NORDIC AMERICAN TANKERS Ltd0001000177false12-312020FYD00P2YP60M0.0010.0012024-02-282024-02-2800010001772020-01-012020-12-310001000177dei:BusinessContactMember2020-01-012020-12-3100010001772020-12-3100010001772018-01-012018-12-3100010001772019-01-012019-12-3100010001772019-12-310001000177us-gaap:CommonStockMember2017-12-310001000177us-gaap:TreasuryStockMember2017-12-310001000177srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201409Member2017-12-310001000177us-gaap:RetainedEarningsMember2017-12-310001000177nat:ContributedSurplusMember2017-12-3100010001772017-12-310001000177us-gaap:AdditionalPaidInCapitalMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201409Member2017-12-310001000177us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001000177us-gaap:AdditionalPaidInCapitalMember2017-12-310001000177us-gaap:AccountingStandardsUpdate201409Memberus-gaap:CommonStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310001000177srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201409Memberus-gaap:RetainedEarningsMember2017-12-310001000177us-gaap:AccumulatedOtherComprehensiveIncomeMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201409Member2017-12-310001000177us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001000177us-gaap:RetainedEarningsMember2020-01-012020-12-310001000177us-gaap:RetainedEarningsMember2019-01-012019-12-310001000177nat:ContributedSurplusMember2018-01-012018-12-310001000177us-gaap:CommonStockMember2019-01-012019-12-310001000177us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001000177us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001000177us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001000177nat:ContributedSurplusMember2019-01-012019-12-310001000177us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001000177nat:ContributedSurplusMember2020-01-012020-12-310001000177us-gaap:CommonStockMember2020-01-012020-12-310001000177us-gaap:RetainedEarningsMember2018-01-012018-12-310001000177us-gaap:CommonStockMember2018-01-012018-12-310001000177us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001000177us-gaap:TreasuryStockMember2020-01-012020-12-310001000177us-gaap:TreasuryStockMember2019-01-012019-12-310001000177us-gaap:TreasuryStockMember2018-01-012018-12-310001000177us-gaap:TreasuryStockMember2020-12-310001000177us-gaap:CommonStockMember2020-12-310001000177us-gaap:TreasuryStockMember2019-12-310001000177us-gaap:CommonStockMember2019-12-310001000177srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommonStockMember2017-12-310001000177us-gaap:TreasuryStockMember2018-12-310001000177us-gaap:CommonStockMember2018-12-310001000177srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:TreasuryStockMember2017-12-310001000177srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AdditionalPaidInCapitalMember2017-12-310001000177srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2017-12-310001000177us-gaap:AdditionalPaidInCapitalMember2019-12-310001000177us-gaap:RetainedEarningsMember2018-12-310001000177us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001000177us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2017-12-310001000177us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001000177nat:ContributedSurplusMember2018-12-3100010001772018-12-310001000177us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001000177us-gaap:RetainedEarningsMember2020-12-310001000177us-gaap:AdditionalPaidInCapitalMember2018-12-310001000177us-gaap:RetainedEarningsMember2019-12-310001000177srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMembernat:ContributedSurplusMember2017-12-310001000177nat:ContributedSurplusMember2020-12-310001000177srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001000177us-gaap:AdditionalPaidInCapitalMember2020-12-310001000177nat:ContributedSurplusMember2019-12-310001000177us-gaap:RevolvingCreditFacilityMember2019-12-310001000177us-gaap:RevolvingCreditFacilityMember2018-12-310001000177nat:NordicSpaceMember2020-01-012020-12-310001000177nat:NordicLightMember2020-01-012020-12-310001000177nat:NordicCastorMember2020-01-012020-12-310001000177nat:NordicCygnusMember2020-01-012020-12-310001000177nat:NordicFreedomMember2020-01-012020-12-310001000177nat:NordicSprinterMember2020-01-012020-12-310001000177nat:NordicPolluxMember2020-01-012020-12-310001000177nat:NordicPassatMember2020-01-012020-12-310001000177nat:NordicStarMember2020-01-012020-12-310001000177nat:NordicLunaMember2020-01-012020-12-310001000177nat:NordicVegaMember2020-01-012020-12-310001000177nat:NewbuildingTwoMember2020-01-012020-12-310001000177nat:NordicCosmosMember2020-01-012020-12-310001000177nat:NordicSkierMember2020-01-012020-12-310001000177nat:NordicSiriusMember2020-01-012020-12-310001000177nat:NordicGraceMember2020-01-012020-12-310001000177nat:NordicAquariusMember2020-01-012020-12-310001000177nat:NewbuildingOneMember2020-01-012020-12-310001000177nat:NordicBreezeMember2020-01-012020-12-310001000177nat:NordicMoonMember2020-01-012020-12-310001000177nat:NordicMistralMember2020-01-012020-12-310001000177nat:NordicCrossMember2020-01-012020-12-310001000177nat:NordicTellusMember2020-01-012020-12-310001000177nat:NordicZenithMember2020-01-012020-12-310001000177nat:NordicApolloMember2020-01-012020-12-310001000177nat:BallastTankMember2020-01-012020-12-310001000177nat:CEOAndCFOMember2018-01-012018-12-310001000177nat:CEOAndCFOMember2019-01-012019-12-310001000177nat:NorwegianTaxAdministrationMember2020-01-012020-12-310001000177nat:NorwegianTaxAdministrationMember2019-01-012019-12-310001000177nat:NorwegianTaxAdministrationMember2018-01-012018-12-310001000177us-gaap:CustomerConcentrationRiskMembernat:OneCustomerMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001000177us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2018-01-012018-12-310001000177nat:OneCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2019-01-012019-12-310001000177nat:TwoCharterersMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001000177us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembernat:ChartererOneMember2020-01-012020-12-310001000177us-gaap:CustomerConcentrationRiskMembernat:ChartererOneMemberus-gaap:AccountsReceivableMember2019-01-012019-12-310001000177us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembernat:ChartererTwoMember2019-01-012019-12-310001000177us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembernat:ThreeCharterersMember2019-01-012019-12-310001000177us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembernat:ChartererTwoMember2020-01-012020-12-310001000177us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembernat:ChartererThreeMember2019-01-012019-12-310001000177us-gaap:AccountsReceivableMembernat:TwoCharterersMember2020-01-012020-12-310001000177us-gaap:AccountsReceivableMembernat:ThreeCharterersMember2019-01-012019-12-310001000177us-gaap:AccountingStandardsUpdate201602Member2018-12-310001000177us-gaap:AccountingStandardsUpdate201602Member2019-12-310001000177nat:SpotCharterMember2020-01-012020-12-310001000177nat:TimeCharterMember2020-01-012020-12-310001000177nat:SpotCharterMember2019-01-012019-12-310001000177nat:SpotCharterMember2018-01-012018-12-310001000177nat:TimeCharterMember2019-01-012019-12-310001000177nat:TimeCharterMember2018-01-012018-12-310001000177nat:TimeCharterMember2020-12-310001000177srt:MaximumMember2020-01-012020-12-310001000177nat:VesselsMember2019-01-012019-12-310001000177nat:DrydockingMember2019-01-012019-12-310001000177nat:VesselsMember2020-01-012020-12-310001000177nat:DrydockingMember2020-01-012020-12-310001000177nat:VesselsMember2020-12-310001000177nat:DrydockingMember2020-12-310001000177nat:VesselsMember2019-12-310001000177nat:DrydockingMember2019-12-310001000177nat:HermitageOffshoreServicesLimitedMember2019-12-310001000177nat:HermitageOffshoreServicesLimitedMember2020-01-012020-12-310001000177srt:DirectorMember2020-01-012020-12-310001000177srt:DirectorMember2018-01-012018-12-310001000177srt:DirectorMember2019-01-012019-12-310001000177srt:DirectorMember2020-12-310001000177srt:DirectorMember2019-12-310001000177srt:DirectorMember2018-12-310001000177nat:EquityIncentivePlan2011Member2020-12-310001000177nat:EquityIncentivePlan2011Memberus-gaap:EmployeeStockOptionMember2020-12-310001000177nat:EquityIncentivePlan2011Member2019-01-012019-12-310001000177nat:EquityIncentivePlan2011Member2019-12-310001000177nat:EquityIncentivePlan2011Member2020-01-082020-01-080001000177nat:EquityIncentivePlan2011Member2020-01-012020-12-310001000177us-gaap:EmployeeStockOptionMembernat:AmendedRestated2011EquityIncentivePlanMember2020-01-012020-12-310001000177nat:EquityIncentivePlan2011Member2018-01-012018-12-310001000177us-gaap:EmployeeStockOptionMembernat:AmendedRestated2011EquityIncentivePlanMember2019-12-310001000177us-gaap:ShareBasedCompensationAwardTrancheOneMembernat:AmendedRestated2011EquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2019-01-012019-12-310001000177nat:AmendedRestated2011EquityIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2019-01-012019-12-310001000177us-gaap:EmployeeStockOptionMembernat:AmendedRestated2011EquityIncentivePlanMember2019-01-012019-12-310001000177us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2020-01-012020-12-310001000177us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310001000177us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2020-12-310001000177us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2020-12-310001000177us-gaap:SecuredDebtMember2020-01-012020-12-310001000177nat:BuiltVesselsFinancingMember2017-12-012017-12-010001000177nat:AccordionLoanMember2020-12-160001000177us-gaap:SecuredDebtMember2019-02-120001000177nat:AccordionLoanMember2020-01-012020-12-310001000177us-gaap:SecuredDebtMember2019-02-122019-02-120001000177nat:BuiltVesselsFinancingMember2017-12-010001000177us-gaap:SecuredDebtMember2019-12-310001000177us-gaap:SecuredDebtMember2020-12-310001000177us-gaap:SecuredDebtMemberus-gaap:SubsequentEventMember2021-04-290001000177nat:BuiltVesselsFinancingMember2020-12-310001000177nat:BuiltVesselsFinancingMember2019-12-310001000177us-gaap:SecuredDebtMember2019-10-012019-12-310001000177us-gaap:SecuredDebtMemberus-gaap:SubsequentEventMember2021-01-012021-04-290001000177nat:BuiltVesselsFinancingMember2020-01-012020-12-310001000177srt:MinimumMembernat:BuiltVesselsFinancingMember2017-12-012017-12-010001000177nat:BuiltVesselsFinancingMembersrt:MaximumMember2017-12-012017-12-010001000177nat:SecuredDebtAndAccordionLoanMember2020-12-310001000177srt:MaximumMember2020-10-162020-10-160001000177srt:MaximumMember2019-03-292019-03-290001000177us-gaap:SubsequentEventMember2021-01-012021-04-2200010001772019-11-192019-11-190001000177us-gaap:RightsMember2017-06-160001000177us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001000177us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Member2019-12-310001000177us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001000177us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310001000177us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001000177us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001000177us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310001000177us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001000177us-gaap:SubsequentEventMember2021-02-262021-02-26xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesnat:Vesselutr:tnat:Agreementnat:Segmentnat:Subsidiaryxbrli:purenat:Customernat:Charternat:Buildingnat:Lendernat:Claim

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

| ☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

OR

| ☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: Not applicable

For the transition period from ___________________________ to ___________________________

Commission file number 001-13944

|

NORDIC AMERICAN TANKERS LIMITED |

|

| |

(Exact name of Registrant as specified in its charter) |

|

| |

|

|

| |

(Translation of Registrant’s name into English) |

|

| |

|

|

| |

BERMUDA |

|

| |

(Jurisdiction of incorporation or organization) |

|

| |

|

|

| |

LOM BUILDING |

|

| |

27 REID STREET |

|

| |

Hamilton HM 11 |

|

| |

Bermuda |

|

| |

(Address of principal executive offices) |

|

| |

|

|

| |

Herbjorn Hansson, Chairman, President, and Chief Executive Officer, Tel No. 1 (441) 292-7202, LOM Building, 27 Reid Street, Hamilton HM 11, Bermuda |

|

| |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

|

|

Securities registered or to be registered pursuant to Section 12(b) of the Act: |

|

| |

|

|

|

|

| |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

| |

Common Shares, $0.01 par value |

NAT |

New York Stock Exchange |

|

| |

Series A Participating Preferred Shares |

|

New York Stock Exchange |

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

As of December 31, 2020, there were outstanding 151,446,112 common shares of the Registrant, $0.01 par value per share.

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual report or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during this preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ |

Accelerated filer ☒ |

Non-accelerated filer ☐ |

Emerging Growth Company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark which basis of accounting the Registrant has used to prepare the financial statements included in this filing:

☒ U.S. GAAP

☐ International Financial Reporting Standards as issued by the International Accounting Standards Board

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow.

☐ Item 17

☐ Item 18

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

|

|

|

Page |

PART I |

|

|

|

ITEM 1. |

|

1 |

ITEM 2. |

|

1 |

ITEM 3. |

|

1 |

| |

|

|

1 |

| |

|

|

2 |

| |

|

|

2 |

| |

|

|

2 |

ITEM 4. |

|

27 |

| |

|

|

27 |

| |

|

|

29 |

| |

|

|

44 |

| |

|

|

44 |

ITEM 4A. |

|

44 |

ITEM 5. |

|

45 |

| |

|

|

45 |

| |

|

|

52 |

| |

|

|

55 |

| |

|

|

55 |

| |

|

|

55 |

| |

|

|

55 |

| |

|

|

56 |

ITEM 6. |

|

56 |

| |

|

|

56 |

| |

|

|

57 |

| |

|

|

58 |

| |

|

|

58 |

| |

|

|

58 |

ITEM 7. |

|

59 |

| |

|

|

59 |

| |

|

|

59 |

| |

|

|

59 |

ITEM 8. |

|

59 |

| |

|

|

59 |

| |

|

|

60 |

ITEM 9. |

|

60 |

ITEM 10. |

|

60 |

| |

|

|

60 |

| |

|

|

60 |

| |

|

|

65 |

| |

|

|

66 |

| |

|

|

67 |

| |

|

|

75 |

| |

|

|

75 |

| |

|

|

75 |

| |

|

|

76 |

ITEM 11. |

|

76 |

ITEM 12. |

|

76 |

TABLE OF CONTENTS

(continued)

|

|

|

Page |

PART II |

|

|

|

ITEM 13. |

|

76 |

ITEM 14. |

|

76 |

ITEM 15. |

|

77 |

| |

|

|

77 |

| |

|

|

77 |

| |

|

|

77 |

| |

|

|

78 |

ITEM 16. |

|

78 |

ITEM 16A. |

|

78 |

ITEM 16B. |

|

78 |

ITEM 16C. |

|

78 |

| |

|

|

78 |

| |

|

|

78 |

| |

|

|

78 |

| |

|

|

78 |

| |

|

|

78 |

| |

|

|

79 |

ITEM 16D. |

|

79 |

ITEM 16E. |

|

79 |

ITEM 16F. |

|

79 |

ITEM 16G. |

|

79 |

ITEM 16H. |

|

79 |

PART III |

|

|

|

ITEM 17. |

|

79 |

ITEM 18. |

|

79 |

ITEM 19. |

|

80 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed herein may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. This report and any other written or oral statements made by us or on our behalf may include forward-looking statements, which reflect our current views with respect to future events and financial performance, and are not intended to give any assurance as to future results. When used in this document, the words “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “target,” “project,” “likely,” “will,” “would,” “may,” “seek,” “continue,” “possible,” “might,” “forecast,” “potential,” “should,” “could” and similar expressions, terms, or phrases may identify forward-looking statements.

The forward-looking statements are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, our management’s examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include the strength of world economies and currencies, general market conditions, including fluctuations in charter rates and vessel values, changes in demand in the tanker market, as a result of changes in the petroleum production levels set by the Organization of the Petroleum Exporting Countries (“OPEC”), and worldwide oil consumption and storage, changes in our operating expenses, including bunker prices, drydocking and insurance costs, the market for our vessels, availability of financing and refinancing, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation and potential costs due to environmental damage and vessel collisions, general domestic and international political conditions or events including “trade wars”, potential disruption of shipping routes due to accidents or political events, the length and severity of epidemics and pandemics, including the ongoing global outbreak of the novel coronavirus (“COVID-19”) and its impact on the demand for seaborne transportation in the tanker sector, vessel breakdowns and instances of off-hire, failure on the part of a seller to complete a sale of a vessel to us and other important factors described from time to time in the reports filed by the Company with the Securities and Exchange Commission, or the SEC.

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable

| ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable

Throughout this annual report, all references to “Nordic American Tankers,” “NAT,” the “Company,” “the Group,” “we,” “our,” and “us” refer to Nordic American Tankers Limited and its subsidiaries. Unless otherwise indicated, all references to “U.S. dollars,” “USD,” “dollars,” “US$” and “$” in this annual report are to the lawful currency of the United States of America and references to “Norwegian Kroner” or “NOK” are to the lawful currency of Norway.

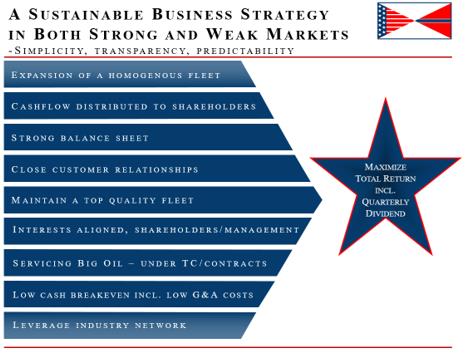

NORDIC AMERICAN TANKERS LTD. IS VERY DIFFERENT FROM OTHER STOCK LISTED TANKER COMPANIES. PLEASE SEE ITEM 4. A. FOR THE NAT OVERALL STRATEGY.

| A. |

Selected Financial Data |

The following selected historical financial information should be read in conjunction with our audited financial statements and related notes, which are included herein, together with Item 5. Operating and Financial Review and Prospects. The Statements of Operations data for each of the three years ended December 31, 2020, 2019 and 2018 and selected Balance Sheet data as of December 31, 2020 and 2019 have been derived from our audited financial statements included elsewhere in this document. The Statements of Operations financial information for the years ended December 31, 2017 and 2016 and selected balance sheet information as of December 31, 2018, 2017 and 2016 have been derived from our audited financial statements not included in this Annual Report on Form 20-F.

SELECTED CONSOLIDATED FINANCIAL DATA |

|

Year ended December 31, |

|

All figures in thousands of USD except share data |

|

2020 |

|

|

2019 |

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

Voyage Revenues |

|

|

354,619 |

|

|

|

317,220 |

|

|

|

289,016 |

|

|

|

297,141 |

|

|

|

357,451 |

|

Voyage Expenses |

|

|

(121,089 |

) |

|

|

(141,770 |

) |

|

|

(165,012 |

) |

|

|

(142,465 |

) |

|

|

(125,987 |

) |

Vessel Operating Expense |

|

|

(66,883 |

) |

|

|

(66,033 |

) |

|

|

(80,411 |

) |

|

|

(87,663 |

) |

|

|

(80,266 |

) |

General and Administrative Expenses |

|

|

(17,586 |

) |

|

|

(13,481 |

) |

|

|

(12,727 |

) |

|

|

(12,575 |

) |

|

|

(12,296 |

) |

Depreciation Expenses |

|

|

(67,834 |

) |

|

|

(63,965 |

) |

|

|

(60,695 |

) |

|

|

(100,669 |

) |

|

|

(90,889 |

) |

Impairment Loss on Vessel |

|

|

- |

|

|

|

- |

|

|

|

(2,168 |

) |

|

|

(110,480 |

) |

|

|

- |

|

Impairment Loss on Goodwill |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(18,979 |

) |

|

|

- |

|

Loss on Disposal of Vessels |

|

|

- |

|

|

|

- |

|

|

|

(6,619 |

) |

|

|

- |

|

|

|

- |

|

Settlement Received |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,328 |

|

Net Operating Income (Loss) |

|

|

81,227 |

|

|

|

31,971 |

|

|

|

(38,616 |

) |

|

|

(175,690 |

) |

|

|

53,341 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Income |

|

|

96 |

|

|

|

298 |

|

|

|

334 |

|

|

|

347 |

|

|

|

215 |

|

Interest Expense |

|

|

(31,481 |

) |

|

|

(38,390 |

) |

|

|

(34,549 |

) |

|

|

(20,464 |

) |

|

|

(11,170 |

) |

Other Financial (Expense) Income |

|

|

255 |

|

|

|

(4,160 |

) |

|

|

(14,729 |

) |

|

|

(644 |

) |

|

|

(98 |

) |

Total Other Expenses |

|

|

(31,130 |

) |

|

|

(42,252 |

) |

|

|

(48,944 |

) |

|

|

(20,761 |

) |

|

|

(11,053 |

) |

Income Tax Expense |

|

|

(64 |

) |

|

|

(71 |

) |

|

|

(79 |

) |

|

|

(83 |

) |

|

|

(102 |

) |

Loss on Equity Method Investment |

|

|

- |

|

|

|

- |

|

|

|

(7,667 |

) |

|

|

(8,435 |

) |

|

|

(46,642 |

) |

Net Income (Loss) |

|

|

50,033 |

|

|

|

(10,352 |

) |

|

|

(95,306 |

) |

|

|

(204,969 |

) |

|

|

(4,456 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Earnings (Loss) per Share |

|

|

0.34 |

|

|

|

(0.07 |

) |

|

|

(0.67 |

) |

|

|

(1.97 |

) |

|

|

(0.05 |

) |

Cash Dividends Declared per Share |

|

|

0.45 |

|

|

|

0.10 |

|

|

|

0.07 |

|

|

|

0.53 |

|

|

|

1.37 |

|

Basic and Diluted Weighted Average Shares Outstanding |

|

|

149,292,586 |

|

|

|

142,571,361 |

|

|

|

141,969,666 |

|

|

|

103,832,680 |

|

|

|

92,531,001 |

|

Market Price per Common Share as of December 31, |

|

|

2.95 |

|

|

|

4.92 |

|

|

|

2.00 |

|

|

|

2.46 |

|

|

|

8.40 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other financial data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Provided by (Used in) Operating Activities |

|

|

110,944 |

|

|

|

52,858 |

|

|

|

(16,103 |

) |

|

|

31,741 |

|

|

|

127,786 |

|

Cash Dividends Paid |

|

|

67,242 |

|

|

|

14,255 |

|

|

|

9,936 |

|

|

|

54,226 |

|

|

|

125,650 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Balance Sheet Data (at period end): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents |

|

|

57,847 |

|

|

|

48,847 |

|

|

|

49,327 |

|

|

|

58,359 |

|

|

|

82,170 |

|

Total Assets |

|

|

974,347 |

|

|

|

1,030,903 |

|

|

|

1,071,111 |

|

|

|

1,141,063 |

|

|

|

1,349,904 |

|

Total Long-Term Debt (1) |

|

|

334,615 |

|

|

|

375,364 |

|

|

|

417,836 |

|

|

|

388,855 |

|

|

|

442,820 |

|

Common Stock |

|

|

1,514 |

|

|

|

1,472 |

|

|

|

1,420 |

|

|

|

1,420 |

|

|

|

1,020 |

|

Total Shareholders’ Equity |

|

|

599,126 |

|

|

|

595,424 |

|

|

|

602,031 |

|

|

|

711,064 |

|

|

|

871,049 |

|

(1) Debt consists of $341,374, $385,285, $419,867, $391,641 and $447,000 as of December 31, 2020, 2019, 2018, 2017 and 2016, respectively (all numbers in thousands of U.S. dollars), excluding deferred financing costs.

| B. |

Capitalization and Indebtedness |

Not applicable.

| C. |

Reasons for the offer and use of Proceeds |

Not applicable.

The following constitutes a summary of the material risks relevant to an investment in our company. The occurrence of any of the events described in this section could significantly and negatively affect our business, financial condition, operating results or cash available for dividends or the trading price of our common stock.

Summary of Risk Factors

|

• |

If the Suezmax tanker industry, which historically has been cyclical and volatile, is depressed in the future, our revenues, earnings and available cash flow may decrease. |

|

• |

Major outbreaks of diseases and governmental responses thereto could adversely affect our business. |

|

• |

Any decrease in shipments of crude oil may adversely affect our financial performance. |

|

• |

We are dependent on spot charters and any decrease in spot charter rates in the future may adversely affect our earnings and our ability to pay dividends. |

|

• |

Changes in the price of fuel and regulations may adversely affect our profits. |

|

• |

Inability to renew the fleet would adversely affect our business, results of operations, financial condition and ability to pay dividends. |

|

• |

The international Suezmax tanker industry has experienced volatile charter rates and vessel values and there can be no assurance that these charter rates and vessel values will not decrease in the near future. |

|

• |

Our results of operations are subject to seasonal fluctuations, which may adversely affect our financial condition. |

|

• |

Declines in charter rates and other market deterioration could cause us to incur impairment charges. |

|

• |

The value of our vessels may be depressed in the event that we sell a vessel. |

|

• |

An over-supply of Suezmax tanker capacity may lead to reductions in charter rates, vessel values, and profitability. |

|

• |

Delays or defaults by the shipyards in the construction of our newbuildings could increase our expenses and diminish our net income and cash flows. |

|

• |

Political instability, terrorist attacks, international hostilities and global public health threats can affect the seaborne transportation industry, which could adversely affect our business. |

|

• |

We rely on our information systems to conduct our business, and failure to protect these systems against security breaches could adversely affect our business and results of operations. Additionally, if these systems fail or become unavailable for any significant period of time, our business could be harmed. |

|

• |

If we do not manage customer relationships or successfully integrate any acquired Suezmax tankers, we may not be able to grow or effectively manage our growth. |

|

• |

Because some of our expenses are incurred in foreign currencies, we are exposed to exchange rate fluctuations, which could negatively affect our results of operations. |

|

• |

The operation of Suezmax tankers involves certain unique operational risks. |

|

• |

We operate our Suezmax tankers worldwide and as a result, our vessels are exposed to international risks which may reduce revenue or increase expenses. |

|

• |

The smuggling of drugs or other contraband onto our vessels may lead to governmental claims against us. |

|

• |

Acts of piracy on ocean-going vessels could adversely affect our business. |

|

• |

Maritime claimants could arrest one or more of our vessels, which could interrupt our cash flow. |

|

• |

Governments could require our vessels during a period of war or emergency resulting in a loss of earnings. |

|

• |

If we purchase secondhand vessels, we may not receive warranties from the builder and operating cost may increase as a result of aging of the fleet. |

|

• |

Our insurance may not be adequate to cover our losses that may result from our operations due to the inherent operational risks of the tanker industry. |

|

• |

An increase in operating costs would decrease earnings and dividends per share. |

|

• |

We may be unsuccessful in competing in the highly competitive international Suezmax tanker market. |

|

• |

We are subject to laws and regulations which can adversely affect our business, results of operations, cash flows and financial condition, and our ability to pay dividends. |

|

• |

Regulations relating to ballast water discharge may adversely affect our revenues and profitability. |

|

• |

Climate change and greenhouse gas restrictions may adversely impact our operations and markets. |

|

• |

If we fail to comply with international safety regulations, we may be subject to increased liability, which may adversely affect our insurance coverage and may result in a denial of access to, or detention in, certain ports. |

|

• |

Developments in safety and environmental requirements relating to the recycling of vessels may result in escalated and unexpected costs. |

|

• |

Servicing our debt limits funds available for other purposes and if we cannot service our debt, we may lose our vessels. |

|

• |

Our borrowing facilities, contains restrictive covenants which could negatively affect our growth, cause our financial performance to suffer and limit our ability to pay dividends. |

|

• |

Volatility of LIBOR and potential changes of the use of LIBOR as a benchmark could affect our profitability, earnings and cash flow. |

|

• |

We may not be able to finance our future capital commitments. |

|

• |

The current state of the global financial markets and current economic conditions may adversely impact our results of operation, financial condition, cash flows and ability to obtain financing or refinance our existing and future credit facilities on acceptable terms. |

|

• |

We cannot assure you that we will be able to refinance our indebtedness. |

|

• |

We are subject to certain risks with respect to our counterparties on contracts, and failure of such counterparties to meet their obligations could cause us to suffer losses or negatively impact our results of operations and cash flows. |

|

• |

Our share price may continue to be highly volatile, which could lead to a loss of all or part of a shareholder’s investment. |

|

• |

We operate in a cyclical and volatile industry and cannot guarantee that we will continue to make cash distributions. |

|

• |

Future sales of our common stock could cause the market price of our common stock to decline. |

|

• |

Ineffective internal controls could impact the Company’s business and financial results. |

|

• |

Increasing scrutiny and changing expectations from investors, lenders and other market participants with respect to our Environmental, Social and Governance (“ESG”) policies may impose additional costs on us or expose us to additional risks. |

|

• |

A decision of our Board of Directors and the laws of Bermuda may prevent the declaration and payment of dividends. |

|

• |

We have antitakeover protections which could prevent a change of control. |

|

• |

Our vessels may call on ports located in countries or territories that are subject to sanctions or embargoes imposed by the U.S. government, the European Union, the United Nations or other governmental authorities, which could adversely affect the trading price of our common stock. |

|

• |

Because we are a foreign corporation, you may not have the same rights that a shareholder in a U.S. corporation may have. |

|

• |

We are incorporated in Bermuda and it may not be possible for our investors to enforce U.S. judgments against us. |

|

• |

We may have to pay tax on United States source income, which would reduce our earnings. |

|

• |

If the United States Internal Revenue Service were to treat us as a “passive foreign investment company,” that could have adverse tax consequences for United States shareholders. |

|

• |

We may become subject to taxation in Bermuda which would negatively affect our results. |

|

• |

As a Bermuda exempted company incorporated under Bermuda law with subsidiaries in another offshore jurisdiction, our operations may be subject to economic substance requirements. |

Risks Related to Our Business and Financial Condition

If the Suezmax tanker industry, which historically has been cyclical and volatile, is depressed in the future, our revenues, earnings and available cash flow may decrease.

It should be noted that we are specializing in Suezmax tankers. Historically, the tanker industry has been highly cyclical, with volatility in profitability, charter rates and asset values resulting from changes in the supply of and demand for tanker capacity. Fluctuations in charter rates and tanker values result from changes in the supply of and demand for tanker capacity and changes in the supply of and demand for oil and oil products. These factors may adversely affect the rates payable and the amounts we receive in respect of our vessels. Our ability to re-charter our vessels on the expiration or termination of their current spot and time charters and the charter rates payable under any renewal or replacement charters will depend upon, among other things, economic conditions in the tanker market and we cannot guarantee that any renewal or replacement charters we enter into will be sufficient to allow us to operate our vessels profitably.

The factors that influence demand for tanker capacity include:

|

• |

supply and demand for oil and oil products; |

|

• |

global and regional economic and political conditions and developments, including developments in international trade, national oil reserves policies, fluctuations in industrial and agricultural production and armed conflicts; |

|

• |

regional availability of refining capacity; |

|

• |

environmental and other legal and regulatory developments; |

|

• |

the distance oil and oil products are to be moved by sea; |

|

• |

changes in seaborne and other transportation patterns, including changes in the distances over which tanker cargoes are transported by sea; |

|

• |

increases in the production of oil in areas linked by pipelines to consuming areas, the extension of existing, or the development of new, pipeline systems in markets we may serve, or the conversion of existing non-oil pipelines to oil pipelines in those markets; |

|

• |

currency exchange rates; |

|

• |

weather and acts of God, natural disasters and health disasters; |

|

• |

competition from alternative sources of energy and from other shipping companies and other modes of transport; |

|

• |

international sanctions, embargoes, import and export restrictions, nationalizations, piracy and wars; |

|

• |

economic slowdowns caused by public health events such as the recent COVID-19 outbreak; and |

|

• |

regulatory changes including regulations adopted by supranational authorities and/or industry bodies, such as safety and environmental regulations and requirements by major oil companies. |

The factors that influence the supply of tanker capacity include:

|

• |

current and expected purchase orders for tankers; |

|

• |

the number of tanker newbuilding deliveries; |

|

• |

any potential delays in the delivery of newbuilding vessels and/or cancellations of newbuilding orders; |

|

• |

the scrapping rate of older tankers; |

|

• |

technological advances in tanker design and capacity; |

|

• |

tanker charter rates, which are affected by factors that may affect the rate of newbuilding, swapping and laying up of tankers; |

|

• |

port and canal congestion; |

|

• |

price of steel and vessel equipment; |

|

• |

conversion of tankers to other uses or conversion of other vessels to tankers; |

|

• |

with respect to tanker vessel supply, demand for alternative sources of energy and supply and demand for energy resources and oil and petroleum products; |

|

• |

product imbalances (affecting the level of trading activity); |

|

• |

developments in international trade, including refinery additions and closures; |

|

• |

the number of tankers that are out of service; and |

|

• |

changes in environmental and other regulations that may limit the useful lives of tankers. |

The factors affecting the supply and demand for tankers have been volatile and are outside of our control, and the nature, timing and degree of changes in industry conditions are unpredictable, including those discussed above. Continued volatility may reduce demand for transportation of oil over longer distances and increase supply of tankers to carry that oil, which may have a material adverse effect on our business, financial condition, results of operations, cash flows, ability to pay dividends and existing contractual obligations.

Major outbreaks of diseases and governmental responses thereto could adversely affect our business.

The COVID-19 pandemic has resulted in numerous actions taken by governments and governmental agencies in an attempt to mitigate the spread of the virus, including travel bans, quarantines, and other emergency public health measures, and a number of countries implemented lockdown measures.

Such measures against outbreaks of diseases may result in a reduction in global economic activity and volatility in the global financial markets. If such diseases and governmental responses thereto continues on a prolonged basis or becomes more severe, the adverse impact on the global economy and the rate environment for cargo vessels may deteriorate and our financial and operational results may be negatively impacted.

Further, the uncertainties regarding the economic impact of such diseases and governmental response thereto are likely to result in sustained market turmoil, which could also negatively impact our business, financial condition and cash flows. Governments may counter the negative economic impacts with stimulus packages; however, we cannot predict the extent to which such measures will be sufficient to restore or sustain the business and financial condition of companies in the shipping industry. These measures, though contemplated to be temporary in nature, may continue and increase as countries attempt to contain such outbreaks or any reoccurrences thereof.

Measures against outbreaks of diseases (such as COVID-19) in a number of countries may restrict crew rotations on our vessels, which may continue or become more severe. As a result, in 2020, we experienced and may continue to experience disruptions to our normal vessel operations caused by increased deviation time associated with positioning our vessels to countries in which we can undertake a crew rotation in compliance with such measures. Delays in crew rotations have led to issues with crew fatigue and may continue to do so, which may result in delays or other operational issues. In 2020, delays in crew rotations have also caused us to incur additional costs related to crew bonuses paid to retain the existing crew members on board and may continue to do so.

The occurrence or continued occurrence of any of the foregoing events or other epidemics or an increase in the severity or duration of the COVID-19 or other epidemics could have a material adverse effect on our business, results of operations, cash flows, financial condition, value of our vessels, and ability to pay dividends.

Any decrease in shipments of crude oil may adversely affect our financial performance.

The demand for our vessels and services in transporting oil derives primarily from demand for Arabian Gulf, West African, North Sea and Caribbean crude oil, which, in turn, primarily depends on the economies of the world’s industrial countries and competition from alternative energy sources. A wide range of economic, social and other factors can significantly affect the strength of the world’s industrial economies and their demand for crude oil from the mentioned geographical areas. One such factor is the price of worldwide crude oil.

Any decrease in shipments of crude oil from the above mentioned geographical areas would have a material adverse effect on our financial performance. Among the factors which could lead to such a decrease are:

|

• |

increased crude oil production from other areas; |

|

• |

increased refining capacity in the Arabian Gulf or West Africa; |

|

• |

increased use of existing and future crude oil pipelines in the Arabian Gulf or West Africa; |

|

• |

a decision by Arabian Gulf or West African oil-producing nations to increase their crude oil prices or to further decrease or limit their crude oil production; |

|

• |

armed conflict in the Arabian Gulf and West Africa and political or other factors; and |

|

• |

the development, availability and relative costs of nuclear power, natural gas, coal and other alternative sources of energy. |

In addition, volatile economic conditions affecting the world economies may result in reduced consumption of oil products and a decreased demand for our vessels and lower charter rates, which could have a material adverse effect on our earnings and our ability to pay dividends.

We are dependent on spot charters and any decrease in spot charter rates in the future may adversely affect our earnings and our ability to pay dividends.

The 23 vessels that we currently operate are primarily employed in the spot market. We are therefore highly dependent on spot market charter rates.

Changes in the price of fuel and regulations may adversely affect our profits.

Fuel, including bunkers, is a significant, if not the largest, expense in our shipping operations, and changes in the price of fuel may adversely affect our profitability. The price and supply of fuel is unpredictable and fluctuates based on events outside our control, including geopolitical developments, supply and demand for oil and gas, actions by OPEC and other oil and gas producers, war and unrest in oil producing countries and regions, regional production patterns and environmental concerns, which may reduce our profitability and have a material adverse effect on our future performance, results of operations, cash flows and financial position.

Effective January 1, 2020, the IMO implemented a new regulation for a 0.50% global sulfur cap on emissions from vessels. Under this new global cap, vessels must use marine fuels with a sulfur content of no more than 0.50% against the former regulations specifying a maximum of 3.50% sulfur in an effort to reduce the emission of sulfur oxide into the atmosphere.

All of our vessels have transitioned to burning IMO compliant fuels. Low sulfur fuel of 0.50% sulfur content or lower, is presently more expensive than the non-compliant Heavy Fuel Oil containing 3.5% sulfur and may become more expensive, although the cost differential in 2020 was less than anticipated.

Our operations and the performance of our vessels, and as a result our results of operations, cash flows and financial position, may be negatively affected to the extent that compliant sulfur fuel oils are unavailable, of low or inconsistent quality, or upon occurrence of any of the other foregoing events. Costs of compliance with these and other related regulatory changes may be significant and may have a material adverse effect on our future performance, results of operations, cash flows and financial position. As a result, an increase in the price of fuel beyond our expectations may adversely affect our profitability at the time of charter negotiation. Further, fuel may become much more expensive in the future, which may reduce the profitability and competitiveness of our business versus other forms of transportation.

Inability to renew the fleet would adversely affect our business, results of operations, financial condition and ability to pay dividends.

If we do not set aside funds or are unable to borrow or raise funds for vessel replacement, we will be unable to replace the vessels in our fleet upon the expiration of their useful lives. Our cash flows and income are dependent on the revenues earned by the chartering of our vessels. If we are unable to replace the vessels in our fleet upon the expiration of their useful lives, our business, results of operations, financial condition and ability to pay dividends would be adversely affected. Any funds set aside for vessel replacement will not be available for dividends.

The international Suezmax tanker industry has experienced volatile charter rates and vessel values and there can be no assurance that these charter rates and vessel values will not decrease in the near future.

The Baltic Dirty Tanker Index, or the BDTI, a U.S. dollar daily average of charter rates issued by the Baltic Exchange that takes into account input from brokers around the world regarding crude oil fixtures for various routes and oil tanker vessel sizes, has been volatile. For example, in 2020, the BDTI reached a high of 1,550 and a low of 403. The Baltic Clean Tanker Index, or BCTI, a comparable index to the BDTI, has similarly been volatile. In 2020, the BCTI reached a high of 2,190 and a low of 309. Although the BDTI and BCTI were 600 and 515, respectively, as of April 20, 2021, there can be no assurance that the crude oil and petroleum products charter market will increase, and the market could again decline. This volatility in charter rates depends, among other factors, on changes in the supply and demand for tanker capacity and changes in the supply and demand for oil and oil products, the demand for crude oil and petroleum products, the inventories of crude oil and petroleum products in the United States and in other industrialized nations, oil refining volumes, oil prices, and any restrictions on crude oil production imposed by the Organization of the Petroleum Exporting Countries, or OPEC, and non-OPEC oil producing countries.

Charter rates in the Suezmax tanker industry are volatile. We anticipate that future demand for our vessels, and in turn our future charter rates, will be dependent upon economic growth in the world’s economies, as well as seasonal and regional changes in demand and changes in the capacity of the world’s fleet. There can be no assurance that economic growth will not stagnate or decline leading to a decrease in vessel values and charter rates. A decline in vessel values and charter rates would have an adverse effect on our business, financial condition, results of operation and ability to pay dividends.

Our results of operations are subject to seasonal fluctuations, which may adversely affect our financial condition.

We operate our vessels in markets that have historically exhibited seasonal variations in demand and, as a result, charter rates.

Declines in charter rates and other market deterioration could cause us to incur impairment charges.

Our vessels are evaluated for impairment continuously or whenever events or changes in circumstances indicate that the carrying amount of a vessel may not be recoverable. The review for potential impairment indicators and projection of future cash flows related to the vessel is complex and requires us to make various estimates, including future charter rates and earnings from operating the vessel. All of these items have historically been volatile. We estimate the undiscounted cash flows from operating the vessels over their remaining useful lives and compare those to the net carrying values of the vessels. If the total estimated undiscounted net cash flows for a vessel are less than the carrying amount of the vessel the vessel is deemed impaired and written down to its fair market value. The carrying values of our vessels may not represent their fair market value at any point in time because the market prices of secondhand vessels tend to fluctuate with changes in charter rates and the cost of newbuildings. Any impairment charges incurred as a result of declines in charter rates could negatively affect our business, financial condition and operating results. Impairment is assessed on a vessel by vessel basis.

The value of our vessels may be depressed in the event that we sell a vessel.

Tanker values have generally experienced high volatility. Investors can expect the fair market value of our tankers to fluctuate, depending on general economic and market conditions affecting the tanker industry and competition from other shipping companies, types and sizes of vessels and other modes of transportation. In addition, as vessels age, they generally decline in value. These factors will affect the value of our vessels for purposes of covenant compliance under our borrowing facilities and at the time of any vessel sale. If for any reason we sell a tanker at a time when tanker prices have fallen, the sale may be at less than the tanker’s carrying amount on our financial statements, with the result that we would also incur a loss on the sale and a reduction in earnings, which could reduce our ability to pay dividends. The carrying values of our vessels may not represent their charter-free market value at any point in time.

An over-supply of Suezmax tanker capacity may lead to reductions in charter rates, vessel values, and profitability.

The market supply of Suezmax tankers is affected by a number of factors such as demand for energy resources, oil, and petroleum products, as well as strong overall economic growth in parts of the world economy including Asia. If the capacity of new ships delivered exceeds the capacity of tankers being scrapped and lost, tanker capacity will increase. If the supply of tanker capacity increases and if the demand for tanker capacity does not increase correspondingly, charter rates could materially decline. A reduction in charter rates and the value of our vessels may have a material adverse effect on our results of operations and our ability to pay dividends.

Delays or defaults by the shipyards in the construction of our newbuildings could increase our expenses and diminish our net income and cash flows.

Vessel construction projects are generally subject to risks of delay that are inherent in any large construction project, which may be caused by numerous factors, including shortages of equipment, materials or skilled labor, unscheduled delays in the delivery of ordered materials and equipment or shipyard construction, failure of equipment to meet quality and/or performance standards, financial or operating difficulties experienced by equipment vendors or the shipyard, unanticipated actual or purported change orders, inability to obtain required permits or approvals, design or engineering changes and work stoppages and other labor disputes, adverse weather conditions, pandemics or any other events of force majeure. Significant delays could adversely affect our financial position, results of operations and cash flows. Additionally, failure to complete a project on time may result in the delay of revenue from that vessel, and we will continue to incur costs and expenses related to delayed vessels, such as supervision expense and interest expense for the issued and outstanding debt. As of December 31, 2020, we have orders for two Suezmax newbuildings for delivery in 2022.

Political instability, terrorist attacks, international hostilities and global public health threats can affect the seaborne transportation industry, which could adversely affect our business.

We conduct most of our operations outside of the United States, and our business, results of operations, cash flows, financial condition and ability to pay dividends, if any, in the future may be adversely affected by changing economic, political and government conditions in the countries and regions where our vessels are employed or registered. Moreover, we operate in a sector of the economy that is likely to be adversely impacted by the effects of political conflicts.

Currently, the world economy faces a number of challenges, including trade tensions between the United States and China and between the United States and the European Union, continuing turmoil and hostilities in the Middle East, the Korean Peninsula, North Africa, Venezuela, Iran and other geographic areas and countries, continuing economic weakness in the European Union, geopolitical events such as the withdrawal of the U.K. from the European Union ("Brexit"), continuing threat of terrorist attacks around the world, continuing instability and conflicts and other recent occurrences in the Middle East and in other geographic areas and countries such as those between the United States and North Korea or Iran, or between the Houthi and Arab counties in Yemen, or internally in Libya, and stabilizing growth in China, as well as the public health concerns stemming from the COVID-19 outbreak.

The threat of future terrorist attacks around the world, continues to cause uncertainty in the world's financial markets and international commerce and may affect our business, operating results and financial condition. Continuing conflicts and recent developments in the Middle East, may lead to additional acts of terrorism and armed conflict around the world, which may contribute to further economic instability in the global financial markets and international commerce. Additionally, any escalations between the United States and Iran could result in retaliation from Iran that could potentially affect the shipping industry, through increased attacks on vessels in the Strait of Hormuz (which already experienced an increased number of attacks on and seizures of vessels in 2019 and 2020). These uncertainties could also adversely affect our ability to obtain additional financing or insurance on terms acceptable to us or at all. Any of these occurrences could have a material adverse impact on our operating results, revenues and costs.

Additionally, in Europe, large sovereign debts and fiscal deficits, low growth prospects and high unemployment rates in a number of countries have contributed to the rise of Eurosceptic parties, which would like their countries to leave the Euro. The Brexit further increases the risk of additional trade protectionism. Brexit, or similar events in other jurisdictions, could impact global markets, including foreign exchange and securities markets; any resulting changes in currency exchange rates, tariffs, treaties and other regulatory matters could in turn adversely impact our business and operations.

Also, China and the US have implemented certain increasingly protective trade measures with continuing trade tensions, including significant tariff increases, between these countries, although it is not yet certain how the new Biden administration will proceed with US China relations. These trade barriers to protect domestic industries against foreign imports, depress shipping demand. Protectionist developments, or the perception they may occur, may have a material adverse effect on global economic conditions, and may significantly reduce global trade. Moreover, increasing trade protectionism may cause an increase in (a) the cost of goods exported from regions globally, (b) the length of time required to transport goods and (c) the risks associated with exporting goods. Such increases may significantly affect the quantity of goods to be shipped, shipping time schedules, voyage costs and other associated costs, which could have an adverse impact on our charterers’ business, operating results and financial condition and could thereby affect their ability to make timely charter hire payments to us and to renew and increase the number of their time charters with us. This could have a material adverse effect on our business, results of operations, financial condition and our ability to pay any cash distributions to our stockholders.

In addition, public health threats such as influenza and other highly communicable diseases or viruses, outbreaks of which have from time to time occurred in various parts of the world in which we operate, including China, Japan and South Korea, which may even become pandemics, such as the COVID-19 virus, could lead to a significant decrease of demand for the transportation of crude oil. Such events may also adversely impact our operations, including timely rotation of our crews, the timing of completion of any outstanding or future newbuilding projects or repair works in drydock as well as the operations of our customers. Delayed rotation of crew may adversely affect the mental and physical health of our crew and the safe operation of our vessels as a consequence.

We rely on our information systems to conduct our business, and failure to protect these systems against security breaches could adversely affect our business and results of operations. Additionally, if these systems fail or become unavailable for any significant period of time, our business could be harmed.

We rely on our computer systems and network infrastructure across our operations, including on our vessels. The safety and security of our vessels and efficient operation of our business, including processing, transmitting and storing electronic and financial information, are dependent on computer hardware and software systems, which are increasingly vulnerable to security breaches and other disruptions. Any significant interruption or failure of our information systems or any significant breach of security could adversely affect our business and results of operations.

Our vessels rely on information systems for a significant part of their operations, including navigation, provision of services, propulsion, machinery management, power control, communications and cargo management. We have in place safety and security measures on our vessels and onshore operations to secure our vessels against cyber-security attacks and any disruption to their information systems. However, these measures and technology may not adequately prevent security breaches despite our continuous efforts to upgrade and address the latest known threats. A disruption to the information system of any of our vessels could lead to, among other things, wrong routing, collision, grounding and propulsion failure.

Beyond our vessels, we rely on industry accepted security measures and technology to securely maintain confidential and proprietary information maintained on our information systems. However, these measures and technology may not adequately prevent security breaches. The technology and other controls and processes designed to secure our confidential and proprietary information, detect and remedy any unauthorized access to that information were designed to obtain reasonable, but not absolute, assurance that such information is secure and that any unauthorized access is identified and addressed appropriately. Such controls may in the future fail to prevent or detect, unauthorized access to our confidential and proprietary information. In addition, the foregoing events could result in violations of applicable privacy and other laws. If confidential information is inappropriately accessed and used by a third party or an employee for illegal purposes, we may be responsible to the affected individuals for any losses they may have incurred as a result of misappropriation. In such an instance, we may also be subject to regulatory action, investigation or liable to a governmental authority for fines or penalties associated with a lapse in the integrity and security of our information systems.

Our operations, including our vessels, and business administration could be targeted by individuals or groups seeking to sabotage or disrupt such systems and networks, or to steal data, and these systems may be damaged, shutdown or cease to function properly (whether by planned upgrades, force majeure, telecommunications failures, hardware or software break-ins or viruses, other cyber-security incidents or otherwise). For example, the information systems of our vessels may be subject to threats from hostile cyber or physical attacks, phishing attacks, human errors of omission or commission, structural failures of resources we control, including hardware and software, and accidents and other failures beyond our control. The threats to our information systems are constantly evolving, and have become increasingly complex and sophisticated. Furthermore, such threats change frequently and are often not recognized or detected until after they have been launched, and therefore, we may be unable to anticipate these threats and may not become aware in a timely manner of such a security breach, which could exacerbate any damage we experience.

We may be required to expend significant capital and other resources to protect against and remedy any potential or existing security breaches and their consequences. A cyber-attack could result in significant expenses to investigate and repair security breaches or system damages and could lead to litigation, fines, other remedial action, heightened regulatory scrutiny and diminished customer confidence. In addition, our remediation efforts may not be successful and we may not have adequate insurance to cover these losses.

The unavailability of the information systems or the failure of these systems to perform as anticipated for any reason could disrupt our business and could have a material adverse effect on our business, results of operations, cash flows and financial condition.

If we do not manage relationships with customers or successfully integrate any acquired Suezmax tankers, we may not be able to grow or effectively manage our growth.

One of our principal strategies is to continue to grow by expanding our operations and adding vessels to our fleet. Our future growth will depend upon a number of factors, some of which may not be within our control. These factors include our ability to:

|

• |

identify suitable tankers and/or shipping companies for acquisitions at attractive prices, which may not be possible if asset prices rise too quickly, |

|

• |

manage relationships with customers and suppliers, |

|

• |

identify businesses engaged in managing, operating or owning tankers for acquisitions or joint ventures, |

|

• |

integrate any acquired tankers or businesses successfully with our then-existing operations, |

|

• |

hire, train and retain qualified personnel and crew to manage and operate our growing business and fleet, |

|

• |

identify additional new markets, |

|

• |

improve our operating, financial and accounting systems and controls, and |

|

• |

obtain required financing for our existing and new operations. |

Our failure to effectively identify, purchase, manage customer relationships and integrate any tankers or businesses could adversely affect our business, financial condition and results of operations. We may incur unanticipated expenses as an operating company. It is possible that the number of employees employed by the company, or current operating and financial systems may not be adequate as we implement our plan to expand the size of our fleet. Finally, acquisitions may require additional equity issuances or debt issuances (with amortization payments), both of which could lower dividends per share. If we are unable to expand or execute the certain aspects of our business or events noted above, our financial condition and dividend rates may be adversely affected.

Because some of our expenses are incurred in foreign currencies, we are exposed to exchange rate fluctuations, which could negatively affect our results of operations.

The charterers of our vessels pay us in U.S. dollars. While we mostly incur our expenses in U.S. dollars, we may incur expenses in other currencies, most notably the Norwegian Kroner. Declines in the value of the U.S. dollar relative to the Norwegian Kroner, or the other currencies in which we may incur expenses in the future, would increase the U.S. dollar cost of paying these expenses and thus would affect our results of operations.

Risks Related to the Operations of Our Vessels and Regulations

The operation of Suezmax tankers involves certain unique operational risks.

The operation of Suezmax tankers has unique operational risks associated with the transportation of oil. An oil spill may cause significant environmental damage, and a catastrophic spill could exceed the insurance coverage available. Compared to other types of vessels, tankers are exposed to a higher risk of damage and loss by fire, whether ignited by a terrorist attack, collision, or other cause, due to the high flammability and high volume of the oil transported in tankers.

Further, our vessels and their cargoes will be at risk of being damaged or lost because of events such as marine disasters, bad weather and other acts of God, business interruptions caused by mechanical failures, grounding, fire, explosions and collisions, human error, war, terrorism, piracy, diseases (such as the ongoing outbreak of COVID-19), quarantine and other circumstances or events. Changing economic, regulatory and political conditions in some countries, including political and military conflicts, have from time to time resulted in attacks on vessels, mining of waterways, piracy, terrorism, labor strikes and boycotts. These hazards may result in death or injury to persons, loss of revenues or property, the payment of ransoms, environmental damage, higher insurance rates, damage to our customer relationships and market disruptions, delay or rerouting.