Table of Contents

UNITED STATES SECURITY AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

| x |

Filed by the Registrant |

¨ |

Filed by a Party other than the Registrant |

Check the appropriate box:

|

¨ |

Preliminary Proxy Statement | |||

|

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). | |||

|

x |

Definitive Proxy Statement | |||

|

¨ |

Definitive Additional Materials | |||

|

¨ |

Soliciting Material Pursuant to Section 240.14a-12 | |||

|

ENDO HEALTH SOLUTIONS INC. | ||||

| (Name of Registrant as Specified in Its Charter) | ||||

|

| ||||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | ||||

|

Payment of Filing Fee (check the appropriate box): | ||||

|

x |

No fee required | |||

|

¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

|

(1) |

Title of each class of securities to which transaction applies

| |||

|

| ||||

| (2) |

Aggregate number of securities to which transaction applies

| |||

|

| ||||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined)

| |||

|

| ||||

| (4) |

Proposed maximum aggregate value of transaction

| |||

|

| ||||

| (5) |

Total fee paid

| |||

|

| ||||

|

¨ |

Fee paid previously with preliminary materials. | |||

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount Previously Paid

| |||

|

| ||||

| (2) |

Form, Schedule or Registration Statement No.

| |||

|

| ||||

| (3) |

Filing Party

| |||

|

| ||||

| (4) |

Date Filed

| |||

|

| ||||

Table of Contents

| Endo 1400 Atwater Drive Malvern, PA 19355 484.216.0000 | ||||||||

|

|

endo.com | |||||||

Dear Fellow Endo Health Solutions Inc. Stockholder:

It is my pleasure to invite you to the Annual Meeting of Stockholders of Endo Health Solutions Inc. (the Company), which will be held on May 22, 2013 at 10:00 a.m., local time, at our corporate headquarters located at 1400 Atwater Drive, Malvern, Pennsylvania 19355.

At the meeting, we will be electing ten members of our Board of Directors, voting to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm and conducting an advisory vote on the compensation of our named executive officers. In addition to these formal items of business, we will report on our Company’s performance.

We look forward to seeing you at the Annual Meeting should you be able to attend.

Your vote is important. Whether you plan to attend the meeting or not, we encourage you to read this Proxy Statement and vote your shares. Please vote by promptly completing and returning your proxy by internet, by mail or by attending the Annual Meeting and voting in person by ballot. You may revoke your proxy at any time before it is exercised as explained in this Proxy Statement.

Thank you for your continued interest in Endo.

| Very truly yours, |

|

| RAJIV DE SILVA |

| President and Chief Executive Officer |

April 10, 2013

endo | AMS Endo Pharmaceuticals HealthTronics Qualitest

Table of Contents

| Endo 1400 Atwater Drive Malvern, PA 19355 484.216.0000 | ||||||||

|

|

endo.com | |||||||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 22, 2013

Notice is hereby given that the 2013 Annual Meeting of Stockholders of Endo Health Solutions Inc., a Delaware corporation, will be held on May 22, 2013 at 10:00 a.m., local time, at our corporate headquarters located at 1400 Atwater Drive, Malvern, Pennsylvania 19355.

The purposes of the meeting are:

| (1) | To elect ten directors, representing all of the members of the Board of Directors of the Company, to serve until the next Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| (2) | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2013; |

| (3) | To conduct an advisory vote on the compensation of our named executive officers; and |

| (4) | To act upon such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on April 1, 2013 are entitled to notice of and to vote at the 2013 Annual Meeting and any adjournment thereof.

This year, we have elected to furnish proxy materials to our stockholders electronically, so that we can both provide our stockholders with the information they need and also reduce our costs of printing and delivery and the environmental impact of our Annual Meeting.

It is important that your shares be represented and voted at the Annual Meeting. Please vote by promptly completing and returning your proxy by internet, by mail or by attending the Annual Meeting and voting in person by ballot, so that whether you intend to be present at the Annual Meeting or not, your shares can be voted. Returning your proxy will not limit your rights to attend or vote at the Annual Meeting.

| By order of the Board of Directors, |

|

| CAROLINE B. MANOGUE |

| Executive Vice President, Chief Legal Officer & Secretary |

Malvern, Pennsylvania

April 10, 2013

endo | AMS Endo Pharmaceuticals HealthTronics Qualitest

Table of Contents

Proxy Statement for 2013 Annual Meeting of Stockholders

endo | 1400 Atwater Drive | Malvern, Pennsylvania 19355

Table of Contents

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

1 |

Table of Contents

You are entitled to cast one vote for each share of Endo common stock you own on the record date. Provided that a quorum is present, (1) in order for a nominee to be elected as a director, such nominee must receive more votes “for” than “against,” (2) the ratification of the appointment of the Company’s registered public accounting firm and (3) the approval, on an advisory basis, of the compensation to be paid to Endo’s named executive officers will each require the affirmative vote of a majority of shares entitled to vote and represented at the Annual Meeting in person or by proxy.

The presence of the holders of a majority of the outstanding shares of common stock as of the record date entitled to vote at the Annual Meeting, present in person or represented by proxy, is necessary to constitute a quorum. Shares represented by a proxy marked “abstain” on any matter will be considered present at the Annual Meeting for purposes of determining a quorum. Abstentions will have no effect on the election of the nominees, but will have the effect of a vote “against” the ratification of the appointment of the Company’s independent registered public accounting firm and the approval, on an advisory basis, of the compensation to be paid to Endo’s named executive officers. Shares represented by a proxy as to which there is a “broker non-vote” (for example, where a broker does not have the discretionary authority to vote the shares), will be considered present for the Annual Meeting for purposes of determining a quorum, and will have no effect on the vote with respect to the election of directors or the proposal to approve, on an advisory basis, the compensation to be paid to Endo’s named executive officers. Broker non-votes, if any, will have the effect of a vote “against” the ratification of the appointment of the Company’s independent registered public accounting firm.

All shares of common stock that have been properly voted and not revoked, will be voted at the Annual Meeting in accordance with your instructions. If you execute the proxy but do not give voting instructions, the shares of common stock represented by that proxy will be voted FOR each of the nominees for election as director, FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2013 and FOR the approval, on an advisory basis, of the compensation to be paid to Endo’s named executive officers.

Voting on Other Matters

If other matters are properly presented at the Annual Meeting for consideration, the persons named in the proxy will have the discretion to vote on those matters for you. At the date the Company began printing this Proxy Statement, no other matters had been raised for consideration at the Annual Meeting.

How You May Revoke or Change Your Vote

You can revoke your proxy at any time before it is voted at the Annual Meeting by:

| • | sending written notice of revocation to the Secretary of the Company; |

| • | timely delivering a valid, later-dated proxy; or |

| • | attending the Annual Meeting and voting in person. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor from the holder of record, to be able to vote at the meeting. |

List of Stockholders

The names of stockholders of record entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the Annual Meeting for any purpose germane to the meeting, between the hours of 8:45 a.m. and 4:30 p.m., at our principal executive offices at 1400 Atwater Drive, Malvern, Pennsylvania 19355, by contacting the Secretary of the Company.

Cost of Proxy Solicitation

The Company will pay for preparing, printing and mailing this Proxy Statement and we will pay for the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission. The Company will reimburse banks, brokers and other custodians, nominees and fiduciaries for their reasonable out-of-pocket costs of sending the proxy materials to our beneficial owners. We have also retained MacKenzie Partners, Inc. to assist in soliciting proxies. We will pay MacKenzie Partners, Inc. a base fee of approximately $12,500, plus reasonable out-of-pocket expenses for these services.

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

2 |

Table of Contents

The Board of Directors

The Amended and Restated Certificate of Incorporation of the Company provides that the number of directors of the Company shall be not less than seven nor more than eleven, the exact number of which shall be fixed from time to the time by resolution of the Board of Directors or by a resolution adopted by holders of a majority of the Company’s common stock. On September 27, 2012, the Board of Directors, or Board, fixed the number of directors at ten.

Under the terms of the Company’s charter and by-laws, directors need not be stockholders of the Company or residents of the State of Delaware. However, pursuant to the Stock Ownership Guidelines approved by the Board of Directors, each non-employee Director should, but is not required to have ownership of the Company’s common stock equal in value to at least five times his or her current annual cash retainer to be achieved within five years of joining the Board, or in the case of non-employee Directors serving at the time the Ownership Guidelines were adopted, within five years of the date of the adoption, or December 10, 2015, as further described in the section titled “Common Stock Ownership Guidelines”. Directors are elected for a one-year term and generally hold office until their successors have been duly elected and qualified. Non-employee Directors receive compensation for their services as determined by the Board of Directors. See “COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS—2012 Compensation of Non-Employee Directors.” A vacancy on the Board, or a newly created directorship resulting from any increase in the authorized number of directors, may be filled by a majority of the directors then in office, even though less than a quorum remains. A director appointed to fill a vacancy remains a director until his or her successor is duly elected and qualified, or until his or her earlier death, resignation or removal.

Currently, the Board of Directors consists of ten members. Currently serving as directors are Roger H. Kimmel, Rajiv De Silva, John J. Delucca, Nancy J. Hutson, Ph.D., Michael Hyatt, William P. Montague, David B. Nash, M.D., M.B.A., Joseph C. Scodari, Jill D. Smith and William F. Spengler. On February 25, 2013, the Company announced that Rajiv De Silva had been named the Company’s President and Chief Executive Officer, and a member of the Board of Directors, effective March 18, 2013, on which date David P. Holveck retired. All of the current members are nominated by the Board of Directors of the Company for the election as directors of the Company.

The Board annually determines the independence of directors based on a review by the directors and the Nominating & Governance Committee. No director is considered independent unless the Board of Directors has determined that he or she has no material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that has a material relationship with the Company. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, among others. To evaluate the materiality of any such relationship, the Board has adopted categorical independence standards consistent with the NASDAQ Exchange listing guidelines. These standards are available on the Company’s website at www.endo.com, under “Investors-Corporate Governance-Nominating & Governance Committee.”

Members of the Audit, Compensation, and Nominating & Governance Committees must meet applicable independence tests of the NASDAQ.

The Board of Directors has affirmatively determined that nine of its ten current members are independent directors under the NASDAQ rules and regulations. The nine independent directors under the NASDAQ rules and regulations are Messrs. Kimmel, Delucca, Hyatt, Montague, Scodari and Spengler, Drs. Hutson and Nash, and Ms. Smith. If the nominees recommended by the Board of Directors are elected at the 2013 Annual Meeting, nine of the Company’s ten directors will be independent directors under the NASDAQ rules and regulations.

On an annual basis and upon the nomination of any new director, the Nominating & Governance Committee and the Board review directors’ responses to a questionnaire asking about their relationships with the Company (and those of their immediate family members) and other potential conflicts of interest, as well as material provided by management related to transactions, relationships, or arrangements between the Company and the directors or parties related to the directors. The Nominating & Governance Committee has determined that the nine non-employee directors currently serving are independent, and that the members of the Audit, Compensation, and Nominating & Governance Committees also meet the independence tests referenced above. Specifically, the Nominating & Governance Committee and the Board have determined that all non-employee directors have not had during the last three years (i) any of the relationships listed above or (ii) any other material relationship with the Company that would compromise his or her independence. The Nominating & Governance Committee recommended this determination to the Board of Directors and explained the basis for its decision, and this determination was adopted by the full Board.

As of the date of this Proxy Statement, there are no material proceedings to which any director or executive officer of the Company, or any associate thereof, is a party that are adverse to the Company or any of its subsidiaries.

Between January 1, 2012 and December 31, 2012, the Board of Directors as a whole met 17 times and acted by written consent on 10 occasions. All members of the Board of Directors who are standing for election attended 75% or more of the Board meetings held during their respective terms and 75% or more of the combined meetings of the Committees of the Board of Directors on which they served in 2012.

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

3 |

Table of Contents

Nominees

There are ten nominees for election as directors of the Company to serve until the 2014 Annual Meeting of Stockholders of the Company or until their successors are duly elected and qualified or until his/her earlier death, resignation or removal. All of the nominees are currently serving as directors of the Company. In addition, all of the nominees were elected to the Board at the last annual meeting, with the exception of Mr. De Silva and Ms. Smith. On February 25, 2013, the Company announced that Rajiv De Silva had been named the Company’s President and Chief Executive Officer, with effect from March 18, 2013, the date on which David P. Holveck retired. Mr. De Silva was also appointed to the Board effective March 18, 2013, upon Mr. Holveck’s retirement. Jill D. Smith was appointed to the Board in September 2012.

| Set forth below are summaries of the background, business experience and descriptions of the principal occupation of each of the Company’s current nominees for election as directors: |

The proposed nominees for election as directors have confirmed that they are each willing to serve as directors of the Company. If, as a result of circumstances not now known or foreseen, a nominee shall be unavailable or unwilling to serve as a director, an alternate nominee may be designated by the present Board of Directors to fill the vacancy.

The Board believes that each of the Company’s directors is highly qualified to serve as a member of the Board and each has contributed to the mix of skills, core competencies and qualifications of the Board. When evaluating candidates for election to the Board, the Nominating & Governance Committee seeks candidates with certain qualities that it believes are important, including experience, skills, expertise, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest, those criteria and qualifications described in each director’s biography below and such other relevant factors that the Nominating & Governance Committee considers appropriate in the context of the needs of the Board of Directors. Although not specified in the charter, the Committee also considers ethnicity and gender when selecting candidates so that additional diversity may be represented on the Board. Our directors are highly experienced and have diverse backgrounds and skills as well as extensive track records of success in what we believe are highly relevant positions. A number of our directors also have served as directors of Endo for many years and the Company benefits from their knowledge of our history, operations and corporate philosophy. The Board believes that each director’s service as the Chairman, Vice Chairman, President and Chief Executive Officer, Executive Vice President & Chief Financial Officer or Senior Executive of significant companies has provided the directors with skills that are important to serving on our Board. | |||||

|

ROGER H. KIMMEL, 66, is currently Chairman of the Board of Endo and is Chairman of Endo’s Nominating & Governance Committee and a member of Endo’s Audit Committee and Transactions Committee. Mr. Kimmel became Chairman of the Board upon the retirement of founder Carol A. Ammon on May 30, 2007. Mr. Kimmel had been a Director of Algos Pharmaceutical Corporation since July 1996 and became a Director of Endo following its merger with Algos in July 2000. Mr. Kimmel has been Vice Chairman of Rothschild Inc., an investment banking firm, since January 2001. Previously, Mr. Kimmel was a partner of the law firm Latham & Watkins for more than five years. Mr. Kimmel is also a director of PG&E Corporation, a public energy-based holding company. Mr. Kimmel has been Chairman of the Board of Trustees of the University of Virginia Law School Foundation (not- for-profit) since January 2009. He has been a public speaker on corporate governance issues and private equity transactions. Mr. Kimmel brings knowledge of the Company’s business, history and culture to the Board and the Chairman position. Through his experiences as Vice Chairman of an international investment banking firm and as a former corporate lawyer, Mr. Kimmel brings a unique skill set to the Board, including leadership capabilities, business strategy insight, risk management skills, mergers and acquisitions, corporate finance, international business and legal expertise. Mr. Kimmel also has extensive corporate governance experience from his services on other company boards, his investment banking advisory roles, and his previous legal experience. | |||||

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

4 |

Table of Contents

| RAJIV DE SILVA, 46, is President, Chief Executive Officer and a Director of Endo. On February 25, 2013, the Company announced that Mr. De Silva had been named the Company’s President and Chief Executive Officer, and a member of the Board of Directors, effective March 18, 2013, on which date David P. Holveck retired. Prior to joining Endo in March 2013, Mr. De Silva served as the President of Valeant Pharmaceuticals International, Inc. from October 2010 to January 2013 and served as its Chief Operating Officer, Specialty Pharmaceuticals from January 2009 until January 2013. He was responsible for all specialty pharmaceutical operations, including sales and marketing, research and development, manufacturing and business development. He has broad international experience, having managed businesses in the United States, Europe, Canada, Latin America, Asia, South Africa and Australia/New Zealand. Prior to joining Valeant, Mr. De Silva held various leadership positions with Novartis. He served as President of Novartis Vaccines USA and Head, Vaccines of the Americas at Novartis. During this time, he played a key leadership role at Novartis’ Vaccines & Diagnostics Division. Mr. De Silva also served as President of Novartis Pharmaceuticals Canada. He originally joined Novartis as Global Head of Strategic Planning for Novartis Pharma AG in Basel, Switzerland. Prior to his time at Novartis, Mr. De Silva was a Principal at McKinsey & Company and served as a member of the leadership group of its Pharmaceuticals and Medical Products Practice. Mr. De Silva has been a Director of AMAG Pharmaceuticals, Inc. since February 2012. He holds a Bachelor of Science in Engineering, Honors from Princeton University, a Master of Science from Stanford University and a Master of Business Administration with Distinction from the Wharton School at the University of Pennsylvania. |

| |||||

| JOHN J. DELUCCA, 70, has been a member of the Board of Directors since 2006 and is the Chairman of Endo’s Audit Committee and is a member of Endo’s Compensation Committee. Mr. Delucca was Executive Vice President and Chief Financial Officer of the REL Consultancy Group, a business consulting firm, until his retirement in 2004. Prior to that, he served as Chief Financial Officer and Executive Vice President, Finance & Administration, of Coty, Inc., a fragrance and beauty products company, from 1999 to 2002. From 1993 to 1999, he was Senior Vice President and Treasurer of RJR Nabisco, Inc. During his career, he also served in executive positions for Hascoe Associates, Inc., The Lexington Group, the Trump Group, International Controls Corp., and Textron, Inc. He previously served as a Non-Executive Director and a member of the Audit Committee and Governance and Nominating Committee of Tier Technologies, Inc., a publicly traded payments solutions company. Mr. Delucca had also served as a Non-Executive Director and chair of the Audit Committee and a member of the compensation Committee of Germany-based Elster Group. Through his senior executive roles and financial experience at various organizations, Mr. Delucca has expertise in financial analysis, financial statements, evaluation of business strategies, and contributes to the Board valuable leadership and risk management skills. Mr. Delucca also has extensive corporate governance experience from his services, both current and historical, on other company boards. |

| |||||

| NANCY J. HUTSON, Ph.D., 63, has been a member of the Board of Directors since 2009 and is Chairman of Endo’s Research & Development Committee and is a member of Endo’s Compensation Committee, Nominating & Governance Committee and Transactions Committee. Dr. Hutson retired from Pfizer, Inc. in 2006 after spending 25 years in various research and leadership positions, most recently serving as Senior Vice President, Pfizer Global Research and Development and Director of Pfizer’s pharmaceutical R&D site, known as Groton/New London Laboratories, the largest R&D site of any pharmaceutical company. At Pfizer, she led 4,500 colleagues (primarily scientists) and managed a budget in excess of $1 billion. She currently is a director of Cubist Pharmaceuticals, Inc. and BioCryst Pharmaceuticals, Inc., and serves on the board of Planned Parenthood of Connecticut. Dr. Hutson brings to the Board valuable pharmaceutical discovery research abilities, scientific expertise and an immense knowledge of the pharmaceutical industry. Her years of senior executive experience also bring a strong skill set to our Board regarding operational leadership and evaluation of business strategy. |

| |||||

| MICHAEL HYATT, 67, is a Director of Endo and is Chairman of Endo’s Transactions Committee and a member of Endo’s Nominating & Governance Committee. Mr. Hyatt had been a director of Algos Pharmaceutical Corporation since November 1996 and became a director of Endo following its merger with Algos in July 2000. Mr. Hyatt is currently a senior advisor to Irving Place Capital, a leading institutional private equity firm focused on making equity investments in middle-market companies. Until 2008, Mr. Hyatt was a Senior Managing Director of Bear Stearns & Co., Inc. Through Mr. Hyatt’s experiences as a senior investment professional, manager and advisor, he has gained expertise in evaluating business strategies, conducting financial analysis and analyzing companies’ future prospects. His career experience makes him a skilled advisor who provides critical insight into financial matters. |

| |||||

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

5 |

Table of Contents

|

|

WILLIAM P. MONTAGUE, 66, has been a member of the Board of Directors since 2009 and is a member of Endo’s Audit Committee, Nominating & Governance Committee and Transactions Committee. Mr. Montague served as Chief Executive Officer of Mark IV Industries, Inc., a leading global diversified manufacturer of highly engineered systems and components for transportation infrastructure, vehicles and equipment, from November 2004 until his retirement on July 31, 2008 and as Director from March 1996. He joined Mark IV Industries in April 1972 as Treasurer/Controller, serving as Vice President of Finance from May 1974 to February 1986, then Executive Vice President and Chief Financial Officer from February 1986 to March 1996 and then as President from March 1996 to November 2004. Mr. Montague is also a director of Gibraltar Industries, Inc., a publicly traded manufacturer and distributor of products for the building and industrial markets. In February 2013, Mr. Montague became a director of Allied Motion Technologies Inc., a publicly traded company focused exclusively on serving the motion control market. Mr. Montague’s senior leadership experience as Chief Executive Officer and Director of Mark IV Industries, Inc. brings to the Board operational and business strategy insights and acquisition experience. His financial experience also brings strong financial and tax expertise to our Board. | |||||

|

|

DAVID B. NASH, M.D., M.B.A., 57, was appointed to the Board in March 2011 and is a member of Endo’s Compensation Committee and Research & Development Committee. He is the founding dean of the Jefferson School of Population Health, located on the campus of Thomas Jefferson University in Philadelphia, Pennsylvania, having taken that position in 2008. Previously, Dr. Nash was the Chairman of the Department of Health Policy of the Jefferson Medical College from 2003 to 2008. Dr. Nash is internationally recognized for his work in outcomes management, medical staff development and quality-of-care improvement; his publications have appeared in more than 100 articles in major journals. Dr. Nash serves on the Board of Directors of Humana Inc., one of the nation’s largest publicly traded health and supplemental benefits companies. The Board believes that Dr. Nash brings a set of attributes that enhance the Company’s ability to help people achieve lifelong well-being. Dr. Nash is a widely recognized innovator in an emerging medical discipline that unites population health, health policy, and individual health. | |||||

|

|

JOSEPH C. SCODARI, 60, has been a member of the Board of Directors since 2008 and is Chairman of Endo’s Compensation Committee and is a member of Endo’s Research & Development Committee and Transactions Committee. Mr. Scodari was Worldwide Chairman, Pharmaceuticals Group, of Johnson & Johnson, a diversified healthcare company, and a Member of Johnson & Johnson’s Executive Committee from March 1, 2005 until March 1, 2008. He joined Johnson & Johnson in 1999 as President of Centocor, Inc., a biotechnology company, when Johnson & Johnson acquired Centocor. At the time of that acquisition, he had been the President and Chief Operating Officer of Centocor and a member of Centocor’s Board of Directors since December 1997. In 2001, he was named Johnson & Johnson’s Company Group Chairman for the North American pharmaceutical business, and became a member of the Johnson & Johnson Pharmaceuticals Group Operating Committee. In 2003, Mr. Scodari was named Johnson & Johnson Company Group Chairman, Global Biopharmaceutical Business. Mr. Scodari is a director of Covance Inc., a publicly traded drug development service company. Prior to joining Centocor, Mr. Scodari served in various senior leadership roles at Sterling Drug and later, Rhone-Poulenc Rorer. Mr. Scodari’s years of experience in the pharmaceutical industry and his senior leadership roles as Worldwide Chairman, Pharmaceuticals Group, of Johnson & Johnson and President of Centocor bring to the Board extensive knowledge of the pharmaceutical industry as well as organizational and operational management expertise. Mr. Scodari also contributes valuable business strategy insights. Mr. Scodari also has extensive corporate governance experience from his services on other company boards. | |||||

|

|

JILL D. SMITH, 55, was appointed to the Board in September 2012 and is a member of Endo’s Audit Committee and Nominating & Governance Committee. Ms. Smith has been international business leader for more than 25 years, including 16 years as a CEO of private and public companies in the technology and information services markets and was most recently chairman, CEO and president of DigitalGlobe Inc., a leading provider of satellite imagery products and services to governments and companies worldwide. Ms. Smith currently serves on the board of SoundBite Communications, Inc. a leading provider of cloud based customer communications and has served on the corporate boards of Germany-based Elster Group and DigitalGlobe (prior to her appointment as Chairman and CEO). In addition, Ms. Smith is a member of the board of Crittenton Women’s Union, among other past professional and trade association board positions. Ms. Smith’s experience as a CEO and her leadership capabilities benefit the Board. Ms. Smith also contributes a global perspective and information technology and strategic insights. | |||||

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

6 |

Table of Contents

| WILLIAM F. SPENGLER, 58, has been a member of the Board of Directors since 2008 and is a member of Endo’s Audit Committee, Compensation Committee and Research & Development Committee. From November 2010 until February 2012, Mr. Spengler was President of ChromaDex Corporation, a publicly traded company that is a leader in the development of phytochemical and botanical reference standards and that discovers, develops and markets novel, natural ingredients. From July 2008 until November 2010, Mr. Spengler served as Executive Vice President and Chief Financial Officer of Smith & Wesson Holding Corporation, a global leader in safety, security, protection and sport. Until March 2008, he was Executive Vice President and Chief Financial Officer at MGI Pharmaceuticals Inc., an oncology- and acute care- focused biopharmaceutical company, where he had worked since 2005. Prior to joining MGI Pharma, Mr. Spengler was Executive Vice President and Chief Financial Officer at Guilford Pharmaceuticals Inc., a bioscience company, from July 2004 to October 2005. From 2002 to 2004, Mr. Spengler served as President, Chief Operating Officer and Director of Osteoimplant Technology, Inc., an orthopedic products company. Mr. Spengler was previously a Vice President of Finance at Black & Decker, and prior to that spent 14 years in various finance, planning and business development positions at Bristol Myers Squibb. Through his senior executive roles and financial experience at various organizations, Mr. Spengler contributes expertise in financial analysis, financial statements, evaluation of business strategies, and brings to the Board valuable leadership and risk management skills. |

| |||||

| Vote Required

Provided that a quorum is present, the nominees for director receiving a majority of the votes cast at the Annual Meeting in person or by proxy will be elected. |

The Board of Directors recommends a vote FOR the election of these nominees for election as directors. |

Stockholder Communications with Directors

The Board has established a process to receive communications from stockholders. Stockholders may contact any member or all members of the Board, any Board committee, or any chair of any such committee by mail. To communicate with the Board of Directors, any individual director or any group or committee of directors, correspondence should be addressed to the Board of Directors or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary” to Endo, 1400 Atwater Drive, Malvern, Pennsylvania 19355.

All communications received as set forth in the preceding paragraph will be opened by the office of our Secretary for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Secretary’s office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

The Company does not have a policy on director attendance at annual meetings. Messrs. Holveck, Kimmel, Hyatt, and Montague attended the 2012 Annual Meeting.

Corporate Governance — Board Leadership Structure and Risk Oversight

Board Leadership Structure

We have a board leadership structure under which Mr. Kimmel serves as Chairman of the Board. Following the annual meeting, we will have ten directors, each of whom is independent with the exception of our President and Chief Executive Officer, Mr. De Silva. Our Board currently has five standing committees, each of which is comprised solely of independent directors with a committee chair. In addition, the Board appoints other committees as the Board considers necessary from time to time.

The Board believes that the Chairman and the role of the President and Chief Executive Officer should be separate and that the Chairman should not be an employee of the Company. Further, the Board believes this separation serves the Company’s stockholders best for setting our strategic priorities and executing our business strategy. We believe that our Board consists of directors with significant leadership, organizational and strategic skills, as discussed above. All of our independent directors have served as the Chairman, Vice Chairman, Chief Executive Officer, Chief Financial Officer, or Senior Executive of other companies. Accordingly, we believe that our independent directors have demonstrated leadership in large enterprises, many with relevant industry experience, and are well-versed in board processes and corporate governance. We believe that having directors with such significant leadership skills benefits our Company and our stockholders.

In accordance with our by-laws and our corporate governance guidelines, the Chairman is responsible for chairing Board meetings and setting the agenda for these meetings. Each director also may suggest items for inclusion on the agenda and may, at any Board meeting, raise subjects that are not on the agenda for that meeting. As required by our corporate governance guidelines, our independent directors meet separately, without management present, at each meeting of the Board. In addition, our Board committees regularly meet without members of management present.

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

7 |

Table of Contents

As part of its annual self-evaluation process, the Board evaluates the Company’s governance structure. We believe that having a President and Chief Executive Officer for our Company with oversight of company operations, coupled with an experienced independent board Chairman and experienced independent directors, who have appointed five committee chairs, is the appropriate leadership structure for Endo.

On a regular basis, the Company’s officers who are responsible for monitoring and managing the Company’s risks, including our President and Chief Executive Officer, our Chief Operating Officer, our Executive Vice President & Chief Financial Officer, our Executive Vice President, Chief Legal Officer & Secretary, our Executive Vice President and Chief Compliance Officer, our Vice President, Controller and Principal Accounting Officer and our Senior Director of Internal Audit, make reports to the Audit Committee. The Audit Committee, in turn, reports to the full Board. While the Audit Committee has primary responsibility for overseeing risk management, our entire Board is actively involved in overseeing risk management for the Company by engaging in periodic discussions with Company officers as the Board may deem appropriate. In addition, each of our Board committees considers the risks within its respective areas of responsibility.

Risk Oversight

The Board of Directors believes that one of its most important responsibilities is to oversee how management manages the various risks the Company faces and has delegated primary responsibility for overseeing the Company’s Enterprise Risk Management (or ERM) program to the Audit Committee. It is management’s responsibility to manage risk and bring to the Audit Committee’s and the Board of Directors’ attention the most material risks to the Company. The Company’s head of internal audit, who reports independently to the Audit Committee, facilitates the ERM program under the sponsorship of our Executive Leadership Committee (or ELC), which includes our President and Chief Executive Officer; Chief Operating Officer; Executive Vice President & Chief Financial Officer; Executive Vice President, Chief Legal Officer & Secretary; Executive Vice President, Research & Development & Chief Scientific Officer; Executive Vice President, Human Resources; Executive Vice President, Enterprise Quality and Supply Chain; Executive Vice President and Chief Compliance Officer; President, American Medical Systems (AMS); and President, HealthTronics. Enterprise risks are identified and prioritized by management, and each risk is assigned by the Board to a Board committee or the full Board for oversight based on the nature of the risk area and the committee’s charter. The committee or full Board agendas include discussions of individual risk areas throughout the year. Additionally, the Audit Committee agendas include periodic updates on the ERM process throughout the year. The Board level risk discussions are led by an assigned executive sponsor, from the ELC, for each risk area.

The Audit Committee also regularly reviews treasury risks (insurance, credit and debt), financial and accounting, legal and compliance risks, information technology security risks and other risk management functions. In addition, the Compensation Committee considers risks related to succession planning and the attraction and retention of talent as well as risks relating to the design of compensation programs and arrangements. The Compensation Committee also reviews compensation and benefits plans affecting Endo employees in addition to those applicable to our executive officers. The full Board considers strategic risks and opportunities and regularly receives detailed reports from the committees regarding risk oversight in their respective areas of responsibility.

Code of Conduct

The Board of Directors has adopted a Code of Conduct that applies to the Company’s directors, executives (including its President and Chief Executive Officer and Executive Vice President & Chief Financial Officer) and employees. The Board has also adopted a Director Code of Conduct. These Codes are posted on the Company’s website at www.endo.com, under “About Us-Corporate Compliance & Business Practices” and “Investors-Corporate Governance-Code of Conduct.”

Insider Trading Policy

Effective July 2001, the Board of Directors adopted an Insider Trading Policy, which was subsequently amended in November 2011. This policy applies to all personnel, including non-employee Directors and officers, arising from our legal and ethical responsibilities as a public company. On April 4, 2013, the Board of Directors approved an amendment to the Insider Trading policy adopting additional hedging restrictions prohibiting non-employee Directors, the Company’s executive officers and all other employees from purchasing any financial instrument that is designed to hedge or offset any decrease in the market value of the Company’s Common Stock, including, but not limited to, covered calls, collars, or other derivative transactions. Non-employee Directors, the Company’s executive officers and all other employees are also restricted from engaging in short sales related to the Company’s Common Stock, and pledging the Company’s Common Stock as collateral for a loan, including holding Common Stock in a margin account.

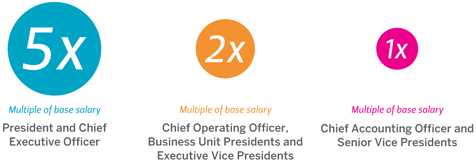

Common Stock Ownership Guidelines

The Board of Directors has adopted stock ownership guidelines (the Ownership Guidelines) both for non-employee Directors and for executive officers and senior management of the Company. The Board of Directors approved the Ownership Guidelines on February 21, 2008, and amended these Ownership Guidelines on April 28, 2010 to increase the required ownership of the President and Chief Executive Officer. The Board of Directors amended the Ownership Guidelines on December 10, 2010 to further increase the required ownership levels for non-employee Directors and for executive management. On February 27, 2013, the Ownership Guidelines were amended by the Board of Directors to reflect the Company’s Code of Conduct. The Board believes that non-employee directors and executive management should have a

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

8 |

Table of Contents

significant equity position in the Company and that the Ownership Guidelines serve to further the Board’s interest in encouraging a longer-term focus in managing the Company. The Board also believes that the Ownership Guidelines align the interests of its directors and executive management with the interests of stockholders and further promote Endo’s commitment to sound corporate governance. The Ownership Guidelines are posted on the Company’s website at www.endo.com, under “Investors-Corporate Governance-Compensation Committee.”

Ownership Guidelines for Non-Employee Directors

As mentioned above, on December 10, 2010, the Board of Directors approved revised Ownership Guidelines, increasing ownership equal in value to at least five times his or her current annual cash retainer to be achieved within five years of joining the Board, or in the case of non-employee Directors serving at the time the Ownership Guidelines were adopted, within five years of the date of the adoption of these revised Ownership Guidelines, or December 10, 2015. Non-employee Directors will not sell any shares of Endo common stock until Ownership Guidelines have been attained, and will continuously own sufficient shares to meet the Ownership Guidelines once attained.

Review and Approval of Transactions with Related Persons

The Board of Directors has adopted written policies and procedures for review, approval and monitoring of transactions involving the Company and “related persons” (directors and executive officers or their immediate family members, or stockholders owning five percent or greater of the Company’s outstanding stock). The policy covers any related person transaction that meets the minimum threshold for disclosure in the Proxy Statement under the relevant rules of the U.S. Securities and Exchange Commission (the SEC) (generally, transactions involving amounts exceeding $120,000 in which a related person has a direct or indirect material interest).

Committees of the Board of Directors

The Board of Directors has a standing Audit Committee, Compensation Committee, Nominating & Governance Committee, Research & Development Committee and Transactions Committee. The following table shows the directors who are currently members or Chairman of each of these committees.

| Name | Audit Committee | Compensation Committee |

Nominating & Governance Committee |

Research & Development Committee |

Transactions Committee | |||||

| Roger H. Kimmel |

Member | - | Chairman | - | Member | |||||

| Rajiv De Silva |

- | - | - | - | - | |||||

| John J. Delucca |

Chairman | Member | - | - | - | |||||

| Nancy J. Hutson, Ph.D. |

- | Member | Member | Chairman | Member | |||||

| Michael Hyatt |

- | - | Member | - | Chairman | |||||

| William P. Montague |

Member | - | Member | - | Member | |||||

| David B. Nash, M.D., M.B.A. |

- | Member | - | Member | - | |||||

| Joseph C. Scodari |

- | Chairman | - | Member | Member | |||||

| Jill D. Smith |

Member | - | Member | - | - | |||||

| William F. Spengler |

Member | Member | - | Member | - |

Audit Committee

The Audit Committee is responsible for overseeing the Company’s financial reporting process on behalf of the Board of Directors. In addition, the Audit Committee reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of the Company’s independent registered public accounting firm, the scope of the annual audits, fees to be paid to the independent registered public accounting firm, the performance of the Company’s independent registered public accounting firm and the accounting practices of the Company and the Company’s internal controls and legal compliance functions. The Audit Committee operates pursuant to a written charter adopted by the Board of Directors, which is available on the Company’s website at www.endo.com, under “Investors-Corporate Governance-Audit Committee.” The charter describes the nature and scope of responsibilities of the Audit Committee.

Management of the Company has the primary responsibility for the Company’s financial reporting process, principles and internal controls as well as preparation of its financial statements. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements and expressing an opinion as to the conformity of such financial statements with accounting principles generally accepted in the United States.

Messrs. Kimmel, Delucca, Montague and Spengler and Ms. Smith currently serve as members of the Audit Committee and subject to their election at the 2013 Annual Meeting, the Board of Directors currently expects to reappoint Messrs. Kimmel, Delucca, Montague and Spengler and Ms. Smith as members of the Audit Committee, effective May 22, 2013. Between January 1, 2012 and December 31, 2012, the Audit Committee met 21 times, including periodic meetings held separately with management, the Company’s internal auditors and the independent registered public accounting firm. Subject to his election at the 2013 Annual Meeting, the Board currently expects to reappoint Mr. Delucca as Chair of the Audit Committee. The Board has determined that Mr. Delucca is a “financial expert”, as defined by the SEC regulations, and he has the related financial management

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

9 |

Table of Contents

expertise within the meaning of the NASDAQ rules. The Board of Directors has determined that Messrs. Kimmel, Delucca, Montague and Spengler and Ms. Smith are “independent” and financially literate in accordance with the criteria established by the SEC and the NASDAQ.

Compensation Committee

The Compensation Committee of the Board of Directors determines the salaries and incentive compensation of the executive officers of the Company and provides broad guidance regarding the salaries and incentive compensation of the other employees of the Company. The Compensation Committee also reviews and acts on any recommendations of the Company’s management for awards granted under the Endo Health Solutions Inc. 2010 Stock Incentive Plan and Endo Health Solutions Inc. Assumed Stock Incentive Plan (formerly named the American Medical Systems Holdings, Inc. 2005 Stock Incentive Plan). The current members of the Compensation Committee are Messrs. Delucca, Scodari and Spengler and Drs. Hutson and Nash. Subject to their election at the 2013 Annual Meeting, the Board of Directors currently expects to reappoint Messrs. Delucca, Scodari and Spengler and Drs. Hutson and Nash as members of the Compensation Committee and to re-appoint Mr. Scodari as Chair of the Compensation Committee, effective May 22, 2013. Each of Messrs. Delucca, Scodari and Spengler and Drs. Hutson and Nash is “independent” in accordance with the criteria established by the SEC and the NASDAQ. Between January 1, 2012 and December 31, 2012, the Compensation Committee met eight times. The Compensation Committee operates pursuant to a written charter adopted by the Board of Directors, which is available on the Company’s website at www.endo.com, under “Investors- Corporate Governance-Compensation Committee.” The charter describes the nature and scope of responsibilities of the Compensation Committee.

The primary purpose of the Compensation Committee is to conduct reviews of the Company’s general executive compensation policies and strategies and oversee and evaluate the Company’s overall compensation structure and programs. The Compensation Committee confirms that total compensation paid to the President and Chief Executive Officer, Executive Vice President & Chief Financial Officer and those other individuals included in the Summary Compensation Table is reasonable and competitive. All of these individuals are referred to as the named executive officers, or NEOs. Responsibilities of the Compensation Committee include, but are not limited to:

| • | evaluating and approving goals and objectives relevant to compensation of the President and Chief Executive Officer and other NEOs, and evaluating the performance of the executives in light of those goals and objectives; |

| • | determining and recommending for approval by the Board of Directors the compensation level of the President and Chief Executive Officer; |

| • | evaluating and approving compensation levels of the NEOs (and certain other employees); |

| • | evaluating and approving all grants of equity-based compensation to the NEOs (and certain other employees); |

| • | recommending to the Board compensation policies for outside directors; |

| • | providing general compensation oversight on significant issues affecting the Company’s compensation philosophy and/or policies; |

| • | providing input to management on whether compensation arrangements for the NEOs (and certain other employees) incentivize excessive risk taking; |

| • | reviewing performance-based and equity-based incentive plans for the President and Chief Executive Officer, other NEOs, and reviewing other benefit programs presented to the Compensation Committee by management; |

| • | reviewing and approving the aggregate amount of dollars, in the case of the annual cash incentive compensation, and performance share units (PSU), restricted stock units (RSU), and stock options, in the case of the annual long-term incentive (LTI) compensation, that is available to the Company each year; |

| • | reviewing at least annually the Company’s succession plan relating to NEO positions and make recommendations to the Board related to the selection of individuals to hold the position of President and Chief Executive Officer; and |

| • | reviewing and recommending to the Board for approval the annual goals and objectives of the Company as a whole, which in turn serve as the foundation for incentive compensation. |

Endo management is required to provide reviews and recommendations for the Compensation Committee’s consideration, and to manage the Company’s executive compensation programs, policies and governance. Direct responsibilities in this regard include, but are not limited to:

| • | providing an ongoing review of the effectiveness of the compensation programs for all employees, including competitiveness, and alignment with the Company’s objectives; |

| • | recommending changes, if necessary, to achieve all program objectives; and |

| • | recommending pay levels, payout and/or awards for NEOs and certain other employees other than the President and Chief Executive Officer. |

The Compensation Committee can exercise its discretion in modifying any recommended adjustments or awards to the NEOs.

Use of Compensation Consultants

The Compensation Committee retains Hay Group as its consultant to provide objective, independent analysis, advice and recommendations with regard to executive compensation including, but not limited to, competitive market data and compensation analysis and recommendations related to our CEO and our other senior executives. Hay Group served as the independent executive compensation consultant to the Compensation Committee for the Company’s entire 2012 fiscal year. The consultant

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

10 |

Table of Contents

reports to the Chairman of the Compensation Committee and has direct access to the other members of the Compensation Committee. The Compensation Committee also authorizes the consultant to share with, request and receive from management certain specified information in order to prepare for meetings with, and respond to requests from, the Compensation Committee. The consultant only interacts with management at the direction of the Compensation Committee and does not perform any other services for the Company. The Compensation Committee may retain other consultants and advisors from time to time.

A representative of Hay Group generally attends meetings of the Compensation Committee, is available to participate in executive sessions and communicates directly with the Compensation Committee.

In making an overall determination of the independence and lack of any conflict of interest regarding Hay Group and Hay Group’s lead advisor to the Compensation Committee, the Compensation Committee considered, among other things, the following factors:

| • | the amount of Hay Group’s fees for executive compensation consulting services, noting in particular that such fees are nominal when considered in the context of Hay Group’s total revenues for the period, |

| • | Hay Group’s policies and procedures concerning conflicts of interest (copies of which were made available to the Compensation Committee), |

| • | there are no other business or personal relationships between any members of the Compensation Committee and Hay Group’s lead advisor to the Compensation Committee, |

| • | the lead Hay Group advisor who provides executive compensation consulting services to the Company does not directly own any stock of the Company, and has agreed not purchase any such stock so long as Hay Group and the lead advisor is engaged to provide executive compensation advisory services to the Compensation Committee (any Company stock held or managed through a third-party), |

| • | there are no other business or personal relationships between the Company’s executives and the lead Hay Group advisor, and |

| • | any other factors relevant to the independence of Hay Group. |

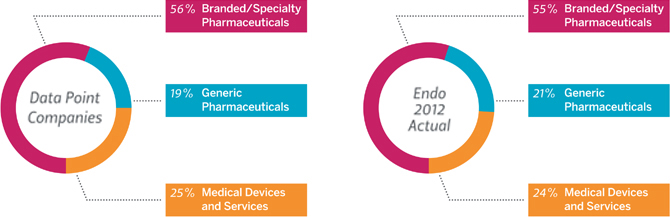

In 2012, Hay Group assisted the Compensation Committee with, among other things, (i) performing a review of the Company’s executive compensation program, (ii) determining the appropriate allocation among short-term and long-term compensation, cash and non-cash compensation, and the different forms of non-cash compensation (iii) identifying appropriate Data Point Companies (as defined below in the CD&A section) for purposes of benchmarking the Company’s executive compensation and (iv) providing an overview of critical issues and trends affecting the executive compensation landscape.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee during 2012 or as of the date of this Proxy Statement is or has been an officer or employee of the Company and no executive officer of the Company served on the compensation committee or board of any company that employed any member of the Company’s Compensation Committee or Board of Directors.

Nominating & Governance Committee

On December 13, 2006, the Board of Directors chartered the Nominating & Governance Committee, which is comprised of independent directors.

The Nominating & Governance Committee of the Board of Directors identifies and recommends to the Board individuals qualified to serve as directors of the Company, recommends to the Board directors to serve on committees of the Board and advises the Board with respect to matters of Board composition and procedures. The Nominating & Governance Committee also oversees the Company’s corporate governance.

The Nominating & Governance Committee will consider director candidates recommended by stockholders. In considering candidates submitted by stockholders, the Nominating & Governance Committee will take into consideration the needs of the Board and the qualifications of the candidate. The Nominating & Governance Committee may also take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. To have a candidate considered by the Nominating & Governance Committee, a stockholder must submit the recommendation in writing and must include the following information:

| • | The name of the stockholder and evidence of the person’s ownership of Company stock, including the number of shares owned and the length of time of ownership; and |

| • | The name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company and the person’s consent to be named as a director if selected by the Nominating & Governance Committee and nominated by the Board. |

The stockholder recommendation and information described above must be sent to the Secretary at Endo, 1400 Atwater Drive, Malvern, Pennsylvania 19355, and must be received by the Secretary not less than 120 days prior to the anniversary date of the Company’s most recent annual meeting of stockholders.

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

11 |

Table of Contents

While the Board does not have a formal policy with respect to diversity, the Board of Directors and the Nominating & Governance Committee advocate diversity in the broadest sense. We believe that it is important that nominees for the Board represent diverse viewpoints and have diverse backgrounds. The Nominating & Governance Committee looks at a broad array of qualifications and attributes including: experience, skills, expertise, and personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest and such other relevant factors that the Nominating & Governance Committee considers appropriate in the context of the needs of the Board of Directors. Although not specified in the charter, the Committee actively considers ethnicity and gender when selecting candidates so that additional diversity may be represented on the Board.

The Nominating & Governance Committee identifies potential nominees by asking current directors and executive officers to notify the Nominating & Governance Committee if they become aware of persons meeting the criteria described above. The Nominating & Governance Committee also, from time to time, may engage firms that specialize in identifying director candidates. As described above, the Nominating & Governance Committee will also consider candidates recommended by stockholders.

Once a person has been identified by the Nominating & Governance Committee as a potential candidate, the Nominating Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Nominating & Governance Committee determines that the candidate warrants further consideration, the Chairman or a member of the Nominating & Governance Committee utilizes a recognized search firm to review the candidate’s qualifications and background. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Nominating & Governance Committee requests information from the candidate, reviews the person’s accomplishments and qualifications, including in light of any other candidates that the Nominating & Governance Committee might be considering, and conducts one or more interviews with the candidate. Generally, Nominating & Governance Committee members may conduct additional due diligence of the candidate. The Nominating & Governance Committee’s evaluation process does not vary based on whether or not a candidate is recommended by a stockholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

The Nominating & Governance Committee has established procedures under which any director who is not elected shall, if requested by the Board upon the Nominating & Governance Committee’s recommendation, tender his or her resignation to the Board of Directors. The Board of Directors will publicly disclose its decisions of whether or not to request any director to tender his or her resignation and whether or not to accept any such tendered resignation and the rationale behind such decisions within 90 days from the date of the certification of the election results.

The current members of the Nominating & Governance Committee are Messrs. Kimmel, Hyatt and Montague, Dr. Hutson and Ms. Smith. The Board has elected Mr. Kimmel as Chairman of the Nominating & Governance Committee. Between January 1, 2012 and December 31, 2012, the Nominating & Governance Committee met four times. Subject to their election at the 2013 Annual Meeting, the Board of Directors currently expects to reappoint Messrs. Kimmel, Hyatt and Montague, Dr. Hutson and Ms. Smith as members of the Nominating & Governance Committee and to re-appoint Mr. Kimmel as Chair of the Nominating & Governance Committee, effective May 22, 2013. The Board of Directors has determined that all of the members of the Nominating & Governance Committee are “independent” in accordance with the criteria established by the SEC and the NASDAQ. The Nominating & Governance Committee operates pursuant to a written charter adopted by the Board of Directors, which is available on the Company’s website at www.endo.com, under “Investors-Corporate Governance-Nominating & Governance Committee.”

Research & Development Committee

On February 27, 2013, the Board of Directors formed a Research & Development Committee to review matters relating to scientific technology, research and development activities and pipeline investments, and to provide advice and counsel to the Company’s management and Transaction Committee in connection with management’s decisions regarding the allocation, deployment, utilization of, and investment in the Company’s scientific assets, as well as decisions regarding acquiring or divesting scientific technology or otherwise investing in research or development programs. The current members of the Research & Development Committee are Drs. Hutson and Nash and Messrs. Scodari and Spengler. Subject to their election at the 2013 Annual Meeting, the Board of Directors currently expects to reappoint Drs. Hutson and Nash and Messrs. Scodari and Spengler as members of the Research & Development Committee, and to reappoint Dr. Hutson as the Chair of the Research & Development Committee, effective May 22, 2013.

Transactions Committee

On July 31, 2007, the Board of Directors formed a Transactions Committee to provide advice and guidance to the Company’s management in connection with the exploration of strategic acquisition and licensing opportunities as well as any overture for merger with the Company, or sale of the Company or other like event. The current members of the Transactions Committee are Messrs. Kimmel, Hyatt, Montague and Scodari and Dr. Hutson. Subject to their election at the 2013 Annual Meeting, the Board of Directors currently expects to reappoint Messrs. Kimmel, Hyatt, Montague and Scodari and Dr. Hutson as members of the Transactions Committee, and to reappoint Mr. Hyatt as the Chair of the Transactions Committee, effective May 22, 2013. Between January 1, 2012 and December 31, 2012, the Transactions Committee met one time.

Audit Committee Report

The Audit Committee has reviewed and discussed the Company’s audited consolidated financial statements as of and for the year ended December 31, 2012 with the management of the Company and Deloitte & Touche LLP, the Company’s independent registered public accounting firm. Further, the Audit Committee has discussed with Deloitte & Touche LLP the matters required to be discussed under auditing standards generally accepted in the United States, including those matters set forth in the Statement of Auditing Standards No. 61, Communications with Audit Committees, as amended and as adopted by the Public Company Accounting oversight Board in Rule 3200T, other standards of the Public Company Accounting Oversight Board (United States), rules of the SEC, and other applicable regulations, relating to the firm’s judgment about the quality, not just

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

12 |

Table of Contents

the acceptability, of the Company’s accounting principles, the reasonableness of significant judgments and estimates, and the clarity of disclosures in the consolidated financial statements.

The Audit Committee also has received the written disclosures and the letter from Deloitte & Touche LLP required by PCAOB Ethics and Independence Rule 3526, Communication with Audit Committees Concerning Independence, which relate to Deloitte & Touche LLP’s independence from the Company, and has discussed with Deloitte & Touche LLP their independence from the Company. The Audit Committee has also considered whether the independent registered public accounting firm’s provision of non-audit services to the Company is compatible with maintaining the firm’s independence. The Audit Committee has concluded that the independent registered public accounting firm is independent from the Company and its management. The Audit Committee has also discussed with management of the Company and Deloitte & Touche LLP such other matters and received such assurances from them as it has deemed appropriate.

The Committee also reviewed management’s report on its assessment of the effectiveness of the Company’s internal control over financial reporting and the independent registered public accounting firm’s report on the effectiveness of the Company’s internal control over financial reporting. In addition, the Audit Committee reviewed key initiatives and programs aimed at strengthening the effectiveness of the Company’s internal and disclosure control structure. As part of this process, the Audit Committee continued to monitor the scope and adequacy of the Company’s internal auditing program.

Based on the reviews, reports and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board approved, that the Company’s audited consolidated financial statements for the year ended December 31, 2012 and management’s assessment of the effectiveness of the Company’s internal control over financial reporting be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012, for filing with the SEC. The Audit Committee has selected, and the Board of Directors has approved, subject to stockholder ratification, the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2013.

Submitted by the Audit Committee of the Company’s Board of Directors.

| Members of the Audit Committee: |

||

| John J. Delucca (Chairman) Roger H. Kimmel William P. Montague Jill D. Smith William F. Spengler |

||

The above Audit Committee Report does not constitute soliciting material, and shall not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates the Audit Committee Report by reference therein.

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

13 |

Table of Contents

The Audit Committee of the Board of Directors has selected Deloitte & Touche LLP, an independent registered accounting firm, to audit the books and financial records of the Company for the year ending December 31, 2013. The Company is asking its stockholders to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2013.

A representative of Deloitte & Touche LLP is expected to be present at the Annual Meeting and available to respond to appropriate questions, and will have the opportunity to make a statement if he or she desires to do so.

| a | Fees for audit services in 2012 and 2011 consisted of: |

| • | Audit of the Company’s annual financial statements; |

| • | Evaluation and reporting on the effectiveness of the Company’s internal controls over financial reporting; |

| • | Reviews of the Company’s quarterly financial statements; and |

| • | Comfort letters, consents and other services related to debt issuances and other SEC matters. |

| Fees for audit services decreased versus prior year due to the nonrecurring purchase accounting and debt issuance work in 2011. |

| b | Fees for audit-related services in 2012 and 2011 consisted of: |

| • | Audit-related fees associated with acquisitions in 2011; and |

| • | Employee benefit plan audits. |

| c | Fees for tax services in 2012 and 2011 consisted of tax compliance and tax planning and advice. |

| • | Tax compliance services are services rendered based upon facts already in existence or transactions that have already occurred to document, compute, and assist the Company in obtaining government approval for amounts to be included in tax filings and consisted of: |

| ¡ | Federal, state and local income tax return assistance; and |

| ¡ | Assistance with tax return filings in certain foreign jurisdictions. |

In considering the nature of the services provided by the Deloitte Entities, the Audit Committee determined that such services are compatible with the provision of independent audit services. The Audit Committee discussed these services with the Deloitte Entities and Company management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

14 |

Table of Contents

Pre-Approval Policy

Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing the work of the independent registered public accounting firm. In recognition of this responsibility, the Audit Committee has established a policy to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm.

Prior to the engagement of the independent registered public accounting firm for the next year’s audit, management will submit a list of services and related fees expected to be rendered during that year within each of the four categories of services to the Audit Committee for approval.

| 1 | Audit services include audit work performed on the financial statements and related to the evaluation and reporting on the effectiveness of the Company’s internal control over financial reporting, as well as work that generally only the independent registered public accounting firm can reasonably be expected to provide, including comfort letters, consents and other services related to SEC matters, and discussion surrounding the proper application of financial accounting and/or reporting standards. |

| 2 | Audit-related services are for assurance and related services that are traditionally performed by the independent registered public accounting firm, including due diligence related to mergers and acquisitions and employee benefit plan audits. |

| 3 | Tax services include all services, except those services specifically related to the audit of the financial statements, performed by the independent registered public accounting firm’s tax personnel, including tax analysis; assisting with the coordination of execution of tax related activities, primarily in the area of corporate developments; supporting other tax related regulatory requirements; and tax compliance and reporting. |

| 4 | Other Fees are those associated with services not captured in the other categories. |

Prior to engagement, the Audit Committee pre-approves the independent registered public accounting firm’s services within each category. The fees are budgeted and the Audit Committee requires the independent registered public accounting firm and management to report actual fees versus budget periodically throughout the year by category of service. During the year, circumstances may arise when it may become necessary to engage the independent registered public accounting firm for additional services not contemplated in the original pre-approval categories. In those instances, the Audit Committee requires specific pre-approval before engaging the independent registered public accounting firm.

The Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next scheduled meeting.

| endo |

| 1400 Atwater Drive | Malvern, Pennsylvania 19355 |

15 |

Table of Contents

Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act requires that we seek a non-binding advisory vote from our stockholders to approve the compensation of our named executive officers, or NEOs, as disclosed in the “COMPENSATION DISCUSSION AND ANALYSIS” (CD&A) and tabular disclosures of this Proxy Statement. Since the annual required vote is advisory, the result of the vote is not binding upon the Board.

Pay-for-performance underlies Endo’s compensation philosophy and supports Endo’s business strategies, but also strives to offer competitive compensation arrangements. In the CD&A, we have provided stockholders with a description of the Company’s compensation programs, including the philosophy and strategy underpinning the programs, the individual elements of the compensation programs and how our compensation plans are administered. Our compensation philosophy is designed to attract and retain highly-talented individuals and motivate them to achieve strong corporate performance, while embracing the Company’s values and leadership attributes. Our programs seek to:

| • | Create long-term stockholder value; |

| • | Closely link compensation with Company performance and individual performance; |