Form 20-F

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| þ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number: 1-14251

SAP AG

(Exact name of Registrant as specified in its charter)

SAP CORPORATION

(Translation of Registrant’s name into English)

Federal Republic of

Germany

(Jurisdiction of incorporation or organization)

Dietmar-Hopp-Allee 16

69190 Walldorf

Federal Republic of Germany

(Address of principal executive offices)

Wendy Boufford

c/o SAP Labs

3410 Hillview Avenue, Palo Alto, CA, 94304, United States of America

650-849-4000 (Tel)

650-849-2650 (Fax)

(Name, Telephone, Email and/or Facsimile number and

Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of each class |

|

Name of each exchange on which registered |

| American Depositary Shares, each Representing one Ordinary Share, without nominal

value |

|

New York Stock Exchange |

| Ordinary Shares, without nominal value |

|

New York Stock Exchange* |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period

covered by the annual report:

Ordinary Shares, without nominal value: 1,228,504,232 (as of December 31, 2012)**

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No

¨

If this report is an annual or transition report, indicate by check mark if

the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No

þ

Note – Checking the box above will not relieve any registrant

required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.)

Yes ¨ No

¨

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

| Large accelerated filer þ |

|

Accelerated filer ¨ |

|

Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial

statements included in this filing:

U.S. GAAP ¨

International Financial Reporting Standards as issued by the International Accounting Standards

Board þ Other ¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the

registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No

þ

| * |

Listed not for trading or quotation purposes, but only in connection with the registration of American Depositary Shares representing such ordinary shares pursuant to

the requirements of the Securities and Exchange Commission. |

| ** |

Including 36,334,516 treasury shares. |

TABLE OF CONTENTS

i

ii

INTRODUCTION

SAP AG is a German stock corporation (Aktiengesellschaft) and is referred to in this report, together with its subsidiaries, as SAP, or as “Company,” “Group,” “we,”

“our,” or “us.” Our Consolidated Financial Statements included in “Item 18. Financial Statements” in this report have been prepared in accordance with International Financial Reporting Standards as issued by the

International Accounting Standards Board, referred to as IFRS throughout this report.

In this report: (i) references to “US$,”

“$,” or “dollars” are to U.S. dollars; (ii) references to “€” or “euro” are to the euro. Our financial statements are denominated in euros, which is the currency of our home country, Germany. Certain

amounts that appear in this report may not add up because of differences due to rounding.

Unless otherwise specified herein, euro financial

data have been converted into dollars at the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”) on

December 31, 2012, which was US$1.3186 per €1.00. No representation is made that such euro amounts actually represent such dollar amounts or that such euro amounts could have been or can be converted into dollars at that or any other

exchange rate on such date or on any other date. The rate used for the convenience translations also differs from the currency exchange rates used for the preparation of the Consolidated Financial Statements. This convenience translation is not a

requirement under IFRS and, accordingly, our independent registered public accounting firm has not audited these US$ amounts. For information regarding recent rates of exchange between euro and dollars, see “Item 3. Key Information –

Exchange Rates.” On March 7, 2013, the Noon Buying Rate for converting euro to dollars was US$1.3098 per €1.00.

Unless the

context otherwise requires, references in this report to ordinary shares are to SAP AG’s ordinary shares, without nominal value. References in this report to “ADRs” are to SAP AG’s American Depositary Receipts, each representing

one SAP ordinary share. References in this report to “ADSs” are to SAP AG’s American Depositary Shares, which are the deposited securities evidenced by the ADRs.

SAP, R/3, ABAP, BAPI, SAP NetWeaver, Duet, PartnerEdge, ByDesign, SAP BusinessObjects

Explorer, StreamWork, SAP HANA, the Business Objects logo, BusinessObjects, Crystal Reports, Crystal Decisions, Web Intelligence, Xcelsius, Sybase, Adaptive Server, Adaptive Server Enterprise,

iAnywhere, Sybase 365, SQL Anywhere, Crossgate, B2B 360°, B2B 360° Services, m@gic EDDY, Ariba, Quadrem, b-process, Ariba Discovery, SuccessFactors, Execution is the Difference, BizX Mobile Touchbase, It’s time to love work again, Jam

and BadAss SaaS and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP AG in Germany or an SAP affiliate company.

Throughout this report, whenever a reference is made to our website, such reference does not incorporate by reference into this report the information

contained on our website.

We intend to make this report and other periodic reports publicly available on our Web site (www.sap.com) without

charge immediately following our filing with the U.S. Securities and Exchange Commission (SEC). We assume no obligation to update or revise any part of this report, whether as a result of new information, future events or otherwise, unless we are

required to do so by law.

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements and information based on the beliefs of, and assumptions made by, our management using information

currently available to them. Any statements contained in this report that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. We have based these forward-looking statements

on our current expectations, assumptions, and projections about future conditions and events. As a result, our forward-looking statements and information are subject to uncertainties and risks. A broad range of uncertainties and risks, many of which

are beyond our control, could cause our actual results and performance to differ materially from any projections expressed in or implied by our forward-looking statements. The uncertainties and risks include, but are not limited to:

| • |

|

Uncertainty in the global economy, financial markets, and in political conditions could have a negative impact on our business, financial position,

profit, and cash flows and put pressure on our operating profit. |

1

| • |

|

Third parties have claimed, and might claim in the future, that we infringe their intellectual property rights, which could lead to damages being

awarded against us and limit our ability to use certain technologies in the future. |

| • |

|

There is a risk that undetected security vulnerabilities shipped and deployed within our software products could cause customer damage.

|

| • |

|

Established customers might not buy additional software products, renew maintenance agreements, or purchase additional professional services, or they

might switch to other products or service offerings (including competitor products). |

We describe these and other risks and

uncertainties in the Risk Factors section.

If one or more of these uncertainties or risks materializes, or if management’s underlying

assumptions prove incorrect, our actual results could differ materially from those described in or inferred from our forward-looking statements and information.

The words “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “counting on,” “is confident,”

“estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “might,” “outlook,” “plan,” “project,” “predict,” “seek,”

“should,” “strategy,” “want,” “will,” “would,” and similar expressions as they relate to us are intended to identify such forward-looking statements. Such statements include, for example, those made

in the Operating Results section, our quantitative and qualitative disclosures about market risk pursuant to the International Financial Reporting Standards (IFRS), namely IFRS 7 and related statements in our Notes to the Consolidated Financial

Statements, the Risk Report, our outlook guidance, and other forward-looking information appearing in other parts of this report. To fully consider the factors that could affect our future financial results, both our Management Report and this

report should be considered, as well as all of our other filings with the Securities and Exchange Commission (SEC). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date specified or

the date of this report. Except where legally required, we undertake no obligation to publicly update or revise any forward-looking statements as a result of new information that we receive about conditions that existed upon issuance of this report,

future events, or otherwise unless we are required to do so by law.

This report includes statistical data about the IT industry and global economic trends that comes from

information published by sources including International Data Corporation (IDC), a provider of market information and advisory services for the information technology, telecommunications, and consumer technology markets; the European Central Bank

(ECB); and the International Monetary Fund (IMF). This type of data represents only the estimates of IDC, ECB, IMF, and other sources of industry data. SAP does not adopt or endorse any of the statistical information provided by sources such as IDC,

ECB, IMF, or other similar sources that is contained in this report. In addition, although we believe that data from these sources is generally reliable, this type of data is imprecise. We caution readers not to place undue reliance on this data.

MEASURES CITED IN THIS REPORT

We use various performance measures to help manage our performance with regard to our primary financial goals, which are growth and profitability, and our primary non-financial goals, which are customer

satisfaction and employee engagement.

Measures We Use to Manage Our Financial Performance

Revised Software and Software-Related Service Revenue Presentation

As a result of placing greater focus on cloud computing, we revised the presentation of our software and software-related service (SSRS) revenue as of January 1, 2012, and we adjusted our comparative

figures accordingly. As a result of these adjustments, the subscription and other software-related service revenue item has been deleted. We believe this creates more transparency regarding SSRS revenue, particularly with respect to revenue from

cloud subscriptions and support. These revenues are no longer recorded under the subscription and other software-related service revenue item, but instead shown as a separate item within the SSRS revenue. Revenue from long-term license agreements

and all other revenue previously shown under SSRS revenue has been broken down into its software and support components and recorded under the software revenue and support revenue items. Thus, we present higher revenue for software and for support

for 2011. This change is merely a reclassification that only

2

affects items within SSRS revenue. The overall sum of SSRS revenue and thus the total revenue are not affected.

In addition, we introduced a new subtotal at the end of 2012 to better reflect our wide range of on-premise and cloud solutions: the software revenue item and the cloud subscription and support revenue

item were merged and are now recorded under the software and cloud subscription revenue item. We believe this creates more transparency and allows better comparability with our biggest competitor.

Measures We Use to Manage Our Operating Financial Performance

In 2012, we used the following key measures to manage our operating financial performance:

Non-IFRS SSRS revenue: Our SSRS revenue includes software and related support revenue plus cloud subscription and support

revenue. The principal source of our software revenue is the fees customers pay for on-premise software licenses resulting in software being installed on the customer’s hardware. We generate cloud subscription and support revenue when we

provide software and the respective support for delivery in the cloud. Software revenue and cloud subscription and support revenue are our key revenue drivers because they tend to affect our other revenue streams. Generally, customers who buy

software licenses also enter into maintenance contracts, and these generate recurring software-related service revenue in the form of support revenue after the software sale. Maintenance contracts cover support services and software updates and

enhancements. Software revenue as well as cloud subscription and support revenue also tend to stimulate service revenue from consulting and training sales.

Non-IFRS bookings/billings revenue: For our cloud activities we look at the recognized revenues as well as the contract values generated in a given period

(bookings/billings). We measure bookings/billings as the amounts that we are contractually entitled to invoice the customers over the shorter of the contract term and the first 12 months following the contract execution date, anniversary of contract

execution date or contract renewal date (12 months bookings/billings). In contrast to the cloud subscription and support revenues that are recognized over the period of providing the cloud service rather than in the period of contract closure, the

booking/billing numbers give insight into the future revenue

potential. When evaluating 12 months bookings/billings numbers, we consider both the total bookings/billings and the subset of bookings/billings that results from new customers or additional

sales to existing customers in the reporting period rather than from subsequent years or renewals of existing contracts. There is no comparable IFRS measure for this figure.

Our Cloud Applications segment has grown significantly through the acquisition of SuccessFactors in early 2012. As SuccessFactors is included in SAP’s financials only from the day of acquisition, a

year-over-year comparison of the bookings/billings is impacted by the acquisition. We therefore analyze and report, in addition to the absolute growth rate of bookings/billings for cloud applications, a pro forma growth rate assuming that the

acquisition of SuccessFactors was completed as of January 1, 2011. A similar analysis is not provided for the Ariba segment due to the Ariba acquisition having occurred late in 2012.

Non-IFRS operating profit/non-IFRS operating margin: In 2012, we used non-IFRS operating profit/non-IFRS operating margin and constant currency non-IFRS operating

profit/non-IFRS operating margin to measure our overall operational process efficiency and overall business performance. Non-IFRS operating margin is the ratio of our non-IFRS operating profit to total non-IFRS revenue, expressed as a percentage.

See below for a discussion of the IFRS and non-IFRS measures we use.

Measures We Use to Manage Our Non-Operating Financial Performance

We use the following measures to manage our non-operating financial performance:

Finance income, net: This measure provides insight especially into the return on liquid assets and capital investments and

the cost of borrowed funds. To manage our financial income, net, we focus on cash flow, the composition of our liquid asset and capital investment portfolio, and the average rate of interest at which assets are invested. We also monitor average

outstanding borrowings and the associated finance costs.

Days of Sales Outstanding and Days of Payables

Outstanding: We manage working capital by controlling the days’ sales outstanding for operating receivables, or DSO (defined as average number of days from the raised invoice to cash

3

receipt from the customer), and the days’ payables outstanding for operating liabilities, or DPO (defined as average number of days from the received invoice to cash payment to the vendor).

Measures We Use to Manage Overall Financial Performance

We use the following measures to manage our overall financial performance:

Earnings per share

(EPS): EPS measures our overall performance, because it captures all operating and non-operating elements of profit as well as income tax expense. It represents the portion of profit after tax allocable to each SAP share

outstanding (using the weighted average number of shares outstanding over the reporting period). EPS is influenced not only by our operating and non-operating business, and income taxes, but also by the number of shares outstanding. We are

authorized by our shareholders to repurchase shares and believe that such repurchases, additional to dividend distributions, are a good means to return value to our shareholders.

Effective tax rate: We define our effective tax rate as the ratio of income tax expense to profit before tax, expressed as a percentage.

Operating, investing, and financing cash flows: Our consolidated statement of cash flows provides insight as to how we

generated and used cash and cash equivalents. When used in conjunction with the other primary financial statements, it provides information that helps us evaluate the changes of our net assets, our financial structure (including our liquidity and

solvency), and our ability to affect the amounts and timing of cash flows in order to adapt to changing circumstances and opportunities.

Measures We Use to Manage Our Non-Financial Performance

In 2012, we used the following key measures to manage our non-financial performance in the areas of employee engagement and customer satisfaction:

Employee Engagement Index: With this index, we measure the level of employee commitment, pride, and loyalty, as well as the level of employee advocacy for SAP. The index is

derived from surveys conducted among our employees. With

this measure, we recognize that we can achieve our growth strategy only with engaged employees.

Net Promoter Score: This score measures the willingness of our customers to recommend or promote SAP to others. It is derived from our customer survey. Conducted each year,

this survey identifies whether a customer is loyal and likely to recommend SAP to friends or colleagues, is neutral, or is unhappy. We introduced this measure in 2012, as we are convinced that we can achieve our financial goals only when our

customers are loyal to and satisfied with SAP and our solutions. To derive the Net Promoter Score (NPS), we start with the percentage of “promoters” of SAP – those who give us a score of 9 or 10 on a scale of 0 to 10. We then subtract

the percentage of “detractors” – those who give us a score of 0 to 6. The methodology calls for ignoring “passives,” who give us a score of 7 or 8.

Value-Based Management

Our holistic view of the performance measures described above,

together with our associated analyses, comprises the information we use for value-based management. We use planning and control processes to manage the compilation of these key measures and their availability to our decision makers across various

management levels.

SAP’s long-term strategic plans are the point of reference for our other planning and controlling processes,

including creating a multiyear plan until 2015. We identify future growth and profitability drivers at a highly aggregated level. This process is intended to identify the best areas in which to target sustained investment. Next, we evaluate our

multiyear plans for our support and development functions and break down the customer-facing plans by sales region. Based on our detailed annual plans, we determine the budget for the respective year. We also have processes in place to forecast

revenue and profit on a quarterly basis, to quantify whether we expect to realize our strategic goals, and to identify any deviations from plan. We continuously monitor the concerned units in the Group to analyze these developments and define any

appropriate actions.

Our entire network of planning, control, and reporting processes is implemented in integrated planning and information

systems, based on SAP software, across all organizational units so that we can conduct the evaluations and analyses needed to make informed decisions.

4

Non-IFRS Financial Measures Cited in This Report

As in previous years, we provided our 2012 financial outlook on the basis of certain non-IFRS

measures. Therefore, this report contains a non-IFRS based comparison of our actual performance in 2012 against our outlook in the chapter Assets, Finances, and Operating Results.

Reconciliations of IFRS to

Non-IFRS Financial Measures for 2012 and 2011

The following table reconciles our IFRS financial measures to the respective and most

comparable non-IFRS financial measures of this report for each of 2012 and 2011. Due to rounding, the sum of the numbers presented in this table might not precisely equal the totals we provide.

Reconciliations of IFRS to Non-IFRS Financial Measures for 2012 and 2011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| € millions, unless otherwise stated |

|

for the years ended December 31 |

|

| |

|

2012 |

|

|

2011 |

|

| |

|

IFRS |

|

|

Adj. |

|

|

Non-IFRS |

|

|

Currency

Impact |

|

|

Non-IFRS

Constant

Currency |

|

|

IFRS |

|

|

Adj. |

|

|

Non-IFRS |

|

| Revenue measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Software |

|

|

4,658 |

|

|

|

0 |

|

|

|

4,658 |

|

|

|

–134 |

|

|

|

4,524 |

|

|

|

4,107 |

|

|

|

0 |

|

|

|

4,107 |

|

| Cloud subscriptions and support |

|

|

270 |

|

|

|

73 |

|

|

|

343 |

|

|

|

–21 |

|

|

|

322 |

|

|

|

18 |

|

|

|

0 |

|

|

|

18 |

|

| Software and cloud subscriptions |

|

|

4,928 |

|

|

|

73 |

|

|

|

5,001 |

|

|

|

–155 |

|

|

|

4,846 |

|

|

|

4,125 |

|

|

|

0 |

|

|

|

4,125 |

|

| Support |

|

|

8,237 |

|

|

|

9 |

|

|

|

8,246 |

|

|

|

–286 |

|

|

|

7,959 |

|

|

|

7,194 |

|

|

|

27 |

|

|

|

7,221 |

|

| Software and software-related service revenue |

|

|

13,165 |

|

|

|

81 |

|

|

|

13,246 |

|

|

|

–441 |

|

|

|

12,806 |

|

|

|

11,319 |

|

|

|

27 |

|

|

|

11,346 |

|

| Consulting |

|

|

2,442 |

|

|

|

0 |

|

|

|

2,442 |

|

|

|

–95 |

|

|

|

2,347 |

|

|

|

2,341 |

|

|

|

0 |

|

|

|

2,341 |

|

| Other services |

|

|

616 |

|

|

|

0 |

|

|

|

616 |

|

|

|

–18 |

|

|

|

599 |

|

|

|

573 |

|

|

|

0 |

|

|

|

573 |

|

| Professional services and other service revenue |

|

|

3,058 |

|

|

|

0 |

|

|

|

3,058 |

|

|

|

–113 |

|

|

|

2,945 |

|

|

|

2,914 |

|

|

|

0 |

|

|

|

2,914 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

16,223 |

|

|

|

81 |

|

|

|

16,304 |

|

|

|

–553 |

|

|

|

15,751 |

|

|

|

14,233 |

|

|

|

27 |

|

|

|

14,260 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expense measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of software and software-related services |

|

|

–2,551 |

|

|

|

414 |

|

|

|

–2,137 |

|

|

|

|

|

|

|

|

|

|

|

–2,107 |

|

|

|

285 |

|

|

|

–1,822 |

|

| Cost of professional services and other services |

|

|

–2,514 |

|

|

|

128 |

|

|

|

–2,385 |

|

|

|

|

|

|

|

|

|

|

|

–2,248 |

|

|

|

32 |

|

|

|

–2,216 |

|

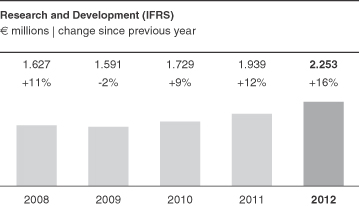

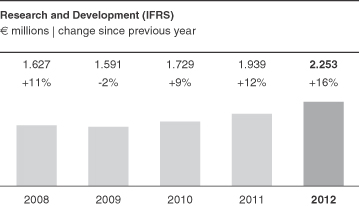

| Research and development |

|

|

–2,253 |

|

|

|

129 |

|

|

|

–2,124 |

|

|

|

|

|

|

|

|

|

|

|

–1,939 |

|

|

|

41 |

|

|

|

–1,898 |

|

| Sales and marketing |

|

|

–3,907 |

|

|

|

223 |

|

|

|

–3,684 |

|

|

|

|

|

|

|

|

|

|

|

–3,081 |

|

|

|

127 |

|

|

|

–2,954 |

|

| General and administration |

|

|

–947 |

|

|

|

164 |

|

|

|

–783 |

|

|

|

|

|

|

|

|

|

|

|

–715 |

|

|

|

30 |

|

|

|

–685 |

|

| Restructuring |

|

|

–8 |

|

|

|

8 |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

–4 |

|

|

|

4 |

|

|

|

0 |

|

| TomorrowNow litigation |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

717 |

|

|

|

–717 |

|

|

|

0 |

|

| Other operating income/expense, net |

|

|

23 |

|

|

|

0 |

|

|

|

23 |

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

0 |

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

–12,158 |

|

|

|

1,067 |

|

|

|

–11,090 |

|

|

|

362 |

|

|

|

–10,728 |

|

|

|

–9,352 |

|

|

|

–198 |

|

|

|

–9,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

|

4,065 |

|

|

|

1,148 |

|

|

|

5,214 |

|

|

|

–191 |

|

|

|

5,023 |

|

|

|

4,881 |

|

|

|

–171 |

|

|

|

4,710 |

|

| Operating margin in % |

|

|

25.1 |

|

|

|

|

|

|

|

32.0 |

|

|

|

|

|

|

|

31.9 |

|

|

|

34.3 |

|

|

|

|

|

|

|

33.0 |

|

Explanation of Non-IFRS Measures

We disclose certain financial measures, such as non-IFRS revenue, non-IFRS operating expenses, non-IFRS operating profit, non-IFRS operating

margin, non-IFRS earnings per share, constant currency revenue and operating profit measures that are not prepared in accordance with IFRS and are therefore considered non-IFRS financial

measures. Our non-IFRS financial measures may not correspond to non-IFRS financial measures

5

that other companies report. The non-IFRS financial measures that we report should only be considered in addition to, and not as substitutes for or superior to, revenue, operating expenses,

operating profit, operating margin, earnings per share or other measures of financial performance prepared in accordance with IFRS.

We

believe that the disclosed supplemental historical and prospective non-IFRS financial information provides useful information to investors because management uses this information, in addition to financial data prepared in accordance with IFRS, to

attain a more transparent understanding of our past performance and our anticipated future results. In 2012, we used these non-IFRS measures consistently in our internal planning and forecasting, reporting and compensation, as well as in our

external communications as follows:

| • |

|

Our management primarily uses these non-IFRS measures rather than IFRS measures as the basis for making financial, strategic and operating decisions.

|

| • |

|

The variable remuneration components of our Executive Board members and employees are based on non-IFRS revenue and non-IFRS operating profit measures

rather than the respective IFRS measures. |

| • |

|

The annual budgeting process for all management units is based on non-IFRS revenue and non-IFRS operating profit numbers rather than the respective

IFRS financial measures. |

| • |

|

All forecast and performance reviews with all senior managers globally are based on these non-IFRS measures, rather than the respective IFRS financial

measures. |

| • |

|

Both our internal performance targets and the guidance we provided to the capital markets are based on non-IFRS revenues and non-IFRS profit measures

rather than the respective IFRS financial measures. |

Our non-IFRS financial measures reflect adjustments based on the items

below, as well as adjustments for the related income tax effects.

Non-IFRS Revenue

Revenue items identified as non-IFRS revenue have been adjusted from the respective IFRS financial measures by including the full amount of support

revenue, cloud subscriptions revenue,

and other similarly recurring revenues which we are not permitted to record as revenue under IFRS due to fair value accounting for the contracts in effect at the time of the respective

acquisitions.

Under IFRS, we record at fair value the contracts in effect at the time entities were acquired. Consequently, our IFRS support

revenue, our IFRS cloud subscriptions and support revenue, our IFRS software and cloud subscription revenue, our IFRS software and software-related service revenue, and our IFRS total revenue for periods subsequent to acquisitions do not reflect the

full amount of revenue that would have been recorded by entities acquired by SAP had they remained stand-alone entities. Adjusting revenue numbers for this revenue impact provides additional insight into the comparability across periods of our

ongoing performance.

Through 2011, our adjustments for deferred revenue write-downs were limited to support revenue. During 2012, we also

made such deferred revenue write-down adjustments for cloud subscriptions revenue and other similarly recurring revenues. As the deferred revenue write-down adjustments for recurring revenues other than support revenue from acquisitions that were

executed through 2011 were immaterial, we have not restated prior-period non-IFRS measures to align with our new non-IFRS revenue definition.

Non-IFRS Operating Expense

Operating

expense figures that are identified as non-IFRS operating expenses have been adjusted by excluding the following expenses:

| • |

|

Acquisition-related charges |

| |

• |

|

Amortization expense/impairment charges of intangibles acquired in business combinations and certain stand-alone acquisitions of intellectual property

(including purchased in-process research and development) |

| |

• |

|

Settlements of pre-existing business relationships in connection with a business combination |

| |

• |

|

Acquisition-related third-party expenses |

| • |

|

Discontinued activities: Results of discontinued operations that qualify as such under IFRS in all respects except that they do not represent a major

line of business |

| • |

|

Expenses from our share-based payments |

6

Non-IFRS Operating Profit, Non-IFRS Operating Margin, and Non-IFRS Earnings per Share

Operating profit, operating margin, and earnings per share identified as non-IFRS operating profit, non-IFRS operating margin, and non-IFRS earnings per

share have been adjusted from the respective IFRS measures by adjusting for the above-mentioned non-IFRS revenue and non-IFRS operating expenses.

We exclude certain acquisition-related expenses for the purpose of calculating non-IFRS operating profit, non-IFRS operating margin, and non-IFRS earnings per share when evaluating SAP’s continuing

operational performance because these expenses generally cannot be changed or influenced by management after the relevant acquisition other than by disposing of the acquired assets. Since management at levels below the Executive Board does not

influence these expenses, we generally do not consider these expenses for the purpose of evaluating the performance of management units. Additionally, these non-IFRS measures have been adjusted from the respective IFRS measures for the results of

the discontinued activities, share-based payment expenses, and restructuring expenses.

Usefulness of Non-IFRS Measures

We believe that our non-IFRS measures are useful to investors for the following reasons:

| • |

|

The non-IFRS measures provide investors with insight into management’s decision making because management uses these non-IFRS measures to run our

business and make financial, strategic, and operating decisions. |

| • |

|

The non-IFRS measures provide investors with additional information that enables a comparison of year-over-year operating performance by eliminating

certain direct effects of acquisitions and discontinued activities. |

| • |

|

Non-IFRS and non-GAAP measures are widely used in the software industry. In many cases, inclusion of our non-IFRS measures may facilitate comparison

with our competitors’ corresponding non-IFRS and non-GAAP measures.

|

Additionally, we believe that our adjustments to our IFRS financial measures for the results of our

discontinued TomorrowNow activities are useful to investors for the following reason:

| • |

|

TomorrowNow activities were discontinued and we will thus continue to exclude potential future TomorrowNow results, which are expected to mainly

comprise expenses in connection with the Oracle lawsuit, from our internal management reporting, planning, forecasting, and compensation plans. Therefore, adjusting our non-IFRS measures for the results of the discontinued TomorrowNow activities

provides insight into the financial measures that SAP uses internally. |

We include the revenue adjustments outlined above

and exclude the expense adjustments outlined above when making decisions to allocate resources, both on a company level and at lower levels of the organization. In addition, we use these non-IFRS measures to gain a better understanding of SAP’s

operating performance from period to period.

We believe that our non-IFRS financial measures described above have limitations, including but

not limited to, the following:

| • |

|

The eliminated amounts could be material to us. |

| • |

|

Without being analyzed in conjunction with the corresponding IFRS measures, the non-IFRS measures are not indicative of our present and future

performance, foremost for the following reasons: |

| |

• |

|

While our non-IFRS profit numbers reflect the elimination of certain acquisition-related expenses, no eliminations are made for the additional revenue

and other revenue that result from the acquisitions. |

| |

• |

|

While we adjust for the fair value accounting of the acquired entities’ recurring revenue contracts, we do not adjust for the fair value

accounting of deferred compensation items that result from commissions paid to the acquired company’s sales force and third parties for closing the respective customer contracts. |

| |

• |

|

The acquisition-related charges that we eliminate in deriving our non-IFRS profit numbers are likely to recur should SAP enter into material business

combinations in the future. |

7

| |

• |

|

The acquisition-related amortization expense that we eliminate in deriving our non-IFRS profit numbers is a recurring expense that will impact our

financial performance in future years. |

| |

• |

|

The revenue adjustment for the fair value accounting of the acquired entities’ contracts and the expense adjustment for acquisition-related

charges do not arise from a common conceptual basis. This is because the revenue adjustment aims to improve the comparability of the initial post-acquisition period with future post-acquisition periods, while the expense adjustment aims to improve

the comparability between post-acquisition periods and pre-acquisition periods. This should particularly be considered when evaluating our non-IFRS operating profit and non-IFRS operating margin numbers as these combine our non-IFRS revenue and

non-IFRS expenses despite the absence of a common conceptual basis. |

| |

• |

|

Our discontinued activities and restructuring charges could result in significant cash outflows. The same applies to our share-based payment expense

because most of our share-based payments are to be settled in cash rather than shares. |

| |

• |

|

The valuation of our cash-settled, share-based payments could vary significantly from period to period due to the fluctuation of our share price and

other parameters used in the valuation of these plans. |

| |

• |

|

We have in the past issued share-based payment awards to our employees every year and we intend to continue doing so in the future. Thus, our

share-based payment expenses are recurring although the amounts usually change from period to period. |

Despite these

limitations, we believe that the presentation of the non-IFRS measures and the corresponding IFRS measures, together with the relevant reconciliations, provides useful information to management and investors regarding present and future business

trends relating to our financial condition and results of operations. We do not evaluate our growth and performance without considering both non-IFRS measures and the comparable IFRS measures. We

caution the readers of our financial reports to follow a similar approach by considering our non-IFRS measures only in addition to, and not as a substitute for or superior to, revenue or other

measures of our financial performance prepared in accordance with IFRS.

Constant Currency Information

We believe it is important for investors to have information that provides insight into our sales. Revenue measures determined under IFRS provide

information that is useful in this regard. However, both sales volume and currency effects impact period-over-period changes in sales revenue. We do not sell standardized units of products and services, so we cannot provide relevant information on

sales volume by providing data on the changes in product and service units sold. To provide additional information that may be useful to investors in breaking down and evaluating changes in sales volume, we present information about our revenue and

various values and components relating to operating profit that are adjusted for foreign currency effects. We calculate constant currency revenue and operating profit measures by translating foreign currencies using the average exchange rates from

the previous year instead of the current year.

We believe that constant currency measures have limitations, particularly as the currency

effects that are eliminated constitute a significant element of our revenue and expenses and could materially impact our performance. We therefore limit our use of constant currency measures to the analysis of changes in volume as one element of the

full change in a financial measure. We do not evaluate our results and performance without considering both constant currency measures in non-IFRS revenue and non-IFRS operating profit measures on the one hand, and changes in revenue, operating

expenses, operating profit, or other measures of financial performance prepared in accordance with IFRS on the other. We caution the readers of our financial reports to follow a similar approach by considering constant currency measures only in

addition to, and not as a substitute for or superior to, changes in revenue, operating expenses, operating profit, or other measures of financial performance prepared in accordance with IFRS.

8

Free Cash Flow

We use our free cash flow measure to estimate the cash flow remaining after all expenditures required to maintain or expand our organic business have been paid off. This measure provides management with

supplemental information to assess our liquidity needs. We calculate free cash flow as net cash from operating activities minus purchases, other than purchases made in connection with business combinations, of intangible assets and property, plant,

and equipment.

Free Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

| € millions |

|

2012 |

|

|

2011 |

|

|

Change |

|

| Net cash flows from operating activities |

|

|

3,822 |

|

|

|

3,775 |

|

|

|

1 |

% |

| Purchase of intangible assets and property, plant, and equipment (without acquisitions) |

|

|

–541 |

|

|

|

–445 |

|

|

|

22 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free Cash Flow |

|

|

3,281 |

|

|

|

3,330 |

|

|

|

–1 |

% |

9

Part I

Item 1, 2, 3

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED

TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

SELECTED FINANCIAL DATA

The following table sets forth our selected consolidated financial data as of and for each of the years in the five-year period ended December 31, 2012. The consolidated financial data has been

derived from, and should be read in conjunction with, our Consolidated Financial Statements prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (IFRS), presented in

“Item 18. Financial Statements” of this report.

Our selected financial data and our Consolidated Financial Statements are presented

in euros. Financial data as of and for the year ended December 31, 2012 has been translated into U.S. dollars for the convenience of the reader.

10

Part I

Item 3

SELECTED FINANCIAL DATA: IFRS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| millions, unless otherwise stated |

|

2012(1) |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

|

2009 |

|

|

2008 |

|

| |

|

US$ |

|

|

€ |

|

|

€ |

|

|

€ |

|

|

€ |

|

|

€ |

|

| Income Statement Data:

Years ended December 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Software and software-related service revenue |

|

|

17,359 |

|

|

|

13,165 |

|

|

|

11,319 |

|

|

|

9,794 |

|

|

|

8,198 |

|

|

|

8,457 |

|

| Total revenue |

|

|

21,392 |

|

|

|

16,223 |

|

|

|

14,233 |

|

|

|

12,464 |

|

|

|

10,672 |

|

|

|

11,575 |

|

| Operating profit |

|

|

5,360 |

|

|

|

4,065 |

|

|

|

4,881 |

|

|

|

2,591 |

|

|

|

2,588 |

|

|

|

2,701 |

|

| Operating margin in %(2) |

|

|

25.1 |

|

|

|

25.1 |

|

|

|

34.3 |

|

|

|

20.8 |

|

|

|

24.3 |

|

|

|

23.3 |

|

| Profit after tax |

|

|

3,722 |

|

|

|

2,823 |

|

|

|

3,439 |

|

|

|

1,813 |

|

|

|

1,750 |

|

|

|

1,848 |

|

| Profit attributable to owners of parent |

|

|

3,722 |

|

|

|

2,823 |

|

|

|

3,438 |

|

|

|

1,811 |

|

|

|

1,748 |

|

|

|

1,847 |

|

| Earnings per share(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic in € |

|

|

3.13 |

|

|

|

2.37 |

|

|

|

2.89 |

|

|

|

1.52 |

|

|

|

1.47 |

|

|

|

1.55 |

|

| Diluted in € |

|

|

3.12 |

|

|

|

2.37 |

|

|

|

2.89 |

|

|

|

1.52 |

|

|

|

1.47 |

|

|

|

1.55 |

|

| Other Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

1,192 |

|

|

|

1,192 |

|

|

|

1,189 |

|

|

|

1,188 |

|

|

|

1,188 |

|

|

|

1,190 |

|

| Diluted |

|

|

1,193 |

|

|

|

1,193 |

|

|

|

1,190 |

|

|

|

1,189 |

|

|

|

1,189 |

|

|

|

1,191 |

|

| Statement of Financial Position Data: At December 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

3,266 |

|

|

|

2,477 |

|

|

|

4,965 |

|

|

|

3,518 |

|

|

|

1,884 |

|

|

|

1,280 |

|

| Total assets(3) |

|

|

35,385 |

|

|

|

26,835 |

|

|

|

23,227 |

|

|

|

20,839 |

|

|

|

13,374 |

|

|

|

13,900 |

|

| Current financial liabilities(4) |

|

|

1,058 |

|

|

|

802 |

|

|

|

1,331 |

|

|

|

142 |

|

|

|

146 |

|

|

|

2,563 |

|

| Non-current financial liabilities(4) |

|

|

5,862 |

|

|

|

4,446 |

|

|

|

2,925 |

|

|

|

4,449 |

|

|

|

729 |

|

|

|

40 |

|

| Issued capital |

|

|

1,621 |

|

|

|

1,229 |

|

|

|

1,228 |

|

|

|

1,227 |

|

|

|

1,226 |

|

|

|

1,226 |

|

| Total equity |

|

|

18,686 |

|

|

|

14,171 |

|

|

|

12,707 |

|

|

|

9,824 |

|

|

|

8,491 |

|

|

|

7,171 |

|

| (1) |

Amounts presented in US$ have been translated for the convenience of the reader at €1.00 to US$1.3186, the Noon Buying Rate for converting

€1.00 into dollars on December 31, 2012. See “Item 3. Key Information – Exchange Rates” for recent exchange rates between the Euro and the dollar. |

| (2) |

Operating profit is the numerator and total revenue is the denominator in the calculation of operating margin. Profit attributable to owners of parent

is the numerator and weighted average number of shares outstanding is the denominator in the calculation of earnings per share. See Note (11) to our Consolidated Financial Statements for more information on earnings per share.

|

| (3) |

The large increase in total assets from 2009 to 2010 was mainly due to the acquisition of Sybase in 2010. The large increase in total assets from 2011

to 2012 was mainly due to the acquisitions of SuccessFactors and Ariba in 2012. See Note (4) to our Consolidated Financial Statements for more information on acquisitions. |

| (4) |

The balances include primarily bonds, private placements and bank loans. Current is defined as having a remaining life of one year or less; non-current

is defined as having a remaining term exceeding one year. The high amount of current financial liabilities during 2008 was due to financial debt incurred to finance the acquisition of Business Objects. The significant increase in non-financial

liabilities in 2010 was due to an acquisition-term loan used to finance the acquisition of Sybase. In addition, we issued two bonds and a U.S. private placement transaction, of which, the proceeds were primarily used to finance the acquisition of

Sybase. The significant increase in non-financial liabilities in 2012 was due to the issuance of a U.S. private placement transaction and Eurobonds in the course of the acquisition of Ariba. See Note (17b) to our Consolidated Financial

Statements for more information on our liabilities. |

11

Part I

Item 3

EXCHANGE RATES

The prices for our ordinary shares traded on German stock exchanges are denominated in euro. Fluctuations in the exchange rate between the euro and the U.S. dollar affect the dollar equivalent of the euro

price of the ordinary shares traded on the German stock exchanges and, as a result, may affect the price of the ADRs traded on the NYSE in the United States. See “Item 9. The Offer and Listing” for a description of the ADRs. In addition,

SAP AG pays cash dividends, if any, in euro. As a result, any exchange rate fluctuations will also affect the dollar amounts received by the holders of ADRs on the conversion into dollars of cash dividends paid in euro on the ordinary shares

represented by the ADRs. Deutsche Bank Trust Company Americas is the depositary (the Depositary) for SAP AG’s ADR program. The deposit agreement with respect to the ADRs requires the Depositary to convert any dividend payments from euro into

dollars as promptly as practicable upon receipt. For additional information on the Depositary and the fees associated with SAP’s ADR program see “Item 12 Description of Securities Other Than Equity Securities – American Depositary

Shares.”

A significant portion of our revenue and expense is denominated in currencies other than the euro. Therefore, fluctuations in

the exchange rate between the euro and the respective currencies in which we conduct business could materially affect our business, financial position, income or cash flows. See “Item 5. Operating and Financial Review and Prospects –

Foreign Currency Exchange Rate Exposure” for details on the impact of these exchange rate fluctuations.

The following table sets forth (i) the average, high and low Noon Buying Rates for the euro expressed

as U.S. dollars per €1.00 for the past five years on an annual basis and (ii) the high and low Noon Buying Rates on a monthly basis from July 2012 through March 7, 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year |

|

Average(1) |

|

|

High |

|

|

Low |

|

| 2008 |

|

|

1.4695 |

|

|

|

1.6010 |

|

|

|

1.2446 |

|

| 2009 |

|

|

1.3955 |

|

|

|

1.5100 |

|

|

|

1.2547 |

|

| 2010 |

|

|

1.3216 |

|

|

|

1.4536 |

|

|

|

1.1959 |

|

| 2011 |

|

|

1.4002 |

|

|

|

1.4875 |

|

|

|

1.2926 |

|

| 2012 |

|

|

1.2909 |

|

|

|

1.3463 |

|

|

|

1.2062 |

|

|

|

|

|

|

|

|

|

|

| Month |

|

High |

|

|

Low |

|

| 2012 |

|

|

|

|

|

|

|

|

| July |

|

|

1.2620 |

|

|

|

1.2062 |

|

| August |

|

|

1.2583 |

|

|

|

1.2149 |

|

| September |

|

|

1.3142 |

|

|

|

1.2566 |

|

| October |

|

|

1.3133 |

|

|

|

1.2876 |

|

| November |

|

|

1.3010 |

|

|

|

1.2715 |

|

| December |

|

|

1.3260 |

|

|

|

1.2930 |

|

| 2013 |

|

|

|

|

|

|

|

|

| January |

|

|

1.3584 |

|

|

|

1.3047 |

|

| February |

|

|

1.3692 |

|

|

|

1.3054 |

|

| March (through March 7, 2013) |

|

|

1.3098 |

|

|

|

1.2988 |

|

| (1) |

The average of the applicable Noon Buying Rates on the last day of each month during the relevant period. |

The Noon Buying Rate on March 7, 2013 was US$1.3098 per €1.00.

DIVIDENDS

Dividend Distribution Policy

Dividends are jointly proposed by SAP AG’s Supervisory Board (Aufsichtsrat) and Executive Board (Vorstand) based on SAP AG’s year-end

stand-alone statutory financial statements, subject to approval by the Annual General Meeting of Shareholders. Dividends are officially declared for the prior year at SAP AG’s Annual General Meeting of Shareholders. SAP AG’s Annual General

Meeting of Shareholders usually convenes during the second quarter of each year. Dividends are usually remitted to the custodian bank on behalf of the shareholder within one business day following the Annual General Meeting of Shareholders. Record

holders of the ADRs on the dividend record date will be entitled to receive

12

Part I

Item 3

payment of the dividend declared in respect of the year for which it is declared. Cash dividends payable to such holders will be paid to the Depositary in euro and, subject to certain exceptions,

will be converted by the Depositary into U.S. dollars.

Dividends paid to holders of the ADRs may be subject to German withholding tax. See

“Item 8. Financial Information – Other Financial Information – Dividend Policy” and “Item 10. Additional Information – Taxation,” for further information.

Annual Dividends Paid and Proposed

The following table sets forth in euro the annual

dividends paid or proposed to be paid per ordinary share in respect of each of the years indicated. One SAP ADR currently represents one SAP AG ordinary share. Accordingly, the final dividend per ADR is equal to the dividend for one SAP AG ordinary

share and is dependent on the euro/U.S. dollar exchange rate. The table does not reflect tax credits that may be available to German taxpayers who receive dividend payments. If you own our ordinary shares or ADRs and if you are a U.S. resident,

refer to “Item 10. Additional Information – Taxation,” for further information.

|

|

|

|

|

|

|

|

|

| |

|

Dividend Paid per

Ordinary Share |

|

| Year Ended December 31, |

|

€ |

|

|

US$ |

|

| 2008 |

|

|

0.50 |

|

|

|

0.68 |

(1) |

| 2009 |

|

|

0.50 |

|

|

|

0.60 |

(1) |

| 2010 |

|

|

0.60 |

|

|

|

0.85 |

(1) |

| 2011 |

|

|

1.10 |

(2) |

|

|

1.38 |

(1) |

| 2012 (proposed) |

|

|

0.85 |

(3) |

|

|

1.11 |

(3),(4) |

| (1) |

Translated for the convenience of the reader from euro into U.S. dollars at the Noon Buying Rate for converting euro into U.S. dollars on the dividend

payment date. The Depositary is required to convert any dividend payments received from SAP as promptly as practicable upon receipt. |

| (2) |

Thereof a special dividend of €0.35 per share to celebrate our

40th anniversary. |

| (3) |

Subject to approval at the Annual General Meeting of Shareholders of SAP AG currently scheduled to be held on June 4, 2013.

|

| (4) |

Translated for the convenience of the reader from euro into U.S. dollars at the Noon Buying Rate for converting euro into U.S. dollars on March 7,

2013 of US$1.3098 per €1.00. The dividend paid may differ due to changes in the exchange rate.

|

The amount of dividends paid on the ordinary shares depends on the amount of profits to be distributed by

SAP AG, which depends in part upon our performance. In addition, the amount of dividends received by holders of ADRs may be affected by fluctuations in exchange rates (see “Item 3. Key Information – Exchange Rates”). The timing and

amount of future dividend payments will depend upon our future earnings, capital needs and other relevant factors, in each case as proposed by the Executive Board and the Supervisory Board of SAP AG and approved by the Annual General Meeting of

Shareholders.

RISK FACTORS

Economic, Political, Social, and Regulatory Risk

Uncertainty in the global economy,

financial markets, or political conditions could have a negative impact on our business, financial position, profit, and cash flows and put pressure on our operating profit.

The ability of our customers to invest in our products is dependent on current economic, financial, and political conditions. In the mid- to long-term, events such as a global economic crisis, shifts in

government policy, fluctuations in national currencies, a potential euro area break-up, U.S. or European recession, or increasing sovereign debts, could negatively impact our customers’ ability and willingness to make investments in our

products and services. These events could reduce the demand for SAP software and services, and lead to the following:

| • |

|

Delayed purchases, decreased deal size, or cancelations of proposed investments |

| • |

|

Higher credit barriers for customers, reducing their ability to finance software purchases |

| • |

|

Increased number of bankruptcies among customers, business partners, and key suppliers |

| • |

|

Increased default risk, which may lead to significant impairment charges in the future |

| • |

|

Market disruption from aggressive competitive behavior, acquisitions, or business practices |

| • |

|

Increased price competition and demand for cheaper products and services

|

13

Part I

Item 3

Economic, financial, or political uncertainty could therefore cause a decline in our revenue and operating

profit. As a result, we could fail to achieve our operating profit target.

Our international business activities expose us to numerous and

potentially conflicting regulatory requirements, and risks which could harm our business, financial position, profit, and cash flows.

We

currently market our products and services in more than 130 countries in the APJ, EMEA, Latin America, and North America regions. Sales in these countries are subject to numerous risks inherent in international business operations. Among others,

these risks include:

| • |

|

Conflict and overlap among tax regimes |

| • |

|

Possible tax constraints impeding business operations in certain countries |

| • |

|

Expenses associated with the localization of our products and compliance with local regulatory requirements |

| • |

|

Operational difficulties in countries with a high corruption perception index |

| • |

|

Protectionist trade policies |

| • |

|

Regulations for import and export |

| • |

|

Works councils, labor unions, and immigration laws in different countries |

| • |

|

Data protection and privacy in regard to access by foreign authorities to customer, partner, or employee data |

| • |

|

Country-specific software certification requirements |

As we expand further into new countries and markets, these risks could intensify. One or more of these factors could negatively impact our operations globally or in one or more countries or regions.

Overall, we could fail to achieve our revenue target.

Social and political instability caused by terrorist attacks, civil unrest, war, or international

hostilities as well as pandemic disease outbreaks or natural disasters may disrupt SAP’s business operations.

Terrorist attacks and

other acts of violence or war, civil and political unrest (such as in the Middle East), or natural disasters (such as “Superstorm Sandy” or similar events) could have a significant negative impact on the related economy or beyond. An event

that results, for example, in the loss of a significant number of our employees, or in the disruption or disablement of operations at our locations, could affect our ability to provide business services. Furthermore, this could have a significant

negative impact on our partners as well as our customers and their investment decisions, which could prevent us from achieving our future revenue and operating profit target.

Market Risks

Our established customers might not buy additional software

solutions, renew maintenance agreements, purchase additional professional services, or they might switch to other products or service offerings (including competitive products).

In 2012, we offered a wide range of support services including SAP MaxAttention, SAP Enterprise Support, and SAP Product Support for Large Enterprises. We continue to depend materially on the success of

our support portfolio and on our ability to deliver high-quality services. Traditionally, our large installed customer base generates additional new software, maintenance, consulting, and training revenue. Existing customers might cancel or not

renew their maintenance contracts, decide not to buy additional products and services, switch to subscription models, or accept alternative offerings from other vendors so that we could fail to achieve our maintenance-related revenue and operating

profit target.

14

Part I

Item 3

The market for our Cloud product portfolio depends on widespread adoption of cloud solutions instead of

on-premise solutions. The market for cloud solutions is at a relatively early stage of development. As a result, if it does not develop or develops more slowly than we expect, our business could be harmed.

The market for cloud computing is at an early stage relative to on-premise solutions. Cloud applications may not achieve and sustain high levels of

demand and market acceptance. Our success will depend on the willingness of organizations to increase their use of software as a service. Many companies have invested substantial personnel and financial resources to integrate traditional enterprise

software into their businesses, and therefore may be reluctant or unwilling to migrate to the cloud. We have encountered customers who were unwilling to subscribe to our Cloud product portfolio because they could not install it on their premises.

Other factors that could affect the market acceptance of cloud solutions include:

| • |

|

Perceived security capabilities and reliability |

| • |

|

Perceived concerns about the ability to scale operations for large enterprise customers |

| • |

|

Concerns with entrusting a third party to store and manage critical employee or company-confidential data |

| • |

|

The level of configurability or customizability of the software |

If organizations do not perceive the benefits of cloud computing, the market for our cloud business might not develop further, or it may develop more slowly than we expect, either of which would adversely

affect our business.

Our market share and profit could decline due to intense competition, consolidation, and technological innovation in

the software industry.

The software industry continues to evolve rapidly and currently is undergoing a significant shift due to

innovations in the areas of mobile, Big Data, cloud computing, and social media. While smaller innovative companies tend to create new markets continuously, large traditional IT vendors tend to enter such markets mostly through acquisitions.

In 2012, most merger and acquisition activities within the software industry were in cloud computing, social media, database and technology, and analytics. Therefore, SAP is facing increased

competition in its business environment from traditional as well as new competitors. This could result in increased price pressure, cost increases, and loss of market share and could negatively impact the achievement of our future operating profit

target.

Business Strategy Risks

Demand for our new solutions may not develop as planned and our strategy on new business models and flexible consumption models may not be successful.

Our customers are looking to take advantage of technological breakthroughs from SAP without compromising their previous IT investments. Thus, our

customers might not realize the expected benefits from these previous investments. Additionally, the introduction of new SAP solutions, technologies, and business models are subject to uncertainties. Therefore, customers might wait for reference

customers first, which might lead to a lower level of adoption of our new solutions and business models or no adoption at all.

Our Cloud

organization recognizes subscription and support revenue from our customers over the term of their agreements, and our business depends substantially on customers renewing their agreements and purchasing additional modules or users from us. Also,

any downturns or upturns in cloud sales may not be immediately reflected in our operating results, and any decline in our customer renewals would harm the future operating results of the cloud business.

We recognize cloud subscription and support revenue over the duration of our cloud business customer agreements, which typically range from one to three

years with some up to five years. As a result, most of the respective revenue recognized in a given period originates from agreements entered into in earlier periods. Consequently, a shortfall in demand for our Cloud portfolio in any period may not

significantly impact our cloud subscription and support

15

Part I

Item 3

revenue for that quarter, but could negatively affect targeted cloud subscription and support revenue in future periods.

To maintain or improve our operating results in the cloud business, it is important that our customers renew their agreements with us when the initial contract term expires and purchase additional modules

or additional users. Our customers have no obligation to renew their subscriptions after the initial subscription period, and we cannot assure that customers will renew subscriptions at the same or higher level of service, if at all.

Our customers’ renewal rates may decline or fluctuate as a result of a number of factors, including their satisfaction or dissatisfaction with our

cloud product portfolio, our customer support, our pricing, the prices of competing products or services, mergers and acquisitions affecting our customer base, the effects of global economic conditions, or reductions in our customers’ spending

levels. If our customers do not renew their subscriptions, renew on less favorable terms, or fail to purchase additional modules or users, our revenue and billings may decline, and we may not realize significantly improved operating results from our

customer base.