UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

For the Quarterly Period Ended:

For the transition period from to

Commission File Number:

NRX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

(Address of principal executive offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered: | ||

| | | The | ||

| | | The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| | Smaller reporting company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of November 14, 2024, the registrant had

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Prepaid expense and other current assets | ||||||||

| Total current assets | ||||||||

| Other assets | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued and other current liabilities | ||||||||

| Accrued clinical site costs | ||||||||

| Convertible note payable and accrued interest, current | ||||||||

| Insurance loan payable | ||||||||

| Warrant liabilities | ||||||||

| Total current liabilities | ||||||||

| Convertible note payable and accrued interest, long term | ||||||||

| Total liabilities | $ | $ | ||||||

| Commitments and Contingencies (Note 8) | ||||||||

| Stockholders’ deficit: | ||||||||

| Preferred stock, $ par value, shares authorized. | $ | $ | ||||||

| Series A convertible preferred stock, $ par value, shares authorized; and shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | ||||||||

| Common stock, $ par value, shares authorized; and shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated other comprehensive loss | ( | ) | ||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total stockholders’ deficit | ( | ) | ( | ) | ||||

| Total liabilities and stockholders' deficit | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share and per share data)

(Unaudited)

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||||||

| 2024 |

2023 |

2024 |

2023 |

|||||||||||||

| Operating expense: |

||||||||||||||||

| Research and development |

$ | $ | $ | $ | ||||||||||||

| General and administrative |

||||||||||||||||

| Settlement expense |

||||||||||||||||

| Total operating expenses |

||||||||||||||||

| Loss from operations |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Other (income) expense: |

` |

|||||||||||||||

| Interest income |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Interest expense |

||||||||||||||||

| Convertible note default penalty |

||||||||||||||||

| Change in fair value of convertible notes payable |

( |

) | ( |

) | ||||||||||||

| Change in fair value of warrant liabilities |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Loss on convertible note redemptions |

||||||||||||||||

| Total other (income) expense |

( |

) | ( |

) | ||||||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| Comprehensive loss: |

||||||||||||||||

| Change in fair value of convertible note attributed to credit risk |

$ | $ | $ | $ | ||||||||||||

| Other comprehensive loss |

||||||||||||||||

| Comprehensive loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| Net loss per share: |

||||||||||||||||

| Basic and diluted |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ( |

) | ||||

| Weighted average common shares outstanding: |

||||||||||||||||

| Basic and diluted |

||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ (DEFICIT) EQUITY

(in thousands, except share data)

(Unaudited)

| Additional | Accumulated Other | Total | ||||||||||||||||||||||||||||||||||||||

| Preferred Stock | Series A Preferred Stock | Common Stock | Paid-in- | Accumulated | Comprehensive | Stockholders’ | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Loss | Deficit | |||||||||||||||||||||||||||||||

| Balance December 31, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | |||||||||||||||||||||||||||||||||||||

| Conversion of Series A preferred stock into common stock | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||

| At-the-market "ATM" offering, net of offering costs of | ||||||||||||||||||||||||||||||||||||||||

| Common stock and warrants issued, net of issuance costs of | ||||||||||||||||||||||||||||||||||||||||

| Common stock and warrants issued in private placement | ||||||||||||||||||||||||||||||||||||||||

| Warrants issued pursuant to the Alvogen Agreement amendment (see Note 6) | — | — | — | |||||||||||||||||||||||||||||||||||||

| Vesting of restricted stock awards | ||||||||||||||||||||||||||||||||||||||||

| Shares issued as repayment of principal and interest for convertible note | ||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Balance - March 31, 2024 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | |||||||||||||||||||||||||||||||||||||

| ATM offering, net of offering costs of | ||||||||||||||||||||||||||||||||||||||||

| Common stock and warrants issued, net of issuance costs of | ||||||||||||||||||||||||||||||||||||||||

| Issuance of shares related to reverse stock split | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| Contract cost related to Alvogen termination (see Note 6) | — | — | — | |||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Balance - June 30, 2024 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | |||||||||||||||||||||||||||||||||||||

| ATM offering, net of offering costs of | ||||||||||||||||||||||||||||||||||||||||

| Common stock issued in exchange for services | ||||||||||||||||||||||||||||||||||||||||

| Shares issued as repayment of principal and interest for convertible note | ||||||||||||||||||||||||||||||||||||||||

| Reclassification of AOCI upon settlement of Streeterville Note | — | — | — | |||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Balance - September 30, 2024 | $ | $ | $ | $ | $ | ( | ) | $ | $ | ( | ) | |||||||||||||||||||||||||||||

| Additional | Accumulated Other | Total | ||||||||||||||||||||||||||||||||||||||

| Preferred Stock | Series A Preferred Stock | Common Stock | Paid-in- | Accumulated | Comprehensive | Stockholders’ | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Income (Loss) | (Deficit) Equity | |||||||||||||||||||||||||||||||

| Balance December 31, 2022 | $ | $ | $ | $ | $ | ( | ) | $ | $ | |||||||||||||||||||||||||||||||

| Common stock and warrants issued, net of issuance costs | ||||||||||||||||||||||||||||||||||||||||

| Change in fair value of convertible note attributed to credit risk | — | — | — | |||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | |||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Balance - March 31, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | $ | ( | ) | |||||||||||||||||||||||||||||

| Common stock and warrants issued, net of issuance costs | ||||||||||||||||||||||||||||||||||||||||

| Change in fair value of convertible note attributed to credit risk | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | |||||||||||||||||||||||||||||||||||||

| Shares issued as repayment of principal and interest for convertible note | ||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Balance - June 30, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||

| Preferred stock and warrants issued, net of issuance costs | ||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | |||||||||||||||||||||||||||||||||||||

| Common stock issued to settle GEM settlement liability | ||||||||||||||||||||||||||||||||||||||||

| Common stock issued as repayment of principal and interest for convertible note | ||||||||||||||||||||||||||||||||||||||||

| Adjustment for deferred offering cost settlement | — | — | — | |||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Balance - September 30, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

| Nine months ended September 30, | ||||||||

| 2024 | 2023 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation expense | ||||||||

| Stock-based compensation | ||||||||

| Common stock issued in exchange for services | ||||||||

| Change in fair value of warrant liabilities | ( | ) | ( | ) | ||||

| Change in fair value of convertible promissory notes | ( | ) | ||||||

| Loss on convertible note redemptions | ||||||||

| Expense for debt issuance costs due to fair value election on Anson Notes | ||||||||

| Warrant issuance costs related to Alvogen termination | ||||||||

| Convertible note default penalty | ||||||||

| Non-cash settlement expense | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expense and other assets | ( | ) | ||||||

| Accounts payable | ||||||||

| Insurance loan payable | ||||||||

| Accrued expense and other liabilities | ( | ) | ( | ) | ||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Purchase of computer equipment | ( | ) | ||||||

| Net cash used in investing activities | ( | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Repayment of convertible note | ( | ) | ( | ) | ||||

| Repayment of insurance note | ( | ) | ||||||

| Expense for debt issuance costs due to fair value election on Anson Notes | ( | ) | ||||||

| Proceeds from issuance of insurance loan | ||||||||

| Proceeds from Anson convertible note, net | ||||||||

| Proceeds from liability classified warrants | ||||||||

| Proceeds from issuance of Series A preferred stock and warrants issued in private placement, net of issuance costs | ||||||||

| Proceeds from issuance of common stock and warrants, net of issuance costs | ||||||||

| Proceeds from issuance of common stock and warrants issued in private placement, net of issuance costs | ||||||||

| Net cash provided by financing activities | ||||||||

| Net decrease in cash and cash equivalents | ( | ) | ( | ) | ||||

| Cash and cash equivalents at beginning of period | ||||||||

| Cash and cash equivalents at end of period | $ | $ | ||||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for interest | $ | $ | ||||||

| Cash paid for taxes | $ | $ | ||||||

| Non-cash investing and financing activities: | ||||||||

| Issuance of common stock as principal and interest repayment for convertible notes | $ | $ | ||||||

| Issuance of common stock warrants as offering costs | $ | $ | ||||||

| Issuance of common stock for settlement of accrued liability | $ | $ | ||||||

| Conversion of Series A preferred stock into common stock | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2024

(Unaudited)

1. Organization

The Business

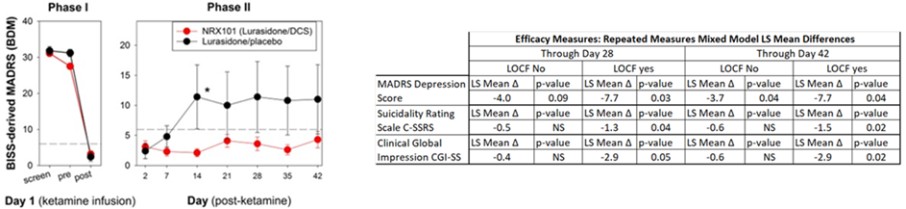

NRx Pharmaceuticals, Inc. (Nasdaq: NRXP) (“NRX” or the “Company”) is a clinical-stage bio-pharmaceutical company which develops and intends to distribute, through its wholly-owned operating subsidiaries, NeuroRx, Inc., (“NeuroRx”) and HOPE Therapeutics, Inc. (“HOPE”), and collectively with NRX and NeuroRx, the “Company”, “we”, “us”, or “our”), novel therapeutics for the treatment of central nervous system disorders including suicidal depression, chronic pain, and post-traumatic stress disorder (“PTSD”) and now schizophrenia. All of our current drug development activities are focused drugs that modulate on the N-methyl-D-aspartate (“NMDA”) receptor in the brain and nervous system, a neurochemical pathway that has been disclosed in detail in our annual filings. NeuroRx is organized as a traditional research and development (“R&D”) company, whereas HOPE is organized as a specialty pharmaceutical company intended to distribute ketamine and other therapeutic options to clinics that serve patients with suicidal depression and PTSD. The Company has two lead drug candidates that are expected to be submitted by year end for Food and Drug Administration (“FDA”) approval with anticipated FDA decision dates under the Prescription Drug User Fee Act ("PDUFA") by the end of June 2025: NRX-101, an oral fixed dose combination of D-cycloserine and lurasidone and NRX-100, a preservative-free formulation of ketamine for intravenous infusion. In February 2024, the Company incorporated HOPE as a wholly-owned subsidiary and in August 2024 completed a carve-out audit of HOPE's financial statements which are necessary for the intended Spin-Off (as defined in Note 7) of HOPE to the Company's shareholders at a future date.

Operations

The Company’s drug development activities have expanded from its original focus on development of NRX-101, a fixed dose combination of D-cycloserine (DCS) and lurasidone for the treatment of suicidal bipolar depression to encompass the development of NRX-101 for the treatment of chronic pain and PTSD and to the development of intravenous ketamine (NRX-100/HTX-100) for the treatment of suicidal depression. These additional indications have been added as the Company has gained access to clinical trials data funded by governmental entities in France and potentially in the United States which has the potential to afford the Company potential safety and efficacy data on key indications at low cost.

2. Going Concern

These consolidated financial statements have been prepared on a going concern basis which contemplates the realization of assets and settlement of liabilities and commitments in the normal course of business. Since inception, the Company has experienced net losses and negative cash flows from operations each fiscal year and has a working capital deficit at September 30, 2024. The Company has

As of September 30, 2024, the Company had $

The Company has secured operating capital that it anticipates as sufficient to fund its drug development operations through year end and to finance submission of FDA New Drug Applications for NRX-100 and NRX-101. The Company may pursue additional equity or debt financing or refinancing opportunities in 2024 and 2025 to fund ongoing clinical activities, to meet obligations under its current debt arrangements and for general corporate purposes. Such arrangements may take the form of loans, equity offerings, strategic agreements, licensing agreements, joint ventures or other agreements. The sale of equity could result in additional dilution to the Company’s existing shareholders. The Company cannot make any assurances that additional financing will be available to it and, if available, on acceptable terms, or that it will be able to refinance its existing debt obligations which could negatively impact the Company’s business and operations and could also lead to a reduction in the Company’s operations. The Company will continue to carefully monitor the impact of its continuing operations on the Company’s working capital needs and debt repayment obligations. As such, the Company has concluded that substantial doubt exists regarding the Company’s ability to continue as a going concern for a period of at least twelve months from the date of issuance of these condensed consolidated financial statements. The accompanying consolidated financial statements do not include any adjustments to reflect the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the company be unable to continue as a going concern.

The accompanying condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the ordinary course of business. The condensed consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that may be necessary if the Company is unable to continue as a going concern.

3. Summary of Significant Accounting Policies

On April 1, 2024, the Company effected a reverse stock split (the “Reverse Stock Split”) of the Company’s common stock, $

Basis of Presentation and Principles of Consolidation

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) as determined by the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) and the rules and regulations of the Securities and Exchange Commission (“SEC”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, the unaudited interim condensed consolidated financial statements reflect all adjustments, which include only normal recurring adjustments, necessary for the fair presentation of the consolidated balance sheet, statements of operations and cash flows for the interim periods presented. The results of operations for any interim periods are not necessarily indicative of the results that may be expected for the entire fiscal year or any other interim period.

Use of Estimates

The preparation of condensed consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and expenses and the disclosure of contingent assets and liabilities in its consolidated financial statements and the reported amounts of expenses during the reporting period. The most significant estimates in the Company’s condensed consolidated financial statements relate to the fair value of the convertible notes payable, fair value of warrant liabilities, fair value of stock options and warrants, and the utilization of deferred tax assets. These estimates and assumptions are based on current facts, historical experience and various other factors believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the recording of expenses that are not readily apparent from other sources. Actual results may differ materially and adversely from these estimates. To the extent there are material differences between the estimates and actual results, the Company’s future results of operations will be affected.

Certain Risks and Uncertainties

The Company’s activities are subject to significant risks and uncertainties including the risk of failure to secure additional funding to properly execute the Company’s business plan. The Company is subject to risks that are common to companies in the pharmaceutical industry, including, but not limited to, development by the Company or its competitors of new technological innovations, dependence on key personnel, reliance on third party manufacturers, protection of proprietary technology, and compliance with regulatory requirements.

Fair Value of Financial Instruments

FASB ASC Topic 820, Fair Value Measurements (“ASC 820”), provides guidance on the development and disclosure of fair value measurements. Under this accounting guidance, fair value is defined as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or a liability.

The accounting guidance classifies fair value measurements in one of the following three categories for disclosure purposes:

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Inputs other than Level 1 prices for similar assets or liabilities that are directly or indirectly observable in the marketplace.

Level 3: Unobservable inputs which are supported by little or no market activity and values determined using pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which the determination of fair value requires significant judgment or estimation. (Refer to Note 11)

Concentration of Credit Risk and Off-Balance Sheet Risk

Financial instruments that potentially expose the Company to concentrations of credit risk consist primarily of cash and cash equivalents. Cash equivalents are occasionally invested in certificates of deposit. The Company maintains each of its cash balances with high-quality and accredited financial institutions and accordingly, such funds are not exposed to unusual credit risk beyond the normal credit risk associated with commercial banking relationships. Deposits in financial institutions may, from time to time, exceed federally insured limits. As of September 30, 2024 the Company’s cash and cash equivalents balance within money market accounts was in excess of the U.S. federally insured limits by $

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less at the time of initial purchase to be cash equivalents, including balances held in the Company’s money market accounts. The Company maintains its cash and cash equivalents with financial institutions, in which balances from time to time may exceed the U.S. federally insured limits. The objectives of the Company’s cash management policy are to safeguard and preserve funds to maintain liquidity sufficient to meet the Company’s cash flow requirements, and to attain a market rate of return.

Revenue Recognition

The Company accounts for revenue under FASB ASC Topic 606, Revenue for Contract with Customers (“ASC 606”) or other accounting standards for revenue not derived from customers. Arrangements may include licenses to intellectual property, research services and participation on joint research committees. The Company evaluates the promised goods or services to determine which promises, or group of promises, represent performance obligations. In contemplation of whether a promised good or service meets the criteria required of a performance obligation, the Company considers the stage of research, the underlying intellectual property, the capabilities and expertise of the customer relative to the underlying intellectual property, and whether the promised goods or services are integral to or dependent on other promises in the contract. When accounting for an arrangement that contains multiple performance obligations, the Company must develop judgmental assumptions, which may include market conditions, timelines and probabilities of regulatory success to determine the stand-alone selling price for each performance obligation identified in the contract.

The Company enters into contractual arrangements that may include licenses to intellectual property and research and development services. When such contractual arrangements are determined to be accounted for in accordance with ASC 606, the Company evaluates the promised good or services to determine which promises, or group of promises, represent performance obligations. When accounting for an arrangement that contains multiple performance obligations, the Company must develop judgmental assumptions, which may include market conditions, timelines and probabilities of regulatory success to determine the stand-alone selling price for each performance obligation identified in the contract.

The License Agreement (the “License Agreement”) with Alvogen Pharma US, Inc., Alvogen, Inc. and Lotus Pharmaceutical Co. Ltd. (collectively, “Alvogen”) (as further discussed in Note 6 below) was accounted for in accordance with ASC 606. In accordance with ASC 606, the Company recognizes revenue when its customer obtains control of promised goods or services, in an amount that reflects the consideration which the Company expects to receive in exchange for those goods or services. To determine revenue recognition for arrangements that the Company determines are within the scope of ASC 606, it performs the following five steps:

i. identify the contract(s) with a customer;

ii. identify the performance obligations in the contract;

iii. determine the transaction price;

iv. allocate the transaction price to the performance obligations within the contract; and

v. recognize revenue when (or as) the entity satisfies a performance obligation.

The Company only applies the five-step model to contracts when it determines that it is probable it will collect the consideration it is entitled to in exchange for the goods or services it transfers to the customer.

At contract inception, once the contract is determined to be within the scope of ASC 606, the Company assesses the goods or services promised within the contract to determine whether each promised good or service is a performance obligation. The promised goods or services in the Company’s arrangements typically consist of a license to intellectual property and research services. The Company may provide options to additional items in such arrangements, which are accounted for as separate contracts when the customer elects to exercise such options, unless the option provides a material right to the customer. Performance obligations are promises in a contract to transfer a distinct good or service to the customer that (i) the customer can benefit from on its own or together with other readily available resources, and (ii) is separately identifiable from other promises in the contract. Goods or services that are not individually distinct performance obligations are combined with other promised goods or services until such combined group of promises meet the requirements of a performance obligation.

The Company determines transaction price based on the amount of consideration the Company expects to receive for transferring the promised goods or services in the contract. Consideration may be fixed, variable, or a combination of both. At contract inception for arrangements that include variable consideration, the Company estimates the probability and extent of consideration it expects to receive under the contract utilizing either the most likely amount method or expected amount method, whichever best estimates the amount expected to be received. The Company then considers any constraints on the variable consideration and includes in the transaction price variable consideration to the extent it is deemed probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved.

The Company then allocates the transaction price to each performance obligation based on the relative standalone selling price and recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when (or as) control is transferred to the customer and the performance obligation is satisfied. For performance obligations which consist of licenses and other promises, the Company utilizes judgment to assess the nature of the combined performance obligation to determine whether the combined performance obligation is satisfied over time or at a point in time and, if over time, the appropriate method of measuring progress. The Company evaluates the measure of progress each reporting period and, if necessary, adjusts the measure of performance and related revenue recognition.

The Company records amounts as accounts receivable when the right to consideration is deemed unconditional. When consideration is received, or such consideration is unconditionally due, from a customer prior to transferring goods or services to the customer under the terms of a contract, a contract liability is recorded as deferred revenue.

The Company’s revenue arrangements may include the following:

Milestone Payments: At the inception of an agreement that includes milestone payments, the Company evaluates each milestone to determine when and how much of the milestone to include in the transaction price. The Company first estimates the amount of the milestone payment that the Company could receive using either the expected value or the most likely amount approach. The Company primarily uses the most likely amount approach as that approach is generally most predictive for milestone payments with a binary outcome. Then, the Company considers whether any portion of that estimated amount is subject to the variable consideration constraint (that is, whether it is probable that a significant reversal of cumulative revenue would not occur upon resolution of the uncertainty.) The Company updates the estimate of variable consideration included in the transaction price at each reporting date which includes updating the assessment of the likely amount of consideration and the application of the constraint to reflect current facts and circumstances.

Royalties: For arrangements that include sales-based royalties, including milestone payments based on a level of sales, and the license is deemed to be the predominant item to which the royalties relate, the Company will recognize revenue at the later of (i) when the related sales occur, or (ii) when the performance obligation to which some or all of the royalty has been allocated has been satisfied (or partially satisfied).

Research Services: The Company incurred research costs in association with the License Agreement. After the First Milestone Payment (as defined in Note 6 below), the Company would have been reimbursed for certain costs incurred related to reasonable and documented out-of-pocket costs for clinical and non-clinical development activities. The Company would have recognized revenue for the reimbursed costs when the First Milestone Payment contingencies had been achieved and the Company had an enforceable claim to the reimbursed costs.

Research and Development Costs

Research and development expense consists primarily of costs associated with the Company’s clinical trials, salaries, payroll taxes, employee benefits, and stock-based compensation charges for those individuals involved in ongoing research and development efforts. Research and development costs are expensed as incurred. Advance payments for goods and services that will be used in future research and development activities are recorded as prepaid assets and expensed when the activity has been performed or when the goods have been received.

Non-cancellable Contracts

The Company may record certain obligations as liabilities related to non-cancellable contracts. If appropriate, the offsetting costs may be recorded as a deferred cost asset.

Convertible Notes Payable and Fair Value Election

As permitted under FASB ASC Topic 825, Financial Instruments (“ASC 825”), the Company elected to account for its promissory notes, which meet the required criteria, at fair value at inception. Subsequent changes in fair value are recorded as a component of non-operating loss in the consolidated statements of operations. The portion of total changes in fair value of the notes attributable to changes in instrument-specific credit risk are determined through specific measurement of periodic changes in the discount rate assumption exclusive of base market changes and are presented as a component of comprehensive income in the accompanying condensed consolidated statements of operations and comprehensive loss. As a result of electing the fair value option, direct costs and fees related to the promissory notes are expensed as incurred.

The Company estimates the fair value of its notes payable using a Monte Carlo simulation model, which uses as inputs the fair value of its Common Stock and estimates for the equity volatility of its Common Stock, the time to expiration (i.e., expected term) of the note, the risk-free interest rate for a period that approximates the time to expiration, and probability of default. Therefore, the Company estimates its expected future equity volatility based on the historical volatility of its Common Stock price utilizing a lookback period consistent with the time to expiration. The time to expiration is based on the contractual maturity date, giving consideration to the redemption features embedded in the notes. The risk-free interest rate is determined based on the U.S. Treasury yield curve in effect at the time of measurement for time periods approximately equal to the time to expiration. Unless otherwise specified, the probability of default is estimated using Bloomberg’s Default Risk function which uses its financial information to calculate a default risk specific to the Company. At September 30, 2024, the Streeterville Note valuation was adjusted to the post settlement amount agreed upon. Interest expense is included within the fair value of the note payable. Management believes those assumptions are reasonable but if these assumptions change, it could materially affect the fair value.

Stock-Based Compensation

The Company expenses stock-based compensation to employees and non-employees over the requisite service period based on the estimated grant-date fair value of the awards. The Company accounts for forfeitures as they occur. Stock-based awards with graded-vesting schedules are recognized on a straight-line basis over the requisite service period for each separately vesting portion of the award. The Company estimates the fair value of stock option grants using the Black-Scholes option pricing model, and the assumptions used in calculating the fair value of stock-based awards represent management’s best estimates and involve inherent uncertainties and the application of management’s judgment. The Company estimates the fair value of restricted stock award grants using the closing trading price of the Company’s Common Stock on the date of issuance. All stock-based compensation costs are recorded in general and administrative or research and development costs in the condensed consolidated statements of operations and comprehensive loss based upon the underlying individual’s role at the Company.

Warrants

The Company accounts for warrants as either equity-classified or liability-classified instruments based on an assessment of the warrant’s specific terms and applicable authoritative guidance in FASB ASC Topic 480, Distinguishing Liabilities from Equity (“ASC 480”) and FASB ASC Topic 815, Derivatives and Hedging (“ASC 815”). The assessment considers whether the warrants are freestanding financial instruments pursuant to ASC 480, meet the definition of a liability pursuant to ASC 480, and whether the warrants meet all of the requirements for equity classification under ASC 815, including whether the warrants are indexed to the Company’s own Common Stock and whether the warrant holders could potentially require “net cash settlement” in a circumstance outside of the Company’s control, among other conditions for equity classification. This assessment, which requires the use of professional judgment, is conducted at the time of warrant issuance and as of each subsequent quarterly period end date while the warrants are outstanding.

For issued or modified warrants that meet all of the criteria for equity classification, the warrants are required to be recorded as a component of additional paid-in capital at the time of issuance. For issued or modified warrants that do not meet all the criteria for equity classification, the warrants are required to be liability classified and recorded at their initial fair value on the date of issuance and remeasured at fair value and each balance sheet date thereafter. Changes in the estimated fair value of the warrants are recognized as a non-cash gain or loss on the statements of operations. The Company generally determines fair value of the Common Stock Warrants (as defined below) using a Black Scholes valuation methodology.

A change in any of the terms or conditions of warrants is accounted for as a modification. The accounting for incremental fair value of warrants is based on the specific facts and circumstances related to the modification which may result in a reduction of additional paid-in capital, recognition of costs for services rendered, or recognized as a deemed dividend.

Preferred Stock

In accordance with ASC 480, the Company’s Series A Preferred Stock was classified as permanent equity as it was not mandatorily redeemable upon an event that is considered outside of the Company’s control. Further, in accordance with ASC 815-40, Derivatives and Hedging – Contracts in an Entity’s Own Equity, the Series A Preferred Stock did not meet any of the criteria that would preclude equity classification. The Company concluded that the Series A Preferred Stock was more akin to an equity-type instrument than a debt-type instrument, therefore the conversion features associated with the convertible preferred stock were deemed to be clearly and closely related to the host instrument and were not bifurcated as a derivative under ASC 815.

Income Taxes

Income taxes are recorded in accordance with FASB ASC Topic 740, Income Taxes (“ASC 740”), which provides for deferred taxes using an asset and liability approach. The Company recognizes deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Deferred tax assets and liabilities are determined based on the difference between the financial statement and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Valuation allowances are provided, if based upon the weight of available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized. The Company accounts for uncertain tax positions in accordance with the provisions of ASC 740. When uncertain tax positions exist, the Company recognizes the tax benefit of tax positions to the extent that the benefit would more likely than not be realized assuming examination by the taxing authority. The determination as to whether the tax benefit will more likely than not be realized is based upon the technical merits of the tax position as well as consideration of the available facts and circumstances. The Company recognizes any interest and penalties accrued related to unrecognized tax benefits as income tax expense.

Loss Per Share

The Company applies the two-class method when computing net income or loss per share attributable to common stockholders. In determining net income or loss attributable to common stockholders, the two-class method requires income or loss allocable to participating securities for the period to be allocated between common and participating securities based on their respective rights to share in the earnings as if all of the income or loss allocable for the period had been distributed. In periods of net loss, there is no allocation required under the two-class method as the participating securities do not have an obligation to fund the losses of the Company.

Basic loss per share of Common Stock is computed by dividing net loss attributable to common stockholders by the weighted average number of shares of Common Stock outstanding for the period. Diluted loss per share reflects the potential dilution that could occur if stock options, restricted stock awards and warrants were to vest and be exercised. Diluted earnings per share excludes, when applicable, the potential impact of stock options, Common Stock warrant shares, convertible notes, and other dilutive instruments because their effect would be anti-dilutive in the periods in which the Company incurs a net loss.

The following outstanding shares of Common Stock equivalents were excluded from the computation of the diluted net loss per share attributable to Common Stock for the periods in which a net loss is presented because their effect would have been anti-dilutive.

| Nine months ended September 30, | ||||||||

| 2024 | 2023 | |||||||

| Stock options | ||||||||

| Restricted stock awards | ||||||||

| Common stock warrants | ||||||||

| Anson Note | ||||||||

| Convertible preferred stock | ||||||||

Recent Accounting Pronouncements Not Yet Adopted

In November 2023, the FASB issued Accounting Standard Update (ASU) No. 2023‑07, Segment Reporting (Topic 280)-Improvements to Reportable Segment Disclosures (ASU 2023-07), which is intended to improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. ASU 2023-07 should be applied on a retrospective basis. ASU 2023-07 is effective for annual periods beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. The Company is in the process of evaluating the impact of this new guidance on its disclosures.

In December 2023, the FASB issued ASU 2023-09-Income Taxes (Topic 740): Improvements to Income Tax Disclosures (ASU 2023-09), which is intended to enhance the transparency and decision usefulness of income tax disclosures, primarily by amending disclosure requirements for the effective tax rate reconciliation and income taxes paid. ASU 2023-09 should be applied on a prospective basis, and retrospective application is permitted. ASU 2023-09 is effective for annual periods beginning after December 15, 2024. Early adoption is permitted. The Company is in the process of evaluating the impact of this new guidance on its disclosures.

4. Prepaid Expense and Other Current Assets

Prepaid expense and other current assets consisted of the following at the dates indicated (in thousands):

| September 30, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| Prepaid expense and other current assets: | ||||||||

| Prepaid insurance | $ | $ | ||||||

| Prepaid clinical development costs | ||||||||

| Other prepaid expense | ||||||||

| Other current receivables | ||||||||

| Total prepaid expense and other current assets | $ | $ | ||||||

5. Accrued and Other Current Liabilities

Accrued and other current liabilities consisted of the following at the dates indicated (in thousands):

| September 30, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| Accrued and other current liabilities: | ||||||||

| Refund liability (see Note 6) | $ | $ | ||||||

| Professional services | ||||||||

| Employee costs | ||||||||

| Accrued research and development expense | ||||||||

| Other accrued expense | ||||||||

| Total accrued and other current liabilities | $ | $ | ||||||

6. Alvogen Licensing Agreement

In June 2023, the Company entered into a License Agreement with Alvogen. Under the License Agreement, the Company granted Alvogen certain license rights to develop, manufacture, and commercialize the Company’s candidate therapeutic product, NRX-101, for the treatment of bipolar depression with suicidality. In exchange for the license granted and the participation of the Company in certain development, regulatory and commercial activities, Alvogen was obligated to pay the Company specified regulatory and commercial milestones, the first of which was $

Termination

Under the License Agreement, as amended, Alvogen was granted early termination rights. On June 21, 2024, the Company received a notice of termination from Alvogen effective immediately. Following the termination of the License Agreement by Alvogen, the amounts advanced pursuant to the amendment became due and payable to Alvogen. Accordingly, the refund liability has not been reclassified as deferred revenue or recorded as revenue as of September 30, 2024.

Upon termination of the License Agreement, the intellectual property rights licensed to Alvogen under the License Agreement reverted to the Company, and all other rights and obligations of each of the parties immediately ceased, except for outstanding amounts owed as of the time of such expiration or termination. As of September 30, 2024, the refund liability due to Alvogen was $

7. Debt

Streeterville Convertible Note

On November 4, 2022, the Company issued an

The initial terms of the Streeterville Note included the following provisions, certain of which were subsequently modified, as described below. The Company had the option to prepay the Streeterville Note during the term by paying an amount equal to

The Streeterville Note contained certain Trigger Events (as defined in the Streeterville Note) that generally, if uncured within five trading days, could result in an event of default in accordance with the terms of the Streeterville Note (such event, an “Event of Default”). Upon an Event of a Default, the Lender could consider the Streeterville Note immediately due and payable. Upon an Event of Default, the interest rate could also be increased to the lesser of

Due to these embedded features within the Streeterville Note, the Company elected to account for the Streeterville Note at fair value at inception. Subsequent changes in fair value were recorded as a component of other income (loss) in the consolidated statements of operations.

Convertible Note Amendments

On March 30, 2023, the Company entered into an Amendment to the Note (the “First Amendment”), pursuant to which the Maximum Percentage was set at

On July 7, 2023, the Company entered into Amendment #2 to the Streeterville Note with Streeterville (the “Second Amendment”). Pursuant to the Second Amendment, the Company agreed to amend the redemption provisions of the Streeterville Note to provide that the Company would pay to Streeterville an amount in cash equal to $

On February 9, 2024, the Company entered into Amendment #3 to the Streeterville Note (the “Third Amendment”), with Streeterville. In accordance with the Third Amendment, the Company and Streeterville agreed to amend the redemption provisions of the Streeterville Note to provide that the Company would pay to Streeterville an amount in cash equal to $

After April 30, 2024, and for the remainder of the payment period through July 31, 2024, Streeterville could redeem any Redemption Amount (as defined in the Streeterville Note), including an amount in excess of the Minimum Payment, subject to the Maximum Monthly Redemption Amount. During the period through July 31, 2024, the Company was permitted to pay the Redemption Amounts by delivery of the Redemption Conversion Shares (as defined below) without regard to the existence of any Equity Conditions Failure, to the extent Streeterville submits redemption notices during such month pursuant to the terms of the Streeterville Note, and only for the Redemption Amounts covered by such notices. Moreover, the Redemption Premium would continue to apply to the Redemption Amounts. To the extent there was an outstanding balance under the Streeterville Note after July 31, 2024, the Company would be required to pay such outstanding balance in full in cash by August 31, 2024. As a result of the alleged Event of Default mentioned below, the Company did not pay any Redemption Amounts during the three months ended September 30, 2024, prior to the settlement, also as described below.

During the Minimum Payment Period (defined in the Streeterville Note, as amended), the Company was permitted to pay the Redemption Amounts in the form of shares of Common Stock of the Company (the “Redemption Conversion Shares”) calculated on the basis of the Redemption Conversion Price (as defined in the Streeterville Note) without regard to the existence of an Equity Conditions Failure. Moreover, the Redemption Premium (as defined in the Streeterville Note) would continue to apply to the Redemption Amounts.

Both the Second Amendment and the Third Amendment (considered cumulatively with the Second Amendment) were deemed to be debt modifications and did not give rise to a debt extinguishment in accordance with FASB ASC Topic 470, Debt, which was accounted for prospectively. The modification did not result in recognition of a gain or loss in the consolidated statements of operations as the modifications were not considered debt extinguishments, but impacted interest expense recognized in subsequent periods, prior to the settlement of the Streeterville Note.

Convertible Note Fair Value Measurements

The Company estimated the fair value of the Streeterville Note using a Monte Carlo simulation model, which used as inputs the fair value of its Common Stock and estimated for the equity volatility and volume volatility of its Common Stock, the time to expiration of the Streeterville Note, the risk-free interest rate for a period that approximated the time to expiration, and probability of default. Therefore, the Company estimated its expected future volatility based on the actual volatility of its Common Stock and historical volatility of its Common Stock utilizing a lookback period consistent with the time to expiration. The time to expiration was based on the contractual maturity date, giving consideration to the mandatory and potential accelerated redemptions beginning six months from the issuance date. The risk-free interest rate was determined by reference to the U.S. Treasury yield curve in effect at the time of measurement for time periods approximately equal to the time to expiration. Probability of default was estimated using either Bloomberg's Default Risk function, which uses its financial information to calculate a default risk specific to the Company, or management's estimates which included, the Company's current cash runway, current efforts to raise financing, and current economic environment.

The discount to the principal amount was included in the carrying value of the Streeterville Note. During 2022, the Company recorded a debt discount of approximately $

During the three and nine months ended September 30, 2024, the Company made cash payments for coupon interest on the Streeterville Note of approximately $

As of September 30, 2024, and December 31, 2023, the Streeterville Note carried a remaining balance of $

Alleged Default

On April 24, 2024, the Company received written notice from counsel for Streeterville that an alleged event of default occurred with respect to the Streeterville Note issued by the Company in favor of Streeterville (the “Notice”). The Notice alleged that, among other things, (i) the announcement of the plan to partially spin-off of HOPE (the “Spin-Off”), constituted a “Fundamental Transaction” (as defined in the Streeterville Note) for which the Company failed to obtain Streeterville’s prior written consent before undertaking such transaction; and (ii) the Company failed to pay the Minimum Payment, as defined in the Streeterville Note, by April 8, 2024, following a Redemption Notice issued on April 3, 2024 by Streeterville to the Company, each of which resulted in the failure to cure a Trigger Event and subsequent Event of Default of the Streeterville Note, resulting in the acceleration of all of the outstanding amounts due thereunder.

Streeterville also filed a complaint (the “Complaint”) naming the Company as a defendant in the Third Judicial District Court of Salt Lake County, Utah. The Complaint was seeking, among other things: (i) declaratory relief for an order enjoining the Company from undertaking any Fundamental Transaction, including the Spin-Off, or otherwise issuing Common Stock or other equity securities (such as the shares of HOPE pursuant to the announced Spin-Off); and (ii) repayment of the Streeterville Note and other unspecified amounts of damages, costs and fees, but no less than $

On July 29, 2024, in connection with the alleged Event of Default that Streeterville claimed occurred with respect to the Streeterville Note, the Company announced an order of the Utah arbitrator denying the petition of Streeterville to enjoin Spin-Off of

Streeterville Settlement

On August 12, 2024, the Company and Streeterville entered into a Settlement and Release of Claims (the “Settlement Agreement”), whereby the Company and Streeterville agreed to settle all disputes between the parties and release the Company from all obligations arising from the Notes at certain Securities Purchase Agreement, dated November 4, 2022 (“Streeterville Notes”), between the Company and Streeterville, and that certain Convertible Promissory Note, dated November 4, 2022, issued to Streeterville by the Company, in exchange for a payment of $

The Company evaluated the terms of the Settlement Amendment in accordance with ASC 470-50, Debt Modifications and Extinguishments. Both the Settlement Amendment and the Third Amendment (considered cumulatively with the Settlement Amendment) were deemed to be debt modifications and did not give rise to a debt extinguishment in accordance with ASC Topic 470, Debt, which will be accounted for prospectively. The modifications did not result in recognition of a gain or loss in the consolidated statements of operations as the modifications were not considered debt extinguishments, but will impact interest expense and the determination of fair value in future periods.

Anson Convertible Promissory Notes

On August 12, 2024, the Company entered into the Purchase Agreement with Investors. The Company agreed to sell, in

In connection with the above offering, the Company engaged EF Hutton LLC as placement agent (the “Placement Agent”), Pursuant to the terms of the engagement with the Placement Agent, the Company will pay a cash fee of

2024 Senior Secured Convertible Promissory Notes

On August 14, 2024, the Company entered into the first tranche Senior Secured Convertible Note Agreements (the “First Tranche Notes”) with Anson Investment Master Fund LP and Anson East Master Fund LP (collectively “Anson”) at various amounts for an aggregate of $

On August 14, 2024, in conjunction with the issuance of the First Tranche Notes, the Company issued warrants to purchase up to

The First Tranche Notes are convertible at the option of the holder at any time after issuance into Common Stock, at a per share conversion price equal to the lower of (a) $

The terms of the First Tranche Notes do not allow any conversion of the First Tranche Notes if it results in Anson owning more than 4.99% of the outstanding shares of Common Stock (the "Beneficial Ownership Limitation"). This limitation can be adjusted up to 9.99% with prior notice, effective 61 days after such notice. Anson must ensure compliance with this limitation when submitting a notice of conversion, and the Company will rely on Anson's representation of compliance.

If the Company issues or grants options for Common Stock at a price lower than the current Conversion Price, the Conversion Price will be adjusted to match this lower price, (the “Base Conversion Price”). The Company must notify Anson of any such issuance, and Anson is entitled to convert shares based on the new Base Conversion Price.

If the Company offers purchase rights to holders of Common Stock, Anson will be entitled to acquire those rights as if they had fully converted the Note, subject to the Beneficial Ownership Limitation. If exercising these rights would exceed the Beneficial Ownership Limitation, the rights will be held in abeyance until they can be exercised without exceeding the limit.

The First Tranche Notes contain mandatory redemption features, whereby if at any time the First Tranche Notes are outstanding, the Company will be required to: (A) use up to 30% of the gross proceeds from any Subsequent Financings (as defined in the Purchase Agreement) in cash, to redeem all or a portion of the Note for an amount equal to the outstanding principal, plus all accrued but unpaid interest, plus all liquidated damages (the “Redemption Obligations”), multiplied by 1.05 (the “Mandatory Redemption Amount”); (B) redeem all of the Redemption Obligations at the Mandatory Redemption Amount in the event of a Change of Control Transaction (as defined in the First Tranche Notes); (C) redeem the Redemption Obligations for the Mandatory Redemption Amount in the event a registration statement is not available for each of the offer and resale of the shares issuable upon conversion of the First Tranche Notes (the “Conversion Shares”); and (D) redeem the Redemption Obligations for the Mandatory Redemption Amount if the Shareholder Approval is not obtained within 180 days following the date of issuance of the First Tranche Notes.

The First Tranche Notes contain certain covenants, and events of default and triggering events, respectively, which would require repayment of the obligations outstanding pursuant to such instruments. The obligations of the Company pursuant to the First Tranche Notes are (i) secured by all assets of the Company and all subsidiaries of the Company pursuant to the Security Agreement and Patent Security Agreement, dated August 14, 2024, by and among the Company, the subsidiaries of the Company, and the Investors, and (ii) guaranteed jointly and severally by the subsidiaries of the Company pursuant to the Subsidiary Guarantee, dated August 14, 2024, by and among the Company, the subsidiaries of the Company, and the Investors.

Due to these embedded features within the First Tranche Notes, the Company elected to account for the First Tranche Notes at fair value at inception. Subsequent changes in fair value are recorded as a component of other income (loss) in the condensed consolidated statements of operations. Additionally the portion of changes in the fair value related to changes in credit risk are recorded to other comprehensive income in the consolidated statements of operations. To determine the initial carrying value of the Notes and the warrants issued to Anson under the First Tranche Notes (see Note 9), the Company allocated the proceeds using the relative fair value method. After allocation, the initial carrying value of the First Tranche Notes and the warrants issued to Anson were $

During the three and nine months ended September 30, 2024 Anson converted $

8. Commitments and Contingencies

Sarah Herzog Memorial Hospital License Agreement

The Company is required to make certain payments related to the development of NRX-101 (the "Licensed Product") in order to maintain the license agreement with the Sarah Herzog Memorial Hospital Ezrat Nashim (“SHMH”) (the "SHMH License Agreement"), including:

Milestone Payments

| End of Phase I Clinical Trials of Licensed Product (completed) | $ | |||

| End of Phase II Clinical Trials of Licensed Product (completed) | $ | |||

| End of Phase III Clinical Trials of Licensed Product | $ | |||

| First Commercial Sale of Licensed Product in U.S. | $ | |||

| First Commercial Sale of Licensed Product in Europe | $ | |||

| Annual Revenues Reach $100,000,000 | $ |

The milestone payments due above may be reduced by

Royalties

A royalty in an amount equal to: (a)

Royalties shall also apply to any revenues generated by sub-licensees from sale of Licensed Products subject to a cap of

Annual Maintenance Fee

A fixed amount of $

Exclusive License Agreement

The Company has entered into a License Agreement with Apkarian Technologies to in-license US Patent 8,653,120 that claims the use of D-cycloserine for the treatment of chronic pain in exchange for a commitment to pay milestones and royalties as development milestones are reached in the field of chronic pain. The patent is supported by extensive nonclinical data and early clinical data that suggest the potential for NMDA antagonist drugs, such as NRX-101 to decrease both chronic pain and neuropathic pain while potentially decreasing craving for opioids. For the three and nine months ended September 30, 2024 and 2023, the Company has recorded no expenses relating to the licensure of the patent.

Legal Proceedings

On July 29, 2024, in connection with the alleged Event of Default that Streeterville claimed occurred with respect to the Streeterville Note, the Company announced an order of the Utah arbitrator denying the petition of Streeterville to enjoin the planned Spin-Off of

On August 12, 2024, the Company signed a settlement agreement with Streeterville to retire its remaining debt for a settlement amount of $

The Company is currently involved in and may from time to time become involved in various legal actions incidental to our business. As of the date of this report, the Company, other than as set forth above, is not involved in any legal proceedings that it believes could have a material adverse effect on its financial position or results of operations. However, the outcome of any current or future legal proceeding is inherently difficult to predict and any dispute resolved unfavorably could have a material adverse effect on the Company’s business, financial position, and operating results.

9. Equity

Common Stock Reverse Stock Split

On March 21, 2024, the Board approved a reverse stock split ratio of 1-for-

Effective April 1, 2024, every

No fractional shares were issued in connection with the Reverse Stock Split. Shareholders who otherwise would have been entitled to receive a fractional share instead became entitled to receive one whole share of Common Stock in lieu of such fractional share. As a result of the Reverse Stock Split,

Preferred Stock

Pursuant to the terms of the Company’s Second Amended and Restated Certificate of Incorporation, the Company has

Common Stock

Pursuant to the terms of the Company’s Second Amended and Restated Certificate of Incorporation, the Company has authorized

On January 2, 2024, the Company issued

From February 20, 2024 to July 29, 2024, the Company announced that it entered into multiple purchase agreements (the “ATM Purchase Agreements”) subject to standard closing conditions where accredited investors purchased

On February 29, 2024, the Company entered into a securities purchase agreement with an investor providing for the issuance and sale of

On February 27, 2024, the Company entered into an underwriting agreement (the “ February Underwriting Agreement”) with EF Hutton LLC (the “Representative”), as the representative of the several underwriters named therein (the “ February Underwriters”), relating to an underwritten public offering (the “ February 2024 Public Offering”) of

On April 18, 2024, the Company entered into an underwriting agreement (the “ April Underwriting Agreement”) with the Representative, as the representative of the several underwriters named therein (the “ April Underwriters”), relating to an underwritten public offering (the “ April 2024 Public Offering”) of

On August 28, 2024, the Company issued

Common Stock Warrants

Substitute Warrants

In connection with the Merger in 2021, each warrant to purchase shares of Common Stock of NRx that was outstanding and unexercised immediately prior to the effective time (whether vested or unvested) was assumed by Big Rock Partners Acquisition Corp. ("BRPA") and converted into a warrant, based on the exchange ratio (of

The Company recognized a gain on the change in fair value of the Substitute Warrants for the three months ended September 30, 2024 and 2023 of $

Assumed Public Warrants

Prior to the Merger, the Company had

During the three and nine months ended September 30, 2024 and 2023

Assumed Private Placement Warrants

Prior to the Merger, the Company had outstanding

The Company recognized a gain on the change in fair value of the Private Placement Warrants for the three months ended September 30, 2024 and 2023 of less than $

Investor Warrants

As discussed above, on February 28, 2024, in conjunction with the sale of

On February 28, 2024, the Company issued to the Representative the Underwriter’s Warrant to purchase up to

On March 5, 2024 the Company issued Underwriter’s Warrant to purchase up to

On April 19, 2024, the Company issued to the Representative the April Underwriter’s Warrant to purchase up to

On May 23, 2024 the Company issued Underwriter’s Warrant to purchase up to

Alvogen Warrants

In conjunction with the amended Alvogen licensing agreement discussed in Note 6, on February 7, 2024 the Company issued warrants to purchase up to

Anson Warrants

The Anson Warrants, originally issued in the Purchase Agreement, are recognized as derivative liabilities in accordance with ASC 815. The Company concluded liability classification was appropriate as certain settlement features included in the Anson Warrants are not indexed to the Company's own stock, and therefore preclude equity classification. Accordingly, the Company recognizes the warrant instruments as liabilities at fair value and adjusts the instruments to fair value at each reporting period. The liabilities are subject to re-measurement at each balance sheet date until exercise or expiration, and any change in fair value is recognized in the Company’s condensed consolidated statements of operations. The Anson Warrants were initially measured at fair value using a Black-Scholes model and have subsequently been measured based on the listed market price of such warrants. Warrant liabilities are classified as current liabilities on the Company's condensed consolidated balance sheets. On August 14, 2024, in conjunction with the issuance of the First Tranche Notes, the Company issued warrants to purchase up to

| Weighted | ||||||||||||||||

| Average | Weighted | Aggregate | ||||||||||||||

| Total | Remaining | Average | Intrinsic Value | |||||||||||||

| Warrant Shares | Term | Exercise Price | (in thousands) | |||||||||||||

| Outstanding as of December 31, 2023 | $ | $ | ||||||||||||||

| Issued | ||||||||||||||||

| Expired | ( | ) | ||||||||||||||

| Outstanding as of March 31, 2024 | ||||||||||||||||

| Issued | ||||||||||||||||

| Outstanding as of June 30, 2024 | $ | $ | ||||||||||||||

| Issued | ||||||||||||||||

| Expired | ( | ) | ||||||||||||||

| Outstanding as of September 30, 2024 | $ | $ | ||||||||||||||

10. Stock-Based Compensation

2016 Omnibus Incentive Plan

Prior to the Merger, NRx maintained its 2016 Omnibus Incentive Plan (the “2016 Plan”), under which NeuroRx granted incentive stock options, restricted stock awards, other stock-based awards, or other cash-based awards to employees, directors, and non-employee consultants. The maximum aggregate shares of Common Stock that were subject to awards and issuable under the 2016 Plan was

In connection with the Merger, each option of NeuroRx that was outstanding and unexercised immediately prior to the Effective Time (whether vested or unvested) was assumed by BRPA and converted into an option to acquire an adjusted number of shares of Common Stock at an adjusted exercise price per share, based on the Exchange Ratio (of ).

Upon the closing of the Merger, the outstanding and unexercised NeuroRx stock options became options to purchase an aggregate

2021 Omnibus Incentive Plan

As of September 30, 2024,

Option Awards

The fair value of each employee and non-employee stock option grant is estimated on the date of grant using the Black-Scholes option-pricing model. The Company is a public company and has limited company-specific historical and implied volatility information. Therefore, it estimates its expected stock volatility based on the limited company-specific historical volatility and implied volatility. The expected term of the Company’s stock options for employees has been determined utilizing the “simplified” method for awards. The risk-free interest rate is determined by reference to the U.S. Treasury yield curve. Expected dividend yield is

The Company issued

The following table summarizes the Company’s employee and non-employee stock option activity under the 2021 Plan for the following periods:

| Number of shares | Weighted average exercise price | Weighted average remaining contractual life (in years) | Aggregate intrinsic value (in thousands) | |||||||||||||

| Outstanding as of December 31, 2023 | $ | $ | ||||||||||||||

| Expired/Forfeited | ( | ) | ||||||||||||||

| Outstanding as of March 31, 2024 | $ | $ | ||||||||||||||

| Expired/Forfeited | ( | ) | ||||||||||||||

| Outstanding as of June 30, 2024 | $ | $ | ||||||||||||||

| Expired/Forfeited | ( | ) | ||||||||||||||

| Outstanding as of September 30, 2024 | $ | $ | ||||||||||||||

| Options vested and exercisable as of September 30, 2024 | $ | $ | ||||||||||||||

Stock-based compensation expense related to stock options was $

At September 30, 2024, the total unrecognized compensation related to unvested employee and non-employee stock option awards granted, was $

Restricted Stock Awards

The following table presents the Company’s Restricted Stock Activity:

| Awards | Weighted Average Grant Date Fair Value | |||||||

| Balance as of December 31, 2023 (unvested) | $ | |||||||

| Vested | ( | ) | ||||||

| Balance as of March 31, 2024 (unvested) | ||||||||

| Vested | ||||||||

| Balance as of June 30, 2024 (unvested) | ||||||||

| Vested | ( | ) | ||||||

| Balance as of September 30, 2024 (unvested) | $ | |||||||

On July 12, 2022, the Board granted an award of

On December 28, 2023, the Company was authorized to grant

Stock-based compensation expense related to RSAs was less than $

Subsequent to September 30, 2024, the Company's CEO announced his resignation and as a result, all unvested RSAs were forfeited. Accordingly, the Company does expect to recognize any further stock-based compensation expense for the balance of unvested RSAs as of September 30, 2024.

The following table summarizes the Company’s recognition of stock-based compensation for the following periods (in thousands):

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Stock-based compensation expense | ||||||||||||||||

| General and administrative | $ | $ | $ | $ | ||||||||||||

| Research and development | ||||||||||||||||

| Total stock-based compensation expense | $ | $ | $ | $ | ||||||||||||

11. Fair Value Measurements

Fair value measurements discussed herein are based upon certain market assumptions and pertinent information available to management as of and during the three and nine months ended September 30, 2024 and 2023. The carrying amount of accounts payable approximated fair value as they are short term in nature. The fair value of stock options and warrants issued for services are estimated based on the Black-Scholes model. The fair value of the convertible notes payable was estimated utilizing a Monte Carlo simulation.

Fair Value on a Recurring Basis

The Company follows the guidance in ASC 820 for its financial assets and liabilities that are re-measured and reported at fair value at each reporting period, and non-financial assets and liabilities that are re-measured and reported at fair value at least annually. The estimated fair value of the money market account represents a Level 1 measurement. The estimated fair value of the warrant liabilities and convertible note payable represent Level 3 measurements. The following table presents information about the Company’s assets and liabilities that are measured at fair value on a recurring basis at September 30, 2024 and December 31, 2023, and indicates the fair value hierarchy of the valuation inputs the Company utilized to determine such fair value (in thousands):

| Description | Level | September 30, 2024 | December 31, 2023 | |||||||||

| Assets: | (Unaudited) | |||||||||||

| Money Market Account | 1 | $ | $ | |||||||||

| Liabilities: | ||||||||||||

| Warrant liabilities (Note 9) | 3 | $ | $ | |||||||||

| Convertible note payable - Streeterville (Note 7) | 3 | $ | $ | |||||||||

| Convertible note payable - Anson (Note 7) | 3 | $ | $ | |||||||||

Convertible Note Payable - Streeterville

The significant inputs used in the Monte Carlo simulation to measure the Streeterville note liability that is categorized within Level 3 of the fair value hierarchy are as follows:

| September 30, | September 30, | |||||||

| 2024 | 2023 | |||||||

| Stock price on valuation date | * | $ | ||||||

| Time to expiration | * | |||||||

| Note market interest rate | * | % | ||||||

| Equity volatility | * | % | ||||||

| Volume volatility | * | % | ||||||

| Risk-free rate | * | % | ||||||

| Probability of default | * | % | ||||||

*As of September 30, 2024, the fair value was determined to be $

The following table sets forth a summary of the changes in the fair value of the Streeterville Note categorized within Level 3 of the fair value hierarchy (in thousands):

| Fair value of the Note as of December 31, 2023 | $ | |||

| Conversions and repayments of principal and interest (cash) | ( | ) | ||

| Conversions and repayments of principal and interest (shares) | ( | ) | ||

| Fair value adjustment through earnings | ||||

| Fair value of the Note as of March 31, 2024 | ||||

| Fair value adjustment through earnings | ||||

| Default penalty | ||||

| Fair value of the Note as of June 30, 2024 | $ | |||

| Conversions and repayments of principal and interest (cash) | ( | ) | ||

| Fair value adjustment through earnings | ( | ) | ||

| Fair value of the Note as of September 30, 2024 | $ | |||

| Convertible note payable - current portion | $ | |||

| Convertible note payable, net of current portion | $ |

| Fair value of the Note as of December 31, 2022 | $ | |||

| Fair value adjustment through earnings | ||||

| Fair value adjustment through accumulated other comprehensive loss | ( | ) | ||

| Fair value of the Note as of March 31, 2023 | ||||

| Conversions and repayments of principal and interest (cash) | ( | ) | ||