Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party Other Than the Registrant ¨

Check the Appropriate Box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

| Pfizer Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of filing fee (Check the appropriate box): | ||||

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Table of Contents

| 1 | The 2011 Financial Report is not included in this filing. The portions of the 2011 Financial Report that are incorporated by reference in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011 (the “2011 Form 10-K”) were filed, and the other portions of the 2011 Financial Report were furnished, solely for the information of the SEC on Exhibit 13 to the 2011 Form 10-K. The 2011 Financial Report is contained in Appendix A to the Proxy Statement being mailed to our shareholders beginning on or about March 15, 2012. The Letter to Shareholders and Corporate and Shareholder Information contained in the materials being mailed to our shareholders beginning on or about March 15, 2012 are not included in this filing. |

Table of Contents

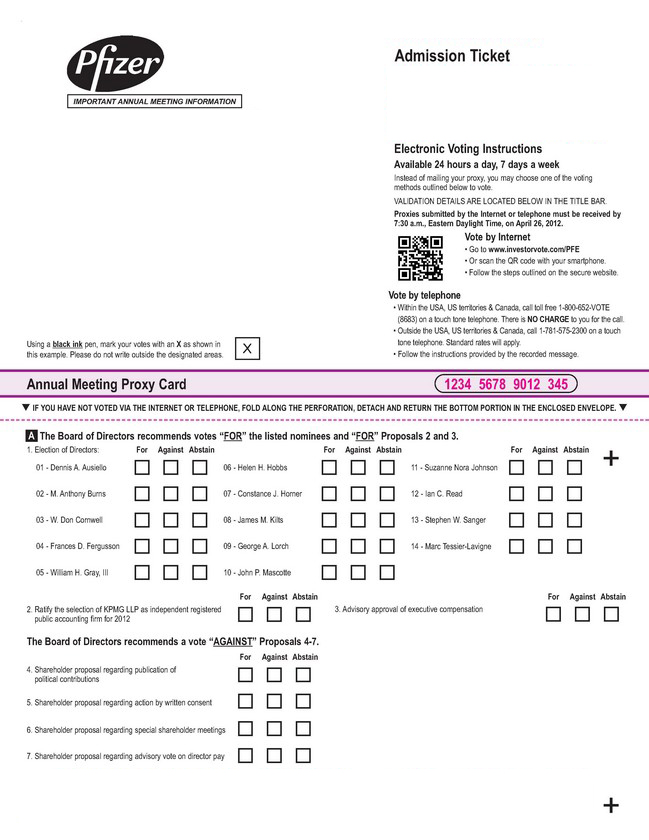

HOW TO VOTE

Most shareholders have a choice of voting on the Internet, by telephone, or by mail using a traditional proxy card. Please refer to the proxy card or other voting instructions included with these proxy materials for information on the voting method(s) available to you. If you vote by telephone or on the Internet, you do not need to return your proxy card.

ANNUAL MEETING ADMISSION

Either an admission ticket or proof of ownership of Pfizer stock, as well as a form of personal photo identification, must be presented in order to be admitted to the Annual Meeting. If you are a shareholder of record, your admission ticket is attached to your proxy card or the “Notice of Internet Availability of Proxy Materials” referred to below. If your shares are held in the name of a broker, bank or other holder of record, you must bring a brokerage statement or other proof of ownership with you to the Meeting, or you may request an admission ticket in advance. For further details, please see “Do I need a ticket to attend the Annual Meeting?” under “Proxy Statement—Questions and Answers About the Annual Meeting and Voting.”

NOTICE AND ACCESS; ELECTRONIC DELIVERY OF PROXY MATERIALS

This year, we are pleased to be distributing our proxy materials to certain shareholders via the Internet under the “notice and access” approach permitted by rules of the Securities and Exchange Commission. This approach conserves natural resources and reduces our costs of printing and distributing the proxy materials, while providing a convenient way to access the materials and vote. On March 15, 2012, we mailed a “Notice of Internet Availability of Proxy Materials” to participating shareholders, containing instructions on how to access the proxy materials on the Internet.

Shareholders who are not participating in notice and access can nonetheless help us reduce costs and conserve resources by opting to receive future proxy materials electronically. Shareholders of record may enroll in the electronic proxy delivery service at any time by going directly to www.computershare-na.com/green. Beneficial owners should contact their broker, bank or other holder of record regarding the availability of this service. We encourage all of our shareholders to consider this option and help us conserve resources and reduce expenses.

HOUSEHOLDING

If you and other Pfizer shareholders living in your household do not receive your proxy materials electronically, you may opt to receive only one copy of future proxy statements and financial reports. Please see “What is ‘householding’ and how does it affect me?” under “Proxy Statement—Questions and Answers about the Annual Meeting and Voting” for more information on this important shareholder program.

PFIZER’S ANNUAL REVIEW AVAILABLE ONLINE

Since Pfizer is working hard to be a greener company, we no longer print paper copies of the Pfizer Annual Review to Shareholders. If you would like to view the Annual Review online, visit www.pfizer.com/annual.

Table of Contents

Proxy Summary

Here are highlights of important information you will find in this Proxy Statement. As it is only a Summary, please review the complete Proxy Statement before you vote.

| PFIZER 2011 COMPANY HIGHLIGHTS |

For additional information about Pfizer, please view our 2011 Annual Review at www.pfizer.com/annual

| 2012 PROXY STATEMENT |

|

i |

Table of Contents

PROXY SUMMARY

| ii |

|

2012 PROXY STATEMENT |

Table of Contents

PROXY SUMMARY

| SHAREHOLDER VOTING MATTERS |

SUMMARY OF SHAREHOLDER VOTING MATTERS

| VOTING MATTER | BOARD VOTE RECOMMENDATION | SEE PAGE NUMBER for more information | ||

| Item 1 Election of Directors |

FOR each nominee |

23 | ||

| Item 2 Ratification of Independent Registered Public Accounting Firm |

FOR |

31 | ||

| Item 3 Advisory Approval of Executive Compensation |

FOR |

34 | ||

| Shareholder Proposals:

Item 4 Publication of Political Contributions

Item 5 Action by Written Consent

Item 6 Special Shareholder Meetings

Item 7 Advisory Vote on Director Pay |

AGAINST

AGAINST

AGAINST

AGAINST |

36

37

38

39 | ||

| OUR DIRECTOR NOMINEES |

You are being asked to vote on these 14 Directors. All Directors are elected annually by a majority of votes cast. Detailed information about each Director’s background, skill sets and areas of expertise can be found beginning on page 24.

| NAME | AGE | DIRECTOR SINCE |

POSITION | INDE- PENDENT |

COMMITTEE MEMBERSHIPS | OTHER CURRENT PUBLIC BOARDS | ||||||||||||||

| AC | CC | CGC | RCC | STC | ||||||||||||||||

| Dennis A. Ausiello, M.D. |

66 | 2006 | Professor, Harvard Medical School and Chief of Medicine, Massachusetts General Hospital |

Yes | M | M | M | M | – | |||||||||||

| M. Anthony Burns | 69 | 1988 | Chairman Emeritus, Ryder System, Inc. |

Yes | M | M | 1 | |||||||||||||

| W. Don Cornwell | 64 | 1997 | Former Chairman and CEO, Granite Broadcasting |

Yes | C | M | M | 2 | ||||||||||||

| Frances D. Fergusson, Ph.D. | 67 | 2009 | President Emeritus, Vassar College |

Yes | M | C | M | 1 | ||||||||||||

| William H. Gray, III | 70 | 2000 | Chairman of Gray Global Strategies |

Yes | C | M | 3 | |||||||||||||

| Helen H. Hobbs, M.D. | 59 | 2011 | Investigator, Howard Hughes Medical Institute and Professor, University of Texas Southwestern Medical Center |

Yes | M | M | – | |||||||||||||

| Constance J. Horner | 70 | 1993 | Former Assistant to the President of the United States and Director of Presidential Personnel |

Yes | M | M | 2 | |||||||||||||

| James M. Kilts | 64 | 2007 | Founding Partner, Centerview Capital | Yes | C | M | 3 | |||||||||||||

| George A. Lorch | 70 | 2000 | Chairman Emeritus, Armstrong Holdings, Inc. |

LEAD INDE- PENDENT |

2 | |||||||||||||||

| John P. Mascotte | 72 | 2009 | Retired President & CEO, Blue Cross and Blue Shield of Kansas City |

Yes | M | M | M | – | ||||||||||||

| Suzanne Nora Johnson | 54 | 2007 | Retired Vice Chairman, Goldman Sachs Group |

Yes | M | M | M | 3 | ||||||||||||

| Ian C. Read | 58 | 2010 | Chairman & CEO, Pfizer | No | 1 | |||||||||||||||

| Steven W. Sanger | 66 | 2009 | Former Chairman & CEO, General Mills |

Yes | M | M | 2 | |||||||||||||

| Marc Tessier-Lavigne, Ph.D. | 52 | 2011 | President, Rockefeller University; former EVP and Chief Scientific Officer, Genentech |

Yes | M | M | 1 | |||||||||||||

| AC | Audit Committee | RCC | Regulatory and Compliance Committee | C |

Chair | |||||

| CC | Compensation Committee | STC |

Science and Technology Committee | M |

Member | |||||

| CGC | Corporate Governance Committee |

|||||||||

| 2012 PROXY STATEMENT |

|

iii |

Table of Contents

PFIZER INC.

235 East 42nd Street

New York, New York 10017-5755

NOTICE OF 2012 ANNUAL MEETING OF SHAREHOLDERS

| TIME AND DATE |

8:30 a.m., Eastern Daylight Time, on Thursday, April 26, 2012. |

| PLACE |

Westin Governor Morris |

| 2 Whippany Road |

| Morristown, New Jersey 07960 |

| WEBCAST |

A webcast of our Annual Meeting will be available on our website, www.pfizer.com, starting at 8:30 a.m., Eastern Daylight Time, on Thursday, April 26, 2012. An archived copy of the webcast will be available on our website through the first week of May 2012. Information included on our website, other than our Proxy Statement and form of proxy, is not a part of our proxy solicitation materials. |

| ITEMS OF BUSINESS |

• | To elect 14 members of the Board of Directors named in the Proxy Statement, each for a term of one year. |

| • | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 2012 fiscal year. |

| • | To conduct an advisory vote to approve our executive compensation. |

| • | To consider certain shareholder proposals, if presented at the Meeting; see the Table of Contents for further information. |

| • | To transact any other business that properly comes before the Meeting and any adjournment or postponement of the Meeting. |

| RECORD DATE |

You can vote if you were a shareholder of record at the close of business on February 28, 2012. |

| MATERIALS TO REVIEW |

This booklet contains our Notice of 2012 Annual Meeting and Proxy Statement. Our 2011 Financial Report is in Appendix A to this Notice of Annual Meeting and Proxy Statement and is followed by certain Corporate and Shareholder Information. Appendix A and the Corporate and Shareholder Information, as well as the accompanying Letter to Shareholders, are not a part of our proxy solicitation materials. You may also access these documents through our website at www.pfizer.com/annualmeeting. |

| PROXY VOTING |

It is important that your shares be represented and voted at the Meeting. You can vote your shares by completing and returning your proxy card or by voting on the Internet or by telephone. See details under “How do I vote?” under “Proxy Statement—Questions and Answers About the Annual Meeting and Voting.” |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 26, 2012: This Notice of Annual Meeting and Proxy Statement and the 2011 Financial Report and Corporate and Shareholder Information are available on our website at www.pfizer.com/annualmeeting. |

Matthew Lepore

Corporate Secretary

March 15, 2012

Table of Contents

| 1 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 21 | ||||

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE, RELATED PERSON TRANSACTIONS, AND INDEMNIFICATION | 22 | |||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| Item 2—Ratification of Independent Registered Public Accounting Firm |

31 | |||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| Item 4—Shareholder Proposal regarding Publication of Political Contributions |

36 | |||

| Item 5—Shareholder Proposal regarding Action by Written Consent |

37 | |||

| Item 6—Shareholder Proposal regarding Special Shareholder Meetings |

38 | |||

| Item 7—Shareholder Proposal regarding Advisory Vote on Director Pay |

39 | |||

| 41 | ||||

| 42 | ||||

| 46 | ||||

| 47 | ||||

| 70 | ||||

| 79 | ||||

| 80 | ||||

| 81 | ||||

| REQUIREMENTS, INCLUDING DEADLINES, FOR SUBMISSION OF PROXY PROPOSALS AND NOMINATION OF DIRECTORS | 82 | |||

| 83 | ||||

| i | ||||

| Inside Back Cover | ||||

|

2012 PROXY STATEMENT |

Table of Contents

| Pfizer Inc. 235 East 42nd Street New York, New York 10017-5755 |

Proxy Statement

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING |

| 2012 PROXY STATEMENT |

|

1 |

Table of Contents

PROXY STATEMENT

| 2 |

|

2012 PROXY STATEMENT |

Table of Contents

PROXY STATEMENT

| 2012 PROXY STATEMENT |

|

3 |

Table of Contents

PROXY STATEMENT

| 4 |

|

2012 PROXY STATEMENT |

Table of Contents

| 2012 PROXY STATEMENT |

|

5 |

Table of Contents

GOVERNANCE OF THE COMPANY

| 6 |

|

2012 PROXY STATEMENT |

Table of Contents

GOVERNANCE OF THE COMPANY

| 2012 PROXY STATEMENT |

|

7 |

Table of Contents

GOVERNANCE OF THE COMPANY

| 8 |

|

2012 PROXY STATEMENT |

Table of Contents

GOVERNANCE OF THE COMPANY

In addition, the independent Directors considered shareholder feedback on the subject of Board leadership, including discussions with institutional investors who expressed interest in learning more about the Board’s rationale for recombining the roles of Chairman and CEO. In general, these investors acknowledge that the independent members of the Board are in the best position to determine the optimal Board structure, although some investors expressed concern about the strength of board independence under a non-independent chair structure. Further, our investors indicated that if the positions of Chairman and CEO should be combined, it was imperative that the Board have independent leadership by appointing a strong Lead Independent Director. The Company’s Corporate Governance Principles require the appointment of a Lead Independent Director if the positions of Chairman and CEO are held by the same individual, and the independent Directors believe that Mr. Lorch provides strong leadership in that position.

While Pfizer’s independent Directors are aware of investor concerns regarding our Board leadership structure, they believe that our Board, comprised entirely of independent Directors other than Mr. Read, remains highly independent, empowered and engaged. Further, the independent Directors remain committed to evaluating our Board leadership structure at least annually. Under the Company’s By-laws and Corporate Governance Principles, the Board can and will change its leadership structure if it determines that doing so is appropriate and in the best interest of Pfizer and its shareholders. The Board believes that these factors provide the appropriate balance between the authority of those who oversee the Company and those who manage it on a day-to-day basis.

Lead Independent Director

The position of Lead Independent Director at Pfizer comes with a clear mandate and significant authority and responsibilities under a Board-approved Charter, including the following:

| • | presiding at executive sessions of the independent Directors; |

| • | calling meetings of the independent Directors; |

| • | serving as liaison between the independent Directors and the Chairman; |

| • | approving information sent to the Board, including the quality, quantity and timeliness of such information; |

| • | approving meeting agendas; |

| • | facilitating the Board’s approval of the number and frequency of Board meetings and approving meeting schedules, to assure that there is sufficient time for discussion of all agenda items; |

| • | authorizing the retention of outside advisors and consultants who report directly to the Board; and |

| • | if requested by shareholders, ensuring that he/she is available, when appropriate, for consultation and direct communication. |

The Charter of the Lead Independent Director can be found on our website at http://www.pfizer.com/about/corporate_governance/lead_independent_charters.jsp.

Until April 2011, the Board included one non-employee Director who was not considered independent. During his tenure, executive sessions of the non-employee Directors took place at least four times each year, and the independent Directors met in executive session at least once each year. Since then, the Board has been composed entirely of independent Directors, except for Mr. Read, and executive sessions of the independent Directors have generally taken place at every regular Board meeting. At these executive sessions, the independent Directors review, among other things, the criteria upon which the performance of the Chief Executive Officer and other senior managers is evaluated, the performance of the Chief Executive Officer against those criteria, and the compensation of the Chief Executive Officer and other senior managers.

| 2012 PROXY STATEMENT |

|

9 |

Table of Contents

GOVERNANCE OF THE COMPANY

The Board’s Role in Risk Oversight

Management is responsible for assessing and managing risk, subject to oversight by the Board. The Board executes its oversight responsibility for risk assessment and risk management directly and through its Committees, as follows:

| • | The Audit Committee has primary responsibility for overseeing the Company’s Enterprise Risk Management, or “ERM,” program. The Company’s Chief Internal Auditor, who reports to the Committee, facilitates the ERM program, in coordination with the Company’s Legal Division and Compliance Group, to complement the Company’s strategic planning process. The Committee’s meeting agendas throughout the year include discussions of individual risk areas, as well as an annual summary of the ERM process. For additional information, see “Board and Committee Information—The Audit Committee” and “Item 2—Ratification of Independent Registered Public Accounting Firm—Audit Committee Report” later in this Proxy Statement. |

| • | The Regulatory and Compliance Committee, formed in February 2011, has primary responsibility for overseeing and reviewing risks associated with the Company’s healthcare law compliance programs and the status of compliance with related laws, regulations and internal procedures. The Committee, in consultation with the Compensation Committee, is responsible for discussing with management the risks associated with our compensation policies and practices for sales and marketing personnel and the alignment of compensation practices with the Company’s compliance standards. For additional information, see “Board and Committee Information—The Regulatory and Compliance Committee” later in this Proxy Statement. |

| • | The Board’s other Committees—Compensation, Corporate Governance, and Science and Technology—oversee risks associated with their respective areas of responsibility. For example, the Compensation Committee considers the risks associated with our compensation policies and practices, with respect to both executive compensation and compensation generally. |

| The Board of Directors is kept informed of its Committees’ risk oversight and other activities through reports of the Committee Chairmen to the full Board. These reports are presented at every regular Board meeting and include discussions of Committee agenda topics, including matters involving risk oversight. |

| • | The Board considers specific risk topics, including risks associated with our strategic plan, our capital structure and our development activities. In addition, the Board receives regular reports from the members of our Executive Leadership Team, or “ELT”—the heads of our principal business and corporate functions—that include discussions of the risks and exposures involved in their respective areas of responsibility. These reports are provided in connection with and discussed at Board meetings. At other times, the Board is routinely informed of developments that could affect our risk profile or other aspects of our business. |

Pfizer Policies on Business Ethics and Conduct

All of our employees, including our Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer, are required to abide by Pfizer’s policies on business conduct to ensure that our business is conducted in a consistently legal and ethical manner. Pfizer’s policies form the foundation of a comprehensive process that includes compliance with corporate policies and procedures, an open relationship among colleagues that contributes to good business conduct, and a high level of integrity. Our policies and procedures cover all major areas of professional conduct, including employment practices, conflicts of interest, intellectual property and the protection of confidential information, and require strict adherence to laws and regulations applicable to the conduct of our business.

Employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of Pfizer’s policies on business conduct. As required by the Sarbanes-Oxley Act of 2002, our Audit Committee has procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

To review Pfizer’s Summary of Policies on Business Conduct, please visit our website at

http://www.pfizer.com/about/corporate_compliance/code_of_conduct.jsp.

| 10 |

|

2012 PROXY STATEMENT |

Table of Contents

GOVERNANCE OF THE COMPANY

| 2012 PROXY STATEMENT |

|

11 |

Table of Contents

GOVERNANCE OF THE COMPANY

The Company’s relationships with its shareholders and other stakeholders are a critical part of our corporate governance profile, and we recognize the value of taking their views into account. Among other things, engagement with our shareholders and other stakeholders helps us to understand the larger context and impact of our operations, learn about expectations for our performance, assess emerging issues that may affect our business or other aspects of our operations, and shape corporate and governance policies. Over the years, this approach has helped us to identify mutual perspectives and goals and to adopt a collaborative approach to these relationships, and has resulted in our receiving essential input from shareholders and other stakeholders.

For example, in the wake of the United States Supreme Court’s 2010 decision in Citizens United vs. The Federal Election Commission, we engaged in extensive discussions with shareholders and stakeholders seeking clarification about Pfizer’s policies on corporate political expenditures. These discussions led to our decision in 2011 to adopt a strict policy against Pfizer making “independent expenditures” in connection with any federal or state election.

Additional information regarding Pfizer’s political contributions can be found at

http://www.pfizer.com/responsibility/grants_contributions/lobbying_and_political_contributions.jsp.

In addition, consistent with Pfizer’s commitment to seek and respond to shareholder input on corporate governance topics, we have considered and discussed with investors a wide variety of matters, including our executive compensation program and disclosures, and have made a number of changes in both areas. See “Compensation Discussion and Analysis” elsewhere in this Proxy Statement.

| 12 |

|

2012 PROXY STATEMENT |

Table of Contents

GOVERNANCE OF THE COMPANY

BOARD AND COMMITTEE INFORMATION

During 2011, the Board of Directors met eight times and had five key Committees: the Audit Committee, the Compensation Committee, the Corporate Governance Committee, the Regulatory and Compliance Committee, and the Science and Technology Committee. Each of our Directors attended at least 94% of the meetings of the Board and the Board Committees on which he or she served that were held during the time he or she was a Director in 2011.

All Board members are expected to attend the Annual Meeting unless an emergency prevents them from doing so. All the Directors then in office attended our 2011 Meeting.

The table below provides membership and meeting information for each of the Board Committees for 2011.

| NAME | AUDIT | COMPENSATION | CORPORATE GOVERNANCE |

REGULATORY AND COMPLIANCE |

SCIENCE AND TECHNOLOGY | |||||||||||||

| Dr. Ausiello |

X | X | X | X | ||||||||||||||

| Dr. Brown(a) |

X | X* | ||||||||||||||||

| Mr. Burns |

X | X | ||||||||||||||||

| Mr. Burt(b) |

X | X | ||||||||||||||||

| Mr. Cornwell |

X* | X | X | |||||||||||||||

| Dr. Fergusson |

X | X* | X | |||||||||||||||

| Mr. Gray |

X* | X | ||||||||||||||||

| Dr. Hobbs(c) |

||||||||||||||||||

| Ms. Horner |

X | X | ||||||||||||||||

| Mr. Kilts |

X* | X | ||||||||||||||||

| Mr. Lorch(d) |

||||||||||||||||||

| Mr. Mascotte |

X | X | X | |||||||||||||||

| Ms. Nora Johnson |

X | X | X | |||||||||||||||

| Mr. Read |

||||||||||||||||||

| Mr. Sanger |

X | X | ||||||||||||||||

| Mr. Steere(e) |

X | |||||||||||||||||

| Dr. Tessier-Lavigne(c) |

||||||||||||||||||

| 2011 Meetings | 15 | 7 | 6 | 4 | 2 |

| * | Committee Chair |

| (a) | Retiring from the Board effective as of the 2012 Annual Meeting. |

| (b) | Member of the Compensation Committee and of the Science and Technology Committee until his retirement effective as of the 2011 Annual Meeting. |

| (c) | Elected on December 12, 2011. In February 2012, Dr. Hobbs joined the Corporate Governance Committee and the Science and Technology Committee, and Dr. Tessier-Lavigne joined the Regulatory and Compliance Committee and the Science and Technology Committee. |

| (d) | Served as Chairman of the Board from December 13, 2010 until December 12, 2011 and as Lead Independent Director thereafter. In both capacities, Mr. Lorch has frequently attended meetings of Committees. However, he is not a member of any Committee, in order to focus on his leadership role. |

| (e) | Member of the Science and Technology Committee until his retirement effective as of the 2011 Annual Meeting. |

The Corporate Governance Committee

The Corporate Governance Committee is comprised entirely of independent Directors and is governed by a Board-approved Charter stating its responsibilities. Under the terms of its Charter, the Committee is responsible for matters of corporate governance and matters relating to the practices, policies and procedures of the Board. This includes developing criteria for Board membership and recommending and recruiting Director candidates. The Committee also assesses Director and candidate independence, considers possible conflicts of interest of Board members and senior executives, reviews related person transactions, and monitors the functions of the various Committees of the Board.

The Committee advises on the structure of Board meetings and recommends matters for consideration by the Board. The Committee also advises on and recommends Director compensation, which is approved by the full Board. The Committee is directly responsible for overseeing the evaluation of the Board and its Committees, reviewing our Director Qualification Standards, and establishing Director retirement policies. The Committee also assists management by reviewing the functions and outside activities of senior executives and reviewing succession plans for elected corporate officers. Finally, the Committee reviews certain public policy issues, including the Company’s political spending policies and practices, as well as its regular detailed disclosures of political spending.

The Board of Directors has determined that each of the members of the Corporate Governance Committee is independent, as defined by the rules of the SEC and the NYSE, as well as under our Director Qualification Standards.

A copy of the Corporate Governance Committee Charter is available on our website at

http://pfizer.com/about/corporate_governance/corporate_governance_committee.jsp.

| 2012 PROXY STATEMENT |

|

13 |

Table of Contents

GOVERNANCE OF THE COMPANY

The Corporate Governance Committee

|

|

| |

| William H. Gray, III, Chair | Helen H. Hobbs | |

|

|

| |

| Dennis A. Ausiello | Constance J. Horner | |

|

|

| |

| Michael S. Brown | John P. Mascotte | |

|

|

| |

| M. Anthony Burns | Stephen W. Sanger | |

| 14 |

|

2012 PROXY STATEMENT |

Table of Contents

GOVERNANCE OF THE COMPANY

| 2012 PROXY STATEMENT |

|

15 |

Table of Contents

GOVERNANCE OF THE COMPANY

In its activities, the Committee considered potential risks and steps the Company has taken to mitigate risk in areas within the Committee’s oversight. With respect to the CIA, the Committee monitored the status of the Company’s compliance with CIA requirements.

The Regulatory and Compliance Committee

The Audit Committee is comprised entirely of independent Directors and is governed by a Board-approved Charter stating its responsibilities. Under its Charter, the Audit Committee is responsible for reviewing with the independent registered public accounting firm, Internal Audit and management the adequacy and effectiveness of internal controls over financial reporting. The Committee also reviews and consults with management, Internal Audit and the independent registered public accounting firm on matters related to the annual audit, the published financial statements, earnings releases, and the accounting principles applied. In addition, the Committee reviews reports from management relating to the status of compliance with laws, regulations and internal procedures.

The Committee is directly responsible for the appointment, compensation, retention and oversight of the Company’s independent registered public accounting firm. To execute this responsibility, the Committee engages in a comprehensive annual evaluation of the independent auditor’s qualifications, performance and independence and considers the advisability and potential impact of selecting a different independent public accounting firm.

In addition, the Committee is responsible for reviewing and discussing with management the Company’s policies with respect to risk assessment and risk management. Further information about the role of the Audit Committee in risk assessment and risk management is included in the section entitled “Governance Information—The Board’s Role in Risk Oversight.”

The Audit Committee has established policies and procedures for the pre-approval of all services provided by the independent auditors. The Audit Committee has also established procedures for the receipt, retention and treatment, on a confidential basis, of complaints received by the Company regarding its accounting, internal controls and auditing matters. Further details of the role of the Audit Committee may be found in “Item 2—Ratification of Independent Registered Public Accounting Firm—Audit Committee Report” later in this Proxy Statement.

The Board of Directors has determined that each of the members of the Audit Committee is financially literate and independent, as defined by the rules of the SEC and the NYSE, as well as independent under our Director Qualification Standards. The Board of Directors also has determined that each of Ms. Nora Johnson and Messrs. Burns, Cornwell and Sanger is an “audit committee financial expert” for purposes of the SEC’s rules.

A copy of the Audit Committee Charter is available on our website at http://pfizer.com/about/corporate_governance/ audit_committee.jsp. The Audit Committee Report appears under “Ratification of Independent Registered Public Accounting Firm.”

The Compensation Committee is comprised entirely of independent Directors and is governed by a Board-approved Charter stating its responsibilities. The Committee determines and oversees the execution of the Company’s executive compensation philosophy and oversees the administration of the Company’s executive compensation programs. Its responsibilities also include overseeing Pfizer’s compensation and benefit plans and policies, administering its stock plans (including reviewing and approving equity grants) and reviewing and approving annually all compensation decisions for the Company’s executive officers, including the Named Executive Officers identified in the 2011 Summary Compensation Table. See “Compensation Discussion and Analysis” later in this Proxy Statement for information concerning the Committee’s role, processes and activities in overseeing executive compensation.

| 16 |

|

2012 PROXY STATEMENT |

Table of Contents

GOVERNANCE OF THE COMPANY

The Board of Directors has determined that each of the members of the Compensation Committee is independent, as defined by the rules of the SEC and the NYSE, as well as under our Director Qualification Standards. In addition, each Committee member is a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934, and is an “outside director” as defined in Section 162(m) of the Internal Revenue Code.

A copy of the Compensation Committee Charter is available on our website at

http://pfizer.com/about/corporate_governance/compensation_committee.jsp. The Compensation Committee Report appears under “Executive Compensation.”

Compensation Committee Interlocks and Insider Participation. During 2011 and as of the date of this Proxy Statement, none of the members of the Compensation Committee was or is an officer or employee of the Company, and no executive officer of the Company served or serves on the compensation committee or board of any company that employed or employs any member of the Company’s Compensation Committee or Board of Directors.

The Science and Technology Committee

Under the terms of its Board-approved Charter, the Science and Technology Committee is responsible for periodically examining management’s direction of and investment in the Company’s pharmaceutical research and development and technology initiatives. This includes evaluating the quality and direction of the Company’s research and development programs, identifying emerging issues and evaluating the level of review by external experts. The Committee also reviews the Company’s approaches to acquiring and maintaining technology, evaluates the technology that the Company is researching and developing and reviews the Company’s patent strategy.

A copy of the Science and Technology Committee Charter is available on our website at

http://pfizer.com/about/corporate_governance/science_ technology_committee.jsp.

| 2012 PROXY STATEMENT |

|

17 |

Table of Contents

GOVERNANCE OF THE COMPANY

COMPENSATION OF NON-EMPLOYEE DIRECTORS

Except as described below, our non-employee Directors receive cash compensation, as well as equity compensation in the form of Pfizer stock units. Each of these components is described below. The 2011 compensation of our non-employee Directors is shown in the Director Compensation Table below. Mr. Read does not receive any compensation for his service as a Director or as Chairman.

Non-Employee Director Compensation

Through April 2011, compensation for our non-employee Directors (other than Dr. Ausiello and Mr. Lorch, as discussed below) consisted of the following:

| • | an annual retainer of $75,000; and |

| • | an award of 5,500 Pfizer stock units under the Pfizer Inc. Nonfunded Deferred Compensation and Unit Award Plan for Non-Employee Directors (the “Unit Award Plan”) to each Director upon joining the Board and an award of 5,500 stock units to each Director upon election at each Annual Meeting of Shareholders, provided the Director continues to serve as a Director following the Meeting. Stock units are not payable until the Director ceases to be a member of the Board, at or after which time they are paid in cash or in shares of Pfizer stock, at the Director’s election. |

In accordance with the Unit Award Plan, on the day of the 2011 Annual Meeting of Shareholders, our non-employee Directors who continued as Directors following that Meeting (other than Dr. Ausiello and Mr. Lorch, as discussed below) were awarded 5,500 stock units with a value at the time of grant of $114,565 (calculated based on the closing stock price of Pfizer common stock of $20.83 per share on the grant date).

In addition, our compensation program for non-employee Directors provided for the following additional annual cash retainers through April 2011:

| • | Audit Committee: Chair—$25,000; Member—$20,000 |

| • | Compensation Committee: Chair—$25,000; Member—$20,000 |

| • | Corporate Governance Committee: Chair—$25,000; Member—$20,000 |

| • | Regulatory and Compliance Committee: Chair—$25,000; Member—$20,000 |

| • | Science and Technology Committee: Chair—$30,000; Senior Member—$20,000; Member—$10,000 |

| • | Lead Independent Director (if applicable): $30,000 |

Effective May 1, 2011, the Board, on the recommendation of the Corporate Governance Committee, and in consultation with the Committee’s independent compensation consultant based on a study of peers and market trends, made the following changes to the compensation program for non-employee Directors (other than Dr. Ausiello and Mr. Lorch, as discussed below):

| • | The annual cash retainer for each non-employee Director was fixed at $137,500. |

| • | The annual cash retainer for the Chair of each key Committee of the Board was fixed at $30,000. |

| • | Directors no longer receive annual cash retainers for serving as members of Committees. |

| • | The equity award to each non-employee Director upon his or her first election as such and annually thereafter was fixed at the number of units having a value of $137,500 on the date of grant (i.e., respectively, the date of his or her first election and the date of the Company’s Annual Meeting of Shareholders), based upon the closing price of Pfizer common stock on that date. |

| • | The annual cash retainer to be paid to the Lead Independent Director (if applicable) was fixed at $50,000. |

In connection with the adjustments to the program, the Board, on the recommendation of the Corporate Governance Committee, also increased the stock ownership requirement applicable to non-employee Directors from $300,000 to $550,000 worth of Pfizer stock. For purposes of this requirement, a Director’s holdings include units granted to the Director as compensation for Board service and shares or units held under a deferral or similar plan. A Director has five years from the date of (a) his or her first election as a Director or (b) if later, an increase in the amount of Pfizer stock required to be held, to satisfy this ownership requirement. None of our Directors has pledged Pfizer stock as collateral for personal loans or other obligations.

The changes to the non-employee Director compensation program implemented in 2011 were recommended by the Corporate Governance Committee based upon the advice and recommendations of an independent compensation consulting firm, J.F. Reda & Associates, LLC. The firm was engaged directly by the Committee to provide advice and recommendations on the compensation of non-Employee Directors and does not render any other services to Pfizer.

| 18 |

|

2012 PROXY STATEMENT |

Table of Contents

GOVERNANCE OF THE COMPANY

Under his employer’s policy, Dr. Ausiello is subject to limitations on the amount of compensation he can receive from the Company and is not permitted to receive any equity compensation for serving as a Director. As a result, Dr. Ausiello receives the customary cash fees for his Board and Committee service, but the dollar value of his annual equity award, subject to the limitation on the amount of his compensation under his employer’s policy, is credited to a deferred cash account to be paid (with an interest equivalent) following his termination of service as a Director. At the direction of the Corporate Governance Committee, the dollar value of Dr. Ausiello’s equity award in excess of the limitation has been contributed to charity.

As Non-Executive Chairman of the Board in 2011, in lieu of the above compensation, Mr. Lorch received $550,000, divided equally between cash and equity. The cash portion was paid quarterly, and the equity portion was credited quarterly in the form of stock units valued at the closing price of Pfizer common stock on the last day of each quarter. Mr. Lorch will receive dividend equivalents on these units, and the units and accumulated dividends will be payable in cash or in shares of Pfizer common stock, at his election, at or after his retirement from the Board. Effective January 1, 2012, Mr. Lorch is compensated under the new program described above.

Deferred Compensation

Non-employee Directors may defer all or a part of their annual cash retainers under the Unit Award Plan until they cease to be members of the Board. At a Director’s election, the fees held in the Director’s account may be credited either with Pfizer stock units or with interest at the rate of return of an intermediate treasury index. The rate of return of the intermediate U.S. Treasury index for 2011 was 6.08%. The numbers of Pfizer stock units are calculated by dividing the amount of the deferred fee by the closing price of our common stock on the last business day of the fiscal quarter in which the fee is earned. If fees are deferred as Pfizer stock units, the number of stock units in a Director’s account is increased by crediting additional stock units based on the value of any dividends on the common stock. When a Director ceases to be a member of the Board, the amount attributable to stock units held in his or her account is paid in cash or in Pfizer stock, at the Director’s election. The amount of any cash payment is determined by multiplying the number of Pfizer stock units in the account by the closing price of our common stock on the last business day before the payment date.

Legacy Warner-Lambert Equity Compensation Plan

Under the Warner-Lambert Company 1996 Stock Plan, as a result of our merger with Warner-Lambert, all stock options and restricted stock awards outstanding as of June 19, 2000 became immediately exercisable or vested.

Under this plan, the directors of Warner-Lambert could elect to defer any or all of the compensation they received for their services. These deferred amounts could have been credited to a Warner-Lambert common stock equivalent account (the “Equivalent Account”). The Equivalent Account was credited, as of the day the fees would have been payable, with stock credits equal to the number of shares of Warner-Lambert common stock that could have been purchased with the dollar amount of such deferred fees. The former Warner-Lambert directors who joined our Board after the merger—Messrs. Burt, Gray and Lorch—had deferred compensation and were entitled to Warner-Lambert stock credits in the Equivalent Account under this plan. Dividend equivalents received under this plan are reinvested. Upon the closing of the merger, these Warner-Lambert stock credits were converted into Pfizer stock equivalent units. These units will be payable in Pfizer common stock at various times in accordance with the Director’s election. These units are described in footnote 2 to the table under “Securities Ownership.”

| 2012 PROXY STATEMENT |

|

19 |

Table of Contents

GOVERNANCE OF THE COMPANY

Matching Gift Programs

Our non-employee Directors may participate in Pfizer’s matching gift programs, which are available to all employees. Under these programs, the Pfizer Foundation (Pfizer’s philanthropic affiliate) will match contributions to eligible non-profit organizations, up to a maximum of $15,000 per year; contributions to religious and certain other types of non-profit organizations, as well as to individuals and others in need, are not eligible and are not matched. In addition, the Pfizer Foundation will match contributions made to the United Way Campaign, up to a maximum of $15,000 per year. The matching contributions made by the Pfizer Foundation with respect to our non-employee Directors are included in the 2011 Director Compensation Table below and described in footnote 2 to the Table. As indicated above, these matching contributions do not reflect all of the charitable contributions made by our Directors.

2011 Director Compensation Table

The following table shows 2011 compensation for our non-employee Directors.

| NAME | FEES EARNED OR PAID IN CASH ($) |

EQUITY/ ($) |

ALL

OTHER ($) |

TOTAL ($) | ||||||||||||

| Dr. Ausiello(3) |

194,167 | 66,665 | 260,832 | |||||||||||||

| Dr. Brown |

160,000 | 114,565 | 39,458 | 314,023 | ||||||||||||

| Mr. Burns |

130,000 | 114,565 | 244,565 | |||||||||||||

| Mr. Burt(4) |

26,250 | 45,000 | 71,250 | |||||||||||||

| Mr. Cornwell |

151,667 | 114,565 | 12,544 | 278,776 | ||||||||||||

| Dr. Fergusson |

146,667 | 114,565 | 17,050 | 278,282 | ||||||||||||

| Mr. Gray |

148,333 | 114,565 | 36,875 | 299,773 | ||||||||||||

| Dr. Hobbs |

7,473 | 137,500 | 50,000 | 194,973 | ||||||||||||

| Ms. Horner |

123,333 | 114,565 | 18,700 | 256,598 | ||||||||||||

| Mr. Kilts |

148,333 | 114,565 | 15,000 | 277,898 | ||||||||||||

| Mr. Lorch(5) |

275,000 | 275,000 | 13,500 | 563,500 | ||||||||||||

| Mr. Mascotte |

126,667 | 114,565 | 30,000 | 271,232 | ||||||||||||

| Ms. Nora Johnson |

133,333 | 114,565 | 30,000 | 277,898 | ||||||||||||

| Mr. Sanger |

130,000 | 114,565 | 30,000 | 274,565 | ||||||||||||

| Mr. Steere(4) |

21,250 | 65,000 | 86,250 | |||||||||||||

| Dr. Tessier-Lavigne |

7,473 | 137,500 | 144,973 | |||||||||||||

| (1) | Represents stock units awarded in 2011 to Directors who were re-elected at the 2011 Annual Meeting of Shareholders (other than Dr. Ausiello and Mr. Lorch, as discussed below), the reported value of which was calculated by multiplying the closing market price of our common stock on the grant date (April 28, 2011) by the number of units granted (5,500). In 2011, Mr. Lorch was credited with 13,752 stock units; these units were credited quarterly and were valued at the closing price of Pfizer common stock on the last day of each quarter. Each of Drs. Hobbs and Tessier-Lavigne received 6,744 stock units upon being elected a Director on December 12, 2011 (determined by dividing the value of the award, $137,500, by $20.39, the closing price of the Company’s common stock on the date of their election). At the end of 2011, the aggregate number of stock units (including dividend equivalents) held by each current non-employee Director was as follows: Dr. Ausiello, 21,000; Dr. Brown, 100,739; Mr. Burns, 82,763; Mr. Cornwell, 80,240; Dr. Fergusson, 17,628; Mr. Gray, 105,448; Dr. Hobbs, 6,744; Ms. Horner, 109,774; Mr. Kilts, 59,067; Mr. Lorch, 77,849; Mr. Mascotte, 17,628; Ms. Nora Johnson, 27,000; Mr. Sanger, 44,644; and Dr. Tessier-Lavigne, 6,744. See Note 3. |

| (2) | The amounts in this column represent: (a) charitable contributions made in 2011 under our matching gift programs (see “Matching Gift Programs” above), as follows: Dr. Ausiello, $9,600; Dr. Brown, $25,900; Mr. Burt, $45,000 (consisting of matching contributions made in 2011 in respect of 2010 and 2011 contributions by Mr. Burt); Dr. Fergusson, $17,050; Mr. Gray, $20,000; Ms. Horner, $3,700; Mr. Kilts, $15,000; Mr. Lorch, $13,500; Mr. Mascotte, $30,000; Ms. Nora Johnson, $30,000; Mr. Sanger, $30,000; and Mr. Steere, $15,000; (b) charitable contributions totaling $57,065 made at the discretion of the Corporate Governance Committee in respect of Dr. Ausiello (see Note 3 below); (c) for Dr. Brown, $13,558 for travel and related activities associated with attendance by Dr. Brown’s spouse at an offsite meeting of the Board and other events to encourage attendance and foster interaction among members of the Board and management; (d) for Mr. Cornwell, $12,544 for travel and related activities associated with attendance by Mr. Cornwell’s spouse at an offsite meeting of the Board and other events to encourage attendance and foster interaction among members of the Board and management; (e) for Mr. Gray, (i) above-market interest on the deferred cash balance under a legacy Warner-Lambert equity compensation plan, paid at the prime rate plus 2%, and (ii) attendance by Mr. Gray’s spouse at an off-site meeting of the Board of Directors to encourage attendance and foster interaction among the members of the Board and management; (f) for Dr. Hobbs, $50,000 for serving on a Pfizer Scientific Advisory Panel for a therapeutic area of research, which service terminated prior to her election as a Director in December 2011; (g) for Ms. Horner, a $15,000 charitable contribution made in honor of her service to the Board and the Company during her tenure as Lead Independent Director until December 2010; and (h) for Mr. Steere, $50,000 relating to his consulting contract with the Company (see “Section 16(a) Beneficial Ownership Reporting Compliance, Related Person Transactions and Indemnification—Transactions with Related Persons”). As indicated above under “Matching Gift Programs,” certain charitable contributions by our Directors are not eligible for matching contributions under the programs, and the amounts in the above table therefore do not reflect all such contributions made by our Directors. |

| (3) | Dr. Ausiello’s employer limits the amount of compensation he can receive from the Company and prohibits him from receiving any equity compensation for serving as a Director. For 2011, he received $136,667 in cash compensation, and an additional $57,500 was credited to a deferred cash account to be paid (with an interest equivalent) following his termination of service as a Director. See “Non-Employee Director Compensation” and Note 2 above. |

| (4) | Messrs. Burt and Steere retired as Directors at the 2011 Annual Meeting of Shareholders. |

| (5) | Mr. Lorch served as Non-Executive Chairman of the Board until December 2011. |

| 20 |

|

2012 PROXY STATEMENT |

Table of Contents

The table below shows the number of shares of our common stock beneficially owned as of the close of business on January 31, 2012 by each of our Directors and each Named Executive Officer listed in the 2011 Summary Compensation Table, as well as the number of shares beneficially owned by all of our Directors and executive officers as a group. Together, these individuals beneficially own less than one percent (1%) of our common stock outstanding. The table and footnotes also include information about stock options, stock appreciation rights in the form of total shareholder return units (“TSRUs”), stock units, restricted stock, restricted stock units and deferred performance-related share awards credited to the accounts of our Directors and executive officers under various compensation and benefit plans.

| BENEFICIAL OWNERS |

NUMBER OF SHARES OR UNITS | OPTIONS EXERCISABLE WITHIN 60 DAYS |

||||||||||

| COMMON STOCK | STOCK UNITS |

|||||||||||

| Dennis A. Ausiello |

2,362 | (1) | 21,000 | (2) | ||||||||

| Michael S. Brown |

1,200 | 100,739 | (2) | |||||||||

| M. Anthony Burns |

24,978 | 82,763 | (2) | |||||||||

| W. Don Cornwell |

2,000 | (1) | 80,240 | (2) | ||||||||

| Frank A. D’Amelio |

181,843 | (3) | 343,564 | (4) | 292,000 | |||||||

| Mikael Dolsten |

190 | (3) | 218,948 | (4) | ||||||||

| Frances D. Fergusson |

17,628 | (2) | ||||||||||

| William H. Gray, III |

28 | 105,448 | (2) | |||||||||

| Helen H. Hobbs |

6,744 | (2) | ||||||||||

| Constance J. Horner |

15,825 | 109,774 | (2) | |||||||||

| James M. Kilts |

2,259 | (1) | 59,067 | (2) | ||||||||

| George A. Lorch |

24,126 | 77,849 | (2) | |||||||||

| John P. Mascotte |

3,940 | 17,628 | (2) | |||||||||

| Suzanne Nora Johnson |

10,000 | 27,000 | (2) | |||||||||

| Ian C. Read |

377,582 | (3) | 512,463 | (4) | 873,000 | |||||||

| Stephen W. Sanger |

1,085 | (1) | 44,644 | (2) | ||||||||

| Amy W. Schulman |

61,748 | (1)(3) | 133,787 | (4) | 100,000 | |||||||

| David Simmons |

40,124 | (3) | 113,704 | (4) | 124,500 | |||||||

| Marc Tessier-Lavigne |

104 | 6,744 | (2) | |||||||||

| All Directors and Executive Officers as a group (27) |

991,326 | 2,990,481 | 2,128,400 | |||||||||

| (1) | Includes the following shares held in the names of family members: Dr. Ausiello, 2,362 shares; Mr. Cornwell, 300 shares; Mr. Kilts, 2,259 shares; Mr. Sanger, 1,085 shares; and Ms. Schulman, 300 shares. Dr. Ausiello, Ms. Schulman and Messrs. Cornwell and Kilts disclaim beneficial ownership of such shares. |

| (2) | Represents units (each equivalent to a share of Pfizer common stock) awarded under our Director compensation plans (see “Compensation of Non-Employee Directors” above). This number also includes the following units resulting from the conversion into Pfizer units of previously deferred Warner-Lambert director compensation under the Warner-Lambert 1996 Stock Plan: Mr. Gray, 57,819 units and Mr. Lorch, 15,219 units. See “Compensation of Non-Employee Directors—Legacy Warner-Lambert Equity Compensation Plan” above. |

| (3) | Includes shares credited under the Pfizer Savings Plan and/or deferred performance shares relating to previously vested awards under the Company’s performance-based share award programs. These plans are described later in this Proxy Statement. |

| (4) | In the case of Messrs. D’Amelio, Read and Simmons and Ms. Schulman, includes units (each equivalent to a share of Pfizer common stock) held under the Pfizer Supplemental Savings Plan and for Mr. Simmons also includes units held under the Pfizer Inc. Deferred Compensation Plan. The Pfizer Supplemental Savings Plan is described later in this Proxy Statement. Also includes the following unvested restricted stock units (each equivalent to a share of Pfizer common stock): Mr. D’Amelio, 322,768; Dr. Dolsten, 218,948; Mr. Read, 406,900 (however, in view of Mr. Read’s age and years of service with Pfizer, a prorated portion of his units would vest upon his retirement); Mr. Simmons, 98,874; and Ms. Schulman, 130,209. This column does not include the following stock appreciation rights in the form of TSRUs: Mr. D’Amelio, 1,039,555; Dr. Dolsten, 530,757; Mr. Read, 2,131,948; Ms. Schulman, 516,701; and Mr. Simmons, 467,124. See the “2011 Outstanding Equity Awards at Fiscal Year-End Table” and “Estimated Benefits upon Termination” for a discussion of the vesting of restricted stock units and TSRUs. |

Beneficial Owners

Based on filings made under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934, as amended, as of December 30, 2011, the only person known by us to be the beneficial owner of more than 5% of our common stock was as follows:

| NAME AND ADDRESS OF BENEFICIAL OWNER(1) | SHARES OF PFIZER COMMON STOCK(1) |

PERCENT OF CLASS | ||||||

| BlackRock, Inc. 40 East 52nd Street New York, NY 10022 |

463,841,882 | 6.03% | ||||||

| (1) | This information is based solely on a Schedule 13G filed with the SEC on February 13, 2012 by BlackRock, Inc. |

| 2012 PROXY STATEMENT |

|

21 |

Table of Contents

Section 16(a) Beneficial Ownership Reporting Compliance, Related Person Transactions, and Indemnification

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our Directors and certain of our officers to file reports of holdings and transactions in Pfizer equity with the SEC and the NYSE. Based on our records and other information, we believe that in 2011 our Directors and our officers who are subject to Section 16(a) met all applicable filing requirements. There were two exceptions:

| • | Upon becoming subject to Section 16 in December 2010, Olivier Brandicourt, President and General Manager of our Primary Care Business Unit, filed a Form 3 with the SEC on a timely basis. Due to an inadvertent administrative error by the Company’s external plan administrator, the Form 3 included an incorrect number of shares of Pfizer common stock (5,494) held in the Company’s Savings Plan. Promptly after being informed of the error, Dr. Brandicourt filed an amendment to the Form 3 reporting the correct number of shares (8,965) held in the Plan. |

| • | Upon his election to the Board of Directors in December 2011, Dr. Tessier-Lavigne filed a Form 3 with the SEC on a timely basis that inadvertently failed to include 104 shares of Pfizer common stock held in a brokerage account that is managed by a portfolio manager. Promptly after being informed of the omission, Dr. Tessier-Lavigne filed an amendment to the Form 3 reporting the ownership of those shares. |

REVIEW OF RELATED PERSON TRANSACTIONS

The Company has adopted a Related Person Transaction Approval Policy that is administered by the Corporate Governance Committee. The Policy applies to any transaction or series of transactions in which the Company or a subsidiary is a participant, the amount involved exceeds $120,000, and a related person has a direct or indirect material interest. Under the Policy, Company management determines whether a transaction requires review by the Committee, and transactions requiring review are referred to the Committee for approval, ratification or other action. Based on its consideration of all of the relevant facts and circumstances, the Committee decides whether or not to approve such transactions and approves only those transactions that are deemed to be in the best interests of the Company. If the Company becomes aware of an existing transaction with a related person that has not been approved under this Policy, the matter is referred to the Committee. The Committee then evaluates all options available, including ratification, revision or termination of such transaction.

TRANSACTIONS WITH RELATED PERSONS

In connection with his retirement in 2001, we entered into a consulting agreement with Mr. Steere, a member of our Board of Directors until April 2011. The agreement provides that Mr. Steere would serve as Chairman Emeritus of the Company and, when and as requested by the Chief Executive Officer, will provide consulting services and advice to the Company and participate in various external activities and events for the benefit of the Company. The term of the agreement, which began on July 1, 2001 after Mr. Steere ceased his employment with the Company, was for five years, with automatic extensions for successive five-year terms, unless Mr. Steere or the Company terminates the agreement at the end of its then-current term. The contract was extended for a five-year term in 2011 and currently extends until mid-2016. Mr. Steere may provide up to 30 days of service per year to the Company, subject to his reasonable availability, for his consulting services or his participation as a Company representative in external activities and events. He must obtain the approval of the Board of Directors before providing any consulting services, advice or service of any kind to any other company or organization that competes with us. For his services and commitments, the Company pays Mr. Steere (i) an annual retainer of $50,000 for his consulting services (subject to his ability to continue to provide the contemplated services), and (ii) an additional fee of $5,000 for each day in excess of 30 days per year that he renders services as described above. We also reimburse him for reasonable expenses that he incurs in providing these services for us.

In addition, under the terms of the agreement, we provide him lifetime access to Company facilities and services comparable to those that were made available to him by the Company prior to his retirement. These include the use of an office and access to the secretarial services of an administrative assistant; access to financial planning services; and the use of a car and driver and of Company aircraft. Mr. Steere has chosen to personally pay for his financial planning services and voluntarily reimburses the Company for all personal use of Company-provided transportation.

We paid Mr. Steere $50,000 in 2011 under the terms of this consulting agreement.

We indemnify our Directors and our elected officers to the fullest extent permitted by law so that they will be free from undue concern about personal liability in connection with their service to the Company. This is required under our By-laws, and we have also entered into agreements with those individuals contractually obligating us to provide this indemnification to them.

| 22 |

|

2012 PROXY STATEMENT |

Table of Contents

| 2012 PROXY STATEMENT |

|

23 |

Table of Contents

|

DENNIS A. AUSIELLO, 66

Position, Principal Occupation and Business Experience:

Jackson Professor of Clinical Medicine at Harvard Medical School and Chief of Medicine at Massachusetts General Hospital since 1996. President of the Association of American Physicians in 2006. Member of the Institute of Medicine of the National Academies of Science and a Fellow of the American Academy of Arts and Sciences. Director of TARIS BioMedical, Inc. and of several non-profit organizations, including the Broad Institute for Human Genetics.

|

| |||||

| Key Attributes, Experience and Skills:

Dr. Ausiello’s experience and training as a practicing physician (Board certified in nephrology), a scientist and a nationally recognized leader in academic medicine enable him to bring valuable insights to the Board, including through his understanding of the scientific nature of our business and the ability to assist us in prioritizing opportunities for drug development. In addition, Dr. Ausiello oversees a large research portfolio and an extensive research and education budget at Massachusetts General Hospital, giving him a critical perspective on drug discovery and development and providing a fundamental understanding of the potential pathways contributing to disease. Through his work as the Chief of Medicine at Massachusetts General Hospital, Dr. Ausiello also brings leadership, oversight and finance experience to the Board. |

Director Since: 2006

Board Committees: Audit, Corporate Governance, Regulatory and Compliance, and Science and Technology

|

|||||

|

M. ANTHONY BURNS, 69

Position, Principal Occupation and Business Experience:

Chairman Emeritus since 2002, Chairman of the Board from 1985 to 2002, Chief Executive Officer from 1983 to 2000, and President from 1979 to 1999 of Ryder System, Inc., a provider of transportation and logistics services. Life Trustee of the University of Miami. Director of J. C. Penney Company, Inc. from 1988 to May 2011; Stanley Black & Decker, Inc. from March 2010 until May 2010; and The Black & Decker Corporation from 2001 until March 2010.

|

| |||||

| Key Attributes, Experience and Skills:

As a result of Mr. Burns’ long tenure as CEO of Ryder System, he provides valuable business, leadership and management insights into driving strategic direction and international operations, among other things. While at Ryder, Mr. Burns was responsible for Ryder’s expansion into international markets, which is important as Pfizer seeks to execute its global growth strategies. In addition, Mr. Burns brings financial expertise to the Board, including through his service on (and in some cases chairmanship of) the audit committees of other public companies, as well as executive compensation experience, including through his service on the compensation committees of several public companies, including prior service on our Compensation Committee. Mr. Burns also served as co-chairman of the Business Roundtable from 1998 to 2001, providing him with exposure to and insight from, CEOs of other large companies. |

Director Since: 1988

Board Committees: Audit and Corporate Governance

Directorship:

|

|||||

| 24 |

|

2012 PROXY STATEMENT |

Table of Contents

NOMINEES FOR DIRECTORS

|

W. DON CORNWELL, 64

Position, Principal Occupation and Business Experience:

Chairman of the Board and Chief Executive Officer of Granite Broadcasting Corporation from 1988 until his retirement in August 2009 and Vice Chairman until December 2009. Granite Broadcasting Corporation filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code in December 2006 and emerged from its restructuring in June 2007. Director of the Wallace Foundation and Trustee of Big Brothers/Sisters of New York and the M.S. Hershey School and Trust from 1995 until 2002.

Key Attributes, Experience and Skills:

Through Mr. Cornwell’s 38-year career as an entrepreneur driving the growth of a consumer-focused media company, an executive in the investment banking industry and a director of several significant consumer product and healthcare companies, he has valuable business, leadership and management experience and brings important perspectives on the issues facing our Company. Mr. Cornwell founded and built Granite, a consumer-focused media company, through acquisitions and operating growth, enabling him to provide insight and guidance on strategic direction and growth. Mr. Cornwell’s strong financial background, including his work at Goldman Sachs prior to co-founding Granite and his service on the audit and investment committees of other companies, also provides financial expertise to the Board, including an understanding of financial statements, corporate finance, accounting and capital markets. |

| |||||

|

Director Since: 1997

Board Committees: Audit (Chair), Compensation, and Regulatory and Compliance

Directorships:

|

||||||

|

FRANCES D. FERGUSSON, 67

Position, Principal Occupation and Business Experience:

President Emeritus of Vassar College since 2006 and President from 1986 to 2006. Served on the Mayo Clinic Board for 14 years, the last four years as its Chairman, and as President of the Board of Overseers of Harvard University from 2007 through 2008. Director of HSBC Bank USA from 1990 through 2008 and of Wyeth from 2005 until 2009.

Key Attributes, Experience and Skills:

Dr. Fergusson has strong leadership skills, having served as President of Vassar College for 20 years and, during her tenure, developing a long-term financial plan and strengthening the College’s financial position. She has also headed strategic planning projects at Vassar and other organizations. Dr. Fergusson’s service on the boards of not-for-profit organizations, including the Mayo Clinic (which she chaired from 1988 to 2002), enables her to bring to the Board experience and knowledge of healthcare from alternate perspectives. In addition, Dr. Fergusson’s past service on the Wyeth Board of Directors affords her extensive knowledge of Wyeth’s business, operations and culture, which brings a connection to that portion of our business and operations. |

| |||||

|

Director Since: 2009

Board Committees: Regulatory and Compliance (Chair), Compensation, and Science and Technology

Directorship:

|

||||||

| 2012 PROXY STATEMENT |

|

25 |

Table of Contents

NOMINEES FOR DIRECTORS

|

WILLIAM H. GRAY, III , 70

Position, Principal Occupation and Business Experience:

Chairman of Gray Global Strategies, Inc., a business advisory firm. Co-Chairman of GrayLoeffler, LLC from 2009-2011, a business advisory and consulting firm. Chairman of the Amani Group, its predecessor, from 2004 through September 2009. Pastor Emeritus of the Bright Hope Baptist Church in Philadelphia since 2005. President and Chief Executive Officer of The College Fund/UNCF (Educational Assistance) from 1991 to 2004. U.S. Congressman from the Second District of Pennsylvania from 1979 to 1991, including service at various times as Budget Committee Chair and House Majority Whip. Director of Visteon Corporation from 2000 until January 2010.

Key Attributes, Experience and Skills:

Mr. Gray’s experience as a U.S. Congressman for 12 years, including his service as Budget Committee Chair and House Majority Whip, position him to provide advice and counsel to our Company in a highly regulated industry and to provide guidance in government relations. Mr. Gray also has valuable experience running a national organization on financial literacy and macro-economic policy. Mr. Gray also brings useful corporate governance and compliance insights from, among other things, his role as an Advisory Council Member of the Business Roundtable Institute for Corporate Ethics. |

| |||||

|

Director Since: 2000

Board Committees: Corporate Governance (Chair) and Science and Technology

Directorships: Dell Inc., J. P. Morgan Chase & Co. and Prudential Financial, Inc.

|

||||||

|

HELEN H. HOBBS, 59

Position, Principal Occupation and Business Experience:

Investigator of the Howard Hughes Medical Institute since 2002, a Professor of Internal Medicine and Molecular Genetics and Director of the McDermott Center for Human Growth and Development at the University of Texas Southwestern Medical Center. In 2007, Dr. Hobbs was elected to the National Academy of Sciences and received the Distinguished Scientist Award from the American Heart Association. In 2005, she became the first recipient of the Clinical Scientist Award from the American Heart Association, and was awarded Germany’s Heinrich Wieland Prize. Dr. Hobbs was elected to the Institute of Medicine in 2004 and the American Academy of Arts and Sciences in 2006. She is a member of the American Society of Clinical Investigation and the Association of American Physicians.

Key Attributes, Experience and Skills:

Dr. Hobbs’s background reflects great achievements in academia and medicine. She has served as a faculty member at the University of Texas Southwestern Medical Center for more than 20 years, and is a leading geneticist in the arena of metabolism and heart disease, areas in which Pfizer has significant investments and experience. Pfizer expects to benefit from her experience, expertise and achievements in both medicine and science. |

| |||||

|

Director Since: 2011

Board Committees: Corporate Governance and Science and Technology

|

||||||

| 26 |

|

2012 PROXY STATEMENT |

Table of Contents

NOMINEES FOR DIRECTORS

|

CONSTANCE J. HORNER, 70

Position, Principal Occupation and Business Experience:

Guest Scholar from 1993 until 2005 at The Brookings Institution, an organization devoted to nonpartisan research, education and publication in economics, government, foreign policy and the social sciences. Commissioner of the U.S. Commission on Human Rights from 1993 to 1998. Served at the White House as Assistant to President George H. W. Bush and as Director of Presidential Personnel from 1991 to 1993. Deputy Secretary, U.S. Department of Health and Human Services, from 1989 to 1991. Director of the U.S. Office of Personnel Management from 1985 to 1989. Fellow, National Academy of Public Administration, and Member of the Board of Trustees of the Prudential Foundation.

Key Attributes, Experience and Skills:

Ms. Horner is well-versed in federal health and health financing policy as well as talent management as a result of her service as the head of the U.S. Office of Personnel Management, which, among other responsibilities, designs and administers the health insurance program for federal employees and retirees and manages policies and programs for the recruitment, training and compensation of the federal workforce; her chairmanship of a White House Competitiveness Council task force making recommendations to improve the drug approval process; and her service as Deputy Secretary of the U.S. Department of Health and Human Services, where she had responsibility for the Food and Drug Administration, the National Institutes of Health, the Public Health Service and the Health Care Financing Administration (now the Center for Medicare and Medicaid Services), lending insight into how the federal government makes health policies that affect Pfizer’s ability to create products and get them to the people who need them. In addition, Ms. Horner’s government experience positions her to provide oversight to our Company in government relations, including regulatory areas. |

| |||||

|

Director Since: 1993

Board Committees: Corporate Governance and Regulatory and Compliance

Directorships: Ingersoll-Rand plc and Prudential Financial, Inc.

|

||||||

|

JAMES M. KILTS, 64

Position, Principal Occupation and Business Experience:

Founding Partner, Centerview Capital, a private equity firm, since 2006. Vice Chairman, The Procter & Gamble Company, from 2005 to 2006. Chairman and Chief Executive Officer, The Gillette Company, from 2001 to 2005 and President, The Gillette Company, from 2003 to 2005. President and Chief Executive Officer, Nabisco Group Holdings Corporation, from 1998 until its acquisition in 2000. Currently Chairman of The Nielsen Company B.V. Supervisory Board and Non-Executive Chairman of the Board of Nielsen Holdings N.V. Trustee of Knox College and the University of Chicago, and a member of the Board of Overseers of Weill Cornell Medical College. Director of New York Times Company from 2005 until 2008.

Key Attributes, Experience and Skills:

Mr. Kilts’ tenure as CEO of Gillette and Nabisco and as Vice Chairman of Procter & Gamble provides valuable business, leadership and management experience, including expertise in cost management, creating value and resource allocation. In addition, Mr. Kilts’ knowledge of consumer businesses has given him insights on reaching consumers and on the importance of innovation—both important aspects of Pfizer’s business. Through his service on the board of MetLife, an insurance company, Mr. Kilts can offer a view of healthcare from another perspective, and through Mr. Kilts’ service on three compensation committees, including ours, he has a strong understanding of executive compensation and related areas. |

| |||||

|

Director Since: 2007

Board Committees: Compensation (Chair) and Science and Technology

Directorships: Meadwestvaco Corporation, MetLife, Inc. and Nielsen Holdings N.V.

|

||||||

| 2012 PROXY STATEMENT |

|

27 |

Table of Contents

NOMINEES FOR DIRECTORS

|

GEORGE A. LORCH, 70

Position, Principal Occupation and Business Experience:

Chairman Emeritus of Armstrong Holdings, Inc., a global manufacturer of flooring and ceiling materials, since 2000, having served as Chairman and Chief Executive Officer and in other executive capacities with Armstrong Holdings, Inc. and its predecessor, Armstrong World Industries, Inc., from 1993 to 2000. Director of Masonite International, Inc., a non-public company, and also a Director of HSBC Finance Co. and HSBC North America Holding Company, non-public, wholly owned subsidiaries of HSBC LLC. Director of The Williams Companies, Inc. until December 2011.

Key Attributes, Experience and Skills: