TABLE OF CONTENTS

INTERIM REPORT JANUARY — JUNE 2012

| INTRODUCTORY NOTES |

3 | |||

| HALF-YEAR FINANCIAL STATEMENTS (UNAUDITED) |

||||

| Interim Management Report |

4 | |||

| Consolidated Interim Financial Statements — IFRS |

26 | |||

| Responsibility Statement |

49 | |||

| SUPPLEMENTARY FINANCIAL INFORMATION (UNAUDITED) |

||||

| IFRS and Non-IFRS Financial Data |

50 | |||

| Multi-Quarter Summary |

54 | |||

| ADDITIONAL INFORMATION |

||||

| Financial Calendar, Investor Services, Addresses, and Imprint |

55 | |||

Introductory Notes

This interim group report meets the requirements of German Accounting Standard No. 16 Zwischenberichterstattung (DRS 16). We prepared the financial data in the Half-Year Financial Statements (Unaudited) section for SAP AG and its subsidiaries in accordance with International Financial Reporting Standards (IFRSs) of the International Accounting Standards Board (IASB) and the respective interpretations by the International Financial Reporting Interpretations Committee (IFRIC) endorsed by the European Union (EU) up to June 30, 2012. This does not apply to numbers expressly identified as non-IFRS. For additional IFRS and non-IFRS information, see the Supplementary Financial Information (Unaudited) section.

This interim group report complies with the legal requirements in accordance with the German Securities Trading Act (Wertpapierhandelsgesetz, WpHG) for a half-year financial report, and comprises the interim review of SAP Group operations, condensed interim consolidated financial statements, and the responsibility statement in accordance with the German Securities Trading Act, section 37w (2).

All of the information in this interim group report is unaudited. This means the information has been subject neither to any audit nor to any review by an independent auditor.

| 3 |

INTERIM MANAGEMENT REPORT

BASIS OF PRESENTATION

Forward-Looking Statements

This half-year financial report contains forward-looking statements and information based on the beliefs of, and assumptions made by, our management using information currently available to them. Any statements contained in this half-year financial report that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. We have based these forward-looking statements on our current expectations, assumptions, and projections about future conditions and events. As a result, our forward-looking statements and information are subject to uncertainties and risks, many of which are beyond our control. If one or more of these uncertainties or risks materializes, or if management’s underlying assumptions prove incorrect, our actual results could differ materially from those described in or inferred from our forward-looking statements and information.

We describe these risks and uncertainties in the Risk and Opportunity Management section, respectively in the there mentioned sources.

The words “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “counting on,” “development,” “is confident,” “estimate,” “expect,” “forecast,” ”future trends,” “guidance,” “intend,” “may,” ”might,” “outlook,” “plan,” “project,” “predict,” “seek,” “should,” “strategy,” “want,” “will,” “would,” and similar expressions as they relate to us are intended to identify such forward-looking statements. Such statements include, for example, those made in the Operating Results section, the Risk and Opportunity Management section, our Forecast for SAP, and other forward-looking information appearing in other parts of this half-year financial report. To fully consider the factors that could affect our future financial results both our Annual Report for December 31, 2011, and Annual Report on Form 20-F for December 31, 2011, should be considered, as well as all of our other filings with the Securities and Exchange Commission (SEC). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date specified or the date of this report. Except where legally required, we undertake no obligation to publicly update or revise any forward-looking statements as a result of new information that we receive about conditions that existed upon issuance of this report, future events, or otherwise unless we are required to do so by law.

Statistical Data

This report includes statistical data about the IT industry and global economic trends that comes from information published by sources including International Data Corporation (IDC), a provider of market information and advisory services for the information technology, telecommunications, and consumer technology markets; the European Central Bank; the International Monetary Fund; the Organisation for Economic Co-operation and Development; and the German Federal Bank. This type of data represents only the estimates of these respective information sources. SAP does not adopt or endorse any of this statistical information. In addition, although we believe that data from these companies is generally reliable, these data could be imprecise. We caution readers not to place undue reliance on this data.

All of the information in this report relates to the situation on June 30, 2012, or the half year ended on that date unless otherwise stated.

Non-IFRS Financial Information

This half-year financial report contains non-IFRS measures as well as financial data prepared in accordance with IFRS. We present and discuss the reconciliation of these non-IFRS measures to IFRS measures in the Supplementary Financial Information (Unaudited) section. For more information about non-IFRS measures, see www.sap.com/corporate-en/investors/newsandreports/reporting-framework.epx.

| 4 | INTERIM MANAGEMENT REPORT |

ECONOMIC CONDITIONS

Global Economic Trends

Global economic growth has weakend slightly in the first half of 2012 .In the second quarter, the economic plight of several European countries, for example, has proved detrimental.

In most of the industrialized countries outside the euro zone, economic growth was low. Restrictive political measures and weaker domestic and export demand caused the economy to slow somewhat in the emerging markets. But the economy remained stable in the emerging markets and thus was a solid contributor to worldwide growth.

A look into the regions

The situation in the euro zone defined the picture in the Europe, Middle East, and Africa (EMEA) region: Gross domestic product (GDP) in the euro zone did not change in the first quarter but waned slightly in the second quarter. This in turn increased market uncertainty and burdened confidence in the economy. The German economy was nevertheless able to record positive growth rates for the first half of the year.

The Americas region was characterized by moderate economic growth in the United States, where demand from the private sector increased. Consumers thus proved to be the new drivers of economic growth – a role previously played by government stimulus programs.

The Asia Pacific Japan (APJ) region experienced a convergence of opposites: On the one hand, the Japanese economy began to grow again following the 2011 recession, primarily due to consumer and government spending. On the other hand, the Chinese economy started in the first half of the year on an unusually weak note – sluggish demand from the euro zone affected its export trade and resulted in the slowest growth rate since the beginning of 2009.

The IT Market

In the first half of 2012, the global IT market grew in the mid-single digit percentage range. Growth was somewhat slower than in 2011 but in the expected range. Reason is primarily the unexpectedly strong growth seen in the previous year. This was particularly evident in the United States, where in 2011 IT spending growth reached its highest level in ten years. Growth rates for IT spending were far above the global average in the first two quarters of 2012 as well, albeit at a lower level than in the previous year.

The mobile devices and applications segment was the main driver of growth in the IT market in the first six months of the year. The level of growth would have been several percentage points lower without this contribution. The non-mobile hardware market stabilized and ended the period growing faster than other market segments. Growth in the software segment was steady.

A look into the regions

First-half the Europe, Middle East, and Africa (EMEA) region IT market growth was minimal. It was held back by the debt crisis in Western Europe. Many companies reduced their IT spending and governments canceled or renegotiated IT contracts.

Half-year IT spending growth in the Americas region was higher than the global average in all market segments. The Latin American markets recorded double-digit growth, compensating the weaker performance in North America.

In the Asia Pacific Japan (APJ) region, the hardware market was particularly strong in the first half of the year and gained some ground on software and services compared with the previous year. IT growth stagnated in Japan, where spending increased only in the software segment, by a few percentage points. By contrast, the emerging markets, particularly in China (albeit at a declining rate) and India, continued to record double-digit growth.

MISSION AND STRATEGY

In the first six months of 2012, we had no changes in our mission or our strategy. For a detailed description of our mission and strategy, see page 69 and the subsequent pages in our 2011 Annual Report and item 4 in our 2011 Annual Report on Form 20-F.

| INTERIM REPORT JANUARY – JUNE 2012 | 5 |

SAP CELEBRATES 40 YEARS OF INNOVATION

Forty years ago, five visionaries – Hasso Plattner, Dietmar Hopp, Klaus Tschira, Hans-Werner Hector, and Claus Wellenreuther – had an idea to help companies run their businesses better, faster, and more efficiently using software solutions. On April 1, 1972, they founded a company called Systemanalyse und Programmentwicklung, a small enterprise that would later become known as SAP.

Today, SAP AG is the market leader in enterprise application software, employing 60,972 people in over 50 countries and serving more than 195,000 customers worldwide. Three in four Forbes 500 companies run SAP software, which powers 80% of the companies on the Dow Jones Sustainability Index and 85% of the top 100 most valued brands in the world. SAP’s theme for its anniversary year is Forty Years of Helping the World Run Better and We’re Just Getting Started.

On April 29, 2012, SAP celebrated its 40th anniversary with a Gala Charity Concert at the National Theater in Mannheim, Germany. Guest of honor was Queen Silvia of Sweden, founder and patron of the World Childhood Foundation, of which SAP is a founding member. Over €200,000 was raised for the charity, which is dedicated to providing education and opportunities to marginalized children.

To help spur entrepreneurship in emerging economies, SAP and Ashoka Changemakers have invited entrepreneurs to participate in a global competition: The Power of Small: Entrepreneurs Strengthening Local Economies. The competition seeks organizations and partnerships that have innovative strategies to help emerging entrepreneurs and small businesses thrive in underserved communities. All finalists will be invited to SAPPHIRE NOW in Madrid, Spain, from November 13 to 15, 2012, where four winners will be announced. Winners will receive a cash prize, a technology donation, as well as promotion and networking opportunities with SAP executives and SAP customers at SAPPHIRE NOW.

Further activities during this anniversary year include the launch of Project Inspiration, an interactive exhibit at headquarters in Walldorf that highlights SAP’s spirit of innovation, and a Web magazine named SAP Milestones. Employees around the globe have been invited to participate in numerous initiatives, and the Company also expanded its 2012 employee share matching plan in celebration of the anniversary.

| 6 | INTERIM MANAGEMENT REPORT |

PORTFOLIO OF SOFTWARE AND SERVICES

In the first half of 2012, we added to our portfolio of software and services. For a detailed description of our portfolio of software and services, see page 76 and the subsequent pages in our 2011 Annual Report and item 4 in our 2011 Annual Report on Form 20-F.

Held in Orlando, Florida, May 14 to 16, 2012, this year’s SAPPHIRE NOW connected more than 75,000 attendees on site, online, and through social media. The message for attendees was clear – SAP is for every company, every person, and every type of data. SAP is committed to solving previously unsolvable business problems and helping companies succeed in the intelligence economy.

Applications

In late May we announced a series of innovations to our line of business finance offerings that aim to improve processes used to conduct financial close and external reporting. Enhancements to the SAP Disclosure Management application and SAP Financial Closing cockpit are intended to deliver increased process efficiency, greater accuracy as well as savings in cost and time.

During the second quarter, we were named by Gartner Inc. as the overall leader in worldwide supply chain management solutions. According to Gartner’s report, Market Snapshot: Supply Chain Management Software, Worldwide, 2011, SAP continues to rank at No. 1 based on revenue.

Similarly, Gartner named SAP the overall market share leader in the worldwide customer relationship management (CRM) market. According to the firm’s report, Market Share Snapshot: CRM Software, 2011, SAP remained No. 1 with 19.3% of the total CRM market based on revenue for 2011, which grew 16.3% compared to 2010.

SAP was also identified as a leader in IDC’s Worldwide Financial Performance, Strategy Management, and GRC Applications 2011 Vendor Shares report.

Following its commitment to deliver regular and digestible innovation to customers, in February SAP announced the second wave of extensive usability and functionality improvements for industry and line-of-business solutions. Launched in October 2011, the accelerated delivery model for SAP Business Suite software allows the delivery of incremental updates without disrupting customers’ business. The innovations will include new user experiences for professional and casual users.

Analytics

At SAPPHIRE NOW in May, we announced SAP Visual Intelligence, software that allows employees and lines of business to creatively visualize and analyze information and apply it to individual and group decision-making. A desktop version of SAP BusinessObjects Explorer software, SAP Visual Intelligence is powered by the SAP HANA platform and empowers users to perform data discovery regardless of their technical skills.

In April, SAP announced SAP BusinessObjects Predictive Analysis software. The new offering aims to equip more people with a tool for predictive modeling and advanced visualization. The software is intended to harness the full value of “big data” when coupled with the power and speed of the SAP HANA platform, enabling organizations to reveal untapped opportunities and hidden risks and act upon them. Customers use the software for insight into large volumes of data. Examples include understanding how historical sales and costs can translate to future performance; comparing predicted results to goals; revealing the causes of customer dissatisfaction and employee turnover; showing how past and emerging trends impact the bottom line.

In March, SAP announced support for the SAP HANA platform from the SAP Planning and Consolidation application version for SAP NetWeaver. The power of SAP HANA dramatically enhances unified planning, budgeting, forecasting, and consolidation processes.

Also in March, we announced the availability of SAP Financial and Controlling Accelerator software powered by the SAP HANA platform. The software enables customers to leverage data effectively in order to gain a competitive edge while unlocking opportunities to improve financial performance. To help ensure quicker time to value, SAP Finance and Controlling Accelerator is available as a rapid-deployment solution.

In February, SAP won two governance, risk and compliance (GRC) Technology Innovation awards from Corporate Integrity, a respected analyst firm. The awards recognized SAP’s “bow-tie” builder, which is part of the SAP Risk Management application; and SAP’s Mobile GRC applications, which include the SAP GRC Access Approver and the SAP GRC Policy Survey. SAP was the only vendor to receive more than one award this year.

| INTERIM REPORT JANUARY – JUNE 2012 | 7 |

Earlier this year, the SAP Planning and Consolidation application was awarded the top mark of “especially excellent” by the EBS Executive Education program of the EBS University of Business and Law in Wiesbaden, Germany.

Mobile

At SAPPHIRE NOW in May, SAP and Capgemini announced an agreement to co-develop a mobile sales execution solution and a joint go-to-market plan for the next five years. This follows the mobility agreement Capgemini signed with SAP and Sybase in September 2011. SAP and Capgemini will design a mobile application for companies selling products via mobile direct store delivery. The solution is expected to be based on the Sybase Unwired Platform.

Also at SAPPHIRE NOW, we announced a new wave of mobile apps designed to help people work more efficiently. With the help of a thriving partner ecosystem, the new SAP mobile apps provide real-time mobile access to human resources, sustainability, finance, sales, and mobile commerce functions. This includes updated versions of existing SAP mobile apps available on more mobile platforms, including Apple, Android and RIM BlackBerry. The new mobile apps extend SAP’s commitment to drive mobile innovation from the enterprise to consumers.

SAP and Amazon chose SAPPHIRE NOW as the forum to announce that the SAP Afaria mobile device management solution is available on Amazon Web Services (AWS) Marketplace, providing a convenient, reliable and cost-effective way for customers to effectively manage and secure their enterprise mobile applications and corporate-liable and personally-owned devices. The availability of the fully configured SAP Afaria 7.0 server on the AWS Marketplace gives customers the ability to immediately take advantage of a comprehensive mobile management platform with the click of a mouse.

The 7.0 release of Afaria was unveiled in late February at the 2012 Mobile World Congress in Barcelona. With this release, SAP aims to allow enterprise IT to more effectively manage mobile applications and devices through a new user interface (UI) for simplified administration, improved workflow, and enterprise integration capabilities.

With enterprises mobilizing more key business functions and allowing employees to work at anytime and from anywhere via mobile devices, managing and securing these mobile environments has never been more critical. The new release of Afaria provides a consumer-like mobile experience in the enterprise while simplifying management and reducing IT costs.

Innovations like these helped position SAP in the leaders quadrant of Gartner’s Magic Quadrant for Mobile Application Development Platforms report. In its May report, Gartner recognized SAP as a market leader for its ability to execute and completeness of vision.

Database and Technology

In mid-June, we proudly looked back on the first year of SAP HANA. Major milestones achieved in the past 12 months include: more than 350 customers; over 150 implemented projects; 16 customers with more than 10,000-times performance improvement over disk-based databases.

At SAPPHIRE NOW in May, SAP announced the continued expansion of the capabilities and scale of the SAP HANA platform to ease developer adoption. This included the release of service pack 4, new access to a development sandbox for SAP HANA in the cloud via AWS, and the next step in a program encouraging startups to develop on SAP HANA.

We also announced new applications built on the SAP HANA platform at SAPPHIRE NOW. These real-time solutions aim to help customers drive new business value with advanced reporting, analysis and planning capabilities in the context of their lines of business and industries. They include the SAP Sales and Operations Planning application, the SAP Cash Forecasting analytic application, the SAP Planning and Consolidation application, the SAP Collections Insight analytic application, the SAP Sales Pipeline Analysis analytic content, the SAP Bank Analyzer rapid-deployment solution for financial reporting with SAP HANA, the SAP Deposits Management rapid-deployment solution for transaction history analysis with SAP HANA, and the SAP Supplier InfoNet site.

In April, SAP announced its innovation road map to help transform the database and mobile markets. At a press conference held in San Francisco, we unveiled our vision for the SAP real-time data platform, comprising the SAP HANA platform, Sybase data management offerings, and SAP solutions for enterprise information management.

Among the provisions of the road map, SAP Sybase ASE is intended as a supported option for SAP Business Suite applications while SAP HANA is

| 8 | INTERIM MANAGEMENT REPORT |

planned to augment the extreme transactions of SAP Sybase ASE with real-time reporting capabilities. In addition, SAP Sybase IQ is envisioned to share common capabilities and life-cycle management with the SAP HANA platform.

In February, we announced two new offerings that will deliver the benefits of the SAP HANA platform to small businesses and midsize enterprises (SMEs).

With analytics powered by SAP HANA for the SAP Business One application and SAP HANA, Edge edition, SMEs will be able to leverage powerful in-memory technology from SAP. By helping organizations act on information as it happens, SAP HANA revolutionizes decision-making, by increasing the speed of existing processes and accessing large amounts of data in shorter periods of time.

Analytics powered by SAP HANA for SAP Business One are intended to provide a cost-effective new combination of a special product version of SAP HANA designed with the needs of small businesses in mind. Targeted at companies using SAP Business One, the channel-only solution aims to offer a small-scale, easy-to-use SAP HANA-based application including operational reporting with SAP Crystal Reports software.

Also in February, SAP announced that Sybase has been positioned by Gartner, Inc. in the leaders quadrant of the Magic Quadrant for Data Warehouse Database Management System report based on evaluation of Sybase IQ software. As the world’s leading column-based enterprise data warehouse, with more than 2,100 customers in more than 4,000 projects worldwide, Sybase IQ delivers faster, more accurate results for mission-critical business intelligence (BI), data warehousing, predictive analytics and reporting solutions on industry standard hardware and operating systems to enterprises across the globe. In combination with BI technology from SAP, Sybase IQ provides a comprehensive data warehousing and database platform to meet customer needs.

In March, we won the 2012 German Innovation Award, in the Large Company category, for our SAP HANA software. The award honors outstanding pioneer innovations of German companies whose innovative drive help change businesses and markets. It was set up by the German Innovation Award initiative, whose partners include the companies Accenture GmbH, EnBW Energie Baden-Württemberg AG, Evonik Industries AG, and the German publication WirtschaftsWoche.

We also took steps to make SAP HANA more affordable and accessible to a wide range of customers. For example, one SAP customer deployed SAP HANA in just 16 days using SAP ERP rapid-deployment solution for operational reporting with SAP HANA.

Cloud

In the first quarter, we reported on enhancements to our cloud offerings that were made possible by our acquisition of SuccessFactors in February. With SuccessFactors founder and CEO Lars Dalgaard at its helm, the newly formed Cloud business unit, serving more than 17 million users, will concentrate on four solution areas aimed at helping customers manage their most business-critical assets and relationships. The cloud portfolio will focus on the following solution areas: employees, financials, customers, and suppliers.

Announced at SAPPHIRE NOW in Orlando, these solutions are planned to be offered in a consistent way and seamlessly integrated into enterprise resource planning (ERP) business software.

SAP plans to deliver its cloud solutions as a set of best-of-breed applications. We plan to offer customers the choice and flexibility to adopt these applications at their own pace, as their business needs evolve. When used together, these applications offer the value of a single solution with a consistent user and customer experience, process and data integrity.

In March, SAP announced several more key updates across its growing portfolio of cloud offerings, including line-of-business application services. New and existing customers alike are responding to our set of cloud solutions, including SAP Sourcing OnDemand, SAP Sales OnDemand and SAP Travel OnDemand.

In February, SAP and SuccessFactors announced their unified product direction for human capital management (HCM) solutions. The combined portfolio will provide end-to-end integrated solutions to help with some of the biggest challenges that companies around the world are facing across all lines of business: managing their talent and turning their strategies into actions and results.

SuccessFactors will continue to support an open approach to connecting with third-party solution providers. Approximately 14% of SuccessFactors customers currently run their systems side-by-side with SAP software. In addition to providing enhanced value for joint customers, SAP and

| INTERIM REPORT JANUARY – JUNE 2012 | 9 |

SuccessFactors will accelerate the development of integration solutions with third-party solution providers.

Our cloud-based SAP Business ByDesign solution became generally available in February 2012. As larger clients adopt the solution for their subsidiary operations in increasing numbers, SAP Business ByDesign continues to broaden its capabilities and integration scenarios for subsidiaries, as well as implementing additional SAP Best Practices packages to improve implementation and provide greater consistency than ever before. SAP Business ByDesign clients can now adapt and configure the system to industries without customization, and customers can access the system from anywhere via mobile and Web devices.

Generally available since July 2011 and designed to empower salespeople to sell more effectively, the SAP Sales OnDemand solution continues on a rapid pace of innovation. With a third wave released in only nine months, the solution now offers native integration with the SAP CRM application, support of further mobile devices and languages including Italian and Portuguese.

SAP also announced the SAP Business One OnDemand solution, a new cloud offering hosted by partners that aims to build upon the broad market success of the SAP Business One application, addressing small enterprise preferences for minimal up-front cost and lower IT operations.

Industries

One of the ways we deliver real innovation to customers is through our deep industry expertise. Through our expertise in 24 industries, we help customers to implement software innovations to realize more value from their business. In the second quarter, we performed strongly in financial services, retail, and professional services.

In June, SAP announced new rapid-deployment solutions for banks that simplify and accelerate the implementation of technology and banking practices. SAP Rapid Deployment solutions address a need for banks to be flexible in competitive markets following the financial crisis. During the second quarter, SAP offered a total of 35 new rapid deployment solutions for applications ranging from supply chain management to human resources.

In May, SAP announced the availability of the SAP Situation Awareness rapid-deployment solution for public sector with SAP HANA. The new solution provides real-time situational awareness to police and first responders as they deal with crime and emergencies.

At SAPPHIRE NOW, SAP announced that it will work closely with Citi and The Royal Bank of Scotland (RBS) to co-innovate a cloud-based services platform. The interoperable, multi-bank platform aims to seamlessly integrate banks with their corporate customers. A combination of SAP’s expertise in enterprise resource planning, treasury management software and new cloud services technologies is driving the solution development. Together with the industry expertise and global networks of Citi and RBS, SAP aims to deliver a new, innovative solution to the corporate banking marketplace.

In January, SAP announced a strategic expansion of its solution portfolio for retail organizations. The enhanced SAP Forecasting and Replenishment application enables retailers and other consumer-facing companies to analyze consumer demand in real time and to manage their supply chains accordingly. It is in general availability since the second quarter of 2012.

In the same month, we introduced the SAP Sales Analysis for Retail analytic application powered by the SAP HANA platform. The application aims to offer prebuilt data models, key performance indicators (KPIs), role-specific dashboards, and customized reports to provide retailers with a deeper understanding of all factors influencing the merchandizing life cycle.

As the retail industry is inundated with large volumes of data, businesses need accurate insight into customer demand, along with a clear understanding of the impact of their promotions on stock levels and profits. SAP HANA provides retailers with real-time access to critical information and allows for real-time interactive analysis not possible with traditional database technology. For retailers operating in separate sales, inventory and promotions systems, SAP Sales Analysis for Retail aims to provide the integration needed for vastly improved scalability and performance.

Also in January, SAP was positioned by Gartner Inc. in the leaders quadrant of the 2011 Magic Quadrant for International Retail Core Banking report. The report recognized SAP for its “ability to execute” and its “completeness of vision.” This recognition demonstrates SAP’s strong position in the bank technology ecosystem and how SAP’s integrated approach to standardized core banking systems continues to resonate with banks.

| 10 | INTERIM MANAGEMENT REPORT |

CUSTOMERS

Here are some examples of key customer wins in the second quarter: Crocs, a leading maker of footwear, chose to move to SAP from their existing software vendor. Japan Post Holdings, replaced their Oracle system with SAP BusinessObjects software. TUI Travel, plc plans to replace its existing financial system in the UK and Central European subsidiaries. Grupo Pao de Acucar, a Brazilian retailer, chose our SAP HANA and mobile innovations. Canadian Pacific, a Canadian rail company, chose Sybase ASE. The NBA – the professional basketball league in the United States – selected SAP’s analytics solutions.

RESEARCH AND DEVELOPMENT

Our total research and development expense rose by 13% to €1,091 million in the first six months of 2012 compared to €966 million in the corresponding period in 2011.

The amounts for 2012 include R&D expense for SuccessFactors, but the comparator amounts for 2011 do not include SuccessFactors numbers.

On our IFRS numbers, the portion of total revenue we spent on research and development in the first six months of 2012 was 15.1%, which is 0.2 percentage points less than the 15.3% recorded for the first six months of 2011. Despite our acquisition of SuccessFactors, on the non-IFRS numbers, the portion of total revenue we spent on R&D in the first six months of 2012 was 14.1%, a 0.5 percentage point decrease in comparison with the portion in the first six months of the previous year, which was 14.6%.

We had 17.331 full-time equivalent (FTE) employees working in research and development teams on June 30, 2012, an increase of 9% compared with June 30, 2011 (June 30, 2011: 15,898; December 31, 2011: 15,861). This growth reflects mainly the addition of research and development employees from SuccessFactors.

At the end of 2011, we announced the opening of our innovation center in Skolkovo, Russia. We will have 70 employees there by the end of 2012; this number will increase to 250 by the end of 2015. SAP plans to invest around €45 million in the new innovation center by 2015. The experts in this new SAP Labs location do research and development primarily in the areas of in-memory computing, analytics, and security of mobile networks.

In addition, we opened an SAP development center in Singapore in January 2012, in a joint project with the Singapore Economic Development Board (EDB) and the National Research Foundation (NRF). The center is one of the largest of its kind in the world. It functions as the center for coordinating all research and development activities of SAP in the Asia-Pacific-Japan region.

Accenture and SAP opened an Innovation Center for SAP Solutions in Beijing, China in May 2012. The center brings together Accenture’s functional and industry expertise with innovative business solutions based on SAP technologies, including the SAP HANA platform, advanced analytics, mobility and cloud computing. The center is designed to help organizations glean deeper insights from data, improve decision-making processes, and embrace the power of SAP HANA and mobile technologies to deliver information anytime, anywhere.

The innovation center in Beijing will localize the solutions that can be applied to help address China’s growing business demands in all industries and will showcase how Chinese customers can benefit from the innovation developments to improve company performance.

An integral part of the center is Accenture’s “Day in the Life” scenarios for a large variety of industries and businesses including telecom, retail, utility, chemical, consumer goods and service, and mining. These scenarios create an immersive environment that showcases how technologies and solutions are used in the execution of industry-specific business processes and helps our customers envision the art of the possible, supports them in developing a technology roadmap to sustain their innovation agenda and allows them to validate their business case through ‘try and buy’ proof of concept.

ACQUISITIONS

In February 2012, SAP acquired SuccessFactors – a provider of cloud-based human capital management solutions. With this merger, SAP seeks to strengthen its position as provider of cloud solutions, platforms, and infrastructures considerably and create an end-to-end offering of cloud and on-premise solutions for managing major business processes. For more information, see note (4) in the Notes to the Interim Financial Statements.

February 2012 also saw us acquire software and associated assets of datango AG. Software from datango AG helps companies improve their employees’ efficiency (Workforce Performance).

| INTERIM REPORT JANUARY – JUNE 2012 | 11 |

This acquisition augments our portfolio of education services software. Customers receive powerful, easy-to-use software tools for use in user training courses, knowledge management, and performance management.

In May 2012, we announced that SAP and Ariba have entered into an agreement that SAP acquire Ariba, the leading cloud-based business commerce network. The acquisition will combine Ariba’s buyer-seller collaboration network with SAP’s broad customer base and business process expertise to create new models for business-to-business collaboration in the cloud. We expect to close the acquisition at the end of the third or in the fourth quarter after all regulatory evaluations and approvals. For more information, see note (4) in the Notes to the Interim Financial Statements.

In June 2012, we acquired Syclo, a leading provider of solutions for asset management, for the field service and inventory management. The addition of Syclo’s expertise in building and selling mobile solutions in industries such as utilities, oil and gas, life sciences, and manufacturing will enhance SAP mobile solutions. Syclo has more than 600 customers in 39 countries across all major asset and mobile-intensive industries.

GROWTH PLANS FOR EMERGING MARKETS

SAP continues to invest in regions whose economies are growing – or have the potential to grow – faster than the global average.

In our 2011 Annual Report, for example, we announced our plan to invest US$2 billion in China by 2015 as part of our growth and innovation strategy. We continue to build a strong organization with solid leadership in China. In the first half of 2012, we added 200 sales professionals to our staff there and have therefore increased our sales force in China by 50%. We have also opened new offices in the cities of Beijing, Shenzhen, and Wuhan. We believe that adequate coverage is the key to success in China due to the size and structure of the country, so we have introduced a more regional and specialized sales coverage model.

We have relocated the global headquarters of our support organization to China. Since then, we have worked successfully together with major Chinese enterprises on their strategic long-term business transformation.

Accenture and SAP opened an innovation center in Beijing in May, 2012. For more information, see the Research and Development section.

In March, SAP announced a four-year plan worth US$450 million to up-skill local talent and drive sustainable innovation and growth in the Middle East and North Africa (MENA) region. The decision highlights the region as a fast-growth market and an integral part of our overall business strategy.

EMPLOYEES

Thanks chiefly to our employees’ enthusiasm, SAP is regularly recognized as an employer of choice in markets around the world. Examples of recent awards we gained are:

| • | SAP Labs listed as one of ten finalists in “India’s Best Companies for Rewards & Recognition – 2012,” a study by Great Place to Work Institute and Edenred. |

| • | SAP received “European IT Workplace of the Year 2012 Award,” from Best Quality Institute (BQI), BITKOM, and European Commission. |

| • | SAP Hungary selected in Hungary “Most Desired Employer 2012” by Aon Hewitt and AISEC. |

| • | SAP America listed in Glassdoor’s “2012 50 Best Places to Work.” |

| • | SAP Canada included in “Top 100 Employer Choices 2012” of Canadian students in the National Post. |

At the end of the first six months of 2012, we had 60,972 full-time equivalent (FTE) employees worldwide (June 30, 2011: 54,043; December 31, 2011: 55,765) – an increase of 5,207 compared to year end 2011. Of these, 2,042 are additional positions resulting from business combinations (especially SuccessFactors) in the first six months of 2012. In addition, the company increased its headcount to capture future growth opportunities.

Our overall employee headcount on June 30, 2012 included 16,531 FTEs based in Germany (June 30, 2011: 15,740; December 31, 2011: 16,011), and 12,246 based in the United States (June 30, 2011: 10,241; December 31, 2011: 10,598).

In the first six months of 2012, we introduced two new share-based compensation plans: the

| 12 | INTERIM MANAGEMENT REPORT |

Employee Participation Plan (EPP) 2015 for employees, and the Long Term Incentive Plan (LTI Plan) 2015 for Executive Board members. These two new plans acknowledge the employees’ contributions toward achieving the company’s ambitious 2015 targets. For more information, see note (14) in the Notes to the Interim Financial Statements.

ORGANIZATION AND CHANGES IN MANAGEMENT

In the middle of April 2012, the SAP Supervisory Board appointed Lars Dalgaard to the SAP Executive Board. In addition, SAP has created a Global Managing Board in May 2012 to lead the company. This body was established in addition to the SAP Executive Board, which retains ultimate responsibility for overseeing and deciding on the activities of the company. The Global Managing Board allows SAP to appoint a broader range of global leaders to help steer the organization. All Executive Board members as well as Robert Enslin will join the Global Managing Board.

After the full integration of Sybase and the recent acquisition of SuccessFactors, the establishment of the Global Managing Board will help SAP drive innovation and scale faster in its core markets as well as in new categories: mobile, database/in-memory and cloud. A re-assignment of responsibilities within this expanded leadership team will help the company further strengthen its focus on customers, growth and operational excellence.

SAP Co-CEOs Bill McDermott and Jim Hagemann Snabe will continue to concentrate on SAP’s strategy development and execution. They will oversee and drive strategy and the innovation portfolio across all markets, further deepen key relationships with customers and partners, and forge operational excellence across all board areas.

Robert Enslin will assume responsibility for all global sales and ecosystem and channel activities. He will add thrust to our go-to-market and strengthen relationships with our customers. The Global Customer Operations organization and Robert Enslin will continue to report to Bill McDermott.

Lars Dalgaard will lead the Company’s new cloud business unit, which combines all cloud assets of SAP and SuccessFactors, to drive market leadership in the cloud for businesses.

Gerd Oswald will be responsible for all on-premise delivery, including development of applications, global services, and business solutions, as well as the SAP Active Global Support organization. This will enable SAP to simplify the consumption of on-premise solutions and accelerate innovation without disruption for SAP customers.

Vishal Sikka continues to be responsible for technology and innovation. In his role as chief technology officer (CTO), he is responsible for all technology of the Company as well as for research and incubation. He specifically drives development in the areas of analytics, database and technology, mobile and the flagship in-memory computing platform SAP HANA.

Werner Brandt remains chief financial officer of SAP, overseeing all finance and administration functions. He also continues as acting labor relations director and chief human resources officer. Luisa Deplazes Delgado will assume responsibility for all human resources functions after she takes up her post as Chief Human Resources Officer.

In July 2012, the Supervisory Board appointed Luisa Deplazes Delgado to the Executive Board. She will be our chief human resources officer and labor relations director from September.

Luisa Deplazes Delgado will drive and enhance our strategic people agenda, focusing on leadership development, talent development, recruitment, employee engagement, and organizational design and simplification.

| INTERIM REPORT JANUARY – JUNE 2012 | 13 |

OPERATING RESULTS, FINANCES, AND ASSETS

In the sections that follow, our operating results, finances, and assets are discussed in detail.

As a result of placing greater focus on cloud computing, we revised the presentation of our software and software-related service revenue as of January 1, 2012, and year-over-year figures have been adjusted accordingly. This creates more transparency regarding software and software-related service revenue, particularly with respect to revenue from cloud subscriptions and support. They are no longer recorded under the subscription and other software-related service revenue item, but instead shown as a separate item within the software and software-related services revenue (SSRS revenue).

Revenue from long-term license agreements and all other revenue previously shown under software and software-related service revenue have been split into their respective software and support components and recorded under the items software and support.

As a result of these adjustments, the subscription and other software-related service revenue row has been deleted, and revenue for software and for support has increased for 2011. This change is merely a reclassification that only affects items within SSRS revenue. The overall sum of SSRS revenue and thus the total revenue are not affected.

Note: In the discussion of our assets, financial position, and income, the financial data displayed for 2012 contain the revenue and expenses, assets, liabilities, and cash flows from SuccessFactors on a pro rata basis effective February 21, 2012. SuccessFactors numbers are thus not included in the data for 2011. On a stand-alone basis, SuccessFactors achieved a year-over-year increase of 112% in its 12-month subscription billings from new business (i.e. new and upsell subscription billings) in the first quarter (compared to their second quarter 2011). The respective increase in the first half of 2012 was 94 %.

Performance Against Our Outlook for 2012 (Non-IFRS)

In this section, all discussion of the first six months contribution to target achievement is based exclusively on non-IFRS measures. However, in the following section the discussion of results refers to IFRS figures only, so those figures are therefore not expressly identified as IFRS figures.

We present, discuss, and explain the reconciliation from IFRS measures to non-IFRS measures in the Supplementary Financial Information (Unaudited) section.

Operational Targets for 2012 (Non-IFRS)

For our outlook based on non-IFRS numbers, see the Forecast for SAP passage in this interim management report.

Key Figures — SAP Group 4/1/- 6/30/2012 (Non-IFRS)

| € millions, unless otherwise stated |

4/1/ - 6/30/2012 |

4/1/ - 6/30/2011 |

Change in % |

Non-IFRS Change in % (constant currency) |

||||||||||||

| Software |

1,059 | 838 | 26 | 19 | ||||||||||||

| Support |

2,014 | 1,745 | 15 | 10 | ||||||||||||

| Cloud subscriptions and support |

69 | 4 | 1,625 | 1,450 | ||||||||||||

| Software and software-related service revenue |

3,142 | 2,587 | 21 | 15 | ||||||||||||

| Total revenue |

3,916 | 3,308 | 18 | 12 | ||||||||||||

| Operating expense |

–2,743 | –2,289 | 20 | 14 | ||||||||||||

| Operating profit |

1,173 | 1,019 | 15 | 8 | ||||||||||||

| Operating margin in % |

30.0 | 30.8 | –0.8pp | –1.2pp | ||||||||||||

| Profit after tax |

831 | 703 | 18 | n.a. | ||||||||||||

| Effective tax rate in % |

25.6 | 27.2 | –1.6pp | n.a. | ||||||||||||

| Earnings per share – basic in € |

0.70 | 0.59 | 19 | n.a. | ||||||||||||

Actual Performance in the Second Quarter of 2012 (Non-IFRS)

In the second quarter of 2012, software and software-related service revenue (non-IFRS) increased 21% over the same period in the previous year to €3,142 million (Q2 2011: €2,587 million). On a constant currency basis, the increase was 15%, of which 2 percentage points were ascribable to SuccessFactors.

| 14 | INTERIM MANAGEMENT REPORT |

Included in our our non-IFRS software and software-related service revenue, our revenue from cloud subscriptions and support was €69 million (Q2 2011: €4 million), an increase of 1,625% compared to the same period in 2011. The amounts for 2012 include cloud subscriptions and cloud support revenue from SuccessFactors. The comparator amounts for 2011 do not include any revenue data from SuccessFactors.

Non-IFRS total revenue in the same period was €3,916 million (Q2 2011: €3,308 million), an increase of 18%. On a constant currency basis, the increase was 12%.

Non-IFRS operating profit was €1,173 million (Q2 2011: €1,019 million), an increase of 15% (8% at constant currencies).

The operating margin (non-IFRS) decreased 0.8 percentage points to 30.0% in the second quarter of 2012 compared to the prior year’s second quarter (Q2 2011: 30.8%). At constant currencies, the operating margin (non-IFRS) decreased by 1.2 percentage points, of which 1.0 percentage points were ascribable to the acquisition of SuccessFactors. Non-IFRS operating profit and non-IFRS operating margin for the second quarter 2012 were impacted by severance expenses which amounted to €31 million (2011: €12 million).

In the second quarter of 2012, non-IFRS profit after tax was €831 million (Q2 2011: €703 million), an increase of 18%. Non-IFRS basic earnings per share was €0.70 (Q2 2011: €0.59), an increase of 19%.

The non-IFRS effective tax rate in the second quarter of 2012 was 25.6% (Q2 2011: 27.2%). The year over year decrease in the effective tax rate mainly arises from the regional allocation of income.

Key Figures — SAP Group 1/1/-6/30/2012 (Non-IFRS)

| € millions, unless otherwise stated |

1/1/ - 6/30/2012 |

1/1/ - 6/30/2011 |

Change |

Non-IFRS Change in % |

||||||||||||

| Software |

1,696 | 1,453 | 17 | 11 | ||||||||||||

| Support |

3,968 | 3,470 | 14 | 10 | ||||||||||||

| Cloud subscriptions and support |

104 | 8 | 1,200 | 1088 | ||||||||||||

| Software and software-related service revenue |

5,768 | 4,931 | 17 | 12 | ||||||||||||

| Total revenue |

7,273 | 6,349 | 15 | 10 | ||||||||||||

| Operating expense |

–5,266 | –4,551 | 16 | 12 | ||||||||||||

| Operating profit |

2,007 | 1,798 | 12 | 6 | ||||||||||||

| Operating margin in % |

27.6 | 28.3 | –0.7pp | –1.1pp | ||||||||||||

| Profit after tax |

1,414 | 1,231 | 15 | n.a. | ||||||||||||

| Effective tax rate in % |

26.7 | 28.9 | –2.2pp | n.a. | ||||||||||||

| Earnings per share – basic in € |

1.19 | 1.04 | 14 | n.a. | ||||||||||||

Actual Performance in the First Half of 2012 (Non-IFRS)

In the first half of 2012, software and software-related service revenue (non-IFRS) increased by 17% over the same period in the previous year to €5,768 million (first half of 2011: €4,931 million). On a constant currency basis, the increase was 12 %, of which almost 2 percentage points were ascribable to SuccessFactors.

Included in our our non-IFRS software and software-related service revenue, our revenue from cloud subscriptions and support was €104 million (first half of 2011: €8 million), an increase of 1,200% compared to the same period in 2011. The amounts for 2012 include cloud subscriptions and cloud support revenue from SuccessFactors as of the acquisition date (February 21, 2012). The comparator amounts for 2011 do not include any revenue data from SuccessFactors.

Non-IFRS total revenue in the same period was €7,273 million (first half of 2011: €6,349 million), an increase of 15%. On a constant currency basis, the increase was 10%.

Non-IFRS operating profit was €2,007 million (first half of 2011: €1,798 million), an increase of 12% (6% at constant currencies).

The operating margin (non-IFRS) decreased in the first half of 2012 by 0.7 percentage points to 27.6%

| INTERIM REPORT JANUARY – JUNE 2012 | 15 |

compared to the prior year’s first half (first half of 2011: 28.3%). At constant currencies, the operating margin (non-IFRS) decreased by 1.1 percentage points to 27.2%, of which 0.8 percentage points were ascribable to the acquisition of SuccessFactors. Non-IFRS operating profit and non-IFRS operating margin for the first half of 2012 were impacted by severance expenses which amounted to €41 million (2011: €25 million).

In the first half of 2012 non-IFRS profit after tax was €1,414 million (first half of 2011: €1,231 million), an increase of 15%. Non-IFRS basic earnings per share was €1.19 (first half of 2011: €1.04), an increase of 14%. The non-IFRS effective tax rate in the first half of 2012 was 26.7% (first half of 2011: 28.9%). The year over year decrease in the effective tax rate mainly arises from the regional allocation of income.

| 16 | INTERIM MANAGEMENT REPORT |

Key Figures SAP Group in the Second Quarter of 2012 (IFRS)

| € millions, unless otherwise stated |

4/1/ - 6/30/2012 |

4/1/ - 6/30/2011 |

Change | Change in % |

||||||||||||

| Software |

1,059 | 838 | 221 | 26 | ||||||||||||

| Support |

2,013 | 1,737 | 276 | 16 | ||||||||||||

| Cloud subscriptions and support |

52 | 4 | 48 | 1,200 | ||||||||||||

| Software and software-related service revenue |

3,124 | 2,579 | 545 | 21 | ||||||||||||

| Total revenue |

3,898 | 3,300 | 598 | 18 | ||||||||||||

| Operating expense |

–2,977 | –2,443 | –534 | 22 | ||||||||||||

| Operating profit |

921 | 857 | 64 | 7 | ||||||||||||

| Operating margin in % |

23.6 | 26.0 | –2.4pp | n.a. | ||||||||||||

| Profit after tax |

661 | 588 | 73 | 12 | ||||||||||||

| Effective tax rate in % |

23.6 | 26.9 | –3.3pp | n.a. | ||||||||||||

| Headcount in full-time equivalents (June 30) |

60,972 | 54,043 | 6,929 | 13 | ||||||||||||

| Days sales outstanding in days (June 30) |

61 | 63 | –2 | –3 | ||||||||||||

| Earnings per share – basic in € |

0.55 | 0.49 | 0.06 | 12 | ||||||||||||

OPERATING RESULTS IN THE SECOND QUARTER (IFRS)

Orders

The total number of software deals we closed decreased slightly from the comparator amount in the second quarter of 2012 to 14,681 (Q2 2011: 14,826). The average value of software orders we received showed an increase of 32% compared with the previous year.

Revenue

In the second quarter of 2012, software revenue was €1,059 million (Q2 2011: €838 million), an increase of 26% compared to the same period in 2011. Software revenues in the second quarter of 2012 included amounts of €85 million (Q2 2011: €22 million) from SAP HANA and €54 million (Q2 2011: €27 million) from Mobile solutions. SAP also saw significant traction in strategic industries, with financial services and retail both growing more than 60 percent in software revenue, and solid growth across manufacturing, which grew more than 20 percent in software revenue.

Total revenue was €3,898 million (Q2 2011: €3,300 million), an increase of 18% compared to the same period in 2011.

Operating Expenses

In the second quarter of 2012, our operating expenses increased by 22% to €2,977 million (Q2 2011: €2,443 million).

The increase in operating expenses is mainly due to the increased headcount and due to increased share-based payment expenses.

Operating Profit and Margin

In the second quarter of 2012, operating profit increased by 7% over the same period in the previous year to €921 million (Q2 2011: €857 million).

Our operating margin decreased by 2.4 percentage points to 23.6 % (Q2 2011: 26.0 %). SAP introduced two new share-based compensation plans at the beginning of the year: the Employee Participation Plan (EPP) 2015 for employees, and the Long Term Incentive Plan (LTI Plan) 2015 for Executive Board members. In this context, our expenses for the share-based payment plans increased to €98 million in the second quarter of 2012 (Q2 2011: €32 million). Those expenses narrowed our operating margin in the second quarter of 2012 by 2.5 % (Q2 2011: 0.9 %).

Profit after Tax and Earnings per Share

In the second quarter of 2012 profit after tax was €661 million (Q2 2011: €588 million), an increase of 12%. Basic earnings per share was €0.55 (Q2 2011: €0.49), an increase of 12%.

The effective tax rate in the second quarter of 2012 was 23.6% (Q2 2011: 26.9%). The year over year decrease in the effective tax rate mainly arises from the regional allocation of income.

| INTERIM REPORT JANUARY – JUNE 2012 | 17 |

Key Figures SAP Group in the First Half of 2011

| € millions, unless otherwise stated |

1/1/ - 6/30/2012 |

1/1/ - 6/30/2011 |

Change | Change in % |

||||||||||||

| Software |

1,696 | 1,453 | 243 | 17 | ||||||||||||

| Support |

3,966 | 3,445 | 521 | 15 | ||||||||||||

| Cloud subscriptions and support |

81 | 8 | 73 | 913 | ||||||||||||

| Software and software-related service revenue |

5,743 | 4,906 | 837 | 17 | ||||||||||||

| Total revenue |

7,248 | 6,324 | 924 | 15 | ||||||||||||

| Operating expense |

–5,696 | –4,870 | –826 | 17 | ||||||||||||

| Operating profit |

1,551 | 1,454 | 97 | 7 | ||||||||||||

| Operating margin in % |

21.4 | 23.0 | –1.6pp | n.a. | ||||||||||||

| Profit after tax |

1,104 | 991 | 113 | 11 | ||||||||||||

| Effective tax rate in % |

25.0 | 28.6 | –3.6pp | n.a. | ||||||||||||

| Earnings per share – basic in € |

0.93 | 0.83 | 0.10 | 12 | ||||||||||||

OPERATING RESULTS (IFRS)

Orders

The total number of software deals we closed grew slightly in the first half of 2012 to 28,207 (first half of 2011: 28,116). The value of software orders we received showed an increase of 21% compared with the previous year.

Revenue

In the first half of 2012, software revenue was €1,696 million (first half of 2011: €1,453 million), an increase of 17% compared to the same period in 2011. Software revenue in the first half of 2012 included €113 million (first half of 2011: €26 million) from SAP HANA and €75 million (first half of 2011: €43 million) from Mobile solutions.

Our revenue from cloud subscriptions and support was €81 million (first half of 2011: €8 million), an increase of 913% compared to the same period in 2011. The amounts for 2012 include cloud subscriptions and cloud support revenue from SuccessFactors as of the acquisition date (February 21, 2012). The comparator amounts for 2011 do not include any revenue data from SuccessFactors.

Total revenue was €7,248 million (first half of 2011: €6,324 million), an increase of 15% compared to the same period in 2011.

Operating Expenses

In the first six months of 2012, our operating expenses increased by 17% to €5,696 million (first half of 2011: €4,870 million). The increase in operating expenses is mainly due to the increased headcount and due to increased share-based payment expenses.

Operating Profit and Margin

In the first six months of 2012, operating profit increased by 7% over the same period in the previous year to €1,551 million (first half of 2011: €1,454 million).

Our operating margin decreased by 1.6 percentage points to 21.4% (first half of 2011: 23.0%). In the first half of 2012, SAP introduced two new share-based payment plans at the beginning of the year: the Employee Participation Plan (EPP) 2015 for employees, and the Long Term Incentive Plan (LTI Plan) 2015 for Executive Board members. In this context, our expenses for the share-based payment plans increased to €181 million in the first half of 2012 (first half of 2011: €84 million). Those expenses narrowed our operating margin in the first half of 2012 by 2.5% (first half of 2011: 1.3%).

Profit after Tax and Earnings per Share

In the first six months of 2012, profit after tax was €1,104 million (first half of 2011: €991 million), an increase of 11%. Basic earnings per share was €0.93 (first half of 2011: €0.83), an increase of 12%.

The effective tax rate in the first half of 2012 was 25.0% (first half of 2011: 28.6%). The year over year decrease in the effective tax rate mainly arises from the regional allocation of income.

| 18 | INTERIM MANAGEMENT REPORT |

FINANCES (IFRS)

Cash Flow and Liquidity

Operating cash flow for the first half of 2012 was €2,400 million (June 30, 2011: €2,269 million), our highest first half figure ever. The improvement in operating cash flow is due to better management of working capital focusing on receivables, which on January 1, 2012, were 13% higher than in the previous year thanks to the Company’s business success in 2011. In the second quarter operating cash flow was impacted by higher tax payments.

Group liquidity stood at €3,595 million on June 30, 2012 (December 31, 2011: €5,601 million). Group liquidity comprised cash and cash equivalents totaling €3,376 million (December 31, 2011: €4,965 million) and short-term investments totaling €219 million (December 31, 2011: €636 million).

Group Liquidity of SAP Group

| € millions |

June 30, 2012 |

December 31, 2011 |

Change | |||||||||

| Cash and cash equivalents |

3,376 | 4,965 | –1,589 | |||||||||

| Short-term investments |

219 | 636 | –417 | |||||||||

| Group Liquidity — gross |

3,595 | 5,601 | –2,006 | |||||||||

| Current bank loans |

1,102 | 101 | 1,001 | |||||||||

| Current private placement transactions |

188 | 423 | –235 | |||||||||

| Current bonds |

0 | 600 | –600 | |||||||||

| Net liquidity 1 |

2,305 | 4,477 | –2,172 | |||||||||

| Non-current bank loans |

2 | 1 | 1 | |||||||||

| Non-current private placement transactions |

1,079 | 1,240 | –161 | |||||||||

| Non-current bonds |

1,600 | 1,600 | 0 | |||||||||

| Net liquidity 2 |

–376 | 1,636 | –2,012 | |||||||||

Net liquidity 1 is total group liquidity minus current bank loans, private placement transactions, and bonds.

Net liquidity 2, defined as net liquidity 1 minus non-current bank loans, private placement transactions, and bonds, was € -376 million (December 31, 2011: €1,636 million). The reduction compared to December 31, 2011, is mainly attributable to dividend payments and expenses related to the acquisition of SuccessFactors: SAP took a short-term bank loan to support the financing. The improvement in operating cash flow in the first half of 2012 had a compensating effect.

In 2009, SAP AG issued several promissory notes (Schuldscheindarlehen) that mature in 2012 and 2014. Due to our strong cash position, we decided to repay two tranches of the 2014 promissory notes with variable interest rates prematurely in July and September 2012. The total amount to be redeemed is €188 million. With these repayments we are able to further decrease our financing costs and optimize our financial result.

Free Cash Flow and Days Sales Outstanding

Our free cash flow and our days’ sales outstanding (DSO) on June 30, 2012 were as follows:

Free Cash Flow

| € millions |

1/1 - 30/6/2012 |

1/1 - 30/6/2011 |

Change in % |

|||||||||

| Free cash flow |

2,125 | 2,021 | 5 | |||||||||

We calculate free cash flow as net cash from operating activities minus purchases of intangible assets and property, plant, and equipment.

Days Sales Outstanding

| June 30, 2012 |

June 30, 2011 |

Change in days |

||||||||||

| Days sales outstanding (DSO) in days |

61 | 63 | –2 | |||||||||

DSO measures the length of time it takes to collect receivables. SAP calculates DSO by dividing the average invoiced accounts receivables balance of the last 12 months by the average monthly sales of the last 12 months.

ASSETS (IFRS)

Analysis of Consolidated Statements of Financial Position

The total assets of the Group were €24,488 million on June 30, 2012, an increase of €1,261 million since December 31, 2011, that arose primarily out of the SuccessFactors acquisition.

The equity ratio on June 30, 2012, was 52% (December 31, 2011: 55%) and thus remained relatively stable.

Investments

Investments in intangible assets and property, plant, and equipment increased significantly in the first six months of 2012 to €3,339 million (first half 2011: €248 million). This increase is due to our acquisition of SuccessFactors and is mainly attributable to additions to goodwill and intangible assets.

| INTERIM REPORT JANUARY – JUNE 2012 | 19 |

Off-Balance-Sheet Financial Instruments

There are no off-balance-sheet financial instruments, such as sale-and-lease-back transactions, asset-backed securities, or liabilities related to special-purpose entities, that are not disclosed in our interim Consolidated Financial Statements. Any factoring contracts are not material in volume.

Competitive Intangibles

The assets that are the basis for our current and future success do not appear on the Consolidated Statements of Financial Position. This is apparent from a comparison of the market capitalization of SAP AG, which was €57.2 billion, with the equity of the SAP Group on the Consolidated Statements of Financial Position, which was €12.8 billion at the end of the first half of 2012 (December 31, 2011: €12.7 billion). This means that the market capitalization of our equity is 347% higher than the book value.

Customer capital, our employees and their knowledge and skills, our ecosystem of partners, the SAP brand, and our past investments in research and development are some of the most important competitive intangibles that influence our market value.

According to the 2011 Interbrand annual survey of the Best Global Brands, SAP is ranked the 24th most valued brand in the world, our highest rank to date.

SUSTAINABILITY

Sustainability is core to our strategic vision of helping the world run better and improving people’s lives.

In July 2012, SAP released its quarterly sustainability update for the second quarter of 2012 (preliminary and unaudited). The key information in summary:

Our greenhouse gas (GHG) emissions for the first two quarters totaled 275 kilotons – an increase of 14% compared to the first two quarters of 2011. This increase is primarily due to increased business activity that led to a significant rise in air travel. On the other hand, we reduced emissions through a higher share of renewable energy in the United States and Canada. If our efforts to reduce emissions do not take hold, there is a risk that we might not meet our year-end emissions target of 480 kilotons. Our GHG emissions for the second quarter totaled 130 kilotons compared to 125 kilotons in the second quarter 2011.

Part of our overall sustainability goal is fostering a diverse workforce, specifically increasing the number of women in management. At the end of the second quarter of 2012, the Company employed 19.0% women in management, compared to 18.2% at the end of June 2011. SAP has set a long-term target to increase the percentage of women in management to 25% by the year 2017, and has started a variety of internal activities, including mentoring and coaching.

An important factor for our success is our ability to attract and retain talented employees. At the end of the second quarter of 2012, the employee retention rate was round 94% (93% at the end of the second quarter of 2011). We define the employee retention rate as the ratio between the average number of employees less voluntary employee departures (fluctuation) and the average number of employees (in full-time equivalents) in the last 12 months.

In the second quarter, SAP’s sustainability efforts were recognized with the SAM Sustainability Awards (Gold Class and Software Sector Lead). We also won two 2012 Social Innovation Awards presented by JustMeans in recognition of our Sustainability Report.

For more information on our sustainability performance and achievements, see our annual sustainability report at www.sapsustainabilityreport.com.

| 20 | INTERIM MANAGEMENT REPORT |

SAP STOCK

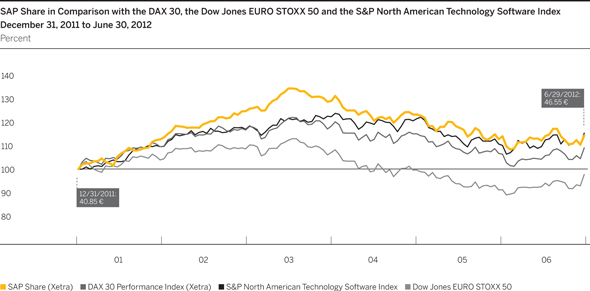

SAP AG common stock is listed on the Frankfurt Stock Exchange as well as a number of other German exchanges. On the New York Stock Exchange (NYSE), SAP American depositary receipts (ADRs), each representing one common share, trade under the symbol SAP. SAP is a component of the DAX, the index of 30 German blue chip companies, the Dow Jones EURO STOXX 50, the S&P North American Technology Software Index, and the TechPGI.

SAP stock outperformed the comparator indexes in the first six months of 2012: The SAP stock price advanced 14%, while the DAX 30 rose by only 8.8% and the EURO STOXX 50 declined by 2.2% in the same period.

In the second quarter, SAP stock broadly tracked the market. It ceded 11.1%, while the DAX and EURO STOXX slipped 7.6% and 8.6% respectively. From a starting point of €52.36 (Xetra closing price) on March 30, SAP stock climbed to its peak for the quarter on the next day of trading, April 2, when it reached €53.21. Subsequently, the stock exchanges suffered repeated setbacks as a result of the volatile political situation in Greece, uncertainties over Spain’s troubled banking sector, and concerns about global economic growth. On May 22, SAP announced its planned acquisition of Ariba, a U.S. company specializing in cloud solutions.

| INTERIM REPORT JANUARY – JUNE 2012 | 21 |

At the Annual General Meeting of Shareholders of SAP, held at the SAP ARENA in Mannheim, Germany, on May 23, 2012, the shareholders accepted all of the board recommendations with a clear majority and formally approved the actions taken by the Executive Board and the Supervisory Board in fiscal year 2011. They resolved that a dividend of €1.10 per share be paid for 2011, including a special dividend of €0.35 per share to celebrate SAP’s 40th anniversary. This represents an overall increase of 83% compared to the previous year’s dividend. The total amount distributed in dividends for 2011 was around €1.3 billion (2010: €713 million), resulting in a 38% (2010: 39%) payout ratio of profit after tax.

The shareholders consented to the system of Executive Board compensation and elected KPMG as the auditor of the financial statements and group financial statements for fiscal year 2012. The Supervisory Board of SAP was also newly elected. Information about the members of the Supervisory Board is posted at http://www.sap.com/corporate-en/investors/governance/supervisory/index.epx. The invitation, agenda items, voting results, speeches, and other information are available at http://www.sap.com/corporate-en/investors/governance/meetings/index.epx.

As a result of the ex-dividend effect and a generally weak market environment, SAP stock fell to its second-quarter low point of €44.16 on June 4, before rallying slightly to end the quarter at €46.55. The results of the European Union Summit in Brussels gave the markets a significant boost at the end of the month.

With the Xetra closing price at €46.54 on June 29, 2012, SAP’s market capitalization was €57.2 billion based on 1,228 million outstanding shares. Deutsche Börse uses the free-float factor to weight companies in the DAX. The free-float factor for SAP was 73.33% on June 29, 2012, resulting in a free-float market capitalization on the same date of approximately €41.93 billion. When measured by its free-float market capitalization on June 29, 2012, SAP was the fourth-largest company listed on the DAX. However, measured by its total market capitalization of €57.2 billion, it was the second-largest DAX company.

Additional information about SAP common stock is available on Bloomberg under the symbol SAP GR, on Reuters under SAPG.F, on Quotron under SAGR.EU, and on the SAP Web site at www.sap.com/investor.

RISK AND OPPORTUNITY MANAGEMENT

We have comprehensive risk-management structures in place, which are intended to enable us to recognize and analyze risks early and to take the appropriate action. For changes in our legal liability risks since our last annual report, see note 13 in the Notes to the Interim Financial Statements. The other risk factors remain largely unchanged since 2011, and are discussed more fully in our 2011 Annual Report and our Annual Report on Form 20-F for 2011. We do not believe the risks we have identified jeopardize our ability to continue as a going concern.

EVENTS AFTER THE END OF THE QUARTER

In July 2012 the SAP Supervisory Board appointed Luisa Deplazes Delgado as a member of the SAP Executive Board. She will begin in September 2012 and will be based in Walldorf. For more information, see the Organization and Changes in Management section.

OUTLOOK

Future Trends in the Global Economy

Global economic development is expected to remain sluggish over the remainder of 2012. Structural obstacles, weak employment and housing markets, and necessary corporate balance sheet restructuring will cloud the economic outlook in the industrialized economies. In comparison, the emerging and developing economies are expected to see relatively solid economic growth for the rest of the year.

A look into the regions

Growth in the Europe, Middle East, and Africa (EMEA) region will continue to depend on economic developments in the euro zone. The economy there is expected to recover very slowly from the euro crisis, or even stagnate. Continuing pressure on a number of government bond markets, fiscal consolidation in the financial services and other industries, and high unemployment will slow the momentum. The course of the euro crisis over the next six months remains to be seen. Thanks to strong domestic demand, the German economy will continue to grow more quickly than the economies of other euro zone countries.

The trends in the U.S. economy will be a key factor in the second half of the year in the Americas region: As more government stimulus measures end, the American economy will be increasingly supported by consumer demand. This will stabilize

| 22 | INTERIM MANAGEMENT REPORT |

U.S. economic growth. However, persistent uncertainty on the global financial markets makes it difficult to foresee whether this recovery will last.

Analysts predict that in the Asia Pacific Japan region, Japanese government will devote the coming months to reducing its national debt and expect them to introduce a consolidation program. As in previous months, reconstruction work will strengthen the economy, and demand for exports will gradually increase until year’s end. In China, economic growth will accelerate in the third and fourth quarters of the year and then stabilize at a higher level.

Future Trends in the IT Market

On the global market, 2012 spending will grow faster than previously expected. Overall growth will be in the mid-single digit percentage range, but it will be less than in 2011.

Looking at the market segments, mobile devices and applications will act as catalysts. The expected introduction of Microsoft Windows 8 in the fall is likely to energize the IT market as well.

The growth of IT spending is expected to be driven by the strong American market. At the same time, improved conditions in Japan will have a positive impact on growth. Plus, the emerging markets will record a considerably higher-than-average rate of growth.

A look into the regions

Shaping the Europe, Middle East, and Africa (EMEA) region in 2012 is the economic crisis in Western Europe, which will cause IT spending in the region to grow more slowly than the global average. Many European companies will cut back their spending and consumer confidence will fall; IT spending in the euro zone will therefore not record any noticeable increase.

By contrast, IT spending in the Americas region will grow faster than the global average. This will be primarily due to the double-digit growth rates in Latin America. In the United States, growth is expected to be near the global average, which is higher than most other important industrialized nations.

Markets in the Asia Pacific Japan (APJ) region will continue to show striking differences: Although the Japanese market has slowly recovered from the natural and ecological disasters in 2011, IT spending will nevertheless only increase at a moderate pace. In stark contrast to this, China and India: Their IT economies, as in the year before, will enjoy double-digit growth in 2012, although the Chinese growth figures will be lower than in 2011.

Forecast for SAP

Operational Targets for 2012 (Non-IFRS)

Revenue and Operating Profit Outlook

SAP reiterates the following outlook for the full-year 2012:

The Company expects full-year 2012 non-IFRS software and software-related service revenue to increase in a range of 10% – 12% at constant currencies (2011: €11.35 billion). This includes a contribution of up to 2 percentage points from SuccessFactors’ business.

The Company expects full-year 2012 non-IFRS operating profit to be in a range of €5.05 billion – €5.25 billion at constant currencies (2011: €4.71 billion). Full-year 2012 non-IFRS operating profit excluding SuccessFactors is expected to be in a similar range.

The Company projects a full-year 2012 IFRS effective tax rate of 26.5% – 27.5% (2011: 27.9%) and a non-IFRS effective tax rate of 27.0% – 28.0% (2011: 26.6%).

The growth we expect in software and software-related service revenue (non-IFRS) is based on our expectation of double-digit growth, at constant currencies, in our software revenue. The increase we expect in non-IFRS operating profit is based on the expectation that the operating margin, not including the SuccessFactors acquisition, will increase by 50 basis points due to increased total revenue and efficiency gains.

We are committed to our ambitious goal of doubling last year’s HANA software revenue to at least €320 million and last year’s mobile software revenue to €220 million.

Differences Between IFRS and Non-IFRS Measures

As noted above, our guidance is based on non-IFRS measures at constant currencies. The following provides additional insight into the impact of the constant currency notion and the items by which our IFRS measures and non-IFRS measures differ.

| INTERIM REPORT JANUARY – JUNE 2012 | 23 |

The following amounts represent the first half year of 2011 and the first half year of 2012 actual differences between IFRS and non-IFRS measures on operating profit as well as the estimates for 2012:

Non-IFRS Measures

| (€ millions) |

Actual Amounts from 1/1 - 6/30/2012 |

Actual Amounts from 1/1 - 6/30/2011 |

Estimated amounts for 1/1 - 12/31/20121) |

|||||||||

| Deferred revenue write-down |

25 | 25 | |

between 60 and 80 |

| |||||||

| Discontinued activities2) |

–5 | 12 | less than 10 | |||||||||

| Stock-based compensation expenses3),4) |

181 | 84 | |

between 400 and 440 |

| |||||||

| Acquisition-related charges5) |

250 | 222 | |

between 480 and 520 |