LITHIA MOTORS INC000102312812-312023Q3falseP1Y00010231282023-01-012023-09-3000010231282023-10-27xbrli:shares00010231282023-09-30iso4217:USD00010231282022-12-310001023128lad:DebtExcludingNotesPayableMember2023-09-300001023128lad:DebtExcludingNotesPayableMember2022-12-310001023128us-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NotesPayableOtherPayablesMember2022-12-310001023128lad:NewVehicleRetailMember2023-07-012023-09-300001023128lad:NewVehicleRetailMember2022-07-012022-09-300001023128lad:NewVehicleRetailMember2023-01-012023-09-300001023128lad:NewVehicleRetailMember2022-01-012022-09-300001023128lad:UsedRetailVehicleMember2023-07-012023-09-300001023128lad:UsedRetailVehicleMember2022-07-012022-09-300001023128lad:UsedRetailVehicleMember2023-01-012023-09-300001023128lad:UsedRetailVehicleMember2022-01-012022-09-300001023128lad:UsedWholesaleVehicleMember2023-07-012023-09-300001023128lad:UsedWholesaleVehicleMember2022-07-012022-09-300001023128lad:UsedWholesaleVehicleMember2023-01-012023-09-300001023128lad:UsedWholesaleVehicleMember2022-01-012022-09-300001023128lad:FinanceAndInsuranceMember2023-07-012023-09-300001023128lad:FinanceAndInsuranceMember2022-07-012022-09-300001023128lad:FinanceAndInsuranceMember2023-01-012023-09-300001023128lad:FinanceAndInsuranceMember2022-01-012022-09-300001023128lad:ServiceBodyAndPartsMember2023-07-012023-09-300001023128lad:ServiceBodyAndPartsMember2022-07-012022-09-300001023128lad:ServiceBodyAndPartsMember2023-01-012023-09-300001023128lad:ServiceBodyAndPartsMember2022-01-012022-09-300001023128lad:FleetAndOtherMember2023-07-012023-09-300001023128lad:FleetAndOtherMember2022-07-012022-09-300001023128lad:FleetAndOtherMember2023-01-012023-09-300001023128lad:FleetAndOtherMember2022-01-012022-09-3000010231282023-07-012023-09-3000010231282022-07-012022-09-3000010231282022-01-012022-09-30iso4217:USDxbrli:shares00010231282023-06-3000010231282022-06-3000010231282021-12-310001023128us-gaap:CommonStockMember2023-06-300001023128us-gaap:CommonStockMember2022-06-300001023128us-gaap:CommonStockMember2022-12-310001023128us-gaap:CommonStockMember2021-12-310001023128us-gaap:CommonStockMember2023-07-012023-09-300001023128us-gaap:CommonStockMember2022-07-012022-09-300001023128us-gaap:CommonStockMember2023-01-012023-09-300001023128us-gaap:CommonStockMember2022-01-012022-09-300001023128us-gaap:CommonStockMember2023-09-300001023128us-gaap:CommonStockMember2022-09-300001023128us-gaap:AdditionalPaidInCapitalMember2023-06-300001023128us-gaap:AdditionalPaidInCapitalMember2022-06-300001023128us-gaap:AdditionalPaidInCapitalMember2022-12-310001023128us-gaap:AdditionalPaidInCapitalMember2021-12-310001023128us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001023128us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001023128us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001023128us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001023128us-gaap:AdditionalPaidInCapitalMember2023-09-300001023128us-gaap:AdditionalPaidInCapitalMember2022-09-300001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001023128us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001023128us-gaap:RetainedEarningsMember2023-06-300001023128us-gaap:RetainedEarningsMember2022-06-300001023128us-gaap:RetainedEarningsMember2022-12-310001023128us-gaap:RetainedEarningsMember2021-12-310001023128us-gaap:RetainedEarningsMember2023-07-012023-09-300001023128us-gaap:RetainedEarningsMember2022-07-012022-09-300001023128us-gaap:RetainedEarningsMember2023-01-012023-09-300001023128us-gaap:RetainedEarningsMember2022-01-012022-09-300001023128us-gaap:RetainedEarningsMember2023-09-300001023128us-gaap:RetainedEarningsMember2022-09-300001023128us-gaap:NoncontrollingInterestMember2023-06-300001023128us-gaap:NoncontrollingInterestMember2022-06-300001023128us-gaap:NoncontrollingInterestMember2022-12-310001023128us-gaap:NoncontrollingInterestMember2021-12-310001023128us-gaap:NoncontrollingInterestMember2023-07-012023-09-300001023128us-gaap:NoncontrollingInterestMember2022-07-012022-09-300001023128us-gaap:NoncontrollingInterestMember2023-01-012023-09-300001023128us-gaap:NoncontrollingInterestMember2022-01-012022-09-300001023128us-gaap:NoncontrollingInterestMember2023-09-300001023128us-gaap:NoncontrollingInterestMember2022-09-3000010231282022-09-300001023128lad:ContractsInTransitMember2023-09-300001023128lad:ContractsInTransitMember2022-12-310001023128us-gaap:TradeAccountsReceivableMember2023-09-300001023128us-gaap:TradeAccountsReceivableMember2022-12-310001023128lad:VehicleReceivablesMember2023-09-300001023128lad:VehicleReceivablesMember2022-12-310001023128lad:ManufacturerReceivablesMember2023-09-300001023128lad:ManufacturerReceivablesMember2022-12-310001023128lad:OtherCurrentReceivablesMember2023-09-300001023128lad:OtherCurrentReceivablesMember2022-12-310001023128lad:NewVehicleRetailMember2023-09-300001023128lad:NewVehicleRetailMember2022-12-310001023128lad:UsedVehicleMember2023-09-300001023128lad:UsedVehicleMember2022-12-310001023128lad:PartsAndAccessoriesMember2023-09-300001023128lad:PartsAndAccessoriesMember2022-12-310001023128lad:AutoLoanAndLeaseReceivablesMember2023-09-30xbrli:pure0001023128lad:AssetBackedTermFundingMember2023-09-300001023128lad:AssetBackedTermFundingMember2022-12-310001023128lad:WarehouseFacilitiesMember2023-09-300001023128lad:WarehouseFacilitiesMember2022-12-310001023128lad:OtherManagedReceivablesMember2023-09-300001023128lad:OtherManagedReceivablesMember2022-12-310001023128lad:FICOScoreLessThan599Memberus-gaap:AutomobileLoanMember2023-09-300001023128us-gaap:FicoScore600To699Memberus-gaap:AutomobileLoanMember2023-09-300001023128lad:FICOScore700To774Memberus-gaap:AutomobileLoanMember2023-09-300001023128lad:FICOScoreGreaterThan775Memberus-gaap:AutomobileLoanMember2023-09-300001023128us-gaap:AutomobileLoanMember2023-09-300001023128lad:OtherFinanceReceivablesMember2023-09-300001023128lad:FICOScoreLessThan599Memberus-gaap:AutomobileLoanMember2022-12-310001023128us-gaap:FicoScore600To699Memberus-gaap:AutomobileLoanMember2022-12-310001023128lad:FICOScore700To774Memberus-gaap:AutomobileLoanMember2022-12-310001023128lad:FICOScoreGreaterThan775Memberus-gaap:AutomobileLoanMember2022-12-310001023128us-gaap:AutomobileLoanMember2022-12-310001023128lad:OtherFinanceReceivablesMember2022-12-3100010231282023-06-122023-06-120001023128lad:VehicleOperationsMember2021-12-310001023128lad:FinancingOperationsMember2021-12-310001023128lad:VehicleOperationsMember2022-01-012022-12-310001023128lad:FinancingOperationsMember2022-01-012022-12-3100010231282022-01-012022-12-310001023128lad:VehicleOperationsMember2022-12-310001023128lad:FinancingOperationsMember2022-12-310001023128lad:VehicleOperationsMember2023-01-012023-09-300001023128lad:FinancingOperationsMember2023-01-012023-09-300001023128lad:VehicleOperationsMember2023-09-300001023128lad:FinancingOperationsMember2023-09-300001023128us-gaap:FranchiseRightsMember2021-12-310001023128us-gaap:FranchiseRightsMember2022-01-012022-12-310001023128us-gaap:FranchiseRightsMember2022-12-310001023128us-gaap:FranchiseRightsMember2023-01-012023-09-300001023128us-gaap:FranchiseRightsMember2023-09-30lad:option0001023128srt:MinimumMember2023-09-300001023128srt:MaximumMember2023-09-300001023128us-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-09lad:financialInstitutionlad:financeCompany0001023128lad:NewVehicleInventoryFloorplanFinancingMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-090001023128lad:UsedVehicleInventoryFloorplanFinancingMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-090001023128lad:ServiceLoanerVehicleFloorplanFinancingMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-090001023128us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-090001023128us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128lad:NewVehicleInventoryFloorplanFinancingMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128lad:UsedVehicleInventoryFloorplanFinancingMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:ServiceLoanerVehicleFloorplanFinancingMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-02-092023-02-090001023128lad:NewVehicleInventoryFloorplanFinancingMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-09-300001023128lad:UsedVehicleInventoryFloorplanFinancingMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-09-300001023128lad:ServiceLoanerVehicleFloorplanFinancingMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-09-300001023128us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberlad:SyndicatedCreditFacilityMember2023-09-300001023128lad:JPMWarehouseFacilityMember2023-07-200001023128lad:JPMWarehouseFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMemberus-gaap:LineOfCreditMember2023-07-202023-07-200001023128lad:JPMWarehouseFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMemberus-gaap:LineOfCreditMember2023-07-202023-07-200001023128lad:JPMWarehouseFacilityMember2023-09-300001023128lad:MizuhoWarehouseFacilityMember2023-07-200001023128us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlad:MizuhoWarehouseFacilityMemberus-gaap:LineOfCreditMember2023-07-202023-07-200001023128us-gaap:NonrecourseMemberus-gaap:CollateralizedAutoLoansMember2023-01-012023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20211ClassAMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20211ClassBMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20211ClassCMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:AutoReceivablesTrust20211ClassDMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20221ClassAMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20221ClassBMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20221ClassCMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20231ClassA1Memberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20231ClassA2Memberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:AutoReceivablesTrust20231ClassA3Member2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20231ClassBMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:AutoReceivablesTrust20231ClassCMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20231ClassDMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20232ClassA1Memberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20232ClassA2Memberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20232ClassA3Memberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20232ClassBMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20232ClassCMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:AutoReceivablesTrust20232ClassDMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:LADAutoReceivablesTrust20233ClassA1Member2023-09-300001023128us-gaap:NonrecourseMemberlad:LADAutoReceivablesTrust20233ClassA2Memberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:LADAutoReceivablesTrust20233ClassA3Memberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:LADAutoReceivablesTrust20233ClassA4Memberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMemberlad:LADAutoReceivablesTrust20233ClassBMember2023-09-300001023128us-gaap:NonrecourseMemberlad:LADAutoReceivablesTrust20233ClassCMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberlad:LADAutoReceivablesTrust20233ClassDMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:NonrecourseMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001023128us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001023128us-gaap:RestrictedStockUnitsRSUMember2023-09-300001023128lad:ShiftTechnologiesIncMember2023-07-012023-09-300001023128lad:ShiftTechnologiesIncMember2023-01-012023-09-300001023128lad:ShiftTechnologiesIncMember2022-07-012022-09-300001023128lad:ShiftTechnologiesIncMember2022-01-012022-09-300001023128us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:SeniorNotesMemberlad:SeniorNotesDue2027Member2023-09-300001023128us-gaap:SeniorNotesMemberlad:SeniorNotesDue2027Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Memberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:SeniorNotesMemberlad:SeniorNotesDue2027Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:SeniorNotesDue2027Memberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128lad:SeniorNotesDue2031Memberus-gaap:SeniorNotesMember2023-09-300001023128lad:SeniorNotesDue2031Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128lad:SeniorNotesDue2031Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128lad:SeniorNotesDue2031Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128lad:SeniorNotesDue2031Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128lad:SeniorNotesDue2031Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128lad:SeniorNotesDue2031Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128lad:SeniorNotesDue2031Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128lad:SeniorNotesDue2031Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2023-09-300001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128lad:SeniorNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:NonrecourseMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:NonrecourseMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:NonrecourseMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:NonrecourseMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:NonrecourseMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:NonrecourseMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:NonrecourseMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:NonrecourseMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128lad:RealEstateMortgagesAndOtherDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128us-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001023128lad:RealEstateMortgagesAndOtherDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128us-gaap:EstimateOfFairValueFairValueDisclosureMemberlad:RealEstateMortgagesAndOtherDebtMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001023128lad:A2023AcquisitionMember2023-01-012023-09-300001023128lad:A2023AcquisitionMember2023-09-30lad:segment0001023128us-gaap:OperatingSegmentsMemberlad:VehicleOperationsMember2023-07-012023-09-300001023128us-gaap:OperatingSegmentsMemberlad:VehicleOperationsMember2022-07-012022-09-300001023128us-gaap:OperatingSegmentsMemberlad:VehicleOperationsMember2023-01-012023-09-300001023128us-gaap:OperatingSegmentsMemberlad:VehicleOperationsMember2022-01-012022-09-300001023128us-gaap:OperatingSegmentsMember2023-07-012023-09-300001023128us-gaap:OperatingSegmentsMember2022-07-012022-09-300001023128us-gaap:OperatingSegmentsMember2023-01-012023-09-300001023128us-gaap:OperatingSegmentsMember2022-01-012022-09-300001023128lad:FinancingOperationsMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300001023128lad:FinancingOperationsMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300001023128lad:FinancingOperationsMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300001023128lad:FinancingOperationsMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300001023128lad:CorporateAndEliminationsMember2023-07-012023-09-300001023128lad:CorporateAndEliminationsMember2022-07-012022-09-300001023128lad:CorporateAndEliminationsMember2023-01-012023-09-300001023128lad:CorporateAndEliminationsMember2022-01-012022-09-300001023128us-gaap:MaterialReconcilingItemsMember2023-07-012023-09-300001023128us-gaap:MaterialReconcilingItemsMember2022-07-012022-09-300001023128us-gaap:MaterialReconcilingItemsMember2023-01-012023-09-300001023128us-gaap:MaterialReconcilingItemsMember2022-01-012022-09-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-Q

| | | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-14733

Lithia Motors, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Oregon | | 93-0572810 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 150 N. Bartlett Street | Medford, | Oregon | 97501 |

| (Address of principal executive offices) | (Zip Code) |

(541) 776-6401

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock without par value | | LAD | | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | Non-accelerated filer | Accelerated filer | Smaller reporting company | Emerging growth company |

| ☒ | ☐ | ☐ | ☐ | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 27, 2023, there were 27,519,538 shares of the registrant’s common stock outstanding.

LITHIA MOTORS, INC.

FORM 10-Q QUARTERLY REPORT

TABLE OF CONTENTS

| | | | | | | | |

| Item Number | Item | Page |

| PART I | FINANCIAL INFORMATION | |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | OTHER INFORMATION | |

| | |

| Item 1. | Legal Proceedings | |

| Item 1A. | | |

| Item 2. | | |

| Item 5. | Other Information | |

| Item 6. | | |

| | |

| SIGNATURE | | |

| | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEETS |

| (In millions; Unaudited) | September 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and restricted cash | $ | 256.2 | | | $ | 246.7 | |

Accounts receivable, net of allowance for doubtful accounts of $4.5 and $3.1 | 999.3 | | | 813.1 | |

| Inventories, net | 4,404.5 | | | 3,409.4 | |

| | | |

| Other current assets | 158.2 | | | 161.7 | |

| Total current assets | 5,818.2 | | | 4,630.9 | |

| | | |

Property and equipment, net of accumulated depreciation of $687.9 and $526.8 | 3,947.7 | | | 3,574.6 | |

| Operating lease right-of-use assets | 472.4 | | | 381.9 | |

Finance receivables, net of allowance for estimated losses of $103.0 and $69.3 | 3,102.1 | | | 2,187.6 | |

| Goodwill | 1,725.6 | | | 1,460.7 | |

| Franchise value | 2,147.7 | | | 1,856.2 | |

| Other non-current assets | 1,056.1 | | | 914.7 | |

| Total assets | $ | 18,269.8 | | | $ | 15,006.6 | |

| | | |

| Liabilities and equity | | | |

| Current liabilities: | | | |

| Floor plan notes payable | $ | 1,261.2 | | | $ | 627.2 | |

| Floor plan notes payable: non-trade | 1,863.4 | | | 1,489.4 | |

| Current maturities of long-term debt | 37.2 | | | 20.5 | |

| Current maturities of non-recourse notes payable | 34.0 | | | — | |

| Trade payables | 307.3 | | | 258.4 | |

| Accrued liabilities | 872.2 | | | 782.7 | |

| | | |

| Total current liabilities | 4,375.3 | | | 3,178.2 | |

| | | |

| Long-term debt, less current maturities | 5,152.8 | | | 5,088.3 | |

| Non-recourse notes payable, less current maturities | 1,435.9 | | | 422.2 | |

| Deferred revenue | 248.1 | | | 226.7 | |

| Deferred income taxes | 323.6 | | | 286.3 | |

| Non-current operating lease liabilities | 424.0 | | | 346.6 | |

| Other long-term liabilities | 243.3 | | | 207.2 | |

| Total liabilities | 12,203.0 | | | 9,755.5 | |

| | | |

| Redeemable non-controlling interest | 44.3 | | | 40.7 | |

| | | |

| Equity: | | | |

Preferred stock - no par value; authorized 15.0 shares; none outstanding | — | | | — | |

Common stock - no par value; authorized 125.0 shares; issued and outstanding 27.6 and 27.3 | 1,126.5 | | | 1,082.1 | |

| | | |

| Additional paid-in capital | 71.1 | | | 76.8 | |

Accumulated other comprehensive loss | (14.7) | | | (18.0) | |

| Retained earnings | 4,813.5 | | | 4,065.3 | |

| Total stockholders’ equity - Lithia Motors, Inc. | 5,996.4 | | | 5,206.2 | |

| Non-controlling interest | 26.1 | | | 4.2 | |

| Total equity | 6,022.5 | | | 5,210.4 | |

| Total liabilities, redeemable non-controlling interest and equity | $ | 18,269.8 | | | $ | 15,006.6 | |

See accompanying condensed notes to consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In millions, except per share amounts; Unaudited) | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

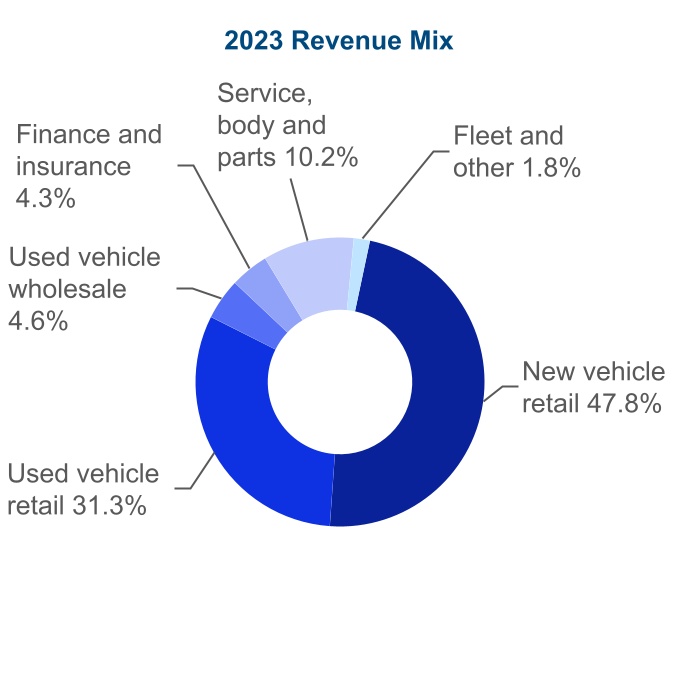

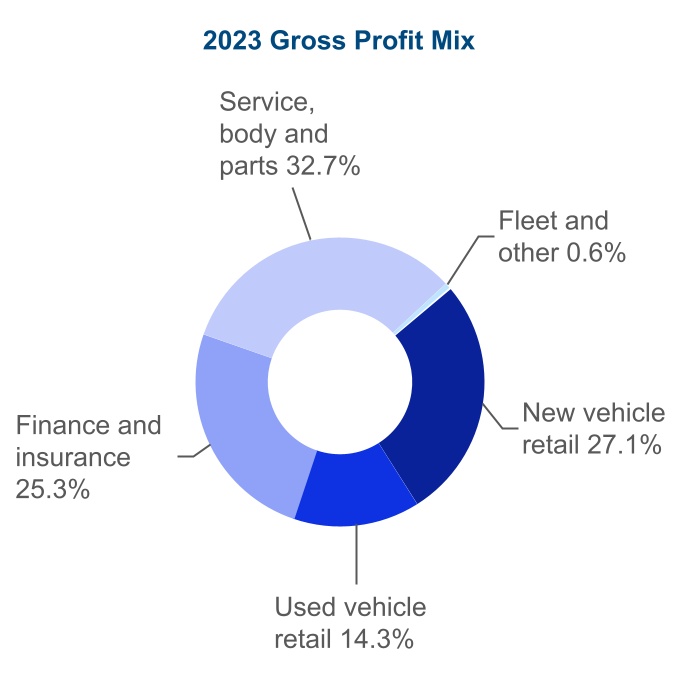

| New vehicle retail | $ | 3,885.8 | | | $ | 3,306.9 | | | $ | 11,179.5 | | | $ | 9,619.4 | |

| Used vehicle retail | 2,620.2 | | | 2,465.8 | | | 7,302.8 | | | 7,197.0 | |

| Used vehicle wholesale | 316.1 | | | 363.2 | | | 1,082.4 | | | 1,131.5 | |

| Finance and insurance | 349.4 | | | 333.3 | | | 1,005.6 | | | 977.0 | |

| Service, body and parts | 838.0 | | | 712.2 | | | 2,378.8 | | | 2,022.6 | |

| Fleet and other | 267.5 | | | 114.3 | | | 418.9 | | | 293.8 | |

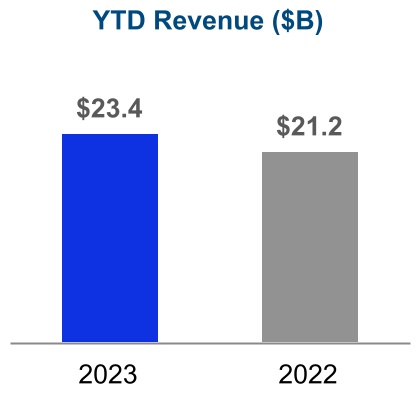

| Total revenues | 8,277.0 | | | 7,295.7 | | | 23,368.0 | | | 21,241.3 | |

| Cost of sales: | | | | | | | |

| New vehicle retail | 3,526.9 | | | 2,903.2 | | | 10,099.6 | | | 8,403.9 | |

| Used vehicle retail | 2,431.2 | | | 2,264.5 | | | 6,735.4 | | | 6,533.6 | |

| Used vehicle wholesale | 322.1 | | | 374.8 | | | 1,091.9 | | | 1,131.5 | |

| Service, body and parts | 375.2 | | | 328.0 | | | 1,077.7 | | | 945.9 | |

| Fleet and other | 250.3 | | | 111.0 | | | 395.2 | | | 283.1 | |

| Total cost of sales | 6,905.7 | | | 5,981.5 | | | 19,399.8 | | | 17,298.0 | |

| Gross profit | 1,371.3 | | | 1,314.2 | | | 3,968.2 | | | 3,943.3 | |

| | | | | | | |

| Financing operations (loss) income | (4.4) | | | (4.6) | | | (43.8) | | | 3.7 | |

| | | | | | | |

| | | | | | | |

| Selling, general and administrative | 850.8 | | | 754.2 | | | 2,458.1 | | | 2,291.3 | |

| Depreciation and amortization | 50.8 | | | 40.5 | | | 146.4 | | | 115.0 | |

| Operating income | 465.3 | | | 514.9 | | | 1,319.9 | | | 1,540.7 | |

| Floor plan interest expense | (40.2) | | | (10.7) | | | (102.6) | | | (19.4) | |

| Other interest expense, net | (58.5) | | | (36.3) | | | (141.5) | | | (90.8) | |

| Other income (expense), net | (5.3) | | | (12.2) | | | 6.8 | | | (36.6) | |

| Income before income taxes | 361.3 | | | 455.7 | | | 1,082.6 | | | 1,393.9 | |

| Income tax provision | (96.4) | | | (125.4) | | | (287.0) | | | (382.1) | |

| Net income | 264.9 | | | 330.3 | | | 795.6 | | | 1,011.8 | |

| Net (income) loss attributable to non-controlling interest | (2.1) | | | 0.5 | | | (4.7) | | | (3.9) | |

| Net income attributable to redeemable non-controlling interest | (1.3) | | | (1.2) | | | (3.6) | | | (4.5) | |

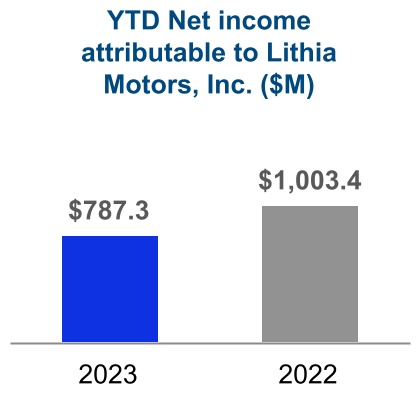

| Net income attributable to Lithia Motors, Inc. | $ | 261.5 | | | $ | 329.6 | | | $ | 787.3 | | | $ | 1,003.4 | |

| | | | | | | |

| Basic earnings per share attributable to Lithia Motors, Inc. | $ | 9.49 | | | $ | 11.97 | | | $ | 28.60 | | | $ | 35.23 | |

| Shares used in basic per share calculations | 27.6 | | | 27.5 | | | 27.5 | | | 28.5 | |

| | | | | | | |

| Diluted earnings per share attributable to Lithia Motors, Inc. | $ | 9.46 | | | $ | 11.92 | | | $ | 28.54 | | | $ | 35.10 | |

| Shares used in diluted per share calculations | 27.6 | | | 27.6 | | | 27.6 | | | 28.6 | |

| | | | | | | |

| Cash dividends paid per share | $ | 0.50 | | | $ | 0.42 | | | $ | 1.42 | | | $ | 1.19 | |

See accompanying condensed notes to consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In millions; Unaudited) | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 264.9 | | | $ | 330.3 | | | $ | 795.6 | | | $ | 1,011.8 | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Foreign currency translation adjustment | (25.9) | | | (16.4) | | | 3.3 | | | (20.3) | |

Gain on cash flow hedges, net of tax expense of none, none, none, and $(0.7), respectively | — | | | — | | | — | | | 1.8 | |

| Total other comprehensive income (loss), net of tax | (25.9) | | | (16.4) | | | 3.3 | | | (18.5) | |

| Comprehensive income | 239.0 | | | 313.9 | | | 798.9 | | | 993.3 | |

| | | | | | | |

| Comprehensive (income) loss attributable to non-controlling interest | (2.1) | | | 0.5 | | | (4.7) | | | (3.9) | |

Comprehensive income attributable to redeemable non-controlling interest | (1.3) | | | (1.2) | | | (3.6) | | | (4.5) | |

| Comprehensive income attributable to Lithia Motors, Inc. | $ | 235.6 | | | $ | 313.2 | | | $ | 790.6 | | | $ | 984.9 | |

See accompanying condensed notes to consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF EQUITY AND REDEEMABLE NON-CONTROLLING INTEREST |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In millions; Unaudited) | 2023 | | 2022 | | 2023 | | 2022 |

| Total equity, beginning balances | $ | 5,759.7 | | | $ | 4,698.0 | | | $ | 5,210.4 | | | $ | 4,629.2 | |

| | | | | | | |

| Common stock, beginning balances | 1,116.1 | | | 1,123.9 | | | 1,082.1 | | | 1,711.6 | |

| Stock-based compensation | 2.5 | | | 1.9 | | | 36.1 | | | 21.0 | |

| Issuance of stock in connection with employee stock purchase plans | 7.9 | | | 9.4 | | | 22.8 | | | 28.1 | |

| | | | | | | |

| | | | | | | |

| Repurchase of common stock | — | | | (28.1) | | | (14.5) | | | (653.6) | |

| | | | | | | |

| Common stock, ending balances | 1,126.5 | | | 1,107.1 | | | 1,126.5 | | | 1,107.1 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Additional paid-in capital, beginning balances | 62.5 | | | 62.2 | | | 76.8 | | | 58.3 | |

| Stock-based compensation | 8.6 | | | 6.8 | | | (5.7) | | | 10.7 | |

| | | | | | | |

| | | | | | | |

| Additional paid-in capital, ending balances | 71.1 | | | 69.0 | | | 71.1 | | | 69.0 | |

| | | | | | | |

| Accumulated other comprehensive (loss) income, beginning balances | 11.2 | | | (5.1) | | | (18.0) | | | (3.0) | |

| Foreign currency translation adjustment | (25.9) | | | (16.4) | | | 3.3 | | | (20.3) | |

Gain on cash flow hedges, net of tax expense of none, none, none, and $(0.7), respectively | — | | | — | | | — | | | 1.8 | |

| Accumulated other comprehensive loss, ending balances | (14.7) | | | (21.5) | | | (14.7) | | | (21.5) | |

| | | | | | | |

| Retained earnings, beginning balances | 4,565.8 | | | 3,510.8 | | | 4,065.3 | | | 2,859.5 | |

| | | | | | | |

| Net income attributable to Lithia Motors, Inc. | 261.5 | | | 329.6 | | | 787.3 | | | 1,003.4 | |

| Dividends paid | (13.8) | | | (11.3) | | | (39.1) | | | (33.8) | |

| | | | | | | |

| Retained earnings, ending balances | 4,813.5 | | | 3,829.1 | | | 4,813.5 | | | 3,829.1 | |

| | | | | | | |

| Non-controlling interest, beginning balances | 4.1 | | | 6.1 | | | 4.2 | | | 2.8 | |

| Contribution (distribution) of non-controlling interest | 19.9 | | | (1.6) | | | 17.2 | | | (2.7) | |

| Net income (loss) attributable to non-controlling interest | 2.1 | | | (0.5) | | | 4.7 | | | 3.9 | |

| Non-controlling interest, ending balances | 26.1 | | | 4.0 | | | 26.1 | | | 4.0 | |

| | | | | | | |

| Total equity, ending balances | $ | 6,022.5 | | | $ | 4,987.7 | | | $ | 6,022.5 | | | $ | 4,987.7 | |

| | | | | | | |

| Redeemable non-controlling interest, beginning balances | $ | 43.0 | | | $ | 39.8 | | | $ | 40.7 | | | $ | 34.0 | |

| Contribution (distribution) of redeemable non-controlling interest | — | | | (0.5) | | | — | | | 2.0 | |

| Net income attributable to redeemable non-controlling interest | 1.3 | | | 1.2 | | | 3.6 | | | 4.5 | |

| Redeemable non-controlling interest, ending balances | $ | 44.3 | | | $ | 40.5 | | | $ | 44.3 | | | $ | 40.5 | |

See accompanying condensed notes to consolidated financial statements.

| | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| | Nine Months Ended September 30, |

| (In millions; Unaudited) | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 795.6 | | | $ | 1,011.8 | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | |

| | | |

| Depreciation and amortization | 154.9 | | | 122.1 | |

| Stock-based compensation | 30.4 | | | 31.7 | |

| | | |

| Loss (gain) on disposal of other assets | 0.1 | | | (0.4) | |

| Gain on disposal of franchise | (31.4) | | | (49.6) | |

| Unrealized investment (gain) loss | (0.1) | | | 32.6 | |

| Deferred income taxes | 47.2 | | | 63.5 | |

| Amortization of operating lease right-of-use assets | 49.1 | | | 37.6 | |

| (Increase) decrease (net of acquisitions and dispositions): | | | |

| Accounts receivable, net | (110.6) | | | (54.0) | |

| Inventories | (498.2) | | | (852.4) | |

| Finance receivables | (907.0) | | | (946.7) | |

| Other assets | 5.8 | | | (85.8) | |

| Increase (decrease) (net of acquisitions and dispositions): | | | |

| Floor plan notes payable | 292.0 | | | 101.1 | |

| Trade payables | (34.1) | | | 9.3 | |

| Accrued liabilities | 9.7 | | | 19.1 | |

| Other long-term liabilities and deferred revenue | 19.4 | | | 42.6 | |

| Net cash used in operating activities | (177.2) | | | (517.5) | |

| Cash flows from investing activities: | | | |

| | | |

| | | |

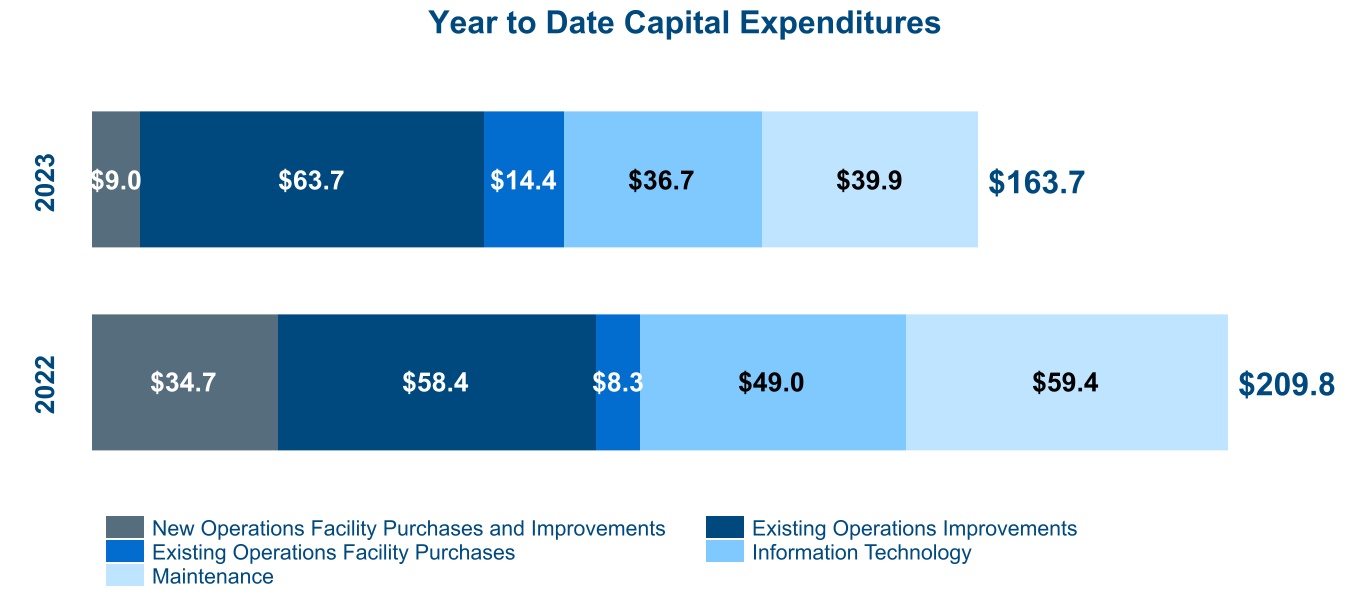

| Capital expenditures | (163.7) | | | (209.8) | |

| Proceeds from sales of assets | 3.1 | | | 16.4 | |

| Cash paid for other investments | (11.1) | | | (9.3) | |

| Cash paid for acquisitions, net of cash acquired | (1,204.7) | | | (962.6) | |

| Proceeds from sales of stores | 136.1 | | | 148.0 | |

| Net cash used in investing activities | (1,240.3) | | | (1,017.3) | |

| Cash flows from financing activities: | | | |

| Borrowings on floor plan notes payable, net: non-trade | 426.7 | | | 429.6 | |

| Borrowings on lines of credit | 9,625.1 | | | 9,178.4 | |

| Repayments on lines of credit | (9,681.0) | | | (7,430.0) | |

| Principal payments on long-term debt and finance lease liabilities, scheduled | (26.2) | | | (42.4) | |

| Principal payments on long-term debt and finance lease liabilities, other | (3.4) | | | (70.0) | |

| Proceeds from issuance of long-term debt | 79.8 | | | 39.6 | |

| Principal payments on non-recourse notes payable | (404.0) | | | (138.7) | |

| Proceeds from issuance of non-recourse notes payable | 1,451.7 | | | 298.2 | |

| Payment of debt issuance costs | (14.3) | | | (4.7) | |

| Proceeds from issuance of common stock | 23.0 | | | 28.1 | |

| Repurchase of common stock | (14.5) | | | (644.4) | |

| Dividends paid | (39.1) | | | (33.8) | |

| Payment of contingent consideration related to acquisitions | (14.0) | | | (7.2) | |

| Other financing activity | 17.2 | | | (2.7) | |

| Net cash provided by financing activities | 1,427.0 | | | 1,600.0 | |

| Effect of exchange rate changes on cash and restricted cash | 5.7 | | | (3.3) | |

Increase in cash and restricted cash | 15.2 | | | 61.9 | |

| Cash and restricted cash at beginning of year | 271.5 | | | 178.4 | |

| Cash and restricted cash at end of period | $ | 286.7 | | | $ | 240.3 | |

See accompanying condensed notes to consolidated financial statements.

| | | | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION |

| Nine Months Ended September 30, |

| (In millions) | 2023 | | 2022 |

| Reconciliation of cash and restricted cash to the consolidated balance sheets |

| Cash | $ | 146.9 | | | $ | 172.7 | |

| Restricted cash from collections on auto loans receivable and customer deposits | 109.3 | | | 60.3 | |

| Cash and restricted cash | 256.2 | | | 233.0 | |

| Restricted cash on deposit in reserve accounts, included in other non-current assets | 30.5 | | | 7.3 | |

| Total cash and restricted cash reported in the Consolidated Statements of Cash Flows | $ | 286.7 | | | $ | 240.3 | |

| | | |

| Supplemental cash flow information: | | | |

| Cash paid during the period for interest | $ | 359.3 | | | $ | 122.2 | |

| Cash paid during the period for income taxes, net | 203.5 | | | 380.0 | |

| Debt paid in connection with store disposals | 13.2 | | | 23.6 | |

| | | |

| Non-cash activities: | | | |

| | | |

| | | |

| Contingent consideration in connection with acquisitions | $ | 7.3 | | | $ | 21.7 | |

| Debt assumed in connection with acquisitions | 401.6 | | | 0.7 | |

| Acquisition of finance leases in connection with acquisitions | 45.0 | | | 78.2 | |

| | | |

| Right-of-use assets obtained in exchange for lease liabilities | 139.1 | | | 22.3 | |

| Unsettled repurchases of common stock | — | | | 9.2 | |

See accompanying condensed notes to consolidated financial statements.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. INTERIM FINANCIAL STATEMENTS

Basis of Presentation

These condensed Consolidated Financial Statements contain unaudited information as of September 30, 2023, and for the three and nine months ended September 30, 2023 and 2022. The unaudited interim financial statements have been prepared pursuant to the rules and regulations for reporting on Form 10-Q. Accordingly, certain disclosures required by accounting principles generally accepted in the United States of America for annual financial statements are not included herein. In management’s opinion, these unaudited financial statements reflect all adjustments (which include only normal recurring adjustments) necessary for a fair presentation of the information when read in conjunction with our 2022 audited Consolidated Financial Statements and the related notes thereto. The financial information as of December 31, 2022, is derived from our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 24, 2023. The results of operations for the interim periods presented are not necessarily indicative of the results to be expected for the full year.

Reclassifications

Certain reclassifications of amounts previously reported have been made to the accompanying Consolidated Financial Statements to maintain consistency and comparability between periods presented. We reclassified certain components within our Consolidated Statements of Cash Flows to present activity associated with Finance Receivables and Non-Recourse Notes Payable. We also reclassified components of our Consolidated Statements of Operations to present Finance Operations Income, and to change our presentation of segment reporting.

NOTE 2. ACCOUNTS RECEIVABLE

Accounts receivable consisted of the following:

| | | | | | | | | | | |

| (in millions) | September 30, 2023 | | December 31, 2022 |

| Contracts in transit | $ | 458.8 | | | $ | 432.5 | |

| Trade receivables | 156.3 | | | 122.6 | |

| Vehicle receivables | 170.3 | | | 105.4 | |

| Manufacturer receivables | 207.8 | | | 151.9 | |

| Other receivables, current | 10.6 | | | 3.8 | |

| | 1,003.8 | | | 816.2 | |

| Less: Allowance for doubtful accounts | (4.5) | | | (3.1) | |

| Total accounts receivable, net | $ | 999.3 | | | $ | 813.1 | |

The long-term portions of accounts receivable and allowance for doubtful accounts were included as a component of other non-current assets in the Consolidated Balance Sheets.

NOTE 3. INVENTORIES AND FLOOR PLAN NOTES PAYABLE

The components of inventories, net, consisted of the following:

| | | | | | | | | | | | | | |

| (in millions) | | September 30, 2023 | | December 31, 2022 |

| New vehicles | | $ | 2,457.3 | | | $ | 1,679.8 | |

| Used vehicles | | 1,724.2 | | | 1,529.3 | |

| Parts and accessories | | 223.0 | | | 200.3 | |

| Total inventories | | $ | 4,404.5 | | | $ | 3,409.4 | |

The new vehicle inventory cost is generally reduced by manufacturer holdbacks and incentives, while the related floor plan notes payable are reflective of the gross cost of the vehicle.

| | | | | | | | | | | | | | |

| (in millions) | | September 30, 2023 | | December 31, 2022 |

| Floor plan notes payable: non-trade | | $ | 1,863.4 | | | $ | 1,489.4 | |

| Floor plan notes payable | | 1,261.2 | | | 627.2 | |

| Total floor plan debt | | $ | 3,124.6 | | | $ | 2,116.6 | |

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 7 |

NOTE 4. FINANCE RECEIVABLES

Interest income on finance receivables is recognized based on the contractual terms of each loan and is accrued until repayment, reaching non-accrual status, charge-off, or repossession. Direct costs associated with loan originations are capitalized and expensed as an offset to interest income when recognized on the loans.

The balances of finance receivables are made up of loans and leases secured by the related vehicles. More than 99% of the portfolio is aged less than 60 days past due with less than 1% on non-accrual status.

Finance Receivables, net

| | | | | | | | | | | |

| (in millions) | September 30, 2023 | | December 31, 2022 |

| Asset-backed term funding | $ | 1,840.2 | | | $ | 482.1 | |

| Warehouse facilities | 861.5 | | | 1,383.9 | |

| Other managed receivables | 503.4 | | | 390.9 | |

| Total finance receivables | 3,205.1 | | | 2,256.9 | |

| Less: Allowance for finance receivable losses | (103.0) | | | (69.3) | |

| Finance receivables, net | $ | 3,102.1 | | | $ | 2,187.6 | |

Finance Receivables by FICO Score

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2023 |

| Year of Origination |

| ($ in millions) | 2023 | | 2022 | | 2021 | | 2020 | | | | | | Total |

<599 | $ | 53.4 | | | $ | 45.3 | | | $ | 20.4 | | | $ | 3.0 | | | | | | | $ | 122.1 | |

| 600-699 | 491.0 | | | 508.2 | | | 171.8 | | | 18.3 | | | | | | | 1,189.3 | |

| 700-774 | 472.6 | | | 459.7 | | | 71.3 | | | 6.6 | | | | | | | 1,010.2 | |

| 775+ | 404.3 | | | 285.9 | | | 16.2 | | | 3.1 | | | | | | | 709.5 | |

| Total auto loan receivables | $ | 1,421.3 | | | $ | 1,299.1 | | | $ | 279.7 | | | $ | 31.0 | | | | | | | 3,031.1 | |

Other finance receivables 1 | | | | | | | | | | | | | 174.0 | |

| Total finance receivables | | | | | | | | | | | | | $ | 3,205.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2022 |

| Year of Origination |

| ($ in millions) | 2022 | | 2021 | | 2020 | | | | | | | | Total |

<599 | $ | 63.0 | | | $ | 30.3 | | | $ | 4.8 | | | | | | | | | $ | 98.1 | |

| 600-699 | 652.6 | | | 243.4 | | | 27.2 | | | | | | | | | 923.2 | |

| 700-774 | 575.9 | | | 97.9 | | | 10.0 | | | | | | | | | 683.8 | |

| 775+ | 369.5 | | | 21.5 | | | 4.5 | | | | | | | | | 395.5 | |

| Total auto loan receivables | $ | 1,661.0 | | | $ | 393.1 | | | 46.5 | | | | | | | | | 2,100.6 | |

Other finance receivables 1 | | | | | | | | | | | | | 156.3 | |

| Total finance receivables | | | | | | | | | | | | | $ | 2,256.9 | |

1Includes legacy portfolio, loans that are originated with no FICO score available, and lease receivables.

In accordance with Topic 326, the allowance for loan and lease losses is estimated based on our historical write-off experience, current conditions and forecasts, as well as the value of any underlying assets securing these loans. Consideration is given to recent delinquency trends and recovery rates. Account balances are charged against the allowance upon reaching 120 days past due status.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 8 |

Rollforward of Allowance for Loan and Lease Losses

Our allowance for loan and lease losses represents the net credit losses expected over the remaining contractual life of our managed receivables. The allowances for credit losses related to finance receivables consisted of the following changes during the period:

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| (in millions) | 2023 | | 2022 |

| Allowance at beginning of period | $ | 69.3 | | | $ | 25.0 | |

| Charge-offs | (79.1) | | | (36.3) | |

| Recoveries | 35.5 | | | 12.2 | |

| Initial allowance for purchased credit-deteriorated loans | 2.3 | | | — | |

| Provision expense | 75.0 | | | 51.5 | |

| Allowance at end of period | $ | 103.0 | | | $ | 52.4 | |

Charge-off Activity by Year of Origination

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| (in millions) | 2023 | | 2022 |

| 2023 | $ | 5.0 | | | $ | — | |

| 2022 | 47.1 | | | 5.7 | |

| 2021 | 23.0 | | | 24.1 | |

| 2020 | 2.3 | | | 3.5 | |

Other finance receivables 1 | 1.7 | | | 3.0 | |

| Total charge-offs | $ | 79.1 | | | $ | 36.3 | |

1Includes legacy portfolio, loans that are originated with no FICO score available, and lease receivables.

Purchased Financial Assets with Credit Deterioration

As part of our acquisition of Priority Auto Group on June 12, 2023, we purchased certain auto loan receivables for which there was evidence of more than insignificant deterioration of credit quality since origination (purchased credit-deteriorated or “PCD” assets). The following is a reconciliation of the difference between the purchase price paid by us for the financial assets and the par value (outstanding principal balance) of the assets on the date we acquired the portfolio:

| | | | | |

| Purchase price of PCD loans at acquisition | $ | 8.0 | |

| Initial allowance for credit losses of PCD loans at acquisition | 2.3 | |

| Noncredit premium of PCD loans at acquisition | (1.2) | |

| Par value of acquired PCD loans at acquisition | $ | 9.1 | |

NOTE 5. GOODWILL AND FRANCHISE VALUE

The changes in the carrying amounts of goodwill are as follows:

| | | | | | | | | | | | | | | | | | | |

| (in millions) | Vehicle Operations | | Financing Operations | | | | Consolidated |

| Balance as of December 31, 2021 | $ | 977.3 | | | $ | — | | | | | $ | 977.3 | |

| | | | | | | |

Additions through acquisitions 1 | 483.4 | | | 17.0 | | | | | 500.4 | |

| Reductions through divestitures | (17.9) | | | — | | | | | (17.9) | |

| | | | | | | |

| Currency translation | 0.7 | | | 0.2 | | | | | 0.9 | |

| Balance as of December 31, 2022 | 1,443.5 | | | 17.2 | | | | | 1,460.7 | |

| | | | | | | |

Additions through acquisitions 2 | 315.0 | | | — | | | | | 315.0 | |

| Reductions through divestitures | (49.9) | | | — | | | | | (49.9) | |

| | | | | | | |

| Currency translation | (0.2) | | | — | | | | | (0.2) | |

| Balance as of September 30, 2023 | $ | 1,708.4 | | | $ | 17.2 | | | | | $ | 1,725.6 | |

1Our purchase price allocation for the 2021 acquisitions were finalized in 2022. As a result, we added $500.4 million of goodwill.

2Our purchase price allocation for a portion of the 2022 acquisitions were finalized in 2023. As a result, we added $315.0 million of goodwill. Our purchase price allocation for the remaining 2022 and 2023 acquisitions are preliminary and goodwill is not yet allocated to our segments. These amounts are included in other non-current assets until we finalize our purchase accounting. See Note 11 – Acquisitions.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 9 |

The changes in the carrying amounts of franchise value are as follows:

| | | | | |

| (in millions) | Franchise Value |

| Balance as of December 31, 2021 | $ | 799.1 | |

| |

Additions through acquisitions 1 | 1,088.4 | |

| Reductions through divestitures | (33.6) | |

| |

| Currency translation | 2.3 | |

| Balance as of December 31, 2022 | 1,856.2 | |

| |

Additions through acquisitions 2 | 305.8 | |

| Reductions through divestitures | (13.8) | |

| |

| Currency translation | (0.5) | |

| Balance as of September 30, 2023 | $ | 2,147.7 | |

1Our purchase price allocation for the 2021 acquisitions were finalized in 2022. As a result, we added $1.1 billion of franchise value.

2Our purchase price allocations for a portion of the 2022 acquisitions were finalized in 2023. As a result, we added $305.8 million of franchise value. Our purchase price allocation for the remaining 2022 and 2023 acquisitions are preliminary and franchise value is not yet allocated to our reporting units. These amounts are included in other non-current assets until we finalize our purchase accounting. See Note 11 – Acquisitions.

NOTE 6. NET INVESTMENT IN OPERATING LEASES

Net investment in operating leases consists primarily of lease contracts for vehicles with individuals and business entities. Assets subject to operating leases are depreciated using the straight-line method over the term of the lease to reduce the asset to its estimated residual value. Estimated residual values are based on assumptions for used vehicle prices at lease termination and the number of vehicles that are expected to be returned.

Net investment in operating leases was as follows:

| | | | | | | | | | | |

| (in millions) | September 30, 2023 | | December 31, 2022 |

Vehicles, at cost 1 | $ | 99.7 | | | $ | 92.2 | |

Accumulated depreciation 1 | (10.2) | | | (7.6) | |

| Net investment in operating leases | $ | 89.5 | | | $ | 84.6 | |

1Vehicles, at cost and accumulated depreciation are recorded in other current assets on the Consolidated Balance Sheets.

NOTE 7. COMMITMENTS AND CONTINGENCIES

Contract Liabilities

We are the obligor on our lifetime oil contracts. Revenue is allocated to these performance obligations and is recognized over time as services are provided to the customer. The amount of revenue recognized is calculated, net of cancellations, using an input method, which most closely depicts performance of the contracts. Our contract liability balances were $309.9 million and $284.3 million as of September 30, 2023, and December 31, 2022, respectively; and we recognized $13.2 million and $42.2 million of revenue in the three and nine months ended September 30, 2023 related to our contract liability balance at December 31, 2022. Our contract liability balance is included in accrued liabilities and deferred revenue.

Leases

We lease certain dealerships, office space, land and equipment. Leases with an initial term of 12 months or less are not recorded on the balance sheet. We recognize lease expense for these leases on a straight-line basis over the lease term. We have elected not to bifurcate lease and non-lease components related to leases of real property.

Most leases include one or more options to renew, with renewal terms that can extend the lease term from one to 24 years or more. The exercise of lease renewal options is at our sole discretion. Certain leases also include options to purchase the leased property. The depreciable life of assets and leasehold improvements are limited by the expected lease term, unless there is a transfer of title or purchase option reasonably certain of exercise.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 10 |

Certain of our lease agreements include rental payments based on a percentage of retail sales over contractual levels and others include rental payments adjusted periodically for inflation. Our lease agreements do not contain any material residual value guarantees or material restrictive covenants.

Our finance lease liabilities are included in long-term debt, with the current portion included in current maturities of long-term debt. The related assets are included in property, plant and equipment, net of accumulated amortization.

We rent or sublease certain real estate to third parties.

Litigation

We are party to numerous legal proceedings arising in the normal course of our business. Although we do not anticipate that the resolution of legal proceedings arising in the normal course of business will have a material adverse effect on our business, results of operations, financial condition, or cash flows, we cannot predict this with certainty.

NOTE 8. DEBT

Credit Facilities

US Bank Syndicated Credit Facility

On February 9, 2023, we amended our existing syndicated credit facility (USB credit facility), comprised of 20 financial institutions, including eight manufacturer-affiliated finance companies, maturing April 29, 2026.

This USB credit facility provides for a total financing commitment of $4.5 billion, which may be further expanded, subject to lender approval and the satisfaction of other conditions, up to a total of $5.5 billion. The allocation of the financing commitment is for up to $1.95 billion in new vehicle inventory floorplan financing, up to $800 million in used vehicle inventory floorplan financing, up to $50 million in service loaner vehicle floorplan financing, and up to $1.70 billion in revolving financing for general corporate purposes, including acquisitions and working capital. We have the option to reallocate the commitments under this USB credit facility, provided that the aggregate revolving loan commitment may not be more than 40% of the amount of the aggregate commitment, and the aggregate service loaner vehicle floorplan commitment may not be more than the 3% of the amount of the aggregate commitment. All borrowings from, and repayments to, our lending group are presented in the Consolidated Statements of Cash Flows as financing activities.

Our obligations under our USB credit facility are secured by a substantial amount of our assets, including our inventory (including new and used vehicles, parts and accessories), equipment, accounts receivable (and other rights to payment) and our equity interests in certain of our subsidiaries. Under our USB credit facility, our obligations relating to new vehicle floor plan loans are secured only by collateral owned by Lithia and its dealerships borrowing under the new vehicle floor plan portion of the USB credit facility.

The interest rate on the USB credit facility varies based on the type of debt, with the rate of one-day SOFR plus a credit spread adjustment of 0.10% plus a margin of 1.10% for new vehicle floor plan financing, 1.40% for used vehicle floor plan financing, 1.20% for service loaner floor plan financing, and a variable interest rate on the revolving financing ranging from 1.00% to 2.00% depending on our leverage ratio. The annual interest rates associated with our floor plan commitments are as follows:

| | | | | |

| Commitment | Annual Interest Rate at September 30, 2023 |

| New vehicle floor plan | 6.51% |

| Used vehicle floor plan | 6.81% |

| Service loaner floor plan | 6.61% |

| Revolving line of credit | 6.41% |

JPM Warehouse Facility

On July 20, 2023, we amended our securitization facility for our auto loan portfolio (JPM warehouse facility) with JPMorgan Chase Bank, as administrative agent and account bank, providing initial commitments for borrowings of up to $1.0 billion. The JPM warehouse facility matures on July 18, 2025. The interest rate on the JPM warehouse facility varies based on the Daily Simple SOFR rate plus 1.15% to 1.95%. As of September 30, 2023, we had $375.0 million drawn on the JPM warehouse facility.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 11 |

Mizuho Warehouse Facility

On July 20, 2023, we amended our securitization facility for our auto loan portfolio (Mizuho warehouse facility), with Mizuho Bank Ltd. as administrative agent and account bank, providing initial commitments for borrowings of up to $750 million. The Mizuho warehouse facility matures on July 20, 2026. The interest rate on the Mizuho warehouse facility varies based on the Daily Simple SOFR rate plus 1.20%. As of September 30, 2023, we had $210 million drawn on the Mizuho warehouse facility.

Non-Recourse Notes Payable

In 2023, we issued approximately $1.5 billion in non-recourse notes payable related to asset-backed term funding transactions. Below is a summary of outstanding non-recourse notes payable issued:

| | | | | | | | | | | | | | | | | |

| ($ in millions) | Balance as of September 30, 2023 | Initial Principal Amount | Issuance Date | Interest Rate | Final Distribution Date |

| LAD Auto Receivables Trust 2021-1 Class A | 52.6 | | $ | 282.8 | | 11/24/21 | 1.300% | 08/17/26 |

| LAD Auto Receivables Trust 2021-1 Class B | 18.3 | | 18.3 | | 11/24/21 | 1.940% | 11/16/26 |

| LAD Auto Receivables Trust 2021-1 Class C | 26.0 | | 26.0 | | 11/24/21 | 2.350% | 04/15/27 |

| LAD Auto Receivables Trust 2021-1 Class D | 17.2 | | 17.2 | | 11/24/21 | 3.990% | 11/15/29 |

| LAD Auto Receivables Trust 2022-1 Class A | 132.7 | | 259.7 | | 08/17/22 | 5.210% | 06/15/27 |

| LAD Auto Receivables Trust 2022-1 Class B | 15.5 | | 15.5 | | 08/17/22 | 5.870% | 09/15/27 |

| LAD Auto Receivables Trust 2022-1 Class C | 23.0 | | 23.0 | | 08/17/22 | 6.850% | 04/15/30 |

| LAD Auto Receivables Trust 2023-1 Class A-1 | — | | 75.1 | | 02/14/23 | 4.929% | 02/15/24 |

| LAD Auto Receivables Trust 2023-1 Class A-2 | 191.4 | | 242.0 | | 02/14/23 | 5.680% | 10/15/26 |

| LAD Auto Receivables Trust 2023-1 Class A-3 | 74.4 | | 74.4 | | 02/14/23 | 5.480% | 06/15/27 |

| LAD Auto Receivables Trust 2023-1 Class B | 20.1 | | 20.1 | | 02/14/23 | 5.590% | 08/16/27 |

| LAD Auto Receivables Trust 2023-1 Class C | 36.7 | | 36.7 | | 02/14/23 | 6.180% | 12/15/27 |

| LAD Auto Receivables Trust 2023-1 Class D | 31.3 | | 31.3 | | 02/14/23 | 7.300% | 06/17/30 |

| LAD Auto Receivables Trust 2023-2 Class A-1 | — | | 87.4 | | 05/24/23 | 5.440% | 05/15/24 |

| LAD Auto Receivables Trust 2023-2 Class A-2 | 262.2 | | 287.0 | | 05/24/23 | 5.930% | 06/15/27 |

| LAD Auto Receivables Trust 2023-2 Class A-3 | 80.0 | | 80.0 | | 05/24/23 | 5.420% | 02/15/28 |

| LAD Auto Receivables Trust 2023-2 Class B | 22.9 | | 22.9 | | 05/24/23 | 5.450% | 04/15/28 |

| LAD Auto Receivables Trust 2023-2 Class C | 54.7 | | 54.7 | | 05/24/23 | 5.580% | 09/15/28 |

| LAD Auto Receivables Trust 2023-2 Class D | 24.8 | | 24.8 | | 05/24/23 | 6.300% | 02/15/31 |

| LAD Auto Receivables Trust 2023-3 Class A-1 | 34.0 | | 63.2 | | 08/23/23 | 5.632% | 08/15/24 |

| LAD Auto Receivables Trust 2023-3 Class A-2 | 127.8 | | 127.8 | | 08/23/23 | 6.090% | 06/15/26 |

| LAD Auto Receivables Trust 2023-3 Class A-3 | 100.0 | | 100.0 | | 08/23/23 | 6.120% | 09/15/27 |

| LAD Auto Receivables Trust 2023-3 Class A-4 | 45.0 | | 45.0 | | 08/23/23 | 5.950% | 03/15/28 |

| LAD Auto Receivables Trust 2023-3 Class B | 22.6 | | 22.6 | | 08/23/23 | 6.090% | 06/15/28 |

| LAD Auto Receivables Trust 2023-3 Class C | 39.9 | | 39.9 | | 08/23/23 | 6.430% | 12/15/28 |

| LAD Auto Receivables Trust 2023-3 Class D | 16.8 | | 16.8 | | 08/23/23 | 6.920% | 12/16/30 |

| Total non-recourse notes payable | $ | 1,469.9 | | $ | 2,094.2 | | | | |

NOTE 9. EQUITY AND REDEEMABLE NON-CONTROLLING INTERESTS

Repurchases of Common Stock

Repurchases of our common stock occurred under a repurchase authorization granted by our Board of Directors and related to shares withheld as part of the vesting of restricted stock units (RSUs). Share repurchases under our authorization were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Repurchases Occurring in 2023 | | Cumulative Repurchases as of September 30, 2023 |

| | | Shares | | Average Price | | Shares | | Average Price |

| Share Repurchase Authorization | | — | | | $ | — | | | 6,904,781 | | | $ | 173.59 | |

As of September 30, 2023, we had $501.4 million available for repurchases pursuant to our share repurchase authorization from our Board of Directors in 2022 and prior years.

In addition, during 2023, we repurchased 70,626 shares at an average price of $204.92 per share, for a total of $14.5 million, related to tax withholding associated with the vesting of RSUs. The repurchase of shares related to

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 12 |

tax withholding associated with stock awards does not reduce the number of shares available for repurchase as approved by our Board of Directors.

NOTE 10. FAIR VALUE MEASUREMENTS

Factors used in determining the fair value of our financial assets and liabilities are summarized into three broad categories:

•Level 1 - quoted prices in active markets for identical securities;

•Level 2 - other significant observable inputs, including quoted prices for similar securities, interest rates, prepayment spreads, credit risk; and

•Level 3 - significant unobservable inputs, including our own assumptions in determining fair value.

We determined the carrying value of accounts receivable, trade payables, accrued liabilities, finance receivables, and short-term borrowings approximate their fair values because of the nature of their terms and current market rates of these instruments. We believe the carrying value of our variable rate debt approximates fair value.

We have investments primarily consisting of our investment in Shift Technologies, Inc. (Shift), a San Francisco-based digital retail company. Shift has a readily determinable fair value following Shift going public in a reverse-merger deal with Insurance Acquisition, a special purpose acquisition company, in the fourth quarter of 2020. We calculated the fair value of this investment using quoted prices for the identical asset (Level 1) and recorded the fair value as part of other non-current assets. For the three and nine-month periods ended September 30, 2023, we recognized a $0.7 million and $0.1 million unrealized investment loss and gain related to Shift, respectively. For the three and nine-month periods ended September 30, 2022, we recognized a $0.3 million and $32.6 million unrealized investment gain and loss related to Shift, respectively. These amounts were recorded as a component of Other income (expense), net.

We have fixed rate debt primarily consisting of amounts outstanding under our senior notes, non-recourse notes payable, and real estate mortgages. We calculated the estimated fair value of the senior notes using quoted prices for the identical liability (Level 1). The fair value of non-recourse notes payable are measured using observable Level 2 market expectations at each measurement date. The calculated estimated fair values of the fixed rate real estate mortgages and finance lease liabilities use a discounted cash flow methodology with estimated current interest rates based on a similar risk profile and duration (Level 2). The fixed cash flows are discounted and summed to compute the fair value of the debt.

We have derivative instruments consisting of an offsetting set of interest rate caps. The fair value of derivative assets and liabilities are measured using observable Level 2 market expectations at each measurement date and is recorded as other current assets, current liabilities and other long-term liabilities in the Consolidated Balance Sheets.

Nonfinancial assets such as goodwill, franchise value, or other long-lived assets are measured and recorded at fair value during a business combination or when there is an indicator of impairment. We evaluate our goodwill and franchise value using a qualitative assessment process. If the qualitative factors determine that it is more likely than not that the carrying value exceeds the fair value, we would further evaluate for potential impairment using a quantitative assessment. The quantitative assessment estimates fair values using unobservable (Level 3) inputs by discounting expected future cash flows of the store. The forecasted cash flows contain inherent uncertainties, including significant estimates and assumptions related to growth rates, margins, working capital requirements, and cost of capital, for which we utilize certain market participant-based assumptions we believe to be reasonable. We estimate the value of other long-lived assets that are recorded at fair value on a non-recurring basis on a market valuation approach. We use prices and other relevant information generated primarily by recent market transactions involving similar or comparable assets, as well as our historical experience in divestitures, acquisitions and real estate transactions. Additionally, we may use a cost valuation approach to value long-lived assets when a market valuation approach is unavailable. Under this approach, we determine the cost to replace the service capacity of an asset, adjusted for physical and economic obsolescence. When available, we use valuation inputs from independent valuation experts, such as real estate appraisers and brokers, to corroborate our estimates of fair value. Real estate appraisers’ and brokers’ valuations are typically developed using one or more valuation techniques including market, income and replacement cost approaches. Because these valuations contain unobservable inputs, we classified the measurement of fair value of long-lived assets as Level 3.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 13 |

There were no changes to our valuation techniques during the nine-month period ended September 30, 2023.

Below are our assets and liabilities that are measured at fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of September 30, 2023 | | As of December 31, 2022 |

| ($ in millions) | | Carrying Value | | Level 1 | | Level 2 | | Level 3 | | Carrying Value | | Level 1 | | Level 2 | | Level 3 |

| Recorded at fair value | | | | | | | | | | | | | | | | |

| Investments | | | | | | | | | | | | | | | | |

| Shift Technologies, Inc. | | $ | 1.9 | | | $ | 1.9 | | | $ | — | | | $ | — | | | $ | 1.8 | | | $ | 1.8 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| Derivatives | | | | | | | | | | | | | | | | |

| Derivative assets | | 16.9 | | | — | | | 16.9 | | | — | | | 22.1 | | | — | | | 22.1 | | | — | |

| Derivative liabilities | | 16.9 | | | — | | | 16.9 | | | — | | | 22.1 | | | — | | | 22.1 | | | — | |

| | | | | | | | | | | | | | | | |

| Recorded at historical value | | | | | | | | | | | | | | | | |

Fixed rate debt 1 | | | | | | | | | | | | | | | | |

4.625% Senior notes due 2027 | | 400.0 | | | 366.0 | | | — | | | — | | | 400.0 | | | 364.0 | | | — | | | — | |

4.375% Senior notes due 2031 | | 550.0 | | | 453.1 | | | — | | | — | | | 550.0 | | | 448.3 | | | — | | | — | |

3.875% Senior notes due 2029 | | 800.0 | | | 674.0 | | | — | | | — | | | 800.0 | | | 656.0 | | | — | | | — | |

| Non-recourse notes payable | | 1,469.9 | | | — | | | 1,452.4 | | | — | | | 422.2 | | | — | | | 411.8 | | | — | |

| Real estate mortgages and other debt | | 618.1 | | | — | | | 602.1 | | | — | | | 489.0 | | | — | | | 399.0 | | | — | |

1Excluding unamortized debt issuance costs

NOTE 11. ACQUISITIONS

In the first nine months of 2023, we completed the following acquisitions:

•In February 2023, Thornhill Acura in Canada.

•In March 2023, Jardine Motors Group in the United Kingdom.

•In June 2023, Priority Auto Group in Virginia.

•In June 2023, Wade Ford in Georgia.

•In July 2023, Hill Country Honda in Texas.

•In August 2023, Arden Auto Group in the United Kingdom.

Revenue and operating income contributed by the 2023 acquisitions subsequent to the date of acquisition were as follows (in millions):

| | | | | | | | |

| Nine Months Ended September 30, | | 2023 |

| Revenue | | $ | 1,721.2 | |

| Operating income | | 54.5 | |

In the first nine months of 2022, we completed the following acquisitions:

•In January 2022, John L. Sullivan Chevrolet, John L. Sullivan Chrysler Dodge Jeep Ram, and Roseville Toyota in California.

•In March 2022, Sahara Chrysler Dodge Jeep Ram, Desert 215 Superstore, and Jeep Only in Nevada.

•In May 2022, Sisley Honda in Canada.

•In June 2022, Esserman International Volkswagen & Acura in Florida.

•In June 2022, Henderson Hyundai Superstore in Nevada.

•In June 2022, Lehman Auto Group in Florida.

•In July 2022, Elk Grove Ford in California.

•In September 2022, Wilde Auto Group in Wisconsin.

All acquisitions were accounted for as business combinations under the acquisition method of accounting. The results of operations of the acquired stores are included in our Consolidated Financial Statements from the date of acquisition.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 14 |

The following tables summarize the consideration paid for the 2023 acquisitions and the preliminary purchase price allocations for identified assets acquired and liabilities assumed as of the acquisition date:

| | | | | | | | |

| (in millions) | | Consideration |

| Cash paid, net of cash acquired | | $ | 1,204.7 | |

| Contingent consideration | | 7.3 | |

| | |

| | |

| | |

| | |

| Total consideration transferred | | $ | 1,212.0 | |

| | | | | | | | |

| (in millions) | | Assets Acquired and Liabilities Assumed |

| Trade receivables, net | | $ | 75.0 | |

| Inventories | | 573.2 | |

| | |

| Goodwill | | 30.5 | |

| Property and equipment | | 393.0 | |

| Operating lease right-of-use assets | | 89.6 | |

| Finance receivables, net | | 8.0 | |

| Other assets | | 725.4 | |

| Trade payables | | (83.5) | |

| Floor plan notes payable | | (353.7) | |

| Borrowings on lines of credit | | (47.9) | |

Finance lease obligations | | (45.0) | |

| Deferred taxes, net | | 9.8 | |

| Other liabilities | | (162.4) | |

| Total net assets acquired and liabilities assumed | | $ | 1,212.0 | |

The purchase price allocations for the acquisitions from the fourth quarter of 2022 through the third quarter of 2023 are preliminary, and we have not obtained and evaluated all of the detailed information necessary to finalize the opening balance sheet amounts in all respects. We recorded the purchase price allocations based upon information that is currently available and recorded unallocated items as a component of other non-current assets in the Consolidated Balance Sheets.

We expect all of the goodwill related to US acquisitions completed in 2023 to be deductible for US federal income tax purposes. Due to local country laws, we do not expect goodwill related to UK acquisitions completed in 2023 to be deductible for UK income tax purposes.