2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the Fiscal Year Ended December 31, 2019

Or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from to .

Commission file number 1-16811

(Exact name of registrant as specified in its charter)

(State of Incorporation) | (I.R.S. Employer Identification No.) | |

(Address of principal executive offices)

Tel. No. (412 ) 433-1121

Securities registered pursuant to Section 12 (b) of the Act:

Title of Each Class | Trading Symbol | Name of Exchange on which Registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. Yes þ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definition of “large accelerated filer,” “accelerated filer," “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ___ | ☐ | ||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Aggregate market value of Common Stock held by non-affiliates as of June 28, 2019 (the last business day of the registrant’s most recently completed second fiscal quarter): $2.6 billion. The amount shown is based on the closing price of the registrant’s Common Stock on the New York Stock Exchange composite tape on that date. Shares of Common Stock held by executive officers and directors of the registrant are not included in the computation. However, the registrant has made no determination that such individuals are “affiliates” within the meaning of Rule 405 under the Securities Act of 1933.

There were 170,047,076 shares of United States Steel Corporation Common Stock outstanding as of February 10, 2020.

Documents Incorporated By Reference:

Portions of the Proxy Statement for the 2020 Annual Meeting of Stockholders are incorporated into Part III.

INDEX

Item 1. | |||

Item 1A | |||

Item 1B | |||

Item 2. | |||

Item 3. | |||

Item 4. | |||

Item 5. | |||

Item 6. | |||

Item 7. | |||

Item 7A | |||

Item 8. | |||

Item 9. | |||

Item 9A | |||

Item 9B | |||

Item 10. | |||

Item 11. | |||

Item 12. | |||

Item 13. | |||

Item 14. | |||

Item 15. | |||

Item 16. | |||

TOTAL NUMBER OF PAGES | 112 | ||

FORWARD-LOOKING STATEMENTS

This report contains information that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “will” and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume changes, share of sales and earnings per share changes, anticipated cost savings, potential capital and operational cash improvements, U. S. Steel's future ability and plans to take ownership of its Big River Steel joint venture as a wholly owned subsidiary, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to the risks and uncertainties described in this report in “Item 1A. Risk Factors” and those described from time to time in our future reports filed with the Securities and Exchange Commission.

References in this Annual Report on Form 10-K to "U. S. Steel," "the Company," "we," "us," and "our" refer to United States Steel Corporation and its consolidated subsidiaries unless otherwise indicated by the context.

Non-Generally Accepted Accounting Principles (non-GAAP) Financial Measures

This report contains certain non-GAAP financial measures such as earnings (loss) before interest, income taxes, depreciation, depletion and amortization (EBITDA), adjusted EBITDA, adjusted net earnings (loss), adjusted net earnings (loss) per diluted share, free cash flow, net debt and cash conversion cycle.

We believe that EBITDA, considered along with the net earnings (loss), is a relevant indicator of trends relating to cash generating activity and provides management and investors with additional information for comparison of our operating results to the operating results of other companies.

Adjusted net earnings (loss) and adjusted net earnings (loss) per diluted share are non-GAAP measures that exclude the effects of restructuring and other charges, the December 24, 2018 Clairton coke making facility fire, the Big River Steel options mark to market, the impact of the tax valuation allowance, the 2018 United Steelworkers labor agreement signing bonus and related costs, Granite City Works temporary idling and restart charges, the loss on shutdown of certain tubular pipe mill assets, gains associated with the sale of our retained interest in U. S. Steel Canada Inc., gains on equity investee transactions, loss on extinguishment of debt and other related costs, the effect of tax reform and other adjustments that are not part of the Company's core operations (Adjustment Items). Adjusted EBITDA is also a non-GAAP measure that excludes the effects of the Adjustment Items. We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA to enhance the understanding of our ongoing operating performance and established trends affecting our core operations, by excluding the effects of events that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA provides insight into management’s view and assessment of the Company’s ongoing operating performance, because management does not consider the adjusting items when evaluating the Company’s financial performance. Adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA should not be considered a substitute for net earnings (loss),

3

earnings (loss) per diluted share or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies.

Net debt is a non-GAAP measure calculated as total debt less cash and cash equivalents. We believe net debt is a useful measure in calculating enterprise value. Both EBITDA and net debt are used by analysts to refine and improve the accuracy of their financial models which utilize enterprise value.

Free cash flow is a measure of cash generated from operations, after any investing activity and dividends paid to stockholders. We believe that free cash flow provides further insight into the Company's overall utilization of cash.

We believe the cash conversion cycle is a useful measure in providing investors with information regarding our cash management performance and is a widely accepted measure of working capital management efficiency. The cash conversion cycle should not be considered in isolation or as an alternative to other GAAP metrics as an indicator of performance.

4

10-K SUMMARY

This section provides an overview of U. S. Steel's business, strategy and financial performance for 2019. It does not contain all of the information that may be important to a reader. Please read the entire Annual Report on Form 10-K.

Our vision is for U. S. Steel to be the industry leader in delivering high-quality, value-added products and innovative solutions that address our customers' most challenging steel needs. Underlying our efforts is our belief that we must operate as a principled company committed to a code of conduct that is rooted in our Gary Principles and our core values. Our core values are articulated in our S.T.E.E.L. Principles - Safety First, Trust and Respect, Environmentally Friendly Activities, Ethical Behavior, and Lawful Business Conduct. These core values guide U. S. Steel and help support the economic and societal benefits associated with strong domestic manufacturing capabilities, of which steel is a foundational industry.

We aim to achieve our vision by successfully executing on our world-competitive, “best of both” strategy. By bringing together the best of the integrated steelmaking model with the best of the mini mill steelmaking model, we will transform our business to drive long-term cash flow through industry cycles. We aim to offer an unparalleled product platform to serve customers, achieve world-competitive positioning in strategic, high-margin end markets, and deliver high-quality, value-added products and innovative solutions that address our customers' most challenging steel needs. To become a “best of both” company, we are enhancing our focus on operational and commercial excellence and promoting technological innovation, so we can establish a more competitive cost structure and enhance our capabilities … two key drivers for our strategy.

The diagram below illustrates our world-competitive “best of both” strategic framework and highlights the key actions to transform our business.

Over the past several years, we have proactively re-shaped our footprint and transformed our balance sheet. We used the strength and foundation of our business to align our balance sheet with the investment horizon to execute our strategy.

Our strategy is informed by our critical success factors, which are the bedrock of the “best of both" strategy: (1) Move

5

Down the Cost Curve; (2) Win in Strategic Markets; and (3) Move Up the Talent Curve. Several of the strategic projects we are undertaking are expected to result in operational improvements. Additionally, the enhanced operating model and organizational structure we implemented beginning in 2020 will also position U. S. Steel to lower its structural fixed costs. We are also investing in new technologies to improve our cost position and increase our capabilities, including our investment in Big River Steel, the electric arc furnace (EAF) at Fairfield Tubular Operations, endless casting and rolling at Mon Valley Works, Gary Works hot strip mill upgrades and the dynamo line at our USSK facility which is within our USSE segment. We will focus on strategic markets, where there is the greatest opportunity to provide differentiated, innovative and value-added solutions that will help our customers succeed. We know that to accomplish our objectives, we also need to move up the talent curve, which we are doing by investing in our employees and providing the training and resources they need to succeed. This will help us reinforce a culture where accountability, fairness and respect are foundational, and high performance and inclusion in all its forms are valued and celebrated.

In 2019, we announced several transformation initiatives key to our strategy. On October 31, 2019, U. S. Steel acquired a 49.9% ownership interest in Big River Steel at a purchase price of approximately $683 million in cash, with a call option to acquire the remaining 50.1% within the next four years. Our investment in Big River Steel will add sustainable steel making technology to our footprint and improve our competitive positioning. Big River Steel is a technological leader combining mini mill technology with aspects of the integrated model to achieve the benefits of each. In December 2019, we announced our intention to indefinitely idle a significant portion of our Great Lakes Works operation near Detroit, Michigan. We expect to begin idling the iron and steelmaking facilities on or around April 1, 2020, and the hot strip mill rolling facility before the end of 2020. This action will transition our footprint to focus on facilities and assets that are differentiated by cost and/or capability.

Ultimately, we intend to center our North American Flat-Rolled operations around three distinct, market-leading assets: Big River Steel, Mon Valley Works, and Gary Works, to transform the business to offer customers differentiated products to deliver highly competitive long-term cash flow generation through higher earnings and lower maintenance capital expenditures.

6

KEY PERFORMANCE INDICATORS

This section provides an overview of select key performance indicators for U. S. Steel which management and investors use to assess the Company's financial performance. It does not contain all of the information you should consider. Fluctuations for year to year changes are explained in Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations."

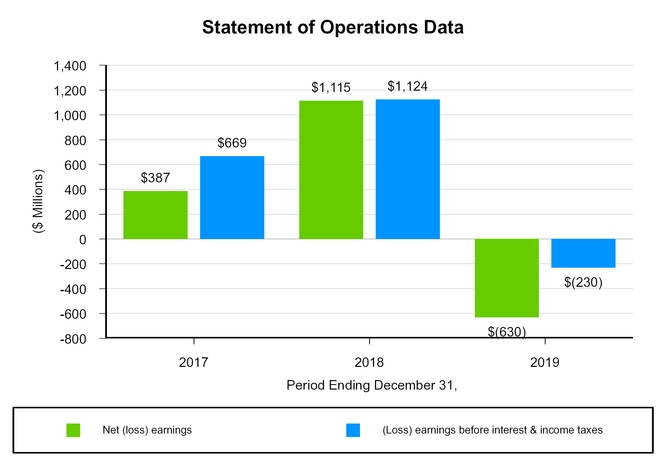

• | Our 2019 net loss includes unfavorable restructuring impacts of $275 million for the indefinite idling of certain of our Flat-Rolled facilities, plant exit costs at USSE and Company-wide headcount reductions implemented to reduce fixed costs and support our strategy to become a world-competitive, "best of both" steel company. Our financial results were also negatively impacted by lower average realized prices across all of our business segments, significant market challenges in our USSE segment and a $334 million non-cash charge to tax expense that increased the valuation allowance related to our net domestic deferred tax asset. |

• | Our 2018 net earnings include a favorable impact of $374 million due to the reversal of a portion of our deferred tax asset valuation allowance. |

• | Our 2017 net earnings include an $81 million income tax benefit from enacted tax legislation. |

7

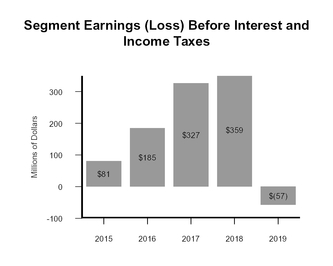

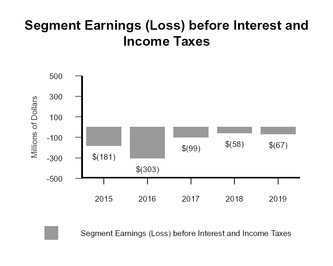

• | After a significant earnings improvement in 2018, we faced a challenging year in 2019 as market conditions in the U.S. weakened in the latter half of the year. Our USSE segment faced significant market challenges from weakening economic conditions, primarily in the manufacturing sector. |

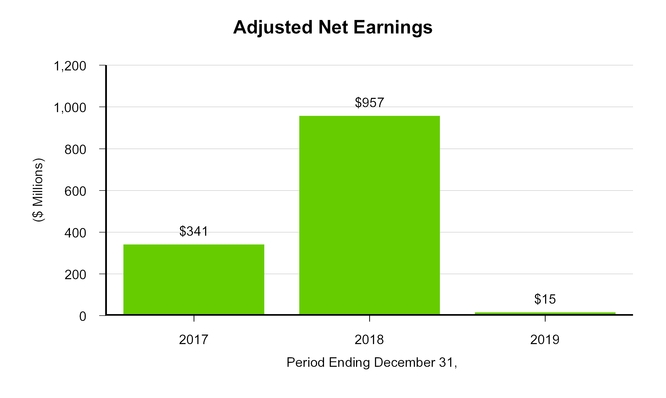

• | These amounts are derived starting from net (loss) earnings as shown on page 7. For a full reconciliation of adjusted net (loss) earnings see page 18. |

8

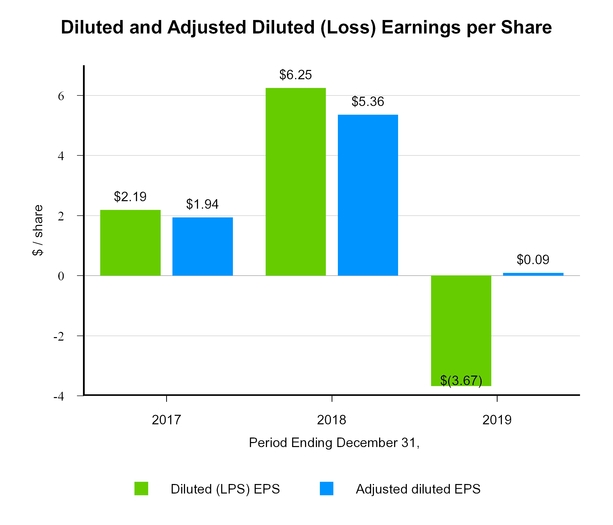

• | See reconciliation from diluted net (loss) earnings per share to adjusted diluted net earnings per share on page 19. |

9

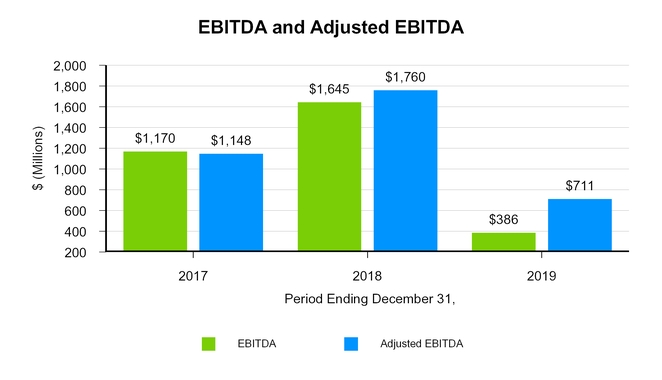

• | These amounts are derived starting from net (loss) earnings as shown on page 7. For a full reconciliation of adjusted EBITDA see page 20. |

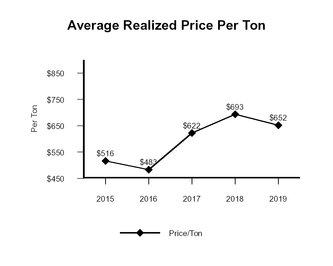

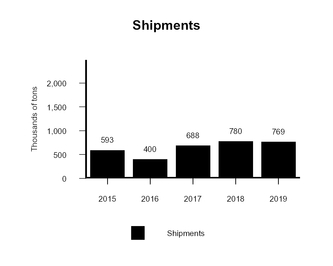

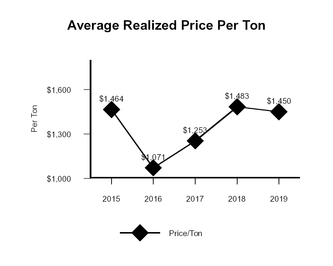

• | EBITDA decreased primarily in our Flat-Rolled and USSE segments in 2019. The primary driver of decreased EBITDA in our Flat-Rolled segment was lower average realized prices related to weakening demand in the latter half of 2019. Our USSE segment temporarily idled one blast furnace as it experienced reduced shipment levels and lower average realized prices as a result of significant market challenges from weakening economic conditions, primarily in the manufacturing sector, and continued high levels of imports, coupled with domestic CO2 cost disadvantages compared to imports. Tubular results continued to be negatively impacted by high levels of imports which resulted in lower selling prices. |

• | EBITDA increased from 2017 to 2018 for all three reportable segments with higher average realized prices in all three segments. |

10

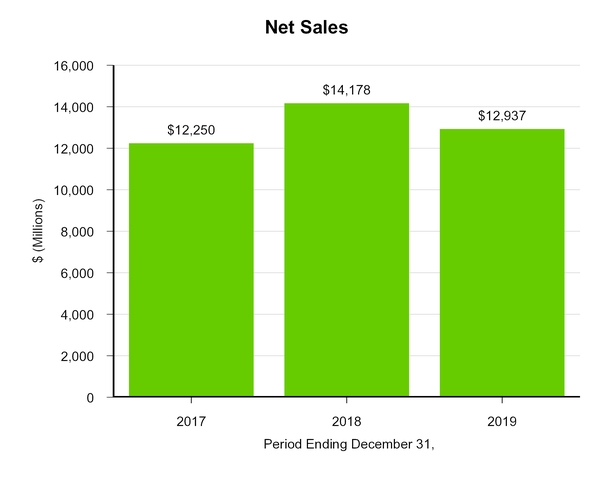

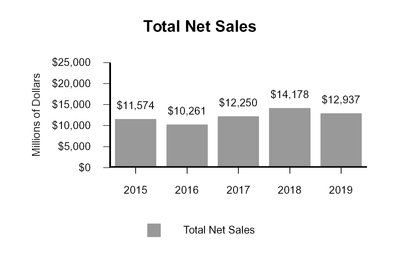

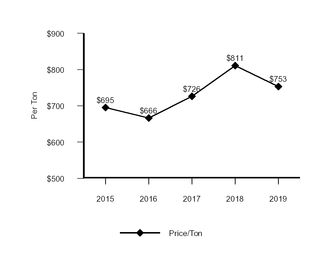

• | The decrease in net sales in 2019 as compared to 2018 was primarily due to lower average realized prices in all of our reportable segments and significantly reduced shipments in our USSE segment. Lower average realized prices in our Flat-Rolled and Tubular segments reflect weakening market conditions in the latter half of 2019. Reduced shipment levels and lower average realized prices in our USSE segment were the result of significant market challenges from weakening economic conditions, primarily in the manufacturing sector, and continued high levels of imports, coupled with domestic CO2 cost disadvantages compared to imports. |

• | The increase in net sales in 2018 as compared to 2017 was primarily due to higher average realized prices in all of our reportable segments and increased shipments in our Flat-Rolled and Tubular segments due to improved market conditions. Improved market conditions for our Flat-Rolled segment reflected accelerated demand for steel products in line with the recent economic growth, as well as the supply-demand balance between imported and domestic steel. The restart of the two blast furnaces at our Granite City Works during 2018 enabled us to take advantage of the improved market dynamics in 2018. |

11

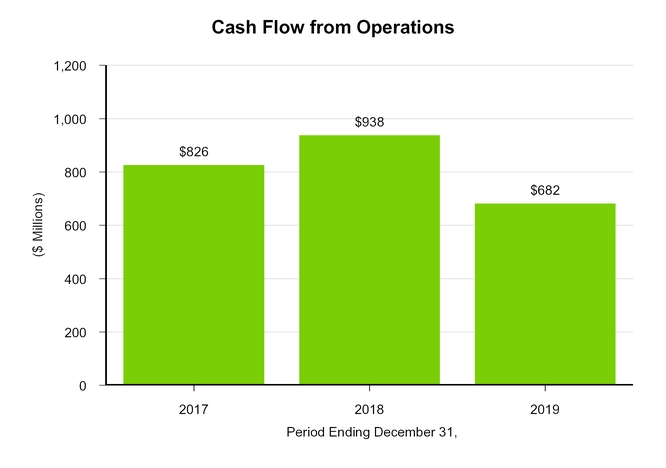

• | In 2019, the positive cash flow from operations was primarily due to efficient use of working capital. |

• | In 2018 and 2017, improved financial performance more than offset the investment in working capital. |

• | Our cash conversion cycle was 30, 28 and 37 days for 2017, 2018 and 2019, respectively. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Financial Condition, Cash Flows and Liquidity – Cash Flows” for the calculation of our cash conversion cycle. |

12

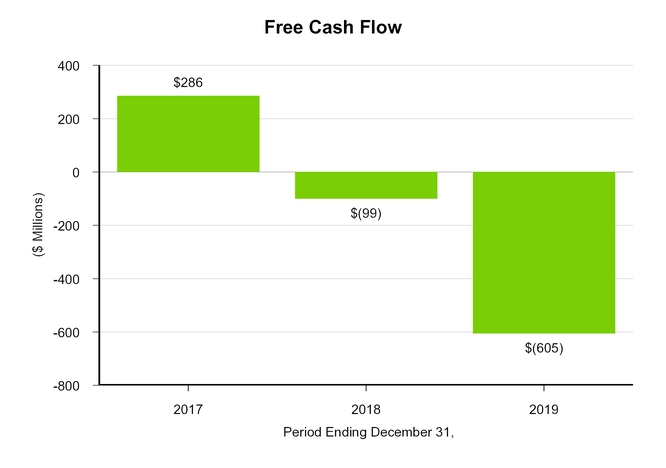

• | The free cash flow shown above was derived starting from cash flow from operations as shown on page 12. For a full reconciliation of free cash flow see page 21. |

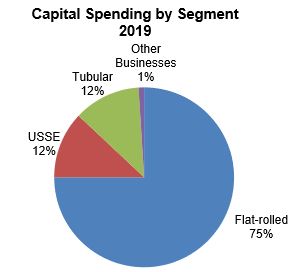

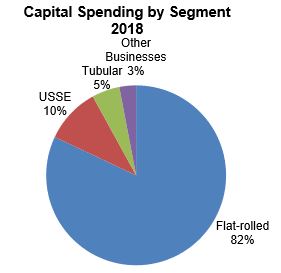

• | A portion of our cash from operations in 2019 was spent on major projects to pursue our strategy to become a world-competitive, "best of both" steel company. Our capital expenditures of $1.3 billion included spending on the new endless casting and rolling facility at our Mon Valley Works and upgrades to the Gary Works hot strip mill, which are both in our Flat-Rolled segment, and spending on the new EAF in our Tubular segment. |

• | Capital expenditures totaled $1.0 billion in 2018, a significant increase from 2017. Our 2018 capital expenditures included $335 million on asset revitalization projects that were focused on delivering improvements in safety, quality, delivery and cost for critical assets in our Flat-Rolled segment. |

13

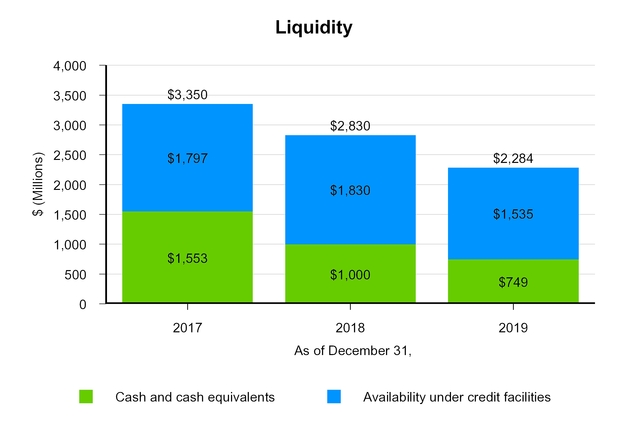

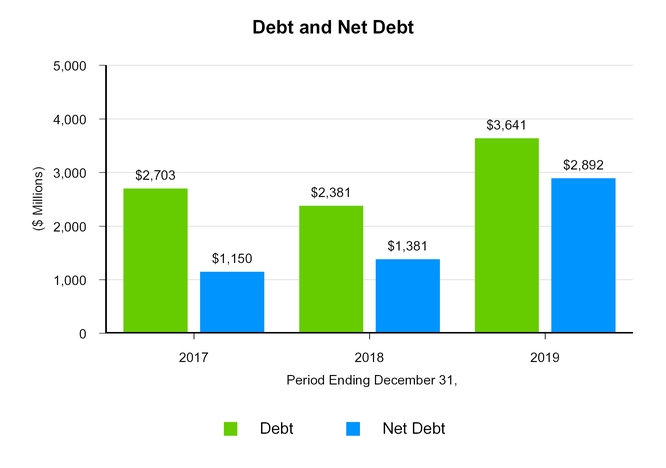

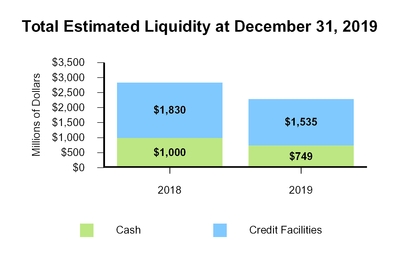

• | In the years leading up to 2018 and 2019, the Company undertook a focused effort to repay or refinance its debt in order to ensure a secure foundation to support execution of its strategy. Beginning with the asset revitalization program, and continuing with the "best of both" strategy, the Company has been maintaining cash in furtherance of its priorities. |

• | Maintaining strong cash and liquidity to support and enable execution of our strategy continues to be a priority. Our total liquidity in 2019 remained strong and supported our ability to satisfy short-term obligations, fund working capital requirements, and enable execution of key strategic priorities including the acquisition of our 49.9% ownership interest in Big River Steel, restart of construction of the electric arc furnace (EAF) at our Fairfield Tubular Operations, invest in the endless casting and rolling facility at Mon Valley Works and invest in the new Dynamo line within our USSE segment. |

14

• | The increase in debt in 2019 was primarily related to net drawings that totaled approximately $760 million on our credit facilities, the $350 million issuance of senior convertible notes and the net increase in environmental revenue bonds of $220 million. |

• | Net debt was derived starting from total debt as shown in the full reconciliation on page 21. |

• | The increase in net debt in 2019 was primarily related to the increase in debt described above and the use of funds to purchase our 49.9% ownership interest in Big River Steel, fund the electric arc furnace construction at Fairfield Tubular Operations and finance other capital expenditures. |

15

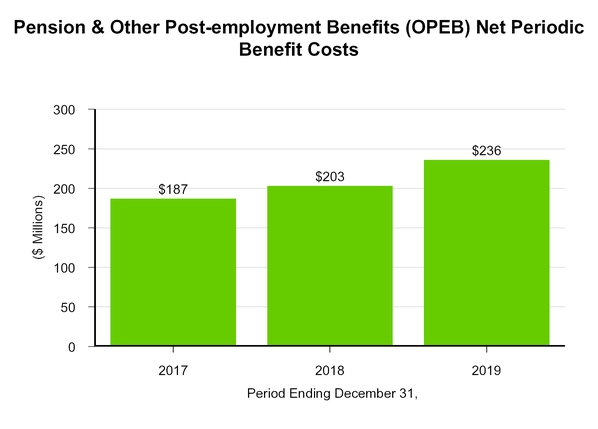

• | The increase in 2019 pension and OPEB expense from 2018 was mainly due to increased contributions to the Steelworkers' Pension Trust (SPT) in 2019 in accordance with the increase in the contribution rate per hour required under the 2018 Labor Agreements (defined below). |

• | The increase in 2018 pension and OPEB expense from 2017 is mainly due to a lower return on assets assumption for pension assets. |

• | For further details, see Note 18 to the Consolidated Financial Statements. |

16

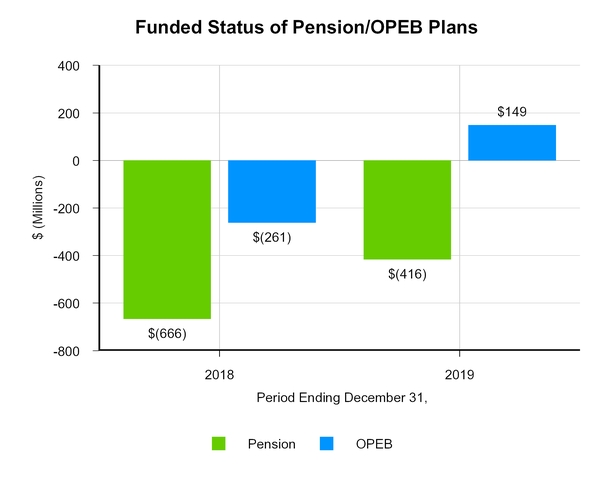

• | The funded status of our pension plan improved by $250 million in 2019 primarily due to higher asset performance and an update to our mortality assumptions partially offset by a decrease in the discount rate. The funded status of our OPEB plan improved by $410 million in 2019 primarily due to higher asset performance, reductions in future health care costs and changes in assumptions on future participant enrollment. |

• | At the end of 2019, on a U.S. GAAP basis the funded status was 93% and 108% for our pension and OPEB obligations, respectively as compared to a funded status of 88% for both obligations at the end of 2018. |

• | Due to the improvement in our funded status, required contributions to the pension plan that were previously projected to begin in 2021 are now projected to begin in 2024. |

• | For further details, see Note 18 to the Consolidated Financial Statements. |

17

NON-GAAP FINANCIAL MEASURES

Throughout this report, we present EBITDA, adjusted EBITDA, adjusted net earnings (loss) and adjusted net earnings (loss) per diluted share, free cash flow and net debt which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance, cash flow and financial position and to facilitate comparison with our competitors. See page 3 for an explanation of our use of certain non-GAAP financial measures.

RECONCILIATION TO ADJUSTED NET EARNINGS (LOSS) (a) | ||||||||||||

Year Ended December 31, | ||||||||||||

(Dollars in millions) | 2019 | 2018 | 2017 | |||||||||

Reconciliation to adjusted net earnings (loss) attributable to United States Steel Corporation | ||||||||||||

Net (loss) earnings attributable to United States Steel Corporation, as reported | $ | (630 | ) | $ | 1,115 | $ | 387 | |||||

December 24, 2018 Clairton coke making facility fire | 41 | — | — | |||||||||

Restructuring and other charges (b) | 263 | — | — | |||||||||

Big River Steel options mark to market, net (c) | 7 | — | — | |||||||||

USW labor agreement signing bonus and related costs | — | 81 | — | |||||||||

Granite City Works restart and related costs | — | 80 | — | |||||||||

Tax valuation allowance | 334 | (374 | ) | — | ||||||||

Loss on shutdown of certain tubular assets (b) | — | — | 35 | |||||||||

Gain associated with retained interest in U. S. Steel Canada Inc. | — | — | (72 | ) | ||||||||

Granite City Works temporary idling charges | — | (8 | ) | 17 | ||||||||

(Gain) loss on equity investee transactions | — | (38 | ) | (2 | ) | |||||||

Loss on extinguishment of debt and other related costs | — | 101 | 57 | |||||||||

Effect of tax reform | — | — | (81 | ) | ||||||||

Total Adjustments | 645 | (158 | ) | (46 | ) | |||||||

Adjusted net (loss) earnings attributable to United States Steel Corporation | $ | 15 | $ | 957 | $ | 341 | ||||||

(b) Included in restructuring and other charges on the Consolidated Statement of Operations.

(c) The Big River Steel options mark to market, net represents the earnings impact of the change in fair value of options related to our investment in a 49.9% ownership interest in Big River Steel. See Note 5 to the Consolidated Financial Statements for further details.

18

RECONCILIATION TO ADJUSTED NET EARNINGS (LOSS) PER SHARE (a) | ||||||||||||

Year Ended December 31, | ||||||||||||

2019 | 2018 | 2017 | ||||||||||

Reconciliation to adjusted diluted net earnings (loss) per share | ||||||||||||

Diluted net (loss) earnings per share, as reported | $ | (3.67 | ) | $ | 6.25 | $ | 2.19 | |||||

December 24, 2018 Clairton coke making facility fire | 0.23 | — | — | |||||||||

Restructuring and other charges (b) | 1.53 | — | — | |||||||||

Big River Steel options mark to market, net (c) | 0.04 | — | — | |||||||||

USW labor agreement signing bonus and related costs | — | 0.45 | — | |||||||||

Granite City Works restart and related costs | — | 0.45 | — | |||||||||

Tax valuation allowance | 1.96 | (2.11 | ) | — | ||||||||

Loss on shutdown of certain tubular assets (b) | — | — | 0.20 | |||||||||

Gain associated with retained interest in U. S. Steel Canada Inc. | — | — | (0.41 | ) | ||||||||

Granite City Works temporary idling charges | — | (0.04 | ) | 0.10 | ||||||||

Gain on equity investee transactions | — | (0.21 | ) | (0.01 | ) | |||||||

Loss on extinguishment of debt and other related costs | — | 0.57 | 0.33 | |||||||||

Effect of tax reform | — | — | (0.46 | ) | ||||||||

Total adjustments | 3.76 | (0.89 | ) | (0.25 | ) | |||||||

Adjusted diluted net earnings (loss) per share | $ | 0.09 | $ | 5.36 | $ | 1.94 | ||||||

(b) Included in restructuring and other charges and cost of sales in the Consolidated Statement of Operations.

(c) The Big River Steel options mark to market, net represents the earnings impact of the change in fair value of options related to our investment in a 49.9% ownership interest in Big River Steel. See Note 5 to the Consolidated Financial Statements for further details.

19

RECONCILIATION TO EBITDA AND ADJUSTED EBITDA | ||||||||||||

Year Ended December 31, | ||||||||||||

(Dollars in millions) | 2019 | 2018 | 2017 | |||||||||

Reconciliation to EBITDA and Adjusted EBITDA | ||||||||||||

Net (loss) earnings attributable to United States Steel Corporation | $ | (630 | ) | $ | 1,115 | $ | 387 | |||||

Income tax (benefit) provision | 178 | (303 | ) | (86 | ) | |||||||

Net interest and other financial costs | 222 | 312 | 368 | |||||||||

Depreciation, depletion and amortization expense | 616 | 521 | 501 | |||||||||

EBITDA | 386 | 1,645 | 1,170 | |||||||||

December 24, 2018 Clairton coke making facility fire | 50 | — | — | |||||||||

Restructuring and other charges (a) | 275 | — | — | |||||||||

USW labor agreement signing bonus and related costs | — | 81 | — | |||||||||

Granite City Works restart and related costs | — | 80 | — | |||||||||

Loss on shutdown of certain tubular assets (a) | — | — | 35 | |||||||||

Gain associated with retained interest in U. S. Steel Canada Inc. | — | — | (72 | ) | ||||||||

Granite City Works temporary idling charges | — | (8 | ) | 17 | ||||||||

Gain on equity investee transactions | — | (38 | ) | (2 | ) | |||||||

Adjusted EBITDA | $ | 711 | $ | 1,760 | $ | 1,148 | ||||||

(a) Included in restructuring and other charges in the Consolidated Statement of Operations.

20

RECONCILIATION TO FREE CASH FLOW | ||||||||||||

Year Ended December 31, | ||||||||||||

(Dollars in millions) | 2019 | 2018 | 2017 | |||||||||

Reconciliation to Free Cash Flow | ||||||||||||

Net cash provided by operating activities | 682 | 938 | 826 | |||||||||

Capital expenditures | (1,252 | ) | (1,001 | ) | (505 | ) | ||||||

Dividends paid | (35 | ) | (36 | ) | (35 | ) | ||||||

Free Cash Flow | $ | (605 | ) | $ | (99 | ) | $ | 286 | ||||

RECONCILIATION TO TOTAL DEBT AND NET DEBT | ||||||||||||

Year Ended December 31, | ||||||||||||

(Dollars in millions) | 2019 | 2018 | 2017 | |||||||||

Reconciliation to Total Debt and Net Debt | ||||||||||||

Short-term debt and current maturities of long-term debt | $ | 14 | $ | 65 | $ | 3 | ||||||

Long-term debt, less unamortized discount and debt issuance costs | 3,627 | 2,316 | 2,700 | |||||||||

Total Debt | 3,641 | 2,381 | 2,703 | |||||||||

Less: Cash and cash equivalents | $ | 749 | $ | 1,000 | 1,553 | |||||||

Net Debt | $ | 2,892 | $ | 1,381 | $ | 1,150 | ||||||

21

PART I

Item 1. BUSINESS

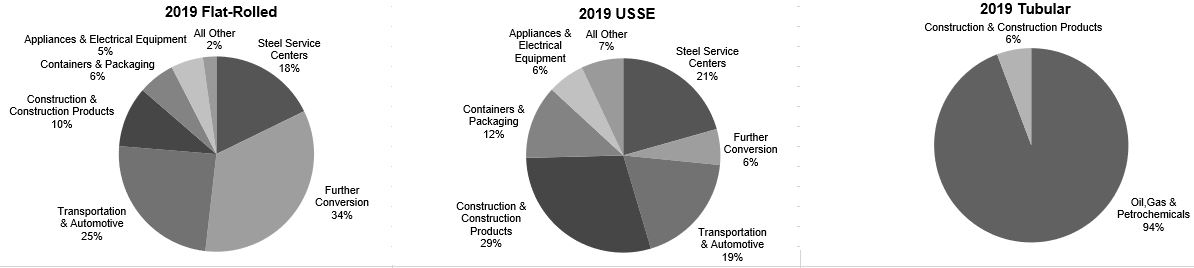

United States Steel Corporation (U. S. Steel) is an integrated steel producer of flat-rolled and tubular products with major production operations in the United States and Europe. An integrated steel producer uses iron ore and coke as primary raw materials for steel production. U. S. Steel has annual raw steel production capability of 22.0 million net tons (17.0 million tons in the United States and 5.0 million tons in Europe). U. S. Steel supplies customers throughout the world primarily in the automotive, construction, consumer (packaging and appliance), electrical, industrial equipment,and energy (oil country tubular goods (OCTG) and line pipe) markets. According to the World Steel Association’s latest published statistics, in 2018 U. S. Steel was the third largest steel producer in the United States and the twenty-sixth largest steel producer in the world. U. S. Steel is also engaged in other business activities consisting primarily of railroad services and real estate operations. U. S. Steel is a Delaware corporation established in 1901.

Segments

U. S. Steel has three reportable segments: North American Flat-Rolled (Flat-Rolled), U. S. Steel Europe (USSE) and Tubular Products (Tubular). The results of our 49.9% ownership interest in Big River Steel and our railroad and real estate businesses that do not constitute reportable segments are combined and disclosed in the Other Businesses category.

Flat-Rolled

The Flat-Rolled segment includes the operating results of U. S. Steel’s integrated steel plants and equity investees in North America (except for Big River Steel, which is included in Other Businesses) involved in the production of slabs, strip mill plates, sheets and tin mill products, as well as all iron ore and coke production facilities in the United States. These operations primarily serve North American customers in the service center, conversion, transportation (including automotive), construction, container, and appliance and electrical markets.

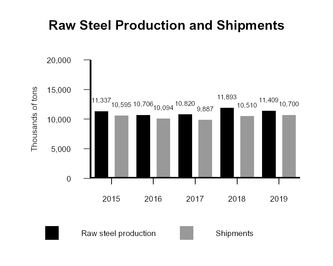

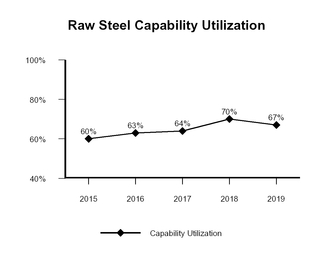

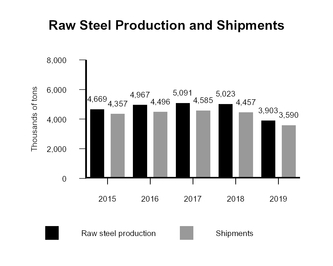

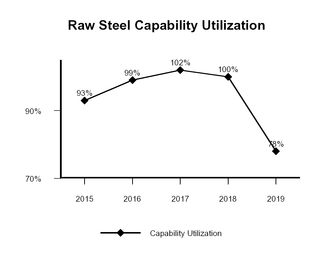

Flat-Rolled has aggregate annual raw steel production capability of 17.0 million tons produced at our Gary Works, Mon Valley Works, Great Lakes Works and Granite City Works facilities. Raw steel production was 11.4 million tons in 2019, 11.9 million tons in 2018 and 10.8 million tons in 2017. Raw steel production averaged 67 percent of capability in 2019, 70 percent of capability in 2018 and 64 percent of capability in 2017. During December 2015 the Granite City Works steelmaking operations were temporarily idled. The steelmaking operations and hot strip mill were restarted during 2018 and 2017, respectively. If its production capability is excluded during the temporary idle period, Flat-Rolled production would have been 76 percent in 2017.

European Operations

The USSE segment includes the operating results of U. S. Steel Košice (USSK), U. S. Steel’s integrated steel plant and coke production facilities in Slovakia, and its subsidiaries. USSE conducts its business mainly in Central and Western Europe and primarily serves customers in the European transportation (including automotive), construction, container, appliance, electrical, service center, conversion and oil, gas and petrochemical markets. USSE produces and sells slabs, strip mill plate, sheet, tin mill products and spiral welded pipe, as well as refractory ceramic materials.

USSE has annual raw steel production capability of 5.0 million tons. USSE’s raw steel production was 3.9 million tons in 2019, 5.0 million tons in 2018, and 5.1 million tons in 2017. USSE’s raw steel production averaged 78 percent of capability in 2019, 100 percent of capability in 2018 and 102 percent of capability in 2017.

Tubular

The Tubular segment includes the operating results of U. S. Steel’s tubular production facilities and an equity investee in the United States. These operations produce and sell seamless and electric resistance welded (ERW) steel casing and tubing (commonly known as OCTG), and standard and line pipe and mechanical tubing and primarily serve customers in the oil, gas and petrochemical markets. Tubular's annual production capability is 1.9 million tons.

U. S. Steel Tubular Products, Inc. (USSTP), a wholly owned subsidiary of U. S. Steel, continues to design and develop a range of premium and semi-premium connections to address the growing needs for technical solutions for our end users' well site production challenges. Through its wholly owned subsidiary, U. S. Steel Oilwell Services, LLC, USSTP

22

also offers rig site services, which provides the technical expertise for proper installation of our tubular products and proprietary connections at the well site.

For further information, see "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" and Note 4 to the Consolidated Financial Statements.

23

Steel Shipments by Market and Segment

The following table except where noted in (1) below does not include shipments to end customers by joint ventures and other equity investees of U. S. Steel. Shipments of materials to these entities are included in the “Further Conversion – Joint Ventures” market classification. No single customer accounted for more than 10 percent of gross annual revenue.

(Thousands of Tons) | Flat-Rolled | USSE | Tubular | Total | ||||||||

Major Market – 2019 | ||||||||||||

Steel Service Centers | 1,902 | 740 | — | 2,642 | ||||||||

Further Conversion – Trade Customers | 2,823 | 214 | — | 3,037 | ||||||||

– Joint Ventures (1) | 819 | — | — | 819 | ||||||||

Transportation and Automotive (1) | 2,620 | 676 | — | 3,296 | ||||||||

Construction and Construction Products | 1,076 | 1,048 | 44 | 2,168 | ||||||||

Containers and Packaging | 652 | 440 | — | 1,092 | ||||||||

Appliances and Electrical Equipment | 570 | 220 | — | 790 | ||||||||

Oil, Gas and Petrochemicals | — | — | 725 | 725 | ||||||||

All Other | 238 | 252 | — | 490 | ||||||||

TOTAL | 10,700 | 3,590 | 769 | 15,059 | ||||||||

Major Market – 2018 (2) | ||||||||||||

Steel Service Centers | 1,904 | 799 | — | 2,703 | ||||||||

Further Conversion – Trade Customers | 2,273 | 287 | — | 2,560 | ||||||||

– Joint Ventures (1) | 810 | — | — | 810 | ||||||||

Transportation & Automotive (1) | 2,874 | 728 | — | 3,602 | ||||||||

Construction and Construction Products | 953 | 1,637 | 38 | 2,628 | ||||||||

Containers and Packaging | 768 | 439 | — | 1,207 | ||||||||

Appliances and Electrical Equipment | 599 | 261 | — | 860 | ||||||||

Oil, Gas and Petrochemicals | — | 11 | 742 | 753 | ||||||||

All Other | 329 | 295 | — | 624 | ||||||||

TOTAL | 10,510 | 4,457 | 780 | 15,747 | ||||||||

Major Market – 2017 (2) | ||||||||||||

Steel Service Centers | 1,953 | 761 | — | 2,714 | ||||||||

Further Conversion – Trade Customers | 1,738 | 284 | — | 2,022 | ||||||||

– Joint Ventures (1) | 715 | — | — | 715 | ||||||||

Transportation and Automotive (1) | 2,982 | 708 | — | 3,690 | ||||||||

Construction and Construction Products | 910 | 1,831 | 41 | 2,782 | ||||||||

Containers and Packaging | 715 | 438 | — | 1,153 | ||||||||

Appliances and Electrical Equipment | 594 | 247 | — | 841 | ||||||||

Oil, Gas and Petrochemicals | — | 10 | 647 | 657 | ||||||||

All Other | 280 | 306 | — | 586 | ||||||||

TOTAL | 9,887 | 4,585 | 688 | 15,160 | ||||||||

(1) PRO-TEC automotive substrate shipments are included in the Transportation and Automotive category.

(2) Shipments previously reported as Exports have been reclassified to one of the other categories to which they relate.

24

Safety

U. S. Steel has a long-standing commitment to the safety and health of the men and women who work in our facilities. Safety is our primary core value. Every employee deserves to return home safely at the end of every day, and we are working to eliminate all injuries and incidents at all of our facilities. Ensuring a safe workplace also improves productivity, quality, reliability and financial performance. By making safety and health a personal responsibility, our employees are making a daily commitment to follow safe work practices, look out for the safety of co-workers and ensure safe working conditions for everyone. A “Safety First” mindset is as essential to our success as the tools and technologies we rely on to do business.

Our objective is to attain a sustainable zero harm culture supported by leadership and owned by an engaged and highly skilled workforce, empowered with the capabilities and resources needed to assess, reduce, and eliminate workplace risks and hazards. In support of these objectives, we have developed an enhanced Safety Management System, initiated new safety communication methods and enhanced contractor safety processes.

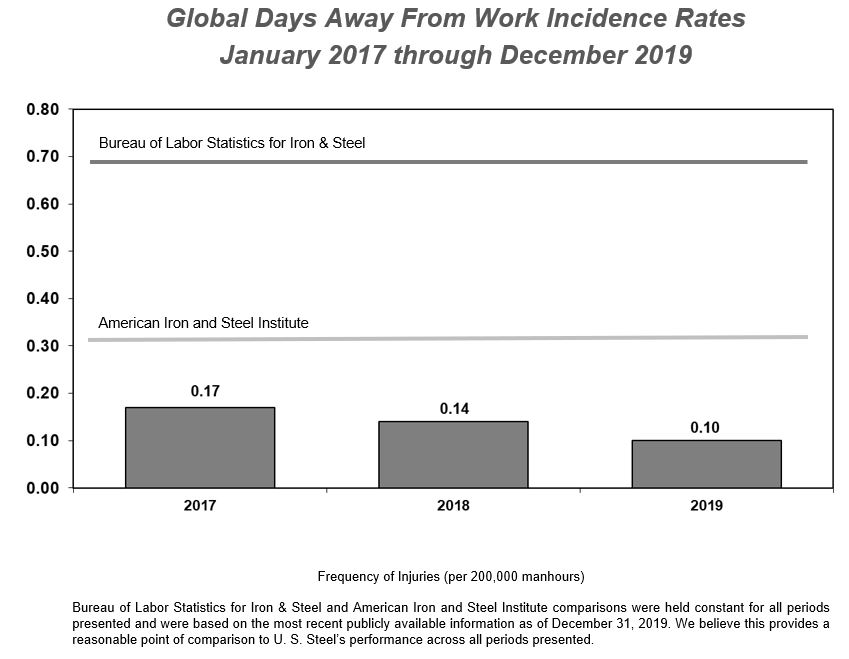

U. S. Steel finished 2019 with a Days Away From Work Rate of 0.10, which is 86% better than the Bureau of Labor Statistics for Iron & Steel rate of 0.70 and 68% better than American Iron and Steel Institute rate of 0.31. Notably, 0.10 is a new Company record that could not have been accomplished without the dedication of our employees and strong partnership with the United Steelworkers.

The three year performance for our key safety measure Days Away From Work rates are shown in the following graph.

25

Environmental Stewardship

U. S. Steel is committed to effective environmental stewardship. We have implemented and continue to develop business practices that are environmentally effective. We believe part of being a good corporate citizen requires a dedicated focus on how our industry affects the environment. U. S. Steel's environmental expenditures totaled $376 million in 2019, $350 million in 2018 and $255 million in 2017. Overall, environmental compliance expenditures represent approximately 2 percent of U. S. Steel’s total costs and expenses. For further information, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Environmental Matters.” We have taken the actions described below in furtherance of that goal.

We continue to work on the promotion of cost-effective environmental strategies through the development of appropriate air, water and waste laws and regulations at the local, state, national and international levels. We are committed to reducing our emissions and are investigating, creating and implementing innovative, best practice solutions throughout our operations to improve our environmental performance and to manage and reduce energy consumption.

In 2019 alone, U. S. Steel recycled 3.7 million tons of purchased and produced steel scrap. Because of steel’s physical properties, our products can be recycled at the end of their useful life without loss of quality, contributing to steel’s high recycling rate and affordability.

Many of our major production facilities have Environmental Management Systems that are certified to the ISO 14001 Standard. This standard, published by the International Organization for Standardization (ISO), provides the framework for the measurement and improvement of environmental impacts of the certified facility.

By using the blast furnace and coke oven gas generated in our cokemaking and steelmaking activities to power our facilities, we avoided consuming natural gas and other fuels from 2015 to 2019 to heat more than 3.6 million households each year. In 2019, we recycled approximately 4.5 million tons of blast furnace slag and 0.6 million tons of steel slag by selling it for use as aggregate and in highway construction.

Reduction of Greenhouse Gas Emissions

This year, U. S. Steel took another step in the execution of our strategy to become the “best of both” in the steel industry with the announcement of its commitment to reduce greenhouse gas emissions intensity across its global footprint. The Company has set a goal to reduce its global greenhouse gas emissions intensity by 20 percent, as measured by the rate of carbon dioxide (CO2) equivalents emitted per ton of finished steel shipped, by 2030 based on 2018 baseline levels. This target will apply to U. S. Steel’s global operations.

These reductions are equivalent to the amount of CO2 being generated by more than 850,000 average-sized homes each year. By creating targeted carbon reduction initiatives to accelerate our transformation toward a future of sustainable steel, we create value for all stakeholders.

U. S. Steel plans to achieve its greenhouse gas emissions intensity reduction goal through the execution of multiple initiatives. These include the use of EAF steelmaking technology at U. S. Steel’s Fairfield Works and at Big River Steel (once fully acquired by the Company), the first LEED-certified steel mill in the nation. EAF steelmaking relies on scrap recycling to produce new steel products, leveraging the ability to continuously recycle steel. Further carbon intensity reductions are expected to come from the Company’s introduction of state-of-the-art endless rolling and casting technology and construction of a cogeneration facility at its Mon Valley Works, as well as implementation of ongoing energy efficiency measures, continued use of renewable energy sources and other process improvements to be developed.

The carbon intensity reduction target reflects our continued commitment to improvement in production efficiency and the manufacture of products that are environmentally friendly. In addition to a commitment to reduce its own greenhouse gas emissions intensity, U. S. Steel is committed to helping its customers achieve their environmental goals. Our industry-leading XG3™ advanced high-strength steel enables automakers to manufacture lighter weight vehicles that meet federal Corporate Average Fuel Economy (CAFE) standards with reduced carbon emissions. As part of our innovation efforts, we continue to look at new steelmaking technologies including those that can further reduce carbon emissions as those technologies mature.

26

Business Strategy

Our strategy is to transform U. S. Steel into a world-competitive, “best of both” steel company. By bringing together the best of the integrated steelmaking model with the best of the mini mill steelmaking model, we will transform our business to drive long-term cash flow through industry cycles. We aim to offer an unparalleled product platform to serve customers, achieve world-competitive positioning in strategic, high-margin end markets, and deliver high-quality, value-added products and innovative solutions that address our customers' most challenging steel needs. To become a “best of both” company, we are enhancing our focus on operational and commercial excellence and promoting technological innovation, so we can establish a more competitive cost structure and enhance our capabilities … two key drivers for our strategy.

Foundational to our efforts is our belief that we must operate as a principled company committed to our S.T.E.E.L. Principles, outlined in our Code of Ethical Business Conduct. Our core value of safety - the safety of our employees, our environment, our communities and our facilities and equipment - has served us well for much of our history and our commitment to it remains as strong as the products we make every day.

Our strategy is informed by our critical success factors, which are the bedrock of the “best of both” strategy: (1) Move Down the Cost Curve, (2) Win in Strategic Markets, and (3) Move Up the Talent Curve.

We continuously aim to move down the cost curve. Leading up to 2019, we improved our balance sheet in order to increase investment in key assets, such as the Gary Works hot strip mill. These investments were made to reduce costs and increase capability. Our improved financial position has also enabled investment in strategic projects, such as the EAF at our Tubular Operations in Fairfield, Alabama. The EAF is expected to reduce cost by $90 per ton as the Company becomes self-sufficient in its rounds supply.

We are focused on winning in strategic markets through a customer-focused business model with an emphasis on creating differentiated, innovative and value-added solutions that will help our customers succeed. As part of this effort, in 2020 we implemented an enhanced operating model and organizational structure to accelerate the company’s strategic transformation and better serve its customers. The realignment of U. S. Steel’s leadership team around more nimble and efficient executive functions, notably to sharpen focus on operational and commercial excellence and promote technological innovation, will enable the company to establish a more competitive cost structure with enhanced capabilities to serve customers in strategic markets.

Core to our strategy is moving up the talent curve. The success of our business is driven by the efforts of our hard-working employees. We know that we must work to identify, attract and retain best-in-class diverse talent. Our goal is to build a pipeline mapping the right people to the right value-driving roles. This includes providing the training and resources they need to succeed and fostering a culture where accountability, fairness and respect are foundational, and high performance and diversity in all its forms are valued and celebrated. This type of environment incentivizes the right behavior and allows for a best talent wins environment to help us achieve our “best of both” strategy.

U. S. Steel will continue to evaluate potential strategic and organizational opportunities, which may include the acquisition, divestiture or consolidation of assets. Given the cyclicality of our industry, we are focused on strategically maintaining and spending cash, in order to invest in areas consistent with the execution of our "best of both" strategy, such as sustainable steel technologies, and are considering various possibilities, including exiting lines of business and the sale of certain assets, that we believe would ultimately result in greater stockholder value. The Company will pursue opportunities based on its long-term strategy, and what the Board of Directors determines to be in the best interests of the Company's stockholders at the time.

"Best of Both"

U. S. Steel is executing a transformational strategy to develop the “best of both” integrated and mini mill capabilities to improve competitiveness and drive through-cycle cash flow. Through a series of operational improvements, strategic investments and portfolio moves, to be completed over the next several years, U. S. Steel plans to execute a strategy focused on differentiating on the basis of cost and/or capability to improve customer focus and competitiveness and drive through-cycle cash flow generation. Execution of U. S. Steel’s strategy will position the Company with a suite of world-class assets with distinct advantages to serve current and future customers with high-tech, sustainable steel solutions. The strategy is focused on commercial differentiation, which the Company currently believes can be achieved by centering its North American Flat-Rolled operations around three core market-leading, differentiated and technologically advanced assets: the investment in Big River Steel (located in Osceola, Arkansas), Mon Valley Works

27

(located near Pittsburgh, Pennsylvania) and Gary Works (located in Gary, Indiana). This will enhance our competitive positioning in strategic end markets to offer customers differentiated products to deliver highly competitive long-term cash flow generation through higher earnings and lower sustaining capital expenditures.

Strategic Projects and Technology Investments

On October 31, 2019, the Company completed the first step in acquiring Big River Steel in Osceola, Arkansas, through the purchase of a 49.9% ownership interest at a purchase price of approximately $683 million in cash, with a call option to acquire the remaining 50.1% within the next four years at an agreed-upon price formula, which in years three and four is based on Big River Steel’s achievement of certain metrics that include: free cash flow, product development, safety and the completion of a proposed expansion of Big River Steel's existing manufacturing line. As part of the current ownership structure, the other Big River Steel equity owners can require U. S. Steel to purchase their 50.1% ownership interest or require U. S. Steel to sell its ownership interest after U. S. Steel's call option expires under certain circumstances.

In May 2019, U. S. Steel announced that it will construct a new endless casting and rolling facility at its Edgar Thomson Plant in Braddock, Pennsylvania, and a cogeneration facility at its Clairton Plant in Clairton, Pennsylvania, both part of the Company's Mon Valley Works. This investment in state-of-the-art sustainable steel technology is expected to significantly upgrade the production capability of our lowest liquid steel cost mill in the U.S., while further reducing conversion costs through improved process efficiencies, yield and energy consumption. Since announcement, the Company identified the potential need for additional equipment at the Edgar Thomson steel shop. The Company has amended the environmental permit applications to include a new ladle metallurgy facility (LMF). In addition, the expected capital costs of achieving the Company’s ambitious environmental targets from its future cogeneration facility have increased. The Company now expects the total investment for the new endless casting and rolling facility at its Edgar Thomson Plant and cogeneration facility at its Clairton Plant to be approximately $1.5 billion, with the expected incremental run-rate EBITDA benefits of approximately $275 million unchanged. The Company does not expect the increase in the expected cost of the new endless casting and rolling and cogeneration facilities to impact the Company’s total capital spending requirements, as lower return projects will be deprioritized from the Company’s total capital plans to offset this increase.

The installation of endless casting and rolling technology will allow differentiated product capabilities to serve strategic markets. With this technology the Mon Valley Works should become the principal source of substrate for the production of the Company's industry-leading XG3TM advanced high strength steel (AHSS), a market leading solution for our customers to improve fuel efficiency. The cogeneration facility, equipped with state-of-the-art emissions control systems at the Company's Clairton Plant, will convert a portion of the coke oven gas generated at its Clairton Plant into electricity to power the steelmaking and finishing facilities throughout U. S. Steel's Mon Valley operations. This project, in addition to producing sustainable AHSS, is expected to improve environmental performance, energy conservation and reduce our carbon footprint associated with Mon Valley Works. First steel production is expected in 2022, contingent upon permitting and construction.

In February 2019, U. S. Steel restarted construction of the EAF steelmaking facility at its Tubular operations in Fairfield, Alabama. The EAF is expected to strengthen our competitive position and reduce cost by $90 per ton as the Company becomes self-sufficient in its rounds supply. The EAF is expected to begin producing steel in the second half of 2020.

The Company expects to invest approximately $500 million, of which approximately 35 percent has already been spent, to upgrade the Gary Works hot strip mill through a series of projects focused on expanding the line's competitive advantages. The Gary Works hot strip mill will further differentiate itself as a leader in heavy-gauge products in strategic markets. We continue to be flexible as we execute the remaining investments at the Gary Works hot strip mill.

In January 2019, U. S. Steel announced the construction of a new Dynamo line at USSE. The new line, a $130 million investment, has an annual capacity of approximately 100,000 metric tons. Construction on the Dynamo line began in mid-2019 and was targeted to be operational in the fourth quarter of 2020, but based on the current market conditions the project operational date has been extended to the fourth quarter of 2022. Upon its completion, the new line will enable production of sophisticated silicon grades of non-grain oriented (NGO) electrical steels to support increased demand in vehicles and generators.

Commercial Strategy

Beginning January 1, 2020, the Company implemented an enhanced operating model and organizational structure to accelerate its strategic transformation and better serve its customers. The new operating model is centered around

28

manufacturing, commercial, and technological excellence. Our former “commercial entity” structure was put into place to deepen understanding of business ownership and our relationships with customers and allowed the Company to identify the technology that would differentiate our products and processes on the basis of cost and/or capabilities. The new enhanced operating model enables us to implement our "best of both" strategy faster by making us a more nimble technologically superior customer driven company positioned to deliver the benefits of our strategy through the business cycle.

Our commercial strategy is focused on providing customer focused solutions with value-added steel products, which includes advanced high strength steels such as our newly developed grades on Gen3 steel, coated sheets for the automotive and appliance industries, electrical steel sheets for the manufacture of motors and electrical equipment, both bare and prepainted galvanized and Galvalume® sheets for construction, hot rolled skelp used in the production of energy transmitting line pipe, heavy gauge-wide hot rolled coils, tin mill products for the packaging industry and pipe, connections, accessories and rig site services for use in drilling for oil and gas.

We are responsive to our customers' changing needs by developing new steel products and uses for steel that meet the evolving market and regulatory demands imposed on them. In connection with this commitment, we have research centers in Pittsburgh, Pennsylvania, and Košice, Slovakia, an automotive center in Troy, Michigan and a Research and Development Laboratory and Test Facility for Tubular products in Houston, Texas. The focus of these centers is to develop new products and to collaborate with our customers to better provide innovative solutions to serve their needs.

For automotive markets, we are in the process of commissioning our first of its kind GEN3 hot dipped galvanize line at our PRO-TEC Coating Company (PRO-TEC) joint venture, and have embedded application engineers at original equipment manufacturers to demonstrate how to best utilize the material in body design to meet automobile passenger safety requirements while significantly reducing weight to meet future vehicle fuel efficiency standards.

In our tubular markets, we continue development of premium and semi-premium tubular connections designed for our customers operating in challenging drilling environments. These connections optimize performance and provide outstanding sealing capabilities for onshore and offshore oil and gas drilling in North America. An example is the USS-FREEDOM HTQ™, which was introduced in 2019 for customers drilling deep, high-pressure horizontal onshore natural gas and oil wells requiring superior torque capacity. Please refer to Item I. Business Strategy for further details of related strategies.

Capital Structure and Liquidity

Our primary financial goal is to enhance stockholder value by utilizing our capital structure, liquidity, and financial flexibility to deploy cash to generate stockholder value. Our cash deployment strategy is aligned with our world-competitive, “best of both” strategy and includes: executing on strategic projects and portfolio moves; maintaining a strong balance sheet and a healthy pension plan; and delivering sustainable growth with a focus on core values such as safety and environmental stewardship. Cash deployment is also performed with a customer-centric focus on improving safety, quality, delivery and cost.

Our liquidity supports our ability to satisfy short-term obligations, fund working capital requirements, and provides a foundation to execute key strategic priorities including the acquisition of our 49.9% ownership interest in Big River Steel that was completed in October 2019, the ongoing investment in the EAF within our Tubular segment and the endless casting and rolling facility at Mon Valley Works.

We are focused on maintaining a strong balance sheet, and may proactively refinance or repay our debt from time to time to protect our capital structure from unforeseen external events and re-financing risks.

In 2019, we undertook several steps to support these goals. The Company entered into a new five-year senior secured asset-based revolving credit facility in an aggregate amount of $2.0 billion maturing in October 2024 (Fifth Credit Facility Agreement). We drew down $700 million on the Fifth Credit Facility Agreement to fund our acquisition of our 49.9% interest in Big River Steel and subsequently repaid $100 million of the amount drawn. In September 2019, USSK drew down €150 million (approximately $165 million) from its €460 million (approximately $517 million) revolving credit facility (USSK Credit Agreement), most of which was repatriated from USSK to its parent, U. S. Steel. USSK entered into a supplemental agreement that amended the USSK Credit Agreement leverage covenant and pledged certain USSK trade receivables and inventory as collateral in support of USSK’s obligations. The USSK Credit Agreement financial covenants also include a minimum stockholders’ equity to assets ratio. We also launched offerings

29

of two series of environmental revenue bonds in aggregate principal amount of approximately $368 million, that will mature between 2024 and 2049. Proceeds of the 2019 Environmental Revenue Bonds in the amount of approximately $93 million were used to redeem a portion of our existing outstanding environmental revenue bonds for which we issued a conditional redemption notice. Proceeds of the 2019 Environmental Revenue Bonds in the amount of $275 million will be used to finance or refinance the acquisition, construction, equipping and installation of certain solid waste disposal facilities, including an EAF and other equipment and facilities at the Company’s Fairfield Works. U. S. Steel issued an aggregate principal amount of $350 million of 5.00% Senior Convertible Notes due November 1, 2026 (2026 Senior Convertible Notes). U. S. Steel received net proceeds of approximately $340 million from the sale of the 2026 Senior Convertible Notes after deducting underwriting fees and offering expenses. The Company intends to use the net proceeds for general corporate purposes, including, without limitation, for previously announced strategic investments and capital expenditures.

Also, in 2019 we entered into a vendor supported Export Credit Agreement (ECA) with various financial institutions for the purpose of financing equipment for the Mon Valley Works endless casting and rolling line. The ECA will make available two loan facilities, a Covered Facility not to exceed approximately $250 million and a Commercial Facility not to exceed approximately $38 million. Funding of the ECA is expected to occur during the first quarter of 2020. See Note 17 to the Consolidated Financial Statements for further details.

We ended 2019 with $2.3 billion of total liquidity.

Steel Industry Background and Competition

The global steel industry is cyclical, highly competitive and has historically been characterized by overcapacity.

U. S. Steel's competitive position may be affected by, among other things, differences among U. S. Steel's and its competitors' cost structure, labor costs, environmental remediation and compliance costs, global capacity and the existence and magnitude of government subsidies provided to competitors.

U. S. Steel competes with many North American and international steel producers. Competitors include 1) integrated producers, which, like U. S. Steel, use iron ore and coke as the primary raw materials for steel production, 2) EAF producers, which primarily use steel scrap and other iron-bearing feedstocks as raw materials and 3) slab re-rollers, who purchase mostly imported semi-finished products and convert them into sheet products. Global steel capacity has continued to increase, with notable changes in 2018 Chinese crude steel production of 928 million metric tonnes, a 6.6% increase from 2017, and estimated to be more than 57 million metric tonnes above the apparent crude steel demand in China (source: worldsteel). In addition, other materials, such as aluminum, plastics and composites, compete with steel in several applications.

EAF producers typically require lower capital expenditures for construction of facilities and may have lower total employment costs; however, these competitive advantages may be minimized or eliminated by the cost of scrap when scrap prices are high. Some EAF producers utilize thin slab casting technology to produce flat-rolled products and are increasingly able to compete directly with integrated producers in many flat-rolled product applications previously produced only by integrated steelmakers. Slab re-rollers do not incur the cost of melting steel, their input costs are driven by the market price of slabs.

U. S. Steel provides defined benefit pension and/or other post-employment benefits to approximately 85,000 current employees, retirees and their beneficiaries. Many of our competitors do not have comparable retiree obligations. Participation in U. S. Steel's main defined benefit pension plan was closed to new entrants on July 1, 2003 and benefit accruals for all non-represented participants were frozen effective December 31, 2015. Participation in U. S. Steel’s retiree medical and life insurance programs for USW-represented employees were closed to employees hired or rehired (except in limited circumstances) on or after January 1, 2016. Retiree medical and life insurance benefits for non-represented employees were eliminated for those who retired after December 31, 2017.

We believe that our major North American and many European integrated steel competitors are confronted with substantially similar environmental regulatory conditions and therefore do not believe that our relative position with regard to such competitors will be materially affected by the impact of environmental laws and regulations. However, if future regulations do not recognize the fact that the integrated steel process involves a series of chemical reactions involving carbon that create carbon dioxide (CO2) emissions without linking these emissions to steel scrap as well, our competitive position relative to mini-mills will be adversely impacted. Our competitive position compared to producers in developing nations such as China, Russia, Ukraine, Turkey, Brazil and India, will be harmed unless such nations

30

require commensurate reductions in CO2 emissions or there are border adjustment tariffs for CO2. Competing materials such as plastics may not be similarly impacted. The specific impact on each competitor will vary depending on a number of factors, including the age and location of its operating facilities and its production methods. U. S. Steel is also responsible for remediation costs related to former and present operating locations and disposal of environmentally sensitive materials. Many of our competitors, including North American producers, or their successors, that have been the subject of bankruptcy relief have no or substantially lower liabilities for such environmental remediation matters.

International Trade

U. S. Steel continues to face import competition, much of which is unfairly traded, supported by foreign governments, and fueled by massive global steel overcapacity, currently estimated to be over 440 million metric tons per year. These imports, as well as the underlying policies/practices and overcapacity, impact the Company’s operational and financial performance. U. S. Steel continues to lead efforts to address these challenges that threaten the Company, our workers, our stockholders, and our country’s national and economic security.

As of the date of this filing, pursuant to a series of Presidential Proclamations issued in accordance with Section 232 of the Trade Expansion Act of 1962, U.S. imports of certain steel products are subject to a 25 percent tariff, except for imports from: (1) Argentina, Brazil, and South Korea, which are subject to restrictive quotas; (2) Canada and Mexico, which are not subject to either tariffs or quotas but tariffs could be re-imposed on surging product groups after consultations; and (3) Australia, which is not subject to tariffs, quotas, or an anti-surge mechanism. A January 24, 2020, Presidential Proclamation expanded the Section 232 tariffs to cover imports of certain downstream steel products from countries subject to the Section 232 tariffs, effective February 8, 2020.

The U.S. Department of Commerce (DOC) is managing a process in which U.S. companies may request and/or oppose temporary product exclusions from the Section 232 tariffs or quotas. Over 114,000 exclusions have been requested for steel products. U. S. Steel opposes exclusion requests for products that are the same as, or substitute products for, those produced by U. S. Steel.

Several legal challenges and retaliatory trade measures have been initiated in response to the Section 232 action. The American Institute for International Steel’s appeal of the March 2019 U.S. Court of International Trade (CIT) decision upholding the constitutionality of the Section 232 statute is pending before the U.S. Court of Appeals for the Federal Circuit (CAFC). There are currently six Section 232 challenges before the CIT. Multiple countries have challenged the Section 232 action at the World Trade Organization (WTO), imposed retaliatory tariffs, and/or acted to safeguard their domestic steel industries from increased steel imports. In turn, the United States has challenged the retaliation at the WTO.

Since its implementation in March 2018, the Section 232 action has supported the U.S. steel industry's and U. S. Steel’s investments in advanced steel capacity, technology, and skills, which strengthens our national and economic security. The Company continues to actively defend the Section 232 action through all available tools and strategies, including by highlighting these benefits and the importance of maintaining the Section 232 action.

In February 2019, the European Commission (EC) imposed a definitive tariff rate quota safeguard on certain steel imports: 25 percent tariffs on certain steel imports that exceed quotas effective through June 2021.

Antidumping (AD) and countervailing (CVD or antisubsidy) duties apply in addition to the Section 232 tariffs and quotas and the EC’s safeguard, and AD/CVD orders will last beyond the Section 232 action and EC’s safeguard. Thus, U. S. Steel continues to actively defend and maintain the 54 U.S. AD/CVD orders and 11 EU AD/CVD orders covering products U. S. Steel produces in multiple proceedings before the DOC, U.S. International Trade Commission (ITC), CIT, CAFC, the EC and European courts, and the WTO.

In July 2019, the ITC voted to continue the 2001 AD/CVD orders on hot-rolled steel from China, India, Indonesia, Taiwan, Thailand, and Ukraine for another five years in the third sunset review of those orders. In August 2019, DOC self-initiated circumvention investigations of imports of corrosion-resistant steel from Costa Rica, Guatemala, Malaysia, South Africa, and the United Arab Emirates made from Chinese or Taiwanese substrate. In December 2019, DOC announced final affirmative circumvention determinations on cold-rolled and corrosion-resistant imports from Vietnam made from Korean and/or Taiwanese substrate, resulting in AD/CVD rates of 3.7 to 456 percent on such imports.

Following the 2018 investigation under Section 301 of the Trade Act of 1974, the United States began imposing a 15 to 25 percent tariff on certain imports from China, including certain steel products. Following the U.S.-China “Phase

31

One” Trade Agreement, effective February 14, 2020, the 15 percent tariffs will decline to 7.5 percent and the 25 percent tariffs will remain pending the negotiation of Phase Two.

In October 2019, China blocked the continuation of the Global Forum on Steel Excess Capacity at the G-20. Over thirty other countries including the United States, however, have committed to continue the Global Forum’s work to reduce global steel overcapacity. The Organization for Economic Co-operation and Development Steel Committee and trilateral negotiations between the United States, EU, and Japan also continue to address global overcapacity.

U. S. Steel will continue to execute a broad, global strategy to maximize opportunities and navigate challenges presented by imports, global steel overcapacity, and international trade law and policy developments.

32

Facilities and Locations as of December 31, 2019

33

Flat-Rolled

The operating results of all facilities within U. S. Steel’s integrated steel plants in the U.S. are included in Flat-Rolled. These facilities include Gary Works, Great Lakes Works, Mon Valley Works and Granite City Works. The operating results of U. S. Steel’s coke and iron ore pellet operations and many equity investees in North America are also included in Flat-Rolled.

Gary Works, located in Gary, Indiana, has annual raw steel production capability of 7.5 million tons. Gary Works has four blast furnaces, six steelmaking vessels, a vacuum degassing unit and four slab casters. Finishing facilities include a hot strip mill, two pickling lines, two cold reduction mills, three temper mills, a double cold reduction line, four annealing facilities and two tin coating lines. Principal products include hot-rolled, cold-rolled and coated sheets and tin mill products. Gary Works also produces strip mill plate in coil. In June 2019, one of the blast furnaces at Gary Works was temporarily idled. We restarted the idled blast furnace in December 2019.

The Midwest Plant, located in Portage, Indiana, processes hot-rolled and cold-rolled bands and produces tin mill products, hot dip galvanized, cold-rolled and electrical lamination sheets. Midwest facilities include a pickling line, two cold reduction mills, two temper mills, a double cold reduction mill, two annealing facilities, two hot dip galvanizing lines, a tin coating line and a tin-free steel line.

East Chicago Tin is located in East Chicago, Indiana and produces tin mill products. Facilities include a pickling line, a cold reduction mill, two annealing facilities, a temper mill, a tin coating line and a tin-free steel line. In the fourth quarter of 2019, East Chicago Tin was indefinitely idled.

Great Lakes Works, located in Ecorse and River Rouge, Michigan, has annual raw steel production capability of 3.8 million tons. Great Lakes facilities include three blast furnaces, two steelmaking vessels, a vacuum degassing unit, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, three annealing facilities, a temper mill, a recoil and inspection line, two electrolytic galvanizing lines (one being the former Double Eagle Steel Coating Company's (DESCO) line) and a hot dip galvanizing line. Principal products include hot-rolled, cold-rolled and coated sheets. In June 2019, a blast furnace at Great Lakes Works was idled and in the fourth quarter of 2019, the former DESCO line was indefinitely idled. The other electrolytic galvanizing line had previously been idled. In December of 2019, U. S. Steel announced that it would indefinitely idle a significant portion of Great Lakes Works. The company expects to begin idling the iron and steelmaking facilities on or around April 1, 2020, and the Hot Strip Mill rolling facility before the end of 2020.

Mon Valley Works consists of the Edgar Thomson Plant, located in Braddock, Pennsylvania; the Irvin Plant, located in West Mifflin, Pennsylvania; the Fairless Plant, located in Fairless Hills, Pennsylvania; and the Clairton Plant, located in Clairton, Pennsylvania. Mon Valley Works has annual raw steel production capability of 2.9 million tons. Facilities at the Edgar Thomson Plant include two blast furnaces, two steelmaking vessels, a vacuum degassing unit and a slab caster. Irvin Plant facilities include a hot strip mill, two pickling lines, a cold reduction mill, three annealing facilities, a temper mill and two hot dip galvanizing lines. The Fairless Plant operates a hot dip galvanizing line. Principal products from Mon Valley Works include hot-rolled, cold-rolled and coated sheets, as well as coke and coke by-products produced at the Clairton Plant.

The Clairton Plant is comprised of ten coke batteries with an annual coke production capacity of 4.3 million tons. Almost all of the coke we produce is consumed by U. S. Steel facilities. From time to time, we may swap coke with other domestic steel producers or sell on the open market. Coke by-products are sold to the chemicals and raw materials industries.

Granite City Works, located in Granite City, Illinois, has annual raw steel production capability of 2.8 million tons. Granite City’s facilities includes two blast furnaces, two steelmaking vessels, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, a hot dip galvanizing line and a hot dip galvanizing/Galvalume® line. Principal products include hot-rolled and coated sheets. Gateway Energy and Coke Company LLC (Gateway) constructed a coke plant to supply Granite City Works with coke under a 15-year supply agreement that expires on December 31, 2024. U. S. Steel owns and operates a cogeneration facility that utilizes by-products from the Gateway coke plant to generate heat and power.

Fairfield Works, located in Fairfield, Alabama, consists of the #5 coating line.

34

U. S. Steel owns a Research and Technology Center located in Munhall, Pennsylvania, (near Pittsburgh) where we carry out a wide range of applied research, development and technical support functions.

U. S. Steel also owns an automotive technical center in Troy, Michigan. This facility brings automotive sales, service, distribution and logistics services, product technology and applications research into one location. Much of U. S. Steel’s work in developing new grades of steel to meet the demands of automakers for high-strength, light-weight and formable materials is carried out at this location.

U. S. Steel has iron ore pellet operations located at Mt. Iron (Minntac) and Keewatin (Keetac), Minnesota, with annual iron ore pellet production capability of 22.4 million tons. During 2019, 2018 and 2017, these operations produced 20.2 million, 21.8 million and 21.1 million tons of iron ore pellets, respectively.

Joint Ventures Within Flat-Rolled