UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NCR ATLEOS Notice of Annual Meeting and 2024 Proxy Statement

A Letter from Our President and Chief Executive Officer

Dear fellow NCR Atleos stockholders,

On behalf of our Executive Team and our Board of Directors, thank you for your interest and support of our new Company, NCR Atleos Corporation, or Atleos. We are pleased to share our first ever Atleos proxy statement and annual report.

We successfully separated our Company

NCR Corporation, now NCR Voyix, has been a leader in financial and commerce technology solutions for nearly 140 years. In early 2022, NCR undertook a strategic review that concluded in September of that year with the decision to split into two public companies. The legal separation to create Atleos met aggressive timelines and was successfully completed in about a year. On October 16, 2023, Atleos became an independent publicly traded company with its shares listed on the New York Stock Exchange under the ticker NATL.

We are now NCR Atleos

Atleos holds leadership positions in both of its core self-service banking businesses, supported by steady global demand for cash access and transactions, and growing demand for convenient and efficient access to banking services.

Atleos services over 600,000 ATMs and operates the largest independent network of ATMs in the world with over 80,000 machines. We have 20,000 employees globally with products in 140 countries, a service organization in 60 countries, and ATM networks in 11 countries.

We are uniquely positioned to benefit from the transition of banking technologies toward self-service based offerings and the introduction of shared banking utility services. Emphasizing innovation will allow Atleos to evolve with our financial institution and retail customers, and meet the emerging preferences of their customers. We are committed to our vision of setting the highest standard in self-service financial solutions. We intend to lead from the front and to catalyze lasting value creation for all of our stakeholders.

Atleos demonstrated strong execution in 2023

Overcoming the risk of distraction from the very complicated and time intensive separation transaction, our teams drove financial performance that exceeded our budgets for revenue and profitability. Our recurring revenue growth outpaced the overall growth rate and now represents more than 71% of our top line. Our productivity initiatives delivered significant direct cost savings with streamlined manufacturing and a rebuilt supply chain.

Atleos made significant strategic progress in 2023

While our strategy presumes that the global fleet of ATMs remains relatively stable, we expect to drive growth by generating more revenue per machine across the 600,000 ATMs we service.

The ATM as a Service business (ATMaaS), our full outsource solution for financial institutions, grew by over 40% in its second full year and added over 6,000 units in 2023. We closed the year with more than 20,000 ATMaaS machines implemented and revenue of over $150 million.

Our Network segment has seen impressive topline growth across most regions. In 2023 we added financial institution partners to the network, added card holders, added new functionality and transaction types and launched into new geographies in Portugal and

Greece. Our revenue per device continued to grow rapidly, end markets remain healthy and cash utilization trends continue to be constructive.

These two key strategic efforts benefit from our unmatched expertise, considerable scale and coverage and leading service capabilities. As financial institutions evolve their retail banking strategy, we stand ready to provide the outsourced solution for self-service financial access. As consumer preferences for transacting shift, we will provide them efficient and safe solutions to complete their transactions.

Thank you

I am extremely grateful for the hard work and dedication of our global Atleos team and am very appreciative of the patience and support our customers and partners showed us as we navigated a very challenging yet rewarding year. I also appreciate our stockholders for your continued interest in our Company and our businesses.

I look forward to a formative and successful 2024.

Sincerely,

|

/s/ Timothy C. Oliver Timothy C. Oliver Chief Executive Officer April 1, 2024 |

Notice of 2024 Annual Meeting and Proxy Statement

Dear fellow NCR Atleos stockholders,

I am pleased to invite you to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) for NCR Atleos Corporation, a Maryland corporation (“Atleos” or the “Company”), that will be held on Tuesday, May 21, 2024 at 12:00 p.m. Eastern Time. This year’s Annual Meeting will conducted as a virtual meeting of stockholders. You will be able to attend the Annual Meeting, vote your shares and submit questions during the Annual Meeting via a live webcast by visiting www.proxydocs.com/NATL. Prior to the Annual Meeting you will be able to authorize a proxy to vote your shares on the matters submitted for stockholder approval at the Annual Meeting, and we encourage you to do so.

The accompanying notice of the Annual Meeting and proxy statement (“Notice”) tell you more about the agenda and procedures for the Annual Meeting. The proxy statement also describes how the Board of Directors of the Company operates and provides information about, among other matters, our director candidates, director and executive officer compensation and certain corporate governance matters. I look forward to sharing more information with you about Atleos at the Annual Meeting.

As in prior years, we are offering our stockholders the option to receive our proxy materials via the Internet. We believe this option allows us to provide our stockholders with the information they need in an environmentally conscious form and at a reduced cost.

Your vote is important. Whether or not you plan to virtually attend the Annual Meeting, I urge you to authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares on the Internet or by telephone, or, if you received the proxy materials by mail, you may also authorize a proxy to vote your shares by mail. Your vote will ensure your representation at the Annual Meeting regardless of whether you attend via webcast on May 21, 2024.

Sincerely,

/s/ Joseph E. Reece

Joseph E. Reece

Chairman of the Board

April 1, 2024

Notice of Annual Meeting of Stockholders of NCR Atleos Corporation

Time

12:00 p.m. Eastern Time

Date

Tuesday, May 21, 2024

Place

Virtual Meeting via webcast at www.proxydocs.com/NATL.

The Annual Meeting will be held in a virtual format only on the Internet. You will be able to participate in the Annual Meeting online and submit your questions during the meeting by visiting www.proxydocs.com/NATL. You will also be able to vote your shares electronically at the Annual Meeting. For more information about our virtual meeting process, please see the Questions Relating to this Proxy Statement – Information about our Virtual Annual Meeting section of this proxy statement.

Purpose

The holders of shares of common stock, par value $0.01 per share (the “common stock”), of NCR Atleos Corporation will, voting together as a single class, be asked to:

Other Important Information

Copies of these proxy materials are available at SEC Filings | NCR Atleos Corporation and www.proxydocs.com/NATL. You may also obtain these materials on the SEC website at www.sec.gov or by contacting the Company’s Corporate Secretary at NCR Atleos Corporation, 864 Spring Street NW, Atlanta, Georgia 30308-1007.

By order of the Board of Directors,

/s/ Ricardo J. Nuñez

Ricardo J. Nuñez Executive Vice President, General Counsel and Secretary |

April 1, 2024

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to Be Held on May 21, 2024

This proxy statement and Atleos’ 2023 Annual Report are available at www.proxydocs.com/NATL. Except to the extent specifically referenced herein, information contained or referenced on our website or social media is not incorporated by reference into and does not form a part of the proxy statement. The Company’s 2023 Annual Report is not proxy soliciting material.

Table of Contents

|

i |

2024 Proxy Statement |

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all the information you should consider. We urge you to read the entire Proxy Statement carefully before voting.

Proxy Statement

This Proxy Statement is furnished to stockholders of NCR Atleos Corporation, a Maryland corporation (the “Company” or “Atleos”), in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”) for exercise at the annual meeting of Atleos’ stockholders to be held on May 21, 2024 (the “2024 Annual Meeting”) and any postponements or adjournments thereof. We are mailing the Notice Regarding the Availability of Proxy Materials to stockholders on or about April 1, 2024.

The Notice Regarding the Availability of Proxy Materials (the “Notice”) directs stockholders to a website where they can access our proxy materials, including this Proxy Statement, the Notice of Annual Meeting of Stockholders, and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Annual Report”). If you would prefer to receive a printed set of our proxy materials mailed to you, please follow the instructions set forth in the Notice.

2024 Annual Meeting of Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date and Time May 21, 2024 12:00 p.m. Eastern Time |

|

Location www.proxydocs.com/NATL |

|

Record Date Close of Business on March 4, 2024

|

|

1 |

2024 Proxy Statement |

Proxy Summary

Proposals and Voting Recommendations

The holders of shares of common stock are being asked to consider and vote upon the following four proposals:

Proposal |

|

Votes Required |

|

Board Vote Recommendation |

|

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal 1: Election of Directors |

|

Majority of the total votes cast for and against each nominee |

|

VOTE FOR |

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal 2: Say on Pay: Advisory Vote on the Compensation of the Named Executive Officers as described in these proxy materials |

|

Majority of votes cast |

|

VOTE FOR |

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal 3: Say on Frequency: Advisory Vote on the Frequency of Future Advisory Votes on the Compensation of the Named Executive Officers as described in these proxy materials |

|

Majority of the votes cast(1) |

|

VOTE FOR |

|

85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal 4: Ratification of the Appointment of Independent Registered Public Accounting Firm for the year ending December 31, 2024 |

|

Majority of votes cast |

|

VOTE FOR |

|

90 |

|

|

|

|

|

|

|

How to Vote

|

|

|

|

|

|

|

|

|

|

Via the Internet |

|

By Telephone |

|

By Mail |

|

|

|

|

|

www.proxypush.com/NATL |

|

1-866-647-2142 |

|

Sign, date and mail your proxy card (record holders) or your voting instruction form

|

Company Overview

Atleos is an industry-leading financial technology company providing self-directed banking solutions to a global customer base including financial institutions, merchants, manufacturers, retailers and consumers. Self-directed banking is a rapidly growing, secular trend that allows banking customers to transact seamlessly between various channels all for the same transaction. Our comprehensive solutions enable the acceleration of self-directed banking through ATM and interactive teller machine (“ITM”) technology, including software, services, hardware and our proprietary Allpoint network. While we provide all our solutions on a modular basis, we have also assembled these capabilities into a turnkey, end-to-end platform which we have branded “ATM as a Service.”

|

2 |

2024 Proxy Statement |

Proxy Summary

We manage our operations in the following segments: Self-Service Banking, Network, and Telecommunications & Technology (T&T).

Separation from NCR Voyix Corporation

On October 16, 2023, Atleos was spun-off from its former parent company (the "Separation"), NCR Corporation (now known as NCR Voyix Corporation or "Voyix" and referred to as "NCR Corp" prior to the Separation) and has since operated as an independent, standalone public company. The Separation was achieved by means of a pro-rata distribution of all of Atleos’ common stock to Voyix's stockholders at the close of business on October 2, 2023. Each holder of Voyix's common stock received one share of Atleos’ common stock for every two shares of Voyix common stock held as of the close of business on October 2, 2023, plus cash in lieu of fractional shares. On October 17, 2023, the Company commenced trading as an independent public company under the ticker symbol “NATL” on the New York Stock Exchange (“NYSE”).

Following the Separation, Voyix does not beneficially own any shares of Atleos common stock and will no longer consolidate Atleos results with any Voyix results.

Although Atleos and Voyix currently operate as separate companies, the rules and regulations of the SEC and the NYSE require that we provide certain information, including compensation information for our directors and named executive officers, for a period of time prior to the Separation. We have sought to clearly indicate throughout this Proxy Statement what information relates to Atleos prior to the Separation, and what information relates to Atleos following the Separation.

|

3 |

2024 Proxy Statement |

Proxy Summary

Corporate Governance Highlights

Director Independence & Oversight |

• Seven of our eight directors are independent • Our Board currently has an Independent Chairman. The Board believes its leadership structure, as well as the Company’s leadership structure, function cohesively and serve the best interests of the Company based on the Company’s strategy and ownership structure • The Audit Committee, Compensation and Human Resource Committee, and Nominating & Governance Committee each consist entirely of independent directors |

Director Qualifications & Evaluation |

• Our Board will review committee and director performance through an annual process of self-evaluation |

Stockholder Rights & Engagement |

• All of our directors will stand for election each year for one-year terms • Our bylaws provide for a majority voting standard in uncontested elections; provided, however that directors will be elected by a plurality voting standard in contested elections • Our officers and directors have rigorous stock ownership guidelines |

Corporate Responsibility |

• Our Board has active oversight of our strategy and risk management, including data privacy, ethics and compliance, cybersecurity, human capital management and sustainability risks • Our Board has adopted anti-hedging, anti-pledging and clawback policies |

Board Composition Highlights

Our Board holds a diverse range of backgrounds, viewpoints and skills that enable its effectiveness and proactiveness and is committed to actively seeking highly qualified women and individuals from historically underrepresented director candidates for consideration. The Board, with input from the Nominating and Governance Committee, is responsible for periodically determining the appropriate skills, perspectives, experiences, and characteristics required of Board candidates, taking into account the Company's needs, strategy, and current make-up of the Board. Additionally, our Board continues to uphold and focus on the independence of Board members and has adopted the definition of independence described in the director independence requirements for NYSE listed companies.

|

4 |

2024 Proxy Statement |

Proxy Summary

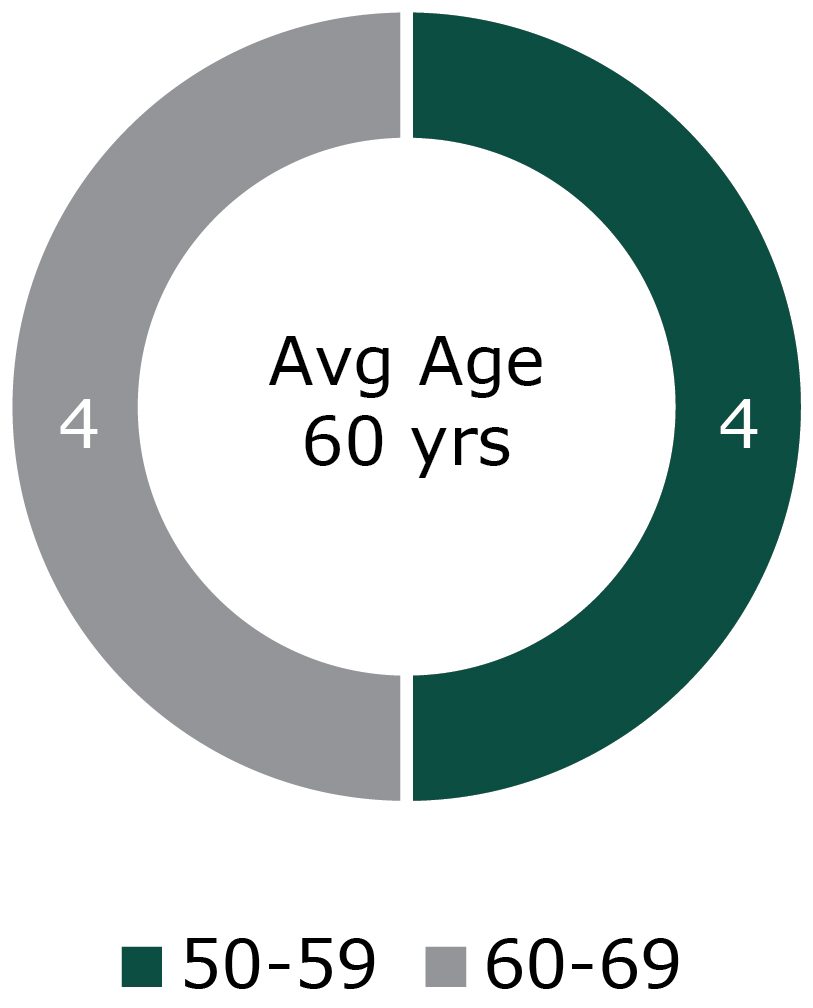

Board Composition at a Glance |

|||

|

|

|

|

Ethnic Diversity |

Gender Diversity |

Independence |

Average Age |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Committee |

||||

Name and Principal Occupation |

|

Age |

|

Independent |

|

Audit |

|

CHRC |

|

NGC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Odilon Almeida, Jr. Operating Partner |

|

62 |

|

• |

|

• |

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mary Ellen Baker Former Executive Vice President & Head of Business |

|

65 |

|

• |

|

Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark W. Begor Chief Executive Officer |

|

65 |

|

• |

|

|

|

Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michelle McKinney Frymire Former Chief Executive Officer CWT (formerly Carlson Wagonlit Travel) |

|

57 |

|

• |

|

|

|

• |

|

Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Frank A. Natoli Chief Operating Officer Associated Materials, LLC |

|

59 |

|

• |

|

|

|

• |

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Timothy C. Oliver President & Chief Executive Officer |

|

55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joseph E. Reece Chairman of the Board |

|

62 |

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeffry H. von Gillern Former Vice Chairman of Technology and Operations |

|

58 |

|

• |

|

• |

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

CHRC = Compensation and Human Resource Committee

NGC = Nominating and Governance Committee

|

5 |

2024 Proxy Statement |

Proxy Summary

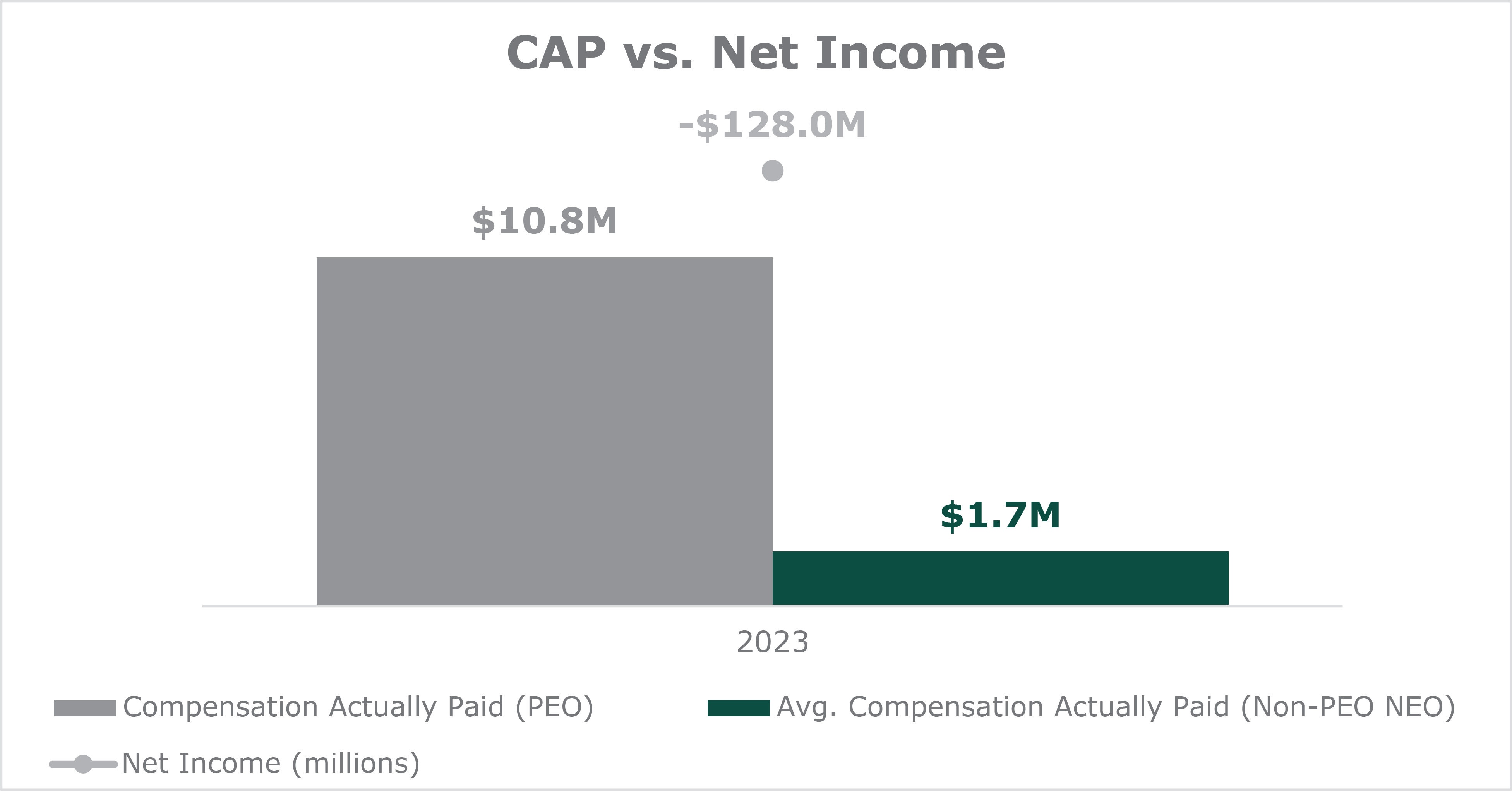

Executive Compensation Highlights

Executive Compensation Philosophy and Design

We are committed to clear, transparent executive compensation programs that drive company performance and encourage the interests of our executives to be aligned with those of stockholders. As described in the Compensation Discussion and Analysis section below, all compensation programs and amounts presented in this Proxy Statement were for fiscal 2023 and made by the compensation committee and leadership of our former parent company, NCR. The Atleos Compensation and Human Resource Committee (the “CHRC”) was not established until the Separation in October of 2023.

Further details about executive compensation decisions are described in the Executive Compensation - Compensation Discussion and Analysis beginning on page 39.

Risk Management Highlights

Oversight

Atleos is committed to a strong oversight mechanism of material risks. The Atleos Board has oversight of executive management’s responsibilities to design, implement and maintain an effective enterprise risk management (“ERM”) framework for our overall operational, information security, strategic, reputational, technology, sustainability, and other risks, including matters relating to diversity, equity and inclusion (“DE&I”), environment, health and safety, sustainability, business continuity planning (“BCP”), third-party risk management (“TPRM”), and the security of our personnel and physical assets. Atleos’ management will be responsible for developing and managing formal programs designed to identify, assess and respond to material and emerging risks and opportunities that may impact the achievement of Atleos’ strategic objectives. In particular, the Audit Committee will assist the Atleos Board in its oversight of risk management.

Our Chief Risk Officer has primary oversight for the Company’s ERM programs, including BCP and TPRM, details of which are reported to the Audit Committee. Atleos’ ERM programs support the Company’s strategic objectives and corporate governance responsibilities. The ERM programs include the following primary objectives:

|

6 |

2024 Proxy Statement |

Proxy Summary

In addition to the Chief Risk Officer, our Chief Compliance Officer has a direct channel to the Board. Further, our Chief Compliance Officer oversees investigations pertaining to fraud, conflicts of interest, violations of laws, and other similar matters, and reports on those activities to one or more Committees of the Board. All of these channels to the Board are designed to prevent risks and initiatives from being siloed into one channel and provide a clear and accurate picture of the Company’s evolving risk landscape.

Business Ethics and Integrity

Our Code of Conduct sets forth standards designed to uphold our values and foster integrity in our relationships with one another and our valued stakeholders. Our Code of Conduct is available at https://www.ncratleos.com/corporate-goverance-docs/ncr-atleos_atleos-code-of-conduct.pdf.

Everyone at Atleos will be required to take our Code of Conduct training annually. Our Code of Conduct training is currently available in 16 languages. Training will be revised annually, taking into account the prior year’s compliance matters and the Company’s compliance risks.

Our Ethics and Compliance Program is responsible for managing the Company’s adherence to the Code of Conduct. Further, our Chief Compliance Officer oversees investigations pertaining to fraud, conflicts of interest, violations of laws, and other similar matters, and reports on those activities to one or more Committees of the Board.

Data Protection, Privacy and Security

At Atleos, we are proud of our data protection, cybersecurity, and privacy programs. These initiatives receive oversight from the Audit Committee, as well as several members of our Executive Leadership Team including the Chief Operating Officer, General Counsel, Chief Security & Cash Operations Officer, and Chief Information & Technology Officer. Atleos’ Chief Security & Cash Operations Officer, Chief Information & Technology Officer and Chief Privacy Officer are responsible for management of these programs. Additional support is provided by our Chief Risk Officer and our Chief Compliance Officer.

Atleos supports appropriate privacy protections for those with whom we interact. We foster a culture that values the privacy rights of individuals. Under the direction of Atleos’ Chief Privacy Officer, the program offers thought leadership, advice and guidance on privacy practices such as: complying with privacy laws and regulations; designing solutions with privacy in mind; implementing contracts governing intracompany activities; minimizing the collection of data; providing meaningful notice and choice; and safeguarding information. The program is supported by a privacy attorney, privacy program managers within the business, and data protection officers in various locations internationally. Many of these privacy professionals have industry recognized privacy certifications from the International Association of Privacy Professionals.

Under the direction of Atleos’ Chief Security & Cash Operations Officer, the Global Information Security organization is responsible for implementing and maintaining an information security program with the goal to protect information technology resources and protect the confidentiality and integrity of data gathered on our people, partners, customers, and business assets. Also, we employ various information technology and protection methods designed to promote data security including firewalls, intrusion prevention systems, denial of service detection, anomaly-based detection, anti-virus/anti-malware, endpoint encryption and detection and response software, Security Information and Event Management system, identity management technology, security analytics, multi-factor authentication and encryption.

|

7 |

2024 Proxy Statement |

Proxy Summary

To further our commitment to data privacy and cybersecurity:

Diversity, Equity and Inclusion

At Atleos, we believe a diverse workforce improves our customer relationships and enables us to understand regional and local nuances of the markets in which we operate. Approximately 81% of our workforce is based outside of the U.S. Accordingly, we strive to build a globally inclusive workplace where all people are treated fairly. We seek to include everyone, lead with empathy, and make our communities better.

We are proud to have two female directors serving on our Board. Notably, two-thirds of the Board’s committees are chaired by women.

Diversity by the numbers*

56 |

19% |

39% |

29% |

countries in which approximately 20,000 of our employees reside

81% of our workforce is based outside |

of our global workforce |

of our U.S. workforce |

of our U.S. |

* Based on data as of December 31, 2023, for NCR Atleos Corporation and its subsidiaries.

Environmental Management

We are committed to managing our environmental footprint in the global communities in which we operate. We strive to minimize the environmental impact of our products and operations while also delivering innovative technologies and solutions designed to support businesses and consumers in their efforts to operate responsibly. For example, Atleos uses remote sensing technology to solve customer equipment issues, which reduces the number of maintenance visits and reduces our carbon footprint.

|

8 |

2024 Proxy Statement |

Proxy Summary

We recognize the importance of minimizing our environmental footprint through energy and greenhouse gas ("GHG") management. That is why we report our Scope 1 and Scope 2 emissions from our global facilities and service operations through CDP (formerly Carbon Disclosure Project). We will complete the annual CDP climate change questionnaire and evaluate our environmental management progress annually to better understand our areas of opportunity to make a true impact.

We are proud to publicly disclose our Scope 1 and Scope 2 GHG emissions data, which has been measured and calculated in alignment with the GHG Protocol Standard. Our emissions data for 2023 is as follows:

Scope 1 – 143,650 mtCO2e

Scope 2 – 4,917 mtCO2e

The reported data for 2023 includes absolute GHG emissions from Scope 1 (generation of heat and transportation) and Scope 2 (generation of purchased electricity) for Atleos business units operating as part of NCR Corporation from January 1, 2023 through the Separation of Atleos on October 16, 2023 and as a standalone business through the balance of 2023 post-separation. This 2023 data will be used as the baseline year for future reporting in line with the GHG Protocol Standard reporting methodology.

We are committed to continued accuracy and transparency and regularly refine our data collection and calculation methodology.

|

9 |

2024 Proxy Statement |

Proposal 1 – Election of Directors

The Board of Directors recommends that you vote FOR each of Odilon Almeida, Jr., Mary Ellen Baker, Mark W. Begor, Michelle McKinney Frymire, Frank A. Natoli, Timothy C. Oliver, Joseph E. Reece and Jeffry H. von Gillern for election as a director of the Company, each to serve until the next annual meeting of stockholders following his or her election and until his or her respective successor is duly elected and qualifies.

The holders of shares of common stock are being asked to consider and vote on each of the eight director nominees up for election, each to serve until the next annual meeting of stockholders following his or her election and until his or her respective successor is duly elected and qualifies. Proxies solicited by the Board and properly authorized will be exercised FOR the election of each of the eight nominees: Odilon Almeida, Jr., Mary Ellen Baker, Mark W. Begor, Michelle McKinney Frymire, Frank A. Natoli, Timothy C. Oliver, Joseph E. Reece and Jeffry H. von Gillern, unless you elect to vote against or abstain from voting with regard to any nominee. The Board has no reason to believe that any of these nominees will be unable to serve. However, if one of them should become unable to serve prior to the Annual Meeting, the proxies may vote for another person recommended by the Nominating and Governance Committee and nominated by the Board, or the Board may reduce the number of directors to be elected at the Annual Meeting.

How Does the Board Recommend that I Vote on this Proposal?

The Board of Directors recommends that you vote FOR the election of each nominee for director.

|

|

Vote FOR each of Odilon Almeida, Jr., Mary Ellen Baker, Mark W. Begor, Michelle McKinney Frymire, Frank A. Natoli, Timothy C. Oliver, Joseph E. Reece and Jeffry H. von Gillern as directors, each to serve until the next annual meeting of stockholders following his or her election and until his or her respective successor is duly elected and qualifies. Properly authorized proxies received by the Board will be voted FOR all nominees for which the stockholder may vote unless they specify otherwise. |

Vote Required for Approval

The affirmative vote of a majority of the total votes cast for and against each nominee by the holders of our common stock (in person via attendance at the virtual Annual Meeting or by proxy), is required to elect each nominee. Abstentions and broker “non-votes” will not be counted as votes cast and will have no effect on the vote required to elect each of these director nominees.

|

10 |

2024 Proxy Statement |

Proposal 1 – Election of Directors

Qualifications, Attributes, Skills and Experiences Represented by the Director Nominees

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual Skills / Qualifications |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CEO or President Leadership Experience as a chief executive officer or president in a major organization |

• |

|

• |

• |

|

• |

• |

|

62.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Communications & Marketing Experience in communications and marketing |

• |

|

• |

• |

|

|

• |

• |

62.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compliance Experience in developing, managing or overseeing an ethics or compliance program |

• |

|

• |

• |

|

• |

|

• |

62.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ERM & Cybersecurity Experience in enterprise risk management (ERM) and cybersecurity |

• |

• |

• |

• |

|

|

|

• |

62.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESG Experience in environmental, social and governance (ESG), community affairs and/or corporate responsibility including sustainability, diversity and inclusion |

• |

|

• |

• |

|

• |

• |

• |

75% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Literacy Experience or expertise in financial accounting and reporting or financial management. |

• |

• |

• |

• |

|

• |

• |

• |

87.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Global Business & Culture Experience and exposure to markets and cultures outside the United States |

• |

|

• |

• |

• |

• |

• |

• |

87.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Government or Regulatory Affairs Experience leading a major organization in government or regulatory affairs |

• |

|

• |

|

|

|

• |

• |

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Human Capital Management Experience in human resources and labor relations (including compensation) management, and fostering talent |

• |

|

• |

• |

|

• |

• |

• |

75% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M&A or Corporate Finance Experience in mergers and acquisitions, capital structure strategy, corporate debt or capital markets |

• |

• |

• |

• |

• |

• |

• |

• |

100% |

|

|

|

|

|

|

|

|

|

|

|

Individual Industry Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banking Background Experience in the banking industry |

• |

• |

• |

|

• |

• |

• |

• |

87.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public Company Board Service Experience as a board member of another publicly traded company |

• |

• |

• |

• |

|

|

• |

|

62.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Strategic Transformation Leadership experience driving strategic direction and growth of an organization shifting its business strategy |

• |

• |

• |

• |

• |

• |

• |

• |

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology or Software Experience implementing technology or software strategies for long-term research and development planning and strategy |

• |

• |

• |

• |

|

• |

|

• |

75% |

|

|

|

|

|

|

|

|

|

|

|

More Information About Our Board of Directors

The Board oversees management in directing the overall performance of the Company on behalf of its stockholders. Members of the Board stay informed of the Company’s business by participating in Board and committee meetings (including regular executive sessions of the Board), by reviewing materials provided to them prior to the meetings and otherwise, and through discussions with the Chief Executive Officer and other members of management and staff.

|

11 |

2024 Proxy Statement |

Proposal 1 – Election of Directors

Nominees for Election

The name, age, principal occupation, other business affiliations and certain other information regarding each nominee for election as a director are set forth below, along with a description of the qualifications that led the Nominating and Governance Committee and Board to conclude that he or she meets the needs of the Board and supports the advancement of the Company’s long-term strategy. The age reported for each director is as of the filing date of this Proxy Statement.

|

|

|

Odilon Almeida, Jr. Director Age: 62 Atleos Committees: Audit, Nominating and Governance |

|

Odilon Almeida, Jr. is an Operating Partner at Advent International, one of the world’s largest and most experienced global private equity firms, with over 345 investments across 41 countries. Previously, from 2021 to 2023, Mr. Almeida served as President, Chief Executive Officer, and a member of the Board of Directors of ACI Worldwide (“ACIW”), a $1.5 billion global software provider of mission-critical real-time payment solutions with operations in over 80 countries. From 2019 to 2020, Mr. Almeida was an operating partner for Advent International. During his 17-year tenure (2002-2019) at Western Union (“WU”), the global leader in cross-border and cross-currency money movement, Mr. Almeida advanced through increasingly significant general management and operating roles at WU, including President of Western Union Global Money Transfer, where he headed the company’s $5 billion consumer business in over 200 countries and territories. From May 2015 to May 2023, Mr. Almeida served on the board of Millicom International (“TIGO”), a leading provider of fixed and mobile telecommunications services. Mr. Almeida became a director of NCR Atleos on October 16, 2023.

Qualifications: Mr. Almeida's qualifications include his extensive experience as a global leader with a strong track record of value creation in the financial, fintech and technology sectors. Over his 40-year career, he has set strategy and led growth acceleration through organic expansion, as well as the acquisition and integration of new businesses. He has proven expertise in leading digital transformation, accelerating global growth, and corporate governance.

Other Current Public Directorships: None |

|

12 |

2024 Proxy Statement |

Proposal 1 – Election of Directors

|

|

|

|

|

|

Mary Ellen Baker Director Age: 65 Atleos Committees: Audit (Chair) |

|

Mary Ellen Baker most recently served as Executive Vice President and Head of Business Services for Citizens Financial Group (Citizens Bank) from August 2016 to June 2022. She also served as a member of Citizens Bank's executive committee while co-leading the bank’s multi-year transformation program focused on digitization, next-generation technology and deployment of advanced analytics. Prior to joining Citizens Bank in 2016, Ms. Baker was an Executive Vice President at PNC Financial Services (“PNC”), where she was the interim Chief Technology Officer and the Executive Vice President of Enterprise Services. Prior to PNC, Ms. Baker spent ten years with Bank of America as a Senior Vice President in several executive roles including the Head of Consumer & Small Business Technology and Operations. Ms. Baker currently serves as a member of the Board of Directors of Metallus, Inc. Ms. Baker became a director of NCR Atleos on October 16, 2023.

Qualifications: Ms. Baker’s qualifications include her significant leadership and management experience; financial services industry technology and innovation experience; and her current experience as a director and committee member of other public companies.

Other Current Public Directorships: Metallus, Inc.

|

|

13 |

2024 Proxy Statement |

Proposal 1 – Election of Directors

|

|

|

Mark W. Begor Director Age: 65 Atleos Committees: Compensation and Human Resource (Chair) |

|

Mark W. Begor was named Chief Executive Officer of Equifax, Inc. ("Equifax") and a member of the Board of Directors in April 2018. Mr. Begor has created a new Equifax during his tenure as CEO. Under his leadership, Equifax has undertaken one of the largest cloud transformation initiatives in its industry. Equifax has invested over $1.5 billion to change nearly every facet of its infrastructure, has become an industry leader in security, is driving AI innovation, and is on track to become the only cloud-native data, analytics and technology company of its kind. Equifax has grown from $3.4B in 2018 to record 2023 annual revenue of $5.265 billion, a compound growth rate of approximately 9.1%. This strong financial performance has enabled the company to complete 14 strategic acquisitions totaling nearly $4 billion since the beginning of 2021 to broaden Equifax capabilities well beyond a traditional credit bureau in the markets the company serves worldwide, while investing record amounts to expand data, analytics, product, and technology capabilities. Before joining Equifax, Mr. Begor served as a Managing Director in the Industrial and Business services group at Warburg Pincus LLC (“Warburg Pincus”), a $40 billion growth-focused private equity firm with more than 120 portfolio companies, from 2016 to 2018. He also served for two years as a member of the Board of Directors at FICO. Prior to joining Warburg Pincus, Mr. Begor spent 35 years at General Electric Company (“GE”), most recently as President and Chief Executive Officer of GE’s $8 billion energy management business from 2014 to 2016. Before leading GE Energy Management, Mark was President and CEO of GE Capital Real Estate. He also served as President and CEO of GE Capital Retail Finance (Synchrony Financial), successfully guiding it through a period where the business doubled in size. Mr. Begor was a Senior Vice President and member of GE’s Corporate Executive Council for 10 years and a GE officer for 19 years. He also served as the Chief Financial Officer at NBCUniversal Media and as GE's Investor Relations leader, where he oversaw a large number of acquisitions and dispositions. Mr. Begor currently serves on the Board of Directors of NCR Atleos. Mr. Begor previously served on the Board of Directors at NCR Corporation from February 2020 until the company separated into NCR Atleos and NCR Voyix in October 2023. Mr. Begor is also on the Board of Trustees at both Dartmouth-Hitchcock Medical Center and the U.S. Ski and Snowboard Foundation. Mr. Begor is a graduate of Syracuse University with a bachelor’s degree in finance and marketing, and he has an MBA from Rensselaer Polytechnic Institute

Qualifications: Mr. Begor’s qualifications include extensive leadership roles; his industry expertise; his current and prior experience as a director and committee member of other public companies; and his independence.

Other Current Public Directorships: Equifax, Inc. |

|

14 |

2024 Proxy Statement |

Proposal 1 – Election of Directors

|

|

|

Michelle McKinney Frymire Director Age: 57 Atleos Committees: Compensation and Human Resource, Nominating and Governance (Chair) |

|

Michelle McKinney Frymire most recently served as Chief Executive Officer of CWT (formerly Carlson Wagonlit Travel), a leader in travel management technology, from May 2021 to May 2022. Ms. Frymire was responsible for leading the company through and beyond the impact of the pandemic, driving the company’s global strategy and overseeing significant investment in the company’s product and technology platforms. As a travel management platform, CWT was heavily impacted by the COVID-19 pandemic and with the support of nearly all of its debt holders CWT filed a pre-packaged Chapter 11 bankruptcy on November 11, 2021, in the U.S. Bankruptcy Court for the Southern District of Texas. CWT’s plan of reorganization was approved by the Bankruptcy Court the following day, on November 12, 2021, and CWT was able to exit Chapter 11 on November 19, 2021. Prior to serving as Chief Executive Officer of CWT, Ms. Frymire served as President and Chief Financial Officer of CWT, in charge of global business strategy and transformation from August 2020 to April 2021. Prior to that role, Ms. Frymire was the Executive Vice President and Chief Financial Officer of CWT from January 2019 to August 2020. Prior to joining CWT, Ms. Frymire was Chief Financial Officer for U.S. Risk Insurance Group, LLC, a privately owned specialty lines underwriting manager and wholesale broker, from 2017 to 2019. From 2015 to 2017, she served as Chief Financial Officer for Service King Collision Repair Centers, an auto body collision repair company. From 2009 to 2015, Ms. Frymire served in a variety of roles for The Service Master Companies, Inc., a residential and commercial services company, most recently as vice president, corporate FP&A and strategy, as well as Chief Financial Officer for TruGreen, a lawn and landscape service provider, from 2009 to 2013. From 2005 to 2009, Ms. Frymire was Chief Financial Officer, vacation ownership for Starwood Hotels & Resorts Worldwide, Inc., a former hospitality company. From 1998 to 2005, Ms. Frymire served in a variety of roles for Delta Air Lines, Inc., a global airline carrier, including vice president of finance, marketing, international, network and technology. From 1994 to 1998, she was managing director, financial planning, analysis and systems for Continental Airlines, a former global airline carrier. Ms. Frymire is currently on the Board of Directors for Cedar Fair, L.P. and Sonder. Ms. Frymire previously served on the Board of Directors of Spirit Realty Capital. Ms. Frymire became a director of NCR Atleos on October 16, 2023.

Qualifications: Ms. Frymire’s qualifications include her extensive executive-level experience, including in the technology, travel and hospitality sectors; her extensive experience in finance and financial expertise; her current experience as a director and committee member of other public companies; and her independence.

Other Current Public Directorships: Cedar Fair, L.P.; Sonder Holdings Inc. |

|

15 |

2024 Proxy Statement |

Proposal 1 – Election of Directors

|

|

|

Frank A. Natoli Director Age: 59 Atleos Committees: Compensation and Human Resource, Nominating and Governance |

|

Mr. Natoli currently serves as Chief Operating Officer of Associated Materials, LLC, a vertically integrated building products company with $1.6 billion in annual revenues. From 2020 to March 2023, Mr. Natoli served as Chief Operating Officer at Springs Window Fashions LLC, a leading global provider of custom window coverings. Mr. Natoli joined Springs Window Fashions, LLC, in 2018 as Executive Vice President, Integrated Supply Chain. In this position, he led the company’s supply chain operations. He also managed the company’s manufacturing footprint as well as the supply chain, procurement, and quality functions. Prior to joining Springs Window Fashions LLC, Mr. Natoli was with Diebold Nixdorf, Inc., (“Diebold”) for 13 years where he held a number of positions of increasing responsibility in technology, operations, transformation and business process improvement. In 2018, Mr. Natoli served as Head of Operations for Diebold and oversaw their global manufacturing and supply chain. From 2012 to 2017, he was Executive Vice President and Chief Innovation Officer and led their global research and development organization, including Diebold’s global engineering, marketing, product management and technology groups. Prior to that, he worked as Vice President and Chief Technology Officer where he was responsible for leading the technology and engineering development group in creating products that meet customers’ needs. He also led support of the company’s service business to improve reliability and align technology with corporate strategies. Prior to that, he also served as Vice President of Operational Excellence and Vice President of Business Transformation. Before joining Diebold in 2005, Mr. Natoli spent 23 years in the automotive industry in engineering, manufacturing and operations roles. Mr. Natoli became a director of NCR Atleos on October 16, 2023.

Qualifications: Mr. Natoli’s qualifications include his extensive executive-level experience and his industry expertise including in the financial services industry and bank technology processing.

Other Current Public Directorships: None

|

|

16 |

2024 Proxy Statement |

Proposal 1 – Election of Directors

|

|

|

Timothy C. Oliver President and Chief Executive Officer Age: 55

|

|

Timothy (Tim) C. Oliver is the President and Chief Executive Officer of Atleos, a position he has held since October 16, 2023. Most recently, Tim served as Chief Financial Officer for NCR Voyix, from July 13, 2020 to October 16, 2023, and was responsible for all aspects of its financial stewardship, compliance and balance sheet management, working with the investor community and partnering with the business units to ensure customer success and profitability. Mr. Oliver served as President and Chief Financial Officer of Spring Window Fashions, LLC, a consumer goods company, and a member of the company's leadership team from 2019 to July of 2020. In this role he focused on, among other things, aligning the company's business portfolio and growth initiatives with its finance strategy. From 2011 to 2019, he served as Chief Financial Officer of the Goldstein Group Inc. (GGI), a privately held conglomerate, and President and Chief Financial Officer of its subsidiary, Alter Trading Corporation (Alter), a privately held metal recycler and broker company. Mr. Oliver also served as President during the last three months in his role at Alter. Before joining GGI and Alter, he was the Senior Vice President and Chief Financial Officer of MEMC Electronic Materials, Inc., a publicly held technology company (now SunEdison, Inc.), from 2009 to 2011, and Senior Executive Vice President and Chief Financial Officer of Metavante Technologies, Inc., a publicly held bank technology processing company, from 2007 to 2009. He also previously served as Vice President and Treasurer of Rockwell Automation, Inc. (Rockwell Automation), an industrial automation and digital transformation company, from 2005 to 2007. Before joining Rockwell Automation, he was Vice President for Investor Relations and Financial Planning at Raytheon Company. Mr. Oliver became a director of NCR Atleos on October 16, 2023.

Qualifications: Mr. Oliver’s qualifications include his deep experience and expertise in our business, proven leadership through the development of his own teams, and exceptional amount of care for our customers, employees and communities. A seasoned corporate finance executive, Tim brings three decades of experience and a successful record of integrating advanced technologies, transforming portfolios and managing economic uncertainties. Tim has worked in the manufacturing, technology and software business sectors and brings accounting expertise and deep experience in mergers and acquisitions, investor relations and financial planning.

Other Current Public Directorships: None |

|

17 |

2024 Proxy Statement |

Proposal 1 – Election of Directors

|

|

|

Joseph E. Reece Chairman of the Board Age: 62

|

|

Joseph E. Reece has been a Managing Partner of SilverBox Capital LLC, and its predecessors, (“SilverBox”), since 2015. SilverBox is an alternative investment manager operating across multiple platforms. Mr. Reece also served as a consultant to BDT & Company from October 2019 to November 2021. He previously served as Executive Vice Chairman and Head of UBS Securities, LLC’s (“UBS”) Investment Bank for the Americas from 2017 to 2018 and was also Co-Head of Risk. Prior to working at UBS, Mr. Reece worked at Credit Suisse from 1997 to 2015, in roles of increasing responsibility, including serving as Global Head of Equity Capital Markets and Co-Head of Credit Risk. Joe’s prior experience includes practicing as an attorney for ten years, including at the law firm of Skadden, Arps, Slate, Meagher & Flom LLP and at the United States Securities and Exchange Commission, where he ultimately served as Special Counsel to the Division of Corporation Finance. Mr. Reece currently serves as a member of the Board of Directors of Compass Minerals Inc., where he serves as its Chairman. He previously served as a member of the Board of Directors of SilverBox Engaged Merger Corp I. (where he was the Executive Chairman from March 2021 to February 2022), UBS Securities, LLC, Atlas Technical Consultants, Inc. and its predecessor company, Boxwood Merger Corp., Del Frisco’s Restaurant Group, Inc., RumbleOn, Inc, CST Brands, Inc., LSB Industries, Inc., and Quotient Technology, Inc. Mr. Reece previously served on the Board of Directors for NCR Corporation, where he was independent Lead Director from November 2, 2022 to May 2, 2023 and was Chairman of the Board from May 2, 2023 to October 16, 2023. Mr. Reece became a director and Chairman of the Board of NCR Atleos on October 10, 2023.

Qualifications: Mr. Reece’s qualifications include his current and prior experience as a director of other public companies; his significant finance and investment experience; his broad industry experience; his experience leading companies in operational, financial and strategic matters; and his independence.

Other Current Public Directorships: Compass Minerals, Inc.

|

|

18 |

2024 Proxy Statement |

Proposal 1 – Election of Directors

|

|

|

Jeffry H. von Gillern

Age: 58 Atleos Committees: Audit, Nominating and Governance |

|

Jeffry H. von Gillern most recently served as Vice Chairman of Technology and Operations Services for U.S. Bancorp and as a member of the Managing Committee of U.S. Bancorp, a position he held from July 2010 to December 31, 2023. In this role, he reported directly to the Chief Executive Officer and Chairman, and was responsible for a substantial annual investment portfolio of projects and led a group of approximately 25,000 staff resources. Mr. von Gillern joined U.S. Bancorp in 2001 as Executive Vice President and he assumed the additional role of Chief Information Officer (“CIO”) in 2007 which he served until 2010. As CIO, he managed a number of important projects and led and supported numerous bank acquisitions, large scale technology upgrades and multiple complex portfolio conversions. Prior to joining U.S. Bancorp, he served as Chief Information Officer of IronPlanet, a leading online marketplace for selling and buying used construction equipment, trucks and government surplus from 2000 to 2001. Prior to that, he was a Senior Vice President at Visa International, where he spent 12 years. Mr. von Gillern was the Lead Director of ViewPointe LLC from 2010 until 2015, and was a Board Director of Syncada, LLC, from 2010 until 2014 and is currently a Board Director and Treasurer of Childrens Hospital of Minnesota. Mr. von Gillern became a director of NCR Atleos on October 16, 2023.

Qualifications: Mr. von Gillern’s qualifications include his significant leadership and management experience; financial services industry experience and technology and innovation experience.

Other Current Public Directorships: None |

|

19 |

2024 Proxy Statement |

Corporate Governance

General

The Board is elected by the stockholders of the Company to oversee and direct the management of the Company. The Board acts as an advisor to senior management and monitors its performance. The Board reviews the Company’s strategies, financial objectives, and operating plans. It also plans for management succession of the Chief Executive Officer, as well as other senior management positions, and oversees the Company’s compliance efforts.

To help discharge its duties and responsibilities, the Board has adopted the Corporate Governance Guidelines that address significant corporate governance issues, including, among other things: the size and composition of the Board; director independence; Board leadership; roles and responsibilities of the Board; risk oversight; director compensation and stock ownership; committee membership and structure, meetings and executive sessions; and director selection, training and retirement. The Corporate Governance Guidelines, as well as the Board’s committee charters, are found under “Corporate Governance” on the “Company” page of Atleos’ website at https://www.ncratleos.com/about-us/corporate-governance. You also may obtain a written copy of the Corporate Governance Guidelines, or any of the Board’s committee charters, by writing to Atleos’ Corporate Secretary at the address listed in the Communications with Directors section of this proxy statement.

Independence

In keeping with our Corporate Governance Guidelines policy, a substantial majority of our Board is independent, which exceeds the NYSE listing standards. The Board has adopted the definition of independence described in the director independence requirements for NYSE listed companies. The Board may amend this definition in the future; if it does, it will disclose the revised definition.

Consistent with our Corporate Governance Guidelines and the NYSE listing standards, on an annual basis the Board, with input from the Nominating and Governance Committee, determines whether each non-employee Board member is considered independent. In doing so, the Board takes into account the factors listed below and such other factors as it may deem relevant. In analyzing the independence of our directors, we did not identify or consider any transactions, relationships or arrangements that would potentially render a director not independent:

|

20 |

2024 Proxy Statement |

Corporate Governance

The Board has affirmatively determined that all of the Company’s non-employee directors and nominees, namely Odilon Almeida, Jr., Mary Ellen Baker, Mark W. Begor, Michelle McKinney Frymire, Frank A. Natoli, Joseph E. Reece and Jeffry H. von Gillern, are independent in accordance with the NYSE listing standards and the Corporate Governance Guidelines.

New Director Orientation

As provided in the Corporate Governance Guidelines, the Company has an orientation process for new directors that includes background material, visits to Company facilities, and meetings with senior management to familiarize the directors with the Company’s strategic and operating plans, key issues, corporate governance, Code of Conduct, and the senior management team. Atleos manages an extensive director orientation program designed to meet the objectives above and comprehensively brief new board members. We expect any new director who joins the Board to complete a similar program. The program includes the provision of written materials to the new directors and onsite or virtual meetings and training with members of the Company’s Executive Leadership Team, including, among others, the Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, General Counsel and Secretary, Chief Information Officer, Chief Audit Executive and various business leaders, as well as other key senior management employees. The program enables the new directors to thoroughly understand the Company’s business and strategic initiatives, as well as overall governance and processes, including, among other things, the Company’s organization, the Company charter, bylaws, Board committee charters, the Company Code of Conduct, and Corporate Governance Guidelines.

|

21 |

2024 Proxy Statement |

Board Leadership Structure, Board Committees and Risk Oversight

Leadership Structure

Our Board is committed to independent leadership and acknowledges there are different structures available to achieve that objective. Our Board has the flexibility to determine a leadership structure as it deems best for the Company from time to time. Under our Corporate Governance Guidelines, the Board shall appoint a Chair of the Board and the Board does not have a guideline on whether the role of Chair should be held by a non-employee or independent director. In the event the positions of Chairman and Chief Executive Officer are held by the same person or if the Chairman is a management employee or a non-independent Director, the independent directors of the Board will select a Lead Director from the independent directors. If the positions of Chair of the Board and Chief Executive Officer are held by the same person or if the Chair is a management employee or a non-independent director, the roles of the Chair and the independent Lead Director will be as set forth in Exhibit B to the Corporate Governance Guidelines.

Currently the roles of Chair and Chief Executive Officer are separated, with Joseph E. Reece serving as a non-employee independent Chairman and Timothy C. Oliver serving as Chief Executive Officer. Our Board believes this provides an effective leadership model for Atleos and our Board to help ensure effective independent oversight at this time. However, the Board believes that the determination of whether to have an executive or non-executive Chair and whether to combine or split the roles of Chair and Chief Executive Officer, should be made based on the best interests of the Company in light of the circumstances of the time. Accordingly, the Board will periodically evaluate its leadership structure.

Additionally, further structural balance is provided by the Company’s well-established corporate governance policies and practices, including its Corporate Governance Guidelines:

|

22 |

2024 Proxy Statement |

Board Leadership Structure, Board Committees and Risk Oversight

Committees of the Board

The Board has three standing committees: the Audit Committee, the Compensation and Human Resource Committee, and the Nominating and Governance Committee. All members of each of these committees are independent Board members.

The Board has adopted a written charter for each standing committee that sets forth the committee’s mission, composition and responsibilities. Each charter can be found under “Committee Memberships and Charters” on the “Corporate Governance” page of Atleos’ website at https://www.ncratleos.com/about-us/corporate-governance/committee-memberships-and-charters.

Director Attendance

All directors are expected to make every effort to attend all meetings of the Board, meetings of the committees of which they are members and the annual meeting of stockholders. Even though we only became an independent public company in October 2023, the Board still held two meetings in 2023, each of the CHRC and Audit Committee held two meetings, while the Nominating and Governance Committee held one meeting. In 2023, each director attended 100% of the total number of meetings of the Board and of the Committees on which each such director served during the period in which they served.

Audit Committee

The Audit Committee is the principal agent of the Board in overseeing: (i) the quality and integrity of the Company’s financial statements; (ii) the assessment of financial risk and risk management programs; (iii) the independence, qualifications, engagement and performance of the Company’s independent registered public accounting firm; (iv) the performance of the Company’s Internal Audit Department; (v) the integrity and adequacy of internal controls; and (vi) the quality and adequacy of disclosures to stockholders. Among other things, the Audit Committee also:

|

23 |

2024 Proxy Statement |

Board Leadership Structure, Board Committees and Risk Oversight

All members of the Audit Committee during 2023 were, and the current members are, independent and financially literate as determined by the Board under applicable SEC rules and NYSE listing standards. In addition, the Board has determined that the current members of the Audit Committee, Ms. Baker, Mr. Almeida and Mr. von Gillern, are each an “audit committee financial expert,” as defined under SEC regulations. The Board has also determined that each member of the Audit Committee is independent based on independence standards set forth in the Corporate Governance Guidelines, the listing standards of the NYSE and the applicable rules of the SEC. No member of the Audit Committee may receive any compensation, consulting, advisory or other fees from the Company, other than the Board compensation described below under the Director Compensation section in this proxy statement, as determined in accordance with applicable SEC rules and NYSE listing standards. Members serving on the Audit Committee are limited to serving on no more than two other audit committees of public company boards of directors, unless the Board evaluates and determines that these other commitments would not impair the member’s effective service to the Company.

The Audit Committee also assists the Board with its oversight of executive management’s responsibilities to design, implement and maintain an effective enterprise risk management, or ERM framework for the Company’s overall operational, information security, strategic, reputational, technology, and other risks. In addition, the Audit Committee assists the Board in fulfilling its oversight responsibilities for matters relating to diversity, equity and inclusion, as well as matters relating to the health, environment, safety, sustainability, and the security of personnel and physical assets. Among other things, the Audit Committee also:

|

24 |

2024 Proxy Statement |

Board Leadership Structure, Board Committees and Risk Oversight

Compensation and Human Resource Committee

The Compensation and Human Resource Committee (“CHRC”) provides general oversight of the Company’s management compensation philosophy and practices, benefit programs, strategic workforce initiatives, and leadership development plans. In doing so, the CHRC reviews and approves total compensation goals, objectives and programs, and the competitiveness of total compensation practices covering executive officers and senior executives reporting directly to the CEO. Among other things, the CHRC also:

The CHRC may delegate its authority to the Company’s Chief Executive Officer and/or other appropriate delegates to make equity awards to individuals (other than executive officers) in limited instances.

To assist in review and oversight of our executive compensation programs, the CHRC retained Farient Advisors LLC ("Farient") in 2023 after reviewing all factors relevant to its independence from management under applicable SEC rules and NYSE listing standards, and concluding that Farient was independent and its work did not raise any conflict of interest. In early 2024, the CHRC undertook a review and selected FW Cook, an independent national executive compensation consulting firm. FW Cook was selected based on their experience and capability to support the post-spin objectives of the CHRC and assist in the review and oversight of our executive compensation programs.

The Board has determined that each member of the CHRC is independent based on independence standards set forth in the Corporate Governance Guidelines which reflect NYSE listing standards and satisfies the additional provisions specific to compensation committee membership set forth in the NYSE listing standards.

|

25 |

2024 Proxy Statement |

Board Leadership Structure, Board Committees and Risk Oversight

Nominating and Governance Committee

The Nominating and Governance Committee (the “Governance Committee”) is responsible for reviewing the Board’s corporate governance practices and procedures, including the review and approval of each related party transaction under the Company’s Related Person Transaction Policy (unless the Governance Committee determines that the approval or ratification of such transaction should be considered by all of the disinterested members of the Board), and the Company’s ethics and compliance program. Among other things, the Governance Committee also:

The Governance Committee is authorized to engage consultants to review the Company’s director compensation program.

The Board has determined that each member of the Governance Committee is independent based on independence standards set forth in the Corporate Governance Guidelines, which reflect the listing standards of the NYSE.

Risk Oversight

As a part of its oversight responsibilities, the Board regularly monitors management’s processes for identifying and addressing areas of material risk to the Company, including operational, financial, cybersecurity, legal, regulatory, strategic, sustainability and reputational risks. In doing so, the Board receives regular assistance and input from its committees, as well as regular reports from members of the Executive Leadership Team and other members of senior management. While the Board and its committees provide oversight, management is responsible for implementing risk management programs, supervising day-to-day risk management and reporting to the Board and its committees on these matters.

Audit Committee: The Audit Committee reviews in a general manner the guidelines and policies governing the process by which the Company conducts risk assessment and risk management. The Audit Committee receives periodic updates on material risks and compliance items from the Company’s Chief Risk Officer and Chief Compliance Officer. The Audit Committee has oversight of executive management’s responsibilities to design, implement and maintain an effective enterprise risk management (ERM) framework.

|

26 |

2024 Proxy Statement |

Board Leadership Structure, Board Committees and Risk Oversight

CHRC and Governance Committee: The CHRC regularly considers potential risks related to the Company’s compensation programs, as discussed below, and the Governance Committee considers risks within the context of its responsibilities (as such responsibilities are defined in the committee charter), including legal and regulatory compliance risks. The Governance Committee also receives periodic updates on compliance and regulatory risk items from the Company’s Chief Risk Officer and Chief Compliance Officer.

Management: At the management level, Atleos also established the Office of Risk Management and appointed a Chief Risk Officer to assist the Company in fulfilling its objectives relating to enterprise risk management (ERM), ethics & compliance (E&C), data privacy, third-party risk management (TPRM), business continuity planning (BCP) and sustainability. The Company’s Chief Risk Officer is responsible for developing and managing formal programs designed to identify, assess and respond to material and emerging risks and opportunities that may impact the achievement of the Company’s strategic objectives. The Audit Committee also regularly receives management reports on information security and enhancements to cybersecurity protections, including benchmarking assessments, which it then shares with the Board. Included among the members of both the Board and the Audit Committee are directors with substantial expertise in cybersecurity matters, and Board members actively engage in dialogue on the Company’s information security plans, and in discussions of improvements to the Company’s cybersecurity defenses. When, in management’s or the Board’s judgment, a threatened cybersecurity incident has the potential for material impacts, management, the Board and applicable committees of the Board will engage to assess and manage the incident.

After each committee meeting, the Audit Committee, CHRC, and Governance Committee each report at the next meeting of the Board all significant items discussed at each committee meeting, which includes a discussion of items relating to risk oversight where applicable.

We believe the leadership structure of the Board also contributes to the effective facilitation of risk oversight as a result of: (i) the role of the Board committees in risk identification and mitigation; (ii) the direct link between management and the Board; and (iii) the role of our active independent Chairman of the Board whose duties include ensuring the Board reviews and evaluates major risks to the Company, as well as measures proposed by management to mitigate such risks.

All of the above elements work together to ensure an appropriate focus on risk oversight.

Compensation Risk Assessment

The Company takes a prudent and risk-balanced approach to its incentive compensation programs to ensure that these programs promote the long-term interests of our stockholders and do not contribute to unnecessary risk-taking. The CHRC evaluates the Company’s executive and broad-based compensation programs, including the mix of cash and equity, balance of short-term and long-term performance focus, balance of revenue and profit-based measures, stock ownership guidelines, clawback policies and other risk mitigators. The CHRC directly engages its independent compensation consultant to assist with this evaluation process. Based on this evaluation, the CHRC concluded that none of the Company’s compensation policies and plans are reasonably likely to have a material adverse effect on the Company.

|

27 |

2024 Proxy Statement |

Board Leadership Structure, Board Committees and Risk Oversight

CHRC Interlocks and Insider Participation

Our CHRC is comprised of three of our independent directors: Mark W. Begor, Michelle McKinney Frymire and Frank A. Natoli. None of these individuals has at any time served as an officer or employee of the Company. None of our executive officers has served as a director or member of the compensation committee of any entity that has one or more of its executive officers serving as a member of our Board or the CHRC.

|

28 |

2024 Proxy Statement |

Director Selection, Communications, Code of Conduct and Compensation

Selection of Nominees for Directors