Table of Contents

INTERIM REPORT JANUARY — JUNE 2013

HELPING THE WORLD RUN BETTER

|

THE BEST-RUN BUSINESSES RUN SAP™ |

Table of Contents

INTERIM REPORT JANUARY — JUNE 2013

| 3 | ||||

| HALF-YEAR FINANCIAL STATEMENTS (UNAUDITED) |

||||

| 4 | ||||

| 25 | ||||

| 52 | ||||

| SUPPLEMENTARY FINANCIAL INFORMATION (UNAUDITED) |

||||

| 53 | ||||

| 59 | ||||

| ADDITIONAL INFORMATION |

||||

| Financial Calendar, Investor Services, Addresses, and Imprint |

60 | |||

Table of Contents

This interim group report meets the requirements of German Accounting Standard No. 16 “Zwischenberichterstattung” (DRS 16). We prepared the financial data in the Quarterly Half-Year Financial Statements (Unaudited) section for SAP AG and its subsidiaries in accordance with International Financial Reporting Standards (IFRS). In doing so, we observed the IFRS (including the interpretations by the International Financial Reporting Interpretations Committee (IFRIC)) both as issued by the International Accounting Standards Board (IASB) and as endorsed by the European Union (EU). This does not apply to numbers expressly identified as non-IFRS. For additional IFRS and non-IFRS information, see the Supplementary Financial Information (Unaudited) section.

This interim group report complies with the legal requirements in accordance with the German Securities

Trading Act (Wertpapierhandelsgesetz, WpHG) for a half-year financial report, and comprises the interim

management report, consolidated interim financial statements, and the responsibility

statement in accordance with the German Securities Trading Act, section 37w (2).

This half-year financial report updates our consolidated financial statements 2012, presents significant events and transactions of the second quarter 2013 and the first half of 2013, and updates the forward-looking information contained in our Management Report 2012. Both the 2012 consolidated financial statements and the 2012 Management Report are part of our 2012 Integrated Report which is available at www.sapintegratedreport.de.

All of the information in this interim group report is unaudited. This means the information has been subject neither to any audit nor to any review by an independent auditor.

| INTERIM REPORT JANUARY – JUNE 2013 | 3 |

Table of Contents

GENERAL INFORMATION

Forward-Looking Statements

This half-year financial report contains forward-looking statements and information based on the beliefs of, and assumptions made by, our management using information currently available to them. Any statements contained in this report that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. We have based these forward-looking statements on our current expectations, assumptions, and projections about future conditions and events. As a result, our forward-looking statements and information are subject to uncertainties and risks, many of which are beyond our control. If one or more of these uncertainties or risks materializes, or if management’s underlying assumptions prove incorrect, our actual results could differ materially from those described in or inferred from our forward-looking statements and information.

We describe these risks and uncertainties in the Risk and Opportunity Management section, respectively in the there-mentioned sources.

The words “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “counting on,” “development,” “is confident,” “estimate,” “expect,” “forecast,” “future trends,” “guidance,” “intend,” “may,” “might,” “outlook,” “plan,” “project,” “predict,” “seek,” “should,” “strategy,” “want,” “will,” “would,” and similar expressions as they relate to us are intended to identify such forward-looking statements. Such statements include, for example, those made in the Operating Results section, the Risk and Opportunity Management section, our Forecast for SAP, and other forward-looking information appearing in other parts of this half-year financial report. To fully consider the factors that could affect our future financial results, both our Annual Report for December 31, 2012, (extract from the SAP Integrated Report 2012) and Annual Report on Form 20-F for December 31, 2012, should be considered, as well as all of our other filings with the Securities and Exchange Commission (SEC). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date specified or the date of this report. Except where legally required, we undertake no obligation to publicly update or revise any forward-looking statements as a result of new information that we receive about conditions that existed upon issuance of this report, future events, or otherwise unless we are required to do so by law.

Statistical Data

This report includes statistical data about the IT industry and global economic trends that comes from information published by sources including International Data Corporation (IDC), a provider of market information and advisory services for the information technology, telecommunications, and consumer technology markets; the European Central Bank (ECB); and the International Monetary Fund (IMF). This type of data represents only the estimates of IDC, ECB, IMF, and other sources of industry data. SAP does not adopt or endorse any of the statistical information provided by sources such as IDC, ECB, IMF, or other similar sources that is contained in this report. In addition, although we believe that data from these sources is generally reliable, this type of data is imprecise. We caution readers not to place undue reliance on this data.

All of the information in this report relates to the situation on June 30, 2013, or the half year ended on that date unless otherwise stated.

Non-IFRS Financial Information

This half-year financial report contains non-IFRS measures as well as financial data prepared in accordance with IFRS. We present and discuss the reconciliation of these non-IFRS measures to the respective IFRS measures in the Supplementary Financial Information (Unaudited) section. For more information about non-IFRS measures, see our Web site www.sap.com/corporate-en/investors/newsandreports/reporting-framework.epx under “Non-IFRS Measures and Estimates.”

| 4 | INTERIM MANAGEMENT REPORT |

Table of Contents

ECONOMIC CONDITIONS

Global Economic Trends

Figures published by the European Central Bank (ECB) indicate that the world economy picked up speed in the first half of 2013, but that the upswing on the whole remained cautious. While many emerging markets recorded more noticeable growth, the economies of most industrialized countries improved only slightly.

According to ECB, economic growth in the Europe, Middle East, and Africa (EMEA) region remained at a slightly negative level in the first two quarters of the year. This was mainly attributable to declining domestic demand and subdued exports. A moderate improvement was recorded in the Americas region, where a gradual increase in private domestic demand lifted a U.S. economy still suffering from government spending cuts. The Latin American economy continued to recover, but at a moderate pace. The Asia-Pacific-Japan (APJ) region, meanwhile, continued to develop very differently from country to country: Japan’s economy grew only marginally in the first half of the year, whereas the emerging and developing economies of Asia continued to perform very well. China, however, failed to reach its excellent growth rates of recent years.

The IT Market

In its current quarterly report, American market research firm International Data Corporation (IDC) reveals that global IT spending grew faster than the overall economy in the first half of 2013. However, growth slowed down. This was mostly due to developments in the hardware segment, such as declining PC sales and a drop in the prices for hardware. Thanks to significant double-digit growth in the mobile sector, however, the hardware segment was ultimately able to record an overall positive result. In the software segment, cloud and SaaS (Software as a Service) products increasingly outranked traditional software and service offerings when it came to IT spending.

The weak growth of the economy in the EMEA region impacted IT market growth, especially in Western and Southern Europe. The IT market in the Americas region – most notably in the United States – was also weaker than expected due to uncertainty about that country’s future economic and fiscal policy stance. The APJ region fared better than the global average, despite the fact that Japan posted continued weak IT sales as well as its economy as a whole showed weakness. Asia’s emerging and developing economies recorded comparatively higher IT revenues in the second quarter, although China – as well as for its economy as a whole – did not quite reach the same turnover rates as in recent years.

Impact on SAP

Companies are shifting their investments to the cloud and are radically simplifying their IT landscape on in-memory technology. While we are driving this fundamental industry transformation it has also impacted our business. SAP’s single-digit growth performance in software license and cloud subscription revenue was mainly due to the slowdown in our on-premise software revenue. This slowdown resulted from the combination of a challenging macroeconomic environment and the accelerating industry shift to the cloud, which is impacting traditional customer buying patterns. Our regional performance shows how SAP benefits by offering customers a seamless choice of software – on premise or in a public or private cloud with broad industry expertise and a broad ecosystem.

The Americas delivered a strong 18% growth rate in software and cloud subscription revenue. We are driving the transition to the cloud in North America, with cloud contributing more than 25% of our overall software and cloud subscription revenues this quarter. American companies are moving to the cloud faster and much more broadly than companies in other geographies, and we are benefiting from this shift.

We achieved excellent growth in Latin America both in our software and cloud business. While many tech companies saw a slowdown in Brazil, we performend very well in this market, with triple-digit software revenue growth. Clearly, customers are choosing SAP innovations to drive their growth agenda.

EMEA delivered a solid performance, with 3% growth in software and cloud subscription revenue, impressive in light of continued market uncertainty in Europe and a tough year-on-year comparison. We saw continued strong growth in our home market Germany, with high single-digit software revenue growth. We are growing in strong double-digits in Africa and the Middle East.

Our performance in APJ was below our expectations mainly due to continued macroeconomic challenges. This trend is also consistent with what our competitors and partners are experiencing in the market. In China, the GDP slowdown has impacted state-owned enterprise IT spending and our revenues from China were below expectations. Additionally we were impacted by the IT purchasing slowdown in Australia and Japan, two of our largest markets in the APJ region. On a positive note, our leadership changes in India and SE Asia had a strong impact, with strong software revenue growth in these regions.

VISION, MISSION, AND STRATEGY

We did not change our vision, mission, or strategy in the first six months of 2013. For a detailed description, see our 2012 Integrated Report and item 4 in our 2012 Annual Report on Form 20-F.

PORTFOLIO OF SOFTWARE AND SERVICES

In the first half of 2013, we made the following enhancements to our portfolio of software and services. For a detailed description of our complete portfolio, see our 2012 Integrated Report and item 4 in our 2012 Annual Report on Form 20-F.

| INTERIM REPORT JANUARY – JUNE 2013 | 5 |

Table of Contents

Our first half of 2013 was marked by SAPPHIRE NOW in Orlando, our premier business technology event for executives, lines of business, and IT decision makers. Many customers and partners took the stage to share how, together with SAP, they are reinventing their businesses and their industries with in-memory technology, cloud computing, and mobility. Major announcements included innovations for line-of-business cloud applications, our next generation user experience with SAP Fiori, the general availability of SAP Business Suite powered by SAP HANA, details of SAP HANA Enterprise Cloud, and the launch of our newest industry vertical, Sports & Entertainment.

Applications

SAP continued to innovate its leading applications portfolio in the first half of 2013, with particular focus on enabling the SAP Business Suite powered by SAP HANA, and delivering a consumer-grade user experience.

SAP Business Suite powered by SAP HANA, a new option for SAP Business Suite customers, was first introduced in January, and was announced as generally available at SAPPHIRE NOW in May together with the general availability of 21 industry solutions. SAP now provides an integrated family of business applications that captures and analyzes transactional data in real time on a single in-memory platform. SAP Business Suite powered by SAP HANA empowers customers to manage all mission-critical business processes such as planning, execution, reporting, and analysis in real time, by using the same relevant live data.

Customers of our applications for small and midsize enterprises can also benefit from the power of SAP HANA. In early March at CeBIT 2013 in Hanover, Germany, SAP announced SAP Business One, version for SAP HANA, the first business management solution for small and midsize enterprises (SMEs) that is run completely in-memory. The application is a scalable, affordable solution with embedded analytics capabilities and high-volume transactions that empower SMEs to run their businesses in real time.

We also made significant progress in enabling a rich user experience with the launch of two solutions:

| • | SAP Fiori is a collection of applications that provide an intuitive user experience. They access SAP software functions, across a variety of devices – desktop, tablet, smartphone. The first release of SAP Fiori includes 25 apps for the most common business functions, such as workflow approvals, information lookups and self-service tasks. |

| • | SAP Screen Personas provides a simple, drag and drop approach to modify most SAP GUI screens. It enables IT and business users to simplify business application screens quickly and easily without any programming knowledge. SAP Screen Personas improves the end-user productivity, visual appeal, and performance of SAP. |

At SAPPHIRE NOW in Orlando, SAP also introduced the SAP for Sports & Entertainment solution portfolio. As SAP’s 25th and newest vertical industry market solution, this portfolio is designed to help the sports and entertainment industry run better – from the fans, athletes, performers and the media to venues, teams, leagues and entertainment companies.

In early June, we announced that we are working with Microsoft to develop real-time incorporation of shop floor information using the SAP Manufacturing Integration and Intelligence (SAP MII) application and Microsoft Office 365, bringing greater manufacturing visibility to the flexible Microsoft Office solutions.

Industry Recognition:

SAP has been positioned by Forrester Research as a Global Power Seller in its “Global Banking Platform Deals in 2012” report. In the evaluation, Forrester recognized 39 new named deals closed by SAP in seven regions, ranking SAP as a top vendor for new banking deals.

SAP has also retained its position as the overall leader in worldwide supply chain management (SCM) according to the recent “Gartner, Market Share Analysis: Supply Chain Management Software, Worldwide, 2012” report.

Analytics

SAP continues to extend its leadership in analytics, enabling business users to turn big data into valuable information through self-service visualizations and predictive analytics. These capabilities help decision-makers quickly identify untapped opportunities and respond to unforeseen risks. At the same time, SAP aims to simplify IT landscapes with our leading enterprise business intelligence suite.

In June, at BI2013 in Amsterdam, SAP announced updates to predictive analytics software that empowers everyone – from sophisticated statisticians to business users – with predictive insight. Now generally available, version 1.0.11 of SAP Predictive Analysis software offers more flexible modeling and performance, which can help users uncover new opportunities from big data in real time. SAP Predictive Analysis includes features to expand predictive model execution to other SAP applications, including SAP Customer Relationship Management and SAP Fraud Management.

| 6 | INTERIM MANAGEMENT REPORT |

Table of Contents

The new version of the predictive analytics software can be combined with SAP Lumira, formerly known as SAP Visual Intelligence software. SAP Lumira enables business users to visualize any amount of data in real time, in a repeatable, self-service way. SAP Lumira Cloud, leveraging SAP HANA, extends SAP Lumira beyond the desktop to the cloud, for simple deployment.

At SAPPHIRE NOW, we introduced the 4.1 version of SAP BusinessObjects BI solutions. This release aims to empower business users with anytime, anywhere access to key insights delivered in context for increased responsiveness, reduced IT costs and workload, and better decision making across the enterprise.

In May, SAP announced a new initiative with Emerging Markets Private Equity Association (EMPEA), a community of more than 300 leading fund managers and institutional investors from nearly 60 countries and representing over US $1 trillion of managed assets. With analytics solutions donated by SAP, EMPEA can now offer both the general public and its members an interactive dashboard that allows investors, private equity fund managers, or governments to look closely at capital flows in emerging markets, identify trends and explore regional details. With better insight, they can make more informed decisions about how, where, and with whom to invest their money.

In February, SAP and the National Basketball Association (NBA) announced the launch of NBA Stats, providing fans with interactive access to official NBA statistics and analyses. Powered by the real-time SAP HANA platform and free to all fans and media, the NBA’s statistical offering will allow users to interact and analyze official league, team, and player statistics in real time through an intuitive, highly visual interface.

In January, we introduced an online analytics dashboard based on SAP HANA that provided National Football League (NFL) fans with insights into the selection of the NFL.com Fantasy Player of the Year for the 2012 season. The dashboard, now live at NFL.com/honors, displays the statistics of the top eight Fantasy Player finalists in a visually rich format.

Industry Recognition:

SAP has been positioned by Gartner as the leader in its “Market Share Analysis: Business Intelligence, Analytics and Performance Management, 2012” report, with a 22.1 percent market share. SAP was also recognized as a leader in the 2013 Gartner Magic Quadrant for Corporate Performance Management (CPM) Suites.

Forrester Research has ranked SAP Predictive Analysis as a leader in its “The Forrester Wave: Big Data Predictive Analytics Solutions, Q1 2013” report.

Cloud

The first half of 2013 brought announcements that further establish SAP’s position in the rapidly-growing cloud market. With over 30 million users in the cloud, SAP has the largest subscriber base in the cloud market.

In early May, SAP announced SAP HANA Enterprise Cloud, a managed cloud offering designed to provide organizations with the ability to deploy SAP HANA and SAP applications powered by SAP HANA quickly and securely via the cloud. SAP HANA Enterprise Cloud speeds up and simplifies deployment of the powerful in-memory database. The option to consume SAP HANA as-a-service means customers can reap the benefits of ‘Big Data’ free of the scalability constraints, the complexity associated with heterogeneous landscapes, and without significant upfront investments in hardware.

One week later, at SAPPHIRE NOW, we announced our unified strategy for SAP’s comprehensive cloud portfolio across four focus areas: People, Customer, Money, and Supplier. SAP’s cloud portfolio combines the proven depth of enterprise solutions and strong line-of-business focus with the speed and simplicity of the cloud. The portfolio includes solutions from SAP companies Ariba and SuccessFactors as well as the SAP Cloud for Customer (formerly SAP Customer OnDemand), SAP Cloud for Financials (formerly SAP Financials OnDemand,), SAP Cloud for Travel (formerly SAP Travel OnDemand), and SAP Business ByDesign solutions. We further announced that the SAP HANA Cloud platform will serve as the foundation for our entire cloud portfolio.

In May, we introduced the new SuccessFactors Onboarding solution. This solution’s capabilities outpace existing solutions in the market today because it has more guidance for hiring managers and richer socialization for new hires.

In January, SAP expanded its SAP PartnerEdge program, allowing us to offer a broader portfolio of SAP cloud solutions through our sales partners.

Industry Recognition:

SuccessFactors, an SAP company, became the first company in the human capital management (HCM) industry to be positioned as a leader in 10 industry analyst reports within the past year. Recognition was garnered based on the company’s comprehensive offerings across the full HCM landscape.

In the cloud-based collaborative commerce market, Ariba, an SAP company, was recognized as a leader for Sourcing and Vendor Management (SVM) tool sets in Forrester Research’s “The Forrester Wave: SVM Tool Set, Q1 2013” report. The citation is based on the firm’s evaluation of Ariba Sourcing, Ariba Contract Management, Ariba Supplier Information and Performance Management, and Ariba Spend Visibility.

| INTERIM REPORT JANUARY – JUNE 2013 | 7 |

Table of Contents

Mobile

SAP delivers new and better ways for customers to securely access data and business processes – from anywhere, at any time.

At SAPPHIRE NOW, we unveiled SAP Mobile Secure, an enterprise mobility management solution portfolio designed to provide customers with enterprise-grade security for devices, apps, and content. This new portfolio optimizes the mobile experience for users of today’s most popular mobile devices.

Also at SAPPHIRE NOW, we announced a partnership with Mocana, one of the fastest-growing global security platform startups, to resell the leading mobile security product Mocana Mobile App Protection (MAP).

In April, we announced a new rapid-deployment solution that simplifies access to analytics on mobile devices, enabling enterprise customers to put real-time insight in the hands of their workers for better, more informed decisions on the go. The SAP Mobile Analytics rapid-deployment solution offers preconfigured software, implementation services, content, and end-user enablement.

Also in April, at the utility customer service conference CS Week in Tampa, Florida, SAP announced the SAP Utilities Customer Engagement mobile app, which offers rich customer service capabilities and allows utility companies to improve relationships with customers while helping to reduce costs.

In February, at the 2013 Mobile World Congress (MWC) in Barcelona, Spain, SAP introduced the SAP Mobile Documents solution designed to meet the demand for simple, highly secure file synchronization and sharing in the enterprise. The new mobile content management solution provides a single point of entry to personal business documents and corporate content via any device.

Also at MWC, SAP announced the launch of the cloud-based SAP Rich Communication Services 365 (SAP RCS 365) mobile service. For mobile subscribers, RCS makes services such as instant messaging, video, and file sharing as simple and intuitive as sending a text message. In addition, it enables mobile operators to create new innovative services, respond to competition in today’s expanding mobile ecosystem, and increase potential revenue per subscriber.

Addressing the growing demand for machine-to-machine (M2M) applications, SAP and Ericsson took advantage of the MWC forum to announce an agreement to jointly market and sell cloud-based M2M solutions and services to enterprises via operators around the globe. The solutions will be based on a combined software-as-a-service (SaaS) offering from SAP and Ericsson, and will provide the infrastructure and business solutions for automatic data transmission between technical devices such as vehicles, freight containers, alarm systems, or vending machines.

Industry Recognition:

SAP has been positioned by Gartner in the leaders’ quadrant of the “Magic Quadrant for Mobile Device Management (MDM)” report. This makes SAP the only Leader recognized by Gartner in both Magic Quadrants related to Enterprise Mobility – Mobile Device Management (MDM) and Mobile Application Development Platforms (MADP).

IT market research advisory firm IDC has again recognized SAP as the market share leader based on 2012 revenue in the mobile enterprise management (MEM) enterprise software market. SAP has been recognized as a leader for the 12th consecutive year in the “Worldwide Mobile Enterprise Management Software 2012 – 2016 Forecast and Analysis and 2012 Vendor Shares” report for its SAP Mobile Secure portfolio.

Database and Technology

SAP innovations in database and technology, in particular SAP HANA, have captured the imagination of customers looking to re-invent their businesses as real-time enterprises. The first half of 2013 brought developments that solidify the place of these innovations at the very core of our portfolio.

At SAPPHIRE NOW 2013, SAP announced three major developments related to SAP HANA:

| • | Ecosystem innovation: Working together with a vibrant ecosystem, SAP aims to make it fast and easy for established partners, ISVs and new startups to build, market, and sell a diverse set of applications for customers of all sizes and across all industries. |

| • | Platform innovation: SAP unveiled a new SAP HANA smart data access technology to help enterprises dynamically derive real-time insights across heterogeneous sources such as Hadoop. New in-memory spatial capabilities in SAP HANA will help businesses uncover richer and meaningful signals from business and geospatial data. |

| • | Joint initiative with HP: The initiative focuses on SAP HANA, enabling customers to reduce the time required to rapidly transact, analyze, and process large amounts of data within a single server. A test system, built from years of HP server technology innovations and optimized with the in-memory SAP HANA database for SAP Business Suite, was demonstrated for the first time at SAPPHIRE NOW. |

In June, SAP Sybase IQ 16 software, a critical component of the SAP Real-Time Data Platform, achieved a Guinness World Record for loading and indexing big data with an audited result of 34.3 terabytes per hour, far surpassing the previous record of 14 terabytes per hour. The SAP Real-Time Data Platform combines SAP HANA with SAP Sybase IQ and other SAP technologies as well as with non-SAP technologies, especially Apache Hadoop.

| 8 | INTERIM MANAGEMENT REPORT |

Table of Contents

In April, SAP announced the availability of the SAP Sybase SQL Anywhere 16 suite, the latest release of data management and synchronization technology. A key element of and satellite server within the SAP Real-Time Data Platform, the suite helps extend business transactions to remote office locations.

Also in April, SAP announced the newest version of SAP Sybase Replication Server, a core component of the SAP Real-Time Data Platform that is designed to provide high-performance, secure and reliable delivery of data across the enterprise.

In late February, at the Strata Conference in California, SAP and Intel announced a technical and business partnership that will help organizations in data-intensive industries become more competitive and agile by leveraging insights across business operations from all their data assets at the pace of business. The two companies plan to build and bring to market a breakthrough Big Data solution for enterprise customers centered on the SAP HANA platform and Intel Distribution for Apache Hadoop software.

Industry Recognition:

On the strength of our advances in database and technology, GRC 20/20, a leading analyst firm, named SAP as one of 12 winners of the 2013 GRC Technology Innovator Awards. SAP was recognized for advancing governance, risk, and compliance (GRC) analytics with SAP HANA Analytics Foundation for SAP solutions for GRC.

| INTERIM REPORT JANUARY – JUNE 2013 | 9 |

Table of Contents

RESEARCH AND DEVELOPMENT

Our total research and development expense rose by 3% to €1,124 million in the first half of 2013, compared to €1,091 million in the corresponding period in 2012.

On our IFRS numbers, the portion of total revenue we spent on research and development in the first half of 2013 was 14.7%, which decreased by 0.4 percentage points compared to the 15.1% recorded for the first half of 2012. On the non-IFRS numbers, the portion of total revenue we spent on R & D in the first half of 2013 was 14.1%, which remained unchanged from the first half of the previous year.

We had 17,374 full-time equivalent (FTE) employees working in research and development teams on June 30, 2013, which remained virtually stable year-on-year (June 30, 2012: 17,331).

ACQUISITIONS

On June 5, 2013, SAP and hybris announced that SAP plans to acquire hybris. The acquisition will enable SAP to deliver the next-generation e-commerce platform based on latest technology, with the choice of on-premise or on-demand deployment. The combination of industry-leading enterprise solutions from SAP with the agile omni-channel commerce solutions of hybris will offer enhanced data access and faster analyses, enabling enterprises to optimize margins and customer loyalty.

Upon completion of the acquisition, which is expected in the third quarter of 2013 and is subject to regulatory approval and other closing conditions, hybris will operate as an independent business unit.

In addition, SAP acquired Ticket-Web, KMS Software Company, Camilion Solutions, and SmartOps in March and April, 2013.

EMPLOYEES

Our vision to help the world run better and improve people’s lives relies on the power of human thinking, innovation, and creativity. For this reason, nothing is more critical to the long-term success of SAP and our customers than our employees. They deliver value to our customers and drive our sustainable growth and profitability.

An important factor for our long-term success is our ability to attract and retain talented employees. In the second quarter of 2013, the employee retention rate was 94% (unchanged from the second quarter of 2012). We define employee retention rate as the ratio between the average number of employees less voluntary employee departures (fluctuation) and the average number of employees (in full-time equivalents).

One of SAP’s overall non-financial goals is fostering a diverse workforce, specifically increasing the number of women in management. At the end of the second quarter of 2013, the company employed 19.8% women in management, compared to 19.0% at the end of the second quarter of 2012 and 19.4% at the end of 2012. SAP has set a long-term target to increase the share of women in management to 25% by the year 2017.

At the end of the first half of 2013, we had 64,937 full-time equivalent (FTE) employees worldwide (June 30, 2012: 60,972; December 31, 2012: 64,422) – an increase of 515 compared to year end 2012.

Our overall employee headcount on June 30, 2013, included 16,683 FTEs based in Germany (June 30, 2012: 16,531), and 13,550 FTEs based in the United States (June 30, 2012: 12,246).

ORGANIZATION

On March 21, 2013, the Supervisory Board of SAP AG approved the proposal of the Executive Board to prepare the conversion of the legal form of SAP AG into a European Company (Societas Europaea, SE).

The Executive Board and the Supervisory Board believe that the planned change of legal form reflects SAP’s position as an internationally-oriented company with European roots. The legal form of European Company takes into account SAP’s European and international business activities. Furthermore, this legal form offers the possibility to optimize both the corporate governance structure and work of the corporate bodies of SAP AG. With the conversion into an SE, the shareholders of SAP AG automatically become shareholders of SAP SE. Shareholders’ rights remain unchanged.

The conversion of legal form requires the approval of the shareholders. This is planned to be secured at the Annual General Meeting of Shareholders in 2014. On June 3, 2013, management invited the employees and appropriate employee representatives in all EU countries and European Economic Area (EEA) countries to elect or nominate their delegates to a Special Negotiating Body (SNB). Once the SNB has been elected, we expect negotiations with the European employees regarding employee involvement in the SE to begin in September 2013 and last six months.

Lars Dalgaard has stepped down from the Executive Board and left the company with effect from June 1, 2013, to join a private equity firm. He will continue to play an active role as an advisor to the SAP Cloud business in the Cloud Governance Board. SAP’s co-CEOs Bill McDermott and Jim Hagemann Snabe will become Executive Board sponsors for all aspects of SAP’s cloud business.

To further accelerate the success in SAP’s cloud business, the company will consolidate its cloud go-to-market under the leadership of Bob Calderoni. Calderoni is president of

| 10 | INTERIM MANAGEMENT REPORT |

Table of Contents

Ariba, an SAP company, and member of the Global Managing Board of SAP AG, and will also continue to lead the Ariba business network activities. He will work closely with Rob Enslin, a fellow member of the Global Managing Board of SAP AG and president of Global Customer Operations responsible for SAP’s worldwide sales and customer operations. The close collaboration between the two SAP managers will ensure a stronger market positioning of SAP’s cloud solutions.

In this context, the responsibilities, especially regarding innovation, have changed. SAP will consolidate all innovation areas under Vishal Sikka, member of the Executive Board of SAP AG. As of June 1, 2013, all SAP On-Premise Delivery, networks (Ariba) and Cloud unit development leaders report directly to Sikka. Additionally, the Executive Board has nominated Bernd Leukert, executive vice president for Application Innovation, to the Global Managing Board of SAP AG with effect from July 1, 2013. In this capacity, Leukert reports directly to Vishal Sikka.

Luisa Deplazes Delgado, member of the Executive Board of SAP AG, Human Resources, and Labor Relations Director, has decided to leave SAP with effect from June 30, 2013 to pursue a responsibility as CEO of another company.

In addition to his role as chief financial officer of SAP AG, Werner Brandt has taken on Executive Board responsibility for Human Resources and became the Labor Relations Director in Germany. In this context, Luka Mucic has become the new head of Finance to support Brandt in his expanded responsibilities. The Executive Board has nominated Mucic to the Global Managing Board of SAP with effect from July 1, 2013.

| INTERIM REPORT JANUARY – JUNE 2013 | 11 |

Table of Contents

ASSETS, FINANCES, AND OPERATING RESULTS

In the sections that follow, our assets, finances, and operating results are discussed in detail.

In the discussion of our assets, finances, and operating results, the financial data presented of 2013 fully contains the revenue and expenses, assets, liabilities, and cash flows from SuccessFactors and Ariba. Comparator amounts contain SuccessFactors numbers on a pro rata basis effective February 21, 2012. Ariba numbers are not included – Ariba was acquired on October 1, 2012.

Performance Against Our Outlook for 2013 (Non-IFRS)

In this section, all discussion of the first halfs’ contribution to target achievement is based exclusively on non-IFRS measures. However, in the following section, the discussion of results refers to IFRS figures only, so those figures are not expressly identified as IFRS figures.

We present, discuss, and explain the reconciliation from IFRS measures to non-IFRS measures in the Supplementary Financial Information (Unaudited) section.

Operational Targets for 2013 (Non-IFRS)

For our outlook based on non-IFRS numbers, see the Forecast for SAP passage in this interim management report.

Key Figures — SAP Group 4/1/ to 6/30/2013 (Non-IFRS)

| Non-IFRS | ||||||||||||||||

| € millions, unless otherwise stated |

4/1/ - 6/30/2013 |

4/1/ - 6/30/2012 |

Change in % |

Change in % (Constant Currency) |

||||||||||||

| Software |

982 | 1,059 | –7 | –3 | ||||||||||||

| Cloud subscriptions and support |

183 | 69 | 166 | 171 | ||||||||||||

| Software and cloud subscription |

1,165 | 1,127 | 3 | 7 | ||||||||||||

| Support |

2,182 | 2,014 | 8 | 11 | ||||||||||||

| Software and software-related service revenue |

3,347 | 3,142 | 7 | 10 | ||||||||||||

| Total revenue |

4,091 | 3,916 | 4 | 8 | ||||||||||||

| Operating expense |

–2,873 | –2,743 | 5 | 7 | ||||||||||||

| Operating profit |

1,219 | 1,173 | 4 | 10 | ||||||||||||

| Operating margin in % |

29.8 | 30.0 | –0.2pp | 0.6pp | ||||||||||||

| Profit after tax |

874 | 831 | 5 | n.a. | ||||||||||||

| Effective tax rate in % |

26.8 | 25.6 | 1.2pp | n.a. | ||||||||||||

| Earnings per share – basic (in €) |

0.73 | 0.70 | 4 | n.a. | ||||||||||||

| Deferred cloud subscriptions and support revenue (June 30) |

361 | 215 | 68 | n.a. | ||||||||||||

Actual Performance in the Second Quarter of 2013 (Non-IFRS)

In the second quarter of 2013, software and software-related service revenue (non-IFRS) increased 7% compared with the same period in the previous year to €3,347 million (Q2 2012: €3,142 million). At constant currencies, the increase was 10%.

Included in our non-IFRS software and software-related service revenue, our revenue from cloud subscriptions and support was €183 million (Q2 2012: €69 million), an increase of 166% compared to the same period in 2012. The amounts for 2013 include full cloud subscriptions and cloud support revenue from SuccessFactors and Ariba; comparator amounts contain SuccessFactors numbers only. Deferred cloud subscriptions and support revenue was €361 million on June 30, 2013 (June 30, 2012: €215 million).

Non-IFRS total revenue in the same period was €4,091 million (Q2 2012: €3,916 million), an increase of 4%. On a constant currency basis, the increase was 8%.

Non-IFRS operating profit was €1,219 million (Q2 2012: €1,173 million), an increase of 4% (10% at constant currencies).

Non-IFRS operating margin was 29.8%, a decrease of 0.2 percentage points compared to the prior year (Q2 2012: 30.0%). The decrease was caused by currency effects: At constant currencies, the non-IFRS operating margin was 30.6%, an increase of 0.6 percentage points.

Non-IFRS operating profit and operating margin for the second quarter of 2013 were affected by the acquisition of Ariba, which impacted the operating margin by approximately 40 basis points.

In the second quarter of 2013, non-IFRS profit after tax was €874 million (Q2 2012: €831 million), an increase of 5%. Non-IFRS basic earnings per share was €0.73 (Q2 2012: €0.70), an increase of 4%.

| 12 | INTERIM MANAGEMENT REPORT |

Table of Contents

The non-IFRS effective tax rate in the second quarter of 2013 was 26.8% (Q2 2012: 25.6%). The year over year increase in the effective tax rate mainly resulted from tax effects on changes in foreign currency exchange rates and from valuation allowances on deferred tax assets which were partly compensated by tax effects relating to changes in the regional allocation of income and by prior year taxes.

| INTERIM REPORT JANUARY – JUNE 2013 | 13 |

Table of Contents

Key Figures — SAP Group 1/1/ to 6/30/2013 (Non-IFRS)

| € millions, unless otherwise stated |

1/1/ - 6/30/2013 |

1/1/ - 6/30/2012 |

Change in % |

Non-IFRS Change in % (Constant Currency) |

||||||||||||

| Software |

1,638 | 1,696 | –3 | 0 | ||||||||||||

| Cloud subscriptions and support |

350 | 104 | 238 | 243 | ||||||||||||

| Software and cloud subscription |

1,989 | 1,799 | 11 | 14 | ||||||||||||

| Support |

4,295 | 3,968 | 8 | 11 | ||||||||||||

| Software and software-related service revenue |

6,284 | 5,768 | 9 | 12 | ||||||||||||

| Total revenue |

7,727 | 7,273 | 6 | 9 | ||||||||||||

| Operating expense |

–5,607 | –5,266 | 6 | 8 | ||||||||||||

| Operating profit |

2,120 | 2,007 | 6 | 11 | ||||||||||||

| Operating margin in % |

27.4 | 27.6 | –0.2pp | 0.4pp | ||||||||||||

| Profit after tax |

1,563 | 1,414 | 11 | n.a. | ||||||||||||

| Effective tax rate in % |

24.5 | 26.7 | –2.2pp | n.a. | ||||||||||||

| Earnings per share – basic (in €) |

1.31 | 1.19 | 10 | n.a. | ||||||||||||

| Deferred cloud subscriptions and support revenue (June 30) |

361 | 215 | 68 | n.a. | ||||||||||||

Actual Performance in the First Half of 2013 (Non-IFRS)

In the first half of 2013, software and software-related service revenue (non-IFRS) increased 9% compared with the same period in the previous year to €6,284 million (first half of 2012: €5,768 million). At constant currencies, the increase was 12%.

Included in our non-IFRS software and software-related service revenue, our revenue from cloud subscriptions and support was €350 million (first half of 2012: €104 million), an increase of 238% compared to the same period in 2012. The amounts for 2013 include full cloud subscriptions and cloud support revenue from SuccessFactors and Ariba; comparator amounts contain SuccessFactors numbers on a pro rata basis with effect from February 21, 2012, only.

Non-IFRS total revenue in the same period was €7,727 million (first half of 2012: €7,273 million), an increase of 6%. On a constant currency basis, the increase was 9%.

Non-IFRS operating profit was €2,120 million (first half of 2012: €2,007 million), an increase of 6% (11% at constant currencies).

Non-IFRS operating margin was 27.4%, a decrease of 0.2 percentage points compared to the prior year (first half of 2012: 27.6%). Non-IFRS operating margin was 28.0% at constant currencies, an increase of 0.4 percentage points.

The operating profit and operating margin (non-IFRS) were adversely affected in a like manner by the acquisitions of SuccessFactors and Ariba. The operating margin thus declined by a total of around 60 basis points.

In the first half of 2013, non-IFRS profit after tax was €1,563 million (first half of 2012: €1,414 million), an increase of 11%. Non-IFRS basic earnings per share was €1.31 (first half of 2012: €1.19), an increase of 10%.

The non-IFRS effective tax rate in the first half of 2013 was 24.5% (first half of 2012: 26.7%). The year over year decrease in the effective tax rate mainly resulted from taxes for prior years and from changes in the regional allocation of income which were partly compensated by valuation allowances on deferred tax assets.

Overall, during the first six months, our non-IFRS numbers at actual currencies experienced a negative currency impact compared to what they would have been if translated at the exchange rates from last year: SSRS revenue was impacted by €163 million or –2.6%, while total revenue was impacted by €194 million or –2.5%, which impacted the SSRS and total revenue growth rates by 3 percentage points each. The operating margin was negatively impacted by 60 basis points.

If exchange rates remained unchanged at the June 2013 level for the remainder of the year, our 2013 full-year non-IFRS SSRS revenue and non-IFRS total revenue at actual currencies would both be approximately 4% lower than the respective constant currency numbers, representing a negative impact of approximately 4 percentage points to the SSRS and total revenue growth rates. Our non-IFRS operating margin at actual currencies would be approximately 80 basis points lower than the respective constant currency margin.

SEGMENT INFORMATION

Since the third quarter of 2012, SAP reports under a new segment structure. For information about the changes to our segment reporting and a description of the activities of our new segments, see the Notes to the Interim Financial Statements section, Note (17).

| 14 | INTERIM MANAGEMENT REPORT |

Table of Contents

SAP has two divisions – On-Premise and Cloud, which are further divided into operating segments. Our On-Premise division is comprised of two operating segments: On-Premise Products and On-Premise Services. In the third quarter of 2012, our Cloud division was comprised of one operating segment: Cloud Applications. Following the acquisition of Ariba, we established a second operating segment in the Cloud division, mainly consisting of the acquired Ariba business (Ariba). The operations of Crossgate, which we acquired in 2011, are also included in the operating segment containing the acquired Ariba business. All operating segments are reportable segments.

Key Figures in SAP Segment Reporting in the Second Quarter of 2013

In the second quarter of 2013, revenue in the On-Premise division increased by 1% to €3,858 million (Q2 2012: €3,824 million). Of this, €3,153 million (Q2 2012: €3,070 million) was revenue from the Products segment, representing an increase of 3%. Revenue from the Services segment decreased by 7% to €705 million (Q2 2012: €754 million).

In the second quarter of 2013, segment revenue in the Cloud division achieved €233 million (Q2 2012: €92 million). Of this, €118 million (Q2 2012: €87 million) was revenue from the Cloud Applications segment, €115 million (Q2 2012: €5 million) was revenue from the Ariba segment. For the Ariba segment, the trailing twelve month network spend volume was approximately US$465 billion, an increase of 27% year-over-year.

The annual cloud revenue run rate is already €932 million. The annual revenue run rate is the second quarter 2013 Cloud division revenue multiplied by 4.

Segment profit for the On-Premise division was €1,945 million (Q2 2012: €1,918 million). Of this, €1,789 million (Q2 2012: €1,756 million) was from the Products segment and €156 million (Q2 2012: €163 million) from the Services segment. In the second quarter of 2013, the operating segment margin (ratio of segment profit divided by segment revenue) for the reportable segments was 57% (Q2 2012: 57%) for the Products segment, and 22% (Q2 2012: 22%) for the Services segment. This resulted in an operating margin of 50% (Q2 2012: 50%) for the entire On-Premise division.

Segment profit for the Cloud division was €23 million (Q2 2012: –€19 million). Of this, –€11 million (Q2 2012: –€14 million) was from the Cloud Applications segment due to additional investments in sales and marketing and €34 million (Q2 2012: –€5 million) from the Ariba segment. In the second quarter of 2013, the operating segment margin for the reportable segments was –9% (Q2 2012: –16%) for the Cloud Applications segment, and 30% (Q2 2012: –100%) for the Ariba segment. This resulted in an operating margin of 10% (Q2 2012: –21%) for the entire Cloud division.

Key Figures in SAP Segment Reporting in the First Half of 2013

In the first half of 2013, revenue in the On-Premise division increased by 2% to €7,270 million (first half of 2012: €7,133 million). Of this, €5,909 million (first half of 2012: €5,659 million) was revenue from the Products segment, representing an increase of 4%. Revenue from the Services segment rose by 8% to €1,360 million (first half of 2012: €1,474 million).

In the first half of 2013, segment revenue in the Cloud division achieved €457 million (first half of 2012: €140 million). Of this, €233 million (first half of 2012: €130 million) was revenue from the Cloud Applications segment, €224 million (first half of 2012: €9 million) was revenue from the Ariba segment.

Segment profit for the On-Premise division was €3,545 million (first half of 2012: €3,463 million, including €3,273 million (first half of 2012: €3,163 million) from the Products segment and €273 million (first half of 2012: €300 million) from the Services segment. In the first half of 2013, the operating segment margin for the reportable segments was 55% (first half of 2012: 56%) for the Products segment, and 20% (first half of 2012: 20%) for the Services segment. This resulted in an operating margin of 49% (first half of 2012: 49%) for the entire On-Premise division.

Segment profit for the Cloud division was €51 million (first half of 2012: –€44 million), including –€9 million (first half of 2012: –€33 million) from the Cloud Applications segment and €60 million (first half of 2012: –€10 million) from the Ariba segment. In the first half of 2013, the operating segment margin for the reportable segments was –4% (first half of 2012: –25%) for the Cloud Applications segment, and 27% (first half of 2012: –108%) for the Ariba segment. This resulted in an operating margin of 11% (first half of 2012: –31%) for the entire Cloud division.

| INTERIM REPORT JANUARY – JUNE 2013 | 15 |

Table of Contents

Key Figures SAP Group in the Second Quarter of 2013 (IFRS)

| € millions, unless otherwise stated |

4/1/ - 6/30/2013 |

4/1/ - 6/30/2012 |

Change | Change in % |

||||||||||||

| Software |

982 | 1,059 | –77 | –7 | ||||||||||||

| Cloud subscriptions and support |

159 | 52 | 107 | 206 | ||||||||||||

| Software and cloud subscription |

1,141 | 1,110 | 30 | 3 | ||||||||||||

| Support |

2,177 | 2,013 | 164 | 8 | ||||||||||||

| Software and software-related service revenue |

3,318 | 3,124 | 194 | 6 | ||||||||||||

| Total revenue |

4,062 | 3,898 | 164 | 4 | ||||||||||||

| Operating expense |

–3,074 | –2,977 | –97 | 3 | ||||||||||||

| Operating profit |

988 | 921 | 68 | 7 | ||||||||||||

| Operating margin in % |

24.3 | 23.6 | 0.7pp | n.a. | ||||||||||||

| Profit after tax |

724 | 661 | 64 | 10 | ||||||||||||

| Effective tax rate in % |

24.8 | 23.6 | 1.2pp | n.a. | ||||||||||||

| Headcount in full-time equivalents (June 30) |

64,598 | 60,972 | 3,626 | 6 | ||||||||||||

| Days sales outstanding in days (June 30) |

62 | 61 | 1 | 2 | ||||||||||||

| Earnings per share – basic (in €) |

0.61 | 0.55 | 0.05 | 11 | ||||||||||||

| Deferred cloud subscriptions and support revenue (June 30) |

354 | 155 | 199 | 128 | ||||||||||||

OPERATING RESULTS IN THE SECOND QUARTER (IFRS)

Orders

The total number of On-Premise software deals we closed decreased by 5% from the comparator amount in the second quarter of 2013 to 13,936 (Q2 2012: 14,681). In addition, the average value of On-Premise software orders we received showed a decrease of 13% compared with the previous year. In the second quarter of 2013, 14% (Q2 2012: 26%) of the value of new software orders came from orders whose volume exceeded €5 million, while 51% (Q2 2012: 44%) came from orders worth less than €1 million.

Revenue

In the second quarter of 2013, software revenue was €982 million (Q2 2012: €1,059 million), a decrease of 7% compared to the same period in 2012. Software revenue in the second quarter of 2013 included amounts of €102 million (Q2 2012: €85 million) from SAP HANA.

Our revenue from cloud subscriptions and support was €159 million (Q2 2012: €52 million), an increase of 206% compared to the same period in 2012. The amounts for 2012 include cloud subscriptions and cloud support revenue from SuccessFactors – Ariba is not included in prior year numbers.

Total revenue was €4,062 million (Q2 2012: €3,898 million), an increase of 4% compared to the same period in 2012.

Operating Expenses

In the second quarter of 2013, our operating expenses increased by 3% to €3,074 million (Q2 2012: €2,977 million).

The increase in operating expenses is mainly due to the increased headcount.

Operating Profit and Margin

In the second quarter of 2013, operating profit increased by 7% compared with the same period in the previous year to €988 million (Q2 2012: €921 million).

Our operating margin increased by 0.7 percentage points to 24.3% (Q2 2012: 23.6%).

Profit After Tax and Earnings per Share

In the second quarter of 2013, profit after tax was €724 million (Q2 2012: €661 million), an increase of 10%. Basic earnings per share was €0.61 (Q2 2012: €0.55), an increase of 11%.

The effective tax rate in the second quarter of 2013 was 24.8% (Q2 2012: 23.6%). The year over year increase in the effective tax rate mainly resulted from tax effects on changes in foreign currency exchange rates and from valuation allowances on deferred tax assets which were partly compensated by tax effects relating to changes in the regional allocation of income and by prior year taxes.

| 16 | INTERIM MANAGEMENT REPORT |

Table of Contents

Key Figures SAP Group in the First Half of 2013 (IFRS)

| € millions, unless otherwise stated |

1/1/ - 6/30/2013 |

1/1/ - 6/30/2012 |

Change | Change in % |

||||||||||||

| Software |

1,638 | 1,696 | –57 | –3 | ||||||||||||

| Cloud subscriptions and support |

296 | 81 | 215 | 266 | ||||||||||||

| Software and cloud subscription |

1,935 | 1,777 | 158 | 9 | ||||||||||||

| Support |

4,286 | 3,966 | 319 | 8 | ||||||||||||

| Software and software-related service revenue |

6,220 | 5,743 | 477 | 8 | ||||||||||||

| Total revenue |

7,663 | 7,248 | 415 | 6 | ||||||||||||

| Operating expense |

–6,029 | –5,696 | –333 | 6 | ||||||||||||

| Operating profit |

1,634 | 1,551 | 83 | 5 | ||||||||||||

| Operating margin in % |

21.3 | 21.4 | –0.1pp | n.a. | ||||||||||||

| Profit after tax |

1,244 | 1,104 | 140 | 13 | ||||||||||||

| Effective tax rate in % |

21.5 | 25.0 | –3.5pp | n.a. | ||||||||||||

| Earnings per share – basic (in €) |

1.04 | 0.93 | 0.12 | 12 | ||||||||||||

| Deferred cloud subscriptions and support revenue (June 30) |

354 | 155 | 199 | 128 | ||||||||||||

OPERATING RESULTS IN THE FIRST HALF (IFRS)

Orders

The total number of On-Premise software deals we closed decreased by 8% from the comparator amount in the first half of 2013 to 25,923 (first half of 2012: 28,207). In contrast, the average value of On-Premise software orders we received remained stable compared with the previous year. In the first half of 2013, 17% (first half of 2012: 21%) of the value of new software orders came from orders whose volume exceeded €5 million, while 50% (first half of 2012: 49%) came from orders worth less than €1 million.

Revenue

In the first half of 2013, software revenue was €1,638 million (first half of 2012: €1,696 million), a decrease of 3% compared to the same period in 2012. Software revenue in the first half of 2013 included amounts of €188 million (first half of 2012: €113 million) from SAP HANA.

Our revenue from cloud subscriptions and support was €1,935 million (first half of 2012: €1,777 million), an increase of 9% compared to the same period in 2012. The amounts for 2012 include cloud subscriptions and cloud support revenue from SuccessFactors since its acquisition date (February 21, 2012). Ariba is not included in prior year numbers.

Total revenue was €7,663 million (first half of 2012: €7,248 million), an increase of 6% compared to the same period in 2012.

Operating Expenses

In the first half of 2013, our operating expenses increased by 6% to €6,029 million (first half of 2012: €5,696 million).

The increase in operating expenses is mainly due to the increased headcount.

Operating Profit and Margin

In the first half of 2013, operating profit increased by 5% compared with the same period in the previous year to €1,634 million (first half of 2012: €1,551 million).

Our operating margin decreased by 0.1 percentage points to 21.3% (first half of 2012: 21.4%).

Profit After Tax and Earnings per Share

In the first half of 2013, profit after tax was €1,244 million (first half of 2012: €1,104 million), an increase of 13%. Basic earnings per share was €1.04 (first half of 2012: €0.93), an increase of 12%.

The effective tax rate in the first half of 2013 was 21.5% (first half of 2012: 25.0%). The year over year decrease in the effective tax rate mainly resulted from taxes for prior years and from changes in the regional allocation of income which were partly compensated by valuation allowances on deferred tax assets.

| INTERIM REPORT JANUARY – JUNE 2013 | 17 |

Table of Contents

FINANCES (IFRS)

Cash Flow and Liquidity

Operating cash flow for the first six months of 2013 was €2,482 million (first half of 2012: €2,400 million). As such, the consistently strong operating cash flow increased slightly over the same period in the previous year, marking SAP’s highest ever cash flow for the first half of a year.

Group liquidity stood at €3,527 million on June 30, 2013 (December 31, 2012: €2,492 million). Group liquidity comprised cash and cash equivalents totaling €3,386 million (December 31, 2012: €2,477 million) and short-term investments totaling €141 million (December 31, 2012: €15 million).

Group Liquidity of SAP Group

| € millions |

June 30, 2013 |

December 31, 2012 |

Change | |||||||||

| Cash and cash equivalents |

3,386 | 2,477 | 909 | |||||||||

| Short-term investments |

141 | 15 | 126 | |||||||||

| Group Liquidity — gross |

3,527 | 2,492 | 1,035 | |||||||||

| Current private placement transactions |

86 | 0 | 86 | |||||||||

| Current bonds |

1,100 | 600 | 500 | |||||||||

| Net liquidity 1 |

2,341 | 1,892 | 449 | |||||||||

| Non-current private placement transactions |

2,026 | 2,094 | –68 | |||||||||

| Non-current bonds |

1,800 | 2,300 | –500 | |||||||||

| Net liquidity 2 |

–1,485 | –2,502 | 1,017 | |||||||||

Net liquidity 1 is total group liquidity minus current bonds which increased on a year-to-date basis by €449 million to €2,341 million .

Net liquidity 2, defined as net liquidity 1 minus non-current private placement transactions, and bonds, was –€1,485 million (December 31, 2012: –€2,502 million).

Thus, net liquidity improved compared to December 31, 2012: dividends paid led to cash outflows which were overcompensated by a positive operating cash flow in the first half of 2013.

Free Cash Flow and Days Sales Outstanding (DSO)

Our free cash flow and our DSO on June 30, 2013, were as follows:

Free Cash Flow

| € millions |

1/1

- 6/30/ 2013 |

1/1

- 6/30/ 2012 |

Change in % |

|||||||||

| Free cash flow |

2,217 | 2,125 | 4 | |||||||||

We calculate free cash flow as net cash from operating activities minus purchases of intangible assets and property, plant, and equipment.

Days Sales Outstanding

| June 30, 2013 |

June 30, 2012 |

Change in Days |

||||||||||

| Days sales outstanding (DSO) in days |

62 | 61 | 1 | |||||||||

DSO measures the length of time it takes to collect receivables. SAP calculates DSO by dividing the average invoiced accounts receivables balance of the last 12 months by the average monthly sales of the last 12 months.

ASSETS (IFRS)

Analysis of Consolidated Statements of Financial Position

The total assets of the Group were €27,494 million on June 30, 2013, an increase of €784 million since December 31, 2012, resulting mainly from an increase in cash and cash equivalents from the operating cash flow, compensated by dividends paid.

The equity ratio on June 30, 2013, was 52% (December 31, 2012: 53%), which remained virtually stable.

Investments

Investments in intangible assets and property, plant, and equipment decreased significantly in the first half of 2013 to €346 million (first half of 2012: €3,324 million). This decrease is due to our prior year acquisition of SuccessFactors and is mainly attributable to additions to goodwill and intangible assets.

Off-Balance-Sheet Financial Instruments

There are no off-balance-sheet financial instruments, such as sale-and-lease-back transactions, asset-backed securities, or liabilities related to special-purpose entities, that are not disclosed in our interim Consolidated Financial Statements. Any factoring contracts are not material in volume.

| 18 | INTERIM MANAGEMENT REPORT |

Table of Contents

Competitive Intangibles

The assets that are the basis for our current and future success do not appear on the Consolidated Statements of Financial Position. This is apparent from a comparison of the market capitalization of SAP AG, which was €69.1 billion, with the equity of the SAP Group on the Consolidated Statements of Financial Position, which was €14.4 billion at the end of the first half of 2013 (December 31, 2012: €14.2 billion). This means that the market capitalization of our equity is more than four times higher than the book value.

Customer capital, our employees and their knowledge and skills, our ecosystem of partners, the SAP brand, and our past investments in research and development are some of the most important competitive intangibles that influence our market value.

According to the 2012 Interbrand annual survey of the Top 100 Best Global Brands, SAP is ranked the 25th most valued brand in the world. Interbrand determined a value of US$15.6 billion.

ENERGY AND EMISSIONS

As we create solutions for our customers to better manage resources, we must also look to ourselves and improve our own environmental performance. We also acknowledge greenhouse gas (GHG) emissions as a proxy measure for inefficient operations and excess spending.

SAP’s greenhouse gas (GHG) emissions for the second quarter 2013 totaled 135 kilotons compared to 130 kilotons in the second quarter of 2012. For the first two quarters 2013, SAP’s GHG emissions totaled 280 kilotons – an increase of 11% compared to the first two quarters of 2012. This rise is primarily due to the acquisitions of SuccessFactors and Ariba, an increase in the number of company cars, as well as an increase in energy consumption of our data centers. If our efforts to reduce emissions do not take hold, there is a risk that we might not meet our year-end emissions target of 460 kilotons. Comparator amounts contain SuccessFactors numbers on a pro rata basis with effect from February 21, 2012. Ariba numbers are not included – Ariba was acquired on October 1, 2012.

As we measure our emissions per employee and per euro of revenue, we gain insight into our efficiency as we grow. Since 2007, we have increased our efficiency according to both measures, lowering our emissions per employee by about 30% and per euro of revenue by about 44% at the end of June 2013 (rolling four quarters).

Since the beginning of 2008, SAP has achieved a €240 million cost avoidance compared to a business-as-usual scenario, through energy saving and emission reduction initiatives.

Our customers benefit from our experience that drives our innovation. For example, in April 2013, we released TwoGo by SAP, a mobility solution that was initially piloted internally. TwoGo helps companies and their employees save fuel by organizing ride-sharing for their daily commute or business travel. At SAP, TwoGo contributes to reducing emissions per employee. Similarly, TwoGo helps organizations demonstrate their commitment to sustainability, by reducing carbon emissions and engaging employees in that mission.

| INTERIM REPORT JANUARY – JUNE 2013 | 19 |

Table of Contents

SAP STOCK

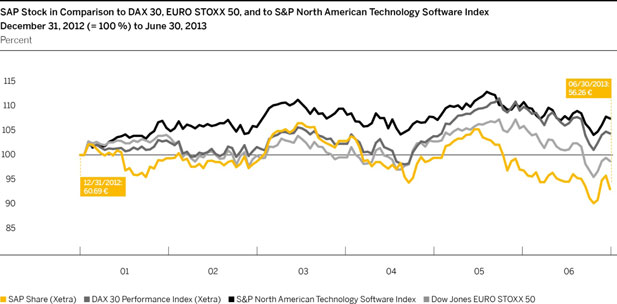

SAP AG common stock is listed on the Frankfurt Stock Exchange as well as a number of other German exchanges. On the New York Stock Exchange (NYSE), SAP American depositary receipts (ADRs), each representing one common share, trade under the symbol SAP. SAP is a component of the DAX (the index of 30 German blue chip companies), the Dow Jones EURO STOXX 50, and the S&P North American Technology Software Index.

Key Facts About SAP Stock / SAP ADRs

| Listings |

||||

| Germany |

Berlin, Frankfurt, Stuttgart | |||

| United States (ADR) |

New York Stock Exchange | |||

| IDs and symbols |

||||

| WKN/ISIN |

716460/DE0007164600 | |||

| NYSE (ADR) |

803054204 (CUSIP | ) | ||

| Reuters |

SAPG.F or .DE | |||

| Bloomberg |

SAP GR | |||

| Weight (%) in indices at 6/30/2013 |

||||

| DAX 30 |

7.59 | % | ||

| Prime All Share |

6.03 | % | ||

| CDAX |

6.16 | % | ||

| HDAX |

6.34 | % | ||

| Dow Jones STOXX 50 |

1.90 | % | ||

| Dow Jones EURO STOXX 50 |

3.38 | % |

The second quarter of 2013 saw SAP stock lose ground to the two major benchmark indices for the first time since the second quarter of 2012. The SAP share price fell 10.0%, whereas the EURO STOXX 50 declined 0.8% and the DAX 30 gained a modest 2.1%.

SAP stock started the three-month period with an Xetra closing price of €62.50 at the end of March, and soon came under pressure in a weak environment. It picked up momentum again shortly after the Q1 results were published on April 19, reaching €64.05, its high for the quarter, on May 15. Contributing to this climb was a general market sentiment reflecting hopes of economic recovery, increased enterprise profits, and most importantly, a persistently liberal central bank policy. Against this backdrop, the DAX recorded an all-time high of 8,530.89 points on May 22.

Disappointing figures from China at the end of May, however, halted the stock markets’ upwards trend. The announcement of personnel changes on the SAP Executive Board as well as the ex-dividend markdown following the Annual General Meeting of Shareholders on June 4 put additional pressure on SAP stock during this period. News of SAP’s planned acquisition of e-commerce specialist hybris subsequently stabilized the SAP share price until concerns about a change in the generous money policy of central banks, a drop in the Japanese share prices, and fears of a financial crisis in China put downward pressure on global share prices. Finally, weaker-than-expected company figures dampened sentiment in the software sector, causing SAP stock to fall to a quarterly low of €54.42 on June 24, before ultimately closing the month at €56.26.

| 20 | INTERIM MANAGEMENT REPORT |

Table of Contents

Capital Stock

SAP’s capital stock on June 30, 2013, was €1,228,504,232 (December 31, 2012: €1,228,504,232). It is issued as 1,228,504,232 no-par shares, each with an attributable value of €1 in relation to the capital stock.

Free Float

On June 30, 2013, the proportion of our stock in free float, applying the definition accepted on the Frankfurt Stock Exchange – which excludes treasury stock from the free float – stood at 72.0% (December 31, 2012: 74.4%).

Market Capitalization

With the Xetra closing price at €56.26 on the last trading day in the second quarter, SAP’s market capitalization was €69.1 billion based on 1,228,504,232 million outstanding shares. SAP was therefore the largest DAX company based on market capitalization.

Deutsche Börse uses the free-float factor to weight companies in the DAX. The free-float factor for SAP was 72.0% on the last trading day in the second quarter, resulting in a free-float market capitalization of approximately €49.7 billion. When measured by its free-float market capitalization, SAP was the fourth-largest company listed on the DAX at the end of the quarter.

For more information about SAP common stock, see the SAP Web site at www.sap.com/investor.

RISK AND OPPORTUNITY MANAGEMENT

We have comprehensive risk-management structures in place, which are intended to enable us to recognize and analyze risks early and to take the appropriate action. For changes in our legal liability risks since our last annual report, see Note 14 in the Notes to the Interim Financial Statements. The other risk factors remain largely unchanged since 2012, and are discussed more fully in our 2012 Integrated Report and our Annual Report on Form 20-F for 2012. We do not believe the risks we have identified jeopardize our ability to continue as a going concern. Opportunities also remain largely unchanged since 2012.

SUPPLEMENTARY REPORT

No events have occurred after June 30, 2013, which have a material significance for the Group’s assets, finances, and operating results.

OUTLOOK

Future Trends in the Global Economy

According to EBC’s current overall economic forecast, the global economy will see more dynamic growth as the year progresses. The IMF, for its part, anticipates the world economy will expand 3.1% over the year as a whole, with economic development varying significantly from country to country.

Looking at the EMEA region, ECB believes that rising global demand will slow the decline of the euro area economy over the remainder of the year. IMF predicts a full-year decrease of 0.6%. The euro area economy is expected to grow again in 2014. Analysts foresee the Americas region, meanwhile, being influenced by contrary effects in the second half of 2013: On the one hand, favorable financing conditions and strong corporate liquidity in the United States will bring about a steady increase in domestic demand; on the other hand, tax increases and federal spending cuts will likely have a restraining effect on the economy. The IMF hence expects the U.S. economy to improve 1.7% over the full year 2013. In Latin America, robust domestic demand and a gradually improving external demand are expected to drive growth. As for the APJ region, experts anticipate that economic development will remain mixed, with cautious expansion in Japan (IMF: +2.0%) and accelerated growth in the region’s emerging and developing economies. For China, the IMF still expects 7.8% full-year growth.

| INTERIM REPORT JANUARY – JUNE 2013 | 21 |

Table of Contents

Economic Trends – Year-Over-Year GDP Growth

| % |

||||||||||||

| World |

2012e | 2013p | 2014p | |||||||||

| World |

3.1 | 3.1 | 3.8 | |||||||||

| Advanced economies |

1.2 | 1.2 | 2.1 | |||||||||

| Developing and emerging economies |

4.9 | 5.0 | 5.4 | |||||||||

| Europe, the Middle East, and Africa (EMEA) |

||||||||||||

| European Union |

–0.2 | –0.1 | 1.2 | |||||||||

| Euro area |

–0.6 | –0.6 | 0.9 | |||||||||

| Germany |

0.9 | 0.3 | 1.3 | |||||||||

| Central and Eastern Europe |

1.4 | 2.2 | 2.8 | |||||||||

| Middle East and North Africa |

4.5 | 3.0 | 3.7 | |||||||||

| Sub-Saharan Africa |

4.9 | 5.1 | 5.9 | |||||||||

| Americas |

||||||||||||

| United States |

2.2 | 1.7 | 2.7 | |||||||||

| Canada |

1.7 | 1.7 | 2.2 | |||||||||

| Central and South America, Caribbean |

3.0 | 3.0 | 3.4 | |||||||||

| Asia Pacific Japan |

||||||||||||

| Asian developing economies |

6.5 | 6.9 | 7.0 | |||||||||

| Japan |

1.9 | 2.0 | 1.2 | |||||||||

| China |

7.8 | 7.8 | 7.7 |

e = Estimate; p = Projection

Source: Internationaler Währungsfonds (IWF), World Economic Outlook Update, Growing Pains, Juli 2013, p. 2.

Future Trends in the IT Market

The global IT market is expected to remain heterogeneous throughout the rest of 2013, growing almost 5% and thus outperforming the overall economy. That is the view expressed by International Data Corporation (IDC), a market research firm based in the United States. Economic uncertainty will probably cause companies to hold back on their IT investments until the end of the year, despite the fact that demand for new products and services exists. According to the experts, mobile solutions and cloud computing will be the segments to see increased spending.

The IT market in EMEA region, particularly in the Western and Southern European countries, is expected to continue growing at rates below the global IT market’s growth rates for the rest of the year yet still outperform the region’s overall economy. Meanwhile, uncertainty will remain in the American IT market due to restrained corporate investment in the USA. IDC therefore forecasts moderate growth for the Americas region at a rate slightly above the global average. The researchers predict that the APJ region will also grow faster than the global average, but with significant regional differences: Spending in Japan will stagnate, whereas emerging and developing countries, especially China, can expect double-digit growth.

Trends in the IT Market – Increased IT Spending Year-Over-Year

| % |

||||||||||||

| World |

2012e | 2013p | 2014p | |||||||||

| Total IT |

5.6 | 4.9 | 5.0 | |||||||||

| Hardware |

7.0 | 5.4 | 5.0 | |||||||||

| Packaged software |

6.2 | 5.6 | 6.3 | |||||||||

| Applications |

6.0 | 5.6 | 6.0 | |||||||||

| IT services |

3.1 | 3.8 | 4.2 | |||||||||

| Europe, Middle East, Africa (EMEA) |

||||||||||||

| IT total |

4.8 | 3.3 | 4.2 | |||||||||

| Packaged software |

4.7 | 4.7 | 5.4 | |||||||||

| Applications |

4.3 | 4.5 | 5.1 | |||||||||

| IT services |

1.0 | 2.2 | 3.6 | |||||||||

| Americas |

||||||||||||

| IT total |

3.9 | 5.3 | 5.2 | |||||||||

| Packaged software |

6.9 | 6.1 | 6.8 | |||||||||

| Applications |

7.0 | 6.2 | 6.5 | |||||||||

| IT services |

4.3 | 4.5 | 4.2 | |||||||||

| Asia Pacific Japan |

||||||||||||

| IT total |

8.9 | 6.3 | 5.5 | |||||||||

| Packaged software |

6.9 | 5.9 | 6.4 | |||||||||

| Applications |

6.0 | 5.7 | 6.4 | |||||||||

| IT services |

4.7 | 5.1 | 5.4 |

e = Estimate, p = Projection

source: IDC Worldwide Black Book Q1 2013

| 22 | INTERIM MANAGEMENT REPORT |

Table of Contents

Impact on SAP

The world is being transformed by the rapid adoption of cloud and in-memory technologies, and in this past quarter this trend became very prominent. Companies are shifting their investments to the cloud and radically simplifying their IT landscape on in-memory technology. In 2010, SAP embarked on a strategy of innovation – in cloud, in-memory, and mobile, all on a stable and consistent core. This foresight is now paying off and we are driving this next evolution of the software industry.

As long as they develop as currently forecast, SAP expects to outperform the global economy and IT industry for the remainder of 2013 although we adjusted our goals for 2013. We are confident we can achieve this thanks to our five innovative market categories Applications, Analytics, Mobile, Cloud, and Database and Technology, which give us a competitive edge even in difficult economic environments. In addition, we benefit from our established innovation strategy and clear customer focus in more than 180 countries and 25 industries.

In the second half of 2013, we will continue to invest in countries in which we expect significant growth, such as Brazil, China, India, Russia, the Middle East and Africa. As such, we see sufficient growth potential, and expect to reach our goals for 2013 as well as our mid-term goals for 2015. For more information, see the Operational Targets for 2013 (Non-IFRS) section.

Forecast for SAP

Operational Targets for 2013 (Non-IFRS)

Revenue and Operating Profit Outlook

SAP reaffirms its full year 2013 non-IFRS operating profit outlook to be in a range of €5.85 billion – €5.95 billion at constant currencies (2012: €5.21 billion). Although the difficult macroeconomic environment in particular in Asia Pacific Japan and the rapid transition to the cloud have resulted in lower software revenue expectations, SAP remains committed to be a double-digit growth company with at least 10% growth in non-IFRS software and software-related service revenue at constant currencies in full year 2013 (2012: €13.25 billion). This replaces the previous growth outlook for non-IFRS software and software-related service revenue of 11% – 13% at constant currencies and the underlying guidance for software and cloud subscription revenue.

In addition, SAP reaffirms its outlook for the fast-growing innovation categories cloud and in-memory. The company continues to expect full year 2013 non-IFRS cloud subscription and support revenue of around €750 million at constant currencies (2012: €343 million) and full year 2013 SAP HANA software revenue in a range of €650 – €700 million (2012: €392 million).

The Company now projects a full-year 2013 IFRS effective tax rate of 24.0% – 25.0% (previously 25.5% – 26.5%) (2012: 26.2%) and a non-IFRS effective tax rate of 25.5% – 26.5% (previously 27.0% – 28.0%) (2012: 27.5%).

We expect our professional services and other service revenue to remain flat in 2013 on a constant currency basis compared to 2012. Taking currency effects into account, we expect to see a slight decline in professional services and other service revenue. We therefore predict that the increase in total revenue in 2013 will be influenced by the expected growth in software and software-related service revenue.