UNDER ARMOUR, INC.

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held September 4, 2024

Notice is hereby given that the Annual Meeting of Stockholders of Under Armour, Inc. will be held on Wednesday, September 4, 2024 at 12:00 p.m., Eastern Time, online at www.virtualshareholdermeeting.com/UAA2024 to consider and vote on the following matters:

| 1. | To elect nine directors nominated by the Board of Directors to serve until the next Annual Meeting of Stockholders and until their respective successors are elected and qualified; |

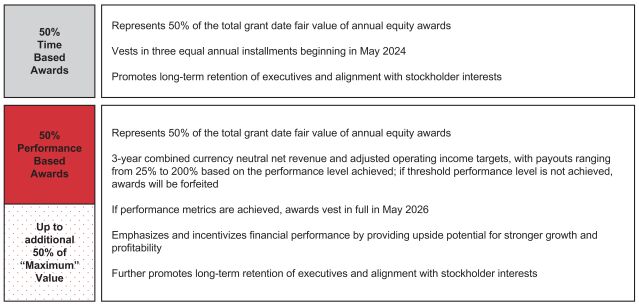

| 2. | To approve, on an advisory basis, our executive compensation; |

| 3. | To approve the amendment and restatement of our Class C Employee Stock Purchase Plan (the “Amended Class C ESPP”) to increase the number of shares of Class C Common Stock authorized for issuance, among other changes; and |

| 4. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year ending March 31, 2025. |

We will also transact any other business that may properly come before the meeting or any adjournment or postponement thereof.

Our Board of Directors recommends that you vote “FOR” the election of the nine nominees to the Board of Directors listed in the accompanying proxy statement, “FOR” the approval of our executive compensation, “FOR” the approval of our Amended Class C ESPP and “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

Only holders of record of Class A Common Stock or Class B Common Stock as of the close of business on June 7, 2024 are entitled to notice of, or to vote at, the Annual Meeting and any adjournment or postponement thereof. Holders of Class C Common Stock have no voting power as to any items of business that may properly be brought before the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting, which will be conducted online only via a live webcast. We believe a virtual Annual Meeting enables increased stockholder participation from locations around the world, and maintains a lower cost to our stockholders and our company, as compared to an in-person meeting. During the virtual meeting, holders of our Class A Common Stock and Class B Common Stock may ask questions and will have the opportunity to vote to the same extent as they would at an in-person meeting of stockholders. Holders of our Class C Common Stock may participate in the virtual Annual Meeting in a view-only format and will not be able to submit questions during the meeting or vote on any matter to be considered at the Annual Meeting. However, in advance of the meeting, holders of our Class C Common Stock may submit questions by contacting Investor Relations through the Under Armour website. We will respond to as many inquiries at the Annual Meeting as time allows.

If you plan to attend the Annual Meeting, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials. If you are a holder of Class C Common Stock, you may attend the Annual Meeting without a 16-digit control number by following the instructions in your Notice of Internet Availability of Proxy Materials or on the instructions that accompany your proxy materials. The Annual Meeting will begin promptly at 12:00 p.m., Eastern Time. Online check-in will begin at 11:45 a.m., Eastern Time, and you should allow ample time for the online check-in procedures.

Whether or not you intend to attend the virtual Annual Meeting, please vote your shares promptly by following the voting instructions you have received.

| By Order of the Board of Directors |

| Mehri Shadman |

| Chief Legal Officer and Corporate Secretary |

Baltimore, Maryland

June 27, 2024