Electronic Arts Inc.

Acquisition Announcement

July 12

th

, 2011

Exhibit 99.2 |

Some

statements

set

forth

in

this

presentation

regarding

EA’s

acquisition

of

PopCap

and

the

expected

impact

of

the

acquisition

on

EA’s

strategic

and

operational

plans,

contain

forward-looking

statements

that

are

subject

to

change.

These

forward-looking

statements

are

subject

to

risks

and

uncertainties

that

could

cause

actual

events

or

actual

future

results

to

differ

materially

from

the

expectations

set

forth

in

the

forward-looking

statements.

Some

of

the

factors

which

could

cause

results

to

differ

materially

from

the

expectations

expressed

in

these

forward-looking

statements

include

the

following:

the

effect

of

the

announcement

of

the

acquisition

on

EA’s

and

PopCap’s

strategic

relationships,

operating

results

and

business

generally,

including

the

ability

to

retain

key

employees;

EA’s

ability

to

successfully

integrate

PopCap’s

operations

and

employees;

the

timing

of

the

completions

of

the

acquisition;

general

economic

conditions;

and

other

factors

described

in

EA’s

SEC

filings

(including

EA’s

Annual

Report

on

Form

10-K

for

the

year

ended

March

31,

2011).

If

any

of

these

risks

or

uncertainties

materializes,

the

potential

benefits

of

the

acquisition

may

not

be

realized,

EA’s

and/or

PopCap’s

operating

results

and

financial

performance

could

suffer,

and

actual

results

could

differ

materially

from

the

expectations

described

in

these

forward-looking

statements.

These

forward-looking

statements

speak

only

as

of

the

date

of

this

presentation.

EA

assumes

no

obligation

to

update

these

forward-looking

statements.

The

preliminary

financial

results

set

forth

in

this

presentation,

including

EA’s

preliminary

results

for

the

first

quarter

of

fiscal

2012

and

business

outlook

for

future

periods

are

estimates

based

on

information

currently

available

to

Electronic

Arts.

While

Electronic

Arts

believes

these

estimates

are

meaningful,

they

could

differ

from

the

actual

amounts

that

Electronic

Arts

ultimately

reports

in

its

Annual

Report

on

Form

10-Q

for

the

fiscal

quarter

ended

June

30,

2011

and

in

subsequent

filings.

Furthermore,

the

financial

information

included

in

this

presentation

regarding

PopCap

is

based

on

information

currently

available

to

Electronic

Arts

as

of

the

date

of

this

presentation

and

is

subject

to

change.

In

addition,

following

the

acquisition,

the

accounting

policies

of

PopCap

will

be

reconciled

with

those

of

Electronic

Arts,

which

may

cause

reported

revenue

and

profits

of

PopCap

to

be

lower

than

currently

presented.

These

forward-looking

statements

are

valid

as

of

July

12,

2011

only.

Electronic

Arts

assumes

no

obligation

and

does

not

intend

to

update

these

forward-looking

statements.

In

addition,

this

presentation

includes

various

third

party

estimates

regarding

the

total

available

segment

and

other

measures,

which

have

not

been

independently

verified

by

us.

Further,

Electronic

Arts

does

not

guarantee

the

accuracy

or

reliability

of

any

such

information

or

forecast.

Safe Harbor Statement

1 |

Summary

2

PopCap accelerates EA’s winning digital strategy

PopCap strengthens EA’s position as a leader in casual gaming and

accelerates EA toward a $1 billion digital business

Casual gaming is the industry’s fastest growing segment

PopCap is a leader on the fastest growing digital gaming platforms,

with five very strong casual IPs

Acquisition price is $650 M cash, plus $100 M EA stock and a non-

GAAP EBIT-based earn-out, resulting in a CY12 EBIT multiple range

of 10X to 20X

This transaction is expected to be at least $0.10 non-GAAP EPS

accretive in fiscal 2013

EA intends to drive further EPS accretion through ongoing share

repurchase program |

PopCap

At A Glance 3

IP

has

been

strong

for

many

years

Franchise

revenue

has

continued

to

grow

over

time

Franchise

Years in

Release

# of

Titles

Major Platforms

Bejeweled

11

5

Facebook, iOS, Android,

XBLA, DS, PSN, Wii, WP7,

PC

PvZ

2

1

iOS, Android, XBLA, DS,

PSN, Mac, PC

Zuma

7

3

Facebook, XBLA, DS, PSN,

Mac, PC

Bookworm

7

3

iOS, XBLA, DS, Mac, PC

Peggle

4

2

iOS, XBLA, DS, PSN, Mac,

PC

Games

Well

Suited

to

Emerging

Platforms

Ideal for touch / simple controls

Strong characters

Mass appeal

Flexible monetization

Success across mobile devices

Fun & approachable gameplay

Overview of PopCap

Founded in 2000. Headquartered in

Seattle, WA

~475 employees

Award-winning and durable IP

80% of PopCap revenue is digital

PopCap has strong IP and a proven ability to create new hits

|

PopCap

Strategic Overview PopCap accelerates EA’s ongoing digital

transformation 4

Long-term game sector growth

is led by digital

Smartphones, smartpads/tablet,

social, PC, IPTV are key platforms

Casual gaming is driving growth with

new consumer demographic

Asia is an important opportunity in

digital

80% of revenue in CY2010 was

digital; > 40% revenue growth rate in

March 2011 quarter

IP expected to gain more distribution

on the highest growth platforms

Well positioned for social games in

Asia

Owns five strong evergreen

franchises with the unique ability to

create compelling future casual IP

across all platforms

PopCap maps well to the digital

opportunity |

Financial

Summary of Transaction Deal is expected to be non-GAAP EPS neutral in FY12

and highly accretive in FY13:

Up-front $650 M cash, $100 M EA stock, with potential of up to $550

M

earn-out

Up to $50 M in long-term equity retention awards

Effective PopCap purchase price multiples will decline to the degree the

earn-out amount increases:

10x PopCap CY12 non-GAAP EBIT in Upper-End Earn-out Scenario

20x PopCap CY12 non-GAAP EBIT in Low-End/No Earn-out Scenario

5

EPS Impact

FY2012

FY2013

Non-GAAP

~$0.00

~$0.10

GAAP

~$0.00

~ ($0.10)

Note:

These forward-looking statements are valid as of July 12, 2011 only and are

subject to change. |

-

5

10

15

20

25

-10%

0%

10%

20%

30%

40%

50%

60%

70%

80%

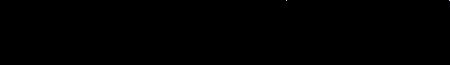

Worldwide Industry Growth Segments

Casual/Social/

Mobile/Tablet/

Browser/Free-to-Play

MMO

Subs + Full Game Downloads

Core Packaged -

Related Digital

Core

Packaged

CY09 –

CY11 CAGR

Source: EA estimates

6

PopCap enhances

EA’s position in one

of gaming’s most

important segments |

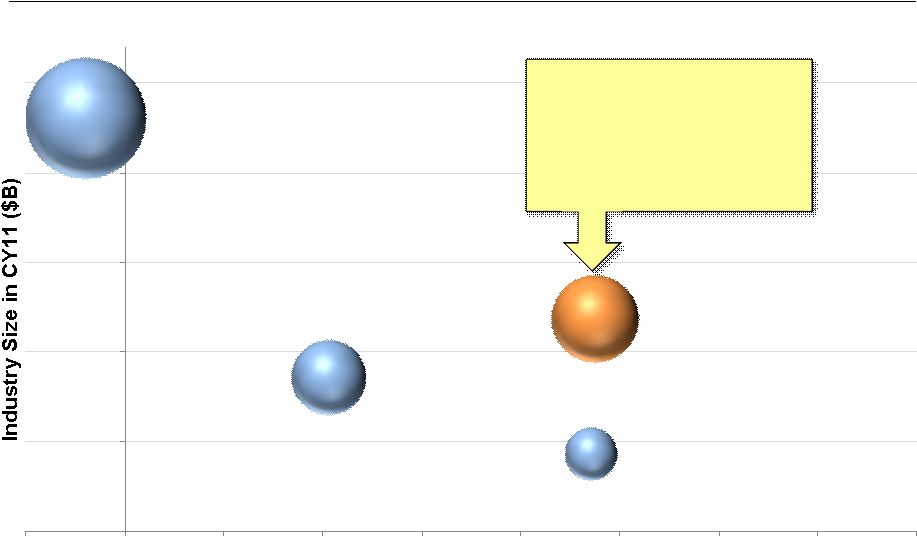

Sector

Analysis – Game Market

Mobile & Social growth outpacing other video game sectors

7

Worldwide Video Game Market Size Estimates by Platform

(in $ billions) |

Sector

Analysis – Mobile/Social

Casual games are driving platform growth on smart phones and social network sites

8 |

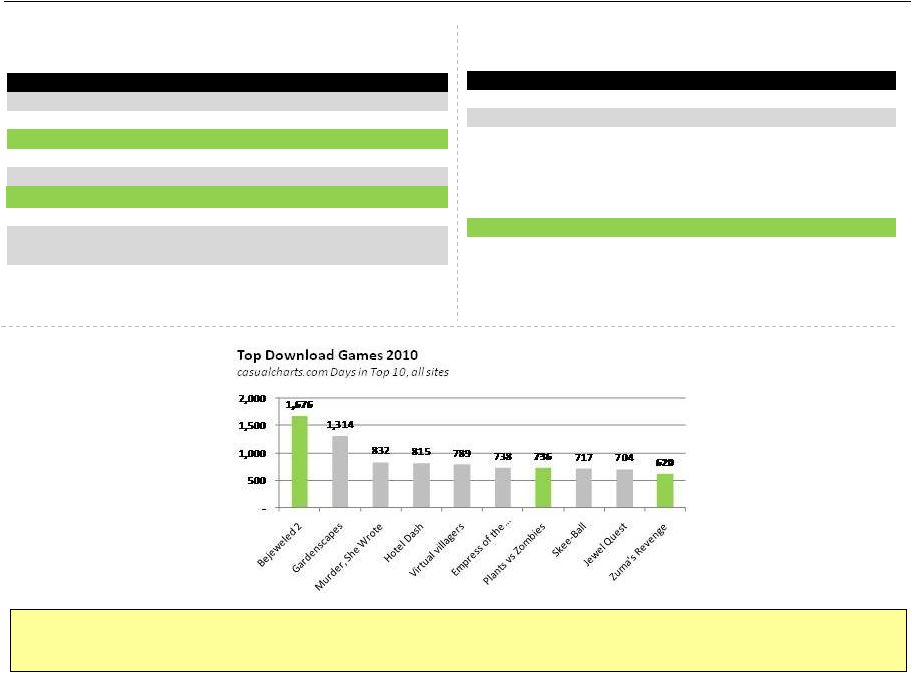

PopCap

Maps Well to New Platform Opportunities PopCap delivers proven best sellers

on multiple platforms with recent breakout success on iOS

9

Top Grossing iOS Games for 2010

iTunes Rewind 2010

#

iPhone Game

Publisher

1

Angry Birds

Electronic Arts

2

Call of Duty: Zombies

Activision

3

Bejeweled 2+Blitz

PopCap Games

4

Zombie Farm

PlayForge

5

Tetris

Electronic Arts

6

Plants vs Zombies

PopCap Games

7

Doodle Jump

Lima Sky

8

Monopoly

Electronic Arts

9

The Sims 3

Electronic Arts

10

Words With Friends

Zynga

EA & PopCap Games in Top 10:

6

Top PC Retail Game Publishers for 2010

NPD PC Games $000s

#

Publisher

2008

2009

2010

1

Activision Blizzard

$165,467

$118,905

$279,616

2

Electronic Arts

194,288

210,510

139,706

3

Take 2 Interactive

29,568

28,903

38,223

4

THQ

41,895

40,733

20,003

5

Square Enix

21,025

6,600

18,013

6

Encore

14,862

16,170

17,193

7

Atari

16,528

17,268

14,859

8

PopCap Games

5,899

10,528

13,838

9

Bethesda SoftWorks

13,077

12,117

13,760

10

Microsoft

32,586

25,242

13,371

Total

$704,982

$682,046

$701,252

EA & PopCap Share

28%

32%

22% |

1.

PopCap has the highest player

engagement of any Top 5

Facebook Game Publisher at 25%

(DAU/MAU)

2.

PopCap has achieved Top 5

success through only two

evergreen franchises: Bejeweled

and Zuma

3.

After 18+ months in the market,

Bejeweled Blitz is #6 in terms of

DAUs and #1 in player

engagement (out of the Top 10)

Success on Facebook –

Winning Combination

10

EA + PopCap = Solid #2 Games Publisher with Big Brands Coming Soon

4. Future outlook is strong with top

IP from both EA and PopCap to

come

DAUs in MMs (Q2 CY11)

Rank

Developer

DAUs

1

Zynga

53.6

2

EA + PopCap

10.0

3

Wooga

4.5

4

Playdom

3.7

5

Digital Chocolate

3.0

Source: Appdata.com as of July 8th, 2011 |

Full Year

Pro Forma

Annualized

Pro Forma

Q4 FY11

Q4 FY11

Pro Forma

PopCap - Console

PopCap - PC

PopCap - Mobile

EA - Total Digital

PopCap Further Accelerates EA’s Digital Growth

11

Pro Forma Non-GAAP Digital Net Revenue

* Note: EA’s Digital non-GAAP net revenue excludes one-time

events Preliminary PopCap estimates as of July 12, 2011, subject to change

$267 M

$1,068 M

EA & PopCap deliver a >$1 billion digital non-GAAP revenue run rate

*

* |

EA

Financial Update 1

12

Revenue Guidance Update:

Share Repurchase Program Update:

2

Repurchase program remains intact

As of July 1, 2011, EA has repurchased a total of 7.1 million shares

for $149 million

Notes:

1. Preliminary estimates as of July 12, 2011, subject to change

2. Repurchase data shown on a shares settled basis. EA is not obligated to

repurchase any specific number of shares under the program and the

repurchase program may be modified, suspended or discontinued at any time FY12

Non-GAAP Revenue Guidance ($ Millions)

Low End

High End

FY12 GAAP Revenue

Guidance ($ Millions)

Low End

High End

Reaffirmed EA Standalone

$3,750

$3,950

Reaffirmed EA Standalone

$3,700

$3,900

PopCap Partial Year

Contribution

$50

$75

PopCap Partial Year

Contribution

$25

$50

Revised Combined Guidance

$3,800

$4,025

Revised Combined Guidance

$3,725

$3,950 |

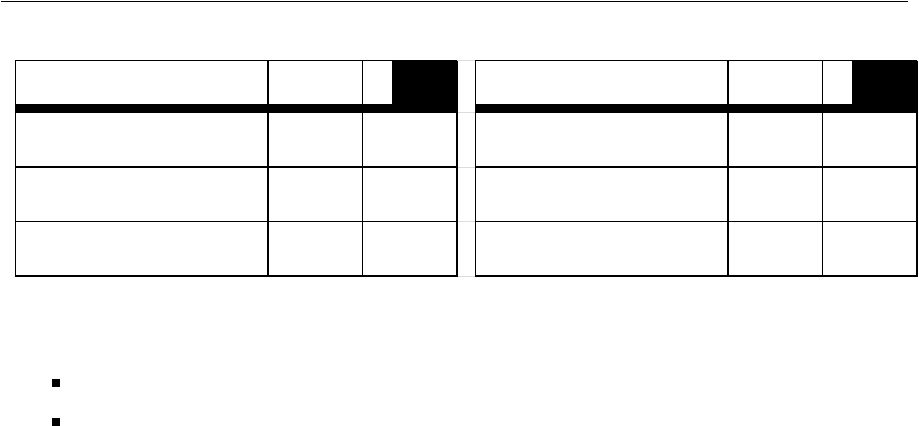

GAAP

to Non-GAAP Reconciliation In

its

press

release

dated

July

12,

2011

announcing

the

PopCap

acquisition,

Electronic

Arts

has

provided

its

preliminary

estimates

for

the

first

quarter

of

fiscal

2012

and

business

outlook

for

the

second

quarter

of

fiscal

2012

and

the

full

fiscal

year

2012.

The

following

table

provides

a

reconciliation

of

the

non-GAAP

financial

measures

for

the

periods

presented

to

the

nearest

comparable

GAAP

financial

measures.

These

are

preliminary

estimates

and

expectations

based

on

current

information

as

of

July

12,

2011

and

are

subject

to

business

and

economic

risks

and

uncertainties

that

could

cause

actual

events

or

actual

future

results

to

differ

materially

from

the

expectations

set

forth

herein.

The

reconciliation

provided

below

reflects

rounding

and

other

approximations.

(in millions except for EPS)

Low

High

Low

High

Low

High

GAAP Net Income (Loss)

212

$

222

$

(364)

$

(320)

$

(14)

$

88

$

Acquisition-related expenses

18

18

30

25

95

85

Change in deferred net revenue

(packaged goods and digital content

(475)

(475)

275

275

75

75

Restructuring and other

18

18

5

5

23

23

Stock-based compensation

38

38

50

50

175

175

Income tax adjustments

57

57

(46)

(52)

(120)

(145)

Non-GAAP Net Income (Loss)

(132)

$

(122)

$

(50)

$

(17)

$

234

$

301

$

GAAP EPS

0.63

$

0.66

$

(1.10)

$

(0.97)

$

(0.04)

$

0.26

$

Shares used for GAAP EPS

337

337

331

331

330

334

Non-GAAP EPS

(0.40)

$

(0.37)

$

(0.15)

$

(0.05)

$

0.70

$

0.90

$

Shares used for non-GAAP EPS

331

331

331

331

334

334

GAAP Revenue

975

$

1,000

$

3,725

$

3,950

$

Change in deferred net revenue

(packaged goods and digital content

(475)

(475)

75

75

Non-GAAP Revenue

500

$

525

$

3,800

$

4,025

$

Q1 FY12

Q2 FY12

FY12

13 |

To

supplement the Company’s unaudited condensed consolidated financial statements presented in

accordance with GAAP, Electronic Arts uses certain non-GAAP measures of

financial performance. The presentation of these non-GAAP financial

measures is not intended to be considered in isolation from, as a substitute

for, or superior to, the financial information prepared and presented in

accordance with GAAP, and may be different from non-GAAP financial measures

used by other companies. In addition, these non-GAAP measures have

limitations in that they do not reflect all of the amounts associated with

the Company’s results of operations as determined in accordance with

GAAP. The non-GAAP financial measures used by Electronic Arts include:

non-GAAP net revenue and non-GAAP diluted earnings (loss) per share.

These non-GAAP financial measures exclude the following items, as

applicable in a given reporting period, from the Company’s unaudited

condensed consolidated statements of operations:

Acquisition-related expenses

Change in deferred net revenue (packaged goods and digital content)

Gain (loss) on strategic investments

Loss on lease obligation and facilities acquisition

Loss on licensed intellectual property commitment

Restructuring charges

Stock-based compensation

Income tax adjustments

Electronic Arts may consider whether other significant non-recurring items that

arise in the future should also be excluded in calculating the non-GAAP

financial measures it uses. Electronic Arts believes that these non-GAAP

financial measures, when taken together with the corresponding GAAP

financial measures, provide meaningful supplemental information regarding the Company’s

performance by excluding certain items that may not be indicative of the

Company’s core business, operating results or future outlook.

Non-GAAP Financial Measures

14 |