Filed Pursuant to Rule 424(b)(4)

Registration No. 333-173619

7,100,000 American Depositary Shares

Jiayuan.com International Ltd.

Representing 10,650,000 Ordinary Shares

This is the initial public offering of our American depositary shares, or ADSs. We are offering 6,700,000 ADSs and the selling shareholder named in this prospectus is offering an additional 400,000 ADSs. Every two ADSs represent three ordinary shares, par value US$0.001 per share. We intend to use approximately US$4.0 million from the proceeds to pay dividends due to the holders of our Series A preferred shares, including US$3.0 million to Fame Gain Investments Ltd. ("Fame Gain"), Qiming Venture Partners, L.P. ("Qiming Partners") and Qiming Managing Directors Fund, L.P. ("Qiming Fund"). Fame Gain is 100% owned by our chairman, Mr. Yongqiang Qian. The general partner of Qiming Partners is Qiming GP, L.P. and one of our directors, Mr. JP Gan, is a managing director of the general partner of both Qiming GP, L.P. and Qiming Fund. We will not receive any proceeds from the sale of ADSs by the selling shareholders.

Prior to this offering, there has been no public market for our ADSs or our ordinary shares. The initial public offering price of our ADSs is US$11.00 per ADS. We have received approval to list our ADSs on the Nasdaq Global Select Market under the symbol "DATE."

Investing in the ADSs involves risks. See "Risk Factors" beginning on page 14.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per ADS | Total | ||

|---|---|---|---|---|

Initial public offering price |

US$11.00 | US$78,100,000 | ||

Underwriting discount |

US$ 0.77 | US$ 5,467,000 | ||

Proceeds to Jiayuan.com International Ltd. (before expenses) |

US$10.23 | US$68,541,000 | ||

Proceeds to the selling shareholder (before expenses) |

US$10.23 | US$ 4,092,000 |

The underwriters expect to deliver the ADSs to purchasers on or about May 16, 2011.

The selling shareholders named in this prospectus have granted the underwriters an option to purchase up to 1,065,000 ADSs at the public offering price, less underwriting discount and commission, within 30 days from the date of this prospectus to cover over-allotments.

Immediately following this offering, Fame Gain, Aprilsky Ltd., funds affiliated with Qiming Partners and other shareholders will continue to hold a majority of our outstanding ordinary shares. Fame Gain is 100% owned by our chairman, Mr. Yongqiang Qian. Aprilsky Ltd. is 100% owned by our chief executive officer, Ms. Haiyan Gong. The general partner of Qiming Partners is Qiming GP, L.P. and one of our directors, Mr. JP Gan, is a managing director of the general partner of Qiming GP, L.P. Our other shareholders include other executive officers as well as shareholders who were shareholders of our company prior to this offering.

| BofA Merrill Lynch | Citi |

| CICC | Oppenheimer & Co. | Stifel Nicolaus Weisel |

The date of this prospectus is May 11, 2011.

You should rely only on the information contained in this prospectus or any free writing prospectus filed with the United States Securities and Exchange Commission, or the SEC, in connection with this offering. We and the selling shareholders have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus or any filed free writing prospectus. We and the selling shareholders are offering to sell, and seeking offers to buy, our ADSs only in jurisdictions where offers and sales are permitted. The information contained in this prospectus or any filed free writing prospectus is accurate only as of its date, regardless of the time of its delivery or any sale of our ADSs.

i

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements included elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our ADSs, discussed under "Risk Factors," before deciding whether to buy our ADSs. We commissioned iResearch Consulting Group, or iResearch, a market research firm in China, to prepare a report for the purpose of providing various industry and other information and illustrating our position in the online dating industry in China. Information from this report appears in the "Prospectus Summary," "Industry," "Business" and other sections of this prospectus. Reference to iResearch in this prospectus is to the information provided in the report prepared by iResearch.

Our Company

We operate the largest online dating platform in China. As a pioneer in China's online dating market, we are committed to addressing the dating and marriage needs of China's rapidly growing urban singles population by providing a trusted, effective platform and a superior user experience. According to iResearch, we ranked first and commanded a 43.7% share of the total amount of money spent in China's online dating market in 2010. Our website, Jiayuan.com, provides single adults with unique opportunities to meet, interact and form a long-term relationship aimed towards marriage. Jiayuan.com also ranked first in terms of number of visits from different Internet Protocol addresses, or unique visitors, average time spent per user and average page views per user among all online dating websites in China in 2010, according to iResearch.

We employ a results-based pricing model, which we believe distinguishes us from other online dating service providers. Unlike dating websites that follow a subscription-based model, we offer users free registration with immediate full search access to our database. This feature engages new users in the site and entices them to begin exploring our database for potential companions. Although the search capabilities and exploratory services are provided for free and our users are not required to pay to send an initial message to another user, either the sender or recipient must purchase a RMB2.00 virtual stamp in order for the message to be readable. After the initial message is read, future communications between the same users are free on Jiayuan.com. Our pricing strategy for the initial message is designed to reach and target the mass market with its affordability. Given the nominal cost of a virtual stamp, we believe this feature of our business is recession-resistant and serves as a strong foundation of our revenue model. Furthermore, for users who intend to send or who have received a large amount of initial messages, we offer various types of fee plans that include the option to send up to 100 initial readable messages per day or unlimited message reading during a specified subscription period.

We believe our results-based pricing model is more attractive to users because they only pay for the results and services that they can see and has been one of the key factors enabling us to attract and retain a large user base. We believe most of our users are well-educated singles seeking long-term relationships aimed towards marriage. Our large and attractive user base combined with our results-based fee structure and user-friendly interface have created what we believe is a superior user experience. According to a survey conducted by iResearch in January 2011, we ranked first in customer satisfaction among our major competitors in China's online dating industry.

We

believe that our "

![]() " (Shiji Jiayuan) brand, which is our Chinese name, has become the most well-known and trusted online dating brand in

China. From July to December 2010, "

" (Shiji Jiayuan) brand, which is our Chinese name, has become the most well-known and trusted online dating brand in

China. From July to December 2010, "

![]() " (Shiji Jiayuan) was searched 25-times more often than "

" (Shiji Jiayuan) was searched 25-times more often than "

![]() " (Jiao You), a common term for "dating" in Chinese, on Baidu.com. Leveraging our brand and national recognition, we have

attracted a critical user mass locally in not only first-tier cities, such as Beijing, Shanghai, Guangzhou and Shenzhen, but also in many second-tier cities across China. We intend to continue

expanding our user base into other

" (Jiao You), a common term for "dating" in Chinese, on Baidu.com. Leveraging our brand and national recognition, we have

attracted a critical user mass locally in not only first-tier cities, such as Beijing, Shanghai, Guangzhou and Shenzhen, but also in many second-tier cities across China. We intend to continue

expanding our user base into other

1

second-tier and third-tier cities. A large user base is a major attraction for new users because of the large number of potential companions available to each of our users at their preferred location. We believe our localized critical mass on a national scale and well-regarded brand name is difficult for competitors to replicate and provides us with an important competitive advantage.

Leveraging the prominence of our brand in China's online dating market, we have been expanding our business to offline events and VIP services. Since 2008, we have hosted on average 670 large scale social gatherings per year in cities throughout China to provide our users offline opportunities to meet in person. Such offline events also promote our national brand name and benefit our online platform. Our VIP services, which offer personalized search services geared towards more affluent clients, help to diversify our revenue mix.

We only started charging fees for messaging services provided on our Jiayuan.com website in October 2008, and currently we derive most of our revenues from our online business. As of March 31, 2011, we had a total of 40.2 million registered user accounts, with an average of 4,744,705 active user accounts in the first quarter of 2011. Active user accounts refer to registered user accounts through which registered users have logged-in to our Jiayuan.com website at least once within a calendar month in the case of user accounts registered in prior months, or on at least two separate days within a calendar month, including the day of completion of the registration process, in the case of user accounts newly registered in the calendar month. In the first quarter of 2011, the number of our average monthly paying user accounts was 882,471, compared to 306,163 in the first quarter of 2010, representing an increase of 188.2%. We generated net revenues of RMB27.6 million, RMB63.9 million and RMB167.6 million (US$25.4 million) in 2008, 2009 and 2010, respectively. We had a net loss of RMB13.9 million in 2008 and net income of RMB5.7 million and RMB16.7 million (US$2.5 million) in 2009 and 2010, respectively. Excluding non-cash share-based compensation expenses, we had a non-GAAP net loss of RMB13.7 million in 2008 and non-GAAP net income of RMB7.3 million and RMB23.7 million (US$3.6 million) in 2009 and 2010, respectively. For a reconciliation of our non-GAAP net (loss)/income to our U.S. GAAP net (loss)/income, see "Summary Consolidated Financial and Operating Data."

Industry Background

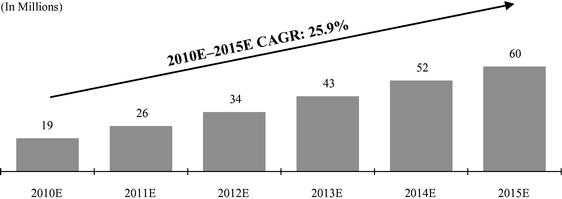

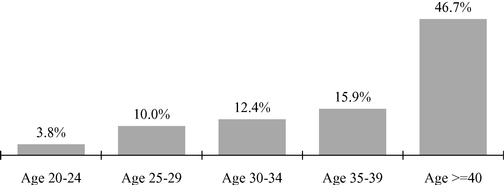

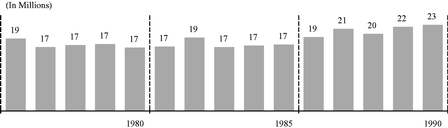

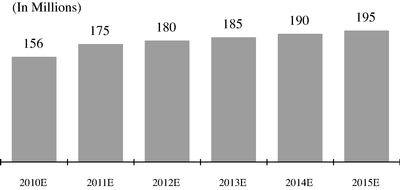

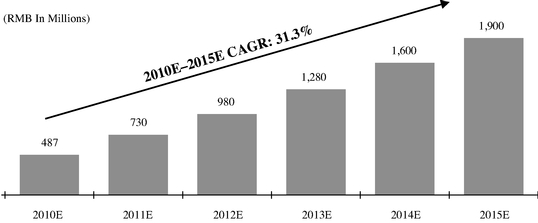

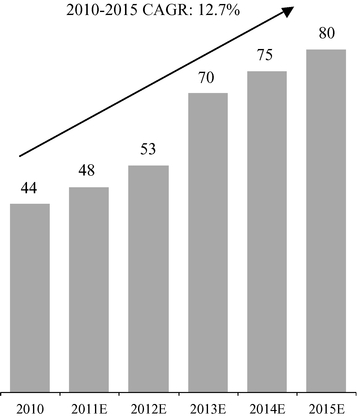

China's online dating market has grown significantly due to improved public acceptance of and confidence in online dating services. While the online dating industry has reached a mature stage in some markets, such as the United States, China's online dating market is still early in its development and is undergoing rapid growth. China's online dating market is projected by iResearch to grow from RMB487 million in 2010 to RMB1.9 billion in 2015, representing a compound annual growth rate for the online dating market of 31.3%, significantly outpacing the 3.4% compound annual growth rate for the online dating market in the United States during the same period as projected by IBISWorld. The tremendous demand for online dating services in China is primarily driven by (i) unprecedented urbanization, (ii) rapid demographic changes, including a growing gender imbalance, (iii) China's unique cultural considerations and traditional values and (iv) China's fast growing Internet industry. According to iResearch, the number of singles over the age of 18 visiting online dating websites increased from 14 million in 2009 to 19 million in 2010 and is expected to reach 60 million in 2015.

Our Competitive Strengths

We believe that the following strengths contribute to our success and differentiate us from our competitors:

- •

- leading market position in the fast growing online dating industry;

- •

- nationally renowned and trusted brand;

2

- •

- large user base and extensive network of cities with critical scale;

- •

- effective and innovative pricing strategy and business model; and

- •

- experienced management team.

Our Strategies

We aim to continue to strengthen our leading market position in China and strive to develop our group of websites into a leading global online dating, marriage and family platform. We intend to achieve this goal by implementing the following strategies:

- •

- continue to promote our brand name and increase our market penetration;

- •

- further increase our paying user base and monetize the services we provide them;

- •

- expand our wireless dating services;

- •

- leverage the success of our online dating platform by expanding our business scope into related areas and niche markets;

and

- •

- continue to enhance our research and development capabilities.

Our Challenges

The successful execution of our strategies is subject to certain risks and uncertainties, including those relating to:

- •

- our ability to continue to attract users to our websites;

- •

- our ability to develop and introduce new online dating services and products that meet our users' needs and expectations;

- •

- our ability to compete effectively with present and future competitors or to adjust to changing market conditions and

trends;

- •

- the continued recognition of our "

" (Shiji Jiayuan) brand and the further enhancement of our other brands;

- •

- substantial uncertainties and restrictions with respect to the interpretation and application of PRC laws and regulations

relating to the distribution of Internet content in China; and

- •

- the corporate structure we have adopted to operate our business in China, under which we do not have equity ownership of our PRC operating companies and Shanghai Shiji Jiayuan Matchmaking Service Center, or Jiayuan Shanghai Center, and instead exercise control over them through contractual arrangements.

See "Risk Factors" and other information included elsewhere in this prospectus for a discussion of these and other challenges, risks and uncertainties.

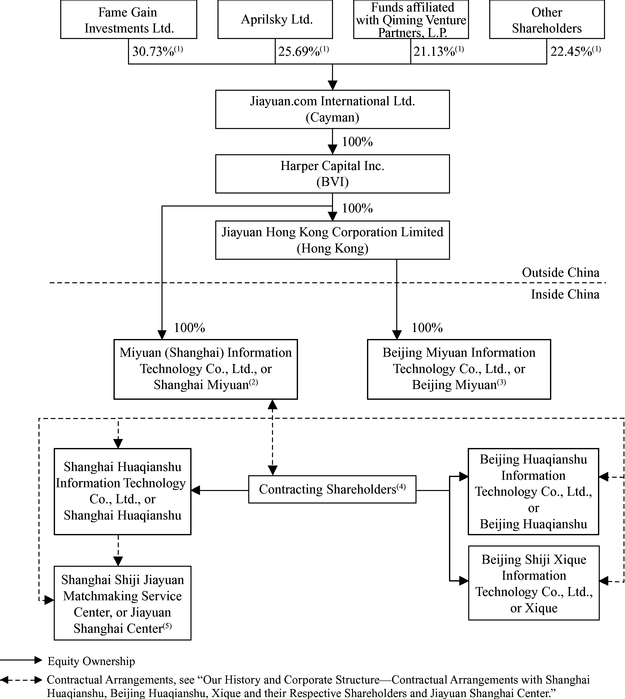

Our History and Corporate Structure

Our founder and chief executive officer, Ms. Haiyan Gong, commenced our online dating business in 2003. Due to PRC legal restrictions on foreign ownership and investment in value-added telecommunications service businesses and the prohibition on privately funded non-enterprise institutions from engaging in profit-making business operations in China, we do not have any direct ownership interests or direct voting rights in any of our PRC operating companies and Jiayuan Shanghai Center. We operate our online dating services and offline VIP services through a series of contractual arrangements entered into among Miyuan (Shanghai) Information Technology Co., Ltd., or Shanghai Miyuan, Beijing Miyuan Information Technology Co., Ltd., or Beijing Miyuan, Shanghai Huaqianshu Information Technology Co., Ltd, or Shanghai Huaqianshu, its shareholders, Jiayuan Shanghai Center, Beijing Huaqianshu Information Technology Co., Ltd., or Beijing Huaqianshu, its shareholders, Beijing Shiji Xique Information Technology Co., Ltd., or Xique, and its shareholders, including an assignment agreement between Beiing Miyuan, Shanghai Miyuan, Beijing Huaqianshu and its shareholders and an assignment agreement between Beijing Miyuan, Shanghai Miyuan, Xique and

3

its shareholders. Shanghai Huaqianshu, Beijing Huaqianshu and Xique, hold, or are in the process of obtaining, the licenses and approvals that are required to operate our business. As a result of these contractual arrangements, we have the right to control management decisions and direct the economic activities that most significantly impact Shanghai Huaqianshu, Beijing Huaqianshu, Xique and Jiayuan Shanghai Center, and to obtain substantially all of the economic benefits in Shanghai Huaqianshu, Beijing Huaqianshu, Xique and Jiayuan Shanghai Center and the obligation to fund their losses. Therefore, we are deemed to be the primary beneficiary of Shanghai Huaqianshu, Beijing Huaqianshu, Xique and Jiayuan Shanghai Center, and, accordingly, under generally accepted accounting principles in the United States, or U.S. GAAP, we consolidate their operating results in our consolidated financial statements. For a more detailed discussion of these contractual arrangements, see "Our History and Corporate Structure," and for a detailed description of the regulatory environment for Internet-based businesses and offline VIP services in China that necessitates our adoption of this structure, see "Regulation." In addition, for a detailed description of the risks associated with our corporate structure and the contractual arrangements that support our corporate structure, see "Risk Factors—Risks Relating to Regulation of Our Business and to Our Structure."

We were required under PRC law to make an initial capital contribution of RMB990,000 in Beijing Miyuan by April 25, 2011. However, in order for us to have made the capital contribution, Beijing Miyuan was required to have obtained a foreign exchange registration certificate from the local branch of the State Administration of Foreign Exchange, or SAFE. A prerequisite to Beijing Miyuan receiving such foreign exchange registration certificate was that the PRC residents holding direct or indirect interests in our company, Ms. Haiyan Gong, our founder and chief executive officer, Mr. Yongqiang Qian, our chairman, Mr. Xu Liu, Mr. Fuping Yu, Mr. Cheng Li and Mr. Qingjun Zhu, complete their registrations and any updated registrations with the local SAFE office under SAFE Circular 75. Due to our reorganization, Ms. Haiyan Gong, Mr. Yongqiang Qian, and Mr. Xu Liu are required to amend their previous registrations and their ownership changes pursuant to the SAFE Circular No. 75 and Mr. Fuping Yu, Mr. Cheng Li and Mr. Qingjun Zhu are required to register in accordance with SAFE Circular No. 75. However, the registrations by these six PRC resident shareholders were not completed in time, and Beijing Miyuan was unable to obtain a foreign exchange registration certificate by April 25, 2011. As a result, we were unable to make the initial capital contribution before the prescribed statutory deadline. Under PRC law, Beijing Miyuan's Foreign Invested Enterprise Approval Certificate issued by the local office of the Ministry of Commerce is consequently deemed to be invalid. We are required to deregister Beijing Miyuan with the local Administration of Industry and Commerce, or AIC, office and return Beijing Miyuan's business license to the local AIC office for cancellation. In addition, the local AIC office may also revoke Beijing Miyuan's business license on its own initiative even if we do not voluntarily deregister Beijing Miyuan and return the business license. If Beijing Miyuan is deregistered and its business license is returned to the local AIC for cancellation, or its business license is revoked by the local AIC office, Beijing Miyuan will no longer be a validly existing legal entity. As of the date of this prospectus, Beijing Miyuan has not commenced operations, it does not have any staff or assets and it does not generate any revenue. See "Risk Factors—Risks Relating to Regulation of Our Business and to Our Structure—If Beijing Miyuan, one of our PRC subsidiaries, is deregistered or if its business license is cancelled or revoked by the government, we may be required to incur additional costs to reorganize our corporate structure" and "Risk Factors—Risks Related to Doing Business in China—PRC regulations relating to the establishment of offshore SPVs by PRC residents may subject our PRC resident beneficial owners or our PRC subsidiaries to liabilities or penalties, limit our ability to inject capital into our PRC subsidiaries, limit our PRC subsidiaries' ability to increase their registered capital or distribute profits to us or may otherwise adversely affect us."

4

The following diagram illustrates our shareholding and corporate structure as of the date of this prospectus:

- (1)

- The

shareholding percentage is determined by dividing (i) the number of ordinary shares held by such person by (ii) the total number of

ordinary shares outstanding as of the date of this prospectus. The shareholding percentage does not take into account any option held by such person, including those options that are currently

exercisable or exercisable within 60 days of the date of this prospectus.

- (2)

- Harper Capital Inc., or Harper, is in the process of transferring its 100% equity interest in Shanghai Miyuan to Jiayuan Hong Kong. We expect to complete this transfer in the second quarter of 2011. Shanghai Miyuan has received all of the required approvals from the Ministry of Commerce to effect this transfer. It is in the process of updating its AIC registration to reflect the equity transfer from Harper to Jiayuan Hong Kong. Shanghai Miyuan is also required to update its foreign exchange registration certificate with the local office of the SAFE after the AIC registration is completed. See "Risk Factors—Risks Relating to Regulation of Our Business and to Our Structure—We may be unable to complete the

5

transfer of the equity interest in Shanghai Miyuan from Harper to Jiayuan Hong Kong which may cause us to incur additional costs, divert resources and management attention."

- (3)

- The

PRC residents holding direct or indirect interests in our company to which we have knowledge are in the process of registering and amending

registrations with the local SAFE branch. These PRC residents are Ms. Haiyan Gong, our founder and chief executive officer, Mr. Yongqiang Qian, our chairman, Mr. Xu Liu,

Mr. Fuping Yu, Mr. Qingjun Zhu and Mr. Cheng Li. Because these registrations are still in process, Beijing Miyuan was unable to obtain a foreign exchange registration certificate

by April 25, 2011, the date on which the first installment of the capital contribution was required to be made. Jiayuan Hong Kong was thus unable to pay the first installment of the capital

contribution. As a result, under PRC law, Beijing Miyuan's Foreign Invested Enterprise Approval Certificate issued by the local office of the Ministry of Commerce is consequently deemed to be invalid.

We are required to deregister Beijing Miyuan with the local AIC office and return Beijing Miyuan's business license to the local AIC office for cancellation. In addition, the local AIC office may also

revoke Beijing Miyuan's business license on its own initiative even if we do not voluntarily deregister Beijing Miyuan and return the business license. If Beijing Miyuan is deregistered and its

business license is returned to the local AIC for cancellation, or its business license is revoked by the local AIC office, Beijing Miyuan will no longer be a validly existing legal entity. See "Risk

Factors—Risks Relating to Regulation of Our Business and to Our Structure—If Beijing Miyuan, one of our PRC subsidiaries, is deregistered or if its business license is

cancelled or revoked by the government, we may be required to incur additional costs to reorganize our corporate structure" and "Risk Factors—Risks Related to Doing Business in

China—PRC regulations relating to the establishment of offshore SPVs by PRC residents may subject our PRC resident beneficial owners or our PRC subsidiaries to liabilities or penalties,

limit our ability to inject capital into our PRC subsidiaries, limit our PRC subsidiaries' ability to increase their registered capital or distribute profits to us or may otherwise adversely affect

us."

- (4)

- These

contracting shareholders are Ms. Haiyan Gong, Mr. Yongqiang Qian, Mr. Xu Liu, Mr. Fuping Yu,

Mr. Qingjun Zhu and Mr. Cheng Li.

- (5)

- Jiayuan Shanghai Center was established by Shanghai Huaqianshu as a privately funded non-enterprise institution that engages in non-profit social services.

6

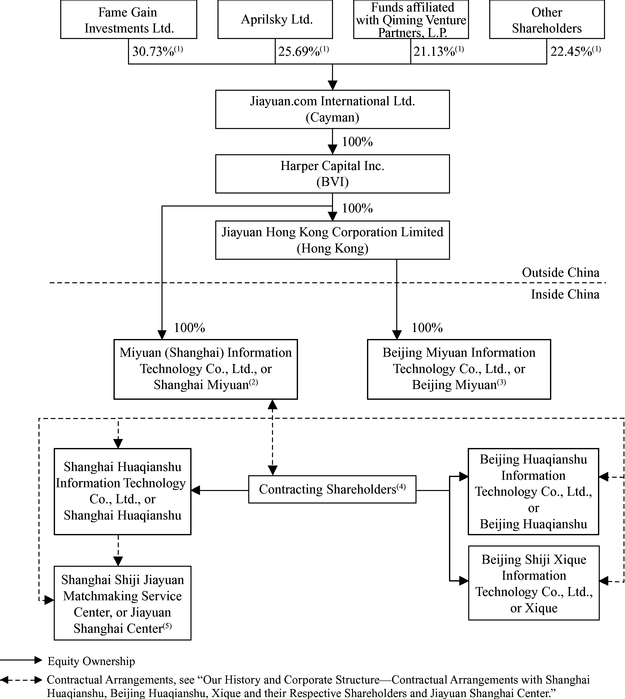

The following diagram illustrates our anticipated shareholding and corporate structure immediately following this offering and assuming that Harper has completed the transfer of its 100% equity interest in Shanghai Miyuan to Jiayuan Hong Kong and that the underwriters do not exercise their over-allotment option:

- (1)

- The

shareholding percentage is determined by dividing (i) the number of ordinary shares held by such person by (ii) the total number of

ordinary shares outstanding immediately after the completion of this offering. The shareholding percentage does not take into account any option held by such person, including those options that are

currently exercisable or exercisable within 60 days of the date of this prospectus.

- (2)

- These

contracting shareholders are Ms. Haiyan Gong, Mr. Yongqiang Qian, Mr. Xu Liu, Mr. Fuping Yu,

Mr. Qingjun Zhu and Mr. Cheng Li.

- (3)

- Jiayuan Shanghai Center was established by Shanghai Huaqianshu as a privately funded non-enterprise institution that engages in non-profit social services.

7

Immediately following this offering, Fame Gain, Aprilsky, funds affiliated with Qiming Venture Partners, L.P. and other shareholders will continue to hold a majority of our outstanding ordinary shares. Fame Gain is 100% owned by our chairman, Mr. Yongqiang Qian. Aprilsky is 100% owned by our chief executive officer, Ms. Haiyan Gong. The general partner of Qiming Venture Partners, L.P. is Qiming GP, L.P. and one of our directors, Mr. JP Gan, is a managing director of the general partner of Qiming GP, L.P. Our other shareholders include other executive officers as well as shareholders who were shareholders of our company prior to this offering. In addition, Mr. Qian, Ms. Gong and Mr. Gan will serve as three of the five members of our board of directors immediately following this offering.

Our Corporate Information

Our principal executive offices are located at Room 1005, Changxin Building, No. 39 Anding Road, Chaoyang District, Beijing, the People's Republic of China, and our telephone number is +8610 6442-8783. Our website address is http://www.jiayuan.com. The information on our website does not form a part of this prospectus. Our registered office in the Cayman Islands is P.O. Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. Our agent for service of process in the United States is CT Corporation System, located at 111 Eighth Avenue, New York, New York 10011. Investor inquiries shall be directed to us at the address and telephone number of our principal office set forth above.

8

Total ADSs offered |

7,100,000 ADSs | |

By us |

6,700,000 |

|

By the selling shareholder |

400,000 |

|

ADSs outstanding immediately after this offering |

7,100,000 ADSs |

|

Ordinary shares outstanding immediately after this offering |

46,889,394 ordinary shares(1) |

|

The ADSs |

Every two ADSs represent three ordinary shares. |

|

|

The depositary will hold the ordinary shares underlying your ADSs. You will have rights as provided in the deposit agreement. You may turn in your ADSs to the depositary in exchange for ordinary shares. The depositary will charge you fees for any exchange. We may amend or terminate the deposit agreement without your consent. If you continue to hold your ADSs, you agree to be bound by the deposit agreement as amended. |

|

|

To better understand the terms of the ADSs, you should carefully read the "Description of American Depositary Shares" section of this prospectus. You should also read the deposit agreement, which is filed as an exhibit to the registration statement that includes this prospectus. |

|

Depositary |

Citibank, N.A. |

|

Over-allotment option |

The selling shareholders have granted the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase up to 1,065,000 additional ADSs at the initial public offering price, less underwriting discount and commission, solely for the purpose of covering over-allotments. We will not receive any proceeds from the sale of ADSs by the selling shareholders if the over-allotment option is exercised. |

|

Use of proceeds |

Our net proceeds from this offering are expected to be approximately US$65.7 million. We plan to use the net proceeds we receive from this offering to pay dividends due to holders of Series A preferred shares, including US$3.0 million to Fame Gain, Qiming Venture Partners L.P. and Qiming Managing Directors Fund, L.P., and for general corporate purposes, including capital expenditures, such as in connection with establishing new offices, expanding our services and purchasing additional hardware for expanded capacity and to meet new demands from new services, and funding possible future strategic acquisitions. See "Use of Proceeds" for additional information. |

9

|

We will not receive any of the proceeds from the sale of ADSs by the selling shareholders. |

|

Listing |

We have received approval for listing our ADSs on the Nasdaq Global Select Market. Our ADSs and ordinary shares will not be listed on any other stock exchange or traded on any over-the-counter trading system. |

|

Nasdaq Global Select Market symbol |

"DATE" |

|

Risk factors |

See "Risk Factors" and other information included in this prospectus for a discussion of risks you should carefully consider before investing in our ADSs. |

|

Lock-up |

We, our directors and executive officers, all of our existing shareholders and certain of our existing option-holders have agreed with the underwriters not to sell, transfer or dispose of, directly or indirectly, any of our ADSs or ordinary shares or securities convertible into or exercisable or exchangeable for our ADSs or ordinary shares for a period of 180 days following the date of this prospectus. See "Underwriting." |

|

Reserved ADSs |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to seven percent of the ADSs offered by this prospectus to our directors, officers, employees, business associates and related persons through a directed share program. |

- (1)

- The number of ordinary shares that will be outstanding immediately after this offering assumes the automatic conversion of all of our preferred shares, but excludes 3,527,113 ordinary shares issuable upon the exercise of options outstanding as of the date of this prospectus

10

SUMMARY CONSOLIDATED FINANCIAL AND OPERATING DATA

The following summary consolidated financial data for the periods and as of the dates indicated should be read in conjunction with our consolidated financial statements and the accompanying notes, "Selected Consolidated Financial and Operating Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations," all of which are included elsewhere in this prospectus.

The summary consolidated statement of operations data for the fiscal years ended December 31, 2008, 2009 and 2010, and the summary consolidated balance sheet data as of December 31, 2008, 2009 and 2010, are derived from our audited consolidated financial statements included elsewhere in this prospectus.

Our consolidated financial statements are prepared in accordance with U.S. GAAP. Our results of operations in any period may not necessarily be indicative of the results that may be expected for any future periods.

For a description of our selected unaudited consolidated financial data as of and for the three months ended March 31, 2011, see "Recent Developments."

11

Consolidated Statement of Operations Data:

| |

Years ended December 31, | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | ||||||||||

| |

RMB |

RMB |

RMB |

US$ |

||||||||||

| |

(in thousands, except share and per share data) |

|||||||||||||

Net revenues |

27,625 | 63,894 | 167,589 | 25,392 | ||||||||||

Cost of revenues(1) |

(21,353 | ) | (28,448 | ) | (61,049 | ) | (9,250 | ) | ||||||

Gross profit |

6,272 | 35,446 | 106,540 | 16,142 | ||||||||||

Operating expenses: |

||||||||||||||

Selling and marketing expenses(1) |

(14,677 | ) | (16,574 | ) | (57,867 | ) | (8,767 | ) | ||||||

General and administrative expenses(1) |

(5,872 | ) | (8,631 | ) | (24,338 | ) | (3,685 | ) | ||||||

Research and development expenses(1) |

— | (8 | ) | (381 | ) | (58 | ) | |||||||

Total operating expenses |

(20,549 | ) | (25,213 | ) | (82,586 | ) | (12,510 | ) | ||||||

Operating (loss)/income |

(14,277 | ) | 10,233 | 23,954 | 3,632 | |||||||||

Interest income, net |

734 | 1,189 | 1,876 | 284 | ||||||||||

Foreign currency exchange losses, net |

(299 | ) | (3 | ) | — | — | ||||||||

Other (expenses)/income, net |

(19 | ) | 6 | 898 | 134 | |||||||||

(Loss)/income before income tax |

(13,861 | ) | 11,425 | 26,728 | 4,050 | |||||||||

Income tax expenses |

— | (5,748 | ) | (10,011 | ) | (1,517 | ) | |||||||

Net (loss)/income attributable to Jiayuan.com International Ltd. |

(13,861 | ) | 5,677 | 16,717 | 2,533 | |||||||||

Accretion of Series A redeemable convertible preferred shares |

(7,504 | ) | (7,976 | ) | (8,690 | ) | (1,317 | ) | ||||||

Income allocated to participating preferred shareholders |

— | (5,677 | ) | (16,717 | ) | (2,533 | ) | |||||||

Net loss attributable to ordinary shareholders |

(21,365 | ) | (7,976 | ) | (8,690 | ) | (1,317 | ) | ||||||

Net loss per share: |

||||||||||||||

Basic |

(0.78 | ) | (0.29 | ) | (0.32 | ) | (0.05 | ) | ||||||

Diluted |

(0.78 | ) | (0.29 | ) | (0.32 | ) | (0.05 | ) | ||||||

Weighted average shares used in calculating net loss per share, basic |

27,272,727 | 27,272,727 | 27,272,727 | 27,272,727 | ||||||||||

Weighted average shares used in calculating net loss per share, diluted |

27,272,727 | 27,272,727 | 27,272,727 | 27,272,727 | ||||||||||

Unaudited pro-forma net income per share(2): |

||||||||||||||

Basic |

0.45 | 0.07 | ||||||||||||

Diluted |

0.44 | 0.07 | ||||||||||||

Weighted average shares used in calculating pro-forma net income per share, basic |

37,056,857 | 37,056,857 | ||||||||||||

Weighted average shares used in calculating pro-forma net income per share, diluted |

38,165,872 | 38,165,872 | ||||||||||||

Non-GAAP net (loss)/income(3) |

(13,716 | ) | 7,302 | 23,680 | 3,588 | |||||||||

- (1)

- Includes share-based compensation expenses as follow:

| |

Years ended December 31, |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | |||||||||

| |

RMB |

RMB |

RMB |

US$ |

|||||||||

| |

(in thousands) |

||||||||||||

Cost of revenues |

96 | 178 | 2,041 | 310 | |||||||||

Selling and marketing expenses |

— | 52 | 700 | 106 | |||||||||

General and administrative expenses |

49 | 1,395 | 4,174 | 632 | |||||||||

Research and development expenses |

— | — | 48 | 7 | |||||||||

Total |

145 | 1,625 | 6,963 | 1,055 | |||||||||

- (2)

- The unaudited pro-forma net income per share for the year ended December 31, 2010 gives effect to (i) the conversion of our Series A preferred shares into ordinary shares on the original date of issuance at the rate of one ordinary share for each preferred share and (ii) the adjustment of dilutive shares whose proceeds are to be used to pay for the difference between the cumulative participating dividends due to holders of our Series A preferred shares, in the amount of RMB25.9 million (US$4.0 million) as of the expected completion date of this offering, and our net income for the year ended December 31, 2010, based on the initial public offering price of US$11.00 per ADS less estimated offering expenses of US$1.20 per ADS where every two ADSs represent three ordinary shares as disclosed on the cover of this prospectus.

12

- (3)

- We define non-GAAP net (loss)/income as net (loss)/income attributable to Jiayuan.com International Ltd. excluding share-based compensation expenses. We review non-GAAP net (loss)/income together with net (loss)/income attributable to Jiayuan.com International Ltd. to obtain a better understanding of our operating performance. We also believe it is useful supplemental information for investors and analysts to assess our operating performance without the effect of non-cash share-based compensation expenses, which have been and will continue to be significant recurring expenses in our business. However, the use of non-GAAP net (loss)/income has material limitations as an analytical tool. One of the limitations of using non-GAAP net (loss)/income is that it does not include all items that impact our net (loss)/income attributable to Jiayuan.com International Ltd. during the periods. In addition, because non-GAAP net (loss)/income is not calculated in the same manner by all companies, it may not be comparable to other similar titled measures used by other companies. In light of the foregoing limitations, you should not consider non-GAAP net (loss)/income in isolation from or as an alternative to net (loss)/income attributable to Jiayuan.com International Ltd. prepared in accordance with U.S. GAAP. Our non-GAAP net (loss)/income is calculated as follows for the periods presented:

| |

Years ended December 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | |||||||||

| |

RMB |

RMB |

RMB |

US$ |

|||||||||

| |

(in thousands) |

||||||||||||

Net (loss)/income attributable to Jiayuan.com International Ltd. |

(13,861 | ) | 5,677 | 16,717 | 2,533 | ||||||||

Add: Share-based compensation expenses |

145 | 1,625 | 6,963 | 1,055 | |||||||||

Non-GAAP net (loss)/income |

(13,716 | ) | 7,302 | 23,680 | 3,588 | ||||||||

Consolidated Balance Sheet Data:

| |

As of December 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | |||||||||

| |

RMB |

RMB |

RMB |

US$ |

|||||||||

| |

(in thousands) |

||||||||||||

Total current assets |

50,655 | 76,407 | 149,229 | 22,612 | |||||||||

Total assets |

54,517 | 80,572 | 164,258 | 24,889 | |||||||||

Total liabilities |

6,813 | 25,566 | 85,572 | 12,966 | |||||||||

Series A redeemable convertible preferred shares |

79,795 | 87,694 | 93,559 | 14,176 | |||||||||

Total shareholders' deficit |

(32,091 | ) | (32,688 | ) | (14,873 | ) | (2,253 | ) | |||||

Key Operating Data:

| |

As of December 31, | As of March 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2011 | |||||||||

Number of registered user accounts |

12,702,855 | 19,243,134 | 35,090,025 | 40,156,311 | |||||||||

| |

Years ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | |||||||

Number of average monthly active user accounts(1) |

— | — | 3,700,348 | |||||||

Number of average monthly paying user accounts |

92,102 | 203,317 | 552,930 | |||||||

| |

Three months ended | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

March 31, 2009 | June 30, 2009 | September 30, 2009 | December 31, 2009 | March 31, 2010 | June 30, 2010 | September 30, 2010 | December 31, 2010 | March 31, 2011 | |||||||||||||||||||

Number of average monthly active user accounts(1) |

— | — | — | — | 2,509,917 | 3,686,260 | 4,201,952 | 4,403,262 | 4,744,705 | |||||||||||||||||||

Number of average monthly paying user accounts |

174,690 | 191,349 | 210,134 | 237,094 | 306,163 | 495,036 | 649,250 | 761,271 | 882,471 | |||||||||||||||||||

- (1)

- The information prior to 2010 is not available.

| |

Three months ended | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

March 31, 2010 | June 30, 2010 | September 30, 2010 | December 31, 2010 | March 31, 2011 | |||||||||||

Number of average monthly VIP customers |

157 | 194 | 252 | 278 | 276 | |||||||||||

13

You should consider carefully all of the information in this prospectus, including the risks and uncertainties described below, before investing in our ADSs. Any of the following risks and uncertainties could have a material adverse effect on our business, financial condition, results of operations and prospects. The market price of our ADSs could decline due to any of these risks and uncertainties, and you may lose all or part of your investment.

Risks Relating to Our Business

Our limited operating history and relatively new business model in an emerging and rapidly evolving market make it difficult to evaluate our future prospects.

Our founder, Ms. Haiyan Gong, commenced our online dating business in 2003. We only began charging our users message fees on our online dating website in October 2008. Prior to this, we generated revenues primarily from charging for non-message related value-added services, such as advanced memberships, priority search rankings and from selling advertisement space on our website. As such, we have a limited relevant operating history from which to evaluate our business, financial performance and prospects. Since the change in our business model in 2008, we have derived a substantial portion of our net revenues from service fees generated from online dating services on our website. Our online services revenue represented 56.8%, 71.0% and 80.0% of our net revenues in 2008, 2009 and 2010, respectively. As a result, we have a short operating history under our current revenue model for you to evaluate in assessing our future prospects. We may not be able to achieve similar results or growth in future periods. Our business model may become obsolete due to development of other business models or technologies. You must consider our business and prospects in light of the risks and difficulties we will encounter as a young company in a new and rapidly evolving market. Our ability to maintain profitability primarily depends on, among other factors, the growth of the online dating industry in China, the continued acceptance of our business model by our users, our ability to generate continuing interest in our websites, our ability to provide services that meet the needs of our users and our ability to control costs and expenses. Accordingly, you should not rely on our results of operations for any prior period as an indication of our future performance. We may not be able to effectively assess or address the evolving risks and difficulties present in the market, which could threaten our capacity to continue operations successfully in the future.

If our efforts to attract a large number of users, convert users into paying users and retain paying users are not successful, our operating results would suffer.

Our future growth depends on our ability to attract a large number of users, convert our users into paying users and retain our paying users. This depends in part on our ability to deliver a high-quality online dating experience to our users and our development and introduction of enhanced services to retain our paying users. As a result, we must invest significant resources in order to enhance our existing services and continue to introduce new services that people will use. If we are unable to predict user preferences or industry changes, or if we are unable to modify and enhance our services on a timely basis, we may lose user interest and fail to attract new and paying users. Our operating results would also be adversely affected if our services are not responsive to the needs of our users and paying users.

Our selling and marketing expenses may increase and if efforts to increase traffic to our websites are not successful or cost-effective, our net revenues and profitability may be materially and adversely affected.

We rely on a variety of different marketing efforts to attract traffic to our various websites and convert users into paying users. Our marketing activities involve considerable expenditures for online and traditional offline advertising and marketing. Our online advertising is designed to direct traffic to

14

our websites and includes purchased listings on various major Internet search engines in China as well as advertising on third-party websites. Purchased listings generally are displayed if searches for a particular word are performed on a search engine. Advertising on third-party websites includes purchasing advertising space and links to our website. Depending on the arrangement, we pay a fixed fee when visitors to these websites click through to our website, a fee based on the volume of clicks to our website or a fee based on the volume of successful registrations from visitors who click through to our website. These arrangements are generally not exclusive. Our offline advertising includes advertising on conventional media such as television stations and print media.

Our selling and marketing expenses vary over time, depending upon a number of factors, many of which are beyond our control. For example, the cost of online advertising has recently increased substantially, and we expect those costs to continue to rise as long as the demand for online advertising remains robust. If we are not able to reduce our other operating costs, increase our paying user base or increase average revenue per user to offset such anticipated increases, our profitability may be materially and adversely affected. In addition, our marketing activities may not be successful or cost-effective. Existing arrangements with third parties can be terminated or allowed to lapse upon their expiration and we may not be able to replace this traffic and the related revenues. We also may not be able to enter into new arrangements with third parties in response to industry trends, which would adversely affect our business, financial condition and results of operations.

Marketing strategies in China are evolving. This further requires us to enhance our marketing strategies and experiment with new marketing methods to keep pace with industry developments. Failure to refine our existing marketing activities or to introduce new effective marketing activities in a cost-effective manner could reduce our market share, cause our net revenues to decline and negatively impact our profitability.

If one or more of our users suffers, or alleges to have suffered physical, financial or emotional harm or our online dating services is misused by users, we may suffer damage to our reputation and our brand, which in turn could adversely affect our net revenues and cause the value of our ADSs to decline.

The nature of online dating is such that we cannot control the actions of our users in their communications or physical actions. It is possible that one or more of our users could be physically, financially, emotionally or otherwise harmed following interaction with other users. We warn our users to exercise caution in meetings they arrange following the use of our services or participation in our offline events, but if one or more of our users suffers or alleges to have suffered physical, financial, emotional or other harm following contact initiated on our online dating website or an online dating website of one of our competitors, any resulting negative publicity or legal action could harm our reputation and business and may have an adverse effect on China's online dating industry in general, potentially leading to, among other things, increased government scrutiny and regulation. From time to time, we are subject to claims, which may include lawsuits, by users relating to incidents that have occurred after users meet each other.

Users may also be able to circumvent the controls we have in place to prevent illegal or dishonest activities and behaviors on our website, such as seeking payment for sexual activity and related activities. Users could also post fraudulent profiles or create false profiles on behalf of other non-consenting parties.

Any such incident involving our online dating services could damage our reputation and our brand. This, in turn, could adversely affect our net revenues and could cause the value of our ADSs to decline. In addition, the affected users could initiate legal or other actions against us, which could cause us to incur significant expenses and damage our reputation.

15

If we are unable to maintain and enhance our brands, we may be unable to maintain or expand our user base.

We believe that the reputation and level of market awareness for our "

![]() "

(Shiji Jiayuan) and "

"

(Shiji Jiayuan) and "

![]() " (Jiayuan) brands have contributed significantly to the success of our business. Maintaining and

enhancing our brand recognition and reputation depends primarily on the quality and consistency of our services, as well as the success of our marketing and promotional efforts. We believe that

maintaining and enhancing our brand is critical to our efforts to attract and expand our user base. We believe that the importance of brand recognition will continue to increase given the growing

number of Internet sites and the low barriers to entry for companies to set up online dating services. To attract and retain users, and to promote and maintain our brands in response to competitive

pressures, we intend to increase our financial commitment to creating and maintaining distinct brand loyalty. If visitors and users to our websites do not perceive our existing services to be of high

quality, or if we introduce new services that are not favorably received, the value of our brands could be diluted, thereby decreasing the attractiveness of our websites. While we have devoted

significant resources to brand promotion efforts in recent years, we cannot assure you that our ongoing marketing efforts will be successful in further promoting our brand. In addition, our brand

image may be harmed by negative publicity relating to our company or websites regardless of its veracity. If we are unable to further maintain and enhance our brand recognition and increase market

awareness for our company and services, our ability to attract users may be harmed and our business prospects may be materially and adversely affected.

" (Jiayuan) brands have contributed significantly to the success of our business. Maintaining and

enhancing our brand recognition and reputation depends primarily on the quality and consistency of our services, as well as the success of our marketing and promotional efforts. We believe that

maintaining and enhancing our brand is critical to our efforts to attract and expand our user base. We believe that the importance of brand recognition will continue to increase given the growing

number of Internet sites and the low barriers to entry for companies to set up online dating services. To attract and retain users, and to promote and maintain our brands in response to competitive

pressures, we intend to increase our financial commitment to creating and maintaining distinct brand loyalty. If visitors and users to our websites do not perceive our existing services to be of high

quality, or if we introduce new services that are not favorably received, the value of our brands could be diluted, thereby decreasing the attractiveness of our websites. While we have devoted

significant resources to brand promotion efforts in recent years, we cannot assure you that our ongoing marketing efforts will be successful in further promoting our brand. In addition, our brand

image may be harmed by negative publicity relating to our company or websites regardless of its veracity. If we are unable to further maintain and enhance our brand recognition and increase market

awareness for our company and services, our ability to attract users may be harmed and our business prospects may be materially and adversely affected.

We have not obtained the trademark registration for the "

![]() " (Shiji Jiayuan) trademark for dating and

marriage agency services. If we cannot secure rights to use this trademark for dating and marriage agency services, we may be subject

to third-party claims, including claims by an individual who applied to register such trademark in 2005, and may be forced to discontinue using this trademark for dating and marriage agency services,

which may adversely affect our ability to maintain our brands, cause us to incur litigation costs and divert resources and management attention.

" (Shiji Jiayuan) trademark for dating and

marriage agency services. If we cannot secure rights to use this trademark for dating and marriage agency services, we may be subject

to third-party claims, including claims by an individual who applied to register such trademark in 2005, and may be forced to discontinue using this trademark for dating and marriage agency services,

which may adversely affect our ability to maintain our brands, cause us to incur litigation costs and divert resources and management attention.

We have not obtained the trademark registration of the "

![]() " (Shiji Jiayuan)

trademark, the Chinese character form of our "Shiji Jiayuan" brand, for dating and marriage agency services under Class 45 (Dating and Marriage Agency

Services) of the International Classification of Goods and Services for such services. We have used this trademark since 2003 and have obtained the trademark registration for this trademark for use on

a website under Class 42 (Website).

" (Shiji Jiayuan)

trademark, the Chinese character form of our "Shiji Jiayuan" brand, for dating and marriage agency services under Class 45 (Dating and Marriage Agency

Services) of the International Classification of Goods and Services for such services. We have used this trademark since 2003 and have obtained the trademark registration for this trademark for use on

a website under Class 42 (Website).

We

applied to the PRC Trademark Office of the State Administration for Industry and Commerce, or the PRC Trademark Office, for the registration of such trademark for dating and marriage

agency services under Class 45 (Dating and Marriage Agency Services) in September 2009. In October 2010, the PRC Trademark Office rejected our trademark registration application on the basis

that an individual had applied to register the "

![]() " (Shiji Jiayuan) trademark under Class 45 in June 2005. After being informed by

the PRC Trademark Office of their decision in October 2010, we filed an

opposition to this individual's trademark registration application under Class 45 on the ground of malicious registration. Our opposition is currently pending. If we are unable to prevail in

our opposition to the trademark registration application with the PRC Trademark Office, there is a risk that litigation may become necessary, which

may force us to incur significant costs and divert resources and management attention. We may lose the right to use our "

" (Shiji Jiayuan) trademark under Class 45 in June 2005. After being informed by

the PRC Trademark Office of their decision in October 2010, we filed an

opposition to this individual's trademark registration application under Class 45 on the ground of malicious registration. Our opposition is currently pending. If we are unable to prevail in

our opposition to the trademark registration application with the PRC Trademark Office, there is a risk that litigation may become necessary, which

may force us to incur significant costs and divert resources and management attention. We may lose the right to use our "

![]() " (Shiji Jiayuan)

trademark for dating and marriage agency services, which could have a material adverse impact on our brand recognition and reputation, our business, results

of operations and financial condition.

" (Shiji Jiayuan)

trademark for dating and marriage agency services, which could have a material adverse impact on our brand recognition and reputation, our business, results

of operations and financial condition.

We are in the process of registering some of our other key trademarks in China. If our applications for our key trademarks are unsuccessful or a third party is able to register them, we may lose our ability to use our key trademarks and be unable to prevent others from using similar or identical trademarks. Furthermore, a lack of registration or license to legally use the trademarks may

16

subject us to trademark infringement claims for our use of key trademarks. Losing the right to use our key trademarks for any reason or being subject to trademark infringement claims may adversely affect our ability to maintain and protect our brands, cause us to incur litigation costs and divert resources and management attention.

Competition presents an ongoing threat to the performance of our business and may make it difficult for us to attract and retain users.

The online dating sector in China is highly competitive. The market is characterized by the frequent introduction of new websites and services, short website life cycles, constantly evolving trends, rapid adoption of technological advancements, as well as price sensitive users. We expect competition in the online dating business in China to continue to increase because there are no substantial barriers to setting up an online dating website. As of December 31, 2010, there were more than 50 online dating websites in China and we compete directly with online dating service providers such as Baihe.com and Zhenai.com. In addition, we face competition from Internet portals and social networking websites such as Sina.com.cn, Sohu.com, QQ.com, 163.com, Renren.com and Kaixin001.com. We also face competition and potential competition from overseas operators of online dating services and Internet companies that offer or seek to offer online dating services in China.

In addition, we compete with traditional dating services, as well as newspapers, magazines and other traditional media companies that provide dating services. We believe that our ability to compete successfully depends upon many factors both within and beyond our control, including the following:

- •

- the size and diversity of our user base;

- •

- the timing and market acceptance of our services, including the developments of and enhancements to those services

relative to those offered by our competitors;

- •

- customer service and support efforts;

- •

- selling and marketing efforts; and

- •

- our brand strength in the marketplace relative to our competitors.

Many of our current and potential competitors, including overseas companies that offer or seek to offer online dating services in China, have longer operating histories, significantly greater financial, technical, marketing and other resources and larger user bases than we do. These factors may allow our competitors to respond more quickly than we can to new or emerging technologies and changes in user requirements. These competitors may engage in more extensive technological development efforts, undertake more far-reaching marketing campaigns and adopt more aggressive pricing policies which may allow them to build larger user bases than we have. Our competitors may develop products or services that are equal or superior to our services or that achieve greater market acceptance than our services. These activities could attract users away from our websites and reduce our market share.

In addition, current and potential competitors may make, strategic acquisitions or establish cooperative and, in some cases, exclusive relationships with significant companies or competitors to expand their businesses or to offer more comprehensive services. To the extent these competitors or potential competitors establish exclusive relationships with major portals, search engines and Internet service providers, our ability to reach potential users may be restricted. Any of these competitors could cause us difficulty in attracting and retaining users and could jeopardize our existing relationships with portals, search engines and other web properties.

If we fail to keep pace with rapid technological change, our competitive position will suffer.

We operate in a market characterized by rapidly changing technologies, evolving industry standards, frequent new product and service announcements, enhancements and changing user

17

demands. Accordingly, our performance will depend on our ability to adapt to rapidly changing technologies and industry standards, and our ability to continually improve the speed, performance, features, ease of use and reliability of our services in response to both evolving demands of the marketplace and competitive services. There may be occasions when we may not be as responsive as many of our competitors in adapting our services to changing industry standards and the needs of our users. Our industry has been subject to constant innovation and competition. Historically, new features may be introduced by one competitor, and if they are perceived as attractive to users, they are often copied later by others. Over the last few years, such new feature introductions in the industry have included instant messaging, message boards, e-cards, virtual gifts, personality profiles and mobile content delivery. In addition, the number of people who access the Internet through devices other than desktop and laptop computers, including mobile telephones and other handheld computing devices, has increased dramatically in the past few years, and we expect this growth to continue.

Introducing new technologies into our systems involves numerous technical challenges, substantial amounts of capital and personnel resources and often takes many months to complete. For example, the lower resolution, functionality and memory currently associated with mobile devices may make the use of our services through such mobile devices more difficult and impair the user experience relative to access via desktop and laptop computers. We intend to continue to devote effort and funds toward the development of additional technologies and services. We may not be able to effectively integrate new technologies on a timely basis or at all, which may decrease user satisfaction with our online dating services. Such technologies, even if integrated, may not function as expected or may be unable to attract and retain a substantial number of mobile device users to our online dating services. We also may not be able to protect such technology from being used by our competitors. Our failure to keep pace with rapid technological changes could have a material and adverse effect on our business.

If we were to lose the services of our founder and chief executive officer, Ms. Haiyan Gong, our business could be disrupted and our business prospects could be adversely affected.

Our founder and chief executive officer, Ms. Haiyan Gong, has played an important role in the growth and development of our business since its inception. To date, we have relied heavily on her expertise in our business operations, relationships with our employees and business partners and reputation in the online dating industry. In addition, she continues to be primarily responsible for formulating our overall business strategies and spearheading the growth of our operations. If Ms. Gong becomes unable or unwilling to continue in her present position, we may not be able to find a suitable replacement and may incur additional expenses in identifying and training a successor. In addition, if she joins a competitor or forms a competing business, it could severely disrupt our business and negatively affect our financial condition and results of operations. Although Ms. Gong is subject to a non-competition agreement wherein Ms. Gong is subject to certain non-competition restrictions during and for a period of two years after termination of her employment with us, we cannot assure you that such non-competition restrictions will be effective or enforceable under PRC law. Moreover, even if the departure of Ms. Gong from our company did not have any actual impact on our operations and the growth of our business, it could create the perception among investors or the marketplace that her departure may severely damage our business and operations and negatively affect investor confidence in us, which may cause the market price of our ADSs to decline. We do not maintain key-person insurance on Ms. Gong.

If we are unable to attract, retain and motivate key personnel or hire qualified personnel, or if such personnel do not work well together, our growth prospects and profitability will be harmed.

Our performance is largely dependent on the talents and efforts of highly skilled individuals. We have recently recruited several members of our management, some of whom have limited experience in the online dating industry. As members of our management have only worked together as a team for a

18

limited time, there are inherent risks in the management of our company with respect to decision-making, business direction, product development and strategic relationships. In the event that the members of our management team are unable to work well together or agree on operating principles, business direction or business transactions or are unable to provide cohesive leadership, our business could be harmed and one or more of those individuals may discontinue their service to our company forcing us to find a suitable replacement. The loss of any of our management or key personnel could seriously harm our business.

Competition in our industry for personnel is intense, and we are aware that our competitors have directly targeted our employees. We do not have non-competition agreements with many of our non-executive employees. We also do not maintain key-person life insurance policies on our executive officers. The incentives to attract, retain and motivate employees provided by our option grants or by future arrangements, such as cash bonuses, may not be as effective as they have been in the past. If we do not succeed in attracting necessary personnel or retaining and motivating existing personnel, we may be unable to grow effectively.

Our inability to effectively manage our growth could materially and adversely affect our profitability.

We have recently experienced a period of rapid growth and expansion. The growth and expansion of our business and services place a continuous significant strain on our management, operational and financial resources. We are required to manage multiple relationships with various strategic associates, technology licensors, users and other third parties. In the event of further growth of our operations or in the number of our third-party relationships, our computer systems or procedures may not be adequate to support our operations, and our management may not be able to manage such growth effectively. To effectively manage our growth, we must continue to implement and improve our operational, financial and management information systems and to expand, train and manage our employee base. If we fail to do so, our management, operational and financial resources could be overstrained and adversely impacted.

Our business depends on our server and network hardware and software and our ability to obtain network capacity; if our current systems safeguards are unable to prevent an interruption in the availability of our services, our reputation and brand may be adversely affected and our net revenue may be reduced.

The performance of our server and networking hardware and software infrastructure is critical to our business and reputation, to our ability to attract visitors and users to our websites, to convert users into paying users and to retain paying users. An unexpected or substantial increase in the use of our websites could strain the capacity of our systems, which could lead to a slower response time or system failures. We have in the past experienced delays due to hacking activities, including an incident in 2009 which caused our online dating website to be temporarily unavailable for less than a day but resulted in no material loss to us. Any future slowdowns or system failures could adversely affect the speed and responsiveness of our websites and would diminish the experience for our visitors and users. We face risks related to our ability to scale up to our expected user levels while maintaining superior performance. If the usage of our websites substantially increases, we may need to purchase additional servers and networking equipments and services to maintain adequate data transmission speeds, the availability of which may be limited or the cost of which may be significant. Any system failure that causes an interruption in service or a decrease in the responsiveness of our websites could reduce traffic on our websites and, if sustained or repeated, could impair our reputation and the attractiveness of our brands as well as reduce net revenue and negatively impact our operating results.

Furthermore, we rely on many different hardware systems and software applications, some of which have been developed internally. If these hardware systems or software applications fail, it would adversely affect our ability to provide our services. If we are unable to protect our data from loss or electronic or magnetic corruption, or if we receive a significant unexpected increase in usage and are

19

not able to rapidly expand our transaction-processing systems and network infrastructure without any systems interruptions, it could seriously harm our business and reputation. We have experienced occasional systems interruptions in the past, and we cannot assure you that we will not incur similar or more serious interruptions in the future. From time to time, our company and our websites have been subject to delays and interruptions due to software viruses, or variants thereof, such as internet worms. To date, we have not experienced delays or systems interruptions that have had a material impact on our business.

In addition, while we have backup systems in place, we do not have disaster recovery systems and in the event of a catastrophic failure involving our websites, we may be unable to serve our web traffic for a significant period of time. Our business is therefore susceptible to earthquakes and other catastrophic events, including acts of terrorism. Our servers operate from two sites in close proximity to one another in Beijing and the absence of a redundant network in a different location could exacerbate this disruption. Any system failure, including network, software or hardware failure, that causes an interruption in the delivery of our websites and services or a decrease in responsiveness of our websites would result in reduced visitor traffic, reduced net revenue and would adversely affect our reputation and brands.

We rely on third-party advertising service providers and their failure or unwillingness to effectively provide services to us could harm us by increasing our costs and reducing our operating margins.

We rely on third-party advertising service providers, such as Baidu, that help market our services. Any failure of such third parties to provide their services could significantly harm our business. The steps we take to improve the marketing of our services will increase our cost and reduce our operating margin and may not be successful. Furthermore, any financial or other difficulties such providers face, the nature and extent of which we cannot predict, may adversely affect our business. Except for certain rights in our contracts with such third-party service providers, we exercise little or no control over them, which increases our vulnerability to problems with the services that they provide.

We are required to estimate a portion of our reported revenues and cost of revenues at period-end, which may require adjustments once we receive billing statements from WVAS partners, which may require subsequent adjustments to our financial statements.

We do not directly bill our users that elect to pay for our online services through their telecommunication operators. Instead, we depend on wireless value-added services, or WVAS, partners to record the sales volume, bill our users, collect payments from the telecommunication operators and remit to us our portion of the revenues. In the years ended December 31, 2008, 2009 and 2010, revenue remitted from WVAS partners accounted for approximately 61.2%, 32.2%, and 19.7%, respectively, of our online revenues. Due to our past experience with the timing of receipt of the monthly statements provided by our WVAS partners, we rely on our own internal estimates for the portion of our reported revenues and cost of revenues and are required to make adjustments when we actually receive the monthly billing statements from our WVAS partners if such statements are materially different from our estimates. Historically, there have been no significant differences between our estimates and WVAS partners' billing statements and we have generally received billing statements a few weeks after the month-end. To the extent that our WVAS partners require longer periods of time to send us monthly billing statements, we may not be able to make any adjustment prior to releasing our period-end results and we cannot assure you that any adjustment which we subsequently make would not be material.

Furthermore, our WVAS partners collect user fees from telecommunication operators, such as China Mobile, China Unicom and China Telecom. Our WVAS partners' relationship with these telecommunication operators could in turn impact our business. Any loss or deterioration of our WVAS partners' relationships with telecommunication operators may affect our ability to collect fees from our users, which would have an adverse effect on our cash flows and any write-off of receivables would affect our results of operations.

20

If we fail to develop or maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential shareholders could lose confidence in our financial reporting, which would harm the value of our shares.

Prior to this offering, we have been a private company with a short operating history and limited accounting personnel with U.S. GAAP experience and other resources with which to address our internal control and procedures over financial reporting. In the preparation of our consolidated financial statements for the years ended December 31, 2008, 2009 and 2010, we identified one material weakness in our internal control over financial reporting, as defined in AU 325, Communicating Internal Control Related Matters Identified in an Audit, of the PCAOB Standard and Related Rules. A material weakness is a deficiency, or a combination of deficiencies, in internal control such that there is a reasonable possibility that a material misstatement of our company's financial statements will not be prevented, or detected and corrected on a timely basis. Effective internal control over financial reporting is necessary for us to provide reliable financial reports, effectively prevent fraud and operate as a public company.

The material weakness identified relates to the lack of sufficient accounting personnel with knowledge to perform period-end reporting procedures under U.S. GAAP, to address complex U.S. GAAP accounting issues and to prepare and review financial statements and related disclosures under U.S. GAAP. The material weakness identified resulted in adjustments in stock-based compensation expenses, accretions on redeemable convertible preferred shares, the presentation of certain revenue items on a gross versus net basis and certain deferred revenue items relating to customer loyalty points and services offered as bundled packages.