0000024090FALSEDEF 14A00000240902023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

_______________________________

| | | | | | | | |

| Filed by the Registrant ☒ | |

| Filed by a Party other than the Registrant ☐ | |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-16(e)(2)) |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

CITIZENS, INC.

(Exact name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

2024

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

Keeping promises around the World.

A MESSAGE FROM OUR CHIEF EXECUTIVE OFFICER

April 29, 2024

Dear Shareholders,

It has been my privilege to lead Citizens' renewed strategy over the past 3+ years. When I agreed to become Interim Chief Executive Officer in August 2020, I was retired from full-time work and thought the job would be short-term. We were facing some serious challenges due to the death of our founder in 2017, which led to an ultimate change-in-control in 2020 and the resignation of our former Chief Executive Officer, followed by litigation with the founder's foundation, which owned the Class B shares and thus held voting control of the Company. Not to mention we were in COVID pandemic lockdowns still and no one had any idea how long the pandemic would last or the effects it would have on the business.

In April 2021, we purchased those Class B shares and set the Company on a course for long-term, sustainable growth. We promised that we would focus on providing long-term stability through introduction of new products and new distribution channels, improved policy retention, roadmap execution, and financial and expense discipline.

I'm proud to say that we continued that growth in 2023. Some of the highlights include the following:

•We introduced 3 new products in both English and Spanish under our CICA Domestic brand, leading to first year premium revenue growth of 13% in our Life Insurance segment.

•We obtained an A.M. Best rating for the first time ever in July 2023. The New York Stock Exchange invited us to ring the Opening Bell in August 2023 to commemorate this accomplishment.

◦CICA Life Insurance Company of America is rated as a B++ with a "Very Strong" balance sheet. We believe this will help us expand our distribution networks and the appeal of our products to consumers.

•We completed the move of our international business from Bermuda to Puerto Rico, which we believe will drive greater demand for our international products.

We have accomplished a lot in the past almost 4 years and I'm proud to be turning over the reins to an experienced growth leader in the life insurance industry, Jon Stenberg. I am confident that he, with the strong management team we have built, will continue to build upon the long-term growth strategy we have implemented.

On behalf of the entire Board of Directors, it is my privilege as the last time as the Chief Executive Officer, and as your fellow shareholder, to invite you to our 2024 Annual Meeting of Shareholders to be held on Tuesday, June 18, 2024 at 10:00 a.m. Central Time, at our headquarters located at 11815 Alterra Parkway, Suite 1500, Austin, Texas 78758. Holders of record of our Class A common stock as of April 19, 2024 are entitled to notice of, and to vote at, the Annual Meeting.

We hope the material contained in this accompanying Proxy Statement demonstrates how seriously we take the trust you place in us through your ownership of Citizens shares, and we ask that you vote in accordance with the Board of Directors’ recommendations as a sign of your support for our continuing efforts. Thank you for helping us Keep our Promises around the world.

Sincerely,

Gerald W. Shields

Chief Executive Officer

Citizens, Inc.

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

| | | | | |

WHEN:

Tuesday, June 18, 2024 10:00 a.m., Central Time |

WHERE:

Citizens, Inc. Headquarters 11815 Alterra Parkway, Suite 1500, Austin, Texas 78758

|

The Notice of Meeting, Proxy Statement and Annual Report on Form 10-K are available free of charge at www.envisionreports.com/cia |

ITEMS OF BUSINESS:

(1) To elect each of the seven (7) director nominees identified in the accompanying Proxy Statement to serve until the next annual meeting of shareholders or until his or her successor is duly elected and qualified;

(2) To ratify the appointment of Grant Thornton LLP as the Company's independent registered public accounting firm for 2024;

(3) To approve, on a non-binding advisory basis, executive compensation (“Say-on-Pay”); and

(4) To transact such other business as may properly come before the Annual Meeting of Shareholders or any adjournment or postponement of the meeting.

RECORD DATE:

Close of business on April 19, 2024. You can vote if you were a shareholder on this date.

On or about April 29, 2024, we first mailed the proxy materials or a Notice of Internet Availability of Proxy Materials to shareholders who own our Class A common stock as of the Record Date in connection with our solicitation of proxies for this year’s Annual Meeting of Shareholders. You may also read the proxy materials, our 2023 Annual Report on Form 10-K and our 2023 Annual Report to Shareholders, on our website at https://www.citizensinc.com/investors/.

By Order of the Board of Directors

Sheryl Kinlaw

Vice President, Chief Legal Officer and Secretary

Austin, Texas

April 29, 2024

| | | | | |

TABLE OF CONTENTS | |

| |

| PROXY SUMMARY | |

| About Citizens | |

2023 Highlights | |

Items of Business at our 2024 Annual Meeting of Shareholders | |

| How to Vote | |

| |

| PROXY STATEMENT | |

| |

| OUR FOCUS ON ESG | |

| Our Culture of Responsibility and Ethics | |

| Our Commitment to Good Corporate Governance | |

| Governance Summary | |

| Social Matters Matter | |

| Focus on the Environment | |

| |

| BOARD MATTERS | |

| Board’s Roles and Responsibilities | |

| Risk Oversight | |

| Proposal No. 1 – Election of Directors | |

| Board Selection | |

| Board Refreshment | |

| Director Independence | |

| Director Nominees | |

| Board Leadership Structure | |

| Board Meetings and Committees of the Board of Directors | |

| Succession Planning | |

| Board Processes | |

| Board and Committee Evaluation Process | |

| Certain Relationships and Related Party Transactions | |

| Compensation Committee Interlocks and Insider Participation | |

| Communications with the Board | |

| Director Compensation | |

| |

| AUDIT COMMITTEE MATTERS | |

| Proposal No. 2 – Ratification of Appointment of our Independent Registered Public Accounting Firm | |

| Appointment and Oversight of Independent Auditor | |

Audit Committee Pre-Approval of Services | |

| Audit Committee and Meetings | |

| Primary Responsibilities and 2023 Actions | |

| Audit Committee Report | |

| |

| Proposal No. 3 – Advisory Vote on Executive Compensation | |

| |

| EXECUTIVE OFFICERS | |

| EXECUTIVE COMPENSATION | |

| COMPENSATION TABLES | |

| Narrative Disclosure to Summary Compensation Table | |

| Outstanding Equity Awards | |

| Stock Vested | |

| Potential Payments Upon Termination | |

| Pay Versus Performance | |

| |

| STOCK OWNERSHIP INFORMATION | |

| Security Ownership of Directors and Management | |

| Security Ownership of Certain Beneficial Owners | |

| |

| INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | |

| |

| OTHER INFORMATION | |

PROXY SUMMARY

This proxy summary highlights selected information that is provided in more detail throughout this Proxy Statement, which is first being sent or made available to shareholders of Citizens, Inc., a Colorado corporation, on or about April 29, 2024. This summary does not contain all of the information you should consider before voting, so please read the full Proxy Statement carefully before voting. For more information regarding our 2023 performance, please read our 2023 Annual Report on Form 10-K.

ABOUT CITIZENS

Citizens, Inc. ("Citizens" or the "Company") is an insurance holding company incorporated in Colorado serving the life insurance needs of individuals in the United States since 1969 and internationally since 1975. Through our domestic insurance subsidiaries, we are licensed to provide insurance benefits to residents in 40 U.S. states and through our international subsidiaries, we provide insurance benefits to residents in over 75 different countries. We pursue a strategy of offering traditional insurance products in niche markets where we believe we are able to achieve competitive advantages.

We operate in two business segments:

•Life Insurance - Internationally, we sell U.S. dollar-denominated ordinary whole life insurance, endowment and critical illness policies to non-U.S. residents, located principally in Latin America and the Pacific Rim. Domestically, we sell whole life insurance, life insurance with living benefits, critical illness, credit life and disability products throughout the U.S.

•Home Service Insurance - We sell final expense life insurance policies to middle- and lower-income households, as well as whole life products with higher allowable face values, in Louisiana, Mississippi and Arkansas.

Our Principal Brands

LIFE INSURANCE SEGMENT

| | | | | |

| Internationally, we conduct our Life Insurance segment business through CICA Life, A.I., a Puerto Rico company ("CICA International"). |

| Domestically, we conduct our Life Insurance segment business through CICA Life Insurance Company of America ("CICA Domestic"). |

HOME SERVICE INSURANCE SEGMENT

| | | | | |

| We conduct our Home Service Insurance segment through Security Plan Life Insurance Company ("SPLIC") and Magnolia Guaranty Life Insurance Company ("Magnolia"). |

2023 HIGHLIGHTS

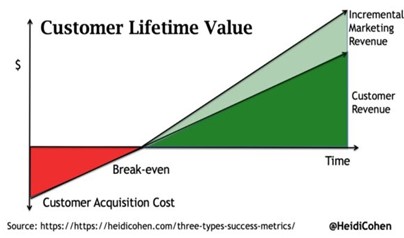

Historically, our insurance companies have only issued a few products and had limited distribution channels. Since 2021, when we purchased all of the outstanding Class B common shares to become a non-controlled company, our strategy shifted to create long-term sustainable growth by focusing on four pillars: (1) first year sales growth through introduction of new products and new distribution channels, (2) improving retention and persistency, (3) focused execution and (4) financial and expense discipline. We believe these factors will lead to growth and profitability.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| First Year Sales Increase | | Improve Policy Retention | | Roadmap Execution | | Financials & Expense Discipline | |

| Achieve first year sales growth across all markets. | | Improve first year policy retention (measured on 15-month renewal). | | Maintain and execute on the approved 5 Quarter Roadmap. | | Maintain and execute on the approved budget. | |

| | | | | | | | |

First Year Sales

New sales are key to growth. First year premiums (i.e, new sales) increased in all 3 of our markets - CICA International, CICA Domestic and our Home Services Insurance segment .

New sales increased 12% from 2022 to 2023. In our Life Insurance segment first year premiums increased by 13% from 2022 to 2023 due to the introduction of critical illness and whole life products in 2022 in our international markets, as well as expansion of our white label distribution network and introduction of new products in our domestic market. In our Home Service Insurance segment, first year premiums increased from 2022 to 2023 by 8% due to focused marketing campaigns and higher critical illness premiums.

Improve Policy Retention

The goal of the retention pillar is to improve policy lapses and surrenders and maintain a high level of persistency in order to retain revenue from in-force policies.

In our international markets, we achieved 100% of our goal, which helped limit the amount of in-force policies that were being surrendered. We did not meet our retention goals in our Home Service Insurance segment in 2023, as our persistency was below target levels. We believe that inflation and rising costs negatively impacted persistency in the Home Service Insurance segment in 2023, as our customer base is primarily lower income individuals.

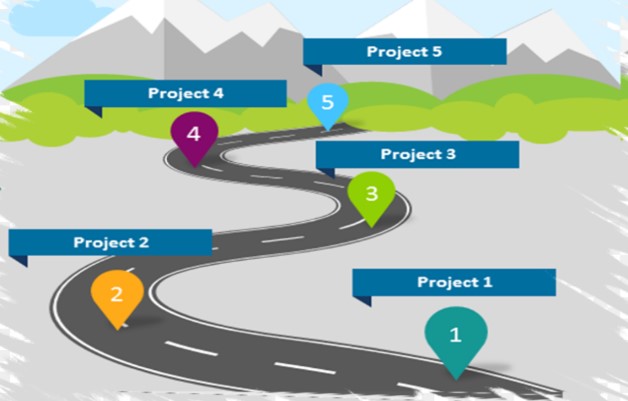

Roadmap Execution

Our roadmap execution is critical to building the capacity for our growth. We achieved above expectations on our 5-quarter roadmap in 2023 by completing over 50 new projects, including the following:

•We developed, filed and rolled out 3 new products in English and Spanish in our domestic market and we signed many new distribution partners and agents, leading to a 13% increase in first year premium growth in our Life Insurance segment.

•We completed the move of our international business from Bermuda to Puerto Rico, which we believe is strategic to driving international growth.

•We merged two of our domestic entities to strengthen the balance sheet of CICA Life Insurance Company of America, which received its first A.M. Best rating of a B++ and a "Very Strong" balance sheet.

Our execution on our strategic initiatives in 2023 led to a 10% increase in amount of insurance issued in 2023 as compared to 2022.

See "Financial Highlights" below and additionally, for specific information on performance on each of the four pillars, see "Executive Compensation – 2023 Executive Compensation Decisions in Detail – Calculating the 2023 Annual Bonus" on page 41.

FINANCIAL HIGHLIGHTS (2023 compared to 2022)

We had income before federal income tax of $26.2 million in 2023, compared to $27.4 million in 2022. In 2023 changes in the fair value of our limited partnership investments due to improved stock market conditions increased investment related gains and losses by $11.1 million and net investment income improved by $3.8 million due to higher yields on our investment portfolio. These year-over-year increases were offset by (i) $6.7 million decrease in premiums due to lower renewal premiums in our life insurance segment and ceasing our property insurance business; (ii) $6.7 million increase in total insurance benefits paid or provided due to higher claims and surrenders and higher policyholder liability remeasurement loss; and (iii) $3.0 million of higher commission expense, driven by higher first year sales (which have higher commission payments) and accrual of expense for renewal commissions we may owe to former independent consultants in Venezuela.

Our net income per diluted share of Class A common stock was $0.48 for the year ended December 31, 2023.

Key operating results (comparison of 2023 v. 2022) Financial Condition at December 31, 2023

↓ $6.7 million of premium revenue • Total assets of $1.7 billion

↑ $3.8 million of net investment income • $4.9 billion of direct insurance in force

↑ $6.7 million of total insurance benefits paid or provided • No debt

↑ $2.0 million of general operating expenses • Book value per Class A common share of

$3.47

ITEMS OF BUSINESS AT OUR 2024 ANNUAL MEETING OF SHAREHOLDERS

The following table summarizes the proposals to be voted upon at the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on June 18, 2024 at 10:00 a.m. Central Time at our headquarters in Austin, Texas, and the Board’s voting recommendation with respect to each proposal.

| | | | | | | | | | | | | | |

| PROPOSAL 1 | VOTING STANDARD | OUR BOARD’S RECOMMENDATION | READ MORE STARTING ON PAGE… |

| 1. | Election of Directors | Majority of Votes Cast | FOR each Nominee | |

| | | | | | | | | | | | | | |

| NAME | AGE | PRINCIPAL OCCUPATION and RELEVANT EXPERIENCE | DIRECTOR SINCE |

INDEPENDENT |

| Gerald W. Shields | 66 | Citizens’ Chief Executive Officer; Vice-Chairman of the Board | 2017 | No |

| Christopher W. Claus | 63 | Retired financial and investment executive USAA of San Antonio | 2017 | Yes |

| Cynthia H. Davis | 58 | Life Insurance underwriter at NFP Corp. / Partners Financial | 2021 | Yes |

| Jerry D. Davis, Jr. | 73 | Chairman of the Board; Retired life insurance company CEO and Chairman | 2017 | Yes |

| Dr. Terry S. Maness | 74 | Former Dean at Baylor University’s Hankamer School of Business; Former Chairman of the Department of Finance, Insurance and Real Estate at Baylor University | 2011 | Yes |

| J. Keith Morgan | 73 | Retired senior legal executive; Former Chief Legal Officer at TIAA-CREF Life Insurance Co. | 2021 | Yes |

| Mary Taylor | 58 | Vice President, Operations and Finance at Northeast Ohio Medical University; CPA; former Lieutenant Governor of Ohio and former Director of the Ohio Department of Insurance | 2021 | Yes |

Pursuant to our mandatory retirement age policy, Gov. Francis Keating is retiring as of the date of the Annual Meeting. The Nominating and Corporate Governance Committee of the Board is currently and will continue to search for candidates who may fill experience or other needs of the Board (including additional diversity needs). No new appointment will be made earlier than October 2024.

Proxies cannot be voted for a greater number of persons than the number of nominees named herein.

| | | | | | | | | | | | | | |

| PROPOSAL 2 | VOTING STANDARD | OUR BOARD’S RECOMMENDATION | READ MORE STARTING ON PAGE… |

| 2. | Ratify the Appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for 2024 | Majority of Votes Cast | FOR | |

Grant Thornton LLP is an independent registered public accounting firm with an established relationship with the Company, significant expertise and reasonable fees.

| | | | | | | | | | | | | | |

| PROPOSAL 3 | VOTING STANDARD | OUR BOARD’S RECOMMENDATION | READ MORE STARTING ON PAGE… |

| 3. | Advisory Vote to Approve Executive Compensation | Majority of Votes Cast | FOR | |

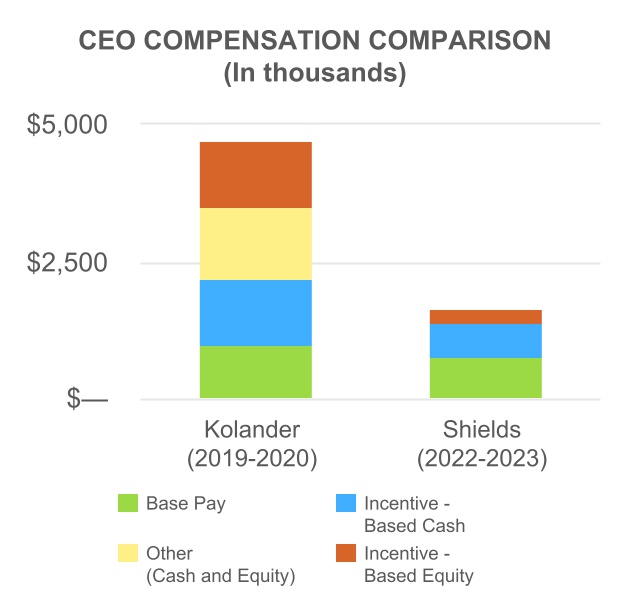

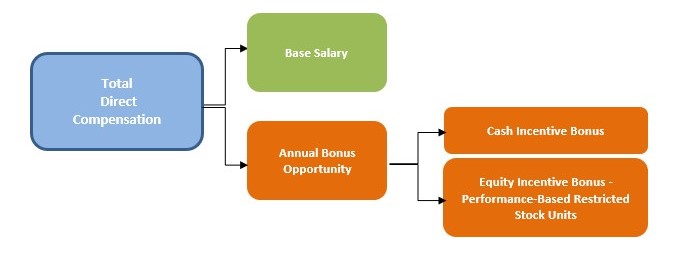

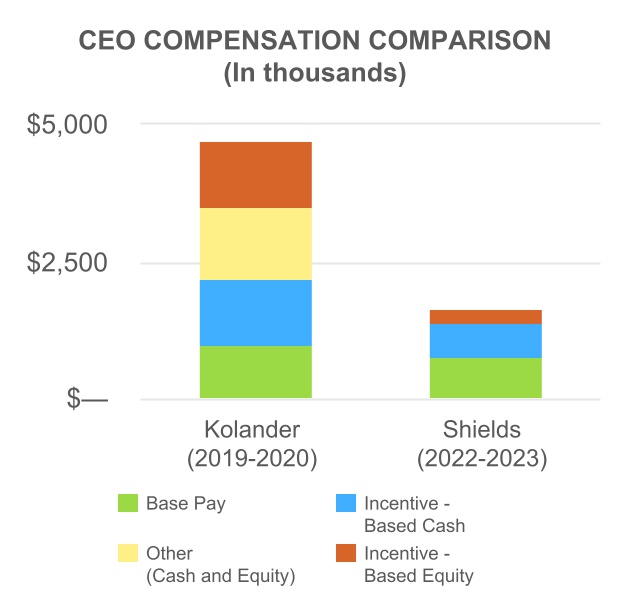

COMPENSATION BEST PRACTICES

Since the death of our founder, Harold E. Riley, in 2017, our Compensation Committee has taken, and continues to take, critical steps to enhance our executive compensation program and move towards market best practices and pay-for-performance. The following table summarizes some highlights of our compensation practices that drive our executive officer compensation program:

| | | | | |

WHAT WE DO | WHAT WE DON'T DO |

+Align our executive pay with performance +Set quantifiable performance objectives that incentivize executives to drive revenue and improve profitability +Annual restricted stock unit (“RSU”) grants to executive officers require achievement of performance goals to receive, then vest over 3 years +Change-in-control severance limited to 2x salary and annual cash incentive pay for CEO +Stock ownership guidelines for CEO and all Section 16 officers +Annual say-on-pay advisory vote (92% of our shareholders voted in favor of "say on pay" in 2023) +Incentive-based compensation recovery policy +Engage independent compensation consultant +Benchmark executive compensation against competitive market practices

| –While the Company is party to an employment contract with the Chief Executive Officer and the President, it does not provide guaranteed salary increases nor non-performance bonus arrangements –No “single trigger” change-in-control payout provisions –No hedging, short sales or pledging of shares by directors or officers –No supplemental executive retirement plan –Limited perquisites |

Other Matters

The transaction of such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof will also be conducted. The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

HOW TO VOTE

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Annual Meeting, we encourage you to submit your proxy or voting instructions as soon as possible. Shareholders of record may vote using any of the following methods:

VOTE IN ADVANCE. Votes submitted in advance must be received by 11:59 p.m. Eastern Time on June 17, 2024. You may vote in advance by any of the following methods:

| | | | | |

| ONLINE or BY SMARTPHONE: |

| Go to http://www.envisionreports.com/cia or scan the QR code. Login details are located on your proxy card. |

|

| |

| BY TELEPHONE: Call toll-free 1-800-652-VOTE (8683) within the USA, U.S. territories and Canada. |

| Please have your proxy card and the last four digits of your Social Security Number or Tax Identification Number available. Follow the simple instructions the recorded message provides you. |

|

| BY MAIL: If you requested printed copies of the proxy materials by mail, you will receive a proxy card, and you may vote by marking, signing and dating your proxy card and returning it in the postage-paid envelope provided by 11:59 p.m. Eastern Daylight Time on June 17, 2024. The named proxies will vote your stock according to your directions. If you submit a signed proxy card without indicating your vote, the person voting the proxy will vote your stock in favor of the proposals. |

| |

VOTE AT THE MEETING |

| |

| IN PERSON: You may vote in person at the Annual Meeting. If you are a beneficial owner of our shares (i.e, your stock is held in the name of a bank, broker or other holder of record), admission is based on proof of ownership, such as a recent brokerage statement and voting in person requires you to obtain a proxy, executed in your favor, by such bank, broker or other holder to be able to vote at the Annual Meeting. |

If your shares are held in a bank or brokerage account, your bank or broker will provide you with materials and instructions for voting your shares. Please check with your bank or broker and follow the voting procedures they provide to vote your shares.

If you have any questions or require assistance with voting your shares, you may also contact Citizens Investor Relations at CIA@darrowir.com or +1 (703) 297-6917.

PROXY STATEMENT

The Board of Directors (the “Board”) of Citizens, Inc. (the “Company”) is furnishing you this Proxy Statement to solicit proxies on its behalf for the items to be voted at the 2024 Annual Meeting of Shareholders (“Annual Meeting”).

Date: Tuesday, June 18, 2024

Time: 10:00 a.m. Central Time

Place: The Company’s principal executive office at

11815 Alterra Parkway, Suite 1500

Austin, Texas 78758

The proxies also may be voted at any adjournments or postponements of the Annual Meeting.

The Board is first furnishing the proxy materials to holders of the Company’s Class A common stock on or about April 29, 2024.

All properly executed written proxies and all properly completed proxies submitted by Internet, telephone or mail that are delivered pursuant to this solicitation will be voted at the Annual Meeting in accordance with the directions given in the proxy unless the proxy is revoked prior to completion of voting at the Annual Meeting. Voting by proxy will not limit your right to vote at the Annual Meeting if you later decide to attend in person. Other than the approval of the items of business listed above, we do not anticipate that any other matters will be raised at the Annual Meeting.

Only owners of record of shares of Class A common stock as of the close of business on April 19, 2024, the Record Date, are entitled to notice of, and to vote at, the Annual Meeting or at any adjournments or postponements thereof. Each shareholder of record on the Record Date is entitled to one vote for each share of Class A common stock held by such shareholder on all matters coming before the Annual Meeting. As of close of business on the Record Date, there were 49,633,705 shares of Class A common stock issued and outstanding and entitled to vote at the Annual Meeting.

OUR FOCUS ON ESG

We believe that creating long-term value for our shareholders implicitly requires enacting and executing sustainable business practices and strategies that, while delivering competitive returns and executing on our strategic initiatives, also incorporate Environmental, Social and Governance (ESG) considerations into our operations.

Our Board plays a pivotal role in ESG, with oversight of all elements of the programs.

We focus on the following areas of ESG:

| | | | | | | | |

GOVERNANCE | SOCIAL | ENVIRONMENT |

| | |

| Shareholder Voting Rights | Pay Equity | Environmental Stewardship |

| Executive Compensation | Employee Engagement | Responsible Investing |

| Risk Oversight | Diversity & Inclusion | |

| Board Composition and Independence | Talent Attraction & Retention (learning and training) | |

| Employee Wellness | |

OUR CULTURE OF RESPONSIBILITY AND ETHICS - THE TIE THAT BINDS OUR ESG PROGRAM

MISSION STATEMENT: INSURANCE IS A PROMISE MADE. CITIZENS IS A PROMISE KEPTTM.

As part of our commitment to ESG, we maintain an active ethics program. Our ethics program is rooted in our mission statement. We provide an intangible product and recognize the faith and profound responsibility entrusted upon us a life insurance company. We maintain a Code of Business Conduct and Ethics (“Code of Ethics”) that provides ethical standards we expect our directors, officers and employees to adhere to while acting on our behalf. The Code of Ethics protects our shareholders by prohibiting conflicts of interest and usurping of corporate opportunities, as well as by protecting the Company’s information and assets and requiring fair dealing. The Code of Ethics includes our Insider Trading Policy, which limits the types of transactions that directors and officers can participate in with our stock. The Board grants any waivers from our Code of Ethics to any of our directors or executive officers, or if we amend our Code of Ethics, we will, as required, disclose these matters on a timely basis. There were no waivers granted in 2023.

Beyond our Code of Ethics and our fiduciary duty, we hold ourselves to the highest standards of integrity, transparency and ethical conduct. This commitment to ethical behavior permeates every aspect of our operations, from the products we offer to the manner in which we interact with our stakeholders and society at large.

Product Integrity: At the heart of our operations lies the promise to provide reliable and comprehensive life insurance products that offer peace of mind and financial security to our policyholders and their loved ones. We ensure that every product we offer is designed and priced with fairness, transparency, and long-term sustainability in mind. Our underwriting processes are rigorous and equitable, ensuring that risk assessment is conducted with utmost integrity and accuracy.

Anti-corruption and Bribery Efforts: Our ethics program includes monitoring of the corruption risks that are most applicable to our industry and company, including anti-money laundering (“AML”) and anti-bribery. To that extent, our Board has direct oversight of the AML program, which is managed by our compliance function through our Chief Legal Officer. Our AML policy requires that all employees and independent agents who sell our products participate in annual AML training. Our AML program is audited by an external, independent third-party at least every other year. In 2022, no deficiencies were found.

Customer-centric Approach: Our commitment to ethical conduct extends to our interactions with policyholders and beneficiaries. We strive to foster trust and transparency in all our communications, ensuring that our customers are well-informed about their policies, rights, and obligations. Moreover, we are dedicated to providing compassionate and empathetic support to our customers during times of need, demonstrating our commitment to their well-being beyond mere contractual obligations.

Corporate Governance: We adhere to the highest standards of corporate governance, guided by principles of accountability, transparency, and integrity. Our Board is comprised of individuals with diverse expertise and backgrounds, ensuring robust oversight and strategic guidance. We maintain open channels of communication with our shareholders, soliciting their input and feedback on matters of strategic importance and corporate governance.

Social Responsibility: Beyond our immediate business interests, we recognize our broader societal responsibilities. We are committed to operating in a manner that contributes positively to the well-being of our employees and the communities in which we operate. This includes supporting initiatives related to healthy communities and empowering individuals and families to make informed decisions about their financial futures.

Environmental Sustainability: We recognize the critical importance of environmental sustainability in securing a prosperous future for generations to come. As such, we are committed to minimizing our environmental footprint and promoting sustainable practices across our operations. This includes efforts to reduce energy consumption, minimize waste generation, and support investments aimed at combating climate change.

OUR COMMITMENT TO GOOD CORPORATE GOVERNANCE

Good corporate governance is a key element of our ESG focus. While the Board is responsible for providing oversight over governance, social and environmental issues, its key priority is ensuring that it functions well and that our management team (to whom the Board has delegated the authority to manage the day-to-day operations of the Company) functions well, and that the Board understands and provides guidance with respect to key risks that might affect our Company and shareholders. Below is a Governance Summary which highlights our governance practices.

GOVERNANCE SUMMARY

| | | | | |

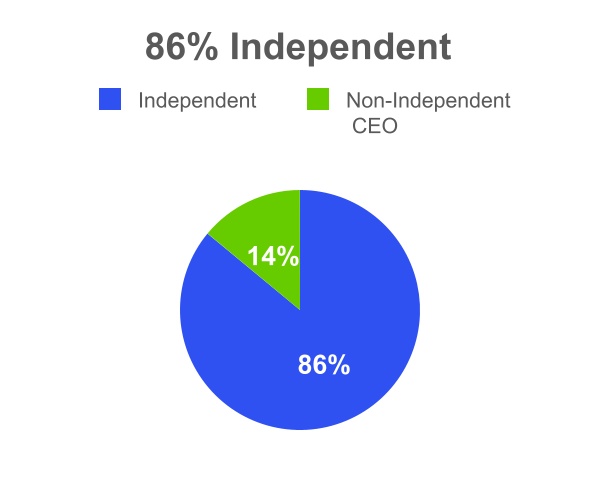

Highly Independent and Diverse Board | ■Our CEO is the only non-independent director ■We elected two women to the Board in 2021 ■All Board committees are composed entirely of independent directors ■We have adopted a heightened standard of director independence - an independent director may only receive up to $25,000 in consulting fees or other income from the Company outside of Board compensation ■Independent directors hold executive sessions at least three times per year without management present ■Directors bring a wide array of qualifications, skills and attributes to our Board; see Director Nominees beginning on page 18 |

Independent Board Chair | ■Independent Board Chair structure provides effective checks and balances to ensure the exercise of independent judgment by the Board |

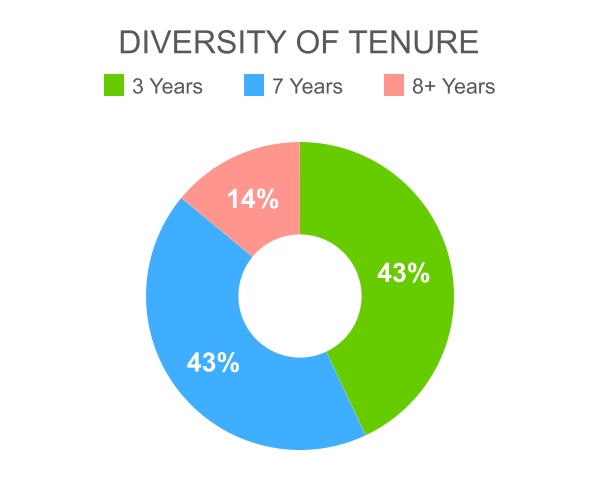

Board Refreshment | ■3 of our 7 director nominees were first elected in 2021 ■2 directors retired in each of 2022 and 2023 pursuant to our Board refreshment policy to help reduce the size of the Board ■Mandatory retirement age at 75 - 1 director retiring in 2024 ■12-year term limit - will apply to one director in 2025 |

Director Accountability | ■Over 75% average director attendance rate at Board and committee meetings in 2023 ■Annual Board and committee self-evaluations and individual director assessments ■Director Resignation Policy if a director does not receive at least >50% of FOR votes at Annual Meeting |

Shareholder Voting Rights | ■Holders of our Class A common stock elect all directors annually (no staggered board; no dual classes of outstanding voting stock) |

Executive Compensation Practices | ■We have an annual “say on pay” advisory vote, as elected by our shareholders. In 2023, 92% of our shareholders voted in favor of "say on pay" ■Stock Ownership Guidelines ■Compensation Recovery Policy |

No Hedging or Pledging Company Stock | ■Our directors and officers are prohibited from entering into hedging transactions or pledging the Company’s securities |

ERM and ESG | ■Our Board and Audit Committee oversee our Enterprise Risk Management (ERM) program and Environmental, Social and Governance (ESG) matters |

NYSE Listing Standards | ■As of the date of this Proxy Statement, we are in compliance with all applicable NYSE listing standards |

Key Corporate Governance Documents

| | |

•Corporate Governance Guidelines |

•Code of Business Conduct and Ethics ◦Includes our Insider Trading Policy |

•Committee Charters •Stock Ownership Guidelines •Director Resignation Policy •Compensation Recovery Policy |

The documents listed above, except for our Compensation Recovery Policy, are available in the Investors – Corporate Governance section of our website at https://www.citizensinc.com/investors/#corporate-governance. Printed copies of all of these documents are also available free of charge upon written request to our Secretary, at Citizens, Inc. Attn: Secretary, P. O. Box 149151, Austin, Texas 78714-9151. Our Compensation Recovery Policy was filed as Exhibit 10.11 to our 2023 Annual Report on Form 10-K.

The Key Corporate Governance Documents, together with our Articles of Incorporation and our Bylaws, form the governance framework for the Board and its committees. We believe good governance strengthens the Board and management’s accountability. The Board regularly (and at least annually) reviews its Corporate Governance Guidelines and other corporate governance documents and from time to time revises them when it believes it serves the interests of the Company and its shareholders to do so and in response to feedback from shareholders, changing regulatory and governance requirements and best practices.

SOCIAL MATTERS MATTER

Our Company revolves around people. We insure people’s lives. We believe in always doing the right thing for our customers, our employees and agents, our shareholders and our community.

Empowering and Engaging Our People

The Company’s focus continues to be fostering a culture that provides equal opportunity for all, and is inclusive and attractive for all of our employees and independent sales agents. Below are some of the key initiatives that we have undertaken to foster such an environment.

Pay Equity. We are committed to provide a fair or living wage for all employees. In 2021, the Company’s outside counsel performed a pay equity audit and concluded that neither gender nor race drive or predict compensation.

Culture of Engagement. We have town hall meetings at least quarterly where all employees are invited to listen to updates from management on results and key initiatives, as well as ask questions. Confidential surveys are provided to employees after each town hall to give our employees the opportunity to provide feedback and suggest additional topics. Through these surveys, we are able to identify opportunities for improvement, and to create action plans based on feedback as appropriate.

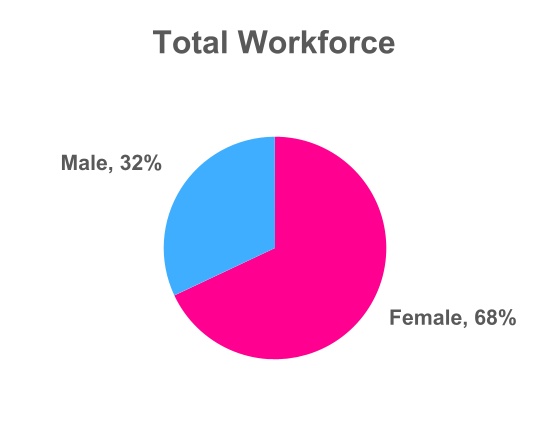

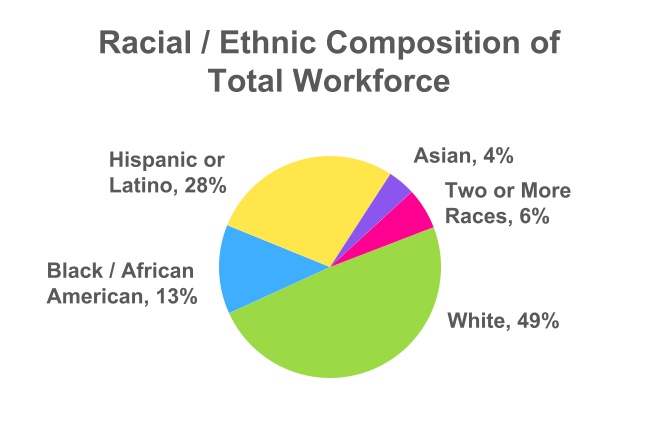

Culture of Diversity and Inclusion. The Company continues to prioritize our efforts in creating and sustaining a culture of diversity and inclusion. The Company derives a great deal of strength from our diverse workforce.

The pie charts below illustrate the gender, racial and ethnic make-up of our total employee workforce as of December 31, 2023:

Culture of Wellness. We are committed to helping our employees have the opportunity to live healthy and active lives. To help ensure the health of our employees, we provide them with a comprehensive benefits package that includes health insurance, dental and vision insurance and fitness center access. Additionally, in response to the COVID-19 pandemic, we have decided to offer a permanent hybrid working environment, where certain employees can work part-time in the office and part-time at home.

Culture of Learning and Training. At the Company, we believe in continuous learning. We offer industry specific training (such as anti-money laundering training, which is required for all employees, and we pay for LOMA education courses), as well as routine training on information security.

FOCUS ON THE ENVIRONMENT

Environmental Stewardship. We are committed to operating in an environmentally responsible manner and strive to be a good steward of the environment. We are headquartered in Austin, Texas, one of the United States’ “greenest” cities. In 2020 we moved into a new leased headquarter building, which was designed to be highly energy efficient and has achieved LEED Gold Certification. The building is outfitted with LED lighting and motion detecting light sensors that help reduce unnecessary energy consumption. As a participant in the Austin Energy Green Building Program, the building was designed and built in a manner that reduced the impact of construction on the environment and utilized materials sourced locally. In addition, the landscaping was designed with native grasses and plants to minimize the use of irrigation and the office has refillable water stations to save use of plastic.

Reducing the amount of paper we use is another key focus for us. As we have introduced new products and enhanced our technology over the past 3 years, we have:

•moved from 100% paper applications to use of an online portal application for our new products;

•created customer portals where we reduce the use of paper through electronic changes to addresses, beneficiaries, etc.;

•created agent portals with electronic commission statements rather than mailing paper statements; and

•increased the use of electronic signature systems, such as DocuSign for our policyholders, agents and standard documents.

Additionally, updated payment processing systems eliminate the need for our policyholders to mail their checks to us, which helps not only reduce paper usage, but also air and road transportation use that might negatively impact our environment.

These efforts help us reduce our carbon footprint in an effort to be good stewards of the environment.

Responsible Investing. We work with our external portfolio manager, Wellington Management, to support and inform financial considerations and prudent diversification by integrating ESG factors into investment decisions. Wellington Management’s ESG philosophy views material ESG issues as strategic business concerns that can affect the value of invested assets. As such, ESG considerations are viewed as both return enhancing and risk mitigating. Wellington Management maintains a comprehensive ESG framework and utilizes proprietary ESG ratings in considering every investment. We made our first investment in a private equity fund focused on global renewal power generation (wind and solar energy) in 2020, and additional investment into companies developing products and solutions with the potential to help mitigate and/or adapt to climate change. Incorporating ESG factors are important in achieving our core objective of long term, sustainable income within our fixed income portfolio and we will continue to seek responsible investing opportunities in the future.

BOARD MATTERS

THE BOARD IS PRIMARILY RESPONSIBLE FOR:

| | | | | | | | | | | |

| ● | Overseeing Citizens’ strategic initiatives, overall performance and direction | |

| ● | Executive oversight - the Board hires, evaluates and compensates the Chief Executive Officer and ensures that effective management is in place | |

| ● | Risk management - Overseeing risk, cybersecurity and internal controls and ensuring strategies are in place to manage these risks effectively | |

| ● | Financial oversight - monitoring the Company's financial performance, including reviewing financial statements and budgets | |

| ● | Overseeing investment of the Company’s assets | |

| ● | Monitoring executive performance, compensation and succession planning | |

| ● | Establishing broad corporate policies, including in relation to good governance and ensuring that the Company adheres to high ethical standards in its operations | |

THE BOARD’S ROLES AND RESPONSIBILITIES

RISK OVERSIGHT

Effective risk oversight is important to ensure that the Company identifies, assesses, manages and mitigates risks that could jeopardize its financial stability, reputation, operations, stakeholder confidence or long-term viability. We believe that an effective enterprise risk management (ERM) program facilitates a collaborative and structured approach that relies on strong communication and collaboration between management and the Board. Management owns the day-to-day operations of risk management, while the Board provides oversight and guidance.

Our ERM process starts with our executive management team, who is responsible for identifying and assessing risks across the organization (collectively, the “Enterprise Risks”). This includes conducting risk assessments, gathering input from various business units, and analyzing the potential impact and likelihood of each risk. Management develops and implements risk management strategies and controls to mitigate identified risks. Management provides regular updates to the Board and its committees on the Company's risk profile, including emerging risks, changes in risk exposure, and the effectiveness of risk mitigation efforts. This allows the Board to oversee and monitor the effectiveness of the Company's risk management efforts on an ongoing basis and to ensure that the key risk management strategies, policies and procedures are aligned with the Company's risk appetite and tolerance levels.

Selected Area of ERM Oversight in 2023

Key Enterprise Risks discussed among executive management, the Board and its committees during 2023 included the following:

| | | | | | | | |

| ● | Mortality risks; pricing and underwriting new products for mortality risks, including the impact of expanded use of simplified underwriting on mortality risk |

| ● | The impact of surrenders and matured endowments on the Company’s liquidity, premiums, operations and financial statements |

| ● | The impact of high interest rates and economic circumstances (such as bank failures) on the Company’s investment portfolio |

| ● | The impact of inflation on the Company's operations, e.g., increased risks of lapses and surrenders, increased costs |

| ● | Risks to the Company’s strategic goals |

| ● | Regulatory risk related primarily to the Company’s international operations |

| ● | Risks related to the rapid expansion of the Company's domestic operations |

| ● | Risks related to acquiring and retaining talent in Austin, Texas |

| ● | Risks related to succession planning and a new Chief Executive Officer |

| ● | The impact to costs related to the rising cost of cybersecurity insurance and catastrophic event reinsurance |

| ● | Financial risks related to the statutory capital ratios of the insurance subsidiaries |

| ● | Stock price risk |

| ● | Cybersecurity risks; other information and data risks |

| ● | Anti-money laundering risks |

Discussions of these topics and additional risks can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission on March 14, 2024.

Oversight of Information Security Risk and Cybersecurity

Like other firms in the financial services sector, insurers like us are particularly vulnerable to cybercrime due to our large amounts of customer data. Insurance-related data is particularly interesting to cybercriminals because of its inherent confidentiality. Often linked to policyholders, sensitive data helps insurers customize their policies, products, and prices for each client. The scope of personally identifiable information and sensitive data processed by insurers puts the industry at increased risk of cybercrime. Cyber attacks can lead to the loss of confidential data, business, and reputation. Additionally, business disruption through cyber incidents is also a major problem for insurance companies, which need to react quickly to fulfill their contracts and maintain the trust of their clients. Because of the risks posed to our business and customers, we have developed robust processes for assessing, identifying and managing our cybersecurity threats.

We recognize the importance of assessing, identifying, and managing material risks associated with cybersecurity threats. Cybersecurity risks related to our business, technical operations, privacy and compliance issues are identified and addressed through a multi-faceted approach including third party assessments, IT security, and external audits. Cybersecurity risks are integrated into our overall enterprise risk management process. To defend, detect and respond to cybersecurity incidents, we, among other things: perform penetration testing using external third-party tools and techniques to test security controls and conduct employee training.

We have implemented incident response and breach management processes which have four overarching and interconnected stages: 1) preparation for a cybersecurity incident, 2) detection and analysis of a security incident, 3) containment, eradication and recovery, and 4) post-incident analysis. Such cybersecurity incident responses are overseen by leaders from our Information Security, IT, Finance, Compliance and Legal teams.

Security events and data incidents are evaluated, ranked by severity and prioritized for response and remediation. Incidents are evaluated to determine materiality as well as operational and business impact, and reviewed for privacy impact. We also conduct tabletop exercises to simulate responses to cybersecurity incidents.

Our risk management program also assesses third party risks, and we perform third-party risk management assessments to identify and mitigate risks from third parties such as vendors, suppliers, and other business partners associated with our use of third-party service providers. Cybersecurity risks are evaluated when determining the selection and oversight of applicable third-party service providers when handling and/or processing our employee, business or customer data. In addition to new vendor onboarding, we perform periodic ongoing security reviews of our critical vendors.

We describe whether and how risks from identified cybersecurity threats, including as a result of any previous cybersecurity incidents, have materially affected or are reasonably likely to materially affect us, including our business strategy, results of operations, or financial condition, under the heading “Cybersecurity and Technology Risks” included as part of our risk factor disclosures at Item 1A - Risk Factors - of this 10-K.

While we have devoted significant financial and personnel resources to implement and maintain the security measures described above, and in order to meet regulatory requirements and customer expectations, there can be no guarantee that our policies and procedures will be properly followed in every instance or that those policies and procedures will be effective. Although our Risk Factors include further detail about the material cybersecurity risks we face, cybersecurity incidents have not materially affected our business to date. We can provide no assurance that there will not be incidents in the future or that they will not materially affect us, including our business strategy, results of operations, or financial condition.

Cyber Governance.

Cybersecurity is a key element of the Company's enterprise risk management (ERM). Identification and management of the Company's key risks, including cybersecurity, starts with the executive management team, who is responsible for identifying key strategic, insurance, financial, regulatory and operational risks to the Company and managing them on a day-to-day basis. Because of the importance of cybersecurity, the Company has a Chief Information Security Officer ("CISO") who is primarily responsible for managing our cybersecurity risk in conjunction with our Vice President of Information Technology. Our CISO is informed about and monitors prevention, detection, mitigation, and remediation efforts through regular communication and reporting from employees in the information technology team and through the use of technological tools and software and results from third party audits. We have an escalation process in place to inform senior management and the Board of Directors of material issues.

Our CISO has served in that position since 2018 and is an experienced security leader with over 20 years’ experience. In addition to his current role, our CISO has led security and IT audit functions at healthcare technology and population health organizations. His experience includes work in the fields of security, application development, and internal audit at a Fortune 100 company. Our CISO is a Certified Information Security Manager (CISM), Certified Information Systems Auditor (CISA), and a member of the ISACA and ISSA organizations. He received his bachelors’ degree from Middle Tennessee State University and served in the United States Marine Corps. Additionally, Gerald W. Shields, our CEO and a member of the Board, has experience in assessing and managing cybersecurity risk and, in addition to his former roles as Chief Information Officer at several companies, he has a Cyber Security Oversight Certificate from Carnegie Mellon Institute.

Our Audit Committee Charter tasks this committee with oversight of the Company's major enterprise risk exposure, including risks related to cybersecurity, and the steps management takes to monitor and control such exposures. The Audit Committee holds its regular meetings on a quarterly basis and at each of those meetings receives a information security update report from the Company's CISO, which report includes cybersecurity events that may have impacted the Company as well as an overview of the Company's security program and efforts to prevent, detect, mitigate, and remediate issues. The CISO also attends the regularly scheduled Board meetings to give his information security report to all members of the Board.

| | |

PROPOSAL NO. 1:

ELECTION OF DIRECTORS |

|

| What Am I Voting On? |

|

Holders of Class A common stock are being asked to elect eight directors to serve until the next annual meeting of shareholders, or until their respective successors are duly elected and qualified. |

|

| Voting Recommendation: FOR |

|

| The Board and the Nominating and Corporate Governance Committee believe the skills, qualities, attributes, and experience of our directors provide the Company with business acumen and a diverse range of perspectives to engage each other and management to effectively address the Company’s evolving needs and represent the best interests of the Company’s shareholders. |

|

| Voting Standard: |

|

| Director nominees receiving the highest number of votes cast by Class A shareholders in their favor will be elected to the Board. Cumulative voting in the election of directors is not permitted and proxies cannot be voted for a greater number of persons than the number of nominees named herein. Under our Director Resignation Policy, if a director receives more “against” votes than “for” votes, such director will be required to submit his or her resignation for Board consideration. |

|

| Abstentions and broker non-votes will be disregarded and have no impact on the vote, other than for establishing a quorum. |

|

Each of the director nominees has consented to serving as a nominee, being named in this Proxy Statement, and serving on the Board if elected. If for any reason any nominee herein named is not a candidate when the election takes place (which is not expected), the proxy will be voted for the election of a substitute nominee at the discretion of the persons named in the proxy.

BOARD SELECTION

Responsibility for Selection of Director Candidates

The Board is responsible for selecting director candidates to stand for election by shareholders. The Board has delegated the screening process for potential directors to the Nominating and Corporate Governance Committee, which identifies, interviews and recruits candidates for the Board. Upon identifying suitable potential Board members, the Nominating and Corporate Governance Committee then recommends individuals qualified to become Board members to the Board for its consideration.

Qualification Standards for Directors

The Nominating and Corporate Governance Committee considers director nominees who are recommended by its members, by other Board members, by management or by shareholders, as well as those identified by third parties known to the members or management. In evaluating potential nominees to the Board, the Nominating and Corporate Governance Committee has adopted standards related to the qualifications of directors of the Company (the “Director Standards”). The Director Standards include, without limitation, independence, character and core values, ability to exercise sound judgment, diversity, demonstrated leadership, and relevant skills and experience in the areas of corporate needs of the Company such as insurance regulation, insurance distribution, finance and accounting, and public company experience.

The Board discusses and promotes efforts to enhance diversity in its Board composition. The Board is committed to diversity and in 2021, added two female directors, both with extensive insurance industry experience. The Board views diversity in the context of the following factors: age, race, gender and ethnicity, geographic knowledge, industry experience, board tenure and culture.

Nominations by Shareholders

Our Board has a policy to consider properly submitted shareholder recommendations for candidates for a director position, which candidates must satisfy the Committee Standards. A shareholder wishing to propose a candidate for the Board’s consideration should follow the procedures in our Bylaws pertaining to shareholder nominations and proposals.

BOARD REFRESHMENT

| | |

•3 new directors in 2021 |

•2 legacy directors retired in each of 2022 and 2023 to allow us to reduce the size of the Board from 10 members to 8 members |

•1 director retiring in 2024 due to mandatory age retirement policy, allowing for reduction in size of board to 7 members or future nomination of a new member to add diversity and experience to the Board. |

| | |

The Company is focused on active board refreshment and continually evaluates the composition of the Board to ensure that it has the right balance of skills, experience, perspective, and rigorous oversight through independent judgment.

In order to encourage refreshment, facilitate an orderly transition of legacy board members, increase diversity and expertise / experience in areas of need, the Board adopted a Board Refreshment and Replacement Plan, a mandatory retirement age and maximum tenure policy. Pursuant to these policies, Gov. Keating is retiring as of the 2024 Annual Meeting.

|

The Board continues to review candidates to potentially fill the vacancy created by Gov. Keating’s retirement. While the Board believes that the nominees represent a good mix of long-term knowledge of the company and new experience who may bring fresh ideas, the Nominating and Corporate Governance Committee continues to search for members that bring additional diversity to our Board, including racial or ethnic diversity.

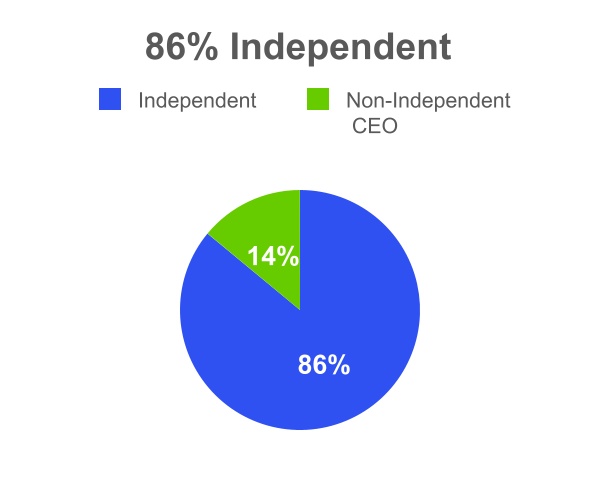

DIRECTOR INDEPENDENCE

| | |

It is the policy of the Company that the Board consist of a majority of independent directors. The Board determines whether a director or nominee is “independent” in accordance with the NYSE Listed Company Manual, which requires an affirmative determination that each independent director has no material relationship with the Company or its affiliates or any executive officer of the Company or his or her affiliates that in the judgment of the Board would impair their effectiveness or independent judgment as a director.

In addition to the standards contained in the NYSE Listed Company Manual, the Board has determined that in order to be deemed independent, a director may not receive more than $25,000 in consulting fees or other income from the Company, other than director fees (the “Enhanced Independence Standards”). |

The Board has determined that all current Board members and nominees, other than Mr. Shields, our Chief Executive Officer, are independent as set forth under the NYSE Listed Company Manual independence requirements and under our Enhanced Independence Standards.

DIRECTOR NOMINEES

The Company’s Board consists of a diverse group of leaders in their respective fields and almost all have extensive experience in the life insurance industry. In these positions, they have gained broad management and industry experience, including strategic planning, business development, compliance, risk management, and leadership development. In addition, some of our directors have experience serving as executive officers, or on boards of directors, of other public or private companies where they have gained experience in governance and compensation matters. Two of our directors are former elected officials who had oversight for insurance responsibilities in their elected roles, and thus bring unique perspectives to the Board. The name, age and other information for each director nominee is listed below.

| | | | | |

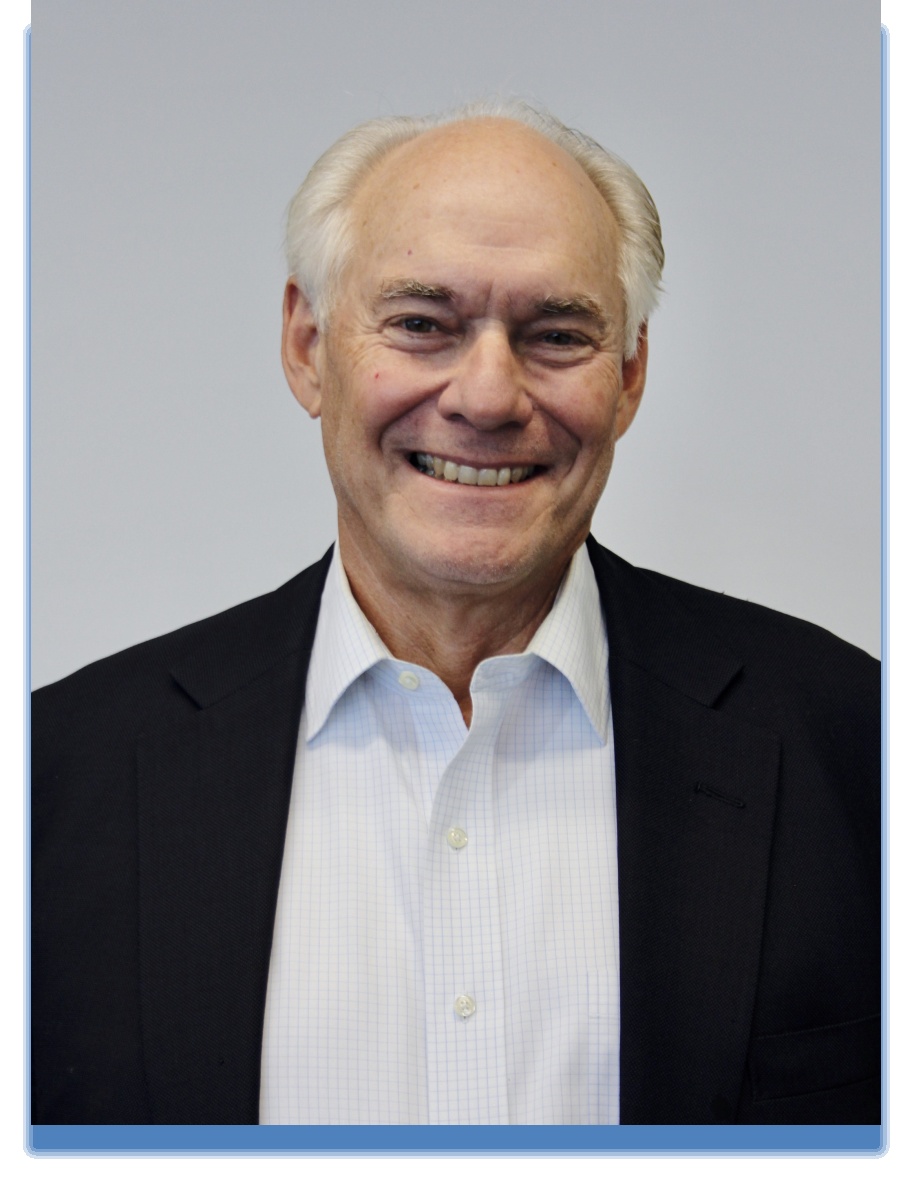

| Gerald W. Shields, 66 |

| Citizens’ Chief Executive Officer since January 1, 2022; served as Interim Chief Executive Officer and President from August 2020 through December 31, 2021 |

|

| Director since 2017; Vice-Chairman of the Board since February 2020 |

|

| Other Current Public Boards: 0 |

|

| Certifications: FLMI; Cyber Security Oversight Certificate (Carnegie Mellon) |

|

| Education: B.A. - Accounting and Computer Science, Baylor University |

Mr. Shields, our Chief Executive Officer, is a seasoned life insurance executive who brings life insurance and information technology experience to our Board. He has more than 30 years’ experience in health insurance management, as well as professional certifications from Harvard University’s Kennedy School of Government, Massachusetts Institute of Technology’s Chief Network Officers Program, and Aubrey Daniels International. He has been named twice in CIO Magazine’s Top 100 CIOs of the Year and has also been the recipient of ComputerWorld’s Top 100 CIO Award.

Prior to Citizens, Mr. Shields served as Chief Information Officer at FirstCare Health Plans from July 2015 to October 2018, and as Senior Vice President and Chief Information Officer at AFLAC from 2002 to 2011.

Mr. Shields’ significant technology and insurance experience are instrumental to the Board’s oversight as the Company advances its strategic technology objectives.

| | | | | |

| Christopher W. Claus, 63 Independent Director |

| Retired executive of USAA of San Antonio |

|

| Director since 2017 |

|

| Committees: Investment Committee (Chair), Compensation Committee, Executive Committee |

|

| Other Current Public Boards: 0 |

|

Education: B.A. - Business, University of Minnesota - Duluth M.B.A. – University of St. Thomas |

Mr. Claus had a 20-year career as an executive at USAA of San Antonio, Texas serving in various roles, including Executive Vice President of USAA’s Enterprise Advice Group from 2013 to 2014, President of USAA’s Financial Advice and Solutions Group from 2007 to 2013, and President of USAA’s Investment Management Company from 2001 to 2006. Until 2023, he served as a director of TrueCar, Inc.

Having served as President of USAA’s Investment Management Company, Mr. Claus brings insurance executive experience and asset management expertise critical to the success of our Company and Board. In his role as Chairman of our Investment Committee, Mr. Claus has strengthened the Board’s oversight of the Company’s assets under management.

| | | | | |

| Cynthia H. Davis, 58 Independent Director |

|

| Life Insurance Underwriter at NFP Corp./Partners Financial |

|

| Director since 2021 |

|

| Committees: Nominating and Corporate Governance Committee (Chair), Executive Committee |

|

| Other Current Public Boards: 0 |

|

| Certifications: FLMI, FALU, LOMA certified Associate - Customer Service |

|

Education: B.A. – Economics, University of Georgia |

Ms. Davis is a seasoned executive in the life insurance industry with over 30 years of underwriting in both the carrier and brokerage side. She is currently the Vice President and Senior Underwriting Consultant at NFP/Partners Financial providing underwriting expertise specializing in complex high net worth cases, foreign nationals and offshore insurance. Previously, Ms. Davis was the Chief Underwriter at Financial Industries Corporation (FIC) and Great American. Ms. Davis is also involved with the Texas Wide Underwriting planning board.

Ms. Davis’ brings to the Board deep knowledge of the insurance industry, which she developed during her long and successful career in the life insurance industry. With significant global experience with both reinsurers and high net worth foreign insureds, she adds valuable and unique expertise to our Board.

| | | | | |

| Jerry D. “Chip” Davis, 73 Independent Director |

|

| Retired life insurance company CEO - National Farm Life Insurance Company |

|

| Director since 2017; Chairman of the Board since February 2020 |

|

| Committees: Compensation Committee (Chair), Executive Committee (Chair), Investment Committee |

|

| Other Current Public Boards: 0 |

|

| Certifications: FLMI |

|

Education: B.S. – Business, Tarleton State Masters – Business Administration – Tarleton State University |

Mr. Davis is a seasoned and proven life insurance executive, having had a 46-year insurance career with National Farm Life Insurance Company (“NFLIC”). Mr. Davis began his career with NFLIC as a Mortgage Loan officer in 1977 and become Senior Vice President and Chief Investment Officer in 1981. He served as President and Chief Executive Officer of NFLIC from 2004 to January 2016. Mr. Davis has served on the board of NFLIC since 2004 and currently serves as chairman.

Mr. Davis’ career as a life insurance executive and service as Chief Investment Officer of a life insurance company brings tremendous experience to our Board and Investment Committee. Specifically, he has experience dealing with state insurance regulators and auditors. His service as as Chief Investment Officer of NFLIC strengthens the investment Committee’s oversight of the Company’s assets under management.

There is no family relationship between Cynthia Davis and Chip Davis.

| | | | | |

| Dr. Terry S. Maness, 75 Independent Director |

|

| Former Dean at Baylor University’s Hankamer School of Business |

|

| Director since 2011 |

|

| Committees: Audit Committee (Chair), Executive Committee |

|

| Other Current Public Boards: 0 |

|

| Certifications: Certified Cash Manager |

|

Education: B.A. and M.S. – Economics, Baylor University M.B.A. and Doctor of Business Administration – Indiana University |

Dr. Maness served as Dean at Baylor University's Hankamer School of Business from 1997 through 2021 and was named Dean Emeritus upon his retirement. Previously, Dr. Maness served as Acting Dean at Baylor University from 1996 to 1997, Associate Dean for Undergraduate Programs at Baylor University from 1978 to 1981 and Chairman of the Department of Finance, Insurance and Real Estate at Baylor University from 1985 to 1996. Dr. Maness is an owner of Business Value Consultants and has owned the company since 1989. In addition to Citizens, he serves on the board of a privately held bank and some nonprofit boards as a way of serving his community.

Dr. Maness’ background as Dean of one of the leading business schools in the United States brings a strong academic presence to our board. He has operated effectively at the highest levels in the academic and business community. He is the author of five books about financial analysis and financial management, and also a contributing author to various publications, such as Journal of Finance, Journal of Banking and Finance, Journal of Financial Education, Journal of Portfolio Management, Journal of Financial and Quantitative Analysis, Journal of Futures Markets, Journal of Cash Management and Corporate Controller.

| | | | | |

| J. Keith Morgan, 73 Independent Director |

|

| Retired senior legal executive; Former Chief Legal Officer at TIAA-CREF |

|

| Director since 2021 |

|

| Committees: Audit Committee, Investment Committee |

|

| Other Current Public Boards: 0 |

|

Education: B.A. – Economics, Duke University J.D., University of Virginia Law School |

| |

| Military Veteran |

Mr. Morgan has decades of experience as a senior legal executive, most recently (2015 - 2018) as Chief Legal Officer & Senior Executive VP at TIAA-CREF, a $1 trillion retirement, insurance and asset management company. Mr. Morgan specializes in securities law, financial regulation, international transactions and mergers and acquisitions. Prior to TIAA-CREF, he spent nearly 20 years at GE, serving as general counsel and senior vice president of GE Commercial Finance Ltd. and GE Capital Corporation. Before joining GE, Mr. Morgan served as the managing partner of Gibson, Dunn & Crutcher's London, Paris, and Saudi Arabia offices. Earlier in his career, he served in the U.S. Navy Judge Advocate General's Corps.

Mr. Morgan’s experience as the Chief Legal Officer of major insurance and asset management companies has provided him with a substantive understanding of the risks, including investment risks, related to a highly regulated company such as Citizens.

| | | | | |

| Mary Taylor, 58 Independent Director |

|

| Senior Vice President, Operations and Finance at Northeast Ohio Medical University |

|

| Director since 2021 |

|

| Committees: Audit Committee, Nominating and Corporate Governance Committee, Compensation Committee |

|

| Other Current Public Boards: 0 |

|

| Certifications: CPA |

|

Education: B.S. – Accounting, University of Akron Master of Taxation, University of Akron |

Ms. Taylor is a Certified Public Accountant and recognized tax and auditing expert with over 30 years of experience in the public and private sector. Since 2020, she has served as the Vice President, Operations and Finance at Northeast Ohio Medical University. During 2019, she served as Executive Vice President and Chief Financial Officer of Welty Building Company and from August 2019 through March 2020 also served as the Chair of the Finance and Operations Advisory Committee.

She has served in the following elected positions:

•2011 to 2019 - Lieutenant Governor of Ohio

◦Served as the Director of the Ohio Department of Insurance from 2011 to 2017

• 2007 to 2011 - Auditor of State of Ohio

•2003 to 2006 - State Representative in Ohio

◦Served on the Finance, Ways and Means, and Education Committees

Ms. Taylor has extensive experience in transforming operations, implementing automation in insurance and delivering results in complex tax cases with the IRS and the Department of Labor. Her unique mix of experience gives her a valuable perspective and ability to oversee management’s efforts to grow and develop Citizens’ business and its interactions with regulators as well as the ability to enhance shareholder value by leveraging her financial and risk management expertise and deep understanding of the insurance business.

BOARD LEADERSHIP STRUCTURE

| | |

•Separate Chairman and Chief Executive Officer |

The Board believes that the best and most effective leadership structure for Citizens and its shareholders is to have separate chief executive officer and chairman roles. This structure allows our Chief Executive Officer to focus his time and energy on operating and managing the Company while enhancing the Board’s ability to exercise independent oversight of Citizens’ management on behalf of its shareholders.

Jerry D. “Chip” Davis, Jr. has served as the Company’s Chairman since February 2020. The Board elected Mr. Davis to serve as Chairman due to his 40+ years’ experience in the life insurance industry, including as a leader of a life insurance company. Mr. Davis as an Independent Director.

BOARD MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Company’s business affairs are conducted under the direction of the Board. The Board met 6 times during 2023, and each director attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board held during 2023, and (ii) the total number of meetings held by each committee of the Board on which such director served during 2023. We expect all of our directors to attend our 2024 annual meeting of shareholders and all directors serving at the time attended the 2023 annual meeting.

Select officers and employees regularly attend Board meetings to present information on our business and strategy, and Board members have access to our officers and employees outside of Board meetings. Board members are encouraged to make site visits to meet with our employees, and to accept invitations to attend and speak at internal Company meetings.

To promote open discussion, our independent directors hold regularly scheduled executive sessions without management present. These sessions allow the independent directors to review key decisions and discuss matters in a manner independent of management.

To assist it in carrying out its duties, the Board has delegated certain authority to four separately-designated standing committees shown in the table below along with the number of meetings held in 2023. All committees are chaired by and consist entirely of independent directors. The Committee Chairs review and approve agendas for all meetings of their respective Committees.

| | | | | | | | | | | | | | |

|

Audit Committee | Compensation Committee |

Investment Committee | Nominating and Corporate Governance Committee |

| 4 meetings | 4 meetings | 7 meetings | 3 meetings |

| Christopher W. Claus | | • | | |

| Cynthia H. Davis | | | | |

| Jerry D. Davis, Jr. | | | • | |

| Francis A. Keating II | | | | • |

| Dr. Terry S. Maness | | | | |

| J. Keith Morgan | • | | • | |

| Gerald W. Shields (CEO) |

|

| | |

| Mary Taylor | • | • | | • |

The primary responsibilities of each of the standing committees are defined in each respective charter and summarized below. The charters for the Audit, the Compensation and the Nominating and Corporate Governance Committees incorporate the requirements of the U.S. Securities and Exchange Commission (SEC) and the NYSE to the extent applicable. Current, printable versions of these charters are available on Citizens’ website at https://www.citizensinc.com/investors/#corporate-governance.

Audit Committee

The purpose of the Audit Committee is to assist the Board’s oversight and monitoring of:

•the Company’s accounting and financial reporting processes and the audits of its consolidated financial statements;

•the adequacy of the Company’s internal control over financial reporting;

•the integrity of the Company's consolidated financial statements;

•the qualifications and independence of the Company's independent auditor;

•the appointment, retention, performance, and compensation of the Company's independent auditor and the performance of the internal audit function;

•the Company’s compliance with legal and regulatory requirements related to matters within the scope of the Committee’s responsibilities;

•the Company’s enterprise risk management program; and

•any related party transactions.

Audit Committee Financial Expert. The Board has determined that all of the members of the Audit Committee are “financially literate” within the meaning of the NYSE listing standards. In addition, the Board has determined that both Dr. Terry S. Maness (Chair) and Mary Taylor qualify as an “audit committee financial expert” within the meaning of applicable SEC regulations. For additional information on the Audit Committee’s role and its oversight of the Independent Auditor during 2023, see “Audit Committee Report” on page 29.

Compensation Committee

The Compensation Committee is responsible for:

•evaluating and approving director and executive officer compensation, plans and programs;

•reviewing and taking actions with respect to incentive compensation and equity-based plans;

•reviewing market data to assess the competitive position of the Company’s director and executive compensation;

•retaining a compensation consultant to assist the committee and the Board in evaluating director and executive officer compensation; and

•evaluating the risks and rewards associated with the Company’s compensation policies and practices.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance committee is responsible for:

•identifying, recruiting and recommending candidates for the Board;

•developing, approving, or recommending to the Board for approval, and assessing, corporate governance policies for the Company;

•overseeing the evaluation of the Board; and

•apprising the Board of corporate governance developments and practices, considering the long-term best interests of the Company’s shareholders.

Investment Committee

The Investment Committee is responsible for:

•overseeing the management of the Company’s investment activities;

•reviewing the performance of management and engaged investment advisors; and

•ensuring conformance of the Company’s investments with the Company’s investment guidelines and relevant regulations.

Executive Committee

In addition to the four committees described above, the Board has formed an Executive Committee, which consists of the Chair of each of the 4 standing committees. This committee exercises the powers of the Board, as needed, in between regularly scheduled Board meetings. The Board then reviews and ratifies or approves the actions of the Executive Committee.

During 2023, the Executive Committee was tasked with leading the search for the Company's new CEO - see below in Succession Planning.

SUCCESSION PLANNING

Our Board has ultimate oversight for appointment of our Chief Executive Officer and succession planning. Gerald W. Shields was appointed Chief Executive Officer, effective January 1, 2022 and the initial term of the Shields Employment Agreement expired on December 31, 2023 (see "Narrative Disclosure to Summary Compensation Table - Shields Employment Agreement on page 44 below for a more detailed description of the Shields Employment Agreement). In 2023, the Board delegated the authority to its Executive Committee to lead the search process for Mr. Shields' successor. In order to give the Executive Committee additional time to complete the search process, in November 2023, the Board extended Mr. Shields' Employment Agreement through June 30, 2024.

On March 18, 2024, the Company announced that Jon Stenberg was appointed President and would succeed Mr. Shields as Chief Executive Officer effective July 1, 2024.

BOARD PROCESSES

BOARD AND COMMITTEE EVALUATION PROCESS

The Board and each committee conduct an annual self-assessment. This evaluation is intended to assess whether the Board and the committees are functioning effectively. As part of this self-assessment, the directors are asked to consider the Board’s role, relations with management, composition and meetings. Each committee is asked to consider its role and the responsibilities articulated in the committee’s charter, the composition of the committee and the committee meetings. The self-assessment responses and comments are compiled by the Secretary of the Company and presented to the Nominating and Corporate Governance Committee for initial review. The responses and comments are reviewed with each committee and the full Board and are utilized by the Board and each committee to improve their operations and processes.

We also conduct individual assessments of each director, which is led by the Chair of the Nominating and Corporate Governance Committee, who participated on each call with each of the other directors. The purpose of these calls was to get one-on-one feedback of such director’s contributions to the Board and follow-up with respect to their Board and committee assessments.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Company identifies related persons using known business affiliations, quarterly disclosure meetings and information provided by directors and executive officers in their annual questionnaires.

The Company has in place the following process controls to identify and approve transactions with related persons:

•Management discusses related persons and affiliates as a standing agenda item during each quarterly disclosure meeting.