Filing and Amending a Form D Notice

A Compliance Guide for Small Entities and Others*

Form D is a form to be used to file a notice of an exempt offering of securities with the Securities and Exchange Commission. Commission rules require the notice to be filed by companies and funds that have sold securities without registration under the Securities Act of 1933 in an offering based on a claim of exemption under Rule 504 or 506 of Regulation D or Section 4(a)(5) of that statute. Commission rules further require the notice to be filed within 15 days after the first sale of securities in the offering. For this purpose, the date of first sale is the date on which the first investor is irrevocably contractually committed to invest. If the due date falls on a Saturday, Sunday or holiday, it is moved to the next business day. The SEC does not charge any filing fee for a Form D notice or amendment.

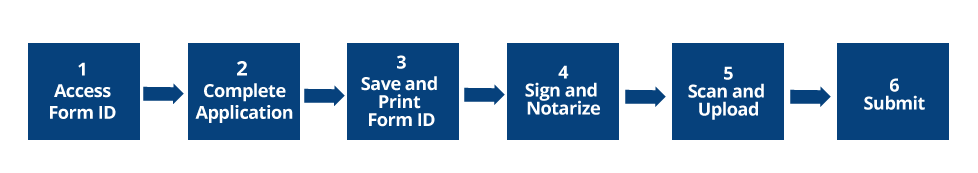

Online Filing Required. Companies and funds must file their Form D notices and amendments with the SEC online, through the Internet, using the SEC's EDGAR (electronic gathering, analysis and retrieval) system. To file online using the EDGAR system, a company or fund must have its own filer identification number (called a "Central Index Key" or "CIK" number) and a set of password-like "access codes." You can obtain a CIK number and EDGAR access codes at any time, even well before your company or fund is ready to file its first online Form D notice. To get them, you must complete and submit an application for EDGAR access online through Form ID. The graphic below illustrates the process of submitting an electronic Form ID application.

For more information on obtaining a CIK and EDGAR access codes, you may review the Commission staff's Guidance on Form D Filing Process. If you have questions about this guidance, you may contact SEC filer support personnel at (202) 551-8900 and choose Option No. 4.

Once you have a CIK number and EDGAR access codes, you can make Form D and other SEC filings online by logging in to the EDGAR system. You will have only one hour after your last keystroke to complete a Form D filing once you have logged in. Therefore, you will want to make sure you have all the information needed to complete the filing before logging in. You can compile the information using a paper version of Form D before entering it online. Once you have all the information you need, you can make your Form D filing by visiting the SEC's Online Forms Login page and logging in using your CIK number and EDGAR access codes. Once logged in, choose "Form D" under "Make a Filing" in the top left corner as shown in the sample image below.

The online version of Form D will appear on your screen. The form provides all the instructions and other information you should need to complete and submit a Form D notice online with the SEC. Once you click the "Submit" button and submit your filing, you will receive an e-mail message notifying you of the status of the submission. If you have questions at this point about the filing process, you may contact SEC filer support personnel at (202) 551-8900 and choose Option No. 4. If you have legal questions about the Form D information requirements, you may contact the SEC’s Office of Small Business Policy at (202) 551-3460.

Once your online Form D submission is accepted, you can obtain a printout of it by visiting the EDGAR Company Search page and entering appropriate search criteria.

Amendments to Form D Filings. A Form D filer may file an amendment to a previously filed Form D notice by indicating in the space provided on the form that the filing is an amendment rather than a new filing. A Form D filer should abide by the following guidance in determining whether it should file an amendment to a previously filed Form D notice:

-

A filer may file an amendment to a previously filed notice at any time.

-

A filer must file an amendment to a previously filed notice for an offering:

-

to correct a material mistake of fact or error in the previously filed notice, as soon as practicable after discovery of the mistake or error;

-

to reflect a change in the information provided in the previously filed notice, except as provided below, as soon as practicable after the change; and

-

annually, on or before the first anniversary of the most recent previously filed notice, if the offering is continuing at that time.

-

-

When amendment is not required: A filer is not required to file an amendment to a previously filed notice to reflect a change that occurs after the offering terminates or a change that occurs solely in the following information contained in a previous Form D notice or amendment:

-

the address or relationship to the issuer of a related person identified;

-

an issuer's revenues or aggregate net asset value;

-

the minimum investment amount, if the change is an increase, or if the change, together with all other changes in that amount since the previously filed notice, does not result in a decrease of more than 10%;

-

any address or state(s) of solicitation for a person receiving sales compensation;

-

the total offering amount, if the change is a decrease, or if the change, together with all other changes in that amount since the previously filed notice, does not result in an increase of more than 10%;

-

the amount of securities sold in the offering or the amount remaining to be sold;

-

the number of non-accredited investors who have invested in the offering, as long as the change does not increase the number to more than 35;

-

the total number of investors who have invested in the offering; and

-

the amount of sales commissions, finders' fees or use of proceeds for payments to executive officers, directors or promoters, if the change is a decrease, or if the change, together with all other changes in that amount since the previously filed notice, does not result in an increase of more than 10%.

-

Definitions of Terms Used in Form D. Terms used but not defined in Form D that are defined in Rule 405 or Rule 501 under the Securities Act of 1933, 17 C.F.R. § 230.405 or 230.501, have the meanings given to them in those rules. More specific information on these definitions may be found in the Guide to Definitions of Terms Used in Form D.

State Form D Filings. Many states also require the filing of Form D notices and amendments, and most of them charge a filing fee. Please visit www.NASAA.org for more information on state Form D filing requirements, including links to the websites of each state's securities regulator. State websites contain bulletins providing details on filing requirements and a contact person for specific questions. Most states allow for either electronic or paper Form D filing, with the majority of states accepting and a few states mandating the electronic filing of Form D. Electronic filing of the Form D can be made through the Electronic Filing Depository (EFD), which is programmed with each state's filing requirements. Please visit www.efdnasaa.org for a list of states that allow electronic filing as well as those that mandate it. As an alternative to electronic filing, in those states that do not mandate electronic filing, a filer may be able to satisfy the state Form D filing requirement by submitting either a printout of the SEC online Form D filing (retrieved from the EDGAR Company Search page) or a completed paper version of Form D, along with the appropriate fee. Please contact the appropriate state regulator with any questions regarding a state Form D filing.

Additional Information on Form D Processing. SEC Filer Support Staff is available to assist small companies and others with questions on filing and amending Form D notices. Our Guidance on Form D Filing Process may answer your questions on the EDGAR Form D filing process. You may direct additional questions about filing the process to SEC personnel by telephoning (202) 551-8900.

Additional Information on Form D Legal Requirements. The staff of the SEC's Division of Corporation Finance has published interpretations of Rule 503, 17 C.F.R. § 230.503, which imposes the SEC Form D filing requirement in most instances, in Section 257 of its Securities Act Rules Compliance and Disclosure Interpretations, and interpretations of the requirements of Form D itself, in Section 130 of its Securities Act Forms Compliance and Disclosure Interpretations. You may obtain answers to other interpretive legal questions relating to Form D by contacting the SEC's Office of Small Business Policy at (202) 551-3460.

Last Reviewed or Updated: Aug. 4, 2017