Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

GRAND FARM INC.

(Exact name of Registrant as specified in its charter)

|

Cayman Islands

|

2040

|

Not Applicable

|

|

(State or other jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Classification Code Number)

|

Identification Number)

|

No.2089 East Hanhua Road

Guohuan Town, Hanjiang District

Putian, Fujian Province, China 351111

Phone: +86-594-3599889

Fax: +86-594-3598158

(Name, address, including zip code, and telephone number

including area code, of registrant’s principal executive office)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

Tel: (302) 738-7210

(Name, address, including zip code, and telephone number

including area code, of agent for service)

Copies to:

|

Kevin K. Leung, Esq.

|

Mitchell S. Nussbaum, Esq.

|

|

Young Jun Kim, Esq.

Francis Chen, Esq.

LKP Global Law, LLP

|

Angela M. Dowd, Esq.

Loeb & Loeb LLP

345 Park Avenue,

|

|

1901 Avenue of the Stars, Suite 480

Los Angeles, California 90067

Tel: 424-239-1890 Fax: 424-869-6692

|

New York, New York 10154

Tel: 212-407-4000 Fax: 212-407-4990

|

|

José Santos, Esq.

Forbes Hare

Elizabethan Square

Grand Cayman KY1-1103

Cayman Islands

Tel: 1 345 943 7700 Fax: 1 345 943 7702

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to Be

Registered(1)

|

Proposed Maximum Aggregate Offering

Price (2) (3)

|

Amount of Registration Fee (3)

|

||||||

|

Ordinary shares, par value $0.002 per share

|

$ | 30,000,000 | $ | 3,483.00 | ||||

|

Underwriter’s warrants to purchase ADSs (4) (5)

|

||||||||

|

Ordinary shares underlying underwriter’s warrants (5)

|

||||||||

|

Total registration fee

|

$ | 3,483.00 | ||||||

|

(1)

|

American depositary shares, or ADSs, issuable upon deposit of the ordinary shares registered hereby will be registered under a separate registration statement on Form F-6. Each ADS represents ordinary shares.

|

|

(2)

|

Includes ordinary shares underlying ADSs that are issuable upon the exercise of a 45-day underwriters’ option to purchase additional ADSs solely to cover over-allotments, if any.

|

|

(3)

|

Estimated solely for the purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

|

|

(4)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended, there are also being registered an indeterminable number of our ordinary shares as may be issued to prevent dilution as a result of stock splits, stock dividends or similar transactions.

|

|

(5)

|

The Registrant will issue to the underwriter (or its designated affiliates) warrants to purchase a number of ADSs that is equal to 7% of the aggregate number of ADSs sold in this offering, including the over-allotment option. The warrants will be exercisable at a per ADS exercise price equal to 150% of the public offering price, and may be exercised on a cashless basis. Pursuant to Rule 457(g) under the Securities Act of 1933, as amended, because the ordinary shares underlying the underwriter’s warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby.

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to the said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION, DATED , 2011

|

GRAND FARM INC.

|

American Depositary Shares Representing

|

Ordinary Shares

|

This is the initial public offering of American depositary shares, or ADSs, of Grand Farm Inc., or Grand Farm Cayman. Grand Farm Cayman is offering ADSs. Each ADS represents of our ordinary shares, par value $0.002 per share.

Prior to this offering, there has been no public market for our ADS or our ordinary shares. We currently expect the initial public offering price to be between $ and $ per share.

We have applied to list our ADSs on the NASDAQ Capital Market under the symbol “GRFM.” There is no assurance that this application will be approved. If the application is not approved, we will not complete this offering.

See “Risk Factors” beginning on page 10 to read about risks you should consider before buying our ADSs.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this registration statement. Any representation to the contrary is a criminal offense.

No offer or invitation to subscribe for the ADSs may be made to the public in the Cayman Islands.

|

Per ADS

|

Total

|

|||||||

|

Public offering price

|

$ | $ | ||||||

|

Underwriting discount

|

$ | $ | ||||||

|

Corporate finance fee

|

$ | $ | ||||||

|

Proceeds, before expenses, to us

|

$ | $ | ||||||

The underwriter has an option exercisable within 45 days from the date of this prospectus to purchase up to of additional ADSs from us at the public offering price, less the underwriting discount, solely to cover over-allotments. The ADSs issuable upon exercise of the underwriter’s over-allotment option have been registered under the registration statement of which this prospectus forms a part.

In consideration of services provided, we have also agreed to issue to the underwriter (or its designated affiliates) warrants to purchase up to ADSs equal to 7% of the number of ADSs sold in this offering, including the over-allotment option, exercisable six months after the closing of this offering and expiring five years from the effective date of the registration statement of which this prospectus forms a part. If these warrants are exercised, each ADS may be purchased at $ (150% of the initial offering price per ADS sold in the offering), and the warrants may be exercised on a cashless basis.

The underwriter expects to deliver the ADSs against payment in U.S. dollars in New York, New York on , 2011.

Newbridge Securities Corporation

Prospectus dated , 2011.

Grand Farm’s pre-packaged short/medium-shaped rice products

Grand Farm’s second production facility in Putian

Grand Farm’s rice bran oil storage silos and production facility located at its second production facility in Putian

TABLE OF CONTENTS

Prospectus

|

PROSPECTUS SUMMARY

|

1

|

|

RISK FACTORS

|

10

|

|

FORWARD-LOOKING STATEMENTS

|

32

|

|

USE OF PROCEEDS

|

33

|

|

DIVIDEND POLICY

|

34

|

|

CAPITALIZATION

|

35

|

|

DILUTION

|

36

|

|

EXCHANGE RATE INFORMATION

|

37

|

|

ENFORCEABILITY OF CIVIL LIABILITIES

|

38

|

|

SELECTED FINANCIAL AND OPERATING DATA

|

39

|

|

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

40

|

|

OUR CORPORATE HISTORY AND STRUCTURE

|

51

|

|

OUR BUSINESS

|

56

|

|

REGULATION

|

64

|

|

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

|

74

|

|

MAJOR SHAREHOLDERS

|

78

|

|

RELATED PARTY TRANSACTIONS

|

79

|

|

DESCRIPTION OF SHARE CAPITAL

|

81

|

|

DESCRIPTION OF AMERICAN DEPOSITARY SHARES

|

89

|

|

SHARES ELIGIBLE FOR FUTURE SALE

|

97

|

|

TAXATION

|

98

|

|

UNDERWRITING

|

110

|

|

EXPENSES RELATING TO THIS OFFERING

|

119

|

|

LEGAL MATTERS

|

120

|

|

EXPERTS

|

120

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

120

|

|

COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

120

|

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

F-1

|

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of its date. To the extent that any fact or event arising after the date of this prospectus represents, individually or in the aggregate, a fundamental change in the information presented in this prospectus, this prospectus will be updated to the extent required by law.

i

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with the more detailed information and financial statements appearing elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our ADSs discussed under “Risk Factors” beginning on page 10 before deciding whether to buy our ADSs.

Conventions That Apply to this Prospectus

In this prospectus, unless otherwise specified or the context so requires:

|

|

“ADSs” refers to our American depositary shares, each of which represents ordinary shares;

|

|

|

“ordinary shares” refers to Grand Farm Inc.’s ordinary shares, par value $0.002 per share;

|

|

|

“we,” “us,” “our company,” or “Company” refers to Grand Farm Inc., and its subsidiaries and consolidated entities;

|

|

|

“Sunlight Blaze” refers to Sunlight Blaze Holdings Limited, a British Virgin Islands company;

|

|

|

“Grand Farm Cayman” refers to Grand Farm Inc., a Cayman Islands exempted company;

|

|

|

“Grand Farm HK” refers to Asia Success Holdings Limited, a Hong Kong company, which is a wholly owned subsidiary of Grand Farm Cayman;

|

|

|

“Grand Farm WFOE” refers to Putian Asia Success Cereals & Oils Technical Service Co., Ltd., a PRC company which is a wholly owned subsidiary of Grand Farm HK;

|

|

|

“Grand Farm China” refers to Fujian Grand Farm Foods Development Co., Ltd., a PRC company which has contractual relationships with Grand Farm WFOE;

|

|

|

“PRC” or “China” refers to the People’s Republic of China, and, for the purposes of this prospectus, excludes Hong Kong, Macau and Taiwan;

|

|

|

“RMB” or “¥” refers to the legal currency of the People’s Republic of China;

|

|

|

“U.S. dollars,” “US$” or “$” refers to the legal currency of the United States;

|

|

|

“mt” refers to metric ton or metric tons;

|

|

|

“kg” refers to kilogram or kilograms; and

|

|

|

“m2” refers to square meter or square meters.

|

Unless otherwise indicated, all information in this prospectus reflects no exercise by the underwriters of their option to purchase up to additional ADSs to cover over-allotments, if any. Unless otherwise indicated, our financial information presented in this prospectus has been prepared in accordance with United States Generally Accepted Accounting Principles, or US GAAP. This prospectus contains conversions of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader.

Unless otherwise noted, all conversions from Renminbi to U.S. dollars were made at the noon buying rate in the City of New York for cable transfers in Renminbi per U.S. dollar as certified for customs purposes by the Federal Reserve Bank of New York, or the noon buying rate, as of December 31, 2010, which was RMB 6.61180 to US$1.00. We make no representation that the Renminbi or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. On May 10, 2011, the noon buying rate was RMB 6.50130 to US$1.00.

Our Business

We are a leading integrated rice producer in China. Established in June 2001, we are headquartered in Putian, Fujian Province. All of our business operations are conducted by Grand Farm China, which we control through a series of contractual arrangements between Grand Farm WFOE, our wholly-owned indirect subsidiary, and Grand Farm China together with its owners. For a description of the contractual arrangements, please see “Our Corporate History and Structure – Contractual Arrangements with Grand Farm China and its Equity Owners” elsewhere this prospectus.

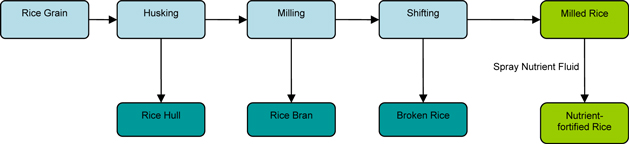

1

We currently produce three types of milled rice that we prepackage and sell under the “Grand Farm” brand to our distributors for wholesale and retail distributions throughout Fujian. We produce regular milled rice and nutrient-fortified rice from short/medium-shaped grain primarily sourced from northeastern China – Panjin in Liaoning Province, Bayan in Heilongjiang Province, and Jilin City and Dehui in Jilin Province. We also produce regular milled rice from long-shaped rice grain sourced from Fujian Province and Jiangxi Province in southern China to cater to consumers who may prefer a different taste and texture than rice made from short/medium-shaped grain, and to diversify our product offerings. All three types of prepackaged milled rice products are consumed by the Chinese consumers as daily staples. In addition to our prepackaged rice products, we produce milled rice from long-shaped rice grains that we sell in bulk directly to brewers throughout Fujian to make beer. Byproducts from our rice milling process, such as rice bran and broken rice, are sold in bulk directly to livestock feed factories and stores. Our net income for the years ended December 31, 2008, 2009 and 2010 was approximately $4.9 million, $12.1 million and $14.1 million, respectively.

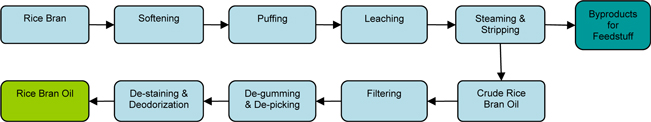

We currently have two production facilities both in Putian. The first facility is located at our headquarters and has two processing lines with combined annual rice grain processing capacity of 260,000 mt, yielding 180,000 mt of milled rice, as well as our proprietary production line for nutrient-fortified rice with annual production capacity of 80,000 mt. Our entire production process at this facility, from sourcing raw materials to production to sales, is ISO9001:2000 certified (for quality control), HACCP certified (for food safety control), and ISO14001:2004 certified (for environment control). Our second facility, located in proximity to our headquarters, houses an integrated refined rice bran oil production line with 24,000 mt in annual production capacity. Oil will largely be produced from the rice bran that we currently sell for livestock feed. We commenced trial production in October 2010 and produced a limited quantity of unrefined, or crude, rice bran oil, which is not suitable for consumption, and expect formal production of refined rice bran oil to commence immediately after we receive a Production License from the Administration of Quality Inspection of Fujian Province, which we are in the process of applying for. If our application process is successful, in addition to the issuance of the Production License, our refined rice bran oil will carry a “QS” (quality safety) label when it is introduced into the market, signifying that we are properly licensed. We currently anticipate completing the application process and obtaining the Production License by the end of May 2011, and to commence formal production of refined rice bran oil immediately thereafter. The timing and results of the application process, however, are ultimately beyond our control, and there is no assurance when we will be issued the Production License, if at all.

The second facility will also house another rice production line with projected annual rice grain processing capacity of 90,000 mt, yielding approximately 60,000 mt of milled rice. Because the building that this production line will occupy requires modifications to accommodate our equipment, we are in the process of registering the plan for the modifications with the Putian Development and Reform Commission, and allowing the Putian Environmental Protection Bureau complete an environmental impact study in connection with such modifications. We currently expect to complete these steps in May 2011, the modifications to the building in September 2011 and the installation of the production line by the end of 2011, and to commence formal production immediately thereafter.

Industry Background and Market Opportunity

China’s Rice Industry

World rice grain output has grown steadily over the past five years. According to the statistics from the U.N. Food and Agriculture Organization, or FAO, global rice grain output reached 689 million mt, equivalent to 460 million mt of milled rice, in 2009. According to FAO, Asia alone accounts for over 90% of the total global rice grain output – reaching 623 million mt. in 2009 – and is also the largest rice consumption region. Of that amount, China accounted for 195 million mt, according to the China National Grain and Oils Information Center, or CNGOIC, and the National Bureau of Statistics of China, or NBS, up from 192 million mt in 2008 and 186 million mt in 2007, making it the world’s largest rice grain producer. With over 60% of its population relying on rice as their staple food source according to FAO, China is also the world’s largest rice consumer, reaching 182 million mt, equivalent to 127 million mt of milled rice, in 2009 as reported by CNGOIC.

Based on internal research, we believe that most Chinese consumers currently buy rice in bulk, and we estimate that approximately 40 million mt of rice were sold pre-packaged (generally 25 kilograms per bag or less) in 2008, less than 30% of the total national rice consumption. Pre-packaged rice is generally less prone to mold and insect infestation, and easier to maintain freshness, according to a study by the Institute of Qiaoxing Light Industry of Fuzhou University. Coupled with the convenience of smaller packaging, we believe that Chinese consumers should generally prefer pre-packaged rice, despite its higher price point, over rice sold in bulk. If China’s urbanization and disposable income levels continue to rise as they have in recent history, we expect pre-packaged rice to eventually overtake bulk rice in consumer preference, especially in the more developed coastal regions of China, including Fujian Province where we are based and our pre-packaged rice is sold.

2

China’s Rice Bran Oil Industry

Despite China being one of the largest rice consuming nations, if not the largest, we believe production of and demand for refined rice bran oil has lagged behind in China due the complexity of and the capital requirements for its production. However, we have seen large Chinese grain and edible oil companies entering this market since 2009, which we believe is driven by growing health awareness and disposable income levels in China’s recent history. Base on internal research, we estimate that Chinese domestic refined rice bran oil production rose from 4,000 mt in 2006 to 33,000 mt in 2010, while demand grew from 190,000 mt to 238,000 mt over the same period. By 2012, we project domestic production of and demand for rice bran oil to reach 63,000 mt and 276,000 mt, respectively. With our production of refined rice bran oil to formally commence immediately after we obtain a Production License anticipated by the end of May 2011, we believe that we are well-positioned to be one of the leading rice bran oil market players.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors in China:

|

|

·

|

We are dedicated to producing the highest quality of rice through our strict quality control measures while at the same time maximizing profit margins from our production process by deriving value from our byproducts such as rice hull, rice bran and broken rice;

|

|

|

·

|

We source our short/medium-shaped rice grain predominantly from three regions in northeastern China which are renowned for the quality of their short/medium-shaped rice crops;

|

|

|

·

|

We have a well-established and extensive sales network throughout Fujian Province;

|

|

|

·

|

We understand the importance of branding and brand recognition, and price our products competitively against other brands to associate our brand with both quality and value; and

|

|

|

·

|

We have strong research and development capabilities.

|

Our Growth Strategies

|

|

·

|

We aim to consolidate our market share in Fujian and then expand into adjacent provinces by increasing brand marketing and awareness, and expanding our sales channels;

|

|

|

·

|

We aim to increase our production capacity, with the goal of achieving annual processing capacity of 0.8 to 1.0 million mt in the next five years;

|

|

|

·

|

We aim to secure long-term strategic supply contracts in order to better secure our grain supplies; and

|

|

|

·

|

We aim to maximize value from our rice processing byproducts, from producing refined rice bran oil from rice bran to generating power from rice hull for our energy needs.

|

Our Corporate History and Structure

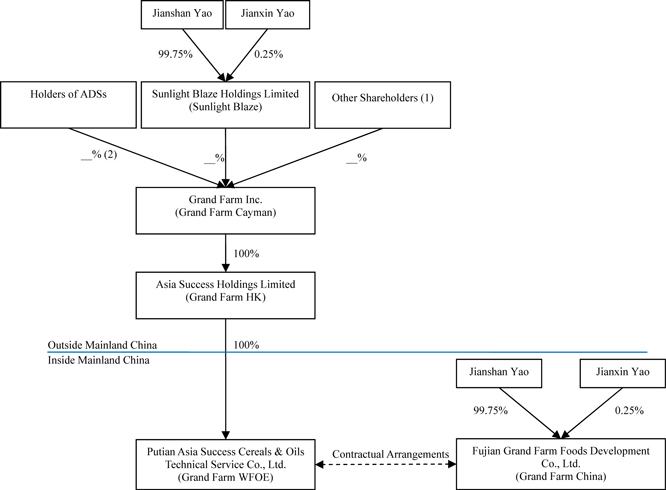

Mr. Jianshan Yao and Mr. Jianxin Yao are the shareholders of Sunlight Blaze, which is a company limited by shares established under the laws of the British Virgin Islands on April 9, 2010. Mr. Jianshan Yao holds 99.75% of Sunlight Blaze’s equity interests, and Mr. Jianxin Yao holds the rest of 0.25%. Sunlight Blaze holds 85% equities of Grand Farm Cayman, which is a limited liability company established under the laws of the Cayman Islands on June 30, 2010, and Grand Farm Cayman holds 100% equities of Grand Farm HK, a Hong Kong company. None of the other shareholders of Grand Farm Cayman holds more than 5% of the issued and outstanding shares of Grand Farm Cayman. Grand Farm WFOE is a limited liability company established under the laws of PRC on September 19, 2010 and is a wholly-owned subsidiary of Grand Farm HK.

3

We operate our business in the PRC through certain contractual arrangements between Grand Farm WFOE and Grand Farm China, a company established under the laws of the PRC in Putian, Fujian Province on May 31, 2001. For a description of the contractual arrangements, please see “Our Corporate History and Structure – Contractual Arrangements with Grand Farm China and its Equity Owners” elsewhere this prospectus. All of the issued and outstanding shares of Grand Farm China are currently held by two Chinese citizens, namely our chairman, Jianshan Yao, who owns a 99.75% equity interest in Grand Farm China, and his brother Jianxin Yao, who holds the remaining 0.25%.

The chart below illustrates our corporate structure as of the date of this prospectus.

|

|

(1)

|

Includes 3% held by Chaotang Li, our strategic development director and a member of our board of directors, through an entity that he owns and controls.

|

Please see the section entitled “Risk Factors — Risks Relating to Our Structure.”

The chart below illustrates our corporate structure immediately after the closing of this offering, assuming all ADSs offered in the offering are sold.

4

|

|

(1)

|

Includes % held by Chaotang Li, our strategic development director and a member of our board of directors, through an entity that he owns and controls.

|

|

|

(2)

|

Each ADS represents of our ordinary shares, par value $0.002 per share.

|

Corporate Information

Our registered office is located at the offices of Offshore Incorporations (Cayman) Limited, Scotia Centre, Fourth Floor, P. O. Box 2804, George Town, Grand Cayman KY1-1112, Cayman Islands, British West Indies. Our principal executive offices are located at No.2089 East Hanhua Road, Guohuan Town, Hanjiang District, Putian, Fujian Province, PRC, and the telephone number at this address is +86-594-3599889. Our website is www.grandfarminc.com. Information contained on our website does not constitute part of, and is not deemed incorporated by reference into, this prospectus. Our agent for service of process in the United States is Puglisi & Associates, whose address is 850 Library Avenue, Suite 204, Newark, Delaware 19711, and whose telephone number is (302) 738-7210.

Our Challenges

We believe that our primary challenges are:

|

|

·

|

Competition from other major rice producers in China;

|

|

|

·

|

Our continuing ability to meet our rice grain needs as larger and better-resourced competitors gain greater control to grain supplies;

|

|

|

·

|

Our access to and costs of grain supplies are impacted by natural disasters; and

|

5

|

|

·

|

There is uncertainty regarding refined rice bran oil market as we move forward on production of this product expected in the near future.

|

Please see “Risk Factors” and other information included in this prospectus for a discussion of these and other risks.

6

The Offering

The following assumes that the underwriters do not exercise their option to purchase up to additional ADSs in the offering, unless otherwise indicated.

|

Price per ADS:

|

We currently estimate that the initial public offering price will be between $ and $ per ADS.

|

|

ADSs offered by us:

|

ADSs

|

|

ADSs outstanding immediately after this Offering:

|

ADSs (or ADSs if the underwriters exercise in full the over-allotment option)

|

|

Ordinary shares outstanding immediately after this Offering:

|

ordinary shares (or ordinary shares if the underwriters exercise in full the over-allotment option)

|

|

The ADSs:

|

Each ADS represents ordinary shares. The depositary will hold the ordinary shares underlying your ADSs and you will have rights as provided in the deposit agreement.

We do not expect to pay dividends in the foreseeable future. If, however, we declare dividends on our ordinary shares, the depositary will pay you the cash dividends and other distributions it receives on our ordinary shares, after deducting its fees and expenses.

You may turn in your ADSs to the depositary in exchange for ordinary shares. The depositary will charge you fees for any exchange.

We may amend or terminate the deposit agreement without your consent. If you continue to hold your ADSs, you agree to be bound by the deposit agreement as amended.

To better understand the terms of the ADSs, you should carefully read the “Description of American Depositary Shares” section of this prospectus. You should also read the deposit agreement, which is filed as an exhibit to the registration statement that includes this prospectus.

|

|

Proposed NASDAQ Capital Market symbol:

|

GRFM

|

|

Option to purchase additional ADSs:

|

We have granted to the underwriters an option, exercisable within 45 days from the date of this prospectus, to purchase up to an additional ADS solely to cover over-allotments.

|

|

Underwriter’s Warrants:

|

For services rendered, we have agreed to issue to the underwriter (or its designated affiliates) warrants to purchase up to ADSs equal to 7% of the aggregate number of ADSs sold in this offering, including the over-allotment option, exercisable six months after the closing of the offering and expiring five years from the effective date of the registration statement of which this prospectus forms a part. If these warrants are exercised, each ADS may be purchased at $ (150% of the initial offering price per ADS sold in the offering), and the warrants may be exercised on a cashless basis.

|

7

|

Timing and settlement for ADSs:

|

The ADSs are expected to be delivered against payment on , 2011.

|

|

Use of proceeds:

|

Our net proceeds from this offering are expected to be approximately $ million assuming a public offering price of $ (the midpoint of the estimated initial public offering price range, after deducting the underwriting discounts and commissions and estimated aggregate offering expenses payable by us). We plan to use net proceeds we receive from this offering to increase our sales and marketing efforts, to expand production capacity and for other general corporate purposes. See “Use of Proceeds” on page 33.

|

|

Risk Factors:

|

Investing in these securities involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 10.

|

|

Lock-Ups:

|

Our directors and officers have agreed with the underwriters not to offer, sell or otherwise dispose of any of our securities for a period of 12 months from the closing of this offering. See “Underwriting” on page 110.

|

|

Depositary:

|

Deutsche Bank Trust Company Americas

|

8

Selected Financial and Operating Data

The following selected financial and operating data as of and for the years ended December 31, 2008, 2009 and 2010, have been derived from our audited consolidated financial statements for the years ended December 31, 2008, 2009 and 2010 that are included elsewhere in this prospectus, and should be read in conjunction with such financial statements and the accompanying notes and “Operating and Financial Review and Prospects” beginning on page 40 of this prospectus. The selected financial and operating data as of and for the year ended December 2007 have been derived from our audited combined financial statements for such year, which are not included in this prospectus. Our results of operations in any period may not necessarily be indicative of the results that may be expected for any future period. See “Risk Factors” beginning on page 10 of this prospectus. In accordance with Item 3.A.1 of Form 20-F, we are omitting our selected combined financial data for fiscal year 2006 because we do not currently have audited financial statements for such year and such information cannot be provided in accordance with US GAAP without unreasonable effort or expense.

|

For the fiscal year ended

December 31,

|

||||||||||||||||

|

2007

|

2008

|

2009

|

2010

|

|||||||||||||

|

(In thousands, except for per share data)

|

||||||||||||||||

|

Revenues

|

$ | 15,166 | $ | 36,007 | $ | 60,533 | $ | 82,189 | ||||||||

|

Income from operations

|

2,592 | 5,886 | 12,891 | 14,843 | ||||||||||||

|

Other expense

|

(582 | ) | (942 | ) | (847 | ) | (769 | ) | ||||||||

|

Net income

|

1,333 | 4,941 | 12,071 | 14,095 | ||||||||||||

|

Net income per share

|

||||||||||||||||

|

- Basic

|

0.05 | 0.20 | 0.48 | $ | 0.56 | |||||||||||

|

- Diluted

|

0.05 | 0.20 | 0.48 | 0.56 | ||||||||||||

|

December 31,

|

||||||||||||||||

|

2007

|

2008

|

2009

|

2010

|

|||||||||||||

|

(In thousands)

|

||||||||||||||||

|

Total assets

|

$ | 19,921 | $ | 30,068 | $ | 44,175 | $ | 54,085 | ||||||||

|

Total liabilities

|

11,092 | 15,594 | 17,623 | 22,153 | ||||||||||||

|

Total shareholders’ equity

|

8,829 | 14,474 | 26,552 | 31,932 | ||||||||||||

|

Total liabilities and shareholders’ equity

|

$ | 19,921 | $ | 30,068 | $ | 44,175 | $ | 54,085 | ||||||||

9

RISK FACTORS

You should carefully consider all of the information in this prospectus, including various changing regulatory, competitive, economic, political and social risks and conditions described below, before making an investment in our ADSs. One or more of a combination of these risks could materially impact our business, results of operations and financial condition. In any such case, the market price of our ADSs could decline, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of the risks below.

Risks Relating to Our Business

We are at an early stage of development and have a limited operating history, which makes it difficult to evaluate and predict our future operating results especially in the highly fragmented rice processing industry in China.

We have a limited operating history, as Grand Farm China commenced business May 2001 in Fujian, China. Accordingly, you should consider our future prospects in light of the risks experienced by companies such as ours operating in the highly fragmented rice processing industry in China. Some of these risks and uncertainties relate to our ability to:

|

|

·

|

maintain our market position and compete with other rice producers, many of which have longer operating histories and greater financial resources than we do;

|

|

|

·

|

comply with changes to regulatory requirements;

|

|

|

·

|

raise our brand recognition and customer loyalty;

|

|

|

·

|

maintain adequate control of our costs and expenses;

|

|

|

·

|

raise sufficient capital to sustain and expand our business;

|

|

|

·

|

and attract, retain, integrate and motivate qualified personnel.

|

If we are unsuccessful in addressing any of the risks and uncertainties listed above, our business, financial condition and results of operations may be materially and adversely affected.

Our operating results fluctuate from period to period, and likely will continue to fluctuate significantly, making them difficult to predict and could cause our operating results for a particular period to fall below expectations, thus resulting in a decrease in the price of our ADSs.

Our operating results from period to period are highly dependent upon, and will fluctuate, based on the following factors:

|

|

·

|

raw material supply and costs be impacted by natural disasters;

|

|

|

·

|

reliability of newly established production facilities;

|

|

|

·

|

market competitions that influence the selling prices of our products;

|

|

|

·

|

sales channel expansion to existing and newly developed market places; and

|

|

|

·

|

the success of our advertising and promotional efforts.

|

Due to these and other factors listed in this “Risk Factors” section, our operating results will vary from period to period, will be difficult to predict for any given period, may be adversely affected from period to period and may not be indicative of our future performance. In addition, our operating results may vary significantly from period to period as a result of factors beyond our control, such as the recent slowdown in China’s economic growth caused in part by the recent severe global crisis in the financial services and credit markets, and may be difficult to predict for any given period. Our past results may not be indicative of our future performance and our quarterly results may not be indicative of our full year results. If our operating results for any period fall below our expectations or the expectations of investors or any market analyst that may issue reports or analyses regarding our ADSs, the price of our ADSs is likely to decrease.

10

As we sell our prepackaged rice products primarily to third-party distributors and do not sell directly to end consumers, , this could affect our ability to efficiently and profitably distribute and market such products, maintain our existing markets and expand our business into other geographic markets.

We do not sell our prepackaged rice products directly to end customers. Instead, we primarily rely on third-party distributors for the sale and distribution of these products throughout Fujian Province, who collectively accounted for 96.28%, 82.39% and 74.09% of our revenues in 2008, 2009 and 2010, respectively. As of December 31, 2010, we had a network of 50 distributors for our prepackaged rice products. We do not enter into long-term agreements with distributors and have no control over their everyday business activities. To the extent that our distributors are distracted from selling our products or do not expend sufficient efforts in managing and selling our products, our sales will be adversely affected. Our ability to maintain our distribution network and attract additional distributors will depend on a number of factors, many of which are outside of our control. Some of these factors include: (i) the level of demand for our brand and products in a particular distribution area; (ii) our ability to price our products at levels competitive with those offered by competing products and (iii) our ability to deliver products in the quantity and at the time ordered by distributors.

There can be no assurance that we will be able to meet all or any of these factors in any of our current or prospective geographic areas of distribution. Furthermore, shortage of adequate working capital may make it impossible for us to do so. Our inability to achieve any of these factors in a geographic distribution area will have a material adverse effect on our relationships with our distributors in that particular geographic area, thus limiting our ability to maintain and expand our market, which will likely adversely affect our revenues and financial results.

We do not have business insurance coverage.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products, or offer them at a high price. As a result, we do not have any business liability, loss of data or disruption insurance coverage for our operations in China. Any business disruption, litigation or natural disaster might result in our incurring substantial costs and the diversion of our resources.

We are dependent upon our existing management and our key personnel, and our business may be severely disrupted if we lose their services.

Our future success depends substantially on the continuing services of our executive officers and our key personnel. If one or more of our executive officers and key personnel were unable or unwilling to continue in their present positions, we might not be able to replace them easily or at all. In addition, if any of our executive officers or key employees joins a competitor or forms a competing company, we may lose know-how, key professionals and staff members as well as suppliers, and our competitive position and business prospects may be materially and adversely affected.

If we fail to accurately project demand for our products, we may encounter problems of excess production capacity, which would materially and adversely affect our business, financial condition and results of operations, as well as damage our reputation and brand.

We plan to use part of the proceeds from this offering, in addition to our cash generated from our operations and bank loans, to fund our production capacity expansion. However, if there is no or little growth in demand for rice as we have expected, we may encounter difficulties in selling our increased production capacity, which would materially and adversely affect our business, financial condition and results of operations.

Many of our customers, including our distributors, contract with us for specified minimum purchase amounts for terms of one year or less, and typically place their purchase orders one week in advance of a required delivery. We take such contracts and orders into account when we formulate our overall operation plans. We project demand for our products based on rolling projections from our customers and customer inventory levels. The varying sales and purchasing cycles of our customers, however, make it difficult for us to accurately forecast future demand for our products. Our inability to accurately predict and to timely meet demand, or the failure of our customers to take up their contracted volume of our products, could materially and adversely affect our business, financial condition and results of operations.

11

Our inability to expand or to manage the expansion of our production capacity and growth could materially adversely affect our business, financial condition and results of operations, and result in a loss of business opportunities.

We plan to use a substantial portion of our net proceeds from this offering to fund our production capacity expansion. However, we may be unsuccessful in the timely or cost-efficient expansion of our production capacity. This project and others may not be constructed on the anticipated timetable or within budget. Any material delay in completing these projects, or any substantial increase in costs or quality issues in connection with these projects, could materially and adversely affect our business, financial condition and results of operations, and result in a loss of business opportunities.

Furthermore, we have limited operational, administrative and financial resources, which may be inadequate to sustain the growth we want to achieve. We have experienced a period of rapid growth and expansion that has placed, and will continue to place, strain on our management personnel, systems and resources. To accommodate our growth pursuant to our strategies, we anticipate that we will need to implement a variety of new and upgraded operational and financial systems procedures and controls, and improve our accounting and other internal management systems, all of which require substantial management efforts and financial resources. We will also need to continue to expand, train, manage and motivate our workforce, and effectively manage our relationships with our customers and suppliers. All of these endeavors will require substantial management effort and skills and the incurrence of additional expenditures. We cannot assure you that we will be able to efficiently or effectively implement our growth strategies and manage the growth of our operations, and any failure to do so may limit our future growth and hamper our business strategy.

Rising prices of our raw materials could yield lower margins for our products if we are unable to pass such rising prices on to our customers, which could reduce our profitability and have a material adverse effect on our business.

Our key raw material is rice grains. Changes in the prices for rice grain would significantly affect our cost of goods sold. In general, rising price of rice grain will produce lower profit margins for us if we are unable to pass such rising costs on to our customers. Whether we can pass such rising costs on to our customers depends on a variety of factors, including rice grain pricing and consumer market conditions. The price of rice is influenced by weather conditions and other factors affecting crop yields, farmer planting decisions and general economic, market and regulatory factors such as government policies and subsidies with respect to agriculture and international trade, and global and local demand and supply. The significance and relative effect of these factors on the price of rice is difficult to predict. Also, although our supply contracts provide us access to rice grains in the off-seasons and other times when grain supplies are less abundant (due to crop failure and other factors), we have no contracts or derivative instruments in place that effectively hedge against the fluctuations in the price of this raw material as our rice grain purchase and rice sales contracts are priced based on market conditions. Any event that tends to negatively affect the supply of this raw material could increase prices and potentially harm our business. To the extent that we cannot fully pass on the price increases in raw material to our customers, or at all, our business and profitability would be materially and adversely affected.

12

Governmental authorities within the PRC periodically set rice prices and enact general industry policies which limit production capacity and use of raw materials. Although governmental pricing guidance has not had a material impact on our business in the past, a significant increase in the market price of rice grain as a result of such governmental efforts would increase our cost of sales, and we may not be able to fully pass those increased costs on to our customers. Such increased costs and other policy initiatives could limit our growth and have a material adverse effect on our business, financial condition and results of operations.

The PRC government has the power to intervene in the price of important types of grain (including rice grain) under certain circumstances, such as when a material change occurs to the market supply and demand and/or the grain price fluctuates significantly, in order to protect the interests of farmers. In practice, the PRC government will periodically purchase a large amount of rice from farmers and set the price for the rice purchased by the government, resulting in effective guidance of the market price by the PRC government. This has a significant impact on the market price of rice for the following year, but does not constitute a legally mandated price for rice. Although such pricing guidance has not had a material impact on our business in the past, a significant increase in the market price of rice as a result of such governmental efforts would increase our cost of sales, and we may not be able to pass those increased costs on to our customers. Such increased costs could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to access rice of the quality required to meet our production standards, or if we are unable to obtain a sufficient supply of raw materials from our suppliers or at all, our business, financial condition and results of operations and financial performance may suffer.

From time to time we may be unable to access rice grain of the quality and type that meets our production standards, which could adversely affect our financial performance. Furthermore, our extended inability to obtain and process rice of the required quality would also reduce our annual production.

If we experience a shortage in the supply of rice grain in the future, irrespective of quality, our production capacities and results of operations would be materially and adversely affected. We source approximately 93% of our short/medium-shaped rice grain from northeastern China. We mainly source long-shaped rice grain from rice grain distributors in Fujian and Jiangxi. If we lose any of these significant sources of rice grains through crop failure or through the failure by our suppliers to abide by the material terms of our sourcing arrangements, we would be required to purchase rice grains at less favorable prices which could adversely affect our profit margins. We may also have difficulty finding alternative sources of rice grains on satisfactory terms in a timely manner, or at all, which could cause us not to operate at full capacity. Identifying and accessing alternative sources may increase our costs and extended lack of raw materials will reduce production capacity which would have a materially adverse effect on our financial performance.

Our dependence on a limited number of suppliers for rice grains could prevent us from timely delivering our products to our customers in the required quantities, which could result in order cancellations and decreased revenues.

We currently work with approximately 44 rice grain suppliers, including state-owned grain reserves. In 2008, our three biggest suppliers accounted for 30%, 28%, and 13% of our total purchase, respectively. In 2009, our three biggest suppliers accounted for 21%, 10% and 10% of our total purchase, respectively. In 2010, our three biggest suppliers accounted for 18%, 8% and 6% of our total purchases, respectively. If we fail to maintain our relationships with these or our other suppliers, we may be unable to produce enough rice or our rice may be available at a higher cost or after a long delay, and we could be prevented from delivering rice to our customers in the required quantities and at prices that are profitable. Problems of this kind may cause us to experience order cancellations and loss of market share. The failure of a supplier to supply rice grains that meet our quality, quantity, and cost requirements in a timely manner could impair our ability to produce rice or increase our costs, particularly if we are unable to obtain rice grains from alternative sources on a timely basis or on commercially reasonable terms.

If we experience problems with our product quality, customer satisfaction with respect to pricing of our products or the timely delivery of our products, we could lose our customers and market acceptance which will affect our sales and have an adverse effect on our business, financial condition and results of operations.

Our growth and sales primarily depend on our ability to maintain quality control and customer satisfaction with respect to pricing and the punctual availability and delivery of our products. If we fail to deliver the same quality of our products with the same punctuality and pricing which our customers have grown accustomed to, or in accordance with the terms of our sales agreements, we could damage our customer relations and market acceptance which will affect sales and our business in general. If we experience deterioration in the performance or quality of any of our products, whether due to problems internally or externally, it could result in delays in delivery, cancellations of orders or customer complaints, loss of goodwill, diversion of the attention of our senior personnel and harm to our brand and reputation. Any and all of these results would have an adverse effect on our business, financial condition and results of operations.

13

Any interruption in our production and distribution processes could impair our financial performance and negatively affect our brand.

Our production operations involve the coordination of raw materials, internal production processes and external distribution processes. We may experience difficulties in coordinating the various aspects of our production processes, thereby causing downtime and delays. We produce and store almost all of our products at our production facilities. We do not maintain back-up facilities, so we depend on these facilities for the continued operation of our business.

A delay or stoppage of production caused by adverse weather, natural disaster or other unanticipated catastrophic event, including, without limitation, power interruptions, water shortage, storms, fires, earthquakes, terrorist attacks and wars, could significantly impair our ability to produce our products and operate our business, as well as delay our research and development activities. Our facilities and certain equipment located in these facilities would be difficult to replace and could require substantial replacement lead-time. Catastrophic events may also destroy any inventory located in our facilities. The occurrence of such an event could materially and adversely affect our business. Any stoppage in production, even if temporary, or delay in delivery to our customers could severely affect our business or reputation. We currently do not have business interruption insurance to offset these potential losses and any interruption in our production operations or production and distribution processes could impair our financial performance and negatively affect our brand.

Failure to properly manage our storage system may damage our products, resulting in operating losses.

Rice storage entails significant risks associated with the storage environment, including moisture, temperature and humidity levels, deviations in which may result in damage to rice in stock. Any significant damage to the products we have in storage could materially and adversely affect our results of operations.

Transportation delays, including as a result of disruptions to infrastructure, could adversely affect our business, results of operations and financial condition.

We rely on both ground and water transportations for the delivery of raw materials and for the delivery of our products to our customers. Any disruptions in this infrastructure network, whether caused by earthquakes, storms, other natural disasters or human error or malfeasance, could materially impact our business. Therefore, any unexpected delay in transportation of our raw materials or in the delivery of our products to our customers could result in significant disruption to our operations, including the closure of our facilities. If for any reason we should lose the use of these facilities, we may not be able to find sufficient alternative methods of transport for products from our existing facilities. We also rely upon others to maintain roads from our production facilities to road and shipping networks, and any failure on their part to maintain such transportation systems could impede the delivery of our raw materials to us and our products to our customers, impose additional costs on us or otherwise cause our business, results of operations and financial condition to suffer.

Environmental compliance and remediation could result in substantially increased capital requirements and operating costs which could adversely affect our business.

We are subject to the PRC laws and regulations relating to the protection of the environment. These laws continue to evolve and are becoming increasingly stringent. The ultimate impact of complying with such laws and regulations is not always clearly known or determinable because regulations under some of these laws have not yet been promulgated or are undergoing revision. The facility where we are headquartered is in compliance with environmental acceptance inspection procedures, and has obtained a formal waste discharge permit. We have also completed the environmental inspection acceptance procedures for our second facility, and we are in the process of obtaining its formal waste discharge permit, although we have not obtained such permit as of the date of this prospectus. In the event that we fail to comply with any of the aforesaid procedures in the future, we may be subject to a fine or be required to make corrections within a prescribed period. Our business and operating results could be materially and adversely affected if we were required to increase expenditures to comply with any new environmental regulations affecting our operations. Although we have designed and implemented procedures and measures to promote occupational health and safety, we cannot completely eliminate the risks of contamination, injury to employees or others, or other harms related to our operations. In the event of future incidents, we could be liable for any damages that may result, including potentially significant monetary damages for any civil litigation or government proceedings related to a personal injury claim, as well as other fines, penalties and other consequences, including suspension or revocation of our licenses or permits or suspending production or ceasing operations at our research and manufacturing facilities, all of which could have a material adverse effect on our business, reputation, financial condition and results of operations.

14

The expansion of our sales and marketing and distribution efforts in new provinces and regions may not be as successful as in Fujian, or at all.

We plan to expand our sales and marketing and distribution efforts into provinces and regions beyond Fujian. However, our experience in the sales and marketing and distribution of our products in Fujian may not be applicable in other parts of China. We cannot assure you that we will be able to leverage such experience to expand into other provinces and regions. When we enter new markets, we may face intense competition from other rice producers with established experience or presence in the geographical areas in which we plan to enter and from other rice producers with similar target customers. In addition, expansion of sales into new markets in new provinces will require the hiring and training of a new sales force to market and sell our products in that region, the assimilation with the local business cultures of new regions which may be very different from the business culture of Fujian, and require a diversion of resources and time of our senior management personnel. If we fail to integrate effectively in new markets, our operating efficiency may be affected. Furthermore, because customers in new provinces may be far away from our production facilities, our profit margins may be lower because of increased costs in the transportation of our products. Demand for rice and government regulation may also be different in other provinces. Our failure to manage our planned expansion of sales into new provinces may have a material adverse effect on our business, financial condition and results of operations and we may not have the same degree of success in other provinces that we have had so far to date, or at all.

Our production activities are and will continue to be conducted in concentrated locations. Damage to or disruptions at our production facilities could materially and adversely affect our business, financial condition and results of operations, especially since we do not have any business interruption insurance.

Our two operating production facilities are located in Fujian Province, making our operations particularly vulnerable to natural and other disasters that may occur in that province. Operating hazards, natural disasters or other unanticipated or catastrophic events, including power interruptions, water shortages, storms, typhoons, fires, explosions, earthquakes, terrorist attacks, wars, and labor disputes in and around these provinces could cause damage to or destroy our facilities or equipment therein. Any of these or similar events could significantly impair our ability to operate our business, as well as delay our research and development activities and commercial production. Our facilities and equipment are expensive and potentially difficult and time-consuming to repair or replace. Catastrophic events may also result in damage to or the destruction of inventory located in our production facilities. In addition, we do not carry any business interruption or other insurance that would compensate us in the event of a loss of this type. The occurrence of such an event could result in substantial costs and diversion of resources, and our business, financial condition and results of operations may be materially and adversely affected.

Our business is capital intensive and our growth strategy may require additional capital which may not be available on favorable terms or at all.

We may require additional cash resources due to changed business conditions, implementation of our strategy to expand our manufacturing capacity or potential investments or acquisitions we may pursue. Furthermore, if we fail to complete this offering, or complete it at a level below our expectations, we will not have the capital necessary to support our future expansion activities, which could force us to sell debt securities or additional equity securities, or obtain additional credit facilities from banks in the PRC in order to implement our growth strategy or to otherwise meet our capital needs. The sale of additional equity securities could result in dilution of your holdings. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could limit our ability to expand our business operations and could harm our overall business prospects.

15

If our land use rights are revoked, we would have no operational capabilities.

Under Chinese law land is owned by the state or rural collective economic organizations. The state may issue to a land user a land use right certificate giving such land user certain rights akin to land ownership of the land for a fixed period of time of generally 50 years or more. Such land use rights, however, can be revoked and the land user forced to vacate at any time when redevelopment of the land is in the public interest. The public interest rationale is interpreted quite broadly and the process of land appropriation may be less than transparent. The land on which our headquarters and production facility occupies relies on such land use rights, and the loss of such rights would have a material adverse effect on our company and our operations.

The production activities from our second production facility will be disrupted if we are unable to renew the lease for the plant site, and the remedies offered by the lease agreement is limited in case of early lease termination by the lessor, all of which could adversely affect our business prospects, especially with respect to our anticipated refined rice bran oil business. In addition, our ability to install a rice production line at this facility, and to commence production therefrom, is dependent on the successful completion of an environmental impact study being conducted by the Putian Environmental Protection Bureau.

We are leasing the 11,611 m2 site of our second production facility, which houses our refined rice bran oil production line, pursuant to a lease agreement entered into between Grand Farm China and Fujian Jia Jia Food Co., Ltd., or Fujian Jia Jia, originally from July 1, 2009 to December 31, 2020, now extended to December 31, 2028. Although Grand Farm China has priority under the lease agreement to continue the lease upon expiration, such priority is subject to Fujian Jia Jia’s willingness to continue the lease and is thus not guaranteed. If Fujian Jia Jia refuses to continue the lease or will only continue the lease upon terms that are not reasonable or acceptable to us, all of our activities at this production facility, including refined rice bran oil production which we are planning to launch immediately after we obtain a Production License anticipated by the end of May 2011, will be disrupted. In addition, if Fujian Jia Jia terminates the lease agreement, as now extended, before its term expire, our remedy is limited to up to RMB 20,000,000 from Fujian Jia Jia as compensation. Such amount may not be sufficient to cover all of the losses incurred by us for the disruption to ongoing production activities and the costs to relocate our production facility.

This facility will also house another rice production line with projected annual rice grain processing capacity of 90,000 mt, yielding approximately 60,000 mt of milled rice. Because the building that this production line will occupy requires modifications to accommodate our equipment, we are in the process of registering the plan for the modifications with the Putian Development and Reform Commission, and allowing the Putian Environmental Protection Bureau to complete an environmental impact study in connection with such modifications. While we currently expect the study to be completed by May 2011, the timing of the completion is ultimately beyond our control, and there is no guarantee that the study will be completed by then or that the result of the study will be favorable to us.

We cannot commence production of refined rice bran oil until we have the required Production License.

According to the Regulation of the People's Republic of China on the Administration on Production License for Industrial Products, or the Production License Regulation, and its implementation measures, we must have a Production License before we can commence production of refined rice bran oil, which we are in the process of applying for with the Administration of Quality Inspection of Fujian Province. While we currently anticipate obtaining the Production License by the end of May 2011, the timing of the approval is ultimately beyond our control, and there is no guarantee that we will obtain the Production License by then or that our application will be approved at all. While we are not relying on the sales of refined rice bran oil as our sole source of revenue, we have already expended resources in connection with, and established a facility for, the production of refined rice bran oil. Any delay in obtaining the Production License, whether due to the pace of the application review process or otherwise, will delay our anticipated production launch, which may in turn increase our economic burdens associated with this product. If we cannot ultimately succeed in obtaining the Production License, however, we will be unable to use our production facility for its intended purpose and derive such economic benefits that we are anticipating from the production and sales of refined rice bran oil.

We face risks related to health epidemics and other outbreaks or acts of terrorism in China, which could result in reduced demand for our products or disrupt our operations.

Our business could be materially and adversely affected by an outbreak of H1N1 influenza A, avian flu, severe acute respiratory syndrome or another epidemic, or an act of terrorism. From time to time, there have been reports on the occurrences of avian flu in various parts of China, including a few confirmed human cases and deaths. Since 2009, human cases of H1N1 influenza A virus infection have been identified internationally. Any prolonged recurrence of H1N1 influenza A, avian flu, severe acute respiratory syndrome or other adverse public health developments in China or elsewhere in Asia may have a material and adverse effect on our business operations. In addition, terrorist attacks, such as those that took place on September 11, 2001, geopolitical uncertainty and international conflicts, could adversely affect our business operations. Any of these events could adversely affect China’s economy and cause an immediate and prolonged drop in consumer demand. An immediate and prolonged drop in consumer demand could severely disrupt our business operations and adversely affect our results of operations. Furthermore, a significant portion of our revenues are derived from government customers, which may reduce their spending on our products during a crisis, which could adversely affect our results of operations and could probably be difficult to recover once the threat has subsided.

16

The Chinese agricultural market is highly competitive and our growth and results of operations may be adversely affected if we are unable to compete effectively.

The agricultural market in China is highly fragmented, largely regional and highly competitive, and we expect competition to increase and intensify within the sector. We face significant competition in our rice business. Many of our competitors have greater financial, research and development and other resources than we have. Competition may also develop from consolidation within the rice industry in China. Our competitors may be better positioned to take advantage of industry consolidation and acquisition opportunities than we are. As competition intensifies, our margins may be compressed by more competitive pricing and we may lose our market share and experience a reduction in our revenues and profit.

Risks Relating to Our Structure

Grand Farm WFOE’s contractual arrangements with Grand Farm China and its shareholders may not be as effective in providing control over Grand Farm China as direct ownership of Grand Farm China, and the shareholders of Grand Farm China may have potential conflicts of interest with us.

Grand Farm Cayman has no ownership interest in Grand Farm China and conducts substantially all of its operations and generates substantially all its revenues through contractual arrangements that its indirect subsidiary, Grand Farm WFOE, has entered into with Grand Farm China and its shareholders, and such contractual arrangements are designed to provide Grand Farm Cayman with effective control over Grand Farm China. Grand Farm Cayman depends on Grand Farm China to hold and maintain certain licenses necessary for its farming business. Grand Farm China also owns all of the necessary intellectual property, facilities and other assets relating to the operation of our business, and employs personnel for our production and product distribution. See “Our Corporate History and Structure” for a description of the contractual arrangements with Grand Farm China.

The contractual arrangements, however, may not be as effective in providing Grand Farm Cayman with control over Grand Farm China as direct ownership. If Grand Farm Cayman had direct ownership of Grand Farm China, it would be able to exercise its rights as a shareholder to effect changes in the board of directors of Grand Farm China, which in turn could effect changes, subject to any applicable fiduciary obligations, at the management level. In lieu of actual ownership, Grand Farm Cayman has to rely on contractual rights to effect control and management of Grand Farm China, which exposes Grand Farm Cayman to the risk of potential breach of contract by the shareholders of Grand Farm China. In addition, as Grand Farm China is jointly owned by its shareholders, it may be difficult for Grand Farm Cayman to change Grand Farm China’s corporate structure if such shareholders refuse to cooperate with it.

The shareholders, officers and/or directors of Grand Farm China may breach, or cause Grand Farm China to breach, the contracts for a number of reasons. For example, the interests of the shareholders of Grand Farm China and the interests of Grand Farm Cayman may conflict and we may fail to resolve such conflicts; the shareholders may believe that breaching the contracts will lead to greater economic benefit for them; or the shareholders may otherwise act in bad faith. If any of the foregoing were to happen, we may have to rely on legal or arbitral proceedings to enforce our contractual rights, including specific performance or injunctive relief, and claiming damages. Such arbitral and legal proceedings may cost us substantial financial and other resources, and result in disruption of our business, and we cannot assure you that the outcome will be in our favor.

In addition, as all of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through either arbitration or litigation in the PRC, they would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. The legal environment in the PRC is not as developed as in other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could further limit our ability to enforce these contractual arrangements. Furthermore, these contracts may not be enforceable in China if PRC government authorities or courts take a view that such contracts contravene PRC laws and regulations or are otherwise not enforceable for public policy reasons. In the event we are unable to enforce these contractual arrangements, we may not be able to exert effective control over Grand Farm China, and our ability to conduct our business may be materially and adversely affected.

17

Grand Farm WFOE and Grand Farm China’s contractual arrangements may result in adverse PRC tax consequences to us.

Under the Tax Collection and Management Law and its implementation rules issued in 2001 and 2002, respectively, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities. “Related parties” are defined as organizations or entities that (1) have a direct or indirect control relationship in terms of capital, operation or sales/purchase; (2) are directly or indirectly owned by a common third party; or (3) possess any other connected relationship based on equity. We could face material and adverse tax consequences if the PRC tax authorities determine that contractual arrangements between Grand Farm WFOE and Grand Farm China were not made on an arm’s length basis and adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. A transfer pricing adjustment could result in a reduction, for PRC tax purposes, of adjustments recorded by Grand Farm China, which could adversely affect us by (i) increasing Grand Farm China’s PRC tax liability without reducing Grand Farm WFOE’s PRC tax liability, which could further result in claims being made against us for underpaid PRC taxes; or (ii) limiting the ability of Grand Farm WFOE and Grand Farm China to maintain preferential PRC tax treatments and other financial incentives.

All of Grand Farm Cayman’s revenues have been, and will continue to be, generated through Grand Farm China, our variable interest entity, or VIE, and Grand Farm Cayman relies on payments made by Grand Farm China to Grand Farm WFOE, our subsidiary, pursuant to contractual arrangements to transfer any such revenues to Grand Farm WFOE. Any restriction on such payments and any increase in the amount of PRC taxes applicable to such payments may materially and adversely affect our business and our ability to pay dividends to our shareholders.

We conduct substantially all of our operations through Grand Farm China, our VIE, which generates all of our revenues. As Grand Farm China is not directly owned by us, it is not able to make dividend payments to us. Instead, Grand Farm WFOE, our indirect subsidiary in China, entered into a number of contracts with Grand Farm China, pursuant to which Grand Farm China pays Grand Farm WFOE for certain services that Grand Farm WFOE provides to Grand Farm China. However, depending on the nature of the services provided, some of these payments are subject to PRC taxes at different rates, including business taxes and VAT, which effectively reduce the payments that Grand Farm WFOE may receive from Grand Farm China. We cannot assure you that the PRC government will not impose restrictions on such payments or change the tax rates applicable to such payments. Any such restrictions on such payments or increases in the applicable tax rates may materially and adversely affect our ability to receive payments from Grand Farm China or the amount of such payments, and may in turn materially and adversely affect our business, our net income and our ability to pay dividends to our shareholders.

The shareholders of our variable interest entity may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.