.

16 To Our Stakeholders

Table of Contents

INDEPENDENCE OF THE SUPERVISORY BOARD

We believe a sufficient degree of independence of our Supervisory Board members is essential for effective and responsible corporate management and control. Our Supervisory Board has a defined objective for its composition regarding the minimum number of independent members on the shareholder representative side, as recommended in the Code, section 5.4.1, paragraph 2. The objective is five such members. At its meeting on October 9, 2014, the Supervisory Board determined that all of its shareholder representative members are independent in the meaning of the Code, section 5.4.2 and that the number of independent members is sufficient in the meaning of that section. The Audit Committee is chaired by Erhard Schipporeit, who for many years was the chief financial officer of a DAX company that is also listed on a U.S. stock exchange and therefore qualifies as an independent financial expert in the meaning of the German Stock Corporation Act, section 100 (5).

DIVERSITY IN THE COMPANY

The Executive Board follows the recommendation in the Code that executive boards should have regard to diversity when appointing people to leadership positions, and in particular to employ appropriate numbers of women in such positions. In support of this, we maintain a diversity policy for leadership appointments. In May 2011, we also set a target to increase the percentage of leadership positions held by women from 18% at the beginning of 2011 to 25% in 2017. It goes without saying that ability is still the primary selection criterion for any position at SAP. Globally, the percentage of leadership positions held by women at the end of 2014 was 21.3%.

Section 5.1.2 of the Code contains the recommendation that supervisory boards should strive for appropriate numbers of women at executive board level as well. The Supervisory Board follows this recommendation and has ruled that when a new member is needed for the Executive Board, applications should be sought from within SAP and from outside, and that the shortlist should comprise 50% women if possible. As reported above, the Supervisory Board has defined objectives to promote diversity in its membership and attain an appropriate number of female members, as envisioned in the second paragraph of section 5.4.1 in the Code.

CODE OF BUSINESS CONDUCT

SAP’s corporate governance includes our Code of Business Conduct for employees and members of the Executive Board. The Code of Business Conduct expresses the high standards that we require from our employees and Executive Board members and sets out the main principles that guide our business conduct toward customers, business partners, and shareholders. We see our Code of Business Conduct as the standard for our dealings involving customers, business partners, vendors, shareholders, and competitors. By following our Code of Business Conduct, we demonstrate a commitment against all forms of unfair competitive practice, corruption, and misrepresentation. Our global compliance organization monitors worldwide compliance with the Code of Business Conduct and other policies applying within the Group. It regularly reviews these internal policies, revises them if necessary, and delivers related employee training.

APPLYING INTERNATIONAL CORPORATE GOVERNANCE STANDARDS

SAP is an NYSE-listed company and we are therefore subject to certain U.S. financial legislation (including among others the U.S. Sarbanes-Oxley Act of 2002) and to the applicable SEC and NYSE regulations. Besides implementing the requirements of the U.S. Sarbanes-Oxley Act, section 404, and other U.S. Sarbanes-Oxley Act requirements, including conducting an annual audit of our internal control over financial reporting, we comply with those of the corporate governance standards codified in the NYSE Listed Company Manual, section 303A, which bind foreign private issuers. The section 303A standards that apply to SAP include the requirement to have an audit committee composed of members who are independent in the meaning of the U.S. Sarbanes-Oxley Act, and related reporting requirements. Erhard Schipporeit, the chairperson of the Audit Committee, is an audit committee financial expert in the meaning of the U.S. Sarbanes-Oxley Act.

Corporate Governance Report 17

Table of Contents

ANNUAL GENERAL MEETING OF SHAREHOLDERS

Our shareholders exercise their rights, such as the rights to put questions to the management and to vote, at the Annual General Meeting of Shareholders. Shareholders and the public are able to watch a live broadcast of the entire Annual General Meeting of Shareholders on the Internet. They can vote their shares at the meeting or instruct a proxy of their choice or one of the proxies provided for that purpose by SAP. Alternatively, they can participate online or vote by mail. The invitation to the Annual General Meeting of Shareholders includes full details and instructions. Every shareholder can access all of the paperwork on the SAP public Web site in good time for the meeting.

TRANSPARENCY, COMMUNICATION, AND SERVICE FOR SHAREHOLDERS

Our shareholders can obtain full and timely information about SAP on our public Web site and can access current and historical Company data. Among other information, we post all of our financial reports, all relevant news about the Company’s governing bodies and their corporate governance documentation, information requiring ad hoc (current) disclosure, press releases, and news of directors’ dealings notifiable pursuant to the German Securities Trading Act, section 15a.

FINANCIAL ACCOUNTING, RISK MANAGEMENT, AND INTERNAL CONTROL

We prepare the SAP SE financial statements in accordance with the German Commercial Code and our consolidated financial statements in accordance with IFRS. We prepare a management report, as required by the German Commercial Code, and the SAP Annual Report on Form 20-F in accordance with SEC requirements. The Executive Board is responsible for financial accounting. The Supervisory Board approves the SAP SE financial statements, the consolidated financial statements, and the combined management report. The SAP SE financial statements, the consolidated financial statements, and the combined management report are audited by KPMG AG Wirtschaftsprüfungsgesellschaft, the auditor elected for that purpose by the Annual General Meeting of Shareholders.

In addition to our annual financial statements, we also prepare interim reports for the first, second, and third quarters. Our quarterly reports comply with the German Securities Trading Act and are submitted to the Audit Committee of the Supervisory Board before they are published.

In German stock-corporation and commercial law, there are special requirements for internal risk management that apply to SAP. To meet them, our global risk management system supports risk planning, identification, analysis, handling, and elimination. We maintain standard documentation of all our internal control structures and continually evaluate their effectiveness. As a company listed on the NYSE, we instruct our auditor, KPMG, to conduct an annual audit of our internal control over financial reporting in accordance with the requirements of the U.S. Sarbanes-Oxley Act of 2002, section 404. The audit as at December 31, 2014, confirmed that our internal control is effective. In compliance with the reporting requirements in the German Commercial Code, sections 289 (5) and 315 (2) (5), the combined SAP SE and SAP Group management report contains full information about the principal features of the internal controls and risk management structure applying to SAP’s consolidated financial reporting.

EXECUTIVE BOARD AND SUPERVISORY BOARD SHAREHOLDINGS

Section 6.3, sentence 2, in the Code recommends that all directors’ shareholdings be reported in the Corporate Governance Report, broken down by Executive Board and Supervisory Board memberships if the entire holdings exceed 1% of the shares issued by the Company. In fulfillment of this recommendation, we refer to the Compensation Report in our Combined Management Report for 2014, which contains the recommended information.

18 To Our Stakeholders

Table of Contents

Report from the Supervisory Board

Professor Hasso Plattner

Chairperson of the

Supervisory Board of SAP SE

Dear Shareholders,

We are pleased to report that 2014 was another good year for SAP and that the Company forged ahead even faster than expected with its transformation into THE cloud company powered by SAP HANA. This is all the more remarkable because the year was marked by political turmoil and economic challenges in some regions of the world.

The software industry is transitioning from traditional on-premise to cloud solutions. The Supervisory Board supports management’s strategy of positioning SAP in the vanguard of that transition. It has put SAP on the road to mastering today’s and tomorrow’s challenges and opportunities and to delivering more of the good results it achieved in 2014.

COOPERATION BETWEEN THE EXECUTIVE AND SUPERVISORY BOARDS

We discharged all of our duties as a Supervisory Board in accordance with the law and the Company’s Articles of Incorporation. We were consulted by the Executive Board throughout the year and kept the global management of the Company under observation and scrutiny for legal compliance, adherence to proper accounting principles, business focus, and reasonableness. We agreed the Company’s strategy with the Executive Board and regularly discussed the Company’s progress toward executing it with the Executive Board. We were directly involved when the Executive Board made any decision of fundamental importance to SAP.

Report from the Supervisory Board 19

Table of Contents

We received regular, full, and timely reports, both in writing and from Executive Board members in person. They kept us up to date on the Company’s strategy, plans, business performance, risks, risk management, compliance, and transactions of special significance for SAP. The Executive Board advised us when business deviated from plan or target, and why.

The content and scope of the Executive Board’s reports to us fully met our requirements for them. Whenever we asked for more information than was in the reports, the Executive Board provided it. In particular, the Executive Board came to Supervisory Board meetings for discussion and to answer our questions. We questioned and probed the Executive Board to satisfy ourselves that the information it gave us was plausible.

Section 11 (6) in the Articles of Incorporation lists certain transactions for which management must seek prior approval from the Supervisory Board. When SAP became an SE, the Supervisory Board established a list comprising these transactions and further categories of transactions for which the Executive Board must obtain the Supervisory Board’s consent, in accordance with the German SE Implementation Act, section 19. That list replaced the former list of transactions requiring consent pursuant to the German Stock Corporation Act, section 111 (4). The Supervisory Board carefully considered all transactions in the listed categories and discussed them with the Executive Board, focusing on the benefits, risks, and other effects of each transaction. The Supervisory Board agreed to all transactions for which its consent was sought by the Executive Board.

The Executive Board also kept the chairperson of the Supervisory Board fully informed between meetings of the Supervisory Board and its committees. In particular, the two co-CEOs, and subsequently the sole CEO, met regularly with the chairperson of the Supervisory Board to discuss SAP’s strategy, plans, the Company’s business performance, risks, risk management, compliance, and various other important matters and decisions. The two co-CEOs, and subsequently the sole CEO, informed the Supervisory Board chairperson, without delay, of important events that were significant for assessing SAP’s situation and progress or for the management of SAP.

SUPERVISORY BOARD MEETINGS AND RESOLUTIONS

In 2014, the Supervisory Board of SAP AG held two ordinary and five extraordinary meetings and the Supervisory Board of SAP SE held two ordinary meetings, one inaugural meeting, and two extraordinary meetings at which we deliberated and resolved on all matters of relevance to the Company. We also adopted four resolutions by correspondence vote. It is customary practice at our meetings that the Executive Board withdraws while we deliberate on items that pertain to the Executive Board or require discussion among Supervisory Board members only. We did so at all meetings in 2014 when such items arose. The Supervisory Board discussed the following matters:

CONVERSION OF SAP AG TO A EUROPEAN COMPANY

As in the previous year, we devoted much attention in our deliberations to the matter of converting SAP AG to a European Company (Societas Europaea, SE). It was the subject of three meetings at which members attended in person (“physical meetings”). We were in continuous and detailed consultation with the Executive Board concerning the progress of negotiations with the Special Negotiating Body and adopted resolutions as required in the course of our deliberations. In particular, the conversion was the focus of our ordinary meeting on February 13 and our extraordinary meeting on March 10. Subsequently, together with the Executive Board, we proposed to the Annual General Meeting of Shareholders that the Company be converted to an SE. That proposal was accepted, with 99% of the voted shares in favor. We are confident the SE form of incorporation is right for SAP’s pan-European and international business, and it has allowed us and the representatives of the Company’s European workforce to establish a tailored worker participation model that is set out in the Employee Involvement Agreement.

20 To Our Stakeholders

Table of Contents

The conversion became legally effective when SAP SE was entered in the commercial register at the Mannheim Municipal Court in Germany on July 7, 2014, at which time the term of office of the Supervisory Board of SAP AG ended.

ACQUISITIONS IN 2014

The Finance and Investment Committee and the Supervisory Board received reports on each relevant acquisition requiring approval during the year and approved each of the transactions that were subject to their consent. The Company’s two most significant acquisitions in 2014 were Fieldglass, Inc. and Concur Technologies, Inc., the latter being the largest in SAP’s history. At our ordinary meeting in March, we explored the proposal to acquire Fieldglass; then, at an extraordinary meeting on March 25, we considered the proposal in-depth. The Executive Board explained to us all aspects of the acquisition, which we discussed exhaustively. We accepted the recommendation of the Finance and Investment Committee to proceed and its associated recommendation for financing the purchase price. At our extraordinary meeting on September 18, in the course of the envisaged acquisition of Concur, the Executive Board reported to us the rationale for that acquisition in detail, the opportunities and risks it presented, and the proposed terms for which it would be made. We discussed all important aspects of the transaction and then accepted the recommendation of the Finance and Investment Committee to acquire Concur and its recommendation concerning the financing. By correspondence vote in October, we approved the Executive Board’s proposed method of refinancing the purchase price loan. In light of these two acquisitions, we made technical amendments to the 2014 and 2015 performance targets in the Long-Term Incentive (LTI) Plan 2015 and to the performance targets in the Short-Term Incentive (STI) Plan 2015, in accordance with the plan terms. The amendments were necessary to eliminate nonrecurring effects of the Fieldglass and Concur acquisitions on the compensation of Executive Board members.

APPOINTMENTS AND RETIREMENTS

We had to make several decisions concerning the composition of seats on the Executive Board and we approved appointments to the Global Managing Board in 2014. After Vishal Sikka left the Executive Board, we held extraordinary meetings on May 4 and May 13. At our May 4 meeting, we appointed Robert Enslin and Bernd Leukert to the Executive Board and confirmed the appointment of Ingrid-Helen Arnold and Stefan Ries to the Global Managing Board. We approved the board appointment contracts and compensation for the new Executive Board members and the terms of the board contract termination agreement with Vishal Sikka at our extraordinary meeting on May 21, as recommended by the General and Compensation Committee.

Other matters addressed at meetings in 2014 included:

Meeting in February

At our meeting on February 13, the Executive Board presented a review of the Company’s business in 2013 and reported on its market standing and other matters. We discussed strategy and execution with the Executive Board. In particular, the Executive Board explained its strategy in the various product fields and its planned simplification measures, which it had defined as core objectives for 2014. Based on its operational plan for 2014, which the Executive Board presented in detail, we discussed in-depth the 2014 budget presented by the Executive Board, including the 2014 capital expenditure budget and liquidity plan, and gave our approval.

We also received and discussed the recommendation of the General and Compensation Committee concerning Executive Board compensation for 2013. Exercising our discretionary powers under the terms of the STI Plan 2013, we determined performance against the defined targets and decided the payouts for Executive Board members. We discussed performance against the annual financial targets for the Medium-Term Incentive (MTI) Plan 2011 and determined the MTI 2011 plan payout. We determined performance for the purposes of the 2013 tranche of the RSU Milestone Plan 2015. We applied a provision in the plan terms to eliminate significant currency effects in 2013. We then turned our attention to Executive Board compensation for 2014. We identified the key performance indicators (KPIs) and set the target numbers for each KPI in the 2014 STI plan and their relative weightings. Conscious of

Report from the Supervisory Board 21

Table of Contents

the growing impetus toward becoming a cloud company and wishing to reinforce it in the incentives for Executive Board members, we amended the performance targets for the 2014 and 2015 tranches of the Restricted Share Units (RSU) Milestone Plan 2015 and fixed their exchange rates to forestall any need for currency effect adjustments in the future. We adopted a resolution on Executive Board members’ individual allocation of rights under the RSU Milestone Plan 2015 (2014 tranche). Finally, we assessed the appropriateness of the Executive Board members’ compensation for 2014, and in each case found it to be appropriate in terms of amount, structure, objective criteria, and for each member’s responsibilities and tasks.

Meeting in March to Discuss the Financial Statements

At our March 20 meeting, we considered the 2013 SAP AG financial statements and consolidated financial statements, the audits conducted by KPMG AG Wirtschaftsprüfungsgesellschaft (KPMG), and the Executive Board’s proposed resolution on the appropriation of SAP AG’s retained earnings for 2013. The Audit Committee reported on all matters for which it is responsible in connection with the 2013 financial statements, particularly on the form and scope of its examination of the documents relating to the financial statements, and recommended that we approve them. The auditor attended the meeting. The auditor reported in detail on the audit and on the results, referring in particular to the six audit focuses that had been agreed between the auditor and the Audit Committee. The auditor also gave us its account of the discussions that had taken place on those matters at the two preceding meetings of the Audit Committee. The auditor discussed the results of the audit with us and answered our questions, and we approved the audit. There were no findings from our own final examination of the 2013 SAP AG financial statements and consolidated financial statements, and we approved them. We examined the Executive Board’s proposal on the appropriation of retained earnings and endorsed it, as recommended by the Audit Committee. We decided on the resolutions we would propose for the agenda of the Annual General Meeting of Shareholders in May 2014. Among them was our recommendation to the shareholders concerning the auditor to elect for 2014; our recommendation followed that of the Audit Committee to us.

At our financial statements meeting, the Executive Board presented its forecast for the first quarter of 2014. The General and Compensation Committee, the Technology and Strategy Committee, the Finance and Investment Committee, the Nomination Committee, and the People and Organization Committee reported to us on all their recent meetings.

SAP SE Supervisory Board Inaugural Meeting in May

We held our inaugural meeting as the first Supervisory Board of SAP SE on May 21, 2014, after the Annual General Meeting of Shareholders. We elected Hasso Plattner to be our chairperson and Christiane Kuntz-Mayr to be our deputy chairperson. We appointed Bill McDermott, Robert Enslin, Bernd Leukert, Luka Mucic, and Gerhard Oswald to the first Executive Board of SAP SE and set their term of office. We filed our written report on the formation audit conducted in connection with the conversion of SAP to an SE. Other items included adopting the Supervisory Board of SAP SE rules of procedure and its list of the categories of transactions for which the Executive Board must obtain the Supervisory Board’s consent in accordance with the German SE Implementation Act, section 19, setting up the Supervisory Board committees of SAP SE, and electing members to those committees. The Supervisory Board of SAP AG subsisted alongside the Supervisory Board of SAP SE until the former board’s term of office expired, which was when the conversion became legally effective.

Meeting in July

We held our first ordinary meeting as the Supervisory Board of SAP SE on July 10. The first item was to approve the nomination of an Executive Board member to be responsible for labor and social affairs. The Executive Board had resolved that Bill McDermott should take on that duty, and we approved its decision.

22 To Our Stakeholders

Table of Contents

The Executive Board then reported to us on business in the second quarter of 2014, its assessment of the first half-year as a whole, and various initiatives forming part of the Company’s Run Simple operating principle. Members of the Executive Board told us about second-quarter growth in cloud and about SAP’s competitive situation. We discussed various strategies with Executive Board and Global Managing Board members for achieving the Company’s objectives and we questioned management about progress on technology development related to SAP HANA. We also considered and approved the terms of the directors’ and officers’ liability insurance policies, which come up for renewal every year.

Meeting in October

Our ordinary meeting on October 9 opened with a report from the Executive Board on the state of the business and the preliminary third-quarter results and a discussion of strategic moves planned in light of the changing business.

In agreement with the Executive Board, we then adopted for publication, as every year in October, the annual declaration of implementation of the German Corporate Governance Code (the “Code” in this report) pursuant to the German Stock Corporation Act, section 161. The General and Compensation Committee reported that it had met immediately before our Supervisory Board meeting to verify compliance with the declaration of implementation of the Code. We determined that we have a sufficient number of independent members on the Supervisory Board. Some Supervisory Board members currently have business dealings with SAP or hold a senior position or material equity in companies that currently have business dealings with SAP, or have done so in the course of the year. SAP’s business dealings with these persons or companies are or were at arm’s length. In our view, especially given the limited scope and materiality of those dealings, they do not affect the independence of the Supervisory Board members concerned and do not give rise to any substantial and not merely temporary conflict of interest in the meaning the Code. Responses to the questionnaire designed to evaluate the work of the Supervisory Board had been analyzed and related efficiency measures agreed in October 2013. We now considered the progress of those measures and noted consequent measures.

The General and Compensation Committee, the Technology and Strategy Committee, and the Finance and Investment Committee reported on their recent meetings.

Work of the Supervisory Board Committees

The committees made a key contribution to the work of the Supervisory Board and reported to us on their work. The following committees were in place in 2014 until the Company became SAP SE:

| ¡ | General and Compensation Committee: Hasso Plattner (chairperson), Panagiotis Bissiritsas, Wilhelm Haarmann, Lars Lamadé, Bernard Liautaud, Margret Klein-Magar |

| ¡ | Audit Committee: Erhard Schipporeit (chairperson), Stefan Schulz, Inga Wiele, Klaus Wucherer |

| ¡ | Finance and Investment Committee: Wilhelm Haarmann (chairperson), Panagiotis Bissiritsas, Hartmut Mehdorn, Kurt Reiner |

| ¡ | Technology and Strategy Committee: Hasso Plattner (chairperson), Stefan Schulz (deputy chairperson), Pekka Ala-Pietilä, Anja Feldmann, Margret Klein-Magar Christiane Kuntz-Mayr, Bernard Liautaud, Kurt Reiner, Inga Wiele, Klaus Wucherer |

| ¡ | People and Organization Committee: Hasso Plattner (chairperson), Anja Feldmann, Wilhelm Haarmann, Christiane Kuntz-Mayr, Lars Lamadé, Hartmut Mehdorn, Mario Rosa-Bian, Stefan Schulz |

| ¡ | Mediation Committee: Hasso Plattner (chairperson), Christiane Kuntz-Mayr, Hartmut Mehdorn, Mario Rosa-Bian |

| ¡ | Nomination Committee: Hasso Plattner (chairperson), Pekka Ala-Pietilä, Bernard Liautaud |

| ¡ | Special Committee: Hasso Plattner (chairperson), Pekka Ala-Pietilä, Wilhelm Haarmann, Margret Klein-Magar, Lars Lamadé, Erhard Schipporeit |

Report from the Supervisory Board 23

Table of Contents

As the Supervisory Board of SAP SE, we reconstituted the committees at the time of conversion as follows:

| ¡ | General and Compensation Committee: Hasso Plattner (chairperson), Panagiotis Bissiritsas, Wilhelm Haarmann, Jim Hagemann Snabe, Lars Lamadé, Bernard Liautaud, Margret Klein-Magar, Christiane Kuntz-Mayr |

| ¡ | Audit Committee: Erhard Schipporeit (chairperson), Steffen Leskovar, Stefan Schulz, Klaus Wucherer |

| ¡ | Finance and Investment Committee: Wilhelm Haarmann (chairperson), Panagiotis Bissiritsas, Hartmut Mehdorn, Kurt Reiner, Mario Rosa-Bian, Jim Hagemann Snabe |

| ¡ | Technology and Strategy Committee: Hasso Plattner (chairperson), Stefan Schulz (deputy chairperson), Pekka Ala-Pietilä, Anja Feldmann, Steffen Leskovar, Bernard Liautaud, Margret Klein-Magar, Kurt Reiner |

| ¡ | People and Organization Committee: Hasso Plattner (chairperson), Catherine Bordelon, Anja Feldmann, Wilhelm Haarmann, Christiane Kuntz-Mayr, Lars Lamadé, Hartmut Mehdorn, Mario Rosa-Bian |

| ¡ | Nomination Committee: Hasso Plattner (chairperson), Pekka Ala-Pietilä, Bernard Liautaud |

| ¡ | Special Committee: Hasso Plattner (chairperson), Pekka Ala-Pietilä, Wilhelm Haarmann, Margret Klein-Magar, Lars Lamadé, Erhard Schipporeit |

Each of the committees was active in 2014 except the Mediation Committee; a European Company does not require a mediation committee.

For more information about the Supervisory Board committees and their duties, see SAP’s Corporate Governance Statement pursuant to the German Commercial Code, section 289a, published on the SAP public Web site at: http://www.sap.com/ corporate-en/about/investors/governance/index.html.

In 2014, the committees (before July 7, 2014, the committees of the Supervisory Board of SAP AG; after that date, the committees of the Supervisory Board of SAP SE) discussed the following matters:

| ¡ | The General and Compensation Committee held six regular meetings, and, outside these meetings, it adopted four resolutions by correspondence. It prepared the Supervisory Board’s resolutions on compensation of the Executive Board and Global Managing Board members. It considered the report from the capital market compliance officer, which it receives early each year, and it deliberated on the conversion of SAP AG to an SE. When it met in March, the Committee received a report from the corporate governance officer. At its July meeting, it adopted new rules of procedure as a reconstituted committee of the Supervisory Board of SAP SE. When the Committee met in September, the Executive Board reported to it on the tasks and membership of the Global Managing Board in the future. The Committee also considered and recommended resolutions for the Supervisory Board concerning amendments, described above, to the Executive Board members’ compensation packages. At its October meeting, the Committee discussed the Company’s implementation of the Code recommendations and prepared the Supervisory Board’s decisions with respect to the declaration of implementation of the Code and ascertaining the independence of Supervisory Board members. |

| ¡ | The Finance and Investment Committee held four meetings, one of which was a joint meeting with the Technology and Strategy Committee. Outside these meetings it adopted one resolution by correspondence. At its March 10 meeting, management presented outline information about the possible acquisition of Fieldglass, which was under consideration at the time and the Committee received a progress report on the Company’s application for a published credit rating. The Committee discussed the standards for listed-company supervisory board due diligence relating to acquisitions and acquisition financing. The Fieldglass acquisition was also the focus of the Committee’s March 25 meeting. The Executive Board presented full details of the planned purchase, and after an exhaustive examination the Committee decided to recommend to the Supervisory Board that it consent to the acquisition. When it met on September 16, the Committee focused solely on the acquisition of Concur. It received a detailed report from the Executive Board about the strategic backdrop, then thoroughly examined and discussed the proposal within the Committee and made a recommendation |

24 To Our Stakeholders

Table of Contents

| to the Supervisory Board to approve the Concur acquisition. On October 8, the Finance and Investment Committee held a joint meeting with the Technology and Strategy Committee. Matters discussed together included the competitive environment in which SAP operates, an analysis of the major acquisitions in the past three years, acquisition strategy, execution of the cloud platform strategy, and an overview of developments in the field of analytics. By correspondence vote on October 24, the Finance and Investment Committee resolved to make a recommendation to the Supervisory Board about refinancing the purchase price credit for the Concur acquisition. |

| ¡ | The Audit Committee held four meetings at which members attended in person (“physical meetings”) and four telephone conference meetings. The telephone conference meetings were all ahead of the publication of interim reports for each quarter. At these meetings, the Committee primarily deliberated on the course of business over the quarter concerned, the process by which the quarterly financial reports were prepared, the interim report to be published, and insights gained from the auditor’s quarterly review of selected software agreements. The physical meetings in February and March concentrated on the SAP AG and consolidated financial reports for 2013 and the reporting process, the internal controls for financial reporting, the most important accounting methods, and the audit. At the February meeting, the Committee also discussed the German Financial Reporting Enforcement Panel’s criteria and the internal audit service’s report for the previous year, organization and processes, and audit plan for 2014. At its meeting in March, the Committee did preparatory work on the Supervisory Board’s recommendations to the Annual General Meeting of Shareholders concerning the election of an auditor and the appropriation of retained earnings and discussed the Company’s compliance system. When it met in July, the Committee defined the focus and agreed the fees for the audit with the auditor, dealt with the internal audit service’s work in the first half of the year, and discussed the Company’s internal controls. At its October meeting, the Committee discussed the report from the chief compliance officer and other compliance system matters and came to the conclusion that the compliance system was effective. The meeting also deliberated on the Company’s insurance strategy and other risk management matters. The auditor attended all physical meetings and telephone conference meetings of the Audit Committee and reported in depth on its audit work and on its quarterly reviews of selected software agreements. |

| ¡ | The Technology and Strategy Committee held three meetings, one of which was a joint meeting with the Finance and Investment Committee. It discussed the key trends in the software industry for the years to come and SAP’s corporate and product strategies. At the Committee’s March 13 meeting, the Executive Board presented the five most strategic issues and objectives for 2014, which included cloud products for human capital management, the new direction for customer relationship management, and user interface design for SAP Fiori. The Executive Board reported to the Committee on SAP HANA Enterprise Cloud and SAP Business Suite in the cloud. The Committee discussed the Company’s product range on July 9. At that meeting, it considered investment and plans for the future in the various product categories. It was given an overview of security design for SAP’s cloud applications. It also discussed product plans in analytics. As reported in the Finance and Investment Committee section above, the Technology and Strategy Committee held a joint meeting with the Finance and Investment Committee on October 8. For more information, see the Finance and Investment Committee section in this Report from the Supervisory Board. |

Report from the Supervisory Board 25

Table of Contents

| ¡ | The Nomination Committee, whose members are all shareholder representatives, held two meetings in 2014. In February, it met to discuss the composition of the Supervisory Board in the future, when SAP AG had been converted to SAP SE. On March 13, it prepared our selection of recommended candidates for the shareholder seats on the Supervisory Board of SAP SE, to be put to the Annual General Meeting of Shareholders, and discussed potential candidates for the Supervisory Board. |

| ¡ | In the past the Special Committee had been tasked with coordinating and managing the Supervisory Board’s outside legal counsel concerned with the investigation and analysis of the facts in connection with the TomorrowNow litigation. We redefined the Committee’s task when, as the Supervisory Board of SAP SE, we reconstituted our committees: It is now tasked with addressing exceptional situations that entail substantial risk, such as major lawsuits. It met only once in 2014, in October, on which occasion it received a report from our retained counsel about the current state of the TomorrowNow litigation. |

| ¡ | The People and Organization Committee held three meetings. In January, it considered the results of the 2013 employee survey, and the Executive Board presented the actions and measures that would be taken in light of those results. In September, the Committee discussed learning and professional development, the approach to learning that SAP was adopting for the future, the deployment of innovative learning methods, and the implementation of people-related projects. On December 16, the Committee met to discuss the Company’s HR strategy and aims for 2014 to 2017. It received progress reports from management on leadership, people sustainability, learning at SAP, and talent recruitment. |

Because our committees reported fully to us at all times, the Supervisory Board had all of the information it needed about all of the matters in the ambit of each committee’s allocated work, so we were always able to deliberate on those matters in detail on a well-informed footing.

CORPORATE GOVERNANCE

The corporate governance officer of SAP monitored the Company’s compliance with all recommendations in the German Corporate Governance Code that, in its declaration of implementation of the Code, SAP claims to follow and reported in full to our General and Compensation Committee. Members of the Executive Board and of the Supervisory Board had no conflicts of interest that were required to be disclosed to the Supervisory Board pursuant to sections 4.3.4 and 5.5.2 of the Code. One of our members is a partner in a firm of attorneys that the Company retained for advice; we consented to the engagement of that firm and approved an account for expenses relating to advice that we had authorized from that firm. The member concerned did not take part in the deliberations on these matters or the vote on the related resolution. There were several transactions in 2013 between the Company and a member of the Executive Board; they were consistent with industry standards and were not material. They were approved by the General and Compensation Committee. The Company made no other contracts with members of the Executive Board or Supervisory Board that would have required a resolution of the Supervisory Board.

For more information about Code compliance, see the Executive and Supervisory Boards’ corporate governance report, which is included in this annual report. We closely examined the Executive Board’s corporate governance statement pursuant to the German Commercial Code, section 289a, and we approved the statement with the combined SAP Group and SAP AG management report.

SAP SE AND CONSOLIDATED FINANCIAL REPORTS FOR 2014

KPMG audited the SAP SE and consolidated financial reports for 2014. The Annual General Meeting of Shareholders elected KPMG as the SAP SE and SAP Group auditor on May 21, 2014, in accordance with our proposal to that meeting, which in turn, reflected the recommendation of the Audit Committee. Before proposing KPMG to the Annual General Meeting of

26 To Our Stakeholders

Table of Contents

Shareholders as auditor for the year, our chairperson and the Audit Committee obtained confirmation from KPMG that circumstances did not exist that might prejudice or raise any doubt concerning its independence as the Company’s auditor. In that connection, KPMG informed us of the volume of other services it provided to the Group in the past year and had been engaged to provide in the year to come. The Supervisory Board has agreed with KPMG that the auditor should report to us and record in the auditor’s report any fact found during the audit that is inconsistent with the declaration given by the Executive Board and us concerning implementation of the German Corporate Governance Code. KPMG examined the SAP SE financial statements prepared in accordance with the German Commercial Code, the consolidated financial statements prepared in accordance with International Financial Reporting Standards (IFRS) as required by the German Commercial Code, section 315a, and the combined SAP Group and SAP SE management report, and certified them without qualification. The auditor thus confirmed that, in its opinion and based on its audit in accordance with the applicable accounting principles, the SAP SE and consolidated financial statements give a true and fair view of the net assets, financial position, and results of operations of SAP SE and the SAP Group. The auditor also confirmed that the combined SAP Group and SAP SE management report is consistent with the corresponding financial statements and as a whole gives a true and fair view of the position of SAP SE and the SAP Group and of foreseeable opportunities and risks. KPMG audited the Company’s system of internal controls over financial reporting and certified without qualification that it complies with the applicable U.S. standards. The auditor states in its opinion that it considers SAP’s internal controls over financial reporting to be effective in all material respects. All Audit Committee and Supervisory Board members received the documents concerning the financial statements mentioned above, the audit reports prepared by KPMG, and the Executive Board’s proposal concerning the appropriation of retained earnings in good time.

On February 12, 2015, the Executive Board finalized the financial reports of SAP SE and the Group for 2014, comprising the SAP SE financial statements, the consolidated financial statements, and the combined management report, for submission to us forthwith.

At the meeting of the Audit Committee on March 18, 2015, and at the meeting of the Supervisory Board on March 19, 2015, the Executive Board explained the financial statements and management report of SAP SE and the Group and its proposal concerning the appropriation of retained earnings. Members of the Executive Board answered questions from the Audit Committee and the Supervisory Board. At the Audit Committee meeting, they also explained the SAP Annual Report on Form 20-F.

After the Executive Board had explained them, the Audit Committee and the Supervisory Board reviewed the financial statements and reports in the light of KPMG’s audit reports. The representatives of the auditor who attended presented full reports on the audit and the results of the audit to the Audit Committee and Supervisory Board meetings and explained the audit report. The auditor also reported that it had not found any material weaknesses in the Company’s internal control and risk-management systems for financial reporting. Both the Audit Committee and the Supervisory Board asked detailed questions about the form, scope, and results of the audit. The Audit Committee reported to us on its own review of the financial statements and management report of SAP SE and the Group, its discussions with the Executive Board and with the auditor, and its supervision of the financial reporting process. It confirmed that as part of its supervisory work, it had addressed the effectiveness of the SAP Group internal control, risk management, and internal auditing systems and found them to be effective.

The Committee reported that KPMG had told it no circumstances had arisen during the audit that might give cause for concern about KPMG’s impartiality and had listed the services it had provided that were not part of the audit. The Committee reported to us that it had examined the auditor’s independence, taking the non-audit services it had rendered into consideration, and stated that, in the Committee’s opinion, the auditor possessed the required degree of independence.

Report from the Supervisory Board 27

Table of Contents