– SAP Learning System Access (previously called SAP Live Access) is now available as an integrated platform within SAP Learning Hub, edition for Preferred Success, providing access to live, preconfigured instances of SAP software to carry out class exercises, cross-train, and gain hands-on experience.

Simplifying Business Journeys

To accelerate the implementation of specific business scenarios, premium engagement services have been bundled into out-of-the box service plans, providing a prescribed implementation approach and road map broken down into phases with individual steps and timelines. Over 25 business scenarios are available.

Enhancing the SAP MaxAttention Program

The SAP MaxAttention program was expanded to enhance collaboration with customers. This includes continuing the launch of the Intelligent Enterprise institute to help customers explore the full potential of SAP products and solutions through thought leadership, think tanks, and unique events. Chapters have now been established in Berlin, London, and New York.

Investment in R&D

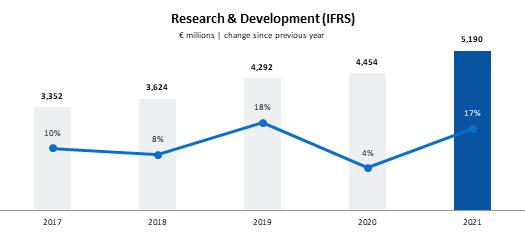

SAP’s strong commitment to R&D is reflected in our expenditures (see graphic below).

In 2021, our IFRS R&D ratio, reflecting R&D expenses as a portion of total operating expenses, increased by 0.9 percentage points (pp) to 22.4% (2020: 21.5%). Our non-IFRS R&D ratio increased by 2.0pp to 23.8% year over year (2020: 21.8%). At the end of 2021, our total full-time equivalent (FTE) headcount in development work was 32,244 (2020: 29,580). Measured in FTEs, our R&D headcount was 30% of total headcount (2020: 29%).

Total R&D expense not only includes our own personnel costs but also the external costs of work and services from the providers and cooperation partners we work with to deliver and enhance our products. We also incur external costs for the following:

- Translating, localizing, and testing products

- Obtaining certification for products in different markets

- Patent attorney services and fees

- Consulting related to our product strategy

- Professional development of our R&D workforce.

Patents

SAP actively seeks intellectual property protection for innovations and proprietary information. Our software innovations continue to strengthen our market position as a leader in business solutions and services. Our investment in R&D has resulted in numerous patents. As at December 31, 2021, SAP held a total of more than 11,605 (2020: 10,931) validated patents worldwide. Of these, 793 (2020: 897) were granted and validated in 2021.

While our intellectual property is important to our success, we believe our business as a whole is not dependent on any particular patent or a combination of patents.

Security, Data Protection, and Privacy

Vision and Strategy

Every day, organizations around the world trust SAP with their data – either on premise at their physical locations, in the cloud, or when using mobile devices while on the move. Our customers need to know that our goal is to keep their data safe, process it in a manner that complies with local legislation, and protect it from malicious use. For this reason, cybersecurity and security, as well as data protection and privacy, are of paramount importance to us.

28