Statement on Amendments to Reduce Unnecessary Burdens on Smaller Issuers by More Appropriately Tailoring the Accelerated and Large Accelerated Filer Definitions

March 12, 2020

Today, the Commission voted on a recommendation from the Division of Corporation Finance to adopt amendments to the accelerated and large accelerated filer definitions in Exchange Act Rule 12b-2. In simple terms, today’s amendments are a much needed recalibration of three categories of reporting companies—smaller reporting company, accelerated filer and large accelerated filer. These three categories exist because we recognize that in regulation in general, and in disclosure requirements in particular, one size does not fit all and that we can advance all aspects of our mission through appropriate calibration of our rule sets.

Taking a step back, I note that today’s amendments are part of an ongoing retrospective review of our regulatory framework. When we modernize our rule sets, individually and collectively, to address current facts and circumstances we have the opportunity to advance all aspects of our mission and, in this case, as in many others, the staff has done just that.

A retrospective review necessarily involves perspective. In the case of today’s amendments, perspective is particularly informative and provides a compelling case for accepting the staff’s recommendations. Below, I summarize some of this broader context that has added to my enthusiastic support for the staff’s recommendation[1] to recalibrate theses definitions.

Amendments are Consistent with Effective Congressional Action. First, in the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, Congress determined that the combination of both Section 404(a), the issuer’s requirement to establish and maintain effective internal control over financial reporting (ICFR), and Section 404(b), the requirement to obtain a separate attestation of the ICFR from an outside auditor, was not appropriate for smaller issuers with less than $75 million in public float and exempted those smaller issuers from the Section 404(b) requirement. In addition, in the 2012 JOBS Act, Congress, on a bipartisan basis, also determined that the combination of both Section 404(a) and Section 404(b) was not appropriate for emerging growth companies (EGCs)—companies with less than $1 billion in annual gross revenues within five years of their initial public offering. Time has proven Congress was right. Providing up to a five-year on-ramp that included an exemption from Section 404(b) for EGCs to join the public markets incentivized more companies to join our public markets and provided public market investors with more investment opportunities. And, importantly, investors have made it clear that this is approach is appropriate. Not once in my years of involvement in the public offering process—as a practitioner and as a regulator—have I heard an investor say that they would not invest, or would be less likely to invest, because the company qualified as an EGC. To be clear, today’s amendments do not expand the definition of EGC. Rather, the amendments we are considering today would only extend the Section 404(b) relief to certain low-revenue smaller issuers, including EGCs that have been public for five years but have not reached $100 million in revenues. That subset of companies—small, former EGCs—is a particular focus of mine. I am not persuaded that after five years of public reporting, which includes providing audited financial statements and conducting Section 404(a) reviews, these smaller companies should, in year six, be subject to a new, additional control attestation requirement.

Amendments Reflect Evolution of Financial Reporting and Related Control Systems. Second, ICFR and the interaction between the Section 404(a) and Section 404(b) processes has evolved over time. In the past two decades, financial reporting, ICFR and the audit process have become more systematized and integrated. In simple terms, this means that controls are a component of reporting software and systems and the controls assessment (Section 404(a)) aspect of audits focuses on the design and adequacy of those systems. That is because, at a hands on level, public company reporting processes have changed and improved, particularly for smaller and medium sized companies.

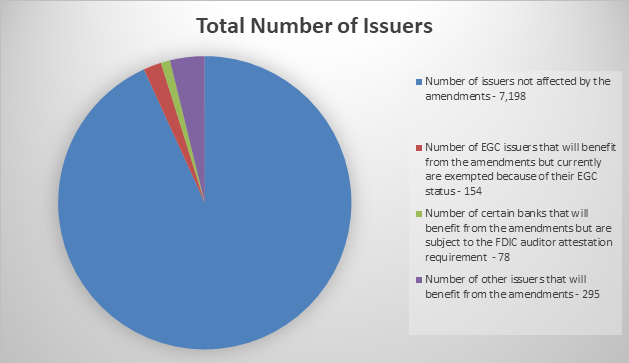

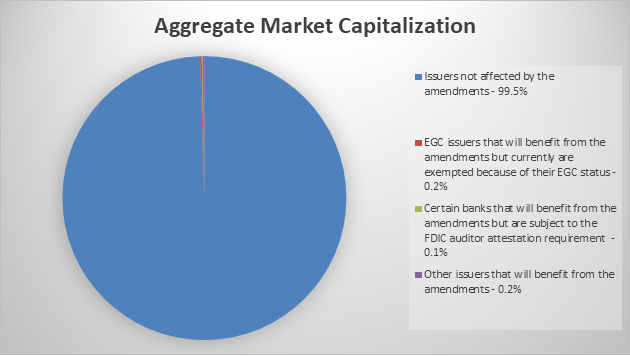

Statistics on the Percentage of Affected Market Capitalization and the Number of Small Issuers Affected Support Conclusion of Appropriate Calibration. Third, today’s amendments are consistent with Commission and Congressional efforts to ensure that we do not have a one-size-fits-all regulatory structure in our public markets. At the proposing stage we heard criticism that the amendments reflected a general lightening of our regulation of the “public markets.” Today’s amendments, while potentially important to each of the smaller issuers (and their shareholders) that will benefit, will not impact the companies that comprise the vast majority of the public markets. Instead, the amendments focus on smaller, low-revenue companies that make up a very small portion of our public market in terms of overall market capitalization and for whom the cost of unnecessary regulation is most acute.

* Source: The estimates in this figure are based on DERA staff analysis of annual reports (and the corresponding XBRL filings) on Forms 10-K, 20-F, or 40-F in calendar year 2018; data on revenues (for the prior fiscal year) from XBRL filings, Compustat, and Calcbench; and additional data from Compustat and Audit Analytics.

* Source: The estimates in this figure are based on DERA staff analysis of data on market capitalization from Compustat corresponding to the end of the fiscal year for annual reports in calendar year 2018, with issuers identified as in the previous figure.

The two pie charts included here illustrate these points, and more generally the soundness and importance of taking a scaled approach to our disclosure requirements. While the charts largely speak for themselves, I will provide some additional context. Today’s amendments would not impact the largest company in the S&P 500 with a market capitalization of approximately $1.2 trillion.[2] They would not even impact the 500th largest company in the S&P 500 with a market capitalization of approximately $3.5 billion.[3] The companies that would be affected are not in the S&P 500 and not in the Russell 1000. Investors should know that the S&P 500 makes up approximately 80 percent of total market capitalization[4] and, when you include the next 500 companies (the Russell 1000), you get to approximately 90 percent of the total market capitalization.[5] We are not talking about any of these companies. Instead, we estimate that companies benefiting from today’s measures collectively represent less than 1 percent of total market capitalization. Notably, the collective market capitalization of the more than 500 companies that will benefit from today’s amendments is less than ¼ of the market capitalization of the largest company in the S&P 500. We are talking about smaller companies that should benefit from scaled regulation and from our commitment to retrospective review and the modernization of our rule sets.

Amendments Recognize that There Are Many Components of ICFR. Finally, going back to my point on never hearing an investor saying something like “I will wait for the five-year EGC period to expire before investing.” On various occasions, I have asked sophisticated, global investors if they have any hesitation in investing in non-U.S. companies due to the absence of a Section 404(b) auditor attestation. While there are various reasons to be concerned about the quality of information provided by non-U.S. reporting companies, by and large I have not heard the absence of a Section 404(b) auditor attestation cited as a source of concern. They do, however, often note a difference in overall control environments. I believe this is, at least in part, because of the multi-faceted regulatory structure we have established around robust financial statements.[6] I believe in this control environment and have often commented that the independent audit committee requirement was one of the most effective aspects of Sarbanes-Oxley.[7] Here, it is worth noting that, smaller issuers that will benefit from today’s amendments will still be required to have their principal executive and financial officers certify that, among other things, they are responsible for establishing and maintaining ICFR and have evaluated and reported on the effectiveness of the company’s disclosure controls and procedures, will continue to be subject to a financial statement audit by an independent auditor who is required to consider ICFR in the performance of that audit and will still be subject to the independent audit committee and other requirements of Sarbanes-Oxley.

I applaud the staff for moving deliberatively and with rigor, with our mission in mind. I would like to acknowledge the many staff members across many divisions and offices who contributed to this effort:

From the Division of Corporation Finance: Bill Hinman, Elizabeth Murphy, Felicia Kung, Michael Seaman, John Fieldsend, Kyle Moffatt, Lindsay McCord, Craig Olinger, Jennifer Zepralka, Michael Coco, and Ben Passey.

From the Division of Economic and Risk Analysis: S.P. Kothari, Hari Phatak, Vlad Ivanov, Tara Bhandari, Mattias Nilsson, Mariesa Ho, and Malou Huth.

From the Office of the General Counsel: Bob Stebbins, Bryant Morris, Dorothy McCuaig, and Shehzad Niazi.

From the Office of the Chief Accountant: Sagar Teotia, Giles Cohen, Marc Panucci, Duc Dang, Louis Collins, and Ryan Wolfe.

From the Division of Investment Management: Dalia Blass, Alison Staloch, Sarah ten Siethoff, Brian Johnson, Mark Uyeda, Angela Mokodean, and Jenson Wayne.

[1] I commend the staff for their thoughtful and robust analysis that is more than sufficient for me to support the recommendation. I offer the following context for additional perspective and color.

[2] Calculated as of March 10, 2020.

[3] Calculated as of March 10, 2020.

[4] See S&P 500 Fact Sheet as of Feb. 28, 2020.

[5] See Russell 1000 Index Fact Sheet as of Feb. 29, 2020.

[6] This regulatory structure includes, but is not limited to, independent audit committees, the issuer’s requirement to establish and maintain effective ICFR and the oversight of the audit profession by the Public Company Accounting Oversight Board.

[7] See Chairman Jay Clayton, Sagar Teotia and William Hinman, Statement on Role of Audit Committees in Financial Reporting and Key Reminders Regarding Oversight Responsibilities (Dec. 30, 2020), available at https://www.sec.gov/news/public-statement/statement-role-audit-committees-financial-reporting.