EX-10.2

EXHIBIT 10.2

PUT/CALL AGREEMENT

This PUT/CALL AGREEMENT (this “Agreement”) is dated as of June 15, 2024 (this “Effective Date”) by and between Nicholas Financial, Inc., a Delaware corporation (“NICK”), Amplex Holdings, Inc., a Delaware corporation (“Amplex Holdings”), and Mark R. Radabaugh (“MR Holder”).

RECITALS

WHEREAS, NICK, MR Holder, Dale B. Beckmann and Amplex Electric, Inc. (“Amplex”) entered into a Share Purchase Agreement, dated May 1, 2024 (the “SPA”), pursuant to which NICK acquired, as of the Closing (as defined in the SPA), 10,710 shares of common stock, no par value per share, of Amplex, which constituted fifty-one percent (51%) of all of the issued and outstanding shares of common stock of Amplex immediately prior to the Closing;

WHEREAS, concurrent with Closing (as defined in the SPA), NICK has (i) converted the Outstanding NICK Debt (as defined in the SPA) into 421 shares of common stock of Amplex at the Share Purchase Price (as that term is defined in the SPA), and (ii) purchased 1,674 shares of Common Stock of Amplex at the Share Purchase Price for an aggregate purchase price of $3,000,0000 (collectively the “Additional NICK Closing Stock”);

WHEREAS, concurrent with Closing, (i) MR Holder contributed 421 shares of common stock of Amplex to Amplex pursuant to the terms of the SPA (the “Amplex Contribution”) and (ii) thereafter, MR Holder and NICK each contributed their shares in Amplex for shares in Amplex Holdings (the “Holdings Contribution,” collectively with the Amplex Contribution the “Contribution”), so that immediately following the Contribution and taking into account the Additional NICK Closing Stock, Amplex Holdings holds 100% of the shares of Amplex stock, NICK holds 12,804 shares of common stock, par value $0.0001 per share of Amplex Holdings (the “Common Stock”) which constitutes 56.47% of the issued and outstanding shares of Common Stock of Amplex Holdings, and MR Holder holds 9,869 shares of Common Stock of Amplex Holdings, which constitutes 43.53% of the issued and outstanding shares of Common Stock of Amplex Holdings immediately following the Contribution and taking into account the Additional NICK Closing Stock;

WHEREAS, NICK and MR Holder have agreed that, under certain circumstances, NICK will have the option to compel MR Holder to sell to NICK the Call Shares (as defined below); and

WHEREAS, NICK and MR Holder have agreed that, under certain circumstances, MR Holder will have the option to compel NICK to purchase from MR Holder the Put Shares (as defined below);

NOW, THEREFORE, in consideration of the mutual covenants and promises set forth in this Agreement and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows.

4888-7933-3785.10 IF " DOCVARIABLE "SWDocIDLocation" Error! No document variable supplied." = "1" " DOCPROPERTY "SWDocID" 250319042v.10" ""

SECTION 1.01. Definitions. Each capitalized term not otherwise defined in this Agreement will have the meaning provided for it in the SPA. In addition to the capitalized terms defined in the SPA and elsewhere in this Agreement, the following capitalized terms have the meanings set forth below:

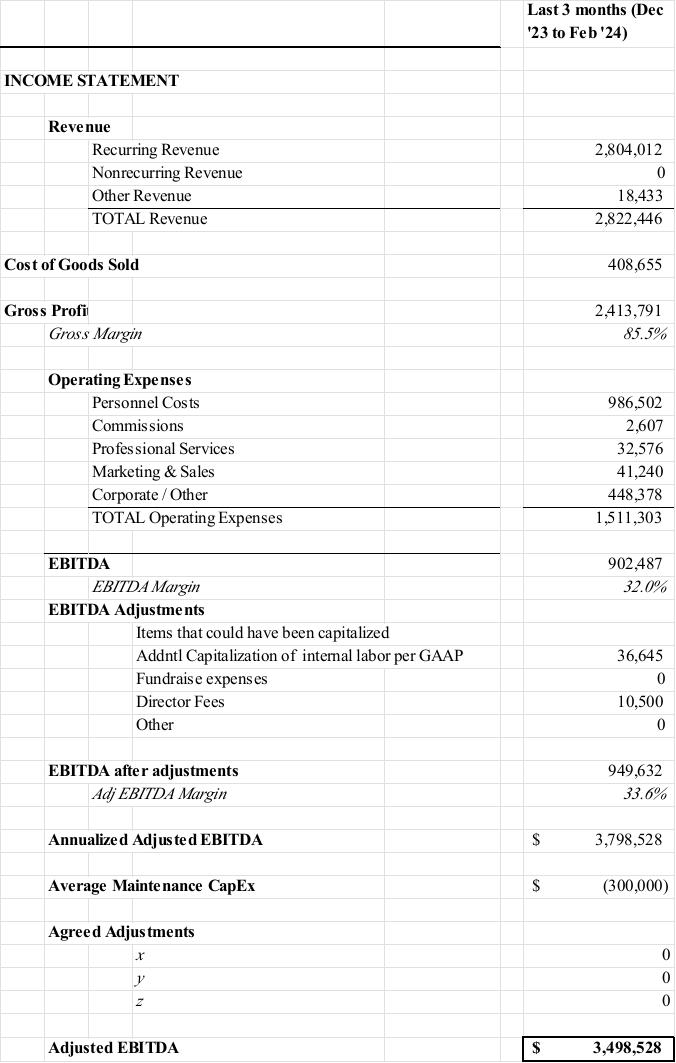

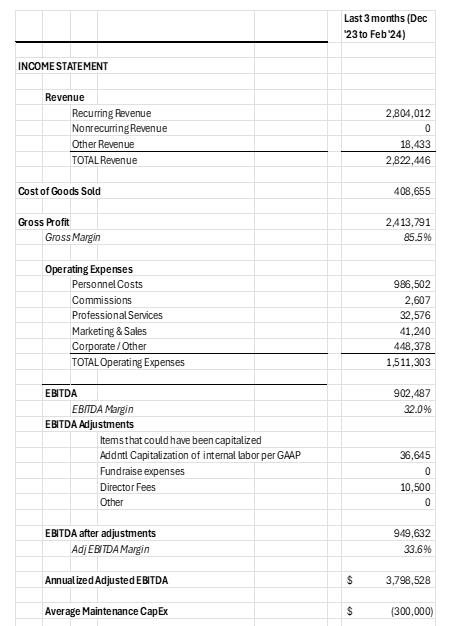

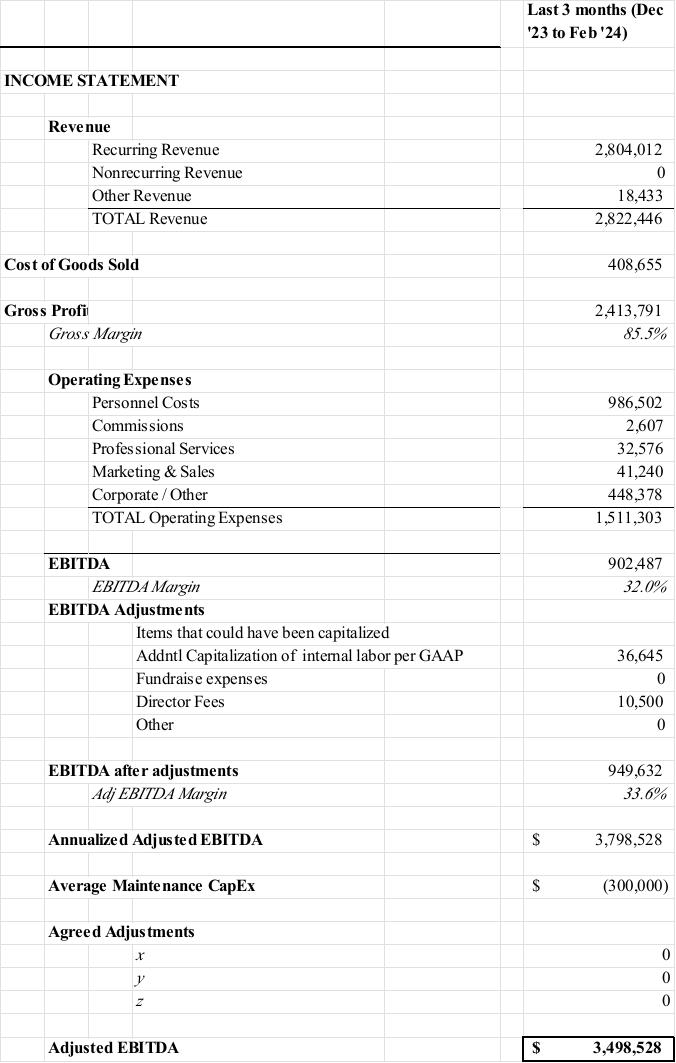

“Adjusted EBITDA” means for any period the sum of EBITDA for such period minus the Average Maintenance CapEx plus or minus (as applicable) the Agreed Adjustments, calculated consistent with the line items and methodology used to calculate the Closing Adjusted EBITDA and as further set forth on Annex A.

“Agreed Adjustments” means certain adjustments to EBITDA for non-recurring costs and expenses and one-time unusual revenues that are mutually agreed upon by NICK and MR Holder pursuant to Section 6.04 for the purposes of calculating the Purchase Price under this Agreement. Agreed Adjustments are intended to include the same type of adjustments as those identified on Annex A and those made in calculating the Closing Adjusted EBITDA, reflecting strategic expenses made by Amplex Holdings and its subsidiaries in one period that benefit future periods.

“Agreed Budgets” means the operating budgets for Amplex Holdings and its subsidiaries agreed upon by NICK and MR Holder for the Measurement Years pursuant to Section 6.02(a).

“Average Maintenance CapEx” means (a) for calculating the Closing Adjusted EBITDA, $260,000 or (b) for calculating Adjusted EBITDA for subsequent periods, the trailing twelve months for the applicable period based on the accounts and methodology (including the percentage allocations for each account) as identified and described on Schedule I attached hereto, or as otherwise agreed.

“Call Shares” means the number of shares of Common Stock of Amplex Holdings identified by NICK in a Call Option Notice to MR Holder that NICK desires to purchase, not to exceed the Maximum Call Shares.

“Closing Adjusted EBITDA” means the Adjusted EBITDA of Amplex Holdings and its subsidiaries for the last three calendar months immediately prior to the Closing Date multiplied by four (4), as finally determined pursuant to Section 6.01.

“Closing Multiple” means the amount equal to: (a) the Closing Valuation divided by (b) the Closing Adjusted EBITDA, as finally determined pursuant to Section 6.01.

“Closing Valuation” means an amount equal to the sum of: Base Purchase Price of $37,500,000.00 minus the Loss of Subscribers Adjustment plus the FTTH Capital Expenditure Adjustment.

“Dispute Notice” means a Call Dispute Notice, Closing Notice, Metric Dispute Notice, or Put Dispute Notice, as applicable.

“EBITDA” means, for any period, the net income of Amplex Holdings and its subsidiaries before interest, taxes, depreciation, and amortization, calculated consistent with the line items and methodology used to calculate the Closing Adjusted EBITDA and as further set forth on Annex A.

“EBITDA Performance Metric” means the Adjusted EBITDA for Amplex Holdings and its subsidiaries for each Measurement Year is equal to or greater than 90% of the Target Adjusted EBITDA for the applicable Measurement Year.

“Exercise Price” means an amount equal to the (a) Closing Multiple multiplied by (b) the Adjusted EBITDA for the three calendar months immediately prior to the date of the Option Closing multiplied by four (4).

“Maximum Call Shares” means as of the date of the Closing of a Call Option that number of shares of Common Stock of Amplex Holdings owned by MR Holder calculated as follows:

80% = (X+Y)/A, where

X = Call Shares

Y = the number of shares of Common Stock of Amplex Holdings owned by NICK as of the date of the Option Closing

A = Outstanding Amplex Holdings Shares immediately prior to the Option Closing

“Measurement Year” means each twelve-month period ended December 31, 2027 and December 31, 2028, individually, and “Measurement Years” means both of them collectively, as the context may require.

“Notice” means a Call Option Notice, Closing Notice, Metric Notice, or a Put Option Notice, as applicable.

“Noticed Item” means: (a) with respect to a Call Option Notice, the Purchase Price set forth in the Call Option Notice; (b) with respect to a Closing Notice, the Closing Adjusted EBITDA or Closing Multiple set forth in the Closing Notice; (c) with respect to a Metric Notice, the Target Adjusted EBITDA set forth in the Metric Notice; and (d) with respect to a Put Option Notice, the Purchase Price set forth in the Put Option Notice or achievement of the EBITDA Performance Metric, as applicable.

“Outstanding Amplex Holdings Shares” means the total issued and outstanding shares of Common Stock of Amplex Holdings held by NICK and MR Holder as of the applicable date.

“Party” means any one of the parties to this Agreement, individually, and “Parties” means all of them collectively, as the context may require.

“Per Share Purchase Price” means the Exercise Price divided by the Outstanding Amplex Holdings Shares as of the date of the Option Closing.

“Purchase Price” means the Per Share Purchase Price multiplied by the number of shares of Common Stock of Amplex Holdings purchased pursuant to the Put Option or Call Option, as applicable.

“Put Shares” means the number of shares of Common Stock of Amplex Holdings identified by MR Holder in a Put Option Notice to NICK that MR Holder desires to sell.

“Target Adjusted EBITDA” means the projected Adjusted EBITDA for Amplex Holdings and its subsidiaries for each Measurement Year calculated based on the Agreed Budgets and determined pursuant to Section 6.03.

SECTION 2.01. Term. This Agreement shall commence as of the Closing Date (as defined in the SPA) and continue until the earlier of (a) the fifteenth anniversary of the Closing Date or (b) such time that all options hereunder have been exercised or expired (the “Term”).

SECTION 3.01 Call Option.

(a)MR Holder hereby grants to NICK a onetime option (the “Call Option”) to buy from MR Holder, and to compel MR Holder to sell to NICK, the Call Shares at such time, pursuant to the following terms and conditions:

(i)The Call Option shall become exercisable on not less than twenty (20) days prior written notice by NICK to MR Holder (the “Call Option Notice”) at any time following the second anniversary of the Closing Date, but prior to the fifth anniversary of the Closing Date (the “Call Period”). The Call Option shall expire on the fifth anniversary of the Closing Date.

(ii)The aggregate purchase price for the Call Shares upon exercise of the Call Option shall be the Purchase Price.

(iii)The Call Option Notice shall include NICK’s good faith calculation of the Purchase Price, along with supporting documentation used in preparation of the calculation of the Purchase Price. If MR Holder disputes the calculation of the Purchase Price included in the Call Option Notice, then MR Holder shall within twenty (20) days of receipt of the Call Option Notice provide written notice, including supporting documentation and with reasonable detail, to NICK of his calculation of the Purchase Price (the “Call Dispute Notice”). During such twenty

(20) day period, NICK shall respond to any questions MR Holder, his accountants and other advisors may have regarding the Call Option Notice. Section 6.05 shall apply following delivery of a Call Dispute Notice. If MR Holder fails to deliver a Call Dispute Notice within such twenty (20) day period, MR Holder will be deemed to have agreed to the Purchase Price set forth in the Put Option Notice, and such Purchase Price will be final and binding.

(iv)Payment of the Purchase Price for the Call Shares shall be made by wire transfer of immediately available funds at the Option Closing to one or more accounts designated by MR Holder in writing to NICK at least two (2) Business Days prior to the Option Closing.

(v)Each of NICK, on the one hand, and MR Holder, on the other hand, shall prepare and deliver to the other, in accordance with Section 7.04 hereof, a schedule (each a “Schedule”) of disclosures, as contemplated by Annex B and Annex C attached hereto, respectively, as promptly as practicable (but in no event more than seven (7) days) after receipt of the Call Option Notice.

(vi)The Parties agree and acknowledge that their respective obligations to consummate the transactions contemplated by this Section 3.01(a) are subject to the satisfaction of all applicable conditions set forth in Article V or the waiver thereof by the Party entitled to the benefit of the applicable conditions.

(a)NICK hereby grants to MR Holder one or more options (each a “Put Option” and collectively the “Put Options” and, collectively with the Call Option, the “Options”) to sell to NICK, and to compel NICK to purchase from MR Holder, the Put Shares for the Purchase Price pursuant to the following terms and conditions:

(i)The Put Options shall become exercisable on not less than ninety (90) days prior written notice by MR Holder to NICK (a “Put Option Notice”) at any time following the fifth anniversary of the Closing Date and prior to the fifteenth anniversary of the Closing Date (the “Put Period”), subject to the following conditions:

(A) If MR Holder is terminated for Cause (as defined in his Employment Agreement (as defined in the SPA), as then in effect), MR Holder shall not have any right to exercise any Put Option, or otherwise take any action that would result in an Option Closing, during the period commencing on the date of such termination through and including the date that is the one-year anniversary of such date of termination.

(B) MR Holder shall not have any right to exercise any Put Option, or otherwise take any action that would result in an Option Closing, if as a result of such Option Closing MR Holder would no longer own at least 158 shares of Common Stock of Amplex Holdings, which number is subject to appropriate adjustment for any stock splits, stock dividends, combinations, recapitalizations and the like, until:

(1)if MR Holder has ceased to serve as the Chief Executive Officer of Amplex or will cease to serve as the Chief

Executive Officer of Amplex as of the Option Closing, the earlier of (x) the date a successor acceptable to the Board of Directors of NICK or Amplex, as determined by NICK (the “Board”), has been appointed to serve as the Chief Executive Officer (or interim Chief Executive Officer of Amplex or substantially similar title) or (y) the date that is eighteen (18) months after the date MR Holder ceased to serve as the Chief Executive Officer of Amplex.

(2)if MR Holder continues to serve as the Chief Executive Officer of Amplex, the date the Board has identified a presumptive successor Chief Executive Officer of Amplex.

(C) So long as MR Holder is the Chief Executive Officer of Amplex from the Closing Date through the fifth anniversary of the Closing Date, the Put Options are only exercisable during the Put Period if the EBITDA Performance Metric has been achieved.

(D) If MR Holder ceases to serve as the Chief Executive Officer of Amplex at any time prior to the fifth anniversary of the Closing Date, the EBITDA Performance Metric condition shall not apply to exercise a Put Option.

(E) MR Holder may exercise the Put Options one or more times during the Put Period; provided, that MR Holder may only exercise a Put Option once per twelve month period and for no less than 1,000 shares of Common Stock of Amplex Holdings (subject to adjustment for any stock split, stock dividend, recapitalization, merger, consolidation, or similar event) per exercise or, if less than 1,000 shares then remain, all the Put Shares that then remain in their entirety.

(ii)The aggregate purchase price for the Put Shares upon exercise of a Put Option shall be the Purchase Price.

(iii)The Put Option Notice shall include MR Holder’s good faith calculation of the Purchase Price, along with supporting documentation used in preparation of the calculation of the Purchase Price. If NICK disputes (A) that the EBITDA Performance Metric has been achieved, if applicable, (B) the satisfaction of the conditions set forth in Section 3.02(a)(i), or (C) the calculation of the Purchase Price included in the Put Option Notice, then NICK shall within twenty (20) days of receipt of the Put Option Notice provide written notice, including supporting documentation and with reasonable detail, to MR Holder of its (I) determination as to whether or not the EBITDA Performance Metric has been achieved, if applicable, (II) determination as to whether or not the applicable condition has been satisfied, or (III) calculation of the Purchase Price (the “Put Dispute Notice”). During such twenty (20) day period, MR Holder shall respond to any questions NICK, its accountants and other advisors may have regarding the Put Option Notice. Section 6.05 shall apply following delivery of a Put Dispute Notice. If NICK fails to deliver a Put Dispute Notice within such twenty (20) day period, the EBITDA Performance

Metric, as applicable, will be deemed achieved and NICK will be deemed to have agreed to the Purchase Price set forth in the Put Option Notice, and such Purchase Price will be final and binding.

(iv)Payment of the Purchase Price for the Put Shares shall be made by wire transfer of immediately available funds at the Option Closing to one or more accounts designated by MR Holder in writing to NICK at least two (2) Business Days prior to the Option Closing or, at the election of NICK, by delivery of a secured promissory note by NICK for payment of the Purchase Price to MR Holder in substantially the form attached hereto as Annex D containing at a minimum the terms set forth therein.

(v)Each of NICK, on the one hand, and MR Holder, on the other hand, shall prepare and deliver to the other, in accordance with Section 7.04 hereof, a Schedule of disclosures, as contemplated by Annex B and Annex C attached hereto, respectively, as promptly as practicable (but in no event more than seven (7) days) after receipt of the Put Option Notice.

(vi)The Parties agree and acknowledge that their respective obligations to consummate the transactions contemplated by this Section 3.02(a) are subject to the satisfaction of all applicable conditions set forth in Article V or the waiver thereof by the Party entitled to the benefit of the applicable conditions.

SECTION 3.03 Transfer Taxes. The Parties agree that all transfer, documentary, sales, use, stamp, registration, value added and other such Taxes imposed in connection with the exercise of any option hereunder shall be borne in equal proportions by (a) NICK, and (b) MR Holder, provided that, for purposes of clarity, any related income, profits or other such Taxes shall be borne solely by the Party receiving such income, profits or other gain.

SECTION 3.04 Option Closing.

(a)Any purchase and sale of the Put Shares or Call Shares pursuant to Section 3.01 or 3.02, as the case may be (each an “Option Closing”), shall take place at 10:00 a.m. Central Time by the electronic exchange of documents on a date to be agreed in writing among the Parties; provided, that such date is no later than twenty (20) days after the date on which all of the conditions to the Option Closing set forth in Article V hereof shall be fulfilled or waived (other than those conditions that by their terms are to be satisfied at the Closing, but subject to the satisfaction of such conditions at the Closing). All proceedings to be taken and all documents to be executed and delivered by the Parties at the Closing shall be deemed to have been taken and executed simultaneously and no proceedings shall be deemed to have been taken nor documents executed or delivered until all have been so taken, executed and delivered.

(b)All Put Shares or Call Shares, as the case may be, to be transferred at an Option Closing shall be delivered with full title and free and clear of any Liens other than those set forth in any of Amplex Holdings’ Organizational Documents.

(c)At an Option Closing, each of NICK and MR Holder shall execute and deliver such documents, instruments and agreements as may be necessary, in the reasonable discretion of NICK or MR Holder, to effectuate the transfers contemplated by this Agreement, including without limitation a written purchase and sale agreement between the Parties with

customary terms and provisions for such a transaction including only the representations and warranties set forth in Annex B and Annex C. Each of the Parties shall, from time to time after the Option Closing, at the request of NICK or MR Holder, as the case may be, and without further consideration, execute and deliver, or cause any one or more of its Affiliates (as defined in the SPA) to execute and deliver, further instruments of transfer and assignment and take such other action as NICK or MR Holder, as the case may be, may reasonably require more effectively to transfer and assign to, and vest in, the transferee, the Put Shares or Call Shares, as the case may be, to be transferred hereunder and otherwise satisfy the obligations of the Parties hereunder.

COVENANTS

SECTION 4.01 Regulatory Matters; Third Party Consents. Upon the exercise of any option pursuant to Section 3.01 or 3.02 hereof, the Parties shall cooperate with each other and use Commercially Reasonable Efforts promptly to prepare and file all necessary documentation, to effect all necessary applications, notices, petitions and filings, to obtain as promptly as practicable all necessary registrations, permits, consents, approvals, waivers and authorizations of all third Persons and Governmental Entities and to satisfy all conditions to the obligations to any Person to consummate the transactions contemplated by this Agreement. If any required consent of or waiver by any third Person (excluding any Governmental Entity) is not obtained prior to an Option Closing, the Parties, each without cost, expense or liability to the other, shall cooperate in good faith to seek an alternative arrangement to achieve the results intended.

SECTION 4.02 Restrictions on Transfer. MR Holder shall not sell, assign, transfer, exchange, devise, pledge, hypothecate, encumber or otherwise alienate or dispose of (each, a “Transfer”) all or any of the shares of Common Stock of Amplex Holdings owned by MR Holder as of the date hereof that are subject to the Call Option (including without limitation any securities issued upon any stock split, stock dividend, recapitalization, merger, consolidation, or similar event) (such shares from time to time that are subject to the Call Option, the “Restricted Shares”) until the earlier expiration or exercise of the Call Option, or any right or interest therein, whether voluntarily or involuntarily, by operation of law, court order, foreclosure, marital property division or otherwise, except (a) in compliance with all applicable U.S. federal and state and foreign securities Laws and (b) in accordance with this Agreement. If any Transfer of the Restricted Shares is made or attempted contrary to the provisions of this Agreement, NICK shall have the right to purchase such Restricted Shares from MR Holder or his transferee at any time before or after the purported Transfer, whether during the Call Period or not, subject to and on the terms as provided in this Agreement. In addition, if MR Holder becomes obligated to sell the Restricted Shares hereunder (and is not otherwise disputing such sale in good faith) and fails to deliver such Restricted Shares to NICK in accordance with the terms of this Agreement, NICK may, at its option, in addition to all other remedies it may have, send to MR Holder by certified mail, return receipt requested, the purchase price for such Restricted Shares as is herein specified. Thereupon, (i) Amplex Holdings shall, and NICK shall cause Amplex Holdings to, cancel on its books the certificate or certificates representing such Restricted Shares sold hereunder; (ii) all of MR Holder’s rights in and to such Restricted Shares shall terminate; and (iii) MR Holder shall indemnify and hold harmless NICK, Amplex Holdings and their respective Affiliates for any Losses (as defined in the SPA) that any of them may sustain or incur by reason of any claim made with respect to the certificate or certificates representing such Restricted Shares. Further, in

addition to any other legal or equitable remedies either Party may have, a Party may enforce its rights under this Agreement by action(s) for specific performance, to the extent permitted by law, or may obtain a temporary and/or permanent injunction restraining any such Transfer (no bond or other security shall be required in connection with such action). Amplex Holdings shall, and NICK may cause Amplex Holdings to, refuse to recognize any purported transferee in violation of this Agreement as a stockholder of Amplex Holdings, and Amplex Holdings shall, and NICK may cause Amplex Holdings to, continue to treat the MR Holder as a stockholder of Amplex Holdings for all purposes, including without limitation for purposes of dividend and voting rights, until all applicable provisions of this Agreement have been complied with. The remedies provided herein are cumulative and not exclusive of any other remedies provided herein or by law.

SECTION 4.03 Legends. Amplex Holdings shall, and NICK will cause Amplex Holdings to, issue all certificates or other instruments representing the Restricted Shares (including without limitation any securities issued upon any stock split, stock dividend, recapitalization, merger, consolidation, or similar event) and to which the provisions of this Agreement apply to be endorsed conspicuously on the face thereof with legends in substantially in the following forms:

“The securities represented by this certificate have not been registered under the Securities Act of 1933, as amended (the “Act”), or any state securities laws and may not be sold, pledged, hypothecated, transferred or otherwise disposed of in the absence of an effective registration statement covering these securities under the Act and all applicable state securities laws or an opinion of counsel (concurred in by counsel to the Company) that registration is not required under the Act or under applicable state securities laws.”

“The securities represented by this certificate are subject to restrictions on transfer and certain other agreements set forth in a Put/Call Agreement dated as of June 17, 2024 by and between the Company and Mark R. Radabaugh, a copy of which is available for inspection at the offices of the Company or may be made available upon request.”

SECTION 4.04 Permitted Transfers. Notwithstanding anything to the contrary contained herein, the following transactions are exempt from the Transfer restrictions contained in this Article IV: MR Holder’s Transfer of any or all of the Restricted Shares (a) held either during his lifetime or on death by will or intestacy to his immediate family or (b) to any custodian or trustee for the account of MR Holder or MR Holder’s immediate family or (c) to any corporation, limited partnership or limited liability company of which the controlling stockholder(s), general partner(s) or member(s) are either MR Holder or members of MR Holder’s immediate family or (d) any trust exclusively for the account of MR Holder or MR Holder’s immediate family (each a “Permitted Transfer”, with each recipient of Restricted Shares in a Permitted Transfer being a “Permitted Transferee”). “Immediate family” as used herein means a spouse, lineal descendant, father, mother, brother, or sister of MR Holder. In the case of each Permitted Transfer, the Permitted Transferee will receive and hold such Restricted Shares subject to the provisions of this Article IV and any other restrictions and obligations set forth in this Agreement and any other agreement to which the Restricted Shares may then be subject with such changes in the terms hereof and thereof as the Board shall determine in good faith are necessary as a result of the change in holder of the Restricted Shares from MR Holder to the Permitted Transferee, and, as conditions precedent to the effectiveness of such Permitted Transfer, such Permitted Transferee will acknowledge the same in writing by executing a counterpart, joinder or other instrument of

adherence to this Agreement and to any other applicable agreement with respect to the Restricted Shares then in effect, each in a form reasonably acceptable to the Board, and there will be no further Transfer of such Restricted Shares except in accordance with this Article IV and the other provisions of this Agreement and any other applicable agreement.

SECTION 4.05. Other Agreements. During the Term, neither MR Holder, Amplex Holdings nor NICK shall, and NICK shall not permit or cause Amplex Holdings to, take any action or enter into any agreement or arrangement of any nature that limits, restricts, prohibits or otherwise hinders the transactions contemplated hereunder, including, but not limited to, any agreement that requires consent prior to either Party exercising any rights provided to such Party under this Agreement, without the prior written consent of MR Holder or NICK, as applicable, such consent to be given or withheld in such Party’s sole discretion.

CONDITIONS

SECTION 5.01 Mutual Conditions. The obligation of the MR Holder, on the one hand, and NICK, on the other hand, to effect the transactions contemplated by this Agreement shall be subject to the condition that no Order issued by any court or agency of competent jurisdiction or other legal restraint or prohibition preventing or materially delaying the consummation of the transactions contemplated by this Agreement shall be in effect, that no Action initiated by any Governmental Entity seeking an injunction shall be pending and that no Law or Order shall have been enacted, entered, promulgated or enforced by any Governmental Entity which prohibits, restricts or makes illegal consummation of the transactions contemplated hereby.

SECTION 5.02 Conditions to NICK’s Obligations. The obligations of NICK to effect the transactions contemplated by Article III hereof shall be subject to the following conditions, any one or more of which may be waived in whole or in part in writing by NICK:

(a)each of the representations and warranties of MR Holder set forth in Annex B to this Agreement that are not qualified as to materiality shall be true and correct in all material respects on and as of the date on which any Party exercises any of the Options set forth in this Agreement and on and as of the date of any Option Closing with the same effect as though made at and as of such date (except those representations and warranties that address matters only as of a specified date, the accuracy of which shall be determined as of that specified date in all respects), and each of the representations and warranties of MR Holder set forth in Annex B to this Agreement that are qualified as to materiality shall be true and correct in all respects on and as of the date on which any Party exercises any of the Options set forth in this Agreement and on and as of the date of any Option Closing with the same effect as though made at and as of such date (except those representations and warranties that address matters only as of a specified date, the accuracy of which shall be determined as of that specified date in all respects);

(b)MR Holder shall have performed and complied in all material respects with all agreements, covenants, obligations and conditions required by this Agreement to be performed or complied with by such Person at or prior to the Option Closing;

(c)MR Holder shall have delivered to NICK a certificate dated as of the Option Closing and signed by MR Holder confirming the satisfaction of the applicable conditions contained in paragraphs (a) and (b) of this Section 5.02;

(d)MR Holder shall have delivered to NICK evidence of transfer to NICK of the Put Shares or Call Shares, as applicable, including to the extent the same are certificated, certificates (or, if such certificate cannot be located by MR Holder, an indemnity in favor of NICK in mutually agreed form) duly endorsed in blank or accompanied by stock transfer powers evidencing transfer to NICK of such Put Shares or Call Shares, as applicable, or appointing NICK or its nominee as attorney for such transfer;

(e)MR Holder shall have made or obtained all requisite regulatory notifications or approvals and consents of third parties due from MR Holder, in form and substance reasonably satisfactory to NICK; and

(f)any disclosures provided by MR Holder in the Schedule of disclosures, as contemplated by Annex B attached hereto shall be satisfactory to NICK in its sole discretion.

SECTION 5.03 Conditions to MR Holder’s Obligations. The obligations of MR Holder to effect the transactions contemplated by Article III hereof shall be subject to the following conditions, any one or more of which may be waived in whole or in part in writing by MR Holder:

(a)each of the representations and warranties of NICK set forth in Annex C to this Agreement that are not qualified as to materiality shall be true and correct in all material respects on and as of the date on which any Party exercises any of the Options set forth in this Agreement and on and as of the date of any Option Closing with the same effect as though made at and as of such date (except those representations and warranties that address matters only as of a specified date, the accuracy of which shall be determined as of that specified date in all respects), and each of the representations and warranties of NICK set forth in Annex C to this Agreement that are qualified as to materiality shall be true and correct in all respects on and as of the date on which any Party exercises any of the Options set forth in this Agreement and on and as of the date of any Option Closing with the same effect as though made at and as of such date (except those representations and warranties that address matters only as of a specified date, the accuracy of which shall be determined as of that specified date in all respects);

(b)NICK shall have performed and complied in all material respects with all agreements, covenants, obligations and conditions required by this Agreement to be performed or complied with by NICK at or prior to the Option Closing;

(c)NICK shall have delivered to MR Holder a certificate, dated as of the Option Closing, from a senior officer of NICK confirming the satisfaction of the conditions contained in paragraphs (a) and (b) of this Section 5.03;

(d)NICK shall have made or obtained all requisite regulatory notifications or approvals and consents of third parties due from NICK, in form and substance reasonably satisfactory to MR Holder; and

(e)any disclosures provided by NICK in the Schedule of disclosures, as contemplated by Annex C attached hereto shall be satisfactory to MR Holder in his sole discretion.

ARTICLE VI

FINANCIAL MATTERS; DISPUTES

SECTION 6.01 Determination of Closing Items. Within ninety (90) days after the Closing Date, MR Holder shall provide in writing to NICK his calculation of the Closing Adjusted EBITDA and the Closing Multiple (the “Closing Notice”). If NICK disputes the calculation of the Closing Adjusted EBITDA or the Closing Multiple in the Closing Notice, then NICK shall within twenty (20) days of receipt of the Closing Notice provide written notice, including supporting documentation and with reasonable detail, to MR Holder of its calculation of the Closing Adjusted EBITDA and the Closing Multiple (the “Closing Dispute Notice”). Section 6.05 shall apply following delivery of a Closing Dispute Notice.

SECTION 6.02 Budgets; Financial Statements.

(a)Budget Process. During the Term, the Parties shall cause Amplex Holdings and its subsidiaries to deliver annually to each of the Parties at least sixty (60) days prior to the end of a fiscal year a proposed operating budget for the following fiscal year for Amplex Holdings and its subsidiaries. The operating budget for Amplex Holdings and its subsidiaries for each Measurement Year shall be subject to review and reasonable approval by each of NICK and MR Holder. If the Parties are unable to agree upon a budget for a Measurement Year by the 45th day following the beginning of such Measurement Year, then the prior year’s budget shall constitute the budget for such Measurement Year, as applicable. Unless otherwise agreed by the Parties, during the Measurement Years, the Parties will cause Amplex Holdings and its subsidiaries to operate materially in accordance with the Agreed Budgets.

(b)Financial Statements. During the Term, the Parties shall cause Amplex Holdings and its subsidiaries to deliver to each of the Parties (the “Financial Statements”):

(i)within thirty (30) days of the end of each month, an unaudited consolidated balance sheet of Amplex Holdings and its subsidiaries for, and as of, the end of such month, an unaudited consolidated statement of operations, prepared in accordance with GAAP, in reasonable detail with comparisons of the financial results against Amplex Holdings and its subsidiaries’ budget for that financial period and Amplex Holdings and its subsidiaries’ financial results for the corresponding period of the previous year, and an updated capitalization table as of the date of such statements; and

(ii)within forty five (45) days after the end of each fiscal quarter, unaudited consolidated statements of income or operations of Amplex Holdings and its subsidiaries for such quarterly period, and unaudited consolidated balance sheets of Amplex Holdings and its subsidiaries as of the end of such quarterly period, setting forth comparisons to the corresponding period in the preceding fiscal period, and all such statements shall be prepared

in accordance with GAAP, consistently applied (except for normal year-end audit adjustments for recurring accruals and the absence of footnotes with respect thereto).

(c)Books and Records. During the Term, the Parties shall cause Amplex Holdings and its subsidiaries to maintain its books and records and prepare the Financial Statements in a manner to allow calculation of Adjusted EBITDA in a manner substantially similar to the manner in which Closing Adjusted EBITDA is calculated.

SECTION 6.03 Determination of Target Adjusted EBITDA. Within thirty (30) days after determination of the Agreed Budgets as provided in Section 6.02, MR Holder shall provide in writing to NICK his calculation of the Target Adjusted EBITDA based on the Agreed Budgets (the “Metric Notice”). If NICK disputes the calculation of the Target Adjusted EBITDA in the Metric Notice, then NICK shall within twenty (20) days of receipt of the Metric Notice provide written notice, including supporting documentation and with reasonable detail, to MR Holder of its, calculation of the Target Adjusted EBITDA (the “Metric Dispute Notice”). Section 6.05 shall apply following delivery of a Metric Dispute Notice.

SECTION 6.04 Agreed Adjustments. From time to time during the Term, each Party may propose to the other Party adjustments to the calculation of EBITDA hereunder for non-recurring costs and expenses and one-time unusual revenues with an explanation for the rationale for such proposed adjustments. Each Party agrees to review such proposed adjustments in good faith and will reasonably consent to such proposed adjustments. All proposed adjustments mutually agreed upon by the Parties shall constitute the “Agreed Adjustments.” If a Party does not agree with a proposed adjustment, the Party shall provide written notice to the proposing Party with an explanation for the rationale for such rejection. NICK and MR Holder agree to meet within fifteen (15) days after notice of a rejection of a proposed adjustment in order to negotiate in good faith the proposed adjustment or an alternative thereto. Agreed Adjustments are intended to include the type of adjustments made in calculating the Closing Adjusted EBITDA and reflected on Annex A.

SECTION 6.05 Dispute Resolution. If NICK and MR Holder agree in writing as to the resolution of any objection in a Dispute Notice, the Noticed Item set forth in the Notice and (with any such changes as may be agreed upon) shall be final and binding. NICK and MR Holder agree to negotiate in good faith to attempt to resolve any such objections in a Dispute Notice, provided that NICK, on the one hand, and MR Holder, on the other hand, shall each have the right, at any time, by written notice to the other, unilaterally to terminate all negotiations with respect to such objections or changes. Not later than thirty (30) days after either MR Holder or NICK shall have terminated such negotiations, then MR Holder and NICK shall submit the remaining issues in dispute to an impartial nationally or regionally recognized firm of independent certified public accountants (provided that neither MR Holder nor NICK nor any of their respective Affiliates shall have utilized the services of such firm in the five (5) years prior to the date of the Dispute Notice), selected by the mutual written agreement of MR Holder and NICK (the “Independent Accountant”). The Independent Accountant shall have sole authority to determine any and all substantive and procedural matters pertaining to the resolution of the dispute between MR Holder and NICK arising under this Section 6.05; provided, however, that the Independent Accountant shall only review those unresolved items and amounts specifically set forth in and objected to in the Dispute Notice, and the Independent Accountant’s determination of each disputed amount shall

be no more than the highest amount claimed by either MR Holder or NICK, nor less than the lowest amount claimed by either MR Holder or NICK, in each case with respect to such disputed amount. MR Holder and NICK shall cooperate with the Independent Accountant in all respects, including providing the Independent Accountant with appropriate supporting documentation used in preparation and review of their calculations of the Noticed Item. The Independent Accountant shall, within thirty (30) days following its selection, deliver to the Parties a written report determining the proper treatment of the disputed items. The determination of the disputed amounts in the calculations of the Noticed Item by the Independent Accountant shall be final and binding upon the Parties hereto, absent manifest error. The costs and expenses of the Independent Accountant shall be borne by the Parties in inverse proportion as they may prevail on the matters resolved by the Independent Accountant, which proportionate allocation shall be calculated on an aggregate basis based on the relative dollar values of the amounts in dispute and shall be determined by the Independent Accountant at the time the determination is rendered on the merits of the matters submitted to the Independent Accountant.

MISCELLANEOUS

SECTION 7.01 Governing Law. THIS AGREEMENT, THE LEGAL RELATIONS BETWEEN THE PARTIES AND THE ADJUDICATION AND THE ENFORCEMENT THEREOF, SHALL BE GOVERNED BY AND INTERPRETED AND CONSTRUED IN ACCORDANCE WITH THE SUBSTANTIVE LAWS OF THE STATE OF DELAWARE, WITHOUT REGARD TO THE PRINCIPLES OF CONFLICTS OF LAW THEREOF.

SECTION 7.02 Jurisdiction; Waiver of Jury Trial and Certain Damages. All actions arising under or relating to this Agreement shall be brought exclusively in the United States District Court for the District of Delaware or in any State court in the State of Delaware and having subject matter jurisdiction over such matters, and each of the Parties hereto consents and agrees to personal jurisdiction, and waives any objection as to the venue, of such courts for purposes of such action. Process in any such suit, action or proceeding may be served on any Party anywhere in the world, whether within or without the jurisdiction of any such court. Without limiting the foregoing, each Party agrees that notice to such Party as provided in Section 7.04 shall be deemed effective service of process on such Party. The parties to this Agreement agree to waive any right to a jury trial as to all disputes and any right to seek INDIRECT, CONSEQUENTIAL OR punitive damages INCLUDING, WITHOUT LIMITATION, LOST PROFITS, UNLESS, AND ONLY TO THE EXTENT, ANY SUCH AMOUNTS ARE INCURRED AS A THIRD PARTY CLAIM.

SECTION 7.03 Captions. The Article and Section captions used in this Agreement are for reference purposes only and will not in any way affect the meaning or interpretation of this Agreement.

SECTION 7.04 Notice. All notices and other communications under this Agreement will be in writing and will be deemed to have been duly given when (a) personally delivered (with written confirmation of receipt); (b) on the next Business Day after the date sent for next Business Day delivery by Federal Express or other nationally recognized overnight courier (receipt requested); (c) on the date sent by email of a .pdf document (with confirmation of transmission),

if sent on a Business Day during the normal business hours of the recipient, or on the next Business Day, if sent on a non-Business Day or on a Business Day but after the normal business hours of the recipient; or (d) on the third (3rd) day after the date mailed, by certified or registered mail, return receipt requested, postage prepaid, as follows:

if to NICK, Amplex Holdings or Amplex:

Nicholas Financial, Inc.

26133 US 19 North, Suite 300

Clearwater, Florida 33763

Attention: Jeff Royal, Chairman

E-mail: jroyal@dundeebanking.com

with copies to:

Kutak Rock LLP

The Omaha Building

1650 Farnam Street

Omaha, NE 68102

Attention: Anthony D. Scioli

Email: anthony.scioli@kutakrock.com

if to MR Holder:

Mark R. Radabaugh

22690 Pemberville Rd

Luckey, Ohio 43443

E-mail: mark@amplex.net

with copies to:

Wilkinson Barker Knauer

2138 W. 32nd Ave, Suite 300

Denver, CO 80211

Attention: Amy K. Fliam

Email: afliam@wbklaw.com

or to such other addresses as may be provided by the Parties from time to time by notice in accordance with this Section.

SECTION 7.05 Assignment. No Party may assign its rights or obligations under this Agreement without the prior written consent of the other, except in accordance with the provisions of Section 4.04. This Agreement shall be binding upon and inure to the benefit of the Parties hereto and their respective heirs, executors, personal representatives, successors and permitted assigns and shall be binding upon any Person to whom any Restricted Shares are Transferred (even if in violation of the provisions of this Agreement) and the heirs, executors, personal representatives, successors and assigns of such Person. No provision of this Agreement shall be construed to

provide a benefit to any Party hereto who no longer owns any shares of capital stock of Amplex Holdings, other than a right to receive a required payment with respect thereto.

SECTION 7.06 Counterparts. This Agreement may be executed in any number of counterparts, each of which will be an original and all of which taken together will constitute one instrument, it being understood that all of the Parties need not sign the same counterpart. Delivery of an executed signature page of this Agreement by facsimile or other electronic image scan transmission shall be effective as delivery of an original manually executed counterpart of this Agreement for all purposes.

SECTION 7.07 Entire Agreement. This Agreement, its Annexes, the SPA and the other documents referred to in this Agreement contain the entire understanding of the Parties with respect to the subject matter contained herein and therein. This Agreement, its Annexes, the SPA and such other documents supersede all prior agreements and understandings among the Parties with respect to such subject matter.

SECTION 7.08 Amendments and Waivers. This Agreement may not be amended, altered or modified except by a written instrument executed by the Parties. Each Party may, by an instrument in writing signed on behalf of such Party, waive compliance by any other Party with any term or provision of this Agreement that such other Party was or is obligated to comply with or perform. No failure or delay by any Party in exercising any right, power or privilege hereunder shall operate as a waiver thereof nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any other right, power or privilege. The rights and remedies herein provided shall be cumulative and not exclusive of any rights or remedies provided by law.

SECTION 7.09 Interpretation. When a reference is made in this Agreement to a Section or Annex, such reference shall be to a Section of or Annex to this Agreement unless otherwise indicated. The headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement. Whenever the words “include,” “includes,” or “including” are used in this Agreement, they shall be deemed to be followed by the words “without limitation.” Whenever the context may require, any pronouns used in this Agreement shall include the corresponding masculine, feminine or neuter forms and the singular form of nouns and pronouns shall include the plural and vice versa. The phrases “the date of this Agreement,” “the date hereof” and terms of similar import, unless the context otherwise requires, shall be deemed to refer to the date set forth in the first paragraph of this Agreement. Unless otherwise indicated as a Business Day, the word “day” means a calendar day. Capitalized terms will have the meanings specified, applicable to both singular and plural forms, for all purposes of this Agreement. The Parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly by the Parties and no presumption or burden of proof shall arise favoring or disfavoring any Party by virtue of the authorship of any of the provisions of this Agreement. The Parties intend that each representation, warranty, and covenant contained herein shall have independent significance.

SECTION 7.10 Severability. Any term or provision of this Agreement which is invalid or unenforceable in any jurisdiction shall, as to that jurisdiction, be ineffective to the extent of such

invalidity or unenforceability without rendering invalid or unenforceable the remaining terms and provisions of this Agreement in any other jurisdiction. If any provision of this Agreement is so broad as to be unenforceable, the provision shall be interpreted to be only so broad as is enforceable.

SECTION 7.11 Expenses. Other than the expenses of the Independent Accountant, each of the Parties shall bear the costs of his or its compliance with this Agreement.

[Remainder of Page Intentionally Left Blank.]

IN WITNESS WHEREOF, the Parties hereto have caused this Put/Call Agreement to be executed as of the Effective Date.

NICK:

NICHOLAS FINANCIAL, INC.

By: /s/ Jeff Royal

Name: Jeff Royal

Title: Chairman

AMPLEX HOLDINGS:

AMPLEX HOLDINGS, INC.

By: __/s/ Jeff Royal____________________________

Name: Jeff Royal

Title: Chairman

MR HOLDER:

/s/ Mark R. Radabaugh

MARK R. RADABAUGH

ANNEX A

Closing Adjusted EBITDA

An example of the calculation of the Closing Adjusted EBITDA is set forth below.

1

A-

4888-7933-3785.10 IF " DOCVARIABLE "SWDocIDLocation" " = "1" " DOCPROPERTY "SWDocID" 250319042v.10" ""

Agreed Adjustments:

•Costs and expenses related to regulatory consulting/employee (e.g., federal or state funding)

•Transaction costs and expenses related to acquisitions

•Transaction costs and expenses related to financings

•Costs and expenses related to strategic initiatives

•Allocated portion of services provided to Amplex Holdings and its subsidiaries by NICK. Generally, the Parties expect that the calculation of EBITDA will not include any asset, liability, or corporate or administrative overhead of or related to NICK or its Affiliates (provided neither Amplex nor its subsidiaries will be considered an Affiliate of NICK for these purposes) except as otherwise agreed upon by the Parties.

2

A-

4888-7933-3785.10 IF " DOCVARIABLE "SWDocIDLocation" " = "1" " DOCPROPERTY "SWDocID" 250319042v.10" ""

ANNEX B

Representations and Warranties of MR Holder

Except as set forth in writing in a Schedule timely delivered to NICK in connection with the exercise of an Option in compliance with the terms of the Put/Call Agreement (the “Agreement”) to which this Annex B is attached (each capitalized term not otherwise defined in the Annexes to the Agreement will have the meaning provided for it in the Agreement), by reference to the appropriate section, subsection or clause of this Annex B (the disclosure in such Schedule of any fact, circumstance or other event for any purpose shall constitute disclosure for all purposes, but only to the extent the relevance of such information to another section, subsection or clause is reasonably apparent in the section, subsection or clause of such Schedule on which such information is disclosed), MR Holder hereby represents and warrants to NICK, as of the date on which any Party exercises an Option set forth in the Agreement and on and as of the date of the applicable Option Closing, as follows:

1.01 Authority; No Violation; Consents.

(a) MR Holder has the full power, authority, and capacity to consummate the Option Closing and, to own and hold the [Put Shares/Call Shares] to be transferred to NICK by MR Holder hereunder.

(b) The consummation by MR Holder of the Option Closing will not (i) violate, conflict with, or result in a breach of any provisions of, or constitute a default (or an event which, with notice or lapse of time or both, would constitute a default) under, or result in the termination of, or accelerate the performance required by, or result in a right of termination or acceleration (which has not been expressly waived) under, any Contract to which MR Holder is a party or by which MR Holder or his [Put Shares/Call Shares] is bound or result in the creation of any Lien on the [Put Shares/Call Shares]; or (ii) violate any applicable Law.

(c) Each notice to, filing with, authorization of, exemption by, or consent or approval of, any Governmental Entity or any other third Person necessary for the consummation by MR Holder of the Option Closing is set forth on Schedule 1.01(c)(1) to this Annex B. Except as set forth on Schedule 1.01(c)(2) to this Annex B, no notice to, filing with, authorization of, exemption by, or consent or approval of, any Governmental Entity or other third Person that has not been obtained or made is necessary for the consummation by MR Holder of any of the transactions contemplated by this Agreement or the consummation of the Option Closing.

1.02 Title.

(a)MR Holder is the direct beneficial and record owner of, and has good and marketable title to, the [Put Shares/Call Shares] free and clear of all Liens other than those arising pursuant to Amplex Holdings’ Organizational Documents or applicable securities Laws. At the Option Closing, MR Holder will transfer to NICK all of the [Put Shares/Call Shares] free and clear of any Liens or adverse claims other than those arising pursuant to Amplex Holdings’ Organizational Documents or applicable securities Laws.

(b)Other than pursuant to this Agreement, Amplex Holdings’ Organizational Documents and as set forth on Schedule 1.02 to this Annex B, the [Put Shares/Call Shares] are not subject to any voting trust agreement or any Contract restricting or otherwise relating to the voting, dividend rights or disposition of such [Put Shares/Call Shares] and no Person has any outstanding or authorized option, warrant or other right relating to the sale or voting of such [Put Shares/Call Shares] or pursuant to which (i) MR Holder is or may become obligated to issue, sell, transfer or otherwise dispose of, redeem or acquire any such [Put Shares/Call Shares] or (ii) MR Holder has granted, or may be obligated to grant, a right to participate in the profits of Amplex Holdings.

1.03 No Actions, Suits or Proceedings. MR Holder is not a party to or bound by any, and there are no, Actions of any nature pending or, to the knowledge of MR Holder, threatened against MR Holder or any of his properties, assets or Affiliates, that challenge the validity or legality of consummation of the Option Closing or which seek to prevent the consummation of the Option Closing.

ANNEX C

Representations and Warranties of NICK

Except as set forth in writing in a Schedule timely delivered to MR Holder in connection with the exercise of an Option in compliance with the terms of the Put/Call Agreement (the “Agreement”) to which this Annex C is attached (each capitalized term not otherwise defined in the Annexes to the Agreement will have the meaning provided for it in the Agreement), by reference to the appropriate section, subsection or clause of this Annex C (the disclosure in such Schedule of any fact, circumstance or other event for any purpose shall constitute disclosure for all purposes, but only to the extent the relevance of such information to another section, subsection or clause is reasonably apparent in the section, subsection or clause of such Schedule on which such information is disclosed), NICK hereby represents and warrants to MR Holder, as of the date on which any Party exercises an Option set forth in the Agreement and on and as of the date of the applicable Option Closing, as follows:

1.01 Organization. NICK is validly existing and in good standing under the laws of the State of Delaware. NICK has all requisite corporate power and authority to carry on its business as it is now being conducted, to own, lease and operate all of its properties and assets, and is duly licensed or qualified to do business in each jurisdiction in which the nature of the business conducted by it or the character or location of the properties and assets owned, leased or operated by it makes such qualification or licensing necessary except for those jurisdictions where the failure to be so qualified or licensed would not, individually or in the aggregate, have a material adverse effect.

1.02 Authority; No Violation; Consents.

(a) NICK has all requisite corporate power, right and authority to consummate the Option Closing. The consummation of the Option Closing has been duly and validly approved by all requisite action on the part of NICK and no other proceedings on the part of NICK are necessary to consummate the Option Closing.

(b) The consummation by NICK of the Option Closing will not (i) violate, conflict with, or result in a breach of any provisions of, or constitute a default (or an event which, with notice or lapse of time or both, would constitute a default) under, or result in the termination of, or accelerate the performance required by, or result in a right of termination or acceleration (which has not been expressly waived), any Contract to which NICK is a party, (ii) violate any applicable Law, or (iii) violate any provision of the Organizational Documents of NICK.

(c) Each notice to, filing with, authorization of, exemption by, or consent or approval of, any Governmental Entity or any other third Person necessary for the consummation by NICK of the Option Closing is set forth on Schedule 1.02(c)(1) to this Annex C. Except as set forth on Schedule 1.02(c)(2) to this Annex C, no notice to, filing with, authorization of, exemption by, or consent or approval of, any Governmental Entity or other third Person that has not been obtained or made is necessary for the consummation by NICK of any of the transactions contemplated by this Agreement or the consummation of the Option Closing.

1.03 No Actions, Suits or Proceedings. NICK is not a party to or bound by any, and there are no, Actions of any nature pending or, to the knowledge of NICK, threatened against NICK or any of its subsidiaries, properties, assets, directors, officers, employees or Affiliates, that challenge the validity or legality of consummation of the Option Closing or which seek to prevent the consummation of the Option Closing.

ANNEX D

Form of Promissory Note and Pledge Agreement

SCHEDULE I

Average Maintenance CapEx

|

|

Account |

% Allocation |

|

|

Fixed Assets: |

|

Plant in Service |

|

14201 Wireless CPE - Post 10/2019 |

100% |

14300 MRS Equipment |

10% |

14940 Tower Site Network Equipment |

100% |

14950 Wireless AP/BH |

100% |

15100 Core Network |

15% |

15201 Automobiles - Post FYE 2022 |

20% |

15510 Towers |

100% |