Long Title. Big Mission.

Omaha, Nebraska

Aug. 15, 2019

Remarks to Maha Discovery Festival Entrepreneurs

Good morning everyone, and thank you to the Maha team for the opportunity to speak to you today. [1] My name is Martha Miller, and I am the first Advocate for Small Business Capital Formation at the U.S. Securities and Exchange Commission, which is the government agency responsible for regulating our capital markets, including how companies raise capital from investors in both the public and the private markets.

Some of you may be scratching your heads wondering who invited someone from the government to an entrepreneurship conference? Or maybe you hoped I was from a different SEC and we could talk about when the Cornhuskers are going to go up against the Bulldogs or the Crimson Tide. Or you may be wondering why you didn’t sneak out for an early coffee break? All valid questions. This presentation is going to look very different from what you might expect from a government official, yet surprisingly familiar. We’ve put together a pitch deck to introduce you to our office, why Congress created us, and why we want to hear from you as entrepreneurs.

Before I delve in, I’ll offer up the standard disclaimer that the views and perspectives I share today represent my own and not necessarily those of the entire agency.

I’ll start with our mission: advocacy is in our title, and it’s at the core of what we do. We are focused on advocating for small businesses and their investors to foster better access to capital markets, strengthening your voice within the SEC and the broader regulatory landscape. To understand our mission, let’s take a step back to where we came from.

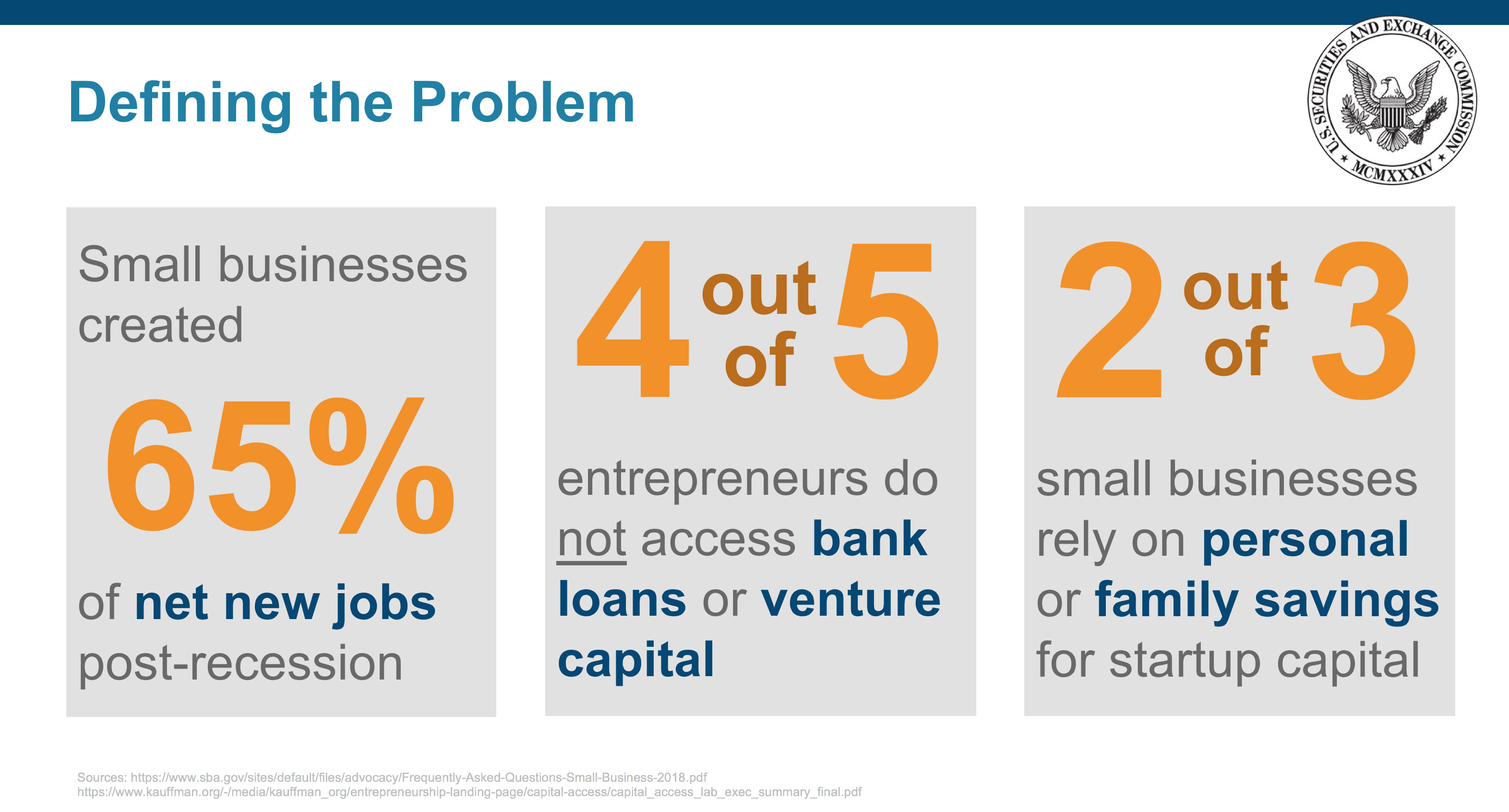

Small businesses are big business: they create a majority of net new jobs in the country. To put a finer point on it: entrepreneurship changes lives. It creates jobs that provide for families. It creates innovation and technology that improves lives, health and opportunities for advancement. And it can create wealth for those who invest and support the growth of promising companies along their path to success.

However, small businesses face significant challenges in accessing capital to transform ideas into opportunity. Four out of five entrepreneurs do not access bank loans or venture capital in funding their companies. [2]Over two thirds of small business founders rely instead on personal or family savings for startup capital. [3] And it probably goes without saying that there are great disparities in who can afford to lean on savings as a source of capital.

In other words: there is a gap between the role we have come to expect of small businesses in creating jobs, innovations and wealth, and the accessibility of capital to do so. At the SEC, we regulate capital markets and create rules that impact how and from whom you can find investment capital. Access to capital is routinely cited as one of the top, if not the most pressing of, issues facing entrepreneurs. Yet small businesses and their investors are often underrepresented during the creation of the rules and laws that impact your access to capital. That underrepresentation isn’t a surprise to me; it is rare to find an entrepreneur who simultaneously focuses on scaling their business, developing their talent, and meeting their investors’ expectations to grow revenue who is also regularly carving out time to come to D.C. or work alongside regulators like the SEC to make sure that the rulebook by which their business plays makes sense.

Recognizing that we needed to do more to proactively engage with entrepreneurs and their investors to bring their perspectives into the regulatory process earlier, Congress created a new office within the SEC with legislation that was broadly supported across the aisle. I was fortunate to have been appointed by the Commissioners to serve as the first Advocate leading the new eponymous office. Put simply, we bring the voice of entrepreneurs and their investors to the table early and often.

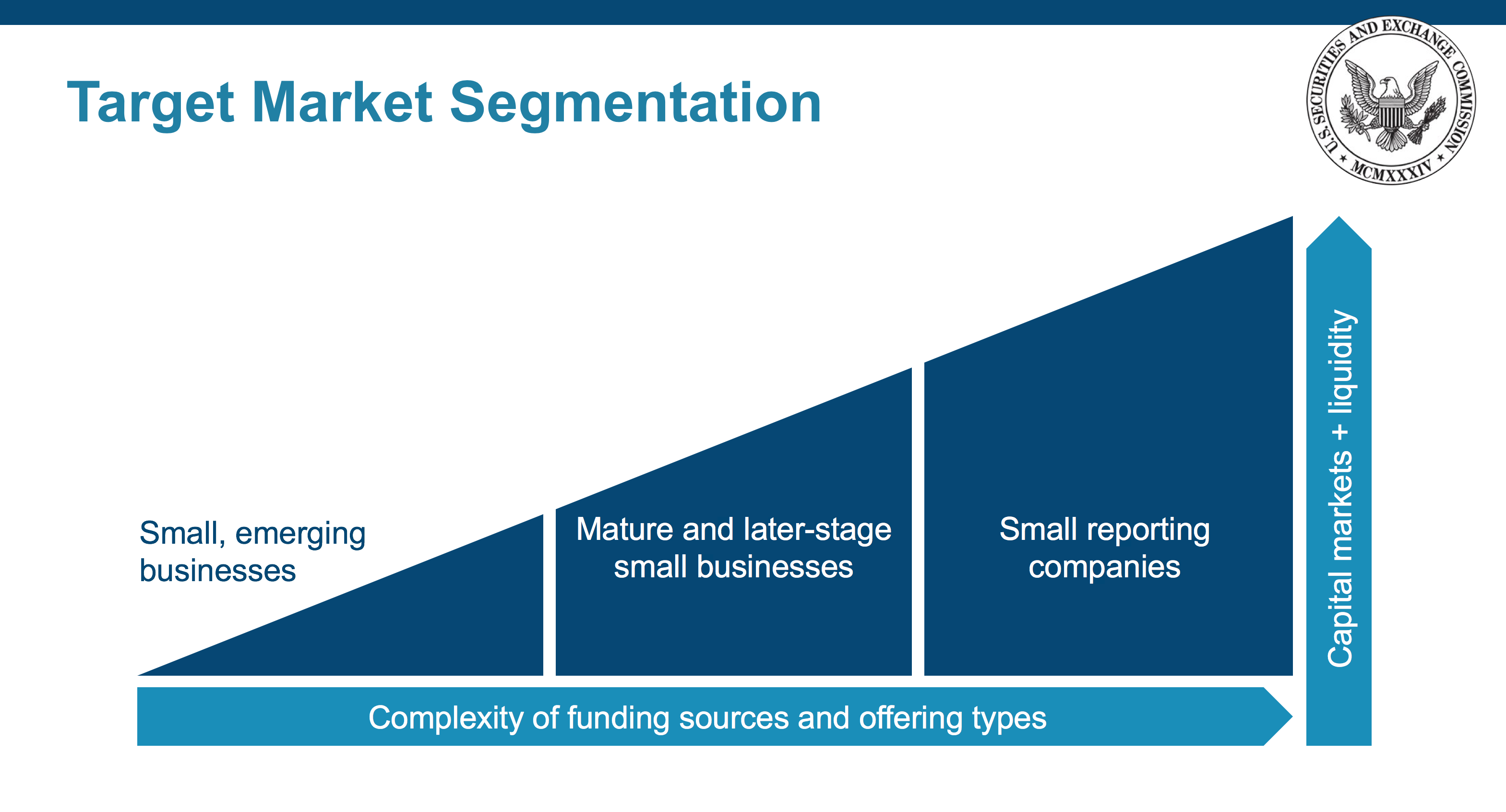

At this point, you may be wondering “what does she mean by ‘small’ business,” a fair question given that everyone seems to have their own definition. As we look at our target market, we segment among three general groups:

- Small, emerging businesses — Generally these companies are looking at some combination of bootstrapping, self-financing, bank debt, friends and family, crowdfunding, angel investors, and seed rounds. This is the funding that gets companies off the ground or through early prototypes.

- Mature and later-stage small businesses — These are the companies who are growing and looking for larger amounts of capital that can fund operations of scale, ventures into new verticals, and preparation for public markets. Most often these investors are institutional in nature, whether syndicate groups, venture capital, private equity, or even public funds.

- Small reporting companies — Companies can access broad pools of investors when they go public, and our office looks at issues faced by companies with less than $250 million in public float.

In a nutshell: “small” in the context of the businesses with which our office works is relative. These businesses encompass a very broad segment of the overall market.

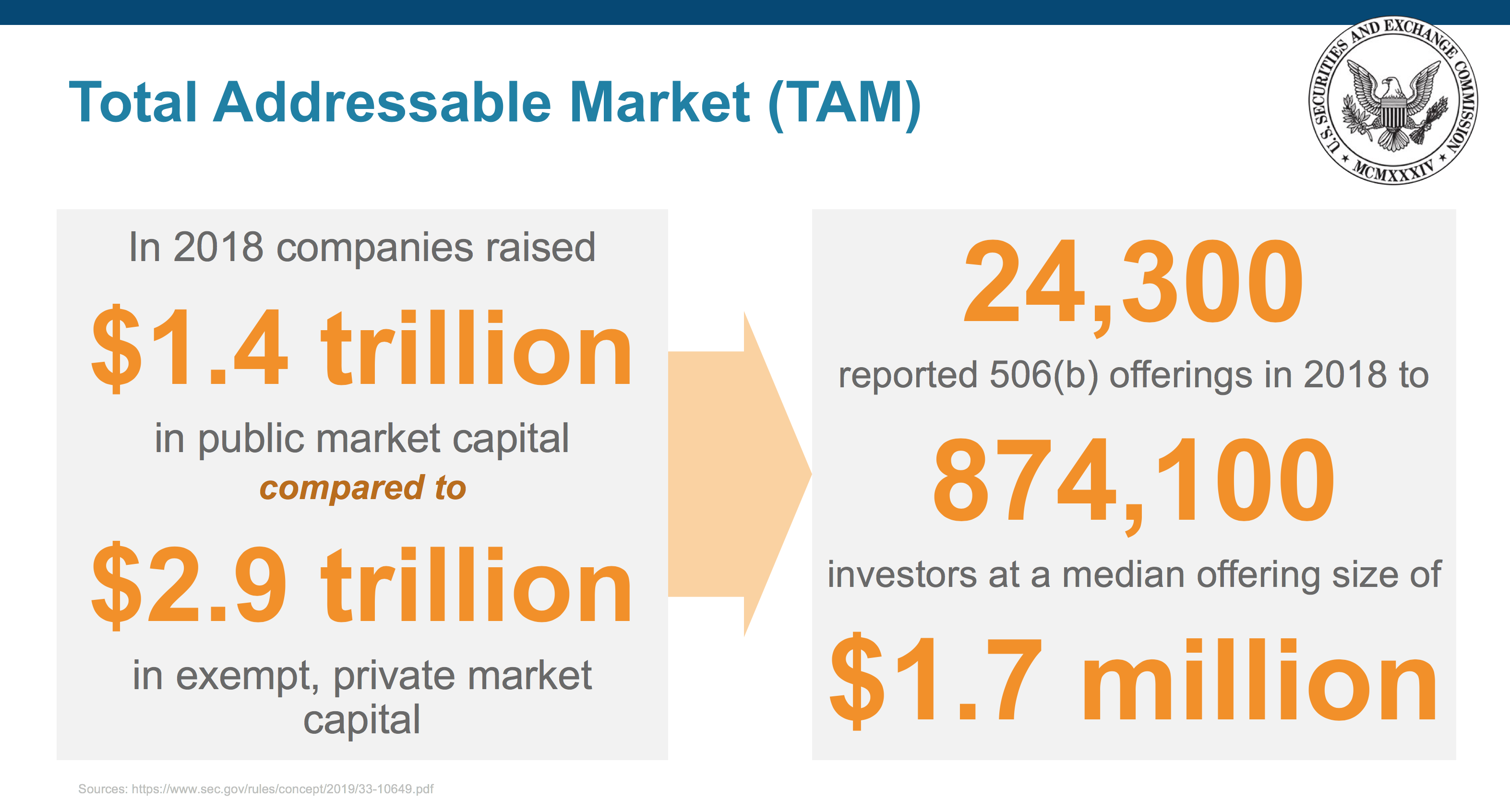

If you’re wearing your investor hat listening to my pitch, you’re wondering what the total addressable market (TAM) looks like for small businesses. In 2018, companies raised $1.4 trillion through registered IPOs and the public markets. Contrasted with the $2.9 trillion raised through offerings exempt from registration, there’s been a clear shift and increase in funding through the exempt framework utilized by small businesses.[4] Anytime you quote a figure in trillions of dollars, it’s hard to conceptualize the magnitude of the amount. Let’s break that down further into individual companies and investors that use the most common exemption from registration for their offerings under Regulation D: Rule 506(b). Companies conducted approximately 24,300 506(b) offerings in 2018, in which approximately 874,100 investors participated with a median offering size of approximately $1.7 million.

What does that tell us about our TAM? In a nutshell, small businesses in the aggregate are big business.

The investor in you may be now wondering: how is this new office going to take such a large TAM and craft a strategy for their serviceable addressable market (SAM) and serviceable obtainable market (SOM)? Unlike a product delivered to a fixed and quantified market that starts small and scales in size, we take an inverse approach: starting with the entire marketplace or TAM as our initial customer, and building solutions that work for the broader ecosystem using feedback from our SOM. To deliver solutions to the entire small business marketplace, we must take the pulse of diverse, representative groups of thought leaders with a wide range of experience, spanning coast to coast, rural to urban, startup to IPO, angel groups to venture capital, retail investors to registered funds. So how are we doing that?

Our go to market plan requires us to use our lean resources to reach as many people as possible, the same objective that many of you may have with your own businesses. I think of our communications along three key channels:

- Inbound inquiries — Our proverbial door is always open. Anyone can email, call or come visit us to talk about the small business capital issues that matter most to you.

- Connections to thought leaders — We don’t come to the table proclaiming to have all the answers. We’re constantly looking to connect with businesses, investors and thought leaders who can add valuable perspectives to the mix and challenge the way we think about issues.

- Outreach to target “customers” — Rather than attempting to create independent brand traction and grow our own network, we utilize existing networks of small businesses and their investors to not only get the message out about our office, but to also deliver solutions to our “customers” that fulfill our mission. A key example is being here today at Maha.[5] Connections through larger networks feed new inbound inquiries that expand our “customer” base.

I will tell one quick story from our visit to a 1 Million Cups event a few months ago, shortly after launching the office. After being introduced and jumping on stage, I rhetorically said to the crowd: “I bet you’re wondering why I’m here today,” to which a gentleman in the front shouted back: “Yeah, why ARE you here?!” I couldn’t help but laugh, as it was the perfect reminder that no one in the room had a clue who I was or what we were trying to do to support the very businesses convening that day. In marketing lingo: we had zero brand awareness. Now when I meet with groups of entrepreneurs, I own our nascent brand and use it as a tool to forge connections. Hence the second slide of this deck.

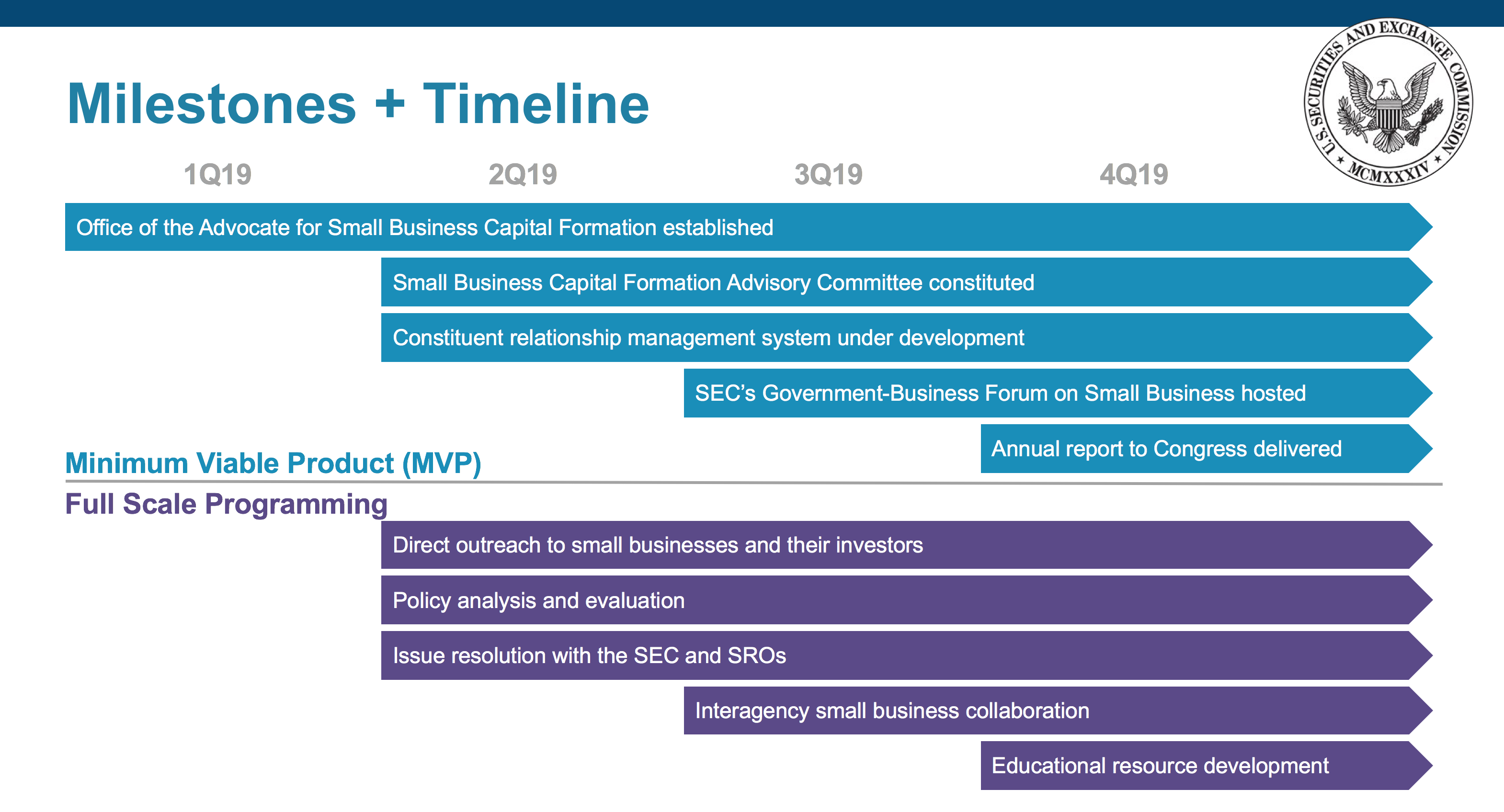

We’ve operationalized the office at warp speed, building out our minimum viable product (MVP) and delivering on incremental and iterative programming in support of our mission. It’s been a productive first 7 months, and we have challenging and exciting work ahead of us for the rest of this year and beyond.

Our key performance indicators (KPIs) are different. We’re not focused on revenue, profit margin, unit economics, conversion rate, MAUs, LTV, CAC, or any other alphabet soup figure. We’re interested in quality resolution of issues, engaging new voices and perspectives, bringing small business perspectives to the rulemaking process early and often, and producing practical, solution-oriented proposals for policy change. We’ll report annually on our work, keeping Congress and the public informed of our progress.

I’ve learned a few valuable lessons along the way, and had a few others reinforced in the process, which I hope may be valuable to your entrepreneurial endeavors. The first is to get input and buy-in to your product early through feedback. Rather than just telling people what our plans were for our office, we instead asked people: “what is your biggest pain point that we can help you solve?” Those answers allowed us to hone and sometimes redirect our focus based upon the expressed customer need. If we had built out the office and stayed quiet until we had offerings ready to launch, we would have missed the mark.

The second lesson is the importance of scaling and incrementally adapting. Rather than aim for transformational adaptation out of the gate, we’re learning through each step of incremental adaptation how to create a cumulatively transformational impact.

The third lesson is to know not only what you do, whether the product you sell or the service you provide, but to be comfortable knowing what you don’t do. As a small scaling office, it’s important for us to own our niche in small business capital formation and help others navigate to the right resources, whether they are provided by us, one of our colleagues at the SEC, or one of our partner agencies.

The last and most important lesson is that how far you go is directly proportionate to the talent of the team around you. I am lucky to be surrounded by colleagues whose passion and talent I would put up against any private company, including Julie Davis, Jenny Riegel, and Malika Sullivan.

The conventional wisdom is that the goal of the pitch deck is to get to the next meeting, not to actually raise money. My goal today is the same. I hope to have sparked your interest so that you will come talk to us, tell us about the capital formation issues you face, and help us improve the opportunities for small businesses and their investors to grow and thrive. I look forward to taking Q&A and staying in touch beyond today.

[1] Special thank you to Lauren Martin and Melanie Phelan for their support not only of our office joining Maha Discovery Festival 2019, but for their work in supporting entrepreneurs across their region.

[2] See https://www.sba.gov/sites/default/files/advocacy/Frequently-Asked-Questions-Small-Business-2018.pdf; https://www.kauffman.org/-/media/kauffman_org/entrepreneurship-landing-page/capital-access/capital_access_lab_exec_summary_final.pdf

[3] See https://www.sba.gov/sites/default/files/advocacy/Frequently-Asked-Questions-Small-Business-2018.pdf; https://www.kauffman.org/-/media/kauffman_org/entrepreneurship-landing-page/capital-access/capital_access_lab_exec_summary_final.pdf

[5] YFC Inc. d/b/a Maha Music Festival is a 501(c)(3) nonprofit whose mission is “to showcase the unique heart and soul of the Midwest, collaborate with our community to provide unforgettable experiences, and position the region as the premier place to put roots down and grow.” https://www.guidestar.org/profile/06-1839109