Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||

| þ |

Definitive Proxy Statement | |||||||

| ¨ |

Definitive Additional Materials | |||||||

| ¨ |

Soliciting Material Pursuant to § 240.14a-12 |

SANDISK CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

SANDISK CORPORATION

951 SanDisk Drive

Milpitas, California 95035

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 12, 2013

To Our Stockholders:

You are cordially invited to attend the 2013 Annual Meeting of Stockholders (the “Annual Meeting”) of SanDisk Corporation, a Delaware corporation (the “Company”), to be held on June 12, 2013 at 8:00 a.m., local time, at the Company’s headquarters, 951 SanDisk Drive, Milpitas, California 95035, for the following purposes:

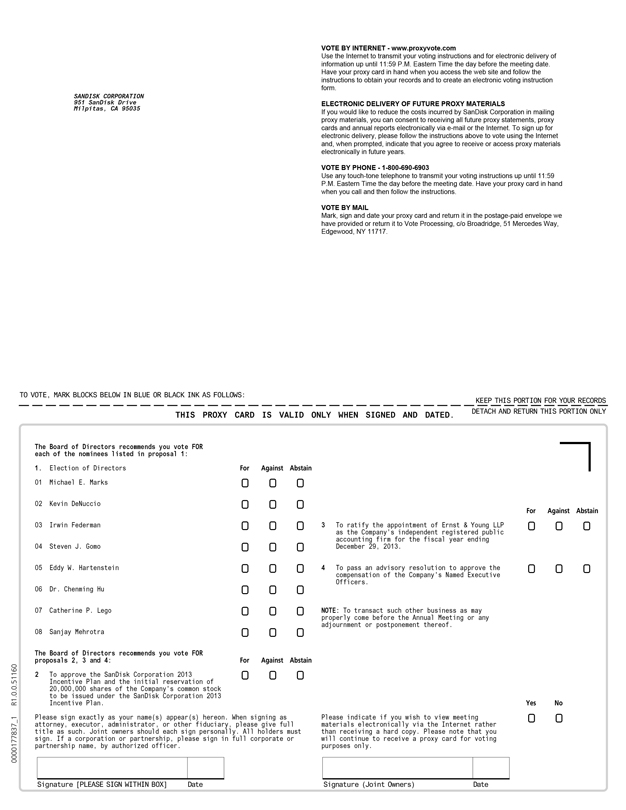

| 1. | To elect eight directors to serve on the Company’s Board of Directors for the ensuing year and until their respective successors are duly elected and qualified. The eight director nominees are Kevin DeNuccio, Irwin Federman, Steven J. Gomo, Eddy W. Hartenstein, Dr. Chenming Hu, Catherine P. Lego, Michael E. Marks and Sanjay Mehrotra. |

| 2. | To approve the SanDisk Corporation 2013 Incentive Plan and the initial reservation of 20,000,000 shares of the Company’s common stock to be issued under the SanDisk Corporation 2013 Incentive Plan. |

| 3. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 29, 2013. |

| 4. | To pass an advisory resolution to approve the compensation of the Company’s Named Executive Officers. |

| 5. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement that accompanies this Notice. The Company’s Board of Directors recommends that you vote (1) “FOR” each of the director nominees listed above; (2) “FOR” the approval of the SanDisk Corporation 2013 Incentive Plan and the initial reservation of 20,000,000 shares of Common Stock to be issued under the SanDisk Corporation 2013 Incentive Plan; (3) “FOR” ratification of the appointment of Ernst & Young LLP; and (4) “FOR” the advisory resolution to approve the compensation of the Company’s Named Executive Officers.

Only stockholders of record at the close of business on April 15, 2013 are entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof.

Regardless of whether you plan to attend the Annual Meeting, please vote your shares as soon as possible so that your shares will be voted in accordance with your instructions. For specific voting instructions, please refer to the instructions on the proxy card or the Notice of Internet Availability of Proxy Materials that was mailed to you. If you attend the meeting, you may revoke your proxy and vote your shares in person.

We look forward to seeing you at the Annual Meeting.

By Order of the Board of Directors,

Michael E. Marks

Chairman of the Board of Directors

Milpitas, California

April 26, 2013

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS AND ANNUAL REPORT

The Company’s proxy materials and Annual Report on Form 10-K are available at www.sandisk.com/IR.

Table of Contents

Table of Contents

FOR THE ANNUAL MEETING OF STOCKHOLDERS OF

SANDISK CORPORATION

TO BE HELD JUNE 12, 2013

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board of Directors” or the “Board” and each member thereof, a “Director”) of SanDisk Corporation, a Delaware corporation (the “Company,” “SanDisk,” “we,” “us,” or “our”), of proxies to be voted at the Company’s 2013 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June 12, 2013, or at any adjournment or postponement thereof, for the purposes described herein. Stockholders of record at the close of business on April 15, 2013 (the “Record Date”) will be entitled to vote at the Annual Meeting. The Annual Meeting will be held at 8:00 a.m., local time, on June 12, 2013, at the Company’s headquarters, 951 SanDisk Drive, Milpitas, California 95035.

These materials were made available to stockholders entitled to vote at the Annual Meeting on or about April 26, 2013.

Important Notice Regarding Internet Availability of Proxy Materials and Annual Report

Pursuant to the rules of the U.S. Securities and Exchange Commission (the “SEC”), the Company is furnishing its proxy materials and Annual Report on Form 10-K (the “Proxy Materials”) primarily via the Internet. Accordingly, the Company began sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to its stockholders of record and beneficial owners on or about April 26, 2013. All stockholders will have the ability to access the Proxy Materials on the website referred to in the Notice or to request a printed set of the Proxy Materials. Instructions on how to access the Proxy Materials over the Internet or to request a printed copy of the Proxy Materials may be found in the Notice. In addition, stockholders may request to receive the Proxy Materials in printed form by mail, or electronically by e-mail, on an ongoing basis.

Choosing to receive future Proxy Materials electronically saves the Company the cost of printing and mailing documents to its stockholders, expedites receipt of the materials and conserves natural resources. If a stockholder chooses to receive future Proxy Materials electronically, the stockholder will receive an e-mail for each future proxy material distribution with instructions containing a link to those materials and a link to the proxy voting site. Any stockholder’s election to receive the Proxy Materials electronically will remain in effect until such stockholder terminates the request.

The Proxy Materials are also available at the Company’s website at www.sandisk.com/IR. In addition, the Company will provide copies of any of the Proxy Materials free of charge to any stockholder who requests copies by calling 1-800-579-1639 or by sending an e-mail with the 12-Digit Control Number found on the Notice or proxy card in the subject line to sendmaterial@proxyvote.com.

On the Record Date, approximately 243,328,582 shares of the Company’s common stock (the “Common Stock”) were outstanding and entitled to vote at the Annual Meeting. The presence in person or by proxy of a majority of the shares of Common Stock entitled to vote will constitute a quorum for the transaction of business at the Annual Meeting.

1

Table of Contents

In addition to voting in person at the Annual Meeting, stockholders may vote by proxy as follows:

Internet. A stockholder can submit a proxy over the Internet by following the instructions provided in the Notice or on the separate proxy card or voting information form.

Telephone. A stockholder can submit a proxy over the telephone by following the instructions provided in the proxy card or separate voting information form.

Mail. A stockholder that received a printed set of the Proxy Materials can submit a proxy by mail by completing, signing and returning the separate proxy card in the prepaid and addressed envelope included with the Proxy Materials.

Stockholders are urged to specify their votes on the proxy they submit by Internet, telephone or mail. If you submit a proxy, but do not specify how you want to vote on a proposal, in the absence of contrary instructions, the shares of Common Stock represented by such proxy will be voted as the Board recommends on each proposal and the persons named as proxies will vote on any other matters properly presented at the Annual Meeting in accordance with their best judgment. Stockholder votes will be tabulated by a representative of Broadridge Financial Solutions, Inc.

Each share of Common Stock outstanding on the Record Date is entitled to one vote on each of the eight Director nominees and one vote on each other matter. To be elected, Directors must receive a majority of the votes cast with respect to such Director (e.g., the number of shares voted FOR a Director nominee must exceed the number of shares voted AGAINST that nominee). Under the Company’s Corporate Governance Principles, each Director nominee submits, in advance of the Annual Meeting, an irrevocable resignation that will become effective if (i) a majority of the votes cast in the election are voted AGAINST the Director nominee and (ii) the Board accepts the tendered resignation. The Nominating and Governance Committee of the Board (the “Nominating and Governance Committee”) considers any tendered resignation and makes a recommendation to the Board about whether to accept or reject the resignation, or to take other action. The Board will consider and act on the Nominating and Governance Committee’s recommendation within 90 days from the date that the election results are certified and will disclose its action publicly within four business days of its decision.

With respect to the approval of the SanDisk Corporation 2013 Incentive Plan (the “2013 Plan”), the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm and the advisory resolution to approve the compensation of the Company’s Named Executive Officers (who are identified below in “Compensation Discussion and Analysis”), you may vote FOR, AGAINST or ABSTAIN with respect to each proposal. In order to be approved, each of these proposals requires the affirmative FOR vote of a majority of the votes cast. Any ABSTAIN vote will have the same effect as a vote AGAINST the matter.

If your shares of Common Stock are held in “street name,” i.e., held for your benefit through a broker, bank, or other nominee, you have the right to instruct your broker, bank or other nominee on how to vote the shares in your account. Please contact your bank, broker or other nominee to obtain a voting information form for you to use to direct how your shares should be voted. If you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you obtain a legal proxy from the bank, broker or other nominee that holds your shares of Common Stock, giving you the right to vote the shares instead of the bank, broker or other nominee holding your shares. A broker or nominee is entitled to vote shares held for a beneficial holder on routine matters, such as the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm, without instructions from the beneficial holder of those shares. On the other hand, absent instructions from the beneficial holder of such shares, a broker or nominee is not entitled to vote shares held for a beneficial holder on non-routine items considered at the Annual Meeting, such as the election of Directors, the approval of the 2013 Plan, and the advisory resolution to approve the compensation of the Company’s Named Executive Officers. Consequently, if you do not give your broker specific instructions,

2

Table of Contents

your shares may not be voted on the non-routine matters and will not be counted in determining the number of shares necessary for approval. However, abstentions and broker non-votes (i.e., when a stockholder does not provide voting instructions to their broker or nominee) will count for purposes of determining whether a quorum exists. Please instruct your broker or nominee so your vote can be counted on all proposals.

Stockholders Sharing the Same Last Name and Address

To reduce the expense of delivering duplicate proxy materials to stockholders who may have more than one account holding Common Stock but who share the same address, the Company has adopted a procedure approved by the SEC called “householding.” Under this procedure, certain stockholders of record who have the same address and last name, and who do not participate in electronic delivery of proxy materials, will receive only one copy of the Notice and the Proxy Materials that are delivered until such time as one or more of these stockholders notifies the Company otherwise.

Stockholders who receive a single set of Proxy Materials as a result of householding and wish to have separate copies of the Notice or the Proxy Materials may submit a request to the Company’s Investor Relations department at 951 SanDisk Drive, Milpitas, California 95035 or call the Company’s Investor Relations department at (408) 801-1000, and the Company will promptly comply with such request. Stockholders may contact the Company’s Investor Relations representative at the phone number above if it receives multiple copies of the Proxy Materials and would prefer to receive a single copy in the future.

Any person giving a proxy has the power to revoke it at any time before the close of voting. Stockholders as of the Record Date may revoke their proxy by filing with the Secretary of the Company an instrument of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. If your shares of Common Stock are held in “street name” (i.e., held for your benefit through a broker, bank, or other nominee), contact your broker or nominee for specific instructions on revoking your vote.

The Board is soliciting proxies for the Annual Meeting. The Company will bear the cost of soliciting proxies. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others to forward to such beneficial owners. The Company may reimburse such persons for the costs they incur to forward the solicitation material to such beneficial owners. The original solicitation of proxies may be supplemented by solicitation by telephone, facsimile or other means by Directors, officers or employees of the Company. No additional compensation will be paid to these individuals for these services. The Company may enlist the help of banks and brokerage firms in soliciting proxies from their customers and reimburse the banks and brokerage firms for related out-of-pocket expenses.

All stockholders entitled to vote as of the Record Date are entitled to attend the Annual Meeting. Such individuals should be prepared to present government-issued photo identification, such as a valid driver’s license or passport, and verification of ownership of Common Stock or proxy status as of the Record Date for admittance. For stockholders of record as of the Record Date, proof of ownership as of the Record Date may be verified prior to admittance into the Annual Meeting. For stockholders who were not stockholders as of the Record Date but hold shares through a bank, broker or other nominee holder, proof of beneficial ownership as of

3

Table of Contents

the Record Date, such as an account statement or similar evidence of ownership, may be verified prior to admittance into the Annual Meeting. For proxy holders, proof of valid proxy status may be verified prior to admittance into the Annual Meeting. Stockholders and proxy holders will be admitted to the Annual Meeting if they comply with these procedures.

Stockholder Proposals to be Presented at the 2014 Annual Meeting of Stockholders

Proposals of stockholders of the Company that are intended to be presented by such stockholders at the 2014 Annual Meeting of Stockholders must be received by the Company no later than December 27, 2013 in order that they may be included in the Proxy Statement and form of proxy relating to that meeting. If the stockholder proposal is to be presented at the 2014 Annual Meeting of Stockholders but is not to be included in the Proxy Statement, the notice of proposal must be received no earlier than January 13, 2014 and no later than February 12, 2014 and with such information required by the Company’s Amended and Restated Bylaws (the “Bylaws”).

4

Table of Contents

ELECTION OF DIRECTORS

The Board currently consists of eight members. All current Directors have been recommended for nomination by the Nominating and Governance Committee, have been nominated by the Board for re-election and are standing for re-election. Each of the eight nominees was elected to the Board by the stockholders at the 2012 Annual Meeting of Stockholders. The Board has determined that each of the nominees listed below, other than Mr. Mehrotra, is independent as defined under SEC rules and the listing standards of the NASDAQ Global Select Market (“NASDAQ”). There are no family relationships between any executive officer, as defined in Rule 3b-7 of the Securities Exchange Act of 1934, as amended (an “executive officer”), and any Director nominee. Directors elected to the Board will serve for the ensuing year and until their respective successors are duly elected and qualified. In the event that any Director nominee is unavailable to serve, which is not anticipated, the proxies will be voted for any nominee who is designated by the current Board to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” each of the nominees named below. In accordance with the procedures described above under “Voting Rights,” a Director nominee must receive a majority of the votes cast with respect to his or her election to the Board. The proxies solicited by this Proxy Statement may not be voted for more than eight nominees.

Set forth below is information regarding the nominees to the Board as of March 15, 2013.

| Name |

Position(s) with |

Age | First | |||||

| Michael E. Marks (1) |

Chairman of the Board | 62 | 2003 | |||||

| Kevin DeNuccio (1)(2) |

Director | 53 | 2009 | |||||

| Irwin Federman (2)(3) |

Director | 77 | 1988 | |||||

| Steven J. Gomo (3) |

Director | 61 | 2005 | |||||

| Eddy W. Hartenstein (1) |

Director | 62 | 2005 | |||||

| Dr. Chenming Hu (2) |

Director | 65 | 2009 | |||||

| Catherine P. Lego (3)(4) |

Director | 56 | 2004 | |||||

| Sanjay Mehrotra |

President, Chief Executive Officer and Director | 54 | 2010 | |||||

| (1) | Member of the Nominating and Governance Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Audit Committee. |

| (4) | Ms. Lego served as a member of the Board from 1989 to 2002 and returned to the Board in May 2004. |

Business Experience and Qualifications of Nominees for Election as Directors

Mr. DeNuccio has served as a Director of the Company since August 4, 2009. Mr. DeNuccio is currently an active angel investor. Mr. DeNuccio was Chief Executive Officer of Metaswitch Networks, a provider of carrier systems and software solutions that enable communication networks to migrate to open, packet-based architectures, from February 2010 to July 2012. Mr. DeNuccio was President and Chief Executive Officer of Redback Networks Inc., a provider of advanced communications networking equipment, from August 2001 to January 2008, during which time it filed for Chapter 11 bankruptcy protection in 2003 and was acquired by LM Ericsson in January 2007 and operated as a wholly-owned subsidiary of LM Ericsson. Mr. DeNuccio held various positions at Cisco Systems, Inc. from 1995 to 2001, including Senior Vice President of Worldwide Service Provider Operations. Previously, Mr. DeNuccio was the founder, President and Chief Executive Officer of Bell Atlantic Network Integration Inc., a wholly-owned subsidiary of Bell Atlantic (now Verizon Communications). Mr. DeNuccio has a B.A. in Finance from Northeastern University and an M.B.A. from

5

Table of Contents

Columbia University. Mr. DeNuccio has served as a director of Metaswitch Networks since December 2008 and Calix, Inc. since September 2012. Mr. DeNuccio previously served as a director of JDS Uniphase Corporation from December 2005 to November 2009 and Redback Networks Inc. from August 2001 to December 2009.

Director Qualifications: Mr. DeNuccio has been a senior executive at many companies in the technology industry and he brings significant senior leadership, management, operational and technological expertise to the Board. The Board values Mr. DeNuccio’s experience in leadership roles in technology companies, including as chief executive officer.

Mr. Federman has served as a Director of the Company since September 1988. Mr. Federman has been a general partner in U.S. Venture Partners, a venture capital firm, since April 1990. Mr. Federman was President and Chief Executive Officer from 1979 to 1987, and Chief Financial Officer from 1970 to 1979, at Monolithic Memories, Inc., a semiconductor company. Mr. Federman has a B.S. in Economics from Brooklyn College and was awarded an Honorary Doctorate of Engineering from Santa Clara University. Mr. Federman has served as a director of Intermolecular, Inc. since June 2005, Mellanox Technologies, Ltd. since June 1999 and Check Point Software Technologies Ltd. since 1995. Mr. Federman previously served as a director of Centillium Communications, Inc. from May 1998 to January 2006 and Nuance Communications, Inc. from 1995 to July 2005.

Director Qualifications: Mr. Federman has served in many senior leadership roles in the semiconductor industry throughout his career. The Board values Mr. Federman’s experience serving as the chief executive officer and chief financial officer of a large, complex, publicly-held technology company, his venture capital experience, which is important to the Board’s understanding of business development, financing, strategic alternatives and industry trends, and his extensive experience on the boards of publicly-held technology companies. The Board also values Mr. Federman’s significant experience, expertise and background in financial and accounting matters, including in the technology industry.

Mr. Gomo has served as a Director of the Company since December 2005. Mr. Gomo was Executive Vice President, Finance and Chief Financial Officer from October 2004 until his retirement in December 2011, and Senior Vice President, Finance and Chief Financial Officer from August 2002 to September 2004, at NetApp, Inc., a storage and data management company. Mr. Gomo was also Chief Financial Officer of Gemplus International S.A. from November 2000 to April 2002, Chief Financial Officer of Asera, Inc. from February 2000 to November 2000 and Chief Financial Officer of Silicon Graphics, Inc. from February 1998 to February 2000. Previously, Mr. Gomo spent 24 years at Hewlett-Packard Company serving in various finance, financial management, manufacturing and general management positions. Mr. Gomo has a B.S. in Business Administration from Oregon State University and an M.B.A. from Santa Clara University. Mr. Gomo has served as a director of Enphase Energy, Inc. since March 2011, NetSuite, Inc. since April 2012, and on the Board of Trustees for the Foundation of Oregon State University since October 2011. Mr. Gomo previously served as a director and member of the Audit Committee of Macromedia, Inc. from April 2004 until its acquisition in December 2005.

Director Qualifications: Mr. Gomo’s service as Chief Financial Officer of NetApp, Inc., as well as various senior finance roles with other companies in the technology industry, provides him with valuable insight into the Company’s business. The Board also values Mr. Gomo’s significant experience, expertise and background in financial and accounting matters in the technology industry.

Mr. Hartenstein has served as a Director of the Company since November 2005. Mr. Hartenstein was President and Chief Executive Officer of the Tribune Company, a multimedia, publishing, digital media and broadcasting company, from May 2011 to January 2013. Mr. Hartenstein has also been publisher and Chief Executive Officer of the Los Angeles Times since August 2008. Mr. Hartenstein was Chief Executive Officer from 2001 to 2004, and President from 1990 to 2001, of DIRECTV, Inc., a television service provider. Mr. Hartenstein was inducted into the Consumer Electronics Association Hall of Fame in 2008, the Broadcasting

6

Table of Contents

and Cable Hall of Fame in 2002 and the National Academy of Engineering in 2001, and received an Emmy from the National Academy of Television Arts and Sciences for lifetime achievement in 2007. Mr. Hartenstein has a B.S. in Aerospace Engineering and Mathematics from California State Polytechnic University, Pomona, and an M.S. in Applied Mechanics from the California Institute of Technology. Mr. Hartenstein has served as a director of Sirius XM Radio Inc. since July 2008, including as the non-executive Chairman of the board of directors since November 2009, and as a director of Broadcom Corporation since June 2008 and City of Hope since 2007. Mr. Hartenstein previously served as Vice Chairman of the board of directors of The DIRECTV Group, Inc. from December 2003 until his retirement in December 2004 and Chairman of the board of directors of DIRECTV, Inc. from 2001 through 2004 and as a director of Thomson, S.A. (Thomson Multimedia) from 1999 until 2008.

Director Qualifications: Mr. Hartenstein has experience in media relations and the communications industry and the Board benefits from his deep experience in the distribution of media content through a variety of channels. Mr. Hartenstein also brings significant senior leadership, technological and industry expertise to the Board. Mr. Hartenstein’s experience as a director of other public companies provides insights with regard to the operation of the Board and its role in overseeing the Company. The Board also values Mr. Hartenstein’s previous experience, including as the chief executive officer, of large, complex, publicly-held companies.

Dr. Hu has served as a Director of the Company since August 4, 2009. Dr. Hu has been the TSMC Distinguished Chair Professor of Microelectronics in Electrical Engineering and Computer Sciences since 2001, and a professor since 1976, at the University of California, Berkeley. Dr. Hu was also Chief Technology Officer of Taiwan Semiconductor Manufacturing Company, a semiconductor company, from June 2001 to July 2004. Dr. Hu is a member of the U.S. National Academy of Engineering, the Chinese Academy of Sciences and Academia Sinica. Dr. Hu has a B.S. from National Taiwan University and an M.S. and a Ph.D. from the University of California, Berkeley, all in electrical engineering. Dr. Hu has served as a director of Inphi Corporation since August 2010, Ambarella, Inc. since November 2011 and Fortinet, Inc. since August 2012. Dr. Hu previously served as a director of FormFactor, Inc. from December 2009 to December 2010, MoSys, Inc. from January 2005 to June 2010 and was founding Chairman of the board of directors of Celestry Design Technologies, Inc.

Director Qualifications: Dr. Hu has experience and expertise in the technologies used and supported by the Company, which is useful in the Board’s understanding of the Company’s research and development efforts, competing technologies and the products and processes that the Company develops. Dr. Hu’s experience as an educator aids his ability to communicate and inform the Board about technology and industry developments and trends. The Board also benefits from Dr. Hu’s experience on the boards of other publicly-held technology companies.

Ms. Lego served as a Director of the Company from 1989 to 2002 and returned to the Board in May 2004. Ms. Lego was a General Partner of The Photonics Fund, an early stage venture capital fund focused on investing in components, modules and systems companies for the fiber optics telecommunications market, from December 1999 to December 2009. Ms. Lego was a general partner at Oak Investment Partners, a venture capital firm, from 1981 to 1992. Ms. Lego previously practiced as a Certified Public Accountant with Coopers and Lybrand. Ms. Lego has a B.A. from Williams College and an M.S. in Accounting from the New York University Graduate School of Business. Ms. Lego has served as a director and Chair of the Audit Committee of Lam Research Corporation since January 2006 and Cosworth Group, a private United Kingdom-based precision engineering products and services company since March 2011. Ms. Lego previously served as a director and Chair of the Audit Committee of WJ Communications, Inc. from October 2004 to May 2008 and StrataLight Communication, Inc. from September 2007 to January 2009.

Director Qualifications: Ms. Lego’s financial expertise, leadership skills and experience as a director of other public companies are valuable to the Board’s operations. The Board values Ms. Lego’s significant experience, expertise and background in financial and accounting matters, including in the technology industry. Ms. Lego’s venture capital experience aids the Board’s understanding of business development, financing, strategic alternatives and industry trends.

7

Table of Contents

Mr. Marks has served as a Director of the Company since August 2003 and as Chairman of the Board since January 2011. Mr. Marks has managed Riverwood Capital, LLC (formerly Bigwood Capital, LLC), a private equity firm, since March 2007. Mr. Marks was interim Chief Executive Officer of Tesla Motors, Inc., a company that designs and manufactures electric vehicles, from August 2007 to November 2007. Mr. Marks was also a senior adviser from January 2007 to January 2008, and a member from January 2006 until January 2007, at Kohlberg Kravis Roberts & Co., a private equity firm. Mr. Marks was Chief Executive Officer of Flextronics, Inc., a leading manufacturing services provider, from January 1994 to January 2006. Mr. Marks has a B.A. and an M.A. in Psychology from Oberlin College and an M.B.A. from Harvard Business School. Mr. Marks has served as a director of Schlumberger Limited since 2005 and on the Board of Trustees of The Juilliard School since December 2011. Mr. Marks previously served as a director of Flextronics, Inc. from 1991 to January 2008, including as Chairman of the board of directors of Flextronics, Inc. from 1993 to January 2003 and upon his retirement as Chief Executive Officer in January 2006 until his retirement from the board of directors in January 2008. Mr. Marks also previously served as a director of Calix Networks, Inc. from 2009 to December 2010, Sun Microsystems, Inc. from April 2007 to January 2010 and Crocs, Inc. from August 2004 to July 2008.

Director Qualifications: Mr. Marks has experience serving as the chief executive officer of a large, complex, publicly-held technology company, which brings valuable senior leadership, management and operational expertise to the Board. The Board also values Mr. Marks’ significant experience, expertise and background in financial and accounting matters, including in the technology industry. Mr. Marks’ private equity experience adds value to the Board’s understanding of business development, financing, strategic alternatives and industry trends. Mr. Marks’ experience as a director for other public companies provides valuable insights with regard to the operation of the Board and its role in overseeing the Company.

Mr. Mehrotra has served as a Director of the Company since July 2010. Mr. Mehrotra co-founded the Company in 1988 and has been the President and Chief Executive Officer of the Company since January 2011. Mr. Mehrotra previously served in various executive roles for the Company, including as President and Chief Operating Officer, Executive Vice President and Chief Operating Officer, Senior Vice President of Product Development, Vice President of Product Development, and Director of Design Engineering. Mr. Mehrotra has more than 30 years of experience in the non-volatile semiconductor memory industry, including engineering and management positions at Integrated Device Technology, Inc., SEEQ Technology, Inc., Intel Corporation and Atmel Corporation. Mr. Mehrotra also holds numerous patents and has published articles in the area of non-volatile memory design and flash memory systems. Mr. Mehrotra has a B.S. and an M.S in Electrical Engineering and Computer Sciences from the University of California, Berkeley. Mr. Mehrotra has served as a director of Cavium, Inc. since July 2009, and currently also serves on the Global Semiconductor Alliance, the Engineering Advisory Board at the University of California, Berkeley, and the Stanford Graduate School of Business Advisory Council.

Director Qualifications: Mr. Mehrotra, as the co-founder, President and Chief Executive Officer of the Company, offers a unique perspective on the industry and the Company’s operations. Mr. Mehrotra brings significant senior leadership and technological and industry expertise to the Board. The Board values Mr. Mehrotra’s experience with the Company as its co-founder, President and Chief Executive Officer, which gives the Board a detailed understanding of the Company’s business and operations.

Corporate Governance Principles and Committee Charters

The Board has adopted a set of Corporate Governance Principles, which address important governance policies that assist the Board in following corporate practices that serve the best interests of the Company and its stockholders, including establishing the Board’s procedures for reviewing resignations submitted pursuant to the Company’s majority voting standard. Stockholders can access the Corporate Governance Principles by clicking

8

Table of Contents

on “Corporate Governance” at www.sandisk.com/IR. The Company will also provide copies of the Corporate Governance Principles free of charge to any stockholder who sends a written request to the Company’s Investor Relations department at 951 SanDisk Drive, Milpitas, CA 95035.

The Board currently has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. The charters for the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee are available by clicking on “Corporate Governance” at www.sandisk.com/IR. The Company will also provide copies of any charter free of charge to any stockholder who sends a written request to the Company’s Investor Relations department at 951 SanDisk Drive, Milpitas, CA 95035.

Communications with the Board

The Company encourages stockholder communications with its Board and has adopted a policy governing such communications. Under this policy, individuals may communicate with the Board by sending an email to the Board’s attention at: BOD@sandisk.com, or by writing to the following address: Board of Directors, c/o Investor Relations, SanDisk Corporation, 951 SanDisk Drive, Milpitas, CA 95035. Communications that are intended specifically for non-management Directors should be sent to the attention of the Chair of the Nominating and Governance Committee. The Company will deliver correspondence to the Board unless the communication is unrelated to the Board’s duties, such as spam, junk mail, advertisements, mass mailings, solicitations, job inquiries or the communication is otherwise irrelevant.

Board Meetings and Attendance

The Board held four meetings during fiscal year 2012 and did not act by unanimous written consent. During fiscal year 2012, each member of the Board attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board held during the period for which such person has been a Director and (ii) the total number of meetings held by all committees of the Board on which such person served during the period for which such Director served on the Board. The Company encourages each incumbent Director and each nominee to the Board to attend its Annual Meeting of Stockholders. All of the Director nominees who were serving as Directors at the time of the 2012 Annual Meeting of Stockholders attended that meeting.

Audit Committee

The Audit Committee of the Board (the “Audit Committee”) held 10 meetings during fiscal year 2012, in addition to taking actions by unanimous written consent in lieu of a meeting. The Audit Committee, which during fiscal year 2012 consisted of, and currently consists of, Directors Lego (Chair), Federman and Gomo, oversees on behalf of the Board the integrity of the Company’s financial statements and the appointment, compensation, qualifications, independence and performance of the Company’s independent registered public accounting firm, the Company’s compliance with legal and regulatory requirements and the performance of the Company’s internal accounting, audit and financial controls. As part of its oversight and review of the Company’s independent registered public accounting firm, the Audit Committee reviews, on an annual basis, the qualifications, independence and performance of the Company’s audit engagement team, and monitors the rotation and selection of the partner-in-charge on the Company’s audit engagement team as required by law, which occurs once every five years. The Audit Committee also regularly reviews the Company’s enterprise risk assessment and mitigation processes and assists the Board with its oversight and annual review of the Company’s enterprise risk management. The Audit Committee is authorized to conduct investigations, and to retain, at the expense of the Company, independent legal, accounting or other professional consultants selected by the Audit Committee, for any matters relating to its purposes. The Board adopted a written charter for the Audit

9

Table of Contents

Committee, which was last reviewed and approved in March 2013. The Board has determined that each member of the Audit Committee is an “audit committee financial expert” as defined by the SEC. The Board has also determined that each member of the Audit Committee is an “independent director” as defined by NASDAQ listing standards and also meets the additional criteria for independence of Audit Committee members set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Compensation Committee

The Compensation Committee of the Board (the “Compensation Committee”) held five meetings during fiscal year 2012 and did not act by unanimous written consent. The Compensation Committee, which during fiscal year 2012 consisted of, and currently consists of, Directors Federman (Chair), DeNuccio and Hu (as well as Mr. Marks through mid-March 2012), has authority for establishing the general compensation policies of the Company, reviewing and setting the compensation of the Company’s executive officers, as defined by NASDAQ listing standards and Rule 16a-1(f) of the Exchange Act (the “Section 16 Officers”), evaluating the performance of the Company’s Section 16 Officers, administering the Company’s incentive and employee stock purchase plans, including the review and grant of incentive awards to the Company’s Section 16 Officers, and recommending to the Board appropriate compensation programs for non-employee directors of the Company (including any equity award policies for non-employee directors). The Board adopted a charter for the Compensation Committee, which was last reviewed and approved in March 2013. The charter requires that the Compensation Committee consist of no fewer than three Directors who satisfy the independence requirements of NASDAQ and applicable law. The Board has determined that each member of the Compensation Committee satisfies such independence requirements.

While the Compensation Committee has primary authority for the administration of the Company’s incentive plans for the Company’s Section 16 Officers, the Board has delegated concurrent authority to the Compensation Committee and a committee that may consist of one or more Directors (the “Special Option Committee”) and a committee that may consist of one or more executive officers of the Company (the “Secondary Executive Committee”) for certain other types of share-based awards. The Special Option Committee may only grant share-based awards (including stock options and restricted stock units) to employees who are not Section 16 Officers. In fiscal year 2012, the Special Option Committee consisted of Mr. Mehrotra. The Secondary Executive Committee may only grant stock options (but not restricted stock units or other share-based awards) to employees who are not Section 16 Officers. In fiscal year 2012, the Secondary Executive Committee consisted of Judy Bruner, the Company’s Executive Vice President, Administration and Chief Financial Officer, and James F. Brelsford, the Company’s Chief Legal Officer and Senior Vice President of IP Licensing. In December 2012, in connection with Mr. Brelsford’s resignation from his position with the Company, Donald Robertson, the Company’s Vice President and Chief Accounting Officer, was appointed to the Secondary Executive Committee. Share-based awards to the Section 16 Officers are made exclusively by the Compensation Committee, and share-based awards to non-employee directors of the Company are recommended by the Compensation Committee to the Board for approval.

Processes and Procedures. For information on the responsibilities and activities of the Compensation Committee, including the processes and procedures for the consideration and determination of Director and executive compensation, see “Director Compensation” and “Executive Compensation—Compensation Discussion and Analysis.”

Independent Compensation Consultant. Pursuant to its charter, the Compensation Committee has the power, in its discretion, to retain at the Company’s expense, independent counsel and other advisors and experts as it deems necessary or appropriate to assist the Compensation Committee in carrying out its duties. Under its charter, the Compensation Committee has the express authority to decide whether to retain a compensation consultant to assist in the evaluation of the Company’s compensation programs. If the Compensation Committee decides, in its discretion, to retain a compensation consultant, the Compensation Committee has the sole authority to retain and terminate such consultant engaged to assist in the evaluation of the compensation of the

10

Table of Contents

Company’s Section 16 Officers (including all of the Named Executive Officers, who are identified below in “Compensation Discussion and Analysis”). In fiscal year 2012, the Compensation Committee did not retain any outside compensation consultants to advise on fiscal year 2012 Director or executive compensation matters. In fiscal year 2012, the Company’s management retained Compensia, Inc., an outside compensation consultant, to assist management in analyzing the Company’s peer companies for fiscal year 2013 compensation, evaluating the competitiveness of the Company’s executive compensation programs relative to the Company’s fiscal year 2012 peer companies and providing management with information on compensation-related trends and developments in the Company’s industry and fiscal year 2012 peer companies, including equity award practices. Compensia did not provide any other services to the Company.

Compensation Committee Interlocks and Insider Participation. During fiscal year 2012, the Compensation Committee consisted of, and currently consists of, Directors Federman (Chair), DeNuccio and Hu (as well as Mr. Marks through mid-March 2012). In fiscal year 2012, no member of the Compensation Committee was a current or former executive officer or employee of the Company. See “Certain Transactions and Relationships” for a description of one transaction occurring during fiscal year 2012 involving Mr. Federman requiring disclosure by the Company under the SEC’s rules requiring disclosure of certain relationships and related-party transactions. None of the Company’s executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, the executive officers of which served as a Director or member of the Compensation Committee during the fiscal year ended December 30, 2012.

Analysis of Risk in Compensation Programs. In setting compensation, the Compensation Committee also considers the risks to the Company’s stockholders, and the Company as a whole, arising out of the Company’s compensation programs. In March 2013, the Company’s management met to discuss and assess the risk profile of the Company’s compensation programs. Their review considered risk-influencing characteristics of the overall structure and individual components of the Company’s compensation program, including the Company’s base salaries, incentive plans and equity plans. A report regarding management’s findings was provided to the Compensation Committee for its review and consideration. Following this review and consideration, the Compensation Committee concurred with management’s conclusions that the Company’s compensation policies were not reasonably likely to have a material adverse effect on the Company and included many features that mitigate the likelihood of excessive risk-taking, including those discussed below.

Balance of Compensation. Individual elements of the Company’s compensation program include base salaries, incentive compensation, and for certain of its employees, share-based awards. By providing a mix of different elements of compensation that reward both short-term and long-term performance, the Company’s compensation programs as a whole provide a balanced approach to incentivizing and retaining employees, without placing an inappropriate emphasis on any particular form of compensation.

Objective Company Results and Pre-established Performance Measures Dictate Annual Incentives. Under the Company’s cash-based incentive plan, payments are subject to the satisfaction of specific annual performance objectives established by the Compensation Committee in advance and may be subject to reimbursement or forfeiture under the Company’s clawback policy. These performance objectives were directly and specifically tied to the Company’s fiscal year 2012 financial results, as quantified by diluted non-GAAP earnings per share, as well as the achievement of strategic objectives for fiscal year 2012.

Use of Long-Term Incentive Compensation. Share-based long-term incentive compensation that vests over a period of years is a key component of the total compensation of many of the Company’s employees. This vesting period encourages the Company’s executives and other employees to focus on sustaining and improving the Company’s long-term performance. These grants are generally made annually, so executives and other key employees always have unvested awards that could decrease significantly in value if the Company’s business is not managed for the long term.

11

Table of Contents

Internal Processes Further Restrict Risk. The Company has in place additional processes to limit risk to the Company from its compensation programs. Specifically, sales commission payments are subject to multiple internal controls regarding payout terms and payroll programs. Additionally, financial results upon which incentive compensation payments are based are subject to regular review and audit. In addition, the Company from time to time engages an external compensation consulting firm to assist in the design and review of the Company’s compensation programs, as well as external legal counsel to assist with the periodic review of the Company’s compensation plans to ensure compliance with applicable laws and regulations.

Nominating and Governance Committee

The Nominating and Governance Committee of the Board held four meetings and did not act by unanimous written consent during fiscal year 2012. During fiscal year 2012, the Nominating and Governance Committee consisted of, and currently consists of, Directors Marks (Chair), DeNuccio and Hartenstein. The Nominating and Governance Committee identifies, considers and recommends Director nominees to be selected by the Board for submission to vote at the Company’s annual stockholder meetings and to fill vacancies occurring between annual stockholder meetings, implements the Board’s criteria for selecting new Directors, develops or reviews and recommends corporate governance policies for the Board, and oversees the annual board and committee evaluation process. The Nominating and Governance Committee is also authorized to conduct investigations and to retain, at the expense of the Company, independent legal, accounting, financial, governance or other professional consultants selected by the Nominating and Governance Committee, for any matters relating to its purposes. The Board adopted a charter for the Nominating and Governance Committee, which was last reviewed and approved in March 2013. The Board has determined that each of the members of the Nominating and Governance Committee is an “independent director” as defined by NASDAQ listing standards.

Board Leadership Structure and Risk Oversight

Board Leadership Structure

Mr. Marks has served as the Chairman of the Board since January 1, 2011. Mr. Mehrotra has served as Chief Executive Officer of the Company since January 1, 2011 and as a Director since July 2010. The Board believes that it is in the Company’s best interests to maintain a separation of the Chairman of the Board and the Chief Executive Officer roles because it allows the Chief Executive Officer of the Company to focus on the Company’s day-to-day business, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. Further, the Board recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position, as well as the commitment required to serve as the Company’s Chairman, particularly as the Board’s oversight responsibilities continue to grow. The Company’s Corporate Governance Principles do not establish this approach as a fixed policy, but as a structure that is considered from time to time.

Each of the current Directors, other than Mr. Mehrotra, is independent and the independent Directors have regular executive sessions. Following an executive session of independent Directors, one or more of the attending Directors may: (1) act as a liaison between the independent Directors and management regarding any specific feedback or issues; (2) provide management with input regarding agenda items for Board and Committee meetings; and (3) coordinate with management regarding information to be provided to the independent Directors in performing their duties. The Board believes that this approach appropriately and effectively complements the Company’s current leadership structure.

Under its charter, the Nominating and Governance Committee periodically reviews the performance of the Board and its Committees, including the functionality and effectiveness of the Board’s leadership structure.

12

Table of Contents

Board Role in Risk Oversight

The Board is actively involved in the oversight of risks that could affect the Company. This oversight is conducted at the Board level and, where relevant to a committee’s duties, through the committees of the Board. While the Board and its committees oversee risk management strategy, management is responsible for implementing and supervising day-to-day risk management processes. In addition, the Audit Committee regularly reviews the Company’s enterprise risk assessment and mitigation processes and assists the Board with its oversight and annual review of the Company’s enterprise risk management. The Company believes this division of risk management responsibilities is the most effective approach for addressing the risks that the Company faces.

Consideration of Director Nominees

Identifying and Evaluating Nominees for Directors

The Nominating and Governance Committee initiates the director nomination process by preparing a slate of potential candidates who, based on their qualifications and other information available to the Nominating and Governance Committee, appear to meet the criteria specified below and/or who have specific desirable qualities, skills or experience (based on input from the full Board). The Nominating and Governance Committee may engage a third-party search firm or other advisors to assist in identifying prospective nominees. The nomination of existing Directors is not automatic, but is based on continuing qualification under the criteria set forth below and the Corporate Governance Principles of the Company. Under the Company’s Corporate Governance Principles, at all times, a majority of the individuals serving as Directors must be “independent” under applicable SEC and stock exchange rules.

After the Nominating and Governance Committee reviews a nominee’s qualifications and characteristics, a new candidate will be interviewed by at least one member of the Nominating and Governance Committee and by the Chief Executive Officer. Upon completion of the evaluation process, the Nominating and Governance Committee determines the list of potential candidates to be recommended to the full Board for nomination at the annual meeting or to fill any vacancy on the Board. The Board will select the slate of nominees, including any nominee to fill a vacancy, only from candidates screened and approved by the Nominating and Governance Committee.

Stockholder-Recommended Nominees

The Nominating and Governance Committee considers recommendations for Director nominees that are properly submitted by stockholders. In evaluating the recommended nominees (“Recommended Candidates”), the Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board and considers the membership criteria set forth under “Identifying and Evaluating Nominees for Directors” and “Director Qualifications.”

In order to be submitted properly, recommendations of Recommended Candidates must be timely delivered to the Chair of the Nominating and Governance Committee, c/o SanDisk Corporation, 951 SanDisk Drive, Milpitas, CA 95035. The recommendation must include the following written materials: (1) all information relating to the Recommended Candidate that is required to be disclosed pursuant to applicable Exchange Act rules and regulations, NASDAQ listing standards and the Company’s Bylaws (including, with respect to the Recommended Candidate, such person’s written consent to being named in the proxy statement as a nominee and, such person’s written consent to serving as a Director if elected); (2) the name(s) and address(es) of the recommending stockholder(s) and the amount of the Company’s securities owned beneficially and of record by such stockholder(s); (3) appropriate biographical information (including a business address and a telephone number) and a statement as to the Recommended Candidate’s qualifications, with a focus on the criteria

13

Table of Contents

described below under “Director Qualifications;” (4) a representation that each recommending stockholder is a holder of record of stock of the Company entitled to vote on the date of submission of such written materials; and (5) any material interest of the recommending stockholder in the recommended nomination.

If the Recommended Candidate is intended to be considered by the Nominating and Governance Committee for recommendation to the Board for the slate of Director nominees to be voted on at an annual meeting of the Company’s stockholders, the written materials must be submitted within the time permitted for submission of a stockholder proposal for inclusion in the Company’s proxy statement for the subject annual meeting and must also comply with Exchange Act rules and regulations, NASDAQ listing standards, and the provisions for stockholder proposals set forth in the Company’s Bylaws.

Director Qualifications

The Nominating and Governance Committee has established the following minimum criteria for evaluating prospective Board candidates:

| • | Reputation for integrity, strong moral character and adherence to high ethical standards; |

| • | Holds or has held a generally recognized position of leadership in the community and/or chosen field of endeavor, and has demonstrated high levels of accomplishment; |

| • | Demonstrated business acumen and experience, and ability to exercise sound business judgment in matters that relate to the current and long-term objectives of the Company; |

| • | Ability to read and understand basic financial statements and other financial information pertaining to the Company; |

| • | Commitment to understand the Company and its business, industry and strategic objectives; |

| • | Commitment and ability to regularly attend and participate in meetings of the Board, Board Committees and stockholders, the number of other company boards on which the candidate serves and ability to generally fulfill all responsibilities as a Director; |

| • | Willingness to represent and act in the interests of all stockholders of the Company rather than the interests of a particular group; |

| • | Good health and ability to serve; |

| • | For prospective non-employee Directors, independence under applicable SEC and stock exchange rules, and the absence of any conflict of interest (whether due to a business or personal relationship) or legal impediment to, or restriction on, the nominee’s ability to effectively serve as a Director; and |

| • | Willingness to accept the nomination to serve as a Director of the Company. |

Other Factors for Potential Consideration. The Nominating and Governance Committee will also consider the following factors in connection with its evaluation of each prospective nominee:

| • | Whether the prospective nominee will contribute to the Board’s overall diversity of backgrounds, skills, perspectives and experiences; |

| • | Whether the nominee possesses the requisite education, training and experience to qualify as “financially literate” or as an “audit committee financial expert” under applicable SEC and stock exchange rules; |

| • | The composition of the Board and whether the prospective nominee will add to or complement the Board’s existing strengths; |

| • | For incumbent Directors standing for re-election, the incumbent Director’s performance during his or her term, including the number of meetings attended, level of participation and overall contribution to |

14

Table of Contents

| the Company; the number of other company boards on which the individual serves; the composition of the Board at that time; any changed circumstances affecting the individual Director, which may bear on his or her ability to continue to serve on the Board or his or her value to the Board; and the Company’s retirement policy for Directors, as set forth in its Corporate Governance Principles; and |

| • | To the extent desired by the Nominating and Governance Committee, views of the other members of the Board and the Company’s senior management regarding the qualifications and suitability of prospective nominees. |

Director Compensation Table—Fiscal Year 2012

The following table presents information regarding the compensation paid during fiscal year 2012 to Directors who were members of the Board at any time during fiscal year 2012 and who were not also an employee of the Company (referred to herein as “Non-Employee Directors”). Directors employed by the Company are not entitled to receive additional compensation for their service as Directors; information regarding the compensation awarded to Mr. Mehrotra in fiscal year 2012 is included in “Summary Compensation Table—Fiscal Years 2010-2012” elsewhere in this Proxy Statement.

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($) (1)(2)(3) |

Option Awards ($) (1)(2)(3) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||

| Michael E. Marks |

116,875 | (4) | 81,571 | 75,334 | — | 273,780 | ||||||||||||||

| Kevin DeNuccio |

65,000 | 81,571 | 75,334 | — | 221,905 | |||||||||||||||

| Irwin Federman |

85,000 | 81,571 | 75,334 | — | 241,905 | |||||||||||||||

| Steven J. Gomo |

70,000 | 81,571 | 75,334 | — | 226,905 | |||||||||||||||

| Eddy W. Hartenstein |

57,500 | 81,571 | 75,334 | — | 214,405 | |||||||||||||||

| Dr. Chenming Hu |

57,500 | 81,571 | 75,334 | — | 214,405 | |||||||||||||||

| Catherine P. Lego |

80,000 | 81,571 | 75,334 | — | 236,905 | |||||||||||||||

| (1) | The amounts represent the full grant date fair value of the stock awards and option awards granted in fiscal year 2012 as computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. For a discussion of the assumptions and methodologies used to calculate the valuations of the stock awards and option awards, please see the discussion of stock awards and option awards contained in Note 10—“Share-Based Compensation,” of the Notes to Consolidated Financial Statements in Item 8 “Financial Statements and Supplementary Data,” of the Company’s Form 10-K for the fiscal year ended December 30, 2012 filed with the SEC on February 19, 2013. Under general accounting principles, compensation expense with respect to stock awards and option awards granted to the Directors is generally recognized over the vesting periods applicable to the awards. |

| (2) | In fiscal year 2012, the Company granted each of the Non-Employee Directors an annual stock option award in the amount of 6,250 shares, with an exercise price of $35.95, and an annual restricted stock unit grant in the amount of 2,269 shares. Subject to the Non-Employee Director’s continued service, the shares subject to each such award vest in one installment on the earlier of (i) the first anniversary of the grant date or (ii) the day immediately preceding the next annual meeting of the Company’s stockholders following the grant date. |

15

Table of Contents

| (3) | The following table presents the number of outstanding and unexercised option awards and the number of unvested stock awards (which term includes restricted stock units for purposes of this Proxy Statement) held by each of the Company’s Non-Employee Directors as of December 30, 2012: |

| Director |

Number of Shares Subject to Outstanding Option Awards as of 12/30/12 |

Number of Unvested Shares or Units as of 12/30/12 | ||||||||

| Michael E. Marks |

37,500 | 2,269 | ||||||||

| Kevin DeNuccio |

31,250 | 6,722 | ||||||||

| Irwin Federman |

31,250 | 2,269 | ||||||||

| Steven J. Gomo |

31,250 | 2,269 | ||||||||

| Eddy W. Hartenstein |

43,750 | 2,269 | ||||||||

| Dr. Chenming Hu |

43,750 | 6,722 | ||||||||

| Catherine P. Lego |

141,750 | 2,269 | ||||||||

| (4) | Includes fees paid to Mr. Marks for his service on the Compensation Committee during the first quarter of fiscal year 2012. |

Elements of Director Compensation

Compensation for Non-Employee Directors during fiscal year 2012 generally consisted of annual retainers and annual share-based awards. The Compensation Committee, consisting solely of independent directors, has the primary responsibility for reviewing and considering any revisions to Non-Employee Director compensation, and recommending any such revisions to the Board for review. The Compensation Committee periodically reviews Non-Employee Director compensation. In such review, the Compensation Committee may review and consider data regarding the competitiveness of the Company’s Non-Employee Director compensation program relative to the Company’s peer companies and general industry trends, which data may be compiled by the Company’s management and/or with the assistance of a compensation consultant. The Board reviews the Compensation Committee’s recommendations and determines the amount of director compensation.

Annual Retainers

The following table sets forth the schedule of the annual retainers for the Non-Employee Directors in effect during fiscal year 2012:

| Type of Fee |

Fiscal Year 2012 | |||

| Annual Board Retainer |

$ | 50,000 | ||

| Additional Annual Retainer to Chairman of the Board |

$ | 50,000 | ||

| Additional Annual Retainer to Chair of Audit Committee |

$ | 30,000 | ||

| Additional Annual Retainer to Chairs of Compensation Committee and Nominating and Governance Committee |

$ | 15,000 | ||

| Additional Annual Retainer to non-Chair Members of Audit Committee |

$ | 20,000 | ||

| Additional Annual Retainer to non-Chair Members of Compensation Committee and Nominating and Governance Committee |

$ | 7,500 | ||

All Non-Employee Directors are also reimbursed for out-of-pocket expenses they incur serving as Directors and as committee members.

Share-based Awards

Under the Company’s Non-Employee Director compensation policy, as currently in effect, a Non-Employee Director who first takes office and who has not been employed by the Company in the preceding twelve (12) months receives, at the time of his or her election or appointment to the Board, (i) an initial option grant to purchase 25,000 shares of Common Stock (the “Initial Option Grant”), and (ii) an initial restricted stock unit

16

Table of Contents

(“RSU”) grant for a number of units determined by dividing $320,000 by the average closing price per share of Common Stock on NASDAQ for the five (5) trading days ended on, and including, the grant date (the “Initial Unit Grant”). Each Non-Employee Director who has served in that capacity for at least six (6) months at the time of grant also receives, on the date of the annual meeting of the Company’s stockholders, an annual award consisting of (i) an option grant to purchase 6,250 shares of Common Stock (the “Annual Option Grant”), and (ii) an RSU grant for a number of units determined by dividing $80,000 by the average closing price per share of Common Stock on NASDAQ for the five (5) trading days ended on, and including, the grant date (the “Annual Unit Grant”). The initial and annual awards described above are granted under, and are subject to, the Company’s Amended and Restated 2005 Incentive Plan, as amended (the “2005 Plan”).

Initial and Annual Stock Option Grants. The Initial and Annual Option Grants are granted with a per share exercise price equal to the fair market value of a share of Common Stock on the grant date. For these purposes, and in accordance with the terms of the 2005 Plan and the Company’s share-based award grant practices, the fair market value is equal to the closing price of a share of the Common Stock on NASDAQ on the grant date.

The stock options granted to Non-Employee Directors are immediately exercisable. However, upon a Non-Employee Director’s cessation of service with the Company, any shares purchased upon exercise of the option that have not vested (as described below) are subject to repurchase by the Company at the lower of (i) the exercise price paid for the shares or (ii) the fair market value of the shares at the time of repurchase (as determined under the 2005 Plan). This type of stock option is generally referred to as an “early exercise” stock option because the holder is permitted to exercise the option prior to the time that the underlying shares vest. Subject to the Non-Employee Director’s continued service, the shares subject to the Initial Option Grant vest, and the Company’s repurchase right lapses, in four substantially equal annual installments on each of the first through fourth anniversaries of the grant date. Subject to the Non-Employee Director’s continued service, the shares subject to the Annual Option Grant vest, and the Company’s repurchase right lapses, in one installment on the earlier of (i) first anniversary of the grant date or (ii) the day immediately preceding the next annual meeting of the Company’s stockholders following the grant date.

Once vested, each option will generally remain exercisable for fully vested shares of Common Stock (i.e., shares which are not subject to the Company’s repurchase right) until its normal expiration date. Each of the options granted to the Company’s Non-Employee Directors under the 2005 Plan has a term of seven (7) years. However, vested stock options may terminate earlier in connection with a change in control of the Company. Pursuant to the terms of the 2005 Plan, stock options granted to the Company’s Non-Employee Directors will vest on an accelerated basis in connection with a change in control of the Company. Shares subject to the option that have not vested will immediately terminate (or be subject to the Company’s repurchase right to the extent already purchased under the option) upon the cessation of the Non-Employee Director’s service. However, the shares subject to options vest, and the Company’s repurchase right lapses, in full if the Non-Employee Director’s cessation of service is as a result of the Director’s death or permanent disability. Non-Employee Directors generally have twelve (12) months to exercise the vested portion of the option following a cessation of service.

The options granted to Non-Employee Directors do not include any dividend or dividend equivalent rights. However, Non-Employee Directors are entitled to dividends with respect to shares purchased upon the exercise of options, whether or not such shares have vested under the option, at the same rate as the Company’s other stockholders.

Initial and Annual RSU Grants. Each RSU awarded to the Company’s Non-Employee Directors represents a contractual right to receive one share of the Common Stock if the time-based vesting requirements described below are satisfied.

Subject to the Non-Employee Director’s continued service, the units subject to the Initial Unit Grant vest in four substantially equal annual installments on each of the first through fourth anniversaries of the grant date. Subject to the Non-Employee Director’s continued service, the units subject to the Annual Unit Grant vest in one

17

Table of Contents

installment on the earlier of (i) the first anniversary of the grant date or (ii) the day immediately preceding the next annual meeting of the Company’s stockholders following the grant date. Pursuant to the terms of the 2005 Plan, RSUs granted to the Company’s Non-Employee Directors will vest on an accelerated basis in connection with a change in control of the Company. Upon the cessation of the Non-Employee Director’s service, any unvested RSUs will generally terminate. However, RSUs granted to a Non-Employee Director vest in full if the Non-Employee Director’s cessation of service is as a result of the Director’s death or permanent disability.

RSUs will generally be paid in an equivalent number of shares of the Common Stock as they vest. Non-Employee Directors are not entitled to voting or dividend rights with respect to the RSUs, and the RSUs generally may not be transferred, except to the Company or to a beneficiary of the Non-Employee Director upon his or her death. However, non-Employee Directors are entitled to the following dividend equivalent rights with respect to the RSUs. If the Company pays a cash dividend on its Common Stock and the dividend record date occurs after the grant date and before all of the RSUs have either been paid or terminated, then the Company will credit the Non-Employee Director’s bookkeeping account with an amount equal to (i) the per-share cash dividend paid by the Company on its Common Stock with respect to the dividend record date, multiplied by (ii) the total number of outstanding and unpaid RSUs (including any unvested RSUs) as of the dividend record date. These dividend equivalents will be subject to the same vesting, payment and other terms and conditions as the original RSUs to which they relate (except that the dividend equivalents may be paid in cash or such other form as the plan administrator may deem appropriate).

The Board administers the 2005 Plan as to Non-Employee Director awards and has the ability to interpret and make all required determinations under the plan, subject to plan limits. This authority includes making required proportionate adjustments to outstanding awards to reflect any impact resulting from various corporate events such as reorganizations, mergers and stock splits.

Required Vote

The required vote for the election of each Director is as described above under “Voting Rights.”

Recommendation of the Board of Directors

The Board believes that Proposal No. 1 is in the Company’s best interests and the best interests of its stockholders’ and unanimously recommends a vote FOR the election of each of the Director nominees.

18

Table of Contents

APPROVAL OF THE SANDISK CORPORATION 2013 INCENTIVE PLAN

The Company’s stockholders are being asked to vote on a proposal to approve the SanDisk Corporation 2013 Incentive Plan (the “2013 Plan”), which is attached as Annex A to this Proxy Statement, under which 20,000,000 shares of the Company’s Common Stock will initially be reserved for issuance, to be used by the Company over multiple years. The 2013 Plan was approved by the Board, based on the recommendation of the Company’s Compensation Committee, on March 14, 2013, subject to stockholder approval at the Annual Meeting. The 2013 Plan is intended to serve as a successor to and replacement for our 2005 Plan, which is expected to expire pursuant to its terms on March 15, 2015. In addition, the 2013 Plan will replace any shares available for future grant under plans assumed by SanDisk in connection with acquisitions (the “Assumed Plans”). If approved, the 2013 Plan will take effect on June 13, 2013, the day after the 2013 Annual Meeting, and will expire on March 14, 2023. If the Company’s stockholders do not approve the 2013 Plan, then the term, conditions and current share limits of the 2005 Plan will continue in effect, and the Company will continue to make awards under the 2005 Plan, subject to such terms, conditions and share limits.

The following table sets forth information regarding outstanding grants as of March 15, 2013 under the 2005 Plan, as well as the Company’s 1995 Stock Option Plan (the “1995 Plan”) and 1995 Non-Employee Directors Stock Option Plan (the “Directors Plan” and collectively with the 2005 Plan and the 1995 Plan, the “Predecessor Plans”), both of which expired in 2005, and the Assumed Plans. Awards other than options and stock appreciation rights are referred to as full value awards in the table below.

| Plan |

Options and Stock Appreciation Rights Outstanding (# of Shares) |

Weighted- Average Exercise Price ($ per Share) |

Weighted- Average Remaining Term (Years) |

Full

Value Awards Outstanding (# of Shares) |

Shares Available for Future Grant (# of Shares) |

|||||||||||||||

| 2005 Plan |

10,001,508 | $ | 41.22 | 4.22 | 4,115,630 | 9,748,206 | ||||||||||||||

| Other Predecessor Plans |

739,912 | $ | 27.55 | 1.42 | — | — | ||||||||||||||

| Assumed Plans |

565,038 | $ | 37.42 | 3.88 | 46,390 | 61,688 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

11,306,458 | $ | 40.14 | 4.02 | 4,162,020 | 9,809,894 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Stockholder approval of the 2013 Plan will not affect any awards outstanding under the Predecessor Plans or the Assumed Plans at the time of the Annual Meeting. Other than automatic Non-Employee Director grants under the 2005 Plan, which will take effect immediately upon the election of the Non-Employee Directors to the Board at the Annual Meeting, and other than awards established under the Company’s annual cash incentive program for fiscal year 2013, no further awards will be made under the 2005 Plan or the Assumed Plans following stockholder approval of the 2013 Plan at the Annual Meeting and the portion of the share reserves under the 2005 Plan and the Assumed Plans which are in excess of the then-outstanding awards under the 2005 Plan and the Assumed Plans will be cancelled upon such stockholder approval. However, to the extent any awards outstanding under the Predecessor Plans subsequently expire, terminate or lapse, the number of shares of Common Stock subject to those expired, terminated or lapsed awards will be added to the share reserve available for issuance under the 2013 Plan, up to a maximum of 10,000,000 additional shares.

Why Stockholders Should Vote for the Adoption of the 2013 Plan