Share-Based Payments |

12 Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dec. 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-Based Payments | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-Based Payments | (B.3) Share-Based Payments

The operating expense line items in our income statement include the following share-based payment expenses: Share-Based Payment Expenses by Functional Area

Share-based payment expenses related to the Qualtrics plan are included in the results from discontinued operations (for more information, see Note (D.1)). Our major share-based payment plans are described below. a)Equity-Settled Share-Based Payments Equity-Settled Move SAP Plan (Move) Starting in 2022, we decided to grant share units under Move that we intend to predominantly settle in shares instead of cash. For more information about the terms and conditions of the cash-settled Move, see section b) Cash-Settled Share-Based Payments in this Note (B.3). Different vesting schedules apply to specific share units. Granted share units will vest in different tranches mainly as follows:

The number of PSUs that will vest under the different tranches is mainly contingent upon achievement of two equally weighted KPIs in the year of grant: Operating profit (non-IFRS at constant currencies) and Cloud revenue (at constant currencies). Depending on the weighted average performance, the number of PSUs vesting ranges between 0% and 200% of the number initially granted. Performance against the KPI target was 112.4% in 2023 (2022: 84.3)%. We intend to settle the share units classified as equity-settled by reissuing treasury shares upon vesting (for more information, see Note (E.2)). The valuation was based on the following parameters and assumptions: Fair Value and Parameters Used at Grant Date in 2023

1 For these awards, the fair value is calculated by subtracting expected future dividends, if any, until maturity of the respective award from the prevailing share price as at the measurement date. Fair Value and Parameters Used at Grant Date in 2022

1 For these awards, the fair value is calculated by subtracting expected future dividends, if any, until maturity of the respective award from the prevailing share price as at the measurement date. Changes in Outstanding Awards

2 We have changed the classification of some share units granted under the Move plan with the initial intention to settle in shares from equity-settled to cash-settled because a cash outflow became probable. Share units with switched classification are considered in the number of granted share units. The weighted average share price for awards exercised in 2023 was € 130.59 (2022: €92.00). Own SAP Plan (Own) Under the share purchase plan Own, employees have the opportunity to purchase, on a monthly basis, SAP shares without any required holding period. The investment per each eligible employee is limited to a percentage of the respective employee's monthly base salary. SAP matches the employee investment by 40% and adds a subsidy of €20 per month for non-executives. As part of SAP’s 50th anniversary celebration, SAP’s contribution was temporarily doubled from 40% to 80% from January to March 2022, contributing to the peak in 2022. This plan is not open to members of the Executive Board. Numbers of Shares Purchased

As a result of Own, we have commitments to grant SAP shares to employees. We have fulfilled and intend to continue to meet these commitments through an agent who administers the equity-settled programs and purchases shares on the open market. Recognized Expense

b)Cash-Settled Share-Based Payments Cash-Settled Move SAP Plan (Move) Including Grow SAP Plan To retain and engage executives and certain employees, we grant share units under Move representing a contingent right to receive a cash payment determined by the SAP share price and the number of share units that ultimately vest. Since 2022, we intend to settle share units granted from then on predominantly in shares. For more information about the terms and conditions of the equity-settled Move, see section a) Equity-Settled Share-Based Payments in this Note (B.3). Obligations from outstanding share units granted before 2022 will continue to be settled in cash. From 2020 to 2023, we granted share units under the Grow SAP Plan that we intend to settle in cash. This fixed term plan has broadly the same terms and conditions as Move and recognizes all employees’ commitment to SAP’s success, and deepens their participation in our future company performance. Different vesting schedules apply to specific share units. Granted share units under the respective plans will vest in different tranches, mainly as follows: –Restricted Stock Units (RSUs) with service condition only

–Performance Share Units (PSUs) with service condition and upon achieving certain key performance indicators (KPIs)

The number of PSUs that will vest under the different tranches is mainly contingent upon achievement of two equally weighted KPIs in the year of grant: operating profit (non-IFRS at constant currencies) and cloud revenue (at constant currencies). Depending on the weighted average performance, the number of PSUs vesting ranges between 0% and 200% of the number initially granted. Performance against the KPI target was 112.4% in 2023 (2022: 84.3%, 2021: 130.9%). The share units classified as cash-settled are paid out in cash upon vesting. SAP Long-Term Incentive Program 2020 (LTI 2020) The LTI 2020 is a long-term, multiyear performance-based element of our Executive Board compensation that is granted in annual tranches. The LTI 2020 reflects SAP’s long-term strategy and thus sets uniform incentives to achieve key targets from the long-term strategic plans. The LTI 2020 also serves to reward the Executive Board members for long-term SAP share price performance as compared to the market, thus ensuring that shareholders’ interests are also honored. In addition, the LTI 2020 includes a component to ensure long-term retention of our Executive Board members. The LTI 2020 is a virtual share program under which annual tranches with a term of approximately four years each are granted. When the individual tranches are granted, a certain grant amount specified in the Executive Board member’s service contract is converted into virtual shares (share units). For this purpose, the grant amount is divided by the price of the SAP share which corresponds to the arithmetic mean of the SAP share price on the 20 trading days after scheduled publication of the preliminary results for the fourth quarter and the year as a whole (grant price). The share units allocated are composed of Financial Performance Share Units (FSUs), Market Performance Share Units (MSUs), and Retention Share Units. All three types of share units have a vesting period of approximately four years. In contrast to Retention Share Units, FSUs and MSUs are subject to changes in quantity. In this context, the following applies: The number of FSUs initially awarded is multiplied by a performance factor. The performance factor consists of three equally weighted individual performance indicators relating to the three non-IFRS KPIs at constant currencies,derived from SAP’s long-term strategy: total revenue, cloud revenue, and operating income. The performance period throughout which the target achievement for these three KPIs is measured starts at the beginning of the financial year in which the FSUs are awarded and concludes upon the end of the second year following the year in which the share units were awarded. A numerical target value equaling 100% target achievement is set for each KPI. This constitutes, in each case, a cumulative value for the three years of the performance period.

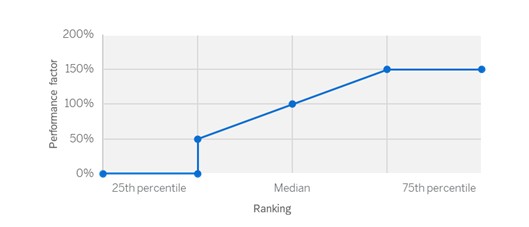

The number of MSUs initially awarded is likewise multiplied by a performance factor. The performance factor depends on the amount of the TSR on the SAP share, measured for an entire performance period of approximately three years, compared to the TSR for NASDAQ-100 companies. If the TSR on the SAP share equals the median, the performance factor will be 100%. If the TSR on the SAP share over the performance period is negative, the maximum performance factor will, however, in deviation from the summary above, be 100%.

The performance of the share units is linked to the performance of the SAP share price, including dividend payments. Accordingly, an amount is paid out for each share unit which equals the SAP share price plus those dividends disbursed in respect of an SAP share in the period from the beginning of the year in which the share units were awarded until the end of the third year following the year in which the share units were awarded. The arithmetic mean of the SAP share price on the trading days after scheduled publication of the preliminary results for the fourth quarter and the year as a whole will be used as the SAP share price. The payout amount per share unit, including the dividend amounts due on the share units, is capped at 200% of the grant price. The tranche is cash-settled and paid in euros after the Annual General Meeting of Shareholders of the corresponding year. If an Executive Board member’s service contract is terminated before the end of the third year following the year in which the share units were granted, the Retention Share Units and PSUs are forfeited in whole or in part, depending on the circumstances of the relevant resignation from office or termination of the service contract. Long-Term Incentive 2016 Plan (LTI 2016 Plan) The purpose of the LTI 2016 Plan was to reward our Executive Board members for the annual achievement of SAP’s Operating profit (non-IFRS at constant currencies) targets, to ensure long-term retention of our Executive Board members, and to reward them for the long-term SAP share price performance as compared to its main peer group (Peer Group). An LTI tranche was granted annually and had a term of four years (2016–2019 tranches). All share units granted in this way, comprising 60% PSUs and 40% Retention Share Units, had a vesting period of approximately four years. At the end of the vesting period, the corresponding share units were non-forfeitable. The payout price used for the settlement was the arithmetic mean of the XETRA closing prices of the SAP share on the 20 trading days following the publication of SAP’s fourth-quarter results subsequent to the end of the vesting period. The payout price was capped at 300% of the grant price. The number of PSUs ultimately paid out was dependent on the performance of the SAP share – absolute and relative to the Peer Group Index. The LTI tranche was cash-settled and paid in euros after the Annual General Shareholders’ Meeting of the corresponding year. The last LTI tranche 2019 was paid out in 2023. The valuation was based on the following parameters and assumptions: Fair Value and Parameters Used at Year End 2023

3 For these awards, the fair value is calculated by subtracting expected future dividends, if any, until maturity of the respective award from the prevailing share price as at the measurement date. Fair Value and Parameters Used at Year End 2022

3 For these awards, the fair value is calculated by subtracting expected future dividends, if any, until maturity of the respective award from the prevailing share price as at the measurement date. For the LTI 2020 valuation, the NASDAQ-100 Total Return Index on December 31, 2023, was US$20,158.42 (2022: US$12,994.57). The expected volatility of the NASDAQ-100 companies of 34% to 36% (2022: 36% to 41%), and the expected correlation of SAP and the NASDAQ-100 companies of 24% to 27% (2022: 26% to 32%) are based on historical TSR data for SAP and the NASDAQ-100 companies. The risk-free interest rate is derived from German government bonds with a similar duration. The SAP dividend yield is based on expected future dividends. Changes in Outstanding Awards

4 We have changed the classification of some share units granted under the Move plan with the initial intention to settle in shares from equity-settled to cash-settled because a cash outflow became probable. Share units with switched classification are considered in the number of granted share units. Share-Based Payment Balances

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||